Filed by the Registrant ☒ | ||||

Filed by a Party other than the Registrant ☐ | ||||

Check the appropriate box: | ||||

☐ |

Preliminary Proxy Statement | |||

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ |

Definitive Proxy Statement | |||

☐ |

Definitive Additional Materials | |||

☐ |

Soliciting Material under §240.14a-12 | |||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check all boxes that apply): | ||||

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials: | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| Letter from |

March 29, 2024

|

|

||||||||

| Letter from Our CEO & Chair

|

|

Brian X. Tierney President & CEO

John W. Somerhalder III Non-Executive Board Chair |

||||||

Dear FirstEnergy Shareholders:

Thank you for your confidence in FirstEnergy. On behalf of your Board of Directors and management team, we hope you will join us at our 2024 Annual Meeting of Shareholders on May 22, 2024, at 8 a.m., EDT. A schedule of business to be conducted at the meeting is available in the attached Notice of the 2024 Annual Meeting of Shareholders, and the accompanying Proxy Statement includes information about your Board; items to be voted on; FirstEnergy’s employee, environmental, social and governance (“EESG”) practices; and our executive compensation programs. To support greater accessibility for all shareholders, the meeting will be conducted online. To attend the virtual event, please follow the registration instructions listed on your proxy card. Additional registration information is available in the Questions and Answers section of this Proxy Statement, under the heading, “Attending the Virtual Annual Meeting.”

A New Energy

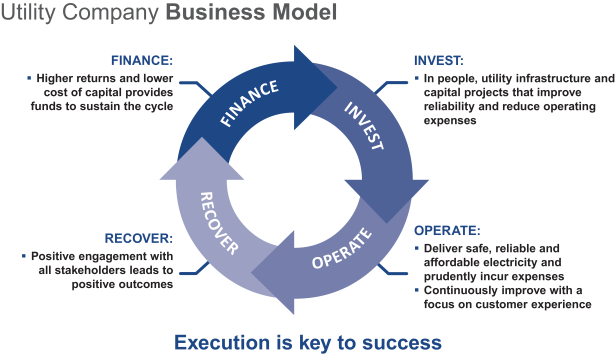

Powered by our passionate employees and guided by our experienced leadership team and engaged Board, FirstEnergy is accelerating its transformation into a premier utility. We’re proud of the progress we’ve made. With a strong foundation, clear focus and robust strategy to deliver long-term value to our shareholders, customers, communities and employees, we’re excited about our future. Your Board and FirstEnergy’s executive management team are aligned behind a business model grounded in investing, operating, recovering costs and financing our regulated utility operations. This business model creates a “virtuous cycle” that will help improve reliability and the customer experience, grow rate base, engage employees, improve returns and maintain a strong balance sheet. Along with our unwavering commitment to ethics and integrity, performance excellence and continuous improvement, we are confident that strong execution of this model will help us achieve our strategic objectives and deliver value to our investors. Our recent results illustrate the compelling progress we are making in your Company’s transformation, guided by the virtuous cycle.

| 2024 PROXY STATEMENT |

| Letter from |

Invest

We invest in our regulated operations to improve reliability and the customer experience. We invest in our people to attract, retain and develop talented, diverse and engaged employees to carry out our mission.

| ◾ | Implementing a robust plan for customer-focused growth. Earlier this year, we expanded our customer-focused growth initiatives with the introduction of Energize365, a five-year, $26 billion regulated investment program to deliver the power our customers depend on now and in the future. Energize365 solidly supports our long-term, 6% to 8% targeted annual operating earnings per share growth rate. |

| ◾ | Revitalizing our leadership team. We were pleased to welcome several leaders, all with extensive utility experience, to FirstEnergy in 2023: Wade Smith is our new President of FirstEnergy Utilities; Toby Thomas is Chief Operating Officer; Abigail Phillips is Vice President and Chief Risk Officer; and Amanda Mertens Campbell is Vice President External Affairs. Each of these outstanding individuals has the experience, leadership and integrity to help lead their functions and make a significant difference at your Company. In addition, we’re working to name new presidents for each of our five operating businesses who will report to Wade, as well as an executive to lead our Shared Services organization. |

Operate

The second phase of the cycle engages our skilled, trained, talented and diverse team of employees to effectively implement our investment plans, seek opportunities for continuous improvement as we deliver safe, reliable and affordable electricity to our customers and deliver value to our investors.

| ◾ | Enhancing our focus on the customer. To execute our vision, we’re shifting more decision-making and accountability for our operations closer to our customers, regulators and employees doing the work. Our new operating structure includes five major businesses: Ohio, Pennsylvania, New Jersey, West Virginia/Maryland and our standalone Transmission properties. This structure will foster better execution at the business unit level. |

| ◾ | Embracing a continuous improvement mindset. We were buffeted by numerous financial headwinds in 2023, including weather and the impact of market conditions on our pension plan. Through a determined effort by our employees, we focused on the things we could control: managing costs, enhancing the customer experience and seeking opportunities for continuous improvement. As a result, we increased our customer-focused investments, exceeded our guidance midpoint and entered 2024 on strong footing. |

| FIRSTENERGY CORP. | ||||

| Letter from |

Recover

Operating effectively leads to strong, predictable results and enhances credibility with our stakeholders. In turn, we build supportive relationships with regulators, customers and intervenors to help drive positive rate outcomes that support recovery of our investments.

| ◾ | Achieving important regulatory milestones. In 2023, we launched a robust regulatory calendar to address investments that benefit our customers through reliability enhancements and a smarter and cleaner electric grid while maintaining our strong affordability position. The results to date – including resolution of base rate cases in Maryland, West Virginia and New Jersey – are reasonable and constructive for FirstEnergy and support prudent investments for customers. |

Finance

With sound capital allocation, enhanced reliability and better regulatory outcomes, FirstEnergy represents a compelling investment and can finance the business at a lower cost of capital, allowing us to begin the virtuous cycle all over again at “Invest.”

| ◾ | Dramatically strengthening our financial position. Since 2021, we’ve raised $7 billion in equity capital to significantly improve our balance sheet in a manner that enhances the overall value of our Company. We’ve also reduced risk associated with our pension plan and optimized our financing plan to retain flexibility in a high interest rate environment. Our stronger balance sheet supports our plan to fund Energize365 investments through organic internal cash flow and utility debt – not incremental equity. |

| ◾ | Returning value to shareholders. Reflecting your Company’s stronger financial position, last year the Board increased the targeted dividend payout ratio to 60 to 70 percent of operating earnings. We subsequently raised the quarterly dividend for the first time in more than three years and announced a second increase earlier this month. Subject to continued Board approval, these increases represent an annual rate of $1.70 per share in 2024, or a 6% increase compared to dividends declared in 2023. Our goal is to increase our dividend with operating earnings growth over time. |

Our Commitment to Responsible Business

Woven through our business model is our commitment to responsible business that supports our customers and employees, demonstrates strong stewardship of the environment and our communities, and is grounded in strong governance. This includes ongoing, constructive engagement with our stakeholders, which positions us to understand and respond to their needs and strengthen these important relationships. Responsible business is good business that helps us refine and execute our strategies while advancing our goal to become a leader in our industry.

Your Board and management team will continue to engage with you regularly and keep you updated on your Company’s progress. I invite you to read more about your Board of Directors, Company strategies, business practices and executive compensation programs in the accompanying Proxy Statement.

FirstEnergy is establishing a track record of strong execution. With a diversified asset mix, improved balance sheet and a strong affordability position, we are well positioned to significantly enhance the customer experience and provide value to our investors. We understand that your confidence in our Company is predicated on execution of our operating, regulatory and investment plans, and we intend to continue demonstrating positive milestones in each of these categories in 2024.

We appreciate your support and thank you in advance for voting promptly.

| Brian X. Tierney | John W. Somerhalder | |

|

|

| 2024 PROXY STATEMENT | ||||

| Notice of Annual Meeting of Shareholders |

Notice of Annual Meeting of Shareholders

Please carefully review this Notice, the FirstEnergy Corp.’s Annual Report to Shareholders for the year ended December 31, 2023 (the “2023 Annual Report”), and the accompanying Proxy Statement of FirstEnergy Corp. (the “Company”) and vote your shares by following the instructions on your proxy card/voting instruction form or Notice of Internet Availability of Proxy Materials to ensure your vote is cast at the 2024 Annual Meeting of Shareholders (the “Annual Meeting”).

| DATE AND TIME

Wednesday, May 22, 2024

RECORD DATE

March 25, 2024 |

WEBCAST

The Annual Meeting will be a virtual meeting of shareholders, conducted via live webcast, and will take place at: www.cesonlineservices.com/fe24_vm. Online access will begin at 7:30 a.m. EDT on May 22, 2024. There will be no physical location for in-person attendance at the Annual Meeting.

Shareholders must register in advance to attend, ask questions or vote at the virtual Annual Meeting. Registration instructions are available in the Questions and Answers section of the accompanying Proxy Statement, under the heading, “Attending the Virtual Annual Meeting.” Only shareholders of record as of the close of business on March 25, 2024, or their proxy holders, may vote at the Annual Meeting. | |

AGENDA

On behalf of the Board of Directors,

|

Mary M. Swann Corporate Secretary and Associate General Counsel Akron, Ohio |

This Notice and accompanying Proxy Statement are first being mailed or made available to shareholders on or about March 29, 2024.

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 22, 2024. Our Proxy Statement is attached. Financial and other information concerning FirstEnergy Corp. is contained in our 2023 Annual Report. The Proxy Statement and the 2023 Annual Report are available, free of charge, at www.FirstEnergyCorp.com/AnnualMeeting.

|

| 2024 PROXY STATEMENT |

| Table of |

Table of Contents

| FIRSTENERGY CORP. | ||||

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

|

FORWARD-LOOKING STATEMENTS

This Proxy Statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from government investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement entered into July 21, 2021 with the U.S. Attorney’s Office for the Southern District of Ohio; the risks and uncertainties associated with government investigations and audits regarding Ohio House Bill 6, as passed by Ohio’s 133rd General Assembly (“HB 6”) and related matters, including potential adverse impacts on federal or state regulatory matters, including, but not limited to, matters relating to rates; the risks and uncertainties associated with litigation, arbitration, mediation, and similar proceedings, particularly regarding HB 6 related matters, including risks associated with obtaining dismissal of the derivative shareholder lawsuits; changes in national and regional economic conditions, including recession, rising interest rates, inflationary pressure, supply chain disruptions, higher energy costs, and workforce impacts, affecting us and/or our customers and those vendors with which we do business; weather conditions, such as temperature variations and severe weather conditions, or other natural disasters affecting future operating results and associated regulatory actions or outcomes in response to such conditions; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity, cyber security, and climate change; the risks associated with physical attacks, such as acts of war, terrorism, sabotage or other acts of violence, and cyber-attacks and other disruptions to our, or our vendors’, information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to meet our goals relating to employee, environmental, social and corporate governance opportunities, improvements, and efficiencies, including our greenhouse gas (“GHG”) reduction goals; the ability to accomplish or realize anticipated benefits through establishing a culture of continuous improvement and our other strategic and financial goals, including, but not limited to, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our Energize365 transmission and distribution investment plan, executing on our rate filing strategy, controlling costs, improving our credit metrics, growing earnings, strengthening our balance sheet; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts may negatively impact our forecasted growth rate, results of operations, and may also cause us to make contributions to our pension sooner or in amounts that are larger than currently anticipated; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; changes to environmental laws and regulations, including but not limited to those related to climate change; changes in customers’ demand for power, including but not limited to, economic conditions, the impact of climate change, emerging technology, particularly with respect to electrification, energy storage and distributed sources of generation; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; future actions taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding factors such as economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; the potential of non-compliance with debt covenants in our credit facilities; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; human capital management challenges, including among other things, attracting and retaining appropriately trained and qualified employees and labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, including, but not limited to, the Inflation Reduction Act of 2022, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our Securities and Exchange Commission (“SEC”) filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s (a) Item 1A. Risk Factors, (b) Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations, and (c) other factors discussed herein and in FirstEnergy’s other filings with the SEC. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise.

|

WEBSITES

Website addresses referenced in this proxy statement are inactive textual references only, and the content on the referenced websites specifically does not constitute a part of this proxy statement.

| 2024 PROXY STATEMENT | 1 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

MISSION STATEMENT

We are a forward-thinking electric utility centered on integrity, powered by a diverse team of employees committed to making customers’ lives brighter, the environment better and our communities stronger.

OUR CORE VALUES

FirstEnergy’s core values encompass what matters most to us. They guide our actions every day and define who we aspire to be in the future.

| 2 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

CODE OF CONDUCT

FirstEnergy’s Code of Conduct, The Power of Integrity, lays the foundation for what we expect from the Board and all employees. It reflects our collective commitment to keep integrity at the forefront of everything we do — a pledge underscored by the inclusion of integrity in our mission, core values and Company strategy.

COMPANY STRATEGY

Our Strategy and Strong Platform for Growth

Our strategy is based on a business model grounded in investing, operating, recovering our costs and financing our regulated utility operations. This business model creates a “virtuous cycle” that will help improve reliability, grow rate base, engage employees, improve returns and achieve a strong balance sheet. Along with our unwavering commitment to ethics and integrity, performance excellence and continuous improvement, this model will help us achieve our strategic objectives.

Through a series of successful strategic actions, FirstEnergy entered 2024 with a much stronger financial foundation. We’ve provided investors with a robust five-year capital investment plan that supports consistent, predictable growth with significantly improved earnings quality, investment grade credit metrics and, subject to further board approval, dividend growth in line with earnings growth. The cornerstone of this plan is our Energize365 grid evolution program focused on transmission and distribution investments that will deliver the power our customers depend on today while also meeting the challenges of tomorrow. With $26 billion in planned investments from 2024 through 2028, Energize365 will forge a smarter, more secure grid, enhance reliability and the customer experience and support the transition toward a more sustainable energy landscape, while ensuring a fair and reasonable regulated return for our investors.

2024-2028 Investment Plan Summary

|

ENERGY TRANSITION: Distribution and Transmission investments to support improvements in grid reliability and resiliency and support interconnection of renewable sources

◾ Clean Energy: WV Solar Generation, Energy Efficiency, EV infrastructure, Energy Storage ◾ Grid Modernization: Programs to drive system resiliency through automation technology and communication (OH Grid Mod II, PA LTIIP, Energize NJ (IIP), Smart Meter) ◾ Transmission: – Operational Flexibility Projects (build capacity and support evolving grid such as interconnection of NJ Offshore Wind and Data Center load) – Enhance System Performance (implement new designs/technologies to reduce load at risk) – Upgrade System Conditions (enhance reliability) – Regulatory Required Projects

Infrastructure Renewal: Base distribution projects to address aging infrastructure (system break/fix, substation equipment replacement)

Fossil Generation: Projects to maintain operations of fossil plants and remain compliant with environmental regulations through the end of their useful life

| |

|

Our Scale and Diversity provides low-risk flexibility to seamlessly shift investments as needed

|

| 2024 PROXY STATEMENT | 3 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

EESG FOCUS

The pillars of our Company strategy are supported by our employee, environmental, social and governance (EESG) priorities and aligned with our commitment to corporate responsibility. Because of this strategic integration, we believe that improving our EESG performance also furthers our strategy and helps us become a more innovative, diverse, sustainable and industry-leading company.

|

EESG Priorities: |

||||||

|

EMPLOYEE: Support the development of a safe, inclusive, equitable, accountable and rewarding work culture where diversity and innovation drive continuous improvement and empower us to make our customers’ lives brighter and our communities stronger |

|||||

|

ENVIRONMENTAL: Protect the environment by minimizing our impact, improving the sustainability of our operations, executing on our climate strategy and finding opportunities to enhance the ecosystems in which we operate |

|||||

|

SOCIAL: Invest in the communities that we serve, promote public safety and economic development, and advance equitable and inclusive business practices to enable positive, sustainable change while delivering superior customer service |

|||||

|

GOVERNANCE: Maintain oversight of significant Company issues and strengthen risk management; build a strong, centralized corporate compliance program; ensure a culture of ethics and integrity; continue stakeholder engagement efforts; and provide consistent, transparent disclosures on a range of EESG topics

|

|||||

COMPANY CULTURE

Our core values are the foundation of our strategy and long-term success. Integrity, Safety, Performance Excellence, Diversity, Equity and Inclusion (DEI), and Stewardship are the bedrock from which we operate, behave and interact every day, without fear of retaliation. We are committed to a culture of continuous improvement, grounded in ethics and integrity where employees feel safe to be themselves, speak up and bring their best to work every day. Creating a work environment that prioritizes employees’ safety, health and well-being is also key to strong culture. We strive to prioritize, operationalize and live these values in everything we do, internally and externally. They guide our behavior, our decisions and ultimately the actions that drive our performance and success.

HUMAN CAPITAL MANAGEMENT

Strong performance and engagement from our workforce drives FirstEnergy’s success. We’re committed to moving the Company forward by keeping each other safe, delivering value to our stakeholders, and transforming our culture in alignment with our core values. Integrity is critical to our path to a stronger, more sustainable FirstEnergy, and reflects our collective commitment to conduct business ethically. We expect all employees to do the right thing, and we treat our coworkers and communities with the respect we all deserve. Further details of our focus on keeping our core values and behaviors at the center of everything we do, and our desire to help our employees to do their best each day are included in the “Our Commitment to EESG” section of this Proxy Statement.

| 4 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

CLIMATE STRATEGY

The world is transitioning toward a more sustainable energy landscape to reduce greenhouse gas (GHG) emissions and avoid negative physical impacts of climate change. We believe that our ability to support that wider effort, as well as adapt, mitigate risks and capitalize on low-carbon opportunities is key to our long-term value and success. Investing in a resilient, flexible and technologically advanced grid, supporting the integration of diversified and renewable energy sources, and reducing our carbon footprint are essential steps to enable the energy transition in our region and ensure our continued participation and growth in a changing energy market.

Serving over 6 million customers across states with varied climate-related challenges, economic conditions and regulatory environments, FirstEnergy is committed to doing its part to help ensure a bright future for our customers, employees, communities and the environment. With a keen understanding of our industry and customers’ needs, our leaders are engaging at the national and local levels to protect our communities and illuminate the path to a stronger, more electrified future. They are also engaging internally on climate matters through our strong governance and oversight practices.

Our climate strategy is two-fold:

| 1) | Reduce our Company’s Scope 1 GHG emissions and achieve Scope 1 carbon neutrality by 2050. |

| 2) | Support broader GHG reductions in our region by helping to enable the energy transition to a low-carbon future. |

To read more about our decarbonization strategy, including information about our Scope 2 and Scope 3 GHG emissions, please visit the Climate Story page of our Corporate Responsibility website (https://www.fecorporateresponsibility.com/climatestory).

| 2024 PROXY STATEMENT | 5 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Proxy Statement Summary

2024 Annual Meeting of Shareholders (the “Annual Meeting” or the “Meeting”)

| ◾ | Time and Date: 8:00 a.m. EDT on Wednesday, May 22, 2024 |

| ◾ | Location: The Annual Meeting will be a virtual meeting of shareholders, conducted via live webcast, and will take place at: www.cesonlineservices.com/fe24_vm. Online access will begin at 7:30 a.m. EDT on May 22, 2024. |

| ◾ | Record Date: March 25, 2024 |

| ◾ | Voting: Shareholders of FirstEnergy Corp. common stock as of the Record Date are entitled to receive the Notice of Annual Meeting of Shareholders and they or their proxy holders may vote their shares at the Annual Meeting. |

| ◾ | Admission: If you plan to attend the Annual Meeting, you must register in advance. Registration instructions are available in the Questions and Answers section of the accompanying Proxy Statement, under the heading, “Attending the Virtual Annual Meeting.” Shareholders may only participate online and must pre-register to vote and ask questions at the virtual Annual Meeting. |

VOTING MATTERS

| Item 1 |

Elect the 10 nominees named in this Proxy Statement to the Board of Directors (“Board”). Refer to page 33 for more detail. |

Item 3 |

Approve on an advisory basis named executive officer compensation. Refer to page 35 for more detail. | |||||||

|

✓ |

Your Board recommends you vote FOR the election of all the nominees listed in this Proxy Statement. |

✓ | Your Board recommends you vote FOR this item. | |||||||

| Item 2 |

Ratify the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for 2024. Refer to page 34 for more detail. |

Items 4 - 6 |

Shareholder proposals. Refer to page 36-44 for more detail. | |||||||

|

✓ |

Your Board recommends you vote FOR this item. |

X | Your Board recommends you vote AGAINST each of these items. | |||||||

| 6 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

HOW TO CAST YOUR VOTE

Your vote is important! Even if you plan to attend our Annual Meeting virtually, please cast your vote as soon as possible by:

|

Do you hold shares directly with FirstEnergy or in the FirstEnergy Corp. Savings Plan?

|

||||||||||||

|

INTERNET |

|

|

|||||||||

| Use the internet at www.cesvote.com | Mail by returning your proxy card/voting instruction form(1) | |||||||||||

|

TELEPHONE |

|

DURING THE MEETING |

|||||||||

| Call toll-free at 1-888-693-8683 | This year’s meeting will be virtual. For details on voting your shares during the meeting, see “Questions and Answers about the Annual Meeting.” | |||||||||||

| |

||||||||||||

|

(1) If your pre-addressed envelope is misplaced, send your proxy card to Corporate Election Services, Inc., the Company’s independent proxy tabulator and Inspector of Election. The address is FirstEnergy Corp., c/o Corporate Election Services, P.O. Box 1150, Pittsburgh, PA 15230.

| ||||||||||||

| Do you hold shares through a bank, broker or other institution (beneficial ownership)?(2) | ||||

| Use the internet at www.proxyvote.com |

Call toll-free at 1-800-454-8683 |

Mail by returning your proxy card/voting instruction form | ||

|

(2) Not all beneficial owners may be able vote at the web address and phone number provided above. If your control number is not recognized, please refer to your voting instruction form for specific voting instructions.

| ||||

Please follow the instructions provided on your proxy card/voting instruction form (the “proxy card”), Notice of Internet Availability of Proxy Materials, or electronic or other communications included with your proxy materials. Shareholders as of the March 25, 2024, Record Date may attend the virtual Annual Meeting and vote if registered in advance by following the Advance Registration Instructions below. Refer to the “Questions and Answers about the Annual Meeting” section below for more details, including the Advance Registration Instructions and questions 2, 13 and 15.

If you have multiple accounts, you may receive more than one proxy card or voting instruction form and related materials. Please vote each proxy card and voting instruction form that you receive.

| 2024 PROXY STATEMENT | 7 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Your Board Nominees

The following provides summary information about each nominee standing for election to your Board. Each member stands for election annually.

Your Board nominees are highly qualified individuals and represent a diversity of gender, ethnicity, age, tenure, thought, background and experiences. Your Board is periodically refreshed with the addition of candidates whom we believe bring new ideas and fresh perspectives into the boardroom.

|

Heidi L. Boyd, 39

Independent Director Senior managing director of Blackstone Infrastructure Group |

Jana T. Croom, 47

Independent Director Chief financial officer of Kimball Electronics, Inc. |

|||

|

Paul Kaleta, 68

Independent Director Retired executive vice president and |

James F. O’Neil III, 65

Independent Director Former Chief executive officer and vice chairman of Orbital Infrastructure Group, Inc. |

|||

|

Leslie M. Turner, 66

Independent Director Retired senior vice president, general counsel and corporate secretary of |

||||

| 8 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

|

|

||||

|

Steven J. Demetriou, 65

Independent Director Executive board chair of Jacobs Solutions Inc. Other public boards 2 |

Lisa Winston Hicks, 57

Independent Director Lead Independent Director of FirstEnergy Corp. Retired board chair | |||

|

John W. Somerhalder II, 68

Director Non-Executive Board Chair of FirstEnergy Corp. Previously Interim President and Other public boards 1 |

Brian X. Tierney, 56

Director President and Chief Executive | |||

|

Melvin D. Williams, 60

Independent Director Retired president of Nicor Gas and Southern Company Gas |

||||

|

|

||||

| OUR COLLECTIVE DIRECTOR NOMINEE SKILLS

| ||

| 2024 PROXY STATEMENT | 9 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Key Board Corporate Governance Features

Your Board is committed to strong corporate governance, which we believe is important to the success of our business and in advancing shareholder interests. Highlights include:

| Independent Oversight | ◾ All directors are independent, other than our Non-Executive Board Chair and CEO

◾ The Board’s three primary standing committees are comprised entirely of independent directors

◾ Independent directors regularly hold executive sessions without management at Board and committee meetings

| |||

| Board & Committee Oversight | ◾ Your Board and Committees regularly review material risks facing your Company and, through the Audit Committee, oversee your Company’s enterprise risk management practices

◾ The Audit Committee also provides oversight of risks related to financial statements and financial controls, cybersecurity regulatory compliance, the Office of Ethics and Compliance and the Internal Audit function

◾ The Operations and Safety Oversight Committee oversees the operational function of the Company, including operational cybersecurity risk

◾ Through the Governance, Corporate Responsibility and Political Oversight Committee, your Board oversees corporate citizenship practices, including the Political and Lobbying Action Plan, EESG and sustainability initiatives

◾ The Compensation Committee oversees the Company’s compensation philosophy, practices and human capital initiatives, and focuses on alignment between pay and performance

◾ Operations and Safety Oversight Committee oversees operational strategy including reliability, safety, cybersecurity risks and audits, as well as environmental practices and policies

| |||

| Shareholder Rights & Accountability |

◾ Annual election of all directors

◾ Clear, effective process for shareholders to raise concerns to your Board

◾ Majority voting standard for uncontested director elections, with an accompanying Director Resignation Policy

◾ General majority voting threshold

◾ Direct investor relations and governance engagement and outreach to shareholders

◾ Advisory vote to approve named executive officer compensation held on an annual basis, consistent with the shareholder advisory vote on frequency

◾ Shareholders may nominate directors through proxy access

◾ Shareholders of 20% or more shares outstanding and entitled to vote may call a special meeting

◾ No poison pill

| |||

| Board Practices | ◾ The Board balances directors’ skills, experiences, and perspectives with a mix of diverse characteristics, including gender, race and ethnicity, tenure and background

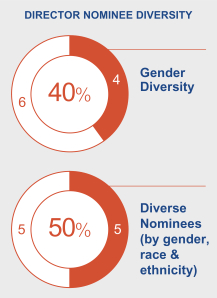

◾ The Board is comprised of 40% female directors and 50% diverse directors by gender, race and ethnicity combined.

◾ Actively seek to include in the director nominee pool candidates of diverse backgrounds, skills and experience, including highly qualified women and people of color

◾ A robust annual evaluation process, including full Board evaluation, Board committee evaluations and individual director evaluations

◾ Policy requiring directors who reach the age of 72 to tender their resignations to your Board to be effective upon acceptance by the Board

◾ Governance, Corporate Responsibility and Political Oversight Committee and full Board engage in rigorous director succession planning

◾ Extensive director orientation and continuing education

◾ Robust stock ownership guidelines

◾ Anti-Hedging and Anti-Pledging Policies

| |||

Our corporate governance practices are described in greater detail in the “Corporate Governance and Board of Directors Information” section beginning on page 12.

| 10 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Executive Compensation Highlights

Under our compensation design, the percentage of pay that is based on performance increases as the responsibilities of a Named Executive Officer (“NEO”) increase. The charts below illustrate the mix of annualized base salary. 2023 target short-term incentive program (“STIP”) and target long-term incentive program (“LTIP”) awards for our NEOs. Approximately 89% of the President and CEO’s total target annual pay and 77% of our other NEOs’ (excluding Mr. Somerhalder) average annual target pay is variable and could be reduced to zero if performance metrics are not met at a minimum threshold level. For the NEOs who were serving as executive officers as of December 31, 2023, the values shown are effective as of December 31, 2023. The charts below exclude Mr. Somerhalder(1) due to the interim status of his role in 2023.

(1) During his role as Interim President and CEO (September 2022 to May 2023), Mr. Somerhalder’s pay mix for 2023 was made up of approximately 12% for base salary, 16% for target STIP award, and 72% for time-based restricted stock. Mr. Somerhalder’s pay mix in his former role is less variable than that of the other NEOs due to his interim status.

We believe that our executive compensation philosophy and practices align with the long-term interests of our shareholders and with commonly viewed best practices in the market.

| WHAT WE

|

◾ LTIP(1) is 100% performance-based and at risk, with no solely time-based vesting requirements ◾ STIP is 100% at risk

◾ All STIP award payouts are contingent on achieving an Operating Earnings threshold, after accounting for the cost of the STIP payout ◾ Individual STIP awards capped at 200% (consistent with peer companies) ◾ Individual LTIP awards capped at 200% (consistent with peer companies) and capped at 100% if absolute Total Shareholder Return (“TSR”) over the performance period is negative

|

◾ Financial and reputational harm, and other detrimental activity ◾ Mandatory recoupment for financial restatement applying to current and former Section 16 Officers

| ||

| WHAT WE

|

|

| ||

(1) Excludes Mr. Somerhalder due to his interim status. For more details see the “Time-based Equity Award for Mr. Somerhalder” section.

Our executive compensation practices are described in greater detail in the “Executive Compensation” section of this proxy statement, beginning on page 55.

| 2024 PROXY STATEMENT | 11 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Corporate Governance and Board of Directors Information

Board Leadership Structure

The positions of CEO, Non-Executive Board Chair and Lead Independent Director are held by separate individuals. Our Third Amended and Restated Code of Regulations, as amended (“Code of Regulations”) and Corporate Governance Policies do not require that the CEO and Board Chair positions be separate, and your Board has not adopted a specific policy or philosophy on whether such roles should remain separate.

In circumstances where the Board Chair is not independent, it is the Board’s policy to designate a Lead Independent Director in order to provide the appropriate governance framework for the independent directors. When appointed, the Lead Independent Director’s responsibilities shall include, but not be limited to, the following:

| ◾ | Serving as principal liaison between the independent directors and management and, if any, the non-executive Board Chair, when needed |

| ◾ | Presiding at executive sessions of the independent directors |

| ◾ | Convening meetings of the Board, as appropriate |

| ◾ | Overseeing Board meeting schedules, agendas, and materials and providing input to Committee Chairs on Committee schedules, agendas, and materials |

| ◾ | In coordination with the Governance, Corporate Responsibility and Political Oversight Committee (the “Governance Committee”) Chair, participating in the process for annual review and evaluation of Board and director performance |

| ◾ | Participation in coordination with the Compensation Committee Chair, in the annual evaluation of the performance and compensation of the CEO and, if any, other executive members of the Board |

| ◾ | Consulting and directly communicating, as requested, with the Company’s major shareholders, and |

| ◾ | Assuming the duties of the Board Chair when the Board Chair is not available to perform his or her duties and otherwise assisting the Board Chair in his or her duties as requested |

On March 22, 2023, the Board appointed Mr. Tierney to serve as President and CEO, effective June 1, 2023. With Mr. Tierney’s appointment, Mr. Somerhalder ended his prior role as Interim President and CEO and continues to serve as Chair of the Board, a role in which he has served as since May 2022. Also, on May 24, 2023, at the recommendation of the Governance Committee, the Board appointed Mr. Tierney as a director of the Company, also effective June 1, 2023.

Your Board will continue to consider whether an alternate Board leadership structure is appropriate if changing circumstances dictate. Your Board schedules regular executive sessions both for your non-management directors and for your independent directors. Because an independent director is required to preside over each such executive session of independent directors, we believe it is efficient and appropriate to have your Lead Independent Director preside over executive sessions of independent directors.

Board Composition and Refreshment

Your Board is comprised of individuals who are highly qualified, diverse and independent (other than Mr. Tierney, who is not considered independent because of his employment with the Company, and Mr. Somerhalder, who is not considered independent because of his prior role as Executive Vice Chair from March 2021 to May 2022). Your Board’s succession planning takes into

| 12 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

account the importance of Board refreshment and having an appropriate balance of experience and perspectives on your Board. As further discussed in the “Board Qualifications” section of this Proxy Statement, your Board and the Governance Committee recognize that the diversity of your Board – including demographic diversity as well as diversity of thought, background and experiences – are important parts of their analysis as to whether your Board possesses a variety of complementary skills and experiences.

The Governance Committee reviews Board succession planning on an ongoing basis. In performing this function, the Governance Committee recruits and recommends nominees for election as directors to your Board. Accordingly, your Board has regularly added directors who bring diversity, new ideas and fresh perspectives into the boardroom. All 10 nominees have joined the Board since the beginning of 2017, with an average tenure of 3.5 years. Your Board is 40% female and 50% diverse when considering ethnicity, race and gender together.

The Governance Committee has authority to retain and engage a third-party search firm to identify a candidate or candidates for the Board.

Board Oversight

Board Response to Government Investigations

Your Company has been cooperating fully with requests related to recent government investigations relating to Ohio House Bill 6. We have pledged full and continuing cooperation with the government investigations.

Your Board has formed various special Board oversight committees since July 2020. Effective July 1, 2021, a Special Litigation Committee was created to take all actions with respect to pending derivative litigation and demands. See “Board Committees” section below. The previously established Independent Review Committee and the Demand Review Committee, both special Board oversight committees, were dissolved in July 2021. Effective December 13, 2022, the Compliance Oversight Sub-committee of the Audit Committee was also dissolved, and the Audit Committee directly oversees the Company’s Office of Ethics and Compliance as provided in the Audit Committee Charter.

Legal Proceedings

Beginning in July 2020, stockholders of the Company filed shareholder derivative lawsuits in the federal courts for the Northern and Southern Districts of Ohio and in the Court of Common Pleas of Summit County, Ohio, asserting claims on behalf of the Company against various former and current officers and directors of the Company arising out of the circumstances at issue in the investigations and proceedings relating to Ohio House Bill 6. The lawsuits, Gendrich v. Anderson, et al. and Sloan v. Anderson, et al. (Common Pleas Court, Summit County, OH; all actions have been consolidated) and Miller v. Anderson, et al. (Federal District Court, N.D. Ohio); Bloom, et al. v. Anderson, et al.; Employees Retirement System of the City of St. Louis v. Jones, et al.; Electrical Workers Pension Fund, Local 103, I.B.E.W. v. Anderson et al.; Massachusetts Laborers Pension Fund v. Jones et al.; The City of Philadelphia Board of Pensions and Retirement v. Anderson et al.; Atherton v. Dowling et al.; Behar v. Anderson, et al. (Federal District Court, S.D. Ohio, all actions have been consolidated), assert claims for breach of fiduciary duty and for violation of Section 14(a) of the Securities Exchange Act of 1934, (the “Exchange Act”), among other claims.

As previously disclosed on March 11, 2022, the plaintiffs and defendants in the lawsuits, and the Special Litigation Committee acting on behalf of the Company, entered into a settlement agreement to resolve all of the shareholder derivative lawsuits. The settlement includes a series of corporate governance enhancements that resulted in the following actions in connection with or following the Company’s 2022 Annual Meeting of shareholder (the “2022 Annual Meeting”):

| ◾ | Six former members of the Board did not stand for re-election at the 2022 Annual Meeting |

| ◾ | A special Board committee of at least three then-recently appointed independent directors was formed on June 15, 2022, within 30 days of the 2022 Annual Meeting, to initiate a review process of the current senior executive team. On September 5, 2022, the special committee, completed its work, discussed its review with the Board, and was thereafter dissolved |

| 2024 PROXY STATEMENT | 13 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

| ◾ | The Board oversees the Company’s lobbying and political activities, including periodically reviewing and approving political and lobbying action plan prepared by management the (“Political and Lobbying Action Plan”) |

| ◾ | The Governance Committee was reconstituted on May 17, 2022, to consist of a majority of independent directors who joined the Board in 2019 or later to oversee the implementation and third-party audits of the Board-approved Political and Lobbying Action Plan |

| ◾ | The Company has implemented enhanced disclosure to shareholders of political and lobbying activities, including in its annual proxy statement as provided in the “Other Important Matters” – “Transparency in Corporate Contributions” section below, and |

| ◾ | The Company has further aligned financial incentives of senior executives to proactively comply with legal and ethical obligations. On May 17, 2022, the Company reconstituted the Compensation Committee to meet the settlement requirements. |

The settlement also includes a payment to FirstEnergy of $180 million, to be paid by insurance, less the court-ordered attorney’s fees awarded to plaintiffs. On August 23, 2022, the Southern District of Ohio granted final approval of the parties’ Settlement Agreement, fully releasing all claims covered by the stipulation of the settlement, and dismissing the action in the Southern District of Ohio with prejudice. On September 20, 2022, a FirstEnergy shareholder filed a motion for reconsideration of the court’s Order of Final Settlement Approval. The S.D. Ohio denied that motion on May 22, 2023. On June 15, 2023, the FirstEnergy shareholder filed an appeal in the U.S. Court of Appeals for the Sixth Circuit. On February 16, 2024, the Sixth Circuit affirmed the S.D. Ohio’s approval of the derivative settlement. Although the lawsuit filed in the Northern District of Ohio remains pending, the Court of Common Pleas of Summit County, Ohio has dismissed the shareholder derivative lawsuit with prejudice. The Sixth Circuit’s affirmance of the settlement agreement is expected to fully resolve all of these shareholder derivative lawsuits.

While your Board cannot predict the outcome of the continuing government investigations and related matters, as your stewards, we are fully committed to providing thorough and complete oversight and will, as a Board, take any necessary actions to address these matters. Your Board will not tolerate any actions or behaviors demonstrating anything less than a commitment to high standards of ethics and compliance for your Company and is committed to continuing improvement of the compliance policies and culture at FirstEnergy.

Risk Management

The Company recognizes both the need to take certain risks in the ordinary course of business, as well as the opportunities that may present themselves related to such risks, which together can help to ensure the overall success of the Company. Led by the Chief Risk Officer (“CRO”), the Company has implemented an Enterprise Risk Management process to identify, prioritize, report, monitor, manage, and mitigate its significant risks, including strategic, financial, operational, compliance, litigation, and reputational risks. An Enterprise Risk Management Committee, chaired by the CRO and consisting of senior executive officers, provides oversight and monitoring to ensure that appropriate risk policies are implemented and effective. The Enterprise Risk Management Committee also vets risk prioritization and mitigation strategies to help ensure that risks are managed in accordance with the Company’s expectations. In addition, other management committees address topical risk issues to support the Board’s oversight of risk management as discussed below. Timely reports on significant risk issues are provided as appropriate to employees, management, senior executive officers, respective Board committees, and the full Board. The leadership of our risk group provides oversight of day-to-day risk management efforts and prepares enterprise-wide risk management reports for presentation to the Audit Committee and your Board.

Your Board administers its risk oversight function through the full Board and its committees, and views risk management as an integral part of the Company’s strategic planning process. Specifically, your Board considers risks applicable to the Company in connection with its consideration of significant business and financial developments of the Company. Also, the Audit Committee charter requires the Audit Committee to oversee the process for identifying, assessing, managing and monitoring enterprise risks, including major financial risks, as well as strategic and operational risks and oversee risks related to the financial statements, payment processes, and financial reporting process and controls, and the regulatory considerations related to cybersecurity. The Audit Committee also reviews and discusses with management the steps taken to monitor, control, and mitigate such exposures.

In addition to the Audit Committee, our other Board committees also play a key role in risk oversight within each of their areas of responsibility. Specifically, the Compensation Committee reviews, discusses and assesses risks related to executive compensation programs, including incentive compensation and equity-based plans, as well as human capital and the relationship between our

| 14 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

risk management policies and practices and compensation. See also, “Risk Assessment of Compensation Programs” found in the CD&A section in this Proxy Statement. The Governance Committee considers risks related to corporate governance, including Board and committee membership, Board effectiveness, related person transactions, and the Company’s corporate citizenship practices, the Political and Lobbying Action Plan and EESG strategies and initiatives, including climate matters. The Finance Committee evaluates risks relating to financial resources and strategies, including capital structure policies, financial forecasts, budgets and financial transactions, commitments, expenditures, long and short-term debt levels, dividend policy, acquisition and divestitures, issuance of securities, exposure to fluctuation in interest rates, share repurchase programs and other financial matters deemed appropriate by your Board. The Operations and Safety Oversight Committee considers risks associated with safety, reliability, cybersecurity, customer service, environmental strategy, protection and sustainability, and the Company’s electric distribution, transmission and generation facilities.

Through this oversight process, your Board engages on significant risk issues on a timely basis, including the risks inherent in the Company’s strategy. The table below illustrates the Board and Board Committees’ primary oversight with respect to key risks, although the complexity of such risks often intersect with each other and/or are also overseen by the full Board. In addition, while the Company’s risk group administratively reports to your Senior Vice President, Chief Financial Officer & Strategy, the CRO also has full access to the Audit Committee and is scheduled to attend and report at other Board committee meetings as part of their respective risk oversight responsibilities.

| Board Committee Reporting for Top Risks

| ||||||||||||

| Audit

|

Compensation

|

Governance., Corporate Responsibility & Political Oversight

|

Finance

|

Operations & Safety

|

Full Board *

| |||||||

|

Artificial Intelligence |

· | |||||||||||

| Climate | · | · | ||||||||||

| Compliance | · | |||||||||||

| Culture | · | |||||||||||

| Customer Affordability | · | |||||||||||

| Cybersecurity | · | · | ||||||||||

| Distribution Reliability | · | |||||||||||

| Environmental | · | |||||||||||

| Execution of our Strategy | · | |||||||||||

| Governance | · | |||||||||||

| Liquidity & Funding | · | |||||||||||

| Pension | · | |||||||||||

| Rate Recovery | · | |||||||||||

| Reputation with Stakeholders | · | |||||||||||

| Safety | · | |||||||||||

| Strategic Choices | · | |||||||||||

| Supply Chain | · | |||||||||||

| Talent Management | · | |||||||||||

| Tech Innovation & Enablement | · | |||||||||||

| Third Party Management & Reliance | · | |||||||||||

|

· Enterprise Risk(s) assessed, discussed, and monitored by each respective Committee. * Full board reporting at least annually on enterprise-wide risk profile. | ||||||||||||

| 2024 PROXY STATEMENT | 15 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Evaluating Board Effectiveness

Your Board is committed to a rigorous evaluation process as further described below. Annually, Board, committee and individual director evaluations are performed and coordinated by the Governance Committee. In 2023, the Governance Committee engaged an independent third party, experienced in corporate governance matters, to assist the Board in assessing its effectiveness and the effectiveness of the Board’s committees and individual directors.

2023 Board Evaluations: A Multi-Step Process

| 1 |

Annual Process is Initiated

Your Board’s Governance Committee initiated the annual Board, committee and individual director evaluation process and presented the proposed approach to your Board for its input. | |

|

| ||

| 2 |

Board & Committee Assessment, Individual Director Evaluations

Each independent director’s opinion was solicited regarding your Board’s and its committees’ effectiveness relating to topics such as ethics and accountability, Board composition and culture, succession planning, and shareholder and stakeholder involvement. In addition, input is obtained from each director as to the performance of the other Board members. | |

|

| ||

|

| ||

| 3 |

Director Self-Assessments

Prior to accepting a re-nomination, each director conducted a self-assessment as to whether he or she satisfies the criteria set forth in the Company’s Corporate Governance Policies and the Governance Committee Charter. | |

|

| ||

| 4 |

Presentation of Findings

The annual Board, committee and individual director assessments were discussed with your Board, committee and directors. These discussions focused on certain key themes and priority areas for the Board. | |

|

| ||

| 5 |

Feedback Incorporated

Your Board, committees and directors are committed to continuous improvement and what they learn from this evaluation process is incorporated in their ongoing work for the Company. | |

|

|

||

Shareholder Outreach and Engagement Program

Commitment to Shareholder Outreach and Engagement

FirstEnergy has a long history of meaningful, robust engagement with our shareholders. We believe consistent, transparent dialogue is essential in order to understand investor feedback on a broad range of issues and provides valuable insights for our Board, its committees, and our management team into investor perspectives and priorities.

In connection with our shareholder outreach during 2023 and the first quarter of 2024, we reached out to our top shareholders representing over 55% of shares outstanding. In addition to our proactive shareholder engagement throughout the year, our management team participates in numerous investor conferences, and in both one-on-one and group meetings.

| 16 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

In 2023 and early 2024, members of management, representing various internal functions including Corporate Responsibility, Corporate Secretary department, Finance, Legal, Human Resources and Investor Relations, met with institutional shareholders. These conversations covered a variety of topics, including:

| ◾ | Our strategic vision |

| ◾ | Board oversight of corporate governance |

| ◾ | Climate matters, clean energy transition and sustainable investments |

| ◾ | Federal and state regulatory matters spanning our five-state service territory |

| ◾ | Financial and operational performance |

| ◾ | Executive compensation |

| ◾ | Company culture |

| ◾ | Our political, lobbying and public policy practices |

As part of our commitment to shareholder engagement and understanding our investors’ perspectives, we welcome the opportunity for future dialogue on matters of mutual interest and to obtain insights and feedback.

Other Governance Practices and Policies

Code of Conduct

FirstEnergy’s Code of Conduct, The Power of Integrity, lays the foundation for what we expect from all FirstEnergy employees, officers and directors, including our CEO, CFO, Chief Accounting Officer and other executives. It reflects our collective commitment to keep integrity at the forefront of everything we do — a pledge underscored by the inclusion of integrity in our mission and core values. By adhering to the expectations of compliance and ethics in this Code, always acting with uncompromising integrity, and speaking up when something doesn’t seem right, we are paving the way for a strong future for FirstEnergy.

Any substantive amendments to, or waivers of, the provisions of this document will be disclosed and made available on our website, as permitted by the SEC and as disclosed in our most recent Annual Report. The Code is available, without charge, upon written request to the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890, and it is accessible on our website at www.firstenergycorp.com/responsibility.

Corporate Governance Policies and Standing Committee Charters

Your Board believes that the Company’s policies and practices should enhance your Board’s ability to represent your interests as shareholders. Your Board established Corporate Governance Policies which, together with Board committee charters, which serve as a framework for meeting your Board’s duties and responsibilities with respect to the governance of the Company. Our Corporate Governance Policies and Board committee charters are reviewed at least annually and the most current versions are available on our website at www.firstenergycorp.com/charters.

Director Orientation and Continuing Education

Your Board recognizes the importance of its members keeping current on Company, industry and governance issues and their responsibilities as directors. All new directors participate in orientation soon after being elected to your Board. Also, your Board makes available and encourages continuing education programs for Board members, which include internal strategy meetings and presentations and engagement with relevant third-party experts, third-party presentations and external programs.

| 2024 PROXY STATEMENT | 17 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Attendance at Board Meetings, Committee Meetings and the Annual Meeting of Shareholders

Our Corporate Governance Policies provide that directors are expected to attend all scheduled Board and applicable committee meetings and the Company’s annual meetings of shareholders. Your Board held 11 meetings in 2023. The overall attendance percentage for our directors was approximately 96% in 2023, and all directors attended more than 75% of the Board meetings and the meetings of the committees upon which he or she served in 2023. Also, all of our directors who were members of the Board at the time of the 2023 Annual Meeting attended the 2023 Annual Meeting.

Non-management directors met, as annually required, as a group in executive session without the CEO or any other non-independent director or member of management at each of the regularly scheduled 2023 Board meetings. Our Lead Independent Director presided over all executive sessions of independent directors.

Other Public Company Board Membership and Related Time Commitments

Our Corporate Governance Policies provide that directors will not, without your Board’s approval, serve on a total of more than four public company boards of directors (including FirstEnergy). Further, without your Board’s approval, no director who serves as an executive officer of any public company may serve on a total of more than two public company boards of directors, including FirstEnergy. When a director has a major change in their responsibilities, including principal employment or directorships, but excluding changes resulting from a normal retirement as well as commitments with non-profit organizations, the Governance Committee considers such change and makes any appropriate recommendation to your Board.

In addition to being a director of the Company, Mr. Demetriou stepped down as chief executive officer of Jacobs Solutions Inc. (formerly Jacobs Engineering Group Inc.) on January 24, 2023, and became Executive Chair of Jacobs Solutions Inc. Mr. Demetriou also stepped down as Chairman of C5 Acquisition Corp. in November 2023, and serves as a director of Arcosa, Inc. The Board has evaluated Mr. Demetriou’s current responsibilities and future commitment expectations and has approved Mr. Demetriou’s directorships.

Communications with your Board of Directors

Your Board provides a process for shareholders and interested parties to send communications to your Board and non-management directors, including our Chair of the Board. As set forth in the Company’s Corporate Governance Policies, shareholders and interested parties may send written communications to your Board or a specified individual director, including our Chair of the Board, by mailing any such communications to the FirstEnergy Board of Directors at the Company’s principal executive office, c/o Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, OH 44308-1890. Our Corporate Governance Policies can be viewed by visiting our website at www.firstenergycorp.com/charters.

The Corporate Secretary or a member of her staff reviews all such communications promptly and relays them directly to a member of your Board, provided that such communications (i) bear relevance to the Company and the interests of the shareholder, (ii) are capable of being implemented by your Board, (iii) do not contain any obscene or offensive remarks, (iv) are of a reasonable length, and (v) are not from a shareholder who has already sent two such communications to your Board in the last year. Your Board may modify procedures for sorting shareholders communications or adopt any additional procedures, provided that they are approved by a majority of independent Directors.

Your Audit Committee also receives, reviews, and acts on complaints and concerns regarding accounting, internal accounting controls or auditing matters, including complaints regarding material ethical or criminal misconduct on the part of the Board of Directors, the Chief Executive Officer (“CEO”), any officer reporting directly to the CEO, the Controller & Chief Accounting Officer, and complaints regarding matters that could lead to significant reputational damage to the Company. Complaints or concerns specifically related to such matters may be made directly to your Audit Committee. Correspondence to the Audit Committee should be addressed to the attention of the Audit Committee Chair (c/o Corporate Secretary), FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890.

| 18 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Board Qualifications

The Governance Committee recommends Board candidates by identifying qualified individuals in a manner that is consistent with criteria approved by your Board. In consultation with the CEO, the Governance Committee, as led by the Board Chair and Lead Independent Director, searches for, recruits, screens, interviews and recommends prospective directors to provide your Board with an appropriate balance of knowledge, experience, diversity attributes and capability on your Board. Suggestions for potential Board candidates come to the Governance Committee from a number of sources, including a third-party search firm, incumbent directors, officers and others. In connection with the Board’s active director succession planning, the Governance Committee regularly evaluates the addition of a director or directors with particular attributes while maintaining an appropriate mix of long-, medium-, and short-term tenured directors in its succession planning.

The Governance Committee considers suggestions for candidates for membership on your Board, including director candidates recommended by shareholders. Provided that shareholders suggesting director candidates have complied with the procedural requirements set forth in the Governance Committee Charter and Code of Regulations, the Governance Committee applies the same criteria and employs substantially similar procedures for evaluating candidates suggested by shareholders for your Board as it would for evaluating any other Board candidate. The Governance Committee will also give due consideration to all recommended candidates that are submitted in writing to the Governance Committee, in care of the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890, received at least 120 days before the publication of the Company’s annual Proxy Statement from a shareholder or group of shareholders owning one half of one percent (0.5 percent) or more of the Company’s voting stock for at least one year, and accompanied by a description of the proposed nominee’s qualifications and other relevant biographical information, together with the written consent of the proposed nominee to be named in the Proxy Statement and to serve on your Board. In addition, we have adopted a proxy access right to permit, under certain circumstances, a shareholder or a group of shareholders to include in our annual meeting proxy statement director candidates whom they have nominated. These proxy access provisions in our Code of Regulations provide, among other things, that a shareholder or group of up to 20 shareholders seeking to include director candidates in our annual meeting proxy statement must own, in the aggregate, 3% or more of the Company’s issued and outstanding Common Stock continuously for at least three years. Also refer to the “Proposals and Business by Shareholders” section of the “Questions and Answers about the Annual Meeting” below for information regarding nominations under the Company’s Code of Regulations.

Director Nomination Related Agreements

On March 16, 2021, your Company entered into a Director Appointment and Nomination Agreement (the “Icahn Director Nomination Agreement”) with Carl C. Icahn, Andrew Teno, Jesse A. Lynn, Icahn Partners LP, Icahn Partners Master Fund LP, Icahn Enterprises G.P. Inc., Icahn Enterprises Holdings L.P., IPH GP LLC, Icahn Capital LP, Icahn Onshore LP, Icahn Offshore LP and Beckton Corp. (collectively, the “Icahn Group”). Mr. Lynn did not stand for re-election at the 2023 Annual Meeting of shareholders and, pursuant to the Icahn Director Nomination Agreement, Mr. Teno resigned from your Board effective December 8, 2023.

On November 6, 2021, your Company entered into a Common Stock Purchase Agreement (the “Blackstone SPA”) with BIP Securities II-B L.P., an affiliate of Blackstone Infrastructure Partners L.P. (“Blackstone”), for the private placement of 25,588,535 shares of the Company’s common stock. Pursuant to the Blackstone SPA, your Board, among other matters, agreed to appoint Mr. Sean T. Klimczak to stand for election as a director at the 2022 and 2023 Annual Meetings. On February 7, 2024, Mr. Klimczak tendered his resignation to the Board. Blackstone subsequently nominated Heidi L. Boyd to serve as its director appointee. Your Board accepted the nomination, appointed Ms. Boyd as a director effective February 16, 2024, and has re-nominated her to stand for reelection as a director at the 2024 Annual Meeting to continue to serve for a term expiring at the 2025 Annual Meeting.

Summaries of the terms of the Icahn Director Nomination Agreement and the Blackstone SPA are provided in the “Certain Relationships and Related Person Transactions” section below.

| 2024 PROXY STATEMENT | 19 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Attributes, Experience, Qualifications and Skills of your Board

In recruiting and selecting Board candidates, the Governance Committee takes into account the size of your Board and considers a skills matrix to determine whether those skills and/or other attributes qualify candidates for service on your Board. The attributes, experiences, qualifications and skills considered in accordance with Corporate Governance Policies and the Governance Committee Charter for each director nominee led your Board to conclude that the nominee is qualified to serve on your Board.

The high-level overview below depicts some of the attributes, experiences, qualifications and skills of our director nominees the Governance Committee takes into account. It is not intended to be an exhaustive list of each director nominee’s skills or contributions to your Board. Also, additional biographical information and qualifications for each nominee is provided in the “Biographical Information and Qualifications of Nominees for Election as Directors” section below and contains information regarding the person’s service as a director, principal occupation, business experience along with key attributes, experience and skills. Each of the nominees brings a strong and unique background and skill set to your Board, giving your Board, as a whole, competence and experience in a wide variety of areas necessary to oversee the operations of the Company.

| 20 | FIRSTENERGY CORP. |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

Board Nominees Skills, Diversity & Committee Memberships

|

Working Knowledge: Significant exposure or advanced training in such area as a board or committee member at FirstEnergy or another company. |

|

Advanced or Managerial Knowledge: (i) Direct professional experience as a subject matter expert; or (ii) individual proficiency in such area and direct-line management over personnel performing related activities. |

| 2024 PROXY STATEMENT | 21 |

| Proxy |

Corporate |

Items to Be |

Commitments to EESG |

Executive & Director Compensation |

Other Important Matters / Q&A |

This matrix above takes into account a level of knowledge that could include direct experience, subject matter expertise, directly managing one or more members of management engaged in such activities, or exposure as a board or board committee member, including on your Board and Board committees.

Board’s Focus on Diversity