EXHIBIT 99.1

|

|

NEWS |

FOR IMMEDIATE RELEASE

VEECO REPORTS FOURTH QUARTER 2014 FINANCIAL RESULTS

Plainview, N.Y., February 17, 2015 — Veeco Instruments Inc. (Nasdaq: VECO) announced its financial results for the fourth quarter and year ended December 31, 2014. Veeco reports its results in conformity with U.S. generally accepted accounting principles (“GAAP”) and also provides results adjusting for certain items. A reconciliation between GAAP and Non-GAAP operating results is provided at the end of this press release.

U.S. Dollars in millions, except per share data

|

|

|

4th Quarter |

|

Full Year |

| ||||||||

|

GAAP Results |

|

Q4 ‘14 |

|

Q4 ‘13 |

|

2014 |

|

2013 |

| ||||

|

Revenues |

|

$ |

113.6 |

|

$ |

73.2 |

|

$ |

392.9 |

|

$ |

331.7 |

|

|

Net loss |

|

(56.9 |

) |

(22.1 |

) |

(66.9 |

) |

(42.3 |

) | ||||

|

Earnings (loss) per share |

|

(1.44 |

) |

(0.57 |

) |

(1.70 |

) |

(1.09 |

) | ||||

|

|

|

4th Quarter |

|

Full Year |

| ||||||||

|

Non-GAAP Results |

|

Q4 ‘14 |

|

Q4 ‘13 |

|

2014 |

|

2013 |

| ||||

|

Adjusted EBITDA |

|

$ |

8.3 |

|

$ |

(23.3 |

) |

$ |

2.6 |

|

$ |

(36.7 |

) |

|

Earnings (loss) per share |

|

0.13 |

|

(0.42 |

) |

(0.10 |

) |

(0.72 |

) | ||||

CEO Commentary

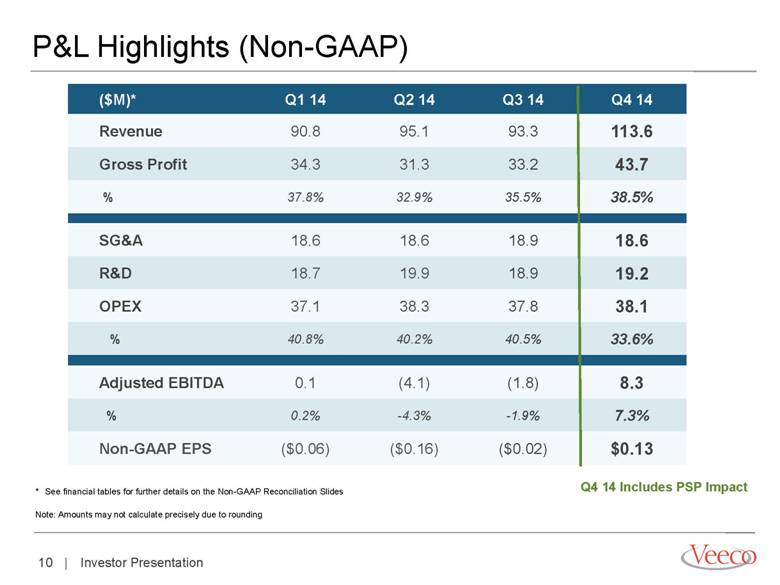

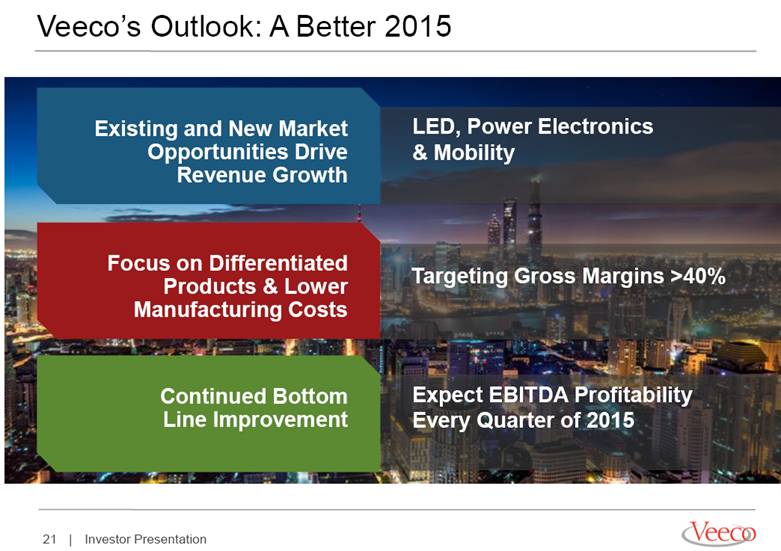

“Veeco achieved significant milestones during 2014 as part of the transition back to growth and profitability,” commented John R. Peeler, Chairman and Chief Executive Officer. “For the full year, revenue increased 18% to $393 million, bookings were up more than 50% to $510 million, and we returned to adjusted EBITDA profitability. We developed differentiated new products, lowered operating expenses and improved gross margins. We also completed the acquisition of Solid State Equipment LLC (now Veeco Precision Surface Processing or “PSP”) in the fourth quarter, improving access to high growth markets through complementary technology that will drive increased sales and profitability.”

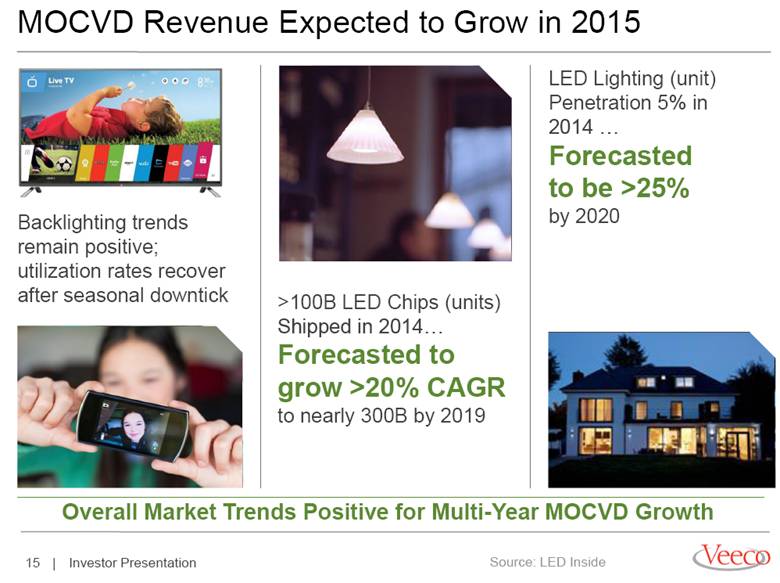

“Fourth quarter results were within our guidance for revenue and above guidance for gross margin and adjusted EBITDA performance. Bookings totaled $196 million, the highest quarterly level since 2011. MOCVD booked $142 million, primarily due to orders for our next generation EPIK700TM MOCVD system. Data Storage bookings of $45 million were also the highest level since 2011, as customers invested in both capacity and technology.”

ALD Business Update

Veeco successfully demonstrated its FAST-ALDTM technology for flexible OLED encapsulation, but at the same time the incumbent deposition technology has progressed to satisfy the current market requirements. As a result, Veeco lowered the near term revenue forecasts for its ALD technology and took an asset impairment charge (goodwill, intangibles and property, plant and equipment) in the fourth quarter. The Company will lower its

spending rate in ALD, refocus R&D efforts on semiconductor and other applications, and continue to monitor the flexible OLED market opportunity.

Outlook

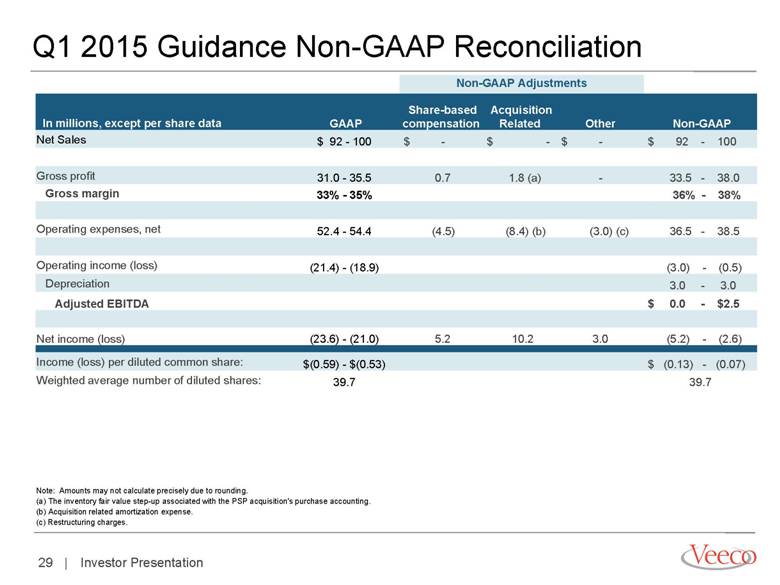

Veeco has begun shipping its new EPIK700 MOCVD system, which is a highly competitive product that improves LED customers’ productivity and yield and lowers their total cost of ownership. As is standard practice with new product introductions, accounting rules require deferral of revenue on initial system shipments. The Company expects to ship over $25 million of EPIK700 systems in the first quarter. The value of these shipments will largely appear as deferred revenue on the balance sheet, and, as a result, Veeco’s first quarter 2015 revenue is currently forecasted to be between $92 and $100 million. Loss per share is currently forecasted to be between ($0.59) to ($0.53) on a GAAP basis and ($0.13) to ($0.07) on a non-GAAP basis. Please refer to the attached financial table for more details.

Mr. Peeler added, “I am highly confident that 2015 will be another year of improved performance for Veeco, fueled by great new products targeted at growth opportunities in LED, power electronics and mobile devices. We have a strong team focused on keeping our organization streamlined and improving both gross margin and bottom line performance.”

Conference Call Information

A conference call reviewing these results has been scheduled for today at 5:00pm ET. To join the call, dial 1-888-724-9511 (toll free) or 913-312-1236 and use passcode 9582112. The call will also be webcast live on the Veeco website at ir.veeco.com. A replay of the call will be available beginning at 8:00pm ET tonight through 8:00pm ET on March 3, 2015 at 1-888-203-1112 (toll free) or 1-719-457-0820, using passcode 9582112, and on the Veeco website. We will post an accompanying slide presentation to our website prior to the beginning of the call.

About Veeco

Our process equipment solutions enable the manufacture of LEDs, power electronics, wireless devices, hard disk drives, and semiconductors. We are the market leader in MOCVD, MBE, Ion Beam and other advanced thin film process technologies. Our high performance systems drive innovation in energy efficiency, consumer electronics and network storage allowing our customers to maximize productivity and achieve a lower cost of ownership. For information on our Company, products, or worldwide service and support, please visit www.veeco.com.

To the extent that this news release discusses expectations or otherwise makes statements about the future, such statements are forward-looking and are subject to a number of risks and uncertainties that could cause actual results to differ materially from the statements made. These factors include the risks discussed in the Business Description and Management’s Discussion and Analysis sections of Veeco’s Annual Report on Form 10-K for the year ended December 31, 2013 and in our subsequent quarterly reports on Form 10-Q, current reports on Form 8-K and press releases. Veeco does not undertake any obligation to update any forward-looking statements to reflect future events or circumstances after the date of such statements.

-financial tables attached-

|

Veeco Contacts: |

|

|

|

|

|

Investors: |

Media: |

|

Debra Wasser 212-704-4588 |

Jeffrey Pina 516-677-0200 x1222 |

|

deb.wasser@edelman.com |

jpina@veeco.com |

Veeco Instruments Inc. and Subsidiaries

Consolidated Statements of Operations

(In thousands, except per share data)

|

|

|

For the three months ended |

|

For the year ended |

| ||||||||

|

|

|

December 31, |

|

December 31, |

| ||||||||

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

| ||||

|

Net sales |

|

$ |

113,569 |

|

$ |

73,209 |

|

$ |

392,873 |

|

$ |

331,749 |

|

|

Cost of sales |

|

75,695 |

|

57,567 |

|

257,991 |

|

228,607 |

| ||||

|

Gross profit |

|

37,874 |

|

15,642 |

|

134,882 |

|

103,142 |

| ||||

|

Operating expenses, net: |

|

|

|

|

|

|

|

|

| ||||

|

Selling, general and administrative |

|

24,490 |

|

26,409 |

|

89,760 |

|

85,486 |

| ||||

|

Research and development |

|

20,424 |

|

20,824 |

|

81,171 |

|

81,424 |

| ||||

|

Amortization |

|

4,195 |

|

2,961 |

|

13,146 |

|

5,527 |

| ||||

|

Restructuring |

|

884 |

|

(286 |

) |

4,394 |

|

1,485 |

| ||||

|

Asset impairment |

|

55,306 |

|

1,220 |

|

58,170 |

|

1,220 |

| ||||

|

Changes in contingent consideration |

|

— |

|

829 |

|

(29,368 |

) |

829 |

| ||||

|

Other income, net |

|

(2,848 |

) |

(876 |

) |

(3,182 |

) |

(1,017 |

) | ||||

|

Total operating expenses, net |

|

102,451 |

|

51,081 |

|

214,091 |

|

174,954 |

| ||||

|

Operating loss |

|

(64,577 |

) |

(35,439 |

) |

(79,209 |

) |

(71,812 |

) | ||||

|

Interest income (expense), net |

|

314 |

|

(18 |

) |

855 |

|

602 |

| ||||

|

Loss before income taxes |

|

(64,263 |

) |

(35,457 |

) |

(78,354 |

) |

(71,210 |

) | ||||

|

Income tax benefit |

|

(7,351 |

) |

(13,372 |

) |

(11,414 |

) |

(28,947 |

) | ||||

|

Net loss |

|

$ |

(56,912 |

) |

$ |

(22,085 |

) |

$ |

(66,940 |

) |

$ |

(42,263 |

) |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Loss per common share: |

|

|

|

|

|

|

|

|

| ||||

|

Basic |

|

$ |

(1.44 |

) |

$ |

(0.57 |

) |

$ |

(1.70 |

) |

$ |

(1.09 |

) |

|

Diluted |

|

$ |

(1.44 |

) |

$ |

(0.57 |

) |

$ |

(1.70 |

) |

$ |

(1.09 |

) |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Weighted average number of shares: |

|

|

|

|

|

|

|

|

| ||||

|

Basic |

|

39,446 |

|

38,904 |

|

39,350 |

|

38,807 |

| ||||

|

Diluted |

|

39,446 |

|

38,904 |

|

39,350 |

|

38,807 |

| ||||

Veeco Instruments Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

December 31, |

|

December 31, |

| ||

|

|

|

2014 |

|

2013 |

| ||

|

Assets |

|

|

|

|

| ||

|

Current assets: |

|

|

|

|

| ||

|

Cash and cash equivalents |

|

$ |

270,811 |

|

$ |

210,799 |

|

|

Short-term investments |

|

120,572 |

|

281,538 |

| ||

|

Restricted cash |

|

539 |

|

2,738 |

| ||

|

Accounts receivable, net |

|

60,085 |

|

23,823 |

| ||

|

Inventories |

|

61,471 |

|

59,726 |

| ||

|

Deferred cost of sales |

|

5,076 |

|

724 |

| ||

|

Prepaid expenses and other current assets |

|

23,132 |

|

22,579 |

| ||

|

Assets held for sale |

|

6,000 |

|

— |

| ||

|

Deferred income taxes |

|

7,976 |

|

11,716 |

| ||

|

Total current assets |

|

555,662 |

|

613,643 |

| ||

|

Property, plant and equipment at cost, net |

|

78,752 |

|

89,139 |

| ||

|

Goodwill |

|

114,959 |

|

91,348 |

| ||

|

Deferred income taxes |

|

1,180 |

|

397 |

| ||

|

Intangible assets, net |

|

159,308 |

|

114,716 |

| ||

|

Other assets |

|

19,594 |

|

38,726 |

| ||

|

Total assets |

|

$ |

929,455 |

|

$ |

947,969 |

|

|

|

|

|

|

|

| ||

|

Liabilities and stockholders’ equity |

|

|

|

|

| ||

|

Current liabilities: |

|

|

|

|

| ||

|

Accounts payable |

|

$ |

18,111 |

|

$ |

35,755 |

|

|

Accrued expenses and other current liabilities |

|

48,418 |

|

51,084 |

| ||

|

Customer deposits and deferred revenue |

|

96,004 |

|

34,754 |

| ||

|

Income taxes payable |

|

5,441 |

|

6,149 |

| ||

|

Deferred income taxes |

|

120 |

|

159 |

| ||

|

Current portion of long-term debt |

|

314 |

|

290 |

| ||

|

Total current liabilities |

|

168,408 |

|

128,191 |

| ||

|

Deferred income taxes |

|

16,397 |

|

28,052 |

| ||

|

Long-term debt |

|

1,533 |

|

1,847 |

| ||

|

Other liabilities |

|

4,185 |

|

9,649 |

| ||

|

Total liabilities |

|

190,523 |

|

167,739 |

| ||

|

|

|

|

|

|

| ||

|

Total stockholders’ equity |

|

738,932 |

|

780,230 |

| ||

|

|

|

|

|

|

| ||

|

Total liabilities and stockholders’ equity |

|

$ |

929,455 |

|

$ |

947,969 |

|

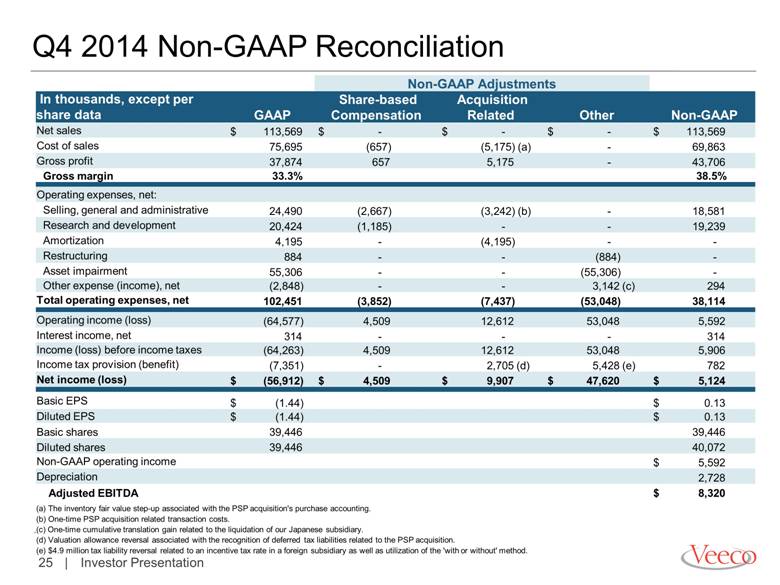

Veeco Instruments Inc. and Subsidiaries

Reconciliation GAAP to Non-GAAP Financial Data

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

Non-GAAP Adjustments |

|

|

| |||||||||

|

For the three months ended December 31, 2014 |

|

GAAP |

|

Share-based |

|

Acquisition |

|

Other |

|

Non-GAAP |

| |||||

|

Net sales |

|

$ |

113,569 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

113,569 |

|

|

Cost of sales |

|

75,695 |

|

(657 |

) |

(5,175 |

)(a) |

— |

|

69,863 |

| |||||

|

Gross profit |

|

37,874 |

|

657 |

|

5,175 |

|

— |

|

43,706 |

| |||||

|

Gross margin |

|

33.3 |

% |

|

|

|

|

|

|

38.5 |

% | |||||

|

Operating expenses, net: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Selling, general and administrative |

|

24,490 |

|

(2,667 |

) |

(3,242 |

)(b) |

— |

|

18,581 |

| |||||

|

Research and development |

|

20,424 |

|

(1,185 |

) |

— |

|

— |

|

19,239 |

| |||||

|

Amortization |

|

4,195 |

|

— |

|

(4,195 |

) |

— |

|

— |

| |||||

|

Restructuring |

|

884 |

|

— |

|

— |

|

(884 |

) |

— |

| |||||

|

Asset impairment |

|

55,306 |

|

— |

|

— |

|

(55,306 |

) |

— |

| |||||

|

Other expense (income), net |

|

(2,848 |

) |

— |

|

— |

|

3,142 |

(c) |

294 |

| |||||

|

Total operating expenses, net |

|

102,451 |

|

(3,852 |

) |

(7,437 |

) |

(53,048 |

) |

38,114 |

| |||||

|

Operating income (loss) |

|

(64,577 |

) |

4,509 |

|

12,612 |

|

53,048 |

|

5,592 |

| |||||

|

Interest income, net |

|

314 |

|

— |

|

— |

|

— |

|

314 |

| |||||

|

Income (loss) before income taxes |

|

(64,263 |

) |

4,509 |

|

12,612 |

|

53,048 |

|

5,906 |

| |||||

|

Income tax provision (benefit) |

|

(7,351 |

) |

— |

|

2,705 |

(d) |

5,428 |

(e) |

782 |

| |||||

|

Net income (loss) |

|

$ |

(56,912 |

) |

$ |

4,509 |

|

$ |

9,907 |

|

$ |

47,620 |

|

$ |

5,124 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic EPS |

|

$ |

(1.44 |

) |

|

|

|

|

|

|

$ |

0.13 |

| |||

|

Diluted EPS |

|

$ |

(1.44 |

) |

|

|

|

|

|

|

$ |

0.13 |

| |||

|

Basic shares |

|

39,446 |

|

|

|

|

|

|

|

39,446 |

| |||||

|

Diluted shares |

|

39,446 |

|

|

|

|

|

|

|

40,072 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Non-GAAP operating income |

|

|

|

|

|

|

|

|

|

$ |

5,592 |

| ||||

|

Depreciation |

|

|

|

|

|

|

|

|

|

2,728 |

| |||||

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

$ |

8,320 |

| ||||

Note: Amounts may not calculate precisely due to rounding.

(a) The inventory fair value step-up associated with the PSP acquisition’s purchase accounting.

(b) One-time PSP acquisition related transaction costs.

(c) One-time cumulative translation gain related to the liquidation of our Japanese subsidiary.

(d) Valuation allowance reversal associated with the recognition of deferred tax liabilities related to the PSP acquisition.

(e) $4.9 million tax liability reversal related to an incentive tax rate in a foreign subsidiary as well as utilization of the ‘with or without’ method.

This table includes financial measures adjusted for the impact of certain items; these financial measures are therefore not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These Non-GAAP financial measures consider exclusion of: share-based compensation expense; one-time charges relating to restructuring initiatives, non-cash asset impairments, certain other non-operating gains and losses, and acquisition-related items such as one-time transaction costs, non-cash amortization of acquired intangible assets, and the stepped-up cost of sales associated with the purchase accounting of acquired inventory.

These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. By excluding these items, non-GAAP financial measures are intended to facilitate meaningful comparisons to historical operating results, competitors’ operating results, and estimates made by securities analysts. Management is evaluated on key performance metrics including adjusted EBITDA, which is used to determine management incentive compensation as well as to forecast future periods. These non-GAAP financial measures may be useful to investors in allowing for greater transparency of supplemental information used by management in its financial and operational decision-making. In addition, similar non-GAAP financial measures have historically been reported to investors; the inclusion of comparable numbers provides consistency in financial reporting. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used in this news release to their most directly comparable GAAP financial measures.

Veeco Instruments Inc. and Subsidiaries

Reconciliation GAAP to Non-GAAP Financial Data

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

Non-GAAP Adjustments |

|

|

| ||||||

|

For the three months ended December 31, 2013 |

|

GAAP |

|

Share-based |

|

Other |

|

Non-GAAP |

| ||||

|

Net sales |

|

$ |

73,209 |

|

$ |

— |

|

$ |

— |

|

$ |

73,209 |

|

|

Cost of sales |

|

57,567 |

|

(462 |

) |

— |

|

57,105 |

| ||||

|

Gross profit |

|

15,642 |

|

462 |

|

— |

|

16,104 |

| ||||

|

Gross margin |

|

21.4 |

% |

|

|

|

|

22.0 |

% | ||||

|

Operating expenses, net: |

|

|

|

|

|

|

|

|

| ||||

|

Selling, general and administrative |

|

26,409 |

|

(2,414 |

) |

— |

|

23,995 |

| ||||

|

Research and development |

|

20,824 |

|

(1,199 |

) |

— |

|

19,625 |

| ||||

|

Amortization |

|

2,961 |

|

— |

|

(2,961 |

) |

— |

| ||||

|

Restructuring |

|

(286 |

) |

— |

|

286 |

|

— |

| ||||

|

Asset impairment |

|

1,220 |

|

— |

|

(1,220 |

) |

— |

| ||||

|

Changes in contingent consideration |

|

829 |

|

— |

|

(829 |

) |

— |

| ||||

|

Other income, net |

|

(876 |

) |

— |

|

— |

|

(876 |

) | ||||

|

Total operating expenses, net |

|

51,081 |

|

(3,613 |

) |

(4,724 |

) |

42,744 |

| ||||

|

Operating income (loss) |

|

(35,439 |

) |

4,075 |

|

4,724 |

|

(26,640 |

) | ||||

|

Interest expense, net |

|

(18 |

) |

— |

|

— |

|

(18 |

) | ||||

|

Income (loss) before income taxes |

|

(35,457 |

) |

4,075 |

|

4,724 |

|

(26,658 |

) | ||||

|

Income tax provision (benefit) |

|

(13,372 |

) |

1,419 |

|

1,645 |

|

(10,308 |

)*** | ||||

|

Net income (loss) |

|

$ |

(22,085 |

) |

$ |

2,656 |

|

$ |

3,079 |

|

$ |

(16,350 |

) |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Basic EPS |

|

$ |

(0.57 |

) |

|

|

|

|

$ |

(0.42 |

) | ||

|

Diluted EPS |

|

$ |

(0.57 |

) |

|

|

|

|

$ |

(0.42 |

) | ||

|

Basic shares |

|

38,904 |

|

|

|

|

|

38,904 |

| ||||

|

Diluted shares |

|

38,904 |

|

|

|

|

|

38,904 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Non-GAAP operating loss |

|

|

|

|

|

|

|

$ |

(26,640 |

) | |||

|

Depreciation |

|

|

|

|

|

|

|

3,384 |

| ||||

|

Adjusted EBITDA |

|

|

|

|

|

|

|

$ |

(23,256 |

) | |||

|

|

|

|

|

|

|

|

|

|

| ||||

Note: Amounts may not calculate precisely due to rounding.

*** The ‘with or without method’ is utilized to determine the income tax effect of the non-GAAP adjustments.

This table includes financial measures adjusted for the impact of certain items; these financial measures are therefore not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These Non-GAAP financial measures consider exclusion of: share-based compensation expense; one-time charges relating to restructuring initiatives, non-cash asset impairments, certain other non-operating gains and losses, and acquisition-related items such as one-time transaction costs, non-cash amortization of acquired intangible assets, and the stepped-up cost of sales associated with the purchase accounting of acquired inventory.

These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. By excluding these items, non-GAAP financial measures are intended to facilitate meaningful comparisons to historical operating results, competitors’ operating results, and estimates made by securities analysts. Management is evaluated on key performance metrics including adjusted EBITDA, which is used to determine management incentive compensation as well as to forecast future periods. These non-GAAP financial measures may be useful to investors in allowing for greater transparency of supplemental information used by management in its financial and operational decision-making. In addition, similar non-GAAP financial measures have historically been reported to investors; the inclusion of comparable numbers provides consistency in financial reporting. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used in this news release to their most directly comparable GAAP financial measures.

Veeco Instruments Inc. and Subsidiaries

Reconciliation GAAP to Non-GAAP Financial Data

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

Non-GAAP Adjustments |

|

|

| |||||||||

|

For the twelve months ended December 31, 2014 |

|

GAAP |

|

Share-based |

|

Acquisition |

|

Other |

|

Non-GAAP |

| |||||

|

Net sales |

|

$ |

392,873 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

392,873 |

|

|

Cost of sales |

|

257,991 |

|

(2,456 |

) |

(5,175 |

)(a) |

— |

|

250,360 |

| |||||

|

Gross profit |

|

134,882 |

|

2,456 |

|

5,175 |

|

— |

|

142,513 |

| |||||

|

Gross margin |

|

34.3 |

% |

|

|

|

|

|

|

36.3 |

% | |||||

|

Operating expenses, net: |

|

|

|

|

|

|

|

|

|

|

| |||||

|

Selling, general and administrative |

|

89,760 |

|

(11,859 |

) |

(3,242 |

)(b) |

— |

|

74,659 |

| |||||

|

Research and development |

|

81,171 |

|

(4,498 |

) |

— |

|

— |

|

76,673 |

| |||||

|

Amortization |

|

13,146 |

|

— |

|

(13,146 |

) |

— |

|

— |

| |||||

|

Restructuring |

|

4,394 |

|

— |

|

— |

|

(4,394 |

) |

— |

| |||||

|

Asset impairment |

|

58,170 |

|

— |

|

— |

|

(58,170 |

) |

— |

| |||||

|

Changes in contingent consideration |

|

(29,368 |

) |

— |

|

— |

|

29,368 |

|

— |

| |||||

|

Other expense (income), net |

|

(3,182 |

) |

— |

|

— |

|

3,142 |

(c) |

(40 |

) | |||||

|

Total operating expenses, net |

|

214,091 |

|

(16,357 |

) |

(16,388 |

) |

(30,054 |

) |

151,292 |

| |||||

|

Operating income (loss) |

|

(79,209 |

) |

18,813 |

|

21,563 |

|

30,054 |

|

(8,779 |

) | |||||

|

Interest income, net |

|

855 |

|

— |

|

— |

|

— |

|

855 |

| |||||

|

Income (loss) before income taxes |

|

(78,354 |

) |

18,813 |

|

21,563 |

|

30,054 |

|

(7,924 |

) | |||||

|

Income tax provision (benefit) |

|

(11,414 |

) |

— |

|

2,705 |

(d) |

4,908 |

(e) |

(3,801 |

) | |||||

|

Net income (loss) |

|

$ |

(66,940 |

) |

$ |

18,813 |

|

$ |

18,858 |

|

$ |

25,146 |

|

$ |

(4,123 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Basic EPS |

|

$ |

(1.70 |

) |

|

|

|

|

|

|

$ |

(0.10 |

) | |||

|

Diluted EPS |

|

$ |

(1.70 |

) |

|

|

|

|

|

|

$ |

(0.10 |

) | |||

|

Basic shares |

|

39,350 |

|

|

|

|

|

|

|

39,350 |

| |||||

|

Diluted shares |

|

39,350 |

|

|

|

|

|

|

|

39,350 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

|

Non-GAAP operating loss |

|

|

|

|

|

|

|

|

|

$ |

(8,779 |

) | ||||

|

Depreciation |

|

|

|

|

|

|

|

|

|

11,426 |

| |||||

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

$ |

2,647 |

| ||||

Note: Amounts may not calculate precisely due to rounding.

(a) The inventory fair value step-up associated with the PSP acquisition’s purchase accounting.

(b) One-time PSP acquisition related transaction costs.

(c) One-time cumulative translation gain related to the liquidation of our Japanese subsidiary.

(d) Valuation allowance reversal associated with the recognition of deferred tax liabilities related to the PSP acquisition.

(e) $4.9 million tax liability reversal related to an incentive tax rate in a foreign subsidiary as well as utilization of the ‘with or without’ method.

This table includes financial measures adjusted for the impact of certain items; these financial measures are therefore not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These Non-GAAP financial measures consider exclusion of: share-based compensation expense; one-time charges relating to restructuring initiatives, non-cash asset impairments, certain other non-operating gains and losses, and acquisition-related items such as one-time transaction costs, non-cash amortization of acquired intangible assets, and the stepped-up cost of sales associated with the purchase accounting of acquired inventory.

These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. By excluding these items, non-GAAP financial measures are intended to facilitate meaningful comparisons to historical operating results, competitors’ operating results, and estimates made by securities analysts. Management is evaluated on key performance metrics including adjusted EBITDA, which is used to determine management incentive compensation as well as to forecast future periods. These non-GAAP financial measures may be useful to investors in allowing for greater transparency of supplemental information used by management in its financial and operational decision-making. In addition, similar non-GAAP financial measures have historically been reported to investors; the inclusion of comparable numbers provides consistency in financial reporting. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used in this news release to their most directly comparable GAAP financial measures.

Veeco Instruments Inc. and Subsidiaries

Reconciliation GAAP to Non-GAAP Financial Data

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

Non-GAAP Adjustments |

|

|

| ||||||

|

For the twelve months ended December 31, 2013 |

|

GAAP |

|

Share-based |

|

Other |

|

Non-GAAP |

| ||||

|

Net sales |

|

$ |

331,749 |

|

$ |

— |

|

$ |

— |

|

$ |

331,749 |

|

|

Cost of sales |

|

228,607 |

|

(1,446 |

) |

— |

|

227,162 |

| ||||

|

Gross profit |

|

103,142 |

|

1,446 |

|

— |

|

104,588 |

| ||||

|

Gross margin |

|

31.1 |

% |

|

|

|

|

31.5 |

% | ||||

|

Operating expenses, net: |

|

|

|

|

|

|

|

|

| ||||

|

Selling, general and administrative |

|

85,486 |

|

(8,338 |

) |

— |

|

77,148 |

| ||||

|

Research and development |

|

81,424 |

|

(3,347 |

) |

— |

|

78,077 |

| ||||

|

Amortization |

|

5,527 |

|

— |

|

(5,527 |

) |

— |

| ||||

|

Restructuring |

|

1,485 |

|

— |

|

(1,485 |

) |

— |

| ||||

|

Asset impairment |

|

1,220 |

|

— |

|

(1,220 |

) |

— |

| ||||

|

Changes in contingent consideration |

|

829 |

|

— |

|

(829 |

) |

— |

| ||||

|

Other income, net |

|

(1,017 |

) |

— |

|

— |

|

(1,017 |

) | ||||

|

Total operating expenses, net |

|

174,954 |

|

(11,685 |

) |

(9,061 |

) |

154,208 |

| ||||

|

Operating income (loss) |

|

(71,812 |

) |

13,130 |

|

9,061 |

|

(49,621 |

) | ||||

|

Interest income, net |

|

602 |

|

— |

|

— |

|

602 |

| ||||

|

Income (loss) before income taxes |

|

(71,210 |

) |

13,130 |

|

9,061 |

|

(49,019 |

) | ||||

|

Income tax provision (benefit) |

|

(28,947 |

) |

4,733 |

|

3,266 |

|

(20,948 |

)*** | ||||

|

Net income (loss) |

|

$ |

(42,263 |

) |

$ |

8,398 |

|

$ |

5,795 |

|

$ |

(28,071 |

) |

|

|

|

|

|

|

|

|

|

|

| ||||

|

Basic EPS |

|

$ |

(1.09 |

) |

|

|

|

|

$ |

(0.72 |

) | ||

|

Diluted EPS |

|

$ |

(1.09 |

) |

|

|

|

|

$ |

(0.72 |

) | ||

|

Basic shares |

|

38,807 |

|

|

|

|

|

38,807 |

| ||||

|

Diluted shares |

|

38,807 |

|

|

|

|

|

38,807 |

| ||||

|

|

|

|

|

|

|

|

|

|

| ||||

|

Non-GAAP operating income (loss) |

|

|

|

|

|

|

|

$ |

(49,621 |

) | |||

|

Depreciation |

|

|

|

|

|

|

|

12,898 |

| ||||

|

Adjusted EBITDA |

|

|

|

|

|

|

|

$ |

(36,723 |

) | |||

Note: Amounts may not calculate precisely due to rounding.

*** The ‘with or without method’ is utilized to determine the income tax effect of the non-GAAP adjustments.

This table includes financial measures adjusted for the impact of certain items; these financial measures are therefore not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These Non-GAAP financial measures consider exclusion of: share-based compensation expense; one-time charges relating to restructuring initiatives, non-cash asset impairments, certain other non-operating gains and losses, and acquisition-related items such as one-time transaction costs, non-cash amortization of acquired intangible assets, and the stepped-up cost of sales associated with the purchase accounting of acquired inventory.

These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. By excluding these items, non-GAAP financial measures are intended to facilitate meaningful comparisons to historical operating results, competitors’ operating results, and estimates made by securities analysts. Management is evaluated on key performance metrics including adjusted EBITDA, which is used to determine management incentive compensation as well as to forecast future periods. These non-GAAP financial measures may be useful to investors in allowing for greater transparency of supplemental information used by management in its financial and operational decision-making. In addition, similar non-GAAP financial measures have historically been reported to investors; the inclusion of comparable numbers provides consistency in financial reporting. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used in this news release to their most directly comparable GAAP financial measures.

Veeco Instruments Inc. and Subsidiaries

Reconciliation GAAP to Non-GAAP Financial Data

(In millions, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

Non-GAAP Adjustments |

|

|

|

|

|

|

| |||||||||||

|

Guidance for the three months ended March 31, 2015 |

|

GAAP |

|

Share-based |

|

Acquisition |

|

Other |

|

Non-GAAP |

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Net sales |

|

$ |

92 |

|

- |

|

$ |

100 |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

92 |

|

- |

|

$ |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Gross profit |

|

31.0 |

|

- |

|

35.5 |

|

0.7 |

|

1.8 |

(a) |

— |

|

33.5 |

|

- |

|

38.0 |

| |||||||

|

Gross margin |

|

33 |

% |

- |

|

35 |

% |

|

|

|

|

|

|

36 |

% |

- |

|

38 |

% | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Operating expenses, net |

|

52.4 |

|

- |

|

54.4 |

|

(4.5 |

) |

(8.4 |

)(b) |

(3.0 |

)(c) |

36.5 |

|

- |

|

38.5 |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Operating income (loss) |

|

(21.4 |

) |

- |

|

(18.9 |

) |

|

|

|

|

|

|

(3.0 |

) |

- |

|

(0.5 |

) | |||||||

|

Depreciation |

|

|

|

|

|

|

|

|

|

|

|

|

|

3.0 |

|

|

|

3.0 |

| |||||||

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.0 |

|

- |

|

$ |

2.5 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Net income (loss) |

|

(23.6 |

) |

- |

|

(21.0 |

) |

5.2 |

|

10.2 |

|

3.0 |

|

(5.2 |

) |

- |

|

(2.6 |

) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

|

Income (loss) per diluted common share: |

|

$ |

(0.59 |

) |

- |

|

$ |

(0.53 |

) |

|

|

|

|

|

|

$ |

(0.13 |

) |

- |

|

$ |

(0.07 |

) | |||

|

Weighted average number of diluted shares: |

|

39.7 |

|

|

|

|

|

|

|

|

|

|

|

39.7 |

|

|

|

|

| |||||||

Note: Amounts may not calculate precisely due to rounding.

(a) The inventory fair value step-up associated with the PSP acquisition’s purchase accounting.

(b) Acquisition related amortization expense.

(c) Restructuring charges.

This table includes financial measures adjusted for the impact of certain items; these financial measures are therefore not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). These Non-GAAP financial measures consider exclusion of: share-based compensation expense; one-time charges relating to restructuring initiatives, non-cash asset impairments, certain other non-operating gains and losses, and acquisition-related items such as one-time transaction costs, non-cash amortization of acquired intangible assets, and the stepped-up cost of sales associated with the purchase accounting of acquired inventory.

These non-GAAP financial measures may be different from non-GAAP financial measures used by other companies. Non-GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. By excluding these items, non-GAAP financial measures are intended to facilitate meaningful comparisons to historical operating results, competitors’ operating results, and estimates made by securities analysts. Management is evaluated on key performance metrics including adjusted EBITDA, which is used to determine management incentive compensation as well as to forecast future periods. These non-GAAP financial measures may be useful to investors in allowing for greater transparency of supplemental information used by management in its financial and operational decision-making. In addition, similar non-GAAP financial measures have historically been reported to investors; the inclusion of comparable numbers provides consistency in financial reporting. Investors are encouraged to review the reconciliation of the non-GAAP financial measures used in this news release to their most directly comparable GAAP financial measures.