UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Fiscal Year Ended December 31 , 2020

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the Transition Period from _____ to _____

Commission File Number: 000-3676

(Exact Name of Registrant as Specified in its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||||

| (Address of Principal Executive Offices) | (Zip Code) | ||||||||||||||||

Registrant's Telephone Number, Including Area Code: (703 ) 960-4600

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transaction period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of outstanding voting stock held by non-affiliates of the Registrant as of June 30, 2020, was approximately $279 million based on the last reported sales price of the registrant's common stock on the NASDAQ Global Select Market as of that date.

Number of shares of Common Stock outstanding as of February 26, 2021: 12,670,234 .

DOCUMENTS INCORPORATED BY REFERENCE

-2-

| TABLE OF CONTENTS | ||||||||

| Page | ||||||||

| ITEM 1 | ||||||||

| ITEM 1A | ||||||||

| ITEM 1B | ||||||||

| ITEM 2 | ||||||||

| ITEM 3 | ||||||||

| ITEM 4 | ||||||||

| ITEM 5 | ||||||||

| ITEM 6 | ||||||||

| ITEM 7 | ||||||||

| ITEM 7A | ||||||||

| ITEM 8 | ||||||||

| ITEM 9 | ||||||||

| ITEM 9A | ||||||||

| ITEM 9B | ||||||||

| ITEM 10 | ||||||||

| ITEM 11 | ||||||||

| ITEM 12 | ||||||||

| ITEM 13 | ||||||||

| ITEM 14 | ||||||||

| ITEM 15 | ||||||||

| ITEM 16 | ||||||||

-3-

Forward Looking Statements

This Annual Report on Form 10-K ("Form 10-K") contains statements that, to the extent they are not recitations of historical fact, constitute "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All such statements are intended to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of such safe harbor provisions.

“Forward-looking” statements, as such term is defined by the Securities and Exchange Commission (the “SEC”) in its rules, regulations and releases, represent our expectations or beliefs, including, but not limited to, statements concerning our operations, economic performance, financial condition, growth and acquisition strategies, investments and future operational plans. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “forecast,” “seek,” “plan,” “predict,” “project,” “could,” “estimate,” “might,” “continue,” “seeking” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors, including, but not limited to, those identified in Item 1A, "Risk Factors” in this Form 10-K. All forward-looking statements made herein are qualified by these cautionary statements and risk factors and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized.

Readers are cautioned not to place undue reliance on these forward looking-statements, which reflect management's analysis only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that occur or arise after the date hereof.

-4-

PART I

ITEM 1. Business

History and Organization

VSE Corporation (“VSE,” the “Company,” “we,” “us,” or “our”) is a diversified aftermarket products and services company providing repair services, parts distribution, logistics, and supply chain management support services for land, sea and air transportation assets and information technology and energy consulting services to government and commercial markets. We serve the United States Government (the "government"), including the United States Department of Defense ("DoD"), federal civilian agencies, and commercial and other customers.

VSE was incorporated in Delaware in 1959 and the parent company serves as a centralized managing and consolidating entity for our three operating segments, each of which consists of one or more wholly owned subsidiaries or unincorporated divisions that perform our services. Our operating segments include the Aviation segment, Fleet segment, and Federal and Defense segment. The term "VSE" or "Company" means VSE and its operating businesses unless the context indicates operations of only VSE as the parent company.

| Revenues (in thousands) Years ended December 31, | |||||||||||||||||||||||||||||||||||

| 2020 | % | 2019 | % | 2018 | % | ||||||||||||||||||||||||||||||

| Aviation | $ | 165,070 | 25 | $ | 224,546 | 30 | $ | 145,423 | 21 | ||||||||||||||||||||||||||

| Fleet | 242,170 | 37 | 214,520 | 28 | 214,809 | 31 | |||||||||||||||||||||||||||||

| Federal and Defense | 254,419 | 38 | 313,561 | 42 | 336,986 | 48 | |||||||||||||||||||||||||||||

| $ | 661,659 | 100 | $ | 752,627 | 100 | $ | 697,218 | 100 | |||||||||||||||||||||||||||

Aviation

Our Aviation segment provides international parts supply and distribution, supply chain solutions, and component and engine accessory maintenance, repair and overhaul ("MRO") services supporting global aftermarket commercial and business and general aviation customers. This business offers a range of services to a diversified global client base of commercial airlines, regional airlines, cargo transporters, MRO integrators and providers, aviation manufacturers, corporate and private aircraft owners, and fixed-base operators ("FBOs"). The Aviation segment generated approximately 25% of our consolidated revenues in 2020. This segment did not have any one client that comprised more than 10% of our consolidated revenues in 2020, 2019 and 2018.

Fleet

Our Fleet segment provides parts supply, inventory management, e-commerce fulfillment, logistics, data management, and other services to assist aftermarket commercial and federal customers with their supply chain management. Operations of this segment are conducted by our wholly owned subsidiary Wheeler Fleet Solutions, which supports the government and commercial truck fleets with parts, sustainment solutions and managed inventory services. Revenues for this business are derived from the sale of vehicle parts and mission critical supply chain services to support client truck fleets. The Fleet segment generated approximately 37% of our consolidated revenues in 2020. The United States Postal Service ("USPS") comprised approximately 27%, 22%, and 25% of our consolidated revenues in 2020, 2019 and 2018, respectively.

Federal and Defense

Our Federal and Defense segment provides aftermarket refurbishment and sustainment services to extend and maintain the life cycle of military vehicles, ships and aircraft for the DoD. The segment provides foreign military sales services, engineering, logistics, maintenance, configuration management, prototyping, technology, and field support services to the DoD and other customers. We also provide energy consulting services and IT solutions to various DoD, federal civilian agencies and commercial clients. The Federal and Defense segment generated approximately 38% of our consolidated revenues in 2020. The foreign military sales program with the U.S. Department of Navy ("FMS Program") comprised approximately 15%, 12%, and 21% of our consolidated revenues in 2020, 2019 and 2018, respectively.

-5-

Acquisition and Divestitures

In January 2019, we acquired 1st Choice Aerospace Inc. ("1st Choice Aerospace"), with operations in Florida and Kentucky. 1st Choice Aerospace provides component MRO services and products for new generation and legacy commercial aircraft families. 1st Choice Aerospace is a subsidiary of VSE Aviation, Inc., under our Aviation segment.

In February 2020, we sold our subsidiary Prime Turbines, LLC ("Prime Turbines") and certain related inventory assets for $20.0 million in cash and a $8.3 million note receivable to be paid over a period from 2020 through 2024. Our Aviation segment discontinued turboprop engine MRO services, and will concentrate on higher growth potential component/accessory repair and parts distribution while further expanding our presence within the global commercial and general aviation markets. Prime Turbines' revenues totaled less than 1% and approximately 4% of our revenue for 2020 and 2019, respectively.

In June 2020, we sold all of the inventory of our subsidiary CT Aerospace, LLC ("CT Aerospace") for a $6.9 million note receivable to be paid to us over a period from 2020 through 2025. Our Aviation segment discontinued sales and leasing of engines and supply of used serviceable engine parts. CT Aerospace's revenues totaled less than 1% and less than 2% of our revenue for 2020 and 2019, respectively.

See Note (2) "Acquisition and Divestitures" to our Consolidated Financial Statements included in Item 8 of this annual report on Form 10-K for additional information regarding our acquisition and divestitures.

Products and Services

We provide a broad array of capabilities and resources to support our clients’ aftermarket transportation assets, vehicle fleets, aircraft, systems, equipment and processes. We focus on creating value by sustaining and extending the life and improving the performance of our client assets through core offerings in supply chain management, parts supply and distribution, MRO, equipment refurbishment, logistics and engineering. We also provide IT solutions and energy consulting services.

Typical offerings include supply chain and inventory management services; vehicle fleet sustainment programs; vehicle fleet parts supply and distribution; MRO of aircraft components and engine accessories; aircraft engine and airframe parts supply and distribution; engineering support for military vehicles; military equipment refurbishment and modification; ship MRO and follow-on technical support; logistics management support; sustainable energy supply and electric power grid modernization projects, IT infrastructure and data management, and IT data services for health and public safety. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” below for more information regarding our business.

Revenues and Contracts

Our revenues are derived from the delivery of products and from contract services performed for our customers. We offer our products and professional and technical services through various ordering agreements and negotiated and competitive contract arrangements.

Our Aviation segment revenues result from the sale of aircraft parts and performance of MRO services for private and commercial aircraft owners, aviation MRO providers, aviation original equipment manufacturers and other clients. Revenues for the sale of aircraft parts are recognized at a point in time when control is transferred to the customer, which usually occurs when the parts are shipped. Revenues for MRO services are recognized over time as the services are transferred to the customer. MRO services revenue recognized is measured based on the cost-to-cost input method, as costs incurred reflect the work completed, and therefore the services transferred to date.

Our Fleet segment revenues result from the sale of aftermarket vehicle parts to government and commercial clients. We recognize revenue from the sale of vehicle parts when the customer takes ownership of the parts.

Our Federal and Defense segment revenues result from professional and technical services that are performed for customers on a contract basis. Revenue is recognized for performance obligations over time as we transfer the services to the customer. The three primary types of contracts used are cost-type, fixed-price, and time and materials. Revenues result from work performed on these contracts by our employees and our subcontractors, and from costs for materials and other work-related costs allowed under our contracts. Revenues on cost-type contracts are recorded as contract allowable costs are incurred and fees are earned, with revenue recognized in direct proportion to our present right to consideration for progress toward the complete satisfaction of the performance obligation. Revenues on fixed-price contracts are recorded as work is performed over the period. Revenue is recognized over time using costs incurred to date relative to total estimated costs at completion. Revenues for time and

-6-

materials contracts are recorded based on the amount we have the right to invoice our customers for work performed and materials delivered.

Customers

Our customers include various government clients and commercial entities. Our USPS work and FMS Program comprised approximately 27% and 15% of our 2020 consolidated revenues, respectively. None of our other customers comprise a significant amount of our 2020 consolidated revenues.

| Revenues by Customer (dollars in thousands) Years ended December 31, | ||||||||||||||||||||||||||||||||||||||

| Customer | 2020 | % | 2019 | % | 2018 | % | ||||||||||||||||||||||||||||||||

| DoD | $ | 236,397 | 36 | $ | 304,334 | 41 | $ | 334,494 | 48 | |||||||||||||||||||||||||||||

Other government* | 216,957 | 33 | 205,775 | 27 | 212,118 | 30 | ||||||||||||||||||||||||||||||||

| Commercial | 208,305 | 31 | 242,518 | 32 | 150,606 | 22 | ||||||||||||||||||||||||||||||||

| Total | $ | 661,659 | 100 | $ | 752,627 | 100 | $ | 697,218 | 100 | |||||||||||||||||||||||||||||

*USPS is part of Other government

Backlog

Funded backlog represents a measure of potential future revenues from work performed on Federal and Defense segment government contracts. Funded backlog is defined as the appropriated and funded value of contracts, less the amount of revenues recognized on such contracts. Our reported backlog is comprised of funding received in incremental amounts for work that is generally expected to be completed within six to twelve months following the award of the funding. Our funded backlog for our Federal and Defense segment as of December 31, 2020, 2019 and 2018 was approximately $183 million, $213 million and $290 million, respectively. Changes in funded backlog on contracts are sometimes unpredictable due to uncertainties associated with changing government program priorities and availability of funds, which is heavily dependent upon the congressional authorization and appropriation process. Delays in this process may temporarily diminish the availability of funds for ongoing and planned work.

In addition to funded backlog levels, we have contract ceiling amounts available for use on multiple award, indefinite delivery, indefinite quantity contracts with DoD and federal civilian agencies. While these contracts increase the opportunities available for us to pursue future work, the actual amount of future work is indeterminate until task orders are placed on the contracts. Frequently, these task orders are competitively awarded. Additionally, these task orders must be funded by the procuring agencies before we can perform work and begin generating revenues.

Marketing

Our marketing activities are conducted by each of our businesses by industry-specific sales representatives and professional marketing and business development staff. New customer contacts and information concerning new programs, requirements and opportunities become available through sales calls and client visits, negotiation with key business partners, and formal and informal briefings. We also participate in professional organizations, attend industry trade shows and events in the course of contract performance, and obtain literature published by government, trade associations, professional organizations and commercial entities.

Human Capital Resources

Our employees have a variety of specialized experience, training and skills that provide the expertise required to service our clients. As of December 31, 2020, we had approximately 1,900 employees, compared to approximately 2,800 as of December 31, 2019. Principal employee categories include (a) mechanics and vehicle, aircraft and equipment technicians, (b) logisticians, (c) warehouse and sales personnel, (d) engineers and technicians in mechanical, electronic, industrial, energy services, and (e) information technology professionals in computer systems, applications and products, configuration, change and data management disciplines. The expertise required by our customers frequently includes knowledge of government regulations and procedures. The amount of our unionized employees varies depending on the types of U.S. Government programs that we are supporting at any given time. As of December 31, 2020, approximately 35% of our total workforce was unionized, compared to 35% as of December 31, 2019.

-7-

We actively seek initiatives and participate in outreach programs to assist individuals who served in the U.S. Armed Forces. These efforts include an emphasis on hiring military veterans to enhance the quality of our workforce.

We are committed to providing a safe working environment for our employees. Supported by our Health, Environmental and Safety Program, we strive to minimize the risk of injury or illness to workers. We provide our employees with upfront and ongoing safety trainings to ensure that safety policies and procedures are effectively communicated and implemented. We also provide our employees with any additional information, leadership, support and equipment needed to safely perform their job function.

We offer competitive pay and comprehensive benefits to attract, reward and retain a qualified and diverse workforce to achieve our vision and mission and meet the dynamic needs of employees and their families. In addition to competitive base pay, we offer annual bonus opportunities, a Company matched 401(k) plan, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leave, flexible work schedules, and employee assistance programs.

We embrace and encourage inclusion in order to achieve a culture and company environment supporting diversity. Our inclusion and diversity initiatives include our practices and policies on employee recruitment and hiring, professional training and development, employee engagement and the development of a work environment built on the premise of diversity and equity. In 2020, we formed the VSE Inclusion & Diversity Council, an employee led group focused on creating a framework and action plan for inclusion and diversity related initiatives across the organization.

Government Regulation and Supervision

Our Federal and Defense segment business is affected by a variety of laws and regulations relating to the award, administration, and performance of U.S. Government contracts. See Item A, "Risk Factors".

Our Federal and Defense segment operates in a heavily regulated environment and is routinely audited and reviewed by the U.S. Government and its agencies, including the Defense Contract Audit Agency, and the Defense Contract Management Agency. These agencies evaluate our contract performance, cost structures, and compliance with applicable laws, regulations, and standards, as well as review the adequacy of our business systems and processes relative to U.S. Government requirements. Business systems subject to audit or review include our accounting systems, purchasing systems, government property management systems, and estimating systems. If an audit uncovers improper or illegal activities, we may be subject to administrative, civil, or criminal proceedings, which could result in fines, penalties, repayments, or compensatory, treble, or other damages. Certain U.S. Government findings against a contractor can also lead to suspension or debarment from future U.S. Government contracts or the loss of export privileges. In addition, any costs we incur that are determined to be unallowable or improperly allocated to a specific contract will not be recovered or must be refunded if already reimbursed.

The U.S. Government has the ability, pursuant to regulations relating to contractor business systems, to decrease or partially withhold contract payments if it determines significant deficiencies exist in one or more such systems.

The U.S. Government generally has the ability to terminate contracts, in whole or in part, with little or no prior notice, for convenience or for default based on performance. In the event of termination of a contract for convenience, a contractor is customarily able to recover costs already incurred on the contract and receive profit on those costs up to the amount authorized under the contract, but not the anticipated profit that would have been earned had the contract been completed. Such a termination could also result in the cancellation of future work on the related program. Termination resulting from our default could expose us to various liabilities, including excess re-procurement costs, and could have a material effect on our ability to compete for future contracts.

Our business, our contracts with various agencies of the U.S. Government, and our subcontracts with other prime contractors are subject to a variety of laws and regulations, including, but not limited to, the Federal Acquisition Regulation, the Truth in Negotiations Act, the Procurement Integrity Act, the False Claims Act, U.S. Cost Accounting Standards, the International Traffic in Arms Regulations promulgated under the Arms Export Control Act, and the Foreign Corrupt Practices Act. A noncompliance determination by a government agency may result in reductions in contract values, contract modifications or terminations, penalties, fines, repayments, compensatory, treble, or other damages, or suspension or debarment.

We have incurred, and will continue to incur, costs and capital expenditures to comply with these laws and regulations. We believe that our operations currently are being conducted in substantial compliance with all applicable regulations. From time to time, we may experience incidents and encounter conditions that are not in compliance with regulations. We may occasionally receive notices from governmental agencies regarding potential violations of these laws or regulations. In such cases, we will

-8-

work with the agencies to address any issues and to implement appropriate corrective action when necessary. However, we do not know of any fact or condition that would result in any material liabilities being incurred in the future.

Competition

The supply chain, logistics, distribution, and MRO services offered by our Aviation and Fleet segments and the federally contracted professional and technical services offered by our Federal and Defense segment are conducted in very competitive operating environments. The vehicle parts aftermarket and aviation parts and repair markets are fragmented, with many large and small global private and public competitors that compete for our customer base.

Large, diversified federal contracting firms with greater financial resources and larger technical staff are capable of providing the same services offered by us. Government agencies emphasize awarding contracts on a competitive basis, as opposed to a sole source or other noncompetitive basis. Most of the significant contracts under which our Federal and Defense segment currently perform services were either initially awarded on a competitive basis, or have been renewed at least once on a competitive basis. These contracts may be indefinite delivery/indefinite quantity type contracts for which the government makes awards for work among several other eligible contract holders, or they may be single award contracts with multiple option years that may or may not be exercised. Accordingly, there can be no assurance regarding the level of work we may obtain under some of these contracts. Government budgets, and in particular the budgets of certain government agencies, can also affect competition in our business. A reallocation of government spending priorities or reallocation of work for small business set-aside programs that results in lower levels of potential business in the markets we serve or the services we offer can cause increased competition.

The extent of competition that we will encounter as a result of changing economic or competitive conditions, customer requirements or technological developments is unpredictable. We believe the principal competitive factors for our business are customer knowledge, technical and financial qualifications, past performance, government budgetary priorities, sales force initiatives and price.

Available Information

Copies of our publicly available Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are filed with or otherwise furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act. Such reports and amendments are also available to the public free of charge through our website www.vsecorp.com as soon as reasonably practicable after the reports are electronically filed with the SEC. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

-9-

ITEM 1A. Risk Factors

Our future results may differ materially from past results and from those projected in the forward-looking statements contained in this Form 10-K due to various uncertainties and risks, including those risks set forth below, nonrecurring events and other important factors disclosed previously and from time to time in our other reports filed with the SEC.

Operational Risks

The COVID-19 outbreak has adversely affected and could in the future continue to adversely affect our business.

The COVID-19 pandemic is adversely affecting, and is expected to continue to adversely affect, our operations, supply chains and distribution systems, and we have experienced and expect to continue to experience varying levels of reductions in demand for our products and services, particularly in the aviation aftermarket. The global aviation market is experiencing a significant decline, specifically in global commercial air travel, which is having a significant impact on the parts distribution and maintenance, repair and overhaul services markets supporting general aviation and commercial aircraft. Our Aviation segment experienced the most impactful reduction in demand for our products and services during fiscal 2020 compared to fiscal 2019, as a decline in commercial aircraft revenue passenger miles contributed to a reduction in demand for aftermarket parts and MRO services. We expect this reduction in demand to continue throughout the first half of 2021. This decrease in demand will adversely impact our operating results for 2021. We cannot estimate with certainty the severity of this impact, but we expect it to be consistent with overall aviation industry trends.

We operate numerous “touch labor” warehouse and maintenance facilities supporting each of our three business segments both in our own facilities and customer facilities. A local outbreak of the virus in any of these facilities could temporarily shut down operations at those facilities until they have been thoroughly cleaned. Employees who become exposed to the virus would need to be quarantined and would be unable to work for 14 days or longer. Similarly, customers who have warehouse or maintenance facilities could be impacted, slowing or reducing demand for our parts distribution services.

Due to the impact of COVID-19 and decisions by our customers to delay the use of, or permanently retire, certain aircraft, demand levels for aviation disruption inventory could decrease in the near term or midterm, which could result in a write-down of existing inventory to adjust to current market trends and adversely affect our results of operations. Furthermore, as a result of COVID-19, some of our commercial customers in the Aviation segment have been and could continue to be negatively impacted as a result of disruption in demand, which has led to delays and could lead to defaults on collections of receivables from them. Such continued delays could further negatively impact our business, results of operations and financial condition.

The impact of the COVID-19 pandemic continues to evolve, and while we expect it to continue to have an adverse effect on our business, financial condition, liquidity, cash flow and results of operations, we are unable to predict the extent, nature or duration of these impacts at this time, although we expect such negative impacts to continue in the first half of 2021.

Certain programs comprise a material portion of our revenue. Our work on large government programs presents a risk to revenue growth and sustainability and profit margins.

The eventual expiration of large government programs or the loss of or disruption of revenues on a single contract may reduce our revenues and profits. Such revenue losses could also erode profits on our remaining programs that would have to absorb a larger portion of the fixed corporate costs previously allocated to the expiring programs or discontinued contract work. Our USPS managed inventory program and our FMS Program each constitute a material portion of our revenues and profits. This concentration of our revenue subjects us to the risk of material adverse revenue disruptions if customer operational decisions, government contractual or other issues prevent or delay the fulfillment of work requirements associated with these key programs. In recent years, revenue levels for our FMS Program have fluctuated widely enough to cause material changes in our overall revenue levels and affect our profit margins. Similarly, variations in volume and types of parts purchased by the USPS in recent years have caused changes in our profit margins.

The USPS has initiated a fleet replacement program for a next generation of the delivery vehicle fleet. The timing of both the roll out of a new fleet and the retirement of the current vehicles and their decision on how many of such vehicles will remain in the fleet could potentially have a significant impact on our future revenues and profits.

-10-

Acquisitions, which have been a part of our business strategy in recent years, present certain risks.

A key element of our business strategy is growth through the acquisition of additional companies. VSE is focused on acquiring complementary assets that add new products, new customers, and new capabilities or new geographic and/or operational competitive advantages in both new and existing markets within our core competencies. Our acquisition strategy is affected by, and poses a number of challenges and risks, including availability of suitable acquisition candidates, availability of capital, diversion of management’s attention, effective integration of the operations and personnel of acquired companies, potential write downs of acquired intangible assets, potential loss of key employees of acquired companies, use of a significant portion of our available cash, compliance with debt covenants and consummation of acquisitions on satisfactory terms.

We may not be able to successfully execute our acquisition strategy, and the failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Changes in future business conditions could cause business investments, recorded goodwill, and/or purchased intangible assets to become impaired, resulting in substantial losses and write-downs that would reduce our operating income.

As part of our business strategy, we acquire non-controlling and controlling interests in businesses. We make acquisitions and investments following careful analysis and due diligence processes designed to achieve a desired return or strategic objective. Business acquisitions involve estimates, assumptions, and judgments to determine acquisition prices, which are allocated among acquired assets, including goodwill, based upon fair market values. Notwithstanding our analyses, due diligence processes, and business integration efforts, actual operating results of acquired businesses may vary significantly from initial estimates. In such events, we may be required to write down our carrying value of the related goodwill and/or purchased intangible assets. In addition, declines in the trading price of our common stock or the market as a whole can result in goodwill and/or purchased intangible asset impairment charges associated with our existing businesses.

As of December 31, 2020, goodwill and purchased intangible assets generated from prior business acquisitions accounted for approximately 31% and 13%, respectively, of our total assets. We evaluate goodwill values for impairment annually in the fourth quarter or when evidence of potential impairment exists. We also evaluate the values of purchased intangible assets when evidence of potential impairment exists. The impairment tests are based on several factors requiring judgments. As a general matter, a significant decrease in expected cash flows or changes in market conditions may indicate potential impairment of recorded goodwill or purchased intangible assets.

Adverse equity market conditions that result in a decline in market multiples and the trading price of our common stock, or other events, such as reductions in future contract awards or significant adverse changes in our operating margins or the operating results of acquired businesses that vary significantly from projected results on which purchase prices are based, could result in an impairment of goodwill or other intangible assets. Any such impairments that result in us recording additional goodwill or intangible asset impairment charges could have a material adverse effect on our financial position or results of operations.

Intense competition from existing and new competitors may harm our business.

The aviation and vehicle parts industries are highly fragmented, have several highly visible leading companies, and are characterized by intense competition. Some of our OEM competitors have greater name recognition than VSE or our subsidiaries, as well as complementary lines of business and financial, marketing and other resources that we do not have. In addition, OEMs, aircraft maintenance providers, leasing companies and U.S. Federal Aviation Administration ("FAA") certificated repair facilities may attempt to bundle their services and product offerings in the supply industry, thereby significantly increasing industry competition.

Pressure on government budgets may adversely affect the flow of work to federal contractors, particularly new programs. Competitor contractors that experience a loss of government work have tended to redirect their marketing efforts toward the types of work that we perform. This increase in competition for our service offerings may adversely affect our ability to win new work or successor contracts to continue work that is currently performed by us under expiring contracts. Unsuccessful bidders frequently protest contract awards, which can delay or reverse the contract awards. Additionally, the government has frequently used contract award criteria that emphasizes lowest price, technically acceptable bids, which further intensifies competition in our government markets.

-11-

Our success is highly dependent on the performance of the aviation aftermarket, which could be impacted by lower demand for business aviation and commercial air travel or airline fleet changes causing lower demand for our goods and services.

General global industry and economic conditions that affect the aviation industry may also affect our business. We are subject to macroeconomic cycles, and when recessions occur, we may experience reduced orders, payment delays, supply chain disruptions or other factors as a result of the economic challenges faced by our customers, prospective customers and suppliers. Further, the aviation industry has historically, from time to time, been subject to downward cycles which reduce the overall demand for jet engine and aircraft component replacement parts and repair and overhaul services, and such downward cycles result in lower sales and greater credit risk. Demand for commercial air travel can be influenced by airline industry profitability, world trade policies, government-to-government relations, terrorism, disease outbreaks, environmental constraints imposed upon aircraft operations, technological changes, price and other competitive factors. These global industry and economic conditions may have a material adverse effect on our business, financial condition and results of operations.

The COVID-19 pandemic has resulted in travel disruption has had an adverse impact on airline spending and demand that has caused a reduction in demand for our aviation products and services for most of 2020. At this point, the extent or duration of the impact that the COVID-19 pandemic may have on our future results remains uncertain.

Global economic conditions and political factors could adversely affect our revenues.

Revenues for work performed in or products delivered to foreign countries are subject to economic conditions in these countries and to political risks posed by ongoing foreign conflicts and potential terrorist activity. Significant domestic and political unrest in client countries can constrain our ability to maintain consistent staffing levels, resulting in a fluctuating level of services performed by our employees. We cannot predict when these conditions will occur or the effect it will have on our revenues. Regime changes in these countries can result in government restrictions upon the continuation of ongoing work. Economic conditions in both the United States and foreign countries, and global prices and availability of oil and other commodities could potentially have an adverse effect on the demand for some of our services, including our aviation services.

The nature of our operations and work performed by our employees present certain challenges related to work force management.

Our financial performance is heavily dependent on the abilities of our operating and administrative staff with respect to technical skills, operating performance, pricing, cost management, safety, and administrative and compliance efforts. A wide diversity of contract types, nature of work, work locations, and legal and regulatory complexities challenges our administrative staff and skill sets. We also face challenges associated with our quality of workforce, quality of work, safety, and labor relations compliance. Our current and projected work in foreign countries exposes us to challenges associated with export and ethics compliance, local laws and customs, workforce issues, extended supply chain, political unrest and war zone threats. Failure to attract or retain an adequately skilled workforce, lack of knowledge or training in critical functions, or inadequate staffing levels can result in lost work, reduced profit margins, losses from cost overruns, performance deficiencies, workplace accidents, and regulatory noncompliance.

Our business could be adversely affected by incidents that could cause an interruption in our operations or impose a significant financial liability on us.

Disruption of our operations due to internal or external system or service failures, accidents or incidents involving employees or third parties working in high-risk locations, or natural disasters, health crisis, epidemics or pandemics, including the COVID-19 pandemic, or other crises could adversely affect our financial performance and condition. The COVID-19 pandemic could potentially impact our global supply chain network for any of our segments. A fire, flood, earthquake, or other natural disaster, health crises, epidemic, pandemic or other crisis at or affecting physical facilities that support key revenue generating operations, or a procurement system or contractual delay could potentially interrupt the revenues from our operations.

Investments in inventory and facilities could cause losses if certain work is disrupted or discontinued.

We have made investments in inventory, facilities and lease commitments to support specific business programs, work requirements, and service offerings. A slowing or disruption of these business programs, work requirements, or service offerings that results in operating below intended levels could cause us to suffer financial losses.

-12-

We are dependent on access to and the performance of third‑party package delivery companies.

Our ability to provide efficient distribution of the products we sell to our customers is an integral component of our overall business strategy, both domestic and international. We do not maintain our own delivery networks, and instead rely on third‑party package delivery companies. We cannot assure that we will always be able to ensure access to preferred shipping and delivery companies or that these companies will continue to meet our needs or provide reasonable pricing terms. In addition, if the package delivery companies on which we rely on experience delays resulting from inclement weather or other disruptions, we may be unable to maintain products in inventory and deliver products to our customers on a timely basis, which may adversely affect our results of operations and financial condition.

Uncertain government budgets and shifting government priorities could delay contract awards and funding and adversely affect our ability to continue work under our government contracts. Additionally, federal procurement directives could result in our loss of work on current programs to small business set-asides and large multiple award contracts.

Our government business is subject to funding delays, terminations (including at the government's convenience), reductions, in-sourcing, extensions and moratoriums associated with the government’s budgeting and contracting process. The federal procurement environment is unpredictable and could adversely affect our ability to perform work under new and existing contracts. We have experienced delays in contract awards and funding on our contracts in recent years that have adversely affected our ability to continue existing work and to replace expiring work. Additionally, our government business is subject to the risk that one or more of our potential contracts or contract extensions may be diverted by the contracting agency to a small or disadvantaged or minority-owned business pursuant to set-aside programs administered by the U.S. Small Business Administration, or may be bundled into large multiple award contracts for very large businesses. These risks can potentially have an adverse effect on our revenue growth and profit margins.

Changes to DoD business practices could have a material effect on DoD's procurement process and adversely impact our current programs and potential new awards.

The defense industry has experienced, and we expect will continue to experience, significant changes to business practices resulting from greater DoD focus on affordability, efficiencies, business systems, recovery of costs, and a re-prioritization of available defense funds to key areas for future defense spending. The DoD continues to adjust its procurement practices, requirements criteria, and source selection methodology in an ongoing effort to reduce costs, gain efficiencies, and enhance program management and control. We expect the DoD's focus on business practices to impact the contracting environment in which we operate as we and others in the industry adjust our practices to address the DoD's initiatives and the reduced level of spending by the DoD. Depending on how these initiatives are implemented, they could have an impact on our current programs, as well as new business opportunities with the DoD. As a result of certain of these initiatives, we experienced, and may continue to experience, a higher number of audits and/or lengthened periods of time required to close open audits. Such additional or lengthier audits could have a material adverse effect on our business, financial condition and results of operations.

Legal and Regulatory Risks

Our business could be adversely affected by government audits or investigations.

Government agencies, including the Defense Contract Audit Agency, the Defense Contract Management Agency and the Department of Labor, routinely audit and investigate government contractors. These agencies review a contractor’s performance under its contracts, cost structure and compliance with applicable laws, regulations and standards. The government also may review the adequacy of, and a contractor’s compliance with, its internal control systems and policies, including the contractor’s purchasing, property, estimating, compensation and management information systems. Any costs found to be improperly allocated to a specific contract will not be reimbursed and any such costs already reimbursed must be refunded.

The scope and rigor of government agency audits and investigations have increased in recent years, resulting in a greater likelihood that an audit or investigation may result in an adverse outcome. We have been subject to unfavorable findings and recommendations from various government agencies from time to time. We expect that government agencies will continue to rigorously audit and investigate us and there may be adverse or disputed findings, resulting in corrective action plans and/or settlements.

If an audit or investigation uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or debarment from doing business with the government. In addition, we could suffer serious harm to our reputation if

-13-

allegations of impropriety were made. Performance of international work can expose us to risks associated with the Foreign Corrupt Practices Act and Export Control Act compliance.

We are subject to numerous government rules and regulations that could expose us to potential liabilities or work loss.

We must comply with and are affected by laws and regulations relating to the award, administration and performance of government contracts. A violation of laws or regulations could result in the imposition of fines and penalties or the termination of contracts or debarment from working or bidding on government contracts.

In some instances, these government contract laws and regulations impose terms or rights that are significantly more favorable to the government than those typically available to commercial parties in negotiated transactions. For example, the government may terminate any government contract or subcontract at its convenience, as well as for performance default.

A termination for default could expose us to liability and have a material adverse effect on our ability to compete for future contracts and orders. A termination for default could also impact our past performance and ability to obtain new or additional work. In addition, the government could terminate a prime contract under which we are a subcontractor, irrespective of the quality of services provided by us as a subcontractor.

Additionally, our contract work that is performed by our subcontractors is subject to government compliance, performance requirements and financial risks. If any of our subcontractors fail to timely meet their contractual obligations or have regulatory compliance or other problems, our ability to fulfill our obligations as a prime contractor may be jeopardized.

The aviation industry is highly regulated by the FAA and similar regulatory agencies in other countries. Aviation engines, engine accessories and components that we sell must meet certain airworthiness standards established by the FAA or the equivalent agencies in certain other countries. We also operate repair facilities that are licensed by the FAA and equivalent agencies of certain other countries to perform such services. New and more stringent regulations may be adopted in the future that could have an adverse effect on us.

Lastly, border tariffs and new trade deals could have significant effects on our customers and, in turn, on our suppliers, which may impact our business.

Due to the nature of our work, we could potentially be exposed to legal actions arising from our operations.

Our work includes many manual tasks, including warehousing, shipping and packing of truck parts inventory, maintaining and repairing military and non-military vehicles, aircraft and equipment, and maintaining and overhauling U.S. Navy ships. Some of our work efforts involve the handling of hazardous materials. These services may pose certain challenges that could cause us to be exposed to legal and other liabilities arising from performance issues, work related incidents or employee misconduct that result in damages, injury or death to third parties. Such events could cause us to suffer financial losses and adversely affect our financial condition. See Item 3, "Legal Proceedings” below.

Environmental and pollution risks could potentially impact our financial results.

Our operations are subject to and affected by a variety of existing federal, state, and local environmental protection laws and regulations. In addition, we could be affected by future laws or regulations, including those imposed in response to concerns over climate change, other aspects of the environment, or natural resources. We expect to incur future capital and operating costs to comply with current and future environmental laws and regulations, and such costs could be substantial, depending on the future proliferation of environmental rules and regulations and the extent to which we discover currently unknown environmental conditions.

Some of our contract work includes the use of chemical solvents and the handling of hazardous materials to maintain, repair, and refurbish vehicles, aircraft engines, and equipment. This exposes us to certain environmental and pollution risks. Various federal, state, and local environmental laws and regulations impose restrictions on the discharge of pollutants into the environment and establish standards for the transportation, storage, and disposal of toxic and hazardous wastes. Substantial fines, penalties, and criminal sanctions may be imposed for noncompliance, and certain environmental laws impose joint and several "strict liability" for remediation of spills and releases of oil and hazardous substances. Such laws and regulations impose liability upon a party for environmental cleanup and remediation costs and damage without regard to negligence or fault on the part of such party and could expose us to liability for the conduct of or conditions caused by third parties.

-14-

Costs associated with compliance with Federal, State and local provisions regulating the discharge of materials or that otherwise relate to the protection of the environment have not had a material adverse effect on our capital expenditures, earnings, or competitive position. However, we cannot predict the likelihood of such a material adverse effect should we experience the occurrence of a future environmental or pollution event.

The adoption of new environmental laws and regulations, stricter enforcement of existing laws and regulations, imposition of new cleanup requirements, discovery of previously unknown or more extensive contamination, litigation involving environmental impacts, our inability to recover related costs under our government contracts, or the financial insolvency of other responsible parties could cause us to incur costs that could have a material adverse effect on our financial position, results of operations, or cash flows.

Technology Risks

Technology security and cyber-attack risks could potentially impact our financial results.

We face the threat to our computer systems of unauthorized access, computer hackers, computer viruses, malicious code, organized cyber-attacks and other security problems and system disruptions, including possible unauthorized access to our and our clients' proprietary or classified information.

Some of our contract work includes data management and technology services associated with Social Security Administration and military medical and health records. This exposes us to certain information and technology security risks. If there is a security breach of sensitive data in our custody or for which we provide services, we could possibly be held liable for damages to third parties related to such security breach and incur costs to prevent future incidents. We also provide refurbishment, maintenance and training services support to international clients directly and through the DoD. Foreign nations with interests that conflict with the international clients we support could be motivated to conduct a cyber-attack to access information on these programs.

We maintain a cybersecurity risk management program to monitor and mitigate cybersecurity threats and an incident response plan for emerging threats. Costs associated with preventing or remediating information management security breaches or complying with related laws and regulations have not had a material adverse effect on our capital expenditures, earnings or competitive position. Additionally, we have obtained insurance that provides coverage for certain cybersecurity incidents. However, the occurrence of a future security breach event could potentially have such an adverse effect.

Financial Risks

There can be no assurance we will continue to pay dividends at current levels or in the future.

The payment of cash dividends and repurchases of our common stock are subject to limitations under applicable law and our bank loan agreement, and to the discretion of our board of directors, considered in the context of then current conditions, including our earnings, other operating results, and capital requirements. Declines in asset values or increases in liabilities, including liabilities associated with benefit plans and assets and liabilities associated with taxes, can reduce stockholders’ equity. A deficit in stockholders’ equity could limit our ability under Delaware law to pay dividends.

Our debt exposes us to certain risks.

As of December 31, 2020, we had $251 million of total debt outstanding (net of unamortized debt issuance costs). The amount of our existing debt, combined with our ability to incur significant amounts of debt in the future, could have important consequences, including:

•Increasing our vulnerability to adverse economic or industry conditions;

•Requiring us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, strategic initiatives, and general corporate purposes;

•Increasing our vulnerability to, and limiting our flexibility in planning for, or reacting to, changes in our business or the industries in which we operate;

•Exposing us to the risk of higher interest rates on borrowings under our Credit Facility, which are subject to variable rates of interest;

•Placing us at a competitive disadvantage compared to our competitors that have less debt; and

•Limiting our ability to borrow additional funds.

-15-

In addition, the interest rate on our term loan borrowings and revolving loan borrowings is based on the London Interbank Offered Rate (“LIBOR”). LIBOR is the subject of recent national, international, and other regulatory guidance and proposals for reform. In July 2017, the Chief Executive of the U.K. Financial Conduct Authority (the “FCA”), which regulates LIBOR, announced that the FCA will no longer persuade or compel banks to submit rates for the calculation of the LIBOR benchmark after 2021. This announcement indicates that the continuation of LIBOR on the current basis cannot and will not be guaranteed after 2021, and it appears likely that LIBOR will be discontinued or modified by 2021. The consequences of the discontinuance of the LIBOR benchmark cannot be entirely predicted but could result in an increase in the cost of our variable rate indebtedness.

Market volatility and adverse capital market conditions may affect our ability to access cost-effective sources of funding and may expose us to risks associated with the financial viability of suppliers and subcontractors.

The financial markets can experience high levels of volatility and disruption, reducing the availability of credit for certain issuers. We may access these markets from time to time to support certain business activities, including funding acquisitions and refinancing existing indebtedness. We may also access these markets to acquire credit support for our letters of credit. A number of factors could cause us to incur higher borrowing costs and experience greater difficulty accessing public and private markets for debt. These factors include disruptions or declines in the global capital markets and/or a decline in our financial performance, outlook, or credit ratings. The occurrence of any or all of these events may adversely affect our ability to fund our operations, meet contractual commitments, make future investments or desirable acquisitions, or respond to competitive challenges.

If the disruptions caused by the COVID-19 global pandemic continue to adversely impact our operations and financial performance, we may face further challenges regarding compliance with the financial covenants in our debt facility.

We have a loan agreement with a bank group comprised of ten banks. Under the terms of our debt facility, we are required to maintain certain financial covenants. As a result of the COVID-19 global pandemic, our business operations have been and could be further disrupted, which could adversely affect our ability to satisfy our financial covenant requirements. In June 2020, we amended our loan agreement to provide increased financial covenant flexibility. We believe the amendment will provide sufficient covenant relief for future near term compliance, however, there can be no assurance that any further future disruption will not adversely impact our business and result in an inability to comply with the financial covenants in our loan agreement. There can be no assurance that we would be able to obtain future changes in a timely manner, on acceptable terms, or at all. If we were not able to satisfactorily obtain further changes to the debt facility, we could be in default, which could trigger an acceleration of repayment provisions that we would be unable to meet and would impair our ability to operate our businesses. If we make changes, it may lead to fees, increased costs, increased interest rates, additional restrictive covenants and other available lender protections that would be applicable to us under the debt facility.

-16-

ITEM 1B. Unresolved Staff Comments

None.

ITEM 2. Properties

Our executive and administrative headquarters are located in a five-story building in Alexandria, Virginia, with approximately 95,000 square feet of office space leased by us through April 2027.

We own facilities located in an industrial park in Somerset, Pennsylvania where we conduct our Fleet segment operations. These properties consist of approximately 30 acres of land and buildings totaling approximately 271,000 square feet of office, engineering and warehouse space.

We own two properties that we use to conduct our Aviation segment operations. The first property consists of a building with approximately 30,500 square feet of warehouse and office space in Independence, Kansas that is located on leased municipal airport land. The second property consists of approximately nine acres of land and a building with approximately 60,000 square feet of warehouse and office space in Hebron, Kentucky, acquired in 2019.

We own and operate two facilities in Ladysmith, Virginia. One of these properties consists of approximately 44 acres of land and multiple storage and vehicle maintenance buildings totaling approximately 56,000 square feet of space. The other property consists of 30 acres of land and buildings totaling approximately 13,500 square feet of space. We also own and operate a property in Texarkana, Arkansas consisting of approximately 10 acres of land and a building totaling approximately 79,000 square feet. We use these properties primarily to provide refurbishment services for military equipment, storage and maintenance.

We also provide services and products from facilities generally occupied under short-term leases primarily located near customer sites to facilitate communications and enhance program performance. As of December 31, 2020, we leased approximately 13 such facilities with a total of approximately 254,000 square feet of office, shop and warehouse space. Our employees often provide services at customer facilities, limiting our requirement for additional space. We also provide services from locations outside of the United States, generally at foreign shipyards, U.S. military installations and aircraft parts distribution facilities.

ITEM 3. Legal Proceedings

We may have certain claims in the normal course of business, including legal proceedings against us and against other parties. In our opinion, the resolution of these other claims will not have a material adverse effect on our results of operations, financial position or cash flows. However, because the results of any legal proceedings cannot be predicted with certainty, the amount of loss, if any, cannot be reasonably estimated.

Further, from time-to-time, government agencies investigate whether our operations are being conducted in accordance with applicable contractual and regulatory requirements. Government investigations of us, whether relating to government contracts or conducted for other reasons, could result in administrative, civil or criminal liabilities, including repayments, fines or penalties being imposed upon us, or could lead to suspension or debarment from future government contracting. Government investigations often take years to complete and many result in no adverse action against us. We believe, based upon current information, that the outcome of any such government disputes and investigations will not have a material adverse effect on our results of operations, financial condition or cash flows.

ITEM 4. Mine Safety Disclosures

Not applicable.

-17-

PART II

ITEM 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

VSE common stock, par value $0.05 per share, is traded on the NASDAQ Global Select Market ("NASDAQ"), trading symbol, "VSEC."

Common Stock - Dividend Paid Per Share

| Dividend Paid Per Share | ||||||||||||||

| Quarter Ended | 2020 | 2019 | ||||||||||||

| March 31 | $ | 0.09 | $ | 0.08 | ||||||||||

| June 30 | 0.09 | 0.09 | ||||||||||||

| September 30 | 0.09 | 0.09 | ||||||||||||

| December 31 | 0.09 | 0.09 | ||||||||||||

| For the Year | $ | 0.36 | $ | 0.35 | ||||||||||

Holders

As of February 1, 2021, VSE common stock, par value $0.05 per share, was held by approximately 226 stockholders of record. The number of stockholders of record is not representative of the number of beneficial holders because many of VSE's shares are held by depositories, brokers or nominees.

Dividends

Pursuant to our bank loan agreement, as discussed in Note (8) "Debt" to our Consolidated Financial Statements included in Item 8 of this annual report on Form 10-K, the payment of cash dividends is subject to annual restrictions. We have paid cash dividends each year since 1973 and have increased our dividend each year since 2004.

Certain Sales and Repurchases of VSE Common Stock

During the fiscal year covered by this Form 10-K, VSE did not sell any of its equity securities that were not registered under the Securities Act. During the fourth quarter of the fiscal year covered by this Form 10-K, no purchases of equity securities of VSE were made by or on behalf of VSE or any "affiliated purchaser" (as defined in Rule 10b-18 (a)(3) under the Exchange Act) other than 25,859 shares of our restricted common stock that were voluntarily forfeited to VSE by participants in its 2006 Restricted Stock Plan to cover their personal tax liability for restricted stock awards under the VSE Corporation 2006 Restricted Stock Plan (the "2006 Restricted Stock Plan").

Equity Compensation Plan Information

We have one compensation plan approved by our stockholders under which our equity securities are authorized for issuance to employees and directors: the 2006 Restricted Stock Plan. The following table sets forth the amounts of securities authorized for issuance under the 2006 Restricted Stock Plan as of December 31, 2020.

-18-

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | ||||||||||||||

| (a) | (b) | (c) | |||||||||||||||

| Equity compensation plans approved by security holders | — | $ | — | 725,945 | |||||||||||||

| Equity compensation plans not approved by security holders | — | $ | — | — | |||||||||||||

| Total | — | $ | — | 725,945 | |||||||||||||

See Note (10) "Stock-Based Compensation Plans" to our Consolidated Financial Statements included in Item 8 of this annual report on Form 10-K for additional information regarding the 2006 Restricted Stock Plan.

-19-

Performance Graph

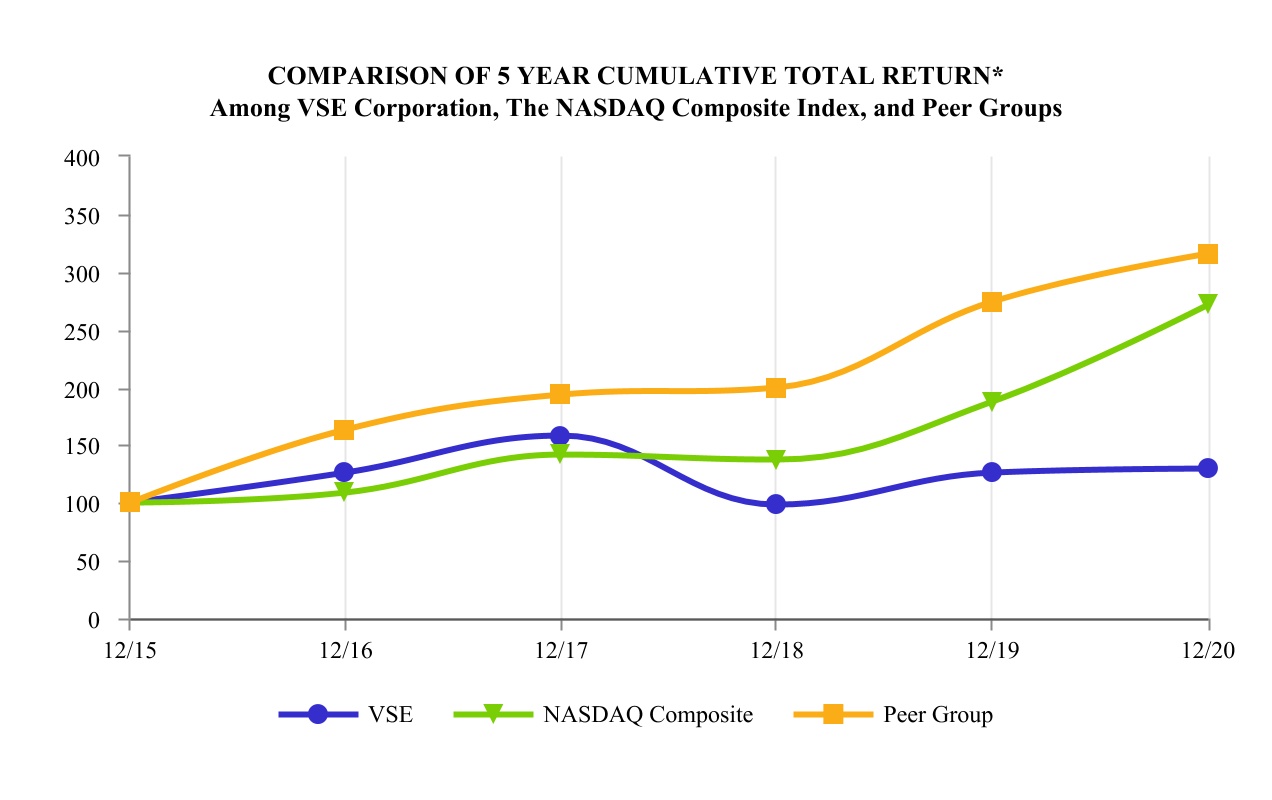

Set forth below is a line graph comparing the cumulative total return of VSE common stock with (a) a performance index for the broad market, the NASDAQ Global Select Market, on which VSE common stock is traded and (b) a the Company's peer group which is comprised of other public companies that operate in industries or lines of businesses similar to ours. These companies include Heico Corporation, Dorman Products, Inc., Navistar International Corporation, Vectrus, Inc., ManTech International Corporation, and CACI International Inc.

The companies in the Peer Group have been weighted based on their relative market capitalization each year. The graph assumes that $100 was invested in our then outstanding common stock, the NASDAQ and the Peer Group index at the beginning of the five-year period and that all dividends were reinvested. The comparisons are not intended to be indicative of future performance of our common stock.

*$100 invested on 12/31/15 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

Performance Graph Table

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||||||||||||||||||||||||||||||

| VSE | 100 | 125.82 | 157.85 | 98.18 | 126.24 | 129.43 | |||||||||||||||||||||||||||||

| NASDAQ Composite | 100 | 108.87 | 141.13 | 137.12 | 187.44 | 271.64 | |||||||||||||||||||||||||||||

| Peer Group | 100 | 163.24 | 193.41 | 199.86 | 274.02 | 315.43 | |||||||||||||||||||||||||||||

-20-

ITEM 6. Selected Financial Data

This consolidated summary of selected financial data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in Item 7 of this Form 10-K and with the Consolidated Financial Statements and related Notes included in Item 8 of this Form 10-K. Results for reporting periods beginning after January 1, 2018 are presented under the adoption of Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers (Topic 606), while prior period amounts are not adjusted and continue to be reported in accordance with previous guidance. Effective January 1, 2019, we adopted ASU 2016-02, Leases (Topic 842), prior periods were not restated for the adoption of ASU 2016-02. The historical results set forth in this Item 6 are not necessarily indicative of VSE's future results of operations.

(in thousands, except per share data)

| Years ended December 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||

| Revenues | $ | 661,659 | $ | 752,627 | $ | 697,218 | $ | 760,113 | $ | 691,790 | |||||||||||||||||||

Net (loss) income (1) | $ | (5,171) | $ | 37,024 | $ | 35,080 | $ | 39,096 | $ | 26,793 | |||||||||||||||||||

| Basic earnings per share: | |||||||||||||||||||||||||||||

Net (loss) income (1) | $ | (0.47) | $ | 3.38 | $ | 3.23 | $ | 3.61 | $ | 2.48 | |||||||||||||||||||

| Diluted earnings per share: | |||||||||||||||||||||||||||||

Net (loss) income (1) | $ | (0.47) | $ | 3.35 | $ | 3.21 | $ | 3.60 | $ | 2.47 | |||||||||||||||||||

| Cash dividends per common share | $ | 0.36 | $ | 0.35 | $ | 0.31 | $ | 0.270 | $ | 0.235 | |||||||||||||||||||

(1) Net income and basic and diluted earnings per share prior to 2017 were not impacted by the Tax Cuts and Jobs Act.

| As of December 31, | |||||||||||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||

| Working capital | $ | 215,729 | $ | 191,158 | $ | 176,342 | $ | 134,563 | $ | 110,021 | |||||||||||||||||||

| Total assets | $ | 780,081 | $ | 845,864 | $ | 638,828 | $ | 629,013 | $ | 661,839 | |||||||||||||||||||

| Long-term debt | $ | 230,714 | $ | 253,128 | $ | 151,133 | $ | 165,614 | $ | 193,621 | |||||||||||||||||||

| Long-term operating lease obligations | $ | 22,815 | $ | 24,441 | $ | — | $ | — | $ | — | |||||||||||||||||||

| Long-term lease obligations | $ | — | $ | — | $ | 18,913 | $ | 20,581 | $ | 21,959 | |||||||||||||||||||

| Stockholders' equity | $ | 356,317 | $ | 363,101 | $ | 328,395 | $ | 293,095 | $ | 255,194 | |||||||||||||||||||

-21-

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

General Overview

Our Business

We are a diversified aftermarket products and services company providing repair services, parts distribution, logistics, supply chain management and consulting services for land, sea and air transportation assets in the public and private sectors. We provide logistics and distribution services for legacy systems and equipment and professional and technical services to the government, including the Department of Defense ("DoD"), federal civilian agencies, and to commercial and other customers. Our operations include supply chain management solutions, parts supply and distribution, and maintenance, repair and overhaul ("MRO") services for vehicle fleet, aviation, and other customers. We also provide vehicle and equipment maintenance and refurbishment, logistics, engineering support, energy services, IT and health care IT solutions, and consulting services. See Item 1, “Business-Customers” above for revenues by customer.

The following discussion should be read along with our Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K.

Acquisition and Divestitures

In January 2019, we acquired 1st Choice Aerospace Inc. ("1st Choice Aerospace"), with operations in Florida and Kentucky. 1st Choice Aerospace provides component MRO services and products for new generation and legacy commercial aircraft families. 1st Choice Aerospace is a subsidiary of VSE Aviation, Inc. under our Aviation segment.

In February 2020, we sold our subsidiary Prime Turbines, LLC ("Prime Turbines") and certain related inventory assets for $20.0 million in cash and a $8.3 million note receivable to be paid over a period from 2020 through 2024. Our Aviation segment discontinued turboprop engine MRO services, and will concentrate on higher growth potential component/accessory repair and parts distribution while further expanding our presence within the global commercial and general aviation markets. Prime Turbines' revenues totaled less than 1% and approximately 4% of our revenue for 2020 and 2019, respectively.

In June 2020, we sold all of the inventory of our subsidiary CT Aerospace, LLC ("CT Aerospace") for a $6.9 million note receivable to be paid to us over a period from 2020 through 2025. Our Aviation segment discontinued sales and leasing of engines and supply of used serviceable engine parts. CT Aerospace's revenues totaled less than 1% and less than 2% of our revenue for 2020 and 2019, respectively.

See Note (2) "Acquisition and Divestitures" to our Consolidated Financial Statements included in Item 8 of this annual report on Form 10-K for additional information regarding our acquisition and divestitures.

Public Common Stock Offering

In February 2021, we completed an underwritten public offering of common stock, generating gross proceeds of approximately $56 million and net proceeds of approximately $52 million through the issuance of 1,599,097 shares of common stock, including an additional 170,497 shares that were issued pursuant to the underwriters' exercise of their option to purchase additional shares, at an offering price of $35.00 per share. We expect to use the net proceeds for general corporate purposes, which may include among other things, financing strategic acquisitions, working capital requirements for new program launches, and repaying outstanding borrowings under our revolving credit facility.

Organization and Segments

Our operations are conducted within three reportable segments aligned with our operating segments: (1) Aviation; (2) Fleet; and (3) Federal and Defense. We provide more information about each of these reportable segments under Item 1, “Business-History and Organization.”

-22-

Concentration of Revenues

| (in thousands) Years ended December 31, | ||||||||||||||||||||||||||||||||||||||

| Source of Revenues | 2020 | % | 2019 | % | 2018 | % | ||||||||||||||||||||||||||||||||

| DoD | $ | 236,397 | 36 | $ | 304,334 | 41 | $ | 334,494 | 48 | |||||||||||||||||||||||||||||

| Other government | 216,957 | 33 | 205,775 | 27 | 212,118 | 30 | ||||||||||||||||||||||||||||||||

| Commercial | 208,305 | 31 | 242,518 | 32 | 150,606 | 22 | ||||||||||||||||||||||||||||||||

| Total Revenues | $ | 661,659 | 100 | $ | 752,627 | 100 | $ | 697,218 | 100 | |||||||||||||||||||||||||||||

COVID-19 Discussion

Forward Looking Information

Disclosures that address business and operating considerations associated with the COVID-19 pandemic are made under highly uncertain conditions and may involve forward looking information that is based on assumptions and expectations regarding future events. Please refer to the discussion under Item 1A, "Risk Factors" of this annual report on Form 10-K with respect to our discussion of trends or uncertainties arising from or impacted by the COVID-19 pandemic.

Demand for Products and Services, Operating Results, and Financial Condition