Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant ☒ | ||||

| Filed by a Party other than the Registrant ☐ | ||||

| Check the appropriate box: | ||||

| ☐ |

Preliminary Proxy Statement | |||

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ |

Definitive Proxy Statement | |||

| ☐ |

Definitive Additional Materials | |||

| ☐ |

Soliciting Material Pursuant to §240.14a-12 | |||

| FirstEnergy Corp. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

|

| ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ |

No fee required. | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

|

| ||||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

|

| ||||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

|

| ||||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

|

| ||||

| (5) |

Total fee paid: | |||

|

| ||||

| ☐ |

Fee paid previously with preliminary materials: | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid:

| |||

|

| ||||

| (2) |

Form, Schedule or Registration Statement No.

| |||

|

| ||||

| (3) |

Filing Party:

| |||

|

| ||||

| (4) |

Date Filed:

| |||

|

| ||||

Table of Contents

Table of Contents

Our Mission We are a forward-thinking electric utility powered by a diverse team of employees committed to making customers’ lives brighter, the environment better and our communities stronger. Our Core Values What Matters to Us Safety Customers Diversity & Inclusion Innovations Performance Social Responsibility Teamwork Behaviors How Employees Contribute to Our Success Courage Integrity Openness Ownership Trust

Table of Contents

|

A message from your independent Chairman, independent Chairman-Elect and CEO

|

|

March 30, 2018 |

|

Dear Fellow Shareholder:

Thank you for the trust you have placed in us. As your Board transitions to new leadership, we remain dedicated to representing your interests and creating long-term value for our shareholders. Your Board demonstrates accountability through commitment to ongoing shareholder outreach and engagement and strong corporate governance practices. In addition, your Board utilizes its deep knowledge and diverse background to guide and support management’s implementation of its regulated strategy, which is designed to transform the Company into a high-performing, fully regulated utility with well-defined growth opportunities. Your Board will continue to work with management as it implements this strategy, which is outlined in the 2017 Annual Report to Shareholders.

In this proxy statement, you will find a review of your Board’s corporate governance philosophy, including:

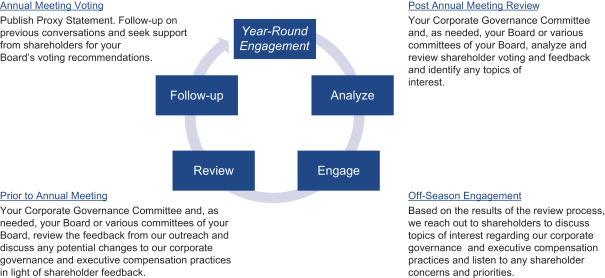

| · | Shareholder Outreach and Engagement |

Your Board listens to our shareholders and considers their views when making decisions in the boardroom. We accomplish this primarily through a robust, year-round shareholder outreach and engagement program in partnership with your Company’s management. Please refer to page 17 for a detailed discussion of this program.

| · | Executive Compensation |

Ensuring that your Company has an executive compensation program that appropriately incentivizes our employees and aligns pay with performance is an important responsibility of your Board. In 2017 and early 2018, your Compensation Committee undertook a robust process to review our executive compensation structure, incorporating input from our shareholder outreach and engagement. As a result, your Compensation Committee and Board adopted several changes to our compensation program for awards granted beginning in 2018, including (i) simplifying and improving the calibration of the long-term incentive plan design structure, (ii) eliminating the annual goal-setting approach in the long-term incentive plan and moving to 3-year cumulative goals, (iii) adopting two financial goals focused on the regulated distribution, regulated transmission and corporate/other segments’ cumulative operating EPS growth and average capital effectiveness, and (iv) adding a relative total shareholder return (“TSR”) modifier including a cap at target payout (100%) if the Company’s absolute TSR for the three-year performance period is negative. Further, your Compensation Committee and the Board added a TSR modifier to the long-term incentive program’s open cycles for certain executives to ensure payouts are aligned with 3-year TSR growth for shareholders. These changes are described beginning on page 49 of this proxy statement.

| · | Board Composition and Succession |

Your Board’s Corporate Governance Committee is focused on the makeup of your Board to ensure it has the right mix of skills and experiences as well as an appropriate balance of institutional knowledge, diversity and fresh perspectives. We continuously review, evaluate and assess our Board composition through a variety of means, including our annual Board, committee and individual director evaluation process, and seek to further enhance your Board’s composition through our comprehensive nomination process and ongoing consideration of potential Board candidates.

Since 2013, we have continued to expand the diversity of your Board while electing seven new directors. Our new independent Board Chairman is expected to assume the role in May. In addition, in the past year we changed the composition of each of our five Board committees, with each committee having at least one new member. We believe these changes demonstrate our commitment to ensuring fresh perspectives and an infusion of new energy on our Board. Please refer to pages iii and 14 for a detailed discussion of our Board composition and succession planning.

We also want to take this opportunity to introduce Ms. Sandra Pianalto, our newest member elected by your Board in February, and to also thank our colleagues, William Cottle and George Smart, who will be retiring from your Board as of the 2018 Annual Meeting. We join our fellow directors in welcoming Sandy and thanking Bill and George for their commitment to your Board. Their leadership and service has been appreciated.

We encourage you to read more about your Board, our strong corporate governance practices, and our executive compensation programs in this proxy statement. We are grateful for your support of your Company and your Board, and thank you in advance for voting promptly.

| Sincerely, | ||||

|

Charles E. Jones President and Chief Executive Officer |

Donald T. Misheff Board Chairman-Elect |

George M. Smart Board Chairman |

Table of Contents

Notice of Annual Meeting of Shareholders

|

Date and Time

|

Location

|

Record Date

| ||||||

| Tuesday, May 15, 2018 8:00 a.m. ET |

John S. Knight Center 77 E. Mill Street Akron, OH 44308

|

March 16, 2018 |

Annual Meeting of Shareholders Agenda

| • | Elect the 12 nominees named in the accompanying proxy statement to the Board of Directors to hold office until the 2019 Annual Meeting of Shareholders and until their successors shall have been elected; |

| • | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018; |

| • | Approve, on an advisory basis, named executive officer compensation; |

| • | Approve a management proposal to amend the Company’s Amended Articles of Incorporation, as amended (the “Amended Articles of Incorporation”) and Amended Code of Regulations, as amended (the “Amended Code of Regulations”) to replace existing supermajority voting requirements with a majority voting power threshold; |

| • | Approve a management proposal to amend the Company’s Amended Articles of Incorporation and Amended Code of Regulations to implement majority voting for uncontested director elections; |

| • | Approve a management proposal to amend the Company’s Amended Code of Regulations to implement proxy access; |

| • | Vote on one shareholder proposal, if properly presented at the Annual Meeting; and |

| • | Take action on other business that may come properly before the Annual Meeting and any adjournment or postponement thereof. |

Please carefully review this notice, the annual report and the accompanying proxy statement and vote your shares by following the instructions on your proxy card/voting instruction form or Notice of Internet Availability of Proxy Materials to ensure your representation at the Annual Meeting. Only shareholders of record as of the close of business on March 16, 2018, or their proxy holders, may vote at the Annual Meeting. If you plan to attend the Annual Meeting, you must register in advance. See the “Attending the Annual Meeting” section of the “Questions and Answers about the Annual Meeting” in the accompanying proxy statement for instructions on how to register.

|

On behalf of the Board of Directors,

| |

|

Ebony L. Yeboah-Amankwah Vice President, Corporate Secretary & Chief Ethics Officer Akron, Ohio |

The notice and accompanying proxy statement are being mailed or made available to shareholders on or about March 30, 2018.

|

Important Notice Regarding Availability of Proxy Materials

|

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 15, 2018. This proxy statement and the 2017 Annual Report are available at www.ReadMaterial.com/FE.

|

|

Important Note Regarding Voter Participation. Please take time to vote your shares!

|

|

Pursuant to applicable rules, if your shares are held in a broker account, you must provide your broker with voting instructions for all matters to be voted on at the Annual Meeting of Shareholders except for the ratification of PricewaterhouseCoopers LLP as FirstEnergy Corp.’s independent registered public accounting firm. Your broker does not have the discretion to vote your shares on any other matters without specific instruction from you to do so.

|

Table of Contents

|

|

|

i

|

| |||

| Environmental, Social & Governance (“ESG”) Overview

|

|

v

|

| |||

| 1 Information About the Meeting |

Questions and Answers about the Annual Meeting | 1 | ||||

| 1 | ||||||

| 4 | ||||||

| 7 | ||||||

| 9 | ||||||

| 11 | ||||||

| Obtaining Additional Information

|

|

11

|

| |||

|

2 Corporate Governance & Board of Directors

|

Corporate Governance and Board of Directors Information | 12 | ||||

| Audit Committee Report | 24 | |||||

| Matters Relating to the Independent Registered Public Accounting Firm |

25 | |||||

| Director Compensation in Fiscal Year 2017 | 26 | |||||

| 3 Items to Be Voted On |

Review of Director Nominees | 29 | ||||

| Biographical Information and Qualifications of Nominees for Election as Directors |

31 | |||||

|

|

|

38

|

| |||

| 4 Executive Compensation |

Executive Compensation | 49 | ||||

| 49 | ||||||

| 49 | ||||||

| 51 | ||||||

|

|

|

79

|

| |||

| 5 Security Ownership & Other Important Matters

|

Security Ownership of Management | 97 | ||||

| Security Ownership of Certain Beneficial Owners | 98 | |||||

| Compensation Committee Interlocks and Insider Participation | 99 | |||||

| Section 16(a) Beneficial Ownership Reporting Compliance | 99 | |||||

| Certain Relationships and Related Person Transactions | 99 | |||||

| Note About Forward-Looking Statements

|

|

101

|

| |||

Appendices

Table of Contents

|

|

2018 Annual Meeting of Shareholders

| · | Time and Date: 8:00 a.m., Eastern time, on Tuesday, May 15, 2018 |

| · | Location: John S. Knight Center, 77 E. Mill Street, Akron, Ohio |

| · | Record Date: March 16, 2018 |

| · | Voting: Shareholders of record of FirstEnergy Corp. common stock as of the Record Date are entitled to receive the Notice of Annual Meeting of Shareholders and they or their proxy holders may vote their shares at the Annual Meeting |

| · | Admission: If you plan to attend the Annual Meeting, you must register in advance. For instructions on how to register, see the “Attending the Annual Meeting” section of the “Questions and Answers about the Annual Meeting” below |

Voting Matters

| Item 1 |

Elect the 12 nominees named in this proxy statement to the Board of Directors.

Refer to page 38 for more detail.

✓Your Board recommends you vote FOR this item.

|

Item 2 |

Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018. Refer to page 39 for more detail.

✓Your Board recommends you vote FOR this item. | |||

| Item 3 |

Approve, on an advisory basis, named executive officer compensation. Refer to page 39 for more detail.

✓Your Board recommends you vote FOR this item.

|

Item 4 |

Approve a management proposal to implement a majority voting power threshold. Refer to page 40 for more detail.

✓Your Board recommends you vote FOR this item. | |||

| Item 5 |

Approve a management proposal to implement majority voting for uncontested director elections. Refer to page 42 for more detail.

✓Your Board recommends you vote FOR this item.

|

Item 6 |

Approve a management proposal to implement proxy access. Refer to page 43 for more detail.

✓Your Board recommends you vote FOR this item.

|

| Item 7 |

Shareholder Proposal. Refer to page 46 for more detail.

X Your Board recommends you vote AGAINST the shareholder proposal. |

i

Table of Contents

How to Cast Your Vote

Your vote is important! Even if you plan to attend our Annual Meeting in person, please cast your vote as soon as possible by:

|

|

| ||

| Internet by going to the website indicated on your proxy materials (or by scanning the QR Code if provided on your proxy card/voting instruction form) |

Telephone by calling the toll-free telephone number on your proxy card/voting instruction form |

Mail by returning your proxy card/voting instruction form |

Please follow the instructions provided on your proxy card/voting instruction form (the “proxy card”), Notice of Internet Availability of Proxy Materials, or electronic or other communications included with your proxy materials. Also refer to the “How You Can Vote” section of the “Questions and Answers about the Annual Meeting” below for more details.

Board Nominees

Each of the twelve members listed below of your Board of Directors (your “Board”) are standing for election. Each member stands for election annually. The following table provides summary information about each director nominee standing for election to your Board.

|

Committee Memberships |

Number of Other Public Company Boards 1 | |||||||||||||||||||||||

| Name | Age | Director Since |

Independent | Audit | Compensation | Corporate Governance |

Finance | Nuclear | ||||||||||||||||

| Paul T. Addison

|

71 | 2003 | Yes | ● | Chair | 0 | ||||||||||||||||||

| Michael J. Anderson

|

66 | 2007 | Yes | Chair | ● | 1 | ||||||||||||||||||

| Steven J. Demetriou

|

59 | 2017 | Yes | ● | ● | 1 | ||||||||||||||||||

| Julia L. Johnson

|

55 | 2011 | 2 | Yes | ● | ● | 3 | |||||||||||||||||

| Charles E. Jones

|

62 | 2015 | No | 0 | ||||||||||||||||||||

| Donald T. Misheff

|

61 | 2012 | Yes | Chair | ● | 2 | ||||||||||||||||||

| Thomas N. Mitchell

|

62 | 2016 | Yes | ● | Chair | 0 | ||||||||||||||||||

| James F. O’Neil III

|

59 | 2017 | Yes | ● | ● | 1 | ||||||||||||||||||

| Christopher D. Pappas

|

62 | 2011 | 2 | Yes | Chair | ● | 2 | |||||||||||||||||

| Sandra Pianalto

|

63 | 2018 | 3 | Yes | ● | ● | 3 | |||||||||||||||||

| Luis A. Reyes

|

66 | 2013 | Yes | ● | ● | 0 | ||||||||||||||||||

| Dr. Jerry Sue Thornton

|

71 | 2015 | Yes | ● | ● | 2 | ||||||||||||||||||

| 1 | As defined under New York Stock Exchange Listed Company Manual Section 303A Corporate Governance Standards Frequently Asked Questions. |

| 2 | Ms. Johnson and Mr. Pappas were previously directors of Allegheny Energy Inc. (“Allegheny Energy”), which merged with your Company in 2011. |

| 3 | Ms. Pianalto was elected to your Board effective February 20, 2018, and is a nominee for election by shareholders at the Annual Meeting. |

As previously disclosed, Messrs. William T. Cottle and George M. Smart will retire from your Board as of the 2018 Annual Meeting in accordance with the mandatory retirement age provisions of our Corporate Governance Policies and were not nominated by your Board for election at this Annual Meeting. The size of your Board, which is currently set at 14, will be reduced to 12 as of the Annual Meeting.

ii

Table of Contents

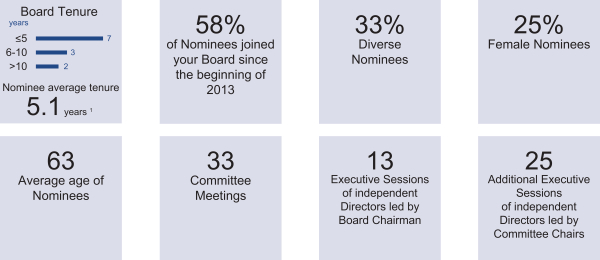

Key Facts About Your Board

We seek to maintain a well-rounded and diverse Board representing a wide breadth of experience and perspectives that balances the institutional knowledge of longer-tenured directors with the fresh perspectives brought by newer directors. Below are highlights regarding our 12 director nominees standing for election to your Board and our Board meetings held in 2017.

| 1 | Service with your Company does not include service by Ms. Johnson and Mr. Pappas as directors of Allegheny Energy, which merged with your Company in 2011. |

Corporate Governance Highlights

Your Company is committed to strong corporate governance, which we believe is important to the success of our business and in advancing shareholder interests. Highlights include:

|

✓ Strong Governance Practices

|

✓ Independent Oversight

|

✓ Shareholder Rights

| ||

| • Director Resignation Policy requiring any director nominee in an uncontested director election who receives a majority of withheld votes to tender his or her resignation

• Consideration of your Board’s diversity, age, experience and skills and other attributes when evaluating nominees for your Board

• A three-part annual evaluation process: full Board evaluation; Board committee evaluations; and individual director evaluations

• Mandatory director retirement age of 72 pursuant to our Corporate Governance Policies

• Corporate Governance Committee and Board engage in rigorous director succession planning

• Robust stock ownership guidelines

• Comprehensive director orientation and continuing education

• Direct investor relations and governance engagement and outreach to shareholders

• Anti-Hedging and Anti-Pledging Policies |

• Separate Board Chairman and Chief Executive Officer (our “CEO”)

• Independent Board Chairman

• All directors are independent, other than the CEO

• Board committees are comprised entirely of independent directors

• Independent directors regularly meet without management present at Board and committee meetings

• Risk oversight by full Board and its committees |

• Annual election of all directors

• Shareholders of 25 percent or more of our shares outstanding and entitled to vote have the right to call a special meeting

• Advisory vote on named executive officer compensation is held on an annual basis, consistent with the shareholder advisory vote on frequency

• Clear, effective process for shareholders to raise concerns to the Board

• No poison pill |

Our corporate governance practices are described in greater detail in the “Corporate Governance and Board of Directors Information” section beginning on page 12.

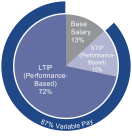

Board Tenure years <5 6-10>10 Nominee average tenure [5.1] years 1 [58]% of Nominees joined your Board since the beginning of 2013 [33]% Diverse Nominees [25]% Female Nominees [63] Average age of Nominees [33] Committee Meetings [13] Executive Sessions of Independent Directors Led by Board Chairman [25] Additional Executive Sessions of Independent Directors Led by Committee Chairs

iii

Table of Contents

Executive Compensation Highlights

We continually strive to make improvements to our executive compensation plans and programs. Some of our key executive compensation highlights include:

We believe what we do and don’t do with respect to executive compensation aligns with the long-term interests of our shareholders and with commonly viewed best practices in the market.

| What We Do | What We Don’t Do | |

|

✓ Pay-for-performance

✓ Caps on short-term and long-term incentive awards

✓ Different financial performance measures in our short- and long-term incentive plans

✓ Robust stock ownership guidelines

✓ Stringent clawback policy

✓ Mitigate undue risk in compensation programs

✓ Annual Say-on-Pay vote

✓ Double-trigger CIC provisions for LTIP stock awards

✓ Independent compensation consultant for the Compensation Committee with only independent directors

✓ Beginning in 2018, LTIP is capped at 100% if absolute TSR over the LTIP performance period is negative |

|

Our executive compensation practices are described in greater detail in the “Executive Compensation” section beginning on page 49.

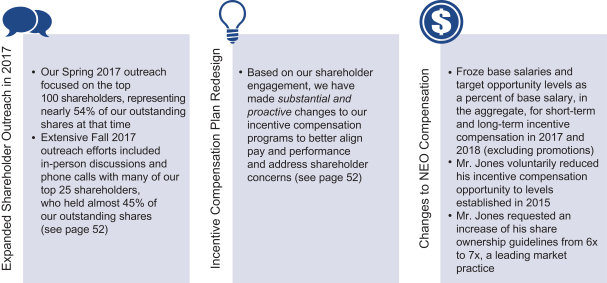

Expanded Shareholder Outreach in 2017 Our Spring 2017 outreach focused on the top 100 shareholders, representing nearly 54% of our outstanding shares at that time Extensive Fall 2017 outreach efforts included in-person discussions and phone calls with many of our top 25 shareholders, who held almost 45% of our outstanding shares (see page [x]) Based on our shareholder engagement, we have made substantial and proactive changes to our incentive compensation programs to better align pay and performance and address shareholder concerns (see page [x]) We acknowledge the overhang on our stock price as we transition away from commodity exposed generation Given that our executives met rigorous financial and operational goals, the compensation programs ending in 2017 resulted in above-target payouts to NEOs (see page [x])

iv

Table of Contents

|

Environmental, Social & Governance (“ESG”) Overview

|

| Meeting Our Environmental Commitments

• Our West Akron Campus, Akron Control Center and West Virginia Operations Headquarters in Fairmont have earned Leadership in Energy and Environmental Design (LEED) certification from the U.S. Green Building Council |

|

| • | Through our partnership with the Electric Power Research Institute (EPRI), we’re helping fuel the next generation of electric vehicles while minimizing cost and the impact on electric system reliability |

| • | We are helping customers better manage their energy use and save money through energy efficiency programs offered by our 10 utilities |

| • | We have established a goal to reduce CO2 emissions companywide by at least 90 percent below 2005 levels by 2045 |

| • | We participate in the CDP (formerly the Carbon Disclosure Project), which enables companies, cities, states and regions to measure and manage the environmental impact of their operations; we strive to demonstrate continuous improvement in our CDP scoring in disclosure programs for Climate Change and Water |

| Bringing Good Energy to Our Customers and Communities

|

| |

|

• Through our multibillion-dollar Energizing the Future transmission program, we continue to upgrade and modernize our transmission system. From 2014 through 2017, we invested $4.4 billion in this program on grid improvement projects, and we plan to invest an additional $4.0 billion to $4.8 billion from 2018 through 2021 |

| • | We have installed nearly 1.5 million smart meters across our four utility operating companies in Pennsylvania since 2014, and plan to deploy smart meters to nearly all our 2 million Pennsylvania customers by mid-2019 |

| • | Emergency response efforts in 2017 were recognized by the Edison Electric Institute, marking the 21st time we’ve been honored for our efforts restoring service to our customers or assisting other utilities with service restoration during emergency events |

| • | Penn Power, Met-Ed and Ohio Edison electric utilities ranked among the highest among utilities of their size and respective regions in J.D. Power’s 2017 Electric Utility Residential Customer Satisfaction Survey |

| • | The resources of FirstEnergy and the FirstEnergy Foundation – combined with the energy and enthusiasm of our employees – benefit hundreds of organizations and thousands of people each year; in 2017, the FirstEnergy Foundation awarded some 1,200 grants totaling more than $6.1 million to community-based organizations where we live and work |

| • | FirstEnergy employees provided $1.8 million to local United Way chapters and nonprofit organizations, while the FirstEnergy Foundation provided more than $2 million to United Way last year |

| Ensuring Strong Corporate Governance Practices and Policies

|

| |

|

• Since 2013, we have elected seven new directors and continued to increase the diversity of your Board • We have separated the positions of Chairman of the Board and Chief Executive Officer |

| • | The Chairman of the Board is independent, as are all Board directors other than the CEO |

| • | Independent directors regularly convene at Board and committee meetings without company management present |

| • | Risk oversight is conducted by the full Board and its committees |

| • | All directors are elected annually |

| • | An advisory vote is held annually on named executive officer compensation |

| 10 Programs

We are helping customers better manage their energy use and save money through energy efficiency programs offered by our 10 utilities |

$4.0B+

Plan to invest $4.0 billion to $4.8 billion in our transmission system from 2018 through 2021 |

1.5M

Installed nearly 1.5 million smart meters across our four utilities in Pennsylvania and plan to deploy smart meters to nearly all our 2 million customers in Pennsylvania by mid-2019 |

7 Directors

Since 2013, we have elected seven new directors and continued to increase the diversity of our Board |

v

Table of Contents

|

Note About Forward-Looking Statements

|

| Certain discussions in this proxy statement contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties described in more detail on page 101. These statements include declarations regarding management’s intents, beliefs and current expectations, including regarding future financial and operational performance (whether associated with compensation arrangements or otherwise), and typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “goal,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements are qualified by, and should be read together with, the risk factors included in (a) Item 1A Risk Factors and Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations in our most recent Annual Report on Form 10-K and (b) other factors discussed in our other filings with the Securities and Exchange Commission.

These risks, unless otherwise indicated, are presented on a consolidated basis for FirstEnergy; if and to the extent a deconsolidation occurs with respect to certain FirstEnergy companies these risks may materially change. Readers are cautioned not to place undue reliance on these forward-looking statements. Except as otherwise noted, the information herein is as of March 21, 2018, the date we commenced printing in order to commence mailing on or about March 30, 2018. We expressly disclaim any current intention to update, except as required by law, any forward-looking statements contained herein as a result of new information, future events or otherwise. |

vi

Table of Contents

Questions and Answers about the Annual Meeting

| 1

|

Q:

|

Why did I receive these proxy materials?

| ||

| A: | You received these proxy materials because you were a shareholder of record or beneficial owner (as defined below) of shares of common stock of FirstEnergy Corp. (“FirstEnergy”, the “Company”, “we”, “us” or “our”) as of the close of business on March 16, 2018, the record date (the “Record Date”). Your Company’s Annual Meeting of Shareholders (also referred to as the “Annual Meeting” or the “Meeting”) will be held on Tuesday, May 15, 2018. We began distributing these proxy materials to shareholders on or about March 30, 2018.

| |||

| 2

|

Q:

|

Can I view future FirstEnergy proxy materials and annual reports on the Internet instead of receiving paper copies? | ||

|

A: |

Yes. If you received paper copies of this proxy statement and the annual report and you are a shareholder of record, you can elect to view future proxy statements and annual reports on the Internet by marking the designated box on your proxy card or by following the instructions when voting by Internet or by telephone. If you choose this option, prior to the next annual meeting, you will be mailed a paper copy of the proxy card along with instructions on how to access the proxy statement and annual report using the Internet unless applicable regulations require delivery of printed proxy materials. Your choice will remain in effect until you notify us that you wish to resume mail delivery of these documents. | |||

|

If you previously elected to access your proxy materials over the Internet, you will not receive the Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) or paper copies of proxy materials in the mail unless required by law. Instead, you will receive a paper copy of the proxy card along with instructions on how to access the proxy statement and annual report using the Internet. | ||||

|

If you received a Notice of Internet Availability, you may not receive printed copies of proxy statements and annual reports in the future unless required by law. However, you may elect to be mailed a paper proxy card with instructions on how to access proxy statements and annual reports using the Internet for future meetings by following the instructions when voting. The Notice of Internet Availability also contains instructions on how you may request delivery of proxy materials in printed form for the Meeting or on an ongoing basis, if desired. | ||||

|

If you are a beneficial owner, refer to the information provided by your broker, bank or other nominee for instructions on how to elect to view future FirstEnergy proxy statements and annual reports on the Internet instead of receiving paper copies. | ||||

1 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| 3

|

Q:

|

Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of receiving a full set of printed proxy materials? | ||

|

A: |

To reduce the environmental impact and related costs of the Meeting, we are pleased to again furnish the proxy materials over the Internet. As a result, we are sending a number of our shareholders a Notice of Internet Availability instead of a printed copy of the proxy materials. All shareholders receiving the Notice of Internet Availability will have the ability to access the proxy materials and vote via the Internet and to request a printed copy of the proxy materials by mail, if desired. Instructions on how to access the proxy materials over the Internet, to vote online, and to request a printed copy may be found in the Notice of Internet Availability. The Notice of Internet Availability identifies the items to be voted on at the Meeting, but shares cannot be voted by marking, writing on and/or returning the Notice of Internet Availability. Any Notice of Internet Availability that is returned will not be counted as votes. In addition, the Notice of Internet Availability contains instructions on how you may request delivery of proxy materials in printed form for this Meeting or on an ongoing basis, if desired.

| |||

| 4

|

Q:

|

Why did we receive just one copy of the proxy statement and annual report when we have more than one stock account in our household? | ||

|

A: |

Where applicable, we follow the Securities and Exchange Commission (the “SEC”) rule that permits us to send one copy each of this proxy statement and the annual report to a household if shareholders provide written or implied consent. We previously mailed a notice to eligible registered shareholders stating our intent to use this rule unless a shareholder provided an objection. Using this rule reduces unnecessary publication and mailing costs. Shareholders continue to receive a separate proxy card or opportunity to vote via the Internet, as applicable, for each stock account. If you are a registered shareholder and received only one copy each of the proxy statement and the annual report in your household, you can request additional copies for some or all accounts for this year or in the future, either by calling Shareholder Services at 1-800-736-3402 or by writing to FirstEnergy Corp., c/o American Stock Transfer & Trust Company, LLC, P.O. Box 2016, New York, NY 10272-2016, and we will promptly deliver the requested copies. You also may contact us in the same manner if you are receiving multiple copies of this proxy statement and/or the annual report in your household and desire to receive one copy. If you are not a registered shareholder and your shares are held by a bank, broker, or other nominee you will need to contact such bank, broker, or other nominee to revoke your election and receive multiple copies of these documents.

| |||

| 5

|

Q:

|

What is the difference between holding shares as a “shareholder of record” and holding shares in “street name” or as a “beneficial owner”? | ||

|

A: |

Shareholder of Record: If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), you are a shareholder of record of the shares. As the shareholder of record, you have the right to vote your shares directly or to grant a proxy to vote your shares to a representative of your Company or to another person. As a record holder you have received either a proxy card to use in voting your shares or a Notice of Internet Availability which instructs you how to vote. | |||

|

Beneficial Owner: If your shares are held through a bank, broker or other nominee, it is likely that they are registered in the name of the bank, broker or other nominee and you are the beneficial owner of shares, meaning that you hold shares in “street name.” You are also a beneficial owner if you own shares through the FirstEnergy Corp. Savings Plan (the “Savings Plan”). |

2 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

|

As a beneficial owner of shares, you have the right to direct the registered holder to vote your shares, and you may attend the Meeting (please see the “Attending the Annual Meeting” section of the “Questions and Answers about the Annual Meeting” below for instructions on how to register in advance). Your bank, broker or other nominee has provided a voting instruction form for you to use in directing how your shares are to be voted. However, since a beneficial owner is not the shareholder of record, you may not vote your shares in person at the Meeting unless you obtain a legal proxy from the registered holder of the shares giving you the right to do so. If you are a Savings Plan participant, because the Savings Plan’s Trustee is the only one who can vote your Savings Plan shares, you cannot vote your Savings Plan shares in person at the Meeting (although you may attend the Meeting by following the instructions on how to register in advance in the “Attending the Annual Meeting” section of the “Questions and Answers about the Annual Meeting” below).

| ||||

| 6

|

Q:

|

Who is soliciting my vote, how are proxy cards being solicited, and what is the cost? | ||

|

A: |

Your Board is soliciting your vote. We have arranged for the services of Morrow Sodali LLC to solicit votes personally or by telephone, mail, or other electronic means for a fee not expected to exceed $19,250, plus reimbursement of reasonable expenses. Votes also may be solicited in a similar manner by officers and employees of your Company and members of your Board on an uncompensated basis. Your Company will pay all reasonable solicitation costs and will reimburse banks, brokers or other nominees for postage and expenses incurred by them for sending proxy materials to beneficial owners. |

3 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| 7

|

Q:

|

What items of business will be voted on at the Meeting and how does the Board recommend that I vote?

| ||||

| A: | ||||||

| Item | Brief Description |

|

Board’s Recommendation

|

| ||

| 1 | Elect the 12 nominees named in this proxy statement to the Board of Directors | |

✓ “FOR” each director nominee |

| ||

| 2 | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018 | ✓ “FOR” | ||||

| 3 | Approve, on an advisory basis, named executive officer compensation | ✓ “FOR” | ||||

| 4 | Approve a management proposal to amend the Company’s Amended Articles of Incorporation, as amended (the “Amended Articles of Incorporation”) and Amended Code of Regulations, as amended (the “Amended Code of Regulations”) to replace existing supermajority voting requirements with a majority voting power threshold | ✓ “FOR” | ||||

| 5 | Approve a management proposal to amend the Company’s Amended Articles of Incorporation and Amended Code of Regulations to implement majority voting for uncontested director elections | ✓ “FOR” | ||||

| 6 | Approve a management proposal to amend the Company’s Amended Code of Regulations to implement proxy access | ✓ “FOR” | ||||

| 7 | Shareholder proposal requesting a reduction in the threshold to call a special shareholder meeting |

X “AGAINST” | ||||

| 8

|

Q:

|

What is a quorum and what other voting information should I be aware of?

| ||

|

A: |

As of the Record Date, 476,834,264 shares of our common stock were outstanding. A majority of these shares represented at the Meeting either in person or by proxy constitutes a quorum. A quorum is required to conduct business at the Meeting. All shares represented at the Meeting are counted for the purpose of determining a quorum. You are entitled to one vote for each share of common stock you owned on the Record Date. A broker non-vote occurs when an entity holding shares in street name, such as a bank or broker, submits a proxy for your shares but does not indicate a vote for a particular “non-routine” proposal (such as Items 1 and 3 – 7) because your broker does not have the authority to vote on that proposal and has not received specific voting instructions. | |||

|

If you are a beneficial owner, we encourage you to provide instructions to your bank, broker, or other nominee by executing the voting form supplied to you by that entity. Pursuant to applicable rules, if your shares are held in a broker account, you must provide your broker with voting instructions for all matters to be voted on at the Annual Meeting except on Item 2. A broker will be permitted to vote your shares on Item 2 without your instructions because Item 2 is considered a “routine” matter under applicable New York Stock Exchange (“NYSE”) rules; however, your broker cannot vote your shares on any other items unless you provide instructions because these are deemed to be “non-routine” matters under NYSE rules. Therefore, your failure to give voting instructions means that your shares will not be voted on these “non-routine” items and, as applicable, your unvoted shares will be broker non-votes. |

4 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| An item to be voted on may require a percentage of votes cast, rather than a percentage of shares outstanding, to determine passage or failure. Votes cast is defined to include both “For” and “Against” votes and excludes abstentions and broker non-votes. If you properly sign and return your proxy card but your proxy card is not completed properly, such as marking more than one box for an item, your vote for that particular item will be treated as an abstention.

| ||||

| 9

|

Q:

|

What is the vote required for each item to be voted on at the Meeting?

|

| A: | ||||

| Item | Brief Description | Vote Required |

Treatment of Broker | |||

| 1 | Elect the 12 nominees named in this proxy statement to the Board of Directors | Nominees receiving the most “For” votes (among votes properly cast in person or by proxy) will be elected.

As further described in Item 1 below, any nominee for director who receives a greater number of votes “Withheld” than votes “For” his or her election must promptly tender his or her resignation to the Corporate Governance Committee following certification of the shareholder vote. |

No effect. | |||

| 2 | Ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2018 | Requires the affirmative vote of a majority of votes cast. | Abstentions - No effect.

Broker Non-votes – Not applicable. | |||

| 3 | Approve, on an advisory basis, named executive officer compensation | This advisory proposal requires the affirmative vote of a majority of the votes cast. | No effect. | |||

| 4 - 6 | Approve a management proposal to amend the Company’s Amended Articles of Incorporation and Amended Code of Regulations to replace existing supermajority voting requirements with a majority voting power threshold

Approve a management proposal to amend the Company’s Amended Articles of Incorporation and Amended Code of Regulations to implement majority voting for uncontested director elections

Approve a management proposal to amend the Company’s Amended Code of Regulations to implement proxy access |

Require the affirmative vote of at least 80 percent of the voting power of the Company (i.e., outstanding common shares). | Have the same effect as an “AGAINST” vote. | |||

| 7 | Shareholder proposal requesting a reduction in the threshold to call a special shareholder meeting |

The non-binding shareholder proposal requires the affirmative vote of a majority of votes cast.

Notwithstanding the results of the shareholder vote, the ultimate adoption of any measures called for by the shareholder proposal is at the discretion of your Board. |

No effect. |

5 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| 10

|

Q:

|

Will any other matters be voted on other than those described in this proxy statement?

| ||

|

A: |

We do not know of any business that will be considered at the Meeting other than the matters described in this proxy statement. However, if other matters are presented properly, your executed appointment of a proxy will give authority to the appointed proxies to vote on those matters at their discretion, unless you indicate otherwise in writing.

|

| 11

|

Q:

|

Where can I find the voting results of the Meeting?

| ||

|

A: |

We will announce preliminary voting results at the Meeting. Final voting results will be reported in a Current Report on Form 8-K, which is required to be filed with the SEC within four business days after the date of the Meeting and will be posted on our website at www.firstenergycorp.com under the tab “Investors,” then by selecting “SEC Filings & Reports.” You may also automatically receive your Company’s SEC filings (which include alerts for the filing of Form 8-Ks by your Company with the SEC) via e-mail by visiting that same website and clicking on “Investors,” “SEC Filings & Reports,” the “E-mail Alert” icon, then selecting “Enable Document Alerts.” |

6 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| 12

|

Q:

|

Who is entitled to vote at the Meeting?

| ||

|

A: |

Shareholders of record of FirstEnergy common stock as of the Record Date are entitled to receive notice of the Meeting and vote their shares. If you plan to attend the Meeting, please see the “Attending the Annual Meeting” section below of these “Questions and Answers about the Annual Meeting” for instructions on how to register in advance. Holders of FirstEnergy Series A Preferred Stock are not entitled to vote at the Annual Meeting.

| |||

| 13

|

Q:

|

How do I vote?

| ||

|

A: |

As further described below, if you are voting by Internet, telephone or mail, your vote must be received by 7:00 a.m., Eastern time, on Tuesday, May 15, 2018, to be counted in the final tabulation, except for shares held by participants in the FirstEnergy Corp. Savings Plan. If you are a participant in the FirstEnergy Corp. Savings Plan, your vote on shares held through the FirstEnergy Corp. Savings Plan must be received by 6:00 a.m., Eastern time, on Monday, May 14, 2018, to be counted in the final tabulation. | |||

| If you are a shareholder of record or an employee who holds unvested restricted stock, you can vote your shares using one of the following methods. Whether you plan to attend the Meeting or not, we encourage you to vote as soon as possible. | ||||

| • By Internet - Go to the website indicated on your proxy card or Notice of Internet Availability and follow the instructions. | ||||

| • By telephone - Call the toll-free telephone number indicated on your proxy card and follow the instructions. | ||||

| • By mail | ||||

| - Complete, date and sign the proxy card that you received in the mail. If you properly sign and return your proxy card but your proxy card is not completed properly, such as marking more than one box for an item, your vote for that particular item will be treated as an abstention. If you properly sign and return your proxy card but do not mark your choices, your shares will be voted as recommended by your Board. | ||||

| - Mail your proxy card in the enclosed postage-paid envelope. If your envelope is misplaced, send your proxy card to Corporate Election Services, Inc., your Company’s independent proxy tabulator and Inspector of Election. The address is FirstEnergy Corp., c/o Corporate Election Services, P.O. Box 3230, Pittsburgh, PA 15230. | ||||

| • At the Meeting - You may vote in person at the Meeting, even if you previously appointed a proxy by Internet, telephone, or mail. | ||||

| If you received a Notice of Internet Availability and would like to vote by telephone or mail, please follow the instructions on your notice to request a paper copy of the proxy materials and proxy card. | ||||

7 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| If you are a participant in the FirstEnergy Corp. Savings Plan, your proxy card will include the shares of common stock held for your account in the FirstEnergy Corp. Savings Plan and any other shares registered with our transfer agent, AST, as of the Record Date. You can vote shares allocated to your Savings Plan account by submitting your voting instructions by telephone or through the Internet as instructed on your proxy card or by completing, signing, and dating the proxy card and returning the form in the enclosed postage-prepaid envelope. Subject to the Employee Retirement Income Security Act of 1974, as amended, and pursuant to the Savings Plan provisions, the Savings Plan’s Trustee will vote all shares as instructed by Savings Plan participants, and shares for which the Savings Plan’s Trustee does not receive timely voting instructions will be voted in the same proportion as the shares held under the Savings Plan for which the Savings Plan’s Trustee receives timely voting instructions. Because the Savings Plan Trustee is the only one who can vote your FirstEnergy Corp. Savings Plan shares, you may not vote such shares at the Meeting. | ||||

| Beneficial owners (other than participants in the FirstEnergy Corp. Savings Plan) will receive instructions from the holder of record (the bank, broker or other nominee that holds your shares) that you must follow for your shares to be voted. Also, please note that if you wish to vote in person at the Meeting, you must request a legal proxy from your bank, broker, or other nominee that holds your shares and present that legal proxy identifying you as the beneficial owner of your shares of FirstEnergy common stock and authorizing you to vote those shares at the Meeting.

| ||||

| 14

|

Q:

|

How may I revoke my proxy?

| ||

|

A: |

You may revoke your appointment of a proxy or change your related voting instructions one or more times by: | |||

| • Mailing a proxy card that revises your previous appointment and voting instructions; | ||||

| • Voting by Internet or telephone after the date of your previous appointment and voting instructions; | ||||

| • Voting in person at the Meeting (other than participants in the FirstEnergy Corp. Savings Plan); or | ||||

| • Notifying the Corporate Secretary of your Company in writing prior to the commencement of the Meeting. | ||||

| The proxy tabulator will treat the last instructions it receives from you as final. For example, if a proxy card is received by the proxy tabulator after the date that a telephone or Internet appointment is made, the tabulator will treat the proxy card as your final instruction. For that reason, it is important to allow sufficient time for your voting instructions on a mailed proxy card to reach the proxy tabulator before changing them by telephone or Internet. Please note that unless you are voting in person at the Meeting, in order to be counted, the revocation or change must be received by the applicable dates and times, discussed above in Question 13, which also includes instructions on how to vote. | ||||

| If you are a beneficial owner of shares, you must follow the directions you receive from your bank, broker, or other nominee to change your vote. | ||||

8 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| 15

|

Q:

|

Do I need to register in advance to attend the Meeting?

| ||

|

A: |

Yes. In accordance with our security procedures, if you plan to attend the Meeting, you will need to register in advance by following the advance registration instructions below. | |||

| Attendance at the Meeting will be limited to your Company’s invited guests and to persons owning FirstEnergy Corp. shares as of the Record Date of March 16, 2018, who register in advance of the Meeting and present: | ||||

| (i) an admission card (refer to further instructions below); and | ||||

| (ii) a valid form of government-issued photo identification. | ||||

| The admission card admits only the named shareholder(s) and is not transferable. If you are a beneficial owner of shares (other than a participant in the FirstEnergy Corp. Savings Plan), to attend the meeting you will also need an original copy of a letter or legal proxy from your bank, broker or other nominee or your account statement showing proof that you beneficially owned FirstEnergy shares as of the Record Date. | ||||

| Advance Registration Instructions | ||||

| If you are a shareholder of record, participant in the FirstEnergy Corp. Savings Plan or an employee who holds unvested restricted stock and you are voting by Internet, telephone or by mail: To register to attend the Meeting, please indicate that you will attend the Meeting when voting by Internet or telephone, or check the appropriate registration box on your proxy card if voting by mail. | ||||

| All other shareholders: To register to attend the Meeting and, as applicable, have an admission card mailed to you, please send a request containing all of the following information by mail to: FirstEnergy Corp. Annual Meeting Registration — A-GO-16, 76 South Main Street, Akron, OH 44308-1890; or by email to: Registration@FirstEnergyCorp.com or by fax: 330-777-6519: | ||||

| 1. Your name, mailing address and telephone number; and | ||||

| 2. If you are a beneficial owner (other than a participant in the FirstEnergy Corp. Savings Plan), proof that you own FirstEnergy shares (such as a photocopy of a letter or legal proxy from your bank, broker, or other nominee or a photocopy of your account statement redacting certain information) as of the Record Date. | ||||

9 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

| Admission Card | ||||

| If you plan to attend the Meeting, you must bring your admission card with you to the Meeting. If you are a shareholder of record, participant in the FirstEnergy Corp. Savings Plan or an employee who holds unvested restricted stock, the admission card portion of your proxy card or one-page Notice of Internet Availability that was included with your proxy material mailing will serve as your admission card. All other shareholders must follow the advance registration instructions above to receive an admission card. | ||||

| Other Related Matters | ||||

| If you desire to have one representative attend the Meeting on your behalf or one representative designated to present a shareholder proposal properly brought before the Meeting, please follow the process under “Advance Registration Instructions—All other shareholders” above and include the name, mailing address and telephone number of that representative. | ||||

| Cameras, recording equipment, computers, large bags and items such as briefcases, backpacks and packages will not be permitted in the Meeting room and may be subject to inspection. No individual may use communication devices, take photographs, or use audio or video recording equipment in the Meeting facilities without the express written permission of your Company. No firearms or weapons will be allowed in the Meeting facilities. Signage and other inappropriate items are likewise prohibited.

| ||||

| 16

|

Q:

|

What are the directions to the Meeting location?

| ||

|

A: |

John S. Knight Center, 77 E. Mill Street, Akron, Ohio | |||

|

• From Ohio Turnpike Via Route 8: Take I-80 East to Exit 180 (Route 8 South). Follow Route 8 South to the Perkins Street exit. Exit right onto Perkins Street. Proceed on Perkins Street until reaching High Street. Turn left onto High Street. Proceed on High Street, passing over East Market Street. The John S. Knight Center is located on the left at the corner of High & Mill Streets. | ||||

|

• From North Via I-77 & West Via I-76: Take I-77/I-76 (they run concurrently briefly) to Exit 22A. Merge with a one-way side street (South Street). Follow South Street to the 2nd light—at that point all traffic must turn left onto Broadway. Follow Broadway to Mill Street. The John S. Knight Center is located at the corner of Broadway & Mill Streets. | ||||

|

• From North and South via I-71: Take I-71 to I-76 East to Exit 22A (Main/Broadway/Downtown) then follow directions above. | ||||

|

• From South: Take I-77 to Exit 22A. Take Broadway and follow Broadway to Mill Street. The John S. Knight Center is located on the left at the corner of Broadway & Mill Streets. | ||||

| Parking is available next to and near the John S. Knight Center. | ||||

10 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

Shareholder Proposals For 2019

| 17

|

Q:

|

When are shareholder proposals due for the 2019 Annual Meeting?

| ||

|

A: |

Under the rules of the SEC, a shareholder who wishes to offer a proposal for inclusion in your Company’s proxy statement and proxy card for the 2019 annual meeting of shareholders must submit the proposal and any supporting statement by November 30, 2018, to the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, OH 44308-1890. Any proposal received after that date will not be eligible for inclusion in the 2019 proxy statement and proxy card. | |||

|

Under our Amended Code of Regulations, a shareholder who wishes to properly introduce an item of business before an annual meeting of shareholders must follow the applicable rules and procedures. The procedures provide that we must receive the notice of intention to introduce an item of business, including nominations of candidates for election to your Board, at an annual meeting not less than 30 nor more than 60 calendar days prior to the annual meeting. In the event public announcement of the date of the annual meeting is not made at least 70 calendar days prior to the date of the meeting, notice must be received not later than the close of business on the 10th calendar day following the day on which the public announcement is first made. Accordingly, if a public announcement of the date of the 2019 annual meeting of shareholders is made at least 70 calendar days prior to the date of the meeting and assuming that our 2019 annual meeting of shareholders is held on the third Tuesday of May, we must receive any notice of intention to introduce an item of business at that meeting no earlier than March 22, 2019 and no later than April 21, 2019; otherwise, we must receive any notice of intention to introduce an item of business at that meeting no later than the close of business on the 10th calendar day following the day on which the public announcement is first made. If we do not receive notice as set forth above or if certain other requirements of applicable law are met, the persons named as proxies in the proxy materials relating to that meeting will use their discretion in voting the proxies when these matters are raised at the meeting. Our Amended Code of Regulations is available on the SEC website and upon written request to the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, OH 44308-1890. The management proposal to be considered as Item 6 below addresses proxy access for shareholders and, if approved, would impact these procedures. |

Obtaining Additional Information

| 18

|

Q:

|

How can I learn more about FirstEnergy’s operations?

| ||

|

A: |

If you received a paper copy of this proxy statement, you can learn more about our operations by reviewing the annual report to shareholders for the year ended December 31, 2017, that is included with the mailing of this proxy statement. If you did not receive a paper copy of this proxy statement, you can view the annual report and other information by visiting www.ReadMaterial.com/FE. | |||

| A copy of our latest Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC, including the financial statements and the financial statement schedules, will be sent to you, without charge, upon written request to the Corporate Secretary, FirstEnergy Corp., 76 South Main Street, Akron, Ohio 44308-1890. You also can view the Form 10-K by visiting your Company’s website at www.firstenergycorp.com under the tab “Investors,” then by selecting “SEC Filings & Reports.” Information contained on any of the Company or third-party websites referenced above or later in this proxy statement is not deemed to be part of this proxy statement. | ||||

11 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

Corporate Governance and Board of Directors Information

Board Leadership Structure

The positions of CEO and Chairman of the Board are separated. Our Amended Code of Regulations and Corporate Governance Policies do not require that your Chairman of the Board and CEO positions be separate, and your Board has not adopted a specific policy or philosophy on whether the role of the CEO and Chairman of the Board should be separate. However, having a separate Chairman of the Board and CEO has typically allowed your CEO to focus more time on our day-to-day operations and, in your Board’s judgement, is appropriate at this time.

Mr. Smart, your independent Chairman of the Board who presides at all executive sessions of the independent directors, will retire from your Board as of the Annual Meeting in accordance with the mandatory retirement age provisions of our Corporate Governance Policies. Effective as of the 2018 Annual Meeting, following Mr. Smart’s retirement, Mr. Donald Misheff has been elected by your Board to serve as your independent Chairman of the Board contingent on his successful election to your Board at the Annual Meeting.

As required by the NYSE listing standards, FirstEnergy schedules regular executive sessions for your independent directors to meet without management participation. Because an independent director is required to preside over each such executive session of independent directors, we believe it is more efficient to have your independent Chairman of the Board preside over all such meetings as opposed to rotating that function among your Company’s independent directors.

Director Independence

Your Board annually reviews the independence of each of its members to make the affirmative determination of independence that is called for by our Corporate Governance Policies and required by the SEC and the listing standards of the NYSE, including certain independence requirements of Board members serving on the Audit Committee, the Compensation Committee and the Corporate Governance Committee.

Your Board adheres to the definition of an “independent” director as established by the NYSE and the SEC. The definition used by your Board to determine independence is included in our Corporate Governance Policies and can be viewed by visiting our website at www.firstenergycorp.com/charters.

Each year, our directors complete a questionnaire that elicits information to assist the Board in assessing whether each director meets the NYSE’s independence standards and the related provisions in the Company’s Corporate Governance Policies. The Company facilitates this review by examining its financial records to determine any amounts paid to or received from entities in which each non-employee director or immediate family member has a relationship based on responses to the questionnaires. Subject to the categorical standards approved by the Board and described below, a list of the entities and the amounts the Company paid to or received from those entities is provided to the Corporate Governance Committee. Utilizing this information, the Corporate Governance Committee presents to the Board (i) an evaluation, with regard to each director, whether the director has any material relationship with the Company or any of its subsidiaries; (ii) a recommendation of whether the amount of any payments between the Company and relevant entities could interfere with a director’s ability to exercise independent judgment; and (iii) a review of any other relevant facts and circumstances regarding the nature of these relationships, to determine whether other factors, regardless of the categorical standards the Board has adopted or under the NYSE’s independence standards, might impede a director’s independence. Based on a review of information concerning each of its non-employee directors and the recommendation of the Corporate Governance Committee, the Board will affirmatively determine whether a director may be considered “independent.”

Additionally, your Board recognizes that in the ordinary course of business, relationships and transactions may occur between your Company and its subsidiaries and entities with which some of our directors are or have been affiliated. Accordingly, our Corporate Governance Policies provide categorical standards to assist your Board in determining what does not constitute a material relationship for purposes of determining a director’s independence. The following commercial and charitable relationships will not be considered to be a material relationship that would impair a director’s independence: (i) if the director, an immediate family member or a person or organization with which the director has an affiliation purchases electricity or related

12 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

products or services from the Company or its subsidiaries in the ordinary course of business and the rates or charges involved in the transaction are fixed in conformity with law or governmental authority or otherwise meet the requirements of Regulation S-K Item 404(a) Instruction 7, and (ii) the aggregate charitable contributions made by the Company to an organization with which a director, an immediate family member or a person or organization with which the director has an affiliation were less than $100,000 in each of the last three fiscal years. Notwithstanding the foregoing, the Board will not treat a director’s relationship with the Company as categorically immaterial if the relationship otherwise conflicts with the NYSE corporate governance listing standards or is required to be disclosed by the Company pursuant to Item 404 of Regulation S-K.

In making such determinations, your Board considered the fact that certain directors are executive officers of companies with which we conducted business. In addition, many of our directors are or were directors, trustees, or similar advisors of entities with which we conducted business or of non-profit organizations with which we conducted business and/or made contributions. Outside of their service as a Company director, none of your Company’s independent directors currently provide professional or other services to your Company, its affiliates or any officer of your Company and none of your Company’s directors are related to any executive officer of your Company.

Specifically, your Board considered the following relationships and transactions, which occurred in the ordinary course of business, between your Company and its subsidiaries and certain entities some of our directors have been affiliated with that existed or occurred during the preceding three years:

| • | Regulated electric services and related non-electric products and services purchased from your Company (by companies where Ms. Pianalto serves as a director and by a university where Ms. Pianalto serves as an advisory trustee and holds a faculty chair); |

| • | Non-regulated electric services and related non-electric products and services purchased from your Company (by companies where Ms. Johnson, Ms. Pianalto, Dr. Thornton and Messrs. Anderson and Pappas serve as directors, by a company where a family member of Mr. Anderson is employed, by a university where Ms. Pianalto serves as an advisory trustee and holds a faculty chair, by a community college where Dr. Thornton is a president emeritus, and by a company where Mr. Reyes serves as a chairman of a nuclear safety review board); |

| • | Purchases by your Company of electric power generation related products and services (from companies where Dr. Thornton, Ms. Johnson, Ms. Pianalto, and Messrs. Anderson and Pappas serve as directors, from a company where a family member of Mr. Anderson is employed and from a company where Mr. Reyes serves as a chairman of a nuclear safety review board); |

| • | Purchases by your Company of public utility water services (from a company where Ms. Johnson serves as a director); |

| • | Purchases by your Company of non-audit related services (from an accounting firm that is not our independent accountant where family members of Messrs. Cottle and Misheff are employed); |

| • | Purchases by your Company for information technology related services and office-related products and services (from a company where Ms. Pianalto serves as a director); and |

| • | Payments by your Company relating to charitable contributions and sponsorships, membership fees/dues, tuition for employee training and related expenses (to a university where Ms. Pianalto serves as an advisory trustee and holds a faculty chair, to an organization where Mr. Reyes serves as a training and accreditation board member and to a community college where Dr. Thornton is a president emeritus). |

In all cases, your Board determined that the nature of the business conducted and any interest of the applicable director in that business were immaterial both to your Company and to the director. Pursuant to your Company’s Corporate Governance Policies, your Board also determined that the amounts paid to or received from the other entity affiliated with the applicable director in connection with the applicable transactions in each of the last three years did not exceed the greater of $1 million or two percent of the consolidated gross revenue of that entity, which is the threshold set forth in the NYSE listing standards and our Corporate Governance Policies. The Corporate Governance Committee determined that none of the relationships described above constituted a related person transaction requiring disclosure under the heading “Certain Relationships and Related Person Transactions” in this proxy statement. Also, in each case where the director is a current executive officer of another company, any transactions constituted less than one percent of your Company’s and the other company’s consolidated gross revenues in each of the last three completed fiscal years.

13 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

Based on the February 2018 independence review, your Board affirmatively determined that all non-employee director nominees—Paul T. Addison, Michael J. Anderson, Steven J. Demetriou, Julia L. Johnson, Donald T. Misheff, Thomas N. Mitchell, James F. O’Neil III, Christopher D. Pappas, Sandra Pianalto, Luis A. Reyes and Dr. Jerry Sue Thornton—are independent pursuant to our Corporate Governance Polices, the rules and regulations of the SEC and the listing standards of the NYSE. Additionally, Messrs. William T. Cottle and George M. Smart, who were not nominated for election to the Board at the Meeting pursuant to your Board’s mandatory retirement age policy, were considered independent directors. Mr. Jones is not considered an independent director because of his employment with your Company.

Board’s Function

Although your Board has the responsibility for establishing broad corporate policies and our overall performance, your Board is not involved in day-to-day operations of your Company. Management keeps the directors informed of our business and operations with various reports and documents that are sent to them each month or more frequently as necessary. Management also makes operating and financial presentations at Board and committee meetings. Your Board established the committees described below to assist in performing its responsibilities.

Board Composition and Refreshment

Your Board is comprised of individuals who are highly-qualified, diverse, and independent (other than Mr. Jones, who is not considered independent because of employment with your Company). Your Board’s succession planning takes into account the importance of Board refreshment and having an appropriate balance of experience and perspectives on your Board. As further discussed in the “Review of Director Nominees” section of this proxy statement, your Board and the Corporate Governance Committee recognizes that the racial, ethnic and gender diversity of your Board are an important part of its analysis as to whether your Board possesses a variety of complementary skills and experiences.

We have regularly added directors who we believe infuse diversity, new ideas and fresh perspectives into the boardroom. Since the beginning of 2013, your Board has added seven new Board members who are currently standing for election as director nominees. The result is more than half of your Board’s director nominees have tenure of five years or less. During this time period, your Board has added four directors that have further diversified your Board, including two female directors. Also, in connection with our mandatory retirement age of 72 for outside directors described below, two of our longest tenured directors will retire from your Board as of the date of the Annual Meeting.

Other Public Company Board Membership

Our Corporate Governance Policies provide that directors will not, without your Board’s approval, serve on the board of directors of more than three other public companies. Further, without the Board’s approval, no director who serves as an executive officer of any public company may serve on a total of more than two public company boards of directors, except for directorships that existed prior to the implementation of this policy.

2017 Board Evaluations

Your Board is committed to a rigorous self-evaluation process. Through this evaluation, directors review your Board’s performance, including areas where the Board feels it functions effectively and areas where the Board believes it can improve. Your Board has a three-part annual evaluation process that is coordinated by the Corporate Governance Committee: a full Board evaluation; committee evaluations; and individual director evaluations.

14 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

The Board and each committee evaluation includes comprehensive questions designed to provide a wholistic evaluation of the performance of the Board and each committee in light of our current needs. Individual director performance evaluations are more specifically tailored to each member by your Board’s Chairman, in consultation with the Chair of the Corporate Governance Committee, in order to consider and review the individual director’s performance, as well as their continued qualifications. The 2017 evaluations were shared as needed with the applicable directors, committee members, and the full Board, and led to discussions to determine which areas the Board would like to focus on during 2018 to enhance its effectiveness.

| 1. Annual Process is Initiated Your Board’s Corporate Governance Committee initiates the annual Board, committee and individual director evaluation process and presents the proposed approach to your Board for comment.

|

|

2. Board & Committee Assessment Surveys Assessment surveys solicit each independent director’s opinion regarding your Board’s and committees’ effectiveness relating to topics such as Board and committee composition and operations, peer director evaluations, strategic direction, shareholder value and executive management.

|

|

3. Individual Director Evaluations & Director Self-Assessments Your Board Chairman, in consultation with the Chair of the Corporate Governance Committee, reviews individual performance and qualifications of each director. In addition, prior to accepting a nomination, each director conducts a self-assessment as to whether he or she satisfies the criteria set forth in the Company’s Corporate Governance Policies and the Corporate Governance Committee Charter.

|

|

4. Presentation of Findings Your Corporate Governance Committee presents its findings to the Board, assessing the contributions of your Board and its committees and discussing any areas in which your Board believes improvement is recommended. Input about the findings is sought from your Board.

|

|

5. Feedback Incorporated Results requiring consideration are addressed at subsequent Board and committee meetings and reported back to the full Board, where appropriate. For example, in 2018, feedback indicated that your Board should remain focused on Board composition and diversity and remain focused on the Company’s strategic initiatives.

|

15 | FirstEnergy Corp. 2018 Proxy Statement

Table of Contents

Board’s Role in Risk Oversight