UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant |

☒ |

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

☒ |

Definitive Proxy Statement |

|

|

|

|

☐ |

Definitive Additional Materials |

|

|

|

|

☐ |

Soliciting Material under § 240.14a-12 |

SONIC FOUNDRY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box): |

|

☒ |

No fee required. |

|

|

|

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

|

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

SONIC FOUNDRY, INC.

222 West Washington Avenue

Madison, Wisconsin 53703

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held January 28, 2021

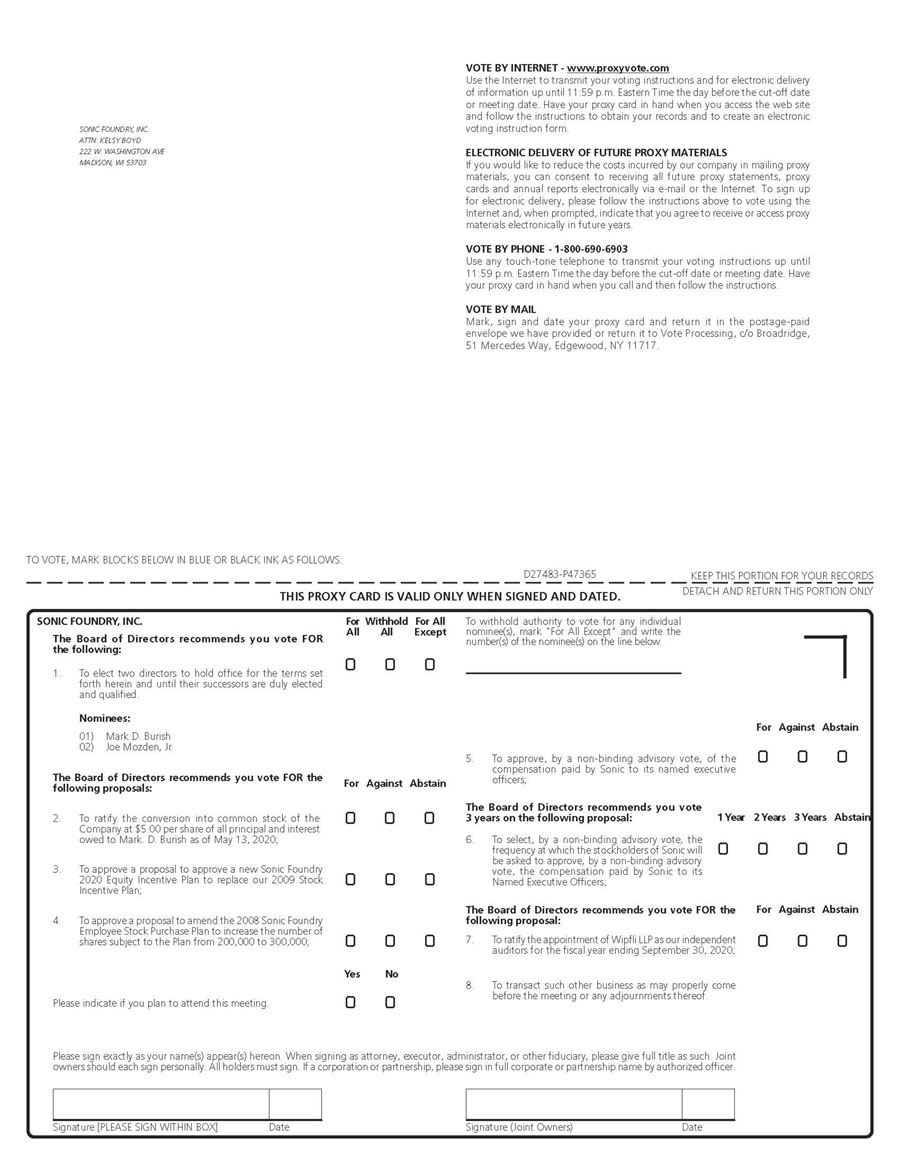

The Annual Meeting of Stockholders of SONIC FOUNDRY, INC., a Maryland corporation (“Sonic”) will be held virtually, over the Internet, on January 28, 2021, for the following purposes:

|

1. |

To elect two directors to hold office for the terms set forth herein and until their successors are duly elected and qualified. |

|

2. |

To ratify the conversion into common stock of the Company at $5.00 per share of all principal and interest owed to Mark. D. Burish as of May 13, 2020; |

|

3. |

To vote on a Proposal to approve a new Sonic Foundry 2020 Equity Incentive Plan to replace our 2009 Stock Incentive Plan; |

|

4. |

To vote on a Proposal to amend the 2008 Sonic Foundry Employee Stock Purchase Plan to increase the number of shares subject to the Plan from 200,000 to 300,000; |

|

5. |

To approve, by a non-binding advisory vote, of the compensation paid by Sonic to its named executive officers; |

|

6. |

To select, by a non-binding advisory vote, the frequency at which the stockholders of Sonic will be asked to approve, by a non-binding advisory vote, the compensation paid by Sonic to its Named Executive Officers; |

|

7. |

To ratify the appointment of Wipfli LLP as our independent auditors for the fiscal year ending September 30, 2020; |

|

8. |

To transact such other business as may properly come before the meeting or any adjournments thereof. |

All the above matters are more fully described in the accompanying Proxy Statement.

The Annual Meeting will be a virtual meeting held over the Internet via Mediasite at http://www.sonicfoundry.com/investors/annual-meeting. You will be able to vote your shares electronically at proxyvote.com by entering your sixteen-digit control number located on your proxy card or in the email you have consented to receive from your bank/broker that retains your shares.

Only holders of record of Common Stock at the close of business on November 20, 2020 are entitled to notice of, and to vote at, this virtual meeting or any adjournment or adjournments thereof. You are invited to attend the virtual annual meeting if you are a stockholder of record or a beneficial owner of shares of our common stock as of the Record Date.

The Company has also arranged for space in our offices located at 222 West Washington Avenue, Suite 100, Madison, Wisconsin 53703 from which you can access the Internet and attend the meeting. Should you wish to do so, please contact Kelsy Boyd at Kelsy.boyd@sonicfoundry.com no later than seven days prior to the virtual annual meeting. This is an option we are providing for your convenience, as required by Maryland law. YOU DO NOT HAVE TO UTILIZE THIS SPACE IN ORDER TO ACCESS THE VIRTUAL MEETING. YOU MAY ACCESS THE VIRTUAL MEETING FROM ANY CONVENIENT LOCATION.

Please complete and return the enclosed proxy in the envelope provided or follow the instructions on the proxy card to authorize a proxy by telephone or over the Internet.

|

|

By Order of the Board of Directors, |

|

|

|

|

|

|

|

|

|

|

/s/ Kelsy Boyd |

|

|

Madison, Wisconsin |

|

Kelsy Boyd |

|

|

December 18, 2020 |

|

Secretary |

|

|

|

|

|

|

─────────────────────────────────────

If you cannot personally attend the virtual meeting, it is earnestly requested that you promptly indicate your vote on the issues included on the enclosed proxy and date, sign and mail it in the enclosed self-addressed envelope, which requires no postage if mailed in the United States or, follow the instructions on the proxy card to authorize a proxy by telephone or over the Internet. Doing so will save us the expense of further mailings. If you sign and return your proxy card without marking choices, your shares will be voted in accordance with the recommendations of the Board of Directors.

─────────────────────────────────────

SONIC FOUNDRY, INC.

222 W. Washington Avenue

Madison, Wisconsin 53703

December 18, 2020

PROXY STATEMENT

The Board of Directors of Sonic Foundry, Inc., a Maryland corporation (“Sonic”), hereby solicits the enclosed proxy. Unless instructed to the contrary on the proxy, it is the intention of the persons named in the proxy to vote the proxies:

FOR the election of Mark D. Burish and Joe Mozden Jr., for terms expiring in 2025;

FOR the ratification of conversion into common stock of the Company at $5.00 per share of all principal and interest owed to Mark. D. Burish as of May 13, 2020;

FOR the approval of a new Sonic Foundry 2020 Equity Incentive Plan to replace our 2009 Stock Incentive Plan;

FOR the approval of a proposal to amend the 2008 Sonic Foundry Employee Stock Purchase Plan to increase the number of shares subject to the Plan from 200,000 to 300,000;

FOR the approval, by a non-binding advisory vote, of the compensation paid by Sonic to its Named Executive Officers;

FOR the selection, by a non-binding advisory vote, of the frequency at which the stockholders of Sonic will be asked to approve, by a non-binding advisory vote, the compensation paid by Sonic to its Named Executive Officers;

FOR the ratification of the appointment of Wipfli LLP as independent auditors of Sonic for the fiscal year ending September 30, 2020.

In the event that a nominee for director becomes unavailable to serve, which management does not expect, the persons named in the proxy reserve full discretion to vote for any other persons who may be nominated. Proxies may also be authorized by telephone or over the Internet by following the instructions on the proxy card. Any stockholder giving a proxy may revoke it at any time prior to the voting of such proxy. This Proxy Statement and the accompanying proxy are being mailed on or about December 17, 2020.

Each holder of Common Stock will be entitled to one vote for each share of Common Stock standing in his or her name on our books at the close of business on November 20, 2020 (the “Record Date”). Only holders of issued and outstanding shares of Sonic's Common stock as of the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting, including any adjournment or postponement thereof. On that date, we had outstanding and entitled to vote 7,980,451 shares of Common Stock, held by approximately 3,000 stockholders, of which approximately 230 were held in street name.

The Annual Meeting will be a virtual meeting held over the Internet via Mediasite at http://www.sonicfoundry.com/investors/annual-meeting. You will be able to vote your shares electronically at proxyvote.com by entering your sixteen-digit control number located on your proxy card or in the email you have consented to receive from your bank/broker that retains your shares.

The Company has also arranged for space in our offices located at 222 West Washington Avenue, Suite 100, Madison, Wisconsin 53703 from which you can access the Internet and attend the virtual meeting. Should you wish to do so, please contact Kelsy Boyd at Kelsy.boyd@sonicfoundry.com no later than seven days prior to the virtual Annual Meeting. This is an option we are providing for your convenience, as required by Maryland law. YOU DO NOT HAVE TO UTILIZE THIS SPACE IN ORDER TO ACCESS THE VIRTUAL MEETING. YOU MAY ACCESS THE VIRTUAL MEETING FROM ANY CONVENIENT LOCATION.

QUORUM; VOTES REQUIRED

Votes cast by proxy or in person at the virtual Annual Meeting will be tabulated by the inspector of elections appointed for the virtual Annual Meeting and will determine whether or not a quorum is present. Where, as to any matter submitted to the stockholders for a vote, proxies are marked as abstentions (or stockholders appear in person but abstain from voting), such abstentions will be treated as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but will not be treated as present and entitled to vote for any other purpose. If a broker indicates on the proxy that it does not have discretionary authority as to certain shares to vote on a particular matter and has not received instructions from the beneficial owner, which is known as a broker non-vote, such shares will also be considered present for purposes of a quorum, provided that the broker exercises discretionary authority on any other matter in the Proxy. A majority of the shares of stock issued, outstanding and entitled to vote at the Annual Meeting, present in person, virtually or represented by proxy, shall constitute a quorum at the virtual Annual Meeting. The election of Directors requires a plurality of the votes present and entitled to vote. Therefore, the two directors who receive the highest vote total will be elected. Neither an abstention nor a withheld vote will affect the outcome of the election. The ratification of the conversion into common stock of the Company at $5.00 per share of all principal and interest owed to Mark. D. Burish as of May 13, 2020, requires the affirmative vote of the holders of a majority of the votes cast by the stockholders entitled to vote at the Annual Meeting, with the 3,291,443 shares of Common Stock currently held by Mark Burish not counted toward approval of this Proposal. If you abstain or withhold your vote on this proposal, it will have no effect on the outcome of the proposal. The vote to approve the 2020 Stock Incentive Plan and the vote to amend the 2008 Employee Stock Purchase Plan, require the affirmative vote of the holders of a majority of shares entitled to vote at the virtual Annual Meeting. If you abstain from voting or withhold your vote on either of these proposals, it will have the same effect as a vote against the proposals. A plurality of the votes cast at the virtual Annual Meeting is required to select, by a non-binding advisory vote, the frequency at which the stockholders of the Company will be asked to approve, by a non-binding advisory vote, the compensation paid by the Company to its Named Executive Officers. If you abstain or withhold your vote on this proposal, it will have no effect on the outcome of the proposal. The non-binding advisory vote of the compensation paid by the Company to its Named Executive Officers and the ratification of the appointment of Wipfli, LLP require the affirmative vote of the holders of a majority of the votes cast at the virtual Annual Meeting. If you abstain or withhold your vote on these proposals, it will have no effect on the outcome of the proposal.

The New York Stock Exchange ("NYSE") has rules that govern brokers who have record ownership of listed company stock held in brokerage accounts for their clients who beneficially own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain discretionary matters but do not have discretion to vote uninstructed shares as to certain other non-discretionary matters. A broker may return a proxy card on behalf of a beneficial owner from whom the broker has not received instructions that casts a vote with regard to discretionary matters but expressly states that the broker is not voting as to non-discretionary matters. The broker's inability to vote with respect to the non-discretionary matters with respect to which the broker has not received instructions from the beneficial owner is referred to as a "broker non-vote". Under current NYSE interpretations, the proposal to ratify the appointment of Wipfli, LLP as our independent auditor is considered a discretionary matter.

DATE, TIME AND PLACE OF ANNUAL MEETING

The Annual Meeting will be held virtually, over the Internet, on January 28, 2021 at 9:00 a.m. (Central time) at http://www.sonicfoundry.com/investors/annual-meeting.

HOW TO VOTE AT THE ANNUAL MEETING

The Annual Meeting will be a virtual meeting held over the Internet via Mediasite at http://www.sonicfoundry.com/investors/annual-meeting. You will be able to vote your shares electronically at proxyvote.com by entering your sixteen-digit control number located on your proxy card or in the email you have consented to receive from your bank/broker that retains your shares.

The Company has also arranged for space in our offices located at 222 West Washington Avenue, Suite 100, Madison, Wisconsin 53703 from which you can access the Internet and attend the virtual meeting. Should you wish to do so, please contact Kelsy Boyd at Kelsy.boyd@sonicfoundry.com no later than seven days prior to the virtual annual meeting. This is an option we are providing for your convenience, as required by Maryland law. YOU DO NOT HAVE TO UTILIZE THIS SPACE IN ORDER TO ACCESS THE VIRTUAL MEETING. YOU MAY ACCESS THE VIRTUAL MEETING FROM ANY CONVENIENT LOCATION.

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Amended and Restated Articles of Incorporation and Bylaws provide that the Board of Directors shall be divided into five classes, with each class having a five-year term. Directors are assigned to each class in accordance with a resolution or resolutions adopted by the Board of Directors. Vacancies on the Board of Directors resulting from death, resignation, disqualification, removal or other causes may be filled by either the affirmative vote of the holders of a majority of the then-outstanding shares or by the affirmative vote of a majority of the remaining directors then in office, even if less than a quorum of the Board of the Directors. Newly created directorships resulting from any increase in the number of directors may, unless the Board of Directors determines otherwise, be filled only by a majority vote of the entire Board of Directors. A director elected by the Board of Directors to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve until the next annual meeting of stockholders or until such director’s successor is elected and qualified.

Our Amended and Restated Articles of Incorporation provide that the number of directors, which shall constitute the whole Board of Directors, shall not be less than three or more than twelve. The currently authorized number of directors is seven. The seat on the Board of Directors currently held by Mark D. Burish is designated as a Class II Board seat, with a term expiring at the Annual Meeting. Additionally, pursuant to the terms of an employment agreement between Joe Mozden Jr, and Sonic, Sonic has agreed to nominate Mr. Mozden for a seat on the Board of Directors beginning at this Annual Meeting and continuing during the term of the agreement. The Board of Directors has nominated Mark D. Burish and Joe Mozden Jr. as Class II Directors for election at the Annual Meeting.

If elected at the Annual Meeting, Messrs. Burish and Mozden would serve until the 2025 Annual Meeting until their successors are elected and qualified or until their earlier death, resignation or removal.

The election of Messrs. Burish and Mozden requires a plurality of the votes present and entitled to vote.

Nominees for Director for a Five-Year term expiring on the 2025 Annual Meeting

Mark D. Burish

Mr. Burish, age 67, has been a director since March 2010 and has served as non-executive chair since April 2011. Mark Burish is a shareholder of the law firm of Hurley Burish, S.C. Madison, Wisconsin which he helped start in 1993. He serves on the Board of several businesses including Mortenson Investment Group, Forward Health Group and Monona Bank. He is the founder and past owner of Our House Senior Living, LLC and Milestone Senior Living, LLC which he started in 1997. He is the managing member of Rare Steakhouses located in Madison and Milwaukee, Wisconsin and Washington, D.C. Mr. Burish received his B.A. degree in communications from Marquette University in 1975 and his J.D. degree from the University of Wisconsin in 1978.

Joe Mozden Jr.

Mr. Mozden, age 57, was appointed by the Board of Directors to serve as the Company’s Chief Executive Officer, effective September 14, 2020, and to serve as a Class II Director. Prior to joining the Company, from 2015 to 2020, Mr. Mozden served as Vice-President of DeVry University and leader of DeVryWORKS, an e-learning platform focused on servicing corporations, military and educational institutions. From 2005 to 2015 he served as Executive Vice-President and Chief Operating Officer for the Allant Group, a private equity-owned multi-channel marketing services provider specializing in database marketing, data aggregation, and analytics for advanced advertising, direct marketing and big data. He also has been in sales and leadership roles at Verizon, Nortel and LSSI, a data aggregator providing content and SaaS offerings to telco, marketing, cable and SEO companies. His other board affiliations include a manufacturing company and a non-for-profit charitable organization. Mr. Mozden received a BS in Electrical Engineering from Rensselaer Polytechnic Institute and an MBA with High Distinction in Finance and International Business from the New York University Stern School of Business

The members of the Board of Directors unanimously recommend a vote FOR the election of Messrs. Burish and Mozden as Class II Directors.

DIRECTORS CONTINUING IN OFFICE

| Frederick H. Kopko, Jr. | Term Expires in 2021 |

| (Class III Director) |

Mr. Kopko, age 65, served as Sonic Foundry’s Secretary from April 1997 to February 2001 and has been a Director since December 1995. Mr. Kopko is a partner of the law firm of McBreen & Kopko, Chicago, Illinois, and has been a partner of that firm since January 1990. Mr. Kopko practices in the area of corporate law. He is the Managing Director, Neltjeberg Bay Enterprises LLC, a merchant banking and business consulting firm and has been a Director of Mercury Air Group, Inc. since 1992. Mr. Kopko received a B.A. degree in Economics from the University of Connecticut, a J.D. degree from the University of Notre Dame Law School and an M.B.A. degree from the University of Chicago.

| Brian T. Wiegand | Term Expires in 2022 |

| (Class IV Director) |

Mr. Wiegand, age, 51, has been a director of the Company since July 2012, and is a serial entrepreneur who successfully founded and sold several internet-based companies. He is currently the founder and CEO of Gravy, Inc., a live video shopping platform. Mr. Wiegand founded and served as CEO of Hopster, a company that links digital marketing efforts with real-world shopping behavior by rewarding consumer purchase loyalty, engagement and advocacy. Hopster announced in October 2014 that it was acquired by Inmar, Incorporated, where Mr. Wiegand served as SVP of Growth and Strategy from the date of purchase to August 2016. Mr. Wiegand co-founded and served as executive chair of the board of Alice.com, an online retail platform that connects manufacturers and consumers in the consumer packaged goods market. Alice.com filed for receivership in August 2013. Mr. Wiegand also co-founded Jellyfish.com, a shopping search engine, in June of 2006. He served as CEO until October 2007 when the company was sold to Microsoft. Mr. Wiegand continued with Microsoft as the General Manager of Social Commerce until May 2008. He also co-founded NameProtect, a trademark research and digital brand protection services company in August 1997 which was sold to Corporation Services Company in March 2007. In addition, Mr. Wiegand founded BizFilings in 1996, the Internet’s leading incorporation Services Company. He served as the president and CEO until 2002 when the company was acquired by Wolters Kluwer. Mr. Wiegand attended the University of Wisconsin – Madison.

| Gary R. Weis | Term Expires in 2023 |

| (Class V Director) |

Mr. Weis, age 73, served as Chief Executive Officer from March 2011 until April 2019, Chief Technology Officer from September 2011 to April 2019 and a Director of Sonic since February 2004. Prior to joining Sonic, he served as President, Chief Executive Officer and a Director of Cometa Networks, a wireless broadband Internet access company from March 2003 to April 2004. From May 1999 to February 2003 he was Senior Vice President of Global Services at AT&T where he was responsible for one of the world's largest data and IP networks, serving more than 30,000 businesses and providing Internet access to more than one million individuals worldwide. While at AT&T, Mr. Weis also was CEO of Concert, a joint venture between AT&T and British Telecom. Previously, from January 1995 to May 1999 he was General Manager of IBM Global Services, Network Services. Mr. Weis served as a Director from March 2001 to February 2003 of AT&T Latin America, a facilities-based provider of telecom services in Brazil, Argentina, Chile, Peru and Columbia. Mr. Weis earned BS and MS degrees in Applied Mathematics and Computer Science at the University of Illinois, Chicago.

| Nelson A. Murphy | Term Expires in 2024 |

| (Class I Director) |

Mr. Murphy, age 60, has been a Director since November 2017. Since January 2015, Mr. Murphy has been the Executive VP, Finance & Operations for Catawba College, a private liberal arts college. From August 2013 to June 2015 Mr. Murphy was VP, International Finance at Syniverse Technologies, Inc. in Luxembourg, a provider of mobile technologies, and from October 2010 to August 2013 served as VP – Finance, Defensive Systems Division at Northrop Grumman Corporation, a global security company. Previously, Mr. Murphy served in various senior finance roles at AT&T including responsibility for finance in operations located in Europe, the Middle East and Latin America. Mr. Murphy has a B.S. in Accounting from Wake Forest University.

| David F. Slayton | Term Expires in 2024 |

| (Class I Director) |

Mr. Slayton, age 51, has been a Director since November 2017. Since April 2013, Mr. Slayton has been the Chief Financial Officer of Ovative Group, a digital media agency and analytics firm. From July 2008 to March 2013, Mr. Slayton was co-founder, Executive Vice President – CFO and a member of the board of Alice.com, an e-commerce retail marketplace. Prior to his service at Alice.com, Mr. Slayton served in senior financial management roles at numerous companies including as Chief Financial Officer at Shavlik Technologies from June 2005 to July 2008, Managing Director and co-founder at Haviland Partners Inc. from August 2003 to February 2005 and as Chief Financial of NameProtect Inc. from July 2000 to July 2003. Mr. Slayton earned a BS in Economics from the Massachusetts Institute of Technology (June 1991) and an MBA in Business Administration from Harvard University (June 1996).

When considering whether the Board of Directors and nominees thereto have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board of Directors to satisfy its oversight responsibilities effectively in light of our business and structure, the Board of Directors focused primarily on the information discussed in each of the Board members' biographical information set forth above. Each of the Company's directors possess high ethical standards, act with integrity and exercise careful, mature judgment. Each is committed to employing his skills and abilities to aid the long-term interests of the stakeholders of the Company. In addition, each of our directors has exhibited judgment and skill, and has either been actively involved with the Company for a considerable period of time or has experience with other organizations of comparable or greater size. In particular, Mr. Kopko has had extensive experience with companies comparable in size to Sonic Foundry, including serving as a director of Mercury Air Group, Inc. and other private and public companies and fills a valuable need with experience in securities and other business law. Mr. Weis has had experience in both developing and established companies, having served as a CEO and Director of Cometa Networks and in several positions at AT&T and IBM, including Senior Vice President of Global Services. While at AT&T, Mr. Weis also was CEO of Concert, a joint venture between AT&T and British Telecom. Mr. Weis served as CEO of the Company from March 2011 to April 2019. Mr. Burish brings additional valuable legal experience to the Board as well as experience obtained through founding multiple companies. Mr. Wiegand has significant experience in founding and operating technology companies and building brand awareness with both businesses and consumers. Mr. Murphy has significant experience in finance and accounting both in the higher education field as well as with technology companies and Mr. Slayton has substantial financial experience in growing technology companies. Mr. Mozden has significant experience in developing and managing e-learning platforms.

CORPORATE GOVERNANCE

Director Independence

The Board has made a subjective determination as to each independent director that no relationship exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviews information provided by the directors in an annual questionnaire with regard to each director’s business and personal activities as they relate to the Company. Based on this review, the Board has affirmatively determined that Nelson A. Murphy, David F. Slayton and Brian T. Wiegand are independent.

Related Person Transaction

The Board has adopted a Related Person Transaction Policy (the “Policy”), which is a written policy governing the review and approval or ratification of Related Person Transactions, as defined in SEC rules.

Under the Policy, each of our directors and executive officers must notify the Chairman of the Audit Committee in writing of any new potential Related Person Transaction involving such person or an immediate family member. The Audit Committee will review the relevant facts and circumstances and will approve or ratify the transaction only if it determines that the transaction is not inconsistent with, the best interests of the Company. The Related Party Transaction must then be approved by the independent directors. In determining whether to approve or ratify a Related Person Transaction, the Audit Committee and the independent directors may consider, among other things, the benefits to the Company; the impact on the director’s independence (if the Related Person is a director or an immediate family member); the availability of other sources for comparable products or services; the terms of the transaction; and the terms available to unrelated third parties or to employees generally.

Board Leadership Structure and Role in Risk Oversight

Mark D. Burish serves as Non-Executive Chairman of the Board and Joe Mozden Jr. serves as our Chief Executive Officer. The Company believes that having separate positions provides an appropriate leadership structure.

Our business and affairs are managed under the direction of our board, which is the Company’s ultimate decision-making body, except with respect to those matters reserved to our stockholders. Our Board’s key mission is to maximize long-term stockholder value. Our Board establishes our overall corporate policies, selects and evaluates our executive management team (which is charged with the conduct of our business), and acts as an advisor and counselor to executive management. Our board also oversees our business strategy and planning, as well as the performance of management in executing its business strategy and assessing and managing risks.

What is the Board’s role in risk oversight?

The board takes an active role in monitoring and assessing the Company’s risks, which include risks associated with operations, credit, financing and capital investments. Management is responsible for the Company’s day-to-day risk management activities and our board’s role is to engage in informed risk oversight. Management, through its disclosure committee, compiles an annual ranking of risks to which the Company could be subjected and reviews the results of this risk assessment with the audit committee. Any significant risks are then reviewed by the board and assigned for oversight. In fulfilling this oversight role, our board focuses on understanding the nature of our enterprise risks, including our operations and strategic direction, as well as the adequacy of our risk management process and overall risk management system. There are a number of ways our board performs this function, including the following:

|

• |

at its regularly scheduled meetings, the board receives management updates on our business operations, financial results and strategy and discusses risks related to the business; |

|

|

• |

the audit committee assists the board in its oversight of risk management by discussing with management, particularly, the Chief Financial Officer, our guidelines and policies regarding financial and enterprise risk management and risk appetite, including major risk exposures, and the steps management has taken to monitor and control such exposures; and |

|

|

• |

through management updates and committee reports, the board monitors our risk management activities, including the annual risk assessment process, risks relating to our compensation programs, and financial and operational risks being managed by the Company. |

The board of directors also has oversight responsibility for risks and exposures related to employee compensation programs and management succession planning and assesses whether the organization’s compensation practices encourage risk taking that would have a material adverse effect on the Company. The compensation committee periodically reviews the structure and elements of our compensation programs and its policies and practices that manage or mitigate such risk, including the balance of short-term and long-term incentives, use of multiple performance measures, and a multi-year vesting schedule for long-term incentives. Based on these reviews, the committee believes our compensation programs do not encourage excessive risk taking.

Board Structure and Meetings

The Board met five times during Fiscal 2019. The Board also acted by written consent from time to time. All directors attended at least 75% of the total number of Board meetings and committee meetings on which they serve (during the period in which each director served).

The Board of Directors has four standing committees, the Audit Committee, the Executive Compensation Committee, the Governance Committee and the Nominations Committee. The Board of Directors also established a special committee of disinterested and independent members to consider and negotiate the terms of transactions between the Company and Mark D. Burish, the Company’s chair.

Sonic has a standing audit committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Members of the Audit Committee are Messrs. Murphy (chair), Slayton and Wiegand. Sonic’s Board of Directors has determined that all members of Sonic’s Audit Committee are “independent” as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act. The Audit Committee provides assistance to the Board in fulfilling its oversight responsibility including: (i) internal and external financial reporting, (ii) risks and controls related to financial reporting, and (iii) the internal and external audit process. The Audit Committee is also responsible for recommending to the Board the selection of our independent public accountants and for reviewing all related party transactions. The Audit Committee met five times in Fiscal 2019. A copy of the charter of the Audit Committee is available on Sonic’s website.

Sonic's Board of Directors has determined that, due to his experience serving in senior financial roles at several companies as well as his degree in accounting and designation as a certified public accountant, Mr. Murphy meets the definition of audit committee financial expert as that term is defined under the rules of the Securities and Exchange Commission.

The Compensation Committee consists of Messrs. Burish (chair) and Wiegand. The Compensation Committee makes recommendations to the Board with respect to salaries of employees, the amount and allocation of any incentive bonuses among the employees, and the amount and terms of stock options to be granted to executive officers. The Compensation Committee met two times in Fiscal 2019. A copy of the charter of the Compensation Committee is available on Sonic’s website.

The Nominations Committee consists of Messrs. Burish (chair) and Wiegand. The purpose of the Nominations Committee is to evaluate and recommend candidates for election as directors, make recommendations concerning the size and composition of the Board of Directors, develop specific criteria for director independence, and assess the effectiveness of the Board of Directors. Our Board of Directors has adopted a charter for the Nominations Committee, which is available on Sonic’s website. The Nominations Committee will review all candidates in the same manner regardless of the source of the recommendation. In recommending candidates for election to the Board of Directors, the Nominations Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board of Directors. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Generally, the Nominations Committee will consider various criteria in considering whether to make a recommendation. These criteria include expectations that directors have substantial accomplishments in their professional backgrounds and are able to make independent, analytical inquiries and exhibit practical wisdom and mature judgment. Director candidates should possess the highest personal and professional ethics, integrity and values, be committed to promoting the long-term interest of our stockholders and be able and willing to devote the necessary time to carrying out their duties and responsibilities as members of the Board. While the Board of Directors has not adopted a policy regarding diversity, we also believe our directors should come from diverse backgrounds and experience bases in order to promote the representation of diverse views on the Board of Directors. Stockholder recommendations of candidates for Board membership will be considered when submitted to Corporate Secretary, Sonic Foundry, Inc., 222 W. Washington Ave., Madison, WI 53703. When submitting candidates for nomination to be elected at Sonic's annual meeting of stockholders, stockholders must also follow the notice procedures and provide the information required by Sonic's bylaws.

In particular, for a stockholder to nominate a candidate for election at the 2021 Annual Meeting of Stockholders, the nomination must be delivered or mailed to and received by Sonic's Secretary between September 30, 2021 and October 30, 2021 (or, if the 2021 annual meeting is advanced by more than 30 days or delayed by more than 60 days from January 28, 2022, not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the tenth calendar day following the date on which public announcement of the date of the annual meeting is first made). The nomination must include the same information as is specified in Sonic's bylaws for stockholder nominees to be considered at an annual meeting, including the following:

|

• |

The stockholder's name and address and the beneficial owner, if any, on whose behalf the nomination is proposed; |

|

• |

The stockholder's reason for making the nomination at the annual meeting, and the signed consent of the nominee to serve if elected; |

|

• |

The number of shares owned by, and any material interest of, the record owner and the beneficial owner, if any, on whose behalf the record owner is proposing the nominee; |

|

• |

A description of any arrangements or understandings between the stockholder, the nominee and any other person regarding the nomination; and |

|

• |

Information regarding the nominee that would be required to be included in Sonic's proxy statement by the rules of the Securities and Exchange Commission, including the nominee's age, business experience for the past five years and any other directorships held by the nominee. |

DIRECTORS COMPENSATION

Our directors who are not also our full-time employees, receive an annual retainer of $10,000 in addition to a fee of $750 for attendance at each meeting of the Board of Directors and $500 per committee meeting attended. In addition, the chair of the Audit Committee receives an Audit Committee annual retainer of $4,000 and the chair of the Compensation Committee receives a $1,500 Compensation Committee annual retainer. Mr. Burish receives an annual retainer of $17,500 as compensation for his services as Chair of the Board of Directors. The total fee compensation earned by the four non- employee directors combined in Fiscal 2019 was $143,000. When traveling from out-of-town, the members of the Board of Directors are also eligible for reimbursement for their travel expenses incurred in connection with attendance at Board meetings and Board Committee meetings. Directors who are also employees do not receive any compensation for their participation in Board or Board Committee meetings.

Pursuant to the 2008 Sonic Foundry Non-Employee Amended Directors Stock Option Plan (the “Directors Plan”) we grant to each non-employee director who is reelected or who continues as a member of the Board of Directors at each annual stockholders meeting a stock option to purchase 2,000 shares of Common Stock. Further, the chair of our Audit Committee receives an additional stock option grant to purchase 500 shares of Common Stock per year pursuant to Sonic’s Non-Employee Amended Directors Stock Option Plan.

The exercise price of each stock option granted was equal to the market price of Common Stock on the date the stock option was granted. Stock options issued under the Directors Plan vest fully on the first anniversary of the date of grant and expire after ten years from date of grant. An aggregate of 150,000 shares are reserved for issuance under the Directors Plan.

If any change is made in the stock subject to the Directors Plan, or subject to any option granted thereunder, the Directors Plan and options outstanding thereunder will be appropriately adjusted as to the type(s), number of securities and price per share of stock subject to such outstanding options.

The options and warrants set forth above have an exercise price equal to the fair market value of the underlying common stock on the date of grant. The term of all such options is ten years.

The following table summarizes cash and equity compensation provided our non-employee directors during the fiscal year ended September 30, 2019.

|

Name (a) |

Fees Earned Or Paid In Cash ($)(1) (b) |

Stock Awards ($)(2) (c) |

Option Awards ($)(3) (d) |

Non-Equity Incentive Plan Compen-sation ($) (e) |

Change in Pension Value and Non-qualified Deferred Compen- sation Earnings ($) (f) |

All Other Compensation ($) (g) |

Total ($) (h) |

|||||||||||||||||||||

|

Mark D. Burish |

35,000 | 0 | 940 | — | — | — | 35,940 | |||||||||||||||||||||

|

Frederick H. Kopko |

14,500 | 0 | 940 | — | — | — | 15,440 | |||||||||||||||||||||

|

Nelson A. Murphy |

34,000 | 0 | 1,175 | — | — | — | 35,175 | |||||||||||||||||||||

|

David F. Slayton |

30,000 | 0 | 940 | — | — | — | 30,940 | |||||||||||||||||||||

|

Brian T. Wiegand |

29,500 | 0 | 940 | — | — | — | 30,440 | |||||||||||||||||||||

|

(1) |

The amount reported in column (b) is the total of retainer fees and meeting attendance fees paid in cash. |

|

(2) |

The amount reported in column (c) is the total of retainer fees and meeting attendance fees awarded in common stock. |

|

(3) |

The amount reported in column (d) is the aggregate grant date fair value of options granted during the fiscal year ended September 30, 2019 in accordance with FASB ASC Topic 718. Each director received an option award of 2,000 shares on September 12, 2019 at an exercise price of $1.39 with a grant date fair value of $1,360. In addition, Mr. Murphy received a grant of 500 shares on September 12, 2019 at an exercise price of $2.24 with a grant date fair value of $340 in connection with his position as chair of the Audit Committee. |

EXECUTIVE OFFICERS OF SONIC

Our executive officers, who are appointed by the Board of Directors, hold office for one-year terms or until their respective successors have been duly elected and have qualified. There are no family relationships between any of the executive officers of Sonic.

Joe Mozden, age 57, was appointed by the Board of Directors to serve as the Company’s Chief Executive Officer, effective September 14, 2020. For further information regarding Mr. Mozden, please refer to “Proposal One: Election of Directors.”

Kelsy Boyd, age 54, has been the Chief Financial Officer since June 1, 2020. Prior to her appointment as Chief Financial Officer she was Executive Vice-President of Finance. She has more than 25 years of financial leadership and consulting experience in the digital media, manufacturing, agriculture and government sectors. Prior to joining Sonic, she provided controller-level consulting services to several private companies between 2018 and 2019. She also served as Finance Director for a municipality from 2015-2017, and as the Chief Financial Officer for a private manufacturing company from 2006-2014. From 1996 to 2003 she had served in various roles for Sonic, including Controller and Senior Director of Operations. She received her BBA in Finance and Accounting from the University of North Dakota, and is a Certified Public Accountant.

Robert M. Lipps, age 49, has been Executive Vice President of Sales since April 2008, joining Sonic Foundry in April 2006 as Vice President of International Sales and assuming expanded responsibility for U.S. central sales in 2007. Mr. Lipps leads the company’s global sales organization including oversight of domestic, international and channel sales. He holds 15 years of sales leadership, business development and emerging market entry expertise in the technology and manufacturing sectors, including sales and channel management. From January 2004 to March 2006 he served as General Manager of Natural Log Homes LLC, a New Zealand based manufacturer of log homes. From July 1999 to Dec 2002 he served as Latin America Regional Manager of Adaytum, a software publisher of planning and performance management solutions, (acquired by Cognos Software, an IBM Company, in January 2003) and from May 1996 to July 1999 he served as International Sales Manager for Persoft, a software publisher of host access and mainframe connectivity solutions (acquired by Esker software in 1998). Mr. Lipps has a B.S. degree in Marketing from the University of Wisconsin at La Crosse.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows information known to us about the beneficial ownership of our Common Stock as of January 28, 2019, by each stockholder known by us to own beneficially more than 5% of our Common Stock, each of our executive officers named in the Summary Compensation Table (“Named Executive Officers”), each of our directors, and all of our directors and executive officers as a group. Unless otherwise noted, the mailing address for these stockholders is 222 West Washington Avenue, Madison, Wisconsin 53703.

Beneficial ownership is determined in accordance with the rules of the SEC, and includes voting or investment power with respect to shares. Shares of common stock issuable upon the exercise of stock options or warrants exercisable within 60 days after January 28,2020, which we refer to as Presently Exercisable Options or Presently Exercisable Stock Warrants, are deemed outstanding for computing the percentage ownership of the person holding the options but are not deemed outstanding for computing the percentage ownership of any other person. Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and investment power with respect to their shares of common stock, except to the extent authority is shared by spouses under applicable law. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for the person named below.

|

Name of Beneficial Owner(1) |

Number of Shares of Class Beneficially Owned |

Percent of Class(2) |

||||||

|

Common Stock |

||||||||

|

Mark D. Burish(3) 33 East Main St. Madison, WI 53703 |

2,194,720 | 32.3 | % | |||||

|

Andrew D. Burish(4) 8020 Excelsior Drive Madison, WI, 53717 |

1,041,948 | 14.9 | ||||||

|

Wealth Trust Axiom LLC (5) 4 Radnor Corp Center, suite 520 |

352,435 | 5.2 | ||||||

|

Gary R. Weis(6) |

389,359 | 5.5 | ||||||

|

Kenneth A. Minor(7) |

203,639 | 2.9 | ||||||

| Robert M. Lipps(8) | 128,187 | |||||||

|

Michael Norregaard (9) |

26,000 | 1.9* | ||||||

|

Frederick H. Kopko, Jr.(10) 29 South LaSalle Street Chicago, IL 60603 |

97,287 | 1.4 | ||||||

|

Brian T. Wiegand (11) 1600 Aspen Commons Middleton, WI 53562 |

80,090 | 1.2 | ||||||

|

Nelson A. Murphy(12) 2300 W. Innes St. Salisbury, NC 28144 |

57,508 | * | ||||||

|

David F. Slayton(13) 701 Washington Ave N., Suite 400 Minneapolis, MN 55401 |

60,667 | * | ||||||

|

All current Executive Officers and Directors as a Group (9 persons)(14) |

3,237,457 | 43.5 | % | |||||

|

* |

less than 1% |

|

(1) |

Sonic believes that the persons named in the table above, based upon information furnished by such persons, except as set forth in notes (5) where such information is based on a Schedule 13G, have, except as set forth in note (5), sole voting and dispositive power with respect to the number of shares indicated as beneficially owned by them. |

|

(2) |

Applicable percentages are based on 6,783,661 shares outstanding, adjusted as required by rules promulgated by the Securities and Exchange Commission. |

|

(3) |

Includes 18,000 shares subject to Presently Exercisable Options. |

|

(4) |

Includes 232,558 shares subject to Presently Exercisable Common Stock Warrants. Information is based on information provided to the Company on January 22, 2019. |

|

(5) |

Information is based on Schedule 13G filed on January 7, 2019 by Albert C. Matt, President of Wealth Trust Axiom LLC. Based on such information, Wealth Trust Axiom LLC has sole dispositive power but not sole voting power with respect to such shares. |

|

(6) |

Includes 293,473 shares subject to Presently Exercisable Options. |

|

(7) |

Includes 160,160 shares subject to Presently Exercisable Options. |

|

(8) |

Includes 126,112 shares subject to Presently Exercisable Options. |

|

(9) |

Includes 20,000 shares subject to Presently Exercisable Options. |

|

(10) |

Includes 18,000 shares subject to Presently Exercisable Options. |

|

(11) |

Includes 14,000 shares subject to Presently Exercisable Options. |

|

(12) |

Includes 4,500 shares subject to Presently Exercisable Options. |

|

(13) |

Includes 4,000 shares subject to Presently Exercisable Options. |

|

(14) |

Includes an aggregate of 658,245 Presently Exercisable Options |

Compensation Discussion and Analysis

Introduction

This Compensation Discussion and Analysis describes our compensation strategy, policies, programs and practices for the executive officers identified in the Summary Compensation Table. Throughout this proxy statement, we refer to these individuals, who serve as our Chief Executive Officer, Chief Financial Officer and Executive Vice President of Sales as the “Named Executive Officers.”

The Executive Compensation Committee (“Committee”) establishes and oversees our compensation and employee benefits programs and approves the elements of total compensation for the executive officers. The day-to-day design and administration of our retirement and employee benefit programs available to our employees are handled by our Human Resources and Finance Department employees. The Committee is responsible for reviewing these programs with management and approving fundamental changes to them.

Overview and Objectives of our Executive Compensation Program

The compensation program for our executive officers is designed to attract, motivate, reward and retain highly qualified individuals who can contribute to Sonic’s growth with the ultimate objective of increasing stockholder value. Our compensation program consists of several forms of compensation: base salary, annual bonus, long-term incentives and limited perquisites and benefits.

Base salary and annual bonus are cash-based while long-term incentives consist of stock option awards. The Committee does not have a specific allocation goal between cash and equity-based compensation or between annual and long-term incentive compensation. Instead, the Committee relies on the process described in this discussion and analysis in its determination of compensation levels and allocations for each executive officer.

The recommendations of the Chief Executive Officer play a significant role in the compensation-setting process. The Chief Executive Officer provides the Committee with an annual overall assessment of Sonic’s achievements and performance, his evaluation of individual performance and his recommendations for annual compensation and long-term incentive awards. The Committee has discretion to accept, reject or modify the Chief Executive Officer’s recommendations. The Committee determines the compensation for the Chief Executive Officer in an executive session.

Market Competitiveness

The Committee’s target is for total cash compensation to average between the 50th and 75th percentile of published compensation data derived from two sources: (i) a peer group of companies that are in our industry, competitors for key talent, or with similar financial characteristics; and (ii) published market survey data for companies within our revenue range. The peer group data was obtained from the most recently filed proxy statement of 12 publicly-traded technology companies with annual revenues ranging from approximately $10 million to just under $100 million; market capitalization from approximately $10 million to approximately $200 million and approximately 300 employees or less. The following companies comprised the peer group for the study: Adesto Technologies, Corp, Asure Software Inc., Bsquare Corporation, Datawatch Corp., FalconStor Software Inc., GlobalSCAPE Inc., Glowpoint Inc., GSE Systems Inc., Inuvo Inc., MAM Software Group, Inc., Qumu Corporation and Smith Micro Software Company. Given competitive recruiting pressures, the Committee retains its discretion to deviate from this target under appropriate circumstances. The Committee periodically receives updates of the published compensation data.

Pay for Performance

The Committee believes that both long- and short-term compensation of executive officers should correlate to Sonic’s overall financial performance. Incentive payouts will be larger with strong performance and smaller if Sonic’s financial results decline. From time to time, extraordinary Board-approved initiatives in a fiscal year, such as a restructuring, acquisition, or divestiture, are considered by the Committee in its overall evaluation of Sonic’s performance.

Peer Group Analysis

Compensation data came from a peer group of twelve public companies that we consider similar to our market for sales, or for key talent, or with similar financial or other characteristics such as number of employees. The companies in the peer group are described above.

Components of Executive Compensation

Base Salary

The Committee seeks to pay the executive officers a competitive base salary in recognition of their job responsibilities for a publicly held company. As noted above, the target compensation range for an executive’s total cash compensation (salary and bonus) is between the 50th and 75th percentile of the market data reviewed by the Committee.

As part of determining annual compensation review, the Committee also considers the Chief Executive Officer’s recommendation regarding individual performance as well as internal equitable considerations.

In evaluating individual performance, the Committee considers initiative, leadership, tenure, experience, skill set for the particular position, knowledge of industry and business, and execution of strategy in placing the individual within the range outlined.

The Committee met on November 11, 2019 for consideration of base wage changes for Messrs. Norregaard and Lipps. At the recommendation of management, the Committee agreed to maintain compensation for Messrs. Norregaard and Lipps at $281,750 and $250,000, respectively. The Committee further agreed to potential bonus awards based on achievement of target adjusted earnings before interest, taxes and depreciation and amortization (“AEBITDA”) achievement for fiscal 2020 of $65,000 and $35,000, respectively.

Annual Performance-Based Variable Compensation

The performance-based variable compensation reported for each executive officer represents compensation that was earned based on incentive plans. The following describes the methodologies used by the Compensation Committee to determine the final annual performance-based variable compensation earned by each executive officer:

Selection of Performance Metrics. For fiscal 2020, the Compensation Committee designed an incentive program driven by achievement of a combination of target adjusted EBTDA and customers billings results. Messrs. Norregaard and Lipps were included in the plan.

Payout Based on Performance Against Goals. For fiscal 2019 the Company’s performance, as evaluated by the Compensation Committee, lead to the determination that no incentive plan would be approved. Total billings – based incentives paid to Mr. Lipps during fiscal 2019 was $7,190.

Stock Options

The Committee has a long-standing practice of providing long-term incentive compensation grants to the executive officers. The Committee believes that such grants, in the form of stock options, help align our executive officers’ interests with those of Sonic’s stockholders. All stock options have been granted under our 1995 Stock Option Plan, the 1999 Non-Qualified Plan or the 2009 Stock Incentive Plan (“Employee Plans”). All but the 2009 Stock Incentive Plan are now terminated.

The Committee reviews option grant recommendations by the Chief Executive Officer for each executive officer, but retains full discretion to accept, reject or revise each recommendation. The Committee’s policy is to grant options on the date it approves them or such other future date as the Committee may agree at the time of approval. The exercise price is determined in accordance with the terms of the Employee Plan and cannot be less than the Fair Market Value, as defined in the Plan, of Sonic’s common stock. The Committee typically grants options once a year, but may grant options to newly hired executives at other times.

In making its determinations, the Committee considers the number of options or shares owned by the executive officers.

No additional option grants were made to Messrs. Norregaard or Lipps following the end of fiscal 2019. At a compensation committee meeting held February 1, 2019, the executive management team proposed cancelling certain vested stock options they held in order to make them available for future employee grants. The impact was to cancel 175,764 options for the former CEO Mr. Weis, and 109,690 options each for Messrs. Minor and Lipps. The committee accepted the management recommendation and authorized cancellation immediately.

Health and Welfare Benefits

Our officers are covered under the same health and welfare plans, including our 401(k) plan, as salaried employees.

Employment Agreements

The Company has employment agreements with Messrs. Norregaard and Lipps and a Retirement and Transition Agreement and Engagement Letter with Mr. Minor. Pursuant to such agreements, Messrs. Norregaard and Lipps receive annual base salaries subject to increase each year at the discretion of the Board of Directors. Messrs. Norregaard and Lipps are also entitled to incidental benefits of employment under the agreements. Each of the employment agreements provides that a cash severance payment be made upon termination, other than for cause, or upon death or disability. In the case of Mr. Norregaard, such cash severance is equal to his then current base compensation paid bi-weekly over a twelve-month period. In the case of Mr. Lipps, such cash severance is equal to the highest cash compensation paid in any of the last three fiscal years immediately prior to termination. In addition, Messrs. Norregaard and Lipps will receive immediate vesting of all previously unvested common stock and stock options and have the right to voluntarily terminate their employment, and receive the same severance arrangement detailed above following (i) any “person” becoming a “ beneficial” owner of stock of Sonic Foundry representing 50% or more of the total voting power of Sonic Foundry’s then outstanding stock; or, (ii) Sonic Foundry is acquired by another entity through the purchase of substantially all of its assets or securities; or (iii) Sonic Foundry is merged with another entity, consolidated with another entity or reorganized in a manner in which any “person” is or becomes a “beneficial” owner of stock of the surviving entity representing 50% or more of the total voting power of the surviving entity’s then outstanding stock; and, within two years and ninety days of any such event, Messrs. Norregaard, Minor or Lipps, as the case may be, is demoted without cause or his title, authority, status or responsibilities are substantially altered, their salary is reduced or the principal office is more than 50 miles outside the Madison metropolitan area. In the case of Mr. Norregaard, it is not considered a termination of any kind, including but not limited to a “voluntary termination”, “involuntary termination”, “constructive termination” or “termination without cause” if the Board of Directors elects to hire a new Chief Executive Officer in replacement of Norregaard, provided that the Board of Directors offers to engage Norregaard as Chief Operating Officer pursuant to substantially the same terms and conditions. Pursuant to the employment agreements, each of Messrs. Norregaard, Minor and Lipps has agreed not to disclose our confidential information and not to compete against us during the term of his employment agreement and for a period of one year thereafter. Such non-compete clauses may not be enforceable, or may only be partially enforceable, in state courts of relevant jurisdictions.

If Sonic terminated Messrs. Norregaard and Lipps on September 30, 2019, (not for cause), or if Messrs. Norregaard and Lipps elected to terminate their employment following a demotion or alteration of duties on September 30, 2019, and a change of control as defined in the employment agreements had occurred, Sonic would be obligated to pay $281,750 and $311,672, respectively (based on fiscal 2018 compensation which was the fiscal year with highest cash compensation in three year period preceding September 30, 2019 for Mr. Lipps). In addition, any non-vested rights of Messrs. Norregaard and Lipps under the Employee Plans, would vest as of the date of employment termination. The value of accelerated vesting of the options under these circumstances would be $6,000 for Mr. Norregaard and $28,000 for Mr. Lipps.

Retirement of Mr. Weis

Effective May 1, 2019, Mr. Gary Weis retired from his position as Chief Executive Officer and Chief Technology Officer. Mr. Weis agreed to serve as Senior Advisor to the Company from the effective date through the termination date of April 30, 2020 and has further agreed to remain on the Board. Pursuant to the terms of the retirement and transition agreement entered into between Mr. Weis and the Company, Mr. Weis has agreed to provide transitional services to the Company as well as transactional and negotiation assistance to the Special Committee of the Board ("Special Committee"). Mr. Weis has agreed not to accept any other employment, consultancy or position that would interfere in any way with Weis's duties and responsibilities to the Company until the termination date. Mr. Weis will report to the Board or, with respect to assistance regarding strategic alternatives, to the Special Committee. Pursuant to the terms of the retirement and transition agreement, Mr. Weis will receive a salary of $30,000 per month, payable biweekly at a rate of $13,846.15. All of Mr. Weis's existing stock options will fully vest on the effective date, and Mr. Weis will be entitled to reimbursement for all reasonable business expenses incurred in connection with the performance of his responsibilities.

Retirement of Mr. Minor

On August 5, 2019, the Company and Kenneth Minor entered into the following: (i) a Retirement and Transition Agreement, and (ii) an Engagement Letter. Pursuant to the Retirement and Transition Agreement, effective October 1, 2019 (the “Effective Date”). Mr. Minor will retire from his position as (i) Chief Financial Officer of Sonic Foundry, (ii) a member of the Board of Directors of Sonic Foundry Media Systems Inc., Mediasite K.K., and Sonic Foundry International B.V., and (iii) an officer of Sonic Foundry Media Systems, Inc. and Sonic Foundry International B.V. Pursuant to the terms of the retirement and transition agreement, until September 30, 2020, Mr. Minor has agreed to provide transitional services to the Company and to not accept any other employment, consultancy or position that would interfere with Mr. Minor's duties and responsibilities to the Company. Pursuant to the terms of the retirement and transition agreement, Mr. Minor will receive a salary of $185,000 per year, along with health insurance coverage. In addition, all of Mr. Minor's existing stock options will fully vest on the effective date.

Pursuant to the terms of the Engagement Letter, effective October 1, 2019, and continuing until terminated by either party upon 60 days prior notice, or as otherwise set forth in the Engagement Letter, Mr. Minor will act as interim Chief Financial Officer ("CFO"). As interim CFO, Mr. Minor will report to the Chief Executive Officer and Board of Directors of the Company and will receive a monthly payment of $7,500.

FY2020 Appointment of CEO and CFO

Effective August 21, 2020, Mr. Norregaard no longer served as Chief Executive Officer of the Company. Effective June 1, 2020, Mr. Minor no longer served as Chief Financial Officer of the Company.

Effective September 14, 2020, the Company entered into an employment agreement with Joe Mozden Jr. for Mr. Mozden to serve as Chief Executive Officer of the Company. Pursuant to such employment agreement, Mr. Mozden receives an annual base salary of $300,000, subject to revision each year at the discretion of the Board of Directors. Mr. Mozden will also receive a bonus of up to $150,000 provided that the Company meets certain metrics to be determined, but which will be primarily based on the Company achieving profitability. The employment agreement further provides that, during the term thereof, the Company will nominate Mr. Mozden to serve as a director of the Company. In addition, pursuant to the employment agreement, Mr. Mozden has also received (i) an initial stock option grant of options to purchase 200,000 shares of common stock, exercisable at the market price of the common stock on the date of grant, which vest ratably over a three (3) year period, and (ii) performance options to purchase 150,000 shares of common stock, exercisable at the market price of the common stock on the date of grant, which vest upon achievement of performance metrics to be determined between the Company and Mr. Mozden. Mr. Mozden is also entitled to incidental benefits of employment under the agreement. The employment agreement further provides that if Mr. Mozden’s employment by the Company is terminated without cause, an amount equal to the sum of (i) Mr. Mozden’s previously-determined performance bonus, but only if all performance-based metrics set forth in such bonus have been fully met prior to the date of termination, and (ii) Mr. Mozden’s base compensation earned over the previous twelve (12) months, shall be paid through equal bi-weekly installments made over a twelve-month period beginning on the day immediately following the date of Mr. Mozden’s termination of employment (the “Severance Period”). In addition, Mr. Mozden will receive immediate vesting of all previously unvested common stock and stock options and have the right to voluntarily terminate his employment, and receive the same severance arrangement detailed above, if his employment is terminated within thirty (30) days following a “Change of Control” or within thirty (30) days following an event constituting “Good Reason”. A “Change of Control” is defined in the employment agreement as the following (i) any “person” who does not currently have 50% or more of the total voting power of Sonic Foundry’s then outstanding stock becomes a “ beneficial” owner of stock of Sonic Foundry representing 50% or more of the total voting power of Sonic Foundry’s then outstanding stock; or, (ii) Sonic Foundry is acquired by another entity through the purchase of substantially all of its assets or securities; or (iii) Sonic Foundry is merged with another entity, consolidated with another entity or reorganized in a manner in which any “person” is or becomes a “beneficial” owner of stock of the surviving entity representing 50% or more of the total voting power of the surviving entity’s then outstanding stock. “Good Reason” is defined in the Employment Agreement as follows: a material diminution without cause of Mr. Mozden’s title, authority, status, duties or responsibilities; a reduction in Mr. Mozden’s salary in excess of twenty-five percent (25%) in any fiscal year; a material breach by the Company of the employment agreement, or; the principal office of the Company is relocated to a location which is more than 50 miles outside the Madison metropolitan area. Pursuant to the employment agreement, Mr. Mozden has agreed not to disclose the Company’s confidential information and not to compete against the Company during the term of his employment agreement and for a period of one year thereafter. Such non-compete clause may not be enforceable, or may only be partially enforceable, in state courts of relevant jurisdictions.

Effective June 1, 2020, the Company entered into a employment agreement with Kelsy Boyd for Ms. Boyd to serve as Chief Financial Officer of the Company. Pursuant to such employment agreement, Ms. Boyd receives an annual base salary of $200,000. Ms. Boyd will also receive a bonus of up to $50,000 provided that the Company meets certain metrics to be determined, but which will be primarily based on the Company’s earnings. In addition, pursuant to the employment agreement, Ms. Boyd has also received an initial stock option grant of options to purchase 40,000 shares of common stock, exercisable at the market price of the common stock on the date of grant, of which options to purchase 10,000 shares will vest six months from the Effective Date, and of which options to purchase 30,000 shares will vest ratably over a three (3) year period. The employment agreement further provides that if Ms. Boyd’s employment by the Company is terminated without cause, an amount equal to Ms. Boyd’s base compensation earned over the previous six (6) months, shall be paid through equal bi-weekly installments made over a twelve-month period beginning on the day immediately following the date of Ms. Boyd’s termination of employment (the “Severance Period”). In addition, Ms. Boyd will have the right to voluntarily terminate her employment, and receive the same severance arrangement detailed above following (i) any “person” becoming a “ beneficial” owner of stock of Sonic Foundry representing 50% or more of the total voting power of Sonic Foundry’s then outstanding stock; or, (ii) Sonic Foundry is acquired by another entity through the purchase of substantially all of its assets or securities; or (iii) Sonic Foundry is merged with another entity, consolidated with another entity or reorganized in a manner in which any “person” is or becomes a “beneficial” owner of stock of the surviving entity representing 50% or more of the total voting power of the surviving entity’s then outstanding stock; and, within sixty days of such event, one of the following occurs: a material diminution of Ms. Boyd’s title, authority, status, duties or responsibilities; a reduction in Ms. Boyd’s salary; a material breach by the Company of the employment agreement, or; the principal office of the Company is relocated to a location which is more than 50 miles outside the Madison metropolitan area. Pursuant to the employment agreement, Ms. Boyd has agreed not to disclose our confidential information and not to compete against us during the term of his employment agreement and for a period of one year thereafter. Such non-compete clause may not be enforceable, or may only be partially enforceable, in state courts of relevant jurisdictions.

Personal Benefits

Our executives receive a limited number of personal benefits certain of which are considered taxable income to them and which are described in the footnotes to the section of this Proxy Statement entitled “Summary Compensation Table. ”

Internal Revenue Code Section 162(m)

Internal Revenue Code Section 162(m) limits the ability of a public company to deduct compensation in excess of $1 million paid annually to the Chief Executive Officer and to each of the other executive officers named in the Summary Compensation Table. There are exemptions from this limit, including compensation that is based on the attainment of performance goals that are established by the Committee and approved by the Company stockholders. No executive officer was affected by this limitation in fiscal 2019.

COMPENSATION COMMITTEE REPORT

The Compensation Committee of Sonic Foundry has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s 2020 Proxy Statement.

COMPENSATION COMMITTEE

Mark D. Burish, Chair

Brian T. Wiegand

Summary Compensation

The following table sets forth the compensation of our principal executive officer, our principal financial officer and our other executive officer for the fiscal year ended September 30, 2019.

|

Name and Principal Position (a)(4) |

Year (b) |

Salary ($) (c) |

Bonus ($) (d) |

Stock Awards ($) (e) |

Option Awards ($)(1) (f) |

Non-Equity Incentive Plan Compensation ($)(2) (g) |

Change in Pension Value and Non-qualified Deferred Compensation Earnings ($) (h) |

All Other Compen- sation ($)(3) (i) |

Total ($) (j) |

|

Michael Norregaard (4) Chief Executive Officer |

2019 |

250,916 |

— |

— |

— |

— |

— |

11,848 |

262,368 |

|

Gary R. Weis (5) Former Chief Executive and Chief Technology Officer |

2019 2018 2017 |

402,343 489,880 487,136 |

— — — |

— — — |

— — 89,143 |

— — — |

— — — |

5,169 4,304 7,537 |

407,512 494,184 583,816 |

|

Kenneth A. Minor (6) Chief Financial Officer and Secretary |

2019 2018 2017 |

267,997 301,990 300,298 |

— — — |

— — — |

— — 49,028 |

— — — |

— — — |

16,790 17,548 13,826 |

284,787 319,538 363,152 |

|

Robert M. Lipps Executive Vice President - Sales |

2019 2018 2017 |

242,810 242,810 241,450 |

— — — |

— — — |

— — 49,028 |

34,077 68,862 61,997 |

— — — |

9,100 8,614 6,149 |

285,987 320,286 358,624 |

|

(1) |

The option awards in column (f) represent the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 for stock options granted during the fiscal year. The assumptions and methodology used in calculating the compensation expense of the option awards are provided in Sonic’s Form 10-K. See Note 1, “Accounting for Stock Based Compensation” in the Notes to the Consolidated Financial Statements in Sonic’s Form 10-K. The amounts in this column represent value attributed to the awards at the date of grant and not necessarily the actual value that will be realized by the executive. There can be no assurance that the options will ever be exercised (in which case no value will be realized by the executive) or that the value on exercise will equal the ASC Topic 718 value. |

|

(2) |

The amounts in column (g) represent cash bonuses which were awarded for performance during the prior fiscal year based on a pre-established formula. |

|

(3) |

The amount shown under column (i) for the fiscal year 2019 includes Sonic’s matching contribution under our 401(k) plan of $11,848, $5,169, $9,640 and $9,100 for Messrs. Norregaard, Weis, Minor and Lipps. Mr. Minor received $650 per month as a car allowance of which the taxable personal portions was $7,150. Mr. Lipps receives a car allowance of $700 per month of which there was no taxable personal portion. Mr. Weis received car and housing allowances totaling $2,500 per month, of which there was no taxable personal portion. |

|

(4) |

Mr. Norregaard was appointed Chief Operating Officer on March 4, 2019 and Chief Executive Officer on April 22, 2019, following the retirement of Mr. Weis as Chief Executive Officer. Mr. Norregaard ceased serving as CEO on Aug. 21, 2020. |

|

(5) |

Mr. Weis retired as Chief Executive Officer on April 22, 2019. |

|

(6) |

Mr. Minor retired and served as interim CFO until May 31, 2020 |

Grants of Plan-Based Awards

The following table shows the plan-based awards granted to the Named Executive Officers during fiscal 2019.

|

Estimated Future Payouts Under Non-Equity Incentive Plan Awards |

Estimated Future Payouts Under Equity Incentive Plan Awards |

All other stock awards: Number of Shares of stock or |

All other option awards: Number of Securities Underlying Options |

Exercise or base price of option awards |

Grant Date fair Value of Stock and option awards ($) (2) |

|||||||||||||||||||||||||||

|

Name (a) |

Grant Date (b) |

Threshold ($) (c) |

Target ($) (d) |

Maximum ($) (e) |

Threshold ($) (f) |

Target ($) (g) |

Maximum ($) (h) |

units (#) (i) |

(#) (j) |