formdef14a.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

þ

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

þ

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

QAD Inc.

100 Innovation Place

Santa Barbara, California 93108

805-566-6000

To All QAD Inc. Stockholders:

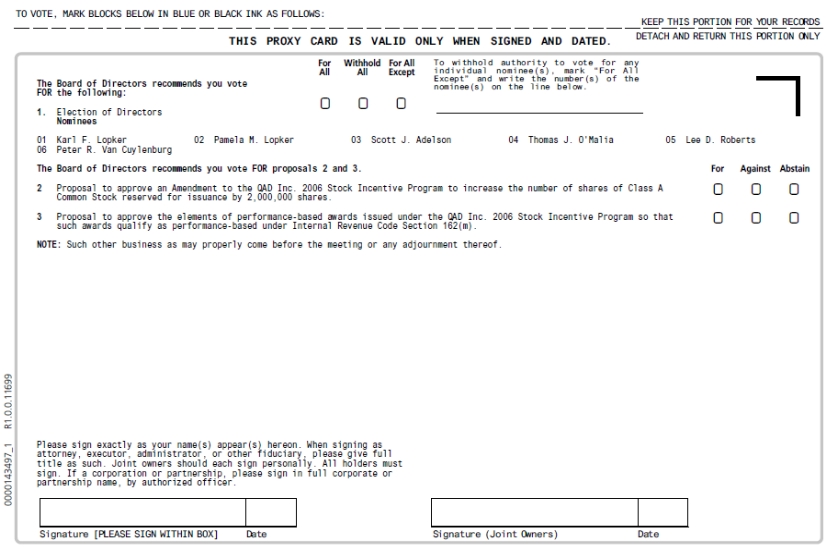

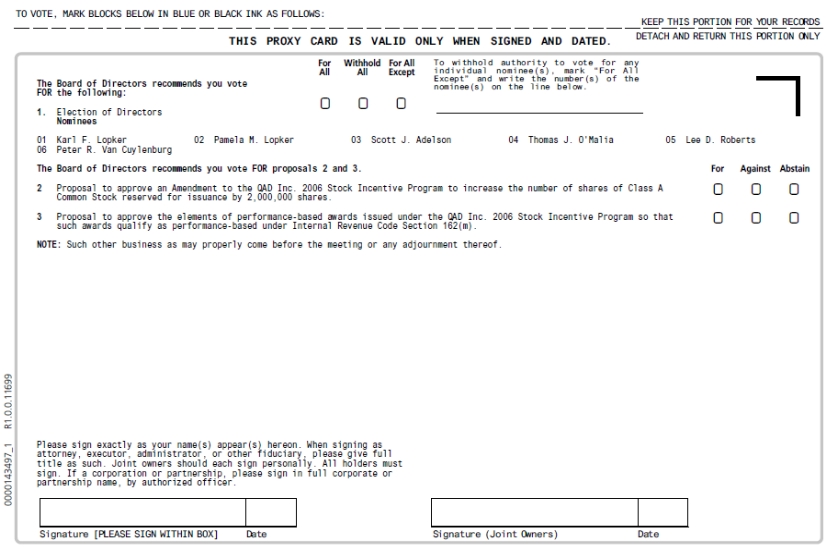

On behalf of the Board of Directors of QAD Inc. ("QAD"), I cordially invite you to attend the Annual Meeting of Stockholders of QAD to be held at the QAD corporate headquarters located at 100 Innovation Place, Santa Barbara, California, on Tuesday, June 12, 2012 at 4:30 p.m. local time. A Notice of the Annual Meeting of Stockholders, proxy card and proxy statement containing information about the matters to be acted upon at the Annual Meeting are enclosed.

At this year's meeting you will be asked to elect six directors, to approve an amendment to QAD’s 2006 Stock Incentive Program and to approve the material terms for payment of performance-based awards under QAD’s 2006 Stock Incentive Program. The accompanying Notice of Annual Meeting and proxy statement describe these proposals. We encourage you to read the enclosed information carefully.

Whether in person or by proxy, it is important that your shares be represented at the Annual Meeting. To ensure your participation in the Annual Meeting, regardless of whether or not you plan to attend in person, please vote the enclosed proxy card today by telephone or on the Internet or by signing, dating and returning your proxy card in the postage-paid envelope provided. If you do attend the Annual Meeting, you may revoke your previous proxy at that time if you wish, and vote in person. If you plan to vote your shares at the Annual Meeting, please note the instructions on page 3 of the enclosed proxy statement.

We look forward to seeing you at the Annual Meeting.

Sincerely,

Karl F. Lopker

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 12, 2012

Notice is hereby given that the Annual Meeting of Stockholders of QAD Inc. will be held on Tuesday, June 12, 2012, at 4:30 p.m. local time, at the QAD corporate headquarters located at 100 Innovation Place, Santa Barbara, California, for the following purposes:

|

|

1.

|

To elect six directors to serve until the next Annual Meeting of Stockholders;

|

|

|

2.

|

To approve an Amendment to the QAD Inc. 2006 Stock Incentive Program to provide for an increase in the number of shares of Class A Common Stock reserved for issuance by 2,000,000 shares;

|

|

|

3.

|

To approve the material terms for payment of performance-based awards issued under the QAD Inc. 2006 Stock Incentive Program so that such awards qualify as performance-based under Internal Revenue Code Section 162(m); and

|

|

|

4.

|

To transact any other business that may properly come before the meeting or any postponement or adjournment thereof.

|

The foregoing items of business are more fully described in the proxy statement accompanying this Notice.

Only stockholders of record at the close of business on April 16, 2012 are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

By Order of the Board of Directors

Daniel Lender

Santa Barbara, California

All stockholders are invited to attend the Annual Meeting. If you are a stockholder of record as of April 16, 2012, you will be admitted to the meeting. If you own stock beneficially through a bank, broker or otherwise, you will be admitted to the meeting if you present a form of photo identification and proof of ownership of such stock or a valid proxy signed by the record holder. Examples of proof of ownership are a recent brokerage statement or a letter from a bank or broker. Whether or not you intend to be present in person at the Annual Meeting, please vote the enclosed proxy card today by telephone or on the Internet or by signing, dating and returning your proxy card in the postage-paid envelope provided.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on June 12, 2012.

Our proxy statement and Annual Report on Form 10-K are available at www.proxyvote.com.

We are mailing a printed copy of proxy materials to each stockholder and are allowing stockholders to access the proxy materials on the Internet at www.proxyvote.com.

QAD Inc.

100 Innovation Place

Santa Barbara, California 93108

805-566-6000

PROXY STATEMENT

THE ANNUAL MEETING

This proxy statement and the enclosed proxy card are being mailed to you by the Board of Directors of QAD Inc., a Delaware corporation ("QAD," the "Company," "we" or "us"), on or about May 9, 2012. The Board of Directors requests that your shares be represented by the proxies named on the proxy card at the Annual Meeting of Stockholders to be held on June 12, 2012.

FREQUENTLY ASKED QUESTIONS

A proxy is your way of legally designating another person to vote for you. That other person is called a “proxy.” If you designate another person as your proxy in writing, the written document is called a “proxy” or a “proxy card.”

What is a “proxy statement”?

A “proxy statement” is a document required by the Securities and Exchange Commission (the “SEC”) that contains information about the matters that stockholders will vote upon at the Annual Meeting. The proxy statement also includes other information required by SEC regulations.

A “quorum” is the minimum number of votes that must be represented at the Annual Meeting for the transaction of any business at such meeting. A majority of the voting power of the Company’s outstanding shares, as of the record date, that are entitled to vote generally in the election of directors, either present at the Annual Meeting or represented by proxy, will constitute a quorum at the Annual Meeting. Shares represented by proxies marked to “withhold” voting for one or more Board nominees, proxies marked to “abstain” from voting for a proposal, broker non-votes and proxies submitted without an indication of voting preferences, are counted for purposes of determining the presence of a “quorum.”

What is a “broker non-vote”?

A broker “non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Who is soliciting my vote?

The Board of Directors of QAD is soliciting your vote at the 2012 Annual Meeting of Stockholders.

What is the purpose of the Annual Meeting?

| |

●

|

Vote to elect six directors as nominated;

|

| |

●

|

Approve an Amendment to the QAD Inc. 2006 Stock Incentive Program to increase the number of shares of Class A Common Stock reserved for issuance by 2,000,000 shares;

|

| |

●

|

Approve the material terms for payment of performance-based awards under the QAD Inc. 2006 Stock Incentive Program; and

|

| |

●

|

Transact any other business that may properly come before the meeting.

|

What are the Board of Directors' recommendations?

The Board recommends a vote:

|

|

|

for the election of the six nominated directors;

|

|

|

|

for the approval of the Amendment to the QAD Inc. 2006 Stock Incentive Program; and

|

|

|

|

for the approval of the material terms for payment of performance-based awards under the QAD Inc. 2006 Stock Incentive Program.

|

Who is entitled to vote at the Annual Meeting?

The Board of Directors set April 16, 2012 as the record date for the Annual Meeting. All stockholders who owned QAD common stock at the close of business on April 16, 2012 may attend and vote at the Annual Meeting.

What are my voting rights?

You have one-twentieth (1/20th) of a vote for each share of QAD Class A common stock you owned at the close of business on the record date and one (1) vote for each share of QAD Class B common stock you owned at the close of business on the record date, provided each share was either held directly in your name as the stockholder of record or held for you as the beneficial owner through a broker, bank or other nominee ("Nominee").

What is the difference between holding shares as a stockholder of record and beneficial owner?

Most stockholders of the Company hold their shares through a Nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with QAD's transfer agent, American Stock Transfer & Trust Company, LLC ("AST"), you are considered the stockholder of record with respect to those shares, and these proxy materials are being sent directly to you by QAD. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting. We have enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a Nominee, you are considered the beneficial owner of the shares which are held in "street name" and these proxy materials are being forwarded to you by your Nominee, who is considered the stockholder of record with respect to these shares. As the beneficial owner, you have the right to direct your Nominee on how to vote and are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you request, complete and deliver a proxy from your Nominee.

How many votes must be present to hold the Annual Meeting?

A majority of the voting power of the Company's outstanding shares as of the record date must be present at the Annual Meeting in order to hold the Annual Meeting and conduct business. Your shares are counted as present at the Annual Meeting if you are present and vote in person at the Annual Meeting or a proxy card has been properly submitted by you or on your behalf. Both abstentions and proxies submitted by brokers that do not indicate a vote because they do not have discretionary authority and have not received instructions as to how to vote on a proposal ("broker non-votes") are counted as present for the purpose of determining the presence of a quorum.

How many votes are required to elect director nominees?

Directors are elected by a plurality of the votes cast. If you withhold authority to vote with respect to the election of some or all of the nominated directors, your shares will not be voted with respect to those nominated directors indicated. Your shares will be counted for purposes of determining whether there is a quorum, but will have no effect on the election of those nominated directors. Abstentions and broker non-votes will also have no effect on the vote.

All proxies, ballots and vote tabulations that identify stockholders are confidential. An independent tabulator will receive, inspect and tabulate your proxy. Your vote will not be disclosed to anyone, other than the independent tabulator, without your consent.

Who will count the votes and where can I find the voting results?

Broadridge Financial Solutions, Inc. will tabulate the voting results. We will announce the preliminary voting results at the Annual Meeting and will publish the results by filing a current report on Form 8-K within four business days of the Annual Meeting.

What shares can be voted?

Each stockholder of record at the close of business on April 16, 2012 is entitled to one-twentieth (1/20th) of a vote for each share of Class A common stock and one (1) vote for each share of Class B common stock registered in the stockholder's name. There is no cumulative voting. On April 16, 2012, there were 12,667,034 outstanding shares of Class A common stock and 3,164,164 outstanding shares of Class B common stock of QAD.

Shares cannot be voted at the meeting unless the owner of record is present in person or is represented by proxy.

What if I don't give specific voting instructions to my broker?

Brokers holding shares must vote according to specific instructions they receive from the beneficial owners of those shares. If brokers do not receive specific instructions, brokers may in some cases vote the shares in their discretion. However, brokers are precluded from exercising voting discretion on certain proposals without specific instructions from the beneficial owner. Brokers cannot vote on Proposals 1, 2 or 3 without instructions from the beneficial owners. If you are a beneficial owner and do not instruct your broker how to vote on the election of directors, your broker will not vote for you. Broker non-votes will not affect the outcome of the vote on Proposal 1 as long as a quorum is present. Broker nonvotes will not have an effect on Proposals 2 or 3 as long as a majority of the shares represented and voting at the meeting cast their votes in favor of those two proposals.

Can I change or revoke my vote after I return my proxy card or voting instruction card?

Even if you voted by telephone or on the Internet or if you signed and delivered the proxy card or voting instruction card in the form accompanying this proxy statement, you retain the power to revoke your proxy or change your vote. You can revoke your proxy or change your vote any time before it is exercised by giving written notice to the Corporate Secretary specifying such revocation. You may change your vote by a later-dated vote by telephone or on the Internet or by timely delivery of a valid, later-dated proxy or by voting by ballot at the Annual Meeting.

What does it mean if I receive more than one proxy or voting instruction card?

It generally means that your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy cards and voting instruction cards you receive.

Who can attend the Annual Meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend.

What do I need to be admitted to the Annual Meeting?

In order to be admitted to the Annual Meeting, a stockholder must present an admission ticket or proof of ownership of QAD stock on the record date. Any holder of a proxy from a stockholder must present the proxy card, properly executed, and an admission ticket.

An admission ticket is attached to the bottom of the proxy card. If you plan to attend the Annual Meeting, please keep this ticket and bring it with you to the Annual Meeting. If you do not bring an admission ticket, proof of ownership of QAD stock on the record date will be needed to be admitted. If your shares are held in the name of a Nominee, a brokerage statement or letter from a Nominee is an example of proof of ownership.

You may vote by telephone, on the Internet, by mail or by attending the Annual Meeting and voting by ballot, all as described below. The Internet and telephone voting procedures are designed to authenticate stockholders by use of a control number and to allow you to confirm that your instructions have been properly recorded. If you vote by telephone or on the Internet, you do not need to return your proxy card or voting instruction card. Telephone and Internet voting facilities are available now and will be available 24 hours a day until 11:59 p.m. Eastern Daylight Time, on June 11, 2012.

Vote on the Internet. If you have Internet access, you may submit your proxy by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. On the Internet voting site, you can confirm that your instructions have been properly recorded. If you vote on the Internet, you can also request electronic delivery of future proxy materials.

Vote by Telephone. You can vote by telephone by following the instructions provided with your proxy materials and on your proxy card or voting instruction card. Voice prompts allow you to vote your shares and confirm that your instructions have been properly recorded.

Vote by Mail. You may choose to vote by mail by marking your proxy card or voting instruction card, dating and signing it, and returning it to Broadridge Financial Solutions, Inc. in the postage-paid envelope provided. If the envelope is missing, please mail your completed proxy card or voting instruction card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. Please allow sufficient time for mailing if you decide to vote by mail. If you sign and return your proxy card or voting instruction card, but do not give voting instructions, the shares represented by that proxy card or voting instruction card will be voted as recommended by the Board of Directors.

Voting at the Annual Meeting. The method or timing of your vote will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However, if your shares are held in the name of a Nominee, you must obtain a legal proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting. You should allow yourself enough time prior to the Annual Meeting to obtain this proxy from the holder of record.

All shares entitled to vote and voted electronically, telephonically or represented by the proxy cards received, dated, signed and not revoked, will be voted at the Annual Meeting in accordance with their instructions.

Who pays for the solicitation of proxies?

QAD will bear the expense of printing and mailing proxy materials. In addition to this solicitation of proxies by mail, our directors, officers and other employees may solicit proxies by personal interview, telephone, facsimile or email. They will not be paid any additional compensation for such solicitation. We will request Nominees who hold shares of common stock in their names to furnish proxy material to beneficial owners of the shares. We will reimburse such Nominees for their reasonable expenses incurred in forwarding solicitation materials to such beneficial owners.

Are there any other matters to be voted on at the Annual Meeting that are not included in the proxy?

We are not currently aware of any other business to be acted upon at the Annual Meeting. However, if other matters are properly brought before the Annual Meeting, your proxy will have the right, in his or her discretion, to vote or act on those matters according to the proxy's best judgment.

Adjournment may be approved by the holders of shares representing a majority of votes present in person or by proxy at the meeting, whether or not a quorum exists, without further notice other than by an announcement made at the Annual Meeting.

Exemptions for a Controlled Company Election

The NASDAQ Stock Market has established specific exemptions from its listing standards for controlled companies, i.e., companies of which more than 50% of the voting power is held by an individual, a group or another entity. QAD is a controlled company by virtue of the fact that Ms. Pamela M. Lopker, President and Chairman of the Board, and Mr. Karl F. Lopker, Chief Executive Officer ("CEO") and Director, jointly control a majority interest in the stock of the Company. Please see "Stock Ownership of Directors, Executive Officers and Certain Beneficial Owners" beginning on page 19 of this proxy statement for additional information.

The Company has elected to rely upon certain of the exemptions provided in the rules. Specifically, the Company will rely on exceptions to the requirements that listed companies (i) have a majority of independent directors, (ii) select, or recommend for the Board's selection, director nominees by a majority of independent directors or a nominating committee comprised solely of independent directors and (iii) determine officer compensation by a majority of independent directors or a compensation committee comprised solely of independent directors. Notwithstanding the fact that the Company is a controlled company, QAD's current practices include (i) having a majority of independent directors, (ii) selecting director nominees by the full Board of Directors and (iii) determining officer compensation by a majority of independent directors or a compensation committee comprised solely of independent directors.

We have enclosed a copy of our 2012 Annual Report on Form 10-K with this proxy statement. If you would like an additional copy, we will send you one without charge. Please call 805-566-5139 or write to request a copy:

QAD Inc.

100 Innovation Place

Santa Barbara, CA 93108

Attn: Investor Relations

The Annual Report on Form 10-K and this proxy statement are available in the Investor Relations section of the QAD Internet site at www.qad.com. The SEC also maintains an Internet site at http://www.sec.gov that contains all SEC filings made by QAD.

At our Annual Meeting, stockholders will elect six directors to hold office until our next Annual Meeting of Stockholders. The directors shall serve until their successors have been duly elected and qualified or until any such director's earlier resignation or removal. Proxies cannot be voted for a greater number of persons than the number of nominees named. If any nominee for any reason is unable to serve or will not serve, the proxies may be voted for such substitute nominee as the proxy holder may determine. We are not aware that any of the nominees will be unable or unwilling to serve as director.

The following incumbent directors are being nominated for re-election to the Board: Karl F. Lopker, Pamela M. Lopker, Scott J. Adelson, Thomas J. O'Malia, Lee D. Roberts and Peter R. van Cuylenburg. Please see "Information Concerning the Nominees for Election" beginning on page 10 of this proxy statement for information concerning each of our incumbent directors standing for re-election.

Required Vote

Directors are elected by a plurality of votes cast. Votes withheld and broker non-votes are not counted toward a nominee's total. If you do not vote for a particular nominee or indicate that you "WITHHOLD AUTHORITY" to vote for a particular nominee, your withholding will have no effect on the election of directors.

The Board of Directors recommends a vote FOR the election of the nominated directors.

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO QAD INC. 2006 STOCK INCENTIVE PROGRAM

(Increase number of shares of Class A Common Stock available for issuance by 2,000,000 shares)

(Collectively referred to as “Awards”)

The stockholders are being asked to approve an amendment to the QAD Inc. 2006 Stock Incentive Program (the “2006 Program”). The complete text of the 2006 Program, including the text of the amendment proposed hereby, is filed as Exhibit A to this proxy statement. The amendment increases the number of shares of QAD common stock subject to the 2006 Program from 3,320,000 Class A shares and 830,000 Class B shares to 5,320,000 Class A shares and 830,000 Class B shares. The Board believes it is in QAD’s best interest to increase the share reserve so that QAD can continue to utilize the 2006 Program to attract and retain the services of those persons essential to the Company’s growth and financial success. The Board has determined that Class A shares will be used predominantly for Awards granted under the 2006 Program, therefore no increase to the number of shares of Class B common stock available for issuance under the 2006 Program is being requested.

The 2,000,000 share increase was approved by the Board in April 2012, subject to stockholder approval at the Annual Meeting.

Of the 3,320,000 shares of Class A common stock and 830,000 shares of Class B common stock currently authorized under the 2006 Program, approximately 672,000 Class A and 322,000 Class B shares remained available for additional grants as of April 16, 2012. The Board believes that the approval of an additional 2,000,000 shares of Class A common stock under the 2006 Program should be sufficient for the Company’s needs under the 2006 Program for the next several years. The actual number of persons who will receive Awards pursuant to the proposed share increase cannot be determined in advance because the Board of Directors or a committee appointed by the Board has the discretion to select the Award recipients.

Summary of the QAD Inc. 2006 Stock Incentive Program

Purpose, structure, awards and eligibility. The 2006 Program is intended to secure for QAD and its stockholders the benefits arising from ownership of common stock by individuals employed or retained by QAD who will be responsible for the future growth of the enterprise. The 2006 Program is designed to help attract and retain superior personnel for positions of substantial responsibility and to provide individuals with an additional incentive to contribute to the Company’s success.

The 2006 Program is composed of six parts and the program administrators may make the following types of awards under the 2006 Program:

| |

(1)

|

incentive stock options under the Incentive Stock Option Plan;

|

| |

(2)

|

nonqualified stock options under the Nonqualified Stock Option Plan;

|

| |

(3)

|

restricted shares (“RSUs”) under the Restricted Shares Plan;

|

| |

(4)

|

rights to purchase stock under the Employee Stock Purchase Plan;

|

| |

(5)

|

stock appreciation rights (“SARs”) under the Stock Appreciation Rights Plan; and

|

| |

(6)

|

specified other stock rights under the Other Stock Rights Plan, which may include the issuance of units representing the equivalent of shares of common stock, payments of compensation in the form of shares of common stock and rights to receive cash or shares of common stock based on the value of dividends paid on a share of common stock.

|

Officers, directors, employees, consultants and other independent contractors or agents of QAD or our subsidiaries who are responsible for or contribute to the management, growth or profitability of our business are eligible for selection by the program administrators to participate in the 2006 Program; provided, however, that incentive stock options granted under the Incentive Stock Option Plan and stock purchase rights granted under the Employee Stock Purchase Plan may only be granted to a person who is an employee of QAD or its subsidiaries.

Shares subject to the 2006 Program. Prior to the approval of the proposed amendment to the 2006 Program, the maximum aggregate number of shares of our Class A and Class B common stock subject to the 2006 Program is 3,320,000 and 830,000 shares, respectively. If the proposed amendment is approved, an additional 2,000,000 shares of our Class A common stock will be added to the 2006 Program for a total of 5,320,000 Class A and 830,000 Class B shares. The shares of common stock issuable under the 2006 Program may be authorized but unissued shares, shares issued and reacquired, or shares purchased by the Company on the open market. If any of the awards granted under the 2006 Program expire, terminate or are forfeited for any reason before they have been exercised, vested or issued in full, the unused shares subject to those expired, terminated or forfeited awards will again be available for purposes of the 2006 Program.

Effective date and duration. All of the plans under the 2006 Program became effective upon the approval of the 2006 Program by a majority of the Company’s stockholders in June 2006. The 2006 Program will continue in effect until July 1, 2016, unless sooner terminated under the general provisions of the 2006 Program.

Administration. The 2006 Program is administered by the Board of Directors or by a committee appointed by the Board. That committee must consist of not less than two directors who are:

| |

|

non-employee directors within the meaning of SEC Rule 16b-3 under the Securities Exchange Act of 1934, so long as non-employee director administration is required under Rule 16b-3; and

|

| |

|

outside directors as defined in Section 162(m) of the Internal Revenue Code of 1986 as amended (the “Code”), so long as the Company chooses to qualify executive remuneration as “performance-based compensation” under Section 162(m) of the Code.

|

Subject to these limitations, the Board of Directors may from time to time remove members from the committee, fill all vacancies on the committee and select one of the committee members as its chair. The program administrators may hold meetings when and where they determine, will keep minutes of their meetings and may adopt, amend and revoke rules and procedures in accordance with the terms of the 2006 Program. The 2006 Program is presently administered by the directors who serve on the Compensation Committee of the Board.

U.S. Federal Income Tax Consequences

Option Grants

Options granted under the 2006 Program may be either incentive stock options which satisfy the requirements of Section 422 of the Code or nonqualified stock options which do not meet those requirements. The federal income tax treatment for incentive stock options and nonqualified stock options are as follows:

| |

|

Incentive Stock Options. No taxable income is recognized by an optionee upon the grant of an incentive stock option. Generally, the optionee will not recognize ordinary income in the year in which the option is exercised although the optionee’s gain from exercise may be subject to alternative minimum tax. If the optionee sells or otherwise disposes of the shares acquired from exercise of the option within two years after the option grant date or within one year of the option exercise date, then this is treated as a disqualifying disposition and the optionee will be taxed in the year of disposition on the gain from exercise, but not exceeding the gain from disposition as ordinary income and the balance of the gain from disposition, if any, as short-term or long-term capital gain. QAD will be entitled to an income tax deduction that equals the amount of the optionee’s compensatory ordinary income. If the optionee does not make a disqualifying disposition, then QAD will not be entitled to a tax deduction.

|

| |

|

Nonqualified Stock Options. No taxable income is recognized by an optionee upon the grant of a nonqualified stock option. Generally, the optionee will recognize ordinary income in the year in which the option is exercised. The amount of ordinary income will equal the excess of the fair market value of the purchased shares on the exercise date over the exercise price paid for the shares. QAD and the optionee are required to satisfy the tax withholding and reporting requirements applicable to that income. QAD will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the optionee with respect to exercised nonqualified stock options. QAD will generally receive the tax deduction in the taxable year that the ordinary income is recognized by the optionee.

|

| |

|

The taxation of restricted shares granted under the 2006 Program is governed by Section 83 of the Code. Generally, the shares vest when the restriction lapses, and the grantee will have ordinary income equal to the difference between the fair market value of the shares on the vesting date and any amount paid for the shares. Alternatively, at the time of the grant, the grantee may elect under Section 83(b) of the Code to include as ordinary income in the year of the grant, an amount equal to the difference between the fair market value of the restricted shares on the grant date and any amount paid for the shares. If the Section 83(b) election is made, the grantee will not recognize any additional compensation income when the restriction lapses, but may have capital gain income or loss upon sale of the shares. QAD will be entitled to an income tax deduction equal to the ordinary income recognized by the grantee in the year in which the grantee recognizes such income.

|

Employee Stock Purchase Plan Issuances

| |

|

The Employee Stock Purchase Plan is intended to satisfy the requirements of Section 423 of the Code. Under a plan that so qualifies, no taxable income will be recognized by a participant, and no deductions will be allowable to QAD, in connection with the grant or the exercise of an outstanding purchase right. Taxable income will not be recognized by the participant until there is a sale or other disposition of the shares acquired under the plan.

|

| |

|

If the participant sells or otherwise disposes of the purchased shares within two years after the start date of the purchase period in which the shares were acquired, or within one year after the purchase date, then the participant will recognize ordinary income in the year of sale or disposition equal to the amount by which the fair market value of the shares on the purchase date exceeds the purchase price paid for those shares, and the balance of any gain or loss from disposition as short-term or long-term capital gain or loss. QAD will be entitled to an income tax deduction, for the taxable year in which the sale or disposition occurs, equal in amount to the ordinary income recognized by the participant.

|

| |

|

If the participant sells or disposes of the purchased shares more than two years after the start date of the purchase period in which the shares were acquired and more than one year after the purchase date, then the participant will recognize ordinary income in the year of sale or disposition equal to the lesser of (1) the amount by which the fair market value of the shares on the sale or disposition date exceeds the purchase price paid for those shares or (2) the purchase price discount to the fair market value of the shares on the start date of that purchase period, and any additional gain upon the disposition will be taxed as a long-term capital gain. QAD will not be entitled to any income tax deduction with respect to that sale or disposition.

|

Stock Appreciation Rights

| |

|

A 2006 Program participant who is granted a stock appreciation right will recognize ordinary income in the year of exercise equal to the amount of the appreciation distribution, whether made in stock or in cash, and tax withholding will apply to the appreciation distribution. QAD will be entitled to an income tax deduction equal to the appreciation distribution in the taxable year that the ordinary income is recognized by the participant.

|

| |

|

Generally, a 2006 Program participant who is granted other stock rights will recognize ordinary income in the year of the grant of the right if a present transfer of stock or value is made to the participant, or in the year of payment if no present transfer occurs, such as in the case of performance shares, restricted stock units or dividend equivalent rights. That income will generally be equal to the fair market value of the granted right or payment and will be subject to tax withholding. QAD will generally be entitled to an income tax deduction equal to the income recognized by the participant on the grant or payment date for the taxable year in which the ordinary income is recognized by the participant.

|

Deductibility of executive compensation

We anticipate that any compensation deemed paid by QAD in connection with the exercise of SARs, incentive stock options and nonqualified stock options granted with exercise prices equal to the fair market value of the shares on the grant date will not be subject to the Code Section 162(m) $1 million limitation per covered individual on the deductibility of the compensation paid to certain executive officers of QAD. Accordingly, we believe any compensation deemed paid under the 2006 Program with respect to the exercise of options and SARs and the disposition of shares will remain deductible by QAD without limitation under Code Section 162(m). Income from the grant or vesting of RSUs would be compensation subject to the deduction limitation under Code Section 162(m), unless such RSUs are “performance-based” for purposes of Section 162(m).

QAD is seeking stockholder approval of this amendment to the 2006 Program in order to increase the number of shares available under the 2006 Program by 2,000,000 Class A shares. The Board believes that it is in the best interest of QAD to have a comprehensive equity incentive program for QAD which will provide a meaningful opportunity for officers, directors, employees, consultants and other independent contractors or agents of QAD or our subsidiaries to acquire a substantial proprietary interest in QAD, thereby encouraging those individuals to remain in QAD’s service and more closely align their interests with those of the stockholders and, at the same time, provide the Company with the flexibility to manage the impact the 2006 Program has on stockholder dilution.

The first sentence of Article 3 of Paragraph 5 of the QAD Inc. 2006 Stock Incentive Program shall be deleted and replaced by the following language:

“The maximum aggregate number of shares of Common Stock subject to the Program is 5,320,000 shares of Class A common stock and 830,000 shares of Class B common stock.”

QAD must receive the affirmative vote of a majority of the shares of our common stock present in person or represented by proxy at the meeting to approve this proposal. If you are present in person or represented by proxy at the meeting and abstain from voting on this proposal, it has the same effect as if you voted “AGAINST” the proposal.

The Board of Directors recommends a vote

FOR the approval of the Amendment to the 2006 Program.

RE-APPROVAL OF THE MATERIAL TERMS OF

THE QAD INC. 2006 STOCK INCENTIVE PROGRAM

FOR PAYMENT OF PERFORMANCE-BASED COMPENSATION

FOR PURPOSES OF SECTION 162(m) OF THE INTERNAL REVENUE CODE

Our stockholders are being asked to re-approve the material terms of the QAD Inc. 2006 Stock Incentive Program (the “2006 Program”) related to the payment of performance-based awards. The purpose of asking stockholders to re-approve these material terms under the 2006 Program is to allow certain performance-based awards granted under the 2006 Program to qualify as tax-deductible performance-based compensation under Section 162(m) of the Code (“Section 162(m)”). Stockholders are not being asked to approve any amendment to the 2006 Program pursuant to this proposal or to re-approve the 2006 Program in its entirety.

Section 162(m) places a limit of $1,000,000 on the amount we may deduct in any one year for compensation paid to a “covered employee,” which for purposes of Section 162(m), means any person who as of the last day of the fiscal year is our chief executive officer or one of our three highest compensated executive officers (other than the chief financial officer) as determined under SEC rules. Subject to the conditions set forth under Section 162(m), qualified performance-based compensation is excluded from this limitation. One of the conditions to qualify for such exclusion is the receipt of stockholder approval every five years of the material terms of performance-based awards in the 2006 Program. Our stockholders previously approved the 2006 Program and its material terms at the annual meeting of stockholders in 2006. Because more than five years have elapsed since such approval, we are asking stockholders to re-approve, at the 2012 Annual Meeting, the material terms of performance-based awards under the 2006 Program.

For purposes of Section 162(m), the material terms of performance-based compensation include (i) the persons eligible to receive awards, (ii) a description of the business criteria on which performance goals are based, and (iii) the maximum award that can be paid to any person as performance-based compensation. Each of these aspects of the 2006 Program is discussed below.

The 2006 Program is administered by the Company's Board. The Board has delegated such administration to a committee consisting solely of persons who are, at the time of their appointment, “non-employee directors” under Rule 16b-3(b)(3)(i) under the Exchange Act, and, to the extent that relief is sought under Section 162(m), “outside directors” under the rules under Section 162(m). References below to the committee include reference to the Board for any periods in which the Board is administering the 2006 Program. The committee generally has the full authority to determine the eligibility of an officer, employee, director, independent contractor or agent of the Company or its subsidiaries who are responsible for or contribute to the management, growth or profitability of the business of the Company or its subsidiaries to receive an award and to authorize the granting of awards to persons who are among those eligible. As of January 31, 2012, we had approximately one thousand five hundred (1,500) employees and four (4) non-employee directors, all of whom were eligible to receive awards under the 2006 Program.

The committee may provide that the grant or vesting of awards under the 2006 Program be made subject to the achievement of performance goals during a performance period set by the committee in accordance with the 2006 Program. In establishing the applicable goals, the committee is authorized to choose from the following business criteria: (i) net sales, (ii) gross sales, (iii) return on net assets, (iv) return on assets, (v) return on equity, (vi) return on capital, (vii) return on revenues, (viii) asset turnover, (ix) economic value added, (x) total stockholder return, (xi) net income, (xii) pre-tax income, (xiii) operating profit margin, (xiv) net income margin, (xv) sales margin, (xvi) market share, (xvii) inventory turnover, (xviii) days sales outstanding, (xix) sales growth, (xx) capacity utilization, (xxi) increase in customer base, (xxii) cash flow, (xxiii) book value, (xxiv) share price performance (including options and stock appreciation rights tied solely to appreciation in the fair market value of the shares), (xxv) earnings per share, (xxvi) stock price earnings ratio, (xxvii) earnings before interest, taxes, depreciation and amortization expenses ("EBITDA"), (xxviii) earnings before interest and taxes ("EBIT"), (xxix) or EBITDA, EBIT or earnings before taxes and unusual or nonrecurring items as measured either against the annual budget or as a ratio to revenue. The above business criteria may be based on objectives related to our performance, or the performance of any business unit of ours, or may be made in comparison with peer group performance. Each award agreement for a performance-based award is to specify (i) the target payment amount and target level of performance with respect to the selected criteria, (ii) the minimum level of performance below which no payment will be made, (iii) the method of determining the amount of any payment to be made if performance is at or above the minimum acceptable level, but falls short of full achievement of the target level of performance, and (iii) the maximum percentage payout (such maximum percentage not to exceed 100% in the case of performance-based restricted shares and 200% in the case of performance shares or performance-based dividend equivalent rights). Performance objectives used may differ among plan participants, among types of awards and from year to year.

The maximum amount of performance-based awards intended to qualify for the Section 162(m) exception that may be awarded to any covered employee during any one calendar year is (i) 160,000 Class A shares of Common Stock and 40,000 Class B shares of Common Stock subject to grants of stock options and stock appreciation rights, or (ii) 80,000 Class A shares of Common Stock and 20,000 Class B shares of Common Stock in restricted shares, performance shares or restricted stock units.

No awards made under the 2006 Program have been made subject to stockholder re-approval by virtue of this Proposal 3. The amounts and types of awards that may be granted under the 2006 Program in the future are not determinable, as the committee will make these determinations in its discretion in accordance with the terms of the 2006 Program. For an understanding of the size and structure of these awards in the past, please see the amounts of equity compensation paid to our named executive officers under the 2006 Program in the “Stock Awards” and “SAR Awards” columns of the Summary Compensation Table in the “Elements of the Executive Compensation Program” section herein.

The Board may at any time amend or revise the terms of the 2006 Program, except that no amendment will be effective without stockholder approval if such approval is required by the terms of the 2006 Program, law or under the NASDAQ Stock Market rules, and no termination, suspension, revision or amendment may materially adversely alter or affect the terms of any then outstanding awards without the consent of the affected grantee.

The Board believes that it is in our best interests and the best interests of our stockholders to enable us to implement compensation arrangements that qualify as tax-deductible, performance-based compensation in the 2006 Program. The Board is therefore recommending that stockholders re-approve, for Section 162(m) purposes, the material terms for providing performance-based awards set forth above. However, stockholder approval of the 2006 Program is only one of several requirements under Section 162(m) that must be satisfied for performance-based awards under the 2006 Program to qualify for the “performance-based” compensation exemption. Nothing in this proposal precludes us, our Board or the committee from making any payment or granting awards that do not qualify for tax deductibility under Section 162(m).

Stockholders are not being asked to approve any amendment to the 2006 Program or to re-approve the 2006 Program itself pursuant to this proposal. This proposal and the foregoing description addresses limited aspects of the 2006 Program, primarily the material terms of performance-based awards that may be granted under the 2006 Program. This description is qualified in its entirety by the full text of the 2006 Program, which can be found in Exhibit A.

The Board of Directors recommends a vote

FOR the re-approval of the Material Terms of the QAD Inc. 2006 Stock Incentive Program

For Payment of Performance-Based Compensation For Purposes of Section 162(m) of the Code

The Board of Directors does not presently intend to bring any other business before the meeting, and, so far as is known to the Board of Directors, no matters are to be brought before the meeting except as specified in the Notice of Annual Meeting of Stockholders. As to any business that may properly come before the meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

There are six nominees for election to the Board of Directors at the Annual Meeting. Valid proxies received will be voted, unless contrary instructions are given, to elect the nominees named in the following table. Should any nominee decline or be unable to accept the nomination to serve as director, an event that we do not currently anticipate, your proxy will have the right, in his or her discretion, to vote for a substitute nominee designated by the Board of Directors, to the extent consistent with the QAD Certificate of Incorporation and its Bylaws. If elected, the nominees will hold office for one-year terms and until their successors are elected and qualified.

The Board oversees the business, assets, affairs, performance and financial integrity of the Company. Four of the six director nominees are independent and two are members of management.

The Board believes that each director nominee possesses the qualities and experience required for membership on the Board. The Board seeks out, and the Board is comprised of, individuals whose background and experience complement other Board members. The nominees for election to the Board, together with biographical information furnished by each of them, are set forth below. Other than Karl F. Lopker and Pamela M. Lopker, who are married to each other, there are no family relationships among executive officers and directors of the Company. All nominees have been directors since last year's Annual Meeting.

|

Nominee for Director to

Hold Office Until 2013

|

|

Age

|

|

Director Since

|

|

Position with the Company

|

|

Current Standing Committees

|

|

Karl F. Lopker

|

|

60

|

|

1981

|

|

Chief Executive Officer, Director

|

|

None

|

|

Pamela M. Lopker

|

|

57

|

|

1981

|

|

President, Chairman of the Board

|

|

None

|

|

Scott J. Adelson

|

|

51

|

|

2006

|

|

Director

|

|

Compensation

|

|

Thomas J. O'Malia

|

|

68

|

|

2006

|

|

Director

|

|

Audit,

Compensation,

Governance

|

|

Lee D. Roberts

|

|

59

|

|

2008

|

|

Director

|

|

Audit,

Compensation (Chairman),

Governance

|

|

Peter R. van Cuylenburg

|

|

64

|

|

1997

|

|

Director

|

|

Audit (Chairman), Compensation,

Governance (Chairman)

|

Information Concerning the Nominees for Election

Karl F. Lopker. Chief Executive Officer of QAD Inc. Mr. Lopker has served as CEO and as a director of the Company since joining QAD in 1981. Previously, he founded Deckers Outdoor Corporation in 1973 and was its President until 1981. Mr. Lopker is certified in Production and Inventory Management by the American Production and Inventory Control Society. He received a Bachelor of Science degree in Electrical Engineering from the University of California, Santa Barbara. Mr. Lopker is married to Pamela M. Lopker, Chairman of the Board and President of QAD. The Board nominated Mr. Lopker to serve as a director based on his industry expertise, knowledge of QAD's customer base, strategic counsel and extensive history with QAD. His in-depth knowledge of the Company, its industry and its customers assists the Board in overseeing management and is important to the Board's oversight of strategy and risk management. Mr. Lopker also brings strong leadership skills and complex business operational experience to the Board by virtue of his over thirty years of experience as CEO.

Pamela M. Lopker. Chairman of the Board and President of QAD Inc. Ms. Lopker founded QAD in 1979 and has been Chairman of the Board and President since the Company's incorporation in 1981. Prior to founding QAD, Ms. Lopker served as Senior Systems Analyst for Comtek Research from 1977 to 1979. She is certified in Production and Inventory Management by the American Production and Inventory Control Society. Ms. Lopker earned a Bachelor of Arts degree in Mathematics from the University of California, Santa Barbara. She is married to Karl F. Lopker, Chief Executive Officer of QAD. The Board nominated Ms. Lopker to serve as a director because she is the founder and visionary for the Company, with over thirty years of enterprise software company experience, extensive software industry expertise and a deep understanding of the Company's products, customers, industry and global operational issues. Her history with, and knowledge of, QAD combined with her unique skills is important to the Board's oversight of long-term strategy and provides the Board with a deep understanding of the Company's business and operations.

Scott J. Adelson has been a director of the Company since April 2006. He has been Senior Managing Director and Global Co-Head of Corporate Finance for Houlihan Lokey since 1999 and has been with Houlihan Lokey since 1987. Mr. Adelson has written and commentated extensively on a number of corporate finance and securities valuation subjects for various business publications. He has served on the board of directors of MPA (Motorcar Parts and Accessories) since April 2008. Mr. Adelson is also an active board member of various middle-market businesses as well as prominent non-profit organizations, such as the Lloyd Greif Center for Entrepreneurial Studies and the Board of Leaders at the University of Southern California, Marshall School of Business. The Board nominated Mr. Adelson to serve as a director because of his experience in advising hundreds of companies on a diverse and in-depth variety of corporate finance issues, including mergers and acquisitions and capital structure, which, combined with his experience on the boards of directors of other companies, provides insight to the Board on strategic and financial issues.

Thomas J. O'Malia has been a director of the Company since August 2006. He is Director Emeritus of the Lloyd Greif Center for Entrepreneurial Studies at the University of Southern California, Marshall School of Business, serving as a Director since 1995. Prior to serving as a Director, Mr. O'Malia served on the faculty from 1981 to 1991 and again from 1995 to the present. In 1985, Mr. O'Malia founded and was Chief Executive Officer of ShopTrac Data Collections Systems, Inc., a software provider that supports manufacturers in improving labor productivity and operational efficiency on the shop floor. ShopTrac was sold to Kronos in 1994. Mr. O'Malia wrote and hosted the award winning distance-learning program "Introduction to Entrepreneurship: Building the Dream," which was nationally televised on PBS. He is a frequent corporate lecturer and has written or co-authored several books including "The Entrepreneurial Journey" and the "Banker's Guide to Financial Statements." In 2007, Mr. O'Malia was named one of the top 12 entrepreneurship professors in the country by Fortune magazine. The Board nominated Mr. O'Malia to serve as a director because of his strong financial background, including a previous position as a commercial banker, that is important to the understanding and oversight of our financial reporting, risk management and finance matters. Mr. O'Malia also brings broad experience with enterprise systems and prior experience as the head of the audit committee and, later, as Chairman of the Board, for Insurance Auto Auctions (NASDAQ listed) that is important to the Board's consideration of strategic matters and corporate governance practices.

Lee D. Roberts has been a director of the Company since January 2008 and currently serves as Chairman of the Compensation Committee. Since October 2008, Mr. Roberts has been President and CEO of BlueWater Consulting, LLC. Prior to that, Mr. Roberts was Vice President and General Manager, Content Management at IBM from October 2006 to September 2008 and Chairman and CEO of FileNet Corporation prior to its acquisition by IBM in 2006. Mr. Roberts joined FileNet in 1997 as President and Chief Operating Officer, was appointed Chief Executive Officer of the company in 1998 and added the title of Chairman in 2002. Since 2011, Mr. Roberts has served on the board of directors of Varolii Corporation, where he is a member of the audit and compensation committees. Mr. Roberts has served on the compensation committee of the board of directors of Embarcadero Technology since 2009, the audit and the compensation committees of the board of directors of Noetix Corporation since 2001, and the audit and compensation committees of the board of directors of Integrien Corporation since 2010. The Board nominated Mr. Roberts to serve as a director because of his extensive executive management experience which enables him to provide strategic counsel important to the Board in its oversight of management. Also, Mr. Robert's financial expertise brings an understanding of strategy, finance, and mergers and acquisitions that is an important aspect of the makeup of our Board of Directors.

Peter R. van Cuylenburg has been a director of the Company since November 1997 and currently serves as Lead Director and Chairman of the Audit Committee and the Governance Committee. From the beginning of 2000 until the present time, Dr. van Cuylenburg has practiced as an independent advisor to several high-technology companies, involving a variety of concurrent Board memberships listed below and a part-time role as a General Partner in a venture capital fund. He is presently a Director of Verimatrix, Inc. a privately-held company (since June 2006) and a General Partner in Crescendo Ventures (since December 2004). Previously Dr. van Cuylenburg was President and Chief Operating Officer of InterTrust Technologies Corporation from October 1999 to December 1999 and advisor to its Chairman from December 1999 to December 2000. Dr. van Cuylenburg served as President of Quantum Corporation's DLTtape and Storage Systems Group (DSS) from September 1996 to October 1999. Past board memberships include: ARC International plc (LSE:ARK), Transitive Technologies Ltd., JNI Inc (JNIC), Peregrine Systems Inc. (PRGNQ), ClearSpeed Technologies Group plc, SealedMedia Ltd., Anadigm Ltd., Elixent Ltd., Mitel Corporation (MLT), Dynatech Corporation, NeXT Computer, Inc., and Cable and Wireless plc. Dr. van Cuylenburg's career includes executive posts at Xerox Corporation, NeXT Computer, Inc., Cable and Wireless plc., and Texas Instruments. The Board nominated Dr. van Cuylenburg to serve as a director of the Company because of his experience over the past 25 years as a Chairman, CEO, President and EVP of various high technology companies. His leadership skills, experience with strategic, operational and financial issues, and service on the boards of a variety of public companies, including various audit, compensation and governance committees, is important to the Board's oversight of strategy, risk management, compensation and corporate governance practices.

Set forth below is certain biographical information concerning our executive officers, except for biographical information regarding Karl F. Lopker and Pamela M. Lopker which is provided above under the heading "Information Concerning the Nominees for Election."

Daniel Lender was first appointed Executive Vice President and Chief Financial Officer in July 2003. Previously, he served as QAD's Vice President of Global Sales Operations and Vice President of Latin America. Mr. Lender joined QAD in 1998 as Treasurer following a nine-year tenure with the former Republic National Bank of New York, last serving as Vice President and Treasurer of the Bank's Delaware subsidiary. He earned a master of business administration degree from the Wharton School of the University of Pennsylvania and a bachelor of science degree in applied economics and business management from Cornell University.

Gordon Fleming has served as Executive Vice President and Chief Marketing Officer since December 2006. Previously, he served in a number of roles including Vice President of Vertical Marketing and Managing Director of QAD Australia Pty. Ltd. Mr. Fleming joined QAD as a Sales Manager in July 1995, working in the Australian subsidiary. Mr. Fleming began his career as a telecommunications engineer working in both the United Kingdom and Nigeria. Later Mr. Fleming moved into corporate finance holding sales and marketing roles with Barclays plc and Schroders plc. Mr. Fleming is a Member of the Institute of Electrical and Electronic Engineers (IEEE) and studied at Worthing College of Technology, UK.

Kara L. Bellamy has served as Senior Vice President, Corporate Controller and Chief Accounting Officer since January 2008. Previously, she served as QAD's Corporate Controller beginning December 2006. She joined QAD as Assistant Corporate Controller in July 2004 after working for Somera Communications, Inc. as its Corporate Controller from 2002 through 2004. Ms. Bellamy worked at the public accounting firm of Ernst & Young from 1997 to 2002. She is a Certified Public Accountant (Inactive) and received a bachelor of arts degree in business economics with an accounting emphasis from the University of California, Santa Barbara.

CORPORATE GOVERNANCE AND RELATED MATTERS

Our Board of Directors currently has six members to be elected at the 2012 Annual Meeting and no vacancies. All directors are elected annually for a term of one year that expires at the subsequent Annual Meeting.

Four current directors, Mr. Adelson, Mr. O'Malia, Mr. Roberts and Dr. van Cuylenburg, are non-management directors and are each "independent" directors as defined under Rule 5605 of the NASDAQ Stock Market listing standards. Mr. O'Malia, Mr. Roberts and Dr. van Cuylenburg have each been designated by the Board of Directors as Audit Committee "financial experts." Dr. van Cuylenburg has been elected by the independent directors as Lead Director. Two directors are management directors, including Mr. Lopker, CEO, and Ms. Lopker, President and Chairman of the Board.

If stockholders or other interested parties wish to communicate with the full Board, the independent directors as a group or any individual director, they may write to QAD Inc., 100 Innovation Place, Santa Barbara, California 93108, Attention: Corporate Secretary or email to directors@qad.com. Further information on how to contact our Board is available through our investor relations Internet site at www.qad.com, under "Investor Relations — Corporate Governance."

Board Leadership Structure

The Board believes that Mr. Lopker and Ms. Lopker are best suited to serve as the Company's CEO and President/Chairman of the Board, respectively, because of their extensive knowledge of the Company's business, industry and customers, and are thus most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. The Board believes that having Mr. Lopker and Ms. Lopker in the roles of CEO and President/Chairman respectively, promotes strategy development and execution and fosters greater communication between management and the Board, which are essential to effective governance.

One of the key responsibilities of the Board is to develop strategic direction and hold management accountable for the execution of strategy once it is developed. The Board believes that having Mr. Lopker and Ms. Lopker in the roles of CEO and President/Chairman, respectively, together with a lead director having the duties described below, is in the best interest of the Company's stockholders because this arrangement provides the appropriate balance between strategy development and oversight of management.

Dr. van Cuylenburg serves as the independent lead director for all meetings of the non-management directors held in executive session. He was elected lead director in April 2008. The role of the independent lead director is, among other things, to establish agendas for such executive sessions in consultation with the other directors; to serve as a liaison between the independent directors and the Chairman and the CEO in matters relating to the Board as a whole (although all independent directors are encouraged to freely communicate with the Chairman, the CEO and other members of management at any time); to review meeting schedules to help ensure there is sufficient time for the discussion of all agenda items; to call meetings of the independent directors as appropriate; and to be available, as appropriate, for consultation and direct communications with stockholders.

The independent directors of the Board are scheduled to meet in executive session, without the Chairman or the CEO present, at every regularly scheduled Board meeting and at additional times as appropriate. They met in executive session on five occasions during fiscal year 2012.

Board of Directors Meetings

Our business, property and affairs are managed under the direction of our Board of Directors. Members of our Board are kept informed of our business through discussions with our President, CEO and other officers and members of management, by reviewing materials provided to them, by visiting our offices and by participating in meetings of the Board and its committees. During fiscal year 2012, the Board of Directors held four regularly scheduled meetings. All current directors attended at least 75% of the aggregate of all meetings of the Board of Directors and of the standing committees of which each director was a member during fiscal year 2012. It is the Company's policy that all members of the Board should attend the Company's Annual Meeting of Stockholders unless extraordinary circumstances prevent a director's attendance. All directors were in attendance at the 2011 Annual Meeting.

Standing Committee Meetings

The Board appoints committees to help carry out its duties. In particular, Board committees work on key issues in greater detail than would be possible at full Board meetings. Each committee reviews the results of its meetings with the full Board. There are currently three standing committees: Audit, Compensation and Governance.

Standing Committee Membership (* Indicates Chair)

|

Audit Committee (1)

|

|

Compensation Committee (2)

|

|

Governance Committee (3)

|

|

Thomas J. O’Malia

|

|

Peter R. van Cuylenburg

|

|

Thomas J. O'Malia

|

|

Lee D. Roberts

|

|

Scott J. Adelson

|

|

Lee D. Roberts

|

|

Peter R. van Cuylenburg*

|

|

Thomas J. O'Malia

|

|

Peter R. van Cuylenburg*

|

| |

|

Lee D. Roberts*

|

|

|

|

(1)

|

Dr. van Cuylenburg replaced Mr. O’Malia as Chairman of the Audit Committee on June 8, 2011.

|

|

(2)

|

Mr. Roberts replaced Dr. van Cuylenburg as Chairman of the Compensation Committee on June 8, 2011.

|

|

(3)

|

Dr. van Cuylenburg replaced Mr. O’Malia as Chairman of the Governance Committee on June 8, 2011

|

The functions performed by these committees are summarized below.

The Audit Committee assists the Board in its oversight of management's fulfillment of its financial reporting and disclosure responsibilities and its maintenance of an appropriate internal control system. It also appoints the registered public accounting firm to serve as the Company's independent auditor and oversees the activities of the Company's internal audit function and compliance function. The current Audit Committee members are Dr. van Cuylenburg, Mr. O'Malia and Mr. Roberts.

The Audit Committee is responsible for the appointment, compensation, retention and oversight of the independent auditor engaged to prepare or issue audit reports on the financial statements and internal control over financial reporting of the Company. The Audit Committee relies on the expertise and knowledge of management, the internal auditors and the independent auditor in carrying out its oversight responsibilities. The Audit Committee's specific responsibilities are delineated in the Audit Committee Charter. The Audit Committee met five times during fiscal year 2012, including meetings to review and discuss each quarterly earnings release prior to its announcement.

Audit Committee Independence and Financial Literacy

All members of the Audit Committee are independent directors. The Board of Directors has determined that each Audit Committee member has sufficient knowledge in financial and auditing matters to serve on the Committee, qualifies as an "audit committee financial expert" as that term is defined in the requirements of the Sarbanes-Oxley Act and meets the independence and financial literacy requirements of the NASDAQ Stock Market.

The current Compensation Committee members are Mr. Roberts, Mr. Adelson, Mr. O'Malia and Dr. van Cuylenburg, each of whom is "independent" as the term is defined in Rule 5605 of the NASDAQ Stock Market listing standards.

The primary responsibilities of the Compensation Committee are to:

| |

●

|

establish and review the general compensation policies applicable to the Chief Executive Officer, Chief Financial Officer, President and other executive officers;

|

| |

●

|

review and approve the level of compensation for the executive officers;

|

| |

●

|

review and advise the Board concerning the performance of the executive officers;

|

| |

●

|

review and advise the Board concerning compensation practices and trends in order to assess the adequacy and competitiveness of the executive compensation programs among comparable companies in the Company's industry;

|

| |

●

|

ensure that senior executive incentive plans are administered in a manner consistent with the Company's compensation strategy;

|

| |

●

|

administer the stock compensation programs; and

|

| |

●

|

review and recommend employment agreements for management and severance arrangements for senior executive officers.

|

The Compensation Committee's role includes producing the report on executive compensation. The specific responsibilities and functions of the Compensation Committee are delineated in the Compensation Committee Charter. The Compensation Committee met six times during fiscal year 2012.

Compensation Committee Interlocks and Insider Participation

None of QAD's executive officers currently serves as a director or member of the compensation committee, or of any other committee, of any board of directors of any other entity.

The members of the Governance Committee are Dr. van Cuylenburg, Mr. O'Malia and Mr. Roberts. The Governance Committee is responsible for the administration of the Company's Code of Business Conduct, continuing Board education, annual evaluations of the Board and its committees, and the annual review of the Company's compliance with NASDAQ governance standards of the NASDAQ Stock Market. QAD's Board believes strongly that good corporate governance accompanies and greatly aids our long-term business success. This success has been the direct result of QAD's key business strategies, people development programs emphasizing "pay for performance" and the highest business standards. QAD's Board has been at the center of these key strategies, helping to design and implement them and seeing that they guide the Company's operations. The specific responsibilities of the Governance Committee are described in the Governance Committee Charter. The Governance Committee met once during fiscal year 2012.

The Board does not have a formal nominating committee. QAD is a "controlled company" as such term is used in the NASDAQ Stock Market rules and, accordingly, is exempted from certain regulations pertaining to the director nomination process. Please see "Exemptions for a Controlled Company Election" on page 4 of this proxy statement. The Board has determined that director nominees be recommended for the Board's selection by a designated committee of one or more directors. These directors do not operate under a charter, but meet as appropriate to recommend nominees to the Board for service on the Company's Board of Directors and to recommend to the Board such persons to fill any vacancy that may arise between Annual Meetings of the Stockholders. The directors nominated for election identified in this proxy statement were nominated unanimously by the full Board.

When evaluating potential director nominees, the committee designated by the Board considers the listing requirements of the NASDAQ Stock Market as well as a potential nominee's personal and professional integrity, experience in corporate management, time available for service, experience in the Company's industry, global business and social perspective, experience as a board member of another publicly-held company, ability to make independent analytical inquiries and practical business judgment. The Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees, but the committee strives to nominate directors with a variety of complementary skills so that, as a group, the Board will possess the appropriate talent, skills, and expertise to oversee the Company's business. After potential nominees are evaluated, the committee designated by the Board makes recommendations regarding nominations to the Board. The committee may retain, at the Company's expense, any independent search firm, experts or advisors that it believes are appropriate in connection with the nomination process.

The policy of the Board is to have the Board consider properly submitted stockholder recommendations for candidates for membership to the Board. In evaluating nominees recommended by stockholders, the Board will utilize the same criteria used for nominees initially proposed by the Board members. If a stockholder wishes to nominate directors for election to the Board at next year's Annual Meeting, nominations must comply with Section 2.7 of our bylaws, including the deadlines set forth on page 36 of this proxy under "Requirements for Stockholder Proposals to be Brought Before the Annual Meeting," and must also be submitted in writing to the following address:

Santa Barbara, CA 93108

Attention: Corporate Secretary

Charters for Board Committees

Each of the Audit Committee, the Compensation Committee and the Governance Committee has a committee charter. The committee charters describe the purpose, responsibilities, structure and operations of each committee. Copies of the committee charters are available on the Company's Internet site at www.qad.com, under "Investor Relations — Corporate Governance."

The Board has an active role, as a whole and at the committee level, in overseeing management of the Company's risks. The Board regularly reviews the Company's operations and the associated risks.

|

|

●

|

The Audit Committee is responsible for overseeing general risk management. It periodically reports to the Board regarding briefings provided by management as well as the Audit Committee's own analysis and conclusions regarding the adequacy of the Company's risk management processes, including adequacy of the system of internal controls.

|

|

|

●

|

The Compensation Committee is responsible for overseeing the management of risks arising from the Company's compensation policies and practices. The Compensation Committee has determined that compensation policies and practices for the Company's employees are not reasonably likely to have a material adverse effect on the Company.

|

Both committees rely on management to be responsible for day-to-day risk management, including the monitoring of material risks facing the Company, such as strategic risks, operational risks, financial risks and legal and compliance risks. In addition, the Board encourages management to promote a corporate culture that incorporates risk management into the Company's corporate strategy and day-to-day business operations. The Board also works, with the input of the Company's executive officers, to assess and analyze the most likely areas of future risk for the Company.

Code of Business Conduct and Code of Ethics