SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

BAY BANKS OF VIRGINIA INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 30, 2018

Dear Fellow Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Bay Banks of Virginia, Inc. (the “Company”) on June 11, 2018, at 5:00 p.m., at the Commonwealth Club, 401 West Franklin Street, Richmond, Virginia.

The primary business of the meeting will be to elect three Company directors, approve, on a non-binding advisory basis, the Company’s named executive officer compensation as described in the accompanying proxy statement, and ratify the appointment of Dixon Hughes Goodman LLP as the Company’s independent auditor for 2018. During the meeting, we also will report to you on the condition and performance of the Company and its subsidiaries, Virginia Commonwealth Bank and VCB Financial Group, Inc. You will have an opportunity to question management on matters that affect the interests of all stockholders.

We hope you can join us for the Annual Meeting on June 11. Whether or not you plan to attend, please complete, sign and date the enclosed proxy and return it promptly in the enclosed envelope. Alternatively, in order to make voting even easier, electronic and telephone voting is available. You will find instructions to vote via the Internet or by phone on your proxy card.

YOUR VOTE IS IMPORTANT

Thank you for your interest in the Company’s affairs. As always, we are most grateful for your continued support of Bay Banks of Virginia.

| Sincerely, | ||||||

|

|

|

|||||

| C. Frank Scott, III |

Randal R. Greene |

|||||

| Chairman of the Board |

President and Chief Executive Officer |

|||||

If you hold your shares through a broker, it is necessary for you to complete the voting instruction form

that you receive from the broker in order for your vote to be counted.

Your Vote is Important.

BAY BANKS OF VIRGINIA, INC.

1801 Bayberry Court

Richmond, Virginia 23226

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 11, 2018

To Our Stockholders:

The Annual Meeting of Stockholders of Bay Banks of Virginia, Inc. (the “Company”) will be held at the Commonwealth Club, 401 West Franklin Street, Richmond, Virginia, on June 11, 2018 at 5:00 p.m. for the following purposes:

| 1. | To elect three (3) Class II directors named in the accompanying proxy statement for terms of three years each; |

| 2. | To approve, on a non-binding advisory basis, the Company’s named executive officer compensation as described in the accompanying proxy statement; |

| 3. | To ratify the appointment of Dixon Hughes Goodman LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2018; and |

| 4. | To transact such other business as may properly come before the meeting or any adjournment thereof. Management knows of no other business to be brought before the meeting. |

Only stockholders of record at the close of business on April 23, 2018 will be entitled to notice of and to vote at the Annual Meeting and any adjournments thereof.

| By Order of the Board of Directors |

|

| Pamela A. Varnier |

| Corporate Secretary |

April 30, 2018

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: A complete set of proxy materials relating to the Company’s Annual Meeting, including the Company’s proxy statement and annual report on Form 10-K for the year ended December 31, 2017, is available on the Internet. These materials may be found at http://www.baybanks.com.

PLEASE MARK, SIGN, DATE AND RETURN YOUR PROXY PROMPTLY, OR VOTE YOUR SHARES VIA THE INTERNET OR TELEPHONE.

BAY BANKS OF VIRGINIA, INC.

1801 Bayberry Court

Richmond, Virginia 23226

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

June 11, 2018

GENERAL

The enclosed proxy is solicited by the Board of Directors of Bay Banks of Virginia, Inc., the holding company for Virginia Commonwealth Bank and VCB Financial Group, Inc., for the Company’s Annual Meeting of Stockholders to be held on June 11, 2018 (the “Annual Meeting”), at the time and place and for the purposes set forth in the accompanying Notice of the Annual Meeting, or any adjournment thereof. The date of this Proxy Statement is April 30, 2018 and the approximate mailing date of this Proxy Statement and accompanying proxy is May 7, 2018.

In this Proxy Statement, we refer to Bay Banks of Virginia, Inc. and its subsidiaries as a combined entity as the “Company” unless the context requires otherwise or unless otherwise noted, and we refer to Virginia Commonwealth Bank as the “Bank.”

Business Items of the Annual Meeting

At the Annual Meeting, you will be asked to vote on the following proposals:

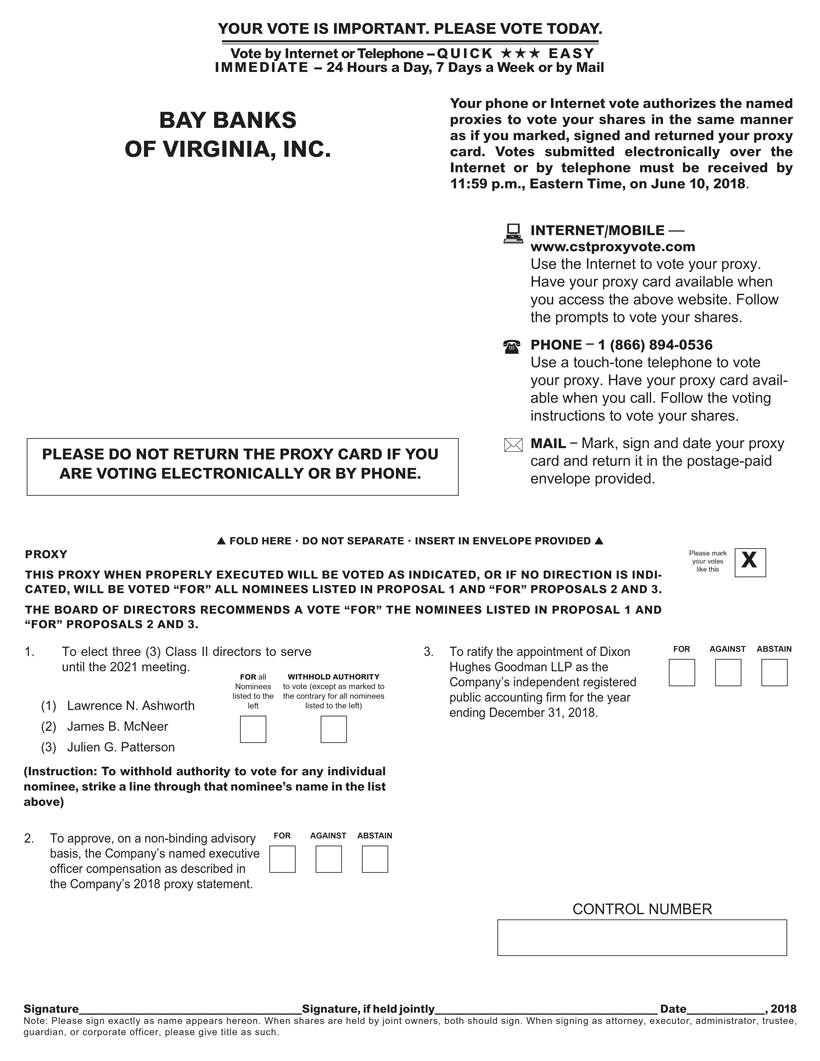

| • | to elect three (3) Class II directors named in this Proxy Statement for terms of three years each (Proposal 1); |

| • | to approve, on a non-binding advisory basis, the Company’s named executive officer compensation as described in this Proxy Statement (Proposal 2); and |

| • | to ratify the appointment of Dixon Hughes Goodman LLP (“DHG”) as the Company’s independent registered public accounting firm for the year ending December 31, 2018 (Proposal 3). |

Stockholders will also be asked to vote on any other matters which may properly come before the Annual Meeting. Management knows of no other business to be brought before the meeting. However, if other matters do properly come before the Annual Meeting, the persons named in the enclosed proxy card possess discretionary authority to vote in accordance with their best judgment with respect to such other matters.

Recommendation of the Board of Directors

The Board of Directors of the Company recommends that you vote “FOR” the election of the director nominees named in this Proxy Statement, “FOR” the approval of the Company’s executive compensation as described in this Proxy Statement and “FOR” the ratification of DHG as the Company’s independent auditors for 2018.

Record Date and Voting Rights of Stockholders

Only stockholders of record of the Company’s common stock at the close of business on April 23, 2018 are entitled to notice of and to vote at the Annual Meeting or any adjournments thereof. The number of shares of the Company’s common stock outstanding and entitled to vote as of the close of business on April 23, 2018 was 13,223,096. The Company has no other class of stock outstanding. Each share of common stock entitles the record holder thereof to one vote upon each matter to be voted upon at the Annual Meeting.

Quorum

The presence of holders of at least sixty percent (60%) of the Company’s common stock entitled to vote at the Annual Meeting, in person or by proxy, will constitute a quorum for the transaction of business. Shares for which you have elected to abstain or to withhold the proxies’ authority to vote on a matter will count toward a quorum, but will not be included in determining the number of votes cast with respect to such matter. Shares held by a brokerage firm, bank, broker-dealer or similar organization that are voted on any matter are included in the quorum; if such shares are not voted on any matter they will not be included in determining whether a quorum is present.

Vote Required

Approval of each of the proposals at the Annual Meeting requires the affirmative vote of more than 60% of the shares represented at the Annual Meeting. With respect to Proposal 1, directors are elected by the affirmative vote of more than 60% of the shares represented at the Annual Meeting. With respect to Proposals 2 (advisory vote on executive compensation) and 3 (ratification of DHG), the proposals will be approved if more than 60% of the shares represented at the Annual Meeting vote for approval of such proposals.

Voting Shares Held in Accounts with Brokerage Firms and Similar Organizations

If your shares are held in an account with a brokerage firm, bank, broker-dealer or similar organization, then your shares are held in “street name.” The firm that holds your shares, or its nominee, is considered the registered stockholder for purposes of voting at the Annual Meeting, and you are considered the beneficial owner. As a beneficial owner, you have the right to direct the firm how to vote the shares held for you, and you must follow the instructions of that firm in order to vote your shares or to change a previously submitted voting instruction. If the firm does not receive instructions from you on how to vote your shares on a non-routine matter, that firm does not have the authority to vote on that matter with respect to your shares. Since you are not the registered owner, you may not vote the shares in person at the Annual Meeting unless you obtain a legal proxy from the firm that holds your shares giving you the right to vote shares registered in its name at the Annual Meeting. Please note that this legal proxy is different from the proxy card or voting instructions you generally receive in the mail. If you wish to vote your shares in person, please contact the firm holding your shares for a legal proxy.

Voting on Routine and Non-Routine Matters

If you own shares that are held in street name, and you do not provide the firm that holds the shares with specific voting instructions, then, under applicable rules, the firm that holds the shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the firm that holds such shares does not receive instructions from you on how to vote your shares on a non-routine matter, that firm will inform the inspector of election of the Annual Meeting that it does not have the authority to vote on the matter with respect to the shares. This is generally referred to as a “broker non-vote.”

2

Proposals 1 (election of directors) and 2 (advisory vote on executive compensation) in this Proxy Statement are matters that are considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with such proposals.

Proposal 3 (ratification of DHG) is considered a routine matter. A broker or other nominee generally may vote on routine matters, and therefore we expect no broker non-votes in connection with Proposal 3.

Revocation and Voting of Proxies

Execution or submission of a proxy will not affect a registered stockholder’s right to attend the Annual Meeting and vote in person. Any registered stockholder who has executed or submitted a proxy may revoke it by attending the Annual Meeting and voting in person. A registered stockholder may also revoke his or her proxy at any time before it is exercised by filing a written notice with the Corporate Secretary of the Company or by submitting a proxy bearing a later date. Proxies will extend to, and will be voted at, any adjourned session of the Annual Meeting.

If your shares are held in street name, please follow the instructions delivered with the notice from your bank or broker or contact them for instructions on how to change or revoke your vote.

How Shares will be Voted

Shares represented by proxies will be voted at the Annual Meeting as follows:

| • | Properly Completed Proxies – Shares represented by a properly completed proxy that contains voting instructions will be voted in accordance with the voting instructions specified in the proxy. |

| • | Proxies Without Voting Instructions – Shares represented by proxies that are properly signed and dated or submitted via the Internet but which do not contain voting instructions will be voted in accordance with the Board’s recommendations set forth above. |

| • | Abstentions – We will count a properly executed or submitted proxy indicating “Abstain” for purposes of determining whether there is a quorum present at the Annual Meeting, but the shares represented by that proxy will not be voted at the Annual Meeting. |

| • | Broker Non-votes – Your broker may not vote your shares for you with respect to Proposals 1 and 2, unless you provide instructions to your broker on how to vote them. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares. If you do not do this, your broker may not vote your shares with respect to Proposals 1 and 2 (a broker non-vote). |

A properly submitted proxy indicating “withhold” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Abstentions and broker non-votes will have the same effect as a vote against a director in Proposal 1 (election of directors). A failure to vote will have no effect on the outcome of Proposal 1.

Abstentions and broker non-votes will have the same effect as a vote against Proposal 2 (advisory vote on executive compensation). A failure to vote will have no effect on the outcome of Proposal 2.

3

Abstentions will have the same effect as a vote against Proposal 3 (ratification of DHG). We do not expect any broker non-votes in connection with Proposal 3. A failure to vote will have no effect on the outcome of Proposal 3.

Costs of Solicitation

The cost of solicitation of proxies will be borne by the Company. Solicitation is being made by mail, and if necessary may be made in person, by telephone or email, or special letter by officers and regular employees of the Company, acting without compensation other than regular compensation.

4

PROPOSAL 1 – ELECTION OF DIRECTORS

The Company’s Board of Directors is divided into three classes (I, II and III), and the term of office for the Class II directors will expire at the Annual Meeting. The current Class II directors are Lawrence N. Ashworth, James B. McNeer and Julien G. Patterson. If elected, Messrs. Ashworth, McNeer and Patterson will serve until the Annual Meeting of Stockholders in 2021 or until their successors are duly elected and qualified.

The persons named in the proxy will vote for the election of the nominees named below unless authority is withheld. If, for any reason, the persons named as nominees should become unavailable to serve, an event that management does not anticipate, proxies will be voted for such other person as the Board of Directors may designate.

The following table provides certain biographical information with respect to each director and director nominee for election at the Annual Meeting. Information on the specific experience and qualifications that led the Board to conclude that each director or director nominee should serve as a director of the Company follows under “Board of Directors Information – Qualifications and Experiences of Directors” beginning on page 7.

The Board of Directors recommends the nominees, as set forth below, for election. The Board of Directors recommends that stockholders vote FOR the nominees.

| Name (Age) |

Company Director Since |

Principal Occupation During Past Five Years | ||

| Class II (Nominees to serve until the 2021 Meeting): |

||||

| Lawrence N. Ashworth (76) |

2017 | Retired from 35 year banking career as executive with regional and community banks. | ||

| James B. McNeer (78) |

2017 | Retired President of Richard Bland College, Petersburg, Virginia. | ||

| Julien G. Patterson (66) |

2009 | Founder and past Chairman of OMNIPLEX World Services Corporation, Chantilly, Virginia; past Chairman of the Virginia State Chamber of Commerce, Richmond, Virginia. | ||

5

| Name (Age) |

Company Director Since |

Principal Occupation During Past Five Years | ||

| Incumbent Directors | ||||

| Class III (Directors serving until the 2019 Meeting): |

||||

| C. Dwight Clarke (55) |

2013 | Partner, Dehnert, Clarke & Co., P.C., Irvington, Virginia. | ||

| Elizabeth H. Crowther, Ed. D. (62) |

2012 | President of Rappahannock Community College, Warsaw, Virginia, since 2004. | ||

| Larry C. Tucker (75) |

2017 | Retired automobile dealership executive, Petersburg, Virginia. | ||

| James P. VanLandingham (68) |

2017 | Retired President of Builders Supply Company, Petersburg, Virginia. | ||

| Class I (Directors serving until the 2020 Meeting): | ||||

| Richard A. Farmar, III (60) |

2004 | President, B. H. Baird Insurance Agency, Warsaw, Virginia. | ||

| Randal R. Greene (58) |

2011 | President and Chief Executive Officer of the Company; Chief Executive Officer of the Bank; President of the Bank from August 2011 until the merger of Virginia BanCorp, Inc. (“Virginia BanCorp”) with the Company in April 2017. | ||

| C. Frank Scott, III (68) |

2017 | Chairman of the Board of Directors of the Company; President of the Bank; Chairman of the Board of VCB Financial Group; Chief Executive Officer of Virginia BanCorp from 2011 until its merger with the Company in April 2017. | ||

Board of Directors Information

Board Independence. The Company’s Board of Directors has determined that, except for Mr. Greene and Mr. Scott, each director is independent within the NASDAQ definition of “independent director.”

Board Meetings. Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of the director’s duties, including attendance at Board and Committee meetings. During 2017, there were 15 meetings of the Board of Directors. Each incumbent director attended at least 75% of the aggregate number of meetings of the Board of Directors and its Committees of which he or she was a member. Directors are encouraged to attend stockholders meetings, and all but one of the then-serving directors attended the 2017 Annual Meeting of Stockholders.

6

There are no family relationships among any of the directors or among any directors and any executive officers. None of the directors serves as a director of any other publicly held company.

Leadership Structure. The positions of Chairman of the Board and Chief Executive Officer are held by separate persons. The Chief Executive Officer serves on the Board of Directors; however, his main focus is to provide leadership to the Company in accomplishing the directives established by the Board. In that role, he is responsible for the general administration, oversight, care and management of the business of the Company, as well as full authority over all officers, managers and employees. Historically, the Chairman of the Board has been an independent director. Following the merger of the Company with Virginia BanCorp, however, the Board of Directors believes that it is appropriate for Mr. Scott, current President of the Bank and former Chief Executive Officer of Virginia BanCorp, to serve as Chairman of the Board to provide enhanced Board oversight following integration of the two banks and during the leadership transition. In addition, the Board of Directors provides independent oversight of the Chief Executive Officer, directs the business and affairs of the Company for the benefit of its stockholders, and balances the interests of the Company’s diverse constituencies including stockholders, customers, employees and communities.

Qualifications and Experiences of Directors.

Class I Directors

Richard A. Farmar, III is President of B. H. Baird Insurance Agency. A graduate of Hampden-Sydney College, he joined B. H. Baird in 1979 and was named President in 1999. He has received the AAI (Accredited Advisor in Insurance) and CPCU (Chartered Property Casualty Underwriter) designations. Mr. Farmar has served as President of the Independent Insurance Agents of Virginia, and as a director of the Keystone Insurers Group and Virginia Financial Services Corporation. He has also served his community as President of numerous organizations; Warsaw Jaycees, Warsaw Rotary Club, George Washington National Memorial Association and the Rappahannock Chapter of Ducks Unlimited. He is a past member of Board of The Haven, and currently serves on the Boards of The Tidewater Foundation and Riverside Hospital. Mr. Farmar has served as Chairman of the Board of the Bank since 2008.

Randal R. Greene is the President, Chief Executive Officer and Vice Chairman of the Company. He is also Vice Chairman and Chief Executive Officer of the Bank and Vice Chairman of VCB Financial Group, Inc. Mr. Greene has over 30 years of community banking and management experience. He received his Bachelor of Business Administration degree from East Tennessee State University. Prior to joining the Company and the Bank, Mr. Greene was Regional President of State of Franklin Bank, a division of Jefferson Federal Bank in Johnson City, Tennessee. From 1996 to 2008, he was President and Chief Executive Officer, director and founder of State of Franklin Savings Bank and Chairman of its Executive Committee. Mr. Greene was the President of State of Franklin Real Estate from 1997 to 2008, growing the company to 100 agents and to number two in market share. He has had a lifetime involvement in Boy Scouts of America and is currently a member of the Executive Board of the Capital Heart of Virginia Boy Scouts Council. Mr. Greene is a former President of the Sequoyah Council, which serves 17 counties in East Tennessee and Southwest Virginia, and former Chairman of the Silver Eagle Dinner for Boy Scouts of America. He has received a Lifetime Achievement Award from East Tennessee State University as one of its distinguished alumni, and is currently a Foundation Board member of East Tennessee State University. Mr. Greene formerly served on the board of the Rappahannock General Hospital Foundation. He also has been a participant of LEAD Northern Neck, a component of LEAD

7

VIRGINIA, designed to build a network of informed, engaged and connected leadership for the Commonwealth of Virginia. Mr. Greene is a member of the Northern Neck Boys & Girls Club Board of Directors, and is currently serving as Chairman of its 2018 capital campaign.

C. Frank Scott, III is Chairman of the Board of Directors of the Company, President of the Bank and Chairman of the Board of Directors of VCB Financial Group, Inc. Prior to its merger with the Company, he served as Chief Executive Officer and President of Virginia BanCorp and Virginia Commonwealth Bank. Mr. Scott joined Virginia Commonwealth Bank in 1999 and was responsible for the overall management of the institution and implementation of business strategy. He became President in 2008 and followed Charles F. Scott, Jr. as Chief Executive Officer in 2011 upon his retirement. Mr. Scott served on the Board of Directors of Virginia BanCorp and Virginia Commonwealth Bank from 1987 until the merger with the Company and the Bank in April 2017, including service on numerous board committees. He also served on many bank committees as an outside director. Mr. Scott is past president of the Petersburg Lions Club, the Southside Virginia Association of Realtors, and the Tri Cities Independent Insurance Agent’s Association. He is currently a member of the board of the Appomattox Educational Foundation, the Prince George Alliance for Education Association, and the Richard Bland College Foundation. He is a member of Redeemer Lutheran Church in Midlothian, and currently serves as a member of the Board of Directors and as Treasurer. Mr. Scott received his B.S. degree in Finance from Virginia Tech in 1974 and his M.A. from the Charles F. Dolan School of Business at Fairfield University in Fairfield Connecticut in 2003.

Class II Directors

Lawrence N. Ashworth served as a director of Virginia Commonwealth Bank and Virginia BanCorp from 2011 until the merger with the Company in April 2017. Prior to retirement, Mr. Ashworth had a 35 year banking career within regional and community banks, with executive and general management responsibilities for risk management on a corporate basis and revenue and profitability growth at the business unit level. Prior to retirement, he worked for Signet Bank for 22 years, in charge of the Signet Business Credit Division, corporate wide, specializing in Asset Based Lending (Signet was sold in 1998), and, more recently, chief credit officer and chief lending officer of Essex Bank. Mr. Ashworth received an M.B.A. from the University of Richmond and B.B.A. in accounting and economics from Marshall University.

James B. McNeer served as a director of Virginia Commonwealth Bank and Virginia BanCorp from 2005 until the merger with the Company in April 2017. He received his B.A. from Emory & Henry College, an M.A. from West Virginia University and a Doctorate from the College of William & Mary. Prior to his retirement, Dr. McNeer was the President of Richard Bland College for 16 years. He spent 44 years teaching, and served as provost and Dean during those years. Dr. McNeer served the City of Colonial Heights as Mayor, and Chairman of its School Board and Public Library. He is past Chairman of the Crater Planning District Commission, a past member of the Southside Regional Hospital Board and a former Trustee of the Southside Regional Medical Center. He is the recipient of the Distinguished Alumni Award from Emory & Henry College, the Southern Christian Leadership Conference Award for Human Rights and the Army Commander’s Award for Public Service. Dr. McNeer has been an adult Sunday School teacher for 44 years, Lay Leader and Chairman of the Staff Parish Relations Committee at his church.

Julien G. Patterson brings to the Board valuable entrepreneurial business and board skills as past Chairman of OMNIPLEX World Services Corporation, a company he founded 29 years ago. The company employs approximately 3,500 men and women worldwide. Mr. Patterson’s security career began with the Central Intelligence Agency (the “CIA”), during which time he designed a wide variety of comprehensive and specialized security training programs, and led those mobile training teams. In 1987,

8

Mr. Patterson left the CIA to begin his career as an entrepreneur. In 1997, Mr. Patterson was named the Greater Washington Entrepreneur of the Year from a field of over 890 nominees. The Entrepreneur of the Year award, sponsored by Ernst & Young LLP, the NASDAQ Stock Market and other nationally known companies, was established to recognize “an elite group of entrepreneurs whose vision, innovation and hard work have established and sustained successful growing businesses.” Mr. Patterson received his undergraduate and honorary doctorate degrees from Norfolk State University, and previously served on its Board of Visitors. He is the past Chairman of the Virginia Economic Development Partnership (for former Governors McDonnell and Kaine), a past Chairman of the Virginia Chamber of Commerce, a past Chairman of the Virginia Community College Foundation, a past Chairman of Virginia FREE, a past director of the Boys & Girls Club of the Northern Neck and the Steamboat Era Museum, and a past trustee of the Virginia Foundation for Independent Colleges. Mr. Patterson currently serves on the board of directors of Northern Neck Insurance Company. He is a keynote speaker, entrepreneurial coach, economic development activist, and international security consultant.

Class III Directors

C. Dwight Clarke is a Partner and Certified Public Accountant of Dehnert, Clarke & Co., P.C., an accounting firm located in Irvington, Virginia. Mr. Clarke has been associated with the firm since 1985 and a partner since June 1990. He works with clients throughout the counties of Lancaster, Northumberland, Middlesex and Mathews. Mr. Clarke graduated from Virginia Tech in 1985 with a B.S. degree in Accounting. He is a member of the American Institute of CPAs and the Virginia Society of CPAs. Active in his community, Mr. Clarke is a member, past President and Treasurer of the Kilmarnock-Irvington-White Stone Rotary Club; board member and Treasurer of the Tidewater Foundation; board member of Rappahannock Westminster Canterbury in Irvington, Virginia; a past board member and Treasurer for both the Lancaster County Chamber of Commerce and the Lancaster Community Library.

Elizabeth H. Crowther, Ed. D. is President of Rappahannock Community College (“RCC”), headquartered in Glenns, Virginia. RCC is the only institution of higher education located in the 12 counties of the Northern Neck and Middle Peninsula. Under her leadership, RCC has added three locations, including the Kilmarnock Center, and the college serves approximately 5,000 students in credit programs and 2,000 in workforce training. She is responsible for establishing guaranteed admission agreements with leading four-year colleges and universities across Virginia, which allow RCC graduates to transfer seamlessly into such institutions. Dr. Crowther earned her B.A. and M.A. degrees from Virginia Tech and her Doctor of Education from the College of William & Mary. Active in her community, Dr. Crowther serves on numerous civic and charitable boards, including the boards for Bon Secours Richmond Health Systems, Lilian Lumber Company, Northern Neck Insurance Company, Rappahannock Community College Educational Foundation, River Counties Community Foundation, Visions of Lancaster and Northumberland Counties, and the Mary Washington regional GO Virginia Board. Dr. Crowther is a current member of the Middlesex Rotary Club and past President of the Strasburg Club, as well as a Paul Harris Fellow.

Larry C. Tucker served as a director of Virginia Commonwealth Bank from 1994 and Virginia BanCorp from 2001, in each case until the merger with the Company in April 2017. Mr. Tucker spent his career in the automobile business starting out in Service Management and working his way up to owner of Petersburg Motors. He retired from the automobile business in 2006 upon the sale of Petersburg Motors. Mr. Tucker also served in the United States Army. He has served as a Director of The Cameron Foundation for 12 years and was Board Chairman for four years. He is a 33-year member of the Rotary Club of Petersburg and a past president. He is a past member and Vice Mayor of the Petersburg City Council and a past member and Vice Chairman of the City’s Hospital Authority.

9

James P. VanLandingham served as a director of Virginia Commonwealth Bank and Virginia BanCorp from 2005 until the merger with the Company in April 2017. Prior to retirement, Mr. VanLandingham was President of Builders Supply Company of Petersburg where he worked since 1975 after receiving his B.A. from Old Dominion University. He is past Chairman and Treasurer of the Southern Building Material Association, which included the states of North Carolina, South Carolina, Tennessee and Virginia. Active in his community, Mr. VanLandingham serves on the board and is Treasurer of the Dinwiddie Industrial Development Authority. He also serves on the board of the Southside Virginia Emergency Crew and is Past President and Treasurer. Mr. VanLandingham is a 40 year member of the Petersburg Rotary Club and a past president. He served multiple terms on the Richard Bland Foundation Board and was Co-Chair of the college’s first major capital campaign which raised $5 million. He is past president of the Petersburg Family YMCA and past Chairman of the Southside United Way Campaign.

Board Involvement in Risk Oversight. Via the Enterprise Risk Committee, established in 2014, the Board oversees risk management to be reasonably certain that the Company’s risk management practices are consistent with Company strategy and functioning appropriately. The Enterprise Risk Committee directs management’s Enterprise Risk Management (“ERM”) program. The ERM program assesses six risk areas on a quarterly basis. These risk areas are credit, market, liquidity, operational, legal and compliance. Furthermore, the Board establishes standards for risk management by approving policies that address and mitigate the aforementioned risks, plus capital risk and fiduciary risk. The Audit Committee oversees financial, accounting and internal control risk management. The Board also monitors, reviews, and reacts to risk through various reports presented by management, internal and external auditors, and regulatory examiners.

Board Committees

The Board of Directors of the Company has, among others, a standing Audit Committee and Compensation Committee.

Audit Committee. The Audit Committee currently consists of C. Dwight Clarke (Chairman), Lawrence N. Ashworth, Richard A. Farmar, III and James P. VanLandingham. All members of the Audit Committee meet the requirements for independence as set forth in the NASDAQ definition of “independent director” and meet the definition of an independent director as set forth in Rule 10A-3 of the Securities Exchange Act of 1934. The Board has determined that Mr. Clarke qualifies as an “audit committee financial expert” as defined by Securities and Exchange Commission regulations. All Audit Committee members bring a diversity of financial knowledge and expertise and have extensive business backgrounds that the Board has determined are sufficient for the proper exercise of their duties on the Committee.

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the Company’s independent registered public accounting firm. Accordingly, the independent registered public accounting firm reports directly to the Audit Committee of the Company. It is the responsibility of the Audit Committee to select the Company’s independent registered public accounting firm, to approve the scope of the independent registered public accounting firm’s audits and to review the reports of examination by the regulatory agencies, the independent registered public accounting firm and the internal auditor. The Committee regularly reports to the Board of Directors of the Company. The charter of the Audit Committee attached as Exhibit A to this Proxy Statement, and is available upon request. To obtain a copy of the charter, please submit a written request to the Company’s Corporate Secretary at the address given in the “Stockholder Proposals” section in the Proxy Statement. The Audit Committee met six times during 2017.

10

Compensation Committee. The Compensation Committee currently consists of Larry C. Tucker (Chairman), Elizabeth H. Crowther, James B. McNeer and Julien G. Patterson. All members of the Compensation Committee meet the requirements for independence as set forth in the NASDAQ definition of “independent director.” As part of its responsibilities, the Committee acts on behalf of the Board in setting executive compensation policy and administering compensation plans; makes decisions or develops recommendations for the Board with respect to the compensation of the Company’s executive officers; recommends to the Board the amount of contributions to the retirement plans of the Company; and selects independent compensation consultants if needed. In the opinion of the Compensation Committee and the Board of Directors, the Company’s compensation programs, practices and policies do not encourage excessive or inappropriate risk taking and are not reasonably likely to have a material adverse effect on the Company. The charter of the Compensation Committee is attached as Exhibit B to this Proxy Statement, and is available upon request. To obtain a copy of the charter, please submit a written request to the Company’s Corporate Secretary at the address given in the “Stockholder Proposals” section in this Proxy Statement. The Compensation Committee met five times in 2017.

Nominating Committee. The Company’s Board of Directors does not have a standing nominating committee. The Board of Directors does not believe that it is necessary to have a nominating committee because it has determined that the functions of a nominating committee can be adequately performed by its independent members and that stockholders are best served by having such directors participate in the selection of board nominees.

In accordance with the Company’s Bylaws, nominations for the election of directors shall be made by the Board of Directors or by any stockholder entitled to vote in the election of directors generally. However, any stockholder entitled to vote in the election of directors generally may nominate one or more persons for election as director(s) at a meeting only if written notice of such stockholder’s intent to make such nomination or nominations has been given, either by personal delivery or by U.S. mail, postage prepaid, to the Secretary of the Company not later than (i) with respect to an election to be held at an annual meeting of stockholders, 120 days prior to the date of the anniversary of the immediately preceding Annual Meeting, and (ii) with respect to an election to be held at a special meeting of stockholders for the election of directors, the close of business on the seventh day following the date on which notice of such meeting is first given to stockholders. Each notice shall set forth: (a) the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; (b) a representation that the stockholder is a holder of record of stock of the Company entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (c) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; (d) such other information regarding each nominee proposed by such stockholder as would be required to be included in a proxy statement filed pursuant to the proxy rules of the Securities and Exchange Commission, had the nominee been nominated, or intended to be nominated, by the Board of Directors; and (e) the consent of each nominee to serve as director of the Company if so elected. The Chairman of the meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure. The above procedures are in addition to the procedures regarding inclusion of stockholder proposals in proxy materials set forth in “Stockholder Proposals” in this Proxy Statement.

Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing board composition. High-level leadership experience in business activities, breadth of knowledge about issues affecting the Company and time available for meetings and consultation on Company matters are among the initial criteria the Board looks for in a candidate. Although the Board has not adopted a formal policy relating to Board diversity, the independent directors seek a diverse group of candidates who possess the background, skills and expertise

11

to make a significant contribution to the Board, to the Company and to its stockholders. The independent directors, along with the other board members as appropriate, evaluate potential nominees, whether proposed by stockholders or otherwise, by reviewing their qualifications, reviewing results of personal and reference interviews and reviewing other relevant information. Consideration is made of a candidate’s ability to complement the existing Board, and the Board’s need for operational, management, financial, technological or other expertise, as well as geographical representation within the Company’s market areas. Other factors, such as a candidate’s race, gender, or national origin, are considered if all other qualifications are met. The full Board selects and recommends candidates for nomination as directors for stockholders to consider and vote upon at an annual meeting.

EXECUTIVE OFFICERS WHO ARE NOT DIRECTORS

The following provides certain biographical information with respect to each executive officer of the Company who is not a director.

Gary L. Armstrong, 57, has served as Executive Vice President of the Company and Executive Vice President and Richmond Market Executive of the Bank since February 2017. Mr. Armstrong is a 32-year banking veteran. After 12 years with larger banks, Mr. Armstrong began his community banking career as the founder of the commercial banking effort at First Market Bank in Richmond, Virginia. Beginning in 2009, Mr. Armstrong spent six years as Executive Vice President and Chief Lending Officer for First Capital Bank. In 2016, he became Richmond Market President for Park Sterling Bank following its acquisition of First Capital Bank.

C. Rodes Boyd, Jr., 61, has served as Executive Vice President of the Company and Executive Vice President and Chief Lending Officer of the Bank since April 2017. Previously, he had served as Executive Vice President and Chief Banking Officer of Virginia Commonwealth Bank since July 2012. Mr. Boyd joined Virginia Commonwealth Bank in April 2011 as Executive Vice President and Chief Credit Officer, a role he served in until July 2012. Prior to joining Virginia Commonwealth Bank, Mr. Boyd was a Vice President in Commercial Banking with The Bank of Richmond and Gateway Bank from 2002 until 2009, and was the Richmond Market President for the Bank of Hampton Roads from March 2009 through December 2010. Mr. Boyd is currently serving a two year term as Chairman of the Lending Executive Committee for the Virginia Bankers Association.

Deborah M. Evans, 55, has served as Senior Vice President of the Company and Senior Vice President and Chief Accounting Officer of the Bank since April 2017. Previously, she served as Chief Financial Officer of the Company from December 2011 until April 2017. From 2005 until December 2011, Ms. Evans served as Treasurer and Principal Financial and Accounting Officer of the Company, and Chief Financial Officer of the Bank. Ms. Evans joined the Company in 1999 and over the last 19 years has served in multiple financial and accounting related roles for the Company and its subsidiaries.

Judy C. Gavant, 58, has served as Executive Vice President and Chief Financial Officer of the Company and the Bank since March 2018. She has over 36 years of experience in accounting, taxation, finance, and mergers and acquisitions, and most recently served as Senior Vice President, Controller and Chief Accounting Officer of Xenith Bankshares, Inc. (“Xenith”), a publicly-traded bank holding company, from July 2016 until it merged with Union Bankshares Corporation on January 1, 2018. She was Senior Vice President, Controller and Principal Accounting Officer of Xenith from August 2010 until July 2016. Prior to joining Xenith in 2010, Ms. Gavant held a variety of positions with Owens & Minor, Inc., Tredegar Corporation and Dominion Energy, Inc., all publicly-traded companies, and PricewaterhouseCoopers LLP. Ms. Gavant is also a Certified Public Accountant.

12

Ramsey K. Hamadi, 49, has served as Chief Strategic Officer of the Company since March 2018. Prior to joining the Company, Mr. Hamadi served as Executive Vice President of American National Bankshares Inc. from August 2016 until October 2017, Executive Vice President and Chief Administrative Officer of American National Bank and Trust Company from January 2017 until October 2017, and Executive Vice President of American National Bank and Trust Company from July 2016 until December 2016. Previously, he had served as Executive Vice President and Chief Financial Officer for NewBridge Bancorp from April 2009 until March 2016.

Douglas F. Jenkins, Jr., 58, has served as Executive Vice President of the Bank since December 2011 and of the Company since May 2014. He currently serves as Chief Banking Officer of the Bank. Mr. Jenkins was Senior Vice President of the Bank from December 2009 until December 2011 and served as Senior Lending Officer from May 2008 until April 2013. He also served as Retail Delivery Administrator from June 2011 until April 2013. Prior to joining the Bank in 2006 as a Business Development Officer, Mr. Jenkins was a Vice President at SunTrust Bank, where he was a member of its Financial Institutions Group.

Eric F. Nost, 61, has served as President and Chief Executive Officer of VCB Financial Group, Inc. since March 2017. Prior to joining the Company, he served as President of C&F Wealth Management, Inc., based in West Point, Virginia for 22 years. Mr. Nost began his career in the financial services industry in 1983 with the former Richmond, Virginia based Wheat, First Securities, Inc. (now part of Wells Fargo) where he served for nine years as Vice President/Investment Officer. Mr. Nost is a Certified Financial Planner.

DIRECTOR COMPENSATION

In the first half of 2017, non-employee directors of the Company received a $7,000 annual retainer, with the exception of the Chairman, who received a $12,000 annual retainer. Effective July 2017, the Company revised its compensation policy for directors of the Company such that non-employee directors receive a $12,000 annual retainer, the Chairman receives a $5,000 annual retainer, Audit Committee members receive a $2,000 annual retainer ($4,000 for the Audit Committee Chair) and other committee members receive a $750 annual retainer ($1,500 for other committee Chairs). Directors also received $500 for each meeting of the Board attended, and $300 for each committee meeting attended. In addition, certain non-employee directors serve as chairpersons on various community boards for the Bank, and received $50 for each meeting attended.

The Company has a nonqualified Directors Deferred Compensation Plan which allows for the deferral of pre-tax income associated with the payment of cash fees and retainers. Directors may elect to defer all or a portion of their director fees and retainers under this plan. Amounts deferred pursuant to the plan can be invested in various mutual funds, with the portfolio composition up to the discretion of the director. Amounts under the plan will be paid following a distributable event. A distributable event includes termination of service as a director or a specific date without regard to continued service as a director. Distributions can be received either as a lump-sum payment or in substantially equal payments over a period of not more than 20 years.

In 2017, each director received stock options under the Company’s 2013 Stock Incentive Plan, including the following awards:

| • | In February 2017, each then-serving non-employee director of the Company received stock options for service during 2016. The Chairman of the Board of the Company and the Chairman of the Board of the Bank each received options for 1,000 shares of the Company’s common stock, and all other directors of the Company received options for 500 shares of the Company’s common stock. |

13

| • | In April 2017, following the merger with Virginia BanCorp, Mr. Scott received stock options for 1,000 shares, and the other new directors of the Company that formerly were directors of Virginia BanCorp received stock options for 500 shares. |

| • | In December 2017, each director of the Company received stock options for service during 2017. Each director received stock options for 579 shares, and the Chairman of the Board of the Bank received additional stock options for 1,000 shares. |

The per share exercise price for the options is equal to the fair market value of a share of the Company’s common stock on the grant date.

The following table presents compensation information on the non-employee directors of the Company for 2017. Such information includes fees and retainers received for service on the boards of directors of the Company’s subsidiaries. Compensation information regarding Mr. Greene and Mr. Scott, who are executive officers of the Company, is presented in the Summary Compensation Table in the “Executive Compensation” section of this Proxy Statement.

2017 Director Compensation

| Name |

Fees Earned or Paid in Cash (1) |

Option Awards (2) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings (3) |

All Other Compensation |

Total | |||||||||||||||

| Lawrence N. Ashworth |

$ | 23,600 | $ | 1,730 | — | $ | — | $ | 25,330 | |||||||||||

| C. Dwight Clarke |

28,200 | 1,829 | — | — | 30,029 | |||||||||||||||

| Elizabeth H. Crowther |

20,200 | 1,829 | — | — | 22,029 | |||||||||||||||

| Richard A. Farmar, III |

28,850 | 4,288 | $ | 119,502 | — | 152,640 | ||||||||||||||

| Robert F. Hurliman |

5,200 | 1,927 | — | — | 7,127 | |||||||||||||||

| James B. McNeer |

20,650 | 1,730 | — | — | 22,380 | |||||||||||||||

| Julien G. Patterson |

15,300 | 1,829 | — | — | 17,129 | |||||||||||||||

| Larry C. Tucker |

21,600 | 1,730 | — | — | 23,330 | |||||||||||||||

| James P. VanLandingham |

22,700 | 1,730 | — | — | 24,430 | |||||||||||||||

| (1) | Includes fees and retainers earned and deferred under the Directors Deferred Compensation Plan previously described. |

| (2) | The amounts reported reflect the aggregate grant date fair value of the awards computed in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation—Stock Compensation. Assumptions used to calculate the value can be found in Note 19 in the Notes to the Company’s consolidated financial statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017. |

| (3) | Consists of investment gains and losses under the Directors Deferred Compensation Plan. |

14

COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides, as of April 23, 2018, certain information with respect to the beneficial ownership of the Company’s common stock for (i) the directors and director nominees of the Company, (ii) each executive officer named in the Summary Compensation Table in the “Executive Compensation” section of this Proxy Statement, (iii) all directors, director nominees and executive officers of the Company as a group, and (iv) each stockholder known by the Company to own beneficially more than 5% of the Company’s common stock. Unless otherwise noted, the address for each of the following is 1801 Bayberry Court, Richmond, Virginia 23226.

| Name |

Amount and Nature of Beneficial Ownership (1) |

Percent of Class |

||||||

| Executive Officers and Directors: | ||||||||

| Lawrence N. Ashworth |

3,341 | (2)(3) | * | |||||

| C. Dwight Clarke |

13,731 | (2)(3) | * | |||||

| Elizabeth H. Crowther |

4,720 | (3) | * | |||||

| Richard A. Farmar, III |

60,143 | (2)(3) | * | |||||

| Randal R. Greene |

88,199 | (3)(4) | * | |||||

| Douglas F. Jenkins |

54,544 | (3)(4) | * | |||||

| James B. McNeer |

7,115 | (2)(3) | * | |||||

| Julien G. Patterson |

355,006 | (2)(3) | 2.68 | % | ||||

| C. Frank Scott, III |

217,395 | (2)(3)(4) | 1.63 | % | ||||

| Larry C. Tucker |

77,179 | (2)(3) | * | |||||

| James P. VanLandingham |

11,858 | (3) | * | |||||

| All directors, director nominees and executive officers as a group (17 persons) |

970,895 | (5) | 7.25 | % | ||||

| 5% Stockholders: |

||||||||

| EJF Capital LLC |

819,827 | (6) | 6.20 | % | ||||

| Bay Banks of Virginia, Inc. Employee Stock Ownership Plan |

758,968 | (7) | 5.74 | % | ||||

| * | Represents less than 1% of Company common stock. |

| (1) | For purposes of this table, beneficial ownership has been determined in accordance with the provisions of Rule 13d-3 of the Securities Exchange Act of 1934 under which, in general, a person is deemed to be the beneficial owner of a security if he has or shares the power to vote or direct the voting of the security or the power to dispose of or direct the disposition of the security, or if he or she has the right to acquire beneficial ownership of the security within 60 days. |

| (2) | Includes shares held by affiliated corporations, close relatives and children, and shares held jointly with spouses or as custodians or trustees, as follows: Mr. Ashworth, 1,181 shares; Mr. Clarke, 1,000 shares; Mr. Farmar, 2,186 shares; Dr. McNeer, 4,789 shares; Mr. Patterson, 354,427 shares; Mr. Scott, 164,996 shares; and Mr. Tucker, 58,209 shares. |

| (3) | Includes shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s equity compensation plans as follows: Mr. Ashworth, 1,079 shares; Mr. Clarke, 5,681 shares; Dr. Crowther, 3,579 shares; Mr. Farmar, 12,681 shares; Mr. Greene, 40,579 shares; Mr. Jenkins, 26,731 shares; Dr. McNeer, 1,079 shares; Mr. Patterson, 579 shares; Mr. Scott, 11,579 shares; Mr. Tucker, 579 shares; and Mr. VanLandingham, 1,079 shares. |

15

| (4) | Includes shares held in the Company’s Employee Stock Ownership Plans, as follows: Mr. Greene, 262 shares; Mr. Jenkins, 1,679 shares; and Mr. Scott, 40,820 shares. |

| (5) | Includes 129,996 shares that may be acquired pursuant to currently exercisable stock options granted under the Company’s equity compensation plans, and 59,430 shares held in the Company’s Employee Stock Ownership Plan. |

| (6) | According to a Schedule 13G/A filed with the SEC on February 14, 2018, each of (i) EJF Capital LLC (“EJF Capital”), (ii) Emmanuel J. Friedman, and (iii) EJF Sidecar Fund, Series LLC – Small Financial Equities Series (“EJF Sidecar”) reported that, as of December 31, 2017, it had shared voting and dispositive power over 819,827 shares of the Company’s common stock. EJF Capital is the managing member of EJF Sidecar, and Mr. Friedman is the controlling member of EJF Capital. The address of the principal business offices of each of EJF Capital, Mr. Friedman, and EJF Sidecar is 2107 Wilson Boulevard, Suite 410, Arlington, Virginia 22201. |

| (7) | Includes shares held in the Bay Banks of Virginia, Inc. Employee Stock Ownership Plan. Randal R. Greene, Douglas F. Jenkins, Jr., Judy C. Gavant, Eric F. Nost and Deborah M. Evans each serve as Trustees for the plan with shared power to direct the voting and disposition of such shares in certain situations. |

16

EXECUTIVE COMPENSATION

The following table provides information on the total compensation paid to or earned by the Company’s executive officers for the years indicated below (the “named executive officers”). No other executive officers of the Company earned over $100,000 in total compensation in 2017. No officer receives compensation from the Company, and all compensation is paid through the Company’s subsidiaries.

Summary Compensation Table

| Year | Salary | Bonus (1) |

Stock Awards |

Option Awards (2) |

Non-Equity Incentive Plan Compensation (3) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings (4) |

All Other Compensation |

Total | ||||||||||||||||||||||||||||

| Randal R. Greene |

2017 | $ | 323,319 | $ | 17,613 | — | $ | 15,816 | $ | 102,000 | $ | 12,992 | $ | 107,742 | (5)(6) | $579,482 | ||||||||||||||||||||

| President & CEO |

2016 | 281,585 | — | — | 10,015 | 70,450 | 15,707 | 48,792 | 426,549 | |||||||||||||||||||||||||||

| C. Frank Scott, III |

2017 | $ | 175,919 | $ | — | — | $ | 17,544 | $ | 60,000 | $ | — | $ | 51,760 | (5)(6) | $ | 305,223 | |||||||||||||||||||

| President of the Bank |

||||||||||||||||||||||||||||||||||||

| Douglas F. Jenkins, Jr. |

2017 | $ | 229,306 | $ | 7,714 | — | $ | 11,213 | $ | 58,750 | $ | 10,342 | $ | 34,446 | (5)(6) | $ |

351,771 |

| ||||||||||||||||||

| Executive Vice President |

2016 | 205,546 | — | — | 5,007 | 30,855 | 3,607 | 28,336 | 273,351 | |||||||||||||||||||||||||||

| (1) | Represents management incentive bonus amounts subject to completion of the merger between the Company and Virginia BanCorp and paid in 2017. |

| (2) | The amounts reported reflect the aggregate grant date fair value of the awards computed in accordance with the Financial Accounting Standards Board’s Accounting Standards Codification Topic 718, Compensation—Stock Compensation. Assumptions used to calculate the value can be found in Note 19 in the Notes to the Company’s consolidated financial statements contained in Item 8 of the Company’s Annual Report on Form 10-K for the year ended December 31, 2017. For Messrs. Greene and Scott, the amounts reported also include grant date fair value of option awards during 2017 for service on the Board of Directors. |

| (3) | Consists of (i) cash bonus payments made to the officer in April 2018 under the Company’s annual incentive plan for 2017 performance, and (ii) cash bonus payments made to the officer in February 2017 under the Company’s annual incentive plan for 2016 performance. |

| (4) | Amounts shown reflect the change in cash value of the executive’s pension plan account and/or the change in the actuarial fair value of the executive’s deferred compensation under the executive’s deferred compensation plan account, and consists of, for 2017: (i) for Mr. Greene, $478 accrued on his behalf under the pension plan and a gain of $12,514 under the deferred compensation plan; and (ii) for Mr. Jenkins, $1,721 accrued on his behalf under the pension plan and a gain of $8,621 under the deferred compensation plan. See “Benefit Plans—Pension Plan” and “Benefit Plans—Deferred Compensation Plan” below. |

| (5) | Consists of, for 2017: (i) for Mr. Greene, $10,317 accrued on his behalf under the 401(k) Plan, $1,123 accrued on his behalf for life insurance, $2,864 contributed on his behalf to the Company’s Employee Stock Ownership Plan, Company contributions of $22,829 to the Company’s deferred compensation plan, $1,157 for personal use of a company vehicle, $13,400 related to relocation expenses, $22,500 in fees for service on the Board of Directors of the Company and the Bank, and $33,552 for use of a Company-leased apartment; (ii) for Mr. Scott, $8,372 accrued on his behalf under the 401(k) Plan, $397 accrued on his behalf for life insurance, $9,881 contributed on his behalf to the Company’s Employee Stock Ownership Plan, $4,110 for personal use of a company vehicle and $29,000 in fees for service on the Board of Directors of the Company and the Bank; and (iii) for Mr. Jenkins, $7,972 accrued on his behalf under the 401(k) Plan, $821 accrued on his behalf for life insurance, $2,857 contributed on his behalf to the Company’s Employee Stock Ownership Plan, Company contributions of $21,389 to the Company’s deferred compensation plan, and $1,407 for personal use of a company vehicle. |

| (6) | Perquisites included the use of a Company-owned vehicle for Messrs. Greene, Scott and Jenkins. The aggregate incremental cost to the Company for all other perquisites was less than $10,000 and therefore is not included. |

17

Executive Compensation Overview

The Compensation Committee is governed by a Compensation Committee Charter which outlines the organization and responsibilities of the Compensation Committee. In general, the Compensation Committee’s philosophy and strategy, as part of the Company’s mission to provide outstanding banking service to its community and to provide an excellent return to its stockholders, is to provide a comprehensive total compensation program that allows the Company to attract, retain and reward skilled and motivated key executives who are essential to the Company’s business plan. The Compensation Committee intends to have a total compensation program that is generally consistent with the Company’s identified industry peers and is designed to reward key executives for achieving operational and financial goals with a view to long-term success and rewards for the Company’s stockholders.

At the discretion of the Compensation Committee and, where appropriate, the Company’s Board of Directors:

| • | The Company’s executive compensation programs may be benchmarked to an industry-specific peer group of financial services organizations in Virginia and, where appropriate, to standardized financial services survey data. Compensation comparability may be determined using, among other criteria, asset size, earnings, location, organizational structure, number of employees, market capitalization and service offerings. |

| • | The Company’s annual incentive plan(s) should provide each participant with target incentive awards that generally track short-term individual goals, as well as performance results for the Company. |

| • | The Compensation Committee believes that meaningful equity participation in the Company by key executives helps align their interests with those of other stockholders. When appropriate, key executives may be eligible to participate in the Company’s long-term equity program. Among other things, company and individual performance may be considered when determining the size, frequency and vesting of stock grants. Grants may be in the form of options, stock or units. |

| • | When appropriate, executives may be selected to participate in the Company’s supplemental and/or perquisite programs. Among other things, consideration may be dependent on comparable data, retention value of the executive and cost to the Company. |

| • | Contractual arrangements between the Company and individual executives may be provided at the discretion of the Compensation Committee. |

| • | The Compensation Committee is charged with creating an equitable compensation program that is in the best interests of stockholders and aligns executive compensation opportunity to the short- and long-term financial success of the Company. |

Elements of Compensation

For 2017, the principal components of compensation for the Company’s executive officers were base salary, incentive stock options and performance-based incentive compensation in the form of cash.

These and other elements of compensation are described below and are detailed in the Summary Compensation Table.

18

Review of Compensation

During 2017, the Compensation Committee used a peer group of 17 banks and bank holding companies based in Virginia, contiguous states and South Carolina for benchmarking compensation. The peer group was modified from prior years to take into account the Company’s changed asset size and complexity resulting from the Virginia BanCorp merger. The Compensation Committee reviews an executive compensation analysis annually, which compares the Company’s practices (and company performance) to those institutions in a peer group as a reference when setting compensation.

The Compensation Committee reviews the compensation for the President and Chief Executive Officer on an annual basis, taking into account, among other things, the Company’s executive compensation philosophy and strategy, the information it receives from any outside sources (including the peer group analysis) and the performance of the Company during the review period.

The Compensation Committee then recommends to the full Board the compensation for the President and Chief Executive Officer for review, discussion, revision if requested, and approval. Compensation for executive officers other than the President and Chief Executive Officer is recommended to the Compensation Committee by the President and Chief Executive Officer on an annual basis. The President and Chief Executive Officer takes into account substantially the same information as the Compensation Committee does when setting the President and Chief Executive Officer’s compensation. The Compensation Committee reviews these recommendations and has the authority to revise the proposed compensation, and approve and finalize such officers’ compensation.

Role of Compensation Consultant

During 2017, the Compensation Committee retained the services of Pearl Meyer & Partners, LLC (“Pearl Meyer”), an independent third-party executive compensation consulting firm, to provide consulting services with respect to the Company’s executive compensation program. The services included developing the custom peer group described above, considering that the Company had almost doubled in terms of asset size with the Virginia BanCorp merger. Pearl Meyer reported directly to the Compensation Committee and provided no other services to the Company other than acting as an executive compensation consultant.

Base Salary

The Company’s executive compensation program has substantially relied on base salary as its primary component. Base salary is paid to recognize the day-to-day duties and responsibilities of the Company’s executive officers. Individual base salary determinations involve consideration of market competitiveness, incumbent qualifications, performance and service longevity. Effective July 1, 2017, the named executive officers received merit increase adjustments. The base salaries for 2017 after these adjustments were:

| Name |

Title |

Base Salary | ||

| Randal R. Greene |

President and Chief Executive Officer of the Company; Chief Executive Officer of the Bank | $340,000 | ||

| C. Frank Scott, III |

President of the Bank | $240,000 | ||

| Douglas F. Jenkins, Jr. |

Executive Vice President of the Company and the Bank | $235,000 |

19

Incentive Compensation

The Company’s incentive compensation consists of a short-term performance-based cash incentive plan that generally includes measurable objectives for each of the Company’s executive officers. For 2017, a performance-based cash incentive plan was approved by the Compensation Committee that established measurable objectives for each of the Company’s executive officers, which was based on projected cost savings in connection with the Virginia BanCorp merger. Depending upon the executive officer position, the categories are weighted to reflect the individual executive’s span of responsibility for the Company’s performance. Cash bonus opportunities, expressed as a percentage of annual salary, for the named executive officers range from 30% (Mr. Greene) to 25% (Messrs. Scott and Jenkins). The Compensation Committee approved the 2017 performance awards in April 2018. Mr. Greene received $102,000, Mr. Scott received $60,000 and Mr. Jenkins received $58,750.

Equity Compensation Plans

The Company’s current equity compensation plan, the Bay Banks of Virginia, Inc. 2013 Stock Incentive Plan (“2013 Plan”), was adopted by the Company’s Board of Directors on February 21, 2013 and was approved by stockholders on May 20, 2013 at the Company’s 2013 annual meeting. The 2013 Plan makes available up to 385,000 shares of common stock for granting stock options in the form of incentive stock options and non-statutory stock options, restricted stock awards and other stock-based awards to employees and directors of the Company and its subsidiaries. The 2013 Plan superseded and replaced the Company’s 2003 Incentive Stock Option Plan and 2008 Non-Employee Directors Stock Option Plan.

The purpose of the 2013 Plan is to further the long-term stability and financial success of the Company by attracting and retaining employees and directors through the use of stock incentives. The Company believes that ownership of its common stock will stimulate the efforts of those persons upon whose judgment, interest and efforts the Company is and will be largely dependent for the successful conduct of its business, and will further the identification of those persons’ interests with the interests of the Company’s stockholders.

The 2013 Plan is administered by the Compensation Committee, which has the power to select plan participants and to grant stock options, restricted stock awards and other-stock based awards on terms the Compensation Committee considers appropriate, including based on performance. In addition, the Compensation Committee has the authority to interpret the plan, to adopt, amend, or waive rules or regulations for the plan’s administration, and to make all other determinations for administration of the plan. For 2017, Mr. Greene was granted incentive stock options for 10,000 shares, Mr. Scott was granted incentive stock options for 10,000 shares and Mr. Jenkins was granted incentive stock options for 7,500 shares. Each of these grants was made on December 7, 2017 with an exercise price of $10.35 and an expiration date of December 7, 2027.

Under the 2013 Plan, of the 385,000 shares authorized, 219,210 were available for granting purposes as of December 31, 2017. Options were outstanding and exercisable for 251,026 shares as of December 31, 2017, under the 2013 Plan and expired stock option plans.

20

The following table presents certain information on the unexercised stock options and restricted stock held by the named executive officers as of December 31, 2017.

Outstanding Equity Awards at Fiscal Year End

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||||||

| Name |

Year of Award |

Number of Securities Underlying Unexercised Options Exercisable(1) |

Number of Securities Underlying Unexercised Options Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options |

Option Exercise Price |

Option Expiration Date |

Number of Shares or Units of Stock That Have Not Vested |

Market Value of Shares or Units of Stock That Have Not Vested(1) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(1) |

||||||||||||||||||||||||||||||

| Randal R. Greene |

2017 | 10,579 | — | — | $ | 10.35 | 12/7/2027 | — | — | — | — | |||||||||||||||||||||||||||||

| 2016 | 5,000 | 7.74 | 12/15/2026 | — | — | — | — | |||||||||||||||||||||||||||||||||

| 2015 | 5,000 | — | — | 5.75 | 12/10/2025 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2013 | 15,000 | — | — | 5.25 | 2/21/2023 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2011 | 5,000 | — | — | 3.20 | 10/6/2021 | — | — | — | — | |||||||||||||||||||||||||||||||

| C. Frank Scott, III |

2017 | 10,579 | — | — | $ | 10.35 | 12/7/2027 | — | — | — | — | |||||||||||||||||||||||||||||

| 2017 | 1,000 | — | — | 9.00 | 4/20/2027 | — | — | — | — | |||||||||||||||||||||||||||||||

| Douglas F. Jenkins, Jr. |

2017 | 7,500 | — | — | $ | 10.35 | 12/7/2027 | |||||||||||||||||||||||||||||||||

| 2016 | 2,500 | — | — | 7.74 | 12/15/2026 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2015 | 2,500 | — | — | 5.75 | 12/10/2025 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2013 | 10,000 | — | — | 5.25 | 2/24/2023 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2011 | 2,000 | — | — | 4.85 | 3/22/2021 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2010 | 1,014 | — | — | 5.43 | 6/3/2020 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2009 | 487 | — | — | 7.40 | 4/29/2019 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2008 | 730 | — | — | 11.09 | 4/8/2018 | — | — | — | — | |||||||||||||||||||||||||||||||

| 2007 | 610 | — | — | 13.87 | 4/10/2017 | — | — | — | — | |||||||||||||||||||||||||||||||

| (1) | All stock options have vested and are exercisable. |

Employment Agreement and Change in Control Arrangements

On November 2, 2016, the Company entered into new employment agreements with Randal R. Greene and Douglas F. Jenkins, Jr., effective immediately. Also on November 2, 2016, the Company entered into an employment agreement with C. Frank Scott, III that became effective upon consummation of the merger with Virginia BanCorp in April 2017.

Employment Agreement with Randal R. Greene. Under the terms of the employment agreement with Mr. Greene, dated November 2, 2016, Mr. Greene is employed as President and Chief Executive Officer of the Company and Chief Executive Officer of the Bank. The term of Mr. Greene’s agreement commenced on November 2, 2016 and will expire on November 2, 2019, unless earlier terminated or extended as provided therein. Beginning on the first anniversary of his agreement and on each anniversary thereafter, the term will be extended an additional year, unless either party gives at least three months prior notice to the other.

21

Mr. Greene receives a base salary of not less than $281,800 and may receive base salary increases and incentive, bonus compensation or other compensation in the amounts determined by the Board of Directors of the Bank. Mr. Greene also is eligible to participate in the Company’s long-term and short-term incentive plans, with a maximum annual incentive compensation of 25% of his base salary, and in cash and non-cash employee benefit plans and is provided with use of a bank-owned automobile and reimbursement for country club membership and fees and certain expenses.

Mr. Greene’s agreement also provides for the termination of his employment at any time by the Company for other than “Cause” or by Mr. Greene for “Good Reason” (as those terms are defined in his agreement). Upon termination under either of these circumstances and provided that Mr. Greene releases and waives his claims against the Company as provided in his agreement, Mr. Greene will be entitled to the following:

| • | an amount equal to the greater of (i) a monthly amount equal to one-twelfth of his annual base salary in each month for the remainder of the term of his agreement, or (ii) a monthly amount equal to one-twelfth of his annual base salary for a period of one year; |

| • | any bonus or other short-term incentive compensation earned, but not yet paid, for the year prior to the year in which his employment terminates; and |

| • | if Mr. Greene so elects, continued participation in the Company’s group health and dental plans for the period in which payments are made above and payment by the Company of its portion of premiums in effect at the date of termination. |

If within one year after a Change in Control (as defined in his agreement), Mr. Greene’s employment is terminated without Cause or if he resigns for Good Reason, Mr. Greene will be entitled to receive a lump sum cash payment equal to 2.99 times the sum of his base salary and most recent annual bonus (in each case, as of the date of termination or, if greater, as of the Change in Control) and continued participation in benefit plans as described above for a period of two years.

Mr. Greene also will be subject, in certain circumstances, to non-competition and non-solicitation restrictions for a period of 24 months following the termination of his employment.

Employment Agreement with C. Frank Scott, III. Under the terms of the employment agreement with Mr. Scott, dated November 2, 2016, Mr. Scott is employed as President of the Bank. The term of the agreement commenced on April 1, 2017 and will expire on the third anniversary thereof, unless earlier terminated or extended as provided therein. The term will be extended for an additional year unless either party gives at least three months prior notice to the other prior to the end of the original term.

Mr. Scott receives an initial base salary of not less than $219,681 and may receive base salary increases and incentive, bonus compensation or other compensation in the amounts determined by the Board of Directors of the Bank. Mr. Scott also is eligible to participate in the Company’s long-term and short-term incentive plans and in cash and non-cash employee benefit plans and is provided with use of a bank-owned automobile and reimbursement for certain expenses.

22

Mr. Scott’s agreement also provides for the termination of his employment at any time by the Company for other than “Cause” or by Mr. Scott for “Good Reason” (as those terms are defined in his agreement). Upon termination under either of these circumstances and provided that Mr. Scott releases and waives his claims against the Company as provided in his agreement, Mr. Scott will be entitled to the following:

| • | a monthly amount equal to one-twelfth of his annual base salary in each month for the remainder of the term of his agreement; |

| • | any bonus or other short-term incentive compensation earned, but not yet paid, for the year prior to the year in which his employment terminates; and |

| • | if Mr. Scott so elects, continued participation in Bay Banks’ group health and dental plans for the period in which payments are made above and payment by Bay Banks of its portion of premiums in effect at the date of termination. |