UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

Form 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ____________ to

Commission file number 1-31429

_____________________________________

Valmont Industries, Inc.

(Exact name of registrant as specified in its charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 47-0351813 (I.R.S. Employer Identification No.) |

One Valmont Plaza, Omaha, Nebraska (Address of Principal Executive Offices) | 68154-5215 (Zip Code) |

(402) 963-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of exchange on which registered | |

Common Stock $1.00 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark whether the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | Non‑accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

At February 21, 2017 there were 22,521,423 of the Company’s common shares outstanding. The aggregate market value of the voting stock held by non-affiliates of the Company based on the closing sale price the common shares as reported on the New York Stock Exchange on June 25, 2016 was $2,917,069,089.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s proxy statement for its annual meeting of shareholders to be held on April 25, 2017 (the “Proxy Statement”), to be filed within 120 days of the fiscal year ended December 31, 2016, are incorporated by reference in Part III.

This Introduction of the 10-K is a summary of Valmont Industries, Inc. It does not contain all of the information you should consider. Please read the entire 10-K carefully before voting or making an investment decision. In particular please refer to the following sections:

Note, this introduction does not contain Part III information as most of the information will be incorporated by reference from our proxy statement to be filed for the annual shareholders meeting on April 25, 2017.

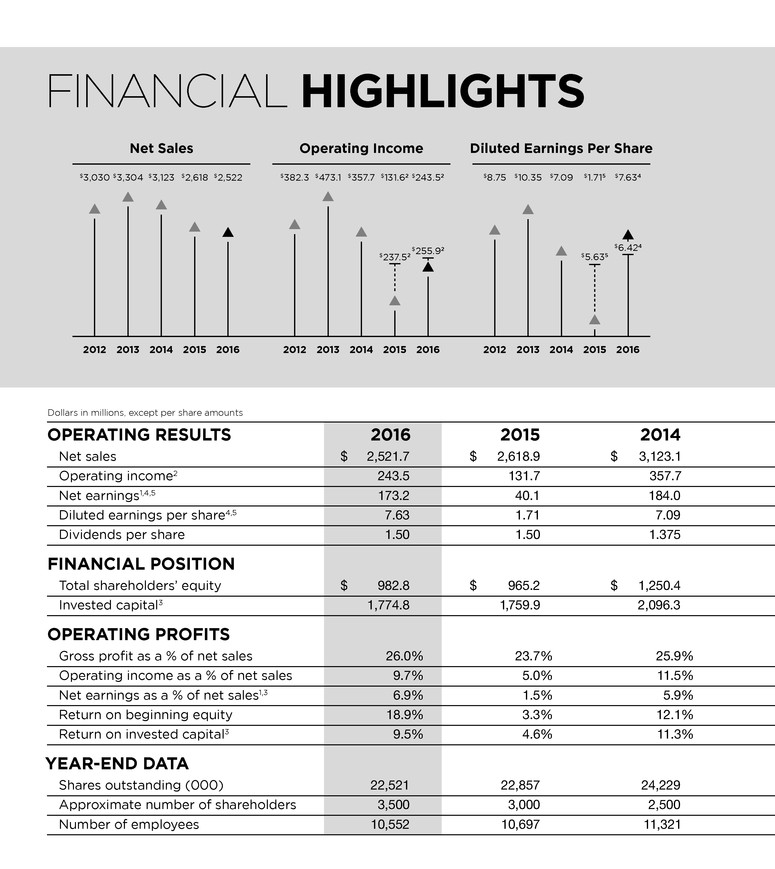

1 Net earnings attributable to Valmont Industries, Inc.

2 Fiscal 2016 GAAP operating income included restructuring expense of $12.4 million (pre-tax). On an adjusted basis, operating income was $255.9 million. Fiscal 2015 GAAP operating income included intangible asset impairments of $42.0 million (pre-tax), restructuring expense of $39.9 million (pre-tax), and other non-recurring expenses of $24.0 million pre-tax on an adjusted basis, operating income was $237.5 million.

3 See Item 6, Selected Financial Data, in this Form 10-K for calculation of invested capital and return on invested capital.

4 Fiscal 2016 included deferred income tax benefit of $30.6 million ($1.35 per share) resulting primarily from the re-measurement of the deferred tax asset for the Company's U.K. defined benefit pension plan. In addition, fiscal 2016 included $9.9 million ($0.44 per share) recorded as a valuation allowance against a tax credit asset. Finally, fiscal 2016 included the reversal of a contingent liability that was recognized as part of the Delta purchase accounting of $16.6 million ($0.73 per share) which is not taxable.

5 Fiscal 2015 included intangible asset impairment of $40.1 million after tax ($1.72 per share), restructuring expense of $28.2 million after tax ($1.20 per share), other non-recurring expenses of $16.3 million after tax ($0.69 per share) and deferred tax expense of $7.1 million ($0.31 per share) due to a change in the U.K. tax rate. Fiscal 2014 included costs associated with refinancing of our long-term debt of $24.2 million after tax ($0.93 per share), and mark-to-market loss of $3.8 million after tax on shares of Delta Pty. Ltd. ($0.15 per share).

For more information on the footnotes above and the reasons why we believe the non-GAAP measures are useful, please see Item 6, Item 7 and Item 8.

VALMONT INDUSTRIES, INC.

Annual Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2016

TABLE OF CONTENTS

Page No. | ||

PART I | ||

Business | ||

Item 1A | Risk Factors | |

Item 1B | Unresolved Staff Comments | |

Item 2 | Properties | |

Item 3 | Legal Proceedings | |

Item 4 | Mine Safety Disclosures | |

PART II | ||

Item 5 | Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |

Item 6 | Selected Financial Data | |

Item 7 | Management's Discussion and Analysis of Financial Condition and Results of Operation | |

Item 7A | Quantitative and Qualitative Disclosures About Market Risk | |

Item 8 | Financial Statements and Supplementary Data | |

Item 9 | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A | Controls and Procedures | |

Item 9B | Other Information | |

Part III | ||

Item 10 | Directors, Executive Officers and Corporate Governance | |

Item 11 | Executive Compensation | |

Item 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13 | Certain Relationships and Related Transactions, and Director Independence | |

Item 14 | Principle Accountant Fees and Services | |

Part IV | ||

Item 15 | Exhibits and Financial Statement Schedules | |

1

PART I

ITEM 1. BUSINESS.

(a) | General Description of Business |

General

We are a diversified global producer of fabricated metal products and are a leading producer of steel, aluminum and composite pole, tower and other structures in our Engineered Support Structures (ESS) segment, steel and concrete pole structures in our Utilities Support Structures (Utility) segment and are a global producer of mechanized irrigation systems in our Irrigation segment. Within our Energy and Mining segment, we manufacture industrial access systems, grinding media used in mining operations, and complex steel structures used in wind energy and utility transmission applications outside the United States. We also provide metal coating services, including galvanizing, painting and anodizing in our Coatings segment. Our products sold through the ESS segment include outdoor lighting, traffic control, and roadway safety structures, wireless communication structures and components. Our pole structures sold through our Utility segment support electrical transmission and distribution lines and related power distribution equipment. Our Irrigation segment produces mechanized irrigation equipment that delivers water, chemical fertilizers and pesticides to agricultural crops. Customers and end-users of our products include state and federal governments, contractors, utility and telecommunications companies, manufacturers of commercial lighting fixtures and large farms as well as the general manufacturing sector. In 2016, approximately 37% of our total sales were either sold in markets or produced by our manufacturing plants outside of North America. We were founded in 1946, went public in 1968 and our shares trade on the New York Stock Exchange (ticker: VMI).

Business Strategy

Our strategy is to pursue growth opportunities that leverage our existing product portfolio, knowledge of our principal end-markets and customers and engineering capability to increase our sales, earnings and cash flow, including:

Increasing the Market Penetration of our Existing Products. Our strategy is to increase our market penetration by differentiating our products from our competitors’ products through superior customer service, technological innovation and consistent high quality. For example, our Utility segment increased its sales between 2010 and 2013 through our engineering capability and strong customer service to meet our customers’ requirements, especially on large, complex projects.

Bringing our Existing Products to New Markets. Our strategy is to expand the sales of our existing products into geographic areas where we do not currently have a strong presence as well as into applications for which end-users do not currently purchase our type of product. We have also expanded our geographic presence in Europe, Middle East, and North Africa for lighting structures. We have also been successful introducing our pole products to utility and wireless communication applications where customers have traditionally purchased lattice tower products. Our strategy of building manufacturing presences in China and India was based primarily on expanding our offering of pole structures for lighting, utility and wireless communication to these markets. Our Irrigation segment has a long history of developing new mechanized irrigation markets in emerging markets. In recent years, these markets include China and Eastern Europe. Our 2015 acquisition of American Galvanizing provides us with a presence in the Northeast U.S. galvanizing market.

Developing New Products for Markets that We Currently Serve. Our strategy is to grow by developing new products for markets where we have a comprehensive understanding of end-user requirements and longstanding relationships with key distributors and end-users. For example, in recent years we developed and sold structures for tramway applications in Europe. The customers for this product line include many of the state and local governments that purchase our lighting structures. Another example is the development and expansion of decorative product concepts for lighting applications that have been introduced to our existing customer base. Our 2014 acquisition of the majority ownership in AgSense allows us to offer expanded remote monitoring services over irrigation equipment and other aspects of a farming operation.

Developing New Products for New Markets and Leverage a Core Competency to Further Diversify our Business. Our strategy is to increase our sales and diversify our business by developing new products for new markets or to leverage a core competency. For example, we have been expanding our offering of specialized decorative lighting poles in the U.S. including the fiberglass composite structures offered through Shakespeare Composite Structures which we acquired in 2014. The decorative lighting market has different customers than our traditional markets and the products to serve that market are different than the poles we manufacture for the transportation and commercial markets. The acquisition of Delta in 2010 gave

2

us a presence in highway safety systems and industrial access systems, products that we believe are complementary to our existing products and provide us with future growth opportunities. The establishment and growth of our Coatings segment was based on using our expertise in galvanizing to develop what is now a global business segment.

Acquisitions

We have grown internally and by acquisition. Our significant business expansions during the past five years include the following (including the segment where the business reports):

2012

• | Acquisition of a galvanizing business with three locations in Ontario, Canada (Coatings) |

2013

• | Acquisition of a manufacturer of perforated, expanded metal for the non-residential market, industrial flooring and handrails for the access systems market, and screening media for applications in the industrial and mining sectors in Australia and Asia (Energy and Mining) |

• | Acquisition of the remaining 40% not previously owned of Valley Irrigation South Africa Pty. Ltd (Irrigation) |

• | Acquisition of a distributor holding proprietary intellectual property for products serving the highway safety market located in New Zealand (ESS) |

2014

• | Acquisition of 90% of a manufacturer of heavy complex steel structures (Valmont SM) with two manufacturing locations in Denmark (Energy and Mining) |

• | Acquisition of a 51% ownership stake in AgSense, which provides farmers with remote monitoring equipment for their pivots and entire farming operation (Irrigation) |

• | Acquisition of a manufacturer of fiberglass composite support structures with two manufacturing locations in South Carolina (ESS) |

2015

• | Acquisition of a galvanizing business located in Hammonton, New Jersey (Coatings) |

2016

• | Acquisition of the remaining 30% not previously owned of IGC Galvanizing Industries (M) Sdn Bhd (Coatings) |

• | Acquisition of 5.2% of the remaining 10% not previously owned of Valmont SM (Energy & Mining) |

There have been no significant divestitures of businesses in the past five years.

(b) Segments

The Company has five reportable segments based on our management structure. Each segment is global in nature with a manager responsible for segment operational performance and allocation of capital within the segment.

Our reportable segments are as follows:

Engineered Support Structures: This segment consists of the manufacture and distribution of engineered metal, wood, and composite structures and components for global lighting and traffic, wireless communication, and roadway safety;

Utility Support Structures: This segment consists of the manufacture of engineered steel and concrete structures for the global utility industry;

Energy and Mining: This segment, all outside of the United States, consists of the manufacture of access systems applications, forged steel grinding media, on and off shore oil, gas, and wind energy structures.

Coatings: This segment consists of galvanizing, anodizing and powder coating services on a global basis; and

Irrigation: This segment consists of the manufacture of agricultural irrigation equipment and related parts and services for the global agricultural industry as well as tubular products for a variety of industrial customers.

3

In addition to these five reportable segments, we had other operations and activities that individually are not more than 10% of consolidated sales, operating income or assets in fiscal years prior to 2016.

Amounts of sales, operating income and total assets attributable to each segment for each of the last three years is set forth in Note 19 of our consolidated financial statements.

(c) | Narrative Description of Business |

Information concerning the principal products produced and services rendered, markets, competition and distribution methods for each of our five reportable segments is set forth below.

Engineered Support Structures Segment

Products Produced—We manufacture steel, aluminum, and composite poles and structures to which lighting and traffic control fixtures are attached for a wide range of outdoor lighting applications, such as streets, highways, parking lots, sports stadiums and commercial and residential developments. The demand for these products is driven by infrastructure, commercial and residential construction and by consumers’ desire for well-lit streets, highways, parking lots and common areas to help make these areas safer at night and to support trends toward more active lifestyles and 24-hour convenience. In addition to safety, customers want products that are visually appealing. In Europe, we are a leader in decorative lighting poles, which are attractive as well as functional. We are leveraging this expertise to expand our decorative product sales in North America and China. Traffic poles are structures to which traffic signals are attached and aid the orderly flow of automobile traffic. While standard designs are available, poles are often engineered to customer specifications to ensure the proper function and safety of the structure. Product engineering takes into account factors such as weather (e.g. wind, ice) and the products loaded on the structure (e.g. lighting fixtures, traffic signals, overhead signs) to determine the design of the pole. This product line also includes roadway safety systems, including guard rail barrier systems, wire rope safety barriers, crash attenuation barriers and other products designed to redirect vehicles when off course and to prevent collisions between vehicles. Highway safety systems are also designed and engineered to absorb collisions and ultimately reduce roadway fatalities and injury.

We also manufacture and distribute a broad range of structures (poles and towers) and components serving the wireless communication market. A wireless communication cell site mainly consists of a steel pole or tower, shelter (enclosure where the radio equipment is located), antennas (devices that receive and transmit data and voice information to and from wireless communication devices) and components (items that are used to mount antennas to the structure and to connect cabling and other parts from the antennas to the shelter). Structures are engineered and designed to customer specifications, which include factors such as the number of antennas on the structure and wind and soil conditions. Due to the size of these structures, design is important to ensure each structure meets performance and safety specifications. We do not provide any significant installation services on the structures we sell.

Markets—The key markets for our lighting, traffic and roadway safety products are the transportation and commercial lighting markets and public roadway building and improvement. The transportation market includes street and highway lighting and traffic control, much of which is driven by government spending programs. For example, the U.S. government funds highway and road improvement through the federal highway program. This program provides funding to improve the nation’s roadway system, which includes roadway lighting and traffic control enhancements. Matching funding from the various states may be required as a condition of federal funding. The current federal highway program was renewed and extended in late 2015. In the United States, there are approximately 4 million miles of public roadways, with approximately 24% carrying over 80% of the traffic. Accordingly, the need to improve traffic flow through traffic controls and lighting is a priority for many communities. Transportation markets in other areas of the world are also heavily funded by local and national governments. The commercial lighting market is mainly funded privately and includes lighting for applications such as parking lots, shopping centers, sports stadiums and business parks. The commercial lighting market is driven by macro-economic factors such as general economic growth rates, interest rates and the commercial construction economy.

The main markets for our communication products have been the wireless telephone carriers and build-to-suit companies (organizations that own cell sites and attach antennas from multiple carriers to the pole or tower structure). We also sell products to state and federal governments for two-way radio communication, radar, broadcasting and security applications. We believe long-term growth should mainly be driven by increased usage, technologies such as 4G (including applications for smart phones, such as streaming video and internet) and demand for improved emergency response systems,

4

as part of the U.S. Homeland Security initiatives. Subscriber growth should continue to increase, although at a lower rate than in the past. In general, as the number of subscribers and usage of wireless communication devices increase, we believe this will result in demand for communication structures and components.

All of the products that we manufacture in this segment are parts of customer investments in basic infrastructure. The total cost of these investments can be substantial, so access to capital is often important to fund infrastructure needs. Due to the nature of these markets, demand can be cyclical as projects sometimes can be delayed due to funding or other issues.

Competition—Our competitive strategy in all of the markets we serve is to provide high value to the customer at a reasonable price. We compete on the basis of product quality, high levels of customer service, timely, complete and accurate delivery of the product and design capability to provide the best solutions to our customers. There are numerous competitors in our markets, most of which are relatively small companies. Companies compete on the basis of price, product quality, reliable delivery and unique product features. Pricing can be very competitive, especially when demand is weak or when strong local currencies result in increased competition from imported products.

Distribution Methods—Sales and distribution activities are handled through a combination of a direct sales force and commissioned agents. Lighting agents represent Valmont as well as lighting fixture companies and sell other related products. Sales are typically to electrical distributors, who provide the pole, fixtures and other equipment to the end user as a complete package. Commercial lighting and highway safety sales are normally made through Valmont sales employees, who work on a salary plus incentive, although some sales are made through independent, commissioned sales agents.

Utility Support Structures Segment

Products Produced—We manufacture steel and concrete pole structures for electrical transmission, substation and distribution applications. Our products help move electrical power from where it is produced to where it is used. We produce tapered steel and pre-stressed concrete poles for high-voltage transmission lines, substations (which transfer high-voltage electricity to low-voltage transmission) and electrical distribution (which carry electricity from the substation to the end-user). In addition, we produce hybrid structures, which are structures with a concrete base section and steel upper sections. Utility structures can be very large, so product design engineering is important to the function and safety of the structure. Our engineering process takes into account weather and loading conditions, such as wind speeds, ice loads and the power lines attached to the structure, in order to arrive at the final design.

Markets—Our sales in this segment are mainly in North America, where the key drivers in the utility business are significant upgrades in the electrical grid to support enhanced reliability standards, policy changes encouraging more generation from renewable energy sources, interconnection of regional grids to share more efficient generation to the benefit of the consumer and increased electrical consumption which has outpaced the transmission investment in the past decades. According to the Edison Electric Institute, the electrical transmission grid in the U.S. requires significant investment in the coming years to respond to the compelling industry drivers and lack of investment over the past 25 years. The expected increase in electrical consumption around the world should also require substantial investment in new electricity generation capacity which will prompt further international growth in transmission grid development. We expect these factors to result in increased demand for electrical utility structures to transport electricity from source to user.

Competition—Our competitive strategy in this segment is to provide high value solutions to the customer at a reasonable price. We compete on the basis of product quality, engineering expertise, high levels of customer service and reliable, timely delivery of the product. There are many competitors. Companies compete on the basis of price, quality and service. Utility sales are often made through a competitive bid process, whereby the lowest bidder is awarded the contract, provided the competitor meets all other qualifying criteria. In weak markets, price is a more important criterion in the bid process.

Distribution Methods—Products are normally sold through commissioned sales agents or sold directly to electrical utilities.

5

Energy and Mining Segment

Products Produced— We produce and distribute access systems, which are engineered structures and components that allow people to move safely and effectively in an industrial, infrastructure or commercial facility. We also produce a line of products which are used in architectural applications. Examples of these products are perforated metal sun screens and facades that can be used on building structures to improve shading and aesthetics. Products offered in this product line are usually engineered to specific customer requirements and include floor gratings, handrails, barriers and sunscreens. This segment also manufactures complex steel structures, rotor houses, crown-mounted compensators, winches, cranes and material handling equipment for offshore and land-based wind energy, oil & gas, and utility transmission outside of North America. We also produce forged steel products used in the mining processing industry.

Markets - Markets for access systems are typically driven by infrastructure, industrial and commercial construction spending and can be cyclical depending on economic conditions in the markets in which we compete. Customers consist of construction firms or installers who participate in infrastructure, industrial and commercial construction projects, natural gas and mineral exploration companies, resellers such as steel service centers, and end users. Markets for the complex steel structures are in oil and gas, wind turbine towers, and material handling systems within Europe. The market for grinding media are mines typically within Australia.

Competition - For both access systems and grinding media, we compete on the basis of product quality and timely, complete and accurate delivery of the product. There are numerous competitors for both of these product lines. Pricing can be very competitive, especially when demand is weak or when strong local currencies result in increased competition from imported products. For offshore and complex steel structures, we compete based on our ability to co-engineer and design solutions with customers, carry out advanced order production of complex steel constructions with electronics and hydraulics and having highly automated series production for more mature products.

Coatings Segment

Services Rendered—We add finishes to metals that inhibit corrosion, extend service lives and enhance physical attractiveness of a wide range of materials and products. Among the services provided include:

• | Hot-dipped Galvanizing |

• | Anodizing |

• | Powder Coating |

• | E-Coating |

In our Coatings segment, we take unfinished products from our customers and return them with a galvanized, anodized or painted finish. Galvanizing is a process that protects steel with a zinc coating that is bonded to the product surface to inhibit rust and corrosion. Anodizing is a process applied to aluminum that oxidizes the surface of the aluminum in a controlled manner, which protects the aluminum from corrosion and allows the material to be dyed a variety of colors. We also paint products using powder coating and e-coating technology (where paint is applied through an electrical charge) for a number of industries and markets.

Markets—Markets for our products are varied and our profitability is not substantially dependent on any one industry or customer. Demand for coatings services generally follows the local industrial economies. Galvanizing is used in a wide variety of industrial applications where corrosion protection of steel is desired. While markets are varied, our markets for anodized or painted products are more directly dependent on consumer markets than industrial markets.

Competition—The Coatings markets traditionally have been very fragmented, with a large number of competitors. Most of these competitors are relatively small, privately held companies who compete on the basis of price and personal relationships with their customers. As a result of ongoing industry consolidation, there are also several (public and private) multi-facility competitors. Our strategy is to compete on the basis of quality of the coating finish and timely delivery of the coated product to the customer. We also use the production capacity at our network of plants to ensure that the customer receives quality, timely service.

6

Distribution Methods—Due to freight costs, a galvanizing location has an effective service area of an approximate 300 to 500 mile radius. While we believe that we are globally one of the largest custom galvanizers, our sales are a small percentage of the total market. Sales and customer service are provided directly to the user by a direct sales force, generally assigned to each specific location.

Irrigation Segment

Products Produced—We manufacture and distribute mechanical irrigation equipment and related service parts under the “Valley” brand name. A Valley irrigation machine usually is powered by electricity and propels itself over a farm field and applies water and chemicals to crops. Water and, in some instances, chemicals are applied through sprinklers attached to a pipeline that is supported by a series of towers, each of which is propelled via a drive train and tires. A standard mechanized irrigation machine (also known as a “center pivot”) rotates in a circle, although we also manufacture and distribute center pivot extensions that can irrigate corners of square and rectangular farm fields as well as conform to irregular field boundaries (referred to as a “corner” machine). Our irrigation machines can also irrigate fields by moving up and down the field as opposed to rotating in a circle (referred to as a “linear” machine). Irrigation machines can be configured to irrigate fields in size from 4 acres to over 500 acres, with a standard size in the U.S. configured for a 160-acre tract of ground. One of the key components of our irrigation machine is the control system. This is the part of the machine that allows the machine to be operated in the manner preferred by the grower, offering control of such factors as on/off timing, individual field sector control, rate and depth of water and chemical application. We also offer growers options to control multiple irrigation machines through centralized computer control or mobile remote control. The irrigation machine used in international markets is substantially the same as the one produced for the North American market.

Other Types of Irrigation — There are other forms of irrigation available to farmers, two of the most prevalent being flood irrigation and drip irrigation. In flood irrigation, water is applied through a pipe or canal at the top of the field and allowed to run down the field by gravity. Drip irrigation involves plastic pipe or tape resting on the surface of the field or buried a few inches below ground level, with water being applied gradually. We estimate that center pivot and linear irrigation comprises 50% of the irrigated acreage in North America. International markets use predominantly flood irrigation, although all forms are used to some extent.

The Company through its majority ownership in AgSense LLC, develops and markets remote monitoring technology for pivot irrigation systems that is sold on a subscription basis under the WagNet product name. WagNet technology allows growers to remotely monitor and operate irrigation equipment and other farm structures such as grain bins. Data management and control is achieved using applications running on either a personal computer-based internet browser or various mobile devices connected to the internet. We also manufacture tubular products for industrial customers primarily in the agriculture industry as well as in the transportation and other industries.

Markets—Market drivers in North American and international markets are essentially the same. Since the purchase of an irrigation machine is a capital expenditure, the purchase decision is based on the expected return on investment. The benefits a grower may realize through investment in mechanical irrigation include improved yields through better irrigation, cost savings through reduced labor and lower water and energy usage. The purchase decision is also affected by current and expected net farm income, commodity prices, interest rates, the status of government support programs and water regulations in local areas. In many international markets, the relative strength or weakness of local currencies as compared with the U.S. dollar may affect net farm income, since export markets are generally denominated in U.S. dollars.

The demand for mechanized irrigation comes from the following sources:

• | conversion from flood irrigation |

• | replacement of existing mechanized irrigation machines |

• | converting land that is not irrigated to mechanized irrigation |

One of the key drivers in our Irrigation segment worldwide is that the usable water supply is limited. We estimate that:

• | only 2.5% of total worldwide water supply is freshwater |

• | of that 2.5%, only 30% of freshwater is available to humans |

• | the largest user of that freshwater is agriculture |

7

We believe these factors, along with the trend of a growing worldwide population and improving diets, reflect the need to use water more efficiently while increasing food production to feed this growing population. We believe that mechanized irrigation can improve water application efficiency by 40-90% compared with traditional irrigation methods by applying water uniformly near the root zone and reducing water runoff. Furthermore, reduced water runoff improves water quality in nearby rivers, aquifers and streams, thereby providing environmental benefits in addition to conservation of water.

Competition—In North America, there are a number of entities that provide irrigation products and services to agricultural customers. We believe we are the leader of the four main participants in the mechanized irrigation business. Participants compete for sales on the basis of price, product innovation and features, product durability and reliability, quality and service capabilities of the local dealer. Pricing can become very competitive, especially in periods when market demand is low. In international markets, our competitors are a combination of our major U.S. competitors and privately‑owned local companies. Competitive factors are similar to those in North America, although pricing tends to be a more prevalent competitive strategy in international markets. Since competition in international markets is local, we believe local manufacturing capability is important to competing effectively in international markets and we have that capability in key regions.

Distribution Methods—We market our irrigation machines and service parts through independent dealers. There are approximately 280 dealer locations in North America, with another approximately 210 dealers serving international markets. The dealer determines the grower’s requirements, designs the configuration of the machine, installs the machine (including providing ancillary products that deliver water and electrical power to the machine) and provides after‑sales service. Our dealer network is supported and trained by our technical and sales teams. Our international dealers are supported through our regional headquarters in South America, South Africa, Western Europe, Australia, China and the United Arab Emirates as well as the home office in Valley, Nebraska.

General

Certain information generally applicable to each of our five reportable segments is set forth below.

Suppliers and Availability of Raw Materials.

Hot rolled steel coil and plate, zinc and other carbon steel products are the primary raw materials utilized in the manufacture of finished products for all segments. We purchase these essential items from steel mills, steel service centers, and zinc producers and these materials are usually readily available. While we may experience increased lead times to acquire materials and volatility in our purchase costs, we do not believe that key raw materials would be unavailable for extended periods. We have not experienced extended or wide-spread shortages of steel during this time, due to what we believe are strong relationships with some of the major steel producers. In the past several years, we experienced volatility in zinc and natural gas prices, but we did not experience any disruptions to our operations due to availability.

Patents, Licenses, Franchises and Concessions.

We have a number of patents for our manufacturing machinery, poles and irrigation designs. We also have a number of registered trademarks. We do not believe the loss of any individual patent or trademark would have a material adverse effect on our financial condition, results of operations or liquidity.

Seasonal Factors in Business.

Sales can be somewhat seasonal based upon the agricultural growing season and the infrastructure construction season. Sales of mechanized irrigation equipment to farmers are traditionally higher during the spring and fall and lower in the summer. Sales of infrastructure products are traditionally higher summer and fall and lower in the winter.

Customers.

We are not dependent for a material part of any segment’s business upon a single customer or upon very few customers. The loss of any one customer would not have a material adverse effect on our financial condition, results of operations or liquidity.

8

Backlog.

The backlog of orders for the principal products manufactured and marketed was $602.9 million at the end of the 2016 fiscal year and $590.4 million at the end of the 2015 fiscal year. An order is reported in our backlog upon receipt of a purchase order from the customer or execution of a sales order contract. We anticipate that most of the 2016 backlog of orders will be filled during fiscal year 2017. At year-end, the segments with backlog were as follows (dollar amounts in millions):

12/31/2016 | 12/26/2015 | ||||||

Engineered Support Structures | $ | 170.9 | $ | 148.2 | |||

Energy & Mining | 99.4 | 110.6 | |||||

Utility Support Structures | 268.1 | 244.6 | |||||

Irrigation | 64.1 | 86.7 | |||||

Coatings | 0.4 | 0.3 | |||||

$ | 602.9 | $ | 590.4 | ||||

Research Activities.

The information called for by this item is included in Note 1 of our consolidated financial statements.

Environmental Disclosure.

We are subject to various federal, state and local laws and regulations pertaining to environmental protection and the discharge of materials into the environment. Although we continually incur expenses and make capital expenditures related to environmental protection, we do not anticipate that future expenditures should materially impact our financial condition, results of operations, or liquidity.

Number of Employees.

At December 31, 2016, we had 10,552 employees.

(d) | Financial Information About Geographic Areas |

Our international sales activities encompass over 100 foreign countries. The information called for by this item is included in Note 19 of our consolidated financial statements. While Australia accounted for approximately 13% of our net sales in 2016, no other foreign country accounted for more than 5% of our net sales. Net sales for purposes of Note 19 include sales to outside customers.

(e) | Available Information |

We make available, free of charge through our Internet web site at http://www.valmont.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission.

9

ITEM 1A. RISK FACTORS.

The following risk factors describe various risks that may affect our business, financial condition and operations.

The ultimate consumers of our products operate in cyclical industries that have been subject to significant downturns which have adversely impacted our sales in the past and may again in the future.

Our sales are sensitive to the market conditions present in the industries in which the ultimate consumers of our products operate, which in some cases have been highly cyclical and subject to substantial downturns. For example, a significant portion of our sales of support structures is to the electric utility industry. Our sales to the U.S. electric utility industry were over $600 million in 2016 and 2015. Purchases of our products are deferrable to the extent that utilities may reduce capital expenditures for reasons such as unfavorable regulatory environments, a slow U.S. economy or financing constraints. In the event of weakness in the demand for utility structures due to reduced or delayed spending for electrical generation and transmission projects, our sales and operating income likely will decrease.

The end users of our mechanized irrigation equipment are farmers. Accordingly, economic changes within the agriculture industry, particularly the level of farm income, may affect sales of these products. From time to time, lower levels of farm income resulted in reduced demand for our mechanized irrigation and tubing products. Farm income decreases when commodity prices, acreage planted, crop yields, government subsidies and export levels decrease. In addition, weather conditions, such as extreme drought may result in reduced availability of water for irrigation, and can affect farmers’ buying decisions. Farm income can also decrease as farmers’ operating costs increase. Increases in oil and natural gas prices result in higher costs of energy and nitrogen‑based fertilizer (which uses natural gas as a major ingredient). Furthermore, uncertainty as to future government agricultural policies may cause indecision on the part of farmers. The status and trend of government farm supports, financing aids and policies regarding the ability to use water for agricultural irrigation can affect the demand for our irrigation equipment. In the United States, certain parts of the country are considering policies that would restrict usage of water for irrigation. All of these factors may cause farmers to delay capital expenditures for farm equipment. Consequently, downturns in the agricultural industry will likely result in a slower, and possibly a negative, rate of growth in irrigation equipment and tubing sales. As of November 2016, the U.S. Department of Agriculture (the “USDA”) estimated U.S. 2016 net farm income to be $66.9 billion, down 17 percent from the USDA’s final U.S. 2015 net farm income of $80.9 billion. If the USDA’s estimate proves accurate, net farm income in 2016 would be at its lowest level since 2009.

We have also experienced cyclical demand for those of our products that we sell to the wireless communications industry. Sales of wireless structures and components to wireless carriers and build-to-suit companies that serve the wireless communications industry have historically been cyclical. These customers may elect to curtail spending on new capacity to focus on cash flow and capital management. Weak market conditions have led to competitive pricing in recent years, putting pressure on our profit margins on sales to this industry. Changes in the competitive structure of the wireless industry, due to industry consolidation or reorganization, may interrupt capital plans of the wireless carriers as they assess their networks.

The access systems and grinding media product lines are dependent on investment spending by our customers in the oil, natural gas, and other mined mineral exploration industries, most specifically in the Asia Pacific region. During periods of continued low oil and natural gas prices, these customers may elect to curtail spending on new exploration sites which will cause us to experience lower demand for these specific product lines.

Due to the cyclical nature of these markets, we have experienced, and in the future we may experience, significant fluctuations in our sales and operating income with respect to a substantial portion of our total product offering, and such fluctuations could be material and adverse to our overall financial condition, results of operations and liquidity.

Changes in prices and reduced availability of key commodities such as steel, aluminum, zinc, natural gas and fuel may increase our operating costs and likely reduce our net sales and profitability.

Hot rolled steel coil and other carbon steel products have historically constituted approximately one-third of the cost of manufacturing our products. We also use large quantities of aluminum for lighting structures and zinc for the galvanization of most of our steel products. Our facilities use large quantities of natural gas for heating and processing tanks in our galvanizing operations. We use gasoline and diesel fuel to transport raw materials to our locations and to deliver finished goods to our customers. The markets for these commodities can be volatile. The following factors increase the cost and reduce the availability of these commodities:

• | increased demand, which occurs when we and other industries require greater quantities of these commodities, which can result in higher prices and lengthen the time it takes to receive these commodities from suppliers; |

10

• | lower production levels of these commodities, due to reduced production capacities or shortages of materials needed to produce these commodities (such as coke and scrap steel for the production of steel) which could result in reduced supplies of these commodities, higher costs for us and increased lead times; |

• | increased cost of major inputs, such as scrap steel, coke, iron ore and energy; |

• | fluctuations in foreign exchange rates can impact the relative cost of these commodities, which may affect the cost effectiveness of imported materials and limit our options in acquiring these commodities; and |

• | international trade disputes, import duties and quotas, since we import some steel for our domestic and foreign manufacturing facilities. |

Increases in the selling prices of our products may not fully recover higher commodity costs and generally lag increases in our costs of these commodities. Consequently, an increase in these commodities will increase our operating costs and likely reduce our profitability. Rising steel prices in 2010 and 2011 put pressure on gross profit margins, especially in our Engineered Support Structures and Utility Support Structures segments. In both of these segments, the elapsed time between the quotation of a sales order and the manufacturing of the product ordered can be several months. As some of these sales are fixed price contracts, rapid increases in steel costs likely will result in lower operating income in these businesses.

Steel prices for both hot rolled coil and plate decreased substantially in North America in 2015 as compared to 2014. Decreases in our product sales pricing and volumes offset the increase in gross profit realized from the lower steel prices. Steel is most significant for our Utility Support Structures segment where the cost of steel has been approximately 50% of the net sales, on average. Assuming a similar sales mix, a hypothetical 20% change in the price of steel would have affected our net sales from our utility support structures segment by approximately $54 million for the year ended December 31, 2016.

We believe the volatility over the past several years was due to significant increases in global steel production and rapid changes in consumption (especially in rapidly growing economies, such as China and India). The speed with which steel suppliers impose price increases on us may prevent us from fully recovering these price increases particularly in our lighting and traffic and utility businesses. In the same respect, rapid decreases in the price of steel can also result in reduced operating margins in our utility businesses due to the long production lead times.

Demand for our infrastructure products and coating services is highly dependent upon the overall level of infrastructure spending.

We manufacture and distribute engineered infrastructure products for lighting and traffic, utility and other specialty applications. Our Coatings segments serve many construction‑related industries. Because these products are used primarily in infrastructure construction, sales in these businesses are highly correlated with the level of construction activity, which historically has been cyclical. Construction activity by our private and government customers is affected by and can decline because of, a number of factors, including (but not limited to):

• | weakness in the general economy, which may negatively affect tax revenues, resulting in reduced funds available for construction; |

• | interest rate increases, which increase the cost of construction financing; and |

• | adverse weather conditions which slow construction activity. |

The current economic uncertainty and slowness in the United States and Europe will have some negative effect on our business. In our North American lighting product line, some of our lighting structure sales are for new residential and commercial areas. As residential and commercial construction remains weak, we have experienced some negative impact on our light pole sales to these markets. In a broader sense, in the event of an overall downturn in the economies in Europe, Australia or China, we may experience decreased demand if our customers have difficulty securing credit for their purchases from us.

In addition, sales in our Engineered Support Structures segment, particularly our lighting, traffic and highway safety products, are highly dependent upon federal, state, local and foreign government spending on infrastructure development projects, such as the 2015 U.S. federal highway bill. The level of spending on such projects may decline for a number of reasons beyond our control, including, among other things, budgetary constraints affecting government spending generally or transportation agencies in particular, decreases in tax revenues and changes in the political climate, including legislative

11

delays, with respect to infrastructure appropriations. For instance, the lack of long-term U.S. federal highway spending legislation for a significant period of time prior to the 2015 U.S. federal highway bill has had a negative impact on our sales in this market. A substantial reduction in the level of government appropriations for infrastructure projects could have a material adverse effect on our results of operations or liquidity.

We may lose some of our foreign investment or our foreign sales and profits may reduce because of risks of doing business in foreign markets.

We are an international manufacturing company with operations around the world. At December 31, 2016, we operated over 80 manufacturing plants, located on six continents, and sold our products in more than 100 countries. In 2016, approximately 37% of our total sales were either sold in markets or produced by our manufacturing plants outside of North America. We have operations in geographic markets that have recently experienced political instability, such as the Middle East, and economic uncertainty, such as Western Europe. Our geographic diversity also requires that we hire, train and retain competent management for the various local markets. We also have a significant manufacturing presence in Australia, Europe and China. We expect that international sales will continue to account for a significant percentage of our net sales in the future. Accordingly, our foreign business operations and our foreign sales and profits are subject to the following potential risks:

• | political and economic instability where we have foreign business operations, resulting in the reduction of the value of, or the loss of, our investment; |

• | recessions in economies of countries in which we have business operations, decreasing our international sales; |

• | difficulties and costs of staffing and managing our foreign operations, increasing our foreign operating costs and decreasing profits; |

• | potential violation of local laws or unsanctioned management actions that could affect our profitability or ability to compete in certain markets; |

• | difficulties in enforcing our rights outside the United States for patents on our manufacturing machinery, poles and irrigation designs; |

• | increases in tariffs, export controls, taxes and other trade barriers reducing our international sales and our profit on these sales; and |

• | acts of war or terrorism. |

As a result, we may lose some of our foreign investment or our foreign sales and profits may be materially reduced because of risks of doing business in foreign markets. In 2015, we recorded a $7 million allowance for doubtful accounts in our Irrigation segment related to a long-term receivable with a Chinese municipal entity.

Failure to comply with any applicable anti-corruption legislation could result in fines, criminal penalties and an adverse effect on our business.

We must comply with all applicable laws, which may include the U.S. Foreign Corrupt Practices Act (FCPA), the UK Bribery Act or other anti-corruption laws. These anti-corruption laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value to improperly influence government officials or private individuals for the purpose of obtaining or retaining a business advantage regardless of whether those practices are legal or culturally expected in a particular jurisdiction. Recently, there has been a substantial increase in the global enforcement of anti-corruption laws. Although we have a compliance program in place designed to reduce the likelihood of potential violations of such laws, violations of these laws could result in criminal or civil sanctions and an adverse effect on the company’s reputation, business and results of operations and financial condition.

12

We are subject to currency fluctuations from our international sales, which can negatively impact our reported earnings.

We sell our products in many countries around the world. Approximately 39% of our fiscal 2016 sales were in markets outside the United States and are often made in foreign currencies, mainly the Australian dollar, euro, Brazilian real, Canadian dollar, Chinese renminbi and South African rand. Because our financial statements are denominated in U.S. dollars, fluctuations in currency exchange rates between the U.S. dollar and other currencies have had and will continue to have an impact on our reported earnings. For example, the U.S. dollar appreciated significantly against most currencies in fiscal 2015. The most significant impact was involving our Australian sales measured in U.S. dollar terms that decreased by approximately $68 million due to exchange rate translation effects in fiscal 2015. If the U.S. dollar weakens or strengthens versus the foreign currencies mentioned above, the result will be an increase or decrease in our reported sales and earnings, respectively. Currency fluctuations have affected our financial performance in the past and may affect our financial performance in any given period. In 2016, we realized a $1.6 million decrease in operating profit, as compared to 2015, from currency translation effects. In cases where local currencies are strong, the relative cost of goods imported from outside our country of operation becomes lower and affects our ability to compete profitably in our home markets.

We also face risks arising from the imposition of foreign exchange controls and currency devaluations. Exchange controls may limit our ability to convert foreign currencies into U.S. dollars or to remit dividends and other payments by our foreign subsidiaries or businesses located in or conducted within a country imposing controls. Currency devaluations result in a diminished value of funds denominated in the currency of the country instituting the devaluation. Actions of this nature could have a material adverse effect on our results of operations and financial condition in any given period.

Our businesses require skilled labor and management talent and we may be unable to attract and retain qualified employees.

Our businesses require skilled factory workers and management in order to meet our customer’s needs, grow our sales and maintain competitive advantages. Skills such as welding, equipment maintenance and operating complex manufacturing machinery may be in short supply in certain geographic areas (ex. United States), leading to shortages of skilled labor and/or increased labor costs. Management talent is critical as well, to help grow our businesses and effectively plan for succession of key employees upon retirement. In some geographic areas, skilled management talent in certain areas may be difficult to find. To the extent we have difficulty in finding and retaining these skills in the workforce, there may be an adverse effect on our ability to grow profitably in the future.

We may incur significant warranty or contract management costs.

In our Utility Support Structures segment, we manufacture large structures for electrical transmission. These products may be highly engineered for very large, complex contracts and subject to terms and conditions that penalize us for late delivery and result in consequential and compensatory damages. From time to time, we may have a product quality issue on a large utility structures order and the costs of curing that issue may be significant. For example, we recorded a $17.0 million reserve in the fourth quarter of 2015 for a commercial settlement with a large customer that requires ongoing quality monitoring. Our products in the Engineered Support Structures segment include structures for a wide range of outdoor lighting and wireless communication applications.

In our Irrigation segment, our products are covered under warranties, some for several years. We may incur significant warranty or product related costs, which may include repairing or replacing defective or non-conforming products, even if another party may have contributed to the problem. In such cases, the costs of correcting the quality issue may be significant.

We face strong competition in our markets.

We face competitive pressures from a variety of companies in each of the markets we serve. Our competitors include companies who provide the technologies that we provide as well as companies who provide competing technologies, such as drip irrigation. Our competitors include international, national, and local manufacturers, some of whom may have greater financial, manufacturing, marketing and technical resources than we do, or greater penetration in or familiarity with a particular geographic market than we have.

13

In addition, certain of our competitors, particularly with respect to our utility and wireless communication product lines, have sought bankruptcy protection in recent years, and may emerge with reduced debt service obligations, which could allow them to operate at pricing levels that put pressures on our margins. Some of our customers have moved manufacturing operations or product sourcing overseas, which can negatively impact our sales of galvanizing and anodizing services.

To remain competitive, we will need to invest continuously in manufacturing, product development and customer service, and we may need to reduce our prices, particularly with respect to customers in industries that are experiencing downturns. We cannot provide assurance that we will be able to maintain our competitive position in each of the markets that we serve.

We could incur substantial costs as the result of violations of, or liabilities under, environmental laws.

Our facilities and operations are subject to U.S. and foreign laws and regulations relating to the protection of the environment, including those governing the discharge of pollutants into the air and water, the management and disposal of hazardous substances and wastes, and the cleanup of contamination. Failure to comply with these laws and regulations, or with the permits required for our operations, could result in fines or civil or criminal sanctions, third party claims for property damage or personal injury, and investigation and cleanup costs. Potentially significant expenditures could be required in order to comply with environmental laws that regulators may adopt or impose in the future.

Certain of our facilities have been in operation for many years and, over time, we and other predecessor operators of these facilities have generated, used, handled and disposed of hazardous and other regulated wastes. We detected contaminants at some of our present and former sites, principally in connection with historical operations. In addition, from time to time we have been named as a potentially responsible party under Superfund or similar state laws. While we are not aware of any contaminated sites that are not provided for in our financial statements, including third‑party sites, at which we may have material obligations, the discovery of additional contaminants or the imposition of additional cleanup obligations at these sites could result in significant liability beyond amounts provided for in our financial statements.

We may not realize the improved operating results that we anticipate from acquisitions we may make in the future, and we may experience difficulties in integrating the acquired businesses or may inherit significant liabilities related to such businesses.

We explore opportunities to acquire businesses that we believe are related to our core competencies from time to time, some of which may be material to us. We expect such acquisitions will produce operating results better than those historically experienced or presently expected to be experienced in the future by us in the absence of the acquisition. We cannot provide assurance that this assumption will prove correct with respect to any acquisition.

Any future acquisitions may present significant challenges for our management due to the time and resources required to properly integrate management, employees, information systems, accounting controls, personnel and administrative functions of the acquired business with those of Valmont and to manage the combined company on a going forward basis. We may not be able to completely integrate and streamline overlapping functions or, if such activities are successfully accomplished, such integration may be more costly to accomplish than presently contemplated. We may also have difficulty in successfully integrating the product offerings of Valmont and acquired businesses to improve our collective product offering. Our efforts to integrate acquired businesses could be affected by a number of factors beyond our control, including general economic conditions. In addition, the process of integrating acquired businesses could cause the interruption of, or loss of momentum in, the activities of our existing business. The diversion of management’s attention and any delays or difficulties encountered in connection with the integration acquired businesses could adversely impact our business, results of operations and liquidity, and the benefits we anticipate may never materialize. These factors are relevant to any acquisition we undertake.

In addition, although we conduct reviews of businesses we acquire, we may be subject to unexpected claims or liabilities, including environmental cleanup costs, as a result of these acquisitions. Such claims or liabilities could be costly to defend or resolve and be material in amount, and thus could materially and adversely affect our business and results of operations and liquidity.

14

We have, from time to time, maintained a substantial amount of outstanding indebtedness, which could impair our ability to operate our business and react to changes in our business, remain in compliance with debt covenants and make payments on our debt.

As of December 31, 2016, we had $756.4 million of total indebtedness outstanding. We had $584.6 million of capacity to borrow under our revolving credit facility at December 31, 2016. We normally borrow money to make business acquisitions and major capital expenditures. From time to time, our borrowings have been significant. Our level of indebtedness could have important consequences, including:

• | our ability to satisfy our obligations under our debt agreements could be affected and any failure to comply with the requirements, including significant financial and other restrictive covenants, of any of our debt agreements could result in an event of default under the agreements governing our indebtedness; |

• | a substantial portion of our cash flow from operations will be required to make interest and principal payments and will not be available for operations, working capital, capital expenditures, expansion, or general corporate and other purposes, including possible future acquisitions that we believe would be beneficial to our business; |

• | our ability to obtain additional financing in the future may be impaired; |

• | we may be more highly leveraged than our competitors, which may place us at a competitive disadvantage; |

• | our flexibility in planning for, or reacting to, changes in our business and industry may be limited; and |

• | our degree of leverage may make us more vulnerable in the event of a downturn in our business, our industry or the economy in general. |

We had $399.9 million of cash at December 31, 2016, which mitigates a portion of the risk associated with our debt. However, approximately 82% of our consolidated cash balances are outside the United States and most of our interest‑bearing debt is borrowed by U.S. entities. In the event that we would have to repatriate cash from international operations to meet cash needs in the U.S., we are likely to incur significant income tax expenses to repatriate that cash. In addition, as we use cash for acquisitions and other purposes, any of these factors could have a material adverse effect on our business, financial condition, results of operations, cash flows and business prospects.

The restrictions and covenants in our debt agreements could limit our ability to obtain future financings, make needed capital expenditures, withstand a future downturn in our business, or the economy in general, or otherwise conduct necessary corporate activities. These covenants may prevent us from taking advantage of business opportunities that arise.

A breach of any of these covenants would result in a default under the applicable debt agreement. A default, if not waived, could result in acceleration of the debt outstanding under the agreement and in a default with respect to, and acceleration of, the debt outstanding under our other debt agreements. The accelerated debt would become immediately due and payable. If that should occur, we may not be able to pay all such debt or to borrow sufficient funds to refinance it. Even if new financing were then available, it may not be on terms that are favorable to us.

We assumed an underfunded pension liability as part of the Delta acquisition and the combined company may be required to increase funding of the plan and/or be subject to restrictions on the use of excess cash.

Delta is the sponsor of a United Kingdom defined benefit pension plan that, as of December 31, 2016, covered approximately 6,500 inactive or retired former Delta employees. At December 31, 2016, this plan was, for accounting purposes, underfunded by approximately £169.8 million ($209.5 million). The current agreement with the trustees of the pension plan for annual funding is approximately £10.0 million ($12.3 million) in respect of the funding shortfall and approximately £1.1 million ($1.4 million) in respect of administrative expenses. Although this funding obligation was considered in the offer price for the Delta shares, the underfunded position may adversely affect the combined company as follows:

• | Laws and regulations in the United Kingdom normally require the plan trustees and us to agree on a new funding plan every three years. The next funding plan will be developed in 2019. Changes in actuarial assumptions, including future discount, inflation and interest rates, investment returns and mortality rates, may |

15

increase the underfunded position of the pension plan and cause the combined company to increase its funding levels in the pension plan to cover underfunded liabilities.

• | The United Kingdom regulates the pension plan and the trustees represent the interests of covered workers. Laws and regulations, under certain circumstances, could create an immediate funding obligation to the pension plan which could be significantly greater than the £169.8 million ($209.5 million) assumed for accounting purposes as of December 31, 2016. Such immediate funding is calculated by reference to the cost of buying out liabilities on the insurance market, and could affect our ability to fund the Company’s future growth of the business or finance other obligations. |

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Our corporate headquarters are located in a leased facility in Omaha, Nebraska, under a lease expiring in 2021. The headquarters of the Company’s reportable segments are located in Valley, Nebraska. We also maintain a management headquarters in Sydney, Australia. Most of our significant manufacturing locations are owned or are subject to long-term renewable leases. Our principal manufacturing locations are in Valley, Nebraska, McCook, Nebraska, Tulsa, Oklahoma, Brenham, Texas, Charmeil, France and Shanghai, China. All of these facilities are owned by us. We believe that our manufacturing capabilities and capacities are adequate for us to effectively serve our customers. Our capital spending programs consist of investment for replacement, achieving operational efficiencies and expand capacities where needed. Our principal operating locations by reportable segment are listed below.

Engineered Support Structures segment North America manufacturing locations are in Nebraska, Texas, Indiana, Minnesota, Oregon, South Carolina, Washington and Canada. The largest of these operations are in Valley, Nebraska and Brenham, Texas, both of which are owned facilities. We have communication components distribution locations in New York, California, Florida, Georgia, and Texas. International locations are in France, the Netherlands, Finland, Estonia, England, Germany, Poland, Morocco, Australia, Indonesia, the Philippines, Thailand, Malaysia, India and China. The largest of these operations are in Charmeil, France and Shanghai, China, all of which are owned facilities.

Utility Support Structures segment North America manufacturing locations are in Alabama, Georgia, Florida, California, Texas, Oklahoma, Pennsylvania, Tennessee, Kansas, Nebraska and Mexico. The largest of these operations are in Tulsa, Oklahoma, Monterrey, Mexico and Hazleton, Pennsylvania. The Tulsa and Monterrey facilities are owned and the Hazleton facility is located on both owned and leased property. Principal international manufacturing locations are in China and France.

Energy and Mining segment is all international locations with manufacturing in Australia, Denmark, Indonesia, Philippines, Thailand, Malaysia and China. The largest of these operations are in Australia, Denmark, and China.

Coatings segment North America operations include U.S. operations located in Nebraska, California, Minnesota, Iowa, Indiana, Illinois, Kansas, New Jersey, Oregon, Utah, Oklahoma, Texas, Virginia, Alabama, Florida and South Carolina and two locations near Toronto, Canada. International operations are located in Australia, Malaysia, the Philippines and India.

Irrigation segment North America manufacturing operations are located in Valley and McCook, Nebraska. Our principal manufacturing operations serving international markets are located in Uberaba, Brazil, Nigel, South Africa, Jebel Ali, United Arab Emirates, Madrid, Spain and Shandong, China. All facilities are owned except for China, which is leased.

Our other North America operations were located in Nebraska and Oregon.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to, nor are any of our properties subject to, any material legal proceedings. We are, from time to time, engaged in routine litigation incidental to our businesses.

16

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

Executive Officers of the Company

Our executive officers at January 20, 2017, their ages, positions held, and the business experience of each during the past five years are, as follows:

Mogens C. Bay, age 68, Chairman and Chief Executive Officer since January 1997.

Mark C. Jaksich, age 59, Executive Vice President and Chief Financial Officer since February 2014. Vice President and Controller, February 2000 to February 2014.

Stephen G. Kaniewski, age 45, President and Chief Operating Officer since October 2016. Joined Valmont in August 2010 as Vice President-Information Technology, and later in January 2014 moved into the Vice President-Global Operations role for the Irrigation segment. In January 2015, he transferred to the Utility Support Structures segment as Senior Vice President and Managing Director and in August 2015 became Group President of Utility Support Structures segment.

Barry A. Ruffalo, age 47, Executive Vice President since March 2015. Mr. Ruffalo was a Group President of various divisions of Lindsay Corporation, an irrigation and infrastructure manufacturer, between 2007 and March 2015.

Vanessa K. Brown, age 64, Senior Vice President-Human Resources since July 2011. Director of Human Resources of North America Engineered Support Structures division from 1997 until 2011.

Timothy P. Francis, age 40, Vice President and Controller since June 2014. Mr. Francis served as Chief Financial Officer of Burlington Capital Group LLC (“BCG”) and America First Multifamily Investors, L.P. (“ATAX”), a NASDAQ listed Limited Partnership in which BCG serves as the General Partner, from January 2012 to May 2014.

John A. Kehoe, age 47, Vice President of Information Technology since June 2014. Mr. Kehoe was a senior information technology executive at Rockwell Collins, an aerospace and defense contractor and manufacturer, from 2004 - 2014.

.

17

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our common stock is traded on the New York Stock Exchange under the symbol “VMI”. We had approximately 3,500 shareholders of common stock at December 31, 2016. Other stock information required by this item is included in Note 21 “Quarterly Financial Data (unaudited)” to the consolidated financial statements and incorporated herein by reference.

Issuer Purchases of Equity Securities

Period | (a) Total Number of Shares Purchased | (b) Average Price paid per share | (c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs | (d) Approximate Dollar Value of Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs | ||||||||||

September 25, 2016 to October 22, 2016 | 30,100 | $ | 128.38 | 30,100 | $ | 135,527,000 | ||||||||

October 23, 2016 to November 26, 2016 | 26,772 | 125.31 | 26,772 | 132,172,000 | ||||||||||

November 27, 2016 to December 31, 2016 | — | — | — | 132,172,000 | ||||||||||

Total | 56,872 | $ | 126.93 | 56,872 | $ | 132,172,000 | ||||||||

On May 13, 2014, we announced a capital allocation philosophy which covered both the quarterly dividend rate as well as a share repurchase program. Specifically, the Board of Directors authorized the purchase of up to $500 million of the Company's outstanding common stock from time to time over twelve months at prevailing market prices, through open market or privately-negotiated transactions. On February 24, 2015, the Board of Directors authorized additional purchases of up to $250 million of the Company's outstanding common stock with no stated expiration date. As of December 31, 2016, we have acquired 4,588,131 shares for approximately $617.8 million under this share repurchase program.

18

ITEM 6. SELECTED FINANCIAL DATA.