Phoenix Guaranteed Income Edge®

available with The Institute’s Models

Retirement Overview

Individuals face a number of challenges when preparing for retirement: Market Risk, Longevity Risk – the risk of outliving your assets, Inflation, Rising Health Care Costs, to name a few

solution to Help Address the Risk of Outliving Your Assets

• Phoenix Guaranteed Income Edge® (Income Edge), an optional stand-alone living benefit paired with three asset

allocation models for which The Institute for Wealth Management (The Institute) acts as investment advisor1.

Equity % / Fixed Income % as follows:

>

• Professional management for separately managed account assets, including the potential for growth in account

value, through customer’s relationship with The Institute

• Income Edge does not change federal income tax treatment of managed account

• PSI – Predictable, sustainable and potentially increasing income for life, first as withdrawals from managed account,

then as payments from Income Edge, if triggered2,3

Model A Conservative 55/45 Model B Conservative Growth 65/35 Model C Moderate 75/25

Highlights – Phoenix

Guaranteed Income Edge®

• Helps address key retirement risks

• Optional 4% or 5% income stream that

will continue for life even if managed

account is reduced to zero2

• If triggered, income payments from Income

Edge would be predictable and unaffected

by negative market performance since

they are 4% or 5% of the RIB in effect when

managed account is exhausted2

• Annual step ups can increase the amount

of possible income payments from Income Edge3

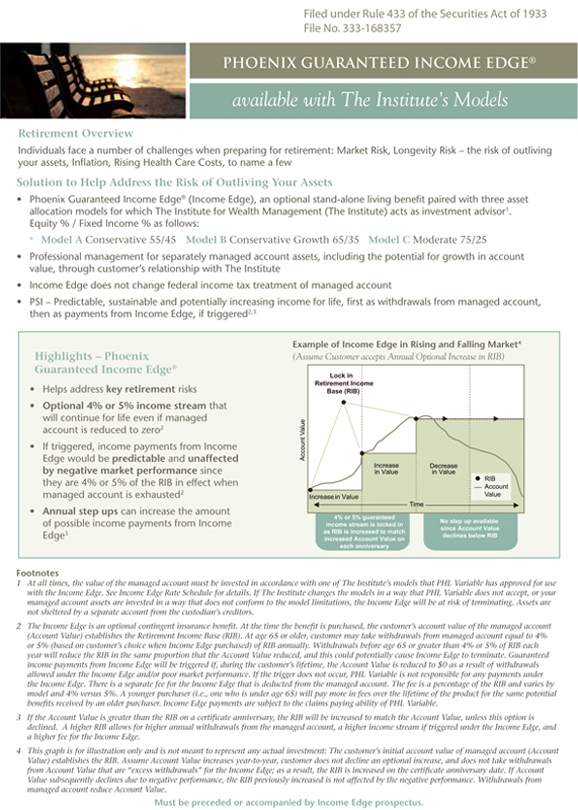

Example of Income Edge in Rising and Falling Market4

(Assume Customer accepts Annual Optional Increase in RIB)

Lock in

Retirement Income

Base (RIB)

Account Value

Increase

in Value

Increase in Value

Decrease

in Value

RIB

Account

Value

Time

4% or 5% guaranteed

income stream is locked in

as RIB is increased to match

increased Account Value on

each anniversary

No step up available

since Account Value

declines below RIB

Footnotes

1 At all times, the value of the managed account must be invested in accordance with one of The Institute’s models that PHL Variable has approved for use

with the Income Edge. See Income Edge Rate Schedule for details. If The Institute changes the models in a way that PHL Variable does not accept, or your

managed account assets are invested in a way that does not conform to the model limitations, the Income Edge will be at risk of terminating. Assets are

not sheltered by a separate account from the custodian’s creditors.

2 The Income Edge is an optional contingent insurance benefit. At the time the benefit is purchased, the customer’s account value of the managed account

(Account Value) establishes the Retirement Income Base (RIB). At age 65 or older, customer may take withdrawals from managed account equal to 4%

or 5% (based on customer’s choice when Income Edge purchased) of RIB annually. Withdrawals before age 65 or greater than 4% or 5% of RIB each

year will reduce the RIB in the same proportion that the Account Value reduced, and this could potentially cause Income Edge to terminate. Guaranteed

income payments from Income Edge will be triggered if, during the customer’s lifetime, the Account Value is reduced to $0 as a result of withdrawals

allowed under the Income Edge and/or poor market performance. If the trigger does not occur, PHL Variable is not responsible for any payments under

the Income Edge. There is a separate fee for the Income Edge that is deducted from the managed account. The fee is a percentage of the RIB and varies by

model and 4% versus 5%. A younger purchaser (i.e., one who is under age 65) will pay more in fees over the lifetime of the product for the same potential

benefits received by an older purchaser. Income Edge payments are subject to the claims paying ability of PHL Variable.

3 If the Account Value is greater than the RIB on a certificate anniversary, the RIB will be increased to match the Account Value, unless this option is

declined. A higher RIB allows for higher annual withdrawals from the managed account, a higher income stream if triggered under the Income Edge, and

a higher fee for the Income Edge.

4 This graph is for illustration only and is not meant to represent any actual investment: The customer’s initial account value of managed account (Account

Value) establishes the RIB. Assume Account Value increases year-to-year, customer does not decline an optional increase, and does not take withdrawals

from Account Value that are “excess withdrawals” for the Income Edge; as a result, the RIB is increased on the certificate anniversary date. If Account

Value subsequently declines due to negative performance, the RIB previously increased is not affected by the negative performance. Withdrawals from managed account reduce Account Value.

Must be preceded or accompanied by Income Edge prospectus.

phoenix Guaranteed Income Edge®

available with The Institute’s Models

The Phoenix Guaranteed Income Edge® Can Help Address Key Retirement Risks

The potential benefits of equity ownership are clear—it can be a way to create real wealth and hedge inflation over time.

Unfortunately, owning equities also poses risks that can severely impact your retirement planning.

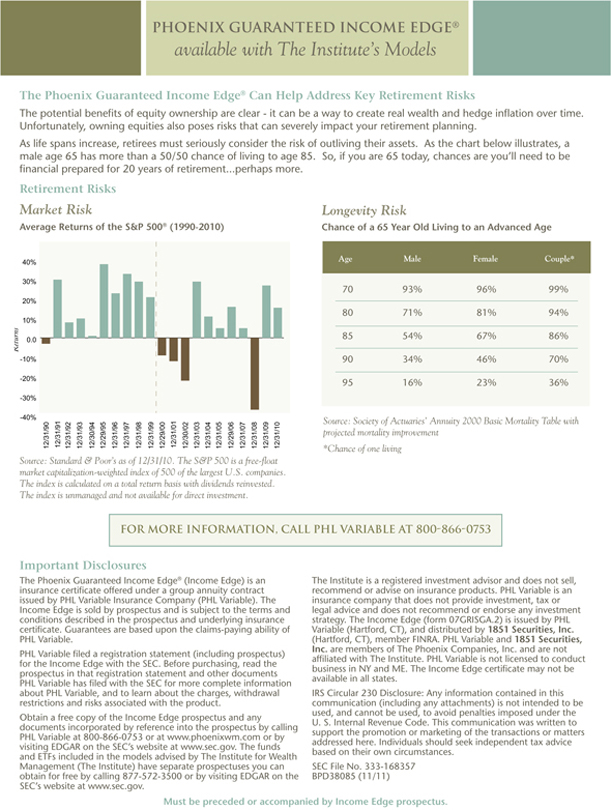

As life spans increase, retirees must seriously consider the risk of outliving their assets. As the chart below illustrates, a

male age 65 has more than a 50/50 chance of living to age 85. So, if you are 65 today, chances are you’ll need to be

financial prepared for 20 years of retirement. perhaps more.

Retirement Risks

Market Risk

Average Returns of the S&P 500® (1990-2010)

Longevity Risk

Chance of a 65 Year Old Living to an Advanced Age

Returns

40%

-30%

-20%

-10%

0.0

10%

20%

30%

40%

12/31/08

12/31/07

12/29/06

12/31/05

12/31/04

12/31/03

12/31/01

12/29/00

12/31/99

12/31/98

12/31/97

12/31/96

12/29/95

12/30/94

12/31/93

12/31/92

12/31/91

12/31/90

12/30/02

12/31/09

12/31/10

Source: Standard & Poor’s as of 12/31/10. The S&P 500 is a free-float

market capitalization-weighted index of 500 of the largest U.S. companies.

The index is calculated on a total return basis with dividends reinvested.

The index is unmanaged and not available for direct investment.

Age Male Female Couple*

70 93% 96% 99%

80 71% 81% 94%

85 54% 67% 86%

90 34% 46% 70%

95 16% 23% 36%

Source: Society of Actuaries’ Annuity 2000 Basic Mortality Table with

projected mortality improvement

*Chance of one living

For more information, call PHL Variable at 800-866-0753

Important Disclosures

The Phoenix Guaranteed Income Edge® (Income Edge) is an

insurance certificate offered under a group annuity contract

issued by PHL Variable Insurance Company (PHL Variable). The

Income Edge is sold by prospectus and is subject to the terms and

conditions described in the prospectus and underlying insurance

certificate. Guarantees are based upon the claims-paying ability of

PHL Variable.

PHL Variable filed a registration statement (including prospectus)

for the Income Edge with the SEC. Before purchasing, read the

prospectus in that registration statement and other documents

PHL Variable has filed with the SEC for more complete information

about PHL Variable, and to learn about the charges, withdrawal

restrictions and risks associated with the product.

Obtain a free copy of the Income Edge prospectus and any

documents incorporated by reference into the prospectus by calling

PHL Variable at 800-866-0753 or at www.phoenixwm.com or by

visiting EDGAR on the SEC’s website at www.sec.gov. The funds

and ETFs included in the models advised by The Institute for Wealth

Management (The Institute) have separate prospectuses you can

obtain for free by calling 877-572-3500 or by visiting EDGAR on the

SEC’s website at www.sec.gov.

The Institute is a registered investment advisor and does not sell,

recommend or advise on insurance products. PHL Variable is an

insurance company that does not provide investment, tax or

legal advice and does not recommend or endorse any investment

strategy. The Income Edge (form 07GRISGA.2) is issued by PHL

Variable (Hartford, CT), and distributed by 1851 Securities, Inc.

(Hartford, CT), member FINRA. PHL Variable and 1851 Securities,

Inc. are members of The Phoenix Companies, Inc. and are not

affiliated with The Institute. PHL Variable is not licensed to conduct

business in NY and ME. The Income Edge certificate may not be

available in all states.

IRS Circular 230 Disclosure: Any information contained in this

communication (including any attachments) is not intended to be

used, and cannot be used, to avoid penalties imposed under the

U. S. Internal Revenue Code. This communication was written to

support the promotion or marketing of the transactions or matters

addressed here. Individuals should seek independent tax advice

based on their own circumstances.

SEC File No. 333-168357

BPD38085 (11/11)

Must be preceded or accompanied by Income Edge prospectus.