PHL VARIABLE INSURANCE CO / CT/

PHL Variable Insurance Company

One American Row

Hartford, CT 06102-5056

April 28, 2011

Mr. Min S. Oh

Staff Attorney

Office of Insurance Products

Division of Investment Management

U.S.

Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549-4644

VIA EDGAR

| RE: |

Phoenix

Foundationssm |

Post-Effective Amendment No. 7 to Registration Statement on Form S-1

File No. 333-132399

Dear Mr. Oh:

Below please find our responses to the Staff’s comments taken orally on

April 22, 2011 and April 27, 2011 regarding the referenced post-effective amendment (“Post-Effective Amendment”). The disclosure changes described below are reflected in the attached revised prospectus and, unless further revised

in response to additional Staff comments, will be included in the definitive prospectus to be filed under Rule 424(b)(3) following effectiveness of the Post-Effective Amendment.

| 1. |

Please define terms and use defined terms consistently (e.g. explain the acronyms used in the section entitled “Retained Asset Account”).

|

RESPONSE: We have revised disclosure throughout the prospectus as requested to achieve greater consistency and

clarity in the use of defined terms.

| 2. |

With regard to the subsection entitled “Free Look Period” explain to the Staff the basis for adding “or federal law” to the last sentence of the

subsection. |

RESPONSE: The Individual Retirement Account (“IRA”) free look provisions of the

Internal Revenue Code and pertinent tax regulations (1.408-6(d)(4)(ii)(A)(2) of the Income Tax Regulations) may result in a free look period different from those of state law. To exercise a free look for an IRA, the contractowner is permitted to

send the notice by mail and the revocation is effective as of the post mark date. This may essentially result in an actual longer free look period.

| 3. |

Confirm that the disclosure in the section of the prospectus entitled “Legal Proceedings” is current. |

RESPONSE: We confirm.

| 4. |

Please explain to the Staff how Form S-1 disclosure requirements have been met when the disclosure has been incorporated by reference to registrant’s Form 10-K

which contains alternative disclosure or has omitted it altogether (e.g., Items 11, 12 and 13 of Form 10-K for Items 11(l), (m) and (n) of Form S-1 and Item 7 of Form 10-K for Item 11(h) of Form S-1).

|

RESPONSE: In concluding that certain disclosure requirements of Form S-1 would be met by incorporation of PHL

Variable’s Form 10-K, which is filed in the “reduced disclosure format” allowed by General Instruction I to Form 10-K, we considered several issues.

First, Question 123.02 of the Compliance and Disclosure Interpretations published by the SEC’s

Division of Corporate Finance (available at http://www.sec.gov/divisions/corpfin/cfguidance.shtml#saf) indicates that a wholly-owned subsidiary that files a reduced disclosure Form 10-K pursuant to General Instruction I of Form 10-K may still use

Form S-3 if otherwise eligible to do so. While this interpretation was provided with respect to Form S-3, we believed it reasonable to conclude that the answer would apply equally to Form S-1 and, accordingly, we concluded that incorporation by

reference of a reduced format Form 10-K would satisfy certain Form S-1 disclosure requirements. We further considered the policy reasons for permitting the reduced disclosure format as articulated in the adopting release for the revised Form 10-K.

Those reasons demonstrated the SEC’s intent to isolate inapplicable information without limiting the information in a way that would be detrimental to the public interest or the protection of investors. Accordingly, we concluded there was a

reasonable basis to determine that disclosure items required under Form S-1 but omitted under the reduced disclosure format of Form 10-K would not be required in an S-1 filing of a registrant meeting the conditions for use of the reduced disclosure

format in Form 10-K.

| 5. |

With regard to Item 16, Exhibit 8, please provide a current tax opinion. |

RESPONSE: A current tax opinion was filed with Post-effective Amendment No. 7. It is referenced in Part II, Item 16(a) (8) as included in exhibit 23(b) and appears as page two of

that exhibit. The opinion also includes a consent to the use of tax counsel’s name under the heading “Legal Matters” in the prospectus.

The following staff comment was taken orally on April 28, 2011.

| 6. |

Add as a risk factor the potential for loss from an MVA due to a withdrawal in the form of an RMD. |

RESPONSE: We have added a final diamond point to the section of the prospectus entitled “Risk Factors” which explains that all

withdrawals before the end of the surrender charge schedule elected, including those taken to meet RMD requirements, will be subject to an MVA and that a negative MVA applied to an RMD will result in a reduced distribution amount.

Please contact me at 860.403.5878 with any questions about this filing.

Sincerely,

/s/ Lois L. McGuire

Lois L. McGuire

Director

Phoenix Life Insurance Company

PHOENIX FOUNDATIONS® EQUITY INDEX ANNUITY

Issued by:

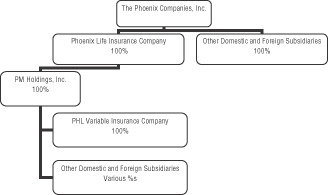

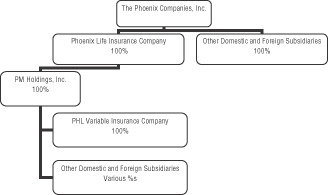

PHL Variable Insurance Company (“PHL Variable”)

(a wholly owned subsidiary of Phoenix Life Insurance Company)

|

|

|

| PROSPECTUS |

|

April 29, 2011 |

PHL Variable is

offering the Phoenix Foundations® Equity Index Annuity, a group and individual single premium deferred equity indexed

annuity contract (“contract”). The contract is an “annuity contract” because it will provide a stream of periodic income payments commonly known as an “annuity.” It is a “deferred” annuity contract because

annuity payments are deferred during the first phase of the contract, called the “accumulation period,” during which you may invest in the investment options available under the contract. The “annuity period” of the contract

begins when your annuity payments start. It is an “equity indexed” contract because you may invest in available “indexed accounts” that earn index credits linked to the performance of an index based on specified equity-based

indexes. (Currently, the S&P 500 Index is the index to which the Indexed Accounts are linked. There is also a Fixed Account currently available under the contract that guarantees a fixed minimum rate of interest on your investment.) This

Prospectus provides important information that a prospective investor should know before investing. Please retain this Prospectus for future reference.

Contracts are available through 1851 Securities, Inc. (“1851 Securities”), the principal underwriter for the contracts.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

1851 Securities is not required to sell

any specific number or dollar amount of securities but will use its best efforts to sell the securities offered.

Your investment in the contract is

subject to possible loss of principal and earnings, since a surrender charge and market value adjustment may apply to withdrawals or upon surrender of the contract. PHL Variable does not guarantee that the contract will have the same or similar

indexed accounts or the Fixed Account for the period you own the contract. We may add and delete indexed accounts which may result in your investment in the contract earning no return even if the index associated with the indexed account increases

in value. We guarantee that the contract will have at least one indexed account. You should carefully consider whether or not this contract is an appropriate investment for you as compared to other investments that may offer comparable returns with

a guarantee of principal and earnings and/or without the imposition of a surrender charge or a market value adjustment. Please see the “Risk Factors” section on page 4.

Purchasing an annuity within a qualified plan or Individual Retirement Account (“IRA”) does not provide any additional tax benefit. Annuities should not be sold in qualified plans or IRAs because of the

tax-deferral feature alone, but rather when other benefits, such as lifetime income payments and death benefit protection support the recommendation.

It

may not be in your best interest to purchase a contract to replace an existing annuity contract or life insurance policy. You must understand the basic features of the proposed contract and your existing coverage before you decide to replace your

present coverage. You must also know if the replacement will result in any tax liability. The contract may not be available in all states. An investment in this annuity contract is not

| |

• |

|

a bank deposit or obligation; or |

| |

• |

|

guaranteed by any bank or by the Federal Insurance Deposit Corporation or any other government agency. |

If you have any questions, please contact:

|

|

|

|

|

PHL Variable Insurance Company

Annuity Operations Division |

|

|

PO Box 8027 |

|

|

Boston, MA 02266-8027 |

|

|

Tel. 800/541-0171 |

1

TABLE OF CONTENTS

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information that we file with the SEC into this prospectus, which means that incorporated

documents are considered part of this prospectus. We can disclose important information to you by referring you to those documents. This prospectus incorporates by reference our Annual Report on Form 10-K for the year ended December 31, 2010

(File No. 333-20277), and the definitive proxy statement filed by the Phoenix Companies, Inc. (“PNX”) pursuant to Regulation 14A on April 1, 2011 (File No. 001-16517). These documents contain information about our financial

results and other matters for the applicable periods.

You may request a copy of any documents incorporated by reference in this

prospectus and any accompanying prospectus supplement (including any exhibits that are specifically incorporated by reference in them), at no cost, by writing to PHL Variable at Investor Relations, One American Row, P.O. Box 5056 Hartford, CT

06102-5056, or telephoning PHL Variable at 860-403-7100. You may also access the incorporated documents at the following web pages: http://www.phoenixwm.phl.com/public/products/regulatory/index.jsp and the “Investor Relations” page of

PNX’s website at www.phoenixwm.com.

PHL Variable electronically files its Annual Report on Form 10-K, as well as its Quarterly

Reports on Form 10-Q, with the SEC. PNX, electronically files its proxy statement with the SEC. The SEC maintains a website that contains reports, information statements and other information regarding issuers that file electronically with the SEC;.

the address of the website is http://www.sec.gov. The public may also read and copy any material we file with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Washington, DC 20549. You may obtain information on the operation of

the Public Reference Room by calling the SEC at 1-800-SEC-0330.

2

Glossary

The following is a list of terms and their

meanings when used throughout this Prospectus. We have bolded and italicized the first occurrence for each term used after this glossary.

Account:

Indexed or fixed account.

Account Value: The value available in each account for annuitization or surrender before the application of any

surrender charge or market value adjustment.

Annuitant/Joint Annuitant: The person(s) on whose life the annuity benefit depends. There may be one

or more annuitants. One is the primary annuitant and the other is considered the joint annuitant.

Beneficiary: The person who receives the death

benefits. If there is no surviving beneficiary, the owner will be the beneficiary. If the owner is not living, the estate of the owner will be the beneficiary.

Contract Anniversary: The same month and date as the contract date in the years following the contract date. If the date does not exist in a month, the last day of the month will be used.

Contract Date: The date on which the contract is issued.

Contract Value: Sum of the account value of each of the accounts.

Contract Year: The 12-month period beginning on the contract date and each 12-month period thereafter.

Fixed Account: Interest is credited daily on the account value allocated to this account at rates that are declared annually.

Free Withdrawal Amount: You may withdraw up to 10% of the contract value in a contract year without a market value adjustment or surrender charge.

Index: The measure used to determine the index credit for an indexed account.

Index Value: The published value of the index, excluding any dividends paid by the companies that comprise the index.

Indexed Account: Each indexed account earns an index credit linked to the performance of an index.

Maturity

Date: The date on which annuity payments begin.

Market Value Adjustment: A calculated amount that is applied to amounts withdrawn or

surrendered before the end of the surrender charge period. It may be positive or negative.

Owner (owner, owners, you, your): Usually the person,

persons or entity to whom we issue the contract.

PHL Variable (our, us, we, company): PHL Variable Insurance Company.

Separate Account: PHL Variable Separate Account MVA1.

Spouse: Federal law defines “spouse” under the Defense of Marriage Act (DOMA), as a man or a woman legally joined. Neither individuals married

under State or foreign laws that

permit a marriage between two men or two women nor individuals participating in a civil union or other like status are spouses for any federal purposes, including provisions of the Internal

Revenue Code relevant to this Contract.

Surrender Value: The contract value adjusted by any market value adjustment and less any applicable

surrender and tax charges.

Written Request (in writing, written notice): Is a request signed by you and received in a form satisfactory to us.

S&P

500® Index

The contract is not

sponsored, endorsed, sold or promoted by Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“S&P”). S&P makes no representation or warranty, express or implied, to the owners of the contract or any

member of the public regarding the advisability of investing in securities generally or in the contract particularly or the ability of the S&P 500® Index to track general stock market performance. S&P’s only relationship to the company is the licensing of certain trademarks and trade names of S&P and

of the S&P 500® Index which is determined, composed and calculated by S&P without regard to the company or

the contract. S&P has no obligation to take the needs of the company or the owners of the contract into consideration in determining, composing or calculating the S&P 500® Index. S&P is not responsible for and has not participated in the determination of the prices and amount of the contract or the timing of the issuance or sale of

the contract or in the determination or calculation of the equation by which the contract is to be converted into cash. S&P has no obligation or liability in connection with the administration, marketing or trading of the contract. S&P DOES

NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE S&P 500® INDEX OR ANY DATA INCLUDED THEREIN AND S&P

SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN. S&P MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY THE COMPANY, OWNERS OF THE CONTRACT, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE

S&P 500® INDEX OR ANY DATA INCLUDED THEREIN. S&P MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS

ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE S&P 500® INDEX OR ANY

DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL S&P HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

Contract Snapshot

The following is a snapshot of the

contract. Please read the rest of this Prospectus for more information.

This prospectus contains information about the

material rights and features of the contract that you should

3

understand before investing. In certain states, this contract may be issued through a group trust, in which case you will receive a certificate in lieu of a contract. The use of the term

“contract” in this Prospectus refers to either the contract or certificate that you will be issued.

FEATURES

| v |

|

Single premium payment. |

| v |

|

Minimum premium payment of $25,000 for non-qualified, qualified plans, and IRA contracts. |

| v |

|

Maximum premium payment of $1,000,000 without our approval. |

| v |

|

One fixed account and three indexed accounts are available for investing. The fixed account is not available in Alabama, Florida and

Nevada. |

| v |

|

Free Withdrawal Amount – during the surrender charge period, 10% of contract value each year free of any surrender charge and

market value adjustments. |

| v |

|

Market Value Adjustment – applied to any withdrawal, including those taken to meet Required Minimum Distribution (“RMD”) requirements under the

provisions of the Internal Revenue Code of 1986 (“the Code”), or full surrender before the end of the surrender charge period, excluding the free withdrawal amount. (See “Federal Income Taxes,” below.)

|

| v |

|

Surrender Charges – applied when you surrender your contract or request a withdrawal before the end of the surrender charge period specified in your

surrender charge schedule, excluding the free withdrawal amount. You have the option of a 7-year or 5-year surrender charge schedule, and each has a different schedule of fees that will be levied upon surrender. If you elect the 5-year surrender

charge schedule, you may receive a lower interest rate or index credit than under the 7-year surrender charge schedule. |

| v |

|

State and Local Taxes – taken from the contract value upon premium payments, withdrawals, surrenders or commencement of annuity payments. Please see the

“State and Local Tax” section of this prospectus for more information. |

| v |

|

Death Benefit – payable upon owner’s death. The Death Benefit equals the contract value at the time of death. Market value adjustments and surrender

charges are waived. The portion of the death benefit that exceeds the premium payable is subject to Federal income tax. See “Federal Income Tax Consideration” for more information. |

| v |

|

You have the right to review and return the contract. If for any reason you are not satisfied, you may return it within ten (10) days (or later, if

applicable state law requires) after you receive it and cancel the contract. Please see the “Free Look Period” section of this prospectus for more information.

|

RISK FACTORS

| v |

|

Investment Risk – Principal and interest when credited are guaranteed by the company unless you make a withdrawal from or surrender the contract, which may

be subject to a surrender charge and MVA. As the indexed accounts do not offer any minimum guaranteed index credit, you are assuming the risk that an investment in the indexed accounts could potentially offer no return. In addition, amounts

withdrawn from an indexed account prior to the end of a contract year will not receive the index credit for that year. |

| v |

|

Loss of Principal Risk – Withdrawals and surrenders from the contract in excess of the free withdrawal amount, prior to the end of the surrender charge

period, are subject to a surrender charge and market value adjustment (“MVA”). A negative MVA is limited to the contract’s interest or index credit earnings, therefore, the application of a negative MVA alone will not result in loss

of principal. However, the combination of the surrender charge and MVA may result in loss of principal. |

| v |

|

Risk That Accounts May Be Eliminated – The contract currently provides four accounts to which you may allocate your premium payment or contract

value—three Indexed Accounts and one Fixed Account, as described in this prospectus. You should be aware that the contract permits us to eliminate any account as described below: |

| |

• |

|

We may add and delete indexed accounts which may result in your investment in the contract earning no return even if the index associated with the indexed

account increases in value. We guarantee that the contract will have at least one indexed account. |

| |

• |

|

We reserve the right to eliminate any indexed account in our sole discretion upon thirty days written notice. We will only eliminate an indexed account at

a contract anniversary, and you will earn the index credit for the indexed account for the prior contract year. |

| |

• |

|

We reserve the right to eliminate the Fixed Account in our sole discretion upon thirty days notice and not add a new fixed account. We will only delete

the Fixed Account on a contract anniversary, and you will earn the interest credited through the end of the prior contract year. |

Our ability to eliminate accounts at any time may adversely impact your contract value for the following reason. There are guarantees applicable to each of the three Indexed Accounts currently offered that provide

a minimum participation in the increase in value of the S&P 500 Index, if any, with respect to your contract value allocated to the account. These guarantees are described in this prospectus. See “Indexed Account A”, “Indexed

Account B”, “Indexed Account C”. Similarly, there is a 1.5% minimum guaranteed interest rate applicable to the Fixed Account. The contract does not permit us to reduce or

4

eliminate the guarantees applicable to any of these accounts as long as we continue to offer the accounts. However, we are permitted in our sole discretion to eliminate any account in the

future. If we eliminate an account, you may reallocate any contract value that was invested in the account to another account available at that time. (Contract value may not remain in an account that has been eliminated.) If one or more of the

accounts described in this prospectus is available at the time, you may reallocate your contract value to any of these accounts and the guarantees described in this prospectus will apply. However, the account or accounts currently available at the

time you may reallocate your account value may not be described in this prospectus and may not provide any guarantees. Additionally, while the contract permits us to add new accounts, we are not required to do so. If we do add new accounts, the

accounts may provide no guarantees, or guarantees that provide less protection than the guarantees applicable to the three Indexed Accounts or the Fixed Account currently available under the contract. For example, if we added an indexed account, the

new indexed account may not have any guarantees, may be tied to an index other than the index in your current indexed account, may have a different formula for determining the index credit, and may be set up in a different manner to measure the

index credit, among other differences. Accordingly, we may add and delete indexed accounts which may result in your investment in the contract earning no return even if the index associated with the indexed account increases in value. We guarantee

that the contract will have at least one indexed account.

Risk That We May Substitute an Index. You should be aware that even if we do

not eliminate a particular indexed account, we may change the index used to measure the index credit applicable to such account upon thirty days written notice, which index we in our sole discretion deem to be appropriate. The new index would

provide different performance than the old index. We are permitted to change an index only if the index for a particular indexed account is discontinued, our agreement with the sponsor of the index is terminated, or the index calculation is

substantially changed. However, you should be aware that we may unilaterally terminate our agreement with the sponsor of an index without cause. Further, we may consider an index to have substantially changed if the fixed number of constituents

materially changes in the index or the criteria for eligibility in the index with respect to size, liquidity, profitability and sector and/or market representation materially changed for the index. You will earn the index credit for the contract

linked to the last published value of the replaced index before its replacement if we replace an index before a contract anniversary date. If an index is changed during a contract year, you will not participate in an increase in the value of either

the old or new index for the remainder of the contract year. If we change the index, it will not affect the minimum guarantees, if any, in the indexed account. If you

do not wish to remain in the indexed account with the replacement index, you have the option to allocate your contract value to the remaining accounts available under the contract. There may be

only one remaining indexed account, and no fixed account, to which to allocate contract value.

In either of the situations described

above involving the elimination of an account or the change in an indexed account’s index, if you do not wish to allocate your contract value to one or more remaining accounts available under the contract and accordingly wish to withdraw your

contract value from the account or surrender the contract, you may be subject to a surrender charge and market value adjustment, which may result in a loss of principal and earnings.

IF WE ELIMINATE ANY TWO OF THE THREE INDEXED ACCOUNTS DESCRIBED IN THIS PROSPECTUS, YOU MAY SURRENDER YOUR CONTRACT WITHOUT THE IMPOSITION OF A

SURRENDER CHARGE AND/OR A NEGATIVE MARKET VALUE ADJUSTMENT WITHIN 45 DAYS OF THE DATE WE MAIL THE NOTICE TO YOU OF THE ELIMINATION OF THE SECOND INDEXED ACCOUNT DESCRIBED IN THIS PROSPECTUS.

| v |

|

Liquidity Risk – This product is designed for long-term investment and should be held for the length of the surrender charge period or longer. Some

liquidity is provided through the free withdrawal provision. However, if you withdraw more than the free withdrawal amount, a surrender charge and MVA will be applied, which may result in the loss of principal and earnings.

|

| v |

|

Reduced Required Minimum Distributions (“RMD”) Risk – Any withdrawal prior to the end of the surrender charge schedule elected, including those

taken to meet RMD requirements under the provisions of the Internal Revenue Code of 1986 (“Code”), will be subject to a Market Value Adjustment. If a negative Market Value Adjustment, although limited to the interest or index credit

earnings proportionately attributable to the withdrawal, is applied to an RMD, the amount you receive will be reduced. |

The Accumulation Period

The contract can help you save for retirement or other long-term purposes during the accumulation period. The accumulation period begins on the

contract date and continues until you begin to receive annuity payments. The contract is available in connection with certain retirement plans that qualify for special federal income tax treatments (“qualified plans” or

“IRAs”), as well as those that do not qualify for such treatment (“non-qualified plans”). Purchase of this contract through a qualified plan or IRA does not provide any additional tax deferral benefits beyond those provided by

the contract. Accordingly, if you are purchasing this contract through a qualified plan, you should consider this contract for its annuity option benefits.

5

Contract Value

Your contract value at any time during the accumulation period is equal to the sum of the account value of the Fixed Account and

Indexed Accounts.

Premium

The amount applied to this contract will be the single premium received minus a deduction for any applicable state and local tax. No benefit associated with any single premium will be provided until it is actually

received by us.

Generally, we require a minimum single premium payment of:

| v |

|

Nonqualified plans – $25,000 |

| v |

|

IRA/Qualified plans – $25,000 |

A contract may not be purchased for a proposed owner who is 86 years of age or older. A premium payment in excess of $1,000,000 requires our prior approval. We reserve the right to reject any application or waive

this limitation, at our sole discretion.

Your premium payment becomes part of the Separate Account, which supports

our insurance and annuity obligations. For more information, see “PHL Variable and the Separate Account.”

Fixed

Account and Indexed Accounts

Currently, one Fixed Account and three Indexed Accounts are available for

investing. The Fixed Account is not available in Alabama, Florida, Massachusetts, Nevada, and Oregon. The Fixed Account earns interest daily, and the rate is declared annually and guaranteed for one year. Each of the Indexed Accounts earns index

credits that are linked to the performance of the S&P 500® Index, and the index credits will never be less than 0%.

For more information, please see the “Fixed Account and Interest Rates” and the “Indexed Accounts and Index Credit” sections of this Prospectus.

Premium Allocation

Your premium payment will be applied within two

business days after its receipt at our Annuity Operations Division if the application or order form is complete. If we do not receive all of the necessary application information, we will hold your premium payment while we attempt to complete the

application. If the application is not completed within five business days, we will inform you of the reason for the delay and return your premium payment, unless you specifically consent to our holding it until the application is complete. Once we

have all of your necessary application information, we will apply your premium payment as requested and issue your contract. Please note that prior to the completion of your application or order form, we will hold the premium in a suspense account,

which is a non-interest-bearing account.

Reallocation of Contract Value

During the 30 days before each contract anniversary, you may reallocate your contract value among the available

accounts. You may make your reallocation request in writing,

or by telephone. Written requests must be received in a form satisfactory to us at our Annuity Operations Division. The company and Phoenix Equity Planning Corporation

(“PEPCO”), our national distributor, will use reasonable procedures to confirm that telephone reallocation requests are genuine. We require verification of account information and may record telephone instructions on tape. The company and

PEPCO may be liable for following unauthorized instructions if we fail to follow our established security procedures. However, you will bear the risk of a loss resulting from instructions entered by an unauthorized third party that the company and

PEPCO reasonably believe to be genuine. We must receive the request prior to the contract anniversary. Your request will be effective as of the contract anniversary, after index crediting for the past year. There is no charge for contract value

reallocation.

Contract Features

Death Benefit

A death benefit is payable as described below when any owner (or primary annuitant when the contract is owned by a non-natural person) dies.

If the owner dies before the maturity date, the death benefit will be paid to the beneficiary.

| |

Ø

|

|

Death of an Owner – Multiple Owners |

If there is more than one owner, a death benefit is payable upon the first owner to die. The death benefit is paid to the surviving owner(s) as the designated beneficiary(s).

| |

Ø

|

|

Death of an Annuitant who is not the Owner |

If the owner and the annuitant are not the same individual and the annuitant dies prior to the maturity date, the owner becomes the annuitant, unless the owner appoints a new annuitant. If a joint annuitant dies

prior to the maturity date, the owner may appoint a new joint annuitant; however, there may be tax consequences. The death of the annuitant or joint annuitant will not cause the death benefit to be paid.

| |

Ø

|

|

Spousal Beneficiary Contract Continuance |

If the spouse of a deceased owner, as designated beneficiary, is entitled to receive all or some portion of the death benefit amount, the spouse may elect to continue the contract as the new owner. See

“Spousal Definition” for further discussion of spousal qualifications. This election is only allowed prior to the maturity date and can be elected only one time. When the spouse elects to continue the contract, the death benefit amount

that the spouse is entitled to receive will become the new contract value for the continued contract.

| |

Ø

|

|

Ownership of the Contract by a Non-Natural Person |

If the owner is not an individual, upon the death of the primary annuitant, the death benefit will be paid to the

6

owner. There are distinct Federal Income Tax ramifications of ownership by a Non-Natural Person. See “Federal Income Tax” section for further details.

The death benefit amount equals the contract value as of the date of death. No market value adjustment, surrender charge or index credit for the

year in which the death occurred will be included in the death benefit calculation. The death benefits provided under this contract will not be less than the minimum benefits required by the state where the contract is delivered.

Payment of the Death Benefit:

There are a number of options for payment of the death benefit, including lump sum, systematic withdrawals and annuity. If the death benefit amount to be paid is less than $2,000, it will be paid in a single lump

sum (see “Annuity Options”). Depending upon state law, the death benefit payment to the beneficiary may be subject to state inheritance or estate taxes and we may be required to pay such taxes prior to distribution. There are specific Code

requirements regarding payment of the death benefits, see “Federal Income Taxes—Distribution at Death.” A recipient should consult a legal or tax adviser in selecting among the death benefit payment options.

Retained Asset Account

Death benefit

proceeds will be payable in a single lump sum. At the time of payment you may elect to have the full death benefit amount sent to you or to have the proceeds applied to a retained asset account, the Phoenix Concierge Account (“PCA”), an

interest bearing draft account with check writing privileges. If you do not affirmatively elect to have the full death benefit amount sent to you, the PCA will become default method of payment when the death claim is greater than or equal to $5,000

and the beneficiary is an individual, trust or estate. The PCA is generally not offered to corporations or similar entities. You may opt out of the PCA at any time by writing a check from the PCA for the full amount of your balance or by calling our

Annuity Service Center. A supplementary contract may be issued when death benefit proceeds are paid through the PCA.

The PCA is part

of our general account. It is not a checking or bank account and is not insured by the Federal Deposit Insurance Corporation (“FDIC”), National Credit Union Share Insurance Fund (“NCUSIF”), or any other state or federal agency

which insures deposits. No additional amounts aside from the death benefit may be deposited into the PCA. As part of our general account, it is subject to the claims of our creditors. We may receive a financial benefit from earnings on amounts left

in the PCA. The guarantee of principal is based on the claims-paying ability of the company and principal is covered by the state guarantee association. Interest paid on amounts in the PCA is taxable as ordinary income in the year such interest is

credited. Please consult a tax advisor.

If an owner dies on or after the maturity date, any remaining annuity payments will be paid according to the

annuity payment option in effect on the date of death. If there is a surviving owner, the payments will be paid to the surviving owner. If there is no surviving owner, the payments will be paid

to the beneficiary. Payments may not be deferred or otherwise extended.

If the annuitant and/or joint annuitant dies, any remaining

period certain annuity payments will be paid according to the annuity payment option in effect on the date of death. If the annuitant and/or joint annuitant are survived by any owner(s), the payments will be paid to the owner(s). If not, the

payments will be paid to the beneficiary. Payments may not be deferred or otherwise extended.

Fixed Account and Interest

Rates

The Fixed Account earns interest daily. The fixed interest rate is declared annually and is guaranteed for one year. While the

company has no specific formula for determining the fixed interest rate, we may consider various factors, including, but not limited to the yields available on the instruments in which we intend to invest the proceeds from the contract, regulatory

and tax requirements, sales commissions, administrative expenses, general economic trends and competitive factors. There is a 1.5% minimum guaranteed interest rate. Subsequent interest rates may be higher or lower than the initial fixed

interest rate and are determined in our sole discretion. If you withdraw a portion of your contract value or surrender the contract, the market value adjustment, as described below, may result in a loss of the credited interest in the Fixed

Account. The Fixed Account is not available in Alabama, Florida and Nevada.

If we delete the Fixed Account, you will have the option to

invest in indexed accounts only. There may be only one remaining indexed account into which to invest. We reserve the right to delete the Fixed Account at the contract anniversary in our sole discretion and not add a new fixed account.

On the contract date, the account value of the Fixed Account is equal to the portion of the premium allocated to the fixed account.

Thereafter, the account value for the Fixed Account equals:

| |

1. |

the initial allocation and any reallocation to the Fixed Account; plus |

| |

2. |

interest credited; less |

| |

3. |

any reallocation of contract value from the Fixed Account; less |

| |

4. |

withdrawals (including applicable market value adjustments, surrender charges and tax deductions). |

Indexed Accounts and Index Credit

Currently, there are three

different Indexed Accounts. On the contract date, the account value for an Indexed Account equals the portion of the premium allocated to the indexed account as of the contract date.

7

On each contract anniversary, the account value equals:

| |

1. |

the account value immediately preceding the contract anniversary, multiplied by the resulting value of (1 + the applicable index credit); less |

| |

2. |

reallocation, if any, from the indexed account; plus |

| |

3. |

reallocation, if any, to the indexed account; less |

| |

4. |

withdrawals (including applicable market value adjustments, surrender charges and tax deductions). |

Index credit is based on account value before reallocation. Reallocations are effective after the index crediting on each contract anniversary.

On any other date, the account value for an indexed account equals:

| |

1. |

the account value for the indexed account on the preceding contract anniversary; less |

| |

2. |

any withdrawals (including applicable market value adjustments, surrender charges and state and local tax deductions) from the Indexed Account since the preceding contract

anniversary. Please see the “State and Local Tax” section on page 10 for more information about tax deductions. |

For the first contract year, the contract date is considered the preceding contract anniversary.

Each of the Indexed Accounts earns index credits that are linked to the performance of the S&P 500® Index. The performance or index value of the S&P 500® Index is its published value, excluding any dividends paid by the companies that comprise the index. The index credit is calculated annually on each contract

anniversary and is credited immediately. The index credit will never be less than the guaranteed minimum index credit. The guaranteed minimum index credit is 0% and will never be less than 0%, even if we add new indexed accounts.

Therefore, you are assuming the risk that an investment in an indexed account could potentially offer no return. The index credit is based on the performance of the index for the last contract year. Amounts withdrawn or surrendered

effective on the contract anniversary will receive the index credit for the past contract year. Amounts withdrawn or surrendered prior to the end of a contract year will not receive the index credit for that contract year.

| v |

|

Indexed Account A – Point-to-Point with Cap Indexed Account |

This account earns an index credit on each contract anniversary that is based on the performance of the Index for the past contract year. The index

credit is subject to a maximum crediting percentage (“index cap”). To determine the index credit as a percentage, we first calculate the index growth, which equals:

(index value on the contract anniversary ÷ index value on the preceding contract anniversary)—1 and then we convert the decimal to the equivalent percentage.

The index credit equals the lesser of the index growth and the applicable index cap, but will never

be less than 0%.

The index cap is the maximum index credit percentage that can be applied to the account value in any given contract

year. For the first contract year, the initial index cap as shown on the contract schedule page is used. On each subsequent contract anniversary, a new index cap will be declared and guaranteed for the following contract year. The subsequent index

caps may be higher or lower than the initial index cap, but will not be lower than the guaranteed minimum index cap.

The guaranteed

minimum index cap is 3%. Although it does not affect the guaranteed minimum index cap, your selection of the five or seven year surrender charge schedule may effect the index credit. See “Surrender Charges” section of this prospectus.

If the index cap is 3% and the performance of the index is between 0% and 3%, the indexed account will be credited with the index growth

amount of 0% through 3%. If the performance of the index is above 3%, the indexed account will be credited with the index credit of 3%. The company at its sole discretion will make the determination whether to declare an index cap above the

guaranteed minimum index cap of 3%. While the company has no specific formula for determining an index cap above the minimum index cap of 3%, we may consider various factors, including, but not limited to the yields available on the instruments in

which we intend to invest the proceeds from the contract, the costs of hedging our investments to meet our contractual obligations, regulatory and tax requirements, sales commissions, administrative expenses, general economic trends and competitive

factors. For example, if the company, in its sole discretion, declares an index cap of 8%, and the performance of the index is between 0% and 8%, the indexed account will be credited with the index growth amount of 0% through 8%. In this

case, if the performance of the index is above 8%, the indexed account will be credited with the index credit of 8%. At any time, if the performance of the index is below 0%, the indexed account will be credited with an index credit of 0%.

Therefore, you are assuming the risk that an investment in this indexed account would offer no return.

| v |

|

Indexed Account B – Performance Trigger Indexed Account |

This account earns an index credit on each contract anniversary that is based on the performance of the Index for the past contract year.

To determine the index credit as a percentage, we first calculate the index growth, which equals:

(index value on the contract anniversary ÷ index value on the preceding contract anniversary)—1 and then we convert the decimal to an

equivalent percentage.

The index credit equals the triggered rate if the index growth is greater than zero. If the index growth is zero

or less, the index credit will be 0%.

8

For the first contract year, the triggered rate as shown on the contract schedule page is used. On

each subsequent contract anniversary, a new triggered rate will be declared and guaranteed for the following contract year. The subsequent triggered rates may be higher or lower than the initial triggered rate, but will not be lower than the

guaranteed minimum triggered rate. The guaranteed minimum triggered rate is 2%. Although it does not affect the guaranteed minimum triggered rate, your selection of the five or seven year surrender charge schedule may effect the index credit.

See “Surrender Charges” section of this prospectus.

If the triggered rate is 2% and the index growth is greater than 0%, the

indexed account will be credited with the triggered rate of 2%. The company, at its sole discretion, will make the determination to declare a triggered rate above the guaranteed minimum triggered rate. While the company has no specific

formula for determining a triggered rate above the guaranteed minimum triggered rate, we may consider various factors, including, but not limited to the yields available on the instruments in which we intend to invest the proceeds from the contract,

the costs of hedging to meet our contractual obligations, regulatory and tax requirements, sales commissions, administrative expenses, general economic trends and competitive factors. For example, if the company, in its sole discretion,

declares a triggered rate of 5%, and the performance of the index is above 0%, the indexed account will be credited with an index credit of 5%. At any time, if the performance of the index is below 0%, the indexed account will be credited with an

index credit of 0%. Therefore, you are assuming the risk that an investment in this indexed account could potentially offer no return.

| v |

|

Indexed Account C – Monthly Average with Spread Indexed Account |

This account earns an index credit on each contract anniversary that is based on the performance of the Index for the past contract year.

To determine the index credit as a percentage, we first calculate the averaged index growth, which equals:

((the sum of the index values on each monthly processing dates during the contract year ÷ 12) ÷ index value on the preceding contract

anniversary)—1 and then we convert the decimal to the equivalent percentage.

Monthly processing date is defined as the same date of

each month for the twelve months following the contract date or subsequent contract anniversary. If the date does not exist in a month the last day in the month will be used.

The index credit equals the averaged index growth less the index spread, but will never be less than 0%.

The index spread is the amount subtracted from the averaged index growth when the index credit is calculated. For the first contract year, the initial index spread as shown on the contract schedule page is used. On

each subsequent contract anniversary, a new index spread will be declared and guaranteed for the following contract year. The subsequent index spreads may be higher or lower than the initial index

spread, but will not be higher than the guaranteed maximum index spread. The guaranteed maximum index spread is 9%. Although it does not affect the guaranteed maximum index spread,

your selection of the five or seven year surrender charge schedule may effect the index credit. For more information, see Surrender Charges. The company, at its sole discretion, will make the final determination as to the index spread

declared. While the company has no specific formula for determining an index spread below the guaranteed maximum index spread, we may consider various factors, such as the yields available on the instruments in which we intend to invest the proceeds

from the contract, the costs of hedging to meet our contractual obligations, regulatory and tax requirements, sales commissions, administrative expenses, general economic trends and competitive factors. For example, if the average index growth is 9%

and the company, in its sole discretion, declares an index spread of 5%, the indexed account will be credited with an index credit of 4%. If the average index growth is 9%, and the company, in its sole discretion, uses the guaranteed

maximum index spread at 9%, the indexed account will be credited with 0%. Therefore, you are assuming the risk that an investment in this indexed account could potentially offer no return.

The contract currently provides four accounts to which you may allocate your premium payment or contract value—three Indexed Accounts and one

Fixed Account, as discussed above. You should be aware that the contract permits us to eliminate any account as described below:

| • |

|

We may add and delete indexed accounts which may result in your investment in the contract earning no return even if the index associated with the indexed

account increases in value. We guarantee that the contract will have at least one indexed account. |

| • |

|

We reserve the right to eliminate any indexed account in our sole discretion upon thirty days written notice. We will only eliminate an indexed account at

a contract anniversary, and you will earn the index credit for the indexed account for the prior contract year. |

| • |

|

We reserve the right to eliminate the Fixed Account in our sole discretion upon thirty days notice and not add a new fixed account. We will only delete

the Fixed Account on a contract anniversary, and you will earn the interest credited through the end of the prior contract year. |

Our ability to eliminate accounts at any time may adversely impact your contract value for the following reason. There are guarantees applicable to each of the three Indexed Accounts currently offered that provide

a minimum participation in the increase in value of the S&P 500 Index, if any, with respect to your contract value allocated to the account. These guarantees are described in this prospectus above. Similarly, there is a 1.5% minimum guaranteed

interest rate applicable to the Fixed Account. The contract does not permit us to reduce or eliminate the guarantees applicable to any of these accounts as long as we continue to offer the accounts. However, we are permitted in our sole

discretion to eliminate any account in the future. If we eliminate an account, you may

9

reallocate any contract value that was invested in the account to another account available at that time (contract value may not remain in an account that has been eliminated). If one or more of

the accounts described in this prospectus is available at the time, you may reallocate your contract value to any of these accounts and the guarantees described in this prospectus will apply. However, the account or accounts currently available at

the time you may reallocate your account value may not be described in this prospectus and may not provide any guarantees. Additionally, while the contract permits us to add new accounts, we are not required to do so. If we do add new accounts, the

accounts may provide no guarantees, or guarantees that provide less protection than the guarantees applicable to the three Indexed Accounts or the Fixed Account currently available under the contract. For example, if we added an indexed account, the

new indexed account may not have any guarantees, may be tied to an index other than the index in your current indexed account, may have a different formula for determining the index credit, and may be set up in a different manner to measure the

index credit, among other differences. Accordingly, we may add and delete indexed accounts which may result in your investment in the contract earning no return even if the index associated with the indexed account increases in value. We guarantee

that the contract will have at least one indexed account.

You should be aware that even if we do not eliminate a particular indexed

account, we may change the index used to measure the index credit applicable to such account upon thirty days written notice, which index we in our sole discretion deem to be appropriate. The new index would provide different performance than

the old index. We are permitted to change an index only if the index for a particular indexed account is discontinued, our agreement with the sponsor of the index is terminated, or the index calculation is substantially changed. However, you should

be aware that we may unilaterally terminate our agreement with the sponsor of an index without cause. Further, we may consider an index to have substantially changed if the fixed number of constituents materially changes in the index or the criteria

for eligibility in the index with respect to size, liquidity, profitability and sector and/or market representation materially changed for the index. You will earn the index credit for the contract linked to the last published value of the replaced

index before its replacement if we replace an index before a contract anniversary date. If an index is changed during a contract year, you will not participate in an increase in value of either the old or new index for the remainder of the contract

year. If we change the index, it will not affect the minimum guarantees, if any, in the indexed accounts. If you do not wish to remain in the indexed account with the replacement index, you have the option to allocate your contract value to the

remaining accounts available under the contract. There may be only one remaining indexed account, and no fixed account, to which to allocate contract value.

In either of the situations described above involving the elimination of an account or the change in an indexed

account’s index, if you do not wish to allocate your contract value to one or more remaining accounts available under the contract and accordingly wish to withdraw your contract value from

the account or surrender the contract, you may be subject to a surrender charge and market value adjustment, which may result in a loss of principal and earnings.

IF WE ELIMINATE ANY TWO OF THE THREE INDEXED ACCOUNTS DESCRIBED IN THIS PROSPECTUS, YOU MAY SURRENDER YOUR CONTRACT WITHOUT THE IMPOSITION OF A SURRENDER CHARGE AND/OR A NEGATIVE MARKET VALUE ADJUSTMENT WITHIN 45

DAYS OF THE DATE WE MAIL THE NOTICE TO YOU OF THE ELIMINATION OF THE SECOND INDEXED ACCOUNT DESCRIBED IN THIS PROSPECTUS.

Nursing Home Waiver

Prior to the maturity date, you may surrender all or a portion of the contract value, adjusted by any applicable market value adjustment, without a

surrender charge, provided that:

| v |

|

more than one year has elapsed since the contract date; and |

| v |

|

the withdrawal is requested within two years of the owner’s admission into a licensed nursing home facility; and |

| v |

|

the owner has been confined to the licensed nursing home facility (as defined below) for at least the preceding 120 days. |

A licensed nursing home facility is defined as a state licensed hospital or state licensed skilled or intermediate care nursing facility at which

medical treatment is available on a daily basis. The owner must provide us with satisfactory evidence of confinement by written notice. There is no fee for this waiver. This waiver is subject to state approval.

Terminal Illness Waiver

Prior to the maturity date, you may surrender all or a portion of the contract value, adjusted by any applicable market value adjustment, without a surrender charge in the event of the owner’s terminal

illness. Terminal Illness is defined as an illness or condition that is expected to result in the owner’s death within six months. The owner must provide us with a satisfactory written notice of terminal illness by a licensed physician, who is

not the owner or a member of the owner’s family. We reserve the right to obtain a second medical opinion from a physician of our choosing at our expense. There is no fee for this waiver. This waiver is subject to state approval.

Withdrawals and Surrenders

You may request a withdrawal from or full surrender of the contract (“surrender”) from the contract value at any time prior to the maturity date. Requests must be made in writing and should include

tax-withholding information.

10

You may withdraw up to 10% of the contract value in a contract year without a market value adjustment

or surrender charge. This amount is referred to as the free withdrawal amount. During the first contract year, the free withdrawal amount will be determined based on the contract value at the time of the first withdrawal. In all subsequent years,

the free withdrawal amount will be based on the contract value on the previous contract anniversary. Any unused percentages of the free withdrawal amount from prior years may not be carried forward to future contract years.

Please note that withdrawal or surrender amounts in excess of the free withdrawal amount before the end of the surrender charge schedule, including

withdrawals taken to meet RMD requirements under the Code, will be subject to a market value adjustment that can result in a loss or gain, a surrender charge and tax deduction(s).

Withdrawals may be subject to income tax on any gains plus a 10% penalty tax if the policyholder is under age 59 1/2. See “Federal Income Taxes.”

Charges

IF WE ELIMINATE ANY TWO OF THE THREE INDEXED ACCOUNTS DESCRIBED IN THIS PROSPECTUS, YOU MAY SURRENDER YOUR CONTRACT WITHOUT THE IMPOSITION OF A

SURRENDER CHARGE AND/OR A NEGATIVE MARKET VALUE ADJUSTMENT WITHIN 45 DAYS OF THE DATE WE MAIL THE NOTICE TO YOU OF THE ELIMINATION OF THE SECOND INDEXED ACCOUNT DESCRIBED IN THIS PROSPECTUS.

Market Value Adjustment

A market value adjustment is applied to

withdrawals, including those taken to meet RMD requirements, or surrenders prior to the end of the surrender charge schedule elected. The market value adjustment is intended to approximate, without exactly replicating, the gains or losses that may

be incurred by the company when it liquidates assets in order to satisfy certain contractual obligations, such as withdrawals or surrenders. When liquidating assets, the company may realize either a gain or loss because of a change in interest rates

from the time of initial investment. The market value adjustment may result in a gain or loss to your contract value and applies to both fixed and indexed accounts.

The market value adjustment equals the contract value withdrawn or surrendered in excess of the free withdrawal amount multiplied by the following:

|

|

|

|

|

|

|

|

|

| [ |

|

1 + i |

|

] |

|

(n/12) |

|

–1 |

| |

1 + j + 0.0050 |

|

|

|

|

|

where:

i - is the Treasury Constant Maturity yield as published by the Federal Reserve on the business day prior to the contract date for the maturity matching the duration of the surrender charge period;

j - is the Treasury Constant Maturity yield as published by the Federal Reserve on the

business day prior to the date of withdrawal or surrender for the maturity matching the remaining years in the surrender charge period (fractional years rounded up to the next full year);

n - is the number of complete months from the time of withdrawal or surrender to the end of the surrender charge period.

If a Treasury Constant Maturity yield for a particular maturity is not published, the yield will be interpolated between the yields for maturities

that are published. If the Treasury Constant Maturity yields are no longer published, we will choose a suitable replacement, subject to any regulatory approvals and provide you with notice accordingly.

A positive market value adjustment will increase the amount withdrawn or surrendered. There is no limit on a positive market value adjustment. A

negative market value adjustment will decrease the amount withdrawn or surrendered. A negative market value adjustment will not decrease the amount withdrawn or surrendered by more than the interest or index credit earnings proportionately

attributable to the withdrawal or surrender amount.

The market value adjustment is waived on the free withdrawal amount, on death, and

on annuitization if annuitization occurs after five contract years. The market value adjustment is not waived on the nursing home and terminal illness waivers.

Surrender Charges

In addition to the application of a market value

adjustment, a surrender charge may apply to a withdrawal or surrender of the contract prior to the end of the surrender charge period specified in your surrender charge schedule. The amount of a surrender charge depends on the period of time your

premium payment is held under the contract and which surrender charge schedule you elected (refer to the charts shown below). You must elect a surrender charge schedule at the time of initial purchase of the contract and you cannot change it later.

In general, we invest in fixed income securities that correspond to the assumed duration of our contractual obligations under the contract. We assume that generally, (1) a contract with a 5-year surrender charge schedule will be surrendered

before a contract with a 7-year surrender charge schedule and (2) a certain number of contracts will be surrendered around the time that the surrender charge schedule expired. Based on these assumptions, the company will invest in shorter term

fixed income securities for contract value with respect to the 5-year surrender charge schedule, while it invests in longer term fixed income securities for contract value with respect to the 7-year surrender charge schedule. Fixed income securities

of a longer duration tend to earn a higher rate of interest than those of a shorter duration. Therefore, if you elect the 5-year surrender charge schedule, we may credit a lower interest rate or index credit than if you elected the 7-year surrender

charge schedule, where we may credit a higher interest rate or index credit. The difference is

11

not fixed and will vary based on market conditions, which we cannot predict.

The

surrender charge is designed to recover the expense of distributing contracts that are surrendered before distribution expenses have been recouped from revenue generated by these contracts. They are deferred charges because they are not deducted

from the premium. Surrender charges are waived on the free withdrawal amount and on death benefits. Surrender charges will also be waived when you begin taking annuity payments provided your contract has been in effect for five years. For more

information, see “Annuity Payment Options.”

Surrender charges are expressed as a percentage of the lesser of (1) and (2),

where

(1) is the result of

(a) the gross amount withdrawn, less

(b) the 10% free withdrawal amount, adjusted by

(c) any applicable market value adjustment

(2) the premium payment less any prior withdrawals for which a surrender charge was paid.

Surrender

charge schedules are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7-Year Surrender Charge Schedule |

| Percent |

|

7% |

|

7% |

|

7% |

|

6% |

|

6% |

|

5% |

|

5% |

|

0% |

| |

| Complete Contract Years |

|

0 |

|

1 |

|

2 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7+ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5-Year Surrender Charge Schedule |

| Percent |

|

7% |

|

7% |

|

7% |

|

6% |

|

6% |

|

0% |

| |

| Complete Contract Years |

|

0 |

|

1 |

|

2 |

|

3 |

|

4 |

|

5+ |

| |

This contract allows you to choose between two

distinct surrender charge schedules. You should consult with a qualified financial advisor before making your election.

Since there may

be a higher interest rate or index credit for one surrender schedule over the other schedule, you should carefully discuss your individual financial situation with your registered representative before you make an election.

If you request a gross withdrawal of a specified amount, we will deduct the surrender charge from the amount requested. For a gross withdrawal, the

surrender charge is calculated based on the gross amount. If you request a net withdrawal of a specified amount, we will deduct the surrender charge from the remaining contract value. For a net withdrawal, the surrender charge is calculated based on

the net amount, plus the applicable surrender charge amount. The withdrawal amount, plus any applicable surrender charge for a net withdrawal, will be deducted from the affected fixed and indexed account on a pro rata basis.

Any distribution costs not paid for by the surrender charge will be paid by PHL Variable from the assets of the General Account.

State and Local Tax

State and local tax is considered any tax charged by a state or municipality on premium payments, whether or not it is characterized as premium tax

or an excise tax. It is also other state or local taxes imposed or any other governmental fees that may be required based on the laws of the state or municipality of delivery, the owner’s state or municipality of residence on the contract date.

Taxes on premium payments currently range from 0% to 3.5% and vary from state to state. We will pay any premium payment tax; any other state or local taxes imposed or other governmental fee due and will only reimburse ourselves upon the remittance

to the applicable state. For a list of states and taxes, see “Appendix A.”

The Annuity Period

Annuity Payments

Annuity payments will begin on the contract’s maturity date if the owner is alive and the contract is still in force.

If the amount to be applied on the maturity date is less than $2,000, we may pay such amount in one lump sum in lieu of providing an

annuity. If the initial monthly annuity payment under an annuity payment option would be less than $20, we may make a single sum payment equal to the total contract value on the date the initial annuity payment would be payable, or make periodic

annuity payments quarterly, semiannually or annually in place of monthly annuity payments.

Your contract

specifies a maturity date at the time of its issuance. However, you may subsequently elect a different maturity date. The maturity date may not be earlier than the fifth contract anniversary. The latest maturity date is the contract anniversary

nearest the annuitant’s 95th birthday or ten years from the contract

date, whichever is later. Generally, under qualified plans or IRAs, the maturity date must be such that distributions begin no later than April 1st of the calendar year following the later of: (a) the year in which the employee attains age 70 1/2 or (b) the calendar year in which the employee retires. The date set

forth in (b) does not apply to an Individual Retirement Annuity (“IRA”). A policyholder can defer the maturity date to the contract anniversary nearest the annuitant’s 95th birthday if we receive documentation concerning the policyholder’s satisfaction of Code Required Minimum Distributions. See

“Federal Income Taxes”

The maturity date election must be made by written notice and must be received by us 30

days before the provisional maturity date. If you do not elect a maturity date, which is different from the provisional maturity date, the provisional maturity date becomes the maturity date.

Fixed Annuity Payment Options

This contract offers several Fixed

Annuity Payment Options. A Fixed Annuity Payment Option provides a series of fixed payments at regular intervals over a specified period or the life of the annuitant. If you have not selected a Fixed Annuity Payment Option by the maturity date, the

default annuity payment is based on Annuity Payment Option A—Life

12

Annuity with 10-Year Period Certain and as long as the annuitant lives. Instead, you may, by sending a written request to our Annuity Operations Division on or before the maturity date of the

contract, elect any of the other Annuity Payment Options. After the first annuity payment, you may not change the elected Annuity Payment Option.

The level of annuity payments payable under the following Annuity Payment Options is based upon the option selected. The amount of each annuity payment will be based on the contract value on the maturity date and

the annuity purchase rates. In addition, factors such as the age at which annuity payments begin, the form of annuity, annuity payment rates, and the frequency of annuity payments will affect the level of annuity payments. The longer the duration

and more frequent the payments, the lower the annuity payment amount. The contract is issued with guaranteed minimum annuity payment rates, however, if the current rate is higher, we’ll apply the higher rate.

The following are descriptions of the Annuity Payment Options currently available under a contract. These descriptions should allow you to

understand the basic differences between the options; however, you should contact our Annuity Operations Division well in advance of the date you wish to elect an option to obtain estimates of annuity payments under each option.

| v |

|

Option A – Life Annuity with Specified Period Certain |

A fixed payout annuity payable monthly while the annuitant is living. If the annuitant dies before the specified period certain has passed, then payments will continue to be made to the surviving owner or the

beneficiary for the remainder of the period certain. The period certain may be specified as 5, 10 or 20 years. The period certain must be specified at the time this option is elected.

| v |

|

Option B – Non-Refund Life Annuity |

A fixed payout annuity payable monthly while the annuitant is living. No monthly payment, death benefit or refund is payable after the death of the annuitant.

| v |

|

Option D – Joint and Survivor Life Annuity |

A fixed payout annuity payable monthly while either the annuitant or joint annuitant is living. You must designate the joint annuitant at the time you elect this option. The joint annuitant must be at least age 40

on the first payment calculation date.

| v |

|

Option E – Installment Refund Life Annuity |

A fixed payout annuity payable monthly while the annuitant is living. If the annuitant dies before the annuity payments made under this option total an amount that refunds the entire amount applied under this

option, we will make a lump sum payment equal to the entire amount applied under this option less the sum of payments already made.

| v |

|

Option F – Joint and Survivor Life Annuity with 10-Year Period Certain |

A fixed payout annuity payable monthly while either the annuitant or joint annuitant is living. If the annuitant and

the joint annuitant die before the 10-year period certain has passed, then payments will continue to be made to the surviving owner or the beneficiary for the remainder of the 10-year period

certain. You must designate the joint annuitant at the time you elect this option. The joint annuitant must be at least age 40 on the first payment calculation date.

| v |

|

Option G – Payments for a Specified Period |

A fixed payout annuity payable monthly over a specified period. Payments continue whether the annuitant lives or dies. The specified period must be in whole numbers of years from 5 to 30, but cannot be greater than

100 minus the age of the annuitant. However, if the Beneficiary of any death benefits payable under this contract elects this Payment Option, the period selected by the beneficiary may not extend beyond the life expectancy of such beneficiary.

| v |

|

Option H – Payments of a Specified Amount |

Equal income installments of a specified amount are paid until the principal sum remaining under this option from the amount applied is less than the amount of the installment. When that happens, the principal sum

remaining will be paid as a final payment. The amount specified must provide payments for a period of at least 5 years.

Calculation of Fixed

Annuity Payments

The guaranteed annuity payment rates will be no less favorable than the following:

| v |

|

under Annuity Payment Options A, B, D, E and F, rates are based on the 2000 Individual Annuity Mortality Table with a 10 year age setback, which results in lower

payments than without the setback, and an interest rate of 2.5%. |

| v |

|

under Options G and H, the interest rate is 1.5%. The Society of Actuaries developed these tables to provide payment rates for annuities based on a set of

mortality tables acceptable to most regulating authorities. It is possible that we may have more favorable (i.e., higher-paying) rates in effect on the maturity date. |

Other Options and Rates

We may offer other annuity payment options or alternative

versions of the options listed above. Other values and tables may be used for other payment options that we may make available.

Other Conditions

Federal income tax requirements also provide that participants in IRAs must begin required minimum

distributions RMDs by April 1 of the year following the year in which they attain age 70 1/2. Minimum distribution requirements do not apply to Roth IRAs. Distributions from qualified plans generally must begin by the later of actual retirement or April 1 of the year following the year participants

attain age 70 1/2. We will assist policyholders with

compliance with RMD requirements.

13

Amounts up to the required minimum distribution may be withdrawn without a deduction for surrender

charges, even if the minimum distribution exceeds the 10% allowable amount. See “See Withdrawals and Surrenders on page 8.” Any amounts withdrawn during the surrender charge period that are in excess of both the RMD and the 10% free

available amount will be subject to any applicable surrender charge.

Miscellaneous Provisions

Amendments to Contracts

Contracts may be amended to conform to changes in applicable law or interpretations of applicable law, or to accommodate design

changes including changes required in order to maintain tax status as an IRA or qualified plan. Except for changes related to tax status, changes in the contract may need to be approved by contract owners and state insurance departments. A change in

the contract that necessitates a corresponding change in this Prospectus must be filed with the SEC.

Assignment

Owners of contracts issued in connection with non-qualified plans may assign their interest in the contract to a spouse or a grantor

trust. A written notice of such assignment must be filed with our Annuity Operations Division before it will be honored.

A pledge or

assignment of a contract is treated as payment received on account of a partial surrender of a contract. See “Federal Income Tax” for more details.

Contracts issued in connection with tax qualified plans or IRAs may not be sold, assigned, discounted or pledged as collateral for a loan or as security for the performance of an obligation, or for any other

purpose, to any person other than to us.

Free Look Period

We may mail the contract to you or we may deliver it to you in person. You may return a contract for any reason within ten days after you receive it

and receive a refund of your premium payment less any withdrawals made as of the date of cancellation. A longer Free Look Period may be required by state or federal law.

Community and Marital Property States