UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

Fisher Communications, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Fisher Communications Urges Shareholders to Reject FrontFour Capital’s

Attempt to Take Control of Fisher’s Board of Directors

Asks Shareholders to Support Fisher’s Four Highly Qualified and Experienced Nominees

Commences Mailing of Proxy Statement for 2011 Annual Meeting

SEATTLE, WA – April 12, 2011 – Fisher Communications, Inc. (NASDAQ: FSCI), a leader in local media innovation, today announced that it filed definitive proxy materials with the U.S. Securities and Exchange Commission for its 2011 Annual Meeting and that it has commenced the mailing of those materials to qualified shareholders. Fisher shareholders of record as of the close of business on March 9, 2011 are entitled to vote at the Annual Meeting scheduled to take place in Seattle on May 11th.

The Company included the following letter in its mailing to shareholders:

April 12, 2011

Dear Fellow Fisher Communications, Inc. (“Fisher”) Shareholder:

We are writing to ask for your support on an important matter regarding the future of your Company. As you may know, David Lorber and FrontFour Capital Group (“FrontFour”), a Connecticut-based hedge fund, has submitted a slate of four nominees for election to Fisher’s Board of Directors. If elected, FrontFour’s four nominees and Mr. Lorber would constitute a majority of the Board, thus, taking control of Fisher. We are asking that you reject the FrontFour nominees and instead elect the highly qualified and experienced candidates being proposed by your Board of Directors.

FRONTFOUR IS SEEKING TO TAKE CONTROL

OF FISHER AT THE EXPENSE OF OTHER SHAREHOLDERS

AND REALIZE A SHORT-TERM GAIN

Mr. Lorber is a sitting Fisher director who is also a member of the Board of Trustees of Huntingdon Real Estate Investment Trust (“Huntingdon”), a Canadian REIT that owns commercial real estate, including warehouses, industrial buildings and parking lots. FrontFour is the largest shareholder of Huntingdon. Huntingdon’s Chief Executive Officer and Trustee, Zachary George, is Mr. Lorber’s co-founding partner of FrontFour. In December 2010, Huntingdon, a REIT with a market cap of approximately $100 million, made an unsolicited proposal to acquire Fisher at an implied offer price of only $23.99. The Huntingdon proposal, which would have required that our shareholders exchange their Fisher stock for shares in Huntingdon, or a combination of cash and Huntingdon shares, was unanimously rejected by Fisher’s voting Board members.

Mr. Lorber has criticized the Board for its quick rejection of the Huntingdon proposal; however, the equity markets quickly confirmed the Board’s assessment. Fisher’s most recent closing share price on April 11, 2011 was $29.86, approximately 25% higher than the value implied by the Huntingdon December 2010 proposal. Furthermore, our Board, including Mr. Lorber, was very well informed about Fisher’s value at that time. Last July, the Board received a non-public assessment from a financial advisor working for the Board concluding that valuations of broadcast assets were near all-time lows and as a result, the environment for transactions in the industry remained weak. Several months later, just weeks before Huntingdon made its unsolicited proposal for Fisher, the Board received a very positive, non-public update on Fisher’s fourth quarter financial performance from management.

FrontFour’s ownership interest in Huntingdon, and the affiliation of Mr. George and Mr. Lorber with Huntingdon, create a direct conflict of interest between its (and Mr. Lorber’s) interests and the interests of our other shareholders. Had our Board pursued the Huntingdon proposal, then all Fisher shareholders would have received a poor value for their Fisher stock. However, as Huntingdon’s largest shareholder, FrontFour would have directly benefitted from the low value proposed for Fisher. Mr. Lorber’s affiliation with Huntingdon, FrontFour and Fisher raises obvious questions about whether he is focused on serving the shareholders and investors of Huntingdon, FrontFour or Fisher.

You should also note that FrontFour has not been a long-term significant Fisher shareholder. Instead, it is a hedge fund that is focused on reaping a significant short-term gain. FrontFour currently owns approximately 2% of Fisher’s shares, over 90% of which have been purchased since May 4, 2010 at prices ranging from $14.21 to $18.81 per share, while Mr. Lorber has been a member of the Fisher Board and generally during periods in which Fisher stock traded at depressed levels.

After Huntingdon’s unsuccessful and opportunistic attempt to buy the Company in December, Mr. Lorber and FrontFour are now trying to take control of your Company through a proxy contest. Furthermore, FrontFour is seeking to gain control of Fisher without any control premium being offered to the rest of the shareholders. If successful, FrontFour says it intends to initiate a sale process for the Company. It would be doing so at a time when valuations of broadcasting stocks remain near the bottom of the market. They have already made up their mind about the future of Fisher and have put forward no plan for how they would operate the business, either before, during or after the sales process or how they would honor their fiduciary duties to all shareholders. Instead, their sole proposal for value creation is to allow four non-broadcasters to join with Mr. Lorber in attempting an ill-timed auction of the Company to potential buyers that may in fact include Huntingdon.

As a shareholder, you should ask yourself whether you want directors who are blindly committed to selling your Company, potentially to an affiliated entity, without knowledge of the industry. Your Board encourages you not to allow your Company to be hijacked by Mr. Lorber with the aid of one of his hedge fund partners and handpicked designees, who appear to be focused only on providing FrontFour with a short-term gain.

FRONTFOUR’S INACCURATE AND MISLEADING STATEMENTS

Fisher’s 2010 Financial Results

FrontFour’s preliminary proxy statement, which was filed with the Securities and Exchange Commission on March 21, 2011, provided a misleading picture of Fisher’s performance. FrontFour asserted that Fisher’s “poor operational and stock performance” was a concern, citing results and stock performance information through 2009. FrontFour’s filing conveniently omitted more recent and publicly available 2010 results, which demonstrate greatly improved performance, in order to deceptively create a false impression of Fisher’s current condition.

The reality is that in 2010, Fisher’s consolidated revenue increased 32% from 2009, EBITDA1 grew approximately 400%, and television revenue was up 40% – all of which were peer-leading results. In addition, TV Broadcast Cash Flow margins expanded significantly. Your Company now enjoys one of the strongest balance sheets in the broadcasting industry, with $52.9 million in cash and cash equivalents on hand as of December 31, 2010. Moreover, during the past 24 months, the Company has used its strong cash

| 1 | Additional information about the calculation of EBITDA can be found on our investor relations website at http://investor.fsci.com, |

position to reduce its total debt by about 34% – from $150 million to $98.8 million – which does not include a $20 million senior notes redemption currently underway.

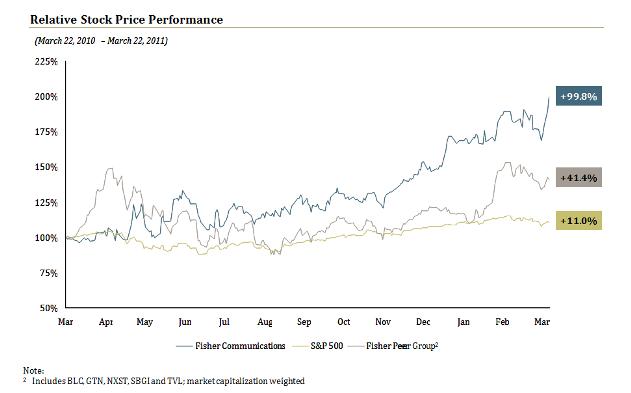

The improved results have not gone unnoticed to the investment community. On a trailing 12-month basis as of March 22, 2011 – prior to the Company’s disclosure that it would explore the possible sale or financing of Fisher Plaza – Fisher’s common stock outperformed its peer group and the S&P 500 by a significant margin.

Fisher’s Corporate Governance

The FrontFour preliminary proxy statement criticizes the Fisher Board for questionable corporate governance practices. In particular, FrontFour and Mr. Lorber criticize the Board for not implementing a proposal to declassify the Company’s Board of Directors that passed a shareholder vote in 2009. FrontFour’s proxy statement notes that “the Board ultimately decided not to enact the non-binding proposal.” What FrontFour fails to mention; however, is that at a December 2009 meeting, Mr. Lorber joined all present directors in the Board’s unanimous decision not to implement the declassification of the Board of Directors.

FISHER IS ON TRACK TO CONTINUE DELIVERING SHAREHOLDER VALUE

Last year marked the fifth consecutive year in which Fisher stations increased their share of television market revenue and television advertising growth rates. Fisher has grown share by improving ratings, strengthening performance in key advertising categories, and taking market share from competitors. Our television and radio stations continue to deliver distinguished news and quality programming which is reflected in our strong operational performance company-wide. The Company is well-positioned to continue delivering growth and creating shareholder value. Now is not the time to disrupt our operational and financial momentum – that is why a vote for Fisher’s candidates is a vote for shareholder value.

SUPPORT YOUR BOARD’S HIGHLY QUALIFIED NOMINEES BY VOTING THE WHITE PROXY CARD

We recommend that you stop FrontFour’s attempt to seize control of your Company by supporting our four highly qualified nominees – Anthony B. Cassara, Richard L. Hawley, Roger L. Ogden and Michael D. Wortsman. In contrast to the FrontFour nominees, our candidates have nearly 100 combined years of broadcast experience and have successfully created shareholder value at other companies in our industry. Our slate also includes Richard Hawley, our audit committee chair and financial expert who has over 37 years of professional experience, including serving as a partner of an international public accounting firm and current service as the chief financial officer of a Fortune 1000 public company, as well as previous experience as chief financial officer of a Fortune 500 company. You can read more about their qualifications in the attached definitive proxy statement. While FrontFour’s actions demonstrate a preoccupation with their own short-term financial gain at the expense of other shareholders, Fisher’s nominees are committed to representing the interests of all shareholders.

You can vote FOR Fisher’s nominees and AGAINST FrontFour’s candidates by simply signing, dating and returning the enclosed WHITE proxy card promptly in the postage-paid envelope provided, or by following the easy instructions to vote by telephone or Internet.

We strongly urge you not to allow a hedge fund that has an obvious conflict of interest to halt Fisher’s progress. You can do so by disregarding any materials you may receive from FrontFour and not sending in any green proxy cards.

Thank you for your continued support.

Sincerely,

| Paul A. Bible Colleen B. Brown Anthony B. Cassara Donald G. Graham, III |

Richard L. Hawley Brian P. McAndrews George F. Warren, Jr. William W. Warren, Jr. Michael D. Wortsman |

If you have any questions or need assistance in voting your shares, please call:

Georgeson

199 Water Street, 26th Floor

New York, NY 10038

(866) 821-0284 (Toll Free)

Banks and Brokerage Firms please call:

(212) 440-9800

Email: fishercommunications@georgeson.com

About Fisher Communications, Inc.

Fisher Communications (FSCI) is an innovative local media company with television, radio, internet and mobile operations throughout the western United States. Fisher operates 13 full power television stations and 7 low power television stations which include network affiliations with ABC, CBS, FOX, Univision and CW that reach 3.5% of U.S. television households, and 10 radio stations targeting a full range of audience demographics. Fisher Interactive Network, its online division, produces more than 125 local and hyper-local websites and delivers comprehensive multiplatform advertising solutions to local businesses. The Company also owns and operates Fisher Plaza, a 300,000 square foot media, telecommunications, and data center facility located near downtown Seattle. The Company is headquartered in Seattle, WA. For more information about Fisher Communications, Inc., go to www.fsci.com.

Forward-Looking Statements

This news release includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words “guidance,” “believes,” “expects,” “intends,” “anticipates,” “could,” or similar expressions. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this news release, concerning, among other things, changes in revenue, cash flow and operating expenses, involve risks and uncertainties, and are subject to change based on various important factors, including the impact of changes in national and regional economies, our ability to service and refinance our outstanding debt, successful integration of acquired television stations (including achievement of synergies and cost reductions), pricing fluctuations in local and national advertising, future regulatory actions and conditions in the television stations’ operating areas, competition from others in the broadcast television markets served by the Company, volatility in programming costs, the effects of governmental regulation of broadcasting, industry consolidation, technological developments and major world news events. Unless required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this news release might not occur. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this release. For more details on factors that could affect these expectations, please see the risk factors in our Annual Report on Form 10-K for the year ended December 31, 2010, which we filed with the SEC on March 8, 2011.

Media Contact:

Sard Verbinnen & Co

Paul Kranhold / Ron Low / David Isaacs

(415) 618-8750

Investor Contacts:

Fisher Communications, Inc.

Hassan Natha

Vice President and Chief Financial Officer

(206) 404-6738

Georgeson

Donna M. Ackerly

Senior Managing Director – Corporate Proxy

(212) 440-9837