Files under rule 433 under the securities act of 1933

File no. 333-168357

PHOENIX GUARANTEED INCOME EDGE®

available with The Institute’s Models

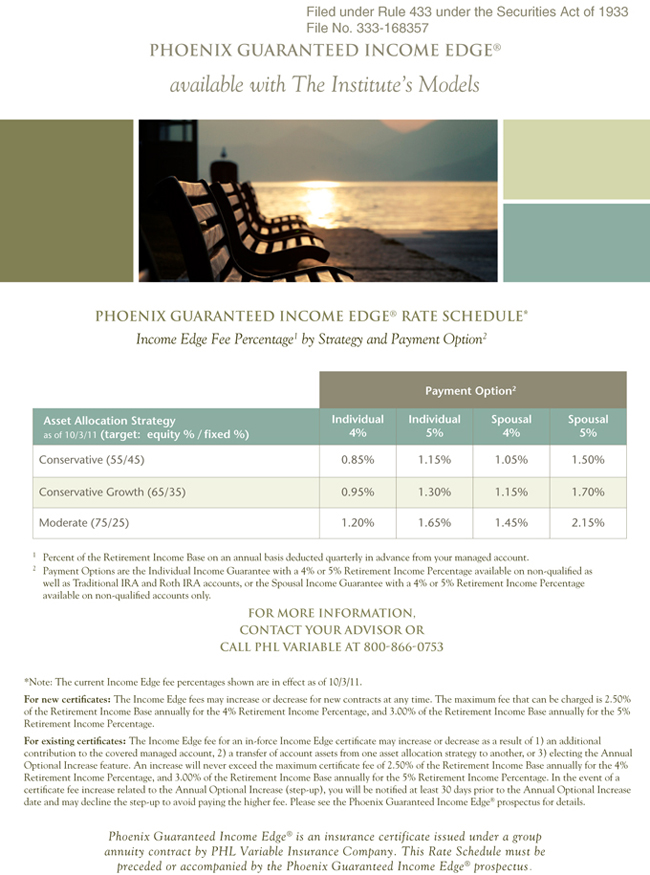

PHOENIX GUARANTEED INCOME EDGE® RATE SCHEDULE*

Income Edge Fee Percentage1 by Strategy and Payment Option2

Payment Option2

Asset Allocation Strategy Individual Individual Spousal Spousal

as of 10/3/11 (target: equity % / fixed %) 4% 5% 4% 5%

Conservative (55/45) 0.85% 1.15% 1.05% 1.50%

Conservative Growth (65/35) 0.95% 1.30% 1.15% 1.70%

Moderate (75/25) 1.20% 1.65% 1.45% 2.15%

1 Percent of the Retirement Income Base on an annual basis deducted quarterly in advance from your managed account.

2 Payment Options are the Individual Income Guarantee with a 4% or 5% Retirement Income Percentage available on non-qualified as well as Traditional IRA and Roth IRA accounts, or the Spousal Income Guarantee with a 4% or 5% Retirement Income Percentage available on non-qualified accounts only.

FOR MORE INFORMATION, CONTACT YOUR ADVISOR OR

CALL PHL VARIABLE AT 800-866-0753

*Note: The current Income Edge fee percentages shown are in effect as of 10/3/11.

For new certificates: The Income Edge fees may increase or decrease for new contracts at any time. The maximum fee that can be charged is 2.50% of the Retirement Income Base annually for the 4% Retirement Income Percentage, and 3.00% of the Retirement Income Base annually for the 5% Retirement Income Percentage.

For existing certificates: The Income Edge fee for an in-force Income Edge certificate may increase or decrease as a result of 1) an additional contribution to the covered managed account, 2) a transfer of account assets from one asset allocation strategy to another, or 3) electing the Annual Optional Increase feature. An increase will never exceed the maximum certificate fee of 2.50% of the Retirement Income Base annually for the 4% Retirement Income Percentage, and 3.00% of the Retirement Income Base annually for the 5% Retirement Income Percentage. In the event of a certificate fee increase related to the Annual Optional Increase (step-up), you will be notified at least 30 days prior to the Annual Optional Increase date and may decline the step-up to avoid paying the higher fee. Please see the Phoenix Guaranteed Income Edge® prospectus for details.

Phoenix Guaranteed Income Edge® is an insurance certificate issued under a group annuity contract by PHL Variable Insurance Company. This Rate Schedule must be preceded or accompanied by the Phoenix Guaranteed Income Edge® prospectus.

PHOENIX GUARANTEED INCOME EDGE®

available with The Institute’s Models

IMPORTANT DISCLOSURES

The Phoenix Guaranteed Income Edge® is sold by prospectus and is subject to the terms and conditions described in the prospectus and underlying insurance certificate.

PHL Variable Insurance Company (PHL Variable) has filed a registration statement (including a prospectus) with the SEC for the Phoenix Guaranteed Income Edge®. Before you invest, you should read the prospectus in that registration statement and other documents PHL Variable has filed with the SEC for more complete information about PHL Variable and the Phoenix Guaranteed Income Edge®. You should carefully consider the charges, withdrawal restrictions and risks associated with the Phoenix Guaranteed Income Edge®. The prospectus contains this and other information.

You can obtain a copy of the prospectus for the Phoenix Guaranteed Income Edge® and any documents incorporated by reference into the prospectus for free by calling PHL Variable at 800-866-0753. You may also access the prospectus and incorporated documents for free at our website at www. phoenixwm.com or by visiting EDGAR on the SEC’s website at www.sec. gov. The funds and ETFs included in the Model Portfolios managed by The Institute for Wealth Management (The Institute) have separate prospectuses you can obtain by calling 877-572-3500 or by visiting EDGAR on the SEC’s website at www.sec.gov.

The offering is comprised of certain asset allocation models for which The Institute acts as investment advisor. The Phoenix Guaranteed Income Edge® is an insurance certificate issued by PHL Variable under a group annuity contract that can provide an income guarantee related to the asset allocation models. The certificate has its own restrictions, charges and risks.

The Phoenix Guaranteed Income Edge® has a separate fee in addition to the fees associated with the underlying investment account. Guarantees are based upon the claims-paying ability of PHL Variable.

The Institute is a registered investment advisor and does not sell, recommend or advise on insurance products. PHL Variable is an insurance company that does not provide investment, tax or legal advice and does not recommend or endorse any investment strategy. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. This communication is not intended to meet the objectives or suitability requirements of any specific individual or account. It is important to remember that there are risks inherent in any investment and that there is no assurance that any asset class or index will provide positive performance over time. Past performance is not a guarantee of future results. Diversification and strategic asset allocations do not assure a profit or protect against loss in declining markets.

The Phoenix Guaranteed Income Edge® (form 07GRISGA.2) is issued by PHL Variable Insurance Company (Hartford, CT), and distributed by 1851 Securities, Inc. (Hartford, CT), member FINRA. PHL Variable and 1851 Securities, Inc. are members of The Phoenix Companies, Inc. PHL Variable and 1851 Securities, Inc. are not affiliated with The Institute.

PHL Variable Insurance Company is not licensed to conduct business in NY and ME. The certificate may not be available in all states.

SEC File No. 333-168357 BPD37658 (10/11)