UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-12793

StarTek, Inc.

(Exact name of registrant as specified in its charter)

Delaware | 84-1370538 | |

(State or other jurisdiction of | (I.R.S. employer | |

incorporation or organization) | Identification No.) | |

8200 E. Maplewood Ave., Suite 100 | ||

Greenwood Village, Colorado | 80111 | |

(Address of principal executive offices) | (Zip code) | |

(303) 262-4500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $.01 par value | New York Stock Exchange, Inc. | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x | |

Non-accelerated filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant on June 30, 2015 was approximately $73.1 million. As of March 8, 2016, there were 15,699,398 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant’s proxy statement to be delivered in connection with its 2016 annual meeting of stockholders, which will be filed within 120 days after the registrant's fiscal year ended December 31, 2015. With the exception of certain portions of the proxy statement specifically incorporated herein by reference, the proxy statement is not deemed to be filed as part of this Form 10-K.

STARTEK, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2015

PART I | Page | |||

Item 1 | Business | |||

Item 1A | Risk Factors | |||

Item 1B | Unresolved Staff Comments | |||

Item 2 | Properties | |||

Item 3 | Legal Proceedings | |||

Item 4 | Mine Safety Disclosures | |||

PART II | ||||

Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||

Item 6 | Selected Financial Data | |||

Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | |||

Item 8 | Financial Statements and Supplementary Data | |||

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||

Item 9A | Controls and Procedures | |||

Item 9B | Other Information | |||

PART III | ||||

Item 10 | Directors, Executive Officers and Corporate Governance | |||

Item 11 | Executive Compensation | |||

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||

Item 13 | Certain Relationships and Related Transactions, and Director Independence | |||

Item 14 | Principal Accounting Fees and Services | |||

PART IV | ||||

Item 15 | Exhibits, Financial Statement Schedules | |||

Part I

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including the following:

• | certain statements, including possible or assumed future results of operations, in “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

• | any statements regarding the prospects for our business or any of our services; |

• | any statements preceded by, followed by or that include the words “may,” “will,” “should,” “seeks,” “believes,” “expects,” “anticipates,” “intends,” “continue,” “estimate,” “plans,” “future,” “targets,” “predicts,” “budgeted,” “projections,” “outlooks,” “attempts,” “is scheduled,” or similar expressions; and |

• | other statements regarding matters that are not historical facts. |

Our business and results of operations are subject to risks and uncertainties, many of which are beyond our ability to control or predict. Because of these risks and uncertainties, actual results may differ materially from those expressed or implied by forward-looking statements, and investors are cautioned not to place undue reliance on such statements. All forward-looking statements herein speak only as of the date hereof, and we undertake no obligation to update any such forward-looking statements. Important factors that could cause actual results to differ materially from our expectations and may adversely affect our business and results of operations include, but are not limited to those items set forth in Item 1A. “Risk Factors” appearing in this Form 10-K.

Unless otherwise noted in this report, any description of “us," “we” or "our" refers to StarTek, Inc. ("STARTEK") and its subsidiaries. Financial information in this report is presented in U.S. dollars.

ITEM 1. BUSINESS

BUSINESS OVERVIEW

STARTEK is a customer engagement business process outsourcing (BPO) services provider, delivering customer care solutions in a different and more meaningful way. We use “engagement” design principles vs. traditional contact center methods, resulting in added value services that create deeper customer relationships through better customer insights and interactions for our clients. Our unique approach to Omni Channel Design and Service, Training Innovation and Analytics, allows STARTEK to deliver full life-cycle care solutions through our engagement centers around the world. Our employees, whom we call Brand Warriors, are at the forefront of our customer engagement services and represent our greatest asset. For over 25 years, STARTEK Brand Warriors have been committed to enhancing the customer experience, providing higher value and making a positive impact for our clients’ business results.

Our vision is to be the most trusted global service provider to customer-centric companies who are looking for more effective ways to engage their customers, on their terms and preferred channels with solutions that are not always available via traditional “contact center” companies.

The STARTEK Advantage System, the sum total of our customer engagement culture, customized solutions and processes, allows us to always remain focused on enhancing our clients’ customer experience, increasing customer lifetime value (CLV) and reducing total cost of ownership. STARTEK has proven results for the multiple services we provide, including sales, order management and provisioning, customer care, technical support, receivables management, and retention programs. We service client programs using a variety of multi-channel customer interaction capabilities, including voice, chat, email, social media, IVR and back-office support. STARTEK has engagement centers in the United States, Canada, Honduras, Jamaica, and the Philippines.

We operate our business within three reportable segments, based on the geographic regions in which our services are rendered: Domestic, Nearshore, and Offshore. As of December 31, 2015, our Domestic segment included the operations of thirteen facilities in the United States and one facility in Canada; our Offshore segment included the operations of four facilities in the Philippines; and our Nearshore segment included the operations of two facilities in Honduras and one facility in Jamaica. Operations at our facility in Costa Rica, which were included in our Nearshore segment, ceased in August 2014. The segment information included in Item 8, Note 16 of the Notes to Consolidated Financial Statements, is incorporated by reference in partial response to this Item 1.

2

SERVICE OFFERINGS

We provide customer experience management throughout the life cycle of our clients’ customers. These service offerings include customer care, sales support, inbound sales, complex order processing, accounts receivable management, technical and product support, up-sell and cross-sell opportunities and other industry-specific processes. We provide these services by leveraging technology, agent performance tools, analytics multi-channel services and self-help applications to enable and empower our Brand Warriors.

Technical and Product Support. Our technical and product support service offering provides our clients’ customers with high-end technical support services through customer preferred channels (telephone, e-mail, chat, facsimile and Internet), 24 hours per day, seven days per week. Technical support inquiries are generally driven by a customer’s purchase and use of a product or service, or by a customer’s need for ongoing technical assistance.

Sales Support. Our revenue generation service supports every stage of the customer life cycle and includes end-to-end pre-sales and post-sales programs. Lead generation, direct sales, account management, retention programs, and marketing analysis and modeling are all available. We have the ability to increase customer purchasing levels, implement product promotion programs, introduce new products and enhanced service offerings, secure additional customer orders and handle inquires related to post-sales support. Unique service offerings are tailored to meet the specific needs of consumers.

Provisioning and Order Processing. Our suite of order processing services range from enterprise level large-scale project management to direct-to-consumer order processing. Complex order processing services provide clients with large-scale project management and direct relationship management for their large enterprise customers. These services include full life cycle order management and technical sales support for high-end telecommunications services, such as wire line, wireless, data and customer premise equipment. In addition, we process order fallout from our clients' automated systems, complete billing review and revenue recovery and perform quality assurance. Direct-to-consumer services include provisioning, order processing and transfer of accounts between client service providers.

Receivables Management. We provide first and third party collections services directly for our clients. We provide these services for our clients in the telecommunication, cable and media and healthcare industries. Our Brand Warriors help our clients reduce bad debt write-offs and recover past due balances in an efficient, compliant and empathetic manner, which promotes and protects our clients' brand and helps them retain customers.

Healthcare Services. Healthcare services focus on four major segments of the market: providers, payers, pharmaceutical and medical devices. Our service offerings include customer care, sales support, accounts receivable management, remote patient care and medical triage. Our healthcare professionals include licensed RN's who compliantly support patients and doctors with their healthcare service needs.

Up-sell and Cross-sell Programs. Whether providing direct response services for marketing campaigns or enabling companies to test new offerings with existing customers, STARTEK is an expert at converting opportunities to sales. Companies invest time and money to develop up-sell and cross-sell opportunities with their customers and we consistently outsell other internal and external providers.

Our goal is to provide higher conversion rates and improve the average revenue per sale. We select managers and representatives who not only have a sales mentality, but are dedicated to helping customers. We utilize a proven sales training methodology that all sales and service representatives employ and they are supported by dedicated management teams. By working with our clients and providing a true sales team culture, we are able to achieve superior results.

Additional Services. We provide other industry-specific processes, including training curriculum development, workforce management, customer analytics, quality monitoring services, and dispositions. These services include technology enabled and human interactions.

Our Solutions Team engages with clients to understand their specific goals and anticipate the needs of their customers. By leveraging the STARTEK Advantage System, the Team customizes solutions to meet clients' goals.

3

CUSTOMER TRENDS

Our clients are increasingly focused on improving customer engagement and reducing total overall cost of ownership. STARTEK delivers a high level of customer satisfaction, as evidenced by our clients’ customer service awards and our ranking relative to other outsourced partners. Our clients also value a combination of onshore, nearshore, and offshore delivery platforms to optimize customer support costs.

Clients are also trying to decrease the number of contacts it takes for their customers to enjoy their products or services as well as increasing the channel options that are available. Process improvement and a push for more Omni Channel solutions has driven further efficiencies for resolution of those contact issues. We are committed to delivering solutions through which we partner with our clients to achieve and deliver these efficiency gains. We believe we are positioned to benefit from this trend as we have developed a comprehensive suite of services and multi-channel solutions that will drive continuous improvement and customer experience on front and back-office transactions.

KEY COMPETITIVE DIFFERENTIATORS

STARTEK Advantage System

Our culture, “Customer Engagement” Operating Platform and custom solutions for every client program combined with our continuous improvement process is the sum total of our STARTEK Advantage System. The STARTEK Advantage System empowers and enables our leaders to constantly look for new ways to deliver consistent execution of operational results while meeting and/or exceeding our clients’ current and future critical business requirements.

STARTEK’s culture is built on trust and servant leadership. Servant leadership puts the employees first and leads with a focus on solving problems and promoting personal development. We are a gathering of like-minded professionals determined to make a positive impact for our employees, our clients and our stakeholders.

STARTEK’s “Customer Engagement” Operating Platform provides the core processes that allow us to be consistent in our service offering across sites and geographies. It includes execution and innovation in every area of the operation including on-boarding and enabling employees, executing against goals, evaluating and improving performance, and enhancing the total experience of our clients’ customers.

STARTEK deploys solutions that leverage what we know, what we have learned from experience across a breadth of clients and industries, and what we hear and understand from the market and most importantly our clients. We will deliver the right people with the right leadership enabled by the right technology and empowered by the right tools to make a meaningful impact on each and every one of our clients’ businesses. The acquisition of Ideal Dialogue gives us the ability to offer a solution for improving customer interactions and, subsequently, customer satisfaction. Ideal Dialogue has developed a unique methodology for training and measuring how we can better engage with customers to improve the customer experience. The acquisition of ACCENT has given us added insights and analytics as well social service capabilities.

We offer a variety of customer engagement management solutions that provide front to back-office capabilities utilizing the right delivery platform including onshore, nearshore, and offshore alternatives. We also offer multi-channel customer interactions, including voice, chat, email and social media. We believe that we are differentiated by our client centric culture, operational flexibility, customer engagement methodology, added value approach and most importantly, the quality of execution and results.

Customization

STARTEK is passionate about our client’s current and future objectives. Our solution configuration is aligned with our clients’ unique requirements but more importantly, the desired outcomes they are looking for. We are flexible and keenly aware that in designing solutions around clients’ strategic goals is critical. Not only do we provide experienced management teams that bring together a trained, productive workforce, equipped with the right tools and technology, we provide front and back end analytics to develop the right solution and proprietary quality assurance tools that ensure a “closed loop” improvement cycle that is easy to measure and manage.

4

Consistent Performance

Performance is core to the STARTEK Operating Platform. Our clients expect consistent performance against the fundamentals of the business no matter the location or method of the service delivery. The operating platform sets the stage for us to drive continuous improvement and focus on the added-value aspects of our clients’ businesses.

Cost Competitive

We are confident in our ability to be cost competitive with solutions that meet our clients’ needs. Through clearly understanding their needs and striving to reach goal congruency, we can assure that our collective financial goals are aligned in the most efficient way.

STRATEGY

STARTEK views successful outsourcing partnerships as those that strike a balance by delivering a better customer experience to clients through an efficient, effective and ever improving support model while generating a fair return for our stakeholders. The STARTEK Advantage System and Brand Warrior mindset is behind everything we do. Our managers and customer engagement specialists all have a STARTEK Brand Warrior mindset, because they are on the front lines for our clients’ brands and have the opportunity to create and improve loyalty for our clients’ products and services each and every day. Our mission is to return value to our stakeholders by promoting and protecting our clients' brands by enabling and empowering us, as Brand Warriors, through servant leadership. Our clients’ business objectives become our business objectives, as we seek to become their trusted partner. Every day, we strive to better understand our clients’ markets and competitive challenges so that we can play a more effective role as trusted partner and success driver in their businesses. We seek to build customer loyalty and reduce clients' costs through specific actionable continuous improvement efforts in all areas. We believe that empowering and enabling our engagement center management and front line employees is the most important way we can deliver the best possible consistent customer experience. STARTEK’s leadership team is committed to driving year-over-year continuous improvement and constantly striving for the success of our clients’ businesses.

We seek to become the trusted partner to our clients and provide meaningful, impactful customer engagement business process outsourcing ("BPO") services. Our approach is to develop relationships with our clients that are truly collaborative in nature where we are focused, flexible and proactive to their business needs. The end result is the delivery of the highest quality customer experience to our clients’ customers. To achieve sustainable, predictable, profitable growth, our strategy is to:

•grow our existing client base by deepening and broadening our relationships,

•diversify our client base by adding new clients and verticals

•improve our market position by becoming the leader in customer engagement services

•improve profitability through operational improvements, increased utilization and higher margin accounts

•expand our global delivery platform to meet our clients' needs,

•broaden our service offerings through more innovative, technology-enabled and added-value solutions

During 2015, STARTEK acquired Accent Marketing Services, L.L.C. ("ACCENT"), a business process outsourcing company with a business model that focuses on data, analytics, and interaction with customers and their constituents to provide excellent service. ACCENT's business model and attention to customer engagement provides an excellent complement to STARTEK's Ideal Dialogue practice. Additionally, the acquisition of ACCENT expands our footprint into Jamaica and enhances our flexibility in meeting customer demands, including more use of internet-based customer service delivery.

During 2014, STARTEK acquired Collection Center, Inc. ("CCI"), a receivables management company located in Bismarck, North Dakota focused on third party collection services for healthcare providers. This complements our first party receivables management capabilities and enhances our portfolio of service offerings to healthcare providers as well as our other verticals.

During 2013, STARTEK acquired two companies that expand our reach with new and existing customers. Ideal Dialogue, Inc. is a company dedicated to improving client engagement through over 50 years of academic study in the science of human communication. STARTEK also acquired RN's On Call, which operates a nurse telephone triage and patient support service company. Registered nurses, specialized professionals, para-medical resources, call center specialists, quality/compliance officers and work flow analysts provide patient support. The phones are answered by certified medical professionals who can provide patients with immediate assistance by utilizing a combination of medical protocols, on call physicians and standing orders. The acquisition launched STARTEK Health, a division of STARTEK, dedicated to providing service to payers,

5

providers, pharmaceutical companies and medical device producers. STARTEK Health has a website dedicated to showcasing capabilities for the healthcare industry at www.startekhealth.com.

The STARTEK Health division is focused on understanding the business aims of the industry including a focus on increasing service levels while faced with the expected increase in cost of delivering care. Industry reforms are further escalating administrative and compliance costs, shifting the focus on trimming operational expenses. At STARTEK Health, we understand these pressures, along with the need to remain flexible given the new healthcare reform mandates, growth in the aging population, varying communication needs of the multiple demographics requiring support, and the desire to achieve improved member satisfaction in a more competitive environment.

HISTORY OF THE BUSINESS

STARTEK was founded in 1987. At that time, our business was centered on supply chain management services, which included packaging, fulfillment, marketing support and logistics services. After our initial public offering on June 19, 1997, we continued to focus on operating customer care contact centers and grew to include our current suite of offerings as described in the “Business Overview” section of this Form 10-K.

SEASONALITY

Our business can be seasonal, dependent on our clients' marketing programs and product launches, which are often geared toward the end of summer and the winter holiday buying season. Our cable and satellite providers also bring a seasonal element towards special sports programming. We also have some seasonality with our healthcare clients.

INDUSTRY

The worldwide outsourced customer care services industry is now projected to be over $72 billion and growing at over 5% per year. Over the past several years, companies handling their own customer care requirements has continued to decrease. Clients are recognizing the value and expertise that can be found by outsourcing activities, such as those we provide. Outsourcing allows them to focus on core competencies, leverage economies of scale and control variable costs of their business while accessing new technology and trained expert personnel. We believe outsourced service providers, including ourselves, will continue to benefit from these outsourcing trends. The industry continues to be very fragmented with the largest competitors combined capturing less than 7% of the global market.

COMPETITION

We compete with a number of companies that provide similar services on an outsourced basis, including business process outsourcing companies such as Teleperformance; Convergys Corporation; Transcom; Expert Global Solutions; Sitel Corporation; Sykes Enterprises, Incorporated; TeleTech Holdings, Inc. and Alorica. We compete with the aforementioned companies for new business and for the expansion of existing business within the clients we currently serve. Many of these competitors are significantly larger than us in revenue, income, number of contact centers and customer service agents, number of product offerings and market capitalization. We believe that while smaller than many of our competitors, we are able to compete because of our focus and scale as well as our ability to add value to our clients' business. We believe our success is contingent more on our targeted service offering and performance delivery to our clients than our overall size. Several of our competitors merged during the last three years, which increased the size and reach of those competitors, which may affect our competitive position. There are also many companies actively pursuing sale so further consolidation in the industry is expected. There are integration challenges involved in consolidations, which may provide us with an opportunity to deliver superior customer service to existing and new clients. We have maintained an opportunistic view of acquisitions, primarily focused on diversification and strategic value in line with our strategic plan.

Some competitors offer a broader range of services than we do, which may result in clients and potential clients consolidating their use of outsourced services with larger competitors, rather than using our services. We primarily compete with the aforementioned companies on the basis of price and quality. As such, our strategy is to execute the STARTEK Advantage System on our clients’ metrics and rank among the top of all of their outsourced vendors, while continuing to be a cost-effective solution and driving year over year improvement. We view our competitive advantage as being a large enough company to offer the breadth of service offerings that are often requested by clients while being agile enough to quickly respond to their needs. In other words, engaging with our clients in a more meaningful way and focusing on their customer engagement in a more meaningful way.

6

CLIENTS

We provide service to clients from locations in the United States, Canada, Honduras, Jamaica, and the Philippines. Approximately 47% of our revenue is derived from clients within the telecommunications industry and 25% from clients within the cable and media industry.

Our three largest customers, T-Mobile USA, Inc. (“T-Mobile”), AT&T Inc. (“AT&T”) and Comcast Cable Communications Management, LLC ("Comcast"), account for a significant percentage of our revenue. While we believe that we have good relationships with these clients, a loss of a large program from one of these clients, a significant reduction in the amount of business we receive from a principal client, renegotiation of pricing on several programs simultaneously for one of these clients, the delay or termination of a principal clients’ product launch or service offering, or the complete loss of one or more of these principal clients would adversely affect our business and our results of operations (See Item 1A. "Risk Factors"). The following table represents revenue concentration of our principal clients:

Year Ended December 31, | ||||||

2015 | 2014 | 2013 | ||||

T-Mobile USA, Inc., a subsidiary of Deutsche Telekom | 24.6 | % | 30.7 | % | 27.7 | % |

AT&T Services, Inc. and AT&T Mobility, LLC, subsidiaries of AT&T, Inc. | 12.4 | % | 22.1 | % | 25.3 | % |

Comcast Cable Communications Management, LLC, subsidiary of Comcast Corporation | 11.3 | % | 16.3 | % | 19.8 | % |

On July 28, 2011, we entered into a new master services agreement with T-Mobile effective July 1, 2011, which covers all services that we provide to T-Mobile. The new master services agreement with T-Mobile replaces the previous master services agreement dated October 1, 2007, has an initial term of five years and will automatically renew for additional one-year periods thereafter, but may be terminated by T-Mobile upon 90 days written notice.

On January 25, 2013, we entered into a new master services agreement with AT&T Services, Inc., that was scheduled to expire on December 31, 2015 and has been extended through June 30, 2016, but may be terminated by AT&T with written notice. Our work for AT&T is covered by several contracts for a variety of different lines of AT&T business. These contracts expire on various dates prior to 2018.

On January 4, 2014, we signed a new master services agreement with Comcast, effective June 22, 2013. The new master services agreement covers all services provided to Comcast, has an initial term of one year, and will automatically renew for additional one-year periods unless either party gives notice of cancellation. This new agreement provides for the same services as the original master services agreement that was signed in 2011 and would have expired in 2014. Neither party gave notice of termination; therefore, the contract has renewed for the year ending June 22, 2016, but Comcast may terminate the agreement upon 90 days written notice.

GOVERNMENT AND ENVIRONMENTAL REGULATION

We are subject to numerous federal, state, and local laws in the states and territories in which we operate, including tax, environmental and other laws that govern the way we conduct our business. There are risks inherent in conducting business internationally, including significant changes in domestic government programs, policies, regulatory requirements, and taxation with respect to foreign operations; potentially longer working capital cycles; unexpected changes in foreign government programs, policies, regulatory requirements and labor laws; and difficulties in staffing and effectively managing foreign operations.

EMPLOYEES AND TRAINING

As of December 31, 2015, we employed approximately 14,500 employees. Approximately 5,300 were employed in the United States and approximately 9,200 were employees in foreign countries. None of our employees were members of a labor union or were covered by a collective bargaining agreement during 2015. We believe the overall relations with our workforce are good.

7

CORPORATE INFORMATION

Our principal executive offices are located at 8200 E. Maplewood Ave., Suite 100, Greenwood Village, Colorado 80111. Our telephone number is (303) 262-4500. Our website address is www.startek.com. Our stock currently trades on the New York Stock Exchange ("NYSE") under the symbol SRT.

Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) and 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) are available free of charge through our website (www.startek.com) as soon as practicable after we furnish it to the Securities and Exchange Commission (“SEC”). We also make available on the “Investor Relations” page of our corporate website, the charters for the Compensation Committee, Audit Committee and Governance and Nominating Committee of our Board of Directors, as well as our Corporate Governance Guidelines and our Code of Ethics and Business Conduct.

None of the information on our website or any other website identified herein is part of this report. All website addresses in this report are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

A substantial portion of our revenue is generated by a limited number of clients. The loss or reduction in business from any of these clients would adversely affect our business and results of operations.

Revenue from our three largest clients, T-Mobile, AT&T and Comcast, accounted for 24.6%, 12.4% and 11.3%, respectively, of our revenues for the year ended December 31, 2015.

We may not be able to retain our principal clients. If we were to lose any of our principal clients, we may not be able to replace the revenue on a timely basis. Loss of a principal client could result from many factors, including consolidation or economic downturns in our clients' industries, as discussed further below.

The future revenue we generate from our principal clients may decline or grow at a slower rate than expected or than it has in the past. In the event we lose any of our principal clients or do not receive call volumes anticipated from these clients, we may suffer from the costs of underutilized capacity because of our inability to eliminate all of the costs associated with conducting business with that client, which could exacerbate the effect that the loss of a principal client would have on our operating results and financial condition. For example, there are no guarantees of volume under the current contract with AT&T. In addition, the current contract with AT&T provides for a tiered incentive pricing structure that provides for lower pricing at higher volumes. Additional productivity gains could be necessary to offset the negative impact that lower per-minute revenue at higher volume levels would have on our margins in future periods.

Our contracts generally do not contain minimum purchase requirements and can generally be terminated by our customers on short notice without penalty.

We enter into written agreements with each client for our services and seek to sign multi-year contracts with our clients. However these contracts generally permit termination upon 30 to 90 days notice by our clients, do not designate us as our clients' exclusive outsourced services provider, do not penalize our clients for early termination, hold us responsible for work performed that does not meet predefined specifications and do not contain minimum purchase requirements or volume commitments. Accordingly, we face the risk that our clients may cancel or renegotiate contracts we have with them, which may adversely affect our results. If a principal client canceled or did not renew its contract with us, our results would suffer. In addition, because the amount of revenue generated from any particular client is generally dependent on the volume and activity of our clients' customers, as described above, our business depends in part on the success of our clients' products. The number of customers who are attracted to the products of our clients may not be sufficient or our clients may not continue to develop new products that will require our services, in which case it may be more likely for our clients to terminate their contracts with us. Moreover, clients who may not terminate their contacts with us without cause could generally reduce the volume of services they outsource to us, which would have an adverse effect on our revenue, results of operations and overall financial condition.

8

We depend on several large clients in the telecommunications industry and our strategy partially depends on a trend of telecommunications companies continuing to outsource services. If the telecommunications industry suffers a downturn or the trend toward outsourcing reverses, our business will suffer.

Our key clients in the telecommunications industry include companies in the wire-line, wireless, cable and broadband lines of business. Currently, our business is largely dependent on continued demand for our services from clients in this industry and on trends in this industry to purchase outsourced services. A significant change in this trend could have a materially adverse effect on our financial condition and results of operations.

Client consolidation could result in a loss of business that would adversely affect our operating results.

The telecommunications industry has had a significant level of consolidation discussion. We cannot assure that additional consolidations will not occur in which our clients acquire additional businesses or are acquired themselves. Such consolidations may decrease our business volume and revenue, which could have an adverse effect on our business, results of operations and financial condition.

Our lack of a wide geographic diversity outside of North America may adversely affect our ability to serve existing customers or limit our ability to obtain new customers.

Although we currently conduct operations in Canada, Honduras, Jamaica, the Philippines and the United States, we do not have a wide geographic diversity. Our lack of such diversity could adversely affect our business if one or more of our customers decide to move their existing business process outsourcing services offshore. It may also limit our ability to gain new clients that may require business process service providers to have this greater flexibility across differing geographies.

The movement of business process outsourcing services to other countries has been extensively reported in the press. Most analysts continue to believe that many outsourced services will continue to migrate to other countries with lower wages than those prevailing in the U.S.

If we decide to open facilities in, or otherwise expand into, additional countries, we may not be able to successfully establish operations in the markets that we target. There are certain risks inherent in conducting business in other countries including, but not limited to, exposure to currency fluctuations, difficulties in complying with foreign laws, unexpected changes in government programs, policies, regulatory requirements and labor laws, difficulties in staffing and managing foreign operations, political instability, and potentially adverse tax consequences. There can be no assurance that one or more of such factors will not have a material adverse effect on our business, growth prospects, results of operations, and financial condition.

Our operating results may be adversely affected if we are unable to maximize our facility capacity utilization.

Our profitability is influenced by our facility capacity utilization. The majority of our business involves technical support and customer care services initiated by our clients' customers, and as a result, our capacity utilization varies, and demands on our capacity are, to some degree, beyond our control. We have experienced, and in the future may experience periods of idle capacity from opening new facilities where forecasted volume levels do not materialize. In addition, we have experienced, and in the future may experience idle peak period capacity when we open a new facility or terminate or complete a large client program. These periods of idle capacity may be exacerbated if we expand our facilities or open new facilities in anticipation of new client business because we generally do not have the ability to require a client to enter into a long-term contract or to require clients to reimburse us for capacity expansion costs if they terminate their relationship with us or do not provide us with anticipated service volumes. From time to time, we assess the expected long-term capacity utilization of our facilities. Accordingly, we may, if deemed necessary, consolidate or close under-performing facilities in order to maintain or improve targeted utilization and margins.

We may incur impairment losses and restructuring charges in future years related to any additional closures. There can be no assurance that we will be able to achieve or maintain optimal facility capacity utilization.

If client demand declines due to economic conditions or otherwise, we would not leverage our fixed costs as effectively, which would have a material adverse effect on our results of operations and financial condition.

Our foreign operations subject us to the risk of currency exchange fluctuations.

Because we conduct a material portion of our business outside the United States we are exposed to market risk from changes in the value of the Canadian dollar, Honduran lempira, the Jamaican dollar, and the Philippine peso. Material fluctuations in

9

exchange rates impact our results through translation and consolidation of the financial results of our foreign operations and, therefore, may negatively impact our results of operations and financial condition. The revenue we earn is generally priced and invoiced in U.S. dollars, but the costs under those contracts may be denominated in Canadian dollars, Philippine pesos and, to a lesser extent, the Honduran lempira and Jamaican dollar. Therefore, the fluctuations in the U.S. dollar to these currencies can cause significant fluctuations in our results of operations. We engage in hedging activities relating to our exposure to such fluctuations in the value of the Canadian dollar and the Philippine peso. During 2015, we did not enter into hedging agreements for the Honduran lempira or the Jamaican dollar. Our hedging strategy, including our ability to acquire the desired amount of hedge contracts, may not sufficiently protect us from further strengthening of these currencies against the U.S. dollar.

Our foreign operations are subject to social, political and economic risks that differ from those in the United States.

We conduct a significant portion of our business and employ a substantial number of people outside of the United States. During 2015, we generated approximately 39.8% or $112.2 million of our revenue from operations outside the United States. Circumstances and developments related to foreign operations that could negatively affect our business, financial condition or results of operations include, but are not limited to, the following factors:

• | difficulties and costs of staffing and managing operations in certain regions; |

• | differing employment practices and labor issues; |

• | local businesses and cultural factors that differ from our usual standards and practices; |

• | volatility in currencies; |

• | currency restrictions, which may prevent the transfer of capital and profits to the United States; |

• | unexpected changes in regulatory requirements and other laws; |

• | potentially adverse tax consequences; |

• | the responsibility of complying with multiple and potentially conflicting laws, e.g., with respect to corrupt practices, employment and licensing; |

• | the impact of regional or country-specific business cycles and economic instability; |

• | political instability, uncertainty over property rights, civil unrest, political activism or the continuation or escalation of terrorist activities; and |

• | access to capital may be more restricted, or unavailable on favorable terms or at all in certain locations. |

Our global growth (including growth in new regions in the United States) also subjects us to certain risks, including risks associated with funding increasing headcount, integrating new offices, and establishing effective controls and procedures to regulate the operations of new offices and to monitor compliance with regulations such as the Foreign Corrupt Practices Act and similar laws.

Although we have committed substantial resources to expand our global platform, if we are unable to successfully manage the risks associated with our global business or to adequately manage operational fluctuations, our business, financial condition and results of operations could be harmed.

If we are not able to hire and retain qualified employees, our ability to service our existing customers and retain new customers will be adversely affected.

Our success is largely dependent on our ability to recruit, hire, train and retain qualified employees. Our business is labor intensive and, as is typical for our industry, continues to experience high personnel turnover. Our operations, especially our technical support and customer care services, generally require specially trained employees, which, in turn, requires significant recruiting and training costs. Such turnover adversely affects our operating efficiency, productivity and ability to fully respond to client demand, thereby adversely impacting our operating results. Some of this turnover can be attributed to the fact that we compete for labor not only with other call centers but also with other similar-paying jobs, including retail, services industries, food service, etc. As such, improvements in the local economies in which we operate can adversely affect our ability to recruit agents in those locations. Further increases in employee turnover or failure to effectively manage these high attrition rates would have an adverse effect on our results of operations and financial condition.

The addition of new clients or implementation of new projects for existing clients may require us to recruit, hire, and train personnel at accelerated rates. We may not be able to successfully recruit, hire, train, and retain sufficient qualified personnel to adequately staff for existing business or future growth, particularly if we undertake new client relationships in industries in which we have not previously provided services. Because a substantial portion of our operating expenses consists of labor-related costs, labor shortages or increases in wages (including minimum wages as mandated by the U.S. and Canadian federal governments, employee benefit costs, employment tax rates, and other labor related expenses) could cause our business, operating profits, and financial condition to suffer. Economic and legislative changes in the U.S. may encourage organizing

10

efforts in the future which, if successful, could further increase our recruiting and training costs and could decrease our operating efficiency and productivity.

Our operating costs may increase as a result of higher labor costs.

During the past economic downturns, we, like a number of companies in our industry, sought to limit our labor costs by limiting salary increases and payment of cash bonuses to our employees. From time to time, the local economies in some of the locations in which we operate experience growth, which causes pressure on labor rates to remain competitive within the local economies. If these growth trends continue, we may need to further increase salaries or otherwise compensate our employees at higher levels in order to remain competitive. Higher salaries or other forms of compensation are likely to increase our cost of operations. If such increases are not offset by increased revenue, they will negatively impact our financial results. Conversely, if labor rates decrease due to higher unemployment in the current economic downturn, our cost of operations may decrease. In the past, some of our employees have attempted to organize a labor union, and economic and legislative changes may encourage organizing efforts in the future, which, if successful, could further increase our recruiting and training costs and could decrease our operating efficiency and productivity.

Failure to attract and retain key management personnel may adversely impact our strategy execution and financial results.

Our ability to attract, successfully integrate and retain key management personnel could have a significant impact on our ability to compete or to execute on our business strategy. Changes in key management personnel may temporarily disrupt our operations as the new management becomes familiar with our business. Accordingly, our future financial performance will depend to a significant extent on our ability to attract, motivate and retain key management personnel.

Our strategy depends on companies continuing to outsource non-core services.

Our existing clients and a number of clients we are currently targeting have been decreasing the number of firms they rely on to outsource their business process outsourced services. Due to financial uncertainties and the potential reduction in demand for our clients' products and services, our clients and prospective clients may decide to further consolidate the number of firms on which they rely for their business process outsourced services to reduce costs. Under these circumstances, our clients may cancel current contracts with us, or we may fail to attract new clients, which will adversely affect our financial condition. In addition, they may seek price reductions on our contracts as means to lower their costs. If global economic and market conditions remain uncertain or persist, spread, or deteriorate further, we may experience material impacts on our business, operating results, and financial condition.

Our business relies heavily on technology and computer systems, which subjects us to various uncertainties.

We have invested in sophisticated and specialized telecommunications and computer technology and have focused on the application of this technology to meet our clients' needs. We anticipate that it will be necessary to continue to invest in and develop new and enhanced technology on a timely basis to maintain our competitiveness. Capital expenditures may be required to keep our technology up-to-date. There can be no assurance that any of our information systems will be adequate to meet our future needs or that we will be able to incorporate new technology to enhance and develop our existing services. We experienced temporary systems interruptions in our IT platform during 2015. The root cause of some or all of the interruptions was identified as a bug in the firewall software of a third party vendor. The bug has been remediated. There can be no assurance that any technology or computer system will not encounter outages or disruptions. When outages occur we may incur remediation expenses, penalties under customer contracts or loss of customer confidence. Moreover, investments in technology, including future investments in upgrades and enhancements to software, may not necessarily maintain our competitiveness. Our future success will also depend in part on our ability to anticipate and develop information technology solutions that keep pace with evolving industry standards and changing client demands.

11

Increases in the cost of telephone and data services or significant interruptions in such services could adversely affect our business.

We depend on telephone and data services provided by various local and long distance telephone companies. Because of this dependence, any change to the telecommunications market that would disrupt these services or limit our ability to obtain services at favorable rates could affect our business. We have taken steps to mitigate our exposure to the risks associated with rate fluctuations and service disruption by entering into long-term contracts with various providers for telephone and data services and by investing in redundant circuits. There is no obligation, however, for the vendors to renew their contracts with us or to offer the same or lower rates in the future, and such contracts are subject to termination or modification for various reasons outside of our control. In addition, there is no assurance that a redundant circuit would not also be disrupted. A significant increase in the cost of telephone services that is not recoverable through an increase in the price of our services or any significant interruption in telephone services, could adversely affect our business.

Unauthorized disclosure of sensitive or confidential client and customer data could expose us to protracted and costly litigation and penalties and may cause us to lose clients.

We are dependent on IT networks and systems to process, transmit and store electronic information and to communicate among our locations around the world and with our alliance partners and clients. Security breaches of this infrastructure could lead to shutdowns or disruptions of our systems and potential unauthorized disclosure of confidential information. We are also required at times to manage, utilize and store sensitive or confidential client or customer data. As a result, we are subject to contractual terms and numerous U.S. and foreign laws and regulations designed to protect this information, such as various U.S. federal and state laws governing the protection of health or other individually identifiable information. If any person, including any of our employees, negligently disregards or intentionally breaches our established controls with respect to such data or otherwise mismanages or misappropriates that data, we could be subject to monetary damages, fines and/or criminal prosecution. Although we maintain cyber liability insurance, such insurance may not adequately or timely compensate us for all losses we may incur. Unauthorized disclosure of sensitive or confidential client or customer data, whether through systems failure, employee negligence, fraud or misappropriation, could damage our reputation and cause us to lose clients. Similarly, unauthorized access to or through our information systems or those we develop for our clients, whether by our employees or third parties, could result in negative publicity, legal liability and damage to our reputation, business, financial condition, results of operations and cash flows.

We process, transmit and store personally identifiable information and unauthorized access to or the unintended release of this information could result in a claim for damage or loss of business and create unfavorable publicity.

We process, transmit and store personally identifiable information, both in our role as a service provider and as an employer. This information may include social security numbers, financial and health information, as well as other personal information. As a result, we are subject to certain contractual terms as well as federal, state and foreign laws and regulations designed to protect personally identifiable information. We take measures to protect against unauthorized access and to comply with these laws and regulations. We use the Internet as a mechanism for delivering our services to clients, which may expose us to potential disruptive intrusions. Unauthorized access, system denials of service, or failure to comply with data privacy laws and regulations may subject us to contractual liability and damages, loss of business, damages from individual claimants, fines, penalties, criminal prosecution and unfavorable publicity, any of which could negatively affect our operating results and financial condition. In addition, third party vendors that we engage to perform services for us may have an unintended release of personally identifiable information.

We are required to comply with laws governing the transmission, security and privacy of protected health information.

In relation to our acquisition of a business process outsourcing provider focusing on health care, we are required to comply with applicable laws governing the transmission, security and privacy of health information, including, among others, the standards of The Health Insurance Portability and Accountability Act (“HIPAA”). The failure to comply with any of these laws could make it difficult to expand our recently acquired health care business process outsourcing business and/or cause us to incur significant liabilities.

12

The failure to comply with debt collection and consumer credit reporting regulations could subject us to fines and other liabilities, which could harm our reputation and business, and could make it more difficult for us to retain existing customers or attract new customers.

The Fair Debt Collection Practices Act ("FDCPA") regulates persons who regularly collect or attempt to collect, directly or indirectly, consumer debts owed or asserted to be owed to another person, which includes our recently acquired debt collection business. Certain of the accounts receivable handled by this business are subject to the FDCPA. Many states impose additional requirements on debt collection communications and some of those requirements may be more stringent than the federal requirements. In addition, many U.S. states require a debt collector to apply for, be granted and maintain a license to engage in debt collection activities in a state. We are currently licensed (or exempt from licensing requirements) to provide debt collection services in most U.S. states. Moreover, regulations governing debt collection are subject to changing interpretations that may be inconsistent among different jurisdictions. We could be subject to fines or other penalties if it is determined to have violated the FDCPA, the Fair Credit Reporting Act or analogous state laws, which could make it more difficult to retain existing customers or attract new customers and could otherwise harm our business.

When we make acquisitions, we could encounter difficulties that harm our business.

We may acquire companies, products, or technologies that we believe to be complementary to our business. If we engage in such acquisitions, we may have difficulty integrating the acquired personnel, operations, products or technologies. Acquisitions may dilute our earnings per share, disrupt our ongoing business, distract our management and employees, increase our expenses, subject us to liabilities, and increase our risk of litigation, all of which could harm our business. If we use cash to acquire companies, products, or technologies, it may divert resources otherwise available for other purposes or increase our debt.

If we are unable to meet the debt covenant requirements under our revolving credit facility, potential growth and results of operations may suffer.

Our secured revolving credit facility contains certain affirmative and negative covenants that may limit or restrict our ability to engage in certain activities, including but not limited to, making certain investments, limiting capital expenditures, incurring additional indebtedness, and engaging in mergers and acquisitions. If we are not able to meet these covenants, our ability to respond to changes in the business or economic conditions may be limited, and we may be unable to engage in certain activities that otherwise may be beneficial to our business. We can provide no assurance that we will be able to meet the financial covenants under our credit facility, or that in the event of noncompliance, that we will be able to obtain waivers or amendments from our lender. If we fail to comply with the terms of the agreement, our lender could decide to call any amounts outstanding immediately, and there can be no assurance that we would have adequate resources or collateral to satisfy the demand. Any such scenario would have a material adverse impact on our financial condition.

Our largest stockholder has the ability to significantly influence corporate actions.

A. Emmet Stephenson, Jr., one of our co-founders, owns approximately 19.0% of our outstanding common stock. Under an agreement we have entered into with Mr. Stephenson, so long as Mr. Stephenson beneficially owns 10% or more (but less than 30%) of our outstanding common stock, Mr. Stephenson will be entitled to designate one of our nominees for election to the board, although he has not currently exercised this right. In addition, our bylaws allow that any holder of 10% or more of our outstanding common stock may call a special meeting of our stockholders. The concentration of voting power in Mr. Stephenson's hands, and the control Mr. Stephenson may exercise over us as described above, may discourage, delay or prevent a change in control that might otherwise benefit our stockholders.

13

Our stock price has been volatile and may decline significantly and unexpectedly.

The market price of our common stock has been volatile, and could be subject to wide fluctuations, in response to quarterly variations in our operating results, changes in management, the degree of success in implementing our business and growth strategies, announcements of new contracts or contract cancellations, announcements of technological innovations or new products and services by us or our competitors, changes in financial estimates by securities analysts, the perception that significant stockholders may sell or intend to sell their shares, or other events or factors we cannot currently foresee. We are also subject to broad market fluctuations, given the overall volatility of the current U.S. and global economies, where the market prices of equity securities of many companies experience substantial price and volume fluctuations that have often been unrelated to the operating performance of such companies. These broad market fluctuations may adversely affect the market price of our common stock. Additionally, because our common stock trades at relatively low volume levels, any change in demand for our stock can be expected to substantially influence market prices thereof.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

14

ITEM 2. PROPERTIES

As of December 31, 2015, we had operating centers in the following cities, containing in the aggregate approximately 978,000 square feet:

Properties | Approximate Square Feet | |

Domestic: | ||

U.S. Facilities | ||

Bismarck, North Dakota | 3,200 | |

Colorado Springs, Colorado | 41,000 | |

Farmington, Missouri | 33,800 | |

Grand Junction, Colorado | 54,500 | |

Greeley, Colorado | 35,000 | |

Greenwood Village, Colorado | 14,100 | |

Hamilton, Ohio | 40,200 | |

Hot Springs, Arkansas | 38,800 | |

Jeffersonville, Indiana | 34,000 | |

Lutz, Florida | 6,300 | |

Lynchburg, Virginia | 41,300 | |

Mansfield, Ohio | 50,000 | |

Myrtle Beach, South Carolina | 54,500 | |

Tell City, Indiana | 25,280 | |

Canadian Facilities | ||

Kingston, Ontario | 49,000 | |

Offshore: | ||

Philippine Facilities | ||

Angeles City, Philippines | 61,100 | |

Frontera Verde, Philippines | 99,200 | |

Iloilo, Philippines | 97,400 | |

Makati City, Philippines | 78,400 | |

Nearshore: | ||

Honduras Facilities | ||

San Pedro Sula, Honduras | 65,200 | |

Tegucigalpa, Honduras | 30,100 | |

Jamaican Facility | ||

Kingston, Jamaica | 25,300 | |

All the above facilities are leased. Sites that are not currently operating as of December 31, 2015 are not included in the list above.

Substantially all of our facility space can be used to support any of our business process outsourced services. We believe our existing facilities are adequate for our current operations. We intend to maintain efficient levels of excess capacity to enable us to readily provide for needs of new clients and increasing needs of existing clients.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

15

Part II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET FOR COMMON STOCK

Our common stock has been listed on the NYSE under the symbol “SRT” since the effective date of our initial public offering on June 19, 1997. The following table sets forth the quarterly high and low sales prices of our common stock as reported on the NYSE for the periods shown:

High | Low | ||

2015 | |||

First Quarter | $10.12 | $7.40 | |

Second Quarter | $8.51 | $5.75 | |

Third Quarter | $6.05 | $2.86 | |

Fourth Quarter | $4.72 | $3.25 | |

2014 | |||

First Quarter | $7.15 | $6.01 | |

Second Quarter | $7.83 | $6.65 | |

Third Quarter | $7.85 | $6.51 | |

Fourth Quarter | $9.85 | $7.18 | |

2013 | |||

First Quarter | $5.99 | $3.93 | |

Second Quarter | $7.24 | $4.14 | |

Third Quarter | $6.51 | $4.58 | |

Fourth Quarter | $6.60 | $5.84 | |

HOLDERS OF COMMON STOCK

As of March 8, 2016, there were approximately 27 recordholders and 15,699,398 shares of common stock outstanding. See Item 1A. “Risk Factors,” set forth in this Form 10-K for a discussion of risks related to control that may be exercised over us by our principal stockholders.

DIVIDEND POLICY

On January 22, 2007, our board of directors announced it would not declare a quarterly dividend on our common stock in the first quarter of 2007, and did not expect to declare dividends in the near future, making the dividend paid in November 2006 the last quarterly dividend that will be paid for the foreseeable future. We plan to invest in growth initiatives in lieu of paying dividends.

STOCK REPURCHASE PROGRAM

Effective November 4, 2004, our board of directors authorized repurchases of up to $25 million of our common stock. The repurchase program will remain in effect until terminated by the board of directors, and will allow us to repurchase shares of our common stock from time to time on the open market, in block trades and in privately-negotiated transactions. Repurchases will be implemented by the Chief Financial Officer consistent with the guidelines adopted by the board of directors, and will depend on market conditions and other factors. Any repurchased shares will be held as treasury stock, and will be available for general corporate purposes. Any repurchases will be made in accordance with SEC rules. As of the date of this filing, no shares have been repurchased under this program.

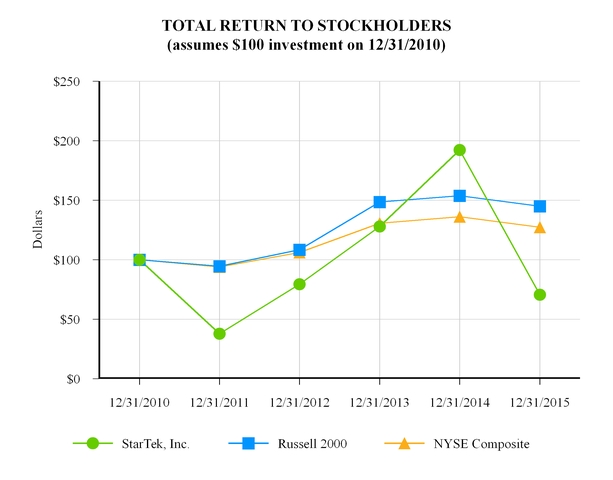

STOCK PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return on our common stock over the past five years with the cumulative total return of the New York Stock Exchange Composite Index ("NYSE Composite") and of the Russell 2000 Index

16

("Russell 2000") over the same period. We do not believe stock price performance shown on the graph is necessarily indicative of future price performance.

The information set forth under the heading "Stock Performance Graph" is not deemed to be "soliciting material" or to be "filed" with the SEC or subject to the SEC's proxy rules or to the liabilities of Section 18 of the Exchange Act, and the graph shall not be deemed to be incorporated into any of our prior or subsequent filings under the Securities Act or the Exchange Act.

17

ITEM 6. SELECTED FINANCIAL DATA

The following selected financial data should be read in conjunction with the Consolidated Financial Statements and Notes thereto which are included in Item 8, "Financial Statements and Supplementary Financial Data," of this Form 10-K. Additionally, the following selected financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," which is included in Item 7.

Year Ended December 31, | |||||||||||||||||

Consolidated Statement of Operations Data | 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||

(In thousands, except per share data) | |||||||||||||||||

Revenue | $ | 282,134 | $ | 250,080 | $ | 231,257 | 198,092 | 219,493 | |||||||||

Cost of services | 257,830 | 219,608 | 206,932 | 175,095 | 203,284 | ||||||||||||

Gross profit | 24,304 | 30,472 | 24,325 | 22,997 | 16,209 | ||||||||||||

Selling, general and administrative expenses | 34,427 | 31,397 | 28,828 | 29,645 | 37,334 | ||||||||||||

Impairment losses and restructuring charges, net | 3,890 | 3,965 | 94 | 4,066 | 5,496 | ||||||||||||

Operating loss | (14,013 | ) | (4,890 | ) | (4,597 | ) | (10,714 | ) | (26,621 | ) | |||||||

Interest and other income (expense), net | (1,139 | ) | (6 | ) | (1,579 | ) | 342 | 33 | |||||||||

Loss before income taxes | (15,152 | ) | (4,896 | ) | (6,176 | ) | (10,372 | ) | (26,588 | ) | |||||||

Income tax expense | 464 | 564 | 230 | 116 | (126 | ) | |||||||||||

Net loss | $ | (15,616 | ) | $ | (5,460 | ) | $ | (6,406 | ) | (10,488 | ) | (26,462 | ) | ||||

Net income (loss) per share from continuing operations: | |||||||||||||||||

Basic | (1.01 | ) | (0.35 | ) | (0.42 | ) | (0.69 | ) | (1.75 | ) | |||||||

Weighted average shares outstanding | |||||||||||||||||

Basic | 15,529 | 15,394 | 15,339 | 15,241 | 15,084 | ||||||||||||

Balance Sheet Data | |||||||||||||||||

Total assets | $ | 115,674 | $ | 93,793 | $ | 89,717 | 93,132 | 101,433 | |||||||||

Long term liabilities | 10,052 | 7,440 | 3,045 | 2,974 | 3,586 | ||||||||||||

Total stockholders' equity | 41,925 | 54,681 | 58,174 | 66,279 | 74,362 | ||||||||||||

Other Selected Financial Data | |||||||||||||||||

Capital expenditures, net of proceeds | 7,722 | 11,661 | 8,843 | 7,305 | 8,958 | ||||||||||||

Depreciation and amortization | 13,261 | 10,379 | 12,527 | 12,957 | 15,750 | ||||||||||||

Cash dividends declared per common share | — | — | — | — | — | ||||||||||||

18

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of the results of operations and financial condition should be read in conjunction with the accompanying Consolidated Financial Statements included elsewhere in this annual report.

OVERVIEW

STARTEK is a business process outsourcing services company with employees we call Brand Warriors who, for over 25 years have been committed to making a positive impact on our clients’ business results. Our mission is to enable and empower our Brand Warriors to promote our clients’ brands every day and bring value to our stakeholders. We accomplish this by aligning with our clients’ business objectives.

STARTEK has proven results for the multiple services we provide, including sales, order management and provisioning, customer care, technical support, receivables management, and retention programs. We manage programs using a variety of multi-channel customer interactions, including voice, chat, email, social media and back-office support. STARTEK has delivery centers in Canada, Honduras, Jamaica, United States, and the Philippines.

We operate our business within three reportable segments, based on the geographic regions in which our services are rendered: Domestic, Nearshore and Offshore. For the year-ended December 31, 2015, our Domestic segment included the operations of thirteen facilities in the U.S. and one facility in Canada. Our Nearshore segment included the operations of two facilities in Honduras and one facility in Jamaica. Our Offshore segment included the operations of four facilities in the Philippines.

We primarily evaluate segment operating performance in each reporting segment based on revenue and gross profit. Certain operating expenses are not allocated to each reporting segment; therefore, we do not present income statement information by reporting segment below the gross profit level.

SIGNIFICANT DEVELOPMENTS

New Facilities

We commenced operations in Hamilton, Ohio in July 2015 and entered into a 5 year lease and a $2.6 million note payable for the construction of the leasehold improvements.

Site Closures

In December 2015, we ceased operations in Kansas City, Missouri. Accordingly, we recorded a restructuring reserve of $0.2 million for employee related and facility related costs. We expect these costs to be paid in the first half of 2016.

In September 2015, and as part of the integration activities related to ACCENT, we closed the former ACCENT headquarters office location in Jeffersonville, Indiana and shifted the activities performed there into our Greenwood Village, Colorado headquarters office or our shared services office in the Philippines. Accordingly, we recorded a restructuring reserve of $0.2 million for employee related and facility related costs. We expect these costs to be paid in the first half of 2016.

In May 2015, we closed the Enid, Oklahoma facility again, and listed it for sale. As of December 31, 2015, the asset remains in Property, Plan and Equipment due to its nominal book value. We have assessed the property's fair value and believe no impairment exists at December 31, 2015.

We ceased operations in Costa Rica in August 2014. We recorded a restructuring reserve of $1.3 million for employee related costs and facility related costs. The restructuring plan was completed in 2015.

OTHER EVENTS

IT Platform Initiative

During the second quarter of 2014, we began the last phase of our IT transformation project by outsourcing our data centers. We recognized $1.7 million in restructuring charges during 2014. We completed our IT transformation project during the third quarter of 2015. We recognized an additional $1.5 million in restructuring charges in 2015, bringing the total cost of the initiative to $3.2 million.

19

ACCENT Acquisition

On June 1, 2015, we acquired 100% of the membership interests of ACCENT pursuant to a Membership Interest Purchase Agreement with MDC Corporate (US) Inc. and MDC Acquisition Inc. ACCENT is a business process outsourcing company providing contact center services and customer engagement solutions with locations in the U.S. and Jamaica. ACCENT’s data-driven approach helps brands maximize their engagement with consumers and enables brands to influence behavior, all while generating a better return on investment across all customer touch points, including phone, online and social media channels. ACCENT's customer engagement agency model and platform complements our Ideal Dialogue practice, significantly enhancing our solution set and commitment to results-driven analytics and customer insights for our clients. Accordingly, we paid a premium for ACCENT, resulting in the recognition of goodwill.

20

RESULTS OF OPERATIONS — YEARS ENDED DECEMBER 31, 2015 AND 2014

The following table summarizes our revenues and gross profit for the periods indicated, by reporting segment:

For the Years Ended December 31, | |||||||||||||

2015 | 2014 | ||||||||||||

(in 000s) | (% of Total) | (in 000s) | (% of Total) | ||||||||||

Domestic: | |||||||||||||

Revenue | $ | 169,945 | 60.2 | % | $ | 130,574 | 52.2 | % | |||||

Cost of services | 158,331 | 61.4 | % | 117,634 | 53.6 | % | |||||||

Gross profit | $ | 11,614 | 47.8 | % | $ | 12,940 | 42.5 | % | |||||

Gross profit % | 6.8 | % | 9.9 | % | |||||||||

Offshore | |||||||||||||

Revenue | 72,914 | 25.8 | % | 85,785 | 34.3 | % | |||||||

Cost of services | 66,242 | 25.7 | % | 70,593 | 32.1 | % | |||||||

Gross profit | $ | 6,672 | 27.5 | % | $ | 15,192 | 49.9 | % | |||||

Gross profit % | 9.2 | % | 17.7 | % | |||||||||

Nearshore | |||||||||||||

Revenue | 39,275 | 13.9 | % | 33,721 | 13.5 | % | |||||||

Cost of services | 33,257 | 12.9 | % | 31,381 | 14.3 | % | |||||||

Gross profit | $ | 6,018 | 24.8 | % | $ | 2,340 | 7.7 | % | |||||

Gross profit % | 15.3 | % | 6.9 | % | |||||||||

Company Total: | |||||||||||||

Revenue | $ | 282,134 | 100.0 | % | $ | 250,080 | 100.0 | % | |||||

Cost of services | 257,830 | 100.0 | % | 219,608 | 100.0 | % | |||||||

Gross profit | $ | 24,304 | 100.0 | % | $ | 30,472 | 100.0 | % | |||||

Gross profit % | 8.6 | % | 12.2 | % | |||||||||

Revenue

Revenue increased by $32.0 million, or 12.8%, from $250.1 million in 2014 to $282.1 million in 2015. This includes ACCENT revenue of $40.4 million. The Domestic segment increase of $39.4 million was due to $34.3 million from the acquisition of ACCENT and $42.3 million of new business and growth from existing clients, partially offset by $31.1 million of volume reductions, $5.0 million of lost programs, and $1.1 million due to site closures. Offshore revenues declined by $12.9 million due to $16.1 million of volume reductions and $6.3 million of lost programs, partially offset by $9.5 million of growth from existing and new clients. The increase in the Nearshore segment of $5.6 million was due to $6.3 million of growth from existing and new clients in our Honduras facilities and $6.5 million of revenue from our Jamaica facility, partially offset by $3.8 million of volume reductions and $3.4 million of lost revenue due to the closure of the Costa Rica site in 2014.

Cost of Services and Gross Profit