VILLAGE SUPER MARKET, INC.

733 Mountain Avenue

Springfield, New Jersey 07081

PROXY STATEMENT

December 15, 2023

Annual Meeting of Shareholders

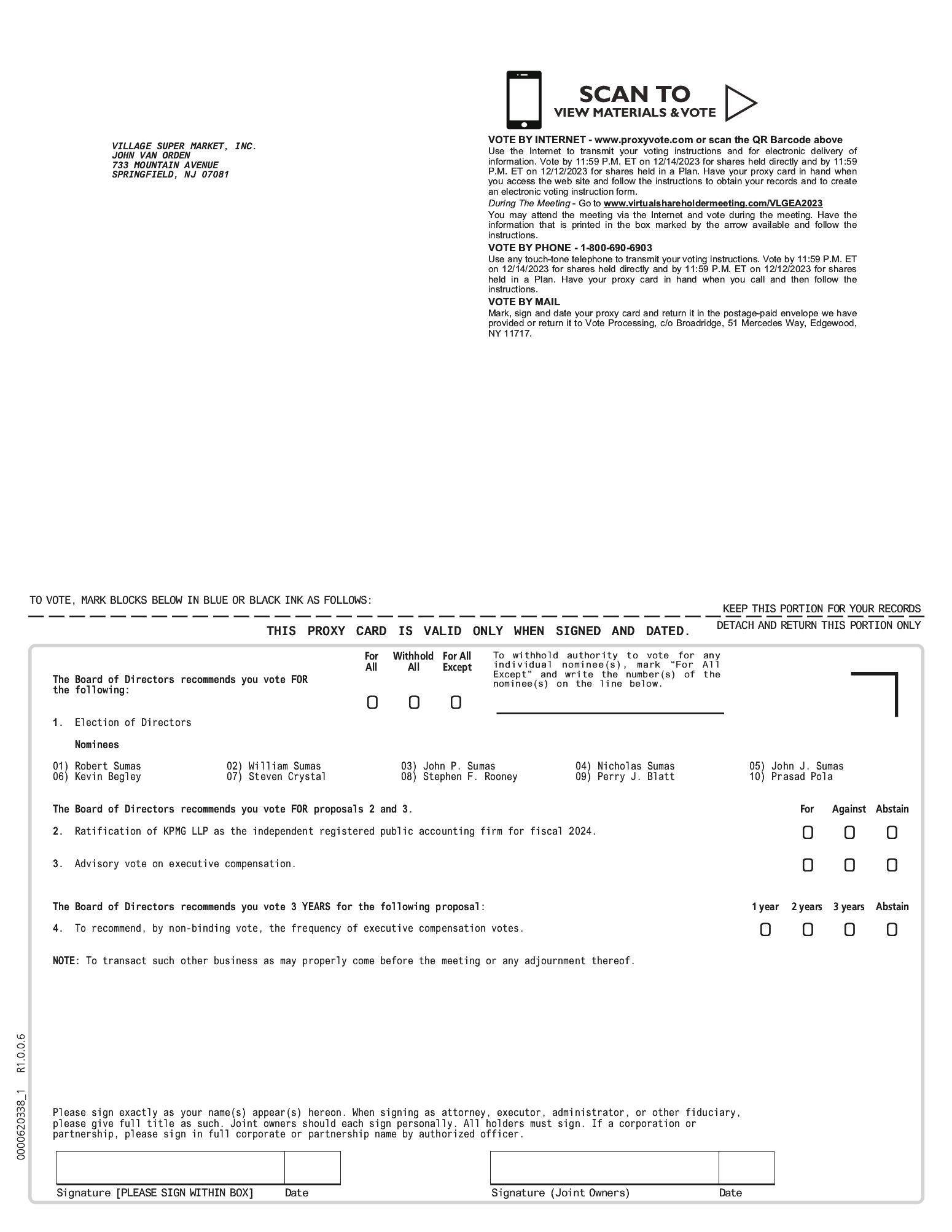

This Proxy Statement and the accompanying form of proxy are being furnished to shareholders of Village Super Market, Inc. (the “Company”) in connection with the solicitation by and on behalf of the Board of Directors of the Company (the “Board of Directors”) of proxies to be voted at the 2023 annual meeting of shareholders of the Company (the “Annual Meeting”) held on Friday, December 15, 2023 at 10:00 A.M., Eastern Time and at all postponements or adjournments thereof. The Annual Meeting will be held in a completely virtual format. You will not be able to attend the Annual Meeting physically. At our virtual Annual Meeting, shareholders will be able to attend, vote your shares and submit questions by visiting www.virtualshareholdermeeting.com/VLGEA2023. To participate in the virtual Annual Meeting, you will need the control number included in your proxy card or voting instruction form. This Proxy Statement was mailed and/or made available to shareholders on or about October 30, 2023.

At the close of business on October 16, 2023, the Company had outstanding and entitled to vote 10,651,144 shares of Class A common stock, no par value (“Class A Stock”), and 4,203,748 shares of Class B common stock, no par value (“Class B Stock”). The holders of the outstanding shares of Class A Stock are entitled to one vote per share and the holders of Class B Stock are entitled to ten votes per share. Shareholders of record at the close of business on October 16, 2023 are entitled to vote at this meeting.

All shares of Common Stock represented by properly executed proxies will be voted at the Annual Meeting, unless such proxies previously have been revoked. Unless the proxies indicate otherwise, the shares of Common Stock represented by such proxies will be voted for the election of the Board of Directors’ nominees for directors, to ratify the selection of KPMG LLP as independent auditors, to approve the compensation of the Company’s named executive officers and to approve the frequency of future advisory votes on the compensation of the Company’s named executive officers. Management does not know of any other matter to be brought before the Annual Meeting.

Directors are elected by a plurality of the number of votes cast. With respect to each other matter to be voted upon, a vote of a majority of the number of votes cast is required for approval. Abstentions and proxies submitted by brokers with a “not voted” direction will not be counted as votes cast with respect to each matter.

Any shareholder who executes and delivers a proxy may revoke it at any time prior to its use by: (a) delivering written notice of such revocation to the Secretary of the Company at its office; (b) delivering to the Secretary of the Company a duly executed proxy bearing a later date; or (c) by voting online at the Annual Meeting.

You may own common shares in one or both of the following ways — either directly in your name as the shareholder of record, or indirectly through a broker, bank or other holder of record in “street name.” If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy directly to us. If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As a holder in street name, you have the right to direct your broker, bank or other holder of record how to vote by completing the voting instruction form that accompanies your proxy materials. If you hold shares in street name and wish to vote your shares directly, you must contact your broker, bank or other holder of record to obtain the instructions and documentation required. Regardless of how you hold your shares, we invite you to attend the Annual Meeting.

The holders of a majority of the shares of the capital stock issued and outstanding on the record date and entitled to vote at the Annual Meeting must be present, in person or by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. Abstentions and “broker non-votes” will be counted for the purpose of determining whether a quorum is present.

With respect to the ratification of the appointment of KPMG LLP (Proposal 2), and the approval of any other matter that may properly come before the Annual Meeting, the affirmative vote of a majority of the votes cast, is required to approve these proposals. As a result, abstentions and “broker non-votes” (see below), if any, will not affect the outcome of the vote on these proposals.

Holders of the Class A Stock and Class B Stock will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the Annual Meeting.