Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-14550

中国东方航空股份有限公司

(Exact Name of Registrant as Specified in Its Charter)

| China Eastern Airlines Corporation Limited | The People’s Republic of China | |

| (Translation of Registrant’s Name Into English) | (Jurisdiction of Incorporation or Organization) |

Kong Gang San Road, Number 92

Shanghai, 200335

People’s Republic of China

Tel: (8621) 6268-6268

Fax: (8621) 6268-6116

(Address and Contact Details of the Board Secretariat’s Office)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on which Registered | |

| American Depositary Shares Ordinary H Shares, par value RMB1.00 per share |

The New York Stock Exchange The New York Stock Exchange* |

| * | Not for trading, but only in connection with the registration of American Depositary Shares. The Ordinary H Shares are also listed and traded on The Stock Exchange of Hong Kong Limited. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

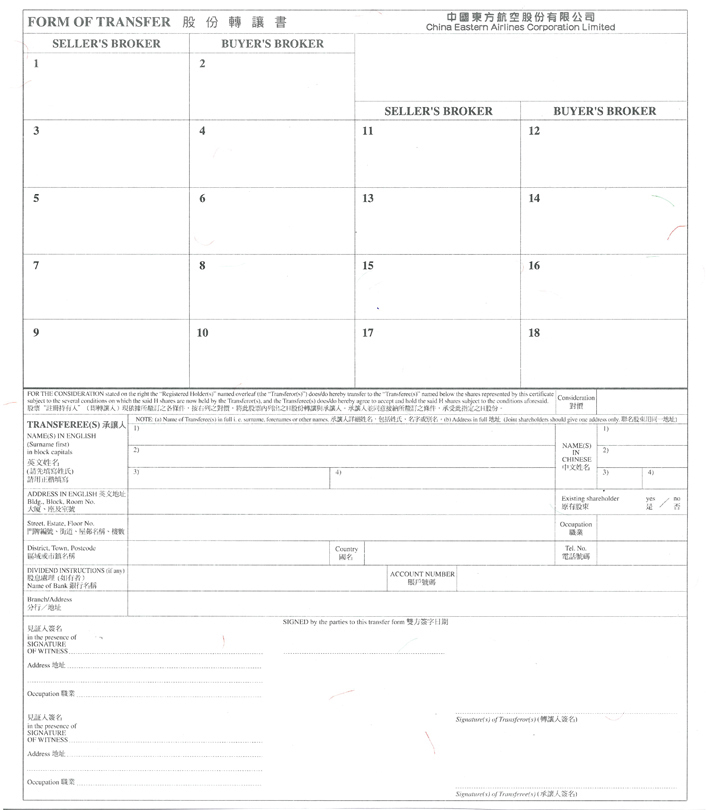

As of December 31, 2017, 9,808,485,682 Ordinary Domestic Shares, par value RMB1.00 per share, were issued and outstanding, and 4,659,100,000 Ordinary H Shares par value RMB1.00 per share, were issued and outstanding. H Shares are Ordinary Shares of the Company listed on The Stock Exchange of Hong Kong Limited. Each American Depositary Share represents 50 Ordinary H Shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 .. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an emerging growth company. See definition of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☒ | Accelerated Filer ☐ | Non-Accelerated Filer ☐ | Emerging Growth Company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ |

Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Table of Contents

Table of Contents

SUPPLEMENTAL INFORMATION AND EXCHANGE RATES

In this Annual Report, unless otherwise specified, the term “dollars”, “U.S. dollars” or “US$” refers to United States dollars, the lawful currency of the United States of America, or the United States or the U.S.; the term “Renminbi” or “RMB” refers to Renminbi, the lawful currency of The People’s Republic of China, or China or the PRC; the term “Hong Kong dollars” or “HK$” refers to Hong Kong dollars, the lawful currency of the Hong Kong Special Administrative Region of China, or Hong Kong; the term “SGD” refers to Singapore dollars, the lawful currency of the Republic of Singapore; the term “JPY” refers to Japan Yen, the lawful currency of Japan; the term “EUR” refers to EURO, the lawful currency of EMU member countries and the term “KRW” refers to Korea Won, the lawful currency of the Republic of Korea. Any discrepancies in the tables included herein between the amounts listed and the totals are due to rounding.

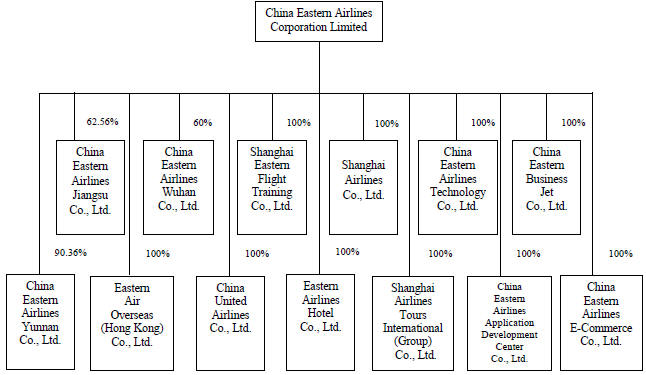

In this Annual Report, the term “we”, “us”, “our”, “our/the Company”, or “our Group” refers to China Eastern Airlines Corporation Limited, a joint stock limited company incorporated under the laws of the PRC on April 14, 1995, and our subsidiaries, or, in respect of references to any time prior to the incorporation of China Eastern Airlines Corporation Limited, the core airline business carried on by its predecessor, China Eastern Airlines, which was assumed by China Eastern Airlines Corporation Limited pursuant to the restructuring described in this Annual Report. The term “CEA Holding” refers to our parent, China Eastern Air Holding Company, which was established on October 11, 2002 as a result of the merger of our former controlling shareholder, Eastern Air Group Company, or EA Group, with China Northwest Airlines Company and Yunnan Airlines Company.

For the purpose of this Annual Report, references to The People’s Republic of China, China and the PRC do not include Hong Kong, Taiwan, or the Macau Special Administrative Region of China, or Macau.

See “Item 3. Key Information — Exchange Rate Information” for details of exchange rates.

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

Certain information contained in this Annual Report may be deemed to constitute forward-looking statements. These forward-looking statements include, without limitation, statements relating to:

| • | the impact of changes in the policies of the Civil Aviation Administration of China, or the CAAC, regarding route rights; |

| • | the impact of the CAAC policies regarding the restructuring of the airline industry in China; |

| • | the impact of macroeconomic fluctuations (including the fluctuations of oil prices, and interest and exchange rates); |

| • | certain statements with respect to trends in prices, volumes, operations, margins, risk management, overall market trends and exchange rates; |

| • | our fleet development plans, including, without limitation, related financing, schedule, intended use and planned disposition; |

| • | our expansion plan of the cargo operations; |

| • | our expansion plans, including possible acquisition of other airlines; |

| • | our marketing plans, including the establishment of additional sales offices; |

| • | our plan to add new pilots; and |

1

Table of Contents

| • | the impact of unusual events on our business and operations. |

The words or phrases “aim”, “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “going forward”, “intend”, “may”, “ought to”, “plan”, “potential”, “predict”, “project”, “seek”, “should”, “will”, “would”, and similar expressions or the negatives thereof, as they relate to our Company or its management, are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, or the Exchange Act. These forward-looking statements are based on current plans and estimates, and speak only as of the date they are made. We undertake no obligation to update or revise any forward-looking statement in light of new information, future events or otherwise. Forward-looking statements are, by their nature, subject to inherent risks and uncertainties, some of which are beyond our control, and are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in particular circumstances. We caution you that a number of important factors could cause actual outcomes to differ, or to differ materially, from those expressed in any forward-looking statement, including, without limitation:

| • | changes in political, economic, legal and social conditions in China; |

| • | any changes in the regulatory policies of the CAAC; |

| • | the development of the high-speed rail network in the PRC; |

| • | fluctuations of interest rates and foreign exchange rates; |

| • | the availability of qualified flight personnel and airport facilities; |

| • | the effects of competition on the demand for and price of our services; |

| • | the availability and cost of aviation fuel, including but not limited to pricing trends and risks associated with fuel hedging; |

| • | any significant depreciation of Renminbi or Hong Kong dollars against U.S. dollars, Japanese yen or Euro, the currencies in which the majority of our borrowings are denominated; |

| • | our ability to obtain adequate financing, including any required external debt and acceptable bank guarantees; and |

| • | general economic conditions in markets where we operate. |

2

Table of Contents

GLOSSARY OF TECHNICAL TERMS

| Capacity measurements | ||

| ATK (available tonne-kilometers) | the number of tonnes of capacity available for the carriage of revenue load (passengers and cargo) multiplied by the distance flown | |

| ASK (available seat kilometers) | the number of seats made available for sale multiplied by the distance flown | |

| AFTK (available freight tonne-kilometers) | the number of tonnes of capacity available for the carriage of cargo and mail multiplied by the distance flown | |

| Traffic measurements | ||

| revenue passenger-kilometers or RPK | the number of passengers carried multiplied by the distance flown | |

| revenue freight tonne-kilometers or RFTK | cargo and mail load in tonnes multiplied by the distance flown | |

| revenue passenger tonne-kilometers or RPTK | passenger load in tonnes multiplied by the distance flown | |

| revenue tonne-kilometers or RTK | load (passenger and cargo) in tonnes multiplied by the distance flown | |

| Load factors | ||

| overall load factor | tonne-kilometers expressed as a percentage of ATK | |

| passenger load factor | passenger-kilometers expressed as a percentage of ASK | |

| Yield and cost measurements | ||

| passenger yield (revenue per passenger-kilometer) | revenue from passenger operations divided by passenger-kilometers | |

| cargo and mail yield (revenue per cargo and mail tonne-kilometer) | revenue from cargo and mail operations divided by cargo and mail tonne-kilometers | |

| average yield (revenue per total tonne-kilometer) | revenue from airline operations divided by tonne-kilometers | |

| unit cost | operating expenses divided by ATK | |

| Tonne | a metric ton, equivalent to 2,204.6 lbs | |

3

Table of Contents

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

| A. | Selected Financial Data |

Pursuant to U.S. Securities and Exchange Commission (“SEC” or “Securities and Exchange Commission”) Release 33-8879 “ Acceptance from Foreign Private Issuers of Financial Statements Prepared in Accordance with International Financial Reporting Standards without Reconciliation to U.S. GAAP “ eliminating the requirement for foreign private issuers to reconcile their financial statements to U.S. GAAP, we prepare our financial statements based on International Financial Reporting Standards, or IFRSs, as issued by the International Accounting Standards Board, or the IASB, and no longer provide a reconciliation between IFRSs and U.S. GAAP.

Our consolidated financial statements as of December 31, 2016 and 2017 and for the years ended December 31, 2015, 2016 and 2017 included in this Annual Report on Form 20-F have been prepared in accordance with IFRSs.

We make an explicit and unreserved statement of compliance with IFRSs with respect to our consolidated financial statements as of December 31, 2016 and 2017 and for the years ended December 31, 2015, 2016 and 2017 included in this Annual Report. Ernst & Young Hua Ming LLP, our current independent registered public accounting firm in the PRC, has issued an unqualified auditor’s report on our consolidated statement of financial position as of December 31, 2017 and the related consolidated statements of profit or loss and other comprehensive income, changes in equity and cash flows for the year ended December 31, 2017. The selected financial data from the consolidated profit or loss and other comprehensive income for the years ended December 31, 2014, 2015 and 2016 and the selected financial data from the consolidated financial position as of December 31, 2014, 2015 and 2016 have been derived from our audited consolidated financial statements, which have been prepared in accordance with IFRSs, and audited by Ernst & Young, an independent registered public accounting firm in Hong Kong. The selected financial data from the consolidated profit or loss and other comprehensive income for the year ended December 31, 2013 and the selected financial data from the consolidated financial position as of December 31, 2013 have been derived from our audited consolidated financial statements, which have been prepared in accordance with IFRSs, and audited by Ernst & Young Hua Ming LLP, an independent registered public accounting firm in the PRC.

The following tables present selected consolidated profit or loss and comprehensive income data for the years ended December 31, 2013, 2014, 2015, 2016 and 2017 and selected consolidated statements of financial position data as of December 31, 2013, 2014, 2015, 2016 and 2017 that were prepared under IFRSs. The selected financial information as of December 31, 2016 and 2017 and for the years ended December 31, 2015, 2016 and 2017 has been derived from, and should be read in conjunction with, the audited consolidated financial statements and their notes included elsewhere in this Annual Report.

4

Table of Contents

| Year Ended December 31, | ||||||||||||||||||||

| 2013 RMB |

2014 RMB |

2015 RMB |

2016 RMB |

2017 RMB |

||||||||||||||||

| (in millions, except per share or per ADS data) | ||||||||||||||||||||

| Consolidated Statements of Profit or Loss and Other Comprehensive Income Data: |

||||||||||||||||||||

| Revenues |

88,245 | 90,185 | 93,969 | 98,904 | 102,475 | |||||||||||||||

| (Loss)/gain on fair value changes of derivative financial instruments |

18 | 11 | 6 | 2 | (311 | ) | ||||||||||||||

| Other operating income and gains |

2,725 | 3,685 | 5,269 | 5,469 | 7,481 | |||||||||||||||

| Operating expenses |

(89,412 | ) | (87,823 | ) | (86,619 | ) | (91,889 | ) | (100,525 | ) | ||||||||||

| Operating profit |

1,576 | 6,058 | 12,625 | 12,486 | 9,431 | |||||||||||||||

| Finance income / (costs), net |

576 | (2,072 | ) | (7,110 | ) | (6,176 | ) | (1,072 | ) | |||||||||||

| Profit before income tax |

2,217 | 4,113 | 5,667 | 6,497 | 8,610 | |||||||||||||||

| Profit for the year attributable to the equity holders of the Company |

2,373 | 3,410 | 4,537 | 4,498 | 6,342 | |||||||||||||||

| Basic and fully diluted earnings per share (1) |

0.20 | 0.27 | 0.35 | 0.33 | 0.44 | |||||||||||||||

| Basic and fully diluted earnings per ADS |

9.81 | 13.45 | 17.5 | 16.5 | 22.0 | |||||||||||||||

| (1) | The calculation of earnings per share for 2013 is based on the net profit attributable to the equity holders of the Company divided by the weighted average number of 12,091,881,000 ordinary shares in issue. The calculation of earnings per share for 2014 is based on the net profit attributable to the equity holders of the Company divided by the weighted average number of 12,674,269,000 ordinary shares in issue. The calculation of earnings per share for 2015 is based on the net profit attributable to the equity holders of the Company divided by the weighted average number of 12,818,509,000 ordinary shares in issue. The calculation of earnings per share for 2016 is based on the net profit attributable to the equity holders of the Company divided by the weighted average number of 13,811,136,000 ordinary shares in issue. The calculation of earnings per share for 2017 is based on the net profit attributable to the equity holders of the Company divided by the weighted average number of 14,467,585,682 ordinary shares in issue. |

| As of December 31, | ||||||||||||||||||||

| 2013 RMB |

2014 RMB |

2015 RMB |

2016 RMB |

2017 RMB |

||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Consolidated Statements of Financial Position Data: |

| |||||||||||||||||||

| Cash and cash equivalents |

1,995 | 1,355 | 9,080 | 1,695 | 4,605 | |||||||||||||||

| Net current liabilities |

(40,472 | ) | (42,887 | ) | (51,309 | ) | (52,194 | ) | (62,035 | ) | ||||||||||

| Non-current assets |

127,458 | 147,586 | 174,914 | 196,436 | 211,434 | |||||||||||||||

| Long term borrowings, including current portion |

(36,175 | ) | (41,210 | ) | (43,675 | ) | (29,749 | ) | (28,842 | ) | ||||||||||

| Obligations under finance leases, including current portion |

(23,135 | ) | (38,695 | ) | (52,399 | ) | (61,041 | ) | (66,868 | ) | ||||||||||

| Total share capital and reserves attributable to the equity holders of the Company |

26,902 | 29,974 | 37,411 | 49,450 | 55,360 | |||||||||||||||

| Non-current liabilities |

(58,404 | ) | (72,928 | ) | (83,674 | ) | (91,876 | ) | (90,621 | ) | ||||||||||

| Total assets less current liabilities |

86,986 | 104,699 | 123,605 | 144,242 | 149,399 | |||||||||||||||

| Total assets |

140,068 | 165,829 | 197,992 | 212,324 | 229,727 | |||||||||||||||

| Net assets |

28,582 | 31,771 | 39,931 | 52,366 | 58,778 | |||||||||||||||

5

Table of Contents

Exchange Rate Information

We present our historical consolidated financial statements in Renminbi. For the convenience of the reader, certain pricing information is presented in U.S. dollars and certain contractual and other amounts that are in Renminbi or Hong Kong dollars amounts include a U.S. dollar equivalent. Unless otherwise noted, all translations from RMB to U.S. dollars, from Hong Kong dollars to U.S. dollars, from U.S. dollars to RMB and from U.S. dollars to Hong Kong dollars in this Annual Report were made at the rate of RMB6.5063 to US$1.00 and HK$7.8128 to US$1.00, the exchange rate set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve Board on December 29, 2017. We make no representation that the Renminbi, Hong Kong dollar or U.S. dollar amounts referred to in this Annual Report could have been or could be converted into U.S. dollars, Hong Kong dollars or Renminbi, as the case may be, at any particular rate or at all. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of RMB into foreign exchange and through restrictions on foreign trade.

On April 13, 2018, the exchange rates as set forth in the H.10 statistical release of the Federal Reserve Board were RMB6.2725=US$1.00 and HK$7.8499=US$1.00. The following table sets forth information concerning exchange rates between the RMB, Hong Kong dollar and the U.S. dollar for the periods indicated. The source of these rates is the Federal Reserve Statistical Release.

| RMB per US$1.00 (1) | HK$ per US$1.00 (1) | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| October 2017 |

6.6533 | 6.5712 | 7.8106 | 7.7996 | ||||||||||||

| November 2017 |

6.6385 | 6.5967 | 7.8118 | 7.7955 | ||||||||||||

| December 2017 |

6.6210 | 6.5063 | 7.8228 | 7.8050 | ||||||||||||

| January 2018 |

6.5263 | 6.2841 | 7.8230 | 7.8161 | ||||||||||||

| February 2018 |

6.3471 | 6.2649 | 7.8267 | 7.8183 | ||||||||||||

| March 2018 |

6.3565 | 6.2685 | 7.8486 | 7.8275 | ||||||||||||

| April 2018 (up to April 13, 2018) |

6.3045 | 6.2655 | 7.8499 | 7.8482 | ||||||||||||

The following table sets forth the average rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each of the periods indicated. The exchange rate refers to the exchange rate as set forth in the G. 5A statistical release of the Federal Reserve Board.

| RMB per US$1.00 (1) |

HK$ per US$1.00 (1) |

|||||||

| 2013 |

6.1478 | 7.7565 | ||||||

| 2014 |

6.1620 | 7.7545 | ||||||

| 2015 |

6.2827 | 7.7524 | ||||||

| 2016 |

6.6400 | 7.7620 | ||||||

| 2017 |

6.7569 | 7.7926 | ||||||

Source: Federal Reserve Statistical Release

| (1) | Averages are based on daily noon buying rates for cable transfers in New York City certified for customs purposes by the Federal Reserve Bank of New York. |

Selected Operating Data

The following table sets forth certain of our operating data for the five years ended December 31, 2017, which is not audited. All references in this Annual Report to our cargo operations, statistics or revenues include figures for cargo and mail.

6

Table of Contents

| Year Ended December 31, | ||||||||||||||||||||||||

| 2013 |

2014 |

2015 |

2016 | 2016 | 2017 |

|||||||||||||||||||

| (non-comparable basis) (1) |

(comparable basis)(2) |

|||||||||||||||||||||||

| Selected Airline Operating Data: |

||||||||||||||||||||||||

| Capacity: |

||||||||||||||||||||||||

| ATK (millions) |

21,714.8 | 22,538.5 | 25,203.0 | 28,002.3 | 25,097.6 | 27,396.9 | ||||||||||||||||||

| ASK (millions) |

152,075.2 | 160,585.1 | 181,792.9 | 206,249.3 | — | 225,996.3 | ||||||||||||||||||

| AFTK (millions) |

8,028.0 | 8,085.8 | 8,841.7 | 9,439.9 | 6,535.2 | 7,057.3 | ||||||||||||||||||

| Traffic: |

||||||||||||||||||||||||

| Revenue passenger-kilometers (millions) |

120,461.1 | 127,749.9 | 146,342.43 | 167,529.2 | — | 183,182.0 | ||||||||||||||||||

| Revenue tonne-kilometers (millions) |

15,551.8 | 16,122.4 | 17,820.4 | 19,712.9 | 17,333.1 | 18,856.1 | ||||||||||||||||||

| Revenue freight tonne-kilometers (millions) |

4,857.2 | 4,802.4 | 4,865.1 | 4,875.2 | 2,495.4 | 2,663.0 | ||||||||||||||||||

| Hours flown (thousands) |

1,540.4 | 1,625.1 | 1,804.4 | 1,956.5 | 1,918.8 | 2,072.7 | ||||||||||||||||||

| Number of passengers carried (thousands) |

79,093.7 | 83,811.5 | 93,780.0 | 101,741.6 | — | 110,811.4 | ||||||||||||||||||

| Weight of cargo carried (millions of kilograms) |

1,410.3 | 1,363.3 | 1,399.4 | 1,395.0 | 929.3 | 933.3 | ||||||||||||||||||

| Load Factor: |

||||||||||||||||||||||||

| Overall load factor (%) |

71.6 | 71.5 | 70.7 | 70.4 | 69.1 | 68.8 | ||||||||||||||||||

| Passenger load factor (%) |

79.2 | 79.6 | 80.5 | 81.2 | — | 81.1 | ||||||||||||||||||

| Yield and Cost Statistics (including fuel surcharge) (RMB): |

||||||||||||||||||||||||

| Passenger yield (passenger revenue/ passenger- kilometers) |

0.61 | 0.61 | 0.56 | 0.52 | — | 0.52 | ||||||||||||||||||

| Cargo and mail yield (cargo and mail revenue/cargo and mail tonne-kilometers) |

1.57 | 1.55 | 1.33 | 1.25 | 1.25 | 1.36 | ||||||||||||||||||

| Average yield (passenger and cargo revenue/ tonne- kilometers) |

5.18 | 5.28 | 4.94 | 4.71 | 5.18 | 5.25 | ||||||||||||||||||

| Unit cost (operating expenses/ATK) |

4.12 | 3.90 | 3.44 | 3.28 | 3.66 | 3.67 | ||||||||||||||||||

7

Table of Contents

Notes:

| (1) | On November 29, 2016, we entered into an equity transfer agreement with Eastern Airlines Industry Investment Company Limited (“Eastern Airlines Industry Investment”), in relation to the transfer of 100% equity interests in Eastern Airlines Logistics Co., Ltd. (“Eastern Logistics”) held by us to Eastern Airlines Industry Investment. China Cargo Airlines Co., Ltd (“China Cargo Airlines”), a non-wholly owned subsidiary of Eastern Logistics, operated nine freighters then. On February 8, 2017, we completed the transfer of 100% equity interest in Eastern Logistics to Eastern Airlines Industry Investment and the nine freighters operated by China Cargo Airlines ceased to be included in our fleet. Under non-comparable basis, our operating data in 2016 comprised of our whole cargo freight data during the period from February to December 2016. |

| (2) | Under comparable basis, our operating data in 2016 did not include our whole cargo freight data during the period from February to December 2016. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Risks Relating to our Business

We may suffer losses in the event of an accident or incident involving our aircraft or the aircraft of any other airline.

As an airline company operating a large fleet, an accident or incident involving one of our aircraft could result in delays and require repair or replacement of a damaged aircraft, which could result in consequential temporary or permanent losses from disruption of service and/or significant liability to injured passengers and others. Unforeseeable or unpredictable events such as inclement weather, mechanical failures, human error, aircraft defects and other force majeure events may affect flight safety, which could result in accidents and/or incidents of passenger injuries or deaths that could lead to significant injury and loss claims. Although we believe that we currently maintain liability insurance in amounts and of the types generally consistent with industry practice, the amount of such coverage may not be adequate to cover the costs related to an accident or incident in full, which could damage our results of operations and financial condition. In addition, any aircraft accident or incident, even if fully insured, could cause a public perception that we are not as safe or reliable as other airlines, which could harm our competitive position and result in a decrease in our operating revenues. Moreover, a major accident or incident involving an aircraft of our competitors may cause the demand for air travel in general to decrease. In particular, certain of our competitors in the Asia Pacific region experienced major aircraft accidents and incidents in 2014, some of which involved destinations and routes that we cover. These accidents and incidents were highly publicized in the media and may have affected public perception of certain air travel routes. The occurrence of any of the foregoing could adversely affect our results of operations and financial condition.

Our indebtedness and other financial obligations may have a material adverse effect on our liquidity and operations.

We have a substantial amount of debt, lease and other financial obligations, and will continue to do so in the future. As of December 31, 2017, our total liabilities were approximately RMB170,949 million and our current liabilities exceeded our current assets by approximately RMB62,035 million. Our total interest-bearing liabilities (including long-term and short-term borrowings, finance leases payable and bonds payable) as of December 31, 2016 and 2017 were approximately RMB117,773 million and RMB130,669 million, respectively, of which short-term liabilities accounted for approximately 30.0% and 37.0%, respectively. Our substantial indebtedness and other financial obligations could materially and adversely affect our business and operations, including being required to dedicate additional cash flow from operations to the payment of principal and interest on our indebtedness, thereby reducing the funds available for operations, maintenance and service improvements and future business opportunities, increasing our vulnerability to economic recessions, reducing our flexibility in responding to changing business and economic conditions, placing us at a disadvantage compared to competitors with lower debt, limiting our ability to arrange for additional financing for working capital, capital expenditures and other general corporate purposes, at all or on terms that are acceptable to us.

8

Table of Contents

Moreover, we are largely dependent upon cash flows generated from our operations and external financing to meet our debt repayment obligations and working capital requirements, which may reduce the funds available for other business purposes. If our operating cash flow is materially and adversely affected by factors such as increased competition, a significant decrease in demand for our services, or a significant increase in jet fuel prices, our liquidity would be materially and adversely affected. We also try to secure sufficient financing through financing arrangements with domestic and foreign banks in China as well as from debt and equity capital markets. However, our ability to obtain financing may be affected by our financial position and leverage, our credit rating and investor perception of the aviation industry, as well as prevailing economic conditions and the cost of financing in general. If we are unable to obtain adequate financing for our capital requirements, our liquidity and operations would be materially and adversely affected.

In addition, the airline industry overall is characterized by a high degree of operating leverage. Due to high fixed costs, including payments made in connection with aircraft leases, and landing and infrastructure fees which are set by government authorities and not within our control, the expenses relating to flight operations do not vary proportionately with the number of passengers carried, while revenues generated from a particular flight are directly related to the number of passengers carried and the fare structure of the flight. Accordingly, a decrease in revenues may result in a disproportionately higher decrease in profits.

We may not be able to secure future financing at terms acceptable to us or at all.

We require significant amounts of external financing to meet our capital commitments for acquiring and upgrading aircraft and flight equipment and for other general corporate needs. As of December 31, 2017, we had total unutilized credit facilities of approximately RMB59.47 billion from various banks. We expect to roll over these bank facilities in the near future. In addition, we generally acquire aircraft through either long-term capital leases or operating leases. In the past, we have obtained guarantees from Chinese banks in respect of payments under our foreign loan and capital lease obligations. However, we cannot assure you that we will be able to roll over our bank facilities or continue to obtain bank guarantees in the future. Unavailability of credit facilities or guarantees from Chinese banks or the increased cost of such guarantees may materially and adversely affect our ability to borrow additional funds or enter into international aircraft lease financing or other additional financing on acceptable terms In addition, if we are not able to arrange financing for our aircraft on order, we may seek to defer aircraft deliveries or use cash from operations or other sources to acquire the aircraft .

Our ability to obtain financing may also be impaired by our financial position, leverage and credit rating. In addition, factors beyond our control, such as recent global market and economic conditions, volatile oil prices, and the tightening of credit markets may result in limited availability of financing and increased volatility in credit and equity markets, which may materially adversely affect our ability to secure financing at reasonable costs or at all. If we are unable to obtain financing for a significant portion of our capital requirements, our ability to expand our operations, purchase new aircraft, pursue business opportunities we believe to be desirable, withstand any future downturn in our business, or respond to increased competition or changing economic conditions may be impaired. We have and in the future will likely continue to have substantial debts. As a result, the interest costs associated with these debts might impair our future profitability.

We are subject to the risk of fuel price fluctuations.

Jet fuel is one of the major expenses of airlines. Significant fluctuations of international oil prices will significantly impact jet fuel prices and our revenue from fuel surcharge and accordingly our results of operations. In 2017, our total aircraft fuel cost was approximately RMB25,131 million, representing an increase of approximately 28.1% from approximately RMB19,626 million in 2016, which was mainly due to an increase in average price of oil as the Organization of Petroleum Exporting Countries (“OPEC”) and other oil suppliers efficiently squeezed excess supply of oil in the market and the political upheaval in the Middle East increased the uncertainty of oil production, and to a lesser extent, an increase in the volume of refueling from 2016 to 2017. In 2017, our total aircraft fuel cost accounted for approximately 25.0% of our total operating expenses, as compared to approximately 21.4% in 2016.

9

Table of Contents

The fluctuations of international crude oil prices and adjustments on domestic jet fuel prices by the National Development and Reform Commission (the “NDRC”) have a significant impact on our profitability. Our results of operation and financial condition are affected by any significant fluctuations that may occur, which are generally due to factors beyond our control. As such, we generally alleviate the pressure from the rise in operating costs arising from the increase in aviation fuel by imposing fuel surcharges, which, however, are subject to government regulations. In order to control fuel costs, we have also entered into fuel hedging transactions using financial derivative products linked to the price of underlying assets such as United States WTI crude oil and Singapore jet fuel during previous years.

Since 2009, the PRC government required prior governmental approval for entering into fuel hedging contracts. We may, from time to time, seek approval from the PRC government to enter into overseas fuel hedging contracts. However, these hedging strategies may not always be effective and high fluctuations in aviation fuel prices exceeding the locked-in price ranges may result in losses. Significant decline in fuel prices may substantially increase the costs associated with such fuel hedging arrangements. In addition, where we may, from time to time, seek to manage the risk of fuel price increases by using derivative contracts, we cannot assure you that, at any given point in time, such fuel hedging transactions will provide any particular level of protection against increased fuel costs. In 2017, we did not engage in any aviation fuel hedging activities.

We are subject to the risk of exchange rate fluctuations.

We operate our business in many countries and territories. We generate revenue in different currencies, and our foreign currency liabilities are typically much higher than our foreign currency assets. Our purchases and leases of aircraft are mainly priced and settled in foreign currencies such as U.S. dollars. Fluctuations in exchange rates will affect our costs incurred from foreign purchases such as aircraft, flight equipment and aviation fuel, and take-off and landing charges in foreign airports. As of December 31, 2017, our total interest-bearing liabilities denominated in foreign currencies, amounted to approximately RMB46,789 million, of which U.S. dollar liabilities accounted for approximately 78.7% of the total amount. Therefore, a significant fluctuation in the U.S. dollar exchange rates will subject us to significant foreign exchange loss/gain arising from the exchange of foreign currency denominated liabilities, which would affect our profitability and business development. We typically use hedging contracts for foreign currencies to reduce the foreign exchange risks for foreign currency revenues generated from flight ticket sales and expenses required to be paid in foreign currencies. As of December 31, 2017, the outstanding foreign currency hedging contracts held by us amounted to a notional amount of US$829 million, which will expire in 2018, compared with US$440 million as of December 31, 2016.

We recorded net foreign exchange gains of approximately RMB2,001 million in 2017, whereas our net foreign exchange losses were approximately RMB3,574 million for 2016. As a result of the large value of existing net foreign currency liabilities denominated in U.S. dollars, our results would be adversely affected if the Renminbi depreciates against the U.S. dollar or the rate of appreciation of the Renminbi against the U.S. dollar decreases in the future. In 2017 and the first quarter of 2018, we expanded our financing channels by issuing guaranteed bonds and credit enhanced bonds denominated in SGD and JPY, and proactively optimized the mix of currency denomination of our debts. As of December 31, 2017, our proportion of U.S. dollar-denominated debts out of our total liabilities decreased to approximately 28.2%. Our foreign exchange fluctuation risks are also subject to other factors beyond our control.

We are subject to the risk of interest rate fluctuations.

Our total interest-bearing liabilities (including long-term and short-term loans and finance leases payable) as of December 31, 2016 and 2017 were approximately RMB117,773 million and RMB130,669 million, respectively, of which short-term liabilities accounted for approximately 30.0% and 37.0%, respectively, and long-term liabilities accounted for approximately 70.0% and 63.0%, respectively. Most of the long-term interest-bearing liabilities were liabilities with floating interest rates. Both the short-term liabilities and long-term interest-bearing liabilities were affected by fluctuations in current market interest rates.

10

Table of Contents

Our interest-bearing liabilities were primarily denominated in RMB and USD. As of December 31, 2016 and December 31, 2017, our liabilities denominated in RMB accounted for approximately 49.1% and 64.2% of our total liabilities, respectively, and liabilities denominated in USD accounted for approximately 44.9% and 28.2% of our total liabilities, respectively. Fluctuations in interest rates of interest-bearing liabilities denominated in these two currencies have and will continue to have significant impact on our finance costs. As of December 31, 2017, the average interest rates of our RMB-denominated liabilities, USD-denominated liabilities, EUR-denominated liabilities, SGD-denominated liabilities and KRW-denominated liabilities was approximately 3.9%, 2.6%, 0.3%, 2.8% and 2.3%, respectively. In the first quarter of 2018, we also issued credit enhanced bonds denominated in JPY with total principal of JPY50.0 billion due in 2021, bearing fixed interest at the rate of 0.33% per annum and 0.64% per annum for different tranches. To cope with the risk of interest rate fluctuation, we strategically changed our debt portfolio by replacing our USD-denominated liabilities with floating interest rates with USD-denominated liabilities with fixed interest rates. As of December 31, 2017, our USD-denominated liabilities with fixed interest rate was approximately USD1,980 million and accounted for approximately 49.8% of our total long-term USD-denominated liabilities, increasing from approximately 16.7% as of December 31, 2015. As of December 31, 2017, our outstanding foreign currency interest rate swap contracts amounted to a notional amount of USD1,420 million, as compared to USD1,636 million as of December 31, 2016. These contracts will expire between 2018 and 2025. We will continue to optimize our liability structure to lower relevant risks by taking consideration of various factors including the market environment, interest rates and strategic plan. However, we cannot assure you that the relevant lending rates may not increase in the future for reasons beyond our control, which may adversely affect our business, prospects, cash flows, financial condition and results of operations. In addition, we expect to issue bonds and notes or enter into additional loan agreements and aircraft leases in the future to fund our operations and capital expenditures, and the cost of financing for these obligations will depend greatly on market interest rates.

Increases in insurance costs or reductions in insurance coverage may have adverse impact our results of operations and financial condition.

We could be exposed to significant liability or loss if our property or operations were to be affected by a natural catastrophe or other event, including aircraft accidents. We maintain insurance policies but we are not fully insured against all potential hazards and risks incident to our business. If we are unable to obtain sufficient insurance with acceptable terms or if the coverage obtained is insufficient relative to actual liability or losses that we experience, whether due to insurance market conditions, policy limitations and exclusions or otherwise, our results of operations and financial condition could be adversely affected.

We may experience difficulty integrating our acquisitions, which could result in a material adverse effect on our operations and financial condition.

We may from time to time expand our business through acquisition of airlines or airline-related businesses. We are devoting significant resources to the integration of our operations in order to achieve the anticipated synergies and benefits of the absorption and acquisitions mentioned above. See “Item 4. Information on the Company” for details. However, such acquisitions involve uncertainties and a number of risks, including:

| • | difficulty with integrating the assets, operations and technologies of the acquired airlines or airline-related businesses, including their employees, corporate cultures, managerial systems, processes, procedures and management information systems and services; |

| • | complying with the laws, regulations and policies that are applicable to the acquired businesses; |

| • | failure to achieve the anticipated synergies, cost savings or revenue-enhancing opportunities resulting from the acquisition of such airlines or airline-related businesses; |

| • | managing relationships with employees, customers and business partners during the course of integration of new businesses; |

11

Table of Contents

| • | attracting, training and motivating members of our management and workforce; |

| • | accessing our debt, equity or other capital resources to fund acquisitions, which may divert financial resources otherwise available for other purposes; |

| • | diverting significant management attention and resources from our other businesses; |

| • | strengthening our operational, financial and management controls, particularly those of our newly acquired assets and subsidiaries, to maintain the reliability of our reporting processes; |

| • | difficulty with exercising control and supervision over the newly acquired operations, including failure to implement and communicate our safety management procedures resulting in additional safety hazards and risks; |

| • | increased financial pressure resulting from the assumption of recorded and unrecorded liabilities of the acquired airlines or airline-related businesses; and |

| • | the risk that any such acquisitions may not close due to failure to obtain the required government approvals. |

We cannot assure you that we will not have difficulties in assimilating the operations, technologies, services and products of newly acquired companies or businesses. Moreover, the continued integration of our acquired companies into our Company depends significantly on integrating the employees of our acquired companies with our employees and on maintaining productive employee relations. In the event that we are unable to efficiently and effectively integrate newly acquired companies or airline-related businesses into our Company, we may be unable to achieve the objectives or anticipated synergies of such acquisitions and such acquisitions may adversely impact the operations and financial results of our existing businesses.

We may be unable to retain key management personnel or pilots.

We are dependent on the experience and industry knowledge of our key management personnel and pilots, and there can be no assurance that we will be able to retain them. Any inability to retain our key management employees or pilots, or attract and retain additional qualified management employees or pilots, could have a negative impact on our operations and profitability.

Our controlling shareholder, CEA Holding, holds a majority interest in our Company, and its interests may not be aligned with other shareholders.

Most of the major airlines in China are currently majority-owned by either the central government or provincial or municipal governments in China. As of December 31, 2017, CEA Holding holds directly or indirectly 56.38% of our Company’s equity stake on behalf of the PRC government. As a result, CEA Holding could potentially elect the majority of the board of directors of the Company (“Board of Directors” or the “Board”) and otherwise be able to control us. CEA Holding also has sufficient voting control to effect transactions without the concurrence of our minority shareholders. The interests of the PRC government as the ultimate controlling shareholder of our Company and most of the other major PRC airlines could conflict with the interests of our minority shareholders. Although the CAAC currently has a policy of equal treatment of all PRC airlines, we cannot assure you that the CAAC will not favor other PRC airlines over our Company.

As our controlling shareholder, CEA Holding has the ability to exercise controlling influence over our business and affairs, including, but not limited to, decisions with respect to:

| • | mergers or other business combinations; |

| • | acquisition or disposition of assets; |

12

Table of Contents

| • | issuance of any additional shares or other equity securities; |

| • | the timing and amount of dividend payments; and |

| • | the management of our Company. |

We engage in related party transactions, which may result in conflict of interests.

We have engaged in, from time to time, and may continue to engage in, in the future, a variety of transactions with CEA Holding and its various members, from whom we receive a number of important services, including support for in-flight catering and assistance with importation of aircraft, flight equipment and spare parts. Because we are controlled by CEA Holding and CEA Holding may have interests that conflict with our interests, we cannot assure you that CEA Holding will not take actions that will serve its interests over the Company’s interests.

We may not be able to accurately report our financial results or prevent fraud if we fail to maintain effective internal controls over financial reporting, resulting in adverse investor perception, which in turn could have a material adverse effect on our reputation and the performance of our shares and ADSs.

We are required under relevant United States securities laws and regulations to disclose in the reports that we file or submit under the Exchange Act to the SEC, including our annual report on Form 20-F, a management report assessing the effectiveness of our internal controls over financial reporting at the end of the fiscal year. Our registered public accounting firm is also required to provide an attestation report on the effectiveness of our internal controls over financial reporting. Our management concluded that our internal controls over financial reporting were effective as of December 31, 2017. However, we may discover other deficiencies or material weaknesses in the course of our future evaluation of our internal controls over financial reporting and we may be unable to address and rectify such deficiencies in a timely manner. Any failure to maintain effective internal controls over financial reporting could lead to diminished investor confidence in the reliability of our consolidated financial statements, thereby adversely affecting our business, operations, and reputation, including negatively affecting our performance in the securities markets and decreasing potential opportunities to obtain financing in the capital markets.

As part of our business strategy, we have adopted various measures to develop the international side of our business and to enhance our competitiveness in the international long-distance flight routes. Due to the differences in certain legal and market environments, we have encountered certain challenges during the course of developing our overseas business. We have already adopted and will continue to implement measures in order to enhance the internal controls of our overseas offices and to continue the development of our overseas business.

Any failure or disruption of our computer, communications, flight equipment or other technology systems could have an adverse impact on our business operations, profitability, reputation and customer services.

We rely heavily on computer, communications, flight equipment and other technology systems to operate our business and enhance customer service. Substantially all of our tickets are issued to passengers as electronic tickets, and we depend on our computerized reservation system to be able to issue, track and accept these electronic tickets. In addition, we rely on other automated systems for crew scheduling, flight dispatch and other operational needs. These systems could be disrupted due to various events, including natural disasters, power failures, terrorist attacks, equipment failures, software failures, computer viruses, cyber attacks and other events beyond our control. We cannot assure you that the measures we have taken to reduce the risk of some of these potential disruptions are adequate to prevent disruptions to or failures of these systems. Any substantial or repeated failure of or disruption to these systems could result in the loss of important data and/or flight delays, and could have an adverse impact on our business operations, profitability, reputation and customer services, including being liable for paying compensation to our customers.

13

Table of Contents

We are subject to cyber security risks and may incur increasing costs in an effort to minimize those risks.

The nature of our business involves the receipt and storage of personal information about our customers. We have a program in place to detect and respond to data security incidents. To date, all incidents we have encountered have been insignificant. If we commit a significant data security breach or fail to detect and appropriately respond to a significant data security breach, we could be exposed to government enforcement actions and private litigation. In addition, our customers could lose confidence in our ability to protect their personal information, which could cause them to stop using our services. The loss of consumer confidence from a significant data security breach could hurt our reputation and adversely affect our business, result of operations and financial condition.

Actual or anticipated attacks may cause us to incur increasing costs, including costs to deploy additional personnel and protection technologies, train employees and engage third-party experts and consultants, costs incurred in connection with the notifications to employees, suppliers or the general public as part of our notification obligations to the various government authorities that govern our business, or costs to dedicate significant resources to system repairs or other increase cyber security protection. We may also be required to pay fines in connection with stolen customer, employee or other confidential information, or incur significant litigation or other costs.

Interruptions or disruptions of service at one or more airports in our primary market could have an adverse impact on us.

Our business is heavily dependent on our operations at our core hub airports in Shanghai, namely, Hongqiao International Airport and Pudong International Airport and our regional hub airports in Xi’an and Kunming. Each of these operations includes flights that connect our primary market to other major cities. Any significant interruptions or disruptions of service at one or more of our primary market airports could adversely impact our operations.

Any adverse public health developments, including SARS, Ebola, avian flu, or influenza A (H1N1), or the occurrence of natural disasters may, among other things, lead to travel restrictions and reduced levels of economic activity in the affected areas, which may in turn significantly reduce demand for our services and have a material adverse effect on our financial condition and results of operations.

Adverse public health epidemics or pandemics could disrupt businesses and the national economy of China and other countries where we do business. The outbreak of Severe Acute Respiratory Syndrome, or SARS, in early 2003 led to a significant decline in travel volumes and business activities and substantially affected businesses in Asia. Moreover, some Asian countries, including China, have encountered incidents of the H5N1 strain of avian flu, many of which have resulted in fatalities. In addition, outbreaks of, and sporadic human infection with, influenza A (H1N1) in 2009, a highly contagious acute respiratory disease, were reported in Mexico and an increasing number of countries around the world, some cases resulting in fatalities. In addition, in April 2013, there has been an ongoing outbreak of the H7N9 strain of avian flu, which has largely been centered in eastern China, and has resulted in fatalities in that region, including Shanghai. Furthermore, in 2014, an outbreak of Ebola virus, a highly contagious hemorrhagic fever with a relatively high fatality rate, in certain African countries resulted in confirmed cases in the United States and Europe. We are unable to predict the potential impact, if any, that the outbreak of influenza A (H1N1) or any other serious contagious disease or the effects of another outbreak of SARS, any strain of avian flu or Ebola may have on our business.

Natural disasters, such as earthquakes, snowstorms, floods or volcanic eruptions such as that of Eyjafjallajökull in Iceland in April and May of 2010 and the natural disasters in Japan in early 2011 may disrupt or seriously affect air travel activity. Any period of sustained disruption to the airline industry may have a material adverse effect on our business, financial condition and results of operations.

14

Table of Contents

Terrorist attacks or the fear of such attacks, even if not made directly on the airline industry, could negatively affect the Company and the airline industry as a whole. The travel industry continues to face on-going security concerns and cost burdens.

The aviation industry as a whole has been beset with high-profile terrorist attacks, most notably on September 11, 2001 in the United States. The CAAC has also implemented increased security measures in relation to the potential threat of terrorist attacks. Terrorist attacks, even if not made directly towards us or on the airline industry, or the fear of or the precautions taken in anticipation of such attacks (including elevated threat warnings or selective cancellation or redirection of flights) could materially and adversely affect us and the entire airline industry. In addition, potential or actual terrorist attacks may result in substantial flight disruption costs caused by grounding of fleet, significant increase of security costs and associated passenger inconvenience, increased insurance costs, substantially higher ticket refunds and significantly decreased traffic and RPK. International terrorist attacks targeting aircraft and airport not only directly threatens our flight safety, aviation security, operational safety and the safety of overseas institutions and employees, but also brings about on-going adverse impact on the outbound tourism demand for places where terrorist attacks have taken place.

Risks Relating to the Aviation Industry

Our business is subject to extensive government regulation.

The Chinese civil aviation industry is subject to a high degree of regulation by the CAAC. Regulatory policies issued or implemented by the CAAC encompass virtually every aspect of airline operations, including, among other things:

| • | route allocation; |

| • | pricing of domestic airfares; |

| • | administration of air traffic control systems and certain airports; |

| • | jet fuel pricing; |

| • | air carrier certifications and air operator certification; |

| • | aircraft registration and aircraft airworthiness certification; and |

| • | airport expense policy. |

Our ability to provide services on international routes is subject to a variety of bilateral civil air transport agreements between China and other countries, international aviation conventions and local aviation laws. As a result of government regulations, we may face significant constraints on our flexibility and ability to expand our business operations or to maximize our profitability.

The downward trend in domestic and global economy could affect air travel.

The airline industry is highly cyclical, and the level of demand for air travel is correlated to the strength of domestic and global economies. Robust demand for our air transportation services depends largely on favorable general economic conditions, including the strength of global and local economies, low unemployment, strong consumer confidence and availability of consumer and business credit. In 2017, the global economy had a steady recovery. Simultaneous economic growth were shown in developed economies, major emerging economies and developing countries. China’s economy had a steady to good growth which was better than expected. The economic structures continued to optimize and the contributions of the service industry continued to increase. Benefited from the favorable continual recovery of the global economy, the global aviation industry had a continuous rise in the demand of travelers. The China’s civil aviation maintained its relatively fast growth rate. However, we cannot assure you that such recovery and growth will continue in the future. The global economy is facing uncertainties, such as the rise of trade protectionism and the occasional occurrence of geopolitical risks. If the macroeconomic climate worsens or trading dispute and conflicts are created, our operations and financial condition may be adversely affected.

15

Table of Contents

We operate in a highly competitive industry.

We face intense competition in each of the domestic, regional and international markets that we serve. In our domestic market, we compete against all airlines that have the same routes, including smaller domestic airlines that have lower operating costs. In the regional and international markets, we compete against international airlines that have significantly longer operating history, better brand recognition, or more resources, such as large sales networks or sophisticated reservation systems. See the section headed “Item 4. Information on the Company — Business Overview — Competition” for more details. The public’s perception of safety of Chinese airlines could also materially and adversely affect our ability to compete against our international competitors. To stay competitive, we have, from time to time in the past, lowered airfares for certain of our routes, and we may continue to do so in the future. Increased competition and pricing pressures may have a material adverse effect on our financial condition and results of operations.

We expect to face substantial competition from the rapid development of the Chinese rail network.

The PRC government is aggressively implementing the expansion of its high-speed rail network, which has provided train services at a speed of up to 350 kilometers per hour connecting major cities such as Beijing, Shanghai, Guangzhou and Hong Kong. The expansion of rail network, improvements in railway service quality, increased passenger capacity and urban center accessibility could enhance the competitiveness of the railway service and negatively affect our market share on some of our key routes, in particular our routes of between 500 km to 800 km. The high-speed railway routes between Shanghai and Kunming, Baoji and Lanzhou and Xi’an and Chengdu commenced operations in 2017, and has affected our Xi’an and Chengdu route, Guiyang and Kunming route, Xi’an and Xining route and Xi’an and Lanzhou route. Increased competition and pricing pressures from the railway service may have an adverse effect on our business, financial condition and results of operations.

Limitations on foreign ownership of PRC airlines may affect our access to funding in the international equity capital markets or pursuing business opportunities.

The current CAAC policies limit foreign ownership of PRC airlines. Under these rules, non-PRC, Hong Kong, Macau or Taiwan residents cannot hold a majority equity interest in a PRC airline. As of December 31, 2017, approximately 32.20% of our total outstanding shares were held by non-PRC, Hong Kong, Macau or Taiwan residents or legal entities (excluding the qualified foreign institutional investors that are approved to invest in the A Share market of the PRC). As a result, our access to funding in the international equity capital markets may be limited. This restriction may also limit the opportunities available to us to obtain funding or other benefits through the creation of equity-based strategic alliances with foreign carriers. We cannot assure you that the CAAC will not increase these limits on foreign ownership of PRC airlines in the future.

Any jet fuel shortages or any increase in jet fuel prices may materially and adversely affect our financial condition and results of operations.

The availability and prices of jet fuel have a significant impact on our financial condition and results of operations. In the past, jet fuel shortages have occurred in China and, on limited occasions, required us to delay or cancel flights. Although jet fuel shortages have not occurred since the end of 1993, we cannot assure you that jet fuel shortages will not occur in the future. Fuel prices continue to be susceptible to, among other factors, political unrest in various parts of the world, OPEC policies, the rapid growth of the economies of certain countries, including China and India, the inventory levels carried by industries, the amount of reserves built by governments, disruptions to production and refining facilities and weather conditions. Fuel efficiency of our aircraft decreases as they advance in age which results in an overall increase in our aviation fuel costs. The foregoing and other factors that impact the global supply and demand for jet fuel may affect our financial performance due to its sensitivity to fuel prices.

In 2017, fuel prices recovered from the previous decline as the OPEC and other oil suppliers efficiently squeezed excess supply of oil in the market and the political upheaval in the Middle East increased the uncertainty of oil production. Setting aside the adjustment in factors such as fuel surcharge, if the average price of jet fuel had increased or decreased by 5%, our jet fuel costs would have increased or decreased by approximately RMB1,257 million in 2017. In addition, the NDRC adjusts gasoline and diesel prices in China from time to time, taking into account the changes in international oil prices, thereby affecting aviation fuel prices. In 2017, we have not conducted aviation fuel hedging activities. As such, we cannot assure you that jet fuel prices will not fluctuate further in the future. Due to the highly competitive nature of the airline industry, we may be unable to fully or effectively pass on to our customers any future increase in jet fuel costs.

16

Table of Contents

The airline industry is subject to increasing environmental regulations, which would increase costs and affect profitability.

In recent years, regulatory authorities in China and other countries have issued a number of directives and other regulations to address, among other things, aircraft noise and engine emissions, the use and handling of hazardous materials, aircraft age and environmental contamination remedial clean-up measures. These requirements impose high fees, taxes and substantial ongoing compliance costs on airlines, particularly as new aircraft brought into service will have to meet the environmental requirements during their entire service life.

We have significant expenditures in respect of environmental compliance, which may affect our operations and financial condition. For example, all of our B737NG and some of our A320 series aircraft newly introduced are equipped with a winglet or sharklet, an additional lifting surface to reduce fuel consumption and noises. We also took measures to reduce the impact of our operations on the environment by optimizing our route network and flight schedules as well as installing energy-saving environmentally friendly engines. In addition, we continue to improve the energy efficiency of our fleet by introducing aircraft with energy-saving technologies, such as B737-8 Max and by retiring old aircraft. However, these measures have resulted in significant costs and expenditures. We expect to continue to incur significant costs and expenditures on an ongoing basis to comply with environmental regulations, which could restrict our ability to modify or expand facilities or continue operations.

Our results of operations tend to be volatile and fluctuate due to seasonality.

The aviation industry is characterized by annual high and low travel seasons. Our operating revenue is substantially dependent on the passenger and cargo traffic volume carried, which is subject to seasonal and other changes in traffic patterns, the availability of appropriate time slots for our flights and alternative routes, the degree of competition from other airlines and alternate means of transportation, as well as other factors that may influence passenger travel demand and cargo and mail volume. As a result, our results tend to be volatile and subject to rapid and unexpected change.

Risks Relating to the PRC

Changes in the economic policies of the PRC government may materially affect our business, financial condition and results of operations.

Since the late 1970s, the PRC government has been reforming the Chinese economic system. These reforms have resulted in significant economic growth and social progress. These policies and measures may be modified or revised from time to time. Adverse changes in economic and social conditions in China, in the policies of the PRC government or in the laws and regulations of China, if any, may have a material adverse effect on the overall economic growth of China and investments in and profitability of the domestic airline industry. These developments, in turn, may have a material adverse effect on our business, financial condition and results of operations.

Changes in the foreign exchange regulations in the PRC may result in fluctuations of the Renminbi and adversely affect our ability to pay dividends or to satisfy our foreign currency liabilities.

A significant portion of our revenue and operating expenses are denominated in Renminbi, while a portion of our revenue, capital expenditures and debts are denominated in U.S. dollars and other foreign currencies. The Renminbi is currently freely convertible in the current account, which includes payment of dividends, trade and service-related foreign currency transactions, but not in the capital account, which includes foreign direct investment, unless approval from or registration or filing with the relevant authorities, is obtained. As a foreign invested enterprise approved by the PRC Ministry of Commerce (the “MOFCOM”), we can purchase foreign currencies without the approval of State Administration of Foreign Exchange (the “SAFE”) for settlement of current account transactions, including for the purpose of dividend payment, by providing commercial documents evidencing these transactions. We can also retain foreign currencies in our current accounts, subject to a maximum amount approved by SAFE, to satisfy foreign currency liabilities or pay dividends. The relevant PRC government authorities may limit or eliminate our ability to purchase and retain foreign currencies in the future. Foreign currency transactions in the capital account are still subject to limitations and require approvals from SAFE. This may affect our ability to raise foreign capital through debt or equity financing, including through loans or capital contributions. We cannot assure you that we will be able to obtain sufficient foreign currencies to pay dividends, if any, or satisfy our foreign currency liabilities.

17

Table of Contents

Furthermore, the value of the Renminbi against the U.S. dollar and other currencies may fluctuate significantly and is affected by, among other things, the PRC government policies, domestic and international economic and political conditions and changes in the supply and demand of the currency. On July 21, 2005, the PRC government changed its policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy resulted in appreciation of the Renminbi against the U.S. dollar by approximately 7.0% in 2008. While there was no material appreciation of Renminbi against the U.S. dollar in 2009, the Renminbi appreciated by approximately 3.0% against the U.S. dollar in 2010 and by approximately 5.1% in 2011. In April 2012, the PBOC widened the daily trading band of the Renminbi against the U.S. dollar, and the Renminbi was allowed to appreciate or depreciate by 1.0% from the PBOC central parity rate, effective April 16, 2012. In March 2014, the PBOC further widened the daily trading band of the Renminbi against the U.S. dollar, and the Renminbi was allowed to appreciate or depreciate by 2% against the U.S. dollar from the daily central parity rate, effective March 17, 2014. On August 11, 2015, the PBOC executed a 2% devaluation in the Renminbi. Within the following two days, the Renminbi depreciated 3.5% against the U.S. dollar. The Renminbi depreciated 6.7% against the U.S. dollar from January 4, 2016 to December 30, 2016. The Renminbi appreciated 6.3% against the U.S. dollar for the year ended December 31, 2017. However, it remains unclear what further fluctuations may occur or what impact this will have on the value of the Renminbi. It is possible that the PRC government could adopt a more flexible foreign exchange policy, which could result in further and more significant revaluations of the Renminbi against the U.S. dollar or any other foreign currency. Any resulting fluctuations in exchange rates as a result of such policy changes may have an adverse effect on our financial condition and results of operations.

Our operations may be adversely affected by rising inflation rates in the PRC.

Increase in inflation is due to many factors beyond our control, such as rising production and labor costs, high debts, changes in the PRC and foreign governmental policy and regulations, and movements in exchange rates and interest rates. The national consumer price index, which is an indicator of the inflation, was 1.4%, 2.0% and 1.6% in 2015, 2016 and 2017, respectively. The national consumer price index was 1.5%, 2.9% and 2.1% in January, February and March, 2018, respectively. We cannot assure you that inflation rates will not increase in the future. If inflation rates rise beyond our expectations, the costs of our business operations may become significantly higher than anticipated, and we may be unable to pass on such higher costs to consumers in amounts that are sufficient to cover those increasing operating costs. As a result, further inflationary pressures in the PRC may have a material adverse effect on our business, financial condition and results of operations, as well as our liquidity and profitability.

Any withdrawal of, or changes to, tax incentives in the PRC may adversely affect our results of operations and financial condition.

Prior to January 1, 2008, except for a number of preferential tax treatment schemes available to various enterprises, industries and locations, business enterprises in China were subject to an enterprise income tax rate of 33% under the relevant PRC Enterprise Income Tax Law. On March 16, 2007, China passed a new enterprise income tax law, or the EIT Law, which took effect on January 1, 2008 and amended on February 24, 2017. The EIT Law imposes a uniform income tax rate of 25% for domestic enterprises and foreign invested enterprises. Business enterprises enjoying preferential tax treatment that was extended for a fixed term prior to January 1, 2008 will still be entitled to such treatment until such fixed term expires. Certain of our subsidiaries are entitled to preferential tax treatment, allowing us to enjoy a lower effective tax rate that would not otherwise be available to us. To the extent that there are any increases in the applicable effective tax rate, withdrawals of, or changes in, our preferential tax treatment or tax exemptions, our tax liability may increase correspondingly.

18

Table of Contents

Uncertainties embodied in the PRC legal system may limit certain legal protection available to investors.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. Legislation over the past 20 years has significantly enhanced the protection afforded to foreign investors in China. However, the interpretation and enforcement of some of these laws and regulations involve uncertainties that may limit the legal protection available to investors. Such uncertainties pervade as the legal system in the PRC continues to evolve. Even where adequate laws exist in the PRC, the enforcement of the existing laws or contracts may be uncertain and sporadic, and it may be difficult to obtain swift and equitable enforcement, including enforcing a foreign judgment. In addition, the PRC legal system is based on written statutes and their interpretation; prior court decisions may be cited as reference but have limited authority as precedents. As such, any litigation in the PRC may be protracted and result in substantial costs and diversion of our resources and management attention. We have full or majority board control over the management and operation of all of our subsidiaries established in the PRC. The control over these PRC entities and the exercise of shareholder rights are subject to their respective articles of association and PRC laws applicable to foreign-invested enterprises in the PRC, which may be different from the laws of other developed jurisdictions.