Table of Contents

Filed pursuant to Rule

424(b)(3)

File No. 333-87218

File No. 333-87218

MARKET VALUE ADJUSTED

GUARANTEED INTEREST ACCOUNT ANNUITY

Issued by:

Issued by:

PHL Variable Insurance Company

| PROSPECTUS | April 30, 2012 |

This prospectus describes a Market Value

Adjusted Guaranteed Interest Account Annuity (“MVA”). The MVA is only available for use under certain PHL Variable Insurance Company (“PHL Variable”) variable accumulation deferred annuity contracts

(“Contract”). The MVA and the Contracts are available through 1851 Securities, Inc. (“1851 Securities”), the principal underwriter.

The Contract prospectus must

accompany this prospectus. You should read the Contract prospectus and keep it, and this prospectus, for future reference.

Neither the Securities and Exchange Commission

(“SEC”) nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

1851 Securities is not required to sell any

specific number or dollar amount of securities but will use its best efforts to sell the securities offered.

Your investment in the MVA is

subject to possible loss of principal and earnings, since a surrender charge and market value adjustment may apply to withdrawals or upon surrender of the Contract. Please see the “Risk Factors” section on page 4.

An investment in the MVA is not:

| • | a bank deposit or obligation; or |

| • | guaranteed by any bank or by the Federal Insurance Deposit Corporation or any other government agency. |

If you have any questions, please contact:

|

PHL Variable

Insurance Company PO Box 22012 Albany, NY 12201-2012 |

|

Tel. 800/866-0753 |

1

TABLE OF CONTENTS

2

Special Terms

As used in this prospectus, the

following terms mean:

Contract: A variable accumulation deferred annuity contract issued by PHL Variable.

Contract

Value: Prior to the end of the guarantee period, the sum of the values under a Contract of all accumulation units held in the subaccounts of the Separate Account plus the values held in the Guaranteed

Interest Account and in the MVA.

Current Rate:

The guaranteed rate currently in effect for amounts allocated to the MVA, established from time to time for various guarantee periods.

Death Benefit:

An amount payable upon the death of the annuitant or owner, as applicable, to the named beneficiary.

Expiration Date:

The date on which the guarantee period ends.

GIA (Guaranteed Interest

Account): An allocation option available in certain Contracts under which premium amounts are guaranteed to earn a fixed rate of interest. Excess interest also may be credited, in the sole discretion of PHL

Variable. The GIA is funded by our general account.

Guarantee Period: The duration for which interest accrues at the guaranteed rate on amounts allocated to the MVA.

Guaranteed Rate:

The effective annual interest rate we use to accrue interest on amounts allocated to the MVA for a guarantee period. Guaranteed rates are fixed at the time an amount is credited to the MVA and remain

constant throughout the guarantee period.

Market Value Adjustment: An adjustment made to the amount that a Contract owner receives if money is withdrawn, transferred or applied to an annuity option from the MVA before the expiration date of the guarantee period.

MVA (Market Value Adjusted Guaranteed Interest

Account Annuity): An account that pays interest at a guaranteed rate if held to the end of the guarantee period. If such amounts are withdrawn, transferred or applied to an annuity option before the end of

the guarantee period, a market value adjustment will be made. Assets allocated to the MVA are part of the assets allocated to PHL Variable Separate Account MVA1 (“Separate Account MVA1”).

PHL Variable (our, us, we, company): PHL Variable Insurance Company.

PNX: The

Phoenix Companies, Inc. PHL Variable is a wholly owned subsidiary of Phoenix Life Insurance Company which is wholly owned by PNX.

Separate

Account: PHL Variable Accumulation Account, a separate account of PHL Variable which funds the Contracts.

3

Incorporation of Certain Documents by

Reference

The SEC allows us to

“incorporate by reference” information that we file with the SEC into this prospectus, which means that incorporated documents are considered part of this prospectus. We can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference our Annual

Report on Form 10-K for the year ended December 31, 2011 (File Number 333-20277) and any future filings we make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, after the date of this prospectus but before the end of any

offering made under this prospectus (excluding current reports or portions thereof which are furnished to but are not filed with the SEC under Items 2.02, 7.01 or 8.01 of Form 8-K, unless such current reports or portions thereof specifically

reference their contents as being filed).

Upon request, we will provide to

each person, including any beneficial owner to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by reference into this prospectus but not delivered with this prospectus. You may request a copy of any

documents incorporated by reference in this prospectus and any accompanying prospectus supplement (including any exhibits that are specifically incorporated by reference in them), at no cost, by writing to PHL Variable at: Investor Relations, One

American Row, P.O. Box 5056, Hartford, CT 06102-5056, or telephoning PHL Variable at 860-403-7100. You may also access the incorporated documents at the following web pages: https://www.phoenixwm.phl.com/public/products/regulatory/index.jsp and the

“Investor Relations” page of PNX’s website at www.phoenixwm.com.

Where You Can Find More Information

We have electronically filed a

registration statement on Form S-3 with the SEC with respect to the MVA. This prospectus is a part of such registration statement, Also, PHL Variable electronically files its Annual Report on Form 10-K, as well as its Quarterly Reports on Form 10-Q,

with the SEC. PNX electronically files its proxy statement and Current Reports on Form 8-K with the SEC. The SEC maintains a website that contains reports, information statements, and other information regarding issuers that file electronically with

the SEC; the address of the website is http://www.sec.gov. The public may also read and copy any material we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the

operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Risk Factors

| ❖ | Investment Risk—Principal and interest when credited are guaranteed by the company unless you make a withdrawal from or surrender the Contract, which may be subject to a surrender charge and Market Value Adjustment. |

| ❖ | Loss of Principal Risk—Withdrawals and surrenders from the Contract in excess of the free withdrawal amount, prior to the end of the surrender charge period, are subject to a surrender charge and Market Value Adjustment. A negative Market Value Adjustment is limited to the Contract’s interest, therefore, the application of a negative Market Value Adjustment alone will not result in loss of principal. However, the combination of the surrender charge and Market Value Adjustment may result in loss of principal. |

| ❖ | Reduced Required Minimum Distributions (“RMD”) Risk— Any withdrawal from the MVA, including those taken to meet RMD requirements under the provisions of the Internal Revenue Code of 1986 (the “Code”), will be subject to a Market Value Adjustment unless the effective date of the withdrawal is within the guarantee period. If a negative Market Value Adjustment, although limited to the Contract’s interest, is applied to an RMD, the amount you receive will be reduced. |

Product

Description

The Nature of the Contract and the MVA

The investment option described in this

prospectus is an MVA available only under the Contracts offered by PHL Variable. The Contract is described in detail in its own prospectus. You should review the Contract prospectus along with this prospectus before deciding to allocate purchase

payments to the MVA.

| ❖ | The MVA currently provides four choices of interest rate Guarantee Periods: |

| • | 3 years |

| • | 5 years |

| • | 7 years |

| • | 10 years |

4

| ❖ | Purchase payments can be allocated to one or more of the available MVA Guarantee Period options. Allocations may be made at the time you make a payment or you may transfer amounts held in the subaccounts of the Separate Account, the GIA or other available MVA guarantee periods. Generally, amounts allocated to MVA options must be for at least $1,000. We reserve the right to limit cumulative amounts allocated to the MVA during any one-week period to not more than $250,000. |

| ❖ | Amounts may be transferred to or from the MVA according to the transfer rules under the Contract. You may make up to six transfers per year from the MVA. (See “The Accumulation Period—Transfers” of the Contract prospectus.) |

| ❖ | Allocations that remain in the MVA until the applicable expiration date will be equal to the amount originally allocated, multiplied by its guaranteed rate, which is compounded on an annual basis. |

| ❖ | A Market Value Adjustment will be made if amounts are withdrawn, transferred or applied to an annuity option from the MVA before the expiration date. (See “The MVA.”) |

| ❖ | The Contract provides for the accumulation of values before maturity and for the payment of annuity benefits thereafter. Since MVA values are part of the Contract Value, your earnings on allocations to the MVA will affect the values available at surrender or maturity. No Market Value Adjustment will be applied to withdrawals to pay Death Benefit proceeds. |

| ❖ | We may offer additional guarantee periods to certain individuals or groups of individuals who meet certain minimum premium criteria. |

| We reserve the right to elaborate upon, supplement or alter the terms or arrangements associated with, or relating to, this prospectus in connection with the offering of flexible premium accumulation deferred annuity contracts utilizing market value adjusted guaranteed interest account contracts to certain institutional investors, provided that such arrangements do not materially and adversely affect the rights or interests of other investors hereunder. |

Availability of the MVA

The MVA is not available in all states. For

information, call our Annuity Operations Division at 800/541-0171.

The MVA

The MVA is available only during the

accumulation phase of your Contract. The MVA option currently offers different guarantee periods, which provide you with the ability to earn interest at different guaranteed rates on all or part of your Contract Value. Each allocation has its own

guaranteed rate and expiration date. Because we change guaranteed rates periodically, amounts allocated to a guarantee period at different times will have different guaranteed rates and expiration dates. The applicable guaranteed rate, however, does

not change during the guarantee period.

We will notify

you of the expiration of the guarantee period and of your available options within 30 days of the expiration date. You will have 15 days before and 15 days following the expiration date (“window period”) to notify us of your election.

During this window period, any withdrawals or transfers from the MVA will not be subject to a Market Value Adjustment. Unless you elect to transfer funds to a different guarantee period, to the subaccounts of the Separate Account, to the GIA or

elect to withdraw funds, we will begin another guarantee period of the same duration as the one just ended and credit interest at the current rate for that new guarantee period. If you choose a guarantee period that is no longer available or if your

original guarantee period is no longer available, we will use the guarantee period with the next longest duration.

We reserve the right, at any

time, to discontinue guarantee periods or to offer guarantee periods that differ from those available at the time your contract was issued. Since guarantee periods may change, please contact us to determine the current guarantee periods being

offered.

Market Value Adjustment

Any withdrawal from the MVA, including those

taken to meet RMD requirements under the provisions of the Code, will be subject to a Market Value Adjustment unless the effective date of the withdrawal is within the window period. (Please refer to “Federal Income Taxes” in the

Contract prospectus for more information.) For this purpose, redemptions, transfers and amounts applied to an annuity option under a Contract are treated as withdrawals. The Market Value Adjustment will be applied to the amount being withdrawn after

the deduction of any applicable administrative charge and before the deduction of any applicable contingent deferred sales charges (surrender charges). See the Contract prospectus for a description of these charges. The Market Value Adjustment can

be positive or negative. The amount being withdrawn after application of the Market Value Adjustment can be greater than or less than the amount withdrawn before the application of the Market Value Adjustment.

A Market Value Adjustment will

not be applied upon the payment of the death benefit.

The Market Value Adjustment will

reflect the relationship between the current rate (defined below) for the amount being withdrawn and the guaranteed rate. It is also reflective of the time remaining in the applicable guarantee period. Generally, if the guaranteed rate is equal to

or lower than the applicable current rate, the Market Value Adjustment will result in a lower payment upon withdrawal. Conversely, if the guaranteed rate is higher than the applicable current rate, the Market Value Adjustment will produce a higher

payment upon withdrawal.

5

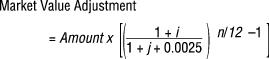

The Market Value Adjustment which

is applied to the amount being withdrawn is determined by using the following formula:

where,

Amount, is the amount being

withdrawn less any applicable administrative charges;

i,

is the guaranteed rate being credited to the amount being withdrawn;

j,

is the current rate, which is the current interest rate for new deposits with a guarantee period equal to the number of years remaining in the current guarantee period, rounded up to the next higher number of complete years;

n,

is the number of months rounded up to the next whole number from the date of the withdrawal or transfer to the end of the current guarantee period.

If the Company does not offer a

guarantee period equal to the number of years remaining in the guarantee period, “j” will be determined by interpolation of the guaranteed rate for the guarantee periods then available.

Examples

The following examples illustrate how the Market

Value Adjustment operates:

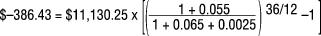

Example 1

$10,000 is deposited on January

1, 1997, into an MVA with a 5-year guarantee period. The guaranteed rate for this deposit amount is 5.50%.

If, on January 1, 1999 (2 years

after deposit), the full amount is taken from this MVA segment, the following amount is available:

| 1. | The accumulated amount prior to application of Market Value Adjustment is: |

| $10,000 x (1.055)2 = $11,130.25 | |

| 2. | The current rate that would be applied on January 1, 1999 to amounts credited to a 3-year MVA segment is 6.50%. |

| 3. | The number of months remaining in the guarantee period (rounded up to next whole number) is 36. |

| 4. | The Market Value Adjustment equals $–386.43, and is calculated as follows: |

The market value for the purposes

of surrender on January 1, 1999 is therefore equal to $10,743.82 ($11,130.25 – $386.43).

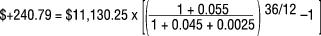

Example 2

$10,000 is deposited on January

1, 1997, into an MVA with a 5-year guarantee period. The guaranteed rate for this amount is 5.50%.

If, on January 1, 1999 (2 years

from deposit), the full amount is taken from this MVA segment, the following amount is available:

| 1. | The accumulated amount prior to application of Market Value Adjustment is: |

| $10,000 x (1.055)2 = $11,130.25 | |

| 2. | The current rate being applied on January 1, 1999 to amounts credited to a 3-year MVA segment is 4.50%. |

| 3. | The number of months remaining in the guarantee period (rounded up to next whole number) is 36. |

| 4. | The Market Value Adjustment equals $240.79, and is calculated as follows: |

The market value for the purposes

of surrender on January 1, 1999 is therefore equal to $11,371.04 ($11,130.25 + $240.79).

THE ABOVE EXAMPLES ARE HYPOTHETICAL

AND ARE NOT INDICATIVE OF FUTURE OR PAST PERFORMANCE.

Setting the Guaranteed Rate

We determine guaranteed rates for current and

future purchase payments, transfers or renewals. Although future guaranteed rates cannot be predicted, we guarantee that the guaranteed rate will never be less than 3% per annum.

6

Deduction of Surrender Charges on

Withdrawals

A Market Value Adjustment will

apply if a withdrawal is made before the expiration date and outside the window period as described above.

Depending on your Contract, a

full or partial withdrawal of Contract Value, including amounts in the MVA, may also be subject to a surrender charge.

Please note that other charges

may also be imposed against the Contract, including mortality and expense risk and administrative charges. For a more detailed explanation of any surrender charge applicable to your Contract and of other applicable charges, please see the

“Charges and Deductions” section of the Contract prospectus.

PHL Variable Separate Account MVA1 and

Investments by PHL Variable

Proceeds from purchases of the

MVA option will be deposited into the PHL Variable Separate Account MVA1 (“Separate Account MVA1”), which is a non-unitized separate account established under Connecticut law. Contract Values attributable to such proceeds are based on

the interest rate we credit to MVA allocations and terms of the Contract, and do not depend on the investment performance of the assets in Separate Account MVA1.

Under Connecticut law, all

income, gains or losses of Separate Account MVA1, whether realized or not, must be credited to or charged against the amounts placed in Separate Account MVA1, without regard to our other income, gains and losses. The assets of the Separate Account

MVA1 may not be charged with liabilities arising out of any other business that we may conduct. Obligations under the Contracts are obligations of PHL Variable.

There are no discrete units in

Separate Account MVA1. No party with rights under any contract participates in the investment gain or loss from assets belonging to Separate Account MVA1. Such gain or loss accrues solely to us. We retain the risk that the value of the assets in

Separate Account MVA1 may drop below the reserves and other liabilities it must maintain. If the Separate Account MVA1 asset value drops below the reserve and other liabilities we must maintain in relation to the Contracts supported by such assets,

we will transfer assets from our general account to Separate Account MVA1. Conversely, if the amount we maintain is too much, we may transfer the excess to our general account.

In establishing guaranteed rates,

we intend to take into account the yields available on the instruments in which we intend to invest the proceeds. The Company’s investment strategy with respect to the proceeds from purchases of the MVA option generally will be to invest

mostly in investment-grade debt such that the asset portfolio duration closely matches that of the liabilities.

You should know that we may

invest in non-investment grade bonds sometimes referred to as “high yield” or “junk” bonds. We expect that any bond purchases made in such investments would be mostly in the highest quality tier within the below

investment grade universe.

Investment-grade or other debt

instruments in which the company intends to invest the proceeds from purchases of the MVA option include:

| ❖ | Securities issued by the United States government or its agencies or instrumentalities. |

| ❖ | Debt securities which have a rating, at the time of purchase, within the six highest rating grades assigned by Moody’s Investors Services, Inc. (Aaa, Aa, A, Baa, Ba, or B), Standard & Poor’s Corporation (AAA, AA, A, BBB, BB, or B) or any other nationally recognized rating service. |

| ❖ | Other debt instruments, although not rated by Moody’s or Standard & Poor’s, are deemed by the Company’s management to have an investment quality comparable to securities described above. |

While the above generally

describes our investment strategy with respect to the proceeds from purchases of the MVA option, we are not obligated to invest the proceeds according to any particular strategy, except as may be required by Connecticut and other state insurance

law.

Distributor

PHL Variable is an indirect,

wholly owned subsidiary of Phoenix Life Insurance Company (“Phoenix”). PHL Variable has designated 1851 Securities, Inc. (“1851 Securities”), to serve as the principal underwriter and distributor of the securities offered

through this prospectus, pursuant to the terms of a distribution agreement. 1851 Securities, an affiliate of PHL Variable, also acts as the principal underwriter and distributor of other variable annuity contracts and variable life insurance

policies issued by PHL Variable and its affiliates. PHL Variable or an affiliate reimburses 1851 Securities for expenses 1851 Securities incurs in distributing the Contracts (e.g. commissions payable to retail broker-dealers who sell the Contracts).

1851 Securities does not retain any fees under the Contracts; however, 1851 Securities may receive 12b-1 fees from the underlying funds.

7

1851 Securities’ principal

executive offices are located at One American Row, PO Box 5056, Hartford, CT 06102-5056. 1851 Securities is registered as a broker-dealer with the SEC under the Securities Exchange Act of 1934, as well as the securities commissions in the states in

which it operates, and is a member of the Financial Industry Regulatory Authority (“FINRA”).

1851 Securities and PHL Variable

enter into selling agreements with broker-dealers who are registered with the SEC and are members of FINRA, and with entities that may offer the Contracts but are exempt from registration. Applications for the Contract are solicited by registered

representatives who are associated persons of such broker-dealer firms. Such representatives act as appointed agents of PHL Variable under applicable state insurance law and must be licensed to sell variable insurance products. PHL Variable intends

to offer the Contract in all jurisdictions where it is licensed to do business and where the Contract is approved. The Contracts are offered on a continuous basis.

On September 15, 2010, 1851

Securities became the principal underwriter and distributor for the SEC registered products.

Compensation

Broker-dealers who have selling

agreements with 1851 Securities and PHL Variable are paid compensation for the promotion and sale of the Contracts. Registered representatives who solicit sales of the Contract typically receive a portion of the compensation payable to the

broker-dealer firm, depending on the agreement between the firm and the registered representative. A broker-dealer firm or registered representative of a firm may receive different compensation for selling one product over another and/or may be

inclined to favor or disfavor one product provider over another product provider due to differing compensation rates.

We generally pay compensation as

a percentage of purchase payments invested in the Contract. Alternatively, we may pay lower compensation on purchase payments but pay periodic asset-based compensation in all or some years based on all or a portion of the Contract Value. The amount

and timing of compensation may vary depending on the selling agreement and the payment option selected by the broker- dealer and/or the registered representative but is not expected to exceed 8.0% of purchase payments if up-front compensation is

paid to registered representatives and up to 2.5% annually of contract value (if asset based compensation is paid).

To the extent permitted by FINRA

rules, overrides and promotional incentives or cash and non-cash payments also may be provided to such broker-dealers based on sales volumes, the assumption of wholesaling functions, or other sales-related criteria. Additional payments may be made

for other services not directly related to the sale of the contract, including the recruitment and training of personnel, production of promotional literature and similar services.

This Contract does not assess a

front-end sales charge, so you do not directly pay for sales and distribution expenses. Instead, you indirectly pay for sales and distribution expenses through the overall charges and fees assessed under the Contract. For example, any profits we may

realize through assessing the mortality and expense risk charge under your Contract may be used to pay for sales and distribution expenses. We may also pay for sales and distribution expenses out of any payments we or 1851 Securities may receive

from the underlying funds for providing administrative, marketing and other support and services to the underlying funds. If your Contract assesses a surrender charge, proceeds from this charge may be used to reimburse us for sales and distribution

expenses. No additional sales compensation is paid if you select any optional benefits under your Contract.

We have unique arrangements for

compensation with select broker-dealer firms based on the firm’s aggregate or anticipated sales of contracts or other factors. We enter into such arrangements at our discretion and we may negotiate customized arrangements with firms based on

various criteria. As such, special compensation arrangements are not offered to all broker-dealer firms. Compensation payments made under such arrangements will not result in any additional charge to you.

Federal Income Taxation Discussion

Please refer to “Federal

Income Taxes” in the Contract prospectus for a discussion of the income tax status of the Contract.

Accounting Practices

The information presented below

should be read with the audited financial statements of PHL Variable and information included elsewhere in this prospectus.

The financial statements and

financial information included in this prospectus have been prepared in conformity with accounting principles generally accepted in the United States.

Description of PHL Variable

Overview

Our executive and administrative office is

located at One American Row, Hartford, Connecticut, 06102-5056.

8

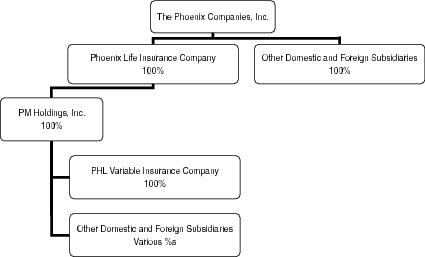

PHL Variable is a stock life

insurance company which provides life insurance and annuity products through third-party distributors. It was incorporated in Connecticut on July 15, 1981 and is a wholly owned subsidiary of Phoenix through its holding company, PM Holdings, Inc.

Phoenix is also a life insurance company, which is wholly owned by PNX, which provides life insurance and annuity products through third-party distributors, supported by wholesalers and financial planning specialists it employs. PNX was organized in

Connecticut in 1851 and in connection with its merger in 1992 with Home Life Insurance Company, Phoenix redomiciled to New York.

On June 25, 2001, the effective

date of its demutualization, Phoenix converted from a mutual life insurance company to a stock life insurance company and became a wholly owned subsidiary of PNX. In addition, on June 25, 2001, PNX completed its initial public offering (IPO).

The following chart illustrates

our corporate structure as of March 31, 2012.

The

Separate Account

On December 7, 1994, We

established the Separate Account, a separate account created under the insurance laws of Connecticut. Under the Contract, you may allocate premium payments and Contract Value to one or more of the investment options of the Separate Account. The

Separate Account is registered with the SEC as a unit investment trust under the Investment Company Act of 1940 (the “1940 Act”) and it meets the definition of a “separate account” under the 1940 Act. Registration under

the 1940 Act does not involve supervision by the SEC of the management or investment practices or policies of the Separate Account or of PHL Variable. Assets allocated to the MVA are not part of the assets allocated to the Separate Account or the

general account of PHL Variable. For a more detailed description of the Separate Account see the section of your Contract prospectus entitled “PHL Variable and the Separate Account.”

Experts

The financial statements and

management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this Prospectus by reference to the

Annual Report on Form 10-K for the year ended December 31, 2011 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in

auditing and accounting.

Legal

Matters

Kathleen A. McGah, Vice President

and Counsel, PHL Variable Insurance Company, Hartford, Connecticut has provided opinions upon legal matters relating to the validity of the securities being issued. Laurie D. Lewis, Counsel, Phoenix, has provided advice on certain matters relating

to income tax laws about the contracts.

9