Investor ProtectorSM Program with Phoenix Guaranteed Income Edge®

INVESTORS CAPITAL

ADVISORY SERVICES

Living your dreams

At Investors Capital Advisory Services, we believe your journey to financial success begins with a trusted, advisory relationship. Our Investor ProtectorSM Program provides your advisor with the tools to plan for your unique investment and retirement needs.

PHOENIX GUARANTEED INCOME EDGE® IS AN INSURANCE CERTIFICATE ISSUED UNDER A GROUP ANNUITY CONTRACT BY PHL VARIABLE INSURANCE COMPANY. THIS BROCHURE MUST BE PRECEDED OR ACCOMPANIED BY THE PHOENIX GUARANTEED INCOME EDGE® PROSPECTUS.

Retirement and Market Risks

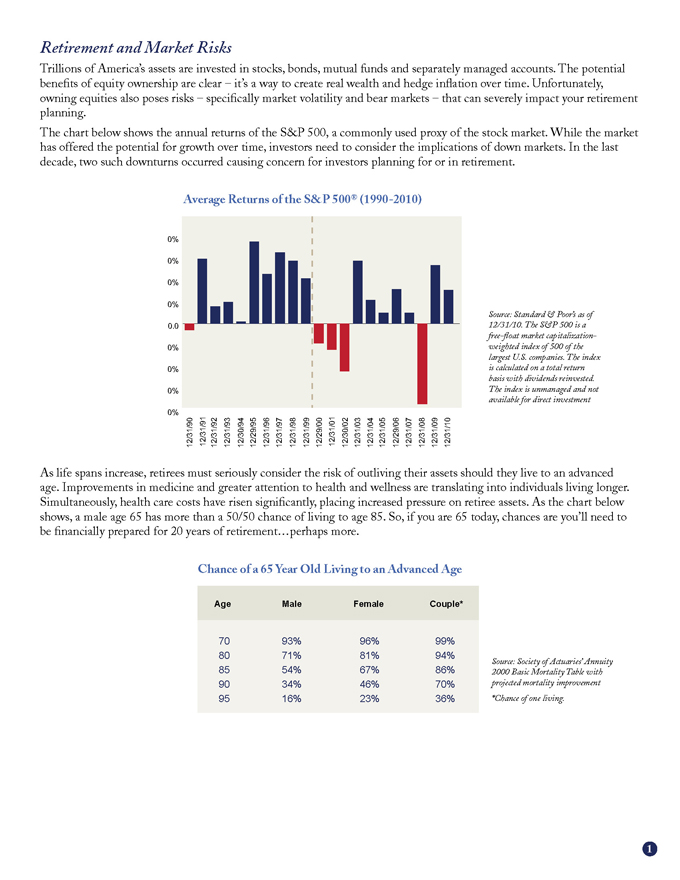

Trillions of America’s assets are invested in stocks, bonds, mutual funds and separately managed accounts. The potential benefits of equity ownership are clear – it’s a way to create real wealth and hedge inflation over time. Unfortunately, owning equities also poses risks – specifically market volatility and bear markets – that can severely impact your retirement planning.

The chart below shows the annual returns of the S&P 500, a commonly used proxy of the stock market. While the market has offered the potential for growth over time, investors need to consider the implications of down markets. In the last decade, two such downturns occurred causing concern for investors planning for or in retirement.

Average Returns of the S&P 500® (1990-2010)

12/31/90 12/31/91 12/31/92 12/31/93 12/30/94 12/29/95 12/31/96 12/31/97 12/31/98

12/31/99 12/29/00 12/31/01 12/30/02 12/31/03 12/31/04 12/31/05 12/29/06 12/31/07 12/31/08 12/31/09 12/31/10

Source: Standard & Poor’s as of 12/31/10. The S&P 500 is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged and not available for direct investment

As life spans increase, retirees must seriously consider the risk of outliving their assets should they live to an advanced age. Improvements in medicine and greater attention to health and wellness are translating into individuals living longer. Simultaneously, health care costs have risen significantly, placing increased pressure on retiree assets. As the chart below shows, a male age 65 has more than a 50/50 chance of living to age 85. So, if you are 65 today, chances are you’ll need to be financially prepared for 20 years of retirement... perhaps more.

Chance of a 65 Year Old Living to an Advanced Age

Age Male Female Couple*

70 93% 96% 99%

80 71% 81% 94%

85 54% 67% 86%

90 34% 46% 70%

95 16% 23% 36%

Source: Society of Actuaries’ Annuity 2000 Basic Mortality Table with projected mortality improvement

*Chance of one living.

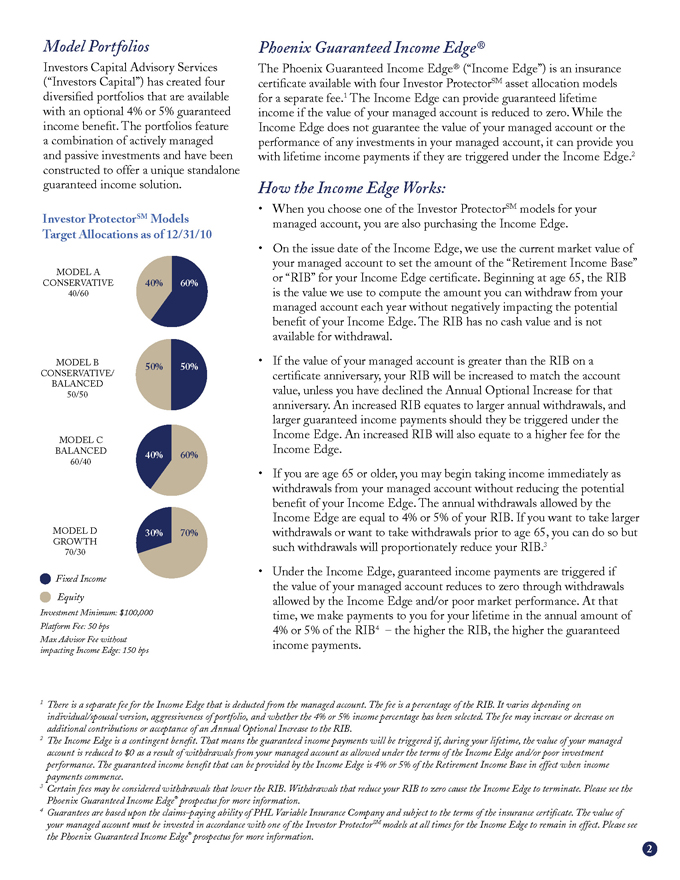

Model Portfolios

Investors Capital Advisory Services (“Investors Capital”) has created four diversified portfolios that are available with an optional 4% or 5% guaranteed income benefit. The portfolios feature a combination of actively managed and passive investments and have been constructed to offer a unique standalone guaranteed income solution.

Investor ProtectorSM Models

Target Allocations as of 12/31/10

MODEL A CONSERVATIVE 40/60

MODEL B CONSERVATIVE/ BALANCED 50/50

MODEL C BALANCED 60/40

MODEL D GROWTH 70/30

Fixed Income

Equity

Investment Minimum: $100,000

Platform Fee: 50 bps

Max Advisor Fee without impacting Income Edge: 150 bps

Phoenix Guaranteed Income Edge®

The Phoenix Guaranteed Income Edge® (“Income Edge”) is an insurance certificate available with four Investor ProtectorSM asset allocation models for a separate fee.1 The Income Edge can provide guaranteed lifetime income if the value of your managed account is reduced to zero. While the Income Edge does not guarantee the value of your managed account or the performance of any investments in your managed account, it can provide you with lifetime income payments if they are triggered under the Income Edge.2

How the Income Edge Works:

When you choose one of the Investor ProtectorSM models for your managed account, you are also purchasing the Income Edge.

On the issue date of the Income Edge, we use the current market value of your managed account to set the amount of the “Retirement Income Base” or “RIB” for your Income Edge certificate. Beginning at age 65, the RIB is the value we use to compute the amount you can withdraw from your managed account each year without negatively impacting the potential benefit of your Income Edge. The RIB has no cash value and is not available for withdrawal.

If the value of your managed account is greater than the RIB on a certificate anniversary, your RIB will be increased to match the account value, unless you have declined the Annual Optional Increase for that anniversary. An increased RIB equates to larger annual withdrawals, and larger guaranteed income payments should they be triggered under the Income Edge. An increased RIB will also equate to a higher fee for the Income Edge.

If you are age 65 or older, you may begin taking income immediately as withdrawals from your managed account without reducing the potential benefit of your Income Edge. The annual withdrawals allowed by the Income Edge are equal to 4% or 5% of your RIB. If you want to take larger withdrawals or want to take withdrawals prior to age 65, you can do so but such withdrawals will proportionately reduce your RIB.3

Under the Income Edge, guaranteed income payments are triggered if the value of your managed account reduces to zero through withdrawals allowed by the Income Edge and/or poor market performance. At that time, we make payments to you for your lifetime in the annual amount of 4% or 5% of the RIB4 – the higher the RIB, the higher the guaranteed income payments.

1 There is a separate fee for the Income Edge that is deducted from the managed account. The fee is a percentage of the RIB. It varies depending on individual/spousal version, aggressiveness of portfolio, and whether the 4% or 5% income percentage has been selected. The fee may increase or decrease on additional contributions or acceptance of an Annual Optional Increase to the RIB.

2 The Income Edge is a contingent benefit. That means the guaranteed income payments will be triggered if, during your lifetime, the value of your managed account is reduced to $0 as a result of withdrawals from your managed account as allowed under the terms of the Income Edge and/or poor investment performance. The guaranteed income benefit that can be provided by the Income Edge is 4% or 5% of the Retirement Income Base in effect when income payments commence.

3 Certain fees may be considered withdrawals that lower the RIB. Withdrawals that reduce your RIB to zero cause the Income Edge to terminate. Please see the Phoenix Guaranteed Income Edge® prospectus for more information.

4 Guarantees are based upon the claims-paying ability of PHL Variable Insurance Company and subject to the terms of the insurance certificate. The value of your managed account must be invested in accordance with one of the Investor ProtectorSM models at all times for the Income Edge to remain in effect. Please see the Phoenix Guaranteed Income Edge® prospectus for more information.

The Phoenix Guaranteed Income Edge® provides clients an option to add an income guarantee to their managed account portfolio.

At a Glance

The Investor ProtectorSM Program offers four diversified separate account portfolios that are available with a 4% or 5% guaranteed income benefit known as the Phoenix Guaranteed Income Edge® (“Income Edge”).5

The Income Edge can provide guaranteed lifetime income if the value of your managed account is reduced to zero.

There are no surrender charges associated with the Income Edge but there is an annual fee taken quarterly in advance.6

The Income Edge was designed to meet needs of investors who are concerned about outliving their assets.

Who Should Consider the Income Edge?

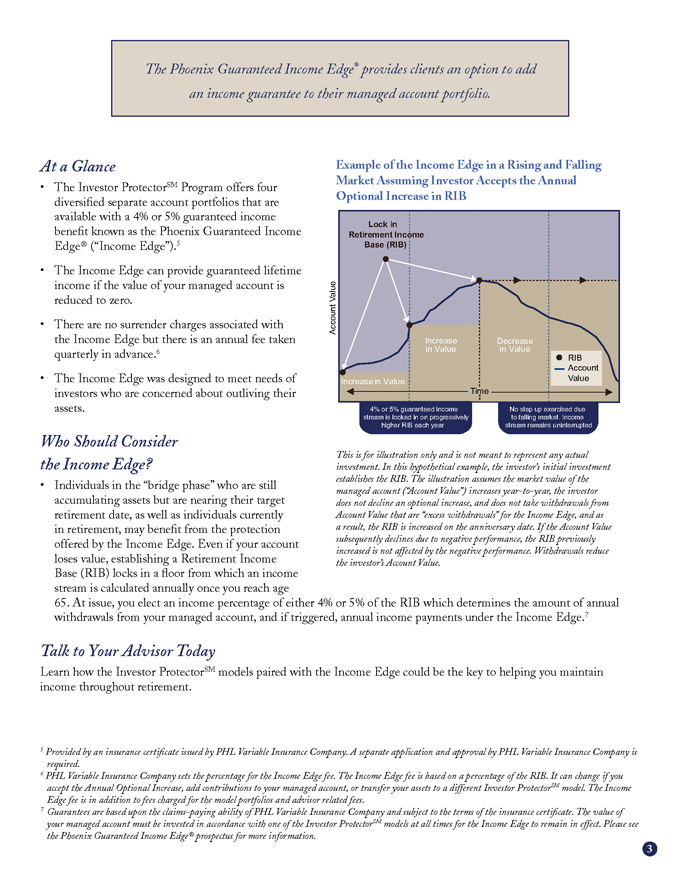

Individuals in the “bridge phase” who are still accumulating assets but are nearing their target retirement date, as well as individuals currently in retirement, may benefit from the protection offered by the Income Edge. Even if your account loses value, establishing a Retirement Income Base (RIB) locks in a floor from which an income stream is calculated annually once you reach age 65. At issue, you elect an income percentage of either 4% or 5% of the RIB which determines the amount of annual withdrawals from your managed account, and if triggered, annual income payments under the Income Edge.7

Example of the Income Edge in a Rising and Falling Market Assuming Investor Accepts the Annual Optional Increase in RIB

Account Value

Lock in Retirement Base (RIB)

RIB Account Value

This is for illustration only and is not meant to represent any actual investment. In this hypothetical example, the investor’s initial investment establishes the RIB. The illustration assumes the market value of the managed account (“Account Value”) increases year-to-year, the investor does not decline an optional increase, and does not take withdrawals from Account Value that are “excess withdrawals” for the Income Edge, and as a result, the RIB is increased on the anniversary date. If the Account Value subsequently declines due to negative performance, the RIB previously increased is not affected by the negative performance. Withdrawals reduce the investor’s Account Value.

Talk to Your Advisor Today

Learn how the Investor ProtectorSM models paired with the Income Edge could be the key to helping you maintain income throughout retirement.

5 Provided by an insurance certificate issued by PHL Variable Insurance Company. A separate application and approval by PHL Variable Insurance Company is required.

6 PHL Variable Insurance Company sets the percentage for the Income Edge fee. The Income Edge fee is based on a percentage of the RIB. It can change if you accept the Annual Optional Increase, add contributions to your managed account, or transfer your assets to a different Investor ProtectorSM model. The Income Edge fee is in addition to fees charged for the model portfolios and advisor related fees.

7 Guarantees are based upon the claims-paying ability of PHL Variable Insurance Company and subject to the terms of the insurance certificate. The value of your managed account must be invested in accordance with one of the Investor ProtectorSM models at all times for the Income Edge to remain in effect. Please see the Phoenix Guaranteed Income Edge® prospectus for more information.

IMPORTANT DISCLOSURES

The Phoenix Guaranteed Income Edge® is sold by prospectus and is subject to the terms and conditions described in the prospectus and underlying insurance certificate.

PHL Variable Insurance Company (PHL Variable) has filed a registration statement (including a prospectus) with the SEC for the Phoenix Guaranteed Income Edge®. Before you invest, you should read the prospectus in that registration statement and other documents PHL Variable has filed with the SEC for more complete information about PHL Variable and the Phoenix Guaranteed Income Edge®. You should carefully consider the charges, withdrawal restrictions and risks associated with the Phoenix Guaranteed Income Edge®. The prospectus contains this and other information.

You can obtain a copy of the prospectus for the Phoenix Guaranteed Income Edge® and any documents incorporated by reference into the prospectus for free by calling PHL Variable at 800-866-0753. You may also access the prospectus and incorporated documents for free at our website at www.phoenixwm.com or by visiting EDGAR on the SEC’s website at www.sec.gov. The funds and ETFs included in the Investor ProtectorSM Model Portfolios have separate prospectuses you can obtain by calling 866-377-4559 or by visiting EDGAR on the SEC’s website at www.sec.gov.

The Investor ProtectorSM Program is comprised of certain asset allocation models for which Investors Capital Advisory Services acts as investment advisor. The Phoenix Guaranteed Income Edge® is an insurance certificate issued by PHL Variable under a group annuity contract that can provide an income guarantee related to the asset allocation models. The certificate has its own restrictions, charges and risks. The Phoenix Guaranteed Income Edge® has a separate fee in addition to the fees associated with the underlying investment account. Guarantees are based upon the claims-paying ability of PHL Variable.

Investors Capital Advisory Services is a registered investment advisor and does not sell, recommend or advise on insurance products. PHL Variable is an insurance company that does not provide investment, tax or legal advice and does not recommend or endorse any investment strategy. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. This communication is not intended to meet the objectives or suitability requirements of any specific individual or account.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any asset class or index will provide positive performance over time. Past performance is not a guarantee of future results. Diversification and strategic asset allocations do not assure a profit or protect against loss in declining markets.

The Phoenix Guaranteed Income Edge® (form 07GRISGA.2) is issued by PHL Variable Insurance Company (Hartford, CT), and distributed by 1851 Securities, Inc. (Hartford, CT), member FINRA. PHL Variable and 1851 Securities, Inc. are members of The Phoenix Companies, Inc. PHL Variable and 1851 Securities, Inc. are not affiliated with Investors Capital Corporation, of which Investors Capital Advisory Services is a part.

PHL Variable Insurance Company is not licensed to conduct business in NY and ME. The certificate may not be available in all states.

“Investor ProtectorSM” is a trademark of Investors Capital Advisory Services and has been licensed for use by PHL Variable Insurance Company and certain of its affiliates. The Phoenix Guaranteed Income Edge® is not sponsored, endorsed, sold or promoted by Investors Capital Advisory Services and Investors Capital Advisory Services makes no representation regarding the advisability of purchasing the Phoenix Guaranteed Income Edge®.

SEC File No. 333-161382

BPD37727 (3/11)

Investor ProtectorSM Program

with Phoenix Guaranteed Income Edge®

INVESTORS CAPITAL

ADVISORY SERVICES

Frequently Asked Questions

PHOENIX GUARANTEED INCOME EDGE® IS AN INSURANCE CERTIFICATE ISSUED UNDER A GROUP ANNUITY CONTRACT BY PHL VARIABLE INSURANCE COMPANY. THIS BROCHURE MUST BE PRECEDED OR ACCOMPANIED BY THE PHOENIX GUARANTEED INCOME EDGE® PROSPECTUS. THIS BROCHURE IS INTENDED FOR USE ONLY BY REGISTERED REPRESENTATIVES AND INVESTMENT ADVISORY REPRESENTATIVES.

Phoenix Guaranteed Income Edge®

Frequently Asked Questions

What is the Phoenix Guaranteed Income Edge®?

The Phoenix Guaranteed Income Edge® (the “Income Edge”) is an insurance certificate available with one of the four Investor ProtectorSM asset allocation models for a separate fee. The Income Edge is offered to investment advisory clients of Investors Capital Advisory Services (“Investors Capital”) whose investments are managed under the Investor ProtectorSM Program, an advisory program offered by Investors Capital. Subject to its conditions, the Income Edge can provide guaranteed lifetime income after the value of the managed account (“Account Value”) is reduced to zero.

The Income Edge is an insurance certificate issued by PHL Variable Insurance Company (“PHL Variable” or “we”) under a group annuity contract. The income guarantee provided by the Income Edge is subject to the claims-paying ability of PHL Variable.

Why was the Phoenix Guaranteed Income Edge® designed?

The Income Edge was designed to meet the needs of investors who are concerned about the risk of outliving their assets. The Income Edge provides guaranteed lifetime income payments in the event the managed account is exhausted by withdrawals allowed by the Income Edge and by market downturns. The Income Edge can assist your clients who are in the “bridge phase” and still accumulating assets in their investment accounts but are nearing their target retirement date, as well as your retired clients who would benefit from the protection offered by the Income Edge.

Is the Phoenix Guaranteed Income Edge® a variable annuity?

The Income Edge is a new breed of product. Technically it is an annuity – but not a variable annuity. Referred to as a Stand Alone Living Benefit (SALB), the Income Edge can be paired with non-annuity investments such as mutual funds and ETFs. The Phoenix Guaranteed Income Edge® is sold by prospectus.

How does the Income Edge work?

When the investor chooses one of the Investor ProtectorSM models for his/her managed account, the investor is also purchasing the Income Edge. The investor elects the individual or spousal version of the Income Edge. He/she also elects an income percentage of either 4% or 5% of the Retirement Income Base which is used to determine the annual withdrawals from the managed account, and if triggered, annual income payments under the Income Edge. The Income Edge may also be added at a later date, if available.

On the issue date of the Income Edge, we use the current market value of the managed account to set the amount of the “Retirement Income Base” or “RIB” for the Income Edge certificate. Beginning at age 65, the RIB is the value we use to compute the amount that can be withdrawn from the managed account each year without negatively impacting the potential benefit of the Income Edge. The RIB has no cash value and is not available for withdrawal.

If the value of the managed account is greater than the RIB on a certificate anniversary, the RIB will be increased to match the Account Value, unless the investor has declined the Annual Optional Increase for that anniversary. An increased RIB equates to larger annual withdrawals, and larger guaranteed income payments should they be triggered under the Income Edge. An increased RIB will also equate to a higher fee for the Income Edge.

Phoenix Guaranteed Income Edge®

Frequently Asked Questions

If the investor is age 65 or older, he/she may begin taking income immediately as withdrawals from his/her managed account without reducing the potential benefit of the Income Edge. The annual withdrawals allowed by the Income Edge are equal to 4% or 5% of the RIB. If the investor wants to take larger withdrawals or wants to take withdrawals prior to age 65, he/she can do so but such withdrawals will proportionately reduce the RIB.1

Under the Income Edge, guaranteed income payments are triggered if the Account Value reduces to zero through withdrawals allowed by the Income Edge and/or poor market performance. At that time, we make payments to the investor for life in the annual amount of 4% or 5% of the RIB2 – the higher the RIB, the higher the guaranteed income payments.

Where are the assets held?

The assets are owned by the investor and held at the custodian for the managed account. The assets are not held at the insurance company.

Does the Income Edge have surrender charges?

No. This product was built for the fee-based space and the investor can remove the Income Edge at any time without being charged an additional fee. The Income Edge has no cash value upon surrender and no surrender charge. It will simply terminate without any additional fees, however any quarterly fees for the Income Edge deducted from the managed account in advance will not be refunded.

What is the investment minimum and cost breakdown for the Investor ProtectorSM model portfolios eligible for the Income Edge?

Investment Minimum: $100,000

Platform Fee: 50 bps

Max Advisor Fees without impacting Income Edge: 150 bps

Rebalanced: Quarterly

What is the fee for the optional Income Edge?

The fee for the Income Edge varies by the model portfolio, retirement income percentage (4% or 5%) and payment option (Individual or Spousal). The fee is calculated and deducted from the managed account quarterly in advance based on the RIB. Drivers of cost include allocation to equities (the more aggressive the portfolio, the greater the fee) and macroeconomic conditions (volatility and interest rates). Please visit www.investorscapital.com for the most current rate sheet. Deduction of the Income Edge fee from the managed account assets is not considered part of the amount that can be withdrawn without negatively impacting the potential benefit of the Income Edge.

What registrations or licenses are required to sell the Phoenix Guaranteed Income Edge®?

In addition to the registrations required to solicit asset allocation models offered by Investors Capital, an advisor must be a registered representative and hold the appropriate state insurance license to sell the Investor ProtectorSM Program which includes the Income Edge. If you do not have the appropriate state insurance license and/or broker-dealer registration to sell the Income Edge, an insurance licensed representative at Investors Capital can assist Please call 866-377-4559.

1 Certain fees may be considered withdrawals that lower the RIB. Withdrawals that reduce the RIB to zero cause the Income Edge to terminate. Please see the Phoenix Guaranteed Income Edge® prospectus for more information.

2 Guarantees subject to claims paying ability of PHL Variable Insurance Company. The Income Edge has terms, conditions and limitations described in the insurance certificate and prospectus for the Phoenix Guaranteed Income Edge®.

Phoenix Guaranteed Income Edge®

Frequently Asked Questions

How does an investor open an account with the Income Edge?

Begin by following the same steps and processes you use today to open a regular managed account. To elect the Income Edge, an investor will need to complete an enrollment form that adds the Phoenix Guaranteed Income Edge® to the investor’s account. The Income Edge enrollment form can be found at www.investorscapital.com.

If you are a registered representative of a broker-dealer with which PHL Variable has a selling agreement for the Income Edge, and you are appointed with PHL Variable, you may assist your client in completing the Income Edge enrollment form.

If you are an investment advisor but do not have the appropriate state insurance license and/or broker-dealer registration to sell the Income Edge, Investors Capital can assist you and your investor. Please call 866-377-4559.

What types of accounts qualify for the Income Edge?

Non-qualified, traditional IRA and Roth IRA accounts are acceptable.

Are there issue age limits for the Income Edge?

Yes, the account owner cannot be greater than age 85 when the Income Edge is issued.

When can an investor begin taking income?

If an investor is 65 years of age, he or she may begin taking income immediately as withdrawals from the managed account. If an investor is younger than age 65, he or she could draw down account assets, but each withdrawal will proportionally reduce the RIB. An investor is not required to take income at age 65.

What happens if withdrawals are taken before age 65?

An investor may take withdrawals from the managed account prior to age 65; however, each withdrawal will be considered an “excess withdrawal” for the purposes of the Income Edge and will decrease the RIB in the same proportion as the Account Value is decreased. There are no additional fees or penalties under the Income Edge due to withdrawals prior to age 65 (although an investor may have tax consequences resulting from any withdrawals). An investor has full access to the Account Value if monies are needed prior to age 65, however, such withdrawals lower the RIB, which may equate to a lower income stream going forward.1 See the Income Edge prospectus for examples.

Example: Eileen Kennedy is age 60, her Account Value is $1,000,000 and RIB is $1,500,000. Eileen needs to access $100,000 for a medical emergency and withdraws the funds from her account. Her Account Value is immediately reduced to $900,000 and because she made the withdrawal before age 65, her RIB is reduced in the same proportion that the withdrawal reduced her Account Value.

Before withdrawal After withdrawal Reduction Amount of Reduction

Account Value $1,000,000 $900,000 10% $100,000

RIB $1,500,000 $1,350,000 10% $150,000

| 1 |

|

Either as lower withdrawals from the managed account or lower Income Edge payments, if triggered. |

Phoenix Guaranteed Income Edge®

Frequently Asked Questions

After age 65, what happens if an investor takes withdrawals from the managed account in excess of the 4% or 5% allowable amount?

An investor may take withdrawals from the managed account at any time; however, any withdrawal above the 4% or 5% allowed under the Income Edge each year after age 65 will be considered an “excess withdrawal” for the purposes of the Income Edge and will decrease the RIB in the same proportion as the Account Value is decreased, not dollar for dollar. There are no additional fees or penalties under the Income Edge (although an investor may have tax consequences resulting from any withdrawal from an account). An investor has full access to the Account Value if monies are needed beyond the 4% or 5% withdrawal amount allowed after age 65, however, such withdrawals lower the RIB, which may equate to a lower income stream going forward.

How can an investor increase annual income?

There are essentially two ways for an investor to potentially increase annual income: Annual Optional Increases and, in certain cases, additional contributions to the managed account.

Annual Optional Increase: Every certificate anniversary of the Income Edge, an investor has the ability to increase the RIB if the Account Value is greater than the RIB. The RIB will be increased to equal the Account Value. When the RIB increases, the 4% or 5% guaranteed income stream available after age 65 will also increase (step-up)1, as will the total fee paid for the Income Edge.2

Additional contributions: An investor may make additional contributions to the managed account at any time. Additional monies can increase the RIB and if the RIB increases, the 4% or 5% guaranteed income stream will also increase (step-up)1, as will the total fee paid for the Income Edge.2,3

Does an investor have to annuitize to receive the income stream?

What makes this concept unique is that an investor does not lose control of the assets as may be the case when an immediate annuity is used to provide an income stream. The income stream is generated by withdrawals taken from the managed account and, if the Account Value reduces to zero during the investor’s lifetime as a result of permitted withdrawals allowed under the Income Edge and/or poor investment performance, the Income Edge then continues a guaranteed income stream of 4% or 5% of the then current RIB for the remainder of the investor’s life.

1 Any increase in the RIB will only increase the amount of the guaranteed income payments under the Income Edge if that increased RIB amount is still in effect at the time the Account Value goes to zero through withdrawals that are allowed under the Income Edge and/or poor performance of the managed account assets.

2 Unless the fee percentage for the Income Edge has decreased. A higher or lower Income Edge fee may apply to the increased portion of the RIB when an investor accepts the Annual Optional Increase, depending on the then current fee schedule.

3 Withdrawals may reduce or eliminate the effect of additional contributions on the RIB. See Income Edge prospectus.

Phoenix Guaranteed Income Edge®

Frequently Asked Questions

If an investor takes withdrawals from the account prior to age 65, these withdrawals will reduce the RIB; however, the investor retains control of the assets and can take such withdrawals if necessary. The Income Edge has no cash value and only provides income payments during the lifetime of the investor after the Account Value reduces to $0 as described above. The Income Edge does not provide any residual value or benefit to the heirs or estate when the investor dies unless the investor has purchased the Spousal Income Guarantee, in which case any income payments provided by the Income Edge will continue for the life of the surviving spouse.

What if an investor dies? What happens to the account?

If an investor dies, the Income Edge terminates, and the balance of the account managed by Investors Capital will be left to the beneficiary. If an investor purchases the Spousal Income Guarantee, the surviving spouse may continue to take withdrawals of the Retirement Income Amount from the Account Value and will receive income payments from the Income Edge if triggered during the spouse’s lifetime, under the terms of the Income Edge certificate.

How are the fees billed and paid?

The Income Edge fee is deducted when the certificate is issued and then quarterly (in advance) from the managed account The Income Edge fee is a percentage of the RIB. It varies depending on individual/spousal version, aggressiveness of portfolio, and whether the 4% or 5% income percentage has been selected. The advisor and platform fees are deducted from the account as they are today and are not counted as withdrawals that could reduce the RIB, unless they exceed the limits cited in the Income Edge prospectus.

How can the Income Edge fee change for an existing certificate?

The fee is calculated as a percentage of the RIB on the first day of each calendar quarter. The percentage used to calculate the fee will not change unless an investor chooses to take certain actions on the account. Actions that may change the fee include electing to increase the RIB at the Annual Optional Increase, making additional contributions to the account, or transferring to a different model portfolio that is also available with the Income Edge.

Examples: Eileen Kennedy currently has $1,000,000 in a managed account and her RIB is $1,000,000. She is paying a 1% fee for the Income Edge related to that account.1 In year 2, Eileen sells a vacation home and deposits $500k into her account. Assuming she doesn’t step-up or change model portfolios, the 1% fee on her $1,000,000 RIB is locked in. The additional $500k would be charged the current fee which may be higher or lower than 1%. In both scenarios below, Eileen will have a new weighted average fee.

1 Example also assumes that Eileen is older than age 65 and no prior withdrawals have been made from the managed account.

Phoenix Guaranteed Income Edge®

Frequently Asked Questions

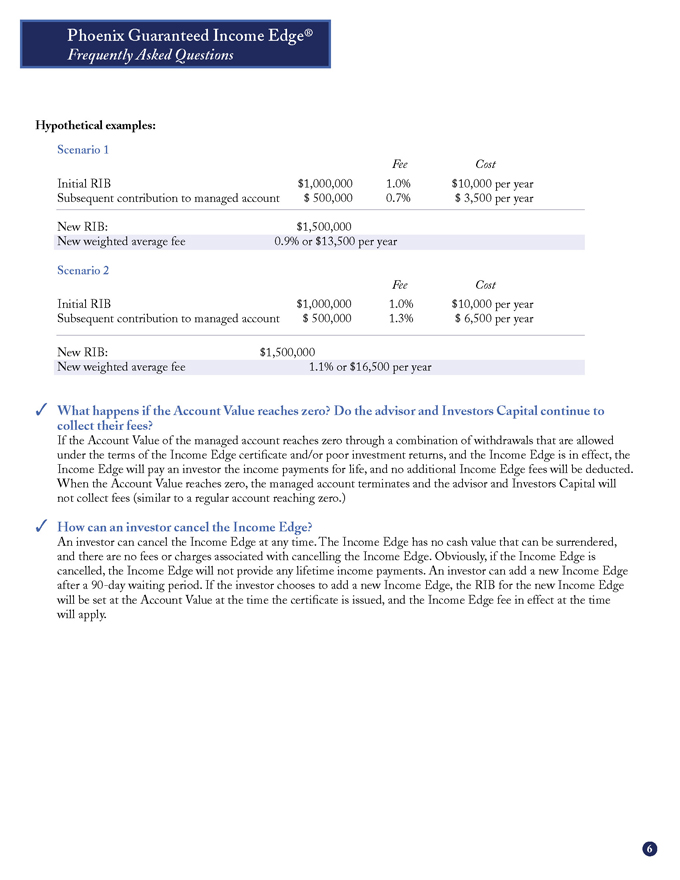

Hypothetical examples:

Scenario 1

Fee Cost

Initial RIB $1,000,000 1.0% $10,000 per year

Subsequent contribution to managed account $500,000 0.7% $3,500 per year

New RIB: $1,500,000

New weighted average fee 0.9% or $13,500 per year

Scenario 2

Fee Cost

Initial RIB $1,000,000 1.0% $10,000 per year

Subsequent contribution to managed account $500,000 1.3% $6,500 per year

New RIB: $1,500,000

New weighted average fee 1.1% or $16,500 per year

What happens if the Account Value reaches zero? Do the advisor and Investors Capital continue to collect their fees?

If the Account Value of the managed account reaches zero through a combination of withdrawals that are allowed under the terms of the Income Edge certificate and/or poor investment returns, and the Income Edge is in effect, the Income Edge will pay an investor the income payments for life, and no additional Income Edge fees will be deducted. When the Account Value reaches zero, the managed account terminates and the advisor and Investors Capital will not collect fees (similar to a regular account reaching zero.)

How can an investor cancel the Income Edge?

An investor can cancel the Income Edge at any time. The Income Edge has no cash value that can be surrendered, and there are no fees or charges associated with cancelling the Income Edge. Obviously, if the Income Edge is cancelled, the Income Edge will not provide any lifetime income payments. An investor can add a new Income Edge after a 90-day waiting period. If the investor chooses to add a new Income Edge, the RIB for the new Income Edge will be set at the Account Value at the time the certificate is issued, and the Income Edge fee in effect at the time will apply.

For more information about the Investor ProtectorSM Program, and the Phoenix Guaranteed Income Edge®, please call 866-377-4559.

How does the Income Edge influence the taxation of the underlying account?

The Internal Revenue Service issued non-precedential rulings addressing the taxation issues surrounding the Income Edge. The highlights of the rulings are listed below:

The Income Edge does not change the tax treatment of the managed account, including eligibility for:

capital gain tax treatment for gains and losses,

current deductibility of any losses, or

any special tax treatment for dividends.

The Income Edge is an annuity for federal income tax purposes and as such, results in no income tax liability until Income Edge payments are actually made.

When payments are made under the Income Edge, a portion of each payment may be excluded from income tax.

Please note that this is a brief summary of a complex area. Investors should be advised to consult with their own tax advisors regarding the tax treatment of their specific accounts.

IRS Circular 230 Disclosure: Any information contained in this communication (including any attachments) is not intended to be used, and cannot be used, to avoid penalties imposed under the U.S. Internal Revenue Code. This communication was written to support the promotion or marketing of the transactions or matters addressed here. Individuals should seek independent tax advice based on their own circumstances.

Important Disclosures

The Phoenix Guaranteed Income Edge® is sold by prospectus and is subject to the terms and conditions described in the prospectus and underlying insurance certificate.

PHL Variable Insurance Company (PHL Variable) has filed a registration statement (including a prospectus) with the SEC for the Phoenix Guaranteed Income Edge®. Before you invest, you should read the prospectus in that registration statement and other documents PHL Variable has filed with the SEC for more complete information about PHL Variable and the Phoenix Guaranteed Income Edge®. You should carefully consider the charges, withdrawal restrictions and risks associated with the Phoenix Guaranteed Income Edge®. The prospectus contains this and other information.

You can obtain a copy of the prospectus for the Phoenix Guaranteed Income Edge® and any documents incorporated by reference into the prospectus for free by calling PHL Variable at 800-866-0753. You may also access the prospectus and incorporated documents for free at our website at www.phoenixwm.com or by visiting EDGAR on the SEC’s website at www.sec.gov. The funds and ETFs included in the Investor ProtectorSM Model Portfolios have separate prospectuses you can obtain by calling 866-377-4559 or by visiting EDGAR on the SEC’s website at www.sec.gov.

The Investor ProtectorSM Program is comprised of certain asset allocation models for which Investors Capital Advisory Services acts as investment advisor. The Phoenix Guaranteed Income Edge® is an insurance certificate issued by PHL Variable under a group annuity contract that can provide an income guarantee related to the asset allocation models. The certificate has its own restrictions, charges and risks. The Phoenix Guaranteed Income Edge® has a separate fee in addition to the fees associated with the underlying investment account. Guarantees are based upon the claims-paying ability of PHL Variable.

Investors Capital Advisory Services is a registered investment advisor and does not sell, recommend or advise on insurance products. PHL Variable is an insurance company that does not provide investment, tax or legal advice and does not recommend or endorse any investment strategy. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. This communication is not intended to meet the objectives or suitability requirements of any specific individual or account.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any asset class or index will provide positive performance over time. Past performance is not a guarantee of future results. Diversification and strategic asset allocations do not assure a profit or protect against loss in declining markets.

The Phoenix Guaranteed Income Edge® (form 07GRISGA is issued by PHL Variable Insurance Company (Hartford, CT), and distributed by 1851 Securities, Inc. (Hartford, CT), member FINRA. PHL Variable and 1851 Securities, Inc. are members of The Phoenix Companies, Inc. PHL Variable and 1851 Securities, Inc. are not affiliated with Investors Capital Corporation, of which Investors Capital Advisory Services is a part.

PHL Variable Insurance Company is not licensed to conduct business in NY and ME. The certificate may not be available in all states.

“Investor ProtectorSM” is a trademark of Investors Capital Advisory Services and has been licensed for use by PHL Variable Insurance Company and certain of its affiliates. The Phoenix Guaranteed Income Edge® is not sponsored, endorsed, sold or promoted by Investors Capital Advisory Services and Investors Capital Advisory Services makes no representation regarding the advisability of purchasing the Phoenix Guaranteed Income Edge®.

SEC File No 333-161382

BPD37728 (3/11)

Investor ProtectorSM Program

with Phoenix Guaranteed Income Edge®

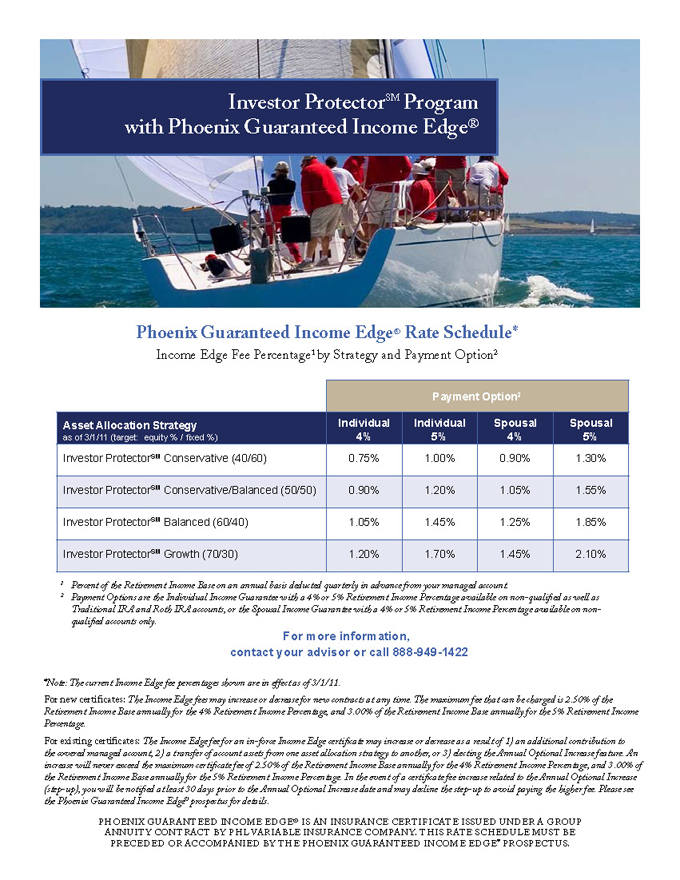

Phoenix Guaranteed Income Edge® Rate Schedule*

Income Edge Fee Percentage1 by Strategy and Payment Option2

Payment Option2

Asset Allocation Strategy as of 3/1/11 (target: equity %/fixed %)

Individual 4% Individual 5% Spousal 4% Spousal 5%

Investor ProtectorSM Conservative (40/60) 0.75% 1.00% 0.90% 1.30%

Investor ProtectorSM Conservative/Balanced (50/50) 0.90% 1.20% 1.05% 1.55%

Investor ProtectorSM Balanced (60/40) 1.05% 1.45% 1.25% 1.85%

Investor ProtectorSM Growth (70/30) 1.20% 1.70% 1.45% 2.10%

1 Percent of the Retirement Income Base on an annual basis deducted quarterly in advance from your managed account.

2 Payment Options are the Individual Income Guarantee with a 4% or 5% Retirement Income Percentage available on non-qualified as well as Traditional IRA and Roth IRA accounts, or the Spousal Income Guarantee with a 4% or 5% Retirement Income Percentage available on non-qualified accounts only.

For more information, contact your advisor or call 888-949-1422

*Note: The current Income Edge fee percentages shown are in effect as of 3/1/11.

For new certificates: The Income Edge fees may increase or decrease for new contracts at any time. The maximum fee that can be charged is 2.50% of the Retirement Income Base annually for the 4% Retirement Income Percentage, and 3.00% of the Retirement Income Base annually for the 5% Retirement Income Percentage.

For existing certificates: The Income Edge fee for an in-force Income Edge certificate may increase or decrease as a result of 1) an additional contribution to the covered managed account, 2) a transfer of account assets from one asset allocation strategy to another, or 3) electing the Annual Optional Increase feature. An increase will never exceed the maximum certificate fee of 2.50% of the Retirement Income Base annually for the 4% Retirement Income Percentage, and 3.00% of the Retirement Income Base annually for the 5% Retirement Income Percentage. In the event of a certificate fee increase related to the Annual Optional Increase (step-up), you will be notified at least 30 days prior to the Annual Optional Increase date and may decline the step-up to avoid paying the higher fee. Please see the Phoenix Guaranteed Income Edge® prospectus for details.

PHOENIX GUARANTEED INCOME EDGE® IS AN INSURANCE CERTIFICATE ISSUED UNDER A GROUP ANNUITY CONTRACT BY PHL VARIABLE INSURANCE COMPANY. THIS RATE SCHEDULE MUST BE PRECEDED OR ACCOMPANIED BY THE PHOENIX GUARANTEED INCOME EDGE® PROSPECTUS.

Investor ProtectorSM Program

with Phoenix Guaranteed Income Edge®

IMPORTANT DISCLOSURES

The Phoenix Guaranteed Income Edge® is sold by prospectus and is subject to the terms and conditions described in the prospectus and underlying insurance certificate.

PHL Variable Insurance Company (PHL Variable) has filed a registration statement (including a prospectus) with the SEC for the Phoenix Guaranteed Income Edge®. Before you invest, you should read the prospectus in that registration statement and other documents PHL Variable has filed with the SEC for more complete information about PHL Variable and the Phoenix Guaranteed Income Edge®. You should carefully consider the charges, withdrawal restrictions and risks associated with the Phoenix Guaranteed Income Edge®. The prospectus contains this and other information.

You can obtain a copy of the prospectus for the Phoenix Guaranteed Income Edge® and any documents incorporated by reference into the prospectus for free by calling PHL Variable at 800-866-0753. You may also access the prospectus and incorporated documents for free at our website at www.phoenixwm.com or by visiting EDGAR on the SEC’s website at www.sec.gov. The funds and ETFs included in the Investor ProtectorSM Model Portfolios have separate prospectuses you can obtain by calling 866-377-4559 or by visiting EDGAR on the SEC’s website at www.sec.gov.

The Investor ProtectorSM Program is comprised of certain asset allocation models for which Investors Capital Advisory Services acts as investment advisor. The Phoenix Guaranteed Income Edge® is an insurance certificate issued by PHL Variable under a group annuity contract that can provide an income guarantee related to the asset allocation models. The certificate has its own restrictions, charges and risks. The Phoenix Guaranteed Income Edge® has a separate fee in addition to the fees associated with the underlying investment account. Guarantees are based upon the claims-paying ability of PHL Variable.

Investors Capital Advisory Services is a registered investment advisor and does not sell, recommend or advise on insurance products. PHL Variable is an insurance company that does not provide investment, tax or legal advice and does not recommend or endorse any investment strategy. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. This communication is not intended to meet the objectives or suitability requirements of any specific individual or account.

It is important to remember that there are risks inherent in any investment and that there is no assurance that any asset class or index will provide positive performance over time. Past performance is not a guarantee of future results. Diversification and strategic asset allocations do not assure a profit or protect against loss in declining markets.

The Phoenix Guaranteed Income Edge® (form 07GRISGA.2) is issued by PHL Variable Insurance Company (Hartford, CT), and distributed by 1851 Securities, Inc. (Hartford, CT), member FINRA. PHL Variable and 1851 Securities, Inc. are members of The Phoenix Companies, Inc. PHL Variable and 1851 Securities, Inc. are not affiliated with Investors Capital Corporation, of which Investors Capital Advisory Services is a part.

PHL Variable Insurance Company is not licensed to conduct business in NY and ME. The certificate may not be available in all states.

“Investor ProtectorSM” is a trademark of Investors Capital Advisory Services and has been licensed for use by PHL Variable Insurance Company and certain of its affiliates. The Phoenix Guaranteed Income Edge® is not sponsored, endorsed, sold or promoted by Investors Capital Advisory Services and Investors Capital Advisory Services makes no representation regarding the advisability of purchasing the Phoenix Guaranteed Income Edge®.

SEC File No. 333-161382

BPD37729 (3/11)