Filed by Minebea Co., Ltd.

Pursuant to Rule 425 under the U.S. Securities Act of 1933

Subject Company: MITSUMI ELECTRIC CO., LTD. (File Number: 132-02801)

Dated March 30, 2016

March 30, 2016

|

Company name:

|

Minebea Co., Ltd.

|

|

|

Representative:

|

Yoshihisa Kainuma,

|

|

|

Representative Director,

|

||

|

President and Chief Executive Officer

|

||

|

(Code number:

|

6479 First Section, Tokyo Stock Exchange)

|

|

|

Contact:

|

Takayuki Ishikawa,

|

|

|

General Manager,

|

||

|

Corporate Communications Office

|

||

|

(Tel: 03-6758-6703)

|

||

|

Company name:

|

MITSUMI ELECTRIC CO., LTD.

|

|

|

Representative:

|

Shigeru Moribe,

|

|

|

President and Representative Director

|

||

|

(Code number:

|

6767 First Section, Tokyo Stock Exchange)

|

|

|

Contact:

|

Kunihiro Noguchi,

|

|

|

General Manager, General Affairs Dept.

|

||

|

(Tel: 042-310-5333)

|

||

Notice Concerning Execution of Business Integration Agreement and Share Exchange Agreement

in Connection with Business Integration of

Minebea Co., Ltd. and MITSUMI ELECTRIC CO., LTD.

Minebea Co., Ltd. (“Minebea”) and MITSUMI ELECTRIC CO., LTD. (“MITSUMI”) agreed (the “Basic Agreement”) to proceed with a discussion and consideration of a business integration (the “Business Integration”) based on the spirit of equal partnership as announced in the “Notice Concerning Execution of Basic Agreement on Business Integration of Minebea Co., Ltd. and MITSUMI ELECTRIC CO., LTD.” dated December 21, 2015, and have held in-depth discussions, as a result of which the two companies reached an agreement to consummate the Business Integration and to conduct a share exchange (the “Share Exchange”), and executed a business integration agreement (the “Business Integration Agreement”) and a share exchange agreement (the “Share Exchange Agreement”) based on the resolutions adopted at their respective meetings of the board of directors held today, as follows.

The Share Exchange is scheduled to be conducted with the effective date of March 17, 2017 subject to obtaining the approval of the Share Exchange Agreement at the extraordinary general meeting of shareholders of MITSUMI to be held on December 27, 2016. Pursuant to the main clause of Article 796, paragraph (2) of the Companies Act, Minebea is expected to conduct the Share Exchange following the procedures for a short-form share exchange that does not require obtaining the approval of shareholders of Minebea at its general meeting of shareholders.

Under the Share Exchange, MITSUMI common stock is scheduled to be delisted on March 14, 2017 (the last trading day will be March 13, 2017) from the first section of Tokyo Stock Exchange, Inc. (the “TSE”) prior to the effective date of the Share Exchange (scheduled to be March 17, 2017).

1

The consummation of the Business Integration and the Share Exchange is subject to obtaining the approval of shareholders of MITSUMI at its general meeting of shareholders and obtaining Japanese and foreign regulatory approvals, such as those from the Japanese Fair Trade Commission, that are necessary to consummate the Business Integration. Depending on the progress of satisfying such conditions, timing of the consummation of the Business Integration and the Share Exchange may be after April 2017. (If there is any change in the schedule, such as the effective date of the Share Exchange, the two companies will make an announcement immediately.)

Description

1. Background and Purpose of the Business Integration

|

|

(1)

|

Background of the Business Integration

|

|

|

Minebea was incorporated in 1951 as Japan’s first specialized manufacturer of miniature ball bearings, and since then, it has manufactured large numbers of bearings and other high-quality and high-precision parts. In recent years, it has also manufactured and sold liquid crystal backlights employed in smartphones, lighting devices and other products. Furthermore, it has adopted five principles as its corporate motto, which are to “be a company where our employees are proud to work,” “earn and preserve the trust of our valued customers,” “respond to our shareholders’ expectations,” “work in harmony with the local community” and “promote and contribute to global society.” Under this corporate motto, Minebea’s basic management principle has been to fulfill its social responsibilities to the various stakeholders—such as shareholders, business partners, local communities, employees and society—and maximize its corporate value. In accordance with this management principle, the Minebea Group sees as its challenge working to boost the earnings capacity of its existing lines while developing new high-value-added products, and leveraging the wealth of experience it has gained in manufacturing, sales, engineering and development as well as the commitment to restructuring its business portfolio, encompassing the hybrid component business that is driven by its combined technological strengths in electronic devices and components as well as machined components, in order to provide flexible prices and meet the needs of its customers. The Minebea Group seeks to actively work on restructuring its business portfolio and increasing corporate value via M&As and alliances. At the same time it seeks to focus on establishing large-scale overseas mass production facilities as well as R&D capabilities in light of regional risk assessment findings.

|

|

|

MITSUMI was established in 1954 as a manufacturer of electronic components, such as coils and transformers. Since then, starting from the introduction of Polyvaricons (variable condenser) to the world in 1955, it has developed world-leading technical capabilities and has offered high-precision, high-quality electronic components with stable performance, excellent reliability and durability for cutting-edge electronic components all over the world during various periods of history. Currently, it manufactures and sells electrical and communication equipment, such as mechanism components, semiconductor devices, power supply parts, high-frequency devices and optical devices, for various electronic devices and products, such as data communication devices, automobiles, healthcare and consumer electronics, other leisure devices, televisions and digital cameras. Recently, in the electronic component industry, the market for data communication devices, such as smartphones and tablet PCs, has been growing and the in-car product market has continued to expand due to increasing installations of electrical devices in automobiles, while the market for PCs, digital cameras and leisure-related products have been sluggish. In such environment, MITSUMI has been competing based on its high technological skills, such as the world’s first mass production of high-performance actuators for cameras, secondary battery-related semiconductors and charger adapters, and creating seeds of various new businesses, but MITSUMI recognizes that its business challenge is a shortage of management resources for the expansion of existing businesses and expansion into new businesses.

|

|

|

Both companies had considered business alliance, including integration with other companies, in order to realize further continuous growth and acceleration of development, as well as addressing their respective challenges in their business areas with the aim of enhancing performance and improving corporate value. As a result, both companies came to recognize that despite both operating in a similar industry, they were not competing much against each other but rather had different sources of competitiveness, and that they would be able to generate significant synergies in terms of mass production, sales, procurement and product development through full-scale collaboration. In particular, the companies believe that linking MITSUMI’s various developing technologies and products to Minebea’s in-house manufactured assembly equipment, mold design, manufacturing capacity and mass-production capacity of overseas factories would likely lead to expansion of customer base and sales, reduction of manufacturing cost, the introduction of innovative products, provision of innovative solutions and other benefits. Under such circumstances, both companies came to share a common perception through mutual discussions that, in order to maximize their corporate value, it would be in the best course of action to aim to become a genuine solutions company by combining analog and digital technologies. Since the execution of the Basic Agreement, both companies held several in-depth discussions and engaged in considerations between their management towards the realization of a business integration based on the spirit of equal partnership and today, they reached a definitive agreement to consummate the Business Integration and the Share Exchange.

|

2

|

|

(2)

|

Purpose of the Business Integration

|

|

|

Through the Business Integration, the two companies will aim to become a genuine solutions company by realizing synergies of integration described below, and will further improve their corporate value as an electro mechanics solutions company.

|

|

|

(i)

|

Growth and evolution of business portfolio

The two companies will aim for growth by increasing cross-selling, such as the strengthening of customer base through the expansion of sales of MITSUMI’s in-car products into Minebea’s sales channel. The two companies will also aim for strategic evolution of the business portfolio that captures the needs of the IoT era by concentrating resources in the high-end and niche markets as well as combining MITSUMI’s product portfolio comprising input, conversion and control devices, such as switches, sensors and connectors, and Minebea’s product portfolio comprising output devices, such as motors and actuators.

|

|

|

(ii)

|

Enhancement of cost competitiveness and capacity to generate cash flow by optimizing manufacturing structure and bases

The two companies will aim for enhancement of cost competitiveness and capacity to generate cash flow by achieving lower fixed costs through, among others, significant improvement in productivity by reallocating manufactured goods and by reducing variable costs through the promotion of large-scale and joint procurement of materials and parts, as well as by proceeding with the mutual utilization of each other’s factories and optimization of manufacturing bases of Minebea and MITSUMI.

|

|

|

(iii)

|

Enhancement of development capabilities and provision of solutions

The two companies will aim for a corporate structure that enhances their development capabilities that enable them to create unique products and provides solutions by gathering both companies’ technological capabilities, such as expansion of Minebea’s smart city business through the application of MITSUMI’s wireless technology, use of MITSUMI’s power source technology in the LED lighting product SALIOT (Smart Adjustable Light for the Internet of Things), utilization of SALIOT as a surveillance camera that employs MITSUMI’s camera module and image processing technology, sharing of both companies’ motor technologies and generation of synergistic effects resulting therefrom, development of PGU (Picture Generation Unit) for the HUD (Head-Up Display) system that utilizes Minebea’s glass technology (J3DD) – such as microoptical element technology and concave mirrors – and MITSUMI’s MEMS and semiconductor technology, and expansion of business to robot-related products and other high-value-added product areas through the application of Minebea’s molds and high-precision processing technology to MITSUMI’s products.

|

2. Outline of the Business Integration

|

|

(1)

|

Method of the Business Integration

|

3

|

|

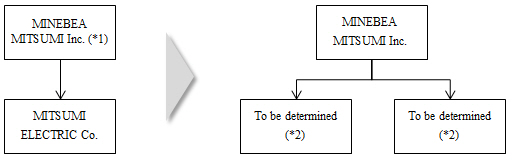

Minebea and MITSUMI will conduct the Share Exchange subject to obtaining the approval of shareholders of MITSUMI at its extraordinary general meeting of shareholders to be held on December 27, 2016 and obtaining Japanese and foreign regulatory approvals, such as those from the Japanese Fair Trade Commission, required for the Business Integration and other requirements. Specifically, shareholders of MITSUMI will be allotted shares of Minebea (whose company name is planned to be changed to MINEBEA MITSUMI Inc. (“MINEBEA MITSUMI”) subject to obtaining the approval of shareholders of Minebea at its general meeting of shareholders).

|

|

|

The two companies plan to conduct, as soon as reasonably possible after the effective date of the Share Exchange, a reorganization, including shifting MINEBEA MITSUMI to a holding company structure in which MITSUMI will remain a corporate entity, by, among others, transferring MINEBEA MITSUMI’s existing business through a company split to MITSUMI or MINEBEA MITSUMI’s wholly-owned subsidiary to be newly established. The two companies will continually discuss and determine the details, including specific method of reorganization and timing, by taking into account how they can maximize synergy effects and optimize the management structure for the business following the Business Integration.

|

|

|

(*1)

|

The company name will be changed from Minebea Co., Ltd. subject to obtaining the approval of shareholders of Minebea at its general meeting of shareholders.

|

|

|

(*2)

|

The companies are planning to shift MINEBEA MITSUMI to a holding company structure in which MITSUMI will remain a corporate entity by, among others, transferring MINEBEA MITSUMI’s existing business through a company split to MITSUMI or MINEBEA MITSUMI’s wholly-owned subsidiary to be newly established.

|

|

|

(2)

|

Management structure following the Business Integration

|

|

|

(i)

|

Company name (planned)

The company name of Minebea is planned to be changed to the following upon the Share Exchange taking effect, subject to obtaining the approval of shareholders of Minebea at its ordinary general meeting of shareholders to be held in June 2016 for the fiscal year ending March 31, 2016.

MINEBEA MITSUMI Kabushiki Kaisha (in English: MINEBEA MITSUMI Inc.)

With respect to the company name of MITSUMI after the Share Exchange takes effect, the two companies will determine how to proceed before the Share Exchange takes effect through continuing mutual discussion.

|

|

|

(ii)

|

Management structure of the two companies (planned)

Management structure of the two companies after the Share Exchange takes effect will be as follows:

MINEBEA MITSUMI

|

|

|

Management structure of MINEBEA MITSUMI will be as below. Subject to obtaining the approval of shareholders at its ordinary general meeting of shareholders to be held in June 2016 for the fiscal year ending March 31, 2016, current Minebea will amend its Articles of Incorporation to set the number of directors to be 12 or less by the effective date of the Share Exchange. After the Share Exchange takes effect, two of MINEBEA MITSUMI’s directors will be appointed by MITSUMI. One of such two directors will be Mr. Shigeru Moribe, who is the President and Representative Director of current MITSUMI, to be appointed as Representative Director, Vice Chairman of MINEBEA MITSUMI. Obligation of current Minebea to consummate the Share Exchange is conditioned upon the current Minebea’s not having reasonably determined that it will be difficult objectively and specifically to achieve the purpose of the Business Integration due to Mr. Shigeru Moribe’s not being the director of MITSUMI for any reason.

|

4

|

Representative Director, Chairman, President, CEO and COO

|

Yoshihisa Kainuma (currently, Representative Director, President and Chief Executive Officer of Minebea)

|

|

Representative Director, Vice Chairman

|

Shigeru Moribe (currently, President and Representative Director of MITSUMI)

|

MITSUMI

|

|

Management structure of MITSUMI will be as below. As of the effective date of the Share Exchange, three to five of MITSUMI’s directors (whose number will be determined by current Minebea in its discretion) will be appointed by current Minebea. Among such directors, Mr. Yoshihisa Kainuma, who is the Representative Director, President and Chief Executive Officer of current Minebea, will be appointed as Chairman of the Board of MITSUMI and another director will be appointed as Representative Director, Vice President of MITSUMI. If the number of MITSUMI’s directors appointed by current Minebea is less than five as of the effective date of the Share Exchange, current Minebea may increase the number of MITSUMI’s directors appointed by current Minebea to five at any time after the effective date of the Share Exchange.

|

|

Chairman of the Board

|

Yoshihisa Kainuma (currently, Representative Director, President and Chief Executive Officer of Minebea)

|

|

Representative Director, President

|

Shigeru Moribe (currently, President and Representative Director of MITSUMI)

|

|

Representative Director, Vice President

|

To be determined (to be appointed by current Minebea)

|

|

|

(iii)

|

Management structure of the holding company after the two companies shift to a holding company structure (planned)

Management structure of the holding company after the two companies shift to a holding company structure will be as below. Other matters regarding the management structure after shifting to a holding company structure will be discussed continually between the two companies and will be determined by the time the two companies shift to a holding company structure.

|

|

Representative Director, Chairman and President

|

Yoshihisa Kainuma (currently, Representative Director, President and Chief Executive Officer of Minebea)

|

|

Representative Director, Vice Chairman

|

Shigeru Moribe (currently, President and Representative Director of MITSUMI)

|

|

|

(iv)

|

Other

Other matters relating to the management structure following the Business Integration will be determined by the two companies by the time they shift to a holding company structure through continuing mutual discussion.

|

|

|

(3)

|

Capital policy after the execution of the Business Integration Agreement

|

|

|

The two companies will announce and implement, as necessary, whether to adopt a policy on shareholder return, including buy-back of stock, as a capital policy after executing the Business Integration Agreement based on mutual discussion and consideration, taking into account the level of profit per share factoring in factors such as the dilution resulting from the increase in the number of issued and outstanding shares (including potential shares relating to bonds with stock acquisition rights) after the Share Exchange takes effect, operating results of the two companies and synergy effects of the Business Integration.

|

5

3. Outline of the Share Exchange

|

|

(1)

|

Schedule of the Share Exchange

|

|

Execution of the basic agreement (both companies)

|

December 21, 2015

|

|

Resolutions of the board of directors approving the execution of the Business Integration Agreement and the Share Exchange Agreement (both companies)

|

March 30, 2016 (today)

|

|

Execution of the Business Integration Agreement and the Share Exchange Agreement (both companies)

|

March 30, 2016 (today)

|

|

Public notice of the record date of the extraordinary general meeting of shareholders (MITSUMI)

|

September 2016 (planned)

|

|

Record date of the extraordinary general meeting of shareholders (MITSUMI)

|

September 2016 (planned)

|

|

Extraordinary general meeting of shareholders to approve the Share Exchange Agreement (MITSUMI)

|

December 27, 2016 (planned)

|

|

Last trading day (MITSUMI)

|

March 13, 2017 (planned)

|

|

Delisting (MITSUMI)

|

March 14, 2017 (planned)

|

|

Effective date of the Share Exchange

|

March 17, 2017 (planned)

|

|

|

The above schedule is currently anticipated. If there is any change to the schedule due to filings with the Fair Trade Commission or other relevant Japanese or foreign authorities, obtaining of permits and approvals, or other reasons during the course of procedures and discussions over the Business Integration, the two companies will announce such change promptly. The Share Exchange is a short-form share exchange for Minebea and is expected to be conducted without obtaining the approval of shareholders of Minebea at its general meeting of shareholders.

|

|

|

(2)

|

Method of the Share Exchange

|

Upon the Share Exchange, Minebea will become the wholly-owning parent company and MITSUMI will become the wholly-owned subsidiary. Pursuant to the main clause of Article 796, paragraph (2) of the Companies Act, Minebea is expected to conduct the Share Exchange following the procedures for a short-form share exchange that does not require obtaining the approval of shareholders of Minebea at its general meeting of shareholders. MITSUMI will conduct the Share Exchange subject to obtaining the approval of the Share Exchange Agreement at the extraordinary general meeting of shareholders of MITSUMI to be held on December 27, 2016.

|

|

(3)

|

Details of allotment in the Share Exchange

|

|

Minebea

|

MITSUMI

|

|

|

Share exchange ratio

for the Share Exchange

|

1

|

0.59

|

|

Number of shares to be delivered

in the Share Exchange

|

Minebea common stock: 47,913,630 shares (planned)

|

|

|

|

(*1)

|

Share allotment ratio

|

0.59 shares of Minebea common stock will be allotted and delivered for each share of MITSUMI common stock.

|

|

(*2)

|

Number of shares to be delivered through the Share Exchange

|

Minebea common stock: 47,913,630 shares (planned)

The above number of shares of common stock has been calculated based on the total number of issued and outstanding shares (87,498,119 shares) of common stock and the number of treasury stock (6,288,575 shares) of MITSUMI as of December 31, 2015.

6

In the Share Exchange, Minebea will allot and deliver to the shareholders of MITSUMI immediately before Minebea acquires all of MITSUMI’s issued and outstanding shares (the “Record Time”) the number of shares of Minebea common stock calculated based on the share exchange ratio for the Share Exchange (the “Share Exchange Ratio”) described in the table above. The shares to be delivered will comprise treasury stock held by Minebea and newly issued shares.

MITSUMI will, at the Record Time, cancel all of its treasury stock (including treasury stock that is acquired by MITSUMI through a purchase as a result of a request for purchase from dissenting shareholders exercised pursuant to Article 785, paragraph (1) of the Companies Act in connection with the Share Exchange) that it holds as of the Record Time pursuant to the resolution at its meeting of the board of directors to be held by the day immediately preceding the effective date of the Share Exchange, and as a result, the number of shares of Minebea common stock to be delivered could be revised in the future due to factors such as the number of shares of treasury stock that will be held by MITSUMI at the Record Time.

|

|

(*3)

|

Treatment of shares constituting less than one unit

|

It is expected that some shareholders will hold shares constituting less than one unit of Minebea common stock (as announced in “Notice Concerning the Change of the Number of Shares Constituting One Unit of Shares and Partial Amendment to the Articles of Incorporation” dated March 30, 2016, Minebea has resolved at its meeting of the board of directors held on March 30, 2016 that it would amend its Articles of Incorporation to change the number of shares constituting one unit of shares from 1,000 shares to 100 shares as of May 1, 2016 pursuant to Article 195, paragraph (1) of the Companies Act) as a result of the Share Exchange. Such shareholders may not sell such shares constituting less than one unit on any securities exchange market. Shareholders who hold shares constituting less than one unit of Minebea may use the following systems on and after the effective date of the Share Exchange.

|

|

(i)

|

System to demand purchase of shares constituting less than one unit (sale of shares constituting less than one unit)

Shareholders who hold shares constituting less than one unit of Minebea may demand that Minebea purchase their shares constituting less than one unit pursuant to Article 192, paragraph (1) of the Companies Act.

|

|

|

(ii)

|

System to further purchase shares constituting less than one unit (purchase to reach one unit)

Shareholders who hold shares constituting less than one unit of Minebea may purchase from Minebea the number of shares needed, together with the number of shares constituting less than one unit they hold, to constitute one unit (100 shares) pursuant to Article 194, paragraph (1) of the Companies Act and the Articles of Incorporation, unless Minebea does not hold the number of treasury stock to satisfy the request for further purchase.

|

|

|

(*4)

|

Treatment of any fractional shares

|

For the current shareholders of MITSUMI who will receive an allotment of fractional shares of Minebea upon the Share Exchange, Minebea will pay cash to each such shareholder in an amount of value of such fractional shares pursuant to Article 234 of the Companies Act and other relevant laws and regulations.

|

|

(4)

|

Treatment of bonds with stock acquisition rights in connection with the Share Exchange

|

|

|

With respect to the stock acquisition rights accompanying the Euro-Yen Denominated Convertible Bonds with Stock Acquisition Rights due 2022 issued by MITSUMI, Minebea will allot and deliver to the holders of such stock acquisition rights the stock acquisition rights of Minebea to replace the stock acquisition rights of MITSUMI according to the terms of the stock acquisition rights and the Share Exchange Ratio, and Minebea will assume and succeed to all of MITSUMI’s obligations under the bonds with stock acquisition rights.

|

7

4. Basis for the Share Exchange Ratio

|

|

(1)

|

Basis and reasons for the Share Exchange Ratio

|

|

|

As described in “(4) Measures to ensure fairness” below, Minebea appointed Nomura Securities Co., Ltd. (“Nomura Securities”) as a third-party calculation institution and Mori Hamada & Matsumoto as a legal advisor, and MITSUMI appointed Daiwa Securities Co. Ltd. (“Daiwa Securities”) as a third-party calculation institution and Anderson Mōri & Tomotsune as a legal advisor, in order to ensure the fairness of the Share Exchange Ratio and other aspects of the Share Exchange, and commenced deliberations on a full scale.

|

|

|

As described in “(4) Measures to ensure fairness” below, after careful discussions and deliberations with reference to the calculation report on the Share Exchange Ratio dated March 30, 2016 received from Nomura Securities as its third-party calculation institution and the legal advice provided by Mori Hamada & Matsumoto as its legal advisor who has no material relationship with either Minebea or MITSUMI, Minebea concluded that the Share Exchange Ratio indicated in “(3) Details of allotment in the Share Exchange” of “3. Outline of the Share Exchange” above was appropriate and would not be detrimental to the interests of the shareholders, and consequently, it was appropriate to consummate the Share Exchange based on the Share Exchange Ratio.

|

|

|

As described in “(4) Measures to ensure fairness” below, after careful discussions and deliberations with reference to the calculation report on the Share Exchange Ratio dated March 30, 2016 received from Daiwa Securities as its third-party calculation institution and the legal advice provided by Anderson Mōri & Tomotsune as its legal advisor who has no material relationship with either Minebea or MITSUMI, MITSUMI concluded that the Share Exchange Ratio indicated in “(3) Details of allotment in the Share Exchange” of “3. Outline of the Share Exchange” above was appropriate and would not be detrimental to the interests of the shareholders, and consequently, it was appropriate to consummate the Share Exchange based on the Share Exchange Ratio.

|

|

|

As such, the two companies carefully negotiated and discussed the Share Exchange Ratio, comprehensively taking into account factors such as the market prices of shares, financial position, and future prospects of each party, based on the due diligence conducted by each company concerning the other, with each company making reference to the results of calculation and analysis of its third-party calculation institution and the legal advice of its legal advisor. As a result of such negotiations and discussions, each company concluded that the Share Exchange Ratio is appropriate and resolved at a meeting of its board of directors held today to execute the Share Exchange Agreement that set forth the Share Exchange Ratio.

|

|

|

(2)

|

Calculation

|

|

(i)

|

Names of the calculation institutions and the relationship with the two companies

|

Neither Nomura Securities nor Daiwa Securities are related parties of either Minebea or MITSUMI and have no material relationships requiring disclosure in regards to the Share Exchange.

|

(ii)

|

Outline of the Calculation

|

Nomura Securities used an average market price analysis for the calculation with regard to Minebea, as shares of Minebea are listed on the TSE and a market share price exists. In addition, as there are several comparable listed companies for which comparison to Minebea is possible, and it is possible to infer by analogy the share value through a comparable company analysis, a comparable company analysis was also used in the calculation. Furthermore, in order to take into account the state of future business operations in the assessment, the discount cash flow analysis (the “DCF Analysis”) was also used in the calculation.

With regard to MITSUMI, as shares of MITSUMI are listed on the TSE and a market share price exists, Nomura Securities used an average market price analysis for the calculation. Furthermore, in order to take into account the state of future business operations in the assessment, the DCF Analysis was also used in the calculation.

In the average market price analysis, Nomura Securities used the closing price on December 18, 2015, which is the business day preceding the day on which the execution of the basic agreement toward the Business Integration was announced (“Record Date (1)”), and the average closing prices for the five-business day period, one-month period, three-month period and six-month period from Record Date (1) on the TSE, as well as the closing price on March 29, 2016 (“Record Date (2)”) and the average closing prices for the five-business day period, one-month period, three-month period and six-month period from Record Date (2) on the TSE.

The following shows the calculation results of each method of analysis, with the per share value of Minebea stock set to one.

8

|

Method of Analysis

|

Share Exchange Ratio

|

|

|

Minebea

|

MITSUMI

|

|

|

Average Market Price Analysis (Record Date (1))

|

Average Market Price Analysis (Record Date (1))

|

0.46~0.57

|

|

Average Market Price Analysis (Record Date (2))

|

Average Market Price Analysis (Record Date (2))

|

0.56~0.65

|

|

Comparable Company Analysis

|

Average Market Price Analysis (Record Date (2))

|

0.42~0.63

|

|

DCF Analysis

|

DCF Analysis

|

0.53~0.70

|

In calculating the Share Exchange Ratio, Nomura Securities used information that was provided by Minebea and MITSUMI as well as public information on the assumption that such materials and information are accurate and complete without any independent verification for accuracy and completeness. Nomura Securities did not independently perform any valuation, appraisal or assessment of assets or liabilities (including contingent liabilities) of Minebea, MITSUMI and their affiliates, including an analysis or valuation of individual assets or liabilities, nor did it request any third-party institution to make such appraisal or assessment. The calculation of the Share Exchange Ratio by Nomura Securities is based on information available and economic conditions as of March 29, 2016. Nomura Securities also assumed that the financial projections (including profit plans and other information) of Minebea and MITSUMI had been reasonably prepared based on the best projection and judgment then available to the management of Minebea and MITSUMI.

The earnings plan of Minebea that Nomura Securities used as a basis for applying the DCF Analysis did not contain a significant increase or decrease in earnings in any fiscal year. The earnings plan of MITSUMI that Nomura Securities used as a basis for applying the DCF Analysis anticipates an operating loss for the fiscal year ending March 31, 2016 for which MITSUMI has announced an earnings forecast, but anticipates an operating profit for the fiscal year ending March 31, 2017 as well as a significant increase in operating profit for the fiscal years ending March 31, 2018 and 2019 due to increase in sales from the release of new products such as image stabilizer actuators and secondary battery protection semiconductors for information and communication devices and antenna and satellite digital radio tuner systems for automobiles, improvement in productivity through promotion of automation in manufacturing and enhanced cost competitiveness through reduction in raw material costs and expenses.

As described in “(4) Measures to ensure fairness” below, Minebea obtained from Nomura Securities a written opinion (fairness opinion) dated March 30, 2016, stating that the agreed Share Exchange Ratio is proper for Minebea from a financial point of view, subject to the assumptions stated above and certain other qualifications.

Daiwa Securities used a market price analysis for the calculation with regard to Minebea and MITSUMI as shares of Minebea and MITSUMI are listed on the first section of the TSE and market share prices exist. In addition, as there are several comparable listed companies for which comparisons to both companies are possible, and it is possible to infer by analogy the share value through a comparable company analysis, a comparable company analysis was also used in the calculation. Furthermore, in order to take into account the state of future business operations in the assessment, the DCF Analysis was also used in the calculation.

In the market price analysis, Daiwa Securities set December 18, 2015, which is the business day preceding the day on which the execution of the basic agreement toward the Business Integration was announced (“Record Date (1)”) and March 29, 2016, which is the business day preceding the day on which the calculation report on the Share Exchange Ratio was prepared (“Record Date (2)”), as the record dates for the calculation, and used the closing prices on Record Date (1) and Record Date (2) and the average closing prices for the one-month period, three-month period and six-month period from each such Record Date.

The following shows the calculation results under each method of analysis. The calculation ranges are the number of shares of Minebea common stock allotted for one share of MITSUMI common stock.

9

|

Method of Analysis

|

Share Exchange Ratio

|

|

Market Price Analysis (Record Date (1))

|

0.46~0.57

|

|

Market Price Analysis (Record Date (2))

|

0.56~0.64

|

|

Comparable Company Analysis

|

0.48~0.76

|

|

DCF Analysis

|

0.47~0.74

|

In calculating the Share Exchange Ratio, Daiwa Securities assumed that materials and information that were provided by each of Minebea and MITSUMI were accurate and complete without any independent verification for accuracy and completeness. Daiwa Securities did not independently perform any valuation, appraisal or assessment of assets or liabilities (including contingent liabilities) of Minebea, MITSUMI and their affiliates, nor did it request any third-party institution to make such valuation, appraisal or assessment. Daiwa Securities also assumed that the business plans, financial forecasts and other information regarding the future provided by each of Minebea and MITSUMI had been reasonably prepared based on the best projection and judgment then possible for the management of Minebea and MITSUMI. With MITSUMI’s consent, Daiwa Securities relied on such information without any independent verification for accuracy, appropriateness or feasibility of the two companies’ business plans. Calculation of the Share Exchange Ratio by Daiwa Securities is based on financial, economic, market and other conditions as of March 29, 2016.

The financial forecast of Minebea that Daiwa Securities used as a basis for applying the DCF Analysis did not contain a significant increase or decrease in earnings in any fiscal year. The financial forecast of MITSUMI that Daiwa Securities used as a basis for applying the DCF Analysis anticipates an operating loss for the fiscal year ending March 31, 2016 for which MITSUMI has announced an earnings forecast, but anticipates an operating profit for the fiscal year ending March 31, 2017 as well as a significant increase in operating profit for the fiscal years ending March 31, 2018 and 2019 due to increase in sales from the release of new products such as image stabilizer actuators and secondary battery protection semiconductors for information and communication devices and antenna and satellite digital radio tuner systems for automobiles, improvement in productivity through promotion of automation in manufacturing and enhanced cost competitiveness through reduction in raw material costs and expenses.

As described in “(4) Measures to ensure fairness” below, MITSUMI obtained from Daiwa Securities a written opinion (fairness opinion) dated March 30, 2016, stating that the agreed Share Exchange Ratio is fair to shareholders of MITSUMI common stock from a financial point of view, subject to the assumptions stated above and certain other qualifications.

|

|

(3)

|

Possibility and reasons for delisting

|

|

|

As a result of the Share Exchange, on March 17, 2017, the effective date of the Share Exchange, Minebea will acquire all of the issued and outstanding shares of MITSUMI. Prior to such date, MITSUMI common stock will be delisted on March 14, 2017 (last trading day will be March 13, 2017) under the prescribed procedures in accordance with the criteria for delisting of shares from the first section of the TSE. After the delisting, MITSUMI common stock may not be traded on the first section of the TSE, but shareholders of MITSUMI (excluding Minebea) will be allotted Minebea common stock as described in “(3) Details of allotment in the Share Exchange” of “3. Outline of the Share Exchange” above pursuant to the Share Exchange Agreement. Minebea common stock allotted to the shareholders of MITSUMI (excluding Minebea) through the Share Exchange remain listed on the first section of the TSE, and even after the effective date of the Share Exchange, may be traded on the first section of the TSE. Consequently, although shareholders of MITSUMI who will be allotted more than 100 shares of Minebea common stock through the Share Exchange, which is a share unit of Minebea, may be allotted shares constituting less than one unit based on the number of shares of MITSUMI common stock they hold, Minebea shares constituting more than one share unit will continue to be able to be traded on the first section of the TSE. Therefore, liquidity of the shares will continue to be provided.

|

10

|

|

On the other hand, shareholders of MITSUMI who are allotted less than 100 shares of Minebea common stock will become holders of shares constituting less than one unit of Minebea through the Share Exchange. Although shares constituting less than one unit may not be sold on the first section of the TSE, the system to demand purchase or the system to further purchase shares constituting less than one unit is, if desired, available for shareholders holding such shares constituting less than one unit. For details of treatment of such shares, see “(*3) Treatment of shares constituting less than one unit” of “(3) Details of allotment in the Share Exchange” of “3. Outline of the Share Exchange” above. Furthermore, for details of treatment of fractional shares, see “(*4) Treatment of any fractional shares” of “(3) Details of allotment in the Share Exchange” of “3. Outline of the Share Exchange” above. Shareholders of MITSUMI may continue to trade their MITSUMI common stock on the first section of the TSE until the last trading day of March 13, 2017 (planned).

|

|

|

(4)

|

Measures to ensure fairness

|

In order to ensure fairness of the Share Exchange Ratio and other aspects of the Share Exchange, Minebea and MITSUMI have taken the following measures:

|

(i)

|

Obtaining calculation report from independent third-party calculation institution

|

Minebea obtained a calculation report on the Share Exchange Ratio dated March 30, 2016 from Nomura Securities as a third-party calculation institution independent of Minebea and MITSUMI. For the outline of the calculation report, see “(2) Calculation” above.

Minebea obtained from Nomura Securities a written opinion (fairness opinion) dated March 30, 2016, stating that the Share Exchange Ratio is proper for Minebea from a financial point of view, subject to the assumptions and other qualifications described in “(2) Calculation” above.

MITSUMI, on behalf of its shareholders, obtained a calculation report on the Share Exchange Ratio dated March 30, 2016 from Daiwa Securities as a third-party calculation institution independent of Minebea and MITSUMI. For the outline of the calculation report, see “(2) Calculation” above.

MITSUMI obtained from Daiwa Securities a written opinion (fairness opinion) dated March 30, 2016, stating that the Share Exchange Ratio is fair to shareholders of MITSUMI common stock from a financial point of view, subject to the assumptions and other qualifications described in “(2) Calculation” above. For material assumptions underlying the fairness opinion of Daiwa Securities, see Exhibit.

|

(ii)

|

Advice from independent law firm

|

Minebea has obtained advice from a legal point of view regarding various procedures of the Share Exchange and method and process of decision-making by the board of directors from Mori Hamada & Matsumoto as its legal advisor for the Share Exchange.

MITSUMI has obtained advice from a legal point of view regarding various procedures of the Share Exchange and method and process of decision-making by the board of directors from Anderson Mōri & Tomotsune as its legal advisor for the Share Exchange.

Both Mori Hamada & Matsumoto and Anderson Mōri & Tomotsune are independent of Minebea and MITSUMI and have no material relationships with either company.

|

|

(5)

|

Measures to avoid conflicts of interest

|

|

|

There is no conflict of interest between Minebea and MITSUMI in connection with the Share Exchange and therefore, the two companies have not taken any special measures.

|

5. Profile of Companies

|

(1)

|

Name

|

Minebea Co., Ltd.

|

MITSUMI ELECTRIC CO., LTD.

|

|||||||

|

(2)

|

Location

|

4106-73, Oaza Miyota, Miyota-machi, Kitasaku-gun, Nagano 389-0293, Japan

|

2-11-2, Tsurumaki, Tama-shi, Tokyo, 206-8567, Japan

|

|||||||

11

|

(3)

|

Name and title of representative

|

Yoshihisa Kainuma,

Representative Director,

President and Chief Executive Officer

|

Shigeru Moribe,

President and Representative Director

|

|||||||||

|

(4)

|

Business

|

·

|

Machined components

|

· |

Manufacture and sale of electrical machinery

|

|||||||

|

·

·

|

Electronic devices and components

Other

|

· | Manufacture and sale of products for electronics industry applications, measurement equipment, optical equipment, medical and hygienic equipment | |||||||||

| · | Manufacture and sale of metals industry products and metal materials | |||||||||||

| · | Manufacture and sale of ceramic products | |||||||||||

|

(5)

|

Amount of capital

|

68,258 million yen

(as of September 30, 2015)

|

39,890 million yen (as of September 30, 2015) |

|||||||||

|

(6)

|

Date of establishment

|

July 1951 | January 1954 | |||||||||

|

(7)

|

Number of issued shares

|

399,167,695 shares

(as of September 30, 2015)

|

87,498,119 shares (as of September 30, 2015) |

|||||||||

|

(8)

|

Fiscal year end

|

March 31 | March 31 | |||||||||

|

(9)

|

Number of employees

|

70,206

(as of September 30, 2015)

|

39,853 (as of September 30, 2015) |

|||||||||

|

(10)

|

Major customers

|

·

|

NIPPON STEEL & SUMITOMO METAL CORPORATION

|

Nintendo Co., Ltd. | ||||||||

| · | Nichia Corporation | |||||||||||

| · | Japan Display Inc. | |||||||||||

|

(11)

|

Main financing banks

|

· |

Sumitomo Mitsui Trust Bank, Limited

|

· |

Sumitomo Mitsui Banking Corporation

|

|||||||

| · | The Bank of Tokyo-Mitsubishi UFJ, Ltd. | · | The Bank of Tokyo-Mitsubishi UFJ, Ltd. | |||||||||

| · | Sumitomo Mitsui Banking Corporation | · | Mizuho Bank, Ltd. | |||||||||

| · | THE HACHIJUNI BANK, LTD. | · | Sumitomo Mitsui Trust Bank, Limited | |||||||||

| · | Mizuho Bank, Ltd. | · | Mitsubishi UFJ Trust and Banking Corporation | |||||||||

|

(12)

|

Major shareholders and shareholding ratios

|

· |

The Master Trust Bank of Japan, Ltd. (Trust Account)

|

7.03%

|

· |

Japan Trustee Services Bank, Ltd. (Trust Account)

|

9.97%

|

|||||

| · |

Japan Trustee Services Bank, Ltd. (Trust Account)

|

4.53%

|

· |

The Master Trust Bank of Japan, Ltd. (Trust Account)

|

9.36%

|

|||||||

| · |

Takahashi Industrial and Economic Research Foundation

|

3.87%

|

· |

Trust & Custody Services Bank, Ltd. (Securities Investment Trust Account)

|

3.38%

|

|||||||

| · |

Sumitomo Mitsui Trust Bank, Limited

|

3.85%

|

· |

Masako Moribe

|

2.83%

|

|||||||

| · |

Japan Trustee Services Bank, Ltd. (Trust Account No. 4)

|

3.39%

|

· |

BNY FOR GCM CLIENT ACCOUNTS (E) GCS (Standing proxy: The Bank of Tokyo-Mitsubishi UFJ, Ltd.)

|

2.63%

|

|||||||

12

| · |

National Mutual Insurance Federation of Agricultural Cooperatives

|

2.60%

|

· |

BNY GCM CLIENT ACCOUNT JPRD ACISG (FE-AC) (Standing proxy: The Bank of Tokyo-Mitsubishi UFJ, Ltd.)

|

1.67%

|

|||||||

| · |

KEIAISHA CO., LTD.

|

2.53%

|

· |

The Nomura Trust and Banking Company, Limited (Investment Trust Account)

|

1.65%

|

|||||||

| · |

The Bank of Tokyo-Mitsubishi UFJ, Ltd.

|

2.52%

|

· |

BNP PARIBAS ARBITRAGE SNC (Standing proxy: BNP Paribas Securities (Japan) Limited)

|

1.39%

|

|||||||

| · |

Sumitomo Mitsui Banking Corporation

|

2.51%

|

· |

BNY FOR GCM CLIENT ACCOUNTS (E) ILM (Standing proxy: The Bank of Tokyo-Mitsubishi UFJ, Ltd.)

|

1.39%

|

|||||||

| · |

The Dai-ichi Life Insurance Company, Limited

|

1 .27%

|

· |

BNP Paribas Securities (Japan) Limited

|

1.17%

|

|||||||

|

(as of September 30, 2015)

|

(as of September 30, 2015)

|

|||||||||||

|

(13)

|

Relationship between companies

|

|

Capital

|

None

|

|||

|

Personnel

|

None

|

|||

|

Transactional

|

None

|

|||

|

Status as a related party

|

None

|

|

(14)

|

Business results and financial conditions for the most recent three years

|

|

Minebea Co., Ltd.

(consolidated)

|

MITSUMI ELECTRIC CO., LTD.

(consolidated) |

|||||||||||||||||||||||

|

Fiscal year

|

Year ended

March 31,

2013

|

Year ended

March 31,

2014

|

Year ended

March 31,

2015

|

Year ended

March 31,

2013

|

Year ended

March 31,

2014

|

Year ended

March 31,

2015

|

||||||||||||||||||

|

Net assets

|

137,858 | 163,463 | 233,679 | 101,521 | 102,992 | 115,431 | ||||||||||||||||||

|

Total assets

|

362,805 | 381,278 | 490,043 | 140,611 | 142,981 | 161,089 | ||||||||||||||||||

|

Net assets per share (yen)

|

351.65 | 422.62 | 604.83 | 1,160.88 | 1,177.71 | 1,319.96 | ||||||||||||||||||

|

Net sales

|

282,409 | 371,543 | 500,676 | 152,098 | 157,360 | 153,045 | ||||||||||||||||||

|

Operating income

|

10,169 | 32,199 | 60,101 | (4,382 | ) | 629 | 952 | |||||||||||||||||

|

Ordinary profit

|

7,673 | 28,065 | 60,140 | (3,274 | ) | 2,632 | 3,980 | |||||||||||||||||

|

Net income

|

1,804 | 20,878 | 39,887 | (11,545 | ) | 3,228 | 3,826 | |||||||||||||||||

|

Net income per share (yen)

|

4.83 | 55.94 | 106.73 | (132.02 | ) | 36.92 | 43.75 | |||||||||||||||||

|

Dividend per share (yen)

|

7.00 | 8.00 | 12.00 |

-

|

5.00 | 14.00 | ||||||||||||||||||

Note:

|

1.

|

Figures are in millions of yen unless otherwise indicated.

|

6. Profile of Minebea following the Share Exchange (planned)

|

(1)

|

Name

|

MINEBEA MITSUMI Kabushiki Kaisha (in English: MINEBEA MITSUMI Inc.)

|

|

(2)

|

Location

|

4106-73, Oaza Miyota, Miyota-machi, Kitasaku-gun, Nagano

|

13

|

(3)

|

Title and name of the Representative

|

Yoshihisa Kainuma, Representative Director, Chairman, President, CEO and COO

|

|

(4)

|

Business

|

· Machined components

· Electronic devices and components

· Other

|

|

(5)

|

Amount of capital

|

To be determined.

|

|

(6)

|

Fiscal year end

|

March 31

|

|

(7)

|

Net assets

|

To be determined.

|

|

(8)

|

Total assets

|

To be determined.

|

7. Overview of Accounting Treatment

It is expected that the accounting treatment of the Share Exchange will be the purchase method, with Minebea as the acquiring company, by applying the “Application Guidelines for Accounting Standards for Corporate Mergers and Accounting Standards for Corporate Splits” (Corporate Accounting Standard Application Guideline No. 10) stipulated in the “Accounting Standard for Business Combination” (ASBJ Statement No. 21).

The amount of goodwill (or negative goodwill) in connection with the Share Exchange has not been determined. It will be announced once it is determined.

8. Forecast

The forecast of operating results, as well as other outlook, following the Business Integration will be announced once they are determined.

(Reference) Minebea (consolidated earnings forecast for the current period announced on February 3, 2016)

(Unit: millions of yen)

|

Net sales

|

Operating income

|

Ordinary profit

|

Net income attributable to shareholders of the parent

|

|

|

Consolidated earnings forecast for current year

(ending March 31, 2016)

|

635,000

|

55,000

|

50,000

|

40,000

|

|

Consolidated results for previous year

(ended March 31, 2015)

|

500,676

|

60,101

|

60,140

|

39,887

|

(Reference) MITSUMI (consolidated earnings forecast for the current period announced on March 30, 2016)

(Unit: millions of yen)

|

Net sales

|

Operating income

|

Ordinary profit

|

Net income attributable to shareholders of the parent

|

|

|

Consolidated earnings forecast for current year

(ending March 31, 2016)

|

165,000

|

(4,600)

|

(9,000)

|

(9,800)

|

|

Consolidated results for previous year

(ended March 31, 2015)

|

153,045

|

952

|

3,980

|

3,826

|

End

14

Minebea may file a registration statement on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the possible share exchange (the “Share Exchange”) pertaining to a business integration between the two companies, if it is consummated. The Form F-4 (if filed in connection with the Share Exchange) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of MITSUMI prior to the shareholders’ meeting at which the Share Exchange will be voted upon. The Form F-4 and prospectus (if a Form F-4 is filed) will contain important information about the two companies, the Share Exchange and related matters. U.S. shareholders to whom the prospectus is distributed are urged to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the Share Exchange carefully before they make any decision at the shareholders’ meeting with respect to the Share Exchange. Any documents filed with the SEC in connection with the Share Exchange will be made available when filed, free of charge, on the SEC’s web site at www.sec.gov. In addition, upon request, the documents can be distributed for free of charge. To make a request, please refer to the contact of Minebea below.

Contacts for inquiries regarding the Business Integration

|

Minebea

Minebea Co., Ltd.

4106-73, Oaza Miyota, Miyota-machi, Kitasaku-gun, Nagano 389-0293, Japan

Takayuki Ishikawa, General Manager

Corporate Communications Office

Tel: 03-6758-6703

Email: corporate_communication@minebea.co.jp

|

MITSUMI

MITSUMI ELECTRIC CO., LTD.

2-11-2, Tsurumaki, Tama-shi, Tokyo, 206-8567, Japan

Kunihiro Noguchi, General Manager

General Affairs Dept.

Tel: 042-310-5160

Email: prwmaster@mitsumi.co.jp

|

15

FORWARD-LOOKING STATEMENTS

This document includes “forward-looking statements” that reflect the plans and expectations of Minebea and MITSUMI in relation to, and the benefits resulting from, their business integration described above. To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the companies in light of the information currently available to them, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of one or both of the companies (or the group after the integration) to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements.

The companies undertake no obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by the companies (or the group after the integration) in their subsequent filings in Japan and filings with the U.S. Securities and Exchange Commission.

The risks, uncertainties and other factors referred to above include, but are not limited to:

|

|

(1)

|

economic and business conditions in and outside Japan;

|

|

|

(2)

|

changes in demand for PCs and peripherals, information and communication equipment, automobiles, consumer electronics and other devices and equipment, which are the main markets of the companies’ products, and in raw material prices, as well as exchange rate fluctuations;

|

|

|

(3)

|

changes in interest rates on loans, bonds and other indebtedness of the companies, as well as changes in financial markets;

|

|

|

(4)

|

changes in the value of assets (including pension assets) such as securities and investment securities;

|

|

|

(5)

|

changes in laws and regulations (including environmental regulations) relating to the companies’ business activities;

|

|

|

(6)

|

increases in tariffs, imposition of import controls and other developments in the companies’ main overseas markets;

|

|

|

(7)

|

interruptions in or restrictions on business activities due to natural disasters, accidents and other causes;

|

|

|

(8)

|

the companies’ being unable to reach an agreement satisfactory to both of them with respect to the details of the business integration or otherwise being unable to complete the business integration;

|

|

|

(9)

|

difficulty of realizing synergies or added value from the business integration by the group after the integration.

|

16

Exhibit

Assumptions and Disclaimers Regarding Daiwa’s Fairness Opinion

In preparing its opinion that the Share Exchange Ratio agreed by MITSUMI ELECTRIC CO., LTD. (“Mitsumi”) and Minebea Co., Ltd. (“Minebea”) is fair from a financial point of view to the holders of the common stock of Mitsumi (the “Daiwa Fairness Opinion”), Daiwa has analyzed and reviewed the Share Exchange Ratio. For such analysis and review, Daiwa has, in principle, used as-is material and information provided by Mitsumi and Minebea as well as publicly available information. Daiwa has assumed and relied on the accuracy and completeness of all information that Daiwa has analyzed or reviewed, and has not independently verified or assumed any obligation to independently verify the accuracy or completeness of such information. Daiwa has not undertaken an independent evaluation, appraisal or assessment of any of the assets or liabilities (including, but not limited to, financial derivative products, off-balance-sheet assets and liabilities and other contingent liabilities), on an aggregate or individual basis, of Mitsumi, Minebea or any of their respective affiliates (where “affiliates” here and hereafter refers to “affiliates” as defined in Article 8(8) of the Ordinance on Terminology, Forms, and Preparation Methods of Financial Statements), nor has Daiwa made any request to a third party for any such valuation, appraisal or assessment. Moreover, in preparing the Daiwa Fairness Opinion, Daiwa has assumed that there are no undisclosed facts (including contingent liabilities and litigation) in the present or future relating to Mitsumi, Minebea or any of their respective affiliates that may affect the Daiwa Fairness Opinion. Daiwa has not evaluated the solvency or creditworthiness of Mitsumi, Minebea or any of their respective affiliates under any applicable laws relating to bankruptcy, insolvency or similar matters. Daiwa has not conducted any physical inspection of the properties or facilities of Mitsumi, Minebea or any of their respective affiliates, nor has Daiwa assumed any obligation to do so. Daiwa understands that Mitsumi’s accounting and legal advisors performed financial and legal due diligence, respectively, on Minebea based on the scope of due diligence agreed upon between the respective advisors and Mitsumi. Daiwa has not independently verified such scope or assumed any obligation with respect to such due diligence.

In preparing the Daiwa Fairness Opinion, Daiwa has assumed that the business plans, financial forecasts and other information regarding the future furnished to Daiwa have been prepared according to reasonable and appropriate procedures, and reflect the best currently available estimates and judgment of the management of Mitsumi and Minebea respectively, and, Daiwa has conducted no independent verifications of the accuracy, validity or feasibility of the business plans, nor has Daiwa assumed any obligation or responsibility to do so.

Daiwa has assumed that all assumptions for the preparation of the business plans and financial forecasts are accurate and feasible. Daiwa has conducted no independent verifications of the accuracy or feasibility thereof, nor has Daiwa assumed any obligation to do so.

Daiwa has assumed that the share exchange agreement will be legally and validly prepared and approved at the general meeting of shareholders of Mitsumi (and if required, at the general meeting of shareholders of Minebea) with terms and conditions substantially the same as those set forth in the draft share exchange agreement that Daiwa has reviewed, that the management integration agreement will be properly and validly executed by Mitsumi and Minebea with terms and conditions substantially the same as those set forth in the draft management integration agreement that Daiwa has reviewed, and that the share exchange will be legally and validly performed and completed pursuant to the terms and conditions of the share exchange agreement and the management integration agreement, without any waiver, revision or amendment of any material terms or conditions thereof. Further, Daiwa has assumed that the share exchange will be legally and validly performed, that the tax effect arising from the share exchange will not be different from the anticipated tax effect provided by Mitsumi and Minebea, and that the governmental, regulatory or other consents or approvals necessary for the execution of the share exchange will be obtained without any prejudice to the benefits expected to be brought by share exchange. Therefore, Daiwa has no obligation to conduct the independent verifications thereof. Daiwa has not evaluated the decision of Mitsumi with respect to its execution of the share exchange or the relative merits of the share exchange as compared to any strategic alternatives that may be available to Mitsumi, nor has Daiwa been requested by Mitsumi to do so. Daiwa is not an accounting, tax or legal expert and has neither independently analyzed or reviewed nor assumed any obligation to independently analyze or review the legality or validity of any matter regarding the share exchange or the appropriateness of the accounting and tax treatment of any matter regarding the share exchange. Daiwa has also assumed that the anticipated tax effects of the share exchange communicated to Daiwa by Mitsumi will be realized.

1

Daiwa has received a fee from Mitsumi as consideration for advisory services regarding the share exchange. Daiwa has provided advisory services in connection with certain aspects of the negotiations for the share exchange, including the preparation of the draft share exchange agreement and the draft management integration agreement and certain other aspects. However, Daiwa has not been involved in any decision-making processes regarding the draft share exchange agreement and the draft management integration agreement.

The Daiwa Securities Group, mainly consisted of Daiwa Securities Group Inc., Daiwa’s parent company, has conducted investment and financing service business concentrating on securities-related business as the principal business, and has provided its services to Mitsumi, Minebea and their respective affiliates, for which the Daiwa Securities Group has received compensation in the past and at the present, and may do so in the future. Mitsumi understands that Daiwa and its affiliates have provided, or may provide in the future, services for transactions other than the share exchange to Minebea and its affiliates, for which Daiwa and its affiliates have received, or may receive, compensation, and has given prior consent to the provision of such services without any objection. In addition, Daiwa and its affiliates may actively trade or hold financial products, including securities and derivatives products, of Mitsumi, Minebea or any of their respective affiliates, for the accounts of Daiwa or its affiliates or for the accounts of customers.

The Daiwa Fairness Opinion was prepared solely in order that Daiwa may provide the Board of Directors of Mitsumi with reference information to review the Share Exchange Ratio at the request of Mitsumi (the “Daiwa Opinion Purpose”). Daiwa, therefore, does not assume any responsibility arising out of or in connection with the use of the Daiwa Fairness Opinion other than for the Daiwa Opinion Purpose. Mitsumi may not cause the Daiwa Fairness Opinion to be disclosed, referred or communicated to any third party, nor to be used for any third party (collectively, “Disclosure”) without Daiwa’s prior written consent. Mitsumi will be also solely responsible for Disclosure with Daiwa’s prior consent, and Daiwa will not be responsible for such Disclosure. Daiwa assumes no liability to any third party other than Mitsumi in connection with the Daiwa Fairness Opinion or the share exchange, as well as arising out of or in connection with the use of the Daiwa Fairness Opinion other than for the Daiwa Opinion Purpose. Moreover, the Daiwa Fairness Opinion does not constitute a recommendation or solicitation to any holders of shares of common stock of Mitsumi as to how such holder of shares should vote on the share exchange (including exercise of the appraisal right of opposing holders of shares), the transfer or receipt of shares of Mitsumi or any other related matters.

2

The Daiwa Fairness Opinion addresses only the fairness of the Share Exchange Ratio from a financial point of view to the holders of the shares of the common stock of Mitsumi, and Mitsumi has not asked Daiwa to address, and the Daiwa Fairness Opinion does not address, the fairness to, or any other consideration of, any third party other than the holders of shares of common stock of Mitsumi. Daiwa does not provide any opinion on any premise or assumption upon which the determination of the Share Exchange Ratio was based or the underlying business decision of Mitsumi to proceed with the share exchange. Daiwa is also not expressing any opinion as to the prices at which the shares of common stock of Mitsumi or Minebea will be traded at any time after the date of this opinion. In addition, Daiwa expresses no opinion with respect to the fairness of the amount or nature of any compensation to be received in relation to the Share Exchange Ratio by any officer, director, employee or any similar such person involved in the share exchange.

The Daiwa Fairness Opinion is based on financial information in part prepared in accordance with accounting principles generally accepted in Japan, and did not take into consideration any possible difference in such financial information if prepared under international financial reporting standards. The Daiwa Fairness Opinion is also based upon financial, economic, market and other conditions as they exist as of the date of the Daiwa Fairness Opinion, and relies on information made available to Daiwa by the date of the Daiwa Fairness Opinion. However, some materials and information used for the review of the Share Exchange Ratio in the share exchange were made at a different point in time because of certain restrictions on available materials and information. Additionally, although the Daiwa Fairness Opinion may be affected by future changes in conditions, Daiwa does not assume any obligation to revise, change, renew, supplement or reaffirm the Daiwa Fairness Opinion.

3