As filed with the Securities and Exchange Commission on February 13, 2014

Registration No. 333-193645

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-10

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Cardiome Pharma Corp.

(Exact name of Registrant as specified in its charter)

| Canada | 2834 | Not Applicable | ||

| (Province or other Jurisdiction | (Primary Standard Industrial | (I.R.S. Employer | ||

| of Incorporation or Organization) | Classification Code Number) | Identification No.) |

6190 Agronomy Road, Suite 405

Vancouver, British Columbia

Canada V6T 1Z3

(604) 677-6905

(Address and telephone number of Registrant's principal executive offices)

CT Corporation System

111 Eighth Avenue

New York, New York 10011

(212) 894-8940

(Name, address and telephone number of agent for service in the United States)

Copies to:

|

Riccardo A. Leofanti, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 222 Bay Street, Suite 1750, P.O. Box 258 Toronto, Ontario, Canada M5K 1J5 (416) 777-4700 |

Joseph A. Garcia, Esq. Blakes, Cassels & Graydon LLP 595 Burrard Street, Suite 2600 Vancouver, British Columbia, Canada V7X 1L3 (604) 631-3300 |

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after this Registration Statement becomes effective.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check appropriate box):

| A. o | Upon filing with the Commission, pursuant to Rule 467(a) (if in connection with an offering being made contemporaneously in the United States and Canada). | |

| B. þ | At some future date (check the appropriate box below): |

| 1. | o | pursuant to Rule 467(b) on ( ) at ( ). | |

| 2. | o | pursuant to Rule 467(b) on ( ) at ( ) because the securities regulatory authority in the review jurisdiction has issued a receipt or notification of clearance on ( ). | |

| 3. | þ | pursuant to Rule 467(b) as soon as practicable after notification of the Commission by the Registrant or the Canadian securities regulatory authority of the review jurisdiction that a receipt or notification of clearance has been issued with respect hereto. | |

| 4. | o | after the filing of the next amendment to this Form (if preliminary material is being filed). |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to the home jurisdiction's shelf prospectus offering procedures, check the following box. þ

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registration Statement shall become effective as provided in Rule 467 under the Securities Act or on such date as the Commission, acting pursuant to Section 8(a) of the Securities Act, may determine.

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR PURCHASERS

SHORT FORM BASE SHELF PROSPECTUS

| New Issue and Secondary Offering | February 13, 2014 |

CARDIOME PHARMA CORP.

U.S.$250,000,000

Common Shares

Preferred Shares

Debt Securities

Warrants

This prospectus relates to the offering for sale from time to time, during the 25-month period that this prospectus, including any amendments hereto, remains effective, of the securities listed above in one or more series or issuances, with a total offering price of such securities, in the aggregate, of up to U.S.$250,000,000. The securities may be offered by us or by our securityholders. The securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the sale and set forth in an accompanying prospectus supplement.

Our common shares are listed on the Nasdaq Stock Market (“Nasdaq”), under the symbol “CRME” and on the Toronto Stock Exchange (“TSX”), under the symbol “COM”. On February 12, 2014, the closing price per share of our common shares was U.S.$8.24 on Nasdaq and C$9.00 on the TSX. Unless otherwise specified in an applicable prospectus supplement, our preferred shares, debt securities and warrants will not be listed on any securities or stock exchange or on any automated dealer quotation system. There is currently no market through which our securities, other than our common shares, may be sold and purchasers may not be able to resell such securities purchased under this prospectus. This may affect the pricing of our securities, other than our common shares, in the secondary market, the transparency and availability of trading prices, the liquidity of these securities and the extent of issuer regulation. See “Risk Factors”.

Our head office is located at Suite 405, 6190 Agronomy Road, Vancouver, British Columbia, Canada, V6T 1Z3 and our registered office is located at Suite 2600, 595 Burrard Street, Three Bentall Centre, Vancouver, British Columbia, Canada, V7X 1L3.

All information permitted under securities legislation to be omitted from this prospectus will be contained in one or more prospectus supplements that will be delivered to purchasers together with this prospectus. Each prospectus supplement will be incorporated by reference into this prospectus for the purposes of securities legislation as of the date of the prospectus supplement and only for the purposes of the distribution of the securities to which the prospectus supplement pertains. You should read this prospectus and any applicable prospectus supplement carefully before you invest in any securities issued pursuant to this prospectus. Our securities may be sold pursuant to this prospectus through underwriters or dealers or directly or through agents designated from time to time at amounts and prices and other terms determined by us or any selling securityholders. In connection with any underwritten offering of securities, the underwriters may over-allot or effect transactions which stabilize or maintain the market price of the securities offered. Such transactions, if commenced, may discontinue at any time. See “Plan of Distribution”. A prospectus supplement will set out the names of any underwriters, dealers, agents or selling securityholders involved in the sale of our securities, the amounts, if any, to be purchased by underwriters, the plan of distribution for such securities, including the net proceeds we expect to receive from the sale of such securities, if any, the amounts and prices at which such securities are sold and the compensation of such underwriters, dealers or agents.

Investing in our securities involves a high degree of risk. You should carefully read the “Risk Factors” section beginning on page 14 of this prospectus.

We are permitted under a multijurisdictional disclosure system adopted by the securities regulatory authorities in Canada and the United States to prepare this prospectus in accordance with the disclosure requirements of Canada. Prospective investors in the United States should be aware that such requirements are different from those of the United States.

Effective January 1, 2010, we adopted United States generally accepted accounting principles (“U.S. GAAP”) as the reporting standard for our consolidated financial statements and changed our reporting currency from Canadian dollars to U.S. dollars. Accordingly, the presentation of financial statements may vary in a material way from financial statements prepared in accordance with International Financial Reporting Standards. Unless otherwise indicated, all dollar amounts and references to “$” in our financial statements are to U.S. dollars.

Owning our securities may subject you to tax consequences both in Canada and the United States. Such tax consequences are not described in this prospectus and may not be fully described in any applicable prospectus supplement. You should read the tax discussion in any prospectus supplement with respect to a particular offering and consult your own tax advisor with respect to your own particular circumstances.

Your ability to enforce civil liabilities under the U.S. federal securities laws may be affected adversely because we are incorporated under the federal laws of Canada, most of our officers and directors and the experts named in this prospectus are Canadian residents, and a substantial portion of our assets and the assets of those officers, directors and experts are located outside of the United States.

Neither the U.S. Securities and Exchange Commission (the “SEC”), nor any state securities regulator has approved or disapproved the securities offered hereby or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offence.

No underwriter has been involved in the preparation of this prospectus or performed any review of the contents of this prospectus.

TABLE OF CONTENTS

| about this prospectus | 1 |

| FORWARD-LOOKING STATEMENTS | 1 |

| DOCUMENTS INCORPORATED BY REFERENCE | 2 |

| DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT | 5 |

| EXCHANGE RATE INFORMATION | 5 |

| CARDIOME PHARMA CORP. | 7 |

| OUR BUSINESS | 7 |

| RISK FACTORS | 14 |

| USE OF PROCEEDS | 29 |

| PRIOR SALES | 30 |

| EARNINGS COVERAGE | 31 |

| CONSOLIDATED CAPITALIZATION | 31 |

| DESCRIPTION OF SHARE CAPITAL | 31 |

| DESCRIPTION OF DEBT SECURITIES | 32 |

| DESCRIPTION OF WARRANTS | 42 |

| CERTAIN INCOME TAX CONSIDERATIONS | 44 |

| SELLING SECURITYHOLDERS | 44 |

| PLAN OF DISTRIBUTION | 44 |

| AUDITORS, TRANSFER AGENT AND REGISTRAR | 46 |

| AGENT FOR SERVICE OF PROCESS | 47 |

| LEGAL MATTERS | 47 |

| WHERE YOU CAN FIND MORE INFORMATION | 47 |

| ENFORCEABILITY OF CIVIL LIABILITIES | 48 |

about this prospectus

You should rely only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement and on the other information included in the registration statement of which this prospectus forms a part. We have not authorized anyone to provide you with different or additional information. If anyone provides you with different or additional information, you should not rely on it. We are not making an offer to sell or seeking an offer to buy the securities offered pursuant to this prospectus in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus or any applicable prospectus supplement is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this prospectus or any applicable prospectus supplement or of any sale of our securities pursuant thereto. Our business, financial condition, results of operations and prospects may have changed since those dates.

Market data and certain industry forecasts used in this prospectus or any applicable prospectus supplement and the documents incorporated by reference in this prospectus or any applicable prospectus supplement were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

In this prospectus and any prospectus supplement, unless otherwise indicated, all dollar amounts and references to “U.S.$” are to U.S. dollars and references to “C$” are to Canadian dollars. This prospectus and the documents incorporated by reference contain translations of some Canadian dollar amounts into U.S. dollars solely for your convenience. See “Exchange Rate Information”.

In this prospectus and in any prospectus supplement, unless the context otherwise requires, references to “we”, “us”, “our” or similar terms, as well as references to “Cardiome” or the “Corporation”, refer to Cardiome Pharma Corp., either alone or together with our subsidiaries.

The names Cardiome, AGGRASTAT® and BRINAVESS® are our trademarks. Other trademarks, product names and company names appearing in this prospectus and any prospectus supplement and documents incorporated by reference in this prospectus and any prospectus supplement are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

This prospectus, including the documents incorporated by reference herein, contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 or forward-looking information under applicable Canadian securities legislation that may not be based on historical fact, including, without limitation, statements containing the words “believe”, “may”, “plan”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect” and similar expressions. Forward-looking statements are necessarily based on estimates and assumptions made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as the factors we believe are appropriate. Forward-looking statements in this short form prospectus and the documents incorporated by reference herein include but are not limited to statements relating to:

| · | our intention to expand the indications for which we may market AGGRASTAT®; |

| · | our plans to develop and commercialize product candidates and the timing of these development programs; |

| · | whether we will receive, and the timing and costs of obtaining, regulatory approvals in the United States, Canada, the European Union and other countries; |

| · | the cost of post-market regulation if we receive necessary regulatory approvals; |

| · | our ability to integrate Correvio LLC (“Correvio”) into our existing business and realize the anticipated benefits of the acquisition; |

| · | clinical development of our product candidates, including the results of current and future clinical trials; |

| · | our ability to enroll patients in our clinical trials; |

| · | the benefits and risks of our product candidates as compared to others; |

| · | our maintenance and establishment of intellectual property rights in our product candidates; |

| · | whether our third party collaborators will maintain their intellectual property rights in the technology we license; |

| · | our need for additional financing and our estimates regarding our capital requirements and future revenues and profitability; |

| · | our estimates of the size of the potential markets for our product candidates; |

| 1 |

| · | our selection and licensing of product candidates; |

| · | our potential relationships with distributors and collaborators with acceptable development, regulatory and commercialization expertise and the benefits to be derived from such collaborative efforts; |

| · | sources of revenues and anticipated revenues, including contributions from distributors and collaborators, product sales, license agreements and other collaborative efforts for the development and commercialization of product candidates; |

| · | our creation of an effective direct sales and marketing infrastructure for approved products we elect to market and sell directly; |

| · | the rate and degree of market acceptance of our products; |

| · | the timing and amount of reimbursement for our products; |

| · | the success and pricing of other competing therapies that may become available; |

| · | our retention and hiring of qualified employees in the future; |

| · | the manufacturing capacity of third-party manufacturers for our product candidates; |

| · | the competition we face from other companies, research organizations, academic institutions and government agencies, and the risks such competition pose to our products; |

| · | the confidential information we possess about patients, customers and core business functions, and the information technologies we use to protect it; |

| · | our intention to continue directing a significant portion of our resources into international sales expansion; |

| · | our ability to get our products approved for use in hospitals; and |

| · | government legislation in all countries that we already, or hope to, sell our products in, and its effect on our ability to set prices, enforce patents and obtain product approvals or reimbursements. |

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies, many of which, with respect to future events, are subject to change. The factors and assumptions used by us to develop such forward-looking statements include, but are not limited to, the assumption that we will be able to reach agreements with regulatory agencies on executable development programs, the assumption that recruitment to clinical trials will continue at rates similar to our completed trials, the assumption that the regulatory requirements, including patient exposure, for approval of marketing authorization applications/new drug approvals will be maintained, the assumption that genericisation of markets for AGGRASTAT® will proceed according to estimates, the assumption that the time required to analyze and report the results of our clinical studies will be consistent with past timing, the assumption that market data and reports reviewed by us are accurate, the assumption that our current good relationships with our suppliers and service providers will be maintained, the assumptions relating to the availability of capital on terms that are favourable to us and the assumptions relating to the feasibility of future clinical trials.

By their very nature, forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause our actual results, events or developments, or industry results, to be materially different from any future results, events or developments expressed or implied by such forward-looking statements or information. In evaluating these statements, prospective purchasers should specifically consider various factors, including the risks outlined herein and in documents incorporated by reference herein under the headings “Risk Factors”. Should one or more of these risks or uncertainties or a risk that is not currently known to us materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this prospectus or, in the case of documents incorporated by reference in this prospectus, as of the date of such documents or, in the case of any prospectus supplement, as of the date of such prospectus supplement and we do not intend, and do not assume any obligation, to update these forward-looking statements, except as required by law. Investors are cautioned that forward-looking statements are not guarantees of future performance and accordingly investors are cautioned not to put undue reliance on forward-looking statements due to their inherent uncertainty.

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with securities commissions or similar authorities in Canada which have also been filed with, or furnished to, the SEC. Copies of the documents incorporated by reference in this prospectus and not delivered with this prospectus may be obtained on request without charge from our Corporate Secretary at Suite 405, 6190 Agronomy Road, Vancouver, British Columbia, Canada, V6T 1Z3 Telephone: (604) 677-6905 or by accessing the disclosure documents through the Internet on the Canadian System for Electronic Document Analysis and Retrieval, or SEDAR, at www.sedar.com. Documents filed with, or furnished to, the SEC are available through the SEC’s Electronic Data Gathering and Retrieval System, or EDGAR, at www.sec.gov.

| 2 |

The following documents, filed with the securities commissions or similar regulatory authorities in each of the provinces of Canada and filed with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, this prospectus:

| · | our annual report on Form 20-F dated March 19, 2013, for the fiscal year ended December 31, 2012; |

| · | our audited consolidated financial statements as at and for the years ended December 31, 2012 and 2011, together with the notes thereto and the auditor’s report thereon; |

| · | our management’s discussion and analysis of our financial condition and results of operations for the year ended December 31, 2012; |

| · | our unaudited interim consolidated financial statements as at and for the three and nine month periods ended September 30, 2013 and 2012; |

| · | our management’s discussion and analysis of our financial condition and results of operations for the three and nine month periods ended September 30, 2013; |

| · | our management information circular dated March 4, 2013, distributed in connection with our special meeting of shareholders held on April 3, 2013; |

| · | our management information circular dated May 24, 2013, distributed in connection with our annual general and special meeting of shareholders held on June 28, 2013; |

| · | our business acquisition report dated January 29, 2014 relating to the acquisition of Correvio; and |

| · | each of the following material change reports: |

| (i) | our report dated February 4, 2013, relating to our announcement that we engaged Quintiles to provide comprehensive post-marketing lifecycle safety and global regulatory affairs services for BRINAVESS®. |

| (ii) | our report dated March 4, 2013, relating to our announcement that we made the final payment to Merck Sharp & Dohme Corp. (as successor in interest to the entity formerly known as Merck & Co., Inc.) (“Merck”) of U.S.$13 million as full and final settlement of all amounts owing under the line of credit stemming from our collaboration and license agreement for vernakalant, signed in April 2009. |

| (iii) | our report dated March 15, 2013, relating to the announcement of our financial results for the year ended December 31, 2012. |

| (iv) | our report dated April 2, 2013, relating to the announcement of changes to our senior management team. |

| (v) | our report dated April 4, 2013, relating to the announcement of shareholder approval of the consolidation of our issued and outstanding common shares on the basis of one (1) post-consolidation common share for every five (5) pre-consolidation common shares. |

| (vi) | our report dated April 12, 2013, relating to the announcement that our share capital began trading on a post-consolidated basis under the same stock symbol effective April 12, 2013. |

| (vii) | our report dated May 2, 2013, relating to the announced completion of the transfer of sponsorship of the U.S. Investigational New Drug Applications for vernakalant intravenous (IV) and oral, and the transfer of the U.S. New Drug Application for vernakalant (IV) from Merck to us. |

| (viii) | our report dated May 3, 2013, relating to the announced transition agreement with Merck for the orderly and efficient transition of rights and responsibilities related to vernakalant. |

| (ix) | our report dated May 15, 2013, relating to the announcement of our financial results for the three months ended March 31, 2013. |

| (x) | our report dated May 28, 2013, relating to the announcement of our board of directors’ adoption of an advanced notice policy for director nominations. |

| 3 |

| (xi) | our report dated June 27, 2013, relating to the announcement of the adoption of the decision by the European Commission of the transfer of the centrally-approved marketing authorisation for BRINAVESS® (vernakalant (IV)) from Merck to us. |

| (xii) | our report dated July 2, 2013, relating to the announcement of shareholder approval of an amendment to our by-laws to incorporate an advanced notice policy for director nominations. |

| (xiii) | our report dated July 3, 2013, relating to the announcement of an agreement with AOP Orphan Pharmaceuticals AG to commercialize BRINAVESS® (vernakalant (IV)) in select European markets. |

| (xiv) | our report dated August 2, 2013, relating to the announcement of our financial results for the six months ended June 30, 2013. |

| (xv) | our report dated September 16, 2013, relating to the announcement of completion of the transfer of commercialization responsibility for BRINAVESS® (vernakalant (IV)) in the European Union from Merck to us. |

| (xvi) | our report dated September 17, 2013, relating to the announcement of an agreement between Cardiome International AG (formerly Cardiome Development AG) and Tzamal Medical Ltd., to sell and distribute BRINAVESS® (vernakalant (IV)) exclusively in Israel. |

| (xvii) | our report dated September 24, 2013, relating to the announcement of an agreement between Cardiome International AG (formerly Cardiome Development AG) and LifePharma (Z.A.M) Ltd., to sell and distribute BRINAVESS® (vernakalant (IV)) exclusively in Cyprus. |

| (xviii) | our report dated September 24, 2013, relating to the announcement of the publication of positive data from an open label study in patients with atrial fibrillation that compared treatment with vernakalant (IV) to oral propafenone and oral flecainide. |

| (xix) | our report dated September 25, 2013, relating to the announcement that BRINAVESS® (vernakalant (IV)) has been approved in Turkey by the Turkish Ministry of Health for the rapid conversion of recent onset atrial fibrillation to sinus rhythm in adults. |

| (xx) | our report dated September 30, 2013, relating to the announcement that BRINAVESS® (vernakalant (IV)) has been approved in South Africa by the Medicines Control Council for the rapid conversion of recent onset atrial fibrillation to sinus rhythm in adults. |

| (xxi) | our report dated October 7, 2013, relating to the announcement of the publication of positive data from an observational, retrospective study performed at the Skåne University Hospital in Malmö, Sweden. |

| (xxii) | our report dated October 9, 2013, relating to the announcement of an agreement with Biospifar S.A., to sell and distribute BRINAVESS® (vernakalant (IV)) exclusively in Colombia. |

| (xxiii) | our report dated October 21, 2013, relating to the announcement of an agreement with Algorithm S.A.L. to sell and distribute BRINAVESS® (vernakalant (IV)) exclusively in certain Middle Eastern and North African countries. |

| (xxiv) | our report dated October 28, 2013, relating to the announcement that the abstract, Conversion of Acute Atrial Fibrillation with Propafenone or Vernakalant, is being presented as an oral presentation by Dr. Diego Conde, Chief of Cardiovascular Emergency Care Section, Instituto Cardiovascular de Buenos Aires, at the Venice Arrhythmias meeting, and providing an update on journal publications by Dr. Conde of comparative studies for intravenous (IV) vernakalant in the treatment of atrial fibrillation versus other antiarrhythmic medications and electrical cardioversion. |

| (xxv) | our report dated November 6, 2013, relating to the announcement of our financial results for the nine months ended September 30, 2013. |

| (xxvi) | our report dated November 18, 2013, relating to the announcement of the acquisition of Correvio LLC. |

| 4 |

| (xxvii) | our report dated November 21, 2013, relating to the announcement of a publication titled, Pharmacological Cardioversion of Atrial Fibrillation with Vernakalant: Evidence in Support of the ESC Guidelines, was published in Europace, the official Journal of the European Heart Rhythm Association, concluding that BRINAVESS® is an efficacious and rapid acting pharmacological cardioversion agent for recent-onset atrial fibrillation. |

Any documents of the type described in Section 11.1 of Form 44-101F1 Short Form Prospectuses filed by the Corporation with a securities commission or similar authority in any province of Canada subsequent to the date of this short form prospectus and prior to the expiry of this prospectus, or the completion of the issuance of securities pursuant hereto, will be deemed to be incorporated by reference into this prospectus.

In addition, to the extent that any document or information incorporated by reference into this prospectus is filed with, or furnished to, the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the date of this prospectus, such document or information will be deemed to be incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part (in the case of a report on Form 6-K, if and to the extent expressly provided therein).

A prospectus supplement containing the specific terms of any offering of our securities will be delivered to purchasers of our securities together with this prospectus and will be deemed to be incorporated by reference in this prospectus as of the date of the prospectus supplement and only for the purposes of the offering of our securities to which that prospectus supplement pertains.

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not to be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of material fact or an omission to state a material fact that is required to be stated or is necessary to make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

Upon our filing a new annual information form and the related annual financial statements and management’s discussion and analysis with applicable securities regulatory authorities during the currency of this prospectus, the previous annual information form, the previous annual financial statements and management’s discussion and analysis and all quarterly financial statements, supplemental information, material change reports and information circulars filed prior to the commencement of our financial year in which the new annual information form is filed will be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of our securities under this prospectus. Upon interim consolidated financial statements and the accompanying management’s discussion and analysis and material change report being filed by us with the applicable securities regulatory authorities during the duration of this prospectus, all interim consolidated financial statements and the accompanying management’s discussion and analysis and material change report filed prior to the new interim consolidated financial statements shall be deemed no longer to be incorporated into this prospectus for purposes of future offers and sales of securities under this prospectus.

References to our website in any documents that are incorporated by reference into this prospectus do not incorporate by reference the information on such website into this prospectus, and we disclaim any such incorporation by reference.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have been or will be filed with the SEC as part of the registration statement of which this prospectus forms a part: (i) the documents listed under the heading “Documents Incorporated by Reference”; (ii) powers of attorney from our directors and officers; (iii) the consent of KPMG LLP; (iv) the consent of Ernst & Young LLP; and (v) the form of indenture relating to the debt securities that may be issued under this prospectus.

EXCHANGE RATE INFORMATION

The following table sets forth for each period indicated: (i) the noon exchange rates in effect at the end of the period; (ii) the high and low noon exchange rates during such period; and (iii) the average noon exchange rates for such period, for one Canadian dollar, expressed in U.S. dollars, as quoted by the Bank of Canada.

| 5 |

| Year Ended December 31 | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| U.S.$ | U.S.$ | U.S.$ | ||||||||||

| Closing | 0.9402 | 1.0051 | 0.9833 | |||||||||

| High | 1.0164 | 1.0299 | 1.0583 | |||||||||

| Low | 0.9348 | 0.9599 | 0.9430 | |||||||||

| Average | 0.9710 | 1.0004 | 1.0111 | |||||||||

| Nine Months Ended September 30 | ||||||||||||

| 2013 | 2012 | 2011 | ||||||||||

| U.S.$ | U.S.$ | U.S.$ | ||||||||||

| Closing | 0.9723 | 1.0166 | 0.9626 | |||||||||

| High | 1.0164 | 1.0299 | 1.0583 | |||||||||

| Low | 0.9455 | 0.9599 | 0.9626 | |||||||||

| Average | 0.9770 | 0.9979 | 1.0225 | |||||||||

On February 12, 2014, the noon exchange rate as quoted by the Bank of Canada was C$1.00 = U.S.$0.9097.

| 6 |

CARDIOME PHARMA CORP.

We were incorporated under the Company Act (British Columbia) on December 12, 1986 under the name Nortran Resources Ltd. In June 1992, we changed our name to Nortran Pharmaceuticals Inc. In June 2001, we changed our name to Cardiome Pharma Corp. On March 8, 2002, we continued under the Canada Business Corporations Act (“CBCA”) and effected a four-to-one share consolidation. On March 1, 2009, we amalgamated with Cardiome Research and Development (Barbados), Inc. (previously our wholly–owned subsidiary). On March 20, 2009, we registered under the Business Corporations Act (British Columbia) as an extra-provincial company. On April 9, 2013, we effected a five-to-one share consolidation of our common shares and began trading on a post-consolidation basis on April 12, 2013. All share and per share information in this prospectus gives effect to the share consolidation on a retroactive basis, unless otherwise indicated.

Prior to November 18, 2013, we had five wholly-owned subsidiaries: Rhythm-Search Developments Ltd., a company incorporated under the Company Act (British Columbia); Cardiome, Inc. (formerly Paralex, Inc.), a company incorporated under the Delaware General Corporation Law; Artesian Therapeutics, Inc., a company incorporated under the Delaware General Corporation Law; Cardiome International AG (formerly Cardiome Development AG.), a company continued under the laws of Switzerland, and Cardiome UK Limited, a company incorporated under the laws of the United Kingdom.

On November 18, 2013, we completed the acquisition of Correvio, a privately held pharmaceutical company headquartered in Geneva, Switzerland. As a result of this transaction, we acquired or incorporated the following wholly-owned subsidiaries:

| Subsidiary Name | Jurisdiction of Incorporation or Organization |

| Correvio LLC | Delaware, U.S.A. |

| Murk Acquisition Sub, Inc. | Delaware, U.S.A. |

| Correvio International S.a.r.l. | Switzerland |

| Correvio GmbH | Germany |

| Correvio Italia S.r.l. | Italy |

| Correvio AB | Sweden |

| Correvio S.a.r.l. | France |

| Correvio Spain S.L. | Spain |

| Correvio Belgium S.p.r.l. | Belgium |

| Correvio (UK) Ltd. | United Kingdom |

| Correvio (Australia) Pty Ltd. | Australia |

Our registered office is located at Suite 2600, 595 Burrard Street, Three Bentall Centre, Vancouver, British Columbia, Canada, V7X 1L3 and our head office and principal place of business are located at Suite 405, 6190 Agronomy Road, Vancouver, British Columbia, Canada, V6T 1Z3.

OUR BUSINESS

Cardiome is a specialty pharmaceutical company dedicated to the development and commercialization of cardiovascular therapies that will improve the quality of life and health of patients suffering from heart disease. We strive to find innovative, differentiated medicines that provide therapeutic and economic value to patients, physicians and healthcare systems. We currently have two marketed, in-hospital, cardiology products, BRINAVESS® and AGGRASTAT®, which are commercially available in numerous markets outside of the United States.

BRINAVESS® (vernakalant (IV)), was approved in the European Union in September 2010 and is currently registered and approved in a total of 56 countries for the rapid conversion of recent onset atrial fibrillation to sinus rhythm in adults (for non-surgery patients with atrial fibrillation of seven days or less) and for use in post-cardiac surgery patients with atrial fibrillation of three days or less. BRINAVESS® is recommended as a first-line therapy in the European Society of Cardiology atrial fibrillation guidelines for the cardioversion of recent-onset atrial fibrillation in patients with no, or moderate, structural heart disease.

| 7 |

AGGRASTAT® (tirofiban HCL) is a reversible GP IIb/IIIa inhibitor (an intravenous anti-platelet drug) for use in Acute Coronary Syndrome (ACS) patients. We acquired the ex-U.S. marketing rights to AGGRASTAT® as part of the Correvio acquisition.

Both BRINAVESS® and AGGRASTAT® are available commercially outside of the United States either directly through our own sales force in Europe or via our distributor and partner network in other parts of the world.

Our Strategy

Our core strategy is to create a hospital-based, profitable and sustainable pharmaceutical company through the acquisition, development and commercialization of innovative, cardiovascular products that we believe will help patients, health care providers, and healthcare systems provide safer, more efficacious and cost effective treatments for heart disease. Key elements of our strategy include:

| · | Expanding our product offering and product pipeline through in-licensing and/or acquisitions. We continuously evaluate in-licensing and acquisition opportunities that complement our product and operational capabilities. Priority will be given to later-stage or approved product opportunities that could be sold through our European, in-hospital, cardiology sales force. |

| · | Successfully obtaining approval for vernakalant worldwide. We intend to continue to advance the approval and development of vernakalant (IV) in the United States, Canada and elsewhere, and vernakalant (oral) worldwide. We intend to pursue a regulatory strategy to further develop both intravenous and oral vernakalant in order to achieve its maximum potential in the treatment of acute and more chronic forms of atrial fibrillation. |

| · | Successfully commercializing BRINAVESS® in currently approved countries. We intend to continue to sell BRINAVESS® in countries where it is presently approved, marketed and reimbursed. Initially, we intend to focus our sales efforts on promoting BRINAVESS® product sales in Europe via a fully dedicated direct sales force operating in eight countries in Western Europe. We also intend to seek reimbursement in countries where the product has regulatory approval but has not launched (namely France, Italy, the United Kingdom and Belgium) in order to broaden the commercial opportunity for BRINAVESS®. |

| · | Continuing to support the worldwide marketing of AGGRASTAT®. We intend to continue to sell AGGRASTAT® in countries where it is presently approved, marketed and reimbursed for as long as these markets are economically viable. Further, we are seeking to expand the indications for which we may market AGGRASTAT® through extension of the indication statement for AGGRASTAT® to include “the reduction of major cardiovascular events in patients with acute myocardial infarction (STEMI – ST-elevated myocardial infarction) intended for primary PCI (percutaneous coronary intervention).” AGGRASTAT® has already been granted this expanded label in some countries. |

| · | Leveraging external resources. We focus our internal resources on those activities that we believe add or create the most value. We maintain a core team of professionals, consultants and staff with the necessary skill base for our operations, and contract out the specialized work required, such as pharmacovigilance, regulatory, commercial manufacturing, and distribution to external organizations. |

| · | Continuing to support our pre-clinical programs in ion channel research by collaborating with external researchers many of whom have extensive knowledge and understanding of these programs. This collective knowledge, experience and expertise helps ensure that the ideas pursued are of a high caliber and are therefore more likely to result in a drug which impacts a specific disease state. Whenever possible, we intend to offset the costs of these programs with funding from applicable granting agencies. |

Our Products and Product Candidates

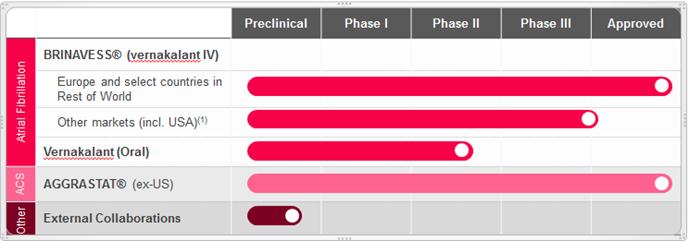

We currently have two commercially available pharmaceutical products, BRINAVESS® and AGGRASTAT®. BRINAVESS®, the intravenous formulation of vernakalant, has been approved in Europe, in some countries in Central and South America, Asia and the Middle East. We hold the global development and commercialisation rights for all indications for vernakalant (IV) and oral on a royalty-free basis, subject to the ongoing transfer of certain rights from Merck and its affiliates to us, which has been delayed in certain jurisdictions due to routine regulatory requirements and is expected to be completed in the first half of 2014. AGGRASTAT® has been approved in numerous countries worldwide and we hold the global marketing rights outside of the United States. We also have several preclinical stage programs. The following chart summarizes our current products and product candidates, including the principal disease being targeted and the development stage for each program.

| 8 |

In 2013, we began establishing a direct, in-hospital sales force in select European markets in support of BRINAVESS® and have complemented our coverage through the acquisition of Correvio. Although BRINAVESS® is not currently marketed in all of the major European countries, our sales force, following the acquisition of Correvio, now has the capability to cover Germany, Spain, Italy, France, the United Kingdom, Sweden, Norway, Finland, Denmark, the Netherlands and Luxembourg. We have partnered with AOP Orphan Pharmaceutical AG (“AOP Orphan”) to commercialize BRINAVESS® in select European markets where we do not currently operate directly, including Austria and parts of Eastern Europe. We expect that AOP Orphan will support us in obtaining product registrations required for the marketing and sale of BRINAVESS® in those markets where this is required and will actively call on customers to promote the product. In addition, we entered into commercialization and sales agreements with Tzamal Medical Ltd. (“Tzamal”) in Israel, LifePharma (Z.A.M.) Ltd. in Cyprus, Biospifar S.A. in Colombia and Algorithm S.A.L. (“Algorithm”) in certain Middle Eastern and North African countries. We have also entered into agreements with Oriola Oy in Finland, Nomeco in Denmark and Tamro in Sweden for warehousing, consignment and distribution services. Correvio also has a significant distributor network, some of which overlap with our existing network. These distributors include, amongst others, Aspen Global Incorporated, Algorithm and Tzamal.

The following chart summarizes our current products and product candidates, including the principal disease being targeted and the development stage for each program.

Notes:

(1) In October 2010, the

Phase 3, ACT 5 study of vernakalant (IV) was suspended and subsequently terminated in the United States. We have not obtained

permission from the FDA to restart the trial.

Vernakalant for Atrial Fibrillation

Atrial fibrillation is the most common cardiac arrhythmia (abnormal heart rhythm). It is characterized by an erratic and often rapid heart rate where the electrical activity of the heart's two small upper chambers (the atria) are not coordinated, resulting in inefficient pumping of blood and an increased risk of developing a blood clot in the heart, which could lead to embolic stroke. If a blood clot in the atria leaves the heart, enters the circulation, and becomes lodged in an artery in the brain, a stroke may result. Approximately 15% of all strokes occur in people with atrial fibrillation.

The risk of developing atrial fibrillation increases with age. The lifetime risk of developing atrial fibrillation at age 55 has been estimated at 24% in men and 22% in women. In addition, during the past 20 years, there has been a 60% increase in hospital admissions for atrial fibrillation independent of changes in known risk factors. Third party research estimates that 5.5 million patients are treated for atrial fibrillation in the seven leading industrialized nations each year.

Vernakalant is a new chemical entity designed by Cardiome’s scientists to treat atrial fibrillation by converting the heart back into normal rhythm and possesses the potential to overcome several limitations of current drugs and devices which are currently utilized to treat atrial fibrillation. Its mechanism of action involves the selective blockade of multiple ion channels in the heart that are known to be active during episodes of atrial fibrillation. The drug is being developed for two potential applications: (a) vernakalant (IV) was developed as an intravenous pharmacological converting agent designed to terminate an atrial fibrillation episode and return the heart to normal rhythm; and (b) vernakalant (oral) is being evaluated as an oral maintenance therapy for the long-term prevention of atrial fibrillation recurrence in patients who have had one or more previous episodes of atrial fibrillation.

| 9 |

Vernakalant (IV)

Cardiome has exclusive, global marketing rights to BRINAVESS®, the intravenous formulation of vernakalant, and is responsible for all future development and commercialization of the product, subject to ongoing transfer of certain rights from Merck and its affiliates to us, which has been delayed in certain jurisdictions due to routine regulatory requirements and is expected to be completed in the first half of 2014. Prior to September 2013, global marketing rights to vernakalant (IV) were held by Merck under two collaboration and license agreements.

Regulatory Matters

North America

In December 2006, our former partner, Astellas Pharma US, Inc. (“Astellas”), filed a New Drug Application (“NDA”) for vernakalant (IV) with the U.S. Food and Drug Administration (“FDA”). In August 2008, Astellas received an action letter from the FDA, informing Astellas that the FDA had completed its review of the NDA for vernakalant (IV) and that the application was approvable. The letter requested additional information associated with the risk of previously identified events experienced by a subset of patients during the clinical trials as well as a safety update from ongoing or completed studies of vernakalant (IV), regardless of indication, dosage form or dose level. The action letter further indicated that if the response to their requests was not satisfactory, additional clinical studies may be required.

In August 2009, we, together with our former partner Astellas, announced that Astellas would undertake a single confirmatory additional Phase 3 clinical trial (ACT 5) under a Special Protocol Assessment. The decision to conduct another trial was reached following extended discussions between Astellas and the FDA to define the best regulatory path forward for vernakalant (IV). ACT 5 began enrolment of recent onset atrial fibrillation patients without a history of heart failure in October 2009.

In October 2010, a clinical hold was placed on the ACT 5 study of vernakalant (IV) following a single unexpected serious adverse event of cardiogenic shock experienced by a patient with atrial fibrillation who received vernakalant (IV).

In July 2011, Merck acquired the rights for the development and commercialization of vernakalant (IV) in North America. Merck and the FDA agreed to terminate the ACT 5 study. Merck began discussions with the FDA to determine the next steps for the development of vernakalant (IV) in the United States.

In May 2013, we completed the transfer of sponsorship of the U.S. Investigational New Drugs (“INDs”) for vernakalant (IV) and vernakalant (oral) and the transfer of the NDA for vernakalant (IV) from Merck to us. We intend to continue discussions with the FDA regarding potential development paths for the vernakalant programs in the United States.

Rest of World (Outside North America)

In July 2009, our former partner Merck submitted a Marketing Authorization Application (“MAA”) to the European Medicines Agency (“EMA”) seeking marketing approval for vernakalant (IV) in the European Union, and as a result of the submission we received a $15 million milestone payment from Merck.

In June 2010, the Committee for Medicinal Products for Human Use of the EMA recommended marketing approval of vernakalant (IV) for the conversion of recent onset atrial fibrillation to sinus rhythm in adults and in September 2010, vernakalant (IV) received marketing approval under the trade name BRINAVESS® in the European Union, Iceland and Norway. This milestone triggered a $30 million milestone payment from Merck. After receipt of marketing approval, Merck began its commercial launch of BRINAVESS® in a number of European countries.

In June 2013 we announced the decision by the European Commission to allow the transfer of the centrally-approved marketing authorisation for BRINAVESS® from Merck to Cardiome.

Clinical Trials

The clinical effect of BRINAVESS® in the treatment of patients with atrial fibrillation has been evaluated in three, randomised, double-blind, placebo-controlled studies (ACT I, ACT II and ACT III) and in an active comparator trial versus intravenous amiodarone. Based on data from 1018 patients in eight Phase 2 and Phase 3 trials, BRINAVESS® has been approved in the European Union, New Zealand and countries in Central America, South America, Asia and the Middle East for the rapid conversion of recent onset atrial fibrillation to sinus rhythm in adults who have experienced atrial fibrillation for the following periods:

| 10 |

| · | For non-surgery patients: ≤ 7 days duration |

| · | For post-cardiac surgery patients: ≤ 3 days duration. |

In August 2010, Merck initiated a 615 patient Phase 3 Asia Pacific vernakalant (IV) study that was expected to support regulatory applications in additional territories for which marketing approval has not yet been obtained. In 2013, the study was terminated as part of the transfer of rights and responsibilities under the collaboration and license agreements from Merck to us, and our analysis of the study is ongoing.

In 2011, Merck initiated a 2,000 patient post-approval study for vernakalant (IV). This non-interventional prospective study is a post-authorization safety study of vernakalant (IV) conducted to collect information about normal conditions of use and appropriate dosing, and to quantify possible medically significant risks associated with the use of vernakalant in real-world clinical practice. In 2013, the transfer of this post-approval safety study (“PASS”) from Merck to us was completed. After the transfer, we recognized that the study had enrolled less quickly than initially anticipated and we filed an application to reduce the number of patients required for this study to 1,300.

Former Collaborations

North America

In October 2003, we entered into a collaboration and license agreement, referred to as the “North American Vernakalant (IV) Agreement”, with an affiliate of Astellas. We granted Astellas an exclusive license to vernakalant (IV) and its related technology to develop, make and sell intravenous or injectable formulations of vernakalant in North America for any and all indications including the treatment of atrial fibrillation and atrial flutter, including a right to sublicense to third parties.

Under the terms of the North American Vernakalant (IV) Agreement, Astellas paid us an up-front payment of $10 million, invested $4 million in us at a 25% premium to our then current share price, and agreed to pay us milestone payments of up to $56 million based on the achievement of specified development and commercialization milestones. In addition, should the product have been approved for use by the applicable regulatory authorities in North America, we would have been entitled to royalty payments of approximately 25% of total North American end-user sales revenue, as well as royalties based on future net sales and sublicense revenue. Following the successful completion of ACT I, in February 2005 we announced the collection of our first milestone payment of $6 million from Astellas.

In July 2006, we amended our North American Vernakalant (IV) Agreement with Astellas. Under the amended terms of our North American Vernakalant (IV) Agreement, Astellas agreed to fund all of the costs associated with the re-submission of the NDA for vernakalant (IV), including the engagement of external consultants, and Astellas paid to us a $10 million milestone payment on the re-submission of the NDA for vernakalant (IV) to the FDA. In addition, a $15 million milestone payment would have been payable on approval of vernakalant (IV) by the FDA.

In October 2010, Astellas suspended patient enrollment in the ACT 5 study of vernakalant (IV) following a single unexpected serious adverse event of cardiogenic shock experienced by a patient with atrial fibrillation who received vernakalant (IV).

In July 2011, Merck acquired the rights for the development and commercialization of vernakalant (IV) in North America from Astellas. All terms, responsibilities and payments that Astellas committed to under the North American Vernakalant (IV) Agreement were assumed by Merck without change.

Merck was responsible for 75% of all the remaining development costs related to seeking regulatory approval in North American markets, and all marketing and commercialization costs for vernakalant (IV) in North America. Under the North American Vernakalant (IV) Agreement we had the right to additional milestone payments with respect to any subsequent drugs developed under the agreement.

In September 2012, Merck gave notice to us of its termination of the North American Vernakalant (IV) Agreement. In May 2013, we announced the completion of the transfer of sponsorship of the U.S. Investigational NDAs for vernakalant (IV), the transfer of the U.S. NDA for vernakalant (IV), and the transfer of sponsorship of all vernakalant Canadian Clinical Trial Applications from Merck to us. All marketing rights for North America have been returned to us.

| 11 |

Outside North America

In April 2009, we entered into a collaboration and license agreement with Merck for the development and commercialization of vernakalant (the “Collaboration Agreement”). The Collaboration Agreement provided an affiliate of Merck with exclusive global rights to vernakalant (oral) and exclusive rights outside of North America to vernakalant (IV).

Under the terms of the Collaboration Agreement, Merck paid us an initial fee of $60 million. In addition, we were eligible to receive up to an additional $200 million in payments, of which we received $45 million, based on the achievement of certain milestones associated with the development and approval of vernakalant products, and up to $100 million for milestones associated with approvals in other subsequent indications of both the intravenous and oral formulations. Also, we were eligible to receive tiered royalty payments on sales of any approved products and had the potential to receive up to $340 million in additional milestone payments based on achievement of significant sales thresholds. Merck was responsible for all costs associated with the development, manufacturing and commercialization of these product candidates.

In July 2009, we received a $15 million milestone payment as a result of Merck’s affiliate filing an MAA with the EMA seeking marketing approval for vernakalant (IV) in the European Union. In September 2010, we received a $30 million milestone payment from Merck as a result of receiving marketing approval for vernakalant (IV) in the European Union, Iceland and Norway under the trade name BRINAVESS®. Under the Collaboration Agreement, we also shipped and were reimbursed for $7 million of clinical supplies provided to Merck.

In September 2012, Merck gave notice to us of its termination of the Collaboration Agreement. On April 24, 2013, we entered into a Transition Agreement with Merck (the “Transition Agreement”) to amend and supplement the provisions of the Collaboration Agreements governing their rights and responsibilities in connection with the termination of the Collaboration Agreement and transfer of rights to, and responsibilities for, vernakalant to us. Pursuant to the Transition Agreement, we took responsibility for worldwide sales, marketing, and promotion of vernakalant (IV) on April 24, 2013. Regulatory product rights and product distribution responsibility were transferred to us upon transfer of the marketing authorizations in the relevant countries, subject to the ongoing transfer of certain rights from Merck and its affiliates to us, which has been delayed in some jurisdictions due to routine regulatory requirements and is expected to be completed in the first half of 2014.

On June 21, 2013, the European Commission approved the transfer of the centrally-approved marketing authorization for BRINAVESS® from Merck to us. We are now the marketing authorization holder for BRINAVESS® in the member states of the European Union. As a result, royalties on sales and the promotional services fee we previously received from Merck ceased on July 1, 2013 and we began benefiting from all sales of BRINAVESS® throughout the world.

On September 16, 2013, we announced the completion of the transfer from Merck to us of commercialization responsibility for BRINAVESS® in the European Union and the responsibility to complete the post-marketing study for BRINAVESS®. We are now supplying BRINAVESS® under our own trade dress in the European Union.

As part of the Collaboration Agreement, Merck granted us a secured, interest-bearing credit facility of up to $100 million accessible in tranches over several years commencing in 2010. In February 2010, we received an advance of $25 million from a Merck affiliate under the credit facility. In January 2012, we received another advance of $25 million from a Merck affiliate under the credit facility. In December 2012, we reached an agreement with Merck to settle our debt obligation. In 2013, we paid Merck $20 million to settle our outstanding debt of $50 million plus accrued interest of $2 million owed to Merck. The settlement between us and Merck terminated the credit facility, extinguished all outstanding debt obligations, and released and discharged the collateral security taken in respect of the advances under the line of credit.

Vernakalant (oral)

Vernakalant (oral) is being developed as an oral maintenance therapy for the long-term prevention of atrial fibrillation recurrence. In July and September 2006, we announced positive top line results for the sequential 300 mg and 600 mg dosing groups, respectively, from the Phase 2a pilot study of vernakalant (oral). In July 2008, we announced positive clinical results from the Phase 2b clinical study of vernakalant (oral) to further evaluate the safety and tolerability, pharmacokinetics and efficacy of vernakalant (oral).

| 12 |

In April 2009, we entered into the Collaboration Agreement with Merck for the development and commercialization of vernakalant. The agreement provided an affiliate of Merck with exclusive global rights to vernakalant (oral) and exclusive rights outside of the United States, Canada and Mexico to vernakalant (IV).

In November 2011, Merck completed an additional multiple rising-dose Phase I study to explore the safety, tolerability, pharmacokinetics and pharmacodynamics of higher doses of vernakalant (oral) than previously studied in healthy subjects and that in this study, vernakalant (oral) was well-tolerated at increased exposures. We also announced that Merck had scheduled, to start in late 2011, an additional Phase I trial assessing the safety and tolerability of vernakalant (oral) when dosed for a more extended period of time at higher exposures.

In March 2012, Merck informed us of its decision to discontinue further development of vernakalant (oral). In September 2012, we announced that Merck would return the global marketing and development rights for vernakalant (oral) to us in connection with Merck’s termination of the Collaboration Agreement. In May 2013, we completed the transfer of sponsorship of the IND for vernakalant (oral) from Merck to us.

Clinical Trials

In an oral dosing study in humans completed in December 2002, vernakalant was shown to have significant oral bioavailability, suggesting that it could also be used for long-term oral therapy. Based on these results, we conducted a series of Phase 1 clinical studies to evaluate vernakalant (oral) as a candidate for further clinical development as an oral maintenance therapy for the long-term prevention of atrial fibrillation recurrence. In August 2005, we announced the successful completion of the Phase 1 studies required to advance clinical testing of vernakalant (oral) into a Phase 2 study.

In July and September 2006, we announced positive top-line results from a Phase 2A pilot trial evaluating 300 mg and 600 mg dosing groups, of vernakalant (oral). For the 300 mg dosing group, 61% (33 of 54) of patients receiving vernakalant (oral) completed the study in normal heart rhythm, as compared to 43% (24 of 56) of all patients receiving placebo. For the 600 mg dosing group, 61% (30 of 49) of patients receiving vernakalant (oral) completed the study in normal heart rhythm, as compared to 43% (24 of 56) of all patients receiving placebo.

A Kaplan-Meier analysis of the results demonstrated a statistically significant efficacy difference between the 300 mg dosing group and the placebo group (p=0.048). The difference between the 600 mg dosing group and the placebo group trended toward but did not reach statistical significance (p=0.060). A combined analysis of all drug group patients relative to the placebo group also demonstrated a statistically significant difference (p=0.028).

The safety data for both dosing groups suggests that vernakalant (oral) appears well-tolerated over the one-month dosing period within the target population. During the 28 days of oral dosing, serious adverse events occurred in 8% of all placebo patients, 10% of patients in the 300 mg dosing group, and 11% of patients in the 600 mg dosing group. Potentially drug-related serious adverse events occurred in 1% of all placebo patients, 4% of patients in the 300 mg dosing group and 5% of patients in the 600 mg dosing group. There were no cases of drug-related “Torsades de Pointes” (an uncommon type of ventricular arrhythmia).

In early 2007, we initiated a Phase 2b clinical study of vernakalant (oral) to further evaluate the safety and tolerability, pharmacokinetics and efficacy of vernakalant (oral) in up to 90 days of oral dosing in patients at risk of recurrent atrial fibrillation. The study included four dosing groups, three of which received the active drug and one that received placebo. Patients received a 150 mg, 300 mg or 500 mg dose of vernakalant (oral) or placebo twice per day. After the first three days, patients still in atrial fibrillation were electrically cardioverted. Successfully cardioverted patients continued to receive vernakalant (oral) or placebo for the remainder of the 90-day trial and were monitored throughout the dosing period. A total of 735 patients were randomized in the study, of which 605 were successfully cardioverted to sinus rhythm and entered the maintenance phase and therefore were evaluated for efficacy.

In March 2008, we announced positive interim analysis results from the Phase 2b trial. In July 2008, we announced final clinical results from the Phase 2b trial. The final results demonstrated that the 500 mg dosing group significantly reduced the rate of atrial fibrillation relapse as compared to the placebo group (two-sided log rank, p=0.0221). The median time to recurrence of atrial fibrillation was greater than 90 days for the 500 mg dosing group, compared to 27 days for the placebo group. Of the patients in the 500 mg dosing group (n=150), 51% completed the study in normal heart rhythm compared to 37% of patients receiving placebo (n=160). Both the 150 mg (n=147) and 300 mg (n=148) dosing groups also trended toward efficacy in preventing relapse to atrial fibrillation, but were not statistically significant when compared with the placebo group. These results provide evidence of a clear dose response, with 500 mg dose taken twice per day proving to be the effective dose to prevent the recurrence of atrial fibrillation in this trial.

| 13 |

There was no significant difference in the incidence of serious adverse events between treatment groups. Potentially drug-related serious adverse events occurred in 0.5% of placebo patients, 1.1% of patients in the 150 mg dosing group, 0.5% of patients in the 300 mg dosing group and 0.5% of patients in the 500 mg dosing group. There were no cases of “Torsades de Pointes”. There were four deaths in the study, all unrelated to vernakalant (oral), with two such patients in the placebo group, one patient in the 150 mg dosing group and one patient in the 300 mg dosing group. There were no deaths in the 500 mg dosing group.

AGGRASTAT® for Acute Coronary Syndrome

AGGRASTAT® contains tirofiban hydrochloride, which is a reversible GP IIb/IIIa inhibitor for use in indicated Acute Coronary Syndrome patients. AGGRASTAT® is used to help assist the blood flow to the heart and to prevent chest pain and/or heart attacks (both STEMI – ST-elevation myocardial infarction, and NONSTEMI – non-ST-elevation myocardial infarction). It works by preventing platelets, cells found in the blood, from forming into blood clots within the coronary arteries and obstructing blood flow to the heart muscle which can result in a heart attack. The medicine may also be used in patients whose heart vessels are dilated with a balloon (percutaneous coronary intervention or PCI, a procedure used to open up blocked or obstructed arteries in the heart in order to improve the blood flow to the heart muscle (myocardium)) with or without the placement of a coronary stent. AGGRASTAT® is administered intravenously, and has been on the market for many years with an excellent safety and efficacy profile.

Pre-clinical Projects

We continue to support pre-clinical research and development work externally through academic research collaborations. The focus of the technology is on modulating cellular proteins (ion channels) that gate the movement of ions across the cell membrane to control a variety of essential functions ranging from the contraction of muscles, to the secretion from glands, to responses to foreign bodies and inflammation. The wide variety of such proteins provides a broad area for the development of therapeutics useful in a large number of human disorders.

U.S. Export Controls and Economic Sanctions

Cardiome is a global, innovation-driven pharmaceutical business with worldwide operations (directly and through distributors). Prior to the acquisition of Correvio, Cardiome did not have operations in the United States and was not subject to U.S. export controls and economic sanctions regulations, such as those instituted by the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”). Correvio , however, does have operations in the United States, and in 2012 it voluntarily reported to OFAC that it had made inadvertent sales of AGGRASTAT®, which treats chest pain and certain heart conditions, into Iran by a third-party Lebanese distributor, as well as reimbursement costs which were paid to another third-party Iranian distributor. Along with the voluntary report, Correvio applied for a specific license to sell AGGRASTAT® through specified intermediaries and distributors into certain hospitals in Iran. Although OFAC has not yet acted on the voluntary report, OFAC did grant Correvio the requested license. Cardiome (or any of our subsidiaries) may generate revenue in the future by way of sales into Iran through a third-party distributor. To the extent required, such sales would be made as permitted by OFAC under either a general or specific license.

RISK FACTORS

Investing in our securities involves a high degree of risk. In addition to the other information included or incorporated by reference in this prospectus or any applicable prospectus supplement, you should carefully consider the risks described below before purchasing our securities. If any of the following risks actually occur, our business, financial condition and results of operations could materially suffer. As a result, the trading price of our securities, including our common shares, could decline, and you might lose all or part of your investment. The risks set out below are not the only risks we face; risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition and results of operations. You should also refer to the other information set forth or incorporated by reference in this prospectus or any applicable prospectus supplement, including our consolidated financial statements and related notes.

Risks Relating to Our Business

We will have significant additional future capital needs and there are uncertainties as to our ability to raise additional funding.

We will require significant additional capital resources to expand our business, in particular the further development of our product candidates, vernakalant (IV) in the United States (and elsewhere) and vernakalant (oral) worldwide. Advancing our product candidates, market expansion of our currently marketed products or acquisition and development of any new products or product candidates will require considerable resources and additional access to capital markets. In addition, our future cash requirements may vary materially from those now expected. For example, our future capital requirements may increase if:

| · | we experience more generic competition for AGGRASTAT® from other life sciences companies or in more markets than anticipated; |

| · | we experience delays or unexpected increases in costs in connection with obtaining regulatory approvals for BRINAVESS® in the various markets where we hope to sell our products; |

| · | we experience unexpected or increased costs relating to preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, or other lawsuits, brought by either us or our competition; |

| · | we experience scientific progress sooner than expected in our discovery, research and development projects, if we expand the magnitude and scope of these activities, or if we modify our focus as a result of our discoveries; |

| 14 |

| · | we experience setbacks in our progress with pre-clinical studies and clinical trials are delayed; |

| · | we are required to perform additional pre-clinical studies and clinical trials; or |

| · | we elect to develop, acquire or license new technologies, products or businesses. |

We could potentially seek additional funding through corporate collaborations and licensing arrangements, through public or private equity or debt financing, or through other transactions. However, if sales are slow to increase or if capital market conditions in general, or with respect to life sciences companies such as ours, are unfavourable, our ability to obtain significant additional funding on acceptable terms, if at all, will be negatively affected. Additional financing that we may pursue may involve the sale of our common shares or financial instruments that are exchangeable for, or convertible into, our common shares which could result in significant dilution to our shareholders.

If sufficient capital is not available, we may be required to delay our business expansion or our research and development projects, either of which could have a material adverse effect on our business, financial condition, prospects or results of operations.

We have a history of significant losses and a significant accumulated deficit.

Although we have been involved in the life sciences industry since 1992, we have, prior to the launch of BRINAVESS® and the acquisition of AGGRASTAT®, only been engaged in research and development. Before Merck obtained marketing approval for BRINAVESS® in the European Union, Iceland and Norway in September 2010, and launched BRINAVESS® in a number of European countries in 2010, none of our product candidates had been approved for marketing or commercialized. Accordingly, we have only recently begun to generate revenue from product sales and have incurred significant operating losses, including net losses of approximately $18.3 million and $27.9 million for the 12 month periods ended December 31, 2012 and 2011, respectively. As of September 30, 2013, our accumulated deficit was $293.5 million. Our losses have resulted in large part from the significant research and development expenditures we have made in seeking to identify and validate new drug targets and compounds that could become marketed drugs. Although we will seek a new collaboration partner for the further research, development, testing and approval of vernakalant (IV) and vernakalant (oral), we anticipate that we will continue to incur these types of expenses in connection with our collaboration. We cannot assure you that we will generate sufficient revenues in the future or achieve profitable operations.

We may not realize the anticipated benefits of past or future acquisitions or product licenses and integration of these acquisitions and any products acquired or licensed may disrupt our business and management.

On November 18, 2013, we announced that we completed the acquisition of Correvio and its pharmaceutical product AGGRASTAT® in order to obtain the ability to market and sell AGGRASTAT® outside of the United States, as well as for the business infrastructure provided by Correvio. We may not be able to fully realize the anticipated future benefits and synergies of the acquisition on a timely basis or at all. The acquisition involves challenges and risks, including risks that the transaction does not advance our business strategy or that we will not realize a satisfactory return. In addition, the seller’s indemnification of us for misrepresentations in representations, breaches of covenants or certain tax matters is capped at the actual consideration paid by us (or $1 million in some cases). The potential failure of the due diligence processes to identify significant problems, liabilities or other shortcomings or challenges with respect to intellectual property, product quality, revenue recognition or other accounting practices, taxes, corporate governance and internal controls, regulatory compliance, employee, customer or partner disputes or issues and other legal and financial contingencies could decrease or eliminate the anticipated benefits and synergies of the Correvio acquisition and could negatively affect our future business and financial results.

The overall success of the Correvio acquisition will depend, in part, on our ability to realize the anticipated benefits and synergies from combining and integrating the Correvio business into our existing business. Integration of Correvio and AGGRASTAT® requires significant management attention and expansion of our staff in marketing, sales and general and administrative functions. We may have difficulties in the integration of the acquired company's departments, systems, including accounting, human resource and other administrative systems, technologies, books and records, and procedures, as well as in maintaining uniform standards, controls, including internal control over financial reporting required by Canadian securities laws, the Sarbanes-Oxley Act of 2002, and related procedures and policies. If we cannot integrate the acquisition successfully, it could have a material adverse impact on our business, financial condition and results of operations.

As part of our business strategy, we may also continue to acquire additional companies, products or technologies principally related to, or complementary to, our current operations. Any such acquisitions will be accompanied by certain risks including but not limited to:

| · | exposure to unknown liabilities of acquired companies and the unknown issues with any associated technologies or research; |

| 15 |

| · | higher than anticipated acquisition costs and expenses; |

| · | the difficulty and expense of integrating operations, systems, and personnel of acquired companies; |

| · | disruption of our ongoing business; |

| · | inability to retain key customers, distributors, vendors and other business partners of the acquired company; |

| · | diversion of management’s time and attention; and |

| · | possible dilution to shareholders. |

We may not be able to successfully overcome these risks and other problems associated with acquisitions and this may adversely affect our business, financial condition or results of operations.