UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the fiscal year ended December 31 , 2022

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period from to

Commission file number: 001-13461

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| | |||||||||||

| | (Zip code) | ||||||||||

| (Address of principal executive offices) | |||||||||||

(713 ) 647-5700

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Ticker symbol(s) | Name of exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| þ | ¨ | Accelerated filer | ||||||||||||

| Non-accelerated filer | ¨ | Smaller reporting company | ||||||||||||

| Emerging growth company | ||||||||||||||

If an emerging growth company, indicate by check mark if that registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

The aggregate market value of common stock held by non-affiliates of the registrant was approximately $2.6 billion based on the reported last sale price of common stock on June 30, 2022, which was the last business day of the registrant’s most recently completed second quarter.

As of February 10, 2023, there were 14,207,379 shares of our common stock, par value $0.01 per share, outstanding.

TABLE OF CONTENTS

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

i

GLOSSARY OF DEFINITIONS

The following are abbreviations and definitions of terms used within this report:

| Terms | Definitions | |||||||

| Brexit | Withdrawal of the U.K. from the EU | |||||||

| BRL | Brazilian Real (R$) | |||||||

| CODM | Chief operating decision maker | |||||||

| COVID-19 pandemic | Coronavirus disease first emerging in December 2019 and resulting in the ongoing global pandemic in 2020, 2021 and 2022 | |||||||

| EBITDA | Earnings before interest, taxes, depreciation and amortization | |||||||

| EV | Electric vehicle | |||||||

| EPS | Earnings per share | |||||||

| EU | European Union | |||||||

| F&I | Finance, insurance and other | |||||||

| FMCC | Ford Motor Credit Company | |||||||

| GBP | British Pound Sterling (£) | |||||||

| GDP | Gross domestic product | |||||||

| IRS | Internal Revenue Service | |||||||

| LIBOR | London Interbank Offered Rate | |||||||

| NOL | Net operating loss | |||||||

| NYSE | New York Stock Exchange | |||||||

| OEM | Original equipment manufacturer | |||||||

| PRU | Per retail unit | |||||||

| PSU | Performance stock unit | |||||||

| ROU | Right-of-use | |||||||

| RSA | Restricted stock award | |||||||

| RSU | Restricted stock unit | |||||||

| SAAR | Seasonally adjusted annual rate of vehicle sales | |||||||

| SEC | Securities and Exchange Commission | |||||||

| SG&A | Selling, general and administrative | |||||||

| SOFR | Secured Overnight Financing Rate | |||||||

| USD | United States Dollar | |||||||

| U.K. | United Kingdom | |||||||

| U.S. | United States of America | |||||||

| U.S. GAAP | Accounting principles generally accepted in the U.S. | |||||||

| VSC | Vehicle service contract | |||||||

| WACC | Weighted average cost of capital | |||||||

1

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

Unless the context requires otherwise, references to “we,” “us,” “our,” or “the Company” mean the business and operations of Group 1 Automotive, Inc. and its subsidiaries.

This Annual Report on Form 10-K (“Form 10-K”) includes certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). These forward-looking statements include, but are not limited to, statements concerning our strategy, future operating performance, future liquidity and availability of financing, capital allocation, the completion of future acquisitions and divestitures, business trends in the retail automotive industry and changes in regulations. When used in this Form 10-K, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may” and similar expressions are intended to identify forward-looking statements.

These forward-looking statements are based on our expectations and beliefs as of the date of this Form 10-K concerning future developments and their potential effect on us. While management believes that these forward-looking statements are reasonable when and as made, there can be no assurance that future developments affecting us will be those that we anticipate. Our forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements, including, but not limited to, the risks set forth in Item 1A. Risk Factors.

Readers are cautioned not to place undue reliance on forward-looking statements. We undertake no responsibility to publicly release the result of any revision of our forward-looking statements after the date they are made, except as required by law.

2

PART I

Item 1. Business

General

Group 1 Automotive, Inc. is a leading operator in the automotive retail industry. Through our omni-channel platform, we sell new and used cars and light trucks; arrange related vehicle financing; sell service and insurance contracts; provide automotive maintenance and repair services; and sell vehicle parts. We are a multinational organization, with operations in geographically diverse markets that extend across 17 states in the U.S. and 34 towns and cities in the U.K. As of December 31, 2022, our retail network consisted of 149 dealerships in the U.S. and 55 dealerships in the U.K.

Discontinued Operations

On November 12, 2021, we entered into a Share Purchase Agreement (the “Brazil Agreement”) with Original Holdings S.A. (“Buyer”). Pursuant to the terms and conditions set forth in the Brazil Agreement, Buyer agreed to acquire 100% of the issued and outstanding equity interests of our Brazilian operations (the “Brazil Disposal Group”) for approximately BRL 510 million in cash (the “Brazil Disposal”). On July 1, 2022, we completed the Brazil Disposal. The Brazil Disposal Group met the criteria to be reported as discontinued operations. Therefore, the related assets, liabilities and operating results of the Brazil Disposal Group are reported as discontinued operations (the “Brazil Discontinued Operations”) for all periods presented. Effective as of the fourth quarter of 2021, we are aligned into two reportable segments: the U.S. and the U.K. Refer to Note 20. Segment Information within our Notes to Consolidated Financial Statements within this Form 10-K, for further information on our reportable segments. Refer to Note 4. Discontinued Operations and Other Divestitures within the Notes to Consolidated Financial Statements within this Form 10-K, for additional information regarding business dispositions. Unless otherwise specified, disclosures in this Form 10-K reflect continuing operations only.

Dealership Operations

Our new vehicle revenues include new vehicle sales and new vehicle lease transactions, sold at our dealerships or via our digital platform, AcceleRide®. We sell retail used vehicles directly to our customers at our dealerships and via AcceleRide® and wholesale our used vehicles at third party auctions. We sell replacement parts and provide both warranty and non-warranty maintenance and repair services at each of our franchised dealerships, as well as provide collision repair services at the 46 collision centers that we operate. We also sell parts to wholesale customers. Revenues from our F&I operations consist primarily of fees for arranging financing and selling vehicle service and insurance contracts in connection with the retail sale of a new or used vehicle. We offer a wide variety of third-party finance, vehicle service and insurance products in a convenient manner at competitive prices. We showcase our products on menus that display pricing and other information, allowing customers to choose the products that suit their needs.

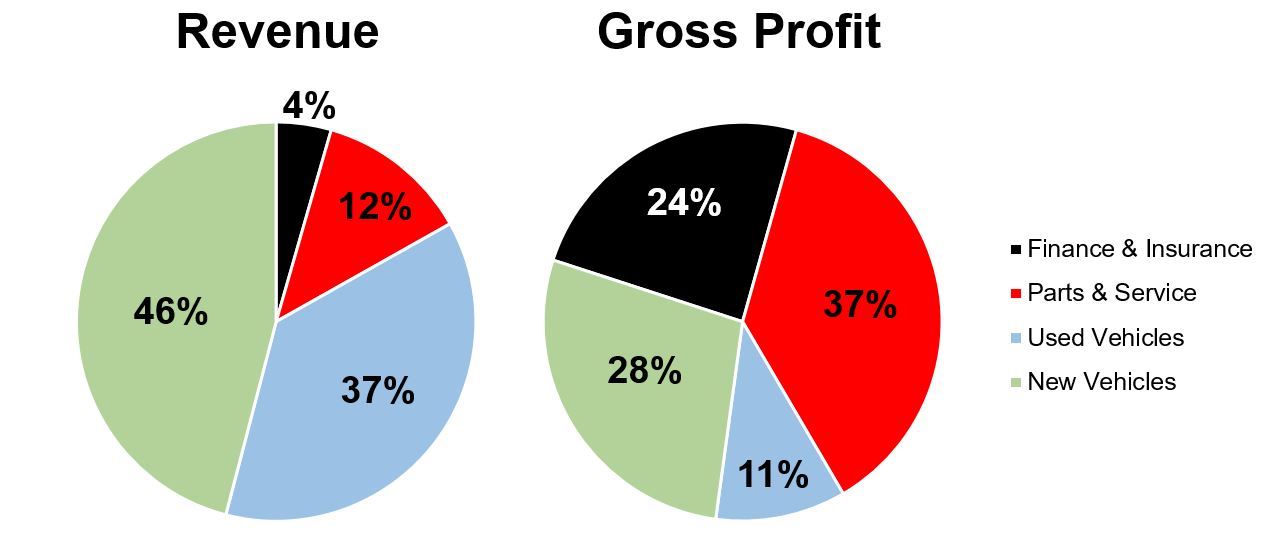

The following chart presents total revenues and gross profit contribution from our operations by new vehicles, used vehicles, parts and service and F&I for the year ended December 31, 2022 (“Current Year”):

3

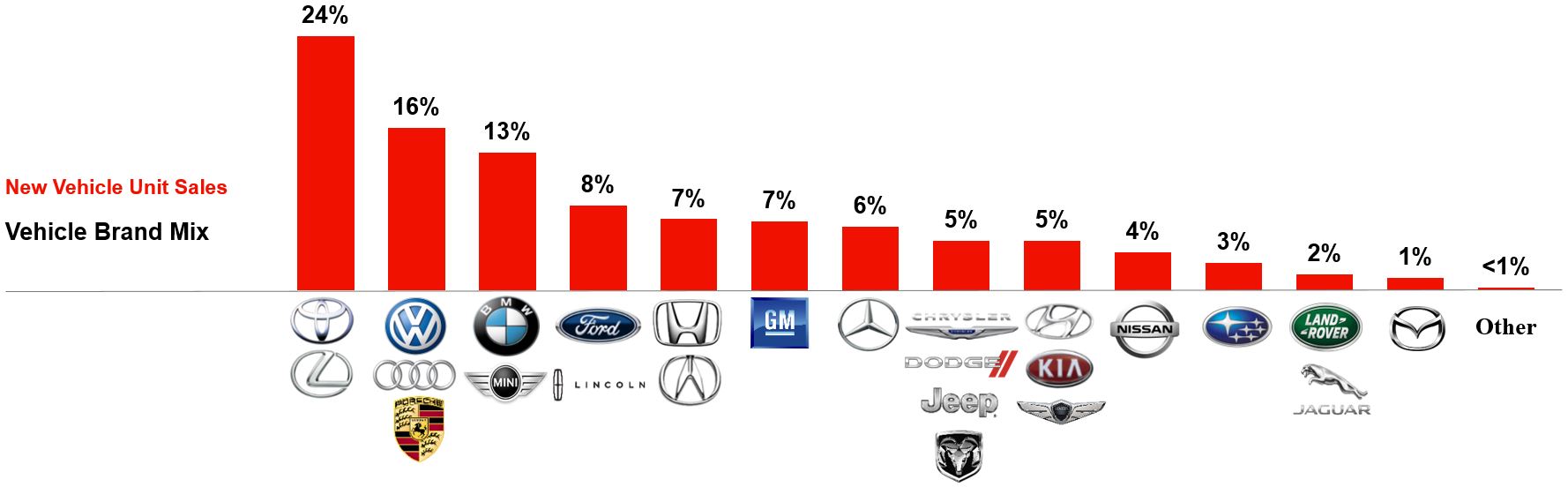

The following chart presents our diversity of new vehicle unit sales by manufacturer for the Current Year:

The following table shows our new vehicle unit sales geographic mix for the Current Year and our franchise count as of December 31, 2022:

| New vehicle unit sales geographic mix (%) | Franchises | ||||||||||||||||

| Region | Geographic Market | ||||||||||||||||

| U.S. | Texas | 37.2 | % | 76 | |||||||||||||

| Massachusetts | 9.9 | % | 22 | ||||||||||||||

| Oklahoma | 5.8 | % | 20 | ||||||||||||||

| California | 5.4 | % | 7 | ||||||||||||||

| Georgia | 3.8 | % | 9 | ||||||||||||||

| New Mexico | 2.4 | % | 9 | ||||||||||||||

| Maine | 2.3 | % | 11 | ||||||||||||||

| New Jersey | 2.2 | % | 9 | ||||||||||||||

| New Hampshire | 1.9 | % | 5 | ||||||||||||||

| Florida | 1.9 | % | 4 | ||||||||||||||

| South Carolina | 1.8 | % | 3 | ||||||||||||||

| Louisiana | 1.7 | % | 10 | ||||||||||||||

| Kansas | 1.5 | % | 3 | ||||||||||||||

| New York | 1.4 | % | 4 | ||||||||||||||

| Alabama | 0.7 | % | 2 | ||||||||||||||

| Maryland | 0.6 | % | 2 | ||||||||||||||

| Mississippi | 0.3 | % | 1 | ||||||||||||||

| 80.8 | % | 197 | |||||||||||||||

| U.K. | United Kingdom | 19.2 | % | 78 | |||||||||||||

| 100.0 | % | 275 | |||||||||||||||

4

Business Strategy

Our business strategy is built upon our commitment to maximize the return on investment for our stockholders. We intend to execute our business strategy by staying close to our core competencies and focusing on three key initiatives, each as further described below:

•organizational growth;

•teamwork and collaboration; and

•aftersales excellence.

Key to the success of these initiatives, is our determination to be great partners to those around us, including but not limited to our customers, employees, vendors, OEM partners, philanthropic partners and the communities in which we do business.

Organizational Growth

In 2021 and 2022, the retail automotive industry experienced multiple merger and acquisition transactions aimed at further consolidation of the industry. Despite this increase in merger and acquisition activity, the industry remains fragmented to a significant degree. We believe there will continue to be opportunity for consolidation within the industry. Consistent with our acquisition activity completed in 2021 and 2022, we intend to pursue growth opportunities in 2023, specifically focusing on brands and dealerships that will provide attractive returns to our dealership portfolio.

We evaluate all brands and geographies to expand our portfolio, seeking to acquire dealerships in growth-positioned or economically stable markets, or that are economically accretive to our existing markets. Acquisitions completed within our existing markets allow us to capitalize on economies of scale and provide for cost saving opportunities in key expense areas such as used vehicle sourcing, advertising, purchasing, data processing and personnel utilization. In addition to cost savings opportunities, scale enables us to make the EV, facility, compliance, real estate, and technology investments necessary to thrive in today’s retail automotive industry.

In addition to expanding our portfolio of dealerships through acquisitions, from time to time, we make decisions to optimize our portfolio by disposing of certain dealerships. In some instances, we dispose of underperforming dealerships where we no longer believe opportunity exists for improvement. We may also dispose of certain dealerships in order to complete strategic acquisition opportunities. We may dispose of a less significant dealership to allow us to acquire a more substantial dealership within the same or another geographic area based on the ownership limitations in the respective franchise agreement.

Refer to Note 3. Acquisitions and Note 4. Discontinued Operations and Other Divestitures within the Notes to Consolidated Financial Statements within this Form 10-K, for additional information regarding our acquisitions and dispositions.

Teamwork and Collaboration

As a multinational automotive retailer, we seek to identify and implement operational improvements within our dealerships by leveraging the unique and varying experiences of our U.S. and U.K. automotive retailers. The U.K. has adopted EV technology at a much faster pace than the U.S., providing us the opportunity to develop best-in-class practices for servicing EV customers through our U.K. dealerships. Alternatively, our dealerships in the U.S. were the first to adopt the use of AcceleRide® and likewise developed standard practices to enhance the customer experience with this technology. With teamwork and collaboration, we are sharing these best-in-class standard practices across our U.S. and U.K. operations.

In addition to benefiting from our shared dealership experiences, we are capitalizing on technology advances in robotic process automation and artificial intelligence to improve our marketing, call center and back-office efficiency. This effort, in recent years, has primarily focused on our U.S. dealerships, from which we have gained valuable insight and knowledge. In late 2022, we launched our first use of robotics within the back-office functions of the U.K. This effort is expected to continue throughout 2023 as we leverage the already established processes developed in the U.S. We continuously evaluate our processes to identify opportunities for process automation, enabling us to facilitate our customers’ vehicle inventory selection on a more expedited basis, process parts inventory and F&I products transactions quicker and price cars more competitively for our customers using the latest and most accurate information available. We believe our continued focus on process automation, while collaborating across our global retail operations, is a key value differentiator within the industry for our stockholders.

5

Aftersales Excellence

We look to strengthen our aftersales excellence by further driving sustained growth in our higher margin parts and service operations. Our success hinges on the retention and hiring of skilled service technicians and advisors and customer retention levels.

Many of our U.S. service operations utilize a four-day work week for service technicians and advisors which allows us to expand our hours of operations during the week. This change has resulted in increased service technician and advisor retention, thereby expanding our service capacity without investing additional capital in facilities.

With a focus on the aftersales impact on the customer journey, we have and will continue to increase customer retention through more convenient service hours, training of our service advisors, selling service contracts with vehicle sales and customer relationship management software that allows us to provide targeted marketing to our customers. Our online service appointment platform and centralized call centers have also improved the customer experience. Improved aftersales customer retention should lead to future additional or replacement vehicle purchases, continuing the containment of the entire customer life cycle within our dealerships.

The complexity of vehicles, especially in the area of electronics, and technological advancements, are making it increasingly difficult for independent repair shops to maintain the expertise and technology to work on these vehicles. Our service departments are equipped for any EV make and any model on the road today. This provides us the opportunity to advance our market share well into the future.

Competition

The automotive retail industry is highly competitive across all our service lines. Consumers have a number of choices when deciding where and how to (i) purchase a new or used vehicle as well as select related vehicle financing and insurance products; (ii) purchase related parts and accessories; and (iii) procure vehicle maintenance and repair services.

New and Used Vehicles Sales

We believe the principal competitive factors in the automotive retailing business are location, service, price, selection, online capabilities, established customer relationships, and reputation. In the new vehicle market, our dealerships compete with other franchised dealerships in their market areas, as well as auto brokers, leasing companies and internet companies that provide referrals to, or broker vehicle sales with, other dealerships or customers. Our new vehicle dealer competitors also have franchise agreements with the various vehicle manufacturers and, as such, generally have access to new vehicles on the same terms as we do. We do not have any cost advantage in purchasing new vehicles from vehicle manufacturers, and our current franchise agreements do not grant us the exclusive right to sell a manufacturer’s product within a given geographic area. Several companies are currently manufacturing EVs for sale primarily through the internet, under a direct to consumer model, without using the traditional dealer-network or are considering such a strategy, including some of our manufacturer partners.

In the used vehicle market, our dealerships compete both in their local market and nationally with other franchised dealers, large multi-location used vehicle retailers, local independent used vehicle dealers, automobile rental agencies and private parties for the supply and resale of used vehicles.

Parts and Service

We believe the principal competitive factors in the parts and service business are the quality of customer service, the use of factory-approved replacement parts, familiarity with a manufacturer’s brands and models, location, price, the availability and competence of technicians, and the availability of training programs to enhance such expertise. In the parts and service market, our dealerships compete with other franchised dealers to perform warranty maintenance and repairs, conduct manufacturer recall services and sell factory replacement parts. Our dealerships also compete with other automobile dealers, franchised and independent service center chains and independent repair shops for non-warranty repair and maintenance business. In addition, our dealerships sell replacement and aftermarket parts both locally and nationally in competition with franchised and independent retail and wholesale parts outlets. A number of regional or national chains offer selected parts and services at prices that may be lower than ours. Our collision centers compete with other large, multi-location companies, as well as local, independent, collision service operations.

F&I

We believe the principal competitive factors in the F&I business are convenience, interest rates, product availability and affordability, product knowledge and flexibility in contract length. We face competition in arranging financing for our customers’ vehicle purchases from a broad range of unaffiliated third-party financial institutions. Many financial institutions now offer their own menu of F&I products, providing an alternative to our product offering, which may reduce our profits from the sale of these products through reduced penetration.

6

Manufacturers’ Relationships and Agreements

Each of our U.S. dealerships operates under one or more franchise agreements with vehicle manufacturers (or authorized distributors). The franchise agreements grant the franchised automobile dealership a non-exclusive right to sell the manufacturer’s or distributor’s brand of vehicles and offer related parts and service within a specified market area. These franchise agreements also grant franchised dealerships the right to use the manufacturer’s or distributor’s trademarks in connection with their operations, and impose numerous operational requirements and restrictions relating to, among other things, inventory levels, working capital levels, the sales process, sales performance requirements, customer satisfaction standards, marketing and branding, facility standards and signage, personnel, changes in management, change in control and monthly financial reporting.

Most of our dealerships’ franchise agreements continue indefinitely and those with definite terms are renewed or superseded by a new agreement. Each of our franchise agreements may be terminated or not renewed by the manufacturer for a variety of reasons, including unapproved changes of ownership or management and performance deficiencies in such areas as sales volume, sales effectiveness and customer satisfaction. In most cases, manufacturers have renewed the franchises upon expiration so long as the dealership is in compliance with the terms of the agreement. From time to time, certain manufacturers may assert sales and customer satisfaction performance requirements under the terms of our framework or franchise agreements. We work with these manufacturers to address any performance issues.

Our dealership service departments perform vehicle repairs and service for customers under manufacturer warranties. We are reimbursed for the repairs and service directly from the manufacturer. Some manufacturers offer rebates to new vehicle customers that we are required, under specific program rules, to adequately document, support and collect. In addition, some manufacturers provide us with incentives to order and/or sell certain models and/or volumes of inventory over designated periods of time. Under the terms of our dealership franchise agreements, the respective manufacturers are able to perform warranty, incentive and rebate audits and charge us back for unsupported or non-qualifying warranty repairs, rebates or incentives.

In addition to the individual dealership franchise agreements discussed above, we have entered into framework agreements in the U.S. with most major vehicle manufacturers and distributors. These agreements impose a number of restrictions on our operations, including our ability to make acquisitions and obtain financing, and on our management. These agreements also impose change of control provisions related to the ownership of our common stock. For a discussion of these restrictions and the risks related to our relationships with vehicle manufacturers, please refer to Item 1A. Risk Factors.

Governmental Regulations

Automotive and Other Laws and Regulations

We operate in a highly regulated industry. A number of laws and regulations applicable to automotive companies affect our business and conduct, including, but not limited to our sales, operations, financing, insurance, advertising and employment practices. These laws and regulations include state franchise laws and regulations, consumer protection laws and other extensive laws and regulations applicable to new and used motor vehicle dealers. Additionally, in every jurisdiction in which we operate, we must obtain various permits and licenses in order to conduct our businesses.

In general, the U.S. jurisdictions in which we operate have automotive dealership franchise laws, providing that, notwithstanding the terms of any franchise agreement, it is unlawful for a manufacturer to terminate or not renew a franchise unless “good cause” exists. It generally is difficult, outside of bankruptcy, for a manufacturer to terminate, or not renew, a franchise under these laws, which were designed to protect dealers.

7

The U.K. generally does not have automotive dealership franchise laws and, as a result, our U.K. dealerships operate without these types of specific protections. However, similar protections may be available as a matter of general U.K. contractual law. In addition, our U.K. dealerships are subject to U.K. antitrust rules prohibiting certain restrictions on the sale of new vehicles and spare parts and on the provision of repairs and maintenance. As a matter of 2020 EU law, authorized dealers are generally able to, subject to manufacturer facility requirements, relocate or add additional facilities throughout the EU, offer multiple brands in the same facility, allow the operation of service facilities independent of new car sales facilities and ease restrictions on cross supplies (including on transfers of dealerships) between existing authorized dealers within the EU. However, certain restrictions on dealerships may be permissible, provided the conditions set out in the relevant EU Block Exemption Regulations are met. The U.K. formally exited the EU on January 31, 2020, and the EU and the U.K. reached an agreement in principle as set out in the EU-U.K. Agreement, which became provisionally applicable on January 1, 2021. The EU-U.K. Agreement commits the parties to maintaining antitrust/competition law based on the common principles underlying the respective competition frameworks, and envisages cooperation and coordination between the U.K. and EU competition authorities. Similarly, as of January 1, 2021, the relevant EU Block Exemption Regulations remain in effect under domestic U.K. law, as amended in accordance with the U.K. competition framework. In July 2022, the Competition and Markets Authority of the U.K. published proposed recommendations broadly similar to the Block Exemption Regulations currently in effect, but these may be further amended, revoked or extended by subsequent U.K. law.

Data Privacy

We are subject to numerous laws and regulations designed to protect information of clients, customers, employees and other third parties that we collect and maintain. Some of the more significant regulations that we are required to comply with include the EU’s General Data Protection Regulation (“GDPR”) and, the California Consumer Privacy Act (“CCPA”) and the Federal Trade Commission (“FTC”) Safeguards Rule. These regulations provide for various data protection requirements related to protection of customer’s personally identifiable information, notice requirements related to data breaches and obligations to inform a consumer, at or before collection, of the purpose and intended use of the collection, and to delete a consumer’s personal information upon request. If an EU or non-EU organization violates the GDPR, the organization can be fined up to 4% of annual global turnover or 20 million euros, whichever is greater. Our dealerships in California are required to comply with the CCPA, which became effective in January 2020. The CCPA also allows the California Attorney General to bring actions against non-compliant businesses with fines of $2,500 per violation or, if intentional, up to $7,500 per violation. The FTC Safeguards Rule contains procedural, technical and personnel requirements that financial institutions, including dealers, must satisfy to meet their information security obligations.

Environmental and Occupational Health and Safety Laws and Regulations

Our business activities in the U.S. and the U.K. are subject to stringent federal, regional, state and local laws, regulations and other controls governing specific health and safety criteria to address worker protection, the release of materials into the environment or otherwise relating to environmental protection. Our operations involve the use, handling and storage of materials such as motor oil and filters, transmission fluids, antifreeze, refrigerants, paints, thinners, batteries, cleaning products, lubricants, degreasing agents, tires and fuel. We contract for recycling and/or disposal of used fluids, filters and other waste materials generated by our operations.

These laws, regulations and controls may impose numerous obligations on our operations including the acquisition of permits to conduct regulated activities, the imposition of restrictions on where or how to manage or dispose of used products and wastes, the incurrence of capital expenditures to limit or prevent releases of such material, and the imposition of substantial liabilities for pollution resulting from our operations or attributable to former operations. For example, in the U.S., most of our dealerships utilize storage tanks that are subject to testing, containment, upgrading and removal regulations under the federal Resource Conservation and Recovery Act, analogous state statutes and their implementing regulations. Failure to comply with these laws, regulations and permits may result in the assessment of sanctions, including administrative, civil and criminal penalties, the imposition of investigatory remedial and corrective action obligations or increase of capital expenditures, restrictions, delays and cancellations in permitting or in the performance or expansion of projects and the issuance of injunctions limiting or preventing some or all of our operations in affected areas. Additionally, certain environmental laws may result in imposition of joint and several strict liability, which could cause us to become liable as a result of our conduct that was lawful at the time it occurred or the conduct of, or conditions caused by, prior operators or other third parties. For instance, an accidental release from one of our storage tanks could subject us to substantial liabilities arising from environmental cleanup and restoration costs, claims made by neighboring landowners and other third parties for personal injury and property damage and fines or penalties for related violations of environmental laws or regulations.

8

Properties that we now or have in the past owned or leased in the U.S. are subject to the federal Comprehensive Environmental Response, Compensation and Liability Act and similar state statutes. These statutes can impose strict and joint and several liability for cleanup costs on those that are considered to have contributed to the release of a hazardous substance, including for historic spills that occurred prior to our ownership of our properties even if we did not know of, or did not cause the release of such hazardous substances. We also are subject to the Clean Water Act, analogous state statutes, and their implementing regulations which, among other things, prohibit discharges of pollutants into regulated waters without permits, require containment of potential discharges of oil or hazardous substances, and require preparation of spill contingency plans. Air emissions from some of our operations, such as vehicle painting, may be subject to the federal Clean Air Act and analogous laws. Laws and regulations protecting the environment are complex and generally become more stringent over time, which may result in increased costs for future environmental compliance and remediation. Comparable laws and regulations have been enacted in the U.K. Certain health and safety standards promulgated by the Occupational Safety and Health Administration of the U.S. Department of Labor and related state agencies also apply to our operations.

The threat of climate change continues to attract considerable attention in the U.S., U.K. and elsewhere globally. As a result, numerous proposals have been made and could continue to be made at the international, national, regional and state levels of government, in locations affecting our business, to monitor and limit existing emissions of greenhouse gas (“GHG”), as well as to restrict or eliminate such future emissions. Gas and diesel-powered automobiles are one source of GHG emissions and in the recent past, the U.S. Environmental Protection Agency (“EPA”), together with the National Highway Traffic Safety Administration (“NHTSA”), implemented GHG emissions limits on vehicles manufactured for operation in the U.S. On January 20, 2021, President Joe Biden issued an executive order recommitting the United States to participation in the Paris Agreement, which is a United Nations-sponsored, non-binding agreement for nations to limit their GHG emissions through individually-determined reduction goals every five years after 2020. The U.K. is similarly committed to the Paris Agreement, and the U.K. announced in late 2020 that it plans to ban sales of new gasoline and diesel-powered vehicles after 2030. Additional regulation of GHG emissions from the vehicles could increase the cost of vehicles sold to us. Consumer concerns regarding climate change could also alter consumer preferences and adversely affect our ability to market and sell vehicles. These developments could increase our costs of operation as well as reduce our volume of business.

Vehicle manufacturers in the U.S. are also subject to regulations by the EPA and the NHTSA that establish corporate average fuel economy (“CAFE”) standards applicable to light-duty vehicles. These agencies have finalized more stringent standards for both heavy-duty and light-duty vehicles and for increased fuel economy for vehicles in upcoming model years. California and other states have indicated they would pursue more stringent CAFE and GHG standards than required by current EPA and NHTSA standards. Comparable laws and regulations have been enacted in the U.K, including updated standards for cars, vans and heavy-duty trucks for upcoming model years. Our OEMs require lead time to prepare new vehicle models and more stringent regulations could result in increased costs and time constraints, or result in our OEMs deciding to increase production targets of EVs in anticipation of such regulations. These developments could also significantly increase our costs of operation as well as reduce our volume of business. For additional information, see Item 1A. Risk Factors within this Form 10-K.

Insurance and Bonding

Our operations expose us to the risk of various liabilities, including:

•claims by employees, customers or other third parties for personal injury or property damage;

•weather events, such as hail, flood, tornadoes and hurricanes; and

•potential fines and civil and criminal penalties resulting from alleged violations of federal and state laws, regulatory requirements and other local laws in the jurisdictions in which we operate.

The automotive retailing business is also subject to substantial risk of real and personal property loss as a result of significant concentration of real and personal property values at dealership locations. Under self-insurance programs, we retain various levels of risk associated with aggregate loss limits and per claim deductibles. In certain cases, we insure costs in excess of our retained risk under various contracts with third-party insurance carriers. Although we believe our insurance coverage is adequate, we cannot assure that we will not be exposed to uninsured losses that could have a material adverse effect on our business, results of operations and financial condition. We are also subject to potential premium cost fluctuations and changes in loss retention limits with the annual renewal of these programs.

For further discussion, refer to Item 1A. Risk Factors, within this Form 10-K.

9

Human Capital

People make up the foundation of everything we do at the Company. Our core values — Integrity, Transparency, Professionalism, Teamwork and Respect — define our culture and help us attract and retain talented employees. As of December 31, 2022, we had 15,491 employees (full-time, part-time and temporary), of which 12,004 were employed in the U.S. and 3,487 in the U.K.

Employee Engagement

We engage in activities aimed at listening to our employees and addressing their concerns. In turn, our employees deliver exceptional service to our customers, and ultimately achieve exceptional results for our investors. We solicit employee feedback through multiple channels such as employee surveys and town halls. Our annual employee survey provides our management team with valuable insight into employees’ perception of workplace culture and progress on our corporate mission. The results inform our overall human capital management methods and other growth strategies.

In 2022, we launched an all-in-one communication platform that keeps our employees across the U.S. and U.K. up-to-date on the latest company news and brings our teams together digitally. The platform offers our executive team the ability to engage in direct and more frequent, real-time communication with our employees. The features of the platform include targeted announcement capabilities, company documents like policies, guidelines and benefits plans, and quick access to employee and department directories. We believe that working together is critical to prepare for coming opportunities and changes affecting us internally and externally.

Training and Development

We offer a variety of training courses and professional development opportunities to employees based on job categories, including a management training program and a technician training program. In addition to job specific courses, we also offer leadership training. Employees have opportunities for various certification levels based on training completed and tenure.

Diversity, Equity and Inclusion (“DEI”)

We maintain a DEI council that is chaired by our Chief Diversity Officer. The council’s mission is to foster a diverse and inclusive culture where employees of all backgrounds are respected, valued and developed. We enhance employee engagement in DEI by offering training, recruitment and career path development where a sense of belonging is apparent throughout the organization. The council has four primary areas of focus: Talent Acquisition, Talent Development, Community Building and Women in the Workplace. The council consists of a diverse group of employees, providing representation across the organization. Each area has an employee chairperson, as well as an executive sponsor. In addition, employees participate in on-going diversity and inclusion training programs which were specifically developed for the Company.

Environmental, Social and Governance (“ESG”)

We are committed towards a more sustainable future by working to improve various aspects of our business in the ESG areas most relevant to us, our stakeholders and our industry. With oversight from our Board of Directors, in 2021 we performed a thorough review of our business operations pertaining to: hiring practices, equal pay, promotional practices, health and safety, health insurance, community impact and environmental impact. Building off this analysis, we performed a second assessment in 2022.

This effort included a detailed desktop study reviewing key material topics relevant to the automotive industry, an analysis of survey responses from our internal and external stakeholders, and interviews with executive leaders across our business and our Board members. With the aide of the assessment results, the Company placed priority on pressing ESG issues and designated resources for their management and disclosure.

Environmental

Our commitment to sustainability includes reducing our impact on the environment and doing our share to contribute to a healthier planet. We look for opportunities to reduce our energy consumption, eliminate waste, and accommodate the growing EV market.

One of our principal business activities is the construction and operation of new and remodeled dealership facilities. We continue to invest in numerous initiatives to improve our carbon and broader environmental footprint as we strive to be good stewards of the environment, such as climate control thermostats and LED lighting to improve our energy efficiency, solar panels to increase our usage of renewable energy, and up-to-date waste management systems to improve our handling of chemicals and other byproducts from our dealerships’ operations. We are continuously working with our OEM partners and third-party construction consultants to enhance the buying experience in our facilities.

10

In 2021, we established a team responsible for driving capital allocation recommendations for the expansion of the EV infrastructure in our dealerships. EV chargers, lifts, shop equipment and battery storage facilities are all critical elements to address the emerging market for EVs. We work closely with our manufacturing partners to market these vehicles and play a large role in servicing them. We are certified to repair and service EVs, including Tesla EVs at select locations. We also provide EV batteries and parts. We are committed to supporting our customers who currently own EVs and those that purchase EVs in the future.

Social

We maintain a human capital strategy that supports a diverse and inclusive workforce with equal opportunity. The Company offers programs for training and career advancement, strong benefits, incentives, and health, safety and wellness initiatives.

Governance

Our Board of Directors has four standing committees to assist in fulfilling its responsibilities: the Audit Committee, the Compensation & Human Resources Committee, the Governance and Corporate Responsibility Committee and the Finance/Risk Management Committee.

Our Governance and Corporate Responsibility Committee advises the Board of Directors on appropriate corporate governance guidelines and has direct oversight of our ESG policies and practices. Other Board of Directors’ committees also play a role in ESG, having oversight responsibilities across areas such as cybersecurity, human capital management, health & safety and corporate risk management. In addition, our management team and cross-functional subject matter experts are responsible for the implementation of our ESG strategy, initiatives and communications.

We believe the composition of our Board of Directors is critical to our success. As the Company continues to evolve, so do the perspectives, skills and experiences that the Board of Directors seeks in its director nominees. Since 2016, we have welcomed five new independent directors, each of whom brings extensive experience and fresh perspectives to enrich the Board of Directors’ dialogue and enhance its ability to effectively oversee our business. One-third of our directors are women, all of whom serve as committee chairs, and two of our members are non-U.S. citizens.

Much of our Board of Directors’ oversight work is delegated to various committees, which meet regularly and report back to the full Board. All committees have significant roles in carrying out the risk oversight function. Each committee is comprised entirely of independent directors (except the Finance/Risk Management Committee) and oversees risks associated with its respective area of responsibility.

At the corporate level, we established a Safety and Risk Steering Committee, which reviews the effectiveness of the Company’s risk management system, including a review of policies and profiles of financial and non-financial risks.

We track and identify new and emerging risks, and to the extent they affect or could potentially affect our business, we develop action plans with assigned sponsors to address and mitigate that risk. We use an internal process to help identify if we have enough controls in place to properly manage each risk.

In late 2022, we appointed a Compliance Officer to oversee compliance across the organization. As the compliance leader, this individual is responsible for establishing standards and implementing procedures to ensure that the compliance programs throughout the organization are effective and efficient in identifying, preventing, detecting and correcting noncompliance with company policies, applicable laws and regulations.

Seasonality

Our operating results are generally subject to seasonal variations, as well as changes in the economic environment. In the U.S., we generally experience higher volumes of vehicle sales and service in the second and third calendar quarters of each year. In addition, in some regions of the U.S., vehicle purchases decline during the winter months due to inclement weather. In the U.K., the first and third quarters tend to be stronger, driven by the vehicle license plate change months of March and September. Other factors unrelated to seasonality, such as changes in economic conditions, manufacturer incentive programs, supply issues, seasonal weather events and/or changes in foreign currency exchange rates may exaggerate seasonal or cause counter-seasonal fluctuations in our revenues and operating income.

The shortage of new vehicle supply, led by a global semiconductor and other parts shortage, as well as the current rising inflation and increasing interest rate environment, has and could continue to lead to a deviation from historical seasonal variations. As a result, historical seasonal variation patterns may not be an appropriate indicator of current and future trends in seasonal variations.

11

Internet Website and Availability of Public Filings

Our internet address is www.group1auto.com. We make the following information available free of charge on our website:

•Annual Report on Form 10-K;

•Quarterly Reports on Form 10-Q;

•Current Reports on Form 8-K;

•Amendments to the reports filed or furnished electronically with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act;

•Our Corporate Governance Guidelines;

•The charters for our Audit, Compensation and Human Resources, Finance/Risk Management and Governance & Corporate Responsibility Committees;

•Our Code of Conduct for Directors, Officers and Employees (“Code of Conduct”);

•Our Code of Ethics for our Chief Executive Officer, Chief Financial Officer and Controller (“Code of Ethics”); and

•Our Sustainability Report.

Within the time period required by the SEC and the NYSE, as applicable, we will post on our website any modifications to the Code of Conduct and Code of Ethics and any waivers applicable to senior officers as defined in the Code of Conduct or Code of Ethics, as applicable, as required by the Sarbanes-Oxley Act of 2002. We make our filings with the SEC available on our website as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the SEC. The SEC also maintains a website at http://sec.gov that contains reports, proxy and information statements, and other information regarding our company that we file and furnish electronically with the SEC.

References to the Company's website in this Form 10-K are provided as a convenience and do not constitute, and should not be deemed, an incorporation by reference of the information contained on, or available through, the website, and such information should not be considered part of this Form 10-K.

Item 1A. Risk Factors

The following risks have had or in the future could have a material adverse effect on our business and results of operations.

Market and Industry Risks

Availability and demand for and pricing of our products and services may be adversely impacted by economic conditions and other factors.

The automotive retail industry, and especially new vehicle unit sales, is influenced by general economic conditions, particularly consumer confidence, the level of personal discretionary spending, interest rates, exchange rates, fuel prices, technology and business model changes, supply conditions, consumer transportation preferences, unemployment rates and credit availability. Consumer spending can be materially and adversely impacted by periods of economic uncertainty or by consumer concern about manufacturer viability.

Increased demand for personal electronics, coupled with the impact of the COVID-19 pandemic on manufacturers, created a shortfall of semiconductor chips. This adversely impacted production of new vehicles, parts and other supplies, thereby reducing new vehicle inventories, increasing new vehicle prices and limiting the availability of replacement parts. Under these conditions, automotive dealer profits have increased sharply as new vehicle prices and margins have more than offset the effects of lower new vehicle volume. At such time that semi-conductor chip and other parts shortages are resolved, vehicle production may increase, and new vehicle prices could decrease thereby resulting in reduced profitability at our dealerships.

A significant portion of our vehicles purchased by customers are financed. Tightening of the credit markets, increases in interest rates and credit conditions may decrease the availability or increase the costs of automotive loans and leases and adversely impact our new and used vehicle sales and margins. In particular, if sub-prime finance companies apply higher credit standards or if there is a decline in the overall availability of credit in the sub-prime lending market, the ability of selected consumers to purchase vehicles could be limited, which could have a material adverse effect on our business and results of operations.

12

In addition, local economic, competitive and other conditions affect the performance of our dealerships. Our results of operations depend substantially on general economic conditions and spending habits in those regions of the U.S. and U.K. where we maintain our operations.

Recent economic and financial developments, including rising inflation, high energy prices, increasing interest rates and the potential recessionary environment could adversely affect our operations and financial condition.

During the Current Year, the global economy experienced rising inflation and increased volatility in gasoline and energy prices. In response to inflationary pressures and macroeconomic conditions, the U.S. Federal Reserve, along with other central banks, including in the U.K., continued to increase interest rates throughout 2022 and have indicated that such increases may continue into 2023, which could lower demand for new and used vehicles in future periods. Additionally, U.S. GDP shrank for two consecutive quarters in the first half of 2022 and increased for the third and fourth quarters of 2022, indicating there is uncertainty as to whether the U.S. economy will experience a recession in the near-term. In Europe, rising energy costs as a result of supply disruptions and increased winter demand for heating could place additional strain on our suppliers’ ability to maintain current production levels of vehicles and vehicle parts. Across the EU, these energy constraints could result in nations or regions enacting emergency energy related policies, limiting energy availability for manufacturers. Any such production constraints could further exacerbate an already ailing supply chain. The impact of these macroeconomic developments on our operations cannot be predicted with certainty.

Rising inflation, increased energy costs and a prolonged recession could adversely impact our operations, the operations of our suppliers and customer demand for our vehicles and services. Continued interest rate increases could have a material adverse impact on our interest expense and ability to obtain financing through the debt markets, as well as consumers’ ability to obtain financing for the purchase of new and used vehicles. Refer to Item 7A. Quantitative and Qualitative Disclosures About Market Risk for additional analysis regarding our interest rate sensitivity.

The Russian invasion of Ukraine and the retaliatory measures imposed by the U.S., U.K., EU and other countries and the responses of Russia to such measures have caused significant disruptions to domestic and foreign economies.

The February 2022 military invasion of Ukraine by Russia (the “Russia and Ukraine Conflict”) had an immediate impact on the global economy resulting in higher prices for oil and other commodities. The U.S., U.K., EU and other countries responded to Russia’s invasion of Ukraine by imposing various economic sanctions and bans. Russia has responded with its own retaliatory measures. These measures have impacted the availability and price of certain raw materials throughout the global economy. The invasion and retaliatory measures have also disrupted economic markets. The global impact of these measures is continually evolving and cannot be predicted with certainty and there is no assurance that Russia’s invasion of Ukraine and responses thereto will not further disrupt the global economy and supply chain. In particular, the Russia and Ukraine Conflict has further impacted the ability of certain OEMs to produce new vehicles and new vehicle parts, which may result in continued disruptions to the supply of new and used vehicles. Further, there is no assurance that when the Russia and Ukraine Conflict ends, countries will not continue to impose sanctions and bans.

While these events have not materially interrupted our operations, these or future developments resulting from the Russia and Ukraine Conflict, such as a cyberattack on the U.S. or our suppliers, could disrupt our operations, increase the cost or decrease the availability of certain materials necessary to produce vehicles we sell or obtain parts to complete maintenance and collision repair services, or make it difficult to access debt and equity capital on attractive terms, if at all, and impact our ability to fund business activities and/or limit future acquisition activity.

Deterioration in market conditions or changes in our credit profile could adversely affect our operations and financial condition.

We rely on the positive cash flow we generate from our operations and our access to the credit and capital markets to fund our operations, growth strategy, and return of cash to our shareholders through share repurchases and dividends. Changes in the credit and capital markets, including market disruptions, limited liquidity and interest rate fluctuations, may increase the cost of financing or restrict our access to these potential sources of future liquidity. Our continued access to liquidity sources on favorable terms depends on multiple factors, including our operating performance and credit ratings. Our debt securities currently are rated just below investment-grade and a downgrade of this rating likely would negatively impact our access to the debt markets and increase our cost of borrowing. Disruptions in the debt markets or any downgrade of our credit ratings could adversely affect our operations and financial condition and our ability to finance acquisitions or return cash to our shareholders. We can make no assurances that our ability to obtain additional financing through the debt markets will not be adversely affected by economic conditions or that we will be able to maintain or improve our current credit ratings.

13

Our floorplan notes payable, mortgages and other debt are benchmarked to SOFR, which can be highly volatile as a result of changing economic conditions. Although we utilize derivative instruments to partially mitigate our exposure to interest rate fluctuations, significant increases in SOFR or other variable interest rates could have a material adverse impact on our interest expense due to the significance of our debt and floorplan balances. Refer to Item 7A. Quantitative and Qualitative Disclosures About Market Risk for additional analysis regarding our interest rate sensitivity.

We may fail to meet analyst and investor expectations, which could cause the price of our stock to decline.

Our common stock is traded publicly, and various securities analysts follow our financial results and frequently issue reports on the Company which include information about our historical financial results as well as their estimates of our future performance. These estimates are based on their own opinions and are often different from management’s estimates or expectations of our business. If our operating results are below the estimates or expectations of public market analysts and expectations of our investors, our stock price could decline.

We are subject to risks associated with our dependence on manufacturer business relationships and agreements.

The success of our dealerships is dependent on vehicle manufacturers whom we rely exclusively on for our new vehicle inventory. Our ability to sell new vehicles is dependent on a vehicle manufacturer’s ability to produce and allocate to our dealerships an attractive, high quality and desirable product mix at the right time in order to satisfy customer demand.

Manufacturers generally support their franchisees by providing direct financial assistance in various areas, including, among others, incentives, floorplan assistance and advertising assistance. A discontinuation or change in our manufacturers’ warranty and incentive programs could adversely affect our business. Manufacturers also provide product warranties and, in some cases, service contracts to customers. Our dealerships perform warranty and service contract work for vehicles under manufacturer product warranties and service contracts and we bill the manufacturer directly as opposed to invoicing the customer. In addition, we rely on manufacturers for various financing programs, OEM replacement parts, training, up-to-date product design, development of advertising materials and programs and other items necessary for the success of our dealerships.

Vehicle manufacturers may be adversely impacted by economic downturns or recessions, significant declines in the sales of their new vehicles, increases in interest rates, adverse fluctuations in currency exchange rates, declines in their credit ratings, reductions in access to capital or credit, labor strikes or similar disruptions (including within their major suppliers), supply shortages, rising raw material costs, rising employee benefit costs, adverse publicity that may reduce consumer demand for their products, including due to bankruptcy, product defects, litigation, ability to keep up with technology and business model changes, poor product mix or unappealing vehicle design, governmental laws and regulations, natural disasters or other adverse events. In particular, all of our OEMs are investing material amounts to develop electric and autonomous vehicles. These investments could cause financial strain on our OEMs or fail to deliver attractive vehicles for customers which could lead to adverse impacts on our business. The OEMs have been and could continue to be impacted by the COVID-19 pandemic’s impact on the economy, factory production, parts shortages, including semiconductor chips, and other disruptions. These and other risks could materially adversely affect the financial condition of any manufacturer and impact its ability to profitably design, market, produce or distribute new vehicles, which in turn could have a material adverse effect on our business, results of operations and financial condition.

During the Current Year, our manufacturers’ production continued at reduced levels as a result of global semiconductor and other parts shortages. Despite recent improvements in production by certain manufacturers driving an improvement in vehicles days’ supply, our new vehicle inventory continues to be impacted compared to historical levels. Our new vehicle days’ supply of inventory was approximately 24 days as of the Current Year, as compared to 12 days and 53 days for the years ended December 31, 2021 and 2020, respectively. It is impossible to predict with certainty the duration of the production issues or when normalized production will resume at these manufacturers. If our manufacturers’ production remains at current reduced levels or in some cases continues to decline, diminishing our ability to meet the immediate needs of our customers, the production shortage could have a material adverse impact on our financial and operating results.

Additionally, many U.S. manufacturers of vehicles, parts and supplies are dependent on imported products and raw materials in their production. Any significant increase in existing tariffs on such goods and raw materials, or implementation of new tariffs, could adversely affect our profits on the vehicles we sell.

14

If we are unable to enter into new franchise agreements with manufacturers in connection with dealership acquisitions or maintain or renew our existing franchise agreements on favorable terms, our operations may be significantly impaired.

We are dependent on our relationships with manufacturers, which exercise a great degree of influence over our operations through the franchise agreements. Our franchise agreements may be terminated or not renewed by the manufacturer for a variety of reasons, including any unapproved changes of ownership or management, sales and customer satisfaction performance deficiencies and other material breaches of the franchise agreements. Manufacturers may also have a right of first refusal if we seek to sell dealerships. Additionally, we cannot guarantee that the terms of any renewals will be as favorable to us as our current agreements. Although we are generally protected by automotive dealership franchise laws requiring “good cause” be shown for such termination, if such an instance occurs, we cannot guarantee that the termination of the franchise will not be successful.

A manufacturer may also limit the number of its dealerships that we may own or the number that we may own in a particular geographic area. Delays in obtaining, or failing to obtain, manufacturer approvals and franchise agreements for dealership acquisitions could adversely affect our acquisition program. From time to time, we have not met all of the manufacturers’ requirements to make acquisitions and have received requests to dispose of certain of our dealerships. In the event one or more of our manufacturers sought to prohibit future acquisitions or imposed requirements to dispose of one or more of our dealerships, our acquisition and growth strategy could be adversely affected. Moreover, our franchise agreements do not give us the exclusive right to sell a manufacturer’s product within a given geographic area. Subject to state laws in the U.S. that are generally designed to protect dealers, a manufacturer may grant another dealer a franchise to start a new dealership near one of our locations, or an existing dealership may move its dealership to a location that would more directly compete against us. The location of new dealerships near our existing dealerships could have a material and adverse effect on our operations and reduce the profitability of our existing dealerships. Furthermore, if current manufacturers or future manufacturers are not required to conduct their business in accordance with state franchise laws and thereby circumvent the current dealer-network to sell directly to the customer, our results of operations may be materially and adversely affected.

Substantial competition in automotive sales and services could adversely impact our sales and our margins.

The automotive retail industry is highly competitive. Within our markets we are subject to competition from franchised automotive dealerships and other businesses as it relates to new and used vehicles, parts and service, as well as acquisitions. The internet has become a significant part of the advertising and sales process in our industry. Customers are using the internet to compare prices for new and used vehicles, automotive repair and maintenance services, finance and insurance products and other automotive products. If we are unable to effectively use the internet to attract customers to our own online channels, such as our AcceleRide® platform, and mobile applications, and, in turn, to our stores, our business, financial condition, results of operations and cash flows could be materially adversely affected. The growing use of social media by consumers increases the speed and extent that information and opinions can be shared, and negative posts or comments on social media about the Company or any of our dealerships could damage our reputation and brand names, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We also face competition in arranging financing for our customers’ vehicle purchases from a broad range of financial institutions. Additionally, we do not have any cost advantage in purchasing new vehicles from vehicle manufacturers, and our franchise agreements do not grant us the exclusive right to sell a manufacturer’s product within a given geographic area. Increased competition can adversely impact our sales volumes and margins as well as our ability to acquire dealerships.

Please see Item 1. Business — Competition for further discussion of competition in our industry.

Global responses to climate change and resulting changes in consumer demand towards fuel efficient vehicles and EVs, and shifts by manufacturers to meet demand, could adversely affect our new and used vehicle sales volumes, parts and service revenues and our results of operations.

Volatile fuel prices have affected and may continue to affect consumer preferences in connection with the purchase of our vehicles. Rising fuel prices result in consumers less likely to purchase larger, more expensive vehicles, such as sports utility vehicles or luxury automobiles, and more likely to purchase smaller, less expensive and more fuel efficient vehicles. Conversely, lower fuel prices could have the opposite effect. Sudden changes in customer preferences make maintenance of an optimal mix of large and small vehicle inventory a challenge. Further increases or sharp declines in fuel prices could have a material adverse effect on our business and results of operations.

15

Changes in fuel prices, changes in customer preferences, government support, improvements in EVs and more EV options have increased the customer demand for more fuel efficient vehicles and EVs. Significant increases in fuel economy requirements, new federal or state restrictions on emissions of carbon dioxide or new federal or state incentive programs that have or may be imposed on vehicles and automobile fuels could adversely affect demand for certain vehicles, annual miles driven or the products we sell. For example, in the U.S., President Biden issued an executive order in 2021 aiming to increase EV sales by 2030. In 2022, the U.S. enacted the Inflation Reduction Act of 2022, which provided a number of incentives to install EV infrastructure, purchase certain “clean vehicles,” or otherwise encourage a shift to vehicles with lower carbon emissions. Representatives of the U.K. government have proposed a ban on the sale of gasoline engines in new cars and new vans that would take effect as early as 2030 and a ban on the sale of gasoline hybrid engines in new cars and new vans as early as 2035. These, and similar proposals could impact demand for certain vehicles, even if not finalized by creating consumer uncertainty.

With a potential increase in demand by consumers for EVs, and government support for such actions, manufacturers have also announced increased production focus on the manufacture of fuel efficient vehicles and EVs. As more EVs potentially enter the market, and internal combustion or diesel engine vehicle production is reduced, it will be necessary to adapt to such changes by selling and servicing these units effectively in order to meet consumer demands and support the profitability of our dealerships. We may not be able to accurately predict, prepare for and respond to new kinds of technological innovations with respect to EV and other technologies that minimize emissions. If maintenance costs of EVs were to substantially decrease, this could have a material adverse effect on our parts and service revenues. If consumer demand increases for fuel efficient vehicles or EVs and our manufacturers are not able to adapt and produce vehicles that meet the customer demands or we are unable to align with the manufacturers of these vehicles, such events could adversely affect our new and used vehicle sales volumes, parts and service revenues and our results of operations.

Our inability to acquire and successfully integrate new dealerships into our business could adversely affect the growth of our revenues and earnings.

Growth in our revenues and earnings partially depends on our ability to acquire new dealerships and successfully integrate those dealerships into our existing operations. We cannot guarantee that we will be able to identify and acquire dealerships in the future. In addition, we cannot guarantee that any acquisitions will be successful or on terms and conditions consistent with past acquisitions. Restrictions by our manufacturers, as well as covenants contained in our debt instruments, may directly or indirectly limit our ability to acquire additional dealerships. Increased competition for acquisitions may develop, which could result in fewer acquisition opportunities available to us and/or higher acquisition prices, and some of our competitors may have greater financial resources than us.

In addition, managing and integrating additional dealerships into our existing mix of dealerships may result in substantial costs, diversion of our management’s attention, delays or other operational or financial problems. Acquisitions involve a number of special risks, including, among other things:

•incurring significantly higher capital expenditures and operating expenses;

•failing to integrate the operations and personnel of the acquired dealerships;

•entering new markets with which we are not familiar;

•incurring undiscovered liabilities at acquired dealerships, generally, in the case of stock acquisitions;

•disrupting our ongoing business;

•failing to retain key personnel of the acquired dealerships;

•impairing relationships with employees, manufacturers and customers; and

•incorrectly valuing acquired entities.

In particular, as a result of the consummation of the acquisition of the Prime Automotive Group (“Prime”), including 28 dealerships, certain real estate and three collision centers in the Northeastern U.S. in November 2021 (the “Prime Acquisition”), we now have a larger business and more assets and employees than we did prior to the transaction. The integration process required us to expand the scope of our operations and financial and other systems. Our management devotes a substantial amount of time and attention to the process of integrating the operations of acquired dealerships into our business.

If any of these factors limits our ability to integrate acquired dealerships into our operations successfully or on a timely basis, our expectations regarding future results of operations, including certain run-rate revenue and expense synergies expected to result from acquisitions, might not be met. As a result, we may not be able to realize the expected benefits that we seek to achieve from the acquisitions. In addition, we may be required to spend additional time or money on integration that otherwise would be spent on the development and expansion of our business, including efforts to further expand our product portfolio.

16

Vehicle manufacturers may alter their distribution models.

In December 2021, Mercedes Benz announced the transition to an agency model for distribution of vehicles in the U.K. The transition began on January 1, 2023. In addition to the announcement by Mercedes Benz in the U.K., certain of our other vehicle manufacturers serving the U.K. and U.S. markets recently announced plans to explore an agency model for selling new vehicles. Under an agency model, our franchised dealerships would receive a fee for facilitating the sale of a new vehicle to a customer but would no longer record the vehicle sales price as revenue, record vehicles in inventory or incur floorplan interest expense, as has been historical practice. The agency model, as adopted by Mercedes Benz, will result in reduced revenues, as we will act as an agent of Mercedes Benz, receiving a commission for each sale and other expense fee support. We do not expect a material negative or positive impact to the U.K. region gross margin and consolidated results of operations from a change to the Mercedes Benz agency model. Notwithstanding this fact, we cannot predict the actions of other manufacturers and whether the agency models proposed by them will have the same terms and conditions as those contracted by Mercedes Benz. The agency model, if adopted by other manufacturers, would reduce revenues. The other impacts to our U.K. and the U.S. regions and consolidated results of operations remain uncertain until such time as the other vehicle manufacturers provide additional details regarding their specific agency model plans. We are uncertain if agency models will be widely adopted in the U.K. or U.S.

Additionally, in 2022, Ford announced potential changes to its distribution model related to EVs. These changes potentially include required dealership capital investment and alterations to vehicle pricing structures. Such changes, if implemented by Ford or other manufacturers, could negatively impact our margins and capital costs. We are uncertain of the nature of the impact of such distribution changes to EVs or if such changes will be widely adopted in the U.S. or the U.K.

Vehicle technology advancements and changes in consumer vehicle ownership preferences could adversely affect our new and used vehicle sales volumes, parts and service revenues and results of operations.

Vehicle technology advancements are occurring at an accelerating pace. These include driver assist functionality, autonomous vehicle development and rideshare and vehicle co-ownership business models. Many in the automotive industry believe that in the near future vehicles will be available to the automotive consumer at low usage costs, which may entice many vehicle owners, particularly in larger, highly populated areas, to abandon individual car ownership in favor of multiple co-ownership ride-sharing opportunities. Increased popularity in the ride-sharing subscription business model could adversely affect our new and used vehicle sales volumes, parts and service revenues and results of operations.

Operational Risks

A cybersecurity breach, including loss of confidential information or a breach of personally identifiable information (“PII”) about our customers or employees, could negatively affect operations and result in high costs.

In the ordinary course of business, we receive significant PII about our customers and our employees. A security incident to obtain such information could be caused by malicious insiders and third parties using sophisticated, targeted methods to circumvent firewalls, encryption and other security defenses, including hacking, fraud, trickery, or other forms of deception. Although many companies across many industries are affected by malicious efforts to obtain access to PII, the automotive dealership industry has been a particular target of identity thieves. The techniques used by cyber attackers change frequently and may be difficult to detect for long periods of time. We have implemented security measures that are designed to detect and protect against cyberattacks.