Table of Contents

As filed with the Securities and Exchange Commission on April 24, 2012

File No. 333-87218

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

Post-Effective Amendment No. 11

to

FORM S-1

on

FORM S-3

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

PHL VARIABLE INSURANCE COMPANY

(Exact name of registrant as specified in its charter)

| Connecticut | 06-1045829 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification Number) |

One American Row

Hartford, CT 06103

(800) 447-4312

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John H. Beers, Esq.

PHL Variable Insurance Company

One American Row

Hartford, CT 06103

(860) 403-5050

(Name, address, including zip code, and telephone number, including area code, of agent for service)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Pursuant to Rule 429 under the Securities Act of 1933, the prospectus herein relates to Registration Statement Numbers 333-20277 and 333-55240.

Calculation of Registration Fee

|

| ||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum per unit |

Proposed maximum offering price |

Amount of registration fee | ||||

| Participating Interests in Market Value Adjustment Account Under Variable Annuity Contracts |

* | * | $500,000,000 | $46,000** | ||||

|

| ||||||||

|

| ||||||||

| * | The maximum aggregate offering price is estimated solely for the purpose of determining the registration fee. The amount to be registered and the proposed maximum offering price per unit are not applicable in that these contracts are not issued in predetermined amounts or units. |

| ** | Registration fee paid concurrently with the filing of the Registration Statement on Form S-1 on April 30, 2002. In addition, previously paid $15,151.52 to register $50,000,000 for registration statement file No. 333-20277 on January 23, 1997 and $50,000 to register $200,000,000 for registration statement file No. 333-55240 on February 8, 2001. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), SHALL DETERMINE.

Table of Contents

EXPLANATORY NOTE

This Post-Effective Amendment No. 11 to Form S-1 on Form S-3 is being filed to convert a Registration Statement on Form S-1 (No. 333-87218), as previously amended and supplemented, into a registration on Form S-3, to incorporate updated financial information, to make non-material changes and to provide information pertaining to Part II, Items 14 and 17.

At the time of the filing of the Registration Statement on Form S-1 and the most recent effective post-effective amendment filed prior hereto, (April 11, 2011, effective April 29, 2011) the Registrant did not meet the requirements for use of Form S-3. However, at the time of filing of this Post-Effective Amendment No. 11, the Registrant meets the requirement for use of the Form S-3 and is filing this Post-Effective Amendment No. 11 on Form S-3 in reliance on Rules 401(c) and 401(e) promulgated under the Securities Act of 1933, as amended, for the purpose of converting the Registration Statement on Form S-1 to a Registration Statement on Form S-3.

Table of Contents

Issued by:

| PROSPECTUS | April 30, 2012 |

| • | a bank deposit or obligation; or |

| • | guaranteed by any bank or by the Federal Insurance Deposit Corporation or any other government agency. |

|

PHL Variable

Insurance Company PO Box 22012 Albany, NY 12201-2012 |

|

Tel. 800/866-0753 |

| ❖ | Investment Risk—Principal and interest when credited are guaranteed by the company unless you make a withdrawal from or surrender the Contract, which may be subject to a surrender charge and Market Value Adjustment. |

| ❖ | Loss of Principal Risk—Withdrawals and surrenders from the Contract in excess of the free withdrawal amount, prior to the end of the surrender charge period, are subject to a surrender charge and Market Value Adjustment. A negative Market Value Adjustment is limited to the contract’s interest, therefore, the application of a negative Market Value Adjustment alone will not result in loss of principal. However, the combination of the surrender charge and Market Value Adjustment may result in loss of principal. |

| ❖ | Reduced Required Minimum Distributions (“RMD”) Risk— Any withdrawal from the MVA, including those taken to meet RMD requirements under the provisions of the Internal Revenue Code of 1986 (the “Code”), will be subject to a Market Value Adjustment unless the effective date of the withdrawal is within the guarantee period. If a negative Market Value Adjustment, although limited to the Contract’s interest, is applied to an RMD, the amount you receive will be reduced. |

| ❖ | The MVA currently provides four choices of interest rate Guarantee Periods: |

| • | 3 years |

| • | 5 years |

| • | 7 years |

| • | 10 years |

| ❖ | Purchase payments can be allocated to one or more of the available MVA guarantee period options. Allocations may be made at the time you make a payment or you may transfer amounts held in the subaccounts of the Separate Account, the GIA or other available MVA guarantee periods. Generally, amounts allocated to MVA options must be for at least $1,000. We reserve the right to limit cumulative amounts allocated to the MVA during any one-week period to not more than $250,000. |

| ❖ | Amounts may be transferred to or from the MVA according to the transfer rules under the Contract. You may make up to six transfers per year from the MVA. (See “The Accumulation Period—Transfers” of the Contract prospectus.) |

| ❖ | Allocations that remain in the MVA until the applicable expiration date will be equal to the amount originally allocated, multiplied by its guaranteed rate, which is compounded on an annual basis. |

| ❖ | A Market Value Adjustment will be made if amounts are withdrawn, transferred or applied to an annuity option from the MVA before the expiration date. (See “The MVA.”) |

| ❖ | The Contract provides for the accumulation of values before maturity and for the payment of annuity benefits thereafter. Since MVA values are part of the Contract Value, your earnings on allocations to the MVA will affect the values available at surrender or maturity. No Market Value Adjustment will be applied to withdrawals to pay Death Benefit proceeds. |

| ❖ | We may offer additional guarantee periods to certain individuals or groups of individuals who meet certain minimum premium criteria. |

| We reserve the right to elaborate upon, supplement or alter the terms or arrangements associated with, or relating to, this prospectus in connection with the offering of flexible premium accumulation deferred annuity contracts utilizing market value adjusted guaranteed interest account contracts to certain institutional investors, provided that such arrangements do not materially and adversely affect the rights or interests of other investors hereunder. |

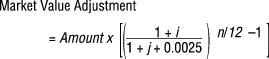

| 1. | The accumulated amount prior to application of Market Value Adjustment is: |

| $10,000 x (1.055)2 = $11,130.25 | |

| 2. | The current rate that would be applied on January 1, 1999 to amounts credited to a 3-year MVA segment is 6.50%. |

| 3. | The number of months remaining in the guarantee period (rounded up to next whole number) is 36. |

| 4. | The Market Value Adjustment equals $–386.43, and is calculated as follows: |

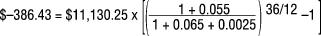

| 1. | The accumulated amount prior to application of Market Value Adjustment is: |

| $10,000 x (1.055)2 = $11,130.25 | |

| 2. | The current rate being applied on January 1, 1999 to amounts credited to a 3-year MVA segment is 4.50%. |

| 3. | The number of months remaining in the guarantee period (rounded up to next whole number) is 36. |

| 4. | The Market Value Adjustment equals $240.79, and is calculated as follows: |

| ❖ | Securities issued by the United States government or its agencies or instrumentalities. |

| ❖ | Debt securities which have a rating, at the time of purchase, within the six highest rating grades assigned by Moody’s Investors Services, Inc. (Aaa, Aa, A, Baa, Ba, or B), Standard & Poor’s Corporation (AAA, AA, A, BBB, BB, or B) or any other nationally recognized rating service. |

| ❖ | Other debt instruments, although not rated by Moody’s or Standard & Poor’s, are deemed by the Company’s management to have an investment quality comparable to securities described above. |

Table of Contents

PART II

INFORMATION NOT REQUIRED IN A PROSPECTUS

| Item 14. | Other Expenses of Issuance and Distribution |

Securities and Exchange Commission Registration Fee of $111,151.52

Estimated Printing and Filing Costs $8,000

Estimated Accounting Fees $8,000

| Item 15. | Indemnification of Directors and Officers |

Section 33-779 of the Connecticut General Statutes states that: “a corporation may provide indemnification of or advance expenses to a director, officer, employee or agent only as permitted by sections 33-770 to 33-778, inclusive.”

Article VI. Section 6.01. of the Bylaws of the Registrant (as amended and restated effective May 16, 2002) provide that: “Each director, officer or employee of the company, and his heirs, executors or administrators, shall be indemnified or reimbursed by the company for all expenses necessarily incurred by him in connection with the defense or reasonable settlement of any action, suit or proceeding in which he is made a party by reason of his being or having been a director, officer or employee of the company, or of any other company in which he was serving as a director or officer at the request of the company, except in relation to matters as to which such director, officer or employee is finally adjudged in such action, suit or proceeding to be liable for negligence or misconduct in the performance of his duties as such director, officer or employee. The foregoing right of indemnification or reimbursement shall not be exclusive of any other rights to which he may be entitled under any statute, bylaw, agreement, vote of shareholders or otherwise.”

| Item 16. | Exhibits |

| 1. (i) | Underwriting Agreement – Incorporated by reference to a filing on Form S-1 (File No. 333-55240) filed via Edgar on February 8, 2001. |

| (ii) | Amended and Restated Principal Underwriting and Distribution Agreement between PHL Variable Insurance Company and 1851 Securities, Inc. dated January 1, 2012. Filed herewith. |

| 2. | Not applicable. |

| 3. (i) | Amended and Restated Certificate of Incorporation of PHL Variable Insurance Company. Incorporated by reference to Registrant’s Filing on Form S-1 (File No. 333-55240) filed via EDGAR on February 8, 2001. |

| (ii) | Bylaws of PHL Variable Insurance Company as amended and restated, effective May 16, 2002. Incorporated by reference to Registrant’s Filing on Form S-1 (File No. 333-87218) filed via EDGAR on May 1, 2004. |

| 4. | Form of Variable Annuity contract with MVA Rider – Incorporated by reference to Registrant’s Filing on Form S-1 (File No. 333-20277) filed via EDGAR on January 23, 1997. |

| 5. | Opinion regarding Legality. Filed herewith as exhibit 23(b). |

| 6. | Not applicable. |

| 7. | Not applicable. |

| 8. | Opinion regarding Tax Matters. Filed herewith. |

| 9. | Not applicable. |

| 10. | Not applicable. |

| 11. | Not applicable. |

| 12. | Not applicable. |

| 13. | Not applicable. |

| 14. | Not applicable. |

| 15. | Not applicable. |

| 16. | Not applicable. |

| 17. | Not applicable. |

| 18. | Not applicable. |

| 19. | Not applicable. |

II-1

Table of Contents

| 20. | Not applicable. |

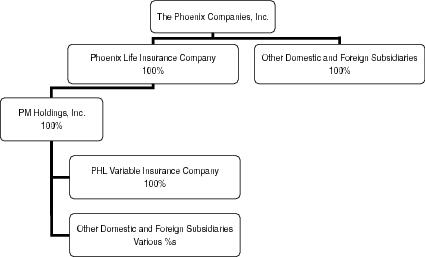

| 21. | The Registrant has no subsidiaries. |

| 22. | Not applicable. |

| 23. | (a) Consent of independent registered public accounting firm. Filed herewith. |

| 23. | (b) Opinion and Consent of Counsel. Filed herewith. |

| 24. | Powers of Attorney. Incorporated by reference to Post-effective Amendment No. 2 on Form S-3 to Registrant’s Filing on Form S-1 (File No. 333-168357), filed via EDGAR on April 11, 2012. |

| 25. | Not applicable. |

| 26. | Not applicable. |

| Item 17. | Undertakings |

The undersigned registrant hereby undertakes pursuant to Item 512 of Regulation S-K:

| (1) | To file, during any period in which offers of sales are being made, a post-effective amendment to this registration statement: |

| (i) | To include any prospectus required by section 10(a)(3) of the Securities Act of 1933; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement. |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement. |

Provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to section 13 or section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering. |

| (4) | That each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use. |

| (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| i. | Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424; |

| ii. | Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| iii. | The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| iv. | Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (6) | The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (7) | Insofar as indemnification for liability arising under the Securities Act of 1933 (the “Act”) may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the Securities and Exchange Commission, such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final adjudication of such issue. |

II-2

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Post-effective Amendment No. 11 on Form S-3 to the registration statement on Form S-1, File No. 333-87218, to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Hartford, State of Connecticut, on this 24th day of April, 2012.

| PHL VARIABLE INSURANCE COMPANY | ||

| By: |

||

| * James D. Wehr President | ||

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated and on the date indicated above.

| Signature |

Title |

|||

|

*Peter A. Hofmann |

Chief Financial Officer |

|||

|

*David R. Pellerin |

Chief Accounting Officer |

|||

|

*Edward W. Cassidy |

Director |

|||

|

*Philip K. Polkinghorn |

Director |

|||

|

*James D. Wehr |

President |

|||

|

*Christopher M. Wilkos |

Director |

|||

| By: | /s/ KATHLEEN A. MCGAH | |

| *Kathleen A. McGah, as Attorney-in-Fact pursuant to Powers of Attorney. | ||

S-1

Table of Contents

Exhibit Index

| Exhibit 1(ii) | Amended and Restated Principal Underwriting and Distribution Agreement dated January 1, 2012 | |

| Exhibit 8 | Opinion regarding Tax Matters | |

| Exhibit 23(a) | Consent of Independent Registered Public Accounting Firm | |

| Exhibit 23(b) | Opinion and Consent of Counsel - Legality | |