Filed pursuant to Rule 424(b)(3)

File No. 333-87218

File No. 333-132399

File No.

333-137802

File No. 333-168357

PHL Variable Insurance Company

Phoenix MVA

Phoenix Foundations® Equity Index Annuity

Phoenix Guaranteed Income Edge® – Lockwood Advisors, Inc.

Phoenix Guaranteed Income Edge® – Institute for Wealth Management, LLC

SUPPLEMENT DATED AUGUST 24, 2015

TO THE

PROSPECTUSES DATED APRIL 30, 2012, As Previously Supplemented

Waiver of Income Edge Fee

(Phoenix Guaranteed Income Edge® – Lockwood Advisors, Inc. and Phoenix Guaranteed Income Edge® – Institute for Wealth Management, LLC (“Income Edge”))

The quarterly portions of the Income Edge Fee for your Certificate that were due on January 1, 2015, April 1, 2015 and July 1, 2015 have been waived by PHL Variable Insurance Company. Until further notice, future Income Edge Fees will be waived by PHL Variable Insurance Company. Except as regards the obligation to pay the quarterly portion of the Income Edge Fee, the terms and conditions of your Certificate are not changed by this fee waiver.

General Information

This supplement provides current information about your PHL Variable Insurance Company (“PHL Variable,” the “Company” and “we”) annuity contract. On July 28, 2015, The Phoenix Companies Inc. (“Phoenix”) completed the previously announced de-stacking of its life subsidiaries. Phoenix completed the de-stacking through an extraordinary dividend of PHL Variable and two affiliated insurers from Phoenix Life Insurance Company (“Phoenix Life”), to Phoenix, effective July 1, 2015. Prior to the de-stacking, Phoenix Life, a direct subsidiary of Phoenix, was the indirect parent of PHL Variable and the two affiliated insurers.

As of July 1, 2015, Phoenix is the direct parent company of PHL Variable and Phoenix Life is no longer an indirect parent of PHL Variable. As result, a financial support arrangement for the benefit of PHL Variable from Phoenix Life is extinguished. The de-stacking was undertaken as a result of discussions with Phoenix Life’s New York insurance regulator related to an intercompany reinsurance treaty between Phoenix Life and the Company entered into during the second quarter of 2015.

| v | The prospectus is revised to delete all references to PHL Variable as directly owned by PM Holdings, Inc. and as indirectly owned by Phoenix Life. Such references are replaced with disclosure providing that PHL Variable is a wholly owned direct subsidiary of Phoenix. |

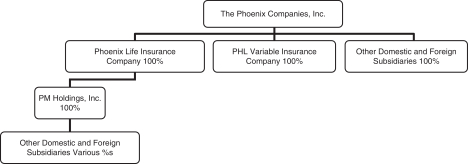

| v | The corporate structure chart in the subsection of “ Description of PHL Variable” entitled “Overview” (Phoenix MVA and Phoenix Foundations® Equity Index Annuity) and in the section “About PHL Variable” (Income Edge) is replaced with the following: |

The following chart illustrates our corporate structure as of July 1, 2015:.

PHL Variable’s Operating and Capital Needs

On July 28, 2015, Phoenix completed the de-stacking of PHL Variable and two affiliated insurers through an extraordinary dividend of the three insurers to Phoenix, effective July 1, 2015. As of July 1, 2015, Phoenix is the direct parent company of PHL Variable and Phoenix Life is no longer an indirect parent of PHL Variable.

| TF1203 | 1 |

In 2014 and 2013, Phoenix made capital contributions of $15.0 million and $45.0 million, respectively, for the Company’s benefit. In 2013, PHL Variable issued a $30.0 million surplus note which was purchased by Phoenix.

As a result of discussions with regulators related to an intercompany reinsurance treaty between Phoenix Life and the Company, effective June 30, 2015, Phoenix completed a de-stacking of its insurance company subsidiaries, including the Company, effective July 1, 2015. Further, Phoenix agreed with Phoenix Life’s New York regulator that it would not use any future dividends paid by Phoenix Life to meet the Company’s capital needs. Upon the effectiveness of the de-stacking, the Company, which had been an indirect subsidiary of both Phoenix and Phoenix Life, became a direct subsidiary of Phoenix. As a result of the de-stacking, an existing commitment by Phoenix Life to maintain the Company’s capital at certain minimum levels was extinguished.

As of June 30, 2015, the Company had an estimated Company Action Level risk-based capital ratio of 201%.

The restriction on Phoenix’s use of Phoenix Life dividends and the extinguishment of Phoenix Life’s commitment to maintain the Company’s capital at certain minimum levels may adversely affect the Company’s ability to meet its cash and debt obligations which may slow or cease its ability to write new life insurance and annuity business. If the Company is unable to meet its capital needs either by itself or with assistance from Phoenix, the Company could become subject to increased regulatory oversight by its domestic insurance regulator or to other regulatory actions including rehabilitation, any of which may materially adversely affect the Company’s business, financial condition or results of operations.

Financial Support Arrangement

PHL Variable no longer has a financial support arrangement with Phoenix Life. On July 28, 2015, Phoenix completed the de-stacking of its life subsidiaries through an extraordinary dividend of PHL Variable and two affiliated insurers from Phoenix Life to Phoenix, effective July 1, 2015. As of July 1, 2015, Phoenix is the direct parent company of PHL Variable and Phoenix Life is no longer an indirect parent of PHL Variable. As a result of the de-stacking, this commitment by Phoenix Life to keep the Company’s capital at certain minimum levels is extinguished. This financial support arrangement, which is now extinguished, was not evidence of indebtedness or an obligation or liability of Phoenix Life to the owner of a PHL Variable contract and did not provide the owner of a PHL Variable contract with recourse against Phoenix Life.

Litigation and arbitration

The Company is regularly involved in litigation and arbitration, both as a defendant and as a plaintiff. The litigation and arbitration naming the Company as a defendant ordinarily involves our activities as an insurer, employer, investor, investment advisor or taxpayer.

It is not feasible to predict or determine the ultimate outcome of all legal or arbitration proceedings or to provide reasonable ranges of potential losses. Management of the Company believes that the ultimate outcome of our litigation and arbitration matters are not likely, either individually or in the aggregate, to have a material adverse effect on the financial condition of the Company beyond the amounts already reported in our financial statements. However, given the large or indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation and arbitration, it is possible that an adverse outcome in certain matters could, from time to time, have a material adverse effect on the results of operations or cash flows in particular quarterly or annual periods.

SEC Cease-and-Desist Order

Phoenix and the Company are subject to a Securities and Exchange Commission (the “SEC”) Order Instituting Cease-and-Desist Proceedings Pursuant to Section 21C of the Securities Exchange Act of 1934, Making Findings, and Imposing a Cease-and-Desist Order which was approved by the SEC in March 2014 (the “March 2014 Order”) and was subsequently amended by an amended SEC administrative order approved by the SEC in August 2014 (the March 2014 Order, as amended, the “Amended Order”). The Amended Order and the March 2014 Order (collectively, the ”Orders”), directed Phoenix and the Company to cease and desist from committing or causing any violations and any future violations of Section 13(a) of the Exchange Act and Rules 13a-1 and 13a-13 thereunder and Section 15(d) of the Exchange Act and Rules 15d-1 and 15d-13 thereunder. Phoenix and the Company remain subject to these obligations. Pursuant to the Orders, Phoenix and the Company were required to file certain periodic SEC reports in accordance with the timetables set forth in the Orders. All of such filings have been made. Phoenix and the Company paid civil monetary penalties to the SEC in the aggregate amount of $1.1 million pursuant to the terms of the Orders.

Cases Brought by Policy Investors

On June 5, 2012, Wilmington Savings Fund Society, FSB, as successor in interest to Christiana Bank & Trust Company and as trustee of 60 unnamed trusts, filed suit against Phoenix, Phoenix Life and the Company in the United States District Court for the Central District of California; the case was later transferred to the District of Delaware (C.A. No. 13-499-RGA) by order dated March 28, 2013. After the plaintiffs twice amended their complaint, and dropped Phoenix as a defendant and dropped one of the plaintiff Trusts, the court issued

| TF1203 | 2 |

an order on April 9, 2014 dismissing seven of the ten counts, and partially dismissing two more, with prejudice. The court dismissed claims alleging that Phoenix Life and the Company committed RICO violations and fraud by continuing to collect premiums while concealing an intent to later deny death claims. The claims that remain in the case seek a declaration that the policies at issue are valid, and damages relating to cost of insurance increases. This case has been settled, and the settlement does not have a material impact on the Company’s financial statements.

On August 2, 2012, Lima LS PLC filed a complaint against Phoenix, Phoenix Life, the Company, James D. Wehr, Philip K. Polkinghorn, Edward W. Cassidy, Dona D. Young and other unnamed defendants in the United States District Court for the District of Connecticut (Case No. CV12-01122). On July 1, 2013, the defendants’ motion to dismiss the complaint was granted in part and denied in part. Thereafter, on July 31, 2013, the plaintiff served an amended complaint against the same defendants, with the exception that Mr. Cassidy was dropped as a defendant. The plaintiffs allege that Phoenix Life and the Company promoted certain policy sales knowing that the policies would ultimately be owned by investors and then challenging the validity of these policies or denying claims submitted on these policies. Plaintiffs are seeking damages, including punitive and treble damages, attorneys’ fees and a declaratory judgment. We believe we have meritorious defenses against this lawsuit and we intend to vigorously defend against these claims. The outcome of this litigation and any potential losses are uncertain.

Cost of Insurance Cases

On November 18, 2011, Martin Fleisher and another plaintiff (the “Fleisher Litigation”), on behalf of themselves and others similarly situated, filed suit against Phoenix Life in the United States District Court for the Southern District of New York (C.A. No. 1:11-cv-08405-CM-JCF (U.S. Dist. Ct; S.D.N.Y.)) challenging cost of insurance (“COI”) rate adjustments implemented by Phoenix Life in 2010 and 2011 in certain universal life insurance policies. The complaint seeks damages for breach of contract. The class certified by the court is limited to holders of Phoenix Life policies issued in New York subject to New York law and subject to Phoenix Life’s 2011 COI rate adjustment. The Company has been named as a defendant in six actions challenging its COI rate adjustments in certain universal life insurance policies implemented concurrently with the Phoenix Life adjustments. (Phoenix Life and the Company are referred to as the “Phoenix Life Companies.”) Five cases have been brought against the Company, while one case has been brought against the Phoenix Life Companies. These six cases, only one of which is styled as a class action, have been brought by (1) Tiger Capital LLC (C.A. No. 1:12-cv- 02939-CM-JCF; U.S. Dist. Ct; S.D.N.Y., complaint filed on March 14, 2012; the “Tiger Capital Litigation”); (2-5) U.S. Bank National Association, as securities intermediary for Lima Acquisition LP ((2: C.A. No. 1:12-cv-06811-CM-JCF; U.S. Dist. Ct; S.D.N.Y., complaint filed on November 16, 2011; 3: C.A. No. 1:13-cv-01580-CM-JCF; U.S. Dist. Ct; S.D.N.Y., complaint filed on March 8, 2013; collectively, the “U.S. Bank N.Y. Litigations”); (4: C.A. No. 3:14- cv-00555-WWE; U.S. Dist. Ct; D. Conn., complaint originally filed on March 6, 2013, in the District of Delaware and transferred by order dated April 22, 2014, to the District of Connecticut; and 5: C.A. No. 3:14-cv-01398-WWE, U.S. Dist. Ct; D. Conn., complaint filed on September 23, 2014, and amended on October 16, 2014, to add Phoenix Life as a defendant, and consolidated with No. 3:14-cv-00555-WWE (collectively the “U.S. Bank Conn. Litigations”)); and (6) SPRR LLC (C.A. No. 1:14-cv-8714-CM; U.S. Dist. Ct.; S.D.N.Y., complaint filed on October 31, 2014; the “SPRR Litigation”). SPRR LLC filed suit against the Company, on behalf of itself and others similarly situated, challenging COI rate adjustments implemented by the Company in 2011. The Tiger Capital Litigation and the two U.S. Bank N.Y. Litigations were assigned to the same judge as the Fleisher Litigation. Plaintiff in the Tiger Capital Litigation seeks damages for breach of contract. Plaintiff in the U.S. Bank N.Y. Litigations and the U.S. Bank Conn. Litigations seeks damages and attorneys’ fees for breach of contract and other common law and statutory claims. The plaintiff in the SPRR Litigation, which has been reassigned to the same judge as the Fleisher Litigation, Tiger Capital Litigation and the two U.S. Bank N.Y. Litigations, seeks damages for breach of contract for a nationwide class of policyholders. The Phoenix Life Companies reached a definitive agreement to settle a COI case, the Tiger Capital Litigation (Tiger Capital LLC (C.A. No. 1:12-cv-02939-CM-JCF; U.S. Dist. Ct; S.D.N.Y.)) on a basis that will not have a material impact on the Company’s financial statements. On June 3, 2015, the parties to the Tiger Capital Litigation advised the court of the settlement, which includes Tiger Capital, LLC’s participation in the class Settlement described below.

Phoenix Life and the Company reached an agreement as of April 30, 2015, memorialized in a formal settlement agreement executed on May 29, 2015, with SPRR, LLC, Martin Fleisher, as trustee of the Michael Moss Irrevocable Life Insurance Trust II, and Jonathan Berck, as trustee of the John L. Loeb, Jr. Insurance Trust (collectively, the SPRR Litigation and the Fleisher Litigation plaintiffs referred to as the “Plaintiffs”), to resolve the Fleisher Litigation and SPRR Litigation (the “Settlement”). A motion for preliminary approval of the Settlement was filed with the United States District Court for the Southern District of New York on May 29, 2015. On June 3, 2015, the court granted preliminary approval of the Settlement, ordered notice be given to class members, and set a hearing on September 9, 2015 to address, among other things, final approval of the Settlement. The proposed Settlement class consists of all policyholders that were subject to the 2010 or 2011 COI rate adjustments (collectively, the “Settlement Class”), including the policies within the above-named COI cases, and will be structured to allow members of the Settlement Class to opt out of the Settlement. The Phoenix Life Companies will establish a Settlement fund, which may be reduced proportionally for any opt-outs, and will pay a class counsel fee if the Settlement is approved. The Phoenix Life Companies will be released by all participating members of the Settlement Class, and the COI rate adjustment for policies participating in the Settlement Class will remain in effect. The Phoenix Life Companies agreed to pay a total of $48.5 million, as reduced for any opt-outs, in connection with the Settlement. The Phoenix Life Companies agreed not to impose additional increases to

| TF1203 | 3 |

COI rates on policies participating in the Settlement Class through the end of 2020, and not to challenge the validity of policies participating in the Settlement Class for lack of insurable interest or misrepresentations in the policy applications. The Settlement is subject to certain conditions and final court approval is intended to resolve all pending COI cases, other than for policyholders who opt-out of the Settlement. Under the Settlement, policyholders who are members of the Settlement Class, including those which have filed individual actions relating to COI rate adjustments, may opt out of the Settlement and separately litigate their claims. The opt-out period expired on July 17, 2015. Opt-out notices have been received by the Phoenix Life Companies, including from U.S. Bank, a party to four COI cases. The Phoenix Life Companies are currently unable to estimate the damages that policyholders who opt out of the Settlement may or may not collect in litigation against the Phoenix Life Companies. There can be no assurance that the ultimate cost to the Company will not be higher or lower than $36.4 million.

Complaints to state insurance departments regarding the Company’s COI rate adjustments have also prompted regulatory inquiries or investigations in several states, with two of such states (California and Wisconsin) issuing letters directing the Company to take remedial action in response to complaints by a single policyholder. The Company disagrees with both states’ positions. On March 23, 2015, an Administrative Law Judge (“ALJ”) in Wisconsin ordered PHL Variable to pay restitution to current and former owners of seven policies and imposed a fine on PHL Variable which, in a total amount, does not have a material impact on PHL Variable’s financial position (Office of the Commissioner of Insurance Case No. 13- C35362). PHL Variable disagrees with the ALJ’s determination and has appealed the order.

For any cases or regulatory directives not resolved by the Settlement, Phoenix Life and the Company believe that they have meritorious defenses against all of these lawsuits and regulatory directives and intend to vigorously defend against them, including by appeal if necessary. For any matters not resolved by the Settlement, the outcome is uncertain and any potential losses cannot be reasonably estimated.

Regulatory matters

State regulatory bodies, the SEC, the Financial Industry Regulatory Authority (“FINRA”), the IRS and other regulatory bodies regularly make inquiries of us and, from time to time, conduct examinations or investigations concerning our compliance with laws and regulations related to, among other things, our insurance and broker-dealer subsidiaries, securities offerings and registered products. We endeavor to respond to such inquiries in an appropriate way and to take corrective action if warranted. Further, Phoenix is providing to the SEC certain information and documentation regarding the restatements of its prior period financial statements and the staff of the SEC has indicated to Phoenix that the matter remains subject to further investigation and potential further regulatory action. We cannot predict the outcome of any of such investigations or actions related to these or other matters.

Regulatory actions may be difficult to assess or quantify. The nature and magnitude of their outcomes may remain unknown for substantial periods of time. It is not feasible to predict or determine the ultimate outcome of all pending inquiries, investigations, legal proceedings and other regulatory actions, or to provide reasonable ranges of potential losses. Based on current information, we believe that the outcomes of our regulatory matters are not likely, either individually or in the aggregate, to have a material adverse effect on our financial condition. However, given the inherent unpredictability of regulatory matters, it is possible that an adverse outcome in certain matters could, from time to time, have a material adverse effect on our financial statements in particular quarterly or annual periods.

State Insurance Department Examinations

During 2012 and 2013, the Connecticut Insurance Department conducted its routine financial and market conduct examination of the Company and two other Connecticut-domiciled insurance affiliates. The Connecticut Insurance Department released its financial examination report for the Company on May 28, 2014 and its market conduct examination report on December 29, 2014.

Unclaimed Property Inquiries

In late 2012, Phoenix and the Company and their affiliates received separate notices from Unclaimed Property Clearing House (“UPCH”) and Kelmar Associates, LLC (“Kelmar”) that UPCH and Kelmar had been authorized by the unclaimed property administrators in certain states to conduct unclaimed property audits. The audits began in 2013 and are being conducted on the Phoenix enterprise with a focus on death benefit payments; however, all amounts owed by any aspect of the Phoenix enterprise are also a focus. This includes any payments to vendors, brokers, former employees and shareholders. UPCH represents 31 states and the District of Columbia and Kelmar represents seven states.

| v | The following replaces the definition of “Spouse” contained within the prospectus section entitled “Glossary” (Phoenix Foundations® Equity Index Annuity) and “Glossary of Special Terms” (Income Edge): |

Spouse: Any two persons legally married. Spouse does not include domestic partner or civil union partner.

| TF1203 | 4 |

| v | The following replaces the prospectus sub-section of “Federal Income Taxes” – “Withholding and Information Reporting” entitled “Spousal Definition” (Phoenix Foundations® Equity Index Annuity) : |

Spousal Definition

The Internal Revenue Code provides special provisions relating to a spouse.

As a result of a 2015 decision by the United States Supreme Court in the case of Obergefell v. Hodges, all states must allow marriages between two people of the same sex and must also recognize a marriage between two people of the same sex when their marriage was lawfully licensed and performed out-of-State. With this decision striking down the prior law, same-sex marriages are now recognized and any options afforded by the federal tax law to a spouse are now available to all spouses, including same-sex spouses.

Since this decision, the Internal Revenue Service (“IRS”) has not changed its prior ruling indicating that civil unions and registered domestic partnerships are not marriages for federal tax purposes.

In the event that a beneficiary of a life insurance policy/contract is defined by a spousal relationship (such as, “my wife” or “my husband”), we will apply this designation to all spouses, regardless of whether they are same-sex or opposite-sex. Individuals with such designations are urged to review them and clarify the beneficiary by full name.

Please note that further legal developments may occur that would impact same-sex civil union couples, domestic partners and spouses. All individuals should contact their tax advisors regarding their personal tax situations.

* * * *

This supplement should be retained with the Prospectus and Supplements for future reference: Income Edge supplements dated September 20, 2012, November 16, 2012, March 6, 2013, as revised March 20, 2013, July 3, 2013, August 20, 2013, November 21, 2013, February 11, 2014, March 13, 2014, June 11, 2014 and September 16, 2014; Phoenix MVA additionally supplemented May 2, 2012; Phoenix Foundations® Equity Index Annuity supplements dated May 2, 2012, September 20, 2012, November 16, 2012, and March 6, 2013, as revised March 20, 2013. If you have any questions, please contact us at 1-800-541-0171.

Cautionary Statement Regarding Forward-Looking Statements

The foregoing contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. We intend for these forward-looking statements to be covered by the safe harbor provisions of the federal securities laws relating to forward-looking statements. These forward-looking statements include statements relating to, or representing management’s beliefs about, future events, transactions, strategies, operations and financial results, including, without limitation, our expectation to provide information within anticipated timeframes and otherwise in accordance with law, the outcome of litigation and claims as well as regulatory examinations, investigations, proceedings and orders arising out of the financial statement restatements of PHL Variable Insurance Company (the “Company”) and its parent, The Phoenix Companies, Inc. (“Phoenix”),and the failure by Phoenix and the Company to file SEC reports on a timely basis, potential penalties that may result from failure to timely file statutory financial statements with state insurance regulators. Such forward-looking statements often contain words such as “will,” “anticipate,” “believe,” “plan,” “estimate,” “expect,” “intend,” “is targeting,” “may,” “should” and other similar words or expressions. Forward-looking statements are made based upon management’s current expectations and beliefs and are not guarantees of future performance. Our ability to maintain a timely filing schedule with respect to our SEC filings is subject to a number of contingencies, including but not limited to, whether existing systems and processes can be timely updated, supplemented or replaced, and whether additional filings may be necessary in connection with the restatements. Our actual business, financial condition or results of operations may differ materially from those suggested by forward-looking statements as a result of risks and uncertainties which include, among others, those risks and uncertainties described in any of our filings with the SEC. Certain other factors which may impact our business, financial condition or results of operations or which may cause actual results to differ from such forward-looking statements are discussed or included in our periodic reports filed with the SEC and are available on our website at www.phoenixwm.com* under “Products/Product Prospectuses.” You are urged to carefully consider all such factors. We do not undertake or plan to update or revise forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances occurring after the date of this document, even if such results, changes or circumstances make it clear that any forward-looking information will not be realized. If we make any future public statements or disclosures which modify or impact any of the forward-looking statements contained in or accompanying this document, such statements or disclosures will be deemed to modify or supersede such statements in this document.

| * | This is intended as an inactive textual reference only. |

| TF1203 | 5 |