UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2012 Commission File Number: 0‑3676

VSE CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

DELAWARE

|

54-0649263

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

Identification No.)

|

|

6348 Walker Lane

|

|

|

|

Alexandria, Virginia

|

22310

|

www.vsecorp.com

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(Webpage)

|

Registrant's Telephone Number, Including Area Code: (703) 960-4600

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Stock, par value $.05 per share

|

The NASDAQ Global Select Market

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [x] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [x] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [x]

The aggregate market value of outstanding voting stock held by nonaffiliates of the Registrant as of June 30, 2012, was approximately $110.6 million based on the last reported sales price of the Registrant's common stock on the NASDAQ Global Select Market as of that date.

Number of shares of Common Stock outstanding as of March 1, 2013: 5,309,416.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant's Proxy Statement for the Annual Meeting of Stockholders expected to be held on May 7, 2013, are incorporated by reference into Part III of this report.

|

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

PART I

|

|

|

|

|

|

|

|

ITEM 1

|

|

5

|

|

ITEM 1A

|

|

9

|

|

ITEM 1B

|

|

11

|

|

ITEM 2

|

|

11

|

|

ITEM 3

|

|

12

|

|

ITEM 4

|

|

12

|

|

ITEM 4(a)

|

|

13

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

ITEM 5

|

|

15

|

|

ITEM 6

|

|

18

|

|

ITEM 7

|

|

19

|

|

ITEM 7A

|

|

31

|

|

ITEM 8

|

|

32

|

|

ITEM 9

|

|

58

|

|

ITEM 9A

|

|

58

|

|

ITEM 9B

|

|

60

|

|

|

|

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

ITEM 10

|

|

60

|

|

ITEM 11

|

|

60

|

|

ITEM 12

|

|

60

|

|

ITEM 13

|

|

60

|

|

ITEM 14

|

|

60

|

|

|

|

|

|

|

|

|

|

PART IV

|

|

|

|

|

|

|

|

ITEM 15

|

|

60

|

|

|

|

|

|

|

|

61

|

|

|

|

|

|

|

|

62-71

|

Forward Looking Statements

This filing contains statements that, to the extent they are not recitations of historical fact, constitute "forward looking statements" under federal securities laws. All such statements are intended to be subject to the safe harbor protection provided by applicable securities laws. For discussions identifying some important factors that could cause actual VSE Corporation ("VSE," the "Company," "us," "our," or "we") results to differ materially from those anticipated in the forward looking statements contained in this filing, see VSE's "Narrative Description of Business" (Items 1, 1A, 2 and 3), and "Management's Discussion and Analysis." Readers are cautioned not to place undue reliance on these forward looking statements, which reflect management's analysis only as of the date hereof. The Company undertakes no obligation to publicly revise these forward looking statements to reflect events or circumstances that arise after the date hereof. Readers should carefully review the risk factors described in other documents the Company files from time to time with the Securities and Exchange Commission, including Quarterly Reports on Form 10-Q filed by the Company subsequent to this Annual Report on Form 10-K ("Form 10-K") and any Current Reports on Form 8-K filed by the Company.

VSE, which was incorporated in Delaware in 1959, serves as a centralized managing and consolidating entity for our business operations. Our business operations are managed under groups consisting of one or more divisions or wholly owned subsidiaries that perform our services. VSE's operating groups include our Federal Group, International Group, IT, Energy and Management Consulting Group, and Supply Chain Management Group. Our Infrastructure Group was eliminated in 2012 upon discontinuation of operations of our Integrated Concepts and Research Corporation ("ICRC") subsidiary. The term "VSE" or "Company" means VSE and its subsidiaries and divisions unless the context indicates operations of the parent company only.

Our business operations consist primarily of diversified logistics, engineering, equipment refurbishment, supply chain management, IT solutions, health care IT, and consulting services performed on a contract basis. Almost all of our contracts are with agencies of the United States Government (the "government") and other government prime contractors.

We seek to provide our customers with competitive, cost-effective solutions to specific problems. These problems generally require a detailed technical knowledge of materials, processes, functional characteristics, information systems, technology and products and an in-depth understanding of the basic requirements for effective systems and equipment.

(b) Financial Information

Our operations are conducted within four reportable segments aligned with our management groups: 1) Federal, which generated approximately 26% of our revenues in 2012; 2) International, which generated approximately 31% of our revenues in 2012; 3) IT, Energy and Management Consulting, which generated approximately 17% of our revenues in 2012; and 4) Supply Chain, which generated approximately 26% of our revenues in 2012. Additional financial information for our reportable segments appears in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and in "Item 8. Financial Statements and Supplementary Data" of this Form 10-K.

(c) Description of Business

Services and Products

Our services include a broad array of capabilities and resources that support military, federal civilian, and other government systems, equipment and processes. We are focused on creating, sustaining and improving the systems, equipment and processes of government through core offerings in logistics, engineering, equipment refurbishment, supply chain management, IT solutions, health care IT, and consulting services.

Typical projects include sustaining engineering support for military vehicles and combat trailers; military equipment refurbishment and modification; ship maintenance, overhaul, and follow-on technical support; logistics management support; machinery condition analysis; specification preparation for ship alterations; ship's force crew training; life cycle support for ships; ship communication systems; energy conservation, energy efficiency, sustainable energy supply, and grid modernization projects; technology road-mapping; IT enterprise architecture development, information assurance/business continuity, security risk management, and network services; medical logistics; medical command and control; and supply chain and inventory management services. See Item 7 "Management's Discussion and Analysis of Financial Information and Results of Operations" for more information regarding our business.

Contracts

Depending on solicitation requirements and other factors, we offer our professional and technical services and products through various competitive contract arrangements and business units that are responsive to customer requirements and may also provide an opportunity for diversification. Some of the contracts permit the contracting agency to issue delivery orders or task orders in an expeditious manner to satisfy relatively short-term requirements for engineering and technical services.

Almost all of our revenues are derived from contract services performed for U.S. Department of Defense ("DoD") agencies or federal civilian agencies, including the United States Postal Service ("USPS"). The U.S. Army, U.S. Army Reserve, U.S. Navy and USPS are our largest customers. Other significant customers include the Department of Treasury, the Department of Energy and the Department of Interior. To a lesser degree, our customers also include various other government agencies and commercial entities.

|

Revenues by Customer

|

|

|

(dollars in thousands)

|

|

|

Years ended December 31,

|

|

|

Customer

|

|

2012

|

|

|

%

|

|

|

2011

|

|

|

%

|

|

|

2010

|

|

|

%

|

|

|

U.S. Army/Army Reserve

|

|

$

|

182,412

|

|

|

|

33.4

|

|

|

$

|

231,615

|

|

|

|

39.9

|

|

|

$

|

463,378

|

|

|

|

57.1

|

|

|

U.S. Navy

|

|

|

120,867

|

|

|

|

22.1

|

|

|

|

140,551

|

|

|

|

24.2

|

|

|

|

198,833

|

|

|

|

24.5

|

|

|

U.S. Air Force

|

|

|

6,963

|

|

|

|

1.3

|

|

|

|

11,971

|

|

|

|

2.0

|

|

|

|

13,304

|

|

|

|

1.7

|

|

|

Total - DoD

|

|

|

310,242

|

|

|

|

56.8

|

|

|

|

384,137

|

|

|

|

66.1

|

|

|

|

675,515

|

|

|

|

83.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

USPS

|

|

|

130,866

|

|

|

|

23.9

|

|

|

|

75,964

|

|

|

|

13.1

|

|

|

|

-

|

|

|

|

-

|

|

|

Department of Treasury

|

|

|

33,369

|

|

|

|

6.1

|

|

|

|

41,434

|

|

|

|

7.1

|

|

|

|

49,332

|

|

|

|

6.1

|

|

|

Department of Interior

|

|

|

16,884

|

|

|

|

3.1

|

|

|

|

24,254

|

|

|

|

4.2

|

|

|

|

29,810

|

|

|

|

3.7

|

|

|

Department of Energy

|

|

|

20,898

|

|

|

|

3.8

|

|

|

|

23,010

|

|

|

|

4.0

|

|

|

|

21,717

|

|

|

|

2.7

|

|

|

Other government

|

|

|

32,231

|

|

|

|

5.9

|

|

|

|

28,160

|

|

|

|

4.8

|

|

|

|

29,598

|

|

|

|

3.6

|

|

|

Total – Federal civilian agencies

|

|

|

234,248

|

|

|

|

42.8

|

|

|

|

192,822

|

|

|

|

33.2

|

|

|

|

130,457

|

|

|

|

16.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial

|

|

|

2,265

|

|

|

|

0.4

|

|

|

|

3,803

|

|

|

|

0.7

|

|

|

|

4,983

|

|

|

|

0.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

546,755

|

|

|

|

100.0

|

|

|

$

|

580,762

|

|

|

|

100.0

|

|

|

$

|

810,955

|

|

|

|

100.0

|

|

The government's procurement practices sometimes include the bundling of various work efforts under large comprehensive management contracts that are awarded to more than one contractor. As a result, the growth opportunities available to us can occur in significant, unpredictable increments. We have pursued these larger opportunities by assembling teams of subcontractors to offer the range of technical competencies required by these larger contracts. Typically the use of subcontractors and large material purchases on government contracts provides lower profit margins than work performed by our own personnel. As a result, the use of such teaming arrangements may lower our overall profit margins in some years. Although the government's practice of using large multiple award contracts is expected to continue, we also have opportunities to compete for other contracts requiring our specific areas of expertise. We are positioned to pursue these opportunities while continuing to use subcontractor teams to compete for large multiple award contracts.

Our contracts with the government are typically cost plus fee, time and materials, or fixed-price contracts. Revenues result from work performed on these contracts by our own employees, from work performed by our subcontractors, and from costs of materials used in performing the work. Revenues on cost‑type contracts are recorded as allowable costs are incurred and fees are earned.

Revenues for time and materials contracts are recorded on the basis of allowable labor hours worked multiplied by the contract defined billing rates, plus the cost of materials used in performance on the contract. Profits or losses on time and material contracts result from the difference between the cost of services performed and the contract defined billing rates for these services.

Revenue recognition methods on fixed-price contracts vary depending on the nature of the work and the contract terms. Revenues on fixed-price service contracts are recorded as work is performed, typically ratably over the service period. Revenues on fixed-price contracts that require delivery of specific items are recorded based on a price per unit as units are delivered.

Backlog

Funded backlog for government contracts represents a measure of our potential future revenues. Funded backlog is defined as the total value of contracts that has been appropriated and funded by the procuring agencies, less the amount of revenues that have already been recognized on such contracts. Our funded backlog as of December 31, 2012, is approximately $250 million. Funded backlog as of December 31, 2011 and 2010 was approximately $282 million and $400 million, respectively. Changes in funded backlog on contracts are sometimes unpredictable due to uncertainties associated with changing government program priorities and availability of funds, which is heavily dependent upon the congressional authorization and appropriation process. Delays in this process, such as those experienced in recent years, may temporarily diminish the availability of funds for ongoing and planned work.

In addition to the funded backlog levels, we have contract ceiling amounts available for use on multiple award, indefinite delivery, indefinite quantity contracts with DoD and federal civilian agencies. While these contracts increase the opportunities available for us to pursue future work, the actual amount of future work is indeterminate until delivery orders are placed on the contracts. Frequently, these delivery orders are competitively awarded. Additionally, these delivery orders must be funded by the procuring agencies before we can perform work and begin generating revenues.

Marketing

Our marketing activities are conducted at the operating group level by our business development staff and our professional staff of engineers, program managers, and other personnel. These activities are centrally coordinated through our Corporate Sales and Marketing Department. Information concerning new programs and requirements becomes available in the course of contract performance, through formal and informal briefings, from participation in professional organizations, and from literature published by the government, trade associations, professional organizations and commercial entities.

Personnel

Services are provided by our staff of professional and technical personnel having high levels of education, experience, training and skills. As of December 31, 2012, we had 2,472 employees, a decrease from 2,516 as compared to December 31, 2011. Principal categories include (a) mechanics and vehicle and equipment technicians, (b) information technology professionals in computer systems, applications and products, configuration, change and data management disciplines, (c) engineers and technicians in mechanical, electronic, industrial, energy and environmental services, (d) logisticians, (e) environmental specialists, and (f) warehouse and sales personnel. The expertise required by our customers also frequently includes knowledge of government administrative procedures. Over 35% of our employees have previously served as members in the U.S. Armed Forces.

Competition

The professional and technical services industry in which we are engaged is very competitive. Numerous other organizations, including large, diversified firms, have greater financial resources and larger technical staffs that are capable of providing the same services offered by us.

Government agencies emphasize awarding contracts on a competitive basis as opposed to a sole source or other noncompetitive basis. Most of the significant contracts under which we currently perform were either initially awarded on a competitive basis or have been renewed at least once on a competitive basis. Government agencies also order services through contracts awarded by the General Services Administration ("GSA"). GSA provides a schedule of services at fixed prices that may be ordered outside of the solicitation process. We have nine GSA schedule contracts for different classes of services. There is no assurance regarding the level of work we may obtain under these contracts. Government budgets, and in particular the budgets of certain government agencies, can also affect competition in our business. A reallocation of government spending priorities or a general decline in government budgets can result in lower levels of potential business, thereby intensifying competition.

The extent and range of competition that we will encounter as a result of changing economic or competitive conditions, customer requirements or technological developments is unpredictable. We believe the principal competitive factors for our business are technical and financial qualifications, past performance and price.

Available Information

Copies of our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. They are available free of charge through our website www.vsecorp.com as soon as reasonably practicable after the reports are electronically filed with the Securities and Exchange Commission ("SEC").

Our future results may differ materially from past results and from those projected in the forward-looking statements contained in this Form 10-K due to various uncertainties and risks, including but not limited to those set forth below, one-time events and other important factors disclosed previously and from time to time in our other filings with the SEC.

Uncertain government budgets and shifting government priorities could delay contract awards and funding and adversely affect our ability to continue work under our government contracts. Additionally, federal procurement directives could result in our loss of work on current programs to set-asides and large multiple award contracts.

Our business is subject to funding delays, terminations, reductions, extensions, and moratoriums caused by the government's budgeting and contracting process. The current federal procurement environment is unpredictable and could adversely affect our ability to perform work nder new and existing contracts. Contract award and funding delays extend across the federal technical services industry. We experienced delays in contract awards and funding on our contracts in recent years that have impacted our ability to continue existing work and to replace expiring work. Additionally, our government business is subject to the risk that one or more of our potential contracts or contract extensions may be awarded by the contracting agency to a small or disadvantaged or minority-owned business pursuant to set-aside programs administered by the Small Business Administration, or may be bundled into large multiple award contracts for very large businesses. These risks can potentially have an adverse effect on our revenue growth and profit margins.

Increased market competition resulting from decreases in government spending for contract services could affect our ability to sustain our revenue levels.

Continuing pressure on government budgets may adversely affect the flow of work to federal contractors, particularly new programs. Consequently, competitor contractors that experience a loss of government work may tend to redirect their marketing efforts toward the types of work performed by us. This increase in competition for our service offerings could potentially affect our ability to win new work or successor contracts to continue work that is currently performed by us under expiring contracts. Furthermore, disappointed bidders frequently protest, which can reverse or delay contract awards.

Our business could be adversely affected by incidents that could cause an interruption in our operations or impose a significant financial liability on us.

Disruption of our operations due to internal or external system or service failures, accidents or incidents involving employees or third parties working in high-risk locations, or natural disasters or other crises could adversely impact our financial performance and condition.

The nature of our operations and work performed by our employees present certain challenges related to work force management.

Our financial performance is heavily dependent on the abilities of our operating and administrative staff with respect to technical skills, operating performance, pricing, cost management, safety, and administrative and compliance efforts. A wide diversity of contract types, nature of work, work locations, and legal and regulatory complexities challenges our administrative staff and skill sets. We also face challenges associated with our quality of workforce, quality of work, safety, and labor relations compliance. Our current and projected work in foreign countries exposes us to challenges associated with export compliance, local laws and customs, workforce issues, extended supply chain, and war zone threats. Failure to attract or retain an adequately skilled workforce, lack of knowledge or training in critical functions, or inadequate staffing levels can result in lost work, reduced profit margins, losses from cost overruns, performance deficiencies, workplace accidents, and regulatory noncompliance.

Our business could be adversely affected by government audits.

Government agencies, including the Defense Contract Audit Agency and the Department of Labor, routinely audit and investigate government contractors. These agencies review a contractor's performance under its contracts, cost structure and compliance with applicable laws, regulations and standards. The government also may review the adequacy of, and a contractor's compliance with, its internal control systems and policies, including the contractor's purchasing, property, estimating, compensation and management information systems. Any costs found to be improperly allocated to a specific contract will not be reimbursed, while such costs already reimbursed must be refunded. If an audit uncovers improper or illegal activities, we may be subject to civil and criminal penalties and administrative sanctions, including termination of contracts, forfeiture of profits, suspension of payments, fines and suspension or prohibition from doing business with the government. In addition, we could suffer serious harm to our reputation if allegations of impropriety were made.

Our work on large government program efforts presents a risk to revenue and profit growth and sustainability.

The eventual expiration of large government programs, or the loss of or disruption of revenues on a single contract, presents the potential for reduced revenues and profits. Such revenue losses could also erode profits on our remaining programs that would have to absorb a larger portion of the fixed corporate costs previously allocated to the expiring programs or discontinued contract work. Our Supply Chain Management Group managed inventory program for USPS, our Federal Group equipment refurbishment program for the U.S. Army Reserve, and our International Group Foreign Military Sales program provide significant amounts of revenues and profits, which if interrupted, could adversely impact our overall financial performance.

Acquisitions, which have been a part of our business strategy in recent years, presents certain risks.

The decision to acquire a company that does not meet expected operating and financial performance targets, the failure to make or timely complete an acquisition, the ineffective integration of an acquisition, or the inability of our company to service debt associated with making an acquisition could potentially adversely impact our financial performance.

Global economic conditions and political factors could adversely affect revenues on current government programs.

Revenues from our government programs for which work is performed in foreign countries are subject to economic conditions in these countries and to political risks posed by ongoing foreign conflicts and potential terrorist activity. A significant amount of our revenues in recent years resulted from the U.S. military involvement in Iraq and Afghanistan, and the winding down of this U.S. military involvement has adversely impacted our revenues. Similarly, political unrest in Egypt has decreased our revenues and further political unrest in Egypt or potential changes in the political landscapes in other countries could potentially impact our future revenues. Adverse results arising from these global economic and political risks could have a material adverse impact on our financial performance.

As a government contractor, we are subject to a number of procurement rules and regulations that could expose us to potential liabilities or loss of work. Additionally, we are exposed to contractual and financial liabilities if our subcontractors do not perform satisfactorily.

We must comply with and are affected by laws and regulations relating to the award, administration and performance of government contracts. Additionally, we are responsible for subcontractor compliance with these laws and regulations. Government contract laws and regulations affect how we conduct business with our customers and, in some instances, impose added costs to us. A violation of specific laws and regulations could result in the imposition of fines and penalties or the termination of contracts or debarment from bidding on government contracts.

In some instances, these laws and regulations impose terms or rights that are significantly more favorable to the government than those typically available to commercial parties in negotiated transactions. For example, the government may terminate any government contract or subcontract at its convenience, as well as for performance default.

A termination for default could expose us to liability and have a material adverse effect on our ability to compete for future contracts and orders. In addition, the government could terminate a prime contract under which we are a subcontractor, irrespective of the quality of services provided by us as a subcontractor.

Additionally, a significant percentage of our contract work is performed by subcontractors, which are subject to government compliance, performance and financial risks. If unsatisfactory performance or compliance failure occurs on the part of subcontractors, we must bear the cost to remedy these deficiencies on our prime contracts.

Due to the nature of our work we could potentially be exposed to legal actions arising from our operations.

The nature of our work poses certain challenges that could potentially cause us to be exposed to legal liability arising from performance issues or from work related incidents that result in damages, injury or death to third parties. Such events could cause us to suffer financial losses and adversely impact our financial condition.

Technology security risks and environmental and pollution risks could potentially impact our financial results.

We are exposed to certain information and technology security risks and to environmental and pollution risks due to the nature of some of the contract work we perform. Costs associated with information management security breaches and pollution clean-up efforts and environmental regulatory compliance have not yet had a material adverse impact on our capital expenditures, earnings, or competitive position. However, the occurrence of a future security breach or environmental or pollution event could potentially have an adverse impact.

Investments in facilities could cause losses if certain work is disrupted or discontinued.

We have made investments in facilities and lease commitments to support specific business programs, work requirements, and service offerings. A slowing or disruption of these business programs, work requirements, or service offerings that results in operating below intended levels could cause us to suffer financial losses.

New accounting standards could result in changes to our methods of quantifying and recording accounting transactions, and could affect financial results and financial position.

Changes to Generally Accepted Accounting Principles in the United States ("GAAP") arise from new and revised guidance issued by the Financial Accounting Standards Board, the SEC, and others. The effects of such changes may include prescribing an accounting method where none had been previously specified, prescribing a single acceptable method of accounting from among several acceptable methods that currently exist, or revoking the acceptability of a current method and replacing it with an entirely different method, among others. These changes could result in unanticipated effects on results of operations, financial position and other financial measures.

ITEM 1B.

Unresolved Staff Comments

None

Our executive and administrative headquarters are located in a five-story building in Alexandria, Virginia, with approximately 95,000 square feet of office space leased by us through April 2027.

We also provide services and products from approximately 30 leased facilities located near customer sites to facilitate communications and enhance program performance. These facilities are generally occupied under short-term leases and currently include a total of approximately 1.2 million square feet of office and warehouse space. Our employees often provide services at customer facilities, limiting our requirement for additional space. We also provide services from several locations outside of the United States, generally at foreign shipyards or U.S. military installations.

We own and operate two facilities in Ladysmith, Virginia. One of these properties consists of approximately 44 acres of land and multiple storage and vehicle maintenance buildings totaling approximately 57,000 square feet of space. The other property consists of 30 acres of land and buildings totaling approximately 13,500 square feet of space. We use these properties primarily to provide refurbishment services for military equipment, storage and maintenance.

We also own five land parcels containing four buildings located in an industrial park in Somerset, Pennsylvania that we use to conduct the operations of our subsidiary Wheeler Bros. Inc. These properties consist of approximately 30 acres of land and buildings totaling approximately 210,000 square feet of office, engineering, and warehouse space.

ITEM 3.

Legal Proceedings

We may have, in the normal course of business, certain claims, including legal proceedings, against us and against other parties. In our opinion, the resolution of these claims will not have a material adverse effect on our results of operations or financial position. However, the results of any claims, including legal proceedings, cannot be predicted with certainty.

On or about May 24, 2012, four complaints were filed in the Circuit Court of the First Circuit, State of Hawaii, by the estates of five deceased individuals and certain of their relatives against VSE and certain other entities and individuals, including Thomas E. Blanchard and Associates, Inc., Richard Bratt, HIDC Small Business Storage LLC, Hawaiian Island Development Co., Inc., Hawaiian Island Homes LTD., Hawaiian Island Commercial LTD., and Ford Island Ventures, LLC, seeking unspecified amounts of general, special and punitive damages as all proven at the time of trial and costs and legal fees. The deceased plaintiffs are Justin Joseph Kelii, Robert Kevin Donor Freeman, Neil Benjiman Sprankle, Bryan Dean Cabalce and Robert Leahey. The complaints allege, among other things, that the explosion of fireworks and diesel fuel that injured and killed the five individuals on or about April 8, 2011 was caused by negligence, actions and omissions of VSE and the other defendants and their employees, agents and representatives. The five deceased individuals were employees of Donaldson Enterprises, Inc., which was a vendor retained by VSE to warehouse, store and dispose of illegal fireworks and other explosives seized by the federal government from entities and persons illegally in possession of the fireworks and other explosives. VSE had a prime contract with the U.S. Department of Treasury to support the Treasury Executive Office for Asset Forfeiture to manage various seized assets, including management and disposal of fireworks and other explosives seized by various federal government agencies.

VSE has denied the allegations against it and, together with its insurance carrier, will aggressively defend the proceedings. While there is no guaranty, VSE's management does not believe that the proceedings will be material to VSE's business or financial condition.

Further, from time-to-time, government agencies investigate whether our operations are being conducted in accordance with applicable regulatory requirements. Government investigations of us, whether relating to government contracts or conducted for other reasons, could result in administrative, civil or criminal liabilities, including repayments, fines or penalties being imposed upon us, or could lead to suspension or debarment from future government contracting. Government investigations often take years to complete and many result in no adverse action against us. We believe, based upon current information, that the outcome of any such government disputes and investigations will not have a material adverse effect on our financial position.

ITEM 4.

Mine Safety Disclosures

Not applicable.

ITEM 4(a). Executive Officers of Registrant

Our executive officers are listed below, as well as information concerning their age and positions held with VSE. There were no family relationships among any of our executive officers. For executive officers who have been with us less than five years, their principal occupations and business experience over the last five years are provided. The executive officers are appointed annually to serve until the first meeting of VSE's Board of Directors (the "Board") following the next annual meeting of stockholders and until their successors are elected and have qualified, or until death, resignation or removal, whichever is sooner.

|

Name

|

Age

|

Position with Registrant

|

|

|

|

|

|

Maurice A. Gauthier

|

65

|

Director, Chief Executive Officer, President and Chief Operating Officer

|

|

|

|

|

|

Randy A. Davies

|

55

|

President, VSE's subsidiary Wheeler Bros., Inc.

|

|

|

|

|

|

Harold J. Flammang, Jr.

|

61

|

Executive Vice President and President, International Group

|

|

|

|

|

|

John T. Harris

|

61

|

President, VSE's subsidiaries Akimeka, LLC and G&B Solutions, Inc.

|

|

|

|

|

|

Thomas M. Kiernan

|

45

|

Vice President, General Counsel and Secretary

|

|

|

|

|

|

James W. Lexo, Jr.

|

64

|

Executive Vice President, Strategic Planning and Business Initiatives

|

|

|

|

|

|

Thomas R. Loftus

|

57

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

Nancy Margolis

|

57

|

President, VSE's subsidiary Energetics Inc.

|

|

|

|

|

|

Donelle L. Moten

|

59

|

President, Federal Group

|

Mr. Gauthier joined VSE in April 2008 as Chief Executive Officer, President and Chief Operating Officer. He was elected as a VSE director by the Board in February 2009. Mr. Gauthier completed a military career of over 28 years of service, retiring in 1997 as a Navy Captain and board certified Department of Defense Major Program Manager. Mr. Gauthier worked for VSE from October 1997 through February 1999 as Vice President and Chief Technology Officer, and as Director of Strategic Planning and Business Development, before joining the Nichols Research Corporation Navy Group as President of its Navy Group. With the acquisition of Nichols Research Corporation by Computer Sciences Corporation ("CSC") in 1999, Mr. Gauthier served as Vice President of CSC's Advanced Marine Center. His most recent assignment with CSC was as Vice President and General Manager of CSC's Navy and Marine Corps Business Unit where he was responsible for the overall leadership and financial performance of a 2,500-employee organization providing systems engineering, technical, information technology and telecommunications support to U.S. Navy and Marine Corps customers. Mr. Gauthier earned a Bachelor of Science degree from the U.S. Naval Academy. He received a Master of Science degree in Systems Engineering from the U.S. Naval Postgraduate School, Monterey, CA. He is a graduate of the Defense Acquisition University's Defense Systems Management College and of the Advanced Executive Program and the International Marketing Program offered by the Kellogg Graduate School of Management at Northwestern University.

Mr. Davies was appointed President and Chief Operating Officer for Wheeler Bros., Inc. ("WBI") in June 2011 immediately following VSE's acquisition of WBI. He is involved in the management of WBI's day-to-day operations, new business development, supply chain initiatives and facilities management. Mr. Davies, who has been with WBI since 1977, was a stockholder and a director of WBI. He was WBI's Vice President of Operations from 1985, to June 2011, when VSE acquired WBI.

Mr. Harris was appointed President and Chief Operating Officer for Akimeka, LLC in August 2010 immediately following VSE's acquisition of the company. Mr. Harris joined Akimeka LLC in 2001 as Chief Operating Officer. Prior to that, he was president of JJA Enterprises, an independent consulting firm specializing in acquisition, business and financial management, and business development services. Mr. Harris has a Bachelor of Science degree from Middle Tennessee State University and an Master of Science degree in Healthcare Administration from Southwest Texas State University. He also carries a Masters equivalent in International Affairs from the Armed Forces Staff College in Norfolk, Virginia.

Mr. Kiernan joined VSE in November 2008 and serves as Vice President, General Counsel, and Corporate Secretary. From 2003 to 2008, Mr. Kiernan served as Vice President, General Counsel and Secretary for Intelsat General Corporation, a subsidiary of Intelsat, Ltd. serving government and commercial customers. From 2000 to 2003, Mr. Kiernan served as a member of the Intelsat, Ltd., Office of General Counsel. From 1994 to 2000, Mr. Kiernan served as corporate counsel for SRA Life Sciences. Mr. Kiernan is a graduate of Virginia Tech University (B.A., Political Science) and George Mason University School of Law. He is a member of the Virginia State Bar.

PART II

|

ITEM 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

VSE common stock, par value $0.05 per share, is traded on the NASDAQ Global Select Market, trading symbol, "VSEC," Newspaper listing, "VSE."

The following table sets forth the range of high and low sales price (based on information reported by the NASDAQ Global Select Market) and cash dividend per share information for our common stock for each quarter and annually during the last two years.

|

Quarter Ended

|

|

High

|

|

|

Low

|

|

|

Dividends

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011:

|

|

|

|

|

|

|

|

|

|

|

March 31

|

|

$

|

33.16

|

|

|

$

|

26.86

|

|

|

$

|

0.060

|

|

|

June 30

|

|

|

30.98

|

|

|

|

24.46

|

|

|

|

0.070

|

|

|

September 30

|

|

|

26.83

|

|

|

|

21.00

|

|

|

|

0.070

|

|

|

December 31

|

|

|

30.68

|

|

|

|

22.32

|

|

|

|

0.070

|

|

|

For the Year

|

|

$

|

33.16

|

|

|

$

|

21.00

|

|

|

$

|

0.270

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31

|

|

$

|

27.14

|

|

|

$

|

22.85

|

|

|

$

|

0.070

|

|

|

June 30

|

|

|

25.64

|

|

|

|

20.76

|

|

|

|

0.080

|

|

|

September 30

|

|

|

24.99

|

|

|

|

21.77

|

|

|

|

0.080

|

|

|

December 31

|

|

|

25.27

|

|

|

|

20.91

|

|

|

|

0.080

|

|

|

For the Year

|

|

$

|

27.14

|

|

|

$

|

20.76

|

|

|

$

|

0.310

|

|

As of February 6, 2013, VSE common stock, par value $0.05 per share, was held by approximately 260 stockholders of record. The number of stockholders of record is not representative of the number of beneficial holders because many of the shares are held by depositories, brokers or nominees.

In 2011 cash dividends were declared quarterly at the annual rate of $0.24 per share through March 31, 2011, and at the annual rate of $0.28 per share commencing June 1, 2011.

In 2012 cash dividends were declared quarterly at the annual rate of $0.28 per share through March 31, 2012, and at the annual rate of $0.32 per share commencing June 1, 2012.

Pursuant to our bank loan agreement (see Note 7 of "Notes to Consolidated Financial Statements" in Item 8 of this Form 10-K), the payment of cash dividends is subject to annual rate restrictions. We have paid cash dividends each year since 1973.

|

(d)

|

Certain Sales and Repurchases of VSE Common Stock

|

During the fiscal year covered by this Form 10-K, VSE did not sell any equity securities of VSE that were not registered under the Securities Act of 1933, as amended. During the fourth quarter of the fiscal year covered by this Form 10-K, no purchases of equity securities of VSE were made by or on behalf of VSE or any "affiliated purchaser" (as defined in Exchange Act Rule 106-18 (a)(3)).

|

(e)

|

Equity Compensation Plan Information

|

We have two compensation plans approved by our stockholders under which our equity securities are authorized for issuance to employees and directors: (i) the VSE Corporation 2004 Non-Employee Directors Stock Plan and (ii) the VSE Corporation 2006 Restricted Stock Plan. On May 3, 2011, the stockholders approved amendments to the VSE Corporation 2006 Restricted Stock Plan extending the term thereof until May 3, 2016.

As of December 31, 2012, 69,238 shares of VSE common stock were available for future issuance under the VSE Corporation 2004 Non-Employee Directors Stock Plan and 91,264 shares of VSE common stock were available for future issuance under the VSE Corporation 2006 Restricted Stock Plan.

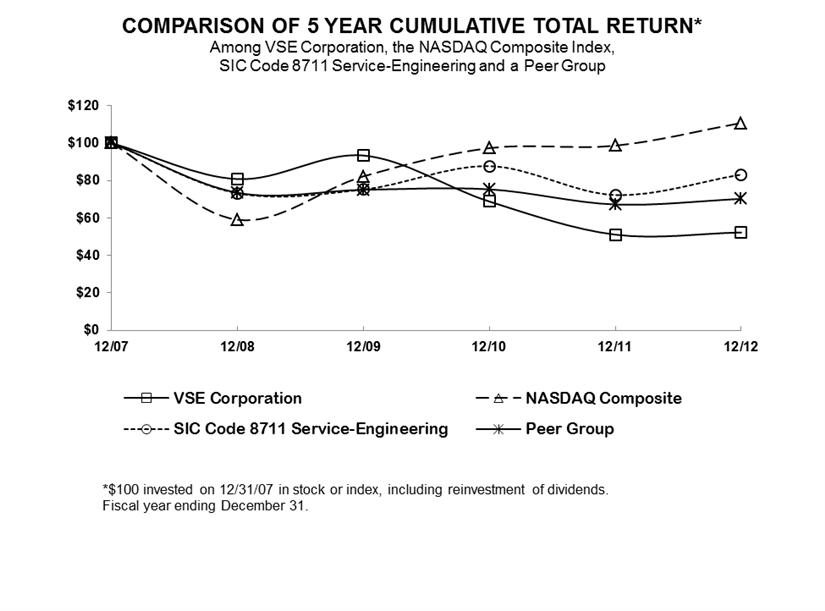

Performance Graph

Set forth below is a line graph comparing the cumulative total return of VSE common stock with (a) a performance index for the broad market (NASDAQ Global Select Market) in which VSE common stock is traded and (b) a published industry index. VSE common stock is traded on the NASDAQ Global Select Market, and our industry group is engineering and technical services (formerly SIC Code 8711). Accordingly, the performance graph compares the cumulative total return for VSE common stock with (a) an index for the NASDAQ Global Select Market (U.S. companies) ("NASDAQ Index") and (b) a published industry index for SIC Code 8711 ("Industry Index").

Performance Graph Table

|

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

|

VSE

|

100

|

80.76

|

93.36

|

68.76

|

51.08

|

52.23

|

|

NASDAQ Composite

|

100

|

59.03

|

82.25

|

97.32

|

98.63

|

110.78

|

|

SIC Code 8711 Service-Engineering

|

100

|

73.19

|

75.22

|

87.68

|

72.27

|

83.19

|

|

Peer Group

|

100

|

73.47

|

75.05

|

75.28

|

67.21

|

70.18

|

ITEM 6.

Selected Financial Data

(In thousands, except per share data)

|

|

|

Years ended December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

546,755

|

|

|

$

|

580,762

|

|

|

$

|

810,955

|

|

|

$

|

974,202

|

|

|

$

|

937,355

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

27,364

|

|

|

$

|

20,190

|

|

|

$

|

23,505

|

|

|

$

|

23,408

|

|

|

$

|

16,501

|

|

|

(Loss) income from discontinued operations

|

|

|

(6,070

|

)

|

|

|

362

|

|

|

|

182

|

|

|

|

616

|

|

|

|

2,539

|

|

|

Net income

|

|

$

|

21,294

|

|

|

$

|

20,552

|

|

|

$

|

23,687

|

|

|

$

|

24,024

|

|

|

$

|

19,040

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

5.18

|

|

|

$

|

3.86

|

|

|

$

|

4.53

|

|

|

$

|

4.56

|

|

|

$

|

3.25

|

|

|

(Loss) income from discontinued operations

|

|

|

(1.15

|

)

|

|

|

0.07

|

|

|

|

0.03

|

|

|

|

0.12

|

|

|

|

0.50

|

|

|

Net income

|

|

$

|

4.03

|

|

|

$

|

3.93

|

|

|

$

|

4.56

|

|

|

$

|

4.68

|

|

|

$

|

3.75

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$

|

5.15

|

|

|

$

|

3.83

|

|

|

$

|

4.50

|

|

|

$

|

4.55

|

|

|

$

|

3.24

|

|

|

(Loss) income from discontinued operations

|

|

|

(1.14

|

)

|

|

|

0.07

|

|

|

|

0.03

|

|

|

|

0.12

|

|

|

|

0.50

|

|

|

Net income

|

|

$

|

4.01

|

|

|

$

|

3.90

|

|

|

$

|

4.53

|

|

|

$

|

4.67

|

|

|

$

|

3.74

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends per common share

|

|

$

|

0.31

|

|

|

$

|

0.27

|

|

|

$

|

0.23

|

|

|

$

|

0.195

|

|

|

$

|

0.175

|

|

|

|

|

As of December 31,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital

|

|

$

|

64,976

|

|

|

$

|

71,123

|

|

|

$

|

54,569

|

|

|

$

|

45,902

|

|

|

$

|

24,179

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$

|

410,211

|

|

|

$

|

454,512

|

|

|

$

|

288,426

|

|

|

$

|

253,990

|

|

|

$

|

275,966

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

$

|

116,377

|

|

|

$

|

144,759

|

|

|

$

|

11,111

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term lease obligations

|

|

$

|

27,435

|

|

|

$

|

33,938

|

|

|

$

|

20,258

|

|

|

$

|

1,100

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity

|

|

$

|

164,335

|

|

|

$

|

143,600

|

|

|

$

|

123,776

|

|

|

$

|

101,310

|

|

|

$

|

76,123

|

|

This consolidated summary of selected financial data should be read in conjunction with Management's Discussion and Analysis of the Financial Condition and Results of Operations included in Item 7 of this Form 10-K and with the Consolidated Financial Statements and related Notes included in Item 8 of this Form 10-K. The historical results set forth in this Item 6 are not necessarily indicative of the results of operations to be expected in the future.

ITEM 7.

Management's Discussion and Analysis of Financial Condition and Results of Operations

Executive Overview

Customers and Services

We provide sustainment services for legacy systems and equipment and professional services to the U.S. Department of Defense ("DoD") and federal civilian agencies, including the United States Postal Service ("USPS"). Our operations consist primarily of logistics, engineering, equipment refurbishment, supply chain management, IT solutions, health care IT, and consulting services performed on a contract basis. Substantially all of our contracts are with United States Government ("government") agencies and other government prime contractors. Our largest customer is the DoD, including agencies of the U.S. Army, Navy and Air Force. We also provide services to civilian government customers. See Item 1 "Business – Contracts" on page 6 for revenues by customer.

Discontinued Operations

In December 2012, we decided to divest and sell our subsidiary, Integrated Concepts and Research Corporation ("ICRC"), thereby eliminating our Infrastructure Group. We acquired ICRC in 2007. ICRC was engaged principally in providing engineering and transportation infrastructure services and construction management services primarily to federal civilian agencies. ICRC's largest contract was with the U.S. Department of Transportation Maritime Administration ("MARAD") for services performed on the Port of Anchorage Intermodal Expansion Project in Alaska (the "PIEP"). The MARAD contract expired on May 31, 2012, when the option year was not exercised. Upon evaluating the impact of the elimination of this PIEP program from ICRC's business base, we determined that expected financial results of our remaining construction management services business would not justify our continuation of its operations. We have commenced efforts to sell ICRC and held preliminary discussions with potential buyers, however, there is no assurance that we will succeed in selling ICRC. On February 20, 2013 we signed a letter of intent with a prospective buyer to sell ICRC. We expect to close on the transaction during the first half of 2013.

Organization and Segments

Our business is managed under operating groups consisting of one or more divisions or wholly owned subsidiaries that perform our services. We have four reportable segments aligned with our management groups: 1) Federal; 2) International; 3) IT, Energy and Management Consulting; and 4) Supply Chain Management.

Federal Group - Our Federal Group provides engineering, technical, management, and integrated logistics support services to U.S. military branches, government agencies and other customers. These services include full life cycle engineering, logistics, maintenance, field support, and refurbishment services to extend and enhance the life of existing vehicles and equipment; comprehensive systems and software engineering, systems technical support, configuration management, obsolescence management, prototyping services, technology insertion programs, and technical documentation and data packages; and management and execution of government programs under large multiple award contracts. This group provides its services to the U.S. Army, Army Reserve, Marine Corps, and other customers. Significant current work efforts for this group include our ongoing U. S. Army Reserve vehicle refurbishment program and various vehicle and equipment maintenance and sustainment programs for U. S. Army commands. Significant work efforts in prior years included task orders performed under our U.S. Army CECOM Rapid Response ("R2") contract, which expired in 2011.

International Group – Our International Group provides engineering, industrial, logistics, maintenance, information technology, fleet-wide ship and aircraft support, and foreign military sales services to the U.S. military branches, government agencies, and other customers. These services include program management, engineering, technical support, logistics services, and follow-on technical support for ship reactivations and transfers; field engineering, ship repair and modernization, ship systems installations, ordnance engineering, facility operations, war reserve materials management, and IT systems integration; aircraft sustainment and maintenance services; and management, maintenance, storage and disposal support for seized and forfeited general property programs. This group provides its services to the U.S. Navy, Air Force, Department of Treasury, Department of Justice, Bureau of Alcohol, Tobacco, Firearms and Explosives ("ATF"), and other customers. Significant current work efforts for this group include ongoing assistance to the U.S. Navy in executing its Foreign Military Sales ("FMS") Program for surface ships sold, leased or granted to foreign countries, various task orders under the U.S. Air Force Contract Field Teams ("CFT") Program, and management of Department of Treasury and ATF seized and forfeited general property programs ("Seized Asset Programs").

IT, Energy and Management Consulting Group - Our IT, Energy and Management Consulting Group consists of our wholly owned subsidiaries Energetics Incorporated ("Energetics"), G&B Solutions, Inc. ("G&B"), and Akimeka, LLC ("Akimeka"). This group provides technical and consulting services primarily to various DoD and civilian government agencies, including the U.S. Departments of Defense, Energy, Homeland Security, Commerce, Interior, Labor, Agriculture and Housing and Urban Development; the Social Security Administration; the Pension Benefit Guaranty Corporation; the National Institutes of Health; customers in the military health system; and other government agencies and commercial clients. Energetics provides technical, policy, business, and management support in areas of energy modernization, clean and efficient energy, climate change mitigation, infrastructure protection, and measurement technology. Effective January 1, 2013, the businesses of G&B and Akimeka were combined, with integration expected to be substantially complete in late 2013. The combined G&B and Akimeka businesses offer solutions in fields that include medical logistics, medical command and control, e-health, information assurance, public safety, enterprise architecture development, information assurance/business continuity, program and portfolio management, network IT services, systems design and integration, quality assurance services, and product and process improvement services.

Supply Chain Management Group – Our Supply Chain Management Group provides sourcing, acquisition, scheduling, transportation, shipping, logistics, data management, and other services to assist our clients with supply chain management efforts. This group is comprised of our Wheeler Bros., Inc. ("WBI") subsidiary, acquired in June 2011, and other VSE Supply Chain Management work. Significant current work efforts for this group include WBI's ongoing Managed Inventory Program ("MIP") for USPS and direct sales to other clients.

|

Concentration of Revenues

|

|

|

|

|

Years ended December 31,

(in thousands)

|

|

|

Source of Revenues

|

|

2012

|

|

|

%

|

|

|

2011

|

|

|

%

|

|

|

2010

|

|

|

%

|

|

|

USPS MIP

|

|

$

|

129,392

|

|

|

|

24

|

|

|

$

|

73,753

|

|

|

|

13

|

|

|

$

|

-

|

|

|

|

-

|

|

|

FMS Program

|

|

|

88,167

|

|

|

|

16

|

|

|

|

100,021

|

|

|

|

17

|

|

|

|

141,418

|

|

|

|

17

|

|

|

U.S. Army Reserve

|

|

|

78,269

|

|

|

|

14

|

|

|

|

62,848

|

|

|

|

11

|

|

|

|

61,064

|

|

|

|

8

|

|

|

R2 and R2-3G Programs

|

|

|

14,559

|

|

|

|

3

|

|

|

|

77,340

|

|

|

|

13

|

|

|

|

407,057

|

|

|

|

50

|

|

|

Other

|

|

|

236,368

|

|

|

|

43

|

|

|

|

266,800

|

|

|

|

46

|

|

|

|

201,416

|

|

|

|

25

|

|

|

Total Revenues

|

|

$

|

546,755

|

|

|

|

100

|

|

|

$

|

580,762

|

|

|

|

100

|

|

|

$

|

810,955

|

|

|

|

100

|

|

Management Outlook

We continue to improve our operating margins and maintain operating income levels in a very challenging environment that has caused our revenue levels to decline. We have accomplished this operating margin and operating income performance by transitioning our business away from lower margin revenue that was predominantly driven by pass-through work to more profitable lines of business. While most of the declines in our programs that have experienced revenue losses in recent years have now run their course, our industry will continue to face challenges to future revenue levels caused by changing government budgeting and spending priorities, initiatives, and processes. We believe that we are positioned to withstand these challenges in the coming year.

We have several key programs centered on our legacy systems and equipment sustainment heritage that we expect to sustain our business in the coming years. Our vehicle and equipment refurbishment program for the U.S. Army Reserve and the U.S. Army remains a strong part of our business and we will target additional client locations and other clients to expand this program. While the contract supporting the U. S. Army Reserve work is being re-competed again through various contract vehicles with an expected award date in 2013, we are optimistic that we will continue our long time service on this program. Our FMS Program revenues for the past two years have been generated primarily from follow on technical services work with very little ship reactivation and transfer work. Our win of the protested award of the contract supporting this work in early 2012 gives us potential contract coverage of up to $1.5 billion over a five-year period. This level of contract coverage, combined with the eligibility, upon approval, of multiple U. S. Navy ships for transfer to foreign government clients, is expected to present us with opportunity for revenue growth from this program in future years. We have delivered a vehicle for evaluation under our USPS contract to develop a more fuel efficient repowered gasoline delivery vehicle that will provide USPS with increased fuel efficiency, enhanced environmental standards, and an extended service life of its vehicle fleet. The repowered vehicle uses an engine designed by our WBI subsidiary specifically for the USPS vehicle fleet. If USPS approves the engine and we successfully move this effort to the production stage, we expect to generate an additional future revenue stream. We cannot determine with certainty if or when production will begin. WBI's supply chain and inventory management competencies also provide us opportunities to further diversify our customer base to other markets, including commercial work.

If the automatic spending reductions mandated by the sequestration provisions of the 2011 Budget Control Act are implemented, they would add to the financial challenges facing our industry. Sequestration could result in delaying or canceling of awards across all sectors of the government as each agency determines how to implement budget cuts. Some of our smaller revenue programs, including some energy and IT programs, may potentially be adversely impacted by sequestration. A significant amount of our revenues come from our larger programs that either do not rely on tax funded government spending or provide service life extension for platforms which are unlikely to be replaced through new procurements. Our USPS Managed Inventory Program and Treasury and ATF Seized Asset Programs are largely self-funded through collections of postage and asset auction proceeds, and our FMS Program is largely funded by foreign government clients. Our U. S. Army Reserve vehicle refurbishment program provides our client with a means to maintain necessary levels of vital capital assets while relieving the client of the need to spend larger amounts on replacement assets. While all the specific effects of sequestration cannot yet be determined, we believe that we are positioned to minimize the negative impact it could have on our financial results in the coming years.

During 2012 we made progress in reducing our bank debt despite significant capital investment requirements associated with the move to our new headquarters building and our purchase of office, warehouse and distribution facilities that support our WBI operations. We do not anticipate similar levels of capital investment in 2013, and therefore expect to be able to continue paying down our debt more quickly. This will position us to consider a variety of financial options to increase shareholder value, including acquisitions.

Bookings and Funded Backlog

Our revenues depend on contract funding ("bookings"), which generally occur at the time contract funding documentation is received. For our revenues that depend on bookings arising from the receipt of contract funding documentation, funded contract backlog is an indicator of potential future revenues. While bookings and funded contract backlog generally result in revenues, occasionally we will have funded contract backlog that expires or is de-obligated upon contract completion and does not generate revenue.

Revenues for WBI are predominantly driven by the rate and timing of parts failure on customer vehicles, and WBI bookings generally occur at the time of sale instead of the receipt of contract funding documentation. Accordingly, WBI does not generally have significant amounts of funded contract backlog and such backlog is not an indicator of WBI's potential future revenues.

A summary of our bookings and revenues for the years ended December 31, 2012, 2011 and 2010, and funded contract backlog as of December 31, 2012, 2011 and 2010 is as follows.

|

|

|

(in millions)

|

|

|

|

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

Bookings

|

|

$

|

539

|

|

|

$

|

493

|

|

|

$

|

750

|

|

|

Revenues

|

|

$

|

547

|

|

|

$

|

581

|

|

|

$

|

811

|

|

|

Funded Backlog

|

|

$

|

250

|

|

|

$

|

282

|

|

|

$

|

400

|

|

Recently Issued Accounting Pronouncements

On January 1, 2012, we adopted an update issued by the Financial Accounting Standards Board ("FASB") to existing guidance on the presentation of comprehensive income. This update requires the presentation of the components of net income and other comprehensive income either in a single continuous statement or in two separate but consecutive statements. Net income and other comprehensive income has been presented in two separate but consecutive statements for the current reporting period and prior comparative period in our consolidated financial statements.

Critical Accounting Policies

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States, which require us to make estimates and assumptions. We believe the following critical accounting policies affect the more significant accounts, particularly those that involve judgments, estimates and assumptions used in the preparation of our consolidated financial statements.

Revenue Recognition

Substantially all of our work is performed for our customers on a contract basis. The three primary types of contracts used are time and materials, cost-type, and fixed-price. Revenues result from work performed on these contracts by our employees and our subcontractors and from costs for materials and other work related costs allowed under our contracts.

Revenues for time and materials contracts are recorded on the basis of contract allowable labor hours worked multiplied by the contract defined billing rates, plus the direct costs and indirect cost burdens associated with materials and subcontract work used in performance on the contract. Generally, profits on time and materials contracts result from the difference between the cost of services performed and the contract defined billing rates for these services.