UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended March 30 , 2024

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

Commission File Number: 001-13057

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||

(212 ) 318-7000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| ☑ | Accelerated filer | ☐ | |||||||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant's voting common stock held by non-affiliates of the registrant was approximately $4.530 billion as of September 29, 2023, the last business day of the registrant's most recently completed second fiscal quarter based on the closing price of the common stock on the New York Stock Exchange.

At May 17, 2024, 40,628,150 shares of the registrant's Class A common stock, $.01 par value and 21,881,276 shares of the registrant's Class B common stock, $.01 par value were outstanding.

Part III incorporates by reference information from certain portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission within 120 days after the fiscal year ended March 30, 2024.

RALPH LAUREN CORPORATION

TABLE OF CONTENTS

| Page | ||||||||

| PART I | ||||||||

| PART II | ||||||||

| PART III | ||||||||

| PART IV | ||||||||

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements in this Form 10-K or incorporated by reference into this Form 10-K, in future filings by us with the Securities and Exchange Commission (the "SEC"), in our press releases, and in oral statements made from time to time by representatives of the Company, may contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, statements regarding our current expectations about the Company's future operating results and financial condition, the implementation and results of our strategic plans and initiatives, store openings and closings, capital expenses, our plans regarding our quarterly cash dividend and Class A common stock repurchase programs, our ability to meet citizenship and sustainability goals, and the senior management of the Company. Forward-looking statements are based on current expectations and are indicated by words or phrases such as "aim," "anticipate," "outlook," "estimate," "ensure," "commit," "expect," "project," "believe," "envision," "goal," "target," "can," "will," and similar words or phrases. These forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed in or implied by such forward-looking statements. These risks, uncertainties, and other factors include, among others:

•the loss of key personnel, including Mr. Ralph Lauren, or other changes in our executive and senior management team or to our operating structure, including any potential changes resulting from the execution of our long-term growth strategy, and our ability to effectively transfer knowledge and maintain adequate controls and procedures during periods of transition;

•the potential impact to our business resulting from inflationary pressures, including increases in the costs of raw materials, transportation, wages, healthcare, and other benefit-related costs;

•the impact of economic, political, and other conditions on us, our customers, suppliers, vendors, and lenders, including potential business disruptions related to the Russia-Ukraine and Israel-Hamas wars, militant attacks on cargo vessels in the Red Sea, civil and political unrest, diplomatic tensions between the U.S. and other countries, rising interest rates, and bank failures, among other factors described herein;

•the potential impact to our business resulting from supply chain disruptions, including those caused by capacity constraints, closed factories and/or labor shortages (stemming from pandemic diseases, labor disputes, strikes, or otherwise), scarcity of raw materials, port congestion, and scrutiny or detention of goods produced in certain territories resulting from laws, regulations, or trade restrictions, such as those imposed by the Uyghur Forced Labor Prevention Act ("UFLPA") or the Countering America's Adversaries Through Sanctions Act ("CAATSA"), which could result in shipment approval delays leading to inventory shortages and lost sales, as well as potential shipping delays, inventory shortages, and/or higher freight costs resulting from the recent Red Sea crisis and/or disruptions to major waterways such as the Suez and Panama canals;

•our ability to effectively manage inventory levels and the increasing pressure on our margins in a highly promotional retail environment;

•our exposure to currency exchange rate fluctuations from both a transactional and translational perspective;

•our ability to recruit and retain qualified employees to operate our retail stores, distribution centers, and various corporate functions;

•the impact to our business resulting from a recession or changes in consumers' ability, willingness, or preferences to purchase discretionary items and luxury retail products, which tends to decline during recessionary periods, and our ability to accurately forecast consumer demand, the failure of which could result in either a build-up or shortage of inventory;

•our ability to successfully implement our long-term growth strategy;

•our ability to continue to expand and grow our business internationally and the impact of related changes in our customer, channel, and geographic sales mix as a result, as well as our ability to accelerate growth in certain product categories;

•our ability to open new retail stores and concession shops, as well as enhance and expand our digital footprint and capabilities, all in an effort to expand our direct-to-consumer presence;

•our ability to respond to constantly changing fashion and retail trends and consumer demands in a timely manner, develop products that resonate with our existing customers and attract new customers, and execute marketing and advertising programs that appeal to consumers;

1 | ||||||||

•our ability to competitively price our products and create an acceptable value proposition for consumers;

•our ability to continue to maintain our brand image and reputation and protect our trademarks;

•our ability to achieve our goals regarding citizenship and sustainability practices, including those related to climate change and our human capital and supply chain;

•our ability and the ability of our third-party service providers to secure our respective facilities and systems from, among other things, cybersecurity breaches, acts of vandalism, computer viruses, ransomware, or similar Internet or email events;

•our efforts to successfully enhance, upgrade, and/or transition our global information technology systems and digital commerce platforms;

•the potential impact to our business if any of our distribution centers were to become inoperable or inaccessible;

•the potential impact to our business resulting from pandemic diseases such as COVID-19, including periods of reduced operating hours and capacity limits and/or temporary closure of our stores, distribution centers, and corporate facilities, as well as those of our customers, suppliers, and vendors, and potential changes to consumer behavior, spending levels, and/or shopping preferences, such as willingness to congregate in shopping centers or other populated locations;

•the potential impact on our operations and on our suppliers and customers resulting from man-made or natural disasters, including pandemic diseases, severe weather, geological events, and other catastrophic events, such as terrorist attacks, military conflicts, and other hostilities;

•our ability to achieve anticipated operating enhancements and cost reductions from our restructuring plans, as well as the impact to our business resulting from restructuring-related charges, which may be dilutive to our earnings in the short term;

•the impact to our business resulting from potential costs and obligations related to the early or temporary closure of our stores or termination of our long-term, non-cancellable leases;

•our ability to maintain adequate levels of liquidity to provide for our cash needs, including our debt obligations, tax obligations, capital expenditures, and potential payment of dividends and repurchases of our Class A common stock, as well as the ability of our customers, suppliers, vendors, and lenders to access sources of liquidity to provide for their own cash needs;

•the potential impact to our business resulting from the financial difficulties of certain of our large wholesale customers, which may result in consolidations, liquidations, restructurings, and other ownership changes in the retail industry, as well as other changes in the competitive marketplace, including the introduction of new products or pricing changes by our competitors;

•our ability to access capital markets and maintain compliance with covenants associated with our existing debt instruments;

•a variety of legal, regulatory, tax, political, and economic risks, including risks related to the importation and exportation of products which our operations are currently subject to, or may become subject to as a result of potential changes in legislation, and other risks associated with our international operations, such as compliance with the Foreign Corrupt Practices Act or violations of other anti-bribery and corruption laws prohibiting improper payments, and the burdens of complying with a variety of foreign laws and regulations, including tax laws, trade and labor restrictions, and related laws that may reduce the flexibility of our business;

•the impact to our business resulting from the potential imposition of additional duties, tariffs, taxes, and other charges or barriers to trade, including those resulting from trade developments between the U.S. and China or other countries, and any related impact to global stock markets, as well as our ability to implement mitigating sourcing strategies;

•changes in our tax obligations and effective tax rate due to a variety of factors, including potential changes in U.S. or foreign tax laws and regulations, accounting rules, or the mix and level of earnings by jurisdiction in future periods that are not currently known or anticipated;

•the potential impact to the trading prices of our securities if our operating results, Class A common stock share repurchase activity, and/or cash dividend payments differ from investors' expectations;

•our ability to maintain our credit profile and ratings within the financial community;

2 | ||||||||

•our intention to introduce new products or brands, or enter into or renew alliances;

•changes in the business of, and our relationships with, major wholesale customers and licensing partners; and

•our ability to make strategic acquisitions and successfully integrate the acquired businesses into our existing operations.

These forward-looking statements are based largely on our expectations and judgments and are subject to a number of risks and uncertainties, many of which are unforeseeable and beyond our control. A detailed discussion of significant risk factors that have the potential to cause our actual results to differ materially from our expectations is described in Part I of this Form 10-K under the heading of "Risk Factors." We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

WEBSITE ACCESS TO COMPANY REPORTS AND OTHER INFORMATION

Our investor website is http://investor.ralphlauren.com. We were incorporated in June 1997 under the laws of the State of Delaware. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed with or furnished to the SEC pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934, are available free of charge at our investor website under the caption "SEC Filings" promptly after we electronically file such materials with or furnish such materials to the SEC. All such filings are also available on the SEC's website at https://www.sec.gov. Information relating to corporate governance at Ralph Lauren Corporation, including our Corporate Governance Policies, our Code of Business Conduct and Ethics for all directors, officers, and employees, our Code of Ethics for Principal Executive Officers and Senior Financial Officers, and information concerning our directors, Committees of the Board of Directors, including Committee charters, and transactions involving Ralph Lauren Corporation securities by directors and executive officers, are available at our website under the captions "Corporate Governance" and "SEC Filings." Paper copies of these filings and corporate governance documents are available to stockholders without charge by written request to Investor Relations, Ralph Lauren Corporation, 650 Madison Avenue, New York, New York 10022.

In this Form 10-K, references to "Ralph Lauren," "ourselves," "we," "our," "us," and the "Company" refer to Ralph Lauren Corporation and its subsidiaries, unless the context indicates otherwise. Due to the collaborative and ongoing nature of our relationships with our licensees, such licensees are sometimes referred to in this Form 10-K as "licensing alliances." Our fiscal year ends on the Saturday closest to March 31. All references to "Fiscal 2025" represent the 52-week fiscal year ending March 29, 2025. All references to "Fiscal 2024" represent the 52-week fiscal year ended March 30, 2024. All references to "Fiscal 2023" represent the 52-week fiscal year ended April 1, 2023. All references to "Fiscal 2022" represent the 53-week fiscal year ended April 2, 2022.

PART I

Item 1. Business.

General

Founded in 1967 by Mr. Ralph Lauren, we are a global leader in the design, marketing, and distribution of luxury lifestyle products, including apparel, footwear & accessories, home, fragrances, and hospitality. For more than 50 years, Ralph Lauren has sought to inspire the dream of a better life through authenticity and timeless style. Our long-standing reputation and distinctive image have been developed across a wide range of products, brands, distribution channels, and international markets. We believe that our global reach, breadth of lifestyle product offerings, and multi-channel distribution network are unique among luxury and apparel companies.

We diversify our business by geography (North America, Europe, and Asia, among other regions) and channel of distribution (retail, wholesale, and licensing). This allows us to maintain a dynamic balance as our operating results do not depend solely on the performance of any single geographic area or channel of distribution. We sell directly to consumers through our integrated retail channel, which includes our retail stores, concession-based shop-within-shops, and digital commerce operations around the world. Our wholesale sales are made principally to major department stores, specialty stores, and third-party digital partners around the world, as well as to certain third-party-owned stores to which we have licensed the right to operate in defined geographic territories using our trademarks. In addition, we license to third parties for specified periods the right to access our various trademarks in connection with the licensees' manufacture and sale of designated products, such as certain apparel, eyewear, fragrances, and home furnishings.

3 | ||||||||

We organize our business into the following three reportable segments: North America, Europe, and Asia. In addition to these reportable segments, we also have other non-reportable segments. See "Our Segments" for further discussion of our segment reporting structure.

Our global reach is extensive, as we sell directly to customers throughout the world via our 564 retail stores and 699 concession-based shop-within-shops, as well as through our own digital commerce sites and those of various third-party digital partners. Merchandise is also available through our wholesale distribution channels at over 9,600 doors worldwide, the majority in specialty stores, as well as through the digital commerce sites of many of our wholesale customers. In addition to our directly-operated stores and shops, our international licensing partners operate 195 stores and shops.

We have been controlled by the Lauren family since the founding of our Company. As of March 30, 2024, Mr. R. Lauren, or entities controlled by the Lauren family, held approximately 84% of the voting power of the Company's outstanding common stock.

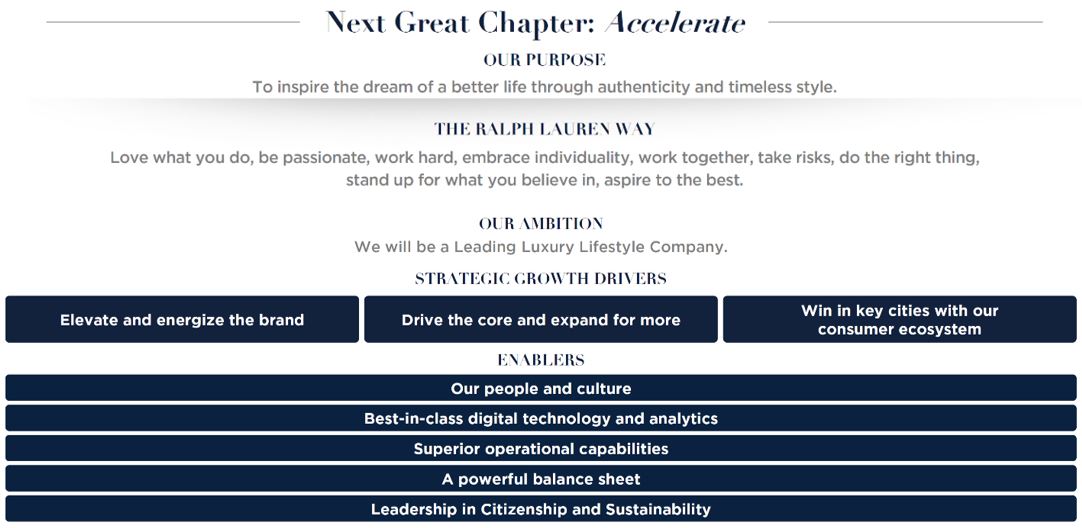

Objectives and Opportunities

Our purpose is to inspire the dream of a better life through authenticity and timeless style. We believe that our size and the global scope of our operations provide us with design, sourcing, and distribution synergies across our business. Our core strengths include a portfolio of luxury lifestyle products spanning five categories: apparel, footwear & accessories, home, fragrances, and hospitality; a well-diversified global multi-channel distribution network; an investment philosophy supported by a strong balance sheet; and an experienced management team. Despite the various risks and uncertainties associated with the current global economic environment, as discussed further in Item 7 — "Management's Discussion and Analysis of Financial Condition and Results of Operations — Global Economic Conditions and Industry Trends," we believe our core strengths will allow us to effectively execute our long-term growth strategy.

An overview of our long-term growth strategy is presented below:

4 | ||||||||

Global Citizenship and Sustainability

At Ralph Lauren, our purpose to inspire the dream of a better life through authenticity and timeless style guides everything we do. From creating iconic products to be worn, loved, and passed on through generations, to preserving the world's natural resources and supporting the people and communities that intersect our business, we continue to challenge ourselves when it comes to positively impacting our world. That is what we call Timeless by Design, our approach to Global Citizenship and Sustainability and our ambition for a better future. We weave our Company's purpose throughout our business through three key pillars:

1.Create with Intent

•Integrated Circularity — Our ethos of timelessness has always guided our creative vision. Today, we continue to deepen this philosophy and apply it to how we are shifting from a linear to circular product economy. With our Live On Promise as our North Star, we are evolving the way our products are designed, made, used, and recirculated. From empowering our designers with circular principles, to using materials that are sustainably sourced or recycled, our approach is designed to lessen our environmental impact.

•Sustainable Materials — Our products are designed to be timeless and worn for generations. With this in mind, we choose our materials thoughtfully to ensure high-quality and durability. We are committed to using materials in ways that not only help our products live on, but also help reduce environmental impact, protect biodiversity and animal welfare, support livelihoods, and improve the traceability of raw materials.

•Design with Intent — Since our founding, Ralph Lauren's design has been inspired by beautiful and interconnected histories, arts, crafts, and cultures. Mindful of our efforts, we are on a journey to evolve from inspiration to collaboration with communities that inspire us. That includes taking meaningful steps to be more inclusive throughout our business, from how we design to how products go to market. At its core, our Design with Intent function is about making sure the products we create and the stories we tell are authentic expressions of heritage, which is foundational to our timeless brand.

•Value Chain for Impact — To build a resilient and responsible supply chain, we are continuing to drive transparency and traceability of our full value chain, to strengthen our relationships with suppliers, and to identify areas for improvement. We work with our suppliers to increase transparency, respect human rights, and promote environmental sustainability.

2.Protect the Environment

•Climate — Significant reductions to global greenhouse gas ("GHG") emissions are collectively needed so we can protect and preserve our planet. That is why we have created an ambitious roadmap with bold near-term and long-term targets to reduce absolute GHG emissions across our operations and supply chain.

•Water Stewardship — We are committed to reducing water consumption across our value chain, as it is critical for communities and ecosystems to thrive and is also an essential resource for our business. We strive to conserve water throughout our operations, support our suppliers to improve their water use efficiency and responsibly manage wastewater, and help improve community access to this resource.

•Waste Management — We are committed to conserving natural resources by managing waste responsibly. We work to minimize waste in our operations and divert waste from landfills and incineration to donation, reuse, and recycling. Our goal is continued improvement as we incorporate "zero waste" principles throughout our business practices.

•Chemical Management — We are committed to monitoring and reducing hazardous chemical use and discharge from our product manufacturing and supply chain.

•Biodiversity — Our business depends on critical resources such as freshwater and essential raw materials, and climate change and biodiversity loss are closely intertwined. As ecosystems and species are increasingly threatened, we are committed to leveraging science to build an in-depth understanding of our current impacts on biodiversity.

5 | ||||||||

3.Champion Better Lives

•Diversity, Equity, and Inclusion — We are committed to creating a culture of diversity, equity, and inclusion ("DE&I") and belonging inside our Company and throughout the communities we serve. Our DE&I strategy consists of five pillars — Talent, Collaboration and Belonging, Learning, Communication and Messaging, and Celebration and Recognition — and is designed to create a culture of belonging, attract and retain diverse talent, and offer opportunities that enable all people to thrive.

•Employee Well-being — The contributions of our employees make Ralph Lauren a vibrant organization. Our people drive our success and we are dedicated to supporting the physical, emotional, social, and financial needs of our employees and their families to help them thrive. To do so, we are focused on employee wellness, engagement, learning and development, and compensation and benefits.

•Community Engagement and Philanthropy — We seek to make the dream of a better life a reality in communities across the globe through contributions and actions that create positive social and environmental impact. The two main drivers of our giving efforts are through the Company's Social Partnerships and Philanthropy department and donations to The Ralph Lauren Corporate Foundation.

•Rights and Empowerment in the Supply Chain — We are committed to conducting our global operations ethically with respect for the dignity of all people who make our products. To support this, we work with suppliers to build capacity, with workers to empower them and with industry partners to collaborate for positive change. Our comprehensive approach integrates risk assessment, monitoring, remediation, capability building, stakeholder engagement, life skills programs and empowerment opportunities for factory workers.

Our most recently published Global Citizenship & Sustainability Report covering Fiscal 2023 may be found on our corporate website at https://corporate.ralphlauren.com/citizenship-and-sustainability. Our Global Citizenship & Sustainability Report covering Fiscal 2024 is expected to be released in September 2024. The content of our sustainability reports is not incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC. See Item 1A — "Risk Factors — Risks Related to Citizenship and Sustainability Issues."

Recent Developments

Next Generation Transformation Project

We are in the early stages of executing a large-scale multi-year global project that is expected to significantly transform the way in which we operate our business and further enable our long-term strategic pivot toward a global direct-to-consumer-oriented model (the "Next Generation Transformation project" or "NGT project"). The NGT project will be completed in phases and involves the redesigning of certain end-to-end processes and the implementation of a suite of information systems on a global scale. Such efforts are expected to result in significant process improvements and the creation of synergies across core areas of operations, including merchandise buying and planning, procurement, inventory management, retail and wholesale operations, and financial planning and reporting, better enabling us to optimize inventory levels and increase the speed to which we can react to changes in consumer demand across markets, among other benefits.

In connection with the preliminary phase of the NGT project, we incurred other charges of $5.1 million during Fiscal 2024, which were recorded within restructuring and other charges, net in the consolidated statements of operations.

Our Brands and Products

Our products, which include apparel and footwear & accessories for men, women, and children, as well as our fragrance and home collections, together with our hospitality portfolio, comprise one of the most widely recognized families of consumer brands. Reflecting a distinctive American perspective, we have been an innovator in aspirational lifestyle branding and believe that, under the direction of internationally renowned designer Mr. Ralph Lauren, we have had a considerable influence on the way people dress and the way that fashion is advertised throughout the world.

We combine consumer insight with our design, marketing, and imaging skills to offer, along with our licensing alliances, broad lifestyle product collections with a unified vision:

•Apparel — Our apparel products include extensive collections of men's, women's, and children's clothing, which are sold under various brand names, including Ralph Lauren Collection, Ralph Lauren Purple Label, Double RL,

6 | ||||||||

Polo Ralph Lauren, Lauren Ralph Lauren, Polo Golf Ralph Lauren, Ralph Lauren Golf, RLX Ralph Lauren, Polo Ralph Lauren Children, and Chaps, among others.

•Footwear & Accessories — Our range of footwear & accessories encompasses men's, women's, and children's, including casual shoes, dress shoes, boots, sneakers, sandals, eyewear, watches, fashion and fine jewelry, scarves, hats, gloves, umbrellas, and leather goods, including handbags, luggage, small leather goods, and belts, which are sold under our Ralph Lauren Collection, Ralph Lauren Purple Label, Double RL, Polo Ralph Lauren, Lauren Ralph Lauren, Polo Ralph Lauren Children, and Chaps brands.

•Fragrance — Our fragrance offerings capture the essence of Ralph Lauren's men's and women's brands with numerous labels, designed to appeal to a variety of audiences. Women's fragrance products are sold under our Ralph Lauren Collection, Woman by Ralph Lauren, Romance Collection, and Ralph Collection. Men's fragrance products are sold under our Ralph's Club, Purple Label, Polo Blue, Polo Red, Polo Green, Polo Black, Polo 67, Safari, Polo Sport, and Big Pony Men's brands. Our fragrance offerings also include Polo Earth, a gender-neutral fragrance designed with sustainability in mind, made of 97% natural-origin ingredients.

•Home — Our home collections, which are sold primarily under our Ralph Lauren, Polo, Lauren by Ralph Lauren, and Chaps brands, reflect the spirit of the Ralph Lauren lifestyle. Our range of home products includes bed and bath lines, furniture, fabric and wall coverings, lighting, dining, floor coverings, and giftware, among others.

•Hospitality — Continuing to engage our consumers with experiential and unique expressions of the brand, our hospitality portfolio is a natural extension of the World of Ralph Lauren as expressed through the culinary arts. Ralph Lauren's global hospitality collection is comprised of our restaurants including The Polo Bar in New York City, RL Restaurant located in Chicago, Ralph's located in Paris, The Bar at Ralph Lauren located in Milan, Ralph's Bar located in Chengdu, China, and our Ralph's Coffee concept in various cities around the world.

Our lifestyle brand image is reinforced by our distribution through our stores and concession-based shop-within-shops, our wholesale channels of distribution, our global digital commerce sites, and our Ralph Lauren restaurants and cafés. We sell our products under the following key brand platforms:

1.Ralph Lauren Luxury — Our Luxury group includes:

Ralph Lauren Collection and Ralph Lauren Purple Label. Ralph Lauren Collection embodies the highest expression of chic, feminine glamour. Each piece is inspired by a vision of timeless luxury and modern elegance and is crafted with unparalleled passion and artistry. For men, Ralph Lauren Purple Label is the ultimate expression of luxury for the modern gentleman. Refined suitings are hand-tailored, including custom made-to-measure suits crafted in the time-honored traditions of Savile Row. Purple Label's sophisticated sportswear is designed with a meticulous attention to detail, capturing the elegance and ease of Ralph Lauren's signature, timeless style. Ralph Lauren Collection and Ralph Lauren Purple Label are made predominantly in Italy with the utmost attention to detail and quality and are available in select Ralph Lauren stores around the world, an exclusive selection of the finest specialty stores, and online at our Ralph Lauren digital commerce sites, including RalphLauren.com.

Double RL. Named after Ralph Lauren's working cattle ranch in Colorado, Double RL is a tribute to America's pioneering spirit and tradition of rugged independence. The foundation of Double RL lies in timeless wardrobe staples for men and women, including authentic American made selvedge denim, military-grade chinos, tube-knit t-shirts, thermals, and flannels. Beyond these iconic styles are added seasonal vintage-inspired collections, along with a full collection of footwear & accessories, including quality belts, bags, and leather goods. Double RL is available at Double RL stores, at select Ralph Lauren stores, and an exclusive selection of the finest specialty stores around the world, as well as online at our Ralph Lauren digital commerce sites, including RalphLauren.com.

Ralph Lauren Home. Ralph Lauren Home represents a full expression of modern luxury — style is a life well-lived. Based on an immersive design ethos, the collection includes furniture, lighting, bed and bath linens, tabletop, decorative accessories and gifts, as well as fabric, wallcoverings, and floorcoverings. Each piece is crafted with the greatest attention to detail. Ralph Lauren Home offers exclusive luxury goods at select Ralph Lauren stores and select wholesale partners, home specialty stores, trade showrooms, and online at our Ralph Lauren digital commerce site, RalphLauren.com.

7 | ||||||||

Ralph Lauren Watches and Jewelry. We offer a premier collection of Swiss-made timepieces, which embody Ralph Lauren's passion for impeccable quality and exquisite design. We also offer premium collections of jewelry, which capture the glamour and craftsmanship of Ralph Lauren's most luxurious designs, from everyday collections to the most refined and precious materials. Ralph Lauren watches and jewelry are available online at RalphLauren.com, at select Ralph Lauren stores, and a few of the finest watch and jewelry retailers around the world.

2.Polo Ralph Lauren — The Polo Ralph Lauren group includes:

Polo Ralph Lauren. Men's Polo combines Ivy League classics and time-honored English haberdashery with downtown styles and all-American sporting looks in sportswear and tailored clothing. Women's Polo represents the epitome of classic and iconic American style with a modern and cool twist. Polo's signature aesthetic includes our renowned polo player logo. Polo Sport reflects the active lifestyle and youthful energy of Polo’s sporting roots through Men's and Women's activewear. Men's and Women's Polo apparel and footwear & accessories are available in Ralph Lauren stores around the world, better department and specialty stores, and online at our Ralph Lauren digital commerce sites, including RalphLauren.com.

Polo Ralph Lauren Children. Polo Ralph Lauren Children is designed to reflect the timeless heritage and modern spirit of Ralph Lauren's collections for men and women. Signature classics include iconic polo knit shirts and luxurious cashmere cable-knit sweaters. Polo Ralph Lauren Children is available in a full range of sizes, from baby to girls 2-16 and boys 2-20. Polo Ralph Lauren Children can be found in select Ralph Lauren stores around the world, better department stores, and online at our Ralph Lauren digital commerce sites, including RalphLauren.com, as well as certain of our retail partners' digital commerce sites.

RLX Ralph Lauren. RLX is the leading edge of Ralph Lauren's performance and activewear. Comprised of functional apparel that address the performance needs of a modern active lifestyle, RLX includes men's and women's apparel and accessories that represent Ralph Lauren's belief that things that are purposefully designed and made of the highest quality achieve a timeless elegance.

Polo Golf Ralph Lauren, Ralph Lauren Golf, and RLX Ralph Lauren Golf. Tested and worn by top-ranked professional golfers, Polo Golf Ralph Lauren, Ralph Lauren Golf, and RLX Ralph Lauren Golf for men and women define excellence in the world of golf. With a sharpened focus on the needs of the modern player but rooted in the rich design tradition of Ralph Lauren, the Golf collections combine state-of-the-art performance wear with luxurious finishing touches. Our Golf collections are available in select Ralph Lauren stores, exclusive private clubs and resorts, and online at RalphLauren.com.

Pink Pony. The Pink Pony campaign is our worldwide initiative in the fight against cancer. In the U.S., a percentage of sales from Pink Pony products benefit the Pink Pony Fund of The Ralph Lauren Corporate Foundation, which supports cancer-related programs for early diagnosis, education, treatment, and research, and is dedicated to bringing patient navigation and quality cancer care to medically underserved communities. Internationally, a network of local cancer charities around the world benefit from the sale of Pink Pony products. Pink Pony consists of dual gender sportswear and accessories. Pink Pony items feature our iconic pink polo player — a symbol of our commitment to the fight against cancer. Pink Pony is available at select Ralph Lauren stores and online at our Ralph Lauren digital commerce sites, including RalphLauren.com. Pink Pony is also available at select Macy's stores and online at Macys.com.

3.Lauren Ralph Lauren — Our Lauren group includes:

Lauren Ralph Lauren. Lauren for women combines aspirational timeless style with modern femininity in a lifestyle collection of sportswear, denim, and dresses, as well as footwear & accessories. Lauren for women is available in select department stores around the world and online at select digital commerce sites, including RalphLauren.com.

Lauren Home. Lauren Home collection includes accessibly-priced, timeless bath and bedding collections, as well as fabric and wall coverings, lighting, dining, and floor coverings, among others. The collection is built upon an assortment of essentials that is designed to be mixed with seasonal updates, all rooted in the brand's classic style.

4.Chaps — Chaps celebrates real American style, delivering classic collections updated for modern lifestyles for men, women, children and home. The modern lifestyle collection offers versatile sportswear, workday essentials, tailored clothing, and occasion dresses that are wearable from season to season. Chaps is available in select department stores and retail partners' digital commerce sites across the U.S., Canada, and Mexico.

8 | ||||||||

Our Segments

We organize our business into the following three reportable segments:

•North America — Our North America segment, representing approximately 44% of our Fiscal 2024 net revenues, primarily consists of sales of our Ralph Lauren branded apparel, footwear & accessories, home, and related products made through our retail and wholesale businesses primarily in the U.S. and Canada. In North America, our retail business is primarily comprised of our Ralph Lauren stores, our outlet stores, and our digital commerce sites, www.RalphLauren.com and www.RalphLauren.ca. Our wholesale business in North America is comprised primarily of sales to department stores and, to a lesser extent, specialty stores.

•Europe — Our Europe segment, representing approximately 30% of our Fiscal 2024 net revenues, primarily consists of sales of our Ralph Lauren branded apparel, footwear & accessories, home, and related products made through our retail and wholesale businesses in Europe and emerging markets. In Europe, our retail business is primarily comprised of our Ralph Lauren stores, our outlet stores, our concession-based shop-within-shops, and our various digital commerce sites. Our wholesale business in Europe is comprised primarily of a varying mix of sales to both department stores and specialty stores, depending on the country, as well as to various third-party digital and licensee partners.

•Asia — Our Asia segment, representing approximately 24% of our Fiscal 2024 net revenues, primarily consists of sales of our Ralph Lauren branded apparel, footwear & accessories, home, and related products made through our retail and wholesale businesses in Asia, Australia, and New Zealand. Our retail business in Asia is primarily comprised of our Ralph Lauren stores, our outlet stores, our concession-based shop-within-shops, and our various digital commerce sites. In addition, we sell our products online through various third-party digital partner commerce sites. Our wholesale business in Asia is comprised primarily of sales to department stores and various third-party digital and licensee partners.

No operating segments were aggregated to form our reportable segments. In addition to these reportable segments, we also have other non-reportable segments, representing approximately 2% of our Fiscal 2024 net revenues, which primarily consist of Ralph Lauren and Chaps branded royalty revenues earned through our global licensing alliances. In addition, prior to its disposition at the end of our first quarter of Fiscal 2022, our other non-reportable segments also included sales of Club Monaco branded products made through our retail and wholesale businesses in the U.S., Canada, and Europe, and our licensing alliances in Asia. See Note 9 to the accompanying consolidated financial statements for additional discussion regarding the disposition of our former Club Monaco business, as well as the transition of our Chaps business to a fully licensed business model.

This segment structure is consistent with how we establish our overall business strategy, allocate resources, and assess performance of our Company.

Approximately 55% of our Fiscal 2024 net revenues were earned outside of the U.S. See Note 20 to the accompanying consolidated financial statements for a summary of net revenues and operating income by segment, as well as net revenues and long-lived assets by geographic location.

Our Retail Business

Our retail business sells directly to customers throughout the world via our 564 retail stores and 699 concession-based shop-within-shops, totaling approximately 4.2 million and 0.7 million square feet, respectively, as well as through our own digital commerce sites and those of various third-party digital partners. We operate our business using a global omni-channel retailing strategy that seeks to deliver an integrated shopping experience with a consistent message of our brands and products to our customers, regardless of whether they are shopping for our products in physical stores or online. We also continue to scale and expand our Connected Retail capabilities to enhance the consumer experience, which include virtual selling appointments, Endless Aisle, Buy Online-Ship from Store, Buy Online-Pick Up in Store, and mobile checkout and contactless payments, among other capabilities.

Ralph Lauren Stores

Our Ralph Lauren stores feature a broad range of apparel, footwear & accessories, watch and jewelry, fragrance, and home product assortments in an atmosphere reflecting the distinctive attitude and image of the Ralph Lauren, Polo, and Double RL brands, including exclusive merchandise that is not sold in department stores. During Fiscal 2024, we opened 34 new Ralph

9 | ||||||||

Lauren stores and closed 11 stores. Our Ralph Lauren stores are primarily situated in major upscale street locations and upscale regional malls, generally in large urban markets.

The following table presents the number of Ralph Lauren stores by segment as of March 30, 2024:

| Ralph Lauren Stores | ||||||||

| North America | 50 | |||||||

| Europe | 44 | |||||||

| Asia | 138 | |||||||

| Total | 232 | |||||||

Our 9 flagship Ralph Lauren regional store locations showcase our iconic styles and products and demonstrate our most refined merchandising techniques. In addition to generating sales of our products, our worldwide Ralph Lauren stores establish, reinforce, and capitalize on the image of our brands. Our Ralph Lauren stores range in size from approximately 400 to 37,900 square feet.

Outlet Stores

We extend our reach to additional consumer groups through our outlet stores worldwide, which are principally located in major outlet centers. Our worldwide outlet stores offer selections of our apparel, footwear & accessories, and fragrances. In addition to these product offerings, certain of our worldwide outlet stores offer watches and home product assortments. During Fiscal 2024, we opened 5 new outlet stores and closed 17 stores.

The following table presents the number of outlet stores by segment as of March 30, 2024:

| Outlet Stores | ||||||||

| North America | 180 | |||||||

| Europe | 59 | |||||||

| Asia | 93 | |||||||

| Total | 332 | |||||||

Our outlet stores range in size from approximately 1,000 to 28,300 square feet. Outlet stores obtain products from our suppliers, our product licensing partners, and our other retail stores and digital commerce operations, and also serve as a secondary distribution channel for our excess and out-of-season products.

Concession-based Shop-within-Shops

The terms of trade for shop-within-shops are largely conducted on a concession basis, whereby inventory continues to be owned by us (not the department store) until ultimate sale to the end consumer. The salespeople involved in the sales transactions are generally our employees and not those of the department store.

The following table presents the number of concession-based shop-within-shops by segment as of March 30, 2024:

| Concession-based Shop-within-Shops | ||||||||

| North America | 1 | |||||||

| Europe | 27 | |||||||

| Asia | 671 | |||||||

Total(a) | 699 | |||||||

(a) Our concession-based shop-within-shops were located at approximately 300 retail locations.

The size of our concession-based shop-within-shops ranges from approximately 100 to 4,700 square feet. We may share in the cost of building out certain of these shop-within-shops with our department store partners.

10 | ||||||||

Directly-Operated Digital Commerce Websites

In addition to our stores, our retail business sells products online in North America, Europe, and Asia through our various directly-operated digital commerce sites, which include www.RalphLauren.com, among others. We continue to expand accessibility to our digital flagships globally while localizing language, currencies, payment methods, product assortments, and content. We also sell our products online through various third-party digital partner commerce sites, primarily in Asia, as well as through our Ralph Lauren app in the U.S.

Our Ralph Lauren digital commerce sites offer our customers access to a broad array of Ralph Lauren, Double RL, Polo, and Lauren apparel, footwear & accessories, watch and jewelry, fragrance, and home product assortments, and reinforce the luxury image of our brands. While investing in digital commerce operations remains a primary focus, it is an extension of our investment in the integrated omni-channel strategy used to operate our overall retail business, in which our digital commerce operations are interdependent with our physical stores.

Our Wholesale Business

Our wholesale business sells our products globally primarily to major department stores, specialty stores, and golf and pro shops, as well as to various third-party digital partners. We have continued to focus on elevating our brand by improving in-store product assortment and presentation, as well as full-price sell-throughs to consumers. As of the end of Fiscal 2024, our wholesale products were sold through over 9,600 doors worldwide, with the majority in specialty stores. Our products are also increasingly being sold through the digital commerce sites of many of our traditional wholesale customers and our third-party digital partners.

The primary product offerings sold through our wholesale channels of distribution include apparel, footwear & accessories, and home product assortments. Our luxury brands, including Ralph Lauren Collection and Ralph Lauren Purple Label, are distributed worldwide through a limited number of premier fashion retailers. In North America, our wholesale business is comprised primarily of sales to department stores, and to a lesser extent, specialty stores. In Europe, our wholesale business is comprised primarily of a varying mix of sales to both department stores and specialty stores, depending on the country, as well as to various third-party digital partners. In Asia, our wholesale business is comprised primarily of sales to department stores and various third-party digital partners. We also distribute our wholesale products to certain licensed stores operated by our partners in Latin America, Asia, Europe, and emerging markets.

We sell most of our excess and out-of-season products through secondary distribution channels worldwide, including our retail outlet stores.

Worldwide Wholesale Distribution Channels

The following table presents by segment the number of wholesale doors in our primary channels of distribution as of March 30, 2024:

| Doors | ||||||||

| North America | 3,329 | |||||||

| Europe | 5,547 | |||||||

| Asia | 802 | |||||||

| Total | 9,678 | |||||||

In addition to our conventional wholesale doors, our products are increasingly being sold through the websites of many of our traditional wholesale customers, as well as those of our third-party digital partners. As of March 30, 2024, our wholesale business served approximately 100 third-party digital partners, primarily in Europe.

We have three key wholesale customers that generate significant sales volume. During Fiscal 2024, sales to our three largest wholesale customers accounted for approximately 13% of our total net revenues. Substantially all sales to our three largest wholesale customers related to our North America segment.

Our products are sold primarily by our own sales forces. Our wholesale business maintains its primary showrooms in New York City, as well as regional showrooms in London, Madrid, Milan, Munich, Paris, and Stockholm. In addition, we utilize virtual showrooms, allowing our customers to experience and discover our product assortments in a retail setting remotely.

11 | ||||||||

Shop-within-Shops. As a critical element of our distribution to department stores, we and our licensing partners utilize shop-within-shops to enhance brand recognition, to permit more complete merchandising of our lines by the department stores, and to differentiate the presentation of our products.

The following table presents by segment the number of shop-within-shops in our primary channels of distribution as of March 30, 2024:

| Shop-within-Shops | ||||||||

| North America | 6,811 | |||||||

| Europe | 7,206 | |||||||

| Asia | 1,068 | |||||||

| Total | 15,085 | |||||||

The size of our shop-within-shops ranges from approximately 65 to 9,200 square feet. Shop-within-shop fixed assets primarily include items such as customized freestanding fixtures, wall cases and components, decorative items, and flooring. We normally share in the cost of building out these shop-within-shops with our wholesale customers.

Replenishment Program. Core products such as knit shirts, chino pants, oxford cloth shirts, select footwear & accessories, and home products can be ordered by our wholesale customers at any time through our replenishment program. We generally ship these products within two to five days of order receipt.

Backlog. We generally receive wholesale orders approximately three to five months prior to the time the products are delivered to customers, except for orders received through our replenishment program which ship within two to five days of order receipt. Our wholesale orders are generally subject to broad cancellation rights. Further, the size of our order backlog depends on several factors, including the timing of the market weeks for our particular lines during which a significant percentage of our orders are received and the timing of shipments, which varies from year-to-year with consideration for holidays, consumer trends, concept plans, and the replenishment program's usage. Consequently, the dollar amount of our backlog as of any date may not be indicative of actual future shipments and therefore is not meaningful in understanding our business as a whole.

Our Licensing Business

Through licensing alliances, we combine our consumer insight, design, and marketing skills with the specific product or geographic competencies of our licensing partners to create and build new businesses. We generally seek out licensing partners who are leaders in their respective markets, contribute the majority of product development costs, provide the operational infrastructure required to support the business, and own the inventory. Our licensing business has been aggregated with other non-reportable segments.

Product Licensing

We grant our product licensees the right to access our various trademarks in connection with the licensees' manufacture and sale of designated products, such as certain apparel, eyewear, fragrances, and home furnishings. Each product licensing partner pays us royalties based upon its sales of our products, generally subject to a minimum royalty requirement for the right to use our trademarks and design services. In addition, our licensing partners may be required to allocate a portion of their revenues to advertising our products and sharing in the creative costs associated with these products. Larger allocations typically are required in connection with launches of new products or in new territories. Our license agreements generally have three to five-year terms and may grant the licensees conditional renewal options.

We work closely with all of our licensing partners to ensure that their products are developed, marketed, and distributed to reach the intended consumer and are presented consistently across product categories to convey the distinctive identity and lifestyle associated with our brands. Virtually all aspects of the design, production quality, packaging, merchandising, distribution, advertising, and promotion of Ralph Lauren products are subject to our prior approval and continuing oversight. We perform a broader range of services for most of our Ralph Lauren Home licensing partners than we do for our other licensing partners, including design, operating showrooms, marketing, and advertising.

12 | ||||||||

The following table lists our largest licensing agreements as of March 30, 2024 for the product categories presented. Except as noted in the table, these product licenses cover North America only.

| Category | Licensed Products | Licensing Partners | ||||||||||||

| Men's Apparel | Underwear and Sleepwear | Hanesbrands, Inc. (includes Japan) | ||||||||||||

| Chaps | 5 Star Apparel LLC (includes South America and South Korea) | |||||||||||||

| Women's Apparel | Outerwear | S. Rothschild & Co., Inc. | ||||||||||||

| Sleepwear | Charles Komar and Sons, Inc. (includes Europe and the Middle East) | |||||||||||||

| Intimates and Sleepwear | Delta Galil (global) | |||||||||||||

| Chaps | 5 Star Apparel LLC (includes South America and South Korea) | |||||||||||||

| Beauty Products | Fragrances, Personal Care | L'Oreal S.A. (global) | ||||||||||||

| Footwear | Men's and Women's Slippers and Children's Footwear | BBC International LLC (global) | ||||||||||||

| Accessories | Eyewear | Luxottica Group S.p.A. (global) | ||||||||||||

| Socks and Hosiery | Renfro Corporation | |||||||||||||

| Home | Utility and Blankets | Keeco (by acquisition of Hollander Sleep & Decor) | ||||||||||||

| Lighting | Visual Comfort of America LLC (global) | |||||||||||||

International Licensing

Our international licensing partners acquire the right to sell, promote, market, and/or distribute various categories of our products in a given geographic area and source products from us, our product licensing partners, and/or independent sources. International licensees' rights may include the right to own and operate retail stores. As of March 30, 2024, our international licensing partners operated 195 stores and shops.

Digital Ecosystem

Investing in our digital ecosystem remains a primary focus and is a key component of our integrated global omni-channel strategy that spans across owned and partnered channels, both physical and digital. Our digital ecosystem is comprised of directly-operated platforms, wholesale partner websites, third-party digital pure players, social commerce, and third-party mixed reality platforms.

Our directly-operated digital commerce sites represent our digital flagships, featuring the most elevated expression of our brands. The strategy for our digital flagships is to deliver distinct and immersive brand experiences, continuously enhance consumer experience, and develop digital content that drives deeper consumer engagement and conversion. We have launched RalphLauren.com flagships across many new markets and introduced additional languages and payment methods globally. We continue to enhance consumer experiences and engagement with greater personalization, enhanced content, and augmented and virtual reality on our digital flagships and Ralph Lauren app. In connection with our long-term growth strategy, we also continue to scale and expand our Connected Retail capabilities to enhance the consumer experience and leverage inventory across direct-to-consumer channels with abilities such as Endless Aisle, Buy Online-Pick up In Store, and same-day delivery.

Our products are also sold through the digital commerce sites of many of our wholesale customers across the globe. With all partners in our ecosystem, we seek to showcase the brand consistently with our values. We collaborate with our key wholesale customers to deliver the right content to the right audience, and leverage consumer insights to develop a holistic, channel-agnostic view of our consumer.

We also sell our products online through various third-party digital pure-play sites to reach a broader audience of consumers, including younger consumers, and amplify our brand messages. On many of these sites, we have created digital shop-in-shop environments with a consistent brand experience, tailored product stories, and an assortment that is carefully curated by our merchants. We also partner closely with our pure-play customers on marketing content and events, as well as optimizing search and other data analyses to drive higher traffic and conversion for our brands.

13 | ||||||||

In connection with our digital commerce operations, we engage consumers through various digital and social media platforms, which are supported through our collaboration with influencers who have an authentic connection to our brand. Ralph Lauren brands are also represented in several mixed reality and gaming platforms, providing digital apparel offerings and virtual brand experiences that attract younger consumers.

Seasonality of Business

Our business is typically affected by seasonal trends, with higher levels of retail sales in our second and third fiscal quarters and higher wholesale sales in our second and fourth fiscal quarters. These trends result primarily from the timing of key vacation travel, back-to-school, and holiday shopping periods impacting our retail business and timing of seasonal wholesale shipments. As a result of changes in our business, consumer spending patterns, and the macroeconomic environment, including those resulting from pandemic diseases and other catastrophic events, historical quarterly operating trends and working capital requirements may not be indicative of our future performance. In addition, fluctuations in sales, operating income (loss), and cash flows in any fiscal quarter may be affected by other events affecting retail sales, such as changes in weather patterns.

Working capital requirements vary throughout the year. Working capital requirements typically increase during the first half of the fiscal year as inventory builds to support peak shipping/selling periods and, accordingly, typically decrease during the second half of the fiscal year as inventory is shipped/sold. Cash provided by operating activities is typically higher in the second half of the fiscal year due to reduced working capital requirements during that period.

Product Design

Our products reflect a timeless and innovative interpretation of American style with a strong international appeal. Our consistent emphasis on new and distinctive design has been an important contributor to the prominence, strength, and reputation of the Ralph Lauren brands.

Our Ralph Lauren products are designed by, and under the direction of, Mr. Ralph Lauren and our design teams. We form design teams around our brands and product categories to develop concepts, themes, and products for each brand and category. Through close collaboration with merchandising, sales, and product management staff, these teams support all of our businesses in order to gain market information and other valuable input.

Marketing and Advertising

Our marketing and advertising programs communicate the themes and images of our brands and are integral to the success of our product offerings. The majority of our advertising programs are created and executed by our in-house creative and advertising agency to ensure consistency of presentation, which are complemented by our marketing experts in each region who help to execute our international strategies.

We create distinctive image advertising for our brands, conveying the particular message of each one within the context of the overall Ralph Lauren aesthetic. Advertisements generally portray a lifestyle rather than a specific item and include a variety of products offered by us and, in some cases, our licensing partners. Our communication campaigns are increasingly being executed through digital and social media platforms to drive further engagement with the younger consumer. With regard to influencers, we believe in fostering long-term relationships with those who have an authentic connection to our brand and influence the areas of culture that matter most to our audiences. We also continue to advertise through print and outdoor media, and, to a lesser extent, through television and cinema.

Our digital advertising programs focus on high impact and innovative digital media outlets, which allow us to convey our key brand messages and lifestyle positioning. We also develop digital editorial initiatives that allow for deeper education and engagement around the Ralph Lauren lifestyle. We deploy these marketing and advertising initiatives through online, mobile, video, email, and social media. Our digital commerce sites present the Ralph Lauren lifestyle online, while offering a broad array of our apparel, footwear & accessories, home, fragrances, and hospitality product lines.

Additionally, we advertise in consumer and trade publications, and participate in cooperative advertising on a shared cost basis with some of our wholesale and licensing partners. We have outdoor advertising placements in key cities as well, focusing on impact and reach. We also provide point-of-sale fixtures and signage to our wholesale customers to enhance the presentation of our products at their retail locations. In addition, when our licensing partners are required to spend an amount equal to a percentage of their licensed product sales on advertising, in certain cases we coordinate the advertising placement on their

14 | ||||||||

behalf. We believe our investments in shop-within-shop environments and retail stores, including our global flagship locations, contribute to and enhance the themes of our brands to consumers.

We also conduct a variety of public relations activities. For example, we typically introduce each of our spring and fall menswear and womenswear collections at press presentations in major cities such as New York City and Milan. Such fashion events, in addition to celebrity dressing occasions, including those related to red carpet events, weddings, and major sporting events, and events hosted in our stores and restaurants, including The Polo Bar in New York City, generate extensive domestic and international media and social coverage.

We are the official outfitter for all on-court officials at the Wimbledon, U.S. Open, and Australian Open tennis tournaments. These tournaments provide worldwide exposure for our brand in a relevant lifestyle environment. We also continue to be the exclusive Official Parade Outfitter for the U.S. Olympic and Paralympic Teams, with the right to manufacture, distribute, advertise, promote, and sell products in the U.S. which replicate the Parade Outfits and associated leisure wear. Most recently, we dressed Team U.S.A. for the Winter Olympic Games in Beijing, China in 2022, and we will be dressing the team for the upcoming Summer Olympic Games in Paris, France in 2024, Winter Olympic Games in Milan, Italy in 2026, and Summer Olympic Games in Los Angeles, U.S. in 2028. As part of our involvement with Team U.S.A., we have established a partnership with athletes serving as brand ambassadors and as the faces of our advertising, marketing, and public relations campaigns. We are also the official apparel outfitter for the Professional Golfers' Association ("PGA") of America, the PGA Championship, the U.S. Golf Association, and the U.S. Ryder Cup Team, as well as a partner of the American Junior Golf Association. We sponsor a roster of professional golfers, including Billy Horschel, Andrea Lee, Doc Redman, Trevor Werbylo, Devon Bling, Smylie Kaufman, Tom Watson, Davis Love III, Jonathan Byrd, and Nick Watney.

We believe our partnerships with such prestigious global athletic events reinforce our brand's sporting heritage in a truly authentic way and serve to connect our Company and brands to our consumers through their individual areas of passion.

Sourcing, Production and Quality

We contract for the manufacture of our products and do not own or operate any production facilities. Over 300 different manufacturers worldwide produce our apparel, footwear & accessories, and home products, with no one manufacturer providing more than 5% of our total products (by dollar value) during Fiscal 2024. We source both finished products and raw materials. Raw materials include fabric, buttons, and other trim. Finished products consist of manufactured and fully assembled products ready for shipment to our customers. In Fiscal 2024, approximately 96% of our products (by dollar value) were produced outside of the U.S., primarily in Asia, Europe, and Latin America, with approximately 19% of our products sourced from Vietnam and 15% from China. See "Import Restrictions and Other Government Regulations," Item 1A — "Risk Factors — Risks Related to Macroeconomic Conditions — Economic conditions could have a negative impact on our major customers, suppliers, vendors, and lenders, which in turn could materially adversely affect our business," and Item 1A — "Risk Factors — Risks Related to our Business and Operations — Our business is subject to risks associated with importing products and the ability of our manufacturers to produce our goods on time and to our specifications."

Most of our businesses must commit to the manufacturing of our garments before we sell finished goods, whether through wholly-owned retail stores or to wholesale customers. We also must commit to the purchase of fabric from mills well in advance of our sales. If we overestimate our primary customers' demand for a particular product or the need for a particular fabric or yarn, we primarily sell the excess products or garments made from such fabric or yarn in our outlet stores or through other secondary distribution channels.

Suppliers operate under the close supervision of our global manufacturing division. All products are produced according to our specifications and standards. Production and quality control staff in Asia and Europe, together with our quality control service providers in the Americas and the Middle East, monitor manufacturing at supplier facilities in order to correct problems prior to shipment of the final product. Procedures have been implemented under our vendor certification and compliance programs so that quality assurance is reviewed early in the production process, allowing merchandise to be received at the distribution facilities and shipped to customers with minimal interruption.

15 | ||||||||

Competition

Competition is very strong in the segments of the fashion and consumer product industries in which we operate. We compete with numerous designers and manufacturers of apparel, footwear, accessories, fragrances, and home products, both domestic and international. We also face increasing competition from companies selling our product categories through the Internet. Some of our competitors may be significantly larger and have substantially greater resources than us. We compete primarily on the basis of timeless style, quality, value, and service, which depend on our ability to:

•anticipate and respond in a timely fashion to changing consumer demands and shopping preferences, including the ever-increasing shift to digital brand engagement, social media communications, and online and cross-channel shopping;

•create and maintain favorable brand recognition, loyalty, and a reputation for quality, including through digital brand engagement and online and social media presence;

•develop and produce innovative, high-quality products in sizes, colors, and styles that appeal to consumers of varying demographics, including age;

•competitively price our products and create a compelling value proposition for consumers, including price increases to mitigate inflationary pressures while simultaneously balancing the risk of lower consumer demand in response to any such price increases;

•provide strong and effective marketing support in several diverse demographic markets, including through digital and social media platforms in order to stay better connected to consumers;

•establish relationships with athletes, musicians, influencers, and other celebrities to promote our brands and products;

•provide attractive, reliable, secure, and user-friendly digital commerce sites;

•adapt to changes in technology, including the successful utilization of data analytics, artificial intelligence, and machine learning;

•obtain sufficient retail floor space and effectively present our products to consumers;

•attract consumer traffic to stores, shop-within-shops, and digital commerce sites;

•source sustainable and traceable raw materials at cost-effective prices;

•anticipate and maintain proper inventory levels;

•ensure product availability and optimize supply chain and distribution efficiencies;

•maintain and grow market share;

•recruit and retain employees to operate our retail stores, distribution centers, and various corporate functions;

•protect our intellectual property; and

•withstand prolonged periods of adverse economic conditions or business disruptions.

See Item 1A — "Risk Factors — Risks Related to our Business and Operations — We face intense competition worldwide in the markets in which we operate."

16 | ||||||||

Distribution

To facilitate global distribution, our products are shipped from manufacturers to a network of distribution centers around the world for inspection, sorting, packing, and delivery to our retail locations and digital commerce and wholesale customers. This network includes the following primary distribution facilities:

| Facility Location | Geographic Region Serviced | Facility Ownership | ||||||||||||

| N. Pendleton Street, High Point, North Carolina | U.S. | Owned | ||||||||||||

| NC Highway 66, High Point, North Carolina | U.S. | Leased | ||||||||||||

| Greensboro, North Carolina | U.S. | Leased | ||||||||||||

| Whitsett, North Carolina | U.S. | Leased | ||||||||||||

| Toronto, Ontario | Canada | Third-party | ||||||||||||

| Parma, Italy | Europe and Latin America | Third-party | ||||||||||||

| Yokohama, Japan | Japan | Third-party | ||||||||||||

| Bugok, South Korea | South Korea | Leased | ||||||||||||

| Tuen Mun, Hong Kong | China and Southeast Asia(a) | Third-party | ||||||||||||

(a)Includes Australia, Cambodia, China, Hong Kong, Macau, Malaysia, New Zealand, the Philippines, Singapore, Taiwan, Thailand, and Vietnam.

All facilities are designed to allow for high-density cube storage and value-added services and utilize unit and carton tracking technology to facilitate process control and inventory management. The distribution network is managed through globally integrated information technology systems.

Information Systems

Our information systems facilitate business processes, consumer experiences, and decision-making support across the Company and our extended ecosystem of manufacturers, vendors, business partners, and customers. Our system applications are connected to support the flow of information across functions, including (i) product design, sourcing, and production; (ii) comprehensive order processing, fulfillment, and distribution; (iii) retail store and digital commerce operations; (iv) marketing and advertising; (v) financial accounting and management reporting; and (vi) human resources.

Our retail operation systems, including point-of-sale registers and merchandising, planning, and inventory management systems, support operational processes within our store network and link with our digital commerce processes to support omni-channel capabilities.

We are continually improving and upgrading our computer systems, services, and software. For example, during Fiscal 2024, we continued the digitalization of our value chain and introduced visual line collaboration. In addition, we continued to enhance our solutions for advanced analytics, furthering our use of artificial intelligence ("AI"), both predictive and generative, and machine learning ("ML") for areas such as forecasting, marketing, and personalization. We also expanded our digital commerce operations to new markets and continued to evolve our consumer experiences, including enhanced search capabilities and redesigning certain of our sites.

See Item 1A — "Risk Factors — Risks Related to Information Systems and Data Security."

See Item 1C — "Cybersecurity" for discussion regarding our cybersecurity risk management and strategy, as well as our cybersecurity governance.

Wholesale Credit Control

We manage our own credit function. We sell our merchandise principally to major department stores, specialty stores, and third-party digital partners, and extend credit based on an evaluation of the wholesale customer's financial capacity and condition, usually without requiring collateral. We monitor credit levels and the financial condition of our wholesale customers on a continuing basis to minimize credit risk. We do not factor or underwrite our accounts receivables, nor do we maintain credit insurance to manage the risk of bad debts. In North America, collection and deduction transactional activities are provided through a third-party service provider. See Item 1A — "Risk Factors — Risks Related to our Business and Operations

17 | ||||||||

— A substantial portion of our revenue is derived from a limited number of large wholesale customers. Our business could be adversely affected as a result of consolidations, liquidations, restructurings, other ownership changes in the retail industry, and/or any financial instability of our large wholesale customers."

Trademarks

We own the RALPH LAUREN, POLO, POLO RALPH LAUREN, and the famous Polo Player Design trademarks in the U.S. and over 120 countries worldwide. Other trademarks that we own include:

•PURPLE LABEL;

•DOUBLE RL;

•RRL & DESIGN;

•RLX;

•RL;

•LAUREN RALPH LAUREN;

•PINK PONY;

•LAUREN;

•RALPH;

•POLO BEAR;

•CHAPS; and

•Various other trademarks.

Mr. Ralph Lauren has the royalty-free right to use as trademarks RALPH LAUREN, DOUBLE RL, and RRL in perpetuity in connection with, among other things, beef and living animals. The trademarks DOUBLE RL and RRL are currently used by the Double RL Company, an entity wholly owned by Mr. R. Lauren. In addition, Mr. R. Lauren has the right to engage in personal projects involving film or theatrical productions (not including or relating to our business) through RRL Productions, Inc., a company wholly owned by Mr. R. Lauren. Any activity by these companies has no direct impact on us.