Exhibit 99.1

|

|

Exhibit 99.1 Sallie Mae Investor Presentation April 2014

|

|

Forward-Looking Statements The following information is current as of April 17, 2014 (unless otherwise noted) and should be read in connection with the Annual Report on Form 10-K for the year ended December 31, 2013 filed by SLM Corporation (“Sallie Mae”) with the SEC on February 19, 2014 (the “2013 Form 10-K”), the Registration Statement on Form 10, as amended (the “Form 10”), filed by Navient Corporation (“Navient”) with the Securities and Exchange Commission (the “SEC”) on April 10, 2014, and subsequent reports filed by Sallie Mae and Navient with the SEC. Definitions for capitalized terms in this presentation not defined herein can be found in the 2013 Form 10-K. This presentation contains forward-looking statements and information based on management’s current expectations as of the date of this presentation. Statements that are not historical facts, including statements about the beliefs and expectations of Sallie Mae and statements that assume or are dependent upon future events, are forward-looking statements. Forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause actual results to be materially different from those reflected in such forward-looking statements. These factors include, among others: the risks and uncertainties set forth in Item 1A “Risk Factors” and elsewhere in the 2013 Form 10-K, in Risk Factors in the Form 10, and the subsequent filings of Sallie Mae and Navient with the SEC; increases in financing costs; limits on liquidity; increases in costs associated with compliance with laws and regulations; changes in accounting standards and the impact of related changes in significant accounting estimates; any adverse outcomes in any significant litigation to which Sallie Mae is a party; credit risk associated with exposure to third parties, including counterparties to derivative transactions; and changes in the terms of student loans and the educational credit marketplace (including changes resulting from new laws and the implementation of existing laws). Sallie Mae could also be affected by, among other things: changes in its funding costs and availability; reductions to its credit ratings or the credit ratings of the United States of America; failures of operating systems or infrastructure, including those of third-party vendors; damage to business reputation; failures to successfully implement cost-cutting and adverse effects of such initiatives on business; risks associated with restructuring initiatives, including the separation of Sallie Mae and Navient into two distinct publicly traded companies; changes in the demand for educational financing or in financing preferences of lenders, educational institutions, students and their families; changes in law and regulations with respect to the student lending business and financial institutions generally; increased competition from banks and other consumer lenders; the creditworthiness of customers; changes in the general interest rate environment, including the rate relationships among relevant money-market instruments and those of earning assets vs. funding arrangements; changes in general economic conditions; and changes in the demand for debt management services. The preparation of Sallie Mae’s consolidated financial statements also require management to make certain estimates and assumptions, including estimates and assumptions about future events. These estimates or assumptions may prove to be incorrect. All forward-looking statements contained in this release are qualified by these cautionary statements and are made only as of the date of this release. Sallie Mae does not undertake any obligation to update or revise these forward-looking statements to conform the statement to actual results or changes in expectations. For additional information on the proposed separation of Sallie Mae and Navient, please see the 2013 Form 10-K and Form 10 of Sallie Mae and Navient, respectively. 2

|

|

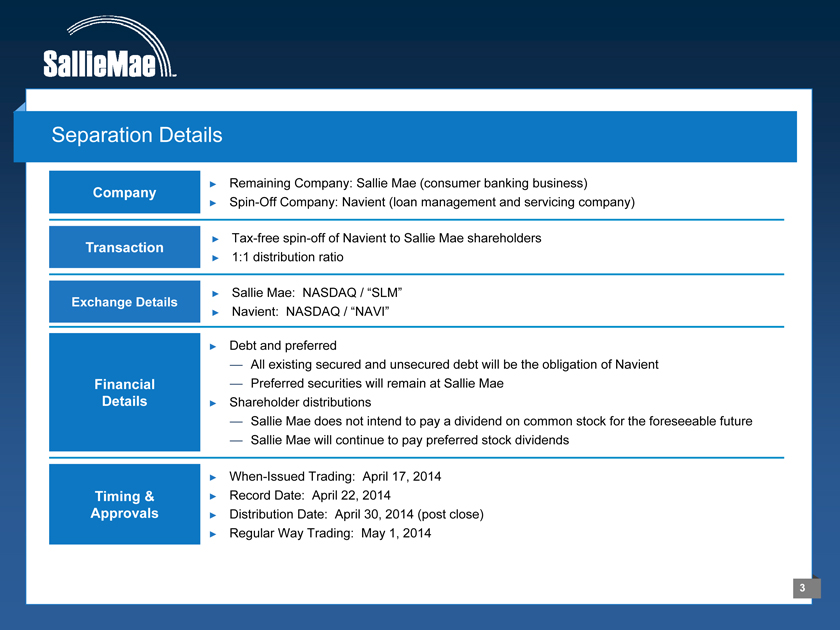

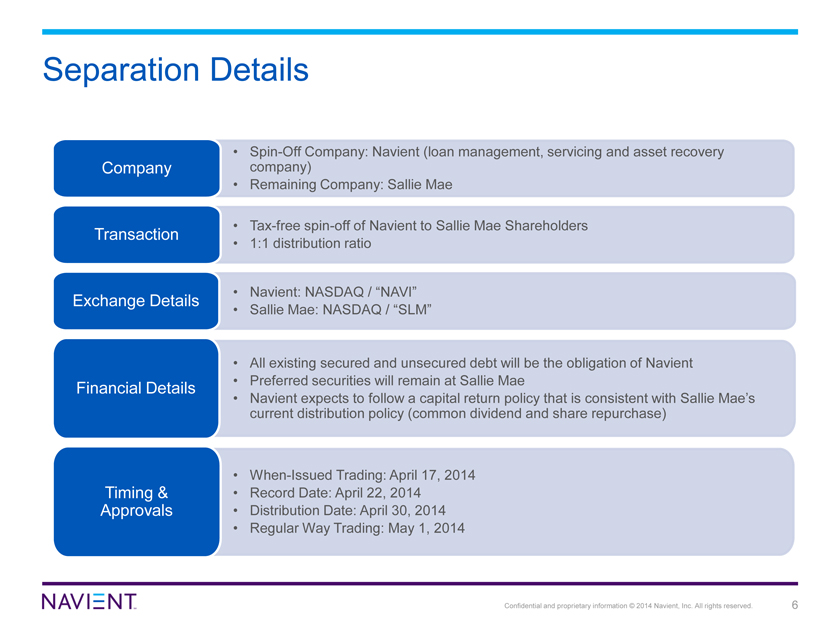

Separation Details Company Remaining Company: Sallie Mae (consumer banking business) Spin-Off Company: Navient (loan management and servicing company) Transaction Tax-free spin-off of Navient to Sallie Mae shareholders 1:1 distribution ratio Exchange Details Sallie Mae: NASDAQ / “SLM” Navient: NASDAQ / “NAVI” Financial Details Debt and preferred All existing secured and unsecured debt will be the obligation of Navient Preferred securities will remain at Sallie Mae Shareholder distributions Sallie Mae does not intend to pay a dividend on common stock for the foreseeable future Sallie Mae will continue to pay preferred stock dividends Timing & Approvals When-Issued Trading: April 17, 2014 Record Date: April 22, 2014 Distribution Date: April 30, 2014 (post close) Regular Way Trading: May 1, 2014 3

|

|

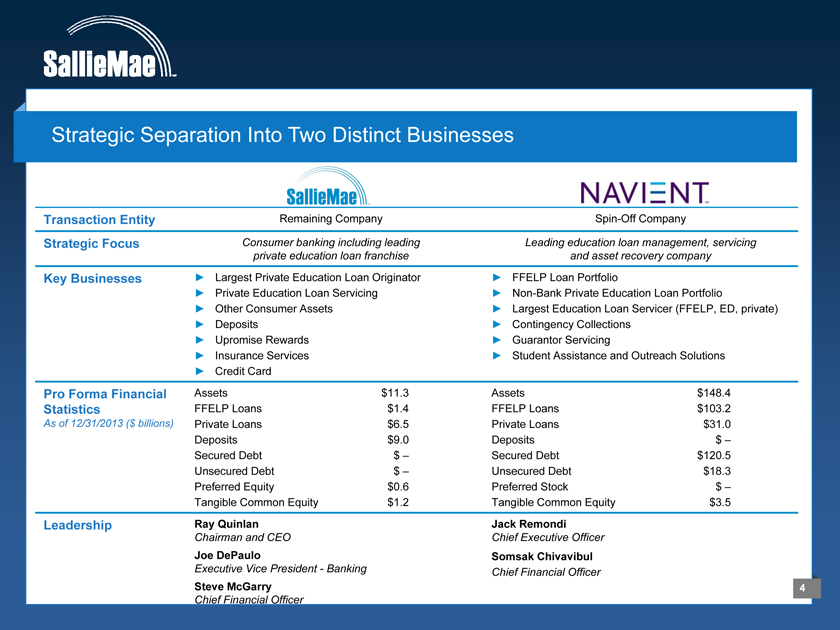

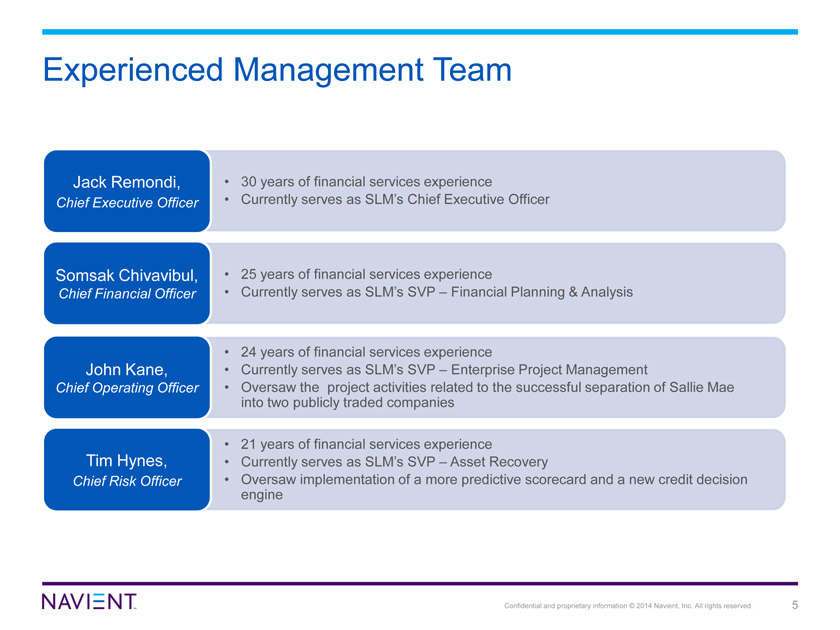

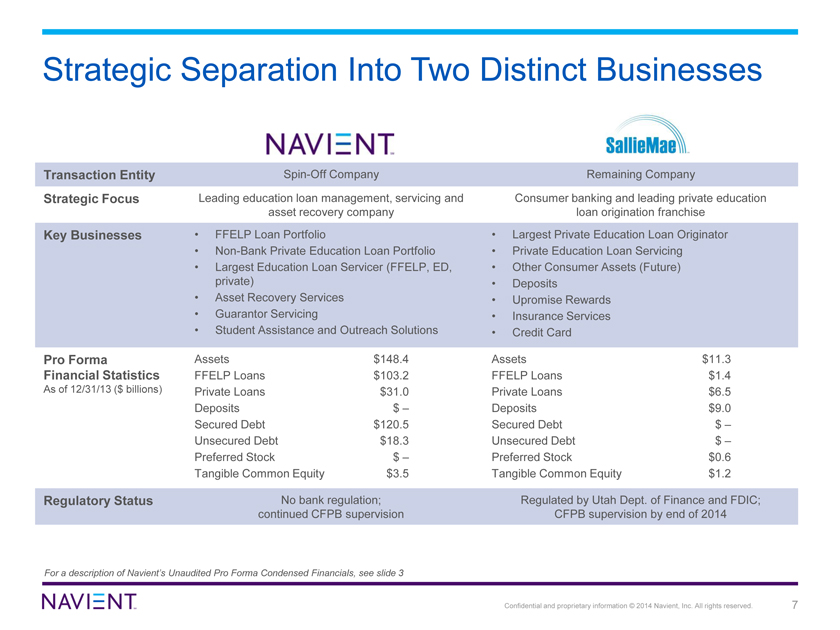

Strategic Separation Into Two Distinct Businesses Transaction Entity Remaining Company Spin-Off Company Strategic Focus Consumer banking including leading private education loan franchise Leading education loan management, servicing and asset recovery company Key Businesses Largest Private Education Loan Originator Private Education Loan Servicing Other Consumer Assets Deposits Upromise Rewards Insurance Services Credit Card FFELP Loan Portfolio Non-Bank Private Education Loan Portfolio Largest Education Loan Servicer (FFELP, ED, private) Contingency Collections Guarantor Servicing Student Assistance and Outreach Solutions Pro Forma Financial Statistics As of 12/31/2013 ($ billions) Assets $11.3 FFELP Loans $1.4 Private Loans $6.5 Deposits $9.0 Secured Debt $ – Unsecured Debt $ – Preferred Equity $0.6 Tangible Common Equity $1.2 Assets $148.4 FFELP Loans $103.2 Private Loans $31.0 Deposits $ – Secured Debt $120.5 Unsecured Debt $18.3 Preferred Stock $ – Tangible Common Equity $3.5 Leadership Ray Quinlan Chairman and CEO Joe DePaulo Executive Vice President - Banking Steve McGarry Chief Financial Officer Jack Remondi Chief Executive Officer Somsak Chivavibul Chief Financial Officer 4

|

|

Sallie Mae Investment Highlights 1 Experienced management team with deep industry knowledge Average of 30+ years of banking and financial services experience 2 Leading brand in the education lending market 40+ years serving the education lending market 50% private education lending market share 3 Simple low cost delivery system Multi-channel delivery system (on-campus, direct) 40% customer serialization rate and improving 4 Attractive customer base Higher employment rates for college graduates 90% of portfolio has cosigners; 746 average FICO 5 Disciplined approach to credit Robust proprietary scorecard Strong SmartOption performance; 0.6% ‘13 charge-offs 6 Strong capital position and funding capabilities 14%+ Total Capital Ratio; all capital ratios significantly in excess of well capitalized Retail direct deposits; future securitizations 7 Targeting high growth and high return business Long-term earnings growth target of 20%+ Long-term ROE target of 15%+ 5

|

|

Management Presenters Experienced management team with extensive asset knowledge and industry expertise Raymond Quinlan Chairman & Chief Executive Officer 30+ years of banking and financial services experience Joined Sallie Mae in 2014 Previously Executive Vice President of Banking at CIT Previously Chairman & CEO of Citigroup Retail Financial Services Joseph DePaulo Executive Vice President - Banking 30+ years of banking and financial services experience Joined Sallie Mae in 2009 as Executive Vice President & Chief Marketing Officer Previously Co-Founder & CEO of Credit One Financial Services Previously U.S. Card group executive at MBNA Steven McGarry Chief Financial Officer 30+ years of banking and financial services experience Joined Sallie Mae in 1997 as a member of the corporate finance team and later took leadership of equity and fixed income investor relations Previously held various positions in Toronto Dominion’s treasury department 6

|

|

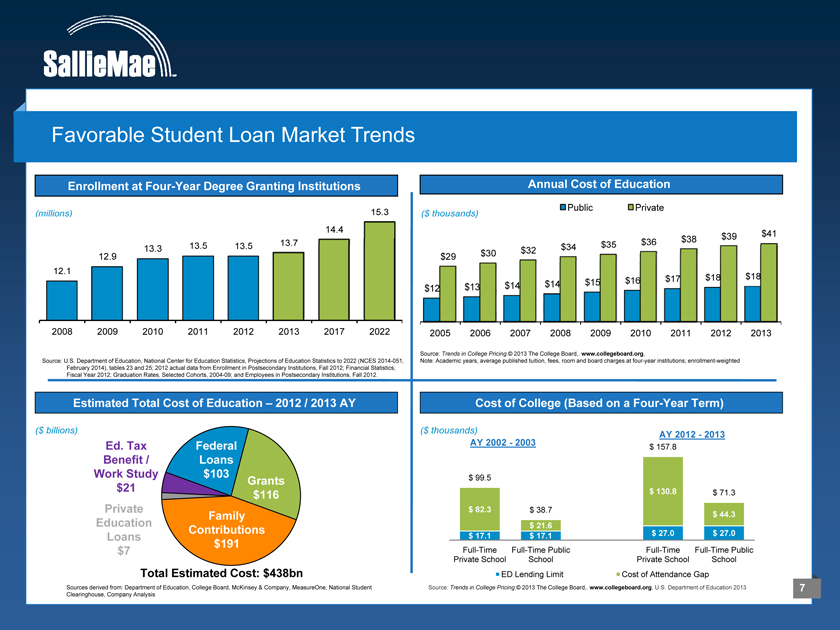

Favorable Student Loan Market Trends Enrollment at Four-Year Degree Granting Institutions (millions) 12.1 12.9 13.3 13.5 13.5 13.7 14.4 15.3 2008 2009 2010 2011 2012 2013 2017 2022 Source: U.S. Department of Education, National Center for Education Statistics, Projections of Education Statistics to 2022 (NCES 2014-051, February 2014), tables 23 and 25; 2012 actual data from Enrollment in Postsecondary Institutions, Fall 2012; Financial Statistics, Fiscal Year 2012; Graduation Rates, Selected Cohorts, 2004-09; and Employees in Postsecondary Institutions, Fall 2012. Annual Cost of Education ($ thousands) Public Private $29 $30 $32 $34 $35 $36 $38 $39 $41 $12 $13 $14 $14 $15 $16 $17 $18 $18 2005 2006 2007 2008 2009 2010 2011 2012 2013 Source: Trends in College Pricing. 2013 The College Board,. www.collegeboard.org, Note: Academic years, average published tuition, fees, room and board charges at four-year institutions; enrollment-weighted Estimated Total Cost of Education – 2012 / 2013 AY ($ billions) Ed. Tax Benefit / Work Study $21 Private Education Loans $7 Federal Loans $103 Grants $116 Family Contributions $191 Total Estimated Cost: $438bn Sources derived from: Department of Education, College Board, McKinsey & Company, MeasureOne, National Student Clearinghouse, Company Analysis Cost of College (Based on a Four-Year Term) ($ thousands) AY 2002 – 2003 AY 2012 – 2013 $ 99.5 $ 38.7 $ 157.8 $ 71.3 $ 82.3 $ 21.6 $ 130.8 $ 44.3 $ 17.1 $ 17.1 $ 27.0 $ 27.0 Full-Time Private School Full-Time Public School Full-Time Private School Full-Time Public School ED Lending Limit Cost of Attendance Gap Source: Trends in College Pricing.© 2013 The College Board,. www.collegeboard.org, U.S. Department of Education 2013 7

|

|

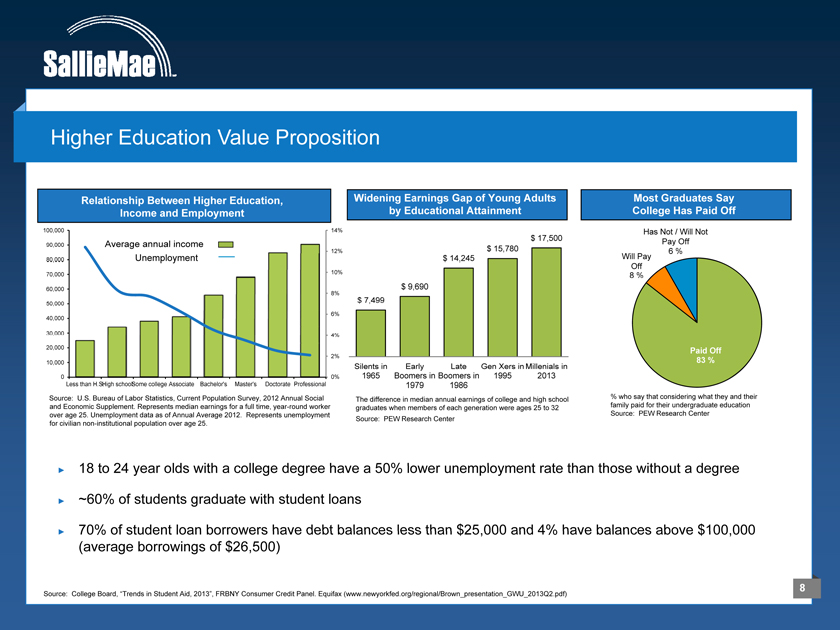

Higher Education Value Proposition Relationship Between Higher Education, Income and Employment Widening Earnings Gap of Young Adults by Educational Attainment Most Graduates Say College Has Paid Off 100,000 90,000 80,000 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 Average annual income Unemployment Less than H.S .High school Some college Associate Bachelor’s Master’s Doctorate Professional Source: U.S. Bureau of Labor Statistics, Current Population Survey, 2012 Annual Social and Economic Supplement. Represents median earnings for a full time, year-round worker over age 25. Unemployment data as of Annual Average 2012. Represents unemployment for civilian non-institutional population over age 25. 14% 12% 10% 8% 6% 4% 2% 0% $ 7,499 $ 9,690 $ 14,245 $ 15,780 $ 17,500 Silents in 1965 Early Boomers in 1979 Late Boomers in 1986 Gen Xers in 1995 Millenials in 2013 The difference in median annual earnings of college and high school graduates when members of each generation were ages 25 to 32 Source: PEW Research Center Has Not / Will Not Pay Off 6 % Will Pay Off 8 % Paid Off 83% % who say that considering what they and their family paid for their undergraduate education Source: PEW Research Center 18 to 24 year olds with a college degree have a 50% lower unemployment rate than those without a degree ~60% of students graduate with student loans 70% of student loan borrowers have debt balances less than $25,000 and 4% have balances above $100,000 (average borrowings of $26,500) Source: College Board, “Trends in Student Aid, 2013”, FRBNY Consumer Credit Panel. Equifax (www.newyorkfed.org/regional/Brown_presentation_GWU_2013Q2.pdf) 8

|

|

The Sallie Mae Brand #1 saving, planning and paying for education company with 40-years of leadership in the education lending market Top ranked brand: 6 out of 10 consumers of education finance recognize the Sallie Mae brand Industry leading market share in private education lending; 50% market share for 2012 / 2013 AY Over 2,400 actively managed university relationships across the U.S. Complementary consumer product offerings Over one million long-term engaged customers across the Sallie Mae brands 9

|

|

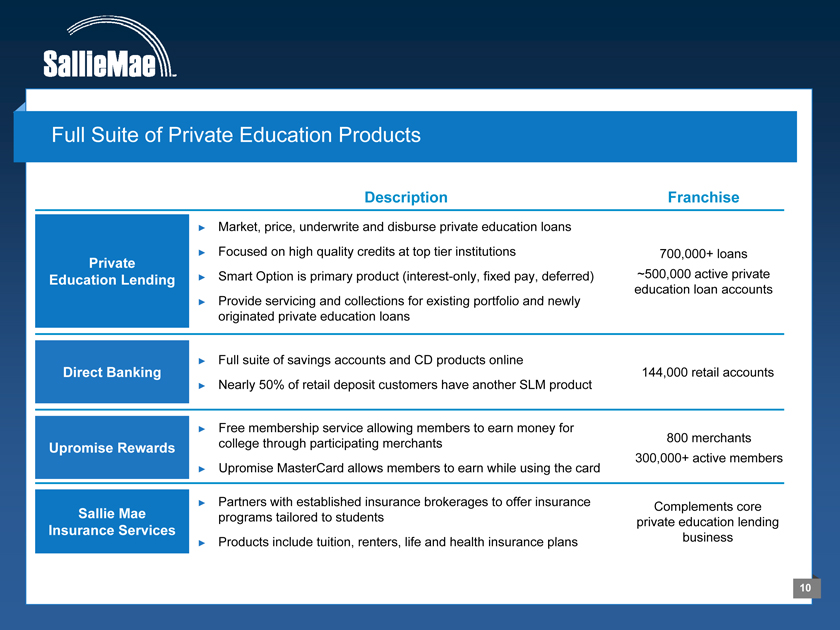

Full Suite of Private Education Products Description Franchise Private Education Lending Market, price, underwrite and disburse private education loans Focused on high quality credits at top tier institutions Smart Option is primary product (interest-only, fixed pay, deferred) Provide servicing and collections for existing portfolio and newly originated private education loans 700,000+ loans ~500,000 active private education loan accounts Direct Banking Full suite of savings accounts and CD products online Nearly 50% of retail deposit customers have another SLM product 144,000 retail accounts Upromise Rewards Free membership service allowing members to earn money for college through participating merchants Upromise MasterCard allows members to earn while using the card 800 merchants 300,000+ active members Sallie Mae Insurance Services Partners with established insurance brokerages to offer insurance programs tailored to students Products include tuition, renters, life and health insurance plans Complements core private education lending business 10

|

|

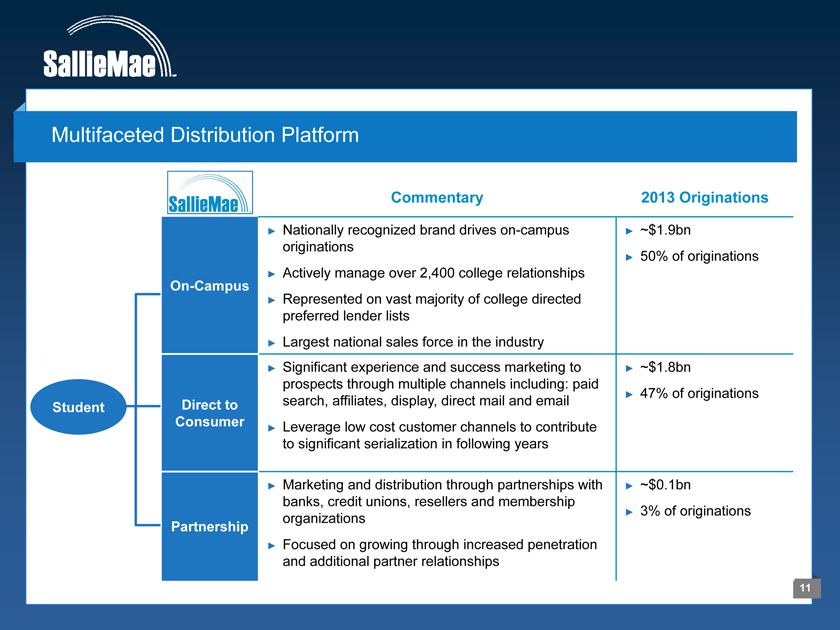

Multifaceted Distribution Platform Student Commentary 2013 Originations On-Campus Nationally recognized brand drives on-campus originations Actively manage over 2,400 college relationships Represented on vast majority of college directed preferred lender lists Largest national sales force in the industry ~$1.9bn 50% of originations Direct to Consumer Significant experience and success marketing to prospects through multiple channels including: paid search, affiliates, display, direct mail and email Leverage low cost customer channels to contribute to significant serialization in following years ~$1.8bn 47% of originations Partnership Marketing and distribution through partnerships with banks, credit unions, resellers and membership organizations Focused on growing through increased penetration and additional partner relationships ~$0.1bn 3% of originations 11

|

|

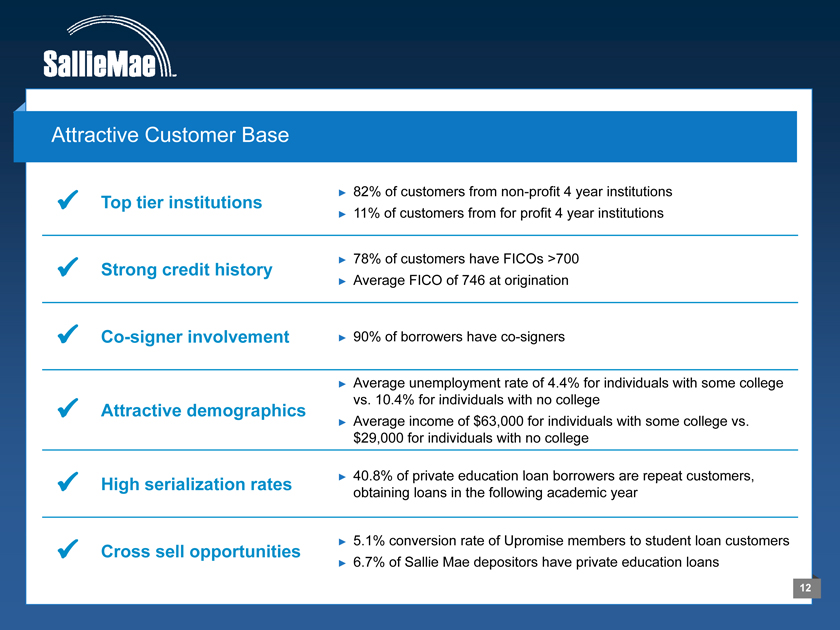

Attractive Customer Base Top tier institutions 82% of customers from non-profit 4 year institutions 11% of customers from for profit 4 year institutions Strong credit history 78% of customers have FICOs >700 Average FICO of 746 at origination Co-signer involvement 90% of borrowers have co-signers Attractive demographics Average unemployment rate of 4.4% for individuals with some college vs. 10.4% for individuals with no college Average income of $63,000 for individuals with some college vs. $29,000 for individuals with no college High serialization rates 40.8% of private education loan borrowers are repeat customers, obtaining loans in the following academic year Cross sell opportunities 5.1% conversion rate of Upromise members to student loan customers 6.7% of Sallie Mae depositors have private education loans 12

|

|

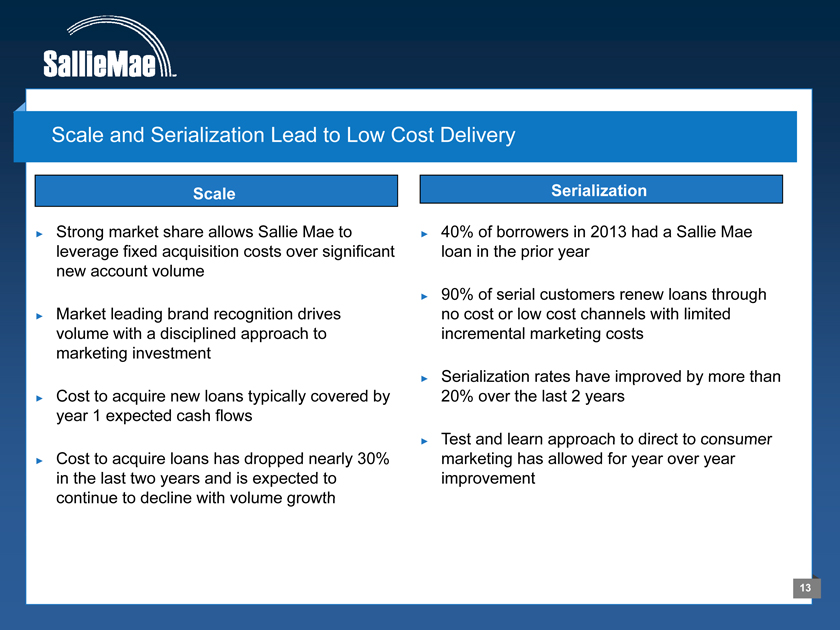

Scale and Serialization Lead to Low Cost Delivery Scale Strong market share allows Sallie Mae to leverage fixed acquisition costs over significant new account volume Market leading brand recognition drives volume with a disciplined approach to marketing investment Cost to acquire new loans typically covered by year 1 expected cash flows Cost to acquire loans has dropped nearly 30% in the last two years and is expected to continue to decline with volume growth Serialization 40% of borrowers in 2013 had a Sallie Mae loan in the prior year 90% of serial customers renew loans through no cost or low cost channels with limited incremental marketing costs Serialization rates have improved by more than 20% over the last 2 years Test and learn approach to direct to consumer marketing has allowed for year over year improvement 13

|

|

Unique Smart Option Product Leads Private Education Lending Market Smart Option student loan product first introduced in 2009 Offers three repayment options designed to help borrowers balance their goals and budget while in school Interest Only: requires interest only payment during in-school period Fixed Repayment: requires $25 monthly payments during in-school period Deferred Repayment: allows the customer to defer payments while in-school Variable and Fixed Interest Rate Options Repayment term is driven by cumulative amount borrowed and grade level Regular communication with customers and cosigners during in-school period Full collection activities are employed at both the customer and cosigner level All loans are certified by the school’s financial aid office to ensure that proceeds are used for education expenses 14

|

|

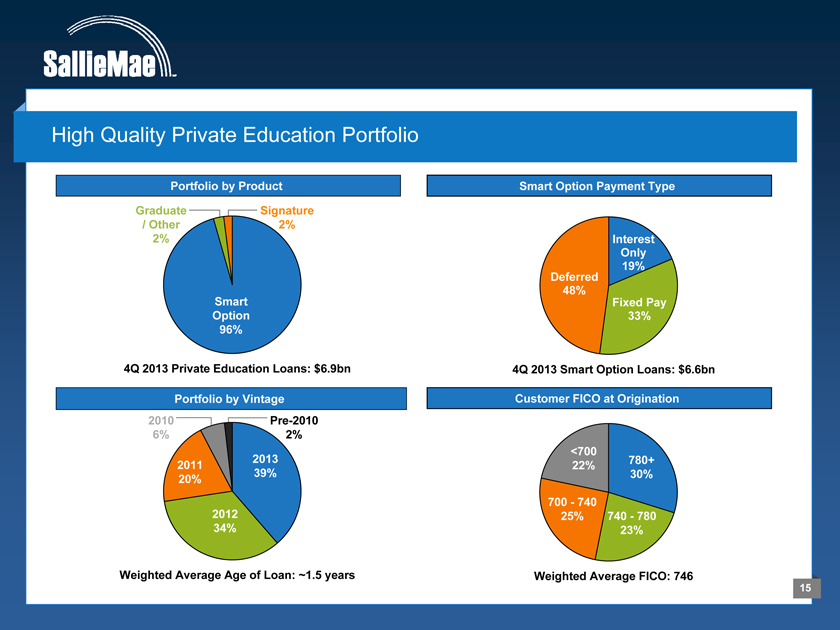

High Quality Private Education Portfolio Portfolio by Product Smart Option Payment Type Graduate / Other 2% Signature 2% Smart Option 96% 4Q 2013 Private Education Loans: $6.9bn Deferred 48% Interest Only 19% Fixed Pay 33% 4Q 2013 Smart Option Loans: $6.6bn Portfolio by Vintage 2010 6% Pre-2010 2% 2011 20% 2013 39% 2012 34% Weighted Average Age of Loan: ~1.5 years Customer FICO at Origination <700 22% 780+ 30% 700 – 740 25% 740 – 780 23% Weighted Average FICO: 746 15

|

|

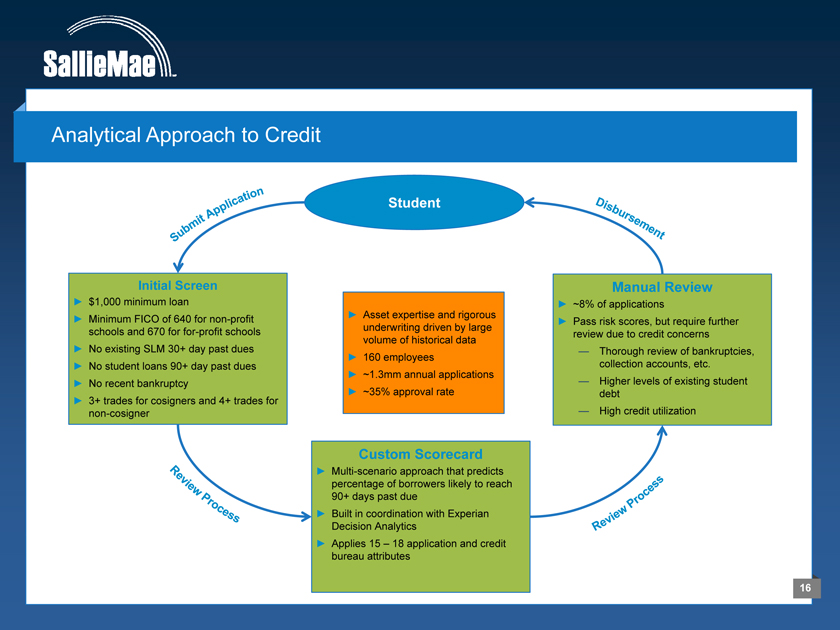

Analytical Approach to Credit Submit Application Student Disbursement Initial Screen $1,000 minimum loan Minimum FICO of 640 for non-profit schools and 670 for for-profit schools No existing SLM 30+ day past dues No student loans 90+ day past dues No recent bankruptcy 3+ trades for cosigners and 4+ trades for non-cosigner Asset expertise and rigorous underwriting driven by large volume of historical data 160 employees ~1.3mm annual applications ~35% approval rate Manual Review ~8% of applications Pass risk scores, but require further review due to credit concerns Thorough review of bankruptcies, collection accounts, etc. Higher levels of existing student debt High credit utilization Custom Scorecard Multi-scenario approach that predicts percentage of borrowers likely to reach 90+ days past due Built in coordination with Experian Decision Analytics Applies 15 – 18 application and credit bureau attributes Review Process Review Process 16

|

|

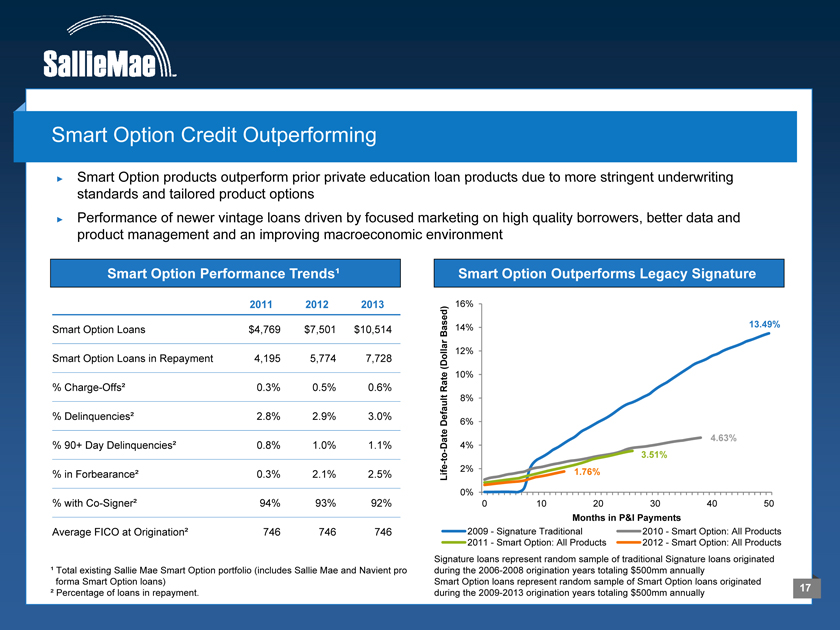

Smart Option Credit Outperforming Smart Option products outperform prior private education loan products due to more stringent underwriting standards and tailored product options Performance of newer vintage loans driven by focused marketing on high quality borrowers, better data and product management and an improving macroeconomic environment Smart Option Performance Trends¹ 2011 2012 2013 Smart Option Loans $4,769 $7,501 $10,514 Smart Option Loans in Repayment 4,195 5,774 7,728 % Charge-Offs² 0.3% 0.5% 0.6% % Delinquencies² 2.8% 2.9% 3.0% % 90+ Day Delinquencies² 0.8% 1.0% 1.1% % in Forbearance² 0.3% 2.1% 2.5% % with Co-Signer² 94% 93% 92% Average FICO at Origination² 746 746 746 ¹ Total existing Sallie Mae Smart Option portfolio (includes Sallie Mae and Navient pro forma Smart Option loans) ² Percentage of loans in repayment. Smart Option Outperforms Legacy Signature Life-to-Date Default Rate (Dollar Based) 16% 14% 12% 10% 8% 6% 4% 2% 0% 13.49% 4.63% 3.51% 1.76% 0 10 20 30 40 50 Months in P&I Payments 2009 - Signature Traditional 2010 - Smart Option: All Products 2011 - Smart Option: All Products 2012 - Smart Option: All Products Signature loans represent random sample of traditional Signature loans originated during the 2006-2008 origination years totaling $500mm annually Smart Option loans represent random sample of Smart Option loans originated during the 2009-2013 origination years totaling $500mm annually 17

|

|

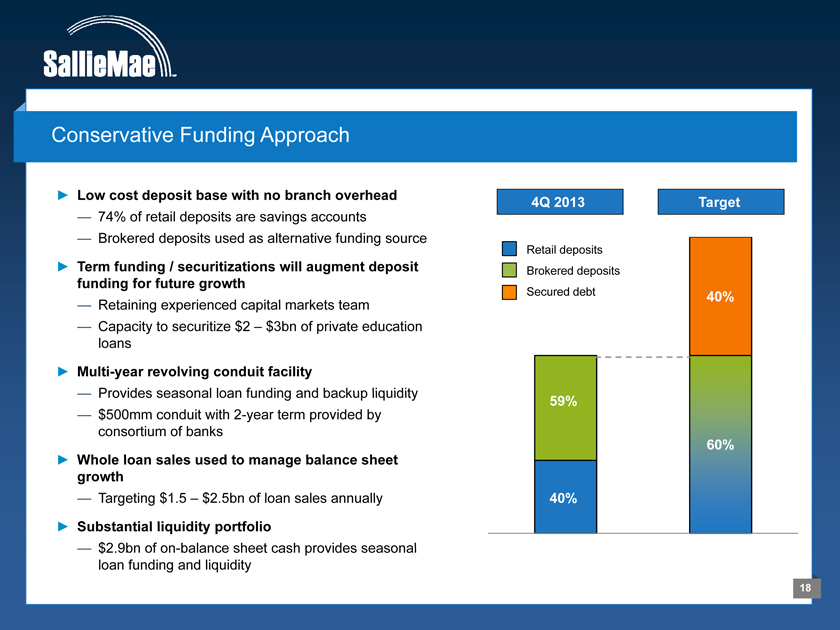

Conservative Funding Approach Low cost deposit base with no branch overhead 74% of retail deposits are savings accounts Brokered deposits used as alternative funding source Term funding / securitizations will augment deposit funding for future growth Retaining experienced capital markets team Capacity to securitize $2 – $3bn of private education loans Multi-year revolving conduit facility Provides seasonal loan funding and backup liquidity $500mm conduit with 2-year term provided by consortium of banks Whole loan sales used to manage balance sheet growth Targeting $1.5 – $2.5bn of loan sales annually Substantial liquidity portfolio $2.9bn of on-balance sheet cash provides seasonal loan funding and liquidity 4Q 2013 Target Retail deposits Brokered deposits Secured debt 40% 59% 40% 60% 18

|

|

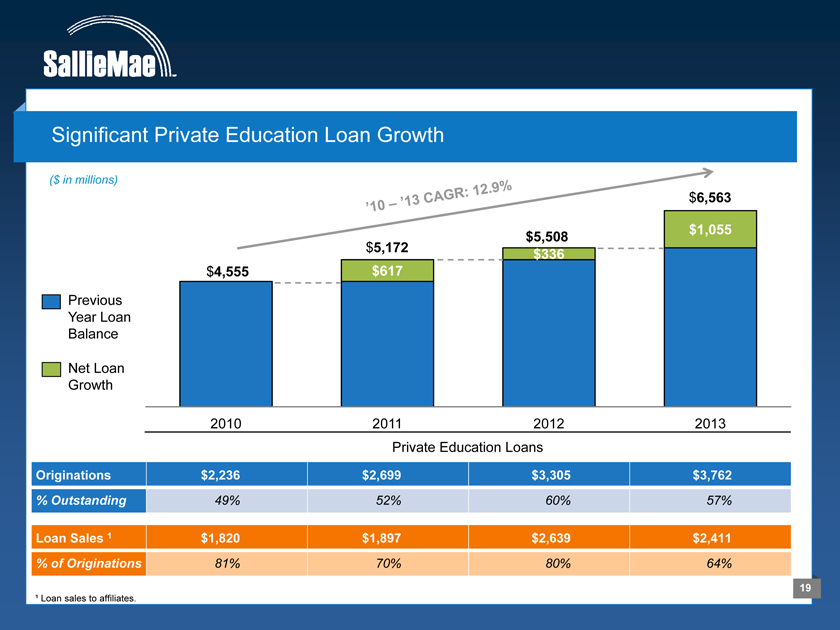

Significant Private Education Loan Growth ($ in millions) ‘10 – ‘13 CAGR: 12.9% Previous Year Loan Balance Net Loan Growth $4,555 $5,172 $5,508 $6,563 $617 $336 $1,055 2010 2011 2012 2013 Originations $2,236 $2,699 $3,305 $3,762 % Outstanding 49% 52% 60% 57% Loan Sales 1 $1,820 $1,897 $2,639 $2,411 % of Originations 81% 70% 80% 64% ¹ Loan sales to affiliates. 19

|

|

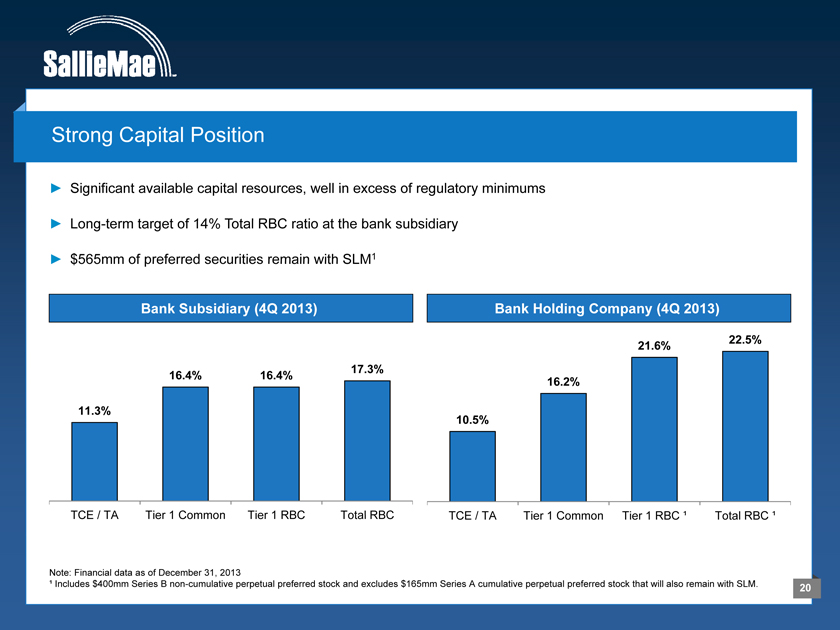

Strong Capital Position Significant available capital resources, well in excess of regulatory minimums Long-term target of 14% Total RBC ratio at the bank subsidiary $565mm of preferred securities remain with SLM1 Bank Subsidiary (4Q 2013) Bank Holding Company (4Q 2013) 11.3% 16.4% 16.4% 17.3% 10.5% 16.2% 21.6% 22.5% TCE / TA Tier 1 Common Tier 1 RBC Total RBC TCE / TA Tier 1 Common Tier 1 RBC ¹ Total RBC ¹ Note: Financial data as of December 31, 2013 ¹ Includes $400mm Series B non-cumulative perpetual preferred stock and excludes $165mm Series A cumulative perpetual preferred stock that will also remain with SLM. 20

|

|

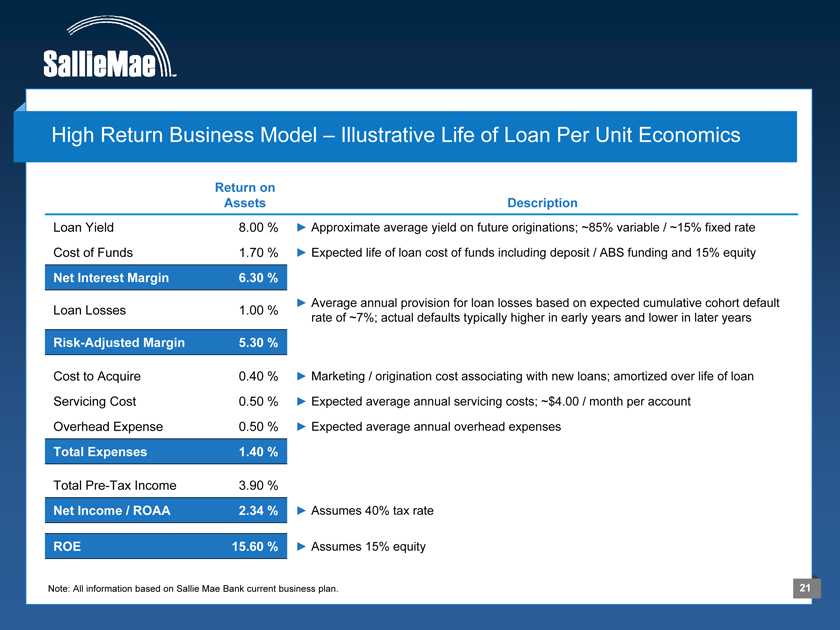

High Return Business Model – Illustrative Life of Loan Per Unit Economics Return on Assets Description Loan Yield 8.00 % Approximate average yield on future originations; ~85% variable / ~15% fixed rate Cost of Funds 1.70 % Expected life of loan cost of funds including deposit / ABS funding and 15% equity Net Interest Margin 6.30 % Loan Losses 1.00 % Average annual provision for loan losses based on expected cumulative cohort default rate of ~7%; actual defaults typically higher in early years and lower in later years Risk-Adjusted Margin 5.30 % Cost to Acquire 0.40 % Marketing / origination cost associating with new loans; amortized over life of loan Servicing Cost 0.50 % Expected average annual servicing costs; ~$4.00 / month per account Overhead Expense 0.50 % Expected average annual overhead expenses Total Expenses 1.40 % Total Pre-Tax Income 3.90 % Net Income / ROAA 2.34 % Assumes 40% tax rate ROE 15.60 % Assumes 15% equity Note: All information based on Sallie Mae Bank current business plan. 21

|

|

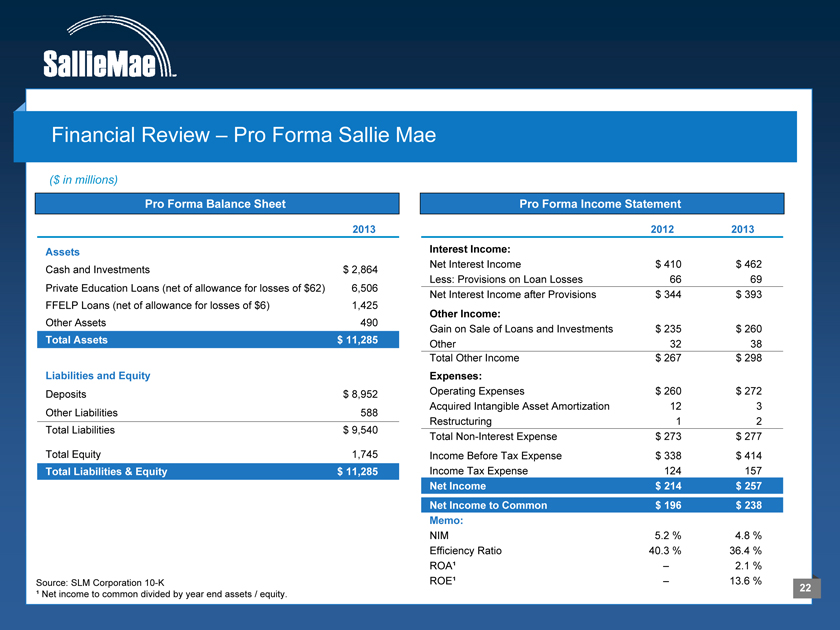

Financial Review – Pro Forma Sallie Mae ($ in millions) Pro Forma Balance Sheet 2013 Assets Cash and Investments $ 2,864 Private Education Loans (net of allowance for losses of $62) 6,506 FFELP Loans (net of allowance for losses of $6) 1,425 Other Assets 490 Total Assets $ 11,285 Liabilities and Equity Deposits $ 8,952 Other Liabilities 588 Total Liabilities $ 9,540 Total Equity 1,745 Total Liabilities & Equity $ 11,285 Pro Forma Income Statement 2012 2013 Interest Income: Net Interest Income $ 410 $ 462 Less: Provisions on Loan Losses 66 69 Net Interest Income after Provisions $ 344 $ 393 Other Income: Gain on Sale of Loans and Investments $ 235 $ 260 Other 32 38 Total Other Income $ 267 $ 298 Expenses: Operating Expenses $ 260 $ 272 Acquired Intangible Asset Amortization 12 3 Restructuring 1 2 Total Non-Interest Expense $ 273 $ 277 Income Before Tax Expense $ 338 $ 414 Income Tax Expense 124 157 Net Income $ 214 $ 257 Net Income to Common $ 196 $ 238 Memo: NIM 5.2 % 4.8 % Efficiency Ratio 40.3 % 36.4 % ROA¹ – 2.1 % ROE¹ – 13.6 % Source: SLM Corporation 10-K ¹ Net income to common divided by year end assets / equity. 22

|

|

Key Financial Targets Target Annual Originations $4 bn + Asset Growth 15.0% – 17.5% Earnings Growth 20% + Annual Loan Sales $1.5 – $2.5 bn ROA 2.0% + ROE 15% + Total RBC 14% 23

|

|

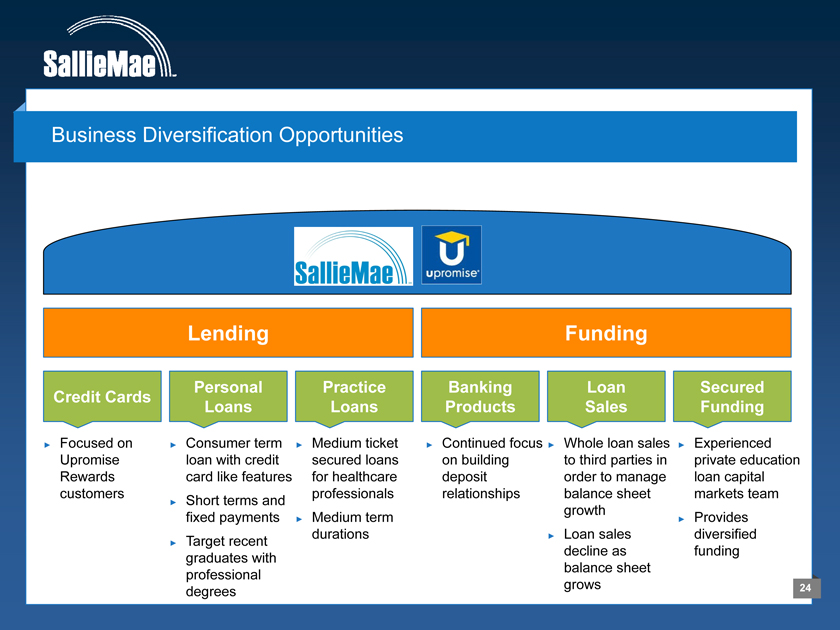

Business Diversification Opportunities Lending Funding Credit Cards Personal Loans Practice Loans Banking Products Loan Sales Secured Funding Focused on Upromise Rewards customers Consumer term loan with credit card like features Short terms and fixed payments Target recent graduates with professional degrees Medium ticket secured loans for healthcare professionals Medium term durations Continued focus on building deposit relationships Whole loan sales to third parties in order to manage balance sheet growth Loan sales decline as balance sheet grows Experienced private education loan capital markets team Provides diversified funding 24

|

|

Sallie Mae Investment Highlights 1 Experienced management team with deep industry knowledge 2 Leading brand in the education lending market 3 Simple low cost delivery system 4 Attractive customer base 5 Disciplined approach to credit 6 Strong capital position and funding capabilities 7 Targeting high growth and high return business 25