UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 10th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(Name and address of agent for service)

(414) 765-6872

(Registrant's telephone number, including area code)

Date of fiscal year end: September 30, 2018

Date of reporting period: September 30, 2018

Item 1. Reports to Stockholders.

SCHARF FUNDS

Scharf Fund

Institutional Class – LOGIX

Retail Class – LOGRX

Scharf Balanced Opportunity Fund

Institutional Class – LOGOX

Retail Class – LOGBX

Scharf Global Opportunity Fund

Retail Class – WRLDX

Scharf Alpha Opportunity Fund

Retail Class – HEDJX

ANNUAL REPORT

September 30, 2018

Scharf Investments, LLC

SCHARF FUNDS

TABLE OF CONTENTS

|

To Our Shareholders

|

2

|

|

|

Investment Highlights

|

12

|

|

|

Expense Examples

|

18

|

|

|

Sector Allocation of Portfolio Assets

|

21

|

|

|

Schedules of Investments

|

25

|

|

|

Statements of Assets and Liabilities

|

42

|

|

|

Statements of Operations

|

46

|

|

|

Statements of Changes in Net Assets

|

48

|

|

|

Statement of Cash Flows

|

54

|

|

|

Financial Highlights

|

55

|

|

|

Notes to Financial Statements

|

61

|

|

|

Report of Independent Registered Public Accounting Firm

|

82

|

|

|

Notice to Shareholders

|

83

|

|

|

Information about Trustees and Officers

|

85

|

|

|

Householding

|

88

|

|

|

Privacy Notice

|

89

|

SCHARF FUNDS

TO OUR SHAREHOLDERS

|

PERFORMANCE AS OF 9/30/2018

|

||||||

|

SCHARF FUND

|

||||||

|

Since

|

Since

|

|||||

|

6

|

One

|

Three

|

Five

|

Inception

|

Inception

|

|

|

Cumulative:

|

Months

|

Year

|

Year

|

Year

|

12/30/2011

|

1/28/2015

|

|

Scharf Fund – Institutional Class

|

8.05%

|

8.93%

|

30.16%

|

59.24%

|

116.08%

|

N/A

|

|

Scharf Fund – Retail Class

|

7.83%

|

8.58%

|

29.02%

|

N/A

|

N/A

|

26.89%

|

|

S&P 500® Index

|

11.41%

|

17.91%

|

61.43%

|

92.10%

|

166.96%

|

57.08%

|

|

(with dividends reinvested)

|

||||||

|

Annualized:

|

||||||

|

Scharf Fund – Institutional Class

|

—

|

—

|

9.19%

|

9.75%

|

12.08%

|

N/A

|

|

Scharf Fund – Retail Class

|

—

|

—

|

8.86%

|

N/A

|

N/A

|

6.70%

|

|

S&P 500® Index

|

—

|

—

|

17.31%

|

13.95%

|

15.65%

|

13.09%

|

|

(with dividends reinvested)

|

||||||

|

SCHARF BALANCED OPPORTUNITY FUND

|

||||||

|

Since

|

Since

|

|||||

|

6

|

One

|

Three

|

Five

|

Inception

|

Inception

|

|

|

Cumulative:

|

Months

|

Year

|

Year

|

Year

|

12/31/2012

|

1/21/2016

|

|

Scharf Balanced Opportunity

|

||||||

|

Fund – Institutional Class

|

5.70%

|

6.32%

|

22.43%

|

41.46%

|

60.03%

|

N/A

|

|

Scharf Balanced Opportunity

|

||||||

|

Fund – Retail Class

|

5.56%

|

6.00%

|

N/A

|

N/A

|

N/A

|

24.77%

|

|

Lipper Balanced Funds Index

|

4.23%

|

6.91%

|

30.00%

|

42.16%

|

56.87%

|

33.36%

|

|

(with dividends reinvested)

|

||||||

|

Bloomberg Barclays U.S.

|

||||||

|

Aggregate Bond Index

|

-0.14%

|

-1.22%

|

3.99%

|

11.28%

|

9.18%

|

3.64%

|

|

S&P 500® Index

|

||||||

|

(with dividends reinvested)

|

11.41%

|

17.91%

|

61.43%

|

92.10%

|

130.13%

|

64.77%

|

|

Annualized:

|

||||||

|

Scharf Balanced Opportunity

|

||||||

|

Fund – Institutional Class

|

—

|

—

|

6.98%

|

7.18%

|

8.52%

|

N/A

|

|

Scharf Balanced Opportunity

|

||||||

|

Fund – Retail Class

|

—

|

—

|

N/A

|

N/A

|

N/A

|

8.56%

|

|

Lipper Balanced Funds Index

|

—

|

—

|

9.14%

|

7.29%

|

8.15%

|

11.29%

|

|

(with dividends reinvested)

|

||||||

|

Bloomberg Barclays U.S.

|

||||||

|

Aggregate Bond Index

|

—

|

—

|

1.31%

|

2.16%

|

1.54%

|

1.34%

|

|

S&P 500® Index

|

||||||

|

(with dividends reinvested)

|

—

|

—

|

17.31%

|

13.95%

|

15.60%

|

20.37%

|

2

SCHARF FUNDS

|

SCHARF GLOBAL OPPORTUNITY FUND

|

|||||

|

Since

|

|||||

|

6

|

One

|

Three

|

Inception

|

||

|

Cumulative:

|

Months

|

Year

|

Year

|

10/14/2014

|

|

|

Scharf Global Opportunity Fund

|

9.48%

|

11.72%

|

41.85%

|

47.12%

|

|

|

MSCI All Country World Index (Net)

|

4.83%

|

9.77%

|

45.82%

|

42.84%

|

|

|

Annualized:

|

|||||

|

Scharf Global Opportunity Fund

|

—

|

—

|

12.34%

|

10.24%

|

|

|

MSCI All Country World Index (Net)

|

—

|

—

|

13.40%

|

9.42%

|

|

|

SCHARF ALPHA OPPORTUNITY FUND

|

|||||

|

Since

|

|||||

|

6

|

One

|

Inception

|

|||

|

Cumulative:

|

Months

|

Year

|

12/31/2015

|

||

|

Scharf Alpha Opportunity Fund

|

2.66%

|

0.79%

|

2.06%

|

||

|

HFRX Equity Hedge Index

|

-2.05%

|

1.79%

|

9.09%

|

||

|

Bloomberg Barclays U.S. Aggregate Bond Index

|

-0.14%

|

-1.22%

|

4.58%

|

||

|

S&P 500® Index (with dividends reinvested)

|

11.41%

|

17.91%

|

50.81%

|

||

|

Annualized:

|

|||||

|

Scharf Alpha Opportunity Fund

|

—

|

—

|

0.74%

|

||

|

HFRX Equity Hedge Index

|

—

|

—

|

3.22%

|

||

|

Bloomberg Barclays U.S. Aggregate Bond Index

|

—

|

—

|

1.64%

|

||

|

S&P 500® Index (with dividends reinvested)

|

—

|

—

|

16.11%

|

||

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-572-4273.

The gross expense ratios, as of the Funds’ registration statement dated January 28, 2018, for the Scharf Fund Institutional Class, Scharf Fund Retail Class, Scharf Balanced Opportunity Fund Institutional Class, Scharf Balanced Opportunity Fund Retail Class, Scharf Global Opportunity Fund, and Scharf Alpha Opportunity Fund are 1.14%, 1.39%, 1.52%, 1.77%, 1.97%, and 3.20%, respectively. The net expense ratios, as of the Funds’ registration statement dated January 28, 2018, for the Scharf Fund Institutional Class, Scharf Fund Retail Class, Scharf Fund Scharf Balanced Opportunity Fund Institutional Class, Scharf Balanced Opportunity Fund Retail Class, Scharf Global Opportunity Fund, and Scharf Alpha Opportunity Fund represent the percentages paid by investors and are 1.01%, 1.26%, 1.02%, 1.27%, 0.71%, and 2.18%, respectively, after fee waivers and expense reimbursements, including acquired fund fees and expenses, interest, taxes and extraordinary expenses. Scharf Investments, LLC (the “Adviser”), the Funds’ investment adviser, has contractually agreed to waive fees through January 27, 2019 for the Scharf Fund, Scharf Balanced Opportunity Fund, Scharf Global Opportunity Fund, and Scharf Alpha Opportunity Fund. The Scharf Fund charges a 2.00% redemption fee on redemptions or exchanges of fund shares that are made within 60 days of purchase. The Scharf Balanced Opportunity Fund, Scharf Global Opportunity Fund, and Scharf Alpha Opportunity Fund charge a 2.00% redemption fee on redemptions or exchanges of fund shares that are made within 15 days of purchase. Had a redemption fee been included, returns would be lower.

3

SCHARF FUNDS

Dear Fellow Shareholders,

For the fiscal year ended September 30, 2018, the Scharf Fund Institutional Class and Retail Class returned 8.93% and 8.58%, respectively, compared to the 17.91% return for the S&P 500® Index (“S&P 500”). The key contributors to relative performance for the period were Microsoft Corp., Advance Auto Parts, Inc., Motorola Solutions, Inc., and Apple, Inc. The key detractors from relative performance were Sodexo SA, Allergan plc, CDK Global, Inc., and Comcast Corp.

For the fiscal year ended September 30, 2018, the Scharf Balanced Opportunity Fund (effective November 1, 2018, known as the Scharf Multi-Asset Opportunity Fund) Institutional Class and Retail Class returned 6.32% and 6.00%, respectively, compared to the 6.91% return for the Lipper Balanced Funds Index, -1.22% return for the Bloomberg Barclays U.S. Aggregate Bond Index, and 17.91% return for the S&P 500. The key contributors to relative performance for the period were Microsoft Corp., Advance Auto Parts, Inc. (“Advance Auto Parts”), Motorola Solutions, Inc., and Apple, Inc. The key detractors from relative performance were Sodexo SA, Allergan plc, CDK Global, Inc., and McKesson Corp. (“McKesson”).

For the fiscal year ended September 30, 2018, the Scharf Global Opportunity Fund returned 11.72% compared to the 9.77% return for the MSCI All Country World Index (Net). The key contributors to relative performance for the period were Advance Auto Parts, Inc., Microsoft Corp., Sherwin-Williams Co., and Sony Corp. The key detractors from relative performance were Sodexo SA, CDK Global, Inc., Allergan plc, and McKesson Corp.

For the fiscal year ended September 30, 2018, the Scharf Alpha Opportunity Fund returned 0.79% compared to the 1.79% return for the HFRX Equity Hedge Index, -1.22% return for the Bloomberg Barclays U.S. Aggregate Bond Index, and 17.91% return for the S&P 500. The key contributors to relative performance for the period were Microsoft Corp., Advance Auto Parts, Inc., Motorola Solutions, Inc., and Sherwin-Williams Co. The key detractors from relative performance were Sodexo SA, CDK Global, Inc., Dollar Tree, Inc., and Allergan plc.

It is hard to believe a decade has passed since the Global Financial Crisis had investors staring into the financial abyss. With unprecedented low interest rates and monetary stimulus since, a rising tide lifted all boats, but passive U.S. indices, growth and momentum stocks floated the highest. While momentum stocks may currently be in favor, our philosophy is rooted in the principle that it is safer and more profitable over the long-run to buy companies with a history of consistent earnings growth trading at a discount to their fair value. This approach will lead to periods of underperformance, especially in the later stages of a bull market. However, we do not worry about short-term stock sentiment if we believe the company’s long-term earnings power is intact. Fundamentally, we believe the market is overvaluing potential future earnings (e.g. growth stocks) and undervaluing actual current earnings (e.g. value stocks). We recognize that the past few years have been tough on a relative basis for the Scharf Funds but we remain vigilant in our attempt to construct portfolios exhibiting consistent earnings growth at favorable prices.

MARKET COMMENTARY

Surviving the Amazon Effect: In a momentum driven market, investors have become quick to dump a stock based on speculation or short-term factors while ignoring the company’s longer-term potential. One such example of this, which negatively impacted several of our stocks in mid-2018, was the announcement of Amazon’s acquisition of PillPack. An online and mail order pharmacy which charges a premium to ship pre-packaged doses of medicine, PillPack

4

SCHARF FUNDS

has a small subscriber base of roughly 50,000 (<0.0% market share). To put this into perspective, CVS Health Corp. (“CVS”) has roughly 25% market share and filled approximately 1.2 billion prescriptions in 2017. While no one should doubt the ability of Amazon to disrupt an industry, we remain skeptical that the purchase of a company with little market share or scale will have a significant near-term impact on the highly regulated and complex pharmacy industry. It took Walmart, the last significant competitor in drug retail, more than a decade to establish just a 5% market share despite its $4 generic drug promotion and high volume of daily customers. In addition, CVS and Walgreens Boots Alliance, Inc. (“Walgreens”) currently have mail order and multi-dose drug dispensing capabilities in place, but both companies have indicated that customers overwhelmingly elect to pick up their prescriptions in-store when presented with the option of mail order.

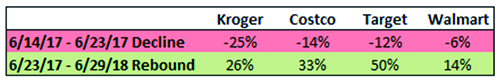

Walgreens, which reported strong earnings the same day as the PillPack announcement, declined roughly 10% on the news. CVS and McKesson also saw large declines. A similar story played out for the shares of supermarket companies when Amazon bought Whole Foods Market in June of 2017. Kroger, for example, was down roughly 25% a week after the announcement. More diverse retailers with grocery businesses also got punished as Costco, Target and Walmart declined 14%, 12% and 6%, respectively. These declines were short lived though as shares of the companies rebounded nicely over the following twelve months.

Grocery Stock Prices Slump then Rebound after Whole Foods Acquisition

|

Source: Bloomberg

|

It’s not just pharmacies and grocery stores that have come under siege. In fact, it is difficult to think of an industry that hasn’t been impacted by fears of an Amazon entry. After increasing reports early last year that Amazon was trying to move deeper into the auto parts segment, shares of auto parts retailers embarked on a slow and steady decline. Current Scharf stock, Advance Auto Parts, was our worst performing stock last year. This Amazon-induced selloff was clearly overdone as shares subsequently rebounded more than 100% off the lows, making it our best performing stock this year. While the stock still hasn’t returned to its all-time highs, this example illustrates the profound distinction between price and value. Prices are arbitrary and can deviate from value, often to a large degree, but over time they should converge. By maintaining a longer-term view and ignoring price volatility, we are able to buy businesses at a discount to their fair value. As successful value investor Preston Athey once said, “One thing you can do as a value investor is to arbitrage time and to recognize that you’re going to be early, but if you get the right price, it all works out in the end.”

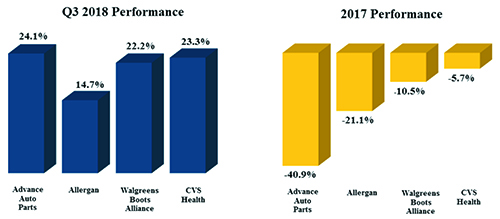

Revenge of the Downtrodden: While growth and momentum stocks continued to power forward this past quarter, we are starting to see signs in our own portfolio that indicate investors are recognizing the value in unfairly beaten up names selling at a discount to the market. The worst performing stocks in the Scharf Fund last year, for example, are among our best performers this most recent quarter.

5

SCHARF FUNDS

|

Source: Bloomberg. Performance quoted is stock performance and doesn’t represent gains/losses for Scharf Fund portfolios. Includes stocks that were owned in the Scharf Fund for all of 2017 and were still owned as of 9/30/2018.

|

Is sentiment finally starting to shift? If interest rates continue to rise, we believe this could be the case. Growth stocks, whose valuations are predicated on the potential for strong long-term earnings, tend to do well in low interest rate environments when the time value of money is low and growth is at a premium. Why is this the case? Imagine you had the option of $1 today or $1.25 five years from now. At a 0% rate of interest you would be wise to wait to receive the higher sum. If, however, you could invest $1 at a risk-free rate of 5% per year, you would have $1.28 in five years and would be smarter to take $1 today. In this way, investors ascribe a lower multiple to stocks, and growth stocks in particular, as rates rise. Thus, a rising rate environment tends to favor stocks trading at lower valuations. Just last week, as the 10-year treasury yield hit its highest mark since 2011, stocks across the board fell with technology shares leading the charge. With the Federal Reserve (“Fed”) on track for more rate increases in coming months, we believe higher multiple stocks could come under further pressure as investors seek safety in those trading at more attractive valuations.

S&P Priced for Unrealistic Future Growth: Now ten years into this current bull market, it is quite remarkable that the S&P just had its best quarter since the fourth quarter of 2013. Investors seemed to shrug off fears about inflation and tariffs and instead focused on the strong economy and robust corporate profits. Second quarter gross domestic product (“GDP’) growth was above 4% and roughly 80% of U.S. companies exceeded analyst earnings expectations, growing earnings 25% on a year-over-year basis. While these numbers were certainly cheered by investors, it is important to remember that they were largely propped up by fiscal stimulus and corporate friendly tax reform.

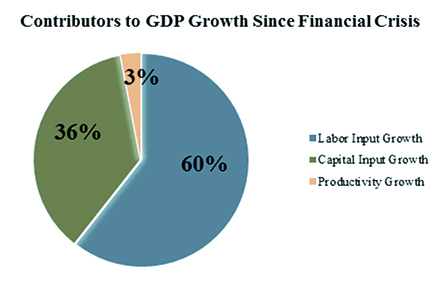

Going forward, there is reason to believe these numbers may not look as rosy. One quarter does not make a year, and despite the 4% GDP growth achieved in Q2, full year growth is expected to come in at just 3%. This is better than recent history but lower than the long-run average of 3.2%. Over the last 25 years, GDP growth has actually declined. Labor input growth, capital input growth, and productivity growth, the three contributors to GDP growth, have all failed to keep up with the levels achieved during the technology powered 1990s. Since the financial crisis, most of the recovery in GDP growth can be attributed to labor input growth (hiring) while productivity growth has been almost nonexistent.

6

SCHARF FUNDS

|

Source: Bernstein Research

|

As the economy runs out of workers, the largest piece of the above pie could shrink considerably. There are now under 6 million unemployed workers, and there are not enough unemployed job seekers available to fill demand for 7 million U.S. job offerings. A sign of the times: Amazon just raised their minimum wage by 36% from $11 to $15 an hour.

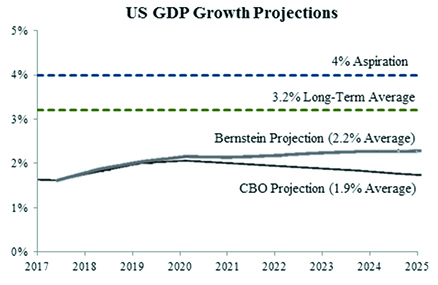

The Congressional Budget Office (“CBO”), which puts out a regular report with GDP growth projections, expects economic growth to be relatively strong this year and next but expects average growth over the next 10 years to come in at just 1.9%. Even with more aggressive assumptions of productivity growth in line with the late 1990s tech boom, GDP growth should only come in at 2.2%, according to a recent analysis from Bernstein Research. Many market participants, on the other hand, are unrealistically pricing in long term growth of 3-4% with some even calling for 5-6%.

|

Source: CBO and Bernstein U.S. Economic Analysis

|

With below average GDP growth going forward, it is difficult to imagine corporate earnings growth keeping pace with the strong double-digit gains of late. In fact, current projections call for markedly lower EPS growth rates over the next 4 quarters despite CBO expectations of strong economic growth up until 2020.

Global Financial Crisis Anniversary: September 15, 2018, marked the 10th Anniversary of the fall of Lehman Brothers. What initially began with falling house prices quickly morphed into a full blown financial panic. Federal Reserve Chairman, Ben Bernanke, and Treasury

7

SCHARF FUNDS

Secretary, Hank Paulsen, warned we might slide into a 1930’s style Great Depression without drastic action. In response, Congress quickly passed an emergency bank bailout, followed by bailouts of AIG, General Motors, Freddie Mac, and Fannie Mae.

The Federal Reserve reduced short-term rates to zero and kept them below inflation for nearly a decade. They also adopted an unconventional approach called Quantitative Easing, or QE, designed to lower long-term interest rates. In an effort to prop up the economy and the financial system, the Fed purchased an incredible $4.5 trillion in treasuries and mortgages. Did these unprecedented and experimental actions work? To that we have to say a resounding – Maybe!

Just as markets were overcome with fear ten years ago, today we are at the opposite end of the pendulum. Unemployment peaked at 10%, but today is near a 50-year low. Similarly, the Consumer Confidence Index is near all-time highs last reached on January 2000, a time of euphoria over the “New Economy” and the peak of the internet bubble. Whereas a decade ago stocks were in freefall, we are now in the longest continuous bull market in history. Even more amazing, we are less than a year away from this being the longest running economic expansion in history.

On the negative side, rates are too low by historical standards and the Federal Reserve still owns trillions of dollars in bonds purchased under QE. As a result, we expect them to raise rates by at least 0.25% every 3 months for the foreseeable future. While the economy should be able to handle rising rates, nobody knows for sure. QE was an untested experiment with unknown long-term ramifications. The unwinding of QE, as well as other similar programs in Europe and Japan, is not something that has been done before. To remove trillions of dollars of stimulus without any disruption to the global economy is no easy task. It might be akin to trying to hit a Nolan Ryan fastball down 0-2 in the count, it can be done, but the results are rarely positive.

The unwinding of QE could cause all sorts of disruptions in the global economy. One potential outcome is if short-term rates rise above long-term rates, an anomaly known as an “inverted yield curve.” Over the past 60 years, inverted yield curves have provided reliable warning signals of an upcoming economic slowdown. If this occurs, that would be an omen the sun is setting on this record-breaking bull market and economic expansion.

INVESTMENT STRATEGY

While we are always mindful of how economic conditions and current events impact companies, we continue to focus the bulk of our research on fundamental research and independent company analysis to identify securities which we believe are trading at significant discounts to fair value. The median stock in our portfolio currently has 61% upside to its historical median high P/E. We use a bottom-up, valuation-oriented strategy because stocks with low valuation ratios have often outperformed stocks with higher valuation ratios over the long term. By purchasing securities when they appear to be at a discount to fair value, we also hope to mitigate potential downside risk. In addition, the firm maintains a limited number of portfolios, favoring quality over quantity. We focus only on our best ideas as we believe owning too many stocks is counterproductive to enhancing risk/reward. Finally, we are style box agnostic and search for compelling investments in companies large and small, foreign and domestic. To that end, we are optimistic about the current portfolios and believe the Funds are well positioned for long-term investors.

8

SCHARF FUNDS

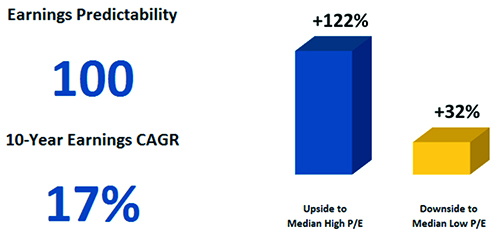

As an example, Starbucks Corp., (“Starbucks”) the dominant specialty coffee company in the U.S., has a proven track record of growth with high returns on capital and a very strong balance sheet. The iconic coffee company was an early adopter of technology in mobile payments and ordering and maintains a substantial lead over other restaurant chains. Starbucks is already very successful in China, with over 3,000 stores, but the growth opportunity there is enormous with management expecting China to be their biggest market someday. For comparison, the Americas segment has roughly 17,000 stores. Starbucks has an earnings predictability score of 100 and has compounded EPS at 17% over the last 10 years. As shown below, Starbucks recently traded below its median low P/E with 122% upside to its median high.

|

High Quality

|

Starbucks Favorability

|

|

Source: Value Line, Scharf Investments, LLC. Data as of 9/30/2018.

|

|

|

CAGR = Compound Annual Growth Rate

|

IN CLOSING

For over 30 years, Scharf Investments, LLC has operated as an independent, employee-owned firm dedicated to providing the highest quality investment management services. During this time, the firm has established a track record based on a disciplined investment approach. That approach continues today with the Scharf Fund, the Scharf Multi-Asset Opportunity Fund, the Scharf Global Opportunity Fund, and the Scharf Alpha Opportunity Fund.

One of our core beliefs has always been that our personal interests should be aligned with those of our clients. As such, every member of our investment committee is invested alongside our clients. On a personal level, as the first and one of the largest individual shareholders in each of the Funds, my family has a significant interest in the Funds’ success. As a shareholder, I hope you take comfort in the knowledge that having our own money invested alongside yours will be a powerful motivator to sharpen our focus.

We thank you for the trust and confidence you have placed in us. We welcome your comments and questions.

Brian Krawez

President and Portfolio Manager

9

SCHARF FUNDS

Mutual fund investing involves risk. Principal loss is possible. The Scharf Alpha Opportunity Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Scharf Alpha Opportunity Fund is more exposed to volatility than a diversified fund. Diversification does not assure a profit, nor does it protect against a loss in a declining market. The Funds may invest in securities representing equity or debt. These securities may be issued by small- and medium-sized companies, which involve additional risks such as limited liquidity and greater volatility. The Funds may invest in foreign securities which involve greater volatility, political, economic and currency risks, and differences in accounting methods. These risks are greater for emerging markets. The Funds may invest in exchange-traded fund (“ETFs”) or mutual funds, the risks of owning either generally reflecting the risks of owning the underlying securities held by the ETF or mutual fund. The Funds follows an investment style that favors relatively low valuations. Investment in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment in lower-rated, non-rated and distressed securities presents a greater risk of loss to principal and interest than higher-rated securities. The Scharf Alpha Opportunity Fund may make short sales of securities, which involves the risk that losses may exceed the original amount invested. The Scharf Alpha Opportunity Fund may use leverage which may exaggerate the effect of any increase or decrease in the value of portfolio securities or the net asset value of the Fund, and money borrowed will be subject to interest costs.

Forward earnings and EPS Growth are not measures of the Fund’s future performance.

The S&P 500® Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general.

The Lipper Balanced Funds Index is an index of open-end mutual funds whose primary objective is to conserve principal by maintaining at all times a balanced portfolio of both equities and bonds.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government related and corporate securities.

MSCI All Country World Index (Net) is a broad measure of stock performance throughout the world, with the exception of U.S. based companies.

The HFRX Equity Hedge Index encompasses various equity hedge strategies, also known as long/short equity, that combine core long holdings of equities with short sales of stock, stock indices, related derivatives, or other financial instruments related to the equity markets.

You cannot invest directly in an index.

Earnings Per Share (“EPS”) is the portion of a company’s profit allocated to each outstanding share of common stock and serves as an indicator of a company’s profitability.

Price to Earnings Ratio (P/E) is a valuation ratio of a company’s current share price compared to its per-share earnings. Upside to historical median P/E and downside to historical median P/E are terms used to describe the adviser’s estimated reward and risk of an individual security.

Earnings Growth is the percentage change in a firm’s earnings per share (EPS) over a specific period of time.

Value Line is an independent investment research and financial publishing firm.

Gross Domestic Product (“GDP”) represents the monetary value of all goods and services produced within a nation’s geographic borders over a specified period of time.

The Consumer Confidence Index measures the degree of optimism about the state of the economy that consumers are expressing through their activities of saving and spending.

10

SCHARF FUNDS

The information provided herein represents the opinion of the Funds’ manager, is subject to change at any time, is not guaranteed and should not be considered investment advice.

The Funds’ holdings and sector allocations are subject to change at any time and should not be considered recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings.

Must be preceded or accompanied by a prospectus.

The Scharf Funds are distributed by Quasar Distributors, LLC.

11

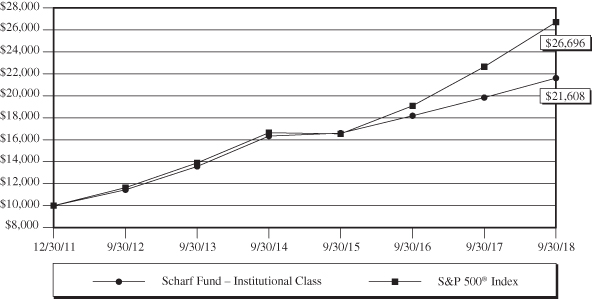

SCHARF FUND

Comparison of the change in value of a hypothetical $10,000 investment

in the Scharf Fund – Institutional Class vs. the S&P 500® Index

Average Annual Total Return for the Periods Ended 9/30/2018:

|

Since

|

Since

|

|||

|

Inception

|

Inception

|

|||

|

1 year

|

5 year

|

(12/30/11)

|

(1/28/15)

|

|

|

Scharf Fund – Institutional Class1

|

8.93%

|

9.75%

|

12.08%

|

—

|

|

Scharf Fund – Retail Class2

|

8.58%

|

—

|

—

|

6.70%

|

|

S&P 500® Index

|

17.91%

|

13.95%

|

15.65%

|

13.09%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-572-4273 (1-866-5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 60 days or less. Indices do not incur expenses and are not available for investment.

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 stocks designed to represent the broad domestic economy.

1 The Fund commenced operations on December 30, 2011.

2 The Fund commenced operations on January 28, 2015.

12

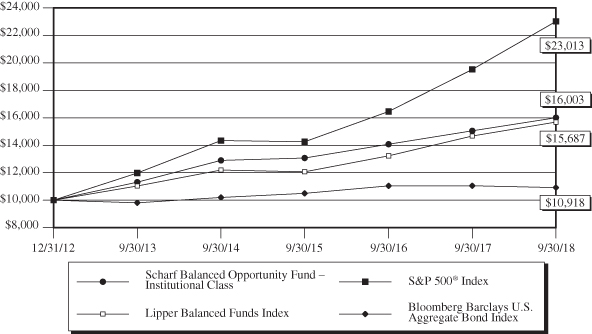

SCHARF BALANCED OPPORTUNITY FUND

Comparison of the change in value of a hypothetical $10,000 investment in

the Scharf Balanced Opportunity Fund vs. the Lipper Balanced Funds Index,

the S&P 500® Index, and the Bloomberg Barclays U.S. Aggregate Bond Index

Average Annual Total Return for the Periods Ended 9/30/2018:

|

Since

|

Since

|

|||

|

Inception

|

Inception

|

|||

|

1 year

|

5 year

|

(12/31/12)

|

(1/12/16)

|

|

|

Scharf Balanced Opportunity Fund –

|

||||

|

Institutional Class1

|

6.32%

|

7.18%

|

8.52%

|

—

|

|

Scharf Balanced Opportunity Fund –

|

||||

|

Retail Class2

|

6.00%

|

—

|

—

|

8.56%

|

|

S&P 500® Index

|

17.91%

|

13.95%

|

15.60%

|

20.37%

|

|

Bloomberg Barclays U.S.

|

||||

|

Aggregate Bond Index

|

-1.22%

|

2.16%

|

1.54%

|

1.34%

|

|

Lipper Balanced Funds Index

|

6.91%

|

7.29%

|

8.15%

|

11.29%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-572-4273 (1-866-5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on

13

SCHARF BALANCED OPPORTUNITY FUND

dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 15 days or less. Indices do not incur expenses and are not available for investment.

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 stocks designed to represent the broad domestic economy.

The Lipper Balanced Funds Index is an equally weighted index of the 30 largest U.S. balanced funds.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government related and corporate securities.

1 The Fund commenced operations on December 31, 2012.

2 The Fund commenced operations on January 21, 2016.

14

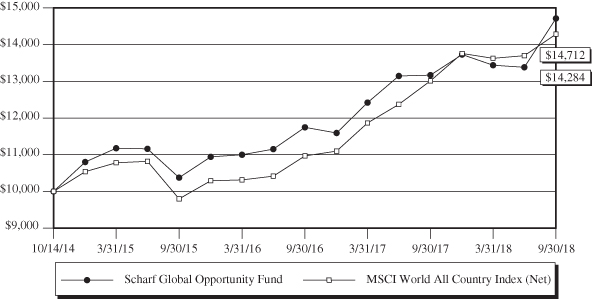

SCHARF GLOBAL OPPORTUNITY FUND

Comparison of the change in value of a hypothetical $10,000 investment in the

Scharf Global Opportunity Fund vs. the MSCI World All Country Index (Net)

Average Annual Total Return for the Periods Ended 9/30/2018:

|

1 year

|

3 year

|

Since Inception1

|

|

|

Scharf Global Opportunity Fund

|

11.72%

|

12.34%

|

10.24%

|

|

MSCI World All Country Index (Net)

|

9.77%

|

13.40%

|

9.42%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-572-4273 (1-866-5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 15 days or less. Indices do not incur expenses and are not available for investment.

The MSCI World All Country Index (Net) captures large and mid cap representation across 23 Developed Markets (DM) and 23 Emerging Markets (EM) countries. Net total return indexes reinvest dividends after the deduction of withholding taxes, using a tax rate appliable to non-resident institutional investors who do not benefit from double taxation treaties.

1 The Fund commenced operations on October 14, 2014.

15

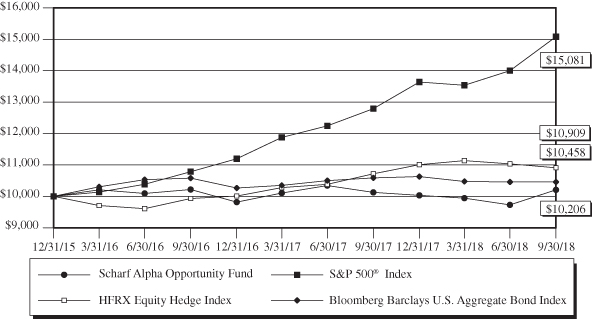

SCHARF ALPHA OPPORTUNITY FUND

Comparison of the change in value of a hypothetical $10,000 investment in

the Scharf Alpha Opportunity Fund vs. the HFRX Equity Hedge Index,

the S&P 500® Index, and the Bloomberg Barclays U.S. Aggregate Bond Index

Cumulative Total Return for the Period Ended 9/30/2018:

|

1 year

|

Since Inception1

|

|

|

Scharf Alpha Opportunity Fund

|

0.79%

|

0.74%

|

|

HFRX Equity Hedge Index

|

1.79%

|

3.22%

|

|

Bloomberg Barclays U.S. Aggregate Bond Index

|

-1.22%

|

1.64%

|

|

S&P 500® Index

|

17.91%

|

16.11%

|

Performance data quoted on this page represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-866-572-4273 (1-866-5SCHARF).

Returns reflect reinvestment of dividends and capital gains distributions. Fee waivers are in effect. In the absence of fee waivers, returns would be reduced. The performance data and graph do not reflect the deduction of taxes that a shareholder would pay on dividends, capital gains distributions, or redemption of Fund shares. The performance data and graph do not reflect the 2.00% redemption fee imposed on shares held 15 days or less. Indices do not incur expenses and are not available for investment.

The HFRX Equity Hedge Index encompasses various equity hedge strategies, also known as long/short equity, that combine core long holdings of equities with short sales of stock, stock indices, related derivatives, or other financial instruments related to the equity markets.

16

SCHARF ALPHA OPPORTUNITY FUND

The S&P 500® Index is an unmanaged capitalization-weighted index of 500 stocks designed to represent the broad domestic economy.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government related and corporate securities.

1 The Fund commenced operations on December 31, 2015.

17

SCHARF FUNDS

EXPENSE EXAMPLES at September 30, 2018 (Unaudited)

Shareholders in mutual funds generally incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, redemption fees, and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service fees, and other fund expenses. The Scharf Fund, Scharf Balanced Opportunity Fund, Scharf Global Opportunity Fund, and the Scharf Alpha Opportunity Fund are no-load mutual funds. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested in the Scharf Fund, the Scharf Balanced Opportunity Fund, the Scharf Global Opportunity Fund, and the Scharf Alpha Opportunity Fund at the beginning of the period and held for the entire period (4/1/18-9/30/18).

Actual Expenses

The first line of each table below provides information about actual account values and actual expenses, with actual net expenses being limited. Effective January 28, 2018, per the operating expense limitation agreement, the actual net expenses are being limited to 0.99%, and 1.24%, for the Scharf Fund Institutional Class and Retail Class, respectively, and 0.70% for the Scharf Global Opportunity Fund. Prior to January 28, 2018, the Scharf Fund’s actual net expenses for the Institutional Class and Retail Class were limited to 1.09% and 1.34%, respectively, and 0.65% for the Scharf Global Opportunity Fund. Per the operating expense limitation agreement, the actual net expenses are being limited to 0.98% and 1.23% for the Scharf Balanced Opportunity Fund Institutional Class and Retail Class, respectively, and 1.00% for the Scharf Alpha Opportunity Fund. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks, and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. The Examples below include, but are not limited to, management fees, fund accounting, custody and transfer agent fees. You may use the information in the first line of the tables, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds.

18

SCHARF FUNDS

EXPENSE EXAMPLES at September 30, 2018 (Unaudited), Continued

To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and will not help you determine the relative total costs of owning different funds, as they may charge transaction costs, such as sales charges (loads), redemption fees, or exchange fees.|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

|

Scharf Fund

|

4/1/18

|

9/30/18

|

4/1/18-9/30/18

|

Ratio*

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,080.50

|

$4.54

|

0.87%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,020.71

|

$4.41

|

0.87%

|

|

Retail Class

|

||||

|

Actual

|

$1,000.00

|

$1,078.30

|

$6.46

|

1.24%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,018.85

|

$6.28

|

1.24%

|

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Scharf Balanced

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

Opportunity Fund

|

4/1/18

|

9/30/18

|

4/1/18-9/30/18

|

Ratio*

|

|

Institutional Class

|

||||

|

Actual

|

$1,000.00

|

$1,057.00

|

$5.05

|

0.98%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,020.16

|

$4.96

|

0.98%

|

|

Retail Class

|

||||

|

Actual

|

$1,000.00

|

$1,055.60

|

$6.34

|

1.23%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,018.90

|

$6.23

|

1.23%

|

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Scharf Global

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

Opportunity Fund

|

4/1/18

|

9/30/18

|

4/1/18-9/30/18

|

Ratio*

|

|

Retail Class

|

||||

|

Actual

|

$1,000.00

|

$1,094.80

|

$2.36

|

0.45%

|

|

Hypothetical (5% return

|

||||

|

before expenses)

|

$1,000.00

|

$1,022.81

|

$2.28

|

0.45%

|

19

SCHARF FUNDS

EXPENSE EXAMPLES at September 30, 2018 (Unaudited), Continued

|

Beginning

|

Ending

|

Expenses Paid

|

Annualized

|

|

|

Scharf Alpha

|

Account Value

|

Account Value

|

During Period*

|

Expense

|

|

Opportunity Fund

|

4/1/18

|

9/30/18

|

4/1/18-9/30/18

|

Ratio*

|

|

Retail Class

|

||||

|

Actual(1)

|

$1,000.00

|

$1,026.60

|

$8.94

|

1.76%

|

|

Hypothetical (5% return

|

||||

|

before expenses)(1)

|

$1,000.00

|

$1,016.24

|

$8.90

|

1.76%

|

|

(1)

|

Excluding interest expense and dividends on short positions, your actual expenses would be $4.87 and your hypothetical expenses would be $4.86.

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of each class, multiplied by the average account value over the period, multiplied by 183 (days in most recent fiscal half-year)/365 days to reflect the one-half year expense.

|

20

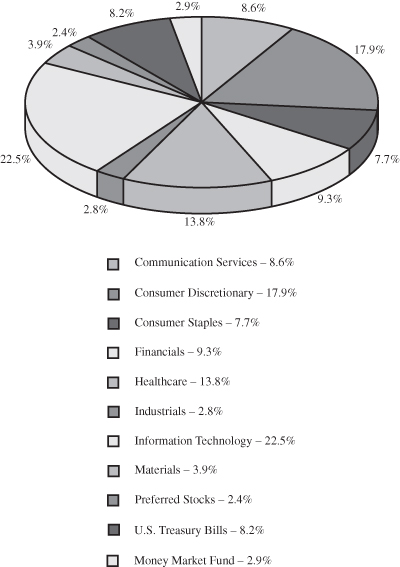

SCHARF FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2018 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Percentages represent market value as a percentage of total investments.

21

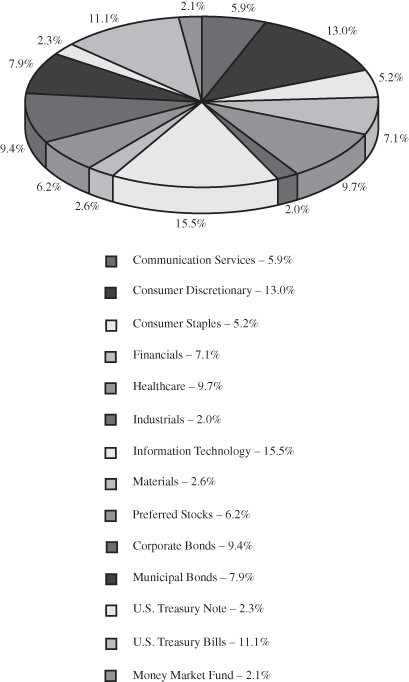

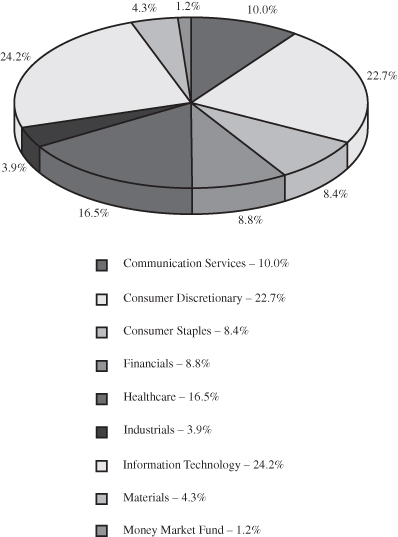

SCHARF BALANCED OPPORTUNITY FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2018 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Percentages represent market value as a percentage of total investments.

22

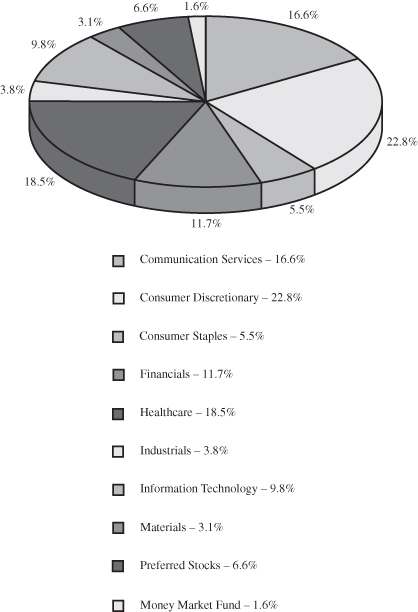

SCHARF GLOBAL OPPORTUNITY FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2018 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Percentages represent market value as a percentage of total investments.

23

SCHARF Alpha OPPORTUNITY FUND

SECTOR ALLOCATION OF PORTFOLIO ASSETS at September 30, 2018 (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

Percentages represent market value as a percentage of total investments.

24

SCHARF FUND

SCHEDULE OF INVESTMENTS at September 30, 2018

|

Shares

|

COMMON STOCKS – 86.57%

|

Value

|

|||||

|

Auto Components – 2.19%

|

|||||||

|

429,300

|

Gentex Corp.

|

$

|

9,212,778

|

||||

|

Chemicals – 3.91%

|

|||||||

|

36,119

|

Sherwin-Williams Co.

|

16,441,730

|

|||||

|

Communications Equipment – 3.23%

|

|||||||

|

104,374

|

Motorola Solutions, Inc.

|

13,583,232

|

|||||

|

Diversified Financial Services – 4.34%

|

|||||||

|

85,173

|

Berkshire Hathaway, Inc. – Class B (a)

|

18,236,391

|

|||||

|

Food & Staples Retailing – 7.55%

|

|||||||

|

195,553

|

CVS Health Corp.

|

15,393,932

|

|||||

|

224,560

|

Walgreens Boots Alliance, Inc.

|

16,370,424

|

|||||

|

31,764,356

|

|||||||

|

Food Products – 3.76%

|

|||||||

|

155,200

|

Hershey Co.

|

15,830,400

|

|||||

|

Health Care Providers & Services – 3.69%

|

|||||||

|

22,835

|

Aetna, Inc.

|

4,632,080

|

|||||

|

82,214

|

McKesson Corp.

|

10,905,687

|

|||||

|

15,537,767

|

|||||||

|

Health Care Technology – 1.51%

|

|||||||

|

98,481

|

Cerner Corp. (a)

|

6,343,161

|

|||||

|

Hotels, Restaurants & Leisure – 5.31%

|

|||||||

|

55,625

|

Sodexo SA (b)

|

5,899,044

|

|||||

|

288,936

|

Starbucks Corp.

|

16,423,122

|

|||||

|

22,322,166

|

|||||||

|

Insurance – 5.01%

|

|||||||

|

136,926

|

Aon plc

|

21,056,480

|

|||||

|

Internet & Direct Marketing Retail – 3.20%

|

|||||||

|

6,788

|

Booking Holdings, Inc. (a)

|

13,467,392

|

|||||

|

IT Services – 1.76%

|

|||||||

|

95,997

|

Cognizant Technology Solutions Corp. – Class A

|

7,406,169

|

|||||

|

Media – 8.64%

|

|||||||

|

497,977

|

Comcast Corp. – Class A

|

17,633,366

|

|||||

|

108,000

|

Liberty Broadband Corp. (a)

|

9,104,400

|

|||||

The accompanying notes are an integral part of these financial statements.

25

SCHARF FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Shares

|

COMMON STOCKS – 86.57%, Continued

|

Value

|

|||||

|

Media – 8.64%, Continued

|

|||||||

|

16,609

|

Liberty Media Corp. – SiriusXM (a)

|

$

|

721,661

|

||||

|

75,784

|

Walt Disney Co.

|

8,862,181

|

|||||

|

36,321,608

|

|||||||

|

Multiline Retail – 3.27%

|

|||||||

|

168,822

|

Dollar Tree, Inc. (a)

|

13,767,434

|

|||||

|

Pharmaceuticals – 4.99%

|

|||||||

|

70,042

|

Allergan plc

|

13,341,600

|

|||||

|

88,496

|

Novartis AG – ADR

|

7,624,815

|

|||||

|

20,966,415

|

|||||||

|

Road & Rail – 2.76%

|

|||||||

|

102,566

|

Kansas City Southern

|

11,618,676

|

|||||

|

Software – 15.05%

|

|||||||

|

265,651

|

CDK Global, Inc.

|

16,619,127

|

|||||

|

225,179

|

Microsoft Corp.

|

25,753,722

|

|||||

|

405,621

|

Oracle Corp.

|

20,913,819

|

|||||

|

63,286,668

|

|||||||

|

Specialty Retail – 3.98%

|

|||||||

|

99,429

|

Advance Auto Parts, Inc.

|

16,736,884

|

|||||

|

Technology Hardware,

|

|||||||

|

Storage & Peripherals – 2.42%

|

|||||||

|

45,173

|

Apple, Inc.

|

10,197,353

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $288,093,160)

|

364,097,060

|

||||||

|

PREFERRED STOCK – 2.45%

|

|||||||

|

Semiconductors &

|

|||||||

|

Semiconductor Equipment – 2.45%

|

|||||||

|

301,810

|

Samsung Electronics Co., Ltd. 3.03% (b)

|

10,298,408

|

|||||

|

TOTAL PREFERRED STOCK

|

|||||||

|

(Cost $4,925,806)

|

10,298,408

|

||||||

The accompanying notes are an integral part of these financial statements.

26

SCHARF FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Shares

|

SHORT-TERM INVESTMENTS – 11.04%

|

Value

|

|||||

|

Money Market Fund – 2.86%

|

|||||||

|

12,010,609

|

First American Treasury Obligations

|

||||||

|

Fund, Class Z, 1.96% (c)

|

$

|

12,010,609

|

|||||

|

TOTAL MONEY MARKET FUND

|

|||||||

|

(Cost $12,010,609)

|

12,010,609

|

||||||

|

Principal

|

|||||||

|

Amount

|

|||||||

|

U.S. Treasury Bills – 8.18%

|

|||||||

|

$

|

6,605,000

|

2.08%, 11/15/18 (d)

|

6,587,858

|

||||

|

27,967,000

|

2.12%, 12/20/18 (d)

|

27,835,011

|

|||||

|

TOTAL U.S. TREASURY BILLS

|

|||||||

|

(Cost $34,428,360)

|

34,422,869

|

||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||

|

(Cost $46,438,969)

|

46,433,478

|

||||||

|

Total Investments in Securities

|

|||||||

|

(Cost $339,457,935) – 100.06%

|

420,828,946

|

||||||

|

Liabilities in Excess of Other Assets – (0.06)%

|

(259,263

|

)

|

|||||

|

TOTAL NET ASSETS – 100.00%

|

$

|

420,569,683

|

|||||

|

ADR

|

American Depository Receipt

|

|

(a)

|

Non-income producing security.

|

|

(b)

|

Foreign issuer.

|

|

(c)

|

Rate shown is the 7-day annualized yield as of September 30, 2018.

|

|

(d)

|

Rate shown is the discount rate at September 30, 2018.

|

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

27

SCHARF BALANCED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2018

|

Shares

|

COMMON STOCKS – 61.08%

|

Value

|

|||||

|

Auto Components – 1.51%

|

|||||||

|

37,901

|

Gentex Corp.

|

$

|

813,356

|

||||

|

Capital Markets – 0.52%

|

|||||||

|

6,758

|

Oaktree Cap Group, LLC

|

279,781

|

|||||

|

Chemicals – 2.57%

|

|||||||

|

3,031

|

Sherwin-Williams Co.

|

1,379,742

|

|||||

|

Communications Equipment – 2.11%

|

|||||||

|

8,715

|

Motorola Solutions, Inc.

|

1,134,170

|

|||||

|

Diversified Financial Services – 3.01%

|

|||||||

|

7,558

|

Berkshire Hathaway, Inc. – Class B (a)

|

1,618,243

|

|||||

|

Food & Staples Retailing – 4.92%

|

|||||||

|

16,515

|

CVS Health Corp.

|

1,300,061

|

|||||

|

18,439

|

Walgreens Boots Alliance, Inc.

|

1,344,203

|

|||||

|

2,644,264

|

|||||||

|

Food Products – 2.72%

|

|||||||

|

14,331

|

Hershey Co.

|

1,461,762

|

|||||

|

Health Care Providers & Services – 2.59%

|

|||||||

|

1,920

|

Aetna, Inc.

|

389,472

|

|||||

|

7,537

|

McKesson Corp.

|

999,783

|

|||||

|

1,389,255

|

|||||||

|

Health Care Technology – 1.09%

|

|||||||

|

9,135

|

Cerner Corp. (a)

|

588,385

|

|||||

|

Hotels, Restaurants & Leisure – 3.73%

|

|||||||

|

4,985

|

Sodexo SA (b)

|

528,661

|

|||||

|

26,005

|

Starbucks Corp.

|

1,478,124

|

|||||

|

2,006,785

|

|||||||

|

Insurance – 3.55%

|

|||||||

|

12,389

|

Aon plc

|

1,905,180

|

|||||

|

Internet & Direct Marketing Retail – 2.23%

|

|||||||

|

603

|

Booking Holdings, Inc. (a)

|

1,196,352

|

|||||

|

IT Services – 1.17%

|

|||||||

|

8,143

|

Cognizant Technology Solutions Corp. – Class A

|

628,232

|

|||||

The accompanying notes are an integral part of these financial statements.

28

SCHARF BALANCED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Shares

|

COMMON STOCKS – 61.08%, Continued

|

Value

|

|||||

|

Media – 5.93%

|

|||||||

|

44,719

|

Comcast Corp. – Class A

|

$

|

1,583,500

|

||||

|

9,600

|

Liberty Broadband Corp. (a)

|

809,280

|

|||||

|

6,772

|

Walt Disney Co.

|

791,918

|

|||||

|

3,184,698

|

|||||||

|

Multiline Retail – 2.85%

|

|||||||

|

18,760

|

Dollar Tree, Inc. (a)

|

1,529,878

|

|||||

|

Pharmaceuticals – 3.60%

|

|||||||

|

6,366

|

Allergan plc

|

1,212,596

|

|||||

|

8,371

|

Novartis AG – ADR

|

721,245

|

|||||

|

1,933,841

|

|||||||

|

Road & Rail – 2.01%

|

|||||||

|

9,550

|

Kansas City Southern

|

1,081,824

|

|||||

|

Software – 10.63%

|

|||||||

|

24,168

|

CDK Global, Inc.

|

1,511,950

|

|||||

|

20,105

|

Microsoft Corp.

|

2,299,409

|

|||||

|

36,806

|

Oracle Corp.

|

1,897,717

|

|||||

|

5,709,076

|

|||||||

|

Specialty Retail – 2.72%

|

|||||||

|

8,677

|

Advance Auto Parts, Inc.

|

1,460,599

|

|||||

|

Technology Hardware,

|

|||||||

|

Storage & Peripherals – 1.62%

|

|||||||

|

3,863

|

Apple, Inc.

|

872,034

|

|||||

|

TOTAL COMMON STOCKS

|

|||||||

|

(Cost $25,393,323)

|

32,817,457

|

||||||

|

PREFERRED STOCKS – 6.23%

|

|||||||

|

Closed-End Fund – 4.08%

|

|||||||

|

42,653

|

GDL Fund – Series C, 4.00%

|

2,194,070

|

|||||

|

Semiconductors &

|

|||||||

|

Semiconductor Equipment – 2.15%

|

|||||||

|

33,900

|

Samsung Electronics Co., Ltd. 3.03% (b)

|

1,156,741

|

|||||

|

TOTAL PREFERRED STOCKS

|

|||||||

|

(Cost $2,677,470)

|

3,350,811

|

||||||

The accompanying notes are an integral part of these financial statements.

29

SCHARF BALANCED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Principal

|

|||||||

|

Amount

|

CORPORATE BONDS – 9.38%

|

Value

|

|||||

|

Beverages – 0.26%

|

|||||||

|

Coca-Cola European Partners LLC

|

|||||||

|

$

|

85,000

|

4.50%, 9/1/2021

|

$

|

86,976

|

|||

|

PepsiCo, Inc.

|

|||||||

|

54,000

|

1.50%, 2/22/2019

|

53,772

|

|||||

|

140,748

|

|||||||

|

Communications Equipment – 0.74%

|

|||||||

|

Motorola Solutions, Inc.

|

|||||||

|

400,000

|

3.50%, 9/1/2021

|

397,254

|

|||||

|

Computer and Electronic

|

|||||||

|

Product Manufacturing – 0.18%

|

|||||||

|

Digital Equipment Corp.

|

|||||||

|

89,000

|

7.75%, 4/1/2023

|

96,727

|

|||||

|

Consumer Finance – 0.22%

|

|||||||

|

American Express Credit Corp.

|

|||||||

|

62,000

|

1.875%, 11/5/2018

|

61,988

|

|||||

|

Medtronic, Inc.

|

|||||||

|

54,000

|

2.50%, 3/15/2020

|

53,652

|

|||||

|

115,640

|

|||||||

|

Diversified Telecommunication Services – 0.50%

|

|||||||

|

AT&T, Inc.

|

|||||||

|

137,000

|

2.375%, 11/27/2018

|

136,956

|

|||||

|

130,000

|

5.80%, 2/15/2019

|

131,524

|

|||||

|

268,480

|

|||||||

|

Food & Staples Retailing – 0.15%

|

|||||||

|

Walgreens Boots Alliance, Inc.

|

|||||||

|

82,000

|

2.70%, 11/18/2019

|

81,748

|

|||||

|

Health Care Providers & Services – 0.06%

|

|||||||

|

Express Scripts Holding Co.

|

|||||||

|

34,000

|

2.25%, 6/15/2019

|

33,849

|

|||||

|

Insurance – 0.06%

|

|||||||

|

American International Group, Inc.

|

|||||||

|

34,000

|

2.30%, 7/16/2019

|

33,854

|

|||||

The accompanying notes are an integral part of these financial statements.

30

SCHARF BALANCED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Principal

|

|||||||

|

Amount

|

CORPORATE BONDS – 9.38%, Continued

|

Value

|

|||||

|

Internet Software & Services – 0.10%

|

|||||||

|

eBay, Inc.

|

|||||||

|

$

|

54,000

|

2.20%, 8/1/2019

|

$

|

53,735

|

|||

|

IT Services – 0.10%

|

|||||||

|

International Business Machines Corp.

|

|||||||

|

54,000

|

1.95%, 2/12/2019

|

53,902

|

|||||

|

Media – 0.02%

|

|||||||

|

Viacom, Inc.

|

|||||||

|

11,000

|

2.75%, 12/15/2019

|

10,941

|

|||||

|

Petroleum and Coal

|

|||||||

|

Products Manufacturing – 3.00%

|

|||||||

|

Murphy Oil USA, Inc.

|

|||||||

|

1,022,000

|

6.00%, 8/15/2023

|

1,055,215

|

|||||

|

557,000

|

5.625%, 5/1/2027

|

554,911

|

|||||

|

1,610,126

|

|||||||

|

Securities and Commodity Contracts

|

|||||||

|

Intermediation and Brokerage – 3.56%

|

|||||||

|

Goldman Sachs Group, Inc.

|

|||||||

|

2,281,000

|

4.00%, (3 Month LIBOR + 0.7675%) 6/1/2043 (c)

|

1,910,337

|

|||||

|

Specialty Retail – 0.38%

|

|||||||

|

Advance Auto Parts, Inc.

|

|||||||

|

50,000

|

5.75%, 5/1/2020

|

51,565

|

|||||

|

L Brands, Inc.

|

|||||||

|

56,000

|

7.00%, 5/1/2020

|

58,660

|

|||||

|

90,000

|

6.625%, 4/1/2021

|

95,319

|

|||||

|

205,544

|

|||||||

|

Technology Hardware,

|

|||||||

|

Storage & Peripherals – 0.05%

|

|||||||

|

HP, Inc.

|

|||||||

|

25,000

|

2.75%, 1/14/2019

|

25,012

|

|||||

|

TOTAL CORPORATE BONDS

|

|||||||

|

(Cost $4,784,526)

|

5,037,897

|

||||||

The accompanying notes are an integral part of these financial statements.

31

SCHARF BALANCED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Principal

|

|||||||

|

Amount

|

MUNICIPAL BONDS – 7.92%

|

Value

|

|||||

|

California Health Facilities Financing Authority,

|

|||||||

|

Revenue Bonds, Chinese Hospital Association

|

|||||||

|

$

|

10,000

|

3.00%, 6/1/2024, Series 2012

|

$

|

10,167

|

|||

|

California Health Facilities Financing

|

|||||||

|

Authority, Revenue Bonds, Persons with

|

|||||||

|

Developmental Disabilities

|

|||||||

|

80,000

|

7.11%, 2/1/2021, Series 2011B

|

85,044

|

|||||

|

145,000

|

7.875%, 2/1/2026, Series 2011B

|

157,798

|

|||||

|

California State, General Obligation,

|

|||||||

|

Highway Safety, Traffic Reduction,

|

|||||||

|

Air Quality and Port Security Bonds

|

|||||||

|

90,000

|

6.509%, 4/1/2039, Series 2009B

|

98,104

|

|||||

|

California State, General Obligation, Various Purpose

|

|||||||

|

125,000

|

6.20%, 10/1/2019

|

129,141

|

|||||

|

405,000

|

5.60%, 11/1/2020

|

427,097

|

|||||

|

745,000

|

6.65%, 3/1/2022, Series 2010

|

813,242

|

|||||

|

980,000

|

7.95%, 3/1/2036, Series 2010

|

1,044,866

|

|||||

|

Commonwealth of Massachusetts,

|

|||||||

|

Build America Bonds

|

|||||||

|

205,000

|

4.20%, 12/1/2021

|

209,809

|

|||||

|

Norman Y Mineta San Jose International Airport SJC

|

|||||||

|

550,000

|

5.00%, 3/1/2019

|

557,144

|

|||||

|

State of California, Build America Bonds

|

|||||||

|

35,000

|

5.70%, 11/1/2021

|

37,721

|

|||||

|

15,000

|

4.988%, 4/1/2039

|

15,860

|

|||||

|

State of Connecticut, Build America Bonds

|

|||||||

|

100,000

|

4.807%, 4/1/2022

|

102,071

|

|||||

|

240,000

|

5.20%, 12/1/2022

|

253,613

|

|||||

|

25,000

|

5.30%, 12/1/2023

|

26,815

|

|||||

|

10,000

|

5.027%, 4/1/2024

|

10,228

|

|||||

|

State of Florida, Build America Bonds

|

|||||||

|

10,000

|

4.65%, 6/1/2020

|

10,114

|

|||||

|

State of Georgia, Build America Bonds

|

|||||||

|

5,000

|

4.503%, 11/1/2025

|

5,176

|

|||||

|

State of Georgia, Economic Development Bonds

|

|||||||

|

10,000

|

3.24%, 10/1/2020

|

10,070

|

|||||

The accompanying notes are an integral part of these financial statements.

32

SCHARF BALANCED OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS at September 30, 2018, Continued

|

Principal

|

|||||||

|

Amount

|

MUNICIPAL BONDS – 7.92%, Continued

|

Value

|

|||||

|

State of Georgia, School Construction Bonds

|

|||||||

|

$

|

15,000

|

4.35%, 2/1/2029

|

$

|

15,887

|

|||

|

State of Illinois, Build America Bonds

|

|||||||

|

100,000

|

5.547%, 4/1/2019

|

101,158

|

|||||

|

20,000

|

5.727%, 4/1/2020

|

20,528

|

|||||

|

State of Maryland, Build America Bonds

|

|||||||

|

10,000

|

4.10%, 3/1/2020

|

10,136

|

|||||

|

20,000

|

4.20%, 3/1/2021

|

20,449

|

|||||

|

5,000

|

4.55%, 8/15/2024

|

5,061

|

|||||

|

State of Michigan, General Obligation,

|

|||||||

|

School Loan and Refunding Bonds

|

|||||||

|

40,000

|

6.95%, 11/1/2020 Series 2009A

|

43,248

|

|||||

|

State of Ohio, Build America Bonds

|

|||||||

|

35,000

|

4.621%, 4/1/2020

|

35,874

|

|||||

|

TOTAL MUNICIPAL BONDS

|

|||||||

|

(Cost $4,421,063)

|

4,256,421

|

||||||

|

U.S. TREASURY NOTE – 2.29%

|

|||||||

|

U. S. Treasury Note – 2.29%

|

|||||||

|

1,245,000

|

1.50%, 11/30/2019

|

1,228,076

|

|||||

|

TOTAL U.S. TREASURY NOTE

|

|||||||

|

(Cost $1,241,063)

|

1,228,076

|

||||||

The accompanying notes are an integral part of these financial statements.

33

SCHARF BALANCED OPPORTUNITY FUND