UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | | | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

You are cordially invited to join our 2024 Annual Meeting of Shareholders to be held on Thursday, August 1, 2024, at 9:00 a.m. Eastern time.

Your vote is very important. Whether you plan to participate in the Annual Meeting or not, please be sure to vote. Information concerning the matters to be considered and voted upon at the 2024 Annual Meeting is set out in the attached Notice of 2024 Annual Meeting and Proxy Statement.

DEAR SHAREHOLDERS:

This year, we continued to focus on our ambition to be the world’s leading luxury lifestyle company, making meaningful progress on our Next Great Chapter: Accelerate plan.

Our teams have continued to deliver strong progress on our plan, supported by our multiple strategic growth drivers – Elevate and Energize the Brand, Drive the Core and Expand for More and Win in Key Cities with Our Consumer Ecosystem – and our five key enablers, all amid ongoing macroeconomic uncertainty.

Anchored by our Purpose – to inspire the dream of a better life through authenticity and timeless style - and our enduring creative vision, our progress includes:

• | Driving excitement and affinity for our brand through our runway show at New York Fashion Week; the launch of Polo Ralph Lauren x Naiomi Glasses, our inaugural Artist in Residence collaboration; on the court at the U.S. Open, Wimbledon, and Australian Open; and iconic celebrity moments including Taylor Swift on the cover of TIME’s 2023 Person of the Year issue; |

• | Leveraging the breadth of our unique lifestyle positioning to continue to create and deliver sophisticated, timeless products while progressing on areas of opportunity like Women’s, Outerwear and Home; and |

• | Elevating our presence in key cities globally, with our expansion in Canada with the opening of our first Ralph Lauren store in the market, as well as digital commerce; store openings in Singapore, Toronto, Prague, Amsterdam, and North Carolina, and continued strategic expansion of our hospitality offerings with Ralph’s Coffee openings throughout Europe, Asia and the United Arab Emirates. |

STRATEGIC GROWTH DRIVERS |

Elevate and Energize our Lifestyle Brand |

Drive the Core and Expand for More |

Win in Key Cities with our Consumer Ecosystem |

| Ralph Lauren 2024 Proxy Statement | i |

Executive Chairman & CEO Letter | | |

STRATEGIC GROWTH ENABLERS |

Our People and Our Culture |

Best-In-Class Digital Technology and Analytics |

Superior Operational Capabilities |

A Powerful Balance Sheet |

Leadership in Citizenship & Sustainability |

Additionally, we continued to make advancements across our enablers. We’ve invested in best-in-class digital technology and analytics, including meaningful progress in how we leverage artificial intelligence and data science to support our employees and build personalized experiences for our consumers. Citizenship & Sustainability continues to guide how and what we create and the stories we tell, from our work to evolve from inspiration to collaboration with the communities that influence our creative vision; to incorporating circular design principles to create products intended to live on from generation to generation. Finally, and importantly, our teams are continuing to focus on being nimble and agile to effectively navigate complex global conditions.

As we look ahead, we are confident that our plan, with its diverse and flexible strategic choices, is relevant as ever in today’s environment. Our plan and strategy will enable us to continue designing products and creating experiences that allow our consumers and teams to dream for years to come, while driving value creation through ongoing revenue growth and progress on productivity and profitability.

Thank you for your support and interest in our Company. We look forward to connecting with you at our 2024 Annual Meeting.

| | |  |

Ralph Lauren | | | Patrice Louvet |

Executive Chairman and Chief Creative Officer | | | President and Chief Executive Officer |

| | | ||

| | | ||

New York, New York June 21, 2024 | | |

ii | Ralph Lauren 2024 Proxy Statement |  |

| | |

PURPOSE OF THE MEETING

The 2024 Annual Meeting of Stockholders of Ralph Lauren Corporation, a Delaware corporation, will be held virtually via live webcast on Thursday, August 1, 2024, at 9:00 a.m. Eastern Time at www.virtualshareholdermeeting.com/RL2024, or at any postponement or adjournment of the meeting, for the following purposes:

1 | To elect 12 directors to serve until the 2025 Annual Meeting of Stockholders; | 3 | To approve, on an advisory basis, the compensation of our named executive officers and our compensation philosophy, policies, and practices as described herein; and | |

2 | To ratify the appointment of Ernst & Young LLP (“Ernst & Young”) as our independent registered public accounting firm for the fiscal year ending March 29, 2025; | 4 | To transact such other business as may properly come before the meeting and any adjournments or postponements thereof. |

The foregoing items of business are described more fully in the accompanying Proxy Statement. Only holders of record of the Company’s Class A and Class B Common Stock at the close of business on June 4, 2024 are entitled to notice of, and to vote at, the 2024 Annual Meeting of Stockholders and any adjournments or postponements thereof.

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

We will be using the Securities and Exchange Commission’s Notice and Access model, which allows us to make the proxy materials available on the Internet, as the primary means of furnishing proxy materials to stockholders. On or about June 21, 2024, we will mail to all stockholders a Notice of Internet Availability of Proxy Materials, which contains instructions for accessing our proxy materials on the Internet and voting by telephone or on the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions for requesting a printed set of proxy materials. The Proxy Statement, Annual Report on Form 10-K for the fiscal year ended March 30, 3024, and Notice of Annual Meeting are available at: http://investor.ralphlauren.com. The information on our investor relations or corporate websites is not incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement.

YOUR VOTE IS IMPORTANT

Please vote promptly by signing, dating, and returning the enclosed proxy card or voting by telephone or on the Internet by following the instructions on your Notice of Internet Availability of Proxy Materials. In the event that a stockholder decides to participate in the online meeting, such stockholder may, if so desired, revoke the proxy by voting those shares when joining the meeting.

By Order of the Board of Directors,

Avery S. Fischer Chief Legal Officer and Secretary | | | New York, New York June 21, 2024 |

| Ralph Lauren 2024 Proxy Statement | iii |

Notice of 2024 Annual Meeting of Stockholders | | |

This document contains, and oral statements made at our Annual Meeting of Stockholders and elsewhere from time to time by representatives of the Company may contain, certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding our current expectations about the Company’s future operating results and financial condition, the implementation and results of our strategic plans and initiatives, store openings and closings, capital expenses, our plans regarding our quarterly cash dividend and Class A common stock repurchase programs, our ability to meet citizenship and sustainability goals, the senior management of the Company, and plans for future executive remuneration. Forward-looking statements are based on current expectations and are indicated by words or phrases such as “aim,” “anticipate,” “outlook,” “estimate,” “ensure,” “commit,” “expect,” “project,” “believe,” “envision,” “goal,” “target,” “can,” “will,” and similar words or phrases. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from the future results, performance or achievements expressed in or implied by such forward-looking statements. These risks, uncertainties, and other factors include, among others: the loss of key personnel, including Mr. Ralph Lauren, or other changes in our executive and senior management team or to our operating structure, including any potential changes resulting from the execution of our long-term growth strategy, and our ability to effectively transfer knowledge and maintain adequate controls and procedures during periods of transition; the potential impact to our business resulting from inflationary pressures, including increases in the costs of raw materials, transportation, wages, healthcare, and other benefit-related costs; the impact of economic, political, and other conditions on us, our customers, suppliers, vendors, and lenders, including potential business disruptions related to the Russia-Ukraine and Israel-Hamas wars, militant attacks on cargo vessels in the Red Sea, civil and political unrest, diplomatic tensions between the U.S. and other countries, rising interest rates, and bank failures, among other factors; the potential impact to our business resulting from supply chain disruptions, including those caused by capacity constraints, closed factories and/or labor shortages (stemming from pandemic diseases, labor disputes, strikes, or otherwise), scarcity of raw materials, port congestion, and scrutiny or detention of goods produced in certain territories resulting from laws, regulations, or trade restrictions, such as those imposed by the Uyghur Forced Labor Prevention Act (“UFLPA”) or the Countering America’s Adversaries Through Sanctions Act (“CAATSA”), which could result in shipment approval delays leading to inventory shortages and lost sales, as well as potential shipping delays, inventory shortages, and/or higher freight costs resulting from the recent Red Sea crisis and/or disruptions to major waterways such as the Suez and Panama canals; our ability to effectively manage inventory levels and the increasing pressure on our margins in a highly promotional retail environment; our exposure to currency exchange rate fluctuations from both a transactional and translational perspective; our ability to recruit and retain qualified employees to operate our retail stores, distribution centers, and various corporate functions; the impact to our business resulting from a recession or changes in consumers’ ability, willingness, or preferences to purchase discretionary items and luxury retail products, which tends to decline during recessionary periods, and our ability to accurately forecast consumer demand, the failure of which could result in either a build-up or shortage of inventory; our ability to successfully implement our long-term growth strategy; our ability to continue to expand and grow our business internationally and the impact of related changes in our customer, channel, and geographic sales mix as a result, as well as our ability to accelerate growth in certain product categories; our ability to open new retail stores and concession shops, as well as enhance and expand our digital footprint and capabilities, all in an effort to expand our direct-to-consumer presence; our ability to respond to constantly changing fashion and retail trends and consumer demands in a timely manner, develop products that resonate with our existing customers and attract new customers, and execute marketing and advertising programs that appeal to consumers; our ability to competitively price our products and create an acceptable value proposition for consumers; our ability to continue to maintain our brand image and reputation and protect our trademarks; our ability to achieve our goals regarding citizenship and sustainability practices, including those related to climate change, our human capital, and our supply chain; our ability and the ability of our third-party service providers to secure our respective facilities and systems from, among other things, cybersecurity breaches, acts of vandalism, computer viruses, ransomware, or similar Internet or email events; our efforts to successfully enhance, upgrade, and/or transition our global information technology systems and digital commerce platforms; the potential impact to our business if any of our distribution centers were to become inoperable or inaccessible; the potential impact to our business resulting from pandemic diseases such as COVID-19, including periods of reduced operating hours and capacity limits and/or temporary closure of our stores, distribution centers, and corporate facilities, as well as those of our customers, suppliers, and vendors, and potential changes to consumer behavior, spending levels, and/or shopping preferences, such as willingness to congregate in shopping centers or other populated locations; the potential impact on our operations and on our suppliers and customers resulting from man-made or natural disasters, including pandemic diseases, severe weather, geological events, and other catastrophic events, such as terrorist attacks, military conflicts, and other hostilities; our ability to achieve anticipated operating enhancements and cost reductions from our restructuring plans, as well as the impact to our business resulting from restructuring-related charges, which may be dilutive to our earnings in

iv | Ralph Lauren 2024 Proxy Statement |  |

Notice of 2024 Annual Meeting of Stockholders | | |

the short term; the impact to our business resulting from potential costs and obligations related to the early or temporary closure of our stores or termination of our long-term, non-cancellable leases; our ability to maintain adequate levels of liquidity to provide for our cash needs, including our debt obligations, tax obligations, capital expenditures, and potential payment of dividends and repurchases of our Class A common stock, as well as the ability of our customers, suppliers, vendors, and lenders to access sources of liquidity to provide for their own cash needs; the potential impact to our business resulting from the financial difficulties of certain of our large wholesale customers, which may result in consolidations, liquidations, restructurings, and other ownership changes in the retail industry, as well as other changes in the competitive marketplace, including the introduction of new products or pricing changes by our competitors; our ability to access capital markets and maintain compliance with covenants associated with our existing debt instruments; a variety of legal, regulatory, tax, political, and economic risks, including risks related to the importation and exportation of products which our operations are currently subject to, or may become subject to as a result of potential changes in legislation, and other risks associated with our international operations, such as compliance with the Foreign Corrupt Practices Act or violations of other anti-bribery and corruption laws prohibiting improper payments, and the burdens of complying with a variety of foreign laws and regulations, including tax laws, trade and labor restrictions, and related laws that may reduce the flexibility of our business; the impact to our business resulting from the potential imposition of additional duties, tariffs, taxes, and other charges or barriers to trade, including those resulting from trade developments between the U.S. and China or other countries, and any related impact to global stock markets, as well as our ability to implement mitigating sourcing strategies; changes in our tax obligations and effective tax rate due to a variety of factors, including potential changes in U.S. or foreign tax laws and regulations, accounting rules, or the mix and level of earnings by jurisdiction in future periods that are not currently known or anticipated; the potential impact to the trading prices of our securities if our operating results, Class A common stock share repurchase activity, and/or cash dividend payments differ from investors’ expectations; our ability to maintain our credit profile and ratings within the financial community; our intention to introduce new products or brands, or enter into or renew alliances; changes in the business of, and our relationships with, major wholesale customers and licensing partners; our ability to make strategic acquisitions and successfully integrate the acquired businesses into our existing operations; and other risk factors identified in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission. These forward-looking statements are based largely on our expectations and judgments and are subject to a number of risks and uncertainties, many of which are unforeseeable and beyond our control. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

RALPH LAUREN CORPORATION REFERENCES

In this document, we refer to Ralph Lauren Corporation as the “Company,” “we,” “us” or “our.” Our fiscal year ends on the Saturday immediately before or after March 31. All references to “Fiscal 2025” represent the fiscal year ending March 29, 2025. All references to “Fiscal 2026” represent the fiscal year ending March 28, 2026. All references to “Fiscal 2024” represent the fiscal year ended March 30, 2024. All references to “Fiscal 2023” represent the fiscal year ended April 1, 2023. All references to “Fiscal 2022” represent the fiscal year ended April 2, 2022. All references to “Fiscal 2021” represent the fiscal year ended March 27, 2021. All references to “Fiscal 2020” represent the fiscal year ended March 28, 2020. All references to “Fiscal 2018” represent the fiscal year ended March 31, 2018. All references to “Fiscal 2017” represent the fiscal year ended April 1, 2017.

NON-U.S. GAAP FINANCIAL MEASURES

The Company uses non-U.S. generally accepted accounting principles (“U.S. GAAP”) financial measures, among other things, to evaluate its operating performance and in order to represent the manner in which the Company conducts and views its business. In addition, as discussed in the “Executive Compensation Matters” section of the Proxy Statement, the Talent, Culture & Total Rewards Committee uses non-U.S. GAAP measures to set and certify the achievement of certain performance-based compensation goals. The Company believes that excluding items that are not comparable from period to period helps investors and others compare operating performance between two periods. While the Company considers the non-U.S. GAAP measures useful in analyzing its results, they are not intended to replace, nor act as a substitute for, any presentation included in the consolidated financial statements prepared in conformity with U.S. GAAP and may be different from non-U.S. GAAP measures reported by other companies. See Appendix B to the Proxy Statement for reconciliation between the non-U.S. GAAP financial measures and the most directly comparable U.S. GAAP measures.

| Ralph Lauren 2024 Proxy Statement | v |

Contents | | |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| Ralph Lauren 2024 Proxy Statement | vii |

| | |

This summary highlights information contained elsewhere in this Proxy Statement. For more complete information about these topics, please review our Annual Report on Form 10-K for Fiscal 2024 and this entire Proxy Statement.

We are mailing the Notice of 2024 Annual Meeting of Stockholders and instructions on how to access this Proxy Statement (or, for those who request it, a hard copy of this Proxy Statement and the enclosed form of proxy) to our stockholders on or about June 21, 2024.

ABOUT RALPH LAUREN

Ralph Lauren Corporation (NYSE: RL) is a global leader in the design, marketing, and distribution of luxury lifestyle products in five categories: apparel, footwear & accessories, home, fragrances, and hospitality. For more than 50 years, Ralph Lauren has sought to inspire the dream of a better life through authenticity and timeless style. Its reputation and distinctive image have been developed across a wide range of products, brands, distribution channels and international markets. The Company’s brand names — which include Ralph Lauren, Ralph Lauren Collection, Ralph Lauren Purple Label, Polo Ralph Lauren, Double RL, Lauren Ralph Lauren, Polo Ralph Lauren Children and Chaps, among others — constitute one of the world’s most widely recognized families of consumer brands. For more information, go to http://investor.ralphlauren.com.

SOLICITATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of the Company, for use in connection with the Annual Meeting of the Company’s Stockholders to be held on August 1, 2024 (the “2024 Annual Meeting”). This Proxy Statement, the accompanying Notice of Annual Meeting, proxy card, and the Company’s 2024 Annual Report on Form 10-K, or alternatively a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), will be mailed to stockholders on or about June 21, 2024. The Board is soliciting your proxy in an effort to give all stockholders of record the opportunity to vote on matters that will be presented at the 2024 Annual Meeting. This Proxy Statement provides you with information on these matters to assist you in voting your shares.

August 1, 2024

9:00 a.m. Eastern Time

Held virtually online

via live webcast at

www.virtualshareholder meeting.com/RL2024

| Ralph Lauren 2024 Proxy Statement | 1 |

Proxy Summary | | |

VIRTUAL STOCKHOLDER MEETING

The 2024 Annual Meeting will be conducted exclusively online via live webcast, allowing all of our stockholders the option to participate in the live, online meeting from any location convenient to them, providing stockholder access to our Board and management and enhancing participation.

Stockholders at the close of business on June 4, 2024 will be allowed to communicate with us and ask questions in our virtual stockholder meeting forum before and during the meeting. All directors and key executive officers are expected to participate in the meeting, and we are committed to acknowledging each question we receive. For further information on the virtual meeting, please see the “Questions and Answers About the Annual Meeting and Voting” section on page 115.

2024 ANNUAL MEETING OF STOCKHOLDERS

Thursday, August 1, 2024 9:00 a.m. Eastern Time | | | Held virtually online via live webcast at www.virtualshareholdermeeting.com/RL2024 | ||||||

Record Date: | | | • Close of business on June 4, 2024, (the “Record Date”). | | | | | ||

Participating in the Annual Meeting: | | | • We invite you to join the 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting” or “Meeting”) online via live webcast. There will not be a physical meeting in New York City. You will be able to participate in the virtual Meeting online, vote your shares electronically, and submit your questions during the Meeting by visiting: www.virtualshareholdermeeting.com/ RL2024 (the “Annual Meeting Website”). Prior to the meeting, you may vote your shares and submit pre-meeting questions online by visiting www.proxyvote.com and following the instructions on your proxy card. | | | | | • Please note that stockholders will need their unique control number which appears on their Notice of Internet Availability, the proxy card (printed in the box and marked by the arrow), and the instructions that accompanied the proxy materials in order to access these sites. Beneficial stockholders who do not have a control number may gain access to the meeting by logging into their broker, brokerage firm, bank, or other nominee’s website and selecting the stockholder communications mailbox to link through to the Meeting. Instructions should also be provided on the voting instruction card provided by your broker, bank, or other nominee. | |

Virtual Meeting Highlights: | | | • All of our stockholders will be able to hear directly from Mr. Ralph Lauren, our Founder and Executive Chairman, Mr. Patrice Louvet, our President and CEO, and others, regardless of location. | | | | | • To ensure access, all validated stockholders may submit questions in advance, beginning on June 21, 2024, by visiting www.proxyvote.com, and may submit questions during the Meeting by visiting the Annual Meeting Website at www.virtualshareholdermeeting.com/ RL2024. All relevant questions received in accordance with the Meeting’s Rules of Conduct (available on the Annual Meeting Website) during the course of the Meeting or solicited in advance, as well as the Company’s responses, will be posted on http://investor.ralphlauren.com soon after the 2024 Annual Meeting. | |

| | • Stockholders will be able to review the Rules of Conduct and other Meeting materials on the 2024 Annual Meeting Website. | | | | | • An audio replay of the 2024 Annual Meeting will be available on http://investor.ralphlauren.com until the 2025 Annual Meeting of Stockholders. | |||

2 | Ralph Lauren 2024 Proxy Statement |  |

Proxy Summary | | |

Voting: | | | • Only holders of record of the Company’s Class A and Class B Common Stock at the close of business on June 4, 2024 are entitled to notice of, and to vote at, the 2024 Annual Meeting, or at any adjournments or postponements thereof. | | | | | • Please authorize a proxy to vote your shares as soon as possible. If you are a beneficial owner of shares of our common stock, your broker will NOT be able to vote your shares with respect to any of the matters presented at the Meeting other than the ratification of the selection of our independent registered public accounting firm, unless you give your broker specific voting instructions. | |

| | | • You do not need to participate in the 2024 Annual Meeting webcast to vote if you submitted your proxy in advance of the 2024 Annual Meeting. | | | | | • See the “Questions and Answers About the Annual Meeting and Voting” section on page 115 of this Proxy Statement for more information. |

MATTERS TO BE VOTED ON

Item for Business | | | Board Recommendation | | | Further Details | |||

1. | | | Election of 12 Directors | | | FOR ALL | | | Page 15 |

2. | | | Ratification of appointment of independent registered public accounting firm | | | FOR | | | Page 111 |

3. | | | Advisory vote on executive compensation | | | FOR | | | Page 114 |

| Ralph Lauren 2024 Proxy Statement | 3 |

Proxy Summary | | |

Name | | | Occupation | | | Age | | | Director Since | | | Independent | | | Other Current Public Company Directorships | | | Committees1 | |||||||||

| | A | | | T | | | N | | | F | |||||||||||||||||

Class A Directors | |||||||||||||||||||||||||||

Linda Findley | | | Former President and Chief Executive Officer Blue Apron Holdings, Inc. | | | 51 | | | 2018 | | |  | | | 0 | | |  | | |  | | | | |  | |

Hubert Joly2 | | | Formerly Chairman of the Board of Directors and Chief Executive Officer Best Buy Co., Inc. | | | 64 | | | 2009 | | |  | | | 1 | | | | |  | | | | |  | ||

Darren Walker | | | President Ford Foundation | | | 64 | | | 2020 | | |  | | | 1 | | | | |  | | |  | | | ||

Class B Directors | |||||||||||||||||||||||||||

Ralph Lauren | | | Executive Chairman and Chief Creative Officer | | | 84 | | | 1997 | | | | | 0 | | | | | | | | | |||||

Patrice Louvet | | | President and Chief Executive Officer | | | 59 | | | 2017 | | | | | 1 | | | | | | | | | |||||

David Lauren | | | Chief Branding and Innovation Officer and Vice Chairman of the Board | | | 52 | | | 2013 | | | | | 0 | | | | | | | | | |||||

Angela Ahrendts | | | Formerly Senior Vice President, Retail Apple, Inc. | | | 64 | | | 2018 | | |  | | | 2 | | | | | | |  | | |  | ||

Frank A. Bennack, Jr. | | | Executive Vice Chairman and Chairman of the Executive Committee The Hearst Corporation | | | 91 | | | 1998 | | |  | | | 0 | | |  | | | | |  | | | ||

Debra Cupp | | | President, North America Microsoft, Inc. | | | 53 | | | 2022 | | |  | | | 0 | | |  | | | | | | | |||

Michael A. George | | | Formerly President and Chief Executive Officer Qurate Retail, Inc. | | | 62 | | | 2018 | | |  | | | 1 | | |  | | |  | | | | |  | |

Valerie Jarrett | | | Chief Executive Officer The Barack Obama Foundation | | | 67 | | | 2020 | | |  | | | 2 | | |  | | | | |  | | | ||

Wei Zhang | | | Former President Alibaba Pictures Group | | | 54 | | | 2022 | | |  | | | 1 | | | | | | |  | | |  | ||

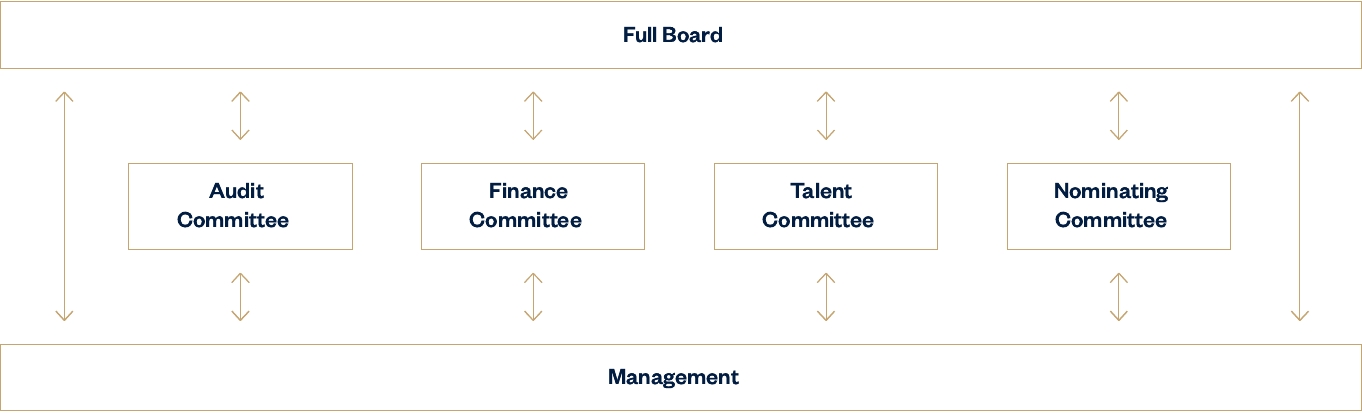

1. | “A” refers to the Audit Committee of the Board (the “Audit Committee”), “T” refers to the Talent, Culture & Total Rewards Committee of the Board (the “Talent Committee”), “N” refers to the Nominating, Governance, Citizenship & Sustainability Committee of the Board (the “Nominating Committee”), and “F” refers to the Finance Committee of the Board (the “Finance Committee”). |

2. | As Lead Independent Director, Mr. Joly is invited to attend all Committee meetings. |

Chair

Chair  Member

Member 4 | Ralph Lauren 2024 Proxy Statement |  |

Proxy Summary | | |

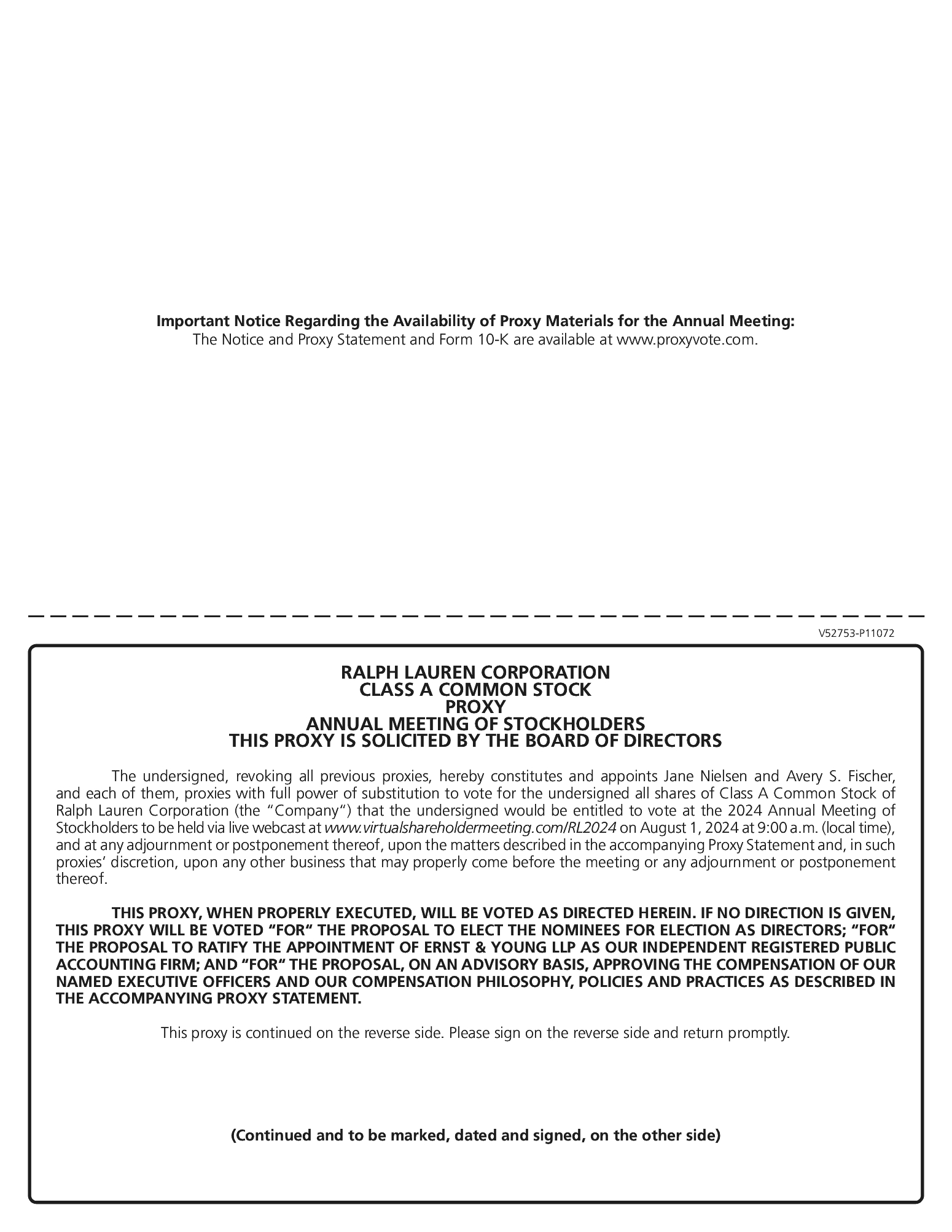

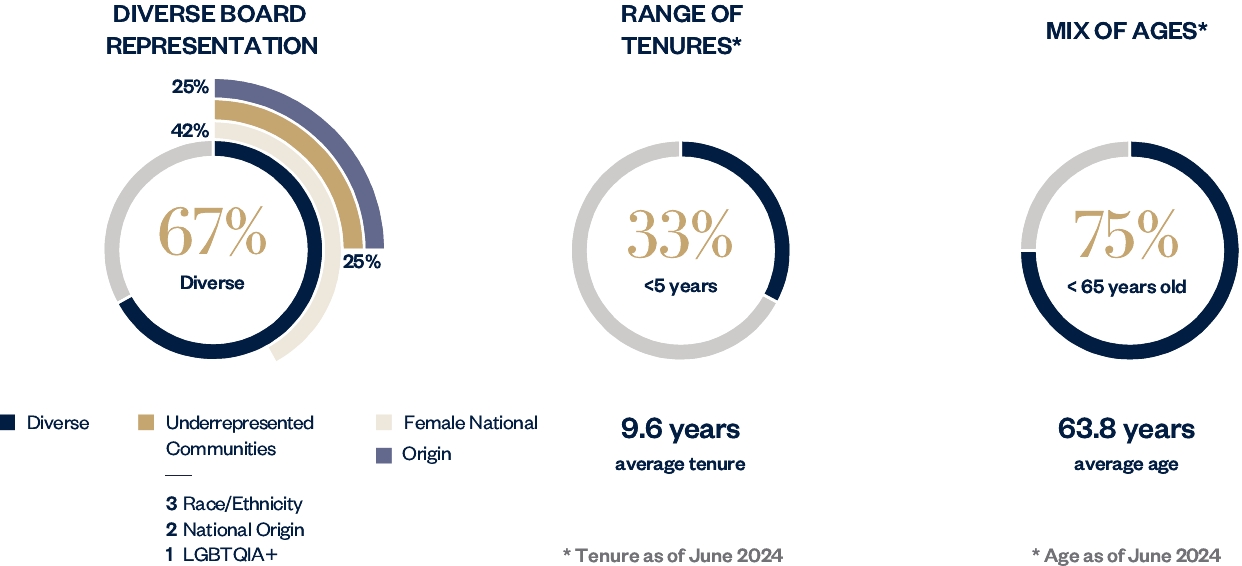

DIRECTOR NOMINEES HIGHLIGHTS

As presented in the chart below, we believe our Board nominees offer a diverse range of key skills and experiences to provide effective oversight of the Company and create long-term sustainable growth for our Company through successful execution of the Company’s strategic plan. Below is a high-level summary which highlights certain of the Board nominees’ skills, qualifications and experiences and is not intended to be an exhaustive list of each director nominee’s contributions to the Board.

BALANCED MIX OF SKILLS, QUALIFICATIONS AND EXPERIENCE

Name | | | Angela Ahrendts | | | Frank A. Bennack, Jr. | | | Debra Cupp | | | Linda Findley | | | Michael A. George | | | Valerie Jarrett | | | Hubert Joly | | | David Lauren | | | Ralph Lauren | | | Patrice Louvet | | | Darren Walker | | | Wei Zhang |

Attributes/Experiences | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||

CEO1 | | |  | | |  | | | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | | |||

International Experience | | |  | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | |  | | |  | | |  | |

Additional Public Company Executive | | |  | | | | |  | | |  | | |  | | |  | | |  | | | | | | |  | | |  | | |  | |||

Retail/Consumer Products | | |  | | | | |  | | |  | | |  | | | | |  | | |  | | |  | | |  | | |  | | |  | ||

E-commerce/Digital/ Technology | | |  | | | | |  | | |  | | |  | | | | |  | | |  | | | | |  | | | | |  | ||||

Data protection/Cyber/IT | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | | | | | |  | | | | | ||||

Finance/Capital Allocation | | |  | | |  | | |  | | |  | | |  | | |  | | |  | | | | | | |  | | |  | | |  | ||

Consumer Insights/ Marketing/Sales | | |  | | |  | | |  | | |  | | |  | | | | |  | | |  | | |  | | |  | | | | |  | ||

Policy/Regulatory/Governance | | |  | | |  | | | | |  | | |  | | |  | | |  | | | | | | | | |  | | | |||||

Diversity | | | | | | | | | | | | | | | | | | | | | | | | | ||||||||||||

Race/Ethnicity | | | | | | | | | | | | |  | | | | | | | | | | |  | | |  | |||||||||

Gender | | |  | | | | |  | | |  | | | | |  | | | | | | | | | | | | |  | |||||||

Nationality | | | | | | | | | | | | | | |  | | | | | | |  | | | | | ||||||||||

Sexual Orientation | | | | | | | | | | | | | | | | | | | | | | |  | | |

1 | Current or former CEO or President experience, public, private and non-profit |

| Ralph Lauren 2024 Proxy Statement | 5 |

Proxy Summary | | |

2024 BUSINESS HIGHLIGHTS | | | |

| |

FISCAL 2024 PERFORMANCE HIGHLIGHTS

At Ralph Lauren Corporation, we are consistently working to bring to life our Purpose of “Inspiring the dream of a better life, through authenticity and timeless style” and creating competitive sustained value for all our stakeholders (employees, consumers, stockholders, partners/suppliers and communities we live and operate in). In Fiscal 2024, we made meaningful progress in the second year of our multi-year, Next Great Chapter: Accelerate plan (“Strategic Plan”), which focuses on three key pillars: Elevate and Energize our Lifestyle Brand, Drive the Core and Expand for More, and Win in Key Cities with our Consumer Ecosystem. We delivered on each of these strategic initiatives while continuing to manage through a highly dynamic global operating environment. By harnessing the power of our iconic brand as we expand across geographies and demographics, we are cutting through culture across fashion, celebrity, sports, gaming and music moments. At the same time, our teams continue to operate with discipline, agility and strength through multiple headwinds in the broader environment, including ongoing inflationary pressures, foreign currency volatility, and geopolitical conflicts including the wars in Ukraine and Gaza.

These efforts translated to solid financial performance in Fiscal 2024. We reported growth across our key financial results, including Total Company Revenue growth and adjusted operating income higher than last year. This was a result of our team’s exceptional execution and our sustainable and resilient strategy, with multiple diversified drivers for long-term growth and value creation.

Results of our Strategic Plan included:

• | Elevate and Energize Our Lifestyle Brand |

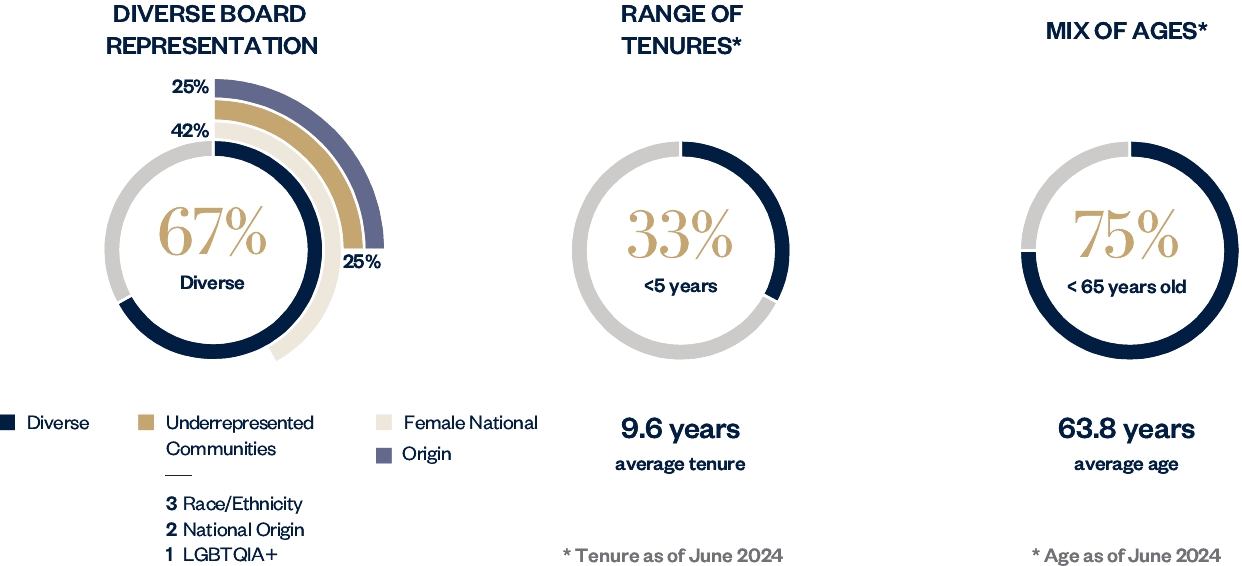

− | Delivered continued momentum in new customer acquisition and loyalty with more than 5 million new consumers in our direct-to-consumer businesses and accelerated net promoter scores led by Next Generation under 35 year old consumers and women |

− | Created powerful, authentic connections with consumers across key cultural moments including: our dynamic annual sponsorships of the U.S. Open, Wimbledon, and Australian Open Tennis Championships; our global “Season for Dreaming” Holiday 2023 campaign with key city takeovers; successful Singles Day and Lunar New Year activations in Asia; our inaugural Artist in Residence collaboration with Naiomi Glasses, a groundbreaking partnership focused on empowering and celebrating artisans within the communities that have historically inspired our designs; and iconic celebrity moments including Taylor Swift on the cover of TIME’s 2023 Person of the Year issue |

6 | Ralph Lauren 2024 Proxy Statement |  |

Proxy Summary | | |

FISCAL 2024 PERFORMANCE HIGHLIGHTS - CONTINUED

• | Drive the Core and Expand for More |

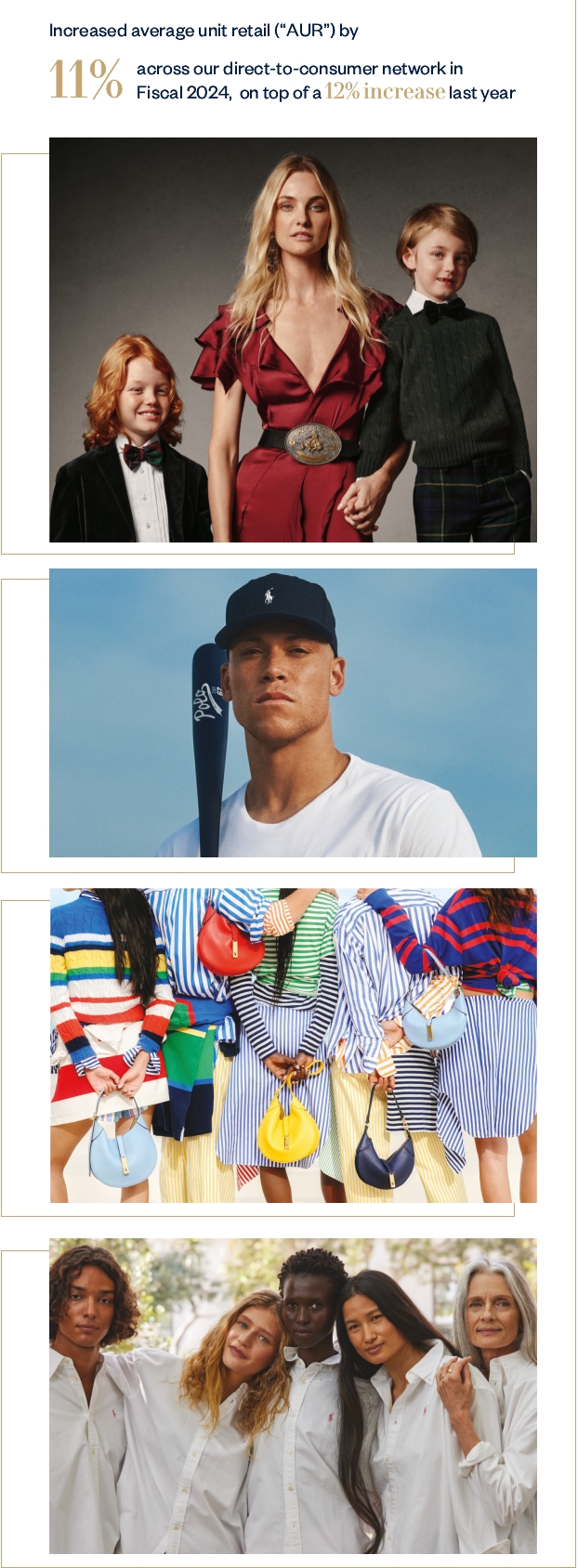

− | Increased average unit retail by 11% across our direct-to-consumer network in Fiscal 2024, on top of a 12% increase last year, reflecting the durability of our multi-pronged elevation approach |

− | Drove continued momentum in both our Core business and high-potential categories, both up high-single-digits to last year in constant currency and outpacing total Company growth |

− | Product highlights included: our Artist in Residence collections; the launch of our newest fragrance Polo 67, inspired by the world of sports with a global campaign featuring New York Yankees captain Aaron Judge; Polo Country x Element Skateboards, an exclusive capsule of unisex styles and skateboards celebrating the great outdoors; our limited-edition Polo ID collaboration with Mr. Bags in China; and our Ralph Lauren Pink Pony collection, supporting our longstanding commitment to cancer care |

• | Win in Key Cities with Our Consumer Ecosystem |

− | By region, sales performance exceeded our expectations led by Asia, up 10% on a reported basis and 14% in constant currency to last year, with China delivering more than 25% growth in both reported and constant dollars. Europe grew 7% on a reported basis and 3% in constant currency. North America declined 2%, with stronger direct-to-consumer performance offset by softer wholesale performance as anticipated |

− | By region, results were led by Asia, up double-digits to last year, including stronger than expected performance in China |

− | Continued to expand and scale our key city ecosystems, including: our new emblematic store openings in Amsterdam and Singapore; our first Ralph Lauren stores in Toronto, Prague, and North Carolina; the launch of our digital commerce flagship in Canada; and our first Ralph’s Coffee in Paris and the United Arab Emirates |

In addition, our business is supported by our fortress foundation, which we define through our five key enablers, including: our people and culture, best-in-class digital technology and analytics, superior operational capabilities, a powerful balance sheet, and leadership in citizenship and sustainability.

| Ralph Lauren 2024 Proxy Statement | 7 |

Proxy Summary | | |

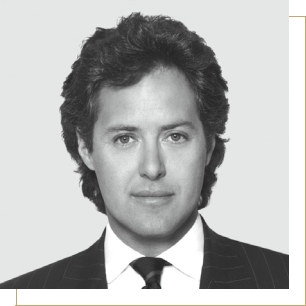

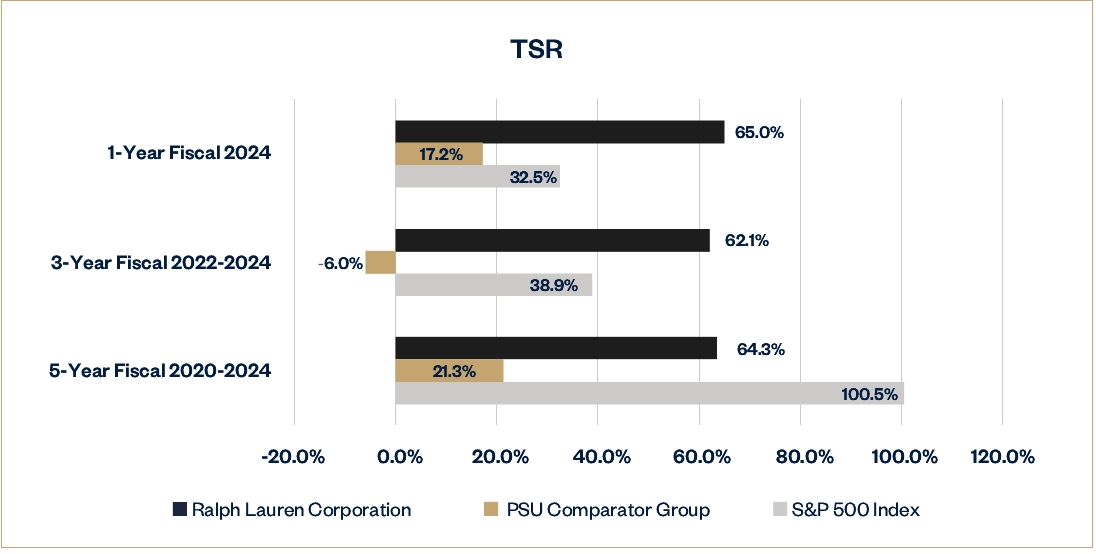

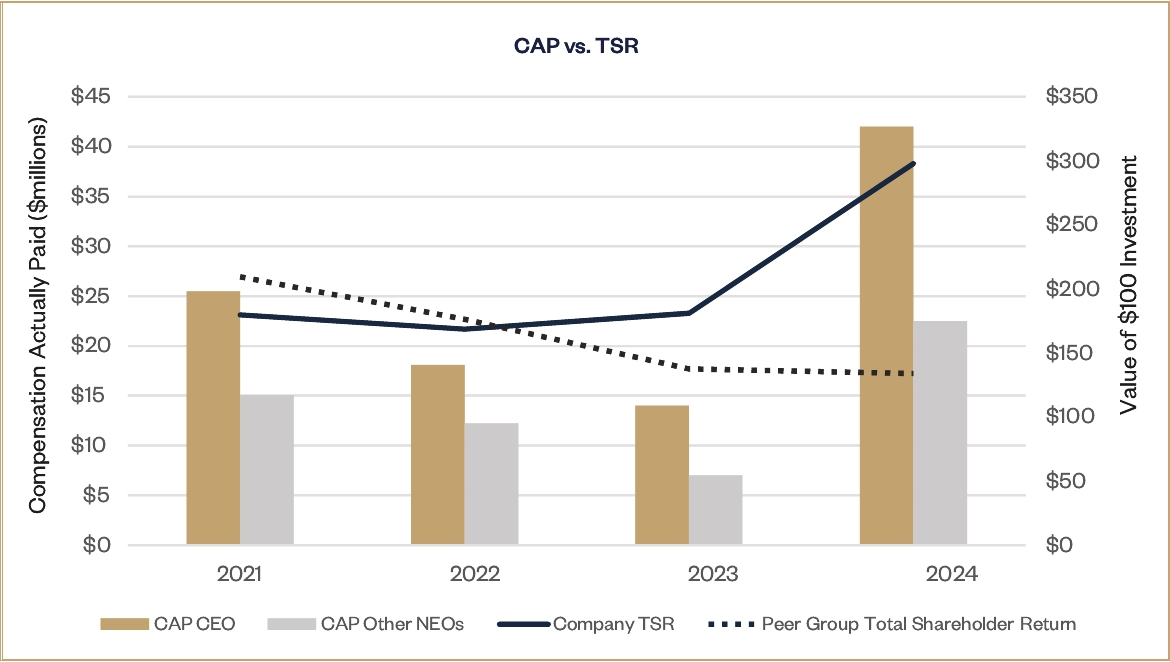

TOTAL SHAREHOLDER RETURN (“TSR”) PERFORMANCE

Our TSR for recent periods, relative to our Fiscal 2024 PSU Comparator Group detailed on page 78 and the S&P 500, is set forth below. TSR is based on stock price appreciation, plus dividends reinvested, with starting and ending share prices based on average closing stock prices for the 20 trading days ending immediately prior to the beginning and end of the performance period. We had very strong TSR results in all three periods with 1-year Fiscal 2024, 3-year Fiscal 2022-2024, and 5-year Fiscal 2020-2024, substantially outperforming the PSU Comparator Group in all three periods. We meaningfully outperformed the S&P 500 in the one-year and three-year periods ended Fiscal 2024 and were behind the S&P 500 for the five-year period ended Fiscal 2024.

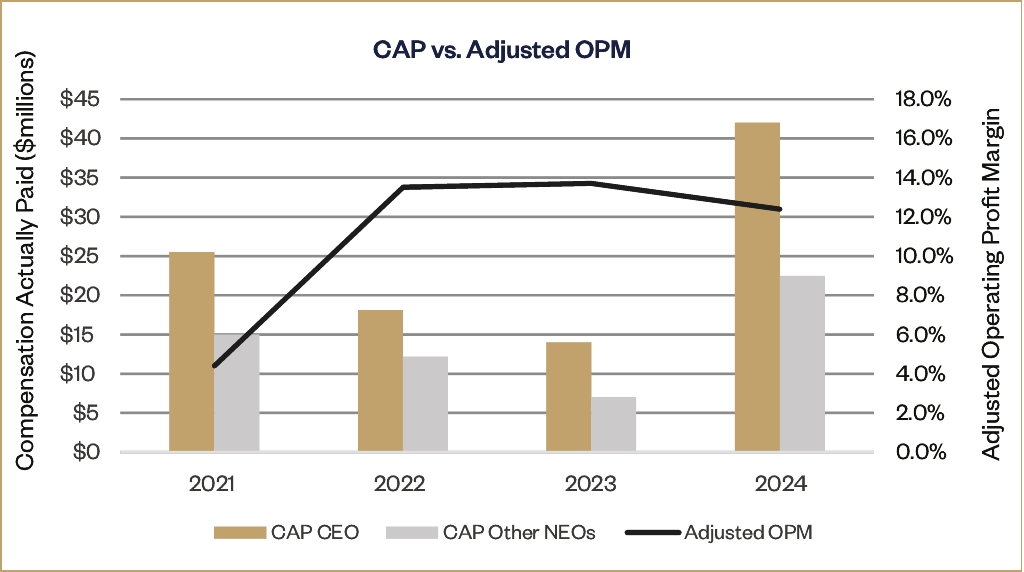

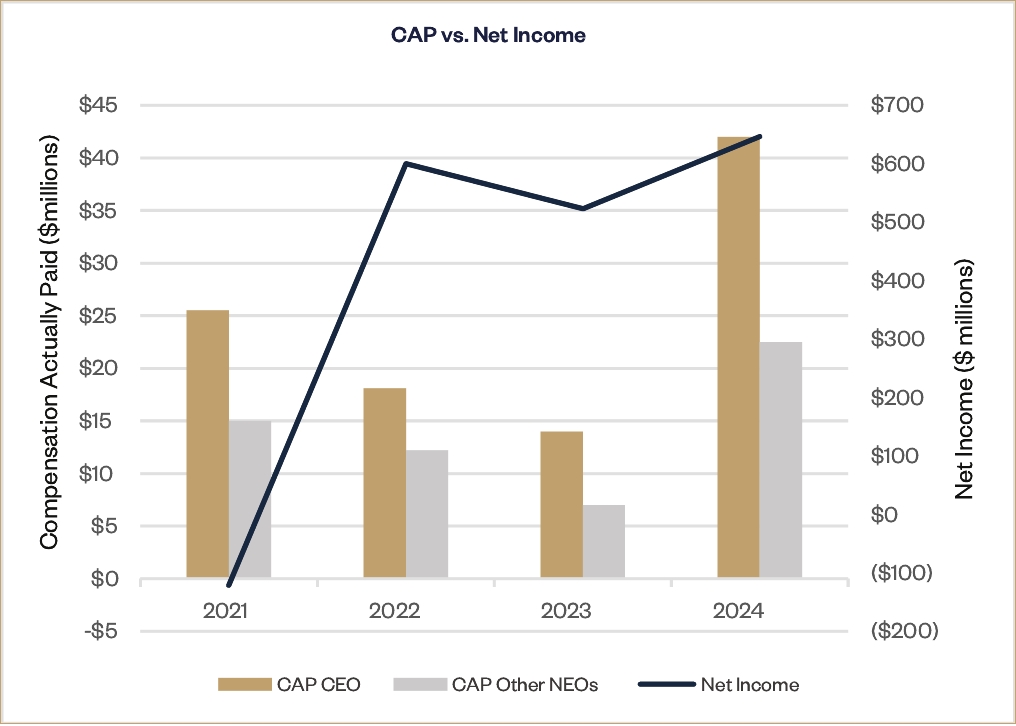

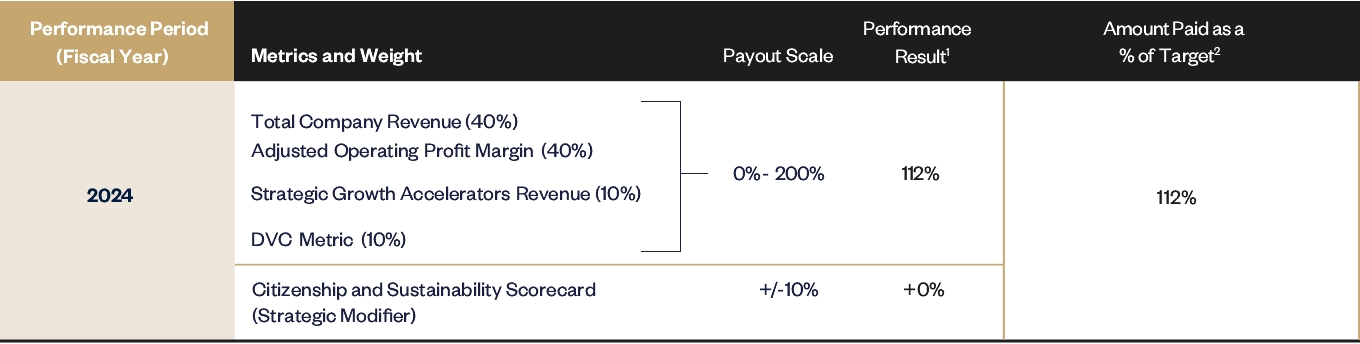

COMPENSATION OBJECTIVES, PRINCIPLES, AND PRACTICES

The key components of our executive compensation program for our named executive officers (“NEOs”) consist of base salary, annual cash incentive, and long-term equity-based incentive opportunities. Our compensation plans are designed to link pay and performance, reward sustained business growth and results, and drive stockholder value. A majority of each NEO’s compensation is variable in the form of annual cash incentive and long-term equity-based awards. Aligned with our Strategic Plan and based on the feedback received from our stockholders in Fiscal 2023 and following review and discussion with management and our independent consultants, and the Talent Committee, we included key financial measures in both our short- and long-term incentive compensation plans in Fiscal 2024.

8 | Ralph Lauren 2024 Proxy Statement |  |

Proxy Summary | | |

Key takeaways impacting executive compensation for Fiscal 2024 are:

• | Overall, our key financial results for Fiscal 2024 were generally strong with Total Company Revenue and Adjusted Operating Profit Margin each near the target set. Each of these measures were weighted 40% in the short-term incentive plan. |

| | | ||

$6,619.0M Total Company Revenue | | | 12.4% Adjusted Operating Profit Margin |

| | |

− | Total Company Revenue was $6,619.0 million on a constant dollar basis, or 99.7% of target, $175.4 million greater than Fiscal 2023 results of $6,443.6 million on a reported dollar basis. |

− | Adjusted Operating Profit Margin was 12.4% on a constant dollar basis, approximately at target, greater than Fiscal 2023 results of 12.0% on a reported dollar basis. |

• | For Fiscal 2024 short-term incentives, strategic growth accelerators revenue, which consisted of revenue from our Women’s Apparel, Outerwear, and Handbags & Small Leather Goods products (“Strategic Growth Accelerators Revenue”), was weighted 10%, to focus on our high-potential growth areas and a Digital Value Chain (“DVC”) metric was weighted 10%, to unlock our goals toward sustainability and raw material usage. Strategic Growth Accelerators Revenue results were 7.6% greater than Fiscal 2023 results and above target and the results of the DVC metric were also above target. |

• | We maintained citizenship and sustainability metrics in the form of a scorecard as our strategic goal modifier to our Fiscal 2024 short-term incentive plan to support our commitment to create positive social and environmental impacts across our Company, our industry and society. Three of the ten metrics were modified during the year to support the systemic changes required to deliver on our diversity, equity & inclusion (“DE&I”) goals holistically and consistent with applicable law and best practices. With one exception, we met or exceeded the strategic goal modifier targets and as a result the Talent Committee determined that no adjustment would be made to the bonus payout under the short-term incentive plan. |

• | As part of our long-term incentives, we granted PSUs in Fiscal 2024 based on three-year Adjusted Return on Invested Capital (“Adjusted ROIC”) and three-year TSR relative to a comparator group of companies to support the Company’s strategy to return to sustainable earnings growth. |

• | The charts below show the components and allocation of the variable and fixed elements that comprise the target total direct compensation for our NEOs at the end of Fiscal 2024. Total direct annual compensation represents base salary plus target bonus and target annual equity in place at the end of Fiscal 2024. |

| Ralph Lauren 2024 Proxy Statement | 9 |

Proxy Summary | | |

GOVERNANCE HIGHLIGHTS

We have in place a comprehensive corporate governance framework which incorporates and, in certain areas, exceeds the corporate governance requirements of the Sarbanes-Oxley Act of 2002, the U.S. Securities and Exchange Commission (“SEC”), the New York Stock Exchange (“NYSE”), and the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”). Even though we could, as a controlled company, rely on exemptions from certain of the NYSE’s corporate governance requirements, we do not do so. In keeping with good corporate governance practices, we maintain a majority of independent directors, and each of our Board Committees are comprised solely of independent directors as required by the NSYE for non-controlled companies.

• | Lead Independent Director – Robust responsibilities that have recently been expanded |

• | Independence – 77% independent Board, as defined in Rule 10A-3 of the Securities Exchange Act of 1933, as amended (“Exchange Act”) and the listing rules of the NYSE, and which exceeds the NYSE listing rules requirement of majority independent directors |

• | Board Leadership – Separate Chairman and CEO roles |

• | Annual Elections – All directors are elected annually |

• | Stock Ownership – Director and executive stock ownership/holding requirements |

• | Stockholder Engagement – Longstanding commitment to significant stockholder outreach, conducted on an ongoing basis and at least once annually, with the presence of the Lead Independent Director upon stockholder request, which directly informs corporate policies and practices |

• | Accountability to Stockholders – Various annual measures in support of stockholder feedback, including: annual election of directors with Class A stockholders solely electing the three Class A directors, annual stockholder advisory vote on executive compensation, and the ability of stockholders to remove directors with or without cause |

• | Board Evolution and Succession Planning – Continued commitment to proactive Board evolution, including rotation of Committee Chairs at least every five years and ongoing assessment of each Board member’s skills and experience for alignment with strategic priorities and risks and to ensure appropriate mix of skills, expertise, and backgrounds on the Board. The evolution of our Board also focuses on diversity and resulted in the nomination of one new female director and one new diverse, female director in Fiscal 2023, and one long-tenured director not standing for re-election at the upcoming 2024 Annual Meeting. In Fiscal 2022, the Board also updated the Lead Independent Director role and appointed Hubert Joly to serve in that role, with recently expanded and well-defined responsibilities |

10 | Ralph Lauren 2024 Proxy Statement |  |

Proxy Summary | | |

• | Citizenship & Sustainability – Oversight of citizenship and sustainability matters by the Nominating, Governance, Citizenship & Sustainability Committee (the “Nominating Committee”) with quarterly reviews, and annual Global Citizenship & Sustainability Report covering Fiscal 2024 expected to be released in September 2024 |

• | Talent & Culture – Oversight of our human capital talent development, DE&I, and corporate culture initiatives by the Talent, Culture & Total Rewards Committee (the “Talent Committee”) including regular talent reviews and executive succession planning |

• | Strategy Engagement – Prioritized independent director access to management with deep focus on strategy and engagement with additional special strategic meetings, including (i) special meetings of the Finance Committee to oversee strategic priorities and growth drivers including our Next Great Chapter: Accelerate plan (the “Strategic Plan”), the fiscal year plan and long range plan, and navigating the prevailing macroeconomic environment; (ii) a dedicated Board effectiveness review held in executive session led by the Lead Independent Director, (iii) a third-party independent consultant Board effectiveness review every three years; and (iv) quarterly review and analysis of enterprise risk management |

• | Diversity Engagement – Active engagement by the Board in the oversight of our corporate culture and deep focus on developing a diverse, equitable and inclusive culture that is aligned with our long-term mission and strategy |

• | Education – Expanded the Board education program and created an online Director Education Portal for internal Ralph Lauren classes on the Company and our business |

• | Anti-Pledging Policy – Policy prohibiting all directors, officers and employees from pledging, hedging or short selling Company stock |

• | Strategic Meetings & Ecosystem Emersion Tours – To ensure that the strength of our global business endures over the long-term, the Board and Committees convene additional special strategic meetings throughout the fiscal year to provide management with oversight, input, and guidance regarding various matters, including emerging risks, our fiscal year and long range plans, progress of our corporate strategy including the implementation of new strategic growth drivers as part of our Strategic Plan, and ecosystem emersion tours with on-location review of our regional key city ecosystems to engage directly with our strategy and consumer experience, most recently in North America and Europe |

STOCKHOLDER ENGAGEMENT

In Fiscal 2024, we continued our ongoing stockholder outreach efforts as we believe the input of our stockholders is an important driver in establishing our corporate governance, compensation, and citizenship and sustainability practices. In Fiscal 2024, the Company contacted stockholders representing over 80% of our outstanding shares of Class A Common Stock, including 100% of our top 25 stockholders, and held meetings with all stockholders that accepted our invitation representing approximately 45% of our Class A Common Stock outstanding. Additionally, we conduct business focused engagement calls throughout the year on the Company’s Strategic Plan and financial performance with existing and prospective stockholders.

We have a longstanding commitment to stockholder outreach, which is conducted on an ongoing basis, and at least once annually, and actively informs corporate policies and practices. Through this ongoing outreach, we have received and considered valuable feedback regarding a variety of stockholder-related matters and we are pleased to highlight our recent responses:

• | The continued use of consistent quantitative financial measures in both the short-term and long-term incentive plans in Fiscal 2024 and the inclusion of citizenship and sustainability metrics in the short-term incentive plan. |

• | An updated comparator group for determining PSUs – Relative TSR to better reflect our brand elevation strategy as discussed in “Compensation Discussion and Analysis – Stockholder Feedback and the Talent Committee Response.” |

• | Supporting regular materiality assessments to help identify and prioritize the citizenship and sustainability issues, risks and opportunities that matter most to our business and stakeholders. |

• | A continued Company and Board-level focus on sustainability and citizenship, including more robust disclosures, inclusion of citizenship and sustainability goals in the Fiscal 2024 bonus plan, and other initiatives to oversee citizenship and sustainability issues and impacts. |

• | Our continued Board and Committee evolution. |

| Ralph Lauren 2024 Proxy Statement | 11 |

Proxy Summary | | |

GLOBAL CITIZENSHIP & SUSTAINABILITY

The Company’s purpose to inspire the dream of a better life through authenticity and timeless style guides everything we do. Since our founding 57 years ago, we have created products that are timeless — that are intended to be worn, loved and passed on through generations. Our Global Citizenship & Sustainability strategy, Timeless by Design, is grounded in this philosophy and how we weave our Company’s Purpose throughout our business. We bring this to life through three pillars of our strategy:

• | Create with Intent – Grounded in our enduring philosophy of timelessness, we are reimagining how and what we create and the stories we tell through our products. This includes our work to embed inclusivity in our design processes and incorporate circular design principles, intended to enable our products to live on from generation to generation. |

• | Protect the Environment – We are continuing to shift toward lower resource and impact business practices, in line with our commitments to be better stewards of our environment for future generations. In addition to creating products more responsibly, we have been transitioning to using more renewable energy, diverting waste, reducing pollution from manufacturing, and improving water use and efficiency and management in priority geographies. |

• | Champion Better Lives – Shaping a business that is timeless and has a positive impact for years to come means building relationships that stand the test of time and focusing on causes and actions that simultaneously benefit our teams, our communities, and our Company. That’s why we’re committed to working to help people thrive today and build a brighter future for tomorrow. |

Please see page 43 for more information. Our most recently published Global Citizenship & Sustainability Report covering Fiscal 2023 may be found on our corporate website at https://corporate.ralphlauren.com/citizenship-and-sustainability. Our Global Citizenship & Sustainability Report covering Fiscal 2024 is expected to be released in September 2024. We regularly conduct materiality assessments to help identify and prioritize the citizenship and sustainability issues, risks and opportunities that matter most to our business and stakeholders. Our most recent assessment was conducted in Fiscal 2022 and next assessment will be completed this fiscal year. The information contained in or linked to or from our Global Citizenship & Sustainability Report and on our corporate website is not incorporated by reference into this Proxy Statement and should not be considered part of this Proxy Statement.

12 | Ralph Lauren 2024 Proxy Statement |  |

| | |

General Information Regarding the Annual Meeting of Stockholders and

Proxy Materials

This Proxy Statement is furnished to the stockholders of Ralph Lauren Corporation, a Delaware corporation, in connection with the solicitation by its Board of Directors of proxies for its 2024 Annual Meeting to be held exclusively online via live webcast at www.virtualshareholdermeeting.com/RL2024 on Thursday, August 1, 2024, at 9:00 a.m. Eastern Time or at any adjournments or postponements thereof. A proxy delivered pursuant to this solicitation may be revoked by the person executing the proxy at any time before it is voted by giving written notice to our Secretary, by delivering a later dated proxy, or by voting online during the 2024 Annual Meeting. The address of our principal executive offices is 650 Madison Avenue, New York, New York 10022.

This Proxy Statement, the Annual Report on Form 10-K for the fiscal year ended March 30, 2024, and the Notice of Annual Meeting will be made available to our stockholders on our website, http://investor.ralphlauren.com, on or about June 21, 2024, and a full printed set of the proxy materials will be made available on request.

| Ralph Lauren 2024 Proxy Statement | 13 |

| | |

Our Board is presently divided into two classes, with all directors being elected annually.

Pursuant to our Amended and Restated Certificate of Incorporation, three Class A Directors will be elected by the holders of Class A Common Stock and nine Class B Directors will be elected by the holders of Class B Common Stock, each to serve until the 2025 Annual Meeting of Stockholders and until his or her successor is elected and qualified.

Over the last few years, the Board has undergone significant evolution, resulting in broadened diversity of backgrounds, skills and experiences, in a lower average tenure, and younger average age. In the past few years, a number of directors joined the Board with key experiences and attributes, such as individuals with experience in digital and technology, entertainment, international sales and operations, corporate citizenship, sustainability, regulatory governance, government affairs, and finance. Additionally, one of our long-tenured directors is not standing for re-election at our 2024 Annual Meeting. Linda Findley, Hubert Joly, and Darren Walker have been nominated for election as Class A Directors. Ralph Lauren, Patrice Louvet, David Lauren, Angela Ahrendts, Frank A. Bennack, Jr., Debra Cupp, Michael A. George, Valerie Jarrett, and Wei Zhang have been nominated for election as Class B Directors.

In Fiscal 2017, we appointed our first formal Lead Independent Director to provide strong, independent leadership for the Board and serve as a liaison between our Board and management. In Fiscal 2022, the Board updated the Lead Independent Director role and approved the appointment of Hubert Joly to serve as the new Lead Independent Director, which was effective following Mr. Joly’s re-election as a director at the 2021 Annual Meeting of Stockholders. Mr. Joly brings extensive experience and proven leadership to the role as one of our longer-tenured directors and prior Chair of our Finance Committee. The Lead Independent Director’s responsibilities include, among other things, serving as liaison between the Chairman and the independent directors, serving as a point of contact upon request for shareholders wishing to communicate with the Board, leading the annual performance evaluation of the Board, leading the annual performance review of the CEO, reviewing with the Board succession planning for the CEO and other key management positions, and playing an increased role in crisis management oversight. Mr. Joly regularly joins each Committee meeting in his role as Lead Independent Director. This role is consistent with good governance practices for lead independent directors, and positively impacts the Board’s operations and decision-making. For more information on the directors, please see “Director Nominees” on page 4, “Board of Directors Effectiveness” on page 34, and “Diversity and Director Nominating Procedures” on page 40.

|

VOTING RECOMMENDATION Our Board recommends a vote “FOR” each nominee as a director to hold office until the 2025 Annual Meeting of Stockholders and until his or her successor is elected qualified. |

| Ralph Lauren 2024 Proxy Statement | 15 |

Proposal 1 | | |

We know of no reason why any nominee would be unable or unwilling to serve. If any nominee becomes unable or unwilling to serve for any reason, our Board, based on the recommendation of the Nominating Committee, may either reduce the number of directors or designate a substitute nominee. If a substitute nominee is designated, the persons named in the enclosed proxy will vote all proxies that would otherwise be voted for the named nominee or nominees for the election of such substitute nominee or nominees.

16 | Ralph Lauren 2024 Proxy Statement |  |

Proposal 1 | | |

| | | Linda Findley |

| | AGE: 51 | ||

| | Ms. Findley has been a director of the Company since August 2018. Ms. Findley most recently served as the President, Chief Executive Officer of Blue Apron Holdings, Inc. (“Blue Apron”) from 2019 until 2024. Prior to that, she served as COO of Etsy, Inc. (“Etsy”), where she oversaw product, design, marketing, and customer engagement and acquisition. Prior to Etsy, Ms. Findley was COO of Evernote, where she oversaw worldwide operations and led cross-functional teams in offices across 10 countries. Previously, she was based out of Hong Kong and led global marketing, business development, and customer service for Alibaba.com. She has also held leadership positions in communications firms including Fleishman-Hillard, Text 100, and Schwartz Communications. Ms. Findley holds a Master’s degree in Journalism from UNC-Chapel Hill and an undergraduate degree in Corporate Communications from Elon University. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Ms. Findley brings to our Board more than 25 years of experience in operations, international marketing, business development, public relations, and customer service. As President and CEO of Blue Apron, she was responsible for the corporate strategy and operations of the business. As COO of Etsy, she oversaw all revenue generating and go to market activities including product management, marketing, design, international expansion, and branding/communications. As COO of Evernote, she oversaw worldwide operations that drove revenue and global growth and led cross-functional teams in offices across 10 countries. With a strong emphasis on global growth, Ms. Findley’s work at Etsy included growth across North America, Asia, Europe, Africa, Latin America, and Russia. She drives strategies and programs that balance global efficiency with local teams. These programs drove both user-growth and monetization strategies, as well as scalable customer experience management to maintain brand and positive user engagement. |

| | | Hubert Joly |

| | AGE: 64 | ||

| | Mr. Joly has been a director of the Company since June 2009 and has served as the Lead Independent Director of the Board since his election at the 2021 Annual Meeting. He is the former Chairman and Chief Executive Officer of Best Buy Co., Inc. (“Best Buy”) where he served from 2012 to 2020. In addition, Mr. Joly is currently a member of the Board of Directors of Johnson & Johnson, a public company, a senior lecturer at Harvard Business School, and a member of the board of trustees of the Minneapolis Institute of Art and the New York Public Library. Previously, he served as President and Chief Executive Officer of Carlson from 2008 to 2012, after he joined Carlson in 2004 as President and Chief Executive Officer of Carlson Wagonlit Travel. He also previously served as Executive Vice President, American Assets at Vivendi Universal from 2002 to 2004 and in various other positions at Vivendi Universal since 1999. He previously served on the boards of Carlson, The Rezidor Hotel Group, Carlson Wagonlit Travel, and the World Travel and Tourism Council. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. Joly brings to our Board extensive management and leadership experience obtained as Chairman and Chief Executive Officer of Best Buy, as a director of Johnson & Johnson, as a member of the faculty at Harvard Business School, and formerly as President and Chief Executive Officer of Carlson and Carlson Wagonlit Travel. His positions give him critical insights into the issues facing a large international corporation, as well as unique perspective on issues and opportunities facing a large multi-channel retailer. Based on his current and past positions at Best Buy, Johnson & Johnson, Harvard Business School, Carlson, Carlson Wagonlit Travel, Vivendi Universal, Electronic Data Systems, and McKinsey & Company, Mr. Joly possesses a deep understanding of international issues affecting us and he provides our Board with valuable insight in the areas of leadership, governance, finance, financial reporting, and strategic planning. |

| Ralph Lauren 2024 Proxy Statement | 17 |

Proposal 1 | | |

| | | Darren Walker |

| | AGE: 64 | ||

| | Mr. Walker has been a director of the Company since July 2020. Mr. Walker has served since 2013 as president of the Ford Foundation (“Ford”), one of the world’s largest foundations with an endowment of $16 billion. He is also the co-founder and chair of the US Impact Investing Alliance, and serves as a member of the board of directors of PepsiCo, Inc., a public company, Bloomberg, Inc., and Carnegie Hall, National Gallery of Art, Lincoln Center for the Performing Arts, Friends of the High Line, and Friends of Art & Preservation in Embassies. Before joining Ford, Mr. Walker was vice president at the Rockefeller Foundation, overseeing global and domestic programs, and COO of the Abyssinian Development Corporation—Harlem’s largest community development organization. Earlier, he had a decade-long career in finance at UBS and with the law firm Cleary Gottlieb Steen & Hamilton. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. Walker brings to our Board insight into the role of business in society gained through his role as President of Ford and leadership in many nonprofit and philanthropic organizations. Through his experience with an international network of diverse social and community initiatives, he provides the Board with a unique perspective on human capital management and talent development and insights on sustainability and public policy matters that are particularly valuable as the Company continues to focus on its sustainability and people and culture goals. |

| | | Ralph Lauren |

| | AGE: 84 | ||

| | Mr. R. Lauren founded our business in 1967 and, for over five decades, has cultivated the iconography of America into a global lifestyle brand. He is currently our Executive Chairman and Chief Creative Officer and has been a director of the Company since prior to our initial public offering in 1997. He had previously been our Chairman and Chief Executive Officer since prior to our initial public offering in 1997 until November 2015. In addition, he was previously a member of our Advisory Board or the Board of Directors of our predecessors since their organization. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. R. Lauren is an internationally recognized fashion designer. His unique role as our Founder and Chief Creative Officer, as well as his experience as our previous Chief Executive Officer, provides our Board with valuable leadership, including in the areas of design, brand management, and marketing. Mr. R. Lauren’s contributions to us since the founding of our business have been instrumental in defining our image and direction. As one of the world’s most innovative design leaders and a fashion icon, his career has spanned over five decades that have resulted in numerous unique tributes for his role within the fashion industry. He is uniquely qualified to bring strategic insight, experience, and in-depth knowledge of our business and the fashion industry to the Board. |

18 | Ralph Lauren 2024 Proxy Statement |  |

Proposal 1 | | |

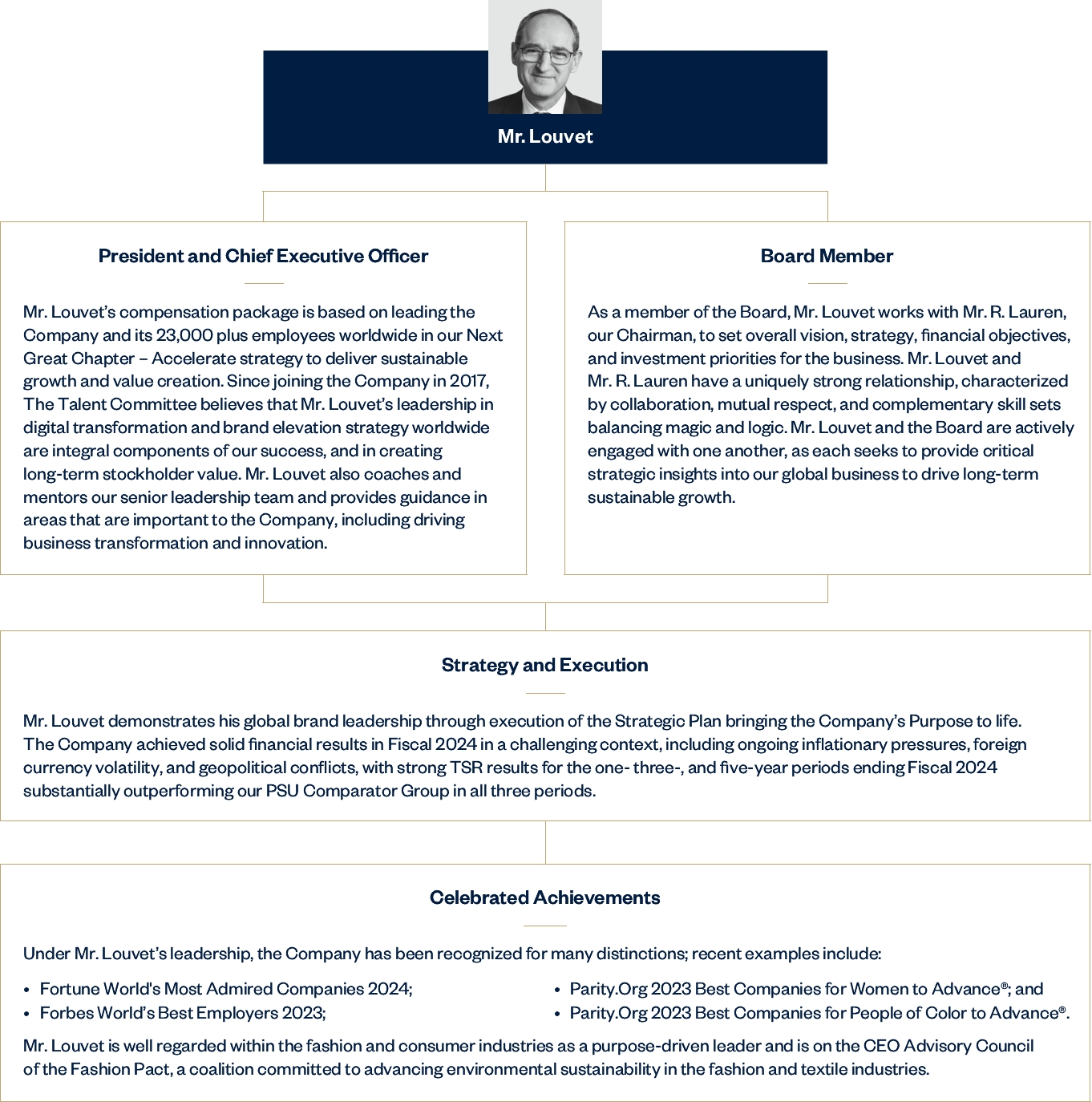

| | | Patrice Louvet |

| | AGE: 59 | ||

| | Mr. Louvet has served as our President and Chief Executive Officer, and a director of the Company since July 2017. Prior to joining the Company, he served as the Group President, Global Beauty, of Procter & Gamble Co. (“P&G”) since February 2015. Prior to that role, Mr. Louvet held successively senior leadership positions at P&G, including the roles of Group President, Global Grooming (Gillette), and President of P&G’s Global Prestige Business. Before he joined P&G, he served as a Naval Officer, Admiral Aide de Camp in the French Navy from 1987 to 1989. Mr. Louvet graduated from École Supérieure de Commerce de Paris and received his M.B.A. from the University of Illinois. Mr. Louvet also serves on the board of trustees of the Hospital of Special Surgery and has served on the board of directors of Danone, a public company, since April 2022. He is also on the CEO Advisory Council of the Fashion Pact, a coalition committed to advancing environmental sustainability in the fashion and textile industries. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. Louvet brings significant leadership and business experience to the Board. His over 25 years in the consumer products industry, with oversight of multiple major global business units, have provided him with a deep understanding of building and growing brands. His position as the Company’s President and Chief Executive Officer provides our Board with valuable perspective into the issues and opportunities facing the Company. Mr. Louvet’s extensive background in managing internationally renowned prestige brands, along with his substantial experience in driving business transformation and innovation, provides our Board with critical strategic insights into our global business. |

| | | David Lauren |

| | AGE: 52 | ||

| | Mr. D. Lauren is our Chief Branding and Innovation Officer, Strategic Advisor to the CEO, and Vice Chairman of the Board since April 2022. He served as our Chief Innovation Officer, Strategic Advisor to the CEO, and Vice Chairman of the Board from October 2016 to March 2022. Prior to that, he served in numerous leadership roles at the Company with responsibility for advertising, marketing, communications and philanthropy. He has been a director of the Company since August 2013. Mr. D. Lauren oversees the Company’s global branding and innovation strategy, processes, and capabilities to drive its brand strength and financial performance across all channels. He has been instrumental in growing the Company’s global digital commerce business and pioneering our technology initiatives. Mr. D. Lauren is also the President of The Ralph Lauren Corporate Foundation and serves on the Board of Trustees of New York-Presbyterian Hospital. Before joining the Company in 2000, he was Editor-In-Chief and President of Swing, a general interest publication for Generation X. Mr. D. Lauren is the son of Mr. R. Lauren. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. D. Lauren brings strong leadership and business experience to our Board. He has been instrumental in the development of the Company’s digital commerce business and the use of innovative marketing to build the Company’s global fashion image as it has expanded internationally. Mr. D. Lauren has been recognized as a leader on the use of new technologies in retail marketing and on using digital platforms to market luxury brands. His in-depth knowledge of these areas and his current position as our Chief Branding and Innovation Officer and Vice Chairman of the Board provides our Board with valuable insight and perspective into our brand development, global digital, digital commerce, and technology initiatives. |

| Ralph Lauren 2024 Proxy Statement | 19 |

Proposal 1 | | |

| | | Angela Ahrendts |

| | AGE: 64 | ||

| | Ms. Ahrendts has been a director of the Company since August 2018. She most recently served as the Senior Vice President, Retail of Apple Inc. (“Apple”) from May 2014 through April 2019. Prior to Apple, Ms. Ahrendts joined Burberry Group plc in January 2006 where she served as a director and Chief Executive Officer beginning in July 2006. She also previously served as Executive Vice President at Liz Claiborne, Inc., as President of Donna Karan International, Inc., and as a member of the United Kingdom’s Prime Minister’s Business Advisory Council. Ms. Ahrendts currently serves on the board of directors of Airbnb, Inc. and WPP plc (where she is the Senior Independent Director), each a public company, and is Senior Operating Adviser at SKKY Partners. She is also on the non-profit Boards of charity: water, The HOW Institute for Society.; and a member of Paul Polman’s Imagine CEO Circle. In January 2021 she became Chair of the Board, Save the Children International. Angela is also a member of the Global Leadership Council of the Oxford University Saïd Business School and the BritishAmerican Business Advisory Board. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Ms. Ahrendts brings to our Board substantial business and leadership experience. Her most recent position as Apple’s Senior Vice President, Retail and Online Stores, and her prior positions at multiple major fashion and apparel companies, such as Burberry, a luxury fashion company, Liz Claiborne, and Donna Karan, give her extensive experience with strategy, real estate and development, operations of physical stores, online stores and contact centers, as well as profound insights into the opportunities and challenges facing our industry. Her extensive background in guiding the retail strategy of renowned international brands, as well as her proven leadership track record in driving successful brand and business transformations, enable her to provide our Board with critical perspective and insight on business, operational, and strategic issues facing the Company. |

| | | Frank A. Bennack, Jr. |

| | AGE: 91 | ||

| | Mr. Bennack has been a director of the Company since January 1998 and served as Lead Independent Director of our Board from Fiscal 2017 until the 2021 Annual Meeting. He is Executive Vice Chairman of The Hearst Corporation (“Hearst”) and served as Hearst’s Chief Executive Officer from 1979 to 2002 and then again from June 2008 to June 2013. Mr. Bennack has been the Chairman of the executive committee and Executive Vice Chairman of the board of directors of Hearst since 2002. He serves on the board and is Chairman Emeritus of Lincoln Center for the Performing Arts, Chairman Emeritus of the New York-Presbyterian Hospital, Chairman of The Paley Center for Media, and a Managing Director of the Metropolitan Opera. He has previously served on the boards of Hearst-Argyle Television, Inc., Wyeth Corporation, and JPMorgan Chase & Co. The Board has determined that Mr. Bennack is an audit committee financial expert. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. Bennack brings to our Board a distinguished career and extensive business experience as Executive Vice Chairman of Hearst, one of the nation’s largest private companies engaged in a broad range of publishing, broadcasting, cable networking, financial and medical data services, and diversified communications activities. His current position as Hearst’s Executive Vice Chairman and previous position as Chief Executive Officer gives him critical insights into the operational issues facing a large corporation and provides our Board with valuable experience in the areas of finance, financial reporting, and strategic planning. As a result of his current and past service as a member of the boards of other various public companies and non-profit organizations, he provides our Board with perspective with respect to governance and other important matters that come before our Board. Mr. Bennack has been a member of our Board since 1998, and therefore, his extensive knowledge of our business is a valuable aspect of his service on our Board. |

20 | Ralph Lauren 2024 Proxy Statement |  |

Proposal 1 | | |

| | | Debra Cupp |

| | AGE: 53 | ||

| | Ms. Cupp has been a director of our Company since August 2022. Ms. Cupp is currently the President of Microsoft North America, a division of Microsoft Corporation, a global technology company. Ms. Cupp leads a significant business responsible for the sales strategy, execution, and revenue growth for the Microsoft US and Canada business which spans enterprise, public sector, small and medium businesses, services, and partner communities. Previously, Ms. Cupp was Corporate Vice President of Worldwide Enterprise and Commercial Industries where she was responsible for the development and execution of Microsoft’s strategy and go-to-market approach. Prior to joining Microsoft in late 2017, Ms. Cupp spent 6 years at SAP, serving most recently as the Senior Vice President and Managing Director of Success Factors for North America. In this position, she was responsible for leading the HR business by driving sales and go-to-market strategies, as well as overseeing operations for the field sales organization. Ms. Cupp also serves on the Board of Directors for Avanade, a private company and the leading provider of innovative digital and cloud services, business solutions, and design-led experiences on the Microsoft ecosystem. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Ms. Cupp brings extensive cross-industry and leadership experience to our Board. Her experience working with large enterprise organizations and their digital transformation journeys enables her to provide unique and valuable insights to our Board about industry and customer trends, and the latest in digital innovation. Ms. Cupp is a collaborative and authentic leader with a proven track record of creating inclusive environments for her employees where progress and growth can be realized. As a veteran in the technology industry, Ms. Cupp has dedicated her career to helping customers of all sizes across public and private sectors use technology as an enabler to achieve their business goals. Her extensive experience, knowledge of these areas, and current position as President of Microsoft North America provides our Board with valuable insight and perspective into strategy and our global technology and digital initiatives. |

| | | Michael A. George |

| | AGE: 62 | ||

| | Mr. George has been a director of the Company since May 2018. Mr. George previously served as the President of QVC, Inc. (“QVC”) from November 2005 through March 2018 and as its Chief Executive Officer since April 2006 through March 2018. In 2018, he was named CEO of QVC’s parent, Liberty Interactive, which was subsequently renamed Qurate Retail, Inc., a position he held through September 2021. Mr. George previously held various positions with Dell, Inc. (“Dell”) from March 2001 to November 2005, most notably as the Chief Marketing Officer and Vice President and General Manager of Dell’s U.S. consumer business. Prior to that, Mr. George was a senior partner at McKinsey & Company and led the firm’s North American Retail Industry Group. Mr. George previously served on the board of directors of Brinker International and Qurate Retail, Inc. and chaired the board of directors of the National Retail Federation, currently serves on the board of directors of Autozone, a public company, and serves on the boards of several not-for-profit organizations. The Board has determined that Mr. George is an audit committee financial expert. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||

| | Mr. George brings to our Board extensive management and business experience through his previous roles of President and Chief Executive Officer of QVC and Chief Executive Officer of Qurate Retail Group. His distinguished career, including his prior experience at Dell and McKinsey, provides him with critical perspective on operational and strategic issues facing the retail industry. As a result of his service as a member of the boards of other public companies and not-for-profit organizations, he also provides our Board with valuable insights regarding governance and other significant matters that come before our Board. |

| Ralph Lauren 2024 Proxy Statement | 21 |

Proposal 1 | | |

| | | Valerie Jarrett |

| | AGE: 67 | ||

| | Ms. Jarrett was appointed as a director of the Company in October 2020. She is a Senior Distinguished Fellow at the University of Chicago Law School, and the Chief Executive Officer of the Obama Foundation. She serves as Board Chair of Civic Nation and Co-Chair of The United State of Women. She also serves on the boards of Sweetgreen and Walgreens Boots Alliance, each a public company, Ariel Investments, the Economic Club of Chicago, and Sesame Street Workshop. The Board has determined that Ms. Jarrett is an audit committee financial expert. | ||

| | EXPERIENCE, QUALIFICATIONS, ATTRIBUTES AND SKILLS | ||