As filed with the Securities and Exchange Commission on August 17, 2009

File No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

Under

THE SECURITIES ACT OF 1933

PHL VARIABLE INSURANCE COMPANY

(Exact name of registrant as specified in its charter)

| Connecticut | 6311 | 06-1045829 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification Number) |

One American Row

Hartford, CT 06102

(800) 447-4312

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John H. Beers, Esq.

PHL Variable Insurance Company

One American Row

Hartford, CT 06102-5056

(860) 403-5050

(Name, address, including zip code, and telephone number, including area code, of agent for service)

As soon as practicable after the registration statement becomes effective.

(Approximate date of commencement of proposed sale to public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Calculation of Registration Fee

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum per unit |

Proposed maximum offering price |

Amount of registration fee | ||||

| Interests in contingent group deferred annuity contracts |

* | * | $5,000,000.00 | $279.00 | ||||

| * | The maximum aggregate offering price is estimated solely for the purpose of determining the registration fee. The amount to be registered and the proposed maximum offering price per unit are not applicable in that these contracts are not issued in predetermined amounts or units. |

| ** | Registration fee paid concurrently with the filing of the Registration Statement on August 17, 2009. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), SHALL DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Phoenix Guaranteed Income EdgeSM

An Insurance Guarantee Issued by:

PHL Variable Insurance Company

The Phoenix Guaranteed Income EdgeSM (“Income Edge”) described in this prospectus is an insurance certificate offered to investment advisory clients of Investors Capital Advisory Services who have established an account with certain model portfolios eligible for the Income Edge (referred to as an “Account”). Subject to certain conditions, the Income Edge guarantees predictable lifetime income payments regardless of the actual performance or value of a client’s Account.

This prospectus provides important information that a prospective purchaser of an Income Edge should know before investing. Please retain this prospectus for future reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The Income Edge is issued by PHL Variable Insurance Company (“PHL Variable”). It is not a bank deposit guaranteed by any bank or by the Federal Deposit Insurance Corporation or any other government agency. A purchase of the Income Edge is subject to certain risks. Please see the “Risk Factors” section on page 7.

The Income Edge is novel and innovative. To date, the tax consequences of the Income Edge have not been addressed in any published authorities. However, we believe that, in general, (i) the tax treatment of transactions involving investments in your Account more likely than not will be the same as in the absence of the Income Edge, and (ii) assuming that the Income Edge is an annuity contract for tax purposes, which is how we intend to treat it for Federal tax reporting purposes, payments under the Income Edge should be treated as ordinary income that is taxable to the extent provided under the tax rules for annuities. We have asked the Internal Revenue Service for specific guidance on these issues that may relate to the Income Edge issued outside an Individual Retirement Account; to date, no conclusions have been reached on these issues. It is possible that the Internal Revenue Service could reach conclusions that are different than those stated herein. Should this occur, policyholders would be notified. At this time, we can provide no assurances, however, that the Internal Revenue Service will agree with the forgoing interpretations of law or that a court would agree with these interpretations if the Internal Revenue Service challenged them. You should consult a tax advisor before purchasing your Income Edge. See “Taxation of the Income Edge” at page 29 for a discussion of the tax consequences of the Income Edge.

PHL Variable will offer the Income Edge through its affiliate, Phoenix Equity Planning Corporation (“PEPCO”), which is the principal underwriter. The Income Edge is offered only to investment advisory clients of Investors Capital Advisory Services. Prospective purchasers may apply to purchase an Income Edge only through Investors Capital Corporation, the registered broker-dealer firm of which Investors Capital Advisory Services is a part. Investors Capital Corporation has entered into a selling agreement with PEPCO in order to offer the Income Edge to investment advisory clients of Investors Capital Advisory Services.

|

PHL Variable Insurance Company | |

| One American Row PO Box 5056 Hartford, CT 06102-5056 | ||

|

Tel. 800/866-0753 |

| Preliminary Prospectus dated August 17, 2009 |

1

TABLE OF CONTENTS

| Heading | Page | |||

|

| ||||

| 4 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 10 | ||||

| 1. | 11 | |||

| 11 | ||||

| What If You Want To Purchase An Income Edge For Your Individual Retirement Account? |

11 | |||

| 2. | 12 | |||

| 3. | 12 | |||

| 12 | ||||

| 12 | ||||

| 15 | ||||

| How Will Investors Capital Manage Your Investments in the Account if You Purchase an Income Edge? |

15 | |||

| What Happens if Your Account is Managed in a Manner Unacceptable to Us? |

15 | |||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 4. | 16 | |||

| 5. | 18 | |||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| The Importance of Considering When to Start Making Withdrawals |

20 | |||

| 6. | 21 | |||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 7. | 21 | |||

| 21 | ||||

| 24 | ||||

| 8. | 25 | |||

| 25 | ||||

| What If You Die Before Your Account Investments Are Reduced to $0? |

26 | |||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

2

| Heading | Page | |||

|

| ||||

| 34 | ||||

| The Phoenix Companies, Inc.—Legal Proceedings about Company Subsidiaries |

34 | |||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

3

Phoenix Guaranteed Income Edge (“Income Edge”)

Certain terms used in this prospectus have specific and important meanings. You will find in the back of this prospectus a listing of all of the terms and the page on which the meaning of each term is explained.

A group annuity contract will be issued to Investors Capital Holdings, Ltd., a Delaware holding company which is the parent of Investors Capital Corporation and/or to Investors Capital Corporation. In most states, Phoenix Guaranteed Income Edge certificates are issued under such group contract to investment advisory clients of Investors Capital Advisory Services (“Investors Capital”) who elect to purchase the Income Edge. In some states, however, we may issue an individual annuity contract to each purchaser. “Income Edge”, “Income Edge certificate” or “certificate” means the Phoenix Guaranteed Income Edge certificate described in this prospectus or, in those states where individual contracts are issued, such individual contract.

“We” or “us” means PHL Variable Insurance Company. “You” or “your” means the owner (or, if applicable, the joint spousal owners) of an Income Edge certificate described in this prospectus.

“Account” means your Investors Capital Investor ProtectorSM investment advisory account, if your account is eligible for the Income Edge.

It is important for you to understand how the Income Edge works and your rights and obligations under the Income Edge. We have tried to anticipate some of the questions you may have when reading the prospectus. You will find these questions and corresponding explanations throughout the prospectus.

The following is a summary of the Income Edge. You should read the entire prospectus.

The Phoenix Guaranteed Income Edge (“Income Edge”) is an insurance certificate offered to investment advisory clients of Investors Capital who have opened an Investor Protector account. There are currently four model portfolios eligible for use with the Income Edge. These model portfolios are referred to as “Asset Allocation Strategies” in the certificates. If you purchase an Income Edge, your assets will be invested in accordance with the model portfolio you select. Your assets will be held in a brokerage account that is referred to as your “Account” in this prospectus. The Income Edge is designed for Investors Capital clients who intend to use the investments in their Account as the basis for a withdrawal program to provide income payments for retirement or other long-term purposes.

Subject to certain conditions, the Income Edge ensures predictable lifetime income payments by providing continuing income payments if your Account value is reduced to $0 by withdrawals (if such withdrawals are limited in accordance with the terms of the Income Edge certificate) and/or poor investment performance while you (or, if you have purchased the Spousal Income Guarantee, you and your spouse) are living. There is an annual fee for the Income Edge. The limitations on the amount and timing of withdrawals are discussed below. There is a $100,000 minimum required to open an Account.

How Does the Income Edge Work?

The Income Edge provides continuing lifetime income payments if your Account value is reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance. The Income Edge has no cash value. Subject to certain conditions, continuing lifetime income payments will begin if, and when, your Account value is reduced to $0 while you (or, if you have purchased the Spousal Income Guarantee, you and your spouse) are still living.

| v | You can apply to purchase an Income Edge when you open your Account or at any time thereafter. When you purchase an Income Edge, we establish a “Retirement Income Base” for you. To be covered by the Income Edge, the assets in your Account must be “Covered Assets,” meaning that they must be invested in accordance with one of the four model portfolios established by Investors Capital. The amount of your Retirement Income Base is equal to your Account value on the date we issue your certificate, the “certificate effective date”. The Retirement Income Base may increase each time you make additional contributions to your Account or you do not decline an Annual Optional Increase that occurs on any anniversary of the certificate effective date, each a “certificate anniversary date”. |

| v | It is important to note that the Income Edge has no cash value. Rather, you own the assets in your Account. |

| v | You may take withdrawals from your Account at any time and in any amount. (As with any investment account, you must liquidate investments to provide for withdrawals.) However, any withdrawals before the Retirement Income Date, which is the later of the certificate effective date or your 65th birthday (or, if you own your certificate jointly with your spouse, the younger spouse’s 65th birthday) and any withdrawals in excess of 5% of your Retirement Income Base during any calendar year on or after the Retirement Income Date, will reduce your Retirement Income Base. Such reductions in your Retirement Income Base will, in turn, reduce the potential benefit of your Income Edge certificate. To obtain the maximum potential benefit from your Income Edge |

4

| under your specific circumstances, you should consider whether to wait until the Retirement Income Date to begin taking withdrawals and thereafter limit your annual withdrawals to 5% of your Retirement Income Base during any calendar year. Withdrawals from an Account that is an Individual Retirement Account (“IRA”) may be subject to Federal tax consequences. You should consult a tax advisor before taking a withdrawal from your Individual Retirement Account. |

| v | In the event that your Account value is reduced to $0 by withdrawals on or after the Retirement Income Date (within the limits of the certificate) and/or poor investment performance before or after the Retirement Income Date, PHL Variable Insurance Company will provide you with lifetime income payments in the amount of 5% of the Retirement Income Base each calendar year, until you (or, if you have purchased the Spousal Income Guarantee, you and your spouse) die. |

| v | Lifetime income payments under your Income Edge are “contingent” because they are triggered only if the withdrawals (within the limits of the certificate) and/or poor investment performance reduce your Account value to $0 within your lifetime (or, if you have purchased the Spousal Income Guarantee, you and your spouse’s lifetime). If this contingency does not occur, you will never receive any payments from us and your guarantee will have no value. |

Example:

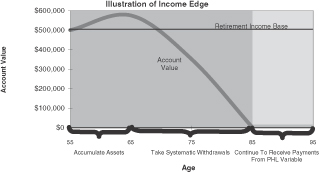

A basic illustration of how the Income Edge works is provided below. More detailed examples are provided throughout this prospectus. The illustration assumes that you apply to purchase an Income Edge at the same time you open your Account. You are 55 years old. You indicate that you will be the sole owner of the Account. Your Retirement Income Base will equal your Account value on the date we issue the certificate, the “certificate effective date”. On the certificate effective date your Account value is $500,000, so your Retirement Income Base will equal $500,000. You do not make additional contributions after the certificate effective date.

You wait ten years until you reach your Retirement Income Date before you begin to take withdrawals from your Account to provide income payments for your retirement (or other long-term purposes). Your Account appreciates over this ten-year period, but because you do not make any additional contributions to your Account and you reject the Annual Optional Increase that would otherwise occur on any certificate anniversary date, your Retirement Income Base remains at $500,000. You begin taking annual systematic withdrawals from your Account in the amount of $25,000, your Retirement Income Amount. Your Retirement Income Amount is equal to 5% of your Retirement Income Base and represents the maximum amount that may be withdrawn annually without reducing your Retirement Income Base on or after the Retirement Income Date.

You continue to take annual withdrawals from your Account of $25,000 a year until you are 85 years old, by which time you have completely liquidated your Account due to the combined impact of the annual withdrawal of the Retirement Income Amount and a prolonged market downturn. Although your Account value has been reduced to $0, your annual income payments of $25,000 continue because we begin paying you lifetime income payments equal to your Retirement Income Amount of 5% of the Retirement Income Base. These payments continue until your death which, for purposes of this illustration, is assumed to be at age 95.

The sample illustration above uses age 55 as the age at purchase. You should note that a younger Income Edge purchaser (i.e., one who is under the age of 65) will pay more in Income Edge fees over the lifetime of the Certificate for the same potential benefits received by an older Income Edge purchaser.

What Does the Income Edge Cost?

When you purchase your Income Edge you are required to pay an annual fee that is payable, quarterly in advance, to us on the first day of each calendar quarter. When you purchase a certificate, the annual Income Edge fee is charged to your Account on the certificate effective date, prorated based on the number of days remaining in the calendar quarter. In contrast, the Account fee and the financial advisor consulting fee for the quarter in which you open an Account with Investors Capital are assessed quarterly in advance. There are two versions of the Income Edge: the Individual Income Guarantee and the Spousal Income Guarantee. If you and your spouse jointly purchase an Income Edge, you will be charged the fee for the Spousal Income Guarantee, which is generally higher than the fee for the Individual Income Guarantee.

5

How is the Income Edge fee percentage for my certificate determined?

Generally, the Income Edge fee (which is calculated on the certificate effective date and then on the first day of each calendar quarter as a percentage of the Retirement Income Base on the date of calculation) depends on the model portfolio in which your Account is invested and which version of the Income Edge, individual or spousal, you have. Your Account can be invested in only one model portfolio at any one time. The guaranteed maximum Income Edge fee percentage for each model portfolio, on an annual basis, is 3.00% for either the Individual Income Guarantee or the Spousal Income Guarantee. You should assume that the guaranteed maximum fee percentage will be charged unless we are offering a lower fee percentage at the time you elect the certificate. You will receive information about any lower fee percentages available when you elect your certificate. Because your certificate may be issued on a day other than the day you complete certificate enrollment and the fee percentages in effect may change in the time between enrollment and the certificate effective date, you should review the specifications page of your certificate to see the Income Edge fee percentage that will apply at issue. This fee percentage will be shown on the specifications page.

As described below, certain transactions may change the Income Edge fee percentage that applies to your certificate at certain points in time; however, in no event will the fee percentage exceed the maximum of 3.00%. You can obtain the fee percentages in effect at any time by contacting your financial advisor or Investors Capital, or by contacting PHL Variable at the number shown on the front of this prospectus.

Your Income Edge fee percentage will be reset if you make an additional contribution, exercise the Annual Optional Increase, or transfer your Account value to a different model portfolio. The new Income Edge fee percentage following one of those transactions will be based, fully or in part, on the Income Edge fee percentage currently in effect for the model portfolio in which your Account is invested immediately following the transaction. The new Income Edge fee percentage will apply on the first day of the following calendar quarter unless another contribution, Annual Optional Increase, or transfer were to occur during the quarter, in which case the Income Edge fee percentage will be reset again. In the case of an additional contribution, the reset Income Edge fee percentage will be a weighted average of the Income Edge fee percentage that applied to your certificate prior to the additional contribution and the Income Edge fee percentage in effect for the model portfolio in which you are invested at the time of the contribution. Following an Annual Optional Increase, the reset Income Edge fee percentage will be a weighted average of the fee percentage that applied to your certificate prior to the Annual Optional Increase and the Income Edge fee percentage in effect for the model portfolio in which you are invested at the time of the Annual Optional Increase. In the case of a transfer, the reset Income Edge fee percentage will be the Income Edge fee percentage in effect for the model portfolio to which you are transferring.

For a complete description of the annual Income Edge fee including the effect of transfers, additional contributions, and the Annual Optional Increase on the fee percentage you will be charged, see Annual Income Edge Fee later in this prospectus.

Additional fees related to your Account

In addition to the Income Edge fees, your Account will also be charged the Investor Protector Program fee, a financial advisor consulting fee, and any fees associated with the underlying investments held in your Account. The Investor Protector Program fee is the fee you agree to pay Investors Capital for managing your Account which, as of the date of this prospectus, includes the Investors Capital advisory fee, a sponsor fee, the administrative fee, and the clearing and custody fee. The Investor Protector Program fee would be charged in the absence of the Income Edge certificate. The financial advisor consulting fee is the fee charged by your financial advisor for providing you with financial advice regarding your investments. Withdrawals from your Account of up to 1.85% of your Account value each calendar year to pay the Investor Protector Program fee and the financial advisor consulting fee will not reduce your Retirement Income Base. Fees may also arise from the underlying investments held in your Account, such as mutual fund fees if your Account holds mutual fund shares.

Incorporation of Certain Documents by Reference

The Securities and Exchange Commission (“SEC”) allows us to “incorporate by reference” information that we file with the SEC into this prospectus, which means that incorporated documents are considered part of this prospectus. We can disclose important information to you by referring you to those documents. This prospectus incorporates by reference our Annual Report on Form 10-K, as amended by Form 10-K/A filed on August 14, 2009, for the year ended December 31, 2008, our current Quarterly Report on Form 10-Q for the period ended June 30, 2009 (File Number 333-20277), and the definitive proxy statement filed by the Phoenix Companies, Inc. pursuant to Regulation 14A on March 16, 2009 (File Number 001-16517).

You may request a copy of any documents incorporated by reference in this prospectus and any accompanying prospectus supplement (including any exhibits that are specifically incorporated by reference in them), at no cost, by writing to the Company at: Investor Relations, One American Row P.O. Box 5056 Hartford, CT 06102-5056, or telephoning the Company at 800-490-4258. You may also access the incorporated documents at the following web pages: https://www.phoenixwm.phl.com/public/products/regulatory/index.jsp and the “Investor Relations” page of The Phoenix Companies, Inc. website at www.phoenixwm.com.

The Company electronically files its Annual Report on Form 10-K, as well its Quarterly Reports on Form 10-Q, with the SEC. The Phoenix Companies, Inc. electronically files its proxy statement with the SEC. The SEC maintains a website that contains reports,

6

information statements, and other information regarding issuers that file electronically with the SEC; the address of the website is http://www.sec.gov. The public may also read and copy any material we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

Income Edge Lifetime Income Payments

| v | The assets in your Account must be invested in accordance with one of the four model portfolios to be covered by Income Edge. Each model portfolio is subject to limits on the amounts and types of investments. We call these limits “Permitted Ranges”. See “Investors Capital and the Model Portfolios” later in this prospectus. Your Account could fail to be invested in accordance with the Permitted Ranges for a variety of reasons including |

| • | reasons you control, such as contributing non-Covered Assets to your Account, |

| • | reasons controlled by or related to Investors Capital, such as making investments outside the Permitted Ranges, or the inability to continue to provide the model portfolios for any reason, or |

| • | reasons outside your control and that of Investors Capital, such as the model portfolios becoming inappropriate for your investment advisory account due to market conditions or other factors. |

Regardless of the reason, if at any time (other than during the Liquidation Period, as discussed below), 100% of your Account investments are not invested in accordance with the Permitted Ranges, your Income Edge will terminate five Business Days later and you will lose your benefits under the Income Edge. We are not required to provide you with any notice that your Income Edge is affected by any of these circumstances prior to termination of your Income Edge.

| v | The asset allocation strategies underlying the model portfolios eligible for Income Edge are designed to provide steady returns that limit both upside and downside potential thereby minimizing the risk to the Company that your Account value will be reduced to $0 before you die, and that the Company would therefore be obligated to begin making lifetime income payments to you (subject to the conditions described in this Prospectus). Accordingly, a significant risk against which the Income Edge protects, i.e., that your Account value will be reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance and that you live beyond the age when your Account value is reduced to $0, may be minimal. |

| v | Because the asset allocation strategies and the limits on the amount you may withdraw annually without reducing your Retirement Income Base lessen the risk that your Account value will be reduced to $0 while you are still alive, there is a low probability that we are required to make any payments to you under your Income Edge. |

| v | The Income Edge is designed to protect you from outliving the assets in your Account. If you terminate the Income Edge or die before your Account value is reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance, neither you nor your estate will receive any payments from us under your Income Edge, nor will your Income Edge provide for any cash value build-up to provide income payments. |

| v | If your Account value is reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance while you are still living, and you therefore receive lifetime income payments from us under your Income Edge, there is a risk that the total amount of the lifetime income payments you receive will not exceed the total Income Edge fees you have paid. |

Tax Consequences

The Income Edge is novel and innovative. To date, the tax consequences of the Income Edge have not been addressed in any published authorities. We intend to treat your Income Edge as an annuity contract in reporting taxable income attributable to the Income Edge to you and to the Internal Revenue Service. Assuming the Income Edge is correctly treated as an annuity contract for tax purposes, any Income Edge payments made to you after your Account value has been reduced to $0 will be ordinary income to you that is taxable to the extent provided under the tax rules for annuities. We believe that, in general, the tax treatment of transactions involving investments in your Account more likely than not will be the same as it would be in the absence of the Income Edge. We have asked the Internal Revenue Service for specific guidance on these issues that may relate specifically to the Income Edge issued outside an IRA; to date, no conclusions have been reached on these issues. It is possible that the Internal Revenue Service could reach conclusions that are different than those stated herein. At this time, we can provide no assurances, however, that the Internal Revenue Service will agree with the forgoing interpretations of law or that a court would agree with these interpretations if the Internal Revenue Service challenged them. You should consult a tax advisor before purchasing your Income Edge. See “Taxation of the Income Edge” later in this prospectus for a discussion of the tax consequences.

Financial Strength of PHL Variable Insurance Company

| v | The Income Edge is not a separate account product. This means that the assets at PHL Variable Insurance Company supporting the Income Edge are not held in a segregated account for the exclusive benefit of Income Edge certificate holders and are not |

7

| insulated from the claims of the Company’s third party creditors. Your lifetime income payments (if any) will be paid from our general account and, therefore, are subject to our claims paying ability. Under Connecticut law, life insurance companies, including PHL Variable, are required to hold a specified amount of reserves in order to meet the contractual obligations of their general account to contract owners. State insurance regulators also require life insurance companies to maintain a minimum amount of capital, which acts as a cushion in the event that the insurer suffers a financial impairment, based on the inherent risks in the insurer’s operations. These risks include those associated with losses that an insurer could incur as the result of its own investment of its general account assets, which could include bonds, mortgages, general real estate investments, and stocks. |

The financial strength of PHL Variable Insurance Company is currently rated by three nationally recognized statistical rating organizations (“NRSRO”). The NRSRO ratings are not specific to the Income Edge certificate and your lifetime income payments, if any. Useful information about PHL Variable’s financial strength, including our current financial strength ratings and information on our general account portfolio of investments, can be found on our website (www.Phoenixwm.com). Additionally, you may obtain information on our financial condition and our financial strength ratings by reviewing Form 10-K as amended by Form 10-K/A filed on August 14, 2009, the Annual Report pursuant to Sections 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended December 31, 2008, and our current Quarterly Report of Form 10-Q for the period ended June 30, 2009, which are incorporated by reference into this prospectus. See Incorporation of Certain Documents by Reference, which appears previously in this prospectus.

Increases To Your Retirement Income Base

| v | Your Retirement Income Base does not automatically increase when the assets in your Account appreciate in value. Your Retirement Income Base only increases if you make additional contributions to your Account or you do not decline the Annual Optional Increase on a certificate anniversary date (and potentially thereafter pay higher Income Edge fees). Therefore, there is a risk that your Retirement Income Base will not increase while you own your Income Edge. |

Withdrawals

| v | If you make any withdrawals from your Account before your Retirement Income Date, or you make withdrawals on or after your Retirement Income Date that exceed your Retirement Income Amount (or, if greater, the RMD), the amount of lifetime income payments that you could receive under your Income Edge, if any, may be reduced. Accordingly, withdrawals must be carefully managed to avoid decreasing the amount of your Retirement Income Base and Retirement Income Amount or causing a termination of your Income Edge that may not be in your best interest. However, due to the long-term nature of the Income Edge, there is a risk that you may need funds prior to your Retirement Income Date, or in an amount in excess of your Retirement Income Amount on or after your Retirement Income Date, and that if you do not have sources of income other than your Account available, you may need to make withdrawals from your Account that will reduce the amount of any lifetime income benefit payments you may receive under your Income Edge. |

| v | You should be aware that any sale, exchange or transfer of your investments in the Account to pay fees other than the Income Edge fee, the Investor Protector Program fee, and the financial advisor consulting fee will be treated as withdrawals from your Account, which may decrease the amount of your Retirement Income Base and Retirement Income Amount. In addition, if the financial advisor consulting fee and the Program fee together equal an amount greater than 1.85% of your Account value in any calendar year, then any sale, exchange, or transfer of your Account investments to pay the portion of the financial advisor consulting fee and Program fee in excess of this amount will be treated as a withdrawal from your Account. The Income Edge fee is the fee that we charge you for the benefits guaranteed to you under the Income Edge certificate. The Investor Protector Program fee is the fee charged for the Account and would be charged even in the absence of the Income Edge certificate. For more information on the Investor Protector Program fee, please see the Schedule F to the Investors Capital Form ADV. The Schedule F may be obtained by writing to Investors Capital at 230 Broadway, Lynnfield, MA 01940 or by calling 1-800-949-1422. The financial advisor consulting fee is the asset-based fee paid to your financial advisor for providing you financial advice regarding your investments. You should note that there is no provision under the Income Edge to cure any decrease in the amount of your Retirement Income Base and Retirement Income Amount due to withdrawals. |

| v | If you take any withdrawals from your Account before the Retirement Income Date or withdraw an amount from your Account in excess of the Retirement Income Amount (or, if greater, the RMD) in any calendar year on or after the Retirement Income Date, you will reduce your Retirement Income Base in the same proportion as you have reduced your Account value by the withdrawals. If a withdrawal in excess of the Retirement Income Amount reduces your Account value to zero, your Retirement Income Base will be reduced to zero and your guarantee will terminate. Your guarantee does not require us to warn you or provide you with notice regarding potentially adverse consequences that may be associated with any withdrawals or other types of transactions involving your Account value. Moreover, the extent to which your Retirement Income Base may decrease may be affected by other factors, such as taking one or more excess withdrawals in a calendar year. You should carefully monitor your Retirement Income Base at all times as well as the amount of any withdrawals. You may call Investors Capital at 1-800-949-1422 for information about your Retirement Income Base. |

| v | On or after the Retirement Income Date, the longer you wait to start making withdrawals from your Account, the less likely you will benefit from your Income Edge because of decreasing life expectancy. Conversely, the longer you wait to begin making |

8

| withdrawals, the more opportunities you will have to take advantage of any appreciation of your Account value by exercising the Annual Optional Increase and locking in a higher Retirement Income Base. You should, of course, carefully consider when to begin making withdrawals, but there is a risk that you will not begin making withdrawals at the most financially beneficial time for you. |

| v | If, on or after the Retirement Income Date, you do not withdraw the entire Retirement Income Amount in any calendar year, you ARE NOT permitted to increase the Retirement Income Amount by the amount not withdrawn in the prior calendar year in the next calendar year. Any withdrawals, individually or in the aggregate, in excess of the Retirement Income Amount (or, if greater, the RMD) in any calendar year will reduce your Retirement Income Base. |

Asset Allocation Strategies in the Account

| v | The four asset allocation strategies eligible for coverage under the Income Edge are generally designed to provide consistent returns thereby minimizing the risk to the Company that your Account value will be reduced to $0, which would obligate the Company to make lifetime income payments to you until death. In minimizing the Company’s payout risk, the asset allocation strategies may also limit the potential for your investments to appreciate. You may earn a higher rate of return with an asset allocation strategy not eligible for coverage under the Income Edge. |

| v | Investors Capital will invest the assets in your Account in accordance with the asset allocation strategy you select, subject to its suitability review. This suitability review may result in Investors Capital changing an asset allocation strategy and the corresponding model portfolio in a way that PHL Variable does not accept for purposes of the certificate. As a result, an asset allocation strategy you choose for use with the certificate may not always be available. Investors Capital has agreed to certain permitted ranges of investments for the asset allocation strategies eligible for use with the Income Edge (“Permitted Ranges”). The Permitted Ranges for the four model portfolios available with the certificate are shown in the section called “About the Account”. Your Account could fail to be invested in accordance with the Permitted Ranges for a variety of reasons including |

| • | reasons you control, such as contributing non-Covered Assets to your Account, |

| • | reasons controlled by or related to Investors Capital, such as making investments outside the Permitted Ranges, or the inability to continue to provide the model portfolios for any reason, or |

| • | reasons outside your control and that of Investors Capital, such as the model portfolios becoming inappropriate for your investment advisory account due to market conditions or other factors. |

Regardless of the reason, if at any time (other than during the Liquidation Period as described below), 100% of your Account investments are not invested in accordance with these Permitted Ranges your Income Edge will terminate five Business Days after such time.

| v | Investors Capital may propose an adjustment to a model portfolio, such as a change in the investments and/or the Permitted Ranges that PHL Variable accepts. Such a change may also cause PHL Variable to change the Income Edge fee percentage for the affected model portfolio. The new fee would apply to your certificate as of your initial investment in the affected model portfolio following the change, or if you are already invested in the affected model portfolio, upon making an additional contribution to the Account or upon the Annual Optional Increase. You would receive notice of any such change. |

| v | If you become dissatisfied with the asset allocation strategy and the corresponding model portfolio in accordance with which the assets in your Account are invested and you make withdrawals to invest in another investment account or other asset allocation strategy not eligible for use with the Income Edge, such withdrawals may reduce the Retirement Income Base and Retirement Income Amount. See “Withdrawals from Your Account” later in this prospectus. In addition, such withdrawals may have tax consequences. See “Taxation of the Income Edge” later in this prospectus for a discussion of the tax consequences of the Income Edge. |

Timing Issues

| v | When you first purchase your Income Edge, the Retirement Income Base is determined as of the close of business on the first business day on which (i) your Account is invested in accordance with a model portfolio eligible for use with the Income Edge AND (ii) your Income Edge application is accepted by us. Therefore, the determination of your Retirement Income Base may be delayed if you contribute securities or other non-cash assets that must be converted to cash so that such cash may be invested in accordance with a model portfolio. There is a risk that the value of your initial contribution into your Account will decrease before the Income Edge certificate effective date and therefore your Retirement Income Base will be less than the dollar amount of your initial contribution due to the timing of the account opening process. |

| v | If you contribute additional assets to your Account (after you first purchase your Income Edge) and the assets are not Covered Assets, then these assets will not be eligible for the Income Edge as an additional contribution until they are sold and the proceeds invested in Covered Assets which sale and investment must occur within the Liquidation Period. The Liquidation Period is the |

9

| period within which you will be required to liquidate and reinvest your assets as necessary so they are Covered Assets or transfer the assets out of the Account into another account. The Liquidation Period is currently thirty calendar days. If Investors Capital determines that the assets cannot be sold and the proceeds invested in Covered Assets within such period then the assets will be refunded to you or remain in the Account and not be eligible for the Income Edge. |

| v | If you purchase an Income Edge and your Account value decreases to $0 prior to the Retirement Income Date, we are not required to begin making lifetime payments (if any) to you until one month after your Retirement Income Date. If you (or, if you have purchased the Spousal Income Guarantee, both you and your surviving spouse) die before the Retirement Income Date, your Income Edge will terminate and you will receive no lifetime income payments from us and your Income Edge will terminate without any value. |

| v | On or after the Retirement Income Date, we calculate the Retirement Income Amount as 5% of the Retirement Income Base as of January 1 of each calendar year. If you make additional contributions or we apply the Annual Optional Increase on a certificate anniversary, your Retirement Income Base will be increased on that date, in a proportionate amount, based on the amount of the contribution or increase and the number of days left in that calendar year. If you make contributions or we apply the Annual Optional Increase, you should be aware that your Retirement Income Amount will change and there is a risk you will inadvertently reduce your Retirement Income Base due to an excessive withdrawal. |

Income Edge Fee

| v | There is a risk that the Income Edge fee percentage that will be applied to any increases in your Retirement Income Base resulting from additional contributions to your Account and/or the Annual Optional Increase and/or transfer of your Account value to a different model portfolio will be a higher percentage than your current Income Edge fee percentage. You should carefully consider the possibility of an increased Income Edge fee before you purchase an Income Edge. See “What Does the Income Edge Cost?”, which appears previously in this prospectus. |

Divorce

| v | Two spouses legally married under federal law may purchase the Spousal Income Guarantee version of the Income Edge to provide predictable lifetime income payments for both spouses by providing continuing income payments if the investments in the spouses’ jointly-owned Account are reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance before both spouses die. There is a risk that if two spouses purchase a Spousal Income Guarantee version of the Income Edge and subsequently determine to obtain a divorce, such divorce could result in a loss of part or all of the income protection provided to each spouse by the Income Edge prior to the divorce. |

Regulatory Protections

| v | The Income Edge certificates are the subject of a registration statement filed with the U.S. Securities and Exchange Commission (the “SEC”) in accordance with the Securities Act of 1933 (the “Securities Act”) and the offering of the Income Edge certificates must be conducted in accordance with the requirements of the Securities Act. We are also subject to applicable periodic reporting and other requirements imposed by the Securities Exchange Act of 1934. However, although there is no direct guidance on this issue, the Company intends to treat Income Edge payments, beginning if, and when, withdrawals from your Account (within the limits of the Certificate) and/or poor investment performance reduce your Account value to $0 on or after the Retirement Income Date, as paid under a fixed annuity contract that is separate from the Income Edge and that is not registered in accordance with, and therefore would not be governed by, the federal securities laws. |

| v | We are not an investment adviser and do not provide investment advice to you in connection with your Income Edge. Therefore, we are not governed by the Investment Advisers Act of 1940 (the “Advisers Act”), and the protections provided by the Advisers Act are not applicable with respect to our sale of the Income Edge to you. |

Using Your Account as Collateral for a Loan

| v | The assets in your Account are owned by you, not by us. We have no control over any of the assets in your Account and you may sell such assets at any time in your complete and sole discretion and without any permission from us. The assets in your Account are not subject to our creditors, although they can be directly attached by your creditors. In addition, you may pledge the assets in your Account as collateral for a loan. In the case of such a pledge, if the assets in your Account decrease in value, your creditor may be able to liquidate assets in your Account to pay the loan. Any such liquidation may constitute a withdrawal from your Account and reduce your Retirement Income Base. Using the assets in your Account as collateral for a loan, therefore, may reduce the future benefit of your Income Edge or cause your Income Edge to terminate. |

The Income Edge is offered to advisory clients of Investors Capital who have an Account eligible for the Income Edge. The Income Edge is designed for Investors Capital clients who intend to use the investments in their Account as the basis for a withdrawal program to provide income payments for retirement or other long-term purposes.

10

Subject to certain conditions, the Income Edge ensures predictable lifetime income payments regardless of the actual performance or value of your Account, by providing continuing income payments if your Account value is reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance. There are limitations on the amount and timing of withdrawals, which are discussed below. There is an annual fee for the Income Edge which is deducted from your Account (or another designated account) quarterly in advance.

Subject to certain conditions, the Income Edge lifetime income payments (equal to the Retirement Income Amount) will begin if and when your Account value is reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance.

| 1. | Purchasing An Income Edge |

How Do You Purchase An Income Edge?

You can purchase an Income Edge when you open your Account or at any time thereafter prior to age 85 (or, if applicable, each spouse is below age 85). You may apply to purchase an Income Edge through Investors Capital Corporation by completing an enrollment form. An enrollment form or application for the Income Edge when the Account is over $5 million is subject to additional review by us before we issue a certificate. We may determine not to issue an Income Edge for any reason, at our sole discretion. If your application is accepted by us at our home office, we will issue an Income Edge certificate to you describing your rights and obligations. The Income Edge certificate is in the form of an individual certificate provided under a group annuity contract issued by PHL Variable Insurance Company to Investors Capital Holdings, Ltd., the parent of Investors Capital Corporation and/or to Investors Capital Corporation. In certain states we may issue an individual contract to you. There are two versions of the Income Edge: the Individual Income Guarantee and the Spousal Income Guarantee.

| v | The Individual Income Guarantee provides predictable lifetime income payments to you regardless of the actual performance or value of your Account investments by providing continuing income payments if the investments in your Account are reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance before you die. |

| v | The Spousal Income Guarantee provides predictable lifetime income payments for both you and your spouse by providing continuing income payments if the investments in your Account are reduced to $0 by withdrawals (within the limits of the certificate) and/or poor market performance before both you and your spouse die. |

| v | When you apply to purchase an Income Edge, you must indicate whether you want the Individual Income Guarantee or the Spousal Income Guarantee. |

| v | Any owner of the Income Edge must be an owner of the Account. |

| v | If you elect the Individual Income Guarantee, there can be only one owner of the Income Edge and that owner must be a natural person, unless the Income Edge is purchased by an IRA. For purposes of the Individual Income Guarantee, the Retirement Income Date is the later of your certificate effective date or your 65th birthday. |

| v | If you elect the Spousal Income Guarantee, joint ownership of the Income Edge is required by legally married spouses as recognized under Federal tax law. Federal law defines “spouse” under the Defense of Marriage Act, as a man or a woman legally joined. Neither individuals married under State or foreign laws that permit a marriage between two men or two women nor individuals participating in a civil union or other like status are spouses for any federal purposes, including provisions of the Internal Revenue Code relevant to this certificate. The age of the younger spouse is used to determine when and if lifetime income payments will be paid under the Income Edge. Accordingly, the Retirement Income Date is the later of the certificate effective date or the younger spouse’s 65th birthday. For example, if on the certificate effective date, one spouse is age 40, while the other spouse is age 60, the Retirement Income Date would be approximately twenty-five years from the certificate effective date (the youngest spouse’s 65th birthday). In the event that the younger spouse dies before his or her 65th birthday, then the Retirement Income Date will be the older spouse’s 65th birthday. If the older spouse has already reached his or her 65th birthday, then the date of the younger spouse’s death will be set as the Retirement Income Date. |

What If You Want To Purchase An Income Edge For Your Individual Retirement Account?

You may purchase the Qualified Income Edge and select the Individual Income Guarantee for your IRA.

| v | A Qualified Income Edge is an Income Edge certificate owned by an IRA including a Roth IRA Account (collectively, “IRA Accounts”). |

| v | The Qualified Income Edge is not available for tax qualified plans other than IRAs. If the Income Edge certificate is purchased in connection with an IRA, you must designate the natural person for whom the IRA is established for the benefit of the Income Edge for purposes of determining Income Edge benefits. The Retirement Income Date for the Qualified Income Edge is the later of the certificate effective date or the date the natural person for whom the IRA is established reaches age 65. The Qualified Income Edge is held within the IRA Account for the benefit of the natural person for whom the IRA is established. |

11

| v | If you purchase a Qualified Income Edge, for an IRA other than a Roth IRA, you may be required to take withdrawals after the Retirement Income Date from your IRA Account to meet required minimum distributions (“RMD”) under the Code. In some cases, the RMD may be more than the Retirement Income Amount. If so, withdrawals from your Account, in proportion to the value of your Account to your overall IRA Account balance, to meet RMD will be treated as permissible withdrawals and will not reduce your Retirement Income Base. For example, suppose that your Account balance is $100,000, your overall IRA Account balance is $200,000, and you must take an RMD of $10,000. Because your Account balance is one half of your overall IRA Account balance, one half of the RMD (i.e., $5,000) will be withdrawn from your Account. Even if this $5,000 exceeds your Retirement Income Amount, your Retirement Income Base will not be reduced. |

| v | Currently, the Spousal Income Guarantee is not available for an IRA Account. |

| 2. | How Does Your Income Edge Work? |

Your Retirement Income Base will equal your Account value on your certificate effective date, the date that we issue you the Income Edge. Your Account value on your certificate effective date will not include any assets in your Account that are not invested in accordance with one of the Asset Allocation Strategies eligible for the Income Edge. If you contribute additional assets to your Account (after you first purchase your Income Edge) and the assets are not Covered Assets, then these assets will not be eligible for the Income Edge as an additional contribution until they are Covered Assets. If Investors Capital determines that the assets cannot be sold and the proceeds invested in Covered Assets, then the assets will be refunded to you and not be eligible for the Income Edge. Your Retirement Income Base may increase as a result of additional contributions to your Account or if you exercise the Annual Optional Increase. See “Increases in Retirement Income Base” later in this prospectus.

On or after your Retirement Income Date, you may withdraw your Retirement Income Amount without reducing your Retirement Income Base. Of course, you may always make withdrawals from your Account before your Retirement Income Date, or in excess of your Retirement Income Amount on or after the Retirement Income Date, but these withdrawals will reduce your Retirement Income Base and your Retirement Income Amount. See “How Do You Structure Withdrawals From Your Account?” later in this prospectus.

In the event that your Account value is reduced to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance, we will continue paying the Retirement Income Amount of 5% of the Retirement Income Base after your Account value reduces to $0 by withdrawals (within the limits of the certificate) and/or poor investment performance until you (or, if you have purchased the Spousal Income Guarantee, you and your spouse) die. Under no circumstances would the payments continue to your heir or estate.

| 3. | Investors Capital and the Account |

Investors Capital is an investment management company that is registered as an investment adviser with the SEC. Investors Capital provides investment advisory services in all 50 states and manages approximately $840 million in client assets. Investors Capital provides portfolio management services to individuals, trusts, corporate entities, employee benefit plans, and institutional clients.

Investors Capital may offer the Accounts through affiliated and unaffiliated registered representatives. Investors Capital may also offer the Accounts through investment advisor representatives, financial advisors and other investment professionals (“Financial Advisors”). The Financial Advisors assist clients in analyzing whether the Account is an appropriate investment advisory product and determining which investment style is appropriate for the client. Certain Financial Advisors may not be permitted to provide you with advice regarding the Income Edge due to state laws and regulations relating to insurance agents. However, these Financial Advisors are permitted to arrange for you to discuss the Income Edge with representatives of Investors Capital Corporation’s affiliated insurance agency or with representatives of PHL Variable who are licensed to talk about whether the Income Edge is appropriate for you and to answer your questions. If you purchase the Income Edge, the custodian for your Account will continue to provide client statements concerning Account activity, strategy and performance to your registered representative or Financial Advisor, while we will send you confirmation statements solely related to the Income Edge.

About the Investor Protector Program

The Investor Protector Program is a discretionary managed account that leverages the expertise and knowledge of Investors Capital’s investment policy committee to actively manage specific portfolios comprised of mutual funds and exchange traded funds. While Investors Capital has a variety of investment strategies across the risk/return spectrum, the Investor Protector Program currently offers four model portfolios, which are the Asset Allocation Strategies eligible for coverage under the certificates. Each of the model portfolios represents a different level of expected risk and return. You may only participate in one of the four model portfolios eligible for the Income Edge at any one time, but may transfer your total Account value from one model portfolio to another under the terms of the Program. You should know that you may only make such transfers once in each 90-day period and that transferring from one model portfolio to another may affect the fee you will pay for your certificate. You may not purchase the Income Edge in connection with an account that participates in one of the non-Income Edge eligible model portfolios.

12

Investors Capital serves as the portfolio manager for the model portfolios and determines the asset allocation and specific investment vehicles for each asset allocation strategy based on a determination about each fund manager’s performance in the specific investment discipline that fits the allocation strategy.

About the Model Portfolios

The model portfolios are the Asset Allocation Strategies currently eligible for coverage under the certificate. There are four sets of Permitted Ranges and each model portfolio eligible for the Income Edge must fall within one of those sets.

| v | The Investor Protector Conservative model portfolio is intended to consist of approximately 40% equity investments and 60% fixed income investments. |

| v | The Investor Protector Conservative/Balanced model portfolio is intended to consist of approximately 50% equity investments and 50% fixed income investments. |

| v | The Investor Protector Balanced model portfolio is intended to consist of approximately 60% equity investments and 40% fixed income investments. |

| v | The Investor Protector Growth model portfolio is intended to consist of approximately 70% equity investments and 30% fixed income investments. |

The Current Permitted Ranges for the Model Portfolios

The current maximum and minimum allocations to funds investing primarily in various asset classes and sub-asset classes are set forth in the following table. Investors Capital (subject to our right to reject any proposed change that would subject us to material additional risk or costs) may make changes to these Permitted Ranges in the future, in which case your Account’s allocations may have to be reallocated accordingly. We will inform you of any such change in writing.

| Style Allocation | Investor Protector Conservative |

Investor Protector Conservative/ Balanced |

Investor Protector Balanced |

Investor Protector Growth |

||||||||||||||||||||

| 40% equities 60% fixed income |

50% equities 50% fixed income |

60% equities 40% fixed income |

70% equities 30% fixed income |

|||||||||||||||||||||

| Sub-asset Class: the sub-asset |

Permitted Ranges |

Permitted Ranges |

Permitted Ranges |

Permitted Ranges |

||||||||||||||||||||

| Min | Max | Min | Max | Min | Max | Min | Max | |||||||||||||||||

| Large Cap US Equity |

15 | % | 31 | % | 18 | % | 38 | % | 21 | % | 45 | % | 26 | % | 55 | % | ||||||||

| Core1 |

0 | % | 31 | % | 0 | % | 38 | % | 0 | % | 45 | % | 0 | % | 55 | % | ||||||||

| Value Tilt2 |

0 | % | 23 | % | 0 | % | 29 | % | 0 | % | 35 | % | 0 | % | 42 | % | ||||||||

| Growth Tilt3 |

0 | % | 10 | % | 0 | % | 11 | % | 0 | % | 12 | % | 0 | % | 14 | % | ||||||||

| Mid Cap US Equity |

0 | % | 16 | % | 3 | % | 20 | % | 6 | % | 24 | % | 7 | % | 29 | % | ||||||||

| Core1 |

0 | % | 16 | % | 0 | % | 20 | % | 0 | % | 24 | % | 0 | % | 29 | % | ||||||||

| Value Tilt2 |

0 | % | 12 | % | 0 | % | 15 | % | 0 | % | 18 | % | 0 | % | 22 | % | ||||||||

| Growth Tilt3 |

0 | % | 4 | % | 0 | % | 5 | % | 0 | % | 6 | % | 0 | % | 7 | % | ||||||||

| Small Cap US Equity |

1 | % | 12 | % | 3 | % | 15 | % | 5 | % | 18 | % | 8 | % | 22 | % | ||||||||

| Core1 |

0 | % | 12 | % | 0 | % | 15 | % | 0 | % | 18 | % | 0 | % | 22 | % | ||||||||

| Value Tilt2 |

0 | % | 10 | % | 0 | % | 12 | % | 0 | % | 14 | % | 0 | % | 17 | % | ||||||||

| Growth Tilt3 |

0 | % | 4 | % | 0 | % | 4 | % | 0 | % | 4 | % | 0 | % | 5 | % | ||||||||

| US REITs*4 |

0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | ||||||||

| Commodities* |

0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | ||||||||

| International Equity** |

1 | % | 16 | % | 5 | % | 20 | % | 9 | % | 24 | % | 11 | % | 29 | % | ||||||||

| Core EAFE6 |

0 | % | 16 | % | 0 | % | 20 | % | 0 | % | 24 | % | 0 | % | 29 | % | ||||||||

| Non-EAFE Developed Markets5A*** |

0 | % | 8 | % | 0 | % | 9 | % | 0 | % | 10 | % | 0 | % | 13 | % | ||||||||

| Non-EAFE Emerging Markets5B*** |

0 | % | 8 | % | 0 | % | 9 | % | 0 | % | 10 | % | 0 | % | 13 | % | ||||||||

| Fixed Income |

55 | % | 70 | % | 45 | % | 60 | % | 35 | % | 50 | % | 25 | % | 40 | % | ||||||||

| US Core Fixed Income7 |

0 | % | 70 | % | 0 | % | 60 | % | 0 | % | 50 | % | 0 | % | 40 | % | ||||||||

| US Shorter duration HQ8 |

0 | % | 70 | % | 0 | % | 60 | % | 0 | % | 50 | % | 0 | % | 40 | % | ||||||||

| US Longer duration HQ9 |

0 | % | 51 | % | 0 | % | 43 | % | 0 | % | 35 | % | 0 | % | 28 | % | ||||||||

| US Corporates HQ10 |

0 | % | 51 | % | 0 | % | 43 | % | 0 | % | 35 | % | 0 | % | 28 | % | ||||||||

| US High Yield* |

0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | ||||||||

| International* |

0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | ||||||||

| Inflation Protected* |

0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | 0 | % | 5 | % | ||||||||

| Overall Equity |

30 | % | 45 | % | 40 | % | 55 | % | 50 | % | 65 | % | 60 | % | 75 | % | ||||||||

| Overall Fixed |

55 | % | 70 | % | 45 | % | 60 | % | 35 | % | 50 | % | 25 | % | 40 | % | ||||||||

13

| * | Max of 15% aggregate in these sub-asset classes |

| ** | At least 50% of International must be Core EAFE |

| *** | Max of 3% in any individual country |

| 1 | “Core” represents a portfolio that has equal allocation to both value and growth stocks, generally represented by a broad-based index such as the S&P 500® Index or the Russell 1000® Index. |

| 2 | “Value Tilt” represents a bias in the portfolio toward securities that are considered undervalued in the market, or have a less-than-average growth orientation. These securities generally have lower price-to-book and price-earnings ratios, higher dividend yields and lower forecasted growth values than the Growth universe. |

| 3 | “Growth Tilt” represents a bias in the portfolio toward securities whose earnings are expected to grow at an above-average rate, or have a higher-than-average growth orientation. These securities generally have higher price-to-book and price-earnings ratios, lower dividend yields and higher forecasted growth values than the Value universe. |

| 4 | US REITs – The risk-return profile of US REITs (Real Estate Investment Trusts) is represented by the FTSE NAREIT Equity Index, which is an unmanaged index generally considered to be representative of the North American Real Estate segment of the market, including all tax qualified REITs with common shares traded on the New York Stock Exchange, American Stock Exchange, or NASDAQ National Market List. In order to operate as a REIT, a publicly traded company must receive at least 75% of its annual gross income from real estate rents, mortgage interest or other qualifying income; have at least 75% of the company’s annual assets consisting of rental real estate, real estate mortgages or other qualifying commercial real estate; and the company must distribute annually at least 90% of its taxable income to its shareholders. |

| 5A | Non-EAFE Developed Markets-While investments in this sub asset class represent international equity exposures in the developed markets* included in the European, Australasian, and Far Eastern markets, as measured by the MSCI EAFE index, the investment results do not correspond necessarily to the price and yield performance of the publicly traded securities in the MSCI EAFE index. Reasons may include, but are not limited to differences in country allocations located in the developed markets* included in the MSCI EAFE index, differences in sector breakdown, and distribution by market capitalization. |

| * | As of March 31, 2009, developed markets in the MSCI EAFE (excludes those from US and Canada) include Japan, United Kingdom, France, Switzerland, Germany, Australia, Spain, Italy, Netherlands, Hong Kong, Sweden, Finland, Singapore, Belgium, Denmark, Norway, Portugal, Austria, Greece, Ireland, and Luxembourg. |

| 5B | Non-EAFE Emerging Markets-Investments in this sub asset class represent international equity exposures in regions or countries outside the developed markets* included in the European, Australasian, and Far Eastern markets, as measured by the MSCI EAFE index. As a result, the investment results are expected to differ significantly from the price and yield performance of the publicly traded securities in the MSCI EAFE index. Reasons may include, but are not limited to differences in country allocations located outside the developed markets* included in the MSCI EAFE index, differences in sector breakdown, and distribution by market capitalization. |

| 6 | CORE EAFE – The risk-return profile of Core EAFE is represented by the MSCI EAFE Index (Europe, Australasia, Far East), which is an unmanaged, free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. As of June 2007 the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden. Switzerland, and the United Kingdom. |

| 7 | US CORE Fixed Income – The risk-return profile of US CORE Fixed Income is represented by the Barclays Capital Aggregate Bond Index (formerly Lehman Brothers Aggregate Bond Index), which is an unmanaged index that includes fixed rate debt issues rated investment grade or higher by Moody’s Investor’s Service, Standard and Poor’s ® Corporation, or Fitch Investor’s Service, in that order. (It also includes Commercial Mortgage Backed Securities.) Bonds or securities included must be fixed rate, although it can carry a coupon that steps up or changes according to a predetermined schedule; must be dollar-denominated and nonconvertible; and must be publicly issued. All issues have at least one year to maturity with intermediate indices including bonds with maturities up to 10 years and long term indices composed of bonds with maturities longer than ten years. |

| 8 | “US Shorter Duration” represents a portfolio of U.S. fixed income securities that have a shorter duration than the average of the Barclays Capital Aggregate Bond Index (formerly Lehman Brothers Aggregate Bond Index). The Barclays Capital Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities up to 30 years. Duration is a measure of how the price of a bond changes in response to interest rate changes. |

| 9 | “US Longer Duration” represents a portfolio of U.S. fixed income securities that have a longer duration than the average of the Barclays Capital Aggregate Bond Index (formerly Lehman Brothers Aggregate Bond Index). The Barclays Capital Aggregate Bond Index includes U.S. government, corporate, and mortgage-backed securities with maturities up to 30 years. Duration is a measure of how the price of a bond changes in response to interest rate changes. |

| 10 | US Corporates High Quality – The risk-return profile of US Corporates high quality is represented by the Barclays Capital Credit Index (formerly Lehman Brothers Credit Index), which is an unmanaged index that includes all publicly issued, fixed rate, nonconvertible investment grade dollar-denominated, SEC-registered corporate debt. |

For more detailed information regarding the Program please refer to Investors Capital’s Form ADV Part II

How Does the Income Edge Relate To Your Account?

The Income Edge is designed for clients participating in the Investor Protector Program who intend to use the investments in their Account as a basis for a withdrawal program to provide income payments for retirement or other long-term purposes.

The Income Edge provides insurance protection relating to your Account managed by Investors Capital by ensuring that regardless of how your investments actually perform or the actual value of your investments when you begin your withdrawal program from your Account, you will have predictable lifetime income payments, subject to certain limitations described herein.

How Will Investors Capital Manage Your Investments in the Account If You Purchase an Income Edge?

Investor Capital constructs asset allocation portfolios based on long-term, forward-looking assumptions for asset class allocation, risk/return and correlation, using extensive capital markets research developed by its advisory team. These portfolios employ a strategic asset allocation approach, implemented utilizing a combination of passive and active investments. The firm constructs its asset allocation portfolios using a multi-fund, multi-manager approach. Each fund is sub-advised by institutional caliber investment managers who are strictly focused on a given investment style, and who have been selected through Investors Capital’s extensive research and manager review. Ongoing due diligence is conducted to ensure managers/funds continue to adhere to Investors Capital’s investment oversight standards.

14

As you have granted Investors Capital discretion over your Account, Investors Capital may, from time to time, make various types of changes which might lead to changes in your Account. For example, Investors Capital may adjust the model portfolios to any extent it deems appropriate, in the best interest of an Income Edge certificate holder, including by changing individual investment vehicles and by making investments within and outside the Permitted Ranges. Investors Capital may do so at its discretion, and does not require certificate holder approval. For instance, Investors Capital may change the investment vehicles used within the portfolio in an attempt to achieve more effective tracking to an index, or make an allocation to a specific sector or investment style. Similarly, Investors Capital may rebalance your Account periodically, as needed, to keep it aligned with the desired investment objective and changing market conditions.

Investors Capital may propose an adjustment to the composition of an asset allocation model, including a change in the Permitted Ranges percentages or specific investment vehicles that PHL Variable may accept for purposes of the certificate. However, such a change may also cause PHL Variable to change the Income Edge fee percentage for the affected model portfolio. The new fee would apply to your certificate as of your initial investment in the affected model portfolio following the change, or if you are already invested in the affected model portfolio, upon making an additional contribution to the Account or exercising the Annual Optional Increase. You would receive notice of any such fee change.

What Happens if Your Account is Managed in a Manner Unacceptable to Us?

In order for your Income Edge to stay in effect, your Account must be invested at all times in accordance with one of the four model portfolios eligible for the Income Edge described above. A model portfolio must continue to meet the Permitted Ranges for it to remain eligible, and changes to a model portfolio that cause it to fall outside the Permitted Ranges will result in termination of the Income Edge unless a change in the Permitted Ranges is accepted by PHL Variable and your assets continue to be Covered Assets. If Investors Capital invests the model portfolios in a manner that is outside of the Permitted Ranges and PHL Variable has not accepted this change, then the Income Edge for owners of any affected Accounts will terminate, unless the model portfolios are brought back into accordance with the Permitted Ranges during the “Cure Period.” The Cure Period is five consecutive Business Days. A “Business Day” is defined as a day when the New York Stock Exchange is open for trading.

What Happens if Your Contributions or Withdrawals or Other Actions Cause the Investments in Your Account to Fall Outside the Permitted Ranges?

Changes you make to your Account, including contributions and withdrawals may temporarily cause the investments in your Account to fall outside of the Permitted Ranges. For example, if you request a withdrawal of $100,000 from your account, Investors Capital first must sell securities that are worth $100,000 in order to raise cash for your withdrawal. At this point in time the investments in your Account may fall outside of the Permitted Ranges due to the higher percentage of cash held in the Account. In addition, after you withdraw the $100,000 in cash, the remaining investments in your Account might not be within the Permitted Ranges and Investors Capital may need to rebalance the investments in your Account. Also, a circumstance outside our control may make Investors Capital unable to maintain the model portfolios.

Cure Period. If the investments in your Account fall outside of the Permitted Ranges, for any reason, for five consecutive Business Days, your Income Edge will terminate. We are not required to give you advance notice of termination. This five-Business Day period is the “Cure Period.” In the event of an extraordinary circumstance where your Account is not able to be rebalanced within the Permitted Ranges during the Cure Period, PHL Variable reserves the right, in its discretion, to extend the Cure Period.

What Happens if the Value of Your Account Is Too Low for Investors Capital to Invest within the Permitted Ranges?

If your Account value is equal to or less than $10,000, the investments in your Account might not be able to be maintained within the Permitted Ranges. As a result, if your Account value has decreased to a value equal to or less than $10,000, Investors Capital may choose to liquidate the securities held in your Account and your Account will hold only cash.

Permitted Ranges Exception. If Investors Capital liquidates the investments and your Account is comprised entirely of cash, your Income Edge will not terminate even though the investments are outside of the Permitted Ranges.

Why Will Your Income Edge Terminate if Your Account is Not Managed Within the Permitted Ranges?

We would not be able to offer the Income Edge if we could not require that your Account be managed within the Permitted Ranges. In order for us to be able to provide the Income Edge for a reasonable fee, we need to know that your Account will be managed within certain constraints—otherwise our risks would be too high for us to be able to make the Income Edge available to you.