Exhibit 99.1

2 FORWARD - LOOKING STATEMENT This confidential presentation, and the oral presentation that supplements it, have been developed by Sussex Bancorp (“Sussex” or the “Company”), were prepared exclusively for the benefit and internal use of the recipient and are not an offer or the solicitation of an offer to buy securities. Neither this presentation, nor the oral presentation that supplements it, nor any of their contents, may be used, reproduced, disseminated, quoted or referred to for any other purpose, in whole or in part, without the prior written consent of the Company. Some of the statements contained in this presentation are “forward - looking statements” within the meaning of the Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this presentation, words such as “may,” “plan,” “contemplate,” “anticipate,” “believe,” “intend,” “continue,” “expect,” “project,” “predict,” “estimate,” “target,” “could,” “is likely,” “should,” “would,” “will,” or similar expressions are intended to identify “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward - looking statements, which speak only as of the date made. These statements may relate to the Company’s future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: ( i ) competition in the industry and markets in which the Company operates; (ii) levels of non - performing assets; (iii) changes in general interest rates; (iv) loan demand; (v) rapid changes in technology affecting the financial services industry; (vi) real estate values; (vii) changes in government regulation; and (viii) general economic and business conditions.

3 Ticker Symbol SBBX Closing Price (Sept. 8, 2014) $9.63 Price to tangible book 95.9% Price to LTM EPS 17.2x Annualized Dividend/ Yield $0.12 / 1.25% 52 week high (9/11/14) $9.85 52 week low (10/28/13) $6.60 • Founded in 1975 • Commercial Bank » Operates an insurance agency • Total Assets of $557 million and 10 branches • Market Cap: $45 million • Regional Corporate Offices (Sussex and Morris Counties NJ) • Regional Lending Offices in Sussex, Bergen and Morris Counties NJ (new lending and branch office in Queens NYC - 4 th Qtr ‘14 ) Company Overview

Strategic Shift • Due to Credit Quality Issues beginning in 2008 Board of Directors executed a change in executive leadership in 2009 resulting in the hiring of Anthony Labozzetta in 2010. Followed by the hiring of Steve Fusco (CFO) and Vito Giannola (CRO). Followed by numerous other changes in management. Simultaneously fix and build a better bank. 1A. Identify, isolate and resolve problem assets 1B. Build our business Attract and retain a management team to execute the Strategic Plan Vision : High performing business bank that serves northern NJ into NYC 4

Vision: High performing business bank that serves northern NJ into NYC Target 2Q14 (YTD) NJ Banks and Thrifts Avg (b) High Performing Peer Median (c) Total Assets > $1 billion in assets $557 million $2.3 billion (average) Med. $551 million $1.1 billion (average) Med. $669 million ROA 1.00% or better 0.47% 0.63% (a) 0.44% 1.09% ROE 8.00% to 12.00% 5.34% 7.12% (a) 2.86% 11.85% NPAs / Assets <1.25% 2.63% 2.78% 1.62% Annual EPS growth Double digit 300% N/A N/A (a) Assumes 70% reduction in credit quality costs impact utilizing a 34% tax rate. (b) Source: SNL - NJ Banks and Thrifts (51) 6/30/14 (c) Source: SNL - High Performing Peers (Banks and Thrifts Assets < or = $5.5 bill and ROAA >0.75% at 6/30/14 5

1A. Identify , isolate and resolve problem assets 6 Source: SNL • Reduced problem assets by $39 million, or 63%

1B. Build Our Business Our Model for generating long term shareholder value Employee Experience Customer Experience Business Banking funded by core deposits Strong long term financial performance 7 7

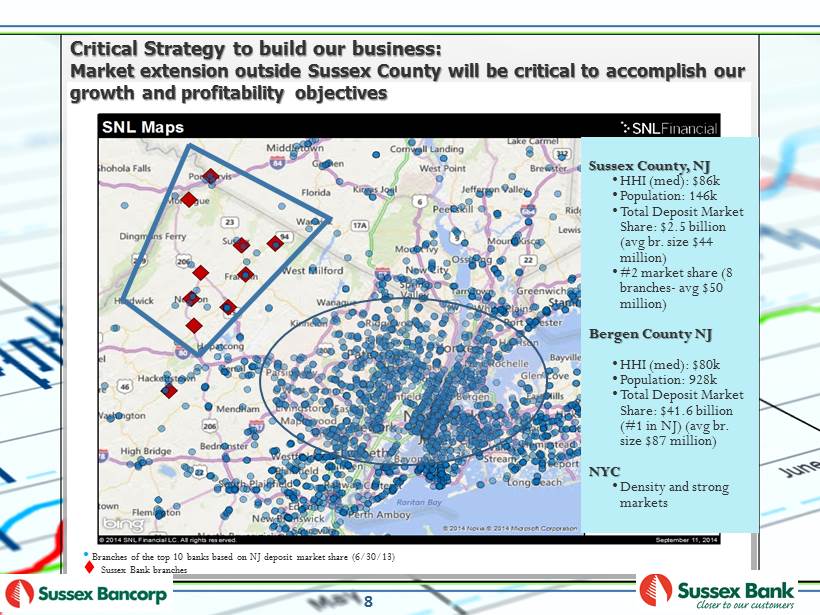

Critical Strategy to build our business: Market extension outside Sussex County will be critical to accomplish our growth and profitability objectives 8 Sussex County, NJ • HHI (med): $86k • Population: 146k • Total Deposit Market Share: $2.5 b illion ( avg br. size $44 million) • # 2 market share (8 branches - avg $50 million) Bergen County NJ • HHI (med): $80k • Population: 928k • Total Deposit Market Share: $41.6 billion (#1 in NJ) ( avg br. size $87 million) NYC • Density and strong markets • Branches of the top 10 banks based on NJ deposit market share (6/30/13) Sussex Bank branches

Commercial Lending • Originated over $ 154 million in new commercial loans in the last 18 months • Commercial loans grew 17% LTM and CAGR 18.5% for last 18 months • Approx. 63% of the loan portfolio were originated outside of Sussex County • Loan pipeline: principally Bergen , Morris and NYC Build our Business 9

Our Commercial Loan Portfolio 10 • Commercial loans, ∆ Regional Commercial Lending Offices

Retail Banking • Total deposits are up 19% ( avg 4.5% per year) since Dec 31, 2009 • Significant improvement in quality of deposits (NIB checking accts are up 98% or 22% annually) • New branches for 2014 • Heath Village, Morris County - September 2014 • Astoria, NYC - Fourth Quarter 2014 Tri - state Insurance Agency • In 2010, operating at a loss and today reporting records profits • Represents 15% of our revenue Build our Business 11

• Total capital is 49% higher at June 30, 2014 than December 31, 2009, which reflects a successful rights offering in August 2013. All regulatory ratios are deemed “well - capitalized”. • Managing and controlling operating expenses (a) , which increased 4.2% (CAGR) for FY 2013 vs. FY 2009 • Closed an underperforming branch (Warwick NY) in 2013 • No fiscal year losses, while recording approximately $20 million in credit quality costs (b) during those 4 fiscal years (2009 through 2013) 12 (a) Excluding loan collection costs and net expenses and write - downs related to foreclosed real estate (b) Provision for loan losses, loan collection costs and net expenses and write - downs related to foreclosed real estate Capital and managing costs

• Net income (total FY 2006 thru 2009) $4.9 million • Costs to resolve problem loans (total FY 2010 thru 2013) $20 million, or $13 million after tax (tax rate of 34%) • Net income (total 2010 thru 2013) $6.8 million 13 Performance over the last 4 fiscal years

Credit Quality Costs Impact on Earnings 14

Stock Performance 1/1/05 through 9/8/14 15 Price Change 1/1/05 – 12/31/09 1/1/10 – 9/8/14 1/1/05 – 9/8/14 SBBX - 76% +187% - 31% KBW Bank Index - 59% +68% - 31% Need to update Source: SNL Financial

Regional Lending Platform Branch Expansion Attract and retain talent Manage operational growth and costs Opportunities for strategic alliances and growth Continue to grow shareholder value “we are building a better bank by growing our businesses, enhancing the quality of our balance sheet, improving profitability and building shareholder value .” Anthony Labozzetta (First Quarter 2014 Earnings Release) Where do we go from here? Continue “Building a better bank” 16

□ Legacy Problem assets ▪ Resolving top 5 non - performing loan relationships represents 61% of non - performing loans ▪ Average balance of the remainder of non - performing loans was $111 thousand ▪ Problem asset costs are declining □ Commercial Loan Growth ▪ Regional lending office(s) in NY ▪ Attracting and retaining talent ▪ Relationships, not just transactions 17 Strategic Initiatives for 2014 and 2015

□ Deposit growth ▪ De - novo branch expansion into NYC ▪ Targeting individual markets in Sussex County ▪ Identifying branch sites in Bergen, Morris, Hudson counties in NJ and NYC □ Digital Banking Business Line ▪ Enhancing the Customer Experience ▪ Technology upgrades / new products ▪ Creating a new branch operating model □ Operational Efficiency Initiatives 18 Strategic Initiatives for 2014 and 2015

Growing shareholder value □ Expand into markets to support long - term growth objectives and improve franchise value ▪ Continue growing commercial loans ▪ Branch expansion and digital banking □ Continue to strengthen profitability and build a high performing bank through: • Managing risks, • Operational efficiencies, • Growing fee income, largely through our insurance subsidiary, and • Significantly reducing credit quality costs □ Outperform the total return of the broader market and bank indexes 19