UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | ||

|

No fee required. | |

|

Fee paid previously with preliminary materials. | |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

Integrity |

| We conduct ourselves with the highest level of ethics both personally and professionally, when we sell to and perform services for our customers, and we never compromise our honesty. | |

|

Respect |

| We treat everyone, customers, colleagues and other stakeholders alike, with dignity and equality. | |

|

Teamwork |

| We put the interest of the group first before our individual interests, as we know that success only comes when we work together. | |

|

Transparency |

| We promote open and honest communication between each other and with our customers. | |

|

Professionalism |

| We set our standards high, so that we can exceed expectations and strive for perfection in everything we do. |

|

2024 ANNUAL MEETING OF

Our 2024 Annual Meeting will be held solely

by

DATE AND TIME:

May 15, 2024 9:00 a.m. Central Daylight Saving Time

Your vote is very important. Please submit your proxy card or voting instruction form as soon as possible. |

Who may vote:

If you owned shares of Group 1 Automotive, Inc. (the “Company” or “Group 1”) common stock at the close of business on March 20, 2024, you are entitled to receive this Notice of the 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”) and to vote at the meeting, either during the virtual meeting or by proxy.

How to attend:

To be admitted to the 2024 Annual Meeting, enter the 16-digit voting control number found on your proxy card, voting instruction form, or email notification. You can find detailed instructions on pages 98-99 of this Proxy Statement.

Please review this Proxy Statement and vote in one of the four ways shown to the right under “Voting Methods Available to You.”

Houston, Texas

By Order of the Board of Directors

Gillian A. Hobson Senior Vice President, Chief Legal Officer and |

| AGENDA | |

| 1 | Election of Nine Directors |

| 2 | Advisory Vote to Approve Executive Compensation |

| 3 | Ratification of Deloitte & Touche LLP as Independent Registered Public Accounting Firm |

| 4 | Approve the 2024 Employee Stock Purchase Plan |

| 5 | Approve the 2024 Long-Term Incentive Plan |

| VOTING METHODS AVAILABLE TO YOU | |

|

Internet Visit the website shown on the proxy card (www.proxyvote.com), voting instruction form or electronic communications. |

|

Telephone Call the telephone number identified in your proxy card, voting instruction form or electronic communications. |

|

Sign, date and return your proxy card or voting instruction form in the enclosed envelope. |

|

During the Meeting Attend the 2024 Annual Meeting online. See pages 98-99 for instructions on how to attend and vote online. |

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on May 15, 2024.

This Notice of the 2024 Annual Meeting of Shareholders and Proxy Statement, as well as the Company’s 2023 Annual Report, are available free of charge at www.proxyvote.com. References in either document to our website are for the convenience of readers, and information available at or through our website is not a part of, nor is it incorporated by reference in, the Proxy Statement or the 2023 Annual Report.

The Board of Directors of Group 1 (the “Board”) is soliciting proxies to be voted at our 2024 Annual Meeting of Shareholders on May 15, 2024, and at any postponed or reconvened meeting. We expect that the proxy materials or a notice of internet availability will be mailed and made available to shareholders beginning on or about April 5, 2024. At the meeting, votes will be taken on the matters listed in the Notice of 2024 Annual Meeting of Shareholders.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 2

This section highlights selected information in this Proxy Statement. Please review the entire Proxy Statement and our 2023 Annual Report before voting your shares.

| Board recommendation |

Page number | |||

| Proposal 1: | Election of Directors |  |

FOR each director nominee | 11 |

| Proposal 2: | Advisory Vote to Approve Executive Compensation |  |

FOR | 38 |

| Proposal 3: | Ratification of Deloitte & Touche LLP as Independent Registered Public Accounting Firm |  |

FOR | 79 |

| Proposal 4: | Approve 2024 Employee Stock Purchase Plan |  |

FOR | 81 |

| Proposal 5: | Approve 2024 Long-Term Incentive Plan |  |

FOR | 87 |

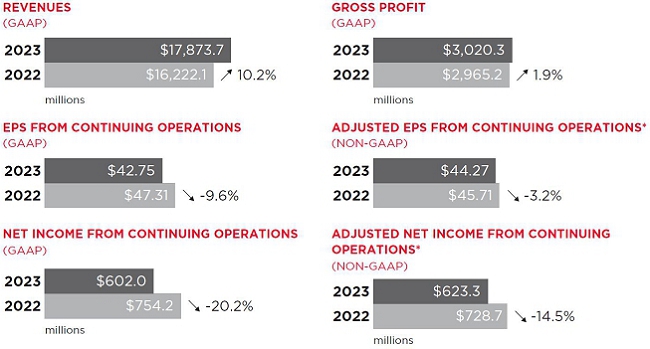

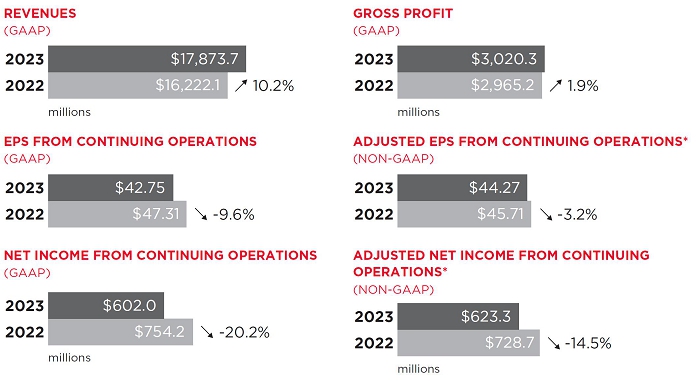

We delivered solid financial results in 2023.

| * | Please see Appendix C on page 130 for an explanation and reconciliation of these non-generally accepted accounting principles (“GAAP”) measures. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 3

| Financial Performance | Capital Allocation | |||

|

Achieved all-time record new and used vehicle units sold, a 13.5% and a 1.6% increase, respectively, compared to the prior year with a total sales increase to $17.9 million |  |

Acquired approximately $1.1 billion in annual revenues | |

|

Achieved all-time record parts and service gross profit of $1.2 billion, a 10% increase compared to the prior year |  |

Issued quarterly dividends totaling $1.80 per share for the full year | |

|

Increased same store parts and service gross profit by 8.1% |  |

Repurchased $172.8 million in common shares, representing 5.1% of Group 1’s outstanding common shares at the beginning of 2023 | |

|

Reported third highest annual adjusted net income from continuing operations as new vehicle margins moderated from pandemic highs |  |

Optimized dealership portfolio with strategic dispositions generating $193.8 million in proceeds | |

In 2023, we made noteworthy progress toward our key strategic priorities, including:

| • | Continued strong EPS: 42% Compound Annual Growth Rate (“CAGR”) over a five-year period. |

| • | Significant free cash flow generation: cash flows from operations and adjusted free cash flows* generated in 2022 and 2023 of $585.9 million and $802.6 million and $190.2 million and $580.8 million, respectively. |

| • | Balanced M&A, share repurchases and dividends. |

| • | $4.5 billion in acquired revenues since the beginning of 2021. |

| • | Strategic disposition of smaller, less profitable stores. |

| • | Repurchased ~4.9 million shares since the beginning of 2021, representing 27% of our share count, as of December 31, 2023. |

| • | Low rent-adjusted leverage* (a non-GAAP measure) of 2.1x, as of December 31, 2023, allows flexibility for M&A. |

| • | #1 ranked call center among the 17 largest auto dealer groups, providing outstanding customer service (based on the 2023 PSI Service Telephone Effectiveness Study). |

| • | AcceleRide®, our state-of-the-art omni-channel platform, is driving retention and efficiencies. |

| • | Continued focus on leveraging technology in robotic automation and artificial intelligence (“AI”) to improve customer service and efficiencies. |

| • | Strive to be great partners to our customers, employees, vendors, original equipment manufacturer (“OEM”) partners and the communities in which we do business. |

| • | Maintaining credible and ethical business practices by committing to the pursuit of excellence. |

| • | Grew current year parts and service revenues on an as-reported and same store basis by 10.6% and 9.0%, respectively, as compared to the prior year. |

| • | Numerous initiatives have driven this growth: |

| - | 4-day work week is a differentiator when hiring and retaining service techs. | |

| - | Same store tech headcount increased 6% from December 2022 to December 2023. | |

| - | Digital applications have driven a 38% penetration in online appointment making. |

| • | Control of dealership real estate is a strong strategic asset. |

| • | Ownership provides better flexibility and lower costs. |

| • | As of December 31, 2023, the Company owned approximately $2.0 billion of gross real estate (67% of dealership locations) financed through $0.8 billion of mortgage debt. |

| * | Please see Appendix C on page 130 for an explanation and reconciliation of adjusted free cash flows and our Annual Report on Form 10-K for additional information on the rent-adjusted leverage. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 4

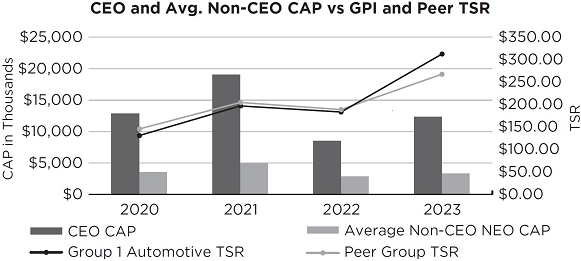

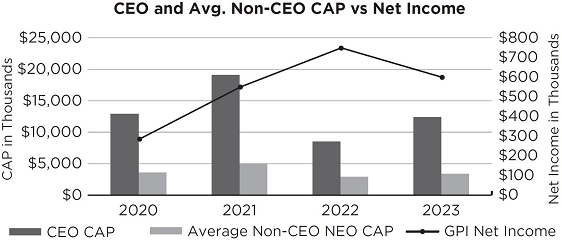

Our compensation program is designed to align our executives’ performance with the interests of our shareholders.

The primary goal of the Compensation & Human Resources (“CHR”) Committee of the Board is to reward and recognize strong financial and operating performance and promote effective strategic leadership to drive long-term shareholder value. This pay-for-performance philosophy is embedded into certain key principles that underpin how the CHR Committee approaches the design of our executive compensation program.

How does our executive compensation program align pay with performance?

| • | We use performance metrics and objectives that recognize and reward contributions that drive shareholder value creation. |

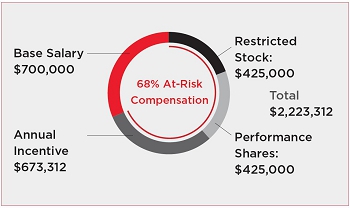

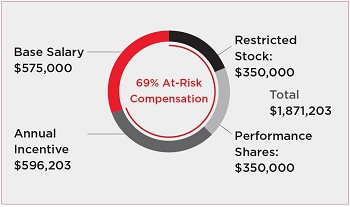

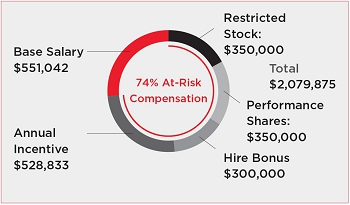

| • | The largest portion of compensation for our Named Executive Officers (“NEOs”) is “at-risk” compensation—annual and long-term incentive awards that are contingent on Company performance on our key metrics and objectives, in addition to our stock price performance. |

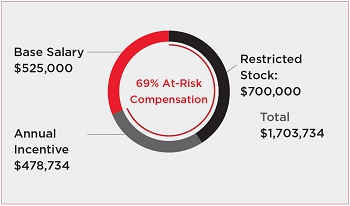

In making annual pay decisions, the CHR Committee focuses primarily on “total direct compensation,” which includes three principal elements: base salaries, annual cash incentives and long-term incentives (“LTI”). See pages 48-53 for details.

The table below shows the 2023 total direct compensation of our NEOs.

2023 PAY DECISIONS AND PAY MIX

|

Base Salary ($K)(1) |

Annual Incentive ($K) |

LTI ($K)(2) |

Total ($K) |

|||

| Daryl A. Kenningham |  |

54% | 1,100 | 1,850 | 3,500 | 6,450 | |

| Daniel J. McHenry |  |

38% | 700 | 673 | 850 | 2,223 | |

| Peter C. DeLongchamps |  |

37% | 575 | 596 | 700 | 1,871 | |

| Gillian A. Hobson |  |

39% | 551 | 529 | 700 | 2,080 | (3) |

| Michael D. Jones |  |

41% | 525 | 479 | 700 | 1,704 |

| (1) | Reflects the base salary in effect for each NEO as of January 1, 2023, other than Ms. Hobson’s which is prorated as of her January 16, 2023 start date. |

| (2) | Reflects target values approved by the CHR Committee for the LTI award granted on February 14, 2023. These values differ from those that will be reported in the Summary Compensation Table in 2024, which will be calculated in accordance with Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 718, Compensation—Stock Compensation. |

| (3) | Includes $300,000 awarded to Ms. Hobson as a hiring bonus in 2023 but omitted from the % calculations on the table. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 5

The CHR Committee believes that the metrics used for our annual and long-term incentive plans are essential indicators of the long-term performance of our Company, therefore serving the fundamental objective of our executive compensation program.

| FINANCIAL METRIC (70%) | STRATEGIC GOALS (30%) | |

| Adjusted Net Income* reflects income statement performance, consistent with the interests of our shareholders. For our corporate executives, we use adjusted net income from continuing operations as our Company-wide earnings metric. | Strategic Goals typically include specific goals that are related to the individual’s functional area. These goals are established at the beginning of each year jointly by the named executive officer and our Chief Executive Officer (“CEO”) and reviewed by the CHR Committee, or in the case of the CEO, by the CHR Committee and the Board. | |

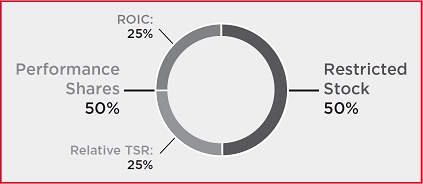

| Metrics for Performance Shares | ||

| Return on Invested Capital measures the returns we earn on our investments to drive sustainable cash flows and growth. | Relative Total Shareholder Return measures the performance of our stock price compared to five domestic automotive retail companies. |

| * | See Appendix C on page 130 for the definition of this financial metric. |

Annual Incentives

In 2023, the CHR Committee set performance goals for the annual incentive financial metric noted above. The following chart shows the adjusted net income financial goal set for annual incentive purposes and Group 1’s 2023 performance relative to this goal. For additional information on this financial metric and the evaluation of performance of strategic goals, please see pages 48-51.

| Weight | Threshold | Target | Maximum | Actual | |

| Adjusted Net Income from Continuing Operations* | 70% | $542 million | $602 million | $662 million | $623.3 million |

| * | Our annual incentive financial goal is based on a non-GAAP financial measure. See page 48 for details on how we measure performance for annual incentive plan purposes and Appendix C on page 130 for the definition of the financial metric referenced in this chart. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 6

Our mission is to create a culture where employees are engaged in building long-term, trusting relationships with our team members, customers and communities. By aligning our business strategy with our desire to support our people, customers and communities, we can make a positive impact and create value for our Company and its stakeholders. With oversight from our Board of Directors, management annually reviews the Company’s sustainability priorities and designates resources for their management. For additional information, please read our Sustainability Report at: https://www.group1corp.com/ESG. A summary of our sustainable business priorities are as follows:

Colleagues

We strive to cultivate a high-performing, diverse workforce and foster a culture of collaboration and learning where all employees feel valued. We are committed to providing a safe, healthy and productive working environment for our employees, improving the quality of lives for all and fostering an organization that is sustainable for the long term. As a people-centric business, we take continuous learning and professional development very seriously.

We encourage our teams to support each other’s professional goals. We equip our management team with the tools to help employees succeed and advance in their careers. All employees are required to complete training courses covering the Code of Conduct, anti-corruption, anti-harassment, anti-discrimination, diversity and inclusion and other relevant topics. We work to enable our colleagues to reach their full potential by fostering a culture of mutual respect and security, an inclusive and diverse work environment, professional development and growth opportunities, safe working conditions and fair hiring and labor standards.

Our customers drive what we do each day, and we seek to provide them with an industry-leading customer experience, both physically in our stores and digitally. To drive the leading customer experience we endeavor to:

| • | Adopt new technology |

| • | Drive process improvement |

| • | Improve the customer aftersales journey |

With a focus on the aftersales impact on the customer journey, we have and will continue to increase customer retention through more convenient service hours, training of our service advisors, selling service contracts with vehicle sales and customer relationship management software that allows us to provide targeted marketing to our customers.

We have a history of philanthropy and volunteerism. We have seen how our outreach and charitable giving can enrich the communities in which our dealerships are located. We actively contribute to our local communities in different and meaningful ways. Our efforts include employee volunteering, donations to local causes, support to educational programs and hosting community gatherings at our dealerships.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 7

The Board is committed to overseeing our sustainable business policies and practices, implementing sound and effective corporate governance practices and continually reviewing best practices and considering the views of our shareholders on various issues. For more information on how our Board and management oversee ESG-related matters, please see the section entitled “Sustainability Oversight” beginning on page 31. Members of our management regularly interface with prospective investors, existing shareholders and research analysts in a variety of event formats to discuss the Company’s publicly disclosed performance, business strategy and outlook, and corporate governance. These interactions help management and the Board understand and consider the views of our shareholders and the perception of the investment community while we dynamically operate in an evolving industry and economy with an objective of maximizing returns.

We look for opportunities to reduce our energy consumption, eliminate waste and accommodate the growing EV market. These opportunities include technological solutions such as: climate control thermostats and LED lighting to improve energy efficiency, solar panels to increase our use of renewable energy and updated waste management systems to improve handling of chemicals and other byproducts from our dealerships’ operations. To prevent material adverse impacts on the environment and to protect local water supplies, all of our U.S. service centers utilize oil water separators to manage wastewater. In addition, at substantially all of our U.S. and U.K. locations, we manage recycling of waste materials. We also recycle IT hardware, tires, oil, paint and damaged automotive parts.

In addition to selling EVs, we support the growing EV market with our certified EV service and repair operations. We have equipped our facilities with EV charging equipment, specialized lifts, EV-specific shop equipment and battery storage to sufficiently cater to the emerging EV market.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 8

Governance and Board Overview

| Skills and Expertise(1) | ||||||||||||||||||||||||||

| DIRECTORS(2) |  |

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Carin M. Barth Co-Founder and President of LB Capital, Inc., a private equity investment firm |

2017 | 2 |  |

|

|

|

|

|

|

|||||||||||||||||

| Daryl A. Kenningham President and Chief Executive Officer of Group 1 |

2022 | 0 |  |

|

|

|

|

|||||||||||||||||||

| Steven C. Mizell Former Executive Vice President and Chief Human Resources Officer at Merck & Co., Inc. |

2021 | 1 |  |

|

|

|

||||||||||||||||||||

| Lincoln Pereira Filho Former Regional Vice President, Brazil of Group 1 |

2013 | 1 |  |

|

|

|

|

| ||||||||||||||||||

| Stephen D. Quinn Former General Partner and Managing Director of Goldman, Sachs & Co. |

2002 | 1 |  |

|

|

|

|

|

||||||||||||||||||

| Steven P. Stanbrook Former Chief Operating Officer, International Markets of S.C. Johnson, Inc. |

2019 | 1 |  |

|

|

|

|

|

||||||||||||||||||

| Charles L. Szews Former Chief Executive Officer of Oshkosh Corporation |

2016 | (5) | 1 |  |

|

|

|

|

|

|

|

|

| |||||||||||||

| Anne Taylor Former Vice Chairman and Managing Partner of the Houston office of Deloitte |

2018 | 2 |  |

|

|

|

|

| ||||||||||||||||||

| Maryann Wright Former Group Vice President of Johnson Controls International |

2014 | 3 |  |

|

|

|

|

| ||||||||||||||||||

| (1) | The lack of a  for

a particular item does not mean that the director does not possess that qualification, characteristic, skill or experience.

We look to each director to be knowledgeable in these areas; however, the for

a particular item does not mean that the director does not possess that qualification, characteristic, skill or experience.

We look to each director to be knowledgeable in these areas; however, the  indicates

that the item is a specific qualification, characteristic, skill or experience that the director brings to the Board. indicates

that the item is a specific qualification, characteristic, skill or experience that the director brings to the Board. |

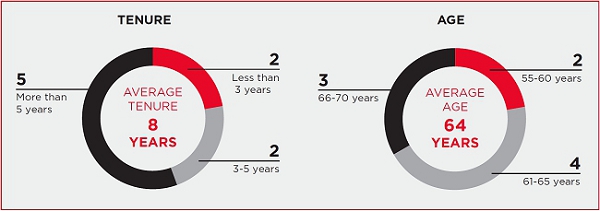

| (2) | Three of our nine directors are female and two of our nine directors are ethnically diverse. |

| (3) | Includes former or current President or CEO and Public Company Executive position experience. |

| (4) | Includes automotive, retail, and engineering/product development experience. |

| (5) | Non-Executive Chair of the Board since May 2023. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 9

In 2023, our Board actively engaged with management on a range of matters, providing effective oversight and guidance to enable the Company to execute on key priorities that underpin our business strategy.

| 97.8% | 97.5% | 100% | ||

| Overall attendance by directors at the five Board meetings during 2023 | Overall attendance by directors at Board and their respective committee meetings in 2023 | Overall attendance by directors at the 2023 Annual Meeting of Shareholders |

Essential to each director’s ability to provide robust and effective oversight is a deep understanding of our businesses, our strategic focus, and significant risks we may encounter, as well as an ongoing awareness of new developments and emerging risks that may arise during their Board service.

Below are some of the ways in which our directors are able to gain such understanding and awareness.

|

Strategy and Business Plan Reviews

Annually, the Board holds a meeting with senior management to review the strategy and long-range plans for each of our businesses and to discuss other topics, such as key Company areas of focus and significant and emerging risks. At the Board’s other meetings, it reviews Company progress against its long-range plans. |

Site Visits

As part of our directors’ continuing education, the Board strives to visit dealerships in at least one market each year. This gives directors insight into the Company’s dealership operations and the opportunity to interact with employees and key executives. | |

|

Outside Perspectives

The Board is periodically briefed by experts and counsel on strategic, financial, legal, compliance, and other matters. This gives them additional perspectives on the Company’s business environment, strategic focus areas, performance, and significant and emerging risks. |

Direct Interaction with Management

Our CEO and other members of senior management communicate with directors on a regular basis outside of regularly scheduled Board and committee meetings, including through periodic written updates and special meetings. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 10

| What

am I voting on? |

We are seeking your support for the election of the nine individuals nominated to serve on the Board until the 2025 Annual Meeting of Shareholders. We believe these nominees have the right experience, skills and perspective to guide the Company and provide effective oversight of our strategy and our business plans. All nominees currently serve as a director of the Company and are well qualified to serve as a director of a large automotive retail company. |

The Board and the Governance & Corporate Responsibility (“GCR”) Committee believe that there are general attributes all directors must exhibit, in addition to key skills and expertise that should be represented on the Board as a whole, but not necessarily by each director.

| • | Objectivity and independence in making informed business decisions |

| • | Extensive, relevant knowledge, experience and sound business judgment |

| • | Highest personal and professional integrity |

| • | Willingness to devote the extensive time necessary to fulfil a director’s duties |

| • | Commitment to the interests of Group 1 and its shareholders |

| • | Diversity of background and viewpoint |

The GCR Committee regularly considers whether the Board has all of the key skills and expertise needed for effective oversight of our businesses and strategy. See “Key Skills and Expertise” on page 12. Further, while the GCR Committee does not maintain a formal list of qualifications, in making its evaluation and recommendation of candidates, the GCR Committee may consider, among other factors, diversity of personal and professional experiences, background and viewpoint, skill, talent and experience in the context of the needs of our Board, independence qualifications, moral character and whether prospective nominees have relevant business and financial experience or have industry or other specialized expertise.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 11

The charts below show the percentage of directors with skills and expertise in each key area. In the nominee biographies on pages 14-22, we highlight for each individual the key skills and areas of expertise upon which the Board particularly relies.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 12

We believe decisions regarding the structure and composition of the Board are critical to ensuring a strong Board that is best suited to guide the Company. As specified in its charter, the GCR Committee oversees our director nomination process and may consider candidates for our Board from any reasonable source, including from a search firm engaged by the GCR Committee or shareholder recommendations.

| Consideration of Necessary Skills, Experience and Attributes | The GCR Committee considers a wide range of factors when assessing potential director nominees. The GCR Committee’s assessment of potential directors includes a review of the potential nominee’s judgment, experience, independence, understanding of our business or other related industries, and such other factors as the GCR Committee concludes are pertinent in light of the needs of the Board. The GCR Committee’s goal is to put forth a diverse slate of candidates with a combination of skills, experience, viewpoints, perspectives and personal qualities that will best serve the Board, the Company and our shareholders. | |

| Assessment of Current Board Composition | With respect to the potential re-nomination of current directors, the GCR Committee assesses their current contributions to the Board. Among other matters, the GCR Committee considers the results of the annual evaluation of the Board and its committees (which the GCR Committee also oversees) when assessing potential director nominees. More detail regarding this annual evaluation process can be found in “—Governance Best Practices” below. | |

| Nomination for Shareholder Vote | The GCR Committee recommends to the Board a slate of candidates for election at each annual meeting of shareholders. The GCR Committee also evaluates whether a potential director nominee meets the qualifications required of all directors and any of the key qualifications and experience to be represented on the Board, as described further in “—Criteria for Board Membership” above. |

Shareholders or a group of shareholders may recommend potential candidates for consideration by the GCR Committee. For additional information on such requests and the applicable timing, please see “How do I Submit Proposals and Nominations for the 2025 Annual Meeting?” in the “Frequently Asked Questions About the Annual Meeting.”

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 13

The Board, upon the recommendation of the GCR Committee, has nominated for election the nine individuals listed in this Proxy Statement. All are current directors of Group 1.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE FOLLOWING NOMINEES: |

| Carin M. Barth | |||

INDEPENDENT DIRECTOR Co-Founder and President of LB Capital, Inc., a private equity investment firm |

Age: 61 Director since: 2017 Board Committees: Audit Committee (Chair), Finance/Risk Management Committee, Governance & Corporate Responsibility Committee |

| |

| Key Skills and Expertise | |||

Finance/Accounting/Sox Financial Expert |

Senior Leadership |

Industry Experience |

|

P&L Responsibility |

Mergers & Acquisitions |

||

Qualifications

Ms. Barth has extensive experience in a variety of financial matters, including as chief financial officer for several entities. She also has a history of corporate and civic governance, which provides additional depth and financial expertise to our Board. Her experience with mergers and acquisitions, in operating a private equity company, her previous and currently held board positions on other publicly traded companies and her audit committee experience are key attributes, among others, that make her well qualified to serve on our Board.

Experience

| • | Co-Founder and President of LB Capital, Inc. since 1988 |

| • | Operating Partner, Mountain Capital, LLC |

| • | Currently serves on the board of The Welch Foundation |

| • | Former board member and current emeritus board member of Ronald McDonald House of Houston |

| • | Commissioner of the Texas Department of Public Safety from 2008 to 2014 |

| • | Appointed by President George W. Bush to serve as Chief Financial Officer of the U.S. Department of Housing and Urban Development from 2004 to 2005 |

Other Current Directorships

| • | Enterprise Products Holdings LLC |

| • | Black Stone Minerals, L.P. |

Former Public Company Directorships

| • | BBVA USA Bancshares, Inc. |

| • | Halcón Resources Corporation |

Degrees

| • | B.S. in Economics, University of Alabama |

| • | M.B.A., Vanderbilt University’s Owen Graduate School of Management |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 14

| Daryl A. Kenningham | |||

DIRECTOR President and Chief Executive Officer of Group 1 |

Age: 59 Director since: 2022 Board Committees: Finance/Risk Management Committee |

| |

| Key Skills and Expertise | |||

Senior Leadership |

Industry Experience |

International |

|

Mergers & Acquisitions |

P&L Responsibility |

||

Qualifications

As our President and Chief Executive Officer, Mr. Kenningham sets the strategic direction of our Company under the guidance of our Board. He has extensive senior executive management experience in the automotive industry. His successful leadership of our Company and extensive knowledge of the automotive industry provides our Board with a unique perspective on the opportunities and challenges we face and makes him well qualified to serve on our Board.

Experience

| • | CEO of Group 1 since January 2023 and President since August 2022 |

| • | Served as Group 1’s Chief Operating Officer from August 2022 to December 2022 |

| • | President of U.S. Operations from 2017 to August 2022 |

| Regional Vice President – West Region from 2016 to 2017 | |

| Regional Vice President – East Region from 2011 to 2016 | |

| • | Served as the Chief Operating Officer of Ascent Automotive from December 2010 to April 2011 |

| • | Served in senior executive roles from 1998 to 2011 at Gulf States Toyota, including Senior Vice President of Gulf States Toyota, President of Gulf States Financial Services, and as President at USA Logistics (previously known as Gulf States Transportation) |

| • | Held various sales, marketing and vehicle distribution positions in the U.S. and Japan with Nissan Motor Corporation from 1988 to 1998 |

Other Current Directorships

| • | None |

Former Public Company Directorships

| • | None |

Degrees

| • | B.A. in Psychology, University of Michigan |

| • | M.B.A., University of Florida |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 15

| Steven C. Mizell | |||

INDEPENDENT DIRECTOR Former Executive Vice President and Chief Human Resources Officer at Merck & Co., Inc. (“Merck”) |

Age: 64 Director since: 2021 Board Committees: Compensation & Human Resources Committee, Governance & Corporate Responsibility Committee |

| |

| Key Skills and Expertise | |||

Senior Leadership |

International |

||

Mergers & Acquisitions |

Human Resources/Cultural |

||

Qualifications

Mr. Mizell’s human resource management expertise from his position with an international, publicly traded company makes him well qualified to serve as a member of our Board. His extensive, global leadership experience and knowledge of human capital management provides our Board with valuable insights. Mr. Mizell will continue serving as a strategic advisor to Merck until July 1, 2024. The chairs of the Board and GCR Committee considered whether Mr. Mizell’s upcoming change in circumstance would impact his service as a director on the Board and determined that it would not. Accordingly, they recommended that Mr. Mizell continue to serve on the Board.

Experience

| • | Served as Executive Vice President and Chief Human Resources Officer at Merck from 2018 to April of 2024, with the company being recognized during his tenure as one of the Top 10 Best Workplaces in Health Care and Biopharma by Fortune and Great Place to Work, Best Workplace for Innovators by Fast Company magazine, Best Companies for Multicultural Women by Working Mother magazine, Top Veteran-Friendly Companies by U.S. Veterans Magazine and Companies that Care by People Magazine |

| • | Joined Monsanto, a global leader in sustainable agriculture, as Senior Vice President, Chief Human Resources Officer in 2004; served as Executive Vice President, Chief Human Resources Officer from 2007 to 2018 |

| • | Previously served as Senior Vice President and Chief Corporate Resources Officer for AdvancePCS, a pharmaceutical company |

| • | Recognized as one of St. Louis’ most influential Diverse Business Leaders |

| • | National Association of Corporate Directors (NACD) Directorship Certified |

Other Current Directorships

| • | Allegion plc |

Former Public Company Directorships

| • | Oshkosh Corporation |

Degrees

| • | B.S. in Industrial Management, Georgia Institute of Technology |

| • | M.S. in Management, Carnegie Mellon University |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 16

| Lincoln Pereira Filho | |||

DIRECTOR Former Regional Vice President, Brazil of Group 1 |

Age: 64 Director since: 2013 Board Committees: Finance/Risk Management Committee (Chair) |

| |

| Key Skills and Expertise | |||

Industry Experience |

Senior Leadership |

Technology/Cybersecurity |

|

International |

Mergers & Acquisitions |

Legal |

|

Qualifications

Mr. Pereira has extensive automotive retailing and manufacturer relations experience, as well as legal, finance, business and management expertise. Mr. Pereira’s experience and expertise in the automotive industry make him well qualified to serve as a member of our Board.

Experience

| • | Served as Group 1’s Regional Vice President, Brazil from 2013 through June 2022 |

| • | Served as a legal representative of United Auto do Brasil Ltda, a public auto group operating in São Paulo and controlled by United Auto Group, from 1999 to 2005 |

| • | Previously practiced law with Cunha Pereira Advogados, representing professional athletes and international racecar drivers, from 1995 through 2005 |

| • | Founded Atrium Telecomunicações Ltda, a provider of local exchange telecommunication services, in 1999. Atrium was sold to Telefónica of Spain in December 2004 |

| • | Founded E-Vertical Tecnologia, a leading provider of high tech facilities management services to commercial properties |

| • | Serves as Vice President of the São Paulo Chamber of Commerce (ACSP) |

| • | Held numerous positions with various banks, both in Brazil and abroad, from 1978 through 1995 |

| • | Serves on the Advisory Board of Equifax Brasil |

Other Current Directorships

| • | None |

Former Public Company Directorships

| • | Associação Brasileira dos Concessionários BMW |

| • | Associação Brasileira dos Distribuidores Toyota |

| • | Boa Vista Serviços S.A.-SCPC |

| • | Tempo Telecomunicações |

Degrees

| • | LL.B, Faculdade de Direito do Largo de São Francisco; London Business School |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 17

| Stephen D. Quinn | |||

INDEPENDENT DIRECTOR Former General Partner and Managing Director of Goldman, Sachs & Co. |

Age: 68 Director since: 2002 Board Committees: Audit Committee, Compensation & Human Resources Committee, Finance/Risk Management Committee, Governance & Corporate Responsibility Committee |

| |

| Key Skills and Expertise | |||

Finance/Accounting/Sox Financial Expert |

Industry Experience |

||

International |

Mergers & Acquisitions |

||

Qualifications

Mr. Quinn was selected to serve as a director on our Board due to his valuable financial expertise and extensive experience with capital markets transactions. His judgment in assessing business strategies and the accompanying risks is an invaluable resource for our business model. Mr. Quinn also has significant historical knowledge of our Company as a result of his role at Goldman Sachs, an underwriter for our initial public offering. The Board believes his experience and expertise in these matters make him well qualified to serve as a member and former Non-Executive Chair of our Board.

Experience

| • | Joined Goldman, Sachs & Co., a full-service global investment banking and securities firm, in August 1981, where he specialized in corporate finance |

| • | Served as a General Partner and Managing Director of Goldman, Sachs & Co. from 1990 until his retirement in 2001 |

Other Current Directorships

| • | Zions Bancorporation |

Former Public Company Directorships

| • | None |

Degrees

| • | B.S. in Economics, Brigham Young University |

| • | M.B.A., Harvard University Graduate School of Business |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 18

| Steven P. Stanbrook | |||

INDEPENDENT DIRECTOR Former Chief Operating Officer, International Markets of S.C. Johnson, Inc. |

Age: 66 Director since: 2019 Board Committees: Audit Committee, Compensation & Human Resources Committee, Finance/Risk Management Committee |

| |

| Key Skills and Expertise | |||

Senior Leadership |

Industry Experience |

International |

|

Mergers & Acquisitions |

Human Resources/Cultural |

P&L Responsibility |

|

Qualifications

Mr. Stanbrook was selected to serve on our Board due to his extensive international operational experience and his background in business development. His previous and current board positions on other publicly traded companies, combined with his global operational experience in a variety of senior management positions, have provided him with a wealth of knowledge in dealing with complex strategic, business matters.

Experience

| • | Retired from S.C. Johnson, Inc., a global manufacturer and marketer of household products, in 2015, following a distinguished 19-year career serving in various roles, including most recently as Chief Operating Officer, International Markets |

| • | Previously held a variety of senior leadership positions with both Sara Lee Corporation, including Chief Executive Officer of Sara Lee Bakery, and CompuServe, the leading, global Internet Service Provider |

| • | Over 30 years of experience operating across the global consumer packaged goods sector |

| • | Director, Voyant Beauty, LLC, a private company |

Other Current Directorships

| • | Primo Water Corporation |

Former Public Company Directorships

| • | Chiquita Brands International, Inc. |

| • | Hewitt Associates, Inc. |

| • | Imperial Brands plc |

Degrees

| • | HNC in Business Studies, Thames Valley University, U.K. |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 19

| Charles L. Szews | |||

INDEPENDENT DIRECTOR Former Chief Executive Officer of Oshkosh Corporation and Non-Executive Chair of the Board |

Age: 67 Director since: 2016 Board Committees: Audit Committee, Compensation & Human Resources Committee, Finance/Risk Management Committee, Governance & Corporate Responsibility Committee |

| |

| Key Skills and Expertise | |||

Finance/Accounting/Sox Financial Expert |

Senior Leadership |

Industry Experience |

|

International |

Mergers & Acquisitions |

Human Resources/Cultural |

|

P&L Responsibility |

Technology/Cybersecurity |

||

Qualifications

Mr. Szews was selected to serve on our Board due to his extensive operational and financial experience and his background in public accounting, auditing and risk management. His previous and current board positions on other publicly traded companies have provided many years of audit committee experience, including as chair. Mr. Szews’ extensive financial and audit experience in a variety of senior management positions, combined with his global operational experience in vehicle manufacturing and distribution, including autonomous and electric vehicles, have provided him with a wealth of knowledge in dealing with complex strategic, financial and accounting matters.

Experience

| • | Joined Oshkosh Corporation, a leading global manufacturer of specialty vehicles and vehicle bodies serving access equipment, defense, fire and emergency, and commercial markets, as Vice President and CFO in 1996; appointed Executive Vice President in October 1997; appointed President and Chief Operating Officer in October 2007 |

| • | Served as Chief Executive Officer at Oshkosh Corporation from January 2011 until his retirement in 2016 |

| • | Vice President and Controller at Fort Howard Corporation during its leveraged buyout |

| • | Began his career with Ernst & Young |

Other Current Directorships

| • | Commercial Metals Company |

Former Public Company Directorships

| • | Rowan Companies plc |

| • | Valaris plc |

| • | Allegion plc |

| • | Gardner Denver, Inc. |

| • | Oshkosh Corporation |

Degrees

| • | B.B.A. in Comprehensive Public Accounting, University of Wisconsin – Eau Claire |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 20

| Anne Taylor | |||

INDEPENDENT DIRECTOR Former Vice Chairman and Managing Partner of the Houston office of Deloitte |

Age: 68 Director since: 2018 Board Committees: Audit Committee, Compensation & Human Resources Committee (Chair) |

| |

| Key Skills and Expertise | |||

Industry Experience |

Technology/Cybersecurity |

Mergers & Acquisitions |

|

Human Resources/ Cultural |

P&L Responsibility |

International |

|

Qualifications

Ms. Taylor is financially literate and has participated in audit committee meetings of many Deloitte clients. She was selected to serve on our Board due to her management and leadership experience, extensive background in global technology, development and execution of business strategy, and corporate governance experience.

Experience

| • | Joined Deloitte, a leading global provider of audit and assurance, consulting, financial advisory, risk advisory, tax and related services in 1987, serving as Regional Managing Partner, Chief Strategy Officer and Global Leader for e-business; served as Vice Chairman and Managing Partner of the Houston office from 2005 until her retirement in 2018; chaired the strategic review of the proposed transaction to separate Deloitte Consulting while serving on Deloitte’s Board of Directors |

| • | Became the first woman to serve on Deloitte’s US executive committee and the management committee of Deloitte Global |

| • | Currently serves on the board of Memorial Hermann Hospital System. Previously served on the boards of the Greater Houston Partnership, United Way of Greater Houston and Junior Achievement and chaired the board of Central Houston, Inc. |

| • | Currently serves on the board of directors of Conway Mackenzie and as a consultant for Bravanti, a consulting firm focused on leadership acceleration |

| • | Previously served as the strategic partner advisor to the World Economic Forum’s Technology Pioneer Program |

Other Current Directorships

| • | Southwestern Energy Company |

| • | Chord Energy Corporation (formerly Whiting Petroleum Corporation) |

Former Public Company Directorships

| • | None |

Degrees

| • | B.S. in Engineering, University of Utah |

| • | M.S. in Engineering, University of Utah |

| • | Attended Princeton University, pursuing PhD studies in Transportation Engineering |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 21

| MaryAnn Wright | |||

INDEPENDENT DIRECTOR Former Group Vice President of Johnson |

Age: 62 Director since: 2014 Board Committees: Compensation & Human Resources Committee, Finance/Risk Management Committee, Governance & Corporate Responsibility Committee (Chair) |

| |

| Key Skills and Expertise | |||

Senior Leadership |

Industry Experience |

International |

|

Mergers & Acquisitions |

Technology/Cybersecurity |

P&L Responsibility |

|

Qualifications

Ms. Wright was selected to serve on our Board because of her extensive experience and her knowledge of the automotive industry, having been named one of the “Leading 100 Women in the Automotive Industry” by Automotive News. Her unique business, manufacturing, engineering and technology background and her extensive global automotive experience make her well qualified to serve as a member of our Board.

Experience

| • | Worked for Johnson Controls Power Solutions, the global leader in automotive lead-acid and advanced batteries, from 2007 through 2017, served as Group Vice President of Engineering & Product Development from 2013 through 2017, and Vice President of Technology and Innovation from 2009 to 2013. She served as Vice President and General Manager for Johnson Controls Hybrid Systems business and as CEO of Johnson Controls-Saft from 2007 through 2009. |

| • | Previously served in the office of the Chair and as Executive Vice President Engineering, Product Development, Commercial and Program Management for Collins & Aikman Corporation |

| • | Served as Director, Sustainable Mobility Technologies and Hybrid Vehicle Programs at Ford Motor Company from 1988 through 2005; Chief Engineer of the 2005 Ford Escape Hybrid, the industry’s first full hybrid SUV; led the launch of Ford’s first hydrogen-powered fuel cell fleet program |

| • | Board Chair of the Friends for Animals of Metro Detroit |

Other Current Directorships

| • | Micron Technology, Inc. |

| • | Brunswick Corporation |

| • | Solid Power, Inc. |

Former Public Company Directorships

| • | Delphi Technologies |

| • | Maxim Integrated Products, Inc. |

Degrees

| • | B.A. in Economics and International Business, University of Michigan |

| • | M.S. in Engineering, University of Michigan |

| • | M.B.A., Wayne State University |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 22

Group 1 is committed to strong corporate governance practices that are designed to maintain high standards of oversight, accountability, integrity and ethics. The Board believes this commitment promotes long-term shareholder value.

Our Board has adopted robust governance practices and continuously reviews and considers these practices to enhance its effectiveness.

| Effective Board oversight | Commitment to shareholder rights | |

|

• Qualified Board with diverse mix of perspectives and tenures

• Regular Board review of strategic plans and priorities

• Regular Board/committee review of significant risks, including cybersecurity risks

• Annual Board evaluation of CEO performance

• CEO and senior management succession planning |

• No hedging, short sales or pledging of Group 1 securities by officers or directors

• Rigorous stock ownership requirements for directors and senior management

| |

| Board independence | Board accountability | |

|

• 7 out of 9 director nominees are independent

• Independent directors meet regularly without management

• Fully independent Audit, CHR and GCR Committees

• Independent Chair and separation of the Chair and CEO roles

|

• Annual Board and committee evaluations

• Annual election of all directors

• Majority voting for directors in uncontested elections

• Ongoing consideration of Board composition and refreshment

• Limits on Board member service on other public company boards |

This commitment to sound governance is also reflected in our Code of Conduct, which reinforces our values and high standards by:

| • | Explaining how our core values of Integrity, Respect, Teamwork, Transparency and Professionalism must inform our actions |

| • | Guiding employees’ conduct with each other, our business partners and our communities |

| • | Emphasizing the responsibility to conduct our business with uncompromising honesty and integrity consistent with our core values, and to report violations of the Code of Conduct without fear of retaliation for good faith reporting |

| • | Discouraging conflicts of interest |

We encourage you to visit the Corporate Governance section of our website at www.group1corp.com for more information about corporate governance at Group 1.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 23

The GCR Committee annually reviews the leadership structure of the Board. In 2023, the GCR Committee affirmed that having an independent director serve as non-executive Chair of the Board continues to be in the best interest of our shareholders at this time. Under our Corporate Governance Guidelines, the Board does not have a policy on whether the roles of Chair of the Board and CEO should be separate or combined. Instead, the Board selects the structure that it believes will provide the most effective leadership and oversight for the Company in the circumstances.

Our CEO is responsible for setting our strategic direction and providing day-to-day leadership, while the Chair of the Board sets the agenda for Board meetings, presides over meetings of the full Board and provides guidance to our CEO. We believe this structure currently provides a greater role for the independent directors in the oversight of our Company and active participation of the independent directors in establishing priorities and procedures for our Board.

Our Board and each of its committees annually conduct a self-evaluation to assess and identify opportunities to improve their respective performance.

| Oversight and leadership | How it works | |||

| The GCR Committee, with assistance from the Board Chair, oversees the annual self-evaluation process. | 1 We engage a third party to collect and summarize feedback on each Board committee. |

3 The results are shared with the committee members and the committee chairs review the results with their committee members. | ||

2 The Board Chair meets individually with each committee chair to discuss the results of the committee’s evaluation. |

4 The results of the Board evaluations are shared with the full Board and the Board Chair leads a discussion of the results and responsive actions to be taken. |

| How it contributes to Board performance | |

|

The evaluations help the Board review:

• Board roles

• Board preparedness, effectiveness and priorities

• Committee assignments, leadership and performance

• Refreshment objectives, including diversity and compensation

• Director succession planning

• Individual director development |

The evaluations have generated improvements to our corporate governance practices and the Board’s effectiveness, including:

• Allocating more time to private sessions of the independent directors

• Prioritizing time at Board meetings for strategy, strategy execution, succession and other discussions

• Expanding information shared with the Board

• Increasing dealership visits

• Enhancing continuing education

• Improving the Board’s self-evaluation process |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 24

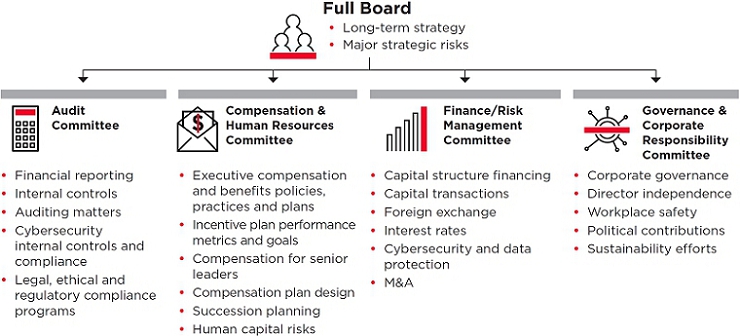

Our Board currently has a standing Audit Committee, CHR Committee, GCR Committee and Finance/Risk Management (“FRM”) Committee. The Audit, GCR and CHR Committees are each composed exclusively of independent directors. Mr. Pereira (a former employee) chairs the FRM Committee (which is not a required committee under New York Stock Exchange (“NYSE”) or Securities and Exchange Commission (“SEC”) rules), because the Board believes he brings particular insights on topics within this committee’s responsibilities.

Each standing committee has the authority to retain independent advisors, to approve the fees paid to those advisors, and to terminate their engagements.

Each committee operates under a charter that it reviews annually. These charters are available on the Corporate Governance section of our website (www.group1corp.com).

|

Audit

Carin M. Barth |

|

|

2023 MEETINGS: 10

COMMITTEE MEMBERS

Stephen D. Quinn

|

• Assists the Board in overseeing and monitoring: the integrity of the Company’s financial statements; the qualifications, independence and performance of the Company’s internal and external auditors; the Company’s compliance with its policies and procedures, internal controls, Code of Conduct, and applicable laws and regulations; and policies and procedures for assessing and managing financial, operational, compliance and other risks

• Recommends the Board submit for shareholder ratification an accounting firm to serve as the Company’s independent auditor and maintains responsibility for compensation, retention and oversight of the auditor

• Pre-approves all auditing services and permitted non-audit services to be performed for the Company by its independent auditor

• Reviews and approves the appointment and replacement of the senior Internal Audit executive

The Board has determined that Ms. Barth, Mr. Quinn, and Mr. Szews each are “audit committee financial experts,” as defined in the SEC rules. | |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 25

|

Compensation & Human Resources

Anne Taylor |

|

|

2023 MEETINGS: 5

COMMITTEE MEMBERS

Steven C. Mizell

|

• Reviews and approves the Company’s executive compensation policies and practices

• Reviews and approves the design of, and sets performance goals for, our annual and long-term incentive programs for executives

• Evaluates the performance of the Company and our NEOs relative to performance goals set by the CHR Committee for the annual and long-term incentive programs

• Reviews and recommends to the Board for approval compensation for the CEO

• Reviews and approves compensation for the other executive officers of the Company

• Evaluates the Company’s compensation policies and practices for any material risks and related mitigation strategies

• Reviews and assesses the development of potential successors to the CEO

• Oversees the Company’s practices, policies, strategies and goals relating to human capital resources management | |

|

Governance & Corporate Responsibility

MaryAnn Wright |

|

|

2023 MEETINGS: 4

COMMITTEE MEMBERS

Carin M. Barth

|

• Identifies and recommends qualified candidates for election to the Board

• Develops and recommends modifications to our Corporate Governance Guidelines

• Reviews and recommends to the Board the need for any changes in the number, composition, and leadership of the Board and its committees

• Reviews and monitors the orientation of new Board members and the continuing education of all directors

• Oversees the design and conduct of the annual self-evaluation of the Board, its committees and individual directors

• Reviews corporate governance developments and trends and, where appropriate, makes recommendations to the Board on the Company’s governance

• Implements the succession process for the CEO, including in the event of an emergency or retirement

• Recommends to the Board appropriate compensation of non-employee directors | |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 26

|

Finance/Risk Management

Lincoln Pereira Filho |

|

|

2023 MEETINGS: 4

COMMITTEE MEMBERS

Carin M. Barth

|

• Reviews certain finance-related activities within limits prescribed by the Board

• Reviews risk management-related activities and oversees the Company’s risk assessment and management policies

• Reviews policies and programs related to: dividends and share repurchases; financing, working and long-term capital requirements; managing exposure with respect to foreign exchange, interest rates; and insurance and risk management

• Provides guidance to the Board and management, as applicable, as to the Company’s financial condition and capital structure; long-term and short-term financial policies and objectives; financial strategies, guidelines and procedures; and compliance with material debt instruments and credit facilities; future capital spending and acquisition opportunities; and capital expenditure plans

• Oversees the Company’s treasury activities and insurance programs

• Reviews the Company’s cybersecurity risk exposures and monitors the Company’s cybersecurity and information security programs | |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 27

Under the Company’s Corporate Governance Guidelines and the NYSE listing standards, a majority of our directors must be independent, meaning that, among other things, they do not have a direct or indirect material relationship with our Company (other than as a director). As part of the Board’s analysis, it determined that none of the non-employee directors have a material relationship with our Company. Mr. Kenningham was determined not to be independent because he is a current employee of Group 1, and Mr. Pereira was determined not to be independent because he was an employee of Group 1 within the past three years. Other than Messrs. Kenningham and Pereira, each nominee satisfies our independence criteria.

The Board has determined that each of the members of the Audit Committee, CHR Committee and GCR Committee are independent under applicable NYSE and SEC rules for committee memberships, and that each member of the Audit Committee also meets the additional independence criteria set forth in Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Four of the six members of the FRM Committee are independent as defined under the NYSE’s listing standards.

During the annual independence review, our GCR Committee determined that the affiliations that our directors have with charitable organizations did not impact the independence of our directors. We did not make any charitable donations to any organizations affiliated with our directors or officers in 2023.

Our Board provides active and independent oversight and guidance to management regarding the Company’s long-term strategy and priorities, risk management, CEO and senior management succession planning, as well as other aspects of our business and affairs. In addition, the Board has adopted robust governance practices to enhance its effectiveness and is engaged on behalf of our shareholders.

As part of its oversight role, the Board:

| • | Annually reviews the Company’s long-term plan and objectives |

| • | Engages in ongoing discussions of near-, medium- and long- term risks and strategic matters, including economic conditions, industry trends and developments, and their impacts on our business, as well as strategic challenges and opportunities |

| • | Is regularly briefed on assessments of the Company’s business portfolio and is engaged in the Company’s acquisitions, divestitures, and other corporate development activities |

| • | Receives regular updates on management’s progress and execution of the Company’s strategy and reviews and approves the Company’s annual budget |

| • | Periodically receives briefings from experts and counsel on strategic, financial, legal and compliance, and other matters |

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 28

The chart below shows the current allocation of general risk oversight functions between management and the Board.

| Management | Board of Directors | |

|

Responsible for identifying, assessing, prioritizing and managing the various risks the Company faces

• Responsible for employing a comprehensive enterprise risk management (“ERM”) program including the establishment and monitoring of robust risk mitigation plans

• Seeks to maintain robust internal processes and an effective internal control environment |

Responsible for Board/committee risk oversight governance, including allocation of risk oversight responsibilities

• FRM Committee oversees management’s ERM program

• The Board has allocated responsibilities to itself and its committees for overseeing particular risks, as shown below |

The Board’s risk oversight governance framework is designed to enable it to understand significant near-, medium- and long-term risks in the Company’s business and strategy, allocate responsibilities for risk oversight among the full Board and its committees, evaluate the Company’s risk management processes and whether they are functioning adequately, and engage in regular communications with management regarding risk trends and developments. For the sake of efficiency, the full Board retains primary oversight responsibility over certain risks that cut across the subject area expertise of multiple committees.

The Company seeks to maintain robust internal processes and an effective internal control environment that facilitate the identification and management of risks and regular communication with the Board. A core element is the Company’s ERM program, which is designed to identify and evaluate the full range of significant risks to the Company, including legal, compliance, financial, operational, strategic and reputational risks. Our Finance function leads the ERM program, with an annual cycle for structured reviews, discussions, and mitigation planning. Risks are identified and evaluated through both a “bottom-up” and a “top-down” process involving senior management and all of the functions and business units. Through this process, senior management considers trends and developments, as well as the effectiveness of the Company’s mitigation plans. Our risk management processes are informed by the results of our ERM program, including those relating to our Internal Audit plans and our financial reporting and SEC disclosures. In addition, from time to time, the individuals responsible for our ERM Program, as well as for the underlying risks within our risk universe, may engage outside advisors and experts for purposes such as benchmarking, testing and assessing their programs and associated controls and procedures.

Management regularly reviews significant risks, including trends and developments, with the Board and its committees, providing updates on long-term risks during annual long-range planning, strategic reviews and through regular reviews of annual operating plans, as well as providing a near- and medium-term focus on financial performance, market environment updates, and presentations on specific associated risk areas. Between Board and committee meetings, directors receive updates regarding developments in the Company’s business as well as emerging risks.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 29

Our Board recognizes the importance of maintaining the trust and confidence of our customers, vendors, shareholders and employees, and devotes significant time and attention to oversight of cybersecurity and information security risk. The Board delegates oversight of our operations risk, including quarterly reviews of cybersecurity and data protection, to the FRM Committee, and delegates compliance with cybersecurity policies to the Audit Committee. Both the FRM Committee and the Audit Committee report to the full Board on cybersecurity matters. Additionally, on an annual basis, management reviews results from tests of key cybersecurity systems with the full Board and the steps taken to mitigate new cybersecurity risks which have been identified. In particular, the Company seeks to assess, identify and manage cybersecurity risks through various processes, including through a multi-layered risk assessment system, security information and event management system, cybersecurity training and awareness, access controls and encryption and data protection. Our IT and Security team, which is headed by our Chief Information Officer (the “CIO”), is responsible for our efforts to comply with cybersecurity standards, establish industry-recognized protocols and protect the integrity, confidentiality and availability of our IT infrastructure. Our CIO and various members of the IT and Security team meet regularly with members of management to address key security and privacy issues, and upon the occurrence of a cybersecurity incident, would convene to assess the materiality of the event and any disclosure obligations, as well as the appropriate remediation and escalation procedures, including escalation to our Chief Executive Officer and the Board of Directors.

The CHR Committee believes that executive compensation payouts must:

| • | Align with the Company’s financial performance |

| • | Be earned in a manner consistent with Group 1’s Code of Conduct |

| • | Promote long-term, sustainable value creation for shareholders |

| • | Provide fair and equitable pay regardless of race and gender |

| • | Strike a balance between appropriate levels of financial opportunity and risk |

| • | Create retention incentives |

The CHR Committee identifies, monitors and mitigates compensation risk in the following ways:

| Sound Incentive Plan Design | The CHR Committee establishes financial performance goals that are challenging, yet realistic. Our program design provides a balanced mix of cash and equity, annual and longer-term incentives. |

| Emphasis on Long-Term Performance | Our long-term incentive program incorporates long-term financial performance metrics that are designed to align the executive’s interests with shareholders’ interests and are capped at industry standard levels. We also cap the number of shares that may be awarded to an individual in a calendar year. |

| Rigorous Share Ownership Requirements | We maintain robust share ownership requirements for our senior executives and directors. These requirements are intended to reduce risk by aligning the economic interests of executives and directors with those of our shareholders. A significant stake in future performance discourages the pursuit of short-term opportunities that can create excessive risk. See page 35 for more information. |

| Prohibition on Short Sales, Pledging and Hedging of Securities | We prohibit directors, officers and employees from entering into transactions involving short sales of our securities. Directors and officers also are prohibited from pledging or assigning Group 1 equity interests as collateral for a loan. Transactions in put options, call options or other derivative securities that have the effect of hedging the value of our securities also are prohibited. |

| Clawback Policy | We maintain a comprehensive policy that provides for the recoupment of incentive compensation if we restate (as defined in the Clawback Policy) our financial statements and recoupment is required under the NYSE listing standards. |

| Post-Employment Covenants | Certain of our NEOs have contractually agreed to not engage in post-employment activities detrimental to the Company, such as disclosing proprietary information, soliciting Group 1 employees or engaging in competitive activities. |

We believe that, for all employees, our compensation programs do not encourage excessive risk and instead encourage behaviors that support sustainable value creation aligned with our shareholders’ interests.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 30

The CHR and GCR Committees provide oversight over CEO and senior management succession planning as follows:

| Compensation & Human Resources Committee |

• At least twice annually, reviews and assesses the development of potential successors for our CEO and other senior leadership. • Recommends to the GCR Committee potential candidates for CEO succession. |

| Governance & Corporate Responsibility Committee |

• Identifies and periodically updates the qualities and characteristics necessary for an effective CEO and other senior leaders of the Company. • Responsible for implementing the succession process for the CEO, including in the event of emergency or retirement. |

In addition, at an annual joint meeting of the CHR Committee and the Board, the CEO and the Senior Vice President & Chief Human Resources Officer brief the Board on succession planning for key senior leadership roles, including the CEO role. The Board’s views are incorporated into succession plans, which are updated annually based on this feedback. Succession plans include readiness assessments, biographical information and career development plans.

Our core values of integrity, transparency, professionalism, teamwork and respect underlie our commitment to conduct our business in ways that are principled and accountable to our shareholders and other key stakeholders, and the communities in which we do business. We are committed to transparency in sharing our sustainability progress. For updates on our progress and to access our Sustainability Reports, please visit https://www.group1corp.com/ESG.

Our CEO is ultimately responsible for our sustainability strategy and performance, with oversight by our Board. As with risk management oversight, the Board has allocated oversight responsibility for sustainability matters to its committees, while retaining full Board oversight of matters that cut across the expertise of multiple committees.

|

Governance & Corporate Responsibility Committee |

|

Compensation & Human Resources Committee |

|

Audit Committee |

|

Finance/Risk Management Committee | |||

• Environmental responsibility & compliance • Health, safety & wellness • Community engagement and charitable efforts |

• Human capital management, including DE&I and talent attraction, development and engagement • Compensation plans and benefits |

• Ethics & compliance | • Data privacy and security | |||||||

The committees are regularly briefed by management on matters for which they have responsibility, including briefings on the Company’s programs, initiatives, goals, risks and opportunities related to these matters. The Board also discusses sustainability risks and opportunities in the context of its review of the Company’s top enterprise risks and mitigation plans, strategic priorities, and long-term planning.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 31

Group 1 is committed to engaging in constructive and meaningful conversations with our shareholders, employees, customers, vendors, regulators and local communities to build long-term relationships. The Board values the input and insights of our stakeholders, and regularly monitors investor sentiment, shareholder voting results, and trends in governance, executive compensation, regulatory, environmental, social and other matters. Each year, management interfaces with prospective investors, existing shareholders, and investment research analysts to discuss the Company’s publicly disclosed performance, business strategy and outlook, and corporate governance. These events include earnings teleconferences, investor calls, meetings, and conferences, non-deal roadshows and site visits.

Key topics include discussions regarding capital allocation, share repurchases, publicly disclosed acquisitions, the impact of our inventory supply on new and used vehicle sales, market trends, parts and service strategies, finance and insurance strategies, digital retail strategies and profitability. This interaction helps management and the Board to understand and consider the views of Group 1’s shareholders, perception of the investment community, and industry and economic outlook from research analysts, while enabling the Company to effectively operate in an evolving industry and economy with a focus of maximizing returns for our shareholders.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 32

Pay Structure

The annual retainer paid to non-employee directors for the 2023 Board cycle is dependent upon the role each director holds, as follows:

| Annual Cash Compensation(1)(2) | 2023 ($) |

|

| Annual Retainer | ||

| Annual Cash Retainer | 45,000 | |

| Equity Retainer(3) | 200,000 | |

| Additional Annual Retainers | ||

| Non-Executive Chair of the Board | 135,000 | |

| Audit Committee Chair | 30,000 | |

| Compensation & Human Resources Committee Chair | 25,000 | |

| Finance/Risk Management Committee Chair | 25,000 | |

| Governance & Corporate Responsibility Committee Chair | 25,000 | |

| Annual Vehicle Stipend | 20,000 |

| (1) | Annual cash retainers are paid quarterly. |

| (2) | Non-employee directors do not receive additional compensation for attending regular Board or committee meetings. |

| (3) | Paid as either restricted stock or restricted stock units, in each case valued at approximately $200,000 on the grant date. |

For 2023, our non-employee directors were paid an annual equity retainer consisting of either restricted stock or restricted stock units valued at approximately $200,000 on the grant date. Messrs. Pereira, Quinn, Stanbrook and Szews elected to receive restricted stock and Mses. Barth, Taylor and Wright and Mr. Mizell elected to receive restricted stock units. The grant was effective January 2, 2023 with the value determined based on the average of the high and low market price of our common stock on that date. Accordingly, each non-employee director received 1,102 shares of restricted stock or restricted stock units, as applicable. Mr. Kenningham receives no compensation for his service as a director.

Restricted stock or restricted stock units granted to our directors vest immediately upon issuance and will settle upon the retirement, death or disability of the director. Since January 1, 2019, all restricted stock units have been settled in cash; prior thereto restricted stock units were settled in shares of common stock upon the termination of the director’s membership on our Board. All accrued dividends related to restricted stock units are also settled in cash upon termination of the director’s membership on our Board.

Non-employee directors currently cannot defer director compensation under the Company’s Deferred Compensation Plan. However, previously deferred amounts remain deferred under the Deferred Compensation Plan until the originally scheduled payment date. Please see the section entitled “Executive Compensation — Nonqualified Deferred Compensation for the 2023 Fiscal Year” for a more fulsome description of the Company’s Deferred Compensation Plan.

GROUP 1 AUTOMOTIVE 2024 PROXY STATEMENT 33

Prior to January 1, 2021, the Company’s Deferred Compensation Plan permitted non-employee directors who elected to participate an opportunity to accumulate additional savings for retirement on a tax-deferred basis. These directors could defer in the Deferred Compensation Plan any portion of their cash compensation received for services provided to our Board or its committees, while remaining 100% vested in deferred funds. We have complete discretion over how the deferred funds are utilized and they represent our unsecured obligation to the participants.

2023 Director Compensation

The following table sets forth a summary of the compensation we paid to our non-employee directors in 2023.

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1),(2) ($) | All Other Compensation(3) ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings(4) ($) | Total ($) | |||||

| Carin M. Barth | 75,000 | 199,853 | 20,000 | 7 | 294,860 | |||||

| Steven C. Mizell | 45,500 | 199,853 | 20,000 | - | 264,853 | |||||

| Lincoln Pereira Filho | 57,500 | 199,853 | 20,000 | - | 277,353 | |||||

| Stephen D. Quinn | 112,500 | 199,853 | 20,000 | - | 332,353 | |||||