UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(Mark One)

For the fiscal year ended

For the transition period from ____________ to ____________

Commission File Number:

(Exact name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

(Address of Principal Executive Offices)

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Indicate by check mark whether the registrant has filed all documents and reports required to be fi led by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☒ No ☐

The aggregate market value of the voting and

non-voting common equity held by non-affiliates as of June 30, 2022, the last business day of the registrant’s most recently

completed second fiscal quarter (based upon the closing sale price of the registrant’s common stock as of such date, as

reported by the NYSE American Exchange) was $

The number of shares of the registrant’s

common stock outstanding as of March 15, 2023 was

Documents incorporated by reference: None.

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statement in this report other than statements of historical fact may be a forward-looking statement for purposes of these provisions, including any statements of our plans and objectives for future operations, our future financial condition or economic performance (including known or anticipated trends), and the assumptions underlying or related to the foregoing. Statements that include the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “estimates,” “potential,” “projected,” “intends,” “believes,” or “continue,” or the negative thereof, or other comparable terminology, are forward-looking statements.

Forward-looking statements in this report include statements about the following matters, although this list is not exhaustive:

| ● | the ongoing development of our staking as a services and our ability to continue development of crypto-related business model outside of the United States; |

| ● | the possibility that our new lines of businesses do not perform or operate as anticipated |

| ● | our ability to continue to be in compliance with the development of applicable regulatory regulations in connection with blockchain, digital asset and the crypto-related industry; |

| ● | the impact of certain industry trends on our performance; |

| ● | our ability and our customers’ ability to comply with applicable government and regulatory requirements in the numerous jurisdictions in which we and our customers operate; |

| ● | our cyber vulnerabilities and the anticipated effects on us if a cybersecurity threat or incident were to materialize; |

| ● | general economic, market, political and regulatory conditions, including anticipated changes in these conditions and the impact of such changes on customer demand and other facets of our business; and |

| ● | the impact of any of the foregoing on the prevailing market price and trading volume of our common stock. |

All of our forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those projected or assumed by such forward-looking statements. Among others, the factors that could cause such differences include: the ability to develop a new staking as a service business; acceptance by our customers using our staking as a service business model; the ongoing effects of the COVID-19 pandemic or any other public health emergencies; our ability to raise debt or equity financing when needed on acceptable terms and in desired amounts, or at all; any noncompliance by our customers, including payment obligations; any economic downturn or other financial crisis; any inability to compete effectively with our better capitalized competitors; limited trading volume in our stock; potential changes in the legislative and regulatory environment; the occurrence of any event, change or other circumstances that could affect our ability to continue successful development of our digital assets staking business model; the possibility that we may not succeed in developing its new lines of businesses due to, among other things, changes in the business environment, competition, changes in regulation, or other economic and policy factors; and the possibility that the Company’s new lines of business may be adversely affected by other economic, business, and/or competitive factors. In addition, we operate in a competitive and evolving industry in which new risks emerge from time to time, and it is not possible for us to predict all of the risks it may face, nor can it assess the impact of all factors on its business or the extent to which any factor or combination of factors could cause actual results to differ from expectations. As a result of these and other potential risks and uncertainties, our forward-looking statements should not be relied on or viewed as predictions of future events.

This cautionary statement should be read as qualifying all forward-looking statements included in this report, wherever they appear. We urge you to consider the limitations on, and risks associated with, forward-looking statements and not unduly rely on the accuracy of forward-looking statements. All forward-looking statements and descriptions of risks included in this report are made as of the date hereof based on information available to us as of the date hereof, and except as required by applicable law, we assume no obligation to update any such forward-looking statement or risk for any reason. You should, however, consult the risks and other disclosures described in the reports we file from time to time with the Securities and Exchange Commission (“SEC”) after the date of this report for updated information.

Use of Certain Defined Terms

On March 25, 2022, the Company changed its name from “AeroCentury Corp” to “Mega Matrix Corp.” All references to the “Company,” or “AeroCentury” refers to AeroCentury Corp. together with its consolidated subsidiaries prior to March 25, 2022 and renamed “Mega Matrix Corp.” commencing on March 25, 2022.

Except where the context otherwise requires and for the purposes of this report only, references to:

| ● | the “Company,” “we,” “us,” and “our” refer to the combined business of Mega Matrix Corp., formerly known as AeroCentury Corp, a Delaware corporation and its consolidated subsidiaries, except where expressly noted otherwise or the context otherwise requires; | |

| ● | “Exchange Act” refers the Securities Exchange Act of 1934, as amended; | |

| ● | “JetFleet” refers to the Company’s majority-owned subsidiary JetFleet Management Corp., a California corporation and formerly known as JetFleet Holding corporation.

| |

| ● | “JV Company” refers to the Company’s majority-owned subsidiary Marsprotocol Technologies Pte. Ltd., a Singapore exempt private company limited by shares.

| |

| ● | “SEC” refers to the Securities and Exchange Commission; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; | |

| ● | “SDP” refers to the Company’s wholly-owned subsidiary Saving Digital Pte. Ltd., a Singapore exempt private company limited by shares; and | |

| ● | “StaaS” refers to staking as a service. |

Discrepancies in any table between the amounts identified as total amounts and the sum of the amounts listed therein are due to rounding.

This annual report on Form 10-K includes our audited consolidated financial statements for the fiscal years ended December 31, 2021 and 2022.

Table of Contents

i

PART I

Item 1. Business.

Overview

We are a Delaware corporation incorporated in 1997. Through our emergence from bankruptcy on September 30, 2021, and new investors and management, we became a holding company located in Palo Alto, California, with the following subsidiaries: Mega Metaverse Corp., a California corporation, JetFleet Management Corp, a California corporation and formerly known as JetFleet Holding Corporation, Saving Digital Pte. Ltd., a Singapore corporation, and Marsprotocol, Inc., a Cayman Islands exempted company.

Previously, we have historically provided leasing and financing services to regional airlines worldwide and have been principally engaged in leasing mid-life regional aircraft to customers worldwide under operating leases and finance leases. In addition to leasing activities, we have also sold aircraft from our operating lease portfolio to third parties, including other leasing companies, financial services companies, and airlines. Our operating performance was driven by the composition of its aircraft portfolio, the terms of its leases, and the interest rate of its debt, as well as asset sales.

Through Saving Digital Pte. Ltd, our wholly-owned subsidiary, we are currently engaged in solo-staking and provide proof-of-stake technology tools in Singapore for the Ethereum network. To a lesser extent, we are engaged in the provision of aircraft advisory and management services since September 30, 2021. We are currently exploring other crypto-related business models outside of the United States.

Recent Developments

On October 20, 2021, we set up Mega Metaverse Corp. (“Mega”), a wholly owned subsidiary incorporated in California. In December 2021, we launched our NFT business in the metaverse ecosystem through Mega, and released our first NFT game “Mano” on March 25, 2022. Due to regulatory challenges, the Company decided to suspend the Mano game and the alSpace platform, and on November 4, 2022, we discontinued the Mano game and the alSpace platform.

On January 1, 2022, JetFleet Management Corp. (“JMC”), a wholly-owned subsidiary of JetfFleet Holding Corporation (“JHC”), was merged with and into JHC, with JHC being the surviving entity. As part of the merger, JHC changed its name to JetFleet Management Corp (“Jetfleet”).

Effective March 25, 2022, we changed our name from Aerocentury Corp. to Mega Matrix Corp. (the “Name Change”) to better reflect our expansion into Metaverse and the NFT gaming business. In connection with the Name Change, we changed our ticker symbol from “ACY” to “MTMT” on the NYSE American Exchange, which became effective on March 28, 2022.

On August 31, 2022, we acquired all of the equity interest in Saving Digital Pte, Ltd., a Singapore corporation (“SDP”) with no operations and approximately $3,800 in cash, from our chairman Yucheng Hu for a nominal consideration of $10,000.

On December 7, 2022, we entered into a definitive agreement and plan of merger (the “Merger Agreement”) related to a proposed merger transaction with MarsProtocol Inc., an exempted company incorporated under the laws of the Cayman Islands and our wholly-owned subsidiary (“MTMT Cayman”) for the purpose of redomiciling the corporation from Delaware to the Cayman Islands. The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, we will merge with and into MTMT Cayman (the “Redomicile Merger”), with MTMT Cayman being the surviving company in the Redomicile Merger. Following the Redomicile Merger, MTMT Cayman, together with its subsidiaries, will own and continue to conduct our business in substantially the same manner as is currently being conducted by us and our subsidiaries. The Merger Agreement contains customary closing conditions, including, among others, approval of the Redomicile Merger by our stockholders, the effectiveness of the registration statement on Form F-4 filed by MTMT Cayman related to the Redomicile Merger and receipt of required regulatory approvals. Pursuant to the Merger Agreement, our Board of Directors (the “Board”) may exercise its discretion to terminate the Merger Agreement, and therefore abandon the Redomicile Merger, at any time prior to the effective time, including after the adoption of the Merger Agreement by the Company’s stockholders. As of the date of this report, the Merger Agreement has not been adopted by our stockholders and we have not yet set a date for a special meeting of stockholders seeking such approval.

Effective February 6, 2023, we changed our ticker symbol from “MTMT” to “MPU” on the NYSE American Exchange to more closely align with our MarsProtocol brand for our digital assets staking business.

On March 1, 2023, in connection with a newly formed joint venture, SDP and Bit Digital Singapore Pte. Ltd. (“Bit Digital”) entered into a shareholders’ agreement (the “Shareholders Agreement”) with Marsprotocol Technologies Pte. Ltd. (the “JV Company”), to provide staking technology tools in digital assets through the staking platform “MarsProtocol,” an individual and institutional grade designed staking platform (the “Joint Venture”). Pursuant to the Shareholders Agreement, SDP will own 60% and Bit Digital will own 40% of the JV Company.

Business of the Company

Through SDP, we are engaged in solo-staking and as a provider proof-of-stake technology tools in Singapore for the Ethereum network, and we plan to continue exploring other crypto-related business models outside of the United States. In addition, to a lesser extent, we are engaged in the provision of aircraft advisory and management services since September 30, 2021 through JetFleet.

1

On September 19, 2022, SDP purchased 37 Ether (ETH) for the purpose of exploring Ethereum staking opportunities following the transition by Ethereum on September 15, 2022 from proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism referred to as the “Merge.” Prior to the Merge, Ethereum utilized a PoW validation method for digital asset transactions. Following the Merge, Ethereum shifted to a PoS validation system where validators stake their ETH into a smart contract on Ethereum to serve as collateral that can be destroyed if the validator behaves dishonestly or lazily. The validator (selected randomly) is then responsible for processing the blockchain transactions, storing data and adding new blocks to the blockchain. Validators receives a transaction fee on their staked coins in ETH as a reward for their active participation in the network. To become a validator on Ethereum, a participant must stake 32 ETH. Till quarter ending December 31, 2022, SDP explored Solo-Staking by staking 160 ETH to become five (5) validators to Ethereum to earn ETH rewards and yield. Solo-Staking enables SDP to utilize its ETH treasury to stake on the Ethereum beacon chain and to earn ETH-denominated rewards directly from the Ethereum protocol.

Through MarsProtocol, the Joint Venture will seek to provide non-custodial staking tools whereby users’ private keys are not stored in its database to ensure the safety of its users’ digital assets. As of the date of this report, such services will not be available to U.S. residents.

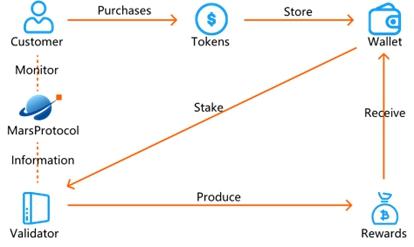

The following diagram summarizes our MarsProtocol StaaS Platform:

The Joint Venture will provide our customers with a right-of-way to access our MarsProtocol platform after they have completed the registration process and the know-your-customer (KYC) verification process. Once registered, the customer can connect their third-party trusted wallet with the nodes to stake their ETH on the Ethereum beacon chain to earn ETH-denominated rewards directly from the Ethereum protocol. Customers can review their transactions and rewards each node produces through the asset dashboard. The Joint Venture or the Marsprotocol platform will not have any access to the Customer’s digital wallet. All decisions to stake will be made by the customer.

Our belief that the ETH and other digital assets that we hold are not securities based on a risk assessment and not a legal standard nor binding on the SEC or any other regulators. If USDC, USDT, or ETH are deemed to be securities under the laws of any U.S. federal, state, or foreign jurisdiction, or in a proceeding in a court of law or otherwise, it may have adverse consequences for such digital asset. See “Item 1A. Risk Factors – Risks Related to our Business – A particular digital asset’s status, such as an ETH, as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty and if a regulator disagrees with our characterization of the ETH and other stable cryptocurrencies, we may be subject to regulatory scrutiny, investigation, fines and penalties, which may adversely affect our business, operating results and financial condition. A determination that an ETH or stable cryptocurrencies is a “security” may adversely affect the value of those ETH, stable cryptocurrencies and our business.”

Competition

Staking as a Services (StaaS) providers offer a convenient and accessible way for users to stake their ETH without having to go through the technical process of running their own staking nodes. These providers typically charge a fee for their services, which can vary depending on the provider and the level of service offered.

The market for Ethereum StaaS is relatively new, but it is already competitive, with several providers vying for market share. Some of the larger competitors in this space include Coinbase, Binance, Kraken, and Bitfinex, which may have better established names, have a broader range of crypto related services, and have larger capital resources.

Competition in the StaaS market is primarily driven by factors such as the fee structure, reliability and uptime of the staking nodes, the user interface and user experience of the platform, and the level of customer support provided. Providers may also differentiate themselves by offering additional features such as staking pools, which allow users to pool their Ethereum with other stakers to increase their chances of earning rewards.

As the Ethereum network continues to evolve and attract more users, it is likely that the StaaS market will become even more competitive, with new providers entering the market and existing providers expanding their offerings to stay ahead of the competition.

2

Ethereum Rewards

From the inception of our solo-staking business in October 2022 through December 31, 2022, we earned an aggregate of 1.5 ETH as rewards.

The following table presents our ETH activities for the year ended December 31, 2022.

| Number of ETH | Amount (1) | |||||||

| Balance at December 31, 2021 | - | $ | - | |||||

| Receipt of ETH as staking reward | 1.5 | 1,800 | ||||||

| Exchange of cash and stable coins into ETH | 300.7 | 396,500 | ||||||

| Borrowings of ETH from a third party | 32.0 | 41,600 | ||||||

| Payment of charges | (0.0 | ) | (100 | ) | ||||

| Impairment of ETH | - | (70,600 | ) | |||||

| Balance at December 31, 2022 | 334.2 | $ | 369,200 | |||||

| (1) | Receipt of digital assets from staking reward are the product of the number of ETH received multiplied by the ETH price obtained from Coinmarketcap, calculated on a daily basis. Sales of digital assets are the actual amount received from sales. |

In addition, through our 51.0% ownership in JetFleet as of December 31, 2022, we will continue to focus on third-party management service contracts for aircraft operations. We believe that as passive investor interest in aircraft assets has increased, there has been increasing demand from aircraft investors for professional third-party aircraft leasing and portfolio management. We intend to take advantage of our reputation, experience and expertise in this aircraft management area. JetFleet conducts all of its operations from its office located at 1818 Gilbreth Rd., Suite 243, Burlingame, California, United States.

Bankruptcy

The Company and its then subsidiaries, JHC and JMC (collectively, the “Debtors”), filed on March 29, 2021, a voluntary petition for bankruptcy protection under Chapter 11 of the U.S. Bankruptcy Code. The filing was made in the U.S. Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) Case No. 21-10636 (the “Chapter 11 Case”). The Company also filed motions with the Bankruptcy Court seeking authorization to continue to operate our business as “debtor-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court.

On August 16, 2021, in the Bankruptcy Court, the Debtors filed unexecuted drafts of its Plan Sponsor Agreement to be entered into between us, Yucheng Hu, TongTong Ma, Qiang Zhang, Yanhua Li, Yiyi Huang, Hao Yang, Jing Li, Yeh Cheng and Yu Wang, and identifying such individuals, collectively, as “Plan Sponsors” (the “Plan Sponsor Agreement”), and related agreements and documents required thereunder (collectively, with the Plan Sponsor Agreement, the “Plan Sponsor Documents”). The Plan Sponsor Documents were intended to cover the transactions contemplated by an investment term sheet entered into with Yucheng Hu and are part of the Debtors’ plan of reorganization as reflected in the Combined Disclosure Statement and Plan filed with the Bankruptcy Court as amended and supplemented from time to time (the “Plan”). On August 31, 2021, the Bankruptcy Court entered an order, Docket No. 0296 (the “Confirmation Order”), confirming the Plan as set forth in the Combined Plan Statement and Plan Supplement.

On September 30, 2021 and pursuant to the Plan Sponsor Agreement, the Company entered into and consummated the transactions contemplated by a Securities Purchase Agreement with the Plan Sponsor, and Yucheng Hu, in the capacity as the representative for the Plan Sponsor thereunder, pursuant to which the Company issued and sold, and the Plan Sponsor purchased, 14,354,635 (adjusted for the Forward Stock Split) shares of our common stock at $0.77 (adjusted for the Forward Stock Split) for each share of common stock for an aggregate purchase price of approximately $11,053,069.

Also on September 30, 2021, and pursuant to the Plan Sponsor Agreement, the Company entered into and consummated the transactions contemplated by a Series A Preferred Stock Purchase Agreement (the “JHC Series A Agreement”) with JHC, pursuant to which JHC issued and sold, and the Company purchased, 104,082 shares of Series A Preferred Stock, no par value, at $19.2156 per share of JHC Series A Preferred Stock, for an aggregate purchase price of $2 million.

Each share of JHC Series A Preferred Stock shall be entitled to one (1) vote on any matter that is submitted to a vote or for the consent of the shareholders of JHC. The JHC Series A Preferred Stock provides the Company with 74.83% voting control over JHC immediately following its issuance.

On January 1, 2022, JMC, a wholly-owned subsidiary of JHC, was merged with and into JHC, with JHC being the surviving entity. As part of the merger, JHC changed its name to JetFleet Management Corp.

Change In Control

As a condition to the closing of the Securities Purchase Agreement, Michael G. Magnusson resigned as President and Chief Executive Officer; Harold M. Lyons resigned as Chief Financial Officer, Treasurer, Senior Vice President, Finance and Secretary; and Michael G. Magnusson, Toni M. Perazzo, Roy E. Hahn, Evan M. Wallach and David P. Wilson resigned as directors of the Company effective October 1, 2021. In connection with the resignations, effective as on October 1, 2021, Yucheng Hu, Florence Ng, Jianan Jiang, Qin Yao and Siyuan Zhu (the “Incoming Directors”) were appointed to serve as members on our Board of Directors. The Incoming Directors were designated by the Plan Sponsor pursuant to the Plan Sponsor Agreement to hold office until our next annual meeting. The Incoming Directors appointed Mr. Hu to serve as Chairman, President and Chief Executive Officer; Ms. Ng to serve as Vice President of Operations; and Qin (Carol) Wang to serve as its Chief Financial Officer, Secretary and Treasurer the Company.

3

Government Regulation

Related to our StaaS Business

U.S Government Regulations

Government regulation of blockchain and digital assets is being actively considered by the United States federal government via a number of agencies and regulatory bodies, as well as similar entities in other countries. State government regulations also may apply to our activities and other activities in which we participate or may participate in the future. Other regulatory bodies are governmental or semi-governmental and have shown an interest in regulating or investigating companies engaged in the blockchain or cryptocurrency business.

Digital assets are assets issued and transferred using distributed ledger or blockchain technology. They are often referred to as crypto assets, cryptocurrency, or digital tokens, among other terminology. Digital assets can be securities, currencies, properties, or commodities, and depending on their characteristics, participants of digital assets must adhere to applicable laws and regulations. For example, the SEC treats some digital assets as “securities,” the Commodity Futures Trading Commission (CFTC) treats some digital assets as “commodities,” and the Internal Revenue Service treats some digital assets as “property.” State regulators oversee digital assets through state money transfer laws, and the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) monitors digital assets for anti-money laundering purposes.

Businesses that are engaged in the transmission and custody of digital assets that is not a security (“non-security digital assets”) such as Bitcoin and ETH, including brokers and custodians, can be subject to U.S. Treasury Department regulations as money services businesses as well as state money transmitter licensing requirements. Non-security digital assets are subject to anti-fraud regulations under federal and state commodity laws, and digital asset derivative instruments are substantively regulated by the U.S. Commodity Futures Trading Commission. Certain jurisdictions, including, among others, New York and a number of countries outside the United States, have developed regulatory requirements specifically for digital assets and companies that transact in them.

In addition, since transactions in non-security digital assets such as Bitcoin and ETH provide a reasonable degree of pseudo anonymity, they are susceptible to misuse for criminal activities, such as money laundering. This misuse, or the perception of such misuse (even if untrue), could lead to greater regulatory oversight of non-security digital asset platforms, and there is the possibility that law enforcement agencies could close such platforms or other related infrastructure with little or no notice and prevent users from accessing or retrieving non-security digital assets via such platforms or infrastructure. For example, in her January 2021 nomination hearing before the Senate Finance Committee, Treasury Secretary Janet Yellen noted that cryptocurrencies have the potential to improve the efficiency of the financial system but that they can be used to finance terrorism, facilitate money laundering, and support malign activities that threaten U.S. national security interests and the integrity of the U.S. and international financial systems. Accordingly, Secretary Yellen expressed her view that federal regulators needed to look closely at how to encourage the use of cryptocurrencies for legitimate activities while curtailing their use for malign and illegal activities. Furthermore, in December 2020, FinCEN proposed a new set of rules for cryptocurrency-based exchanges aimed at reducing the use of cryptocurrencies for money laundering. These proposed rules would require filing reports with FinCEN regarding cryptocurrency transactions in excess of $10,000 and also impose record-keeping requirements for cryptocurrency transactions in excess of $3,000 involving users who manage their own private keys. In January 2021, the Biden Administration issued a memorandum freezing federal rulemaking, including these proposed FinCEN rules, to provide additional time for the Biden Administration to review the rulemaking that had been proposed by the Trump Administration. As a result, it remains unclear whether these proposed rules will take effect.

Digital assets that meet the definition of a “security” under the federal securities laws (“digital assets security”) are regulated by federal securities regulations such as the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Company Act of 1940, and the Investment Advisers Act of 1940.

In addition, businesses that provides a trading platform or exchanges for digital assets that are deemed securities may be required to register with the SEC as a national securities exchange unless an exemption is available. However, if such platform offers trading in digital assets that are not securities, it may have to register as a money-transmission service (MTS) instead of a SEC-regulated national securities exchange. MTSs are money transfer or payment operations that are mainly subject to state regulations, rather than federal regulations but may have to register with FinCEN and face certain reporting requirements.

All of the Company solo-staking and StaaS activities are conducted in Singapore, and the Company does not currently intend to make StaaS available to U.S. residents. In addition, the Company does not consider its holdings of ETH and other digital assets as securities based on a risk assessment, but this is not a legally binding standard recognized by the SEC or other regulators. If USDC, USDT, or ETH are deemed to be securities under the laws of any U.S. federal, state, or foreign jurisdiction, or in a proceeding in a court of law or otherwise, it may have adverse consequences for such digital asset. For additional discussion regarding our belief about the potential risks existing and future regulation pose to our business, see “Item 1A. Risk Factors” in this report.

4

Singapore Government Regulations

Singapore has a robust regulatory framework for financial services, which is overseen by the Monetary Authority of Singapore (“MAS”). The MAS is responsible for ensuring that the financial services industry operates in a safe and sound manner and maintains the stability of the financial system.

In Singapore, based on legal advice received from local counsel, ETH is considered a digital payment token (“DPT”) and regulated under the Payment Services Act 2019 (“PSA”). Currently, the PSA regulates services dealing in DPTs or facilitating the exchange of DPTs. The StaaS business is not considered a regulated activity under the PSA, as it does not involve buying or selling of DPTs or facilitating the exchange of DPTs.

However, the Payment Services (Amendment) Act 2021 (PSAA21) has been passed by Singapore’s parliament and may expand the scope of regulation for DPT services in the future, although it has not yet come into effect.

In terms of Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements, financial institutions in Singapore are required to implement robust measures to prevent money laundering and financing of terrorism. This includes conducting customer due diligence, ongoing monitoring of transactions, and reporting of suspicious transactions to the relevant authorities. The MAS works closely with financial institutions to ensure compliance with AML and KYC requirements, and has the power to impose penalties for non-compliance. As the StaaS business is currently not considered a regulated activity under the PSA, these specific requirements for licensed institutions do not apply to SDP apart from the general duty to report suspicious transactions. However, the regulatory landscape may change with the introduction of the PSAA21 and future amendments.

Related to our Aircraft Management Service

JHC is subject to compliance with federal, state and local government regulations. As a company engaged in international trade, these regulations include the Foreign Corrupt Practices Act, and various export control, money laundering, and anti-terrorism laws and regulations promulgated by the U.S. Department of Commerce and the Department of Treasury.

Intellectual Property

The protection of our technology and intellectual property is an important aspect of our business. We currently rely upon a combination of trademarks, trade secrets, copyrights, nondisclosure contractual commitments, and other legal rights to establish and protect our intellectual property.

As of December 31, 2022, we held one (1) registered trademark and six (6) pending trademark applications in the United States and two (2) in Singapore. We will evaluate our development efforts to assess the existence and patentability of new intellectual property. To the extent that it is feasible, we will file new patent applications with respect to our technology and trademark applications with respect to our brands.

Human Capital Resources

As of March 15, 2023, we had 4 full-time employees, including CEO, CFO, COO and CMO in Singapore. None of our employees are represented by labor unions or covered by collective bargaining agreements. We consider our relationship with our employees to be good.

Corporate Office

Our headquarters are located at 3000 El Camino Real, Bldg. 4, Suite 200, Palo Alto, CA. Our main telephone number is (650) 340-1888.

Other Information

Our website is located at: https://www.megamatrix.io/. We make available on our website our reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). Other than the information expressly set forth in this annual report, the information contained, or referred to, on our website is not part of this annual report. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers, such as us, that file electronically with the SEC.

5

Item 1A. Risk Factors.

An investment in our common stock involves risks. Prior to making a decision about investing in our common stock, you should consider carefully the risks together with all of the other information contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and in our subsequent filings with the SEC. Each of the referenced risks and uncertainties could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities. Additional risks not known to us or that we believe are immaterial may also adversely affect our business, operating results and financial condition and the value of an investment in our securities.

Risks Related to our Business

A particular digital asset’s status, such as an ETH, as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty and if a regulator disagrees with our characterization of the ETH and other stable cryptocurrencies , we may be subject to regulatory scrutiny, investigation, fines and penalties, which may adversely affect our business, operating results and financial condition. A determination that an ETH or stable cryptocurrencies is a “security” may adversely affect the value of those ETH, stable cryptocurrencies and the Company’s business.

The SEC and its staff have taken the position that certain digital assets may fall within the definition of a “security” under U.S. federal securities laws. The legal test for determining whether any given digital asset is a security is a highly complex, fact-driven analysis that may evolve over time, and the outcome is difficult to predict. The Company’s determination that ETH and other stable cryptocurrencies that the Company holds are not securities is a risk-based assessment and not a legal standard or one binding on regulators. The SEC generally does not provide advance guidance or confirmation on the status of any particular digital asset as a security. Furthermore, the SEC’s views in this area have evolved over time and it is difficult to predict the direction or timing of any continuing evolution. It is also possible that a change in the governing administration or the appointment of new SEC commissioners could substantially impact the views of the SEC and its staff. For example, Chair Gary Gensler has repeatedly remarked on the need for further regulatory oversight on crypto assets, crypto trading, and lending platforms by the SEC. Public statements made in the past by senior officials at the SEC have indicated that the SEC does not intend to take the position that Bitcoin or Ethereum are securities (in their current form). In May 2022, the Chair of the U.S. Commodity Futures Trading Commission (the “CFTC”), Rostin Behnam, stated that Bitcoin and Ethereum are commodities. However, in June 2022, Mr. Gensler suggested that Bitcoin is a commodity but did not opine on the status of other crypto assets. In September 2022, Mr. Gensler suggested that he believes a vast majority of cryptocurrencies are securities. However, in March 2023, Mr. Behnam contradicted Mr. Gensler’s position by stating his opinion in front of the Senate Agricultural Committee that Ethereum is a commodity. Such statements by officials at the CFTC and SEC are not official policy statements by these agencies and reflect only the speakers’ views, which are not binding on any agency or court and cannot be generalized to any other crypto asset.

The classification of a digital asset as a security under applicable law has wide-ranging implications for the regulatory obligations that flow from the offer, sale, trading, and clearing of such assets. For example, a digital asset that is a security may generally only be offered or sold pursuant to a registration statement filed with the SEC or in an offering that qualifies for an exemption from registration. Persons that effect transactions in digital assets that are securities may be subject to registration with the SEC as a “broker” or “dealer.” Platforms that bring together purchasers and sellers to trade digital assets that are securities are generally subject to registration as national securities exchanges, or must qualify for an exemption, such as by being operated by a registered broker-dealer as an alternative trading system (“ATS”), in compliance with rules for ATSs. Persons facilitating clearing and settlement of securities may be subject to registration with the SEC as a clearing agency.

In addition, several foreign jurisdictions have taken a broad-based approach to classifying crypto assets as “securities,” while other foreign jurisdictions, such as Switzerland, Malta, and Singapore, have adopted a narrower approach. As a result, certain crypto assets may be deemed to be a “security” under the laws of some jurisdictions but not others. Various foreign jurisdictions may, in the future, adopt additional laws, regulations, or directives that affect the characterization of crypto assets as “securities.”

The Company analyzes whether the ETH and other stable cryptocurrencies that it holds could be deemed to be a “security” under applicable laws. The Company analysis does not constitute a legal standard, but rather represent its management’s assessment regarding the likelihood that a particular digital asset could be deemed a “security” under applicable laws. Regardless of the Company’s conclusions, the Company could be subject to legal or regulatory action in the event the SEC or a court were to determine that ETH and other stable cryptocurrencies that it hold may be deemed a “security” under applicable laws.

There can be no assurances that the Company will properly characterize any given digital asset as a security or non-security or that the SEC, or a court, if the question was presented to it, would agree with our assessment. The Company could be subject to judicial or administrative sanctions for failing to offer or sell digital assets in compliance with the registration requirements, or for acting as a broker or dealer without appropriate registration. Such an action could result in injunctions, cease and desist orders, as well as civil monetary penalties, fines, and disgorgement, criminal liability, and reputational harm. For instance, all transactions in such supported digital asset would have to be registered with the SEC, or conducted in accordance with an exemption from registration, which could severely limit its liquidity, usability and transactability. Further, it could draw negative publicity and a decline in the general acceptance of the digital asset. Also, it may make it difficult for such digital asset to be traded, cleared, and custodied as compared to other digital assets that are not considered to be securities. Due to regulatory challenges, the Company has discontinued the Mano game and the alSpace platform on November 3, 2022. The Company is currently engaging in Solo-Staking in Singapore through SDP and provider of staking technology through the JV Company. Both of these staking activities are conducted in Singapore and StaaS will currently not be made available to U.S. residents. In addition, the Company plans to continue exploring other crypto-related business models outside of the United States.

6

The Company plans to continue to explore other opportunities in the crypto-related business to expand our business model.

Due to regulatory challenges, on November 3, 2022, we have decided to discontinue the Mano game and the alSpace platform. The Company is currently engaging in solo-staking through SDP and a provider of staking technology through the JV Company. Both of these staking activities are conducted in Singapore and StaaS will currently not be made available to U.S. residents. In addition, the Company plans to continue exploring and developing other opportunities in the crypto-related business. However, the Company may not be successful in identifying a new crypto-related business model that is acceptable to the Company, which will adversely affect the Company’s business objective.

Expansion of the Company’s operations into new products, services and technologies, including content categories, is inherently risky and may subject it to additional business, legal, financial and competitive risks.

Historically, the Company’s operations have been focused on third-party management service contracts for aircraft operations. Further expansion of the Company’s operations and its marketplace into additional products and services, such as crypto-related businesses involve numerous risks and challenges, including potential new competition, increased capital requirements and increased marketing spent to achieve customer awareness of these new products and services. Growth into additional content, product and service areas may require changes to the Company’s existing business model and cost structure and modifications to its infrastructure and may expose the Company to new regulatory and legal risks, any of which may require expertise in areas in which the Company has little or no experience. There is no guarantee that the Company will be able to generate sufficient revenue from sales of such products and services to offset the costs of developing, acquiring, managing and monetizing such products and services and the Company’s business may be adversely affected.

If the Company cannot continue to innovate technologically or develop, market and sell new products and services, or enhance existing technology and products and services to meet customer requirements, the Company’s ability to grow our revenue could be impaired.

The Company’s growth largely depends on its ability to innovate and add value to its existing creative platform and to provide its customers and contributors with a scalable, high-performing technology infrastructure that can efficiently and reliably handle increased customer and contributor usage globally, as well as the deployment of new features. For example, PoS business require additional capital and resources. Without improvements to the Company’s technology and infrastructure, our operations might suffer from unanticipated system disruptions, slow performance or unreliable service levels, any of which could negatively affect its reputation and ability to attract and retain customers and contributors. The Company is currently making, and plan to continue making, significant investments to maintain and enhance the technology and infrastructure and to evolve our information processes and computer systems in order to run our business more efficiently and remain competitive. The Company may not achieve the anticipated benefits, significant growth or increased market share from these investments for several years, if at all. If the Company is unable to manage its investments successfully or in a cost-efficient manner, our business and results of operations may be adversely affected.

We rely on systems and services provided by third parties, primarily by Amazon Web Services(AMS), and any failures, errors, defects or disruptions in these systems or services could diminish our brand and reputation, subject us to liability, disrupt our business and adversely affect our operating results and growth prospects. The third-party platforms upon which these systems and software are made available could contain undetected errors.

Our technology infrastructure is critical to the performance of our services and to user satisfaction. We rely on Amazon Web Services(AWS) to provide cloud servers. However, the systems provided by AWS, on which we rely, may not be adequately designed with the necessary reliability and redundancy to avoid performance delays or outages that could be harmful to our business. We cannot assure you that the measures we take, in connection with providing proof-of-stake technology tools, to prevent or hinder cyber-attacks and protect our systems, data and user information and to prevent outages, data or information loss, fraud and to prevent or detect security breaches, including a disaster recovery strategy for server and equipment failure and back-office systems and the use of third parties for certain cybersecurity services, will provide absolute security. As our StaaS platform is new, we may in the future experience, website disruptions, outages and other performance problems due to a variety of factors, including infrastructure changes, human or software errors and capacity constraints. Such disruptions including, but not limited to, unauthorized access to, fraudulent manipulation of, or tampering with our computer systems and technological infrastructure, or those of third parties, could result in a wide range of negative outcomes, each of which could materially adversely affect our business, financial condition, results of operations and prospects.

7

Additionally, our platform or software provided by Tbit Global Limited, may contain errors, bugs, flaws or corrupted data, and these defects may only become apparent after their launch. Furthermore, programming errors, defects and data corruption could disrupt our operations, adversely affect the experience of our users, harm our reputation, cause our users to stop utilizing our services, divert our resources and delay market acceptance of our services, any of which could result in legal liability to us or harm our business, financial condition, results of operations and prospects.

We believe that if our users have a negative experience with our staking service, or if our brand or reputation is negatively affected, users may be less inclined to continue or resume utilizing our StaaS platform or to recommend our services to other potential users. As such, a failure or significant interruption in our service could harm our reputation, business and operating results.

Information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions.

We receive, process, store and use personal information and other customer data. There are numerous federal, state and local laws regarding privacy and the storing, sharing, use, processing, disclosure and protection of personal information and other data. Any failure or perceived failure by us to comply with our privacy policies, our privacy-related obligations to customers or other third parties, or our privacy-related legal obligations, or any compromise of security that results in the unauthorized release or transfer of personally identifiable information or other player data, may result in governmental enforcement actions, litigation or public statements against us by consumer advocacy groups or others and could cause our customers to lose trust in us which could have an adverse impact on our business. The costs of compliance with these types of laws may increase in the future as a result of changes in interpretation or changes in law. Any failure on our part to comply with these types of laws may subject us to significant liabilities.

Third parties we work with may violate applicable laws or our policies, and such violations may also put our customers’ information at risk and could in turn have an adverse impact on our business. We will also be subject to payment card association rules and obligations under each association’s contracts with payment card processors. Under these rules and obligations, if information is compromised, we could be liable to payment card issuers for the associated expense and penalties. If we fail to follow payment card industry security standards, even if no customer information is compromised, we could incur significant fines or experience a significant increase in payment card transaction costs.

Security breaches, computer malware and computer hacking attacks have become more prevalent. Any security breach caused by hacking which involves efforts to gain unauthorized access to information or systems, or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment, and the inadvertent transmission of computer viruses could harm our business. Though it is difficult to determine what harm may directly result from any specific interruption or breach, any failure to maintain performance, reliability, security and availability of our network infrastructure to the satisfaction of our players may harm our reputation and our ability to retain existing players and attract new players.

Because the techniques used to obtain unauthorized access, disable or degrade service, or sabotage systems, change frequently and often are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures.

We are subject to risks related to holding cryptocurrencies and accepting cryptocurrencies as a form of payment.

We accept Bitcoin, ETH or other cryptocurrencies from our customers as a form of payment for our staking services.

Cryptocurrencies are not considered legal tender or backed by any government and have experienced price volatility, technological glitches and various law enforcement and regulatory interventions. The use of cryptocurrency such as Bitcoin has been prohibited or effectively prohibited in some countries. If we fail to comply with any such prohibitions that may be applicable to us, we could face regulatory or other enforcement actions and potential fines and other consequences.

Cryptocurrencies have in the past and may in the future experience periods of extreme volatility. Fluctuations in the value of any cryptocurrencies that we hold may also lead to fluctuations in the value of our common stock. In addition, there is substantial uncertainty regarding the future legal and regulatory requirements relating to cryptocurrency or transactions utilizing cryptocurrency. For instance, governments may in the near future curtail or outlaw the acquisition, use or redemption of cryptocurrencies. In such case, ownership of, holding or trading in cryptocurrencies may then be considered illegal and subject to sanction. These uncertainties, as well as future accounting and tax developments, or other requirements relating to cryptocurrency, could have a material adverse effect on our business.

The value of stablecoins that we hold may be subject to volatility and risk of loss.

As of December 31, 2022, we held approximately $2.97 million in USDC issued by Circle Internet Financial Public Limited Company (“Circle”) and $0.09 million in USDT issued by Tether Limited Inc. (“Tether”). Stablecoins such as USDC are usually backed by the U.S. Dollar and other short-dated U.S. government obligations, and are usually pegged to the U.S. dollar. On March 9, 2023, as a result of the closure of Silicon Valley Bank (“SVB”), Circle announced that $3.3 billion of its roughly $40 billion USDC reserves were held at SVB. As a result, Circle depegged the USDC from its $1.00 peg, trading as low as $0.87. This risk may result in the sell-off of USDC and volatility as to the value of stablecoins, which would expose us to risk of potential loss and could have a material adverse effect on our ability to raise new funding and on our business, financial condition, and results of operations and prospects.

8

We cannot be certain that our StaaS platform and staking services will maintain regulatory approval, and without regulatory approval we may not be able to market and grow our business around the world.

Our StaaS platform and staking services are located in Singapore and are currently not subject to any licensing requirements in Singapore. However, future changes to Singapore’s PSA may introduce new licensing requirements. Any license, permit, approval or finding of suitability may not be granted, granted with delay, revoked, suspended or conditioned at any time. We may be unable to obtain or maintain all necessary registrations, licenses, permits or approvals, and could incur fines or experience delays related to the licensing process which could adversely affect our operations. The regulators in Singapore may refuse to issue or renew a registration or impose conditions which may adversely affect our StaaS business.

While we do not believe that we are required to obtain any license or permit in the United States and/or other jurisdictions, we currently plan to limit our Marsprotocol platform to non-U.S. residents. If it is determined that a license, permit or approval is required in a jurisdiction in which we do not have any license to operate, we will need to obtain such license, permit or approval, or block access from such jurisdiction through IP address filtering. Violations of laws in one jurisdiction could result in disciplinary action and/or fines. Licenses, approvals or findings of suitability may be revoked, suspended or conditioned. In sum, we may not be able to obtain or maintain all necessary registrations, licenses, permits or approvals. The licensing process may result in delays or adversely affect our operations, and our efforts to comply with any new licensing regulations will increase our costs.

We are subject to various laws relating to foreign corrupt practices, the violation of which could adversely affect its operations, reputation, business, prospects, operating results and financial condition.

We are subject to risks associated with doing business outside of the United States, including exposure to complex foreign and U.S. regulations such as the Foreign Corrupt Practices Act (the “FCPA”) and other anti-corruption laws which generally prohibit U.S. companies and their intermediaries from making improper payments to foreign officials for the purpose of obtaining or retaining business. Violations of the FCPA and other anti-corruption laws may result in severe criminal and civil sanctions and other penalties. It may be difficult to oversee the conduct of any contractors, third-party partners, representatives or agents who are not our employees, potentially exposing us to greater risk from their actions. If our employees or agents fail to comply with applicable laws or company policies governing our international operations, we may face legal proceedings and actions which could result in civil penalties, administration actions and criminal sanctions. Any determination that we have violated any anti-corruption laws could have a material adverse impact on our business.

Violations of these laws and regulations could result in significant fines, criminal sanctions against us, our officers or our employees. Additionally, any such violations could materially damage our reputation, brand, international expansion efforts, ability to attract and retain employees and our business, prospects, operating results and financial condition.

Historically, we have dealt with significant amounts of cash in our operations, which have subjected us to various reporting and anti-money laundering regulations. Any violation of anti-money laundering laws or regulations by us could have a material adverse impact on our business.

Risks Related to Ethereum

Risks Associated with Staking on Ethereum 2.0.

The Company has deposited ETH to the Ethereum beacon chain with a view to earning an ETH-denominated return thereon. By running a validator node, the Company will be exposed to the risk of loss of its staked ETH if it fails to operate the node in accordance with applicable protocol rules, as the Company’s digital assets may be “slashed” or inactivity penalties may be applied if the validator node “double signs” or is offline for a prescribed period of time. The Company intends to mitigate this risk by monitoring the staking activities.

9

Speculative and Volatile Nature of ETH.

To date, the Company has deployed a small portion of its capital into ETH. The price of ETH is subject to significant volatility. In addition, there is no guarantee that the Company will be able to sell its ETH at prices quoted on various cryptocurrency trading platforms or at all if it determines to do so. In addition, the supply of ETH is currently controlled by the source code of the Ethereum platform, and there is a risk that the developers of the code and the participants in the Ethereum network could develop and/or adopt new versions of the Ethereum software that significantly increase the supply of ETH in circulation, negatively impacting the trading price of ETH. Any significant decrease in the price of ETH may materially and adversely affect the value of the Company’s securities and, in turn, the Company’s business and financial condition.

The ETH markets are sensitive to new developments, and since volumes are still maturing, any significant changes in market sentiment (by way of sensationalism in the media or otherwise) can induce large swings in volume and subsequent price changes. Such volatility can adversely affect the business and financial condition of the Company.

Momentum pricing typically is associated with growth stocks and other assets whose valuation, as determined by the public, accounts for anticipated future appreciation in value. The Company believes that momentum pricing of ETH has resulted, and may continue to result, in speculation regarding future appreciation in the value of ETH, inflating and making more volatile the value of ETH. As a result, ETH may be more likely to fluctuate in value due to changing investor confidence in future appreciation, which could adversely affect the business and financial condition of the Company.

Underlying Value Risk.

ETH represents a new form of digital value that is still being digested by society. Its underlying value is driven by its utility as a store of value, means of exchange, and unit of account, and notably, the demand for ETH within various use cases of the Ethereum network. Just as oil is priced by the supply and demand of global markets, as a function of its utility to, for instance, power machines and create plastics, so too is ETH priced by the supply and demand of global markets for its own utility within Ethereum’s use cases.

Development of the Ethereum Platform.

The Ethereum platform is an open-source project being developed by a network of software developers, including Vitalik Buterin, a founder of Ethereum. Mr. Buterin or another key participant within the core development group could cease to be involved with the Ethereum platform. Factions could form within the Ethereum community, resulting in different and competing versions of Ethereum being adopted by network participants. Furthermore, network participants running the Ethereum software may choose not to update their versions of the software, resulting in different versions of the Ethereum software running on the network. Any of the foregoing developments could have a significant negative impact on the viability and overall health of the Ethereum platform, the value of ETH and the Company’s business model and assets.

Uncertainty Regarding the Growth of Blockchain and Web 3 Technologies

The further development and use of blockchain, Web 3 technologies and digital assets are subject to a variety of factors that are difficult to evaluate and predict, many of which are beyond the Company’s control. The slowing of or stopping of the development or acceptance of blockchain networks, specifically Ethereum, and blockchain assets would be expected to have a material adverse effect on the Company. Furthermore, blockchain and Web 3 technologies, including Ethereum, may never be implemented to a scale that provides identifiable economic benefit to blockchain-based businesses, including the Company.

The Ethereum network and ETH as digital asset have a limited history. Due to this short history, it is not clear how all elements of ETH will unfold over time, specifically with regard to governance between miners, developers and users, as well as the long-term security model as the rate of inflation of ETH decreases. Since the ETH community has successfully navigated a considerable number of technical and political challenges since its inception, the Company believes that it will continue to engineer its way around future challenges. The history of open-source software development would indicate that vibrant communities are able to change the software under development at a pace sufficient to stay relevant. The continuation of such vibrant communities is not guaranteed, and insufficient software development or any other unforeseen challenges that the community is not able to navigate could have an adverse impact on the business of the Company.

10

Smart Contract Risk

The Ethereum network is based upon the development and deployment of smart contracts, which are self-executing contracts with the terms of the agreement written into software code. There are thousands of smart contracts currently running on Ethereum network. Like all software code, smart contracts are exposed to risk that the code contains a bug or other security vulnerability, which can lead to loss of assets that are held on or transacted through the contract. The smart contract deployed on Ethereum and, as such, may contain a bug or other vulnerability that may lead to the loss of digital assets held in the wallet. The Ethereum developer community audits widely used smart contracts frequently and publishes the results of such audits on public forums. Nevertheless, there is no guarantee against a bug or other vulnerability leading to a loss of digital assets.

Dependence on Ethereum Network Developers

While many contributors to the Ethereum network’s open-source software are employed by companies in the industry, most of them are not directly compensated for helping to maintain the protocol. As a result, there are no contracts or guarantees that they will continue to contribute to the Ethereum network’s software (https://github.com/ether and https://github.com/orgs/ether/people).

Issues with the Cryptography Underlying the Ethereum Network

Although the Ethereum network is one of the world’s most established digital asset networks, the Ethereum network and other cryptographic and algorithmic protocols governing the issuance of digital assets represent a new and rapidly evolving industry that is subject to a variety of factors that are difficult to evaluate. In the past, flaws in the source code for digital assets have been exposed and exploited, including flaws that disabled some functionality for users, exposed users’ personal information and/or resulted in the theft of users’ digital assets. The cryptography underlying ETH could prove to be flawed or ineffective, or developments in mathematics and/or technology, including advances in digital computing, algebraic geometry and quantum computing, could result in such cryptography becoming ineffective. In any of these circumstances, a malicious actor may be able to take the ETH held by the Company. Moreover, functionality of the Ethereum network may be negatively affected such that it is no longer attractive to users, thereby dampening demand for ETH. Even if digital assets other than ETH were affected by similar circumstances, any reduction in confidence in the source code or cryptography underlying digital assets generally could negatively affect the demand for digital assets and therefore adversely affect the business of the Company.

Disputes on the Development of the Ethereum Network may lead to Delays in the Development of the Network

There can be disputes between contributors on the best paths forward in building and maintaining the Ethereum network’s software. Furthermore, the miners and/or stakers supporting the network and other developers and users of the network can disagree with the contributors as well, creating greater debate. Therefore, the Ethereum community often iterates slowly upon contentious protocol issues, which many perceive as prudently conservative, while others worry that it inhibits innovation. It will be important for the community to continue to develop at a pace that meets the demand for transacting in ETH, otherwise users may become frustrated and lose faith in the network. As a decentralized network, strong consensus and unity is particularly important to respond to potential growth and scalability challenges.

The Ethereum Blockchain may Temporarily or Permanently Fork and/or Split

The Ethereum network’s software and protocol are open source. When a modification is released by the developers and a substantial majority of participants consent to the modification, the change is implemented and the Ethereum network continues uninterrupted. However, if a change were activated with less than a substantial majority consenting to the proposed modification, and the modification is not compatible with the software prior to its modification, the consequence would be what is known as a “hard fork” (i.e., a split) of the Ethereum network (and the blockchain). One blockchain would be maintained by the pre-modification software and the other by the post-modification software. The effect is that both blockchain algorithms would be running parallel to one another, but each would be building an independent blockchain with independent native assets.

11

A hard fork could present problems such as two copies of a token for the same NFT. It could also present a problem for a customer having to choose to provide services with respect to digital assets resulting from a fork. In addition, digital asset loan agreements often dictate when and how each of the lender or the borrower of a digital asset pledging a certain digital asset gets the benefit of forked coins in the event of a hard fork. Similarly, derivative counterparties using ISDA-based contractual documentation may be subject to hard fork-related termination events.

Although forks are likely to be addressed by a community-led effort to merge the two groups, such a fork could still adversely affect ETH’s viability.

Risks Related to our Company

Our filing of bankruptcy may adversely affect our business and relationships.

On August 31, 2021, the Bankruptcy Court entered its Findings of Fact, Conclusions of Law and Order Approving and Confirming the Combined Disclosure Statement and Joint Chapter 11 Plan of AeroCentury Corp., and its Affiliated Debtors. The Effective Date of the Plan occurred on September 30, 2021. Each condition precedent to consummation of the Plan has been satisfied and/or waived.

As a result of our bankruptcy filing:

| ● | suppliers, vendors or other contract counterparties may require additional financial assurances or enhanced performance from us; |

| ● | our ability to compete for new business may be adversely affected; |

| ● | our ability to attract, motivate and retain key executives and employees may be adversely affected; |

| ● | our employees may be distracted from performance of their duties or more easily attracted to other employment opportunities; and |

| ● | we may have difficulty obtaining the capital we need to operate and grow our business. |

The occurrence of one or more of these events could have a material adverse effect on our business, financial condition, results of operations and reputation.

Upon our emergence from Chapter 11, the composition of our stockholder base has changed significantly.

As a result of the concentration of our equity ownership, our future strategy and plans may differ materially from those in the past. Upon our emergence from Chapter 11, the Plan Sponsors collectively held approximately 65.0% of our common stock, while holders of our legacy equity interests held approximately 35.0% of our common stock. Therefore, the Plan Sponsors have significant control on the outcome of matters submitted to a vote of stockholders, including, but not limited to, electing directors and approving corporate transactions. As a result, our future strategy and plans may differ materially from those of the past. Circumstances may occur in which the interests of the Plan Sponsors could be in conflict with the interests of other stockholders, and the Plan Sponsors would have substantial influence to cause us to take actions that align with their interests. Should conflicts arise, there can be no assurance that the Plan Sponsors would act in the best interests of other stockholders or that any conflicts of interest would be resolved in a manner favorable to our other stockholders.

12

The composition of our board of directors has changed significantly.

Pursuant to the Plan, the composition of our board of directors changed significantly. Upon our emergence from Chapter 11, our board of directors consisted of five directors, none of whom had previously served on our board of directors. The new directors have different backgrounds, experiences and perspectives from those who previously served on our board of directors and thus may have different views on the issues that will determine our future. There can be no assurance that our new board of directors will pursue, or will pursue in the same manner, our previous strategy and business plans.

Certain information contained in our historical financial statements are not comparable to the information contained in our financial statements after the adoption of fresh start accounting.

Upon our emergence from Chapter 11, we adopted fresh start accounting in accordance with ASC Topic 852 and became a new entity for financial reporting purposes. As a result, we revalued our assets and liabilities based on our estimate of our enterprise value and the fair value of each of our assets and liabilities. These estimates, projections and enterprise valuation were prepared solely for the purpose of the bankruptcy proceedings and should not be relied upon by investors for any other purpose. At the time they were prepared, the determination of these values reflected numerous estimates and assumptions, and the fair values recorded based on these estimates may not be fully realized in periods subsequent to our emergence from Chapter 11.

The consolidated financial statements after our emergence from bankruptcy will not be comparable to the consolidated financial statements on or before that date. This will make it difficult for stockholders to assess our performance in relation to prior periods.

We have a limited operating history in our post-bankruptcy new focus business, so there is a limited track record on which to judge our business prospects and management.

We have limited operating history in providing staking services upon which to base an evaluation of our business and prospects. You must consider the risks and difficulties we face as a small operating company with limited operating history. Further, our StaaS platform is new service, to which we have no experience and will rely upon our third party developers to develop and maintain the StaaS platform.

We will need to raise additional capital or financing to continue to execute and expand our business.

We will need to raise additional capital to support our new operations and execute on our business plan by issuing equity or convertible debt securities. In the event we are required to obtain additional funds, there is no guarantee that additional funds will be available on a timely basis or on acceptable terms. To the extent that we raise additional funds by issuing equity or convertible debt securities, our shareholders may experience additional dilution and such financing may involve restrictive covenants. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other convertible securities that will have additional dilutive effects. We cannot assure that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations. Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets, and the fact that we have not been profitable, which could impact the availability and cost of future financings. If such funds are not available when required, management will be required to curtail investments in additional sales and marketing and product development, which may have a material adverse effect on future cash flows and results of operations.

Our business depends on the continuing efforts of our management. If it loses their services, our business may be severely disrupted.

Our business operations depend on the efforts of our new management, particularly the executive officers named in this document. If one or more of our management were unable or unwilling to continue their employment with us, it might not be able to replace them in a timely manner, or at all. We may incur additional expenses to recruit and retain qualified replacements. Our business may be severely disrupted, and our financial condition and results of operations may be materially and adversely affected. In addition, our management may join a competitor or form a competing company. As a result, our business may be negatively affected due to the loss of one or more members of our management.

13

We may not be able to prevent or timely detect cyber security breaches and may be subject to data, security and/or system breaches which could adversely affect our business operations and financial conditions.