Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 | |

AXA PREMIER VIP TRUST

EQ ADVISORS TRUST

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

AXA EQUITABLE LIFE INSURANCE COMPANY

1290 Avenue of the Americas

New York, New York 10104

February 10, 2017

Dear Contractholder:

Enclosed is a notice and joint proxy statement relating to a Joint Special Meeting of Shareholders of the AXA Premier VIP Trust (the “VIP Trust”) and the EQ Advisors Trust (the “EQ Trust”) (each, a “Trust” and together, the “Trusts”). The Joint Special Meeting of Shareholders is scheduled to be held at the Trusts’ offices, located at 1290 Avenue of the Americas, New York, New York 10104, on March 28, 2017, at 2:30 p.m., Eastern time (the “Meeting”).

The VIP Trust and the EQ Trust are “series” investment companies comprised of separate portfolios (the “VIP Portfolios” and the “EQ Portfolios,” respectively) (each, a “Portfolio” and together, the “Portfolios”). The Portfolios are identified in the tables beginning on page 2 of the joint proxy statement.

As an owner of a variable life insurance policy and/or variable annuity contract or certificate (a “Contract”) that participates in one or more of the Portfolios through the investment divisions of a separate account or accounts established by AXA Equitable Life Insurance Company or another insurance company (each, an “Insurance Company”), you (a “Contractholder”) are entitled to instruct the Insurance Company that issued your policy or contract how to vote the applicable Portfolio shares related to your interest in those accounts as of the close of business on December 31, 2016. The Insurance Company that issued your policy or contract is the record owner of the Portfolio shares related to your interest in those accounts and is referred to as a “shareholder.” The attached Notice of Joint Special Meeting of Shareholders and Joint Proxy Statement concerning the Meeting describe the matters to be considered at the Meeting.

At the Meeting, the shareholders of each Portfolio who are entitled to vote at the Meeting will be asked to approve the proposals applicable to that Portfolio, as described below:

| 1. | Elect a Board of Trustees. |

| 2. | Approve changes to a Portfolio’s fundamental investment restrictions with respect to: |

| a. | diversification |

| b. | borrowing money |

| c. | issuing senior securities |

| d. | issuing senior securities and borrowing money |

| e. | underwriting |

| f. | concentrating |

Table of Contents

| g. | investing in real estate |

| h. | investing in commodities |

| i. | making loans |

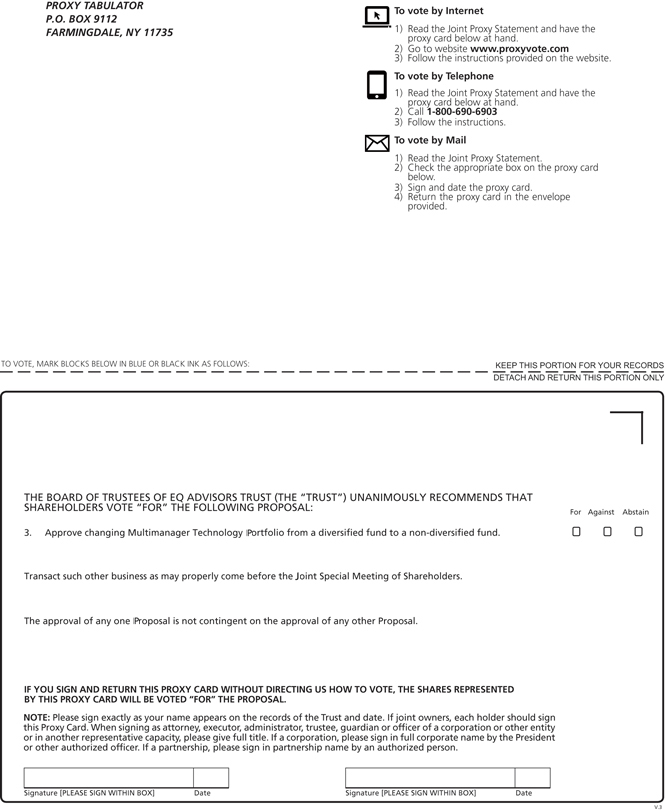

| 3. | Approve changing Multimanager Technology Portfolio from a diversified fund to a non-diversified fund. |

Under Proposal 1, the shareholders of each Trust are being asked separately to elect 10 trustee nominees to serve on the Board of Trustees of their Trust.

The shareholders of the EQ Portfolios are being asked to elect each of the eight current members of the Board of Trustees of the EQ Trust (the “EQ Board”) as well as two new trustee nominees to serve on the EQ Board.

The shareholders of the VIP Portfolios are being asked to elect the same 10 individuals who have been nominated to serve on the EQ Board to serve as the Board of Trustees for the VIP Trust (the “VIP Board”). Eight of the 10 trustee nominees are currently members of the EQ Board, and the remaining two trustee nominees are first-time nominees for the EQ Board. If shareholders of the VIP Portfolios and the EQ Portfolios separately approve the election of the 10 trustee nominees, the same Board of Trustees would oversee both Trusts. Shareholders of the VIP Portfolios are being asked to elect the same members of the EQ Board to serve on the VIP Board in order to create a unified governance and oversight structure for the registered investment companies in the fund complex, which has the potential to provide certain future cost savings for the Trusts, as well as certain administrative efficiencies.

Under Proposals 2.A. through 2.I., the shareholders of each Portfolio (other than the All Asset Moderate Growth – Alt 15 Portfolio) are being asked to approve changes to the fundamental investment restrictions that apply to that Portfolio. The Investment Company Act of 1940, as amended, (the “1940 Act”) requires all mutual funds (such as the Portfolios) to adopt certain “fundamental” investment restrictions with respect to several specific types of investment activities. Fundamental investment restrictions cannot be changed without shareholder approval. The amendments described in Proposals 2.A. through 2.I. are intended to give the Portfolios greater flexibility to take advantage of, and react to, changing financial markets, new investment opportunities, and future changes in applicable law — without the expense and delay of seeking further shareholder approval. The amendments are also intended to create more uniform investment restrictions among the mutual funds in the fund complex. The shareholders of the All Asset Moderate Growth – Alt 15 Portfolio will be asked, by means of a separate proposal in a separate proxy statement, to approve changes to the fundamental investment restrictions that apply to that Portfolio.

Under Proposal 3, the shareholders of Multimanager Technology Portfolio are being asked to change the Portfolio from a diversified fund to a non-diversified fund. Shareholder approval of this change would enable the Portfolio to invest larger percentages of its assets in the securities of a single issuer. The proposed change would provide the Portfolio with increased flexibility to respond to future investment opportunities.

Table of Contents

The Board of Trustees of each Trust has approved the proposals identified above with respect to your Portfolio(s) and recommends that you vote “FOR” each of the proposals on which you are being asked to vote. Although each Board of Trustees has determined that a vote “FOR” each proposal is in your best interest, the final decision is yours.

You are cordially invited to attend the Meeting. Since it is important that your vote be represented whether or not you are able to attend, you are urged to consider these matters and to exercise your voting instructions by completing, dating and signing the enclosed voting instruction card and returning it in the accompanying return envelope at your earliest convenience or by relaying your voting instructions via telephone or the Internet by following the enclosed instructions. For further information on how to instruct an Insurance Company, please see the Contractholder Voting Instructions included herein. Of course, we hope that you will be able to attend the Meeting, and if you wish, you may provide voting instructions in person, even though you may have already returned a voting instruction card or submitted your voting instructions via telephone or the Internet. Please respond promptly in order to save additional costs of proxy solicitation and in order to make sure you are represented.

| Sincerely, | ||

| Steven M. Joenk | ||

| Managing Director | ||

| AXA Equitable Life Insurance Company | ||

Table of Contents

AXA PREMIER VIP TRUST

EQ ADVISORS TRUST

1290 Avenue of the Americas

New York, New York 10104

NOTICE OF JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 28, 2017

To the Shareholders:

NOTICE IS HEREBY GIVEN that a Joint Special Meeting of Shareholders of the AXA Premier VIP Trust (the “VIP Trust”) and the EQ Advisors Trust (the “EQ Trust”) (each, a “Trust” and together, the “Trusts”) will be held at the Trusts’ offices, located at 1290 Avenue of the Americas, New York, New York 10104, on March 28, 2017, at 2:30 p.m., Eastern time (the “Meeting”).

The VIP Trust and the EQ Trust are “series” investment companies comprised of separate portfolios (the “VIP Portfolios” and the “EQ Portfolios,” respectively) (each, a “Portfolio” and together, the “Portfolios”). The Portfolios are identified in the tables beginning on page 2 of the Joint Proxy Statement attached to this notice.

The purpose of the Meeting is to consider and act upon the matters described below:

| 1. | Elect a Board of Trustees. |

| 2. | Approve changes to a Portfolio’s fundamental investment restrictions with respect to, as applicable: |

| a. | diversification |

| b. | borrowing money |

| c. | issuing senior securities |

| d. | issuing senior securities and borrowing money |

| e. | underwriting |

| f. | concentrating |

| g. | investing in real estate |

| h. | investing in commodities |

| i. | making loans |

| 3. | Approve changing Multimanager Technology Portfolio from a diversified fund to a non-diversified fund. |

| 4. | Transact such other business that may properly come before the Meeting or any adjournments thereof. |

i

Table of Contents

The Board of Trustees of each Trust unanimously recommends that you vote in favor of each proposal on which you are being asked to vote.

Please note that owners of variable life insurance policies and/or variable annuity contracts or certificates (the “Contractholders”) issued by AXA Equitable Life Insurance Company or another insurance company (each, an “Insurance Company”) who have invested in shares of one or more of the Portfolios through the investment divisions of a separate account or accounts of an Insurance Company will be given the opportunity to provide the applicable Insurance Company with voting instructions on the above matters.

You should read the Joint Proxy Statement attached to this notice prior to completing your proxy or voting instruction card(s). The record date for determining the number of shares outstanding, the shareholders entitled to vote, and the Contractholders entitled to provide voting instructions at the Meeting and any adjournments or postponements thereof has been fixed as the close of business on December 31, 2016. If you attend the Meeting, you may vote or provide your voting instructions in person.

YOUR VOTE IS IMPORTANT

Please return your proxy card(s) or voting instruction card(s) promptly

Regardless of whether you plan to attend the Meeting, you should vote or provide voting instructions by promptly completing, dating and signing the enclosed proxy or voting instruction card(s) for the Portfolio(s) in which you directly or indirectly own shares and returning the card(s) in the enclosed postage-paid envelope. You also can vote or provide voting instructions through the Internet or by telephone using the 16-digit control number that appears on the enclosed proxy or voting instruction card(s) and following the simple instructions. If you are present at the Meeting, you may change your vote or voting instructions, if desired, at that time. Your Board(s) recommend(s) that you vote or provide voting instructions to vote “FOR” each proposal on which you are being asked to vote.

| By Order of the Boards of Trustees,

Patricia Louie Secretary |

Dated: February 10, 2017

New York, New York

ii

Table of Contents

AXA EQUITABLE LIFE INSURANCE COMPANY

CONTRACTHOLDER VOTING INSTRUCTIONS

FOR THE JOINT SPECIAL MEETING OF SHAREHOLDERS OF

AXA PREMIER VIP TRUST

EQ ADVISORS TRUST

TO BE HELD ON MARCH 28, 2017

Dated: February 10, 2017

GENERAL

These Contractholder Voting Instructions are being furnished by AXA Equitable Life Insurance Company (“AXA Equitable”) or another insurance company (each, an “Insurance Company” and together, the “Insurance Companies”) to owners of their variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contractholders”) who, as of December 31, 2016 (the “Record Date”), had net premiums or contributions allocated to the investment divisions of a separate account or accounts (the “Separate Accounts”) that are invested in shares of one or more of the portfolios (each, a “Portfolio” and together, the “Portfolios”) of the AXA Premier VIP Trust (the “VIP Trust”) and/or the EQ Advisors Trust (the “EQ Trust”) (each, a “Trust” and together, the “Trusts”). Each Trust is a Delaware statutory trust that is registered with the U.S. Securities and Exchange Commission as an open-end management investment company.

Each Insurance Company will offer Contractholders the opportunity to instruct it, as the record owner of all of the shares of beneficial interest in the Portfolios held by its Separate Accounts, as to how it should vote on the relevant proposals (each, a “Proposal” and together, the “Proposals”) that will be considered at the Joint Special Meeting of Shareholders referred to in the preceding Notice and at any adjournments or postponements (the “Meeting”). The enclosed Joint Proxy Statement, which you should read and retain for future reference, sets forth concisely information about the Proposals that a Contractholder should know before completing the enclosed voting instruction card(s).

AXA Equitable is a wholly owned subsidiary of AXA Financial, Inc. AXA Financial, Inc. is a wholly owned subsidiary of AXA, a French insurance holding company. The principal executive offices of AXA Equitable and AXA Financial, Inc. are located at 1290 Avenue of the Americas, New York, New York 10104.

These Contractholder Voting Instructions and the accompanying voting instruction card(s), together with the enclosed proxy materials, are being mailed to Contractholders on or about February 10, 2017.

i

Table of Contents

HOW TO INSTRUCT AN INSURANCE COMPANY

To instruct an Insurance Company as to how to vote the shares held in the investment divisions of its Separate Accounts, Contractholders are asked to promptly complete their voting instructions on the enclosed voting instruction card(s), sign and date the voting instruction card(s), and mail the voting instruction card(s) in the accompanying postage-paid envelope. Contractholders also may provide voting instructions by telephone at 1-800-690-6903 or by Internet at our website at www.proxyvote.com.

If a voting instruction card is not marked to indicate voting instructions but is signed and timely returned, it will be treated as an instruction to vote the shares “FOR” the applicable Proposals.

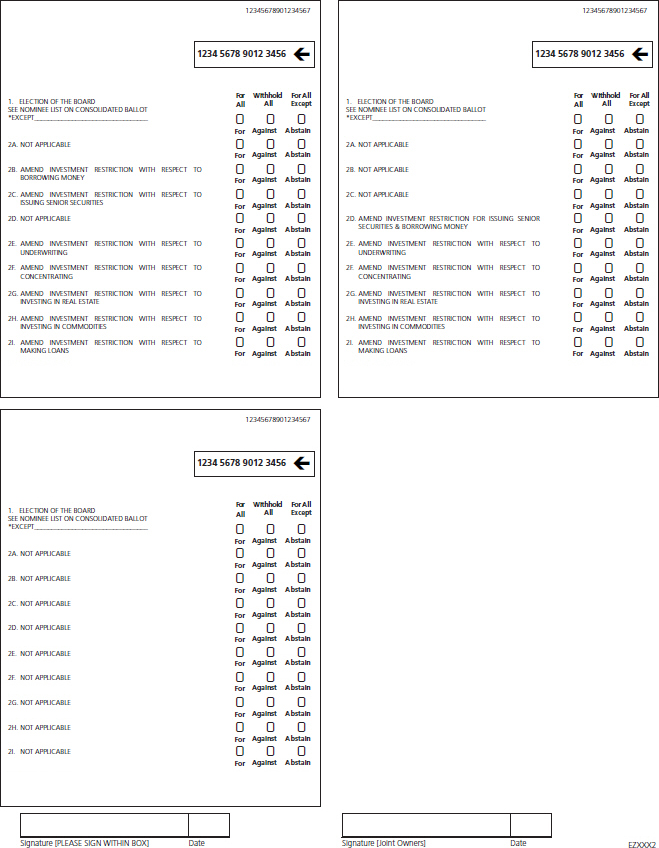

A separate voting instruction card identifying each Proposal applicable to a particular Portfolio will be prepared and mailed to each Contractholder who is entitled to provide voting instructions with respect to that Portfolio. Contractholders who are invested in shares of two or more Portfolios may receive a form of voting instruction card that contains both (i) individual voting instruction cards (or “ballots”), one for each such Portfolio, each of which identifies the Proposals (other than Proposal 3) applicable to that Portfolio, and (ii) a so-called “consolidated” voting instruction card that identifies the Proposals (other than Proposal 3) applicable to all of the Contractholder’s Portfolios. The individual ballots provide a means for a Contractholder who is invested in shares of more than one Portfolio to indicate voting instructions separately on each Proposal (other than Proposal 3) applicable to each Portfolio. The consolidated voting instruction card is provided as a convenient means for a Contractholder who is invested in shares of more than one Portfolio to indicate the same voting instructions for multiple Portfolios with respect to Proposals 1 and 2.A. through 2.I., as applicable. A Contractholder who receives this form of voting instruction card may choose to vote each Portfolio separately using the individual ballots or vote all Portfolios in the same manner using the consolidated voting instruction card. The form of voting instruction card provides instructions for using the individual ballots versus the consolidated voting instruction card. Contractholders who are invested in shares of the Multimanager Technology Portfolio will receive, by means of a separate mailing, a separate voting instruction card on which to indicate voting instructions with respect to Proposal 3.

The number of shares held in the investment division of a Separate Account corresponding to a Portfolio for which a Contractholder may provide voting instructions was determined as of the Record Date by dividing (i) a Contract’s account value (minus any Contract indebtedness) allocable to that investment division by (ii) the net asset value of one Share of the corresponding Portfolio. Each whole share of a Portfolio is entitled to one vote as to each matter with respect to which it is entitled to vote and each fractional share is entitled to a proportionate fractional vote. At any time prior to an Insurance Company’s voting at the Meeting, a Contractholder may revoke his or her voting instructions with respect to that investment division by providing the Insurance Company with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone or the Internet, or appearing and providing voting instructions in person at the Meeting.

ii

Table of Contents

HOW AN INSURANCE COMPANY WILL VOTE

An Insurance Company will vote the shares for which it receives timely voting instructions from Contractholders in accordance with those instructions. Shares in each investment division of a Separate Account that is invested in one or more Portfolios for which an Insurance Company receives a voting instruction card that is signed and timely returned but is not marked to indicate voting instructions will be treated as an instruction to vote the shares “FOR” each applicable Proposal. Shares in each investment division of a Separate Account that is invested in one or more Portfolios for which an Insurance Company receives both a consolidated voting instruction card and individual ballots that are signed and timely returned and not revoked but are marked to indicate conflicting voting instructions will be treated as an instruction to vote the shares in accordance with the instructions marked on the individual ballots. Shares in each investment division of a Separate Account that is invested in one or more Portfolios for which an Insurance Company receives no timely voting instructions from Contractholders, or that are attributable to amounts retained by an Insurance Company and its affiliates as surplus or seed money, will be voted by the applicable Insurance Company either “FOR” or “AGAINST” approval of each applicable Proposal, or as an abstention, in the same proportion as the shares for which Contractholders have provided voting instructions to the Insurance Company. As a result of such proportional voting by the Insurance Companies, it is possible that a small number of Contractholders could determine the outcome of any Proposal.

OTHER MATTERS

The Insurance Companies are not aware of any matters, other than the specified Proposals, to be acted on at the Meeting. If any other matters come before the Meeting, an Insurance Company will vote the shares upon such matters in its discretion. Voting instruction cards may be solicited by directors, officers and employees of AXA Equitable Funds Management Group, LLC, the investment manager of the Trusts, or its affiliates as well as officers and agents of the Trusts. The principal solicitation will be by mail, but voting instructions may also be solicited by telephone, fax, personal interview, the Internet or other permissible means.

If the quorum necessary to transact business with respect to a Trust or a Portfolio is not established or if the vote required to approve a Proposal is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments or postponements of the Meeting in accordance with applicable law to permit further solicitation of voting instructions. The persons named as proxies will vote in their discretion on any such adjournment or postponement.

It is important that your Contract be represented. Please promptly mark your voting instructions on the enclosed voting instruction card(s); then sign and date the voting instruction card(s) and mail the card(s) in the accompanying postage-paid envelope. You also may provide your voting instructions by telephone at 1-800-690-6903 or by Internet at our website at www.proxyvote.com.

iii

Table of Contents

AXA PREMIER VIP TRUST

EQ ADVISORS TRUST

1290 Avenue of the Americas

New York, New York 10104

JOINT PROXY STATEMENT DATED FEBRUARY 10, 2017 FOR THE

JOINT SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 28, 2017

This Joint Proxy Statement relates to the solicitation by the respective Boards of Trustees (each, a “Board” and together, the “Boards”) of the AXA Premier VIP Trust (the “VIP Trust”) and the EQ Advisors Trust (the “EQ Trust”) (each, a “Trust” and together, the “Trusts”) of proxies to be used at the Joint Special Meeting of Shareholders of each Trust to be held at 1290 Avenue of the Americas, New York, New York 10104, on March 28, 2017, at 2:30 p.m., Eastern time, or any adjournment or postponement thereof (the “Meeting”).

This Joint Proxy Statement is being furnished to owners of variable life insurance policies and/or variable annuity contracts or certificates (the “Contracts”) (the “Contractholders”) issued by AXA Equitable Life Insurance Company (“AXA Equitable”) or another insurance company (each, an “Insurance Company” and together, the “Insurance Companies”) who, as of December 31, 2016 (the “Record Date”), had net premiums or contributions allocated to the investment divisions of an Insurance Company’s separate account or accounts (the “Separate Accounts”) that are invested in shares of one or more portfolios (each, a “Portfolio” and together, the “Portfolios”) of a Trust. Contractholders are being provided the opportunity to instruct the applicable Insurance Company to approve or disapprove the Proposals contained in this Joint Proxy Statement in connection with the solicitation by the respective Boards of proxies for the Meeting.

This Joint Proxy Statement also is being furnished to the Insurance Companies as the record owners of shares and to other shareholders (including retirement plan participants) that were invested in one or more of the Portfolios as of the Record Date.

Distribution of this Joint Proxy Statement and proxy or voting instruction card(s) to the Insurance Companies and other shareholders and to Contractholders is scheduled to begin on or about February 10, 2017.

SUMMARY OF PROPOSALS AND PORTFOLIOS VOTING

The following tables show which of the below Proposals shareholders of each Portfolio of the VIP Trust (each, a “VIP Portfolio”) and shareholders of each Portfolio of the EQ Trust (each, an “EQ Portfolio”) are being asked to approve.

1

Table of Contents

The numbers/letters in the table columns correspond to the numbers/letters of the Proposals described below:

| 1. | Elect a Board of Trustees. |

| 2. | Approve changes to a Portfolio’s fundamental investment restrictions with respect to, as applicable: |

| A. | diversification |

| B. | borrowing money |

| C. | issuing senior securities |

| D. | issuing senior securities and borrowing money |

| E. | underwriting |

| F. | concentrating |

| G. | investing in real estate |

| H. | investing in commodities |

| I. | making loans |

| 3. | Approve changing Multimanager Technology Portfolio from a diversified fund to a non-diversified fund. |

| VIP PORTFOLIOS | 1 | 2A | 2B | 2C | 2D | 2E | 2F | 2G | 2H | 2I | 3 | |||||||||||||||||||||||||||||||||

| AXA Aggressive Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA Conservative Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA Conservative Plus Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA Moderate Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA Moderate Plus Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Aggressive Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Alternative 100 Moderate Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Conservative Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Income Strategies Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Interest Rate Strategies Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM International Moderate Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Moderate Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Moderate Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Multi-Sector Bond Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Real Assets Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Small Cap Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| CharterSM Small Cap Value Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| Target 2015 Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| Target 2025 Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| Target 2035 Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| Target 2045 Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| Target 2055 Allocation Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

2

Table of Contents

| EQ PORTFOLIOS | 1 | 2A | 2B | 2C | 2D | 2E | 2F | 2G | 2H | 2I | 3 | |||||||||||||||||||||||||||||||||

| 1290 VT Socially Responsible Portfolio (formerly EQ/Calvert Socially Responsible Portfolio) |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| All Asset Aggressive — Alt 25 Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| All Asset Aggressive — Alt 50 Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| All Asset Aggressive — Alt 75 Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| All Asset Moderate Growth — Alt 15 Portfolio |

X | |||||||||||||||||||||||||||||||||||||||||||

| ATM International Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| ATM Large Cap Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| ATM Mid Cap Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| ATM Small Cap Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| AXA 2000 Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| AXA 400 Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| AXA 500 Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| AXA Aggressive Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA All Asset Growth — Alt 20 Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA Balanced Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Conservative Growth Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Conservative Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Franklin Balanced Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Franklin Small Cap Value Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Franklin Templeton Allocation Managed Volatility |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Global Equity Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Growth Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA International Core Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA International Managed Volatility Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| AXA International Value Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Large Cap Core Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Large Cap Growth Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Large Cap Value Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Mid Cap Value Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Moderate Growth Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Mutual Large Cap Equity Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Natural Resources Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA Real Estate Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA SmartBeta Equity Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Templeton Global Equity Managed Volatility Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA Ultra Conservative Strategy |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/AB Dynamic Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA/AB Dynamic Moderate Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

3

Table of Contents

| EQ PORTFOLIOS | 1 | 2A | 2B | 2C | 2D | 2E | 2F | 2G | 2H | 2I | 3 | |||||||||||||||||||||||||||||||||

| AXA/AB Short Duration Government Bond Portfolio |

X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||||

| AXA/AB Small Cap Growth Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

AXA/ClearBridge Large Cap Growth Portfolio (formerly EQ/Wells Fargo Omega Growth Portfolio) |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

AXA/Doubleline Opportunistic Core Plus Bond Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Goldman Sachs Strategic Allocation Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Horizon Small Cap Value Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Invesco Strategic Allocation Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Janus Enterprise Portfolio (formerly EQ/Morgan Stanley Mid Cap Growth Portfolio) |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Legg Mason Strategic Allocation Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Loomis Sayles Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| AXA/Lord Abbett Micro Cap Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Morgan Stanley Small Cap Growth Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| AXA/Pacific Global Small Cap Value Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

EQ/BlackRock Basic Value Equity Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Boston Advisors Equity Income Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| EQ/Capital Guardian Research Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Common Stock Index Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

EQ/Convertible Securities Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Core Bond Index Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Emerging Markets Equity PLUS Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Energy ETF Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Equity 500 Index Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/GAMCO Mergers and Acquisitions Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| EQ/GAMCO Small Company Value Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| EQ/Global Bond PLUS Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/High Yield Bond Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

EQ/Intermediate Government Bond Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

EQ/International Equity Index |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Invesco Comstock Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/JPMorgan Value Opportunities Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Large Cap Growth Index Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Large Cap Value Index |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Low Volatility Global ETF Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/MFS International Growth |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| EQ/Mid Cap Index Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Money Market Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

|

EQ/Oppenheimer Global Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/PIMCO Global Real Return Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| EQ/PIMCO Ultra Short Bond Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

4

Table of Contents

| EQ PORTFOLIOS | 1 | 2A | 2B | 2C | 2D | 2E | 2F | 2G | 2H | 2I | 3 | |||||||||||||||||||||||||||||||||

| EQ/Quality Bond PLUS Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/Small Company Index Portfolio |

X | X | X | X | X | X | X | X | X | |||||||||||||||||||||||||||||||||||

| EQ/T.Rowe Price Growth Stock Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| EQ/UBS Growth and Income Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

|

Multimanager Aggressive Equity Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

|

Multimanager Core Bond Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

|

Multimanager Mid Cap Growth Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

|

Multimanager Mid Cap Value Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

| Multimanager Technology Portfolio |

X | X | X | X | X | X | X | X | ||||||||||||||||||||||||||||||||||||

As used herein, the term “Enterprise and MONY Portfolios” refers to All Asset Growth – Alt 20 Portfolio, AXA/Loomis Sayles Growth Portfolio, EQ/Boston Advisors Equity Income Portfolio, EQ/GAMCO Mergers and Acquisitions Portfolio, EQ/GAMCO Small Company Value Portfolio, EQ/MFS International Growth Portfolio, EQ/PIMCO Ultra Short Bond Portfolio, EQ/T. Rowe Price Growth Stock Portfolio, and EQ/UBS Growth and Income Portfolio; the term “AXA Managed Volatility Portfolios” refers to ATM International Managed Volatility Portfolio, ATM Large Cap Managed Volatility Portfolio, ATM Mid Cap Managed Volatility Portfolio, ATM Small Cap Managed Volatility Portfolio, AXA 400 Managed Volatility Portfolio, AXA 500 Managed Volatility Portfolio, AXA 2000 Managed Volatility Portfolio, and AXA International Managed Volatility Portfolio; and the term “Multimanager Portfolios” refers to Multimanager Aggressive Equity Portfolio, Multimanager Core Bond Portfolio, Multimanager Mid Cap Growth Portfolio, Multimanager Mid Cap Value Portfolio, and Multimanager Technology Portfolio.

The Board of each Trust has determined that the use of this Joint Proxy Statement for such Trust’s Meeting is in the best interests of the Trust and its shareholders in light of the similar matters being considered and voted on by the shareholders of each of the Trusts.

Each Trust is a Delaware statutory trust that is registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”) as an open-end management investment company. Each Trust’s shares of beneficial interest are referred to as “shares,” and the holders of the shares are referred to as “shareholders.” Each Trust’s Board of Trustees may be referred to herein as the “Board” and its members may be referred to herein as “Trustees.”

AXA Equitable Funds Management Group, LLC (“FMG LLC” or the “Manager”) is the investment manager and administrator of each Portfolio. AXA Distributors, LLC, an affiliate of FMG LLC, is the principal underwriter (distributor) of each Portfolio’s shares. The mailing address for each of these companies and for the Trusts’ principal executive officers is 1290 Avenue of the Americas, New York, New York 10104. In addition, the investment advisers listed in Exhibit A (the “Sub-Advisers”) serve as investment sub-advisers to certain of the EQ Portfolios.

5

Table of Contents

Contractholders of record as of the close of business on the Record Date are entitled to give voting instructions at the Meeting. Additional information regarding outstanding shares, completing your voting instruction card(s) and attending the Meeting is included at the end of this Joint Proxy Statement in the section entitled “Voting Information.”

Important Notice Regarding the Availability of Proxy Materials for the Joint Shareholder Meeting to be Held on March 28, 2017

This Joint Proxy Statement, which you should read and retain for future reference, contains important information regarding the Proposals that you should know before voting or providing voting instructions. Additional information about each Trust has been filed with the SEC and is available upon oral or written request. Distribution of this Joint Proxy Statement and proxy or voting instruction card(s) to the Insurance Companies and other shareholders and to Contractholders is scheduled to begin on or about February 10, 2017. This Joint Proxy Statement and proxy or voting instruction card(s) also will be available at www.proxyvote.com on or about February 10, 2017. It is expected that one or more representatives of each Insurance Company will attend the Meeting in person or by proxy and will vote shares held by the Insurance Company and its affiliates in accordance with voting instructions received from its Contractholders and in accordance with voting procedures established by each Trust.

Each Trust will furnish, without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a Contractholder upon request. Contractholders may request copies of a Trust’s annual and/or semi-annual reports by writing to the Trust at 1290 Avenue of the Americas, New York, New York 10104 or by calling 1-877-222-2144.

6

Table of Contents

7

Table of Contents

Under Proposal 1, the shareholders of each Trust are being asked separately to elect 10 trustee nominees to serve on the Board of Trustees of their Trust.

The shareholders of the EQ Portfolios are being asked to elect each of the eight current members of the Board of Trustees of the EQ Trust (the “EQ Board”) as well as two new trustee nominees to serve on the EQ Board.

The shareholders of the VIP Portfolios are being asked to elect the same 10 individuals who have been nominated to serve on the EQ Board to serve as the Board of Trustees for the VIP Trust (the “VIP Board”). Eight of the 10 trustee nominees are currently members of the EQ Board, and the remaining two trustee nominees are first-time nominees for the EQ Board. If shareholders of the VIP Portfolios and the EQ Portfolios separately approve the election of the 10 trustee nominees, the same Board of Trustees would oversee both Trusts. Shareholders of the VIP Portfolios are being asked to elect the same members of the EQ Board to serve on the VIP Board in order to create a unified governance and oversight structure for the registered investment companies in the fund complex, which has the potential to provide certain future cost savings for the Trusts, as well as certain administrative efficiencies.

Under Proposals 2.A. through 2.I., the shareholders of each Portfolio (other than the All Asset Moderate Growth – Alt 15 Portfolio) are being asked to approve changes to the fundamental investment restrictions that apply to that Portfolio. The 1940 Act requires all mutual funds (such as the Portfolios) to adopt certain “fundamental” investment restrictions with respect to several specific types of investment activities. Fundamental investment restrictions cannot be changed without shareholder approval. The amendments described in Proposals 2.A. through 2.I. are intended to give the Portfolios greater flexibility to take advantage of, and react to, changing financial markets, new investment opportunities, and future changes in applicable law — without the expense and delay of seeking further shareholder approval. The amendments are also intended to create more uniform investment restrictions among the mutual funds in the fund complex. The shareholders of the All Asset Moderate Growth – Alt 15 Portfolio will be asked, by means of a separate proposal in a separate proxy statement, to approve changes to the fundamental investment restrictions that apply to that Portfolio.

Under Proposal 3, the shareholders of Multimanager Technology Portfolio are being asked to change the Portfolio from a diversified fund to a non-diversified fund. Shareholder approval of this change would enable the Portfolio to invest larger percentages of its assets in the securities of a single issuer. The proposed change would provide the Portfolio with increased flexibility to respond to future investment opportunities.

PROPOSAL 1: ELECTION OF BOARD OF TRUSTEES

The purpose of this Proposal is to elect the same 10 trustee nominees (each, a “Nominee” and together, the “Nominees”) to serve on the Board of Trustees of each Trust. The 10 new Nominees together are referred to herein as the “New Board.”

The fund complex currently includes three registered investment companies — the VIP Trust, the EQ Trust, and 1290 Funds. These investment companies share the

8

Table of Contents

same investment manager/adviser, FMG LLC, and certain administrative, legal, compliance, marketing and other functions. Currently, the VIP Trust is overseen by a Board of Trustees that, with the exception of Steven M. Joenk, is composed of different individuals than those who serve on the Board of Trustees that oversees both the EQ Trust and 1290 Funds. As it relates to the VIP Trust, this Proposal is intended to elect the same members who serve on the EQ Board to serve on the VIP Board as part of a broader effort to coordinate and enhance the collective efficiency of the governance and oversight of the VIP Trust, the EQ Trust, and 1290 Funds and to provide for potential cost savings to shareholders of all of the Trusts within the fund complex which may result from such efficiencies. The Board of Trustees of the VIP Trust supports this Proposal as it is intended to provide for potential cost savings to shareholders of the VIP Trust, as well as enhance the potential future growth prospects for the VIP Portfolios, which could lead to additional cost savings.

Eight of the 10 Nominees are currently members of the Board of Trustees that oversees both the EQ Trust and 1290 Funds. The remaining two Nominees currently serve as consultants to the Board of Trustees that oversees both the EQ Trust and 1290 Funds and are first-time Nominees for the Board of Trustees of the EQ Trust (and, by means of a separate proposal in a separate proxy statement, 1290 Funds). One of the 10 Nominees, Steven M. Joenk, is also currently a member of the Board of Trustees that oversees the VIP Trust. Nine of the 10 Nominees are first-time Nominees for the Board of Trustees of the VIP Trust. Assuming that the Proposal for the election of the 10 Nominees is approved by both the shareholders of the VIP Trust and the shareholders of the EQ Trust (and, by means of a separate proposal in a separate proxy statement, the shareholders of 1290 Funds), the same Board of Trustees would oversee the VIP Trust, the EQ Trust, and 1290 Funds.

The Proposed EQ Board

The current EQ Board and its Governance Committee, which consists of all of the current Independent Trustees of the EQ Trust (and is described in more detail below), has determined to increase the size of the EQ Board from eight to 10 members and has proposed for election by shareholders each of the eight current members of the EQ Board as well as two new Board members. The EQ Trust’s current Trustees are Thomas W. Brock, Donald E. Foley, Steven M. Joenk, Christopher P.A. Komisarjevsky, H. Thomas McMeekin, Gary S. Schpero, Kenneth L. Walker and Caroline L. Williams. Mr. Joenk is an “interested person” (as defined in the 1940 Act) (an “Interested Trustee”) of the EQ Trust. Messrs. Brock, Foley, Komisarjevsky, McMeekin, Schpero and Walker and Ms. Williams are not “interested persons” (as defined in the 1940 Act) (each, an “Independent Trustee”) of the EQ Trust. The EQ Trust’s Governance Committee identified the two new Nominees to the EQ Board, Mark A. Barnard and Gloria D. Reeg, through the use of a third party search firm and extensive interviews with multiple candidates. If elected, both Mr. Barnard and Ms. Reeg would be Independent Trustees of the EQ Trust.

As part of its evaluation of this Proposal, the Governance Committee of the EQ Board considered a number of factors, including that (1) the increased size, diversity, skill sets and depth of experience of the New Board should enhance the New Board’s ability to respond to the increasing complexities of the mutual fund business; and (2) a larger number of Independent Trustees should provide additional resources to the New Board for compliance, regulatory and risk management oversight.

9

Table of Contents

The Proposed VIP Board

The current VIP Board and its Compliance, Nominating and Compensation Committee, which consists of all of the current Independent Trustees of the VIP Trust (and is described in more detail below), has determined to increase the size of the VIP Board from six to 10 members and has proposed for election one of the current members of the VIP Board, Steven M. Joenk, as well as nine new Board members. Mr. Joenk is an Interested Trustee of the VIP Trust. The nine new Nominees to the VIP Board are Mark A. Barnard, Thomas W. Brock, Donald E. Foley, Christopher P.A. Komisarjevsky, H. Thomas McMeekin, Gloria D. Reeg, Gary S. Schpero, Kenneth L. Walker and Caroline L. Williams. If elected, Messrs. Barnard, Brock, Foley, Komisarjevsky, McMeekin, Schpero and Walker and Mses. Reeg and Williams would be Independent Trustees of the VIP Trust. The five current Independent Trustees of the VIP Trust are not standing for re-election.

At a meeting held on December 5, 2016, the Compliance, Nominating and Compensation Committee of the VIP Board considered a proposal by FMG LLC to elect the 10 Nominees in order to create a unified governance and oversight structure for the registered investment companies in the fund complex, which has the potential to provide certain future cost savings for the VIP Portfolios and their shareholders, as well as certain administrative efficiencies. At the meeting of the Compliance, Nominating and Compensation Committee, the Committee met with representatives of the EQ Board and discussed, among other things, the skills and qualifications of each of the Nominees and the governance processes and structure employed by the EQ Board, including the Committee structure employed by the EQ Board. The Compliance, Nominating and Compensation Committee also discussed with the representatives of the EQ Board their expectations as to how the oversight of the VIP Trust would be integrated into the oversight structure employed by the EQ Board and the EQ Board members’ familiarity with funds that are similar to the VIP Portfolios and with matters that may arise due to the structure of the VIP Portfolios. In this regard, it was noted that each Nominee is familiar with FMG LLC and its operations, as well as the special regulatory requirements governing registered investment companies and the special responsibilities of investment company trustees, as a result of his or her service as a Trustee of or a consultant to the Board of Trustees of the EQ Trust and 1290 Funds.

As part of its evaluation of the VIP Board proposal, the Compliance, Nominating and Compensation Committee and the current VIP Board considered a number of factors, including the following: (1) a single Board overseeing all of the registered investment companies in the fund complex may facilitate more uniform governance and oversight of the funds in the fund complex; (2) a single Board may reduce certain fund expenses, such as costs associated with holding Board meetings, committee meetings and, to the extent necessary, shareholder meetings; (3) a single Board may assist in reducing the administrative costs and burdens on fund management that are inherent in reporting to two separate Boards and may allow fund management to devote more time and resources to providing other services to the funds in the fund complex; (4) the Nominees have the requisite industry experience, skills and expertise to properly oversee the VIP Trust, comparable in nature to those of the current Trustees of the VIP Trust; (5) through their experience with similar EQ Portfolios, the Nominees have the requisite familiarity with the nature of the VIP Portfolios and the issues the Trustees are likely to face; and (6) the change in the Board oversight structure for the VIP Trust is not expected to be in any way detrimental to the VIP Trust or to shareholders of the VIP Portfolios.

10

Table of Contents

Representatives of FMG LLC also discussed the VIP Board proposal with the Compliance, Nominating and Compensation Committee and expressed their belief that the proposal and the election of the 10 Nominees to the VIP Board is in the best interests of the VIP Trust, the VIP Portfolios and their shareholders. In this regard, the Committee and the VIP Board considered that the proposal was part of a broader effort to coordinate and enhance the collective efficiency of the governance and oversight of the VIP Trust, the EQ Trust, and 1290 Funds and to provide for potential cost savings to shareholders of all of the Trusts within the fund complex which may result from such efficiencies. In considering these various matters, the Compliance, Nominating and Compensation Committee also met privately, with only the Independent Trustees’ independent legal counsel present, to discuss the information provided to it regarding the VIP Board proposal and to discuss collective impressions of the Nominees and their qualifications.

The current VIP Board also considered that FMG LLC has agreed to bear all costs and expenses of the VIP Trust associated with soliciting shareholder approval of this Proposal.

After further discussion, upon the recommendation of its Compliance, Nominating and Compensation Committee, the current VIP Board unanimously determined to recommend that shareholders of the VIP Trust vote “FOR” the election of each Nominee at the Meeting to hold office in accordance with the VIP Trust’s governing documents.

Each Nominee has consented to being named in this Joint Proxy Statement and indicated his or her willingness to serve if elected. In the unanticipated event that any Nominee should be unable to serve, the persons named as proxies may vote for such other person as shall be designated by the applicable Board. The persons named on the accompanying proxy card intend to vote at the Meeting (unless otherwise directed) for the election of the Nominees named below as Trustees of each Trust. With respect to each Trust, to be elected, persons nominated as Trustees must receive a plurality of the votes cast, which means that the ten (10) Nominees receiving the highest number of votes cast at the Meeting will be elected as long as the votes “FOR” a Nominee exceed the votes “AGAINST” that Nominee. Subject to the foregoing, if elected by shareholders of a Trust, each Nominee who would be new to the Board of that Trust would begin service as a Trustee of that Trust on or about April 1, 2017 (the “Effective Date”).

Information regarding each Nominee is provided below. If elected, each Nominee, except Mr. Joenk, would be an Independent Trustee of the Trusts. The business address of all Nominees is 1290 Avenue of the Americas, New York, New York 10104. Messrs. Barnard, Brock, Foley, Komisarjevsky, McMeekin, Schpero and Walker and Mses. Reeg and Williams are referred to herein as “Independent Nominees,” and Mr. Joenk is referred to herein as an “Interested Nominee.”

The Governance Committee of the EQ Board and the Compliance, Nominating and Compensation Committee of the VIP Board each also considered that, if elected by shareholders of the EQ Trust and the VIP Trust, respectively, all but one of the members of the New Board will be Independent Trustees and that, although the Chairman of the New Board will be an Interested Trustee, there will be a Lead Independent Trustee, as discussed below.

11

Table of Contents

| Name, Address and Year of Birth |

Position(s) Held and/ or to be Held with the Trusts |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past Five Years |

Number of Portfolios in Fund Complex Overseen and/or to be Overseen by Trustee or Nominee for Trustee**** |

Other Directorships Held by Trustee or Nominee for Trustee | |||||

| Interested Nominee* | ||||||||||

| Steven M. Joenk (1958) |

Trustee, Chairman, President and Chief Executive Officer | Trustee**, Chairman from September 2004 to present, Chief Executive Officer, President from December 2002 to present (EQ Trust)

Trustee***, Chairman from September 2004 to present, Chief Executive Officer from December 2002 to present, President from November 2001 to present (VIP Trust) |

From May 2011 to present, Chairman of the Board, Chief Executive Officer and President, FMG LLC; from September 1999 to present, Managing Director, AXA Equitable; from September 2004 to April 2011, President, AXA Equitable’s Funds Management Group (“FMG”) unit; from July 2004 to October 1, 2013, Senior Vice President, MONY Life Insurance Company; from July 2004 to present, Senior Vice President, MONY Life Insurance Company of America and Director, MONY Capital Management, Inc., Director and President, 1740 Advisers, Inc.; from July 2004 to January 2011, Director, Chairman of the Board and President, MONY Asset Management, Inc. and Enterprise Capital Management; from January 2005 to January 2011, Director, MONY Financial Resources of Americas Limited; and from November 2005 to present, Director, MONY International Holdings, LLC. | 118 | None. | |||||

12

Table of Contents

| Name, Address and Year of Birth |

Position(s) Held and/ or to be Held with the Trusts |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past Five Years |

Number of Portfolios in Fund Complex Overseen and/or to be Overseen by Trustee or Nominee for Trustee**** |

Other Directorships Held by Trustee or Nominee for Trustee | |||||

| Independent Nominees | ||||||||||

| Mark A. Barnard (1949) |

Consultant† and Trustee | **, † (EQ Trust)

*** (VIP Trust) |

From 1995 to 1998, Manager of Private Investments, from 1998 to 2001, Director of Private Investments, and from 2001 to present, Managing Director – Private Investments, Howard Hughes Medical Institute; from 1985 to 1992, Assistant Director of Real Estate, and from 1992 to 1995, Associate Director of Real Estate, Massachusetts Institute of Technology. | 118 if elected at the Meeting and at a separate meeting of the shareholders of 1290 Funds | From 2003 to 2011, Director, Fortress Investment Company Investment Funds. | |||||

| Thomas W. Brock (1949) |

Trustee | From January 2016 to present** (EQ Trust)

*** (VIP Trust) |

From June 2016 to present, Director and President and Chief Executive Officer, and from January 2016 to June 2016, Director and interim President and Chief Executive Officer, Silver Bay Realty Trust Corp.; from 2006 to 2012, Chief Executive Officer and Co-Founder of Stone Harbor Investment Partners. | 95 (118 if elected at the Meeting) | From 2012 to January, 2016, Lead Independent Director, Audit Committee Member and Compensation Committee Chair, Silver Bay Realty Trust Corp.; from 2005 to present, Director and Audit Committee Member, Liberty All-Star Funds (2); from 2002 to 2005, Director and Audit Committee Member, two registered hedge funds-of-funds sponsored by Bank of America Alternative Advisors; from 2006 to 2012, Director, Stone Harbor Investment Funds (5). | |||||

13

Table of Contents

| Name, Address and Year of Birth |

Position(s) Held and/ or to be Held with the Trusts |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past Five Years |

Number of Portfolios in Fund Complex Overseen and/or to be Overseen by Trustee or Nominee for Trustee**** |

Other Directorships Held by Trustee or Nominee for Trustee | |||||

| Donald E. Foley (1951) |

Trustee | From January 2014 to present** (EQ Trust)

*** (VIP Trust) |

From 2010 to 2011, Chairman of the Board and Chief Executive Officer, Wilmington Trust Corporation; from 1996 to 2010, Senior Vice President, Treasurer and Director of Tax, ITT Corporation; from 1989 to 1996, Assistant Treasurer, International Paper Company. | 95 (118 if elected at the Meeting) | From 2011 to 2012 Director, and from 2012 to 2016 Advisory Committee Member, M&T Corporation; from 2007 to 2011, Director and member of the Audit Committee and Compensation Committee, Wilmington Trust Corporation; from 2008 to 2010, Advisory Board member, Northern Trust Company and Goldman Sachs Management Groups; from 2015 to present, Director, BioSig Technologies, Inc.; from 2015 to present, Director, Wilmington Funds. | |||||

| Christopher P.A. Komisarjevsky (1945) |

Trustee | From March 1997 to present** (EQ Trust)

*** (VIP Trust) |

From 2006 to 2008, Senior Counselor for APCO Worldwide® (global communications consulting) and a member of its International Advisory Council; from 1998 to 2005, President and Chief Executive Officer, Burson-Marsteller Worldwide (public relations); from 1996 to 1998, President and Chief Executive Officer of Burson-Marsteller U.S.A. | 95 (118 if elected at the Meeting) | None. |

14

Table of Contents

| Name, Address and Year of Birth |

Position(s) Held and/ or to be Held with the Trusts |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past Five Years |

Number of Portfolios in Fund Complex Overseen and/or to be Overseen by Trustee or Nominee for Trustee**** |

Other Directorships Held by Trustee or Nominee for Trustee | |||||

| H. Thomas McMeekin (1953) |

Trustee | From January 2014 to present** (EQ Trust)

*** (VIP Trust) |

From 2015 to present, CEO of Blue Key Services, LLC; from 2000 to present, Managing Partner and Founder of Griffin Investments, LLC; from 2009 to 2012 Chief Investment Officer, AIG Life & Retirement and United Guaranty Corporation and Senior Managing Director of AIG Asset Management. | 95 (118 if elected at the Meeting) | From 2015 to present, Director, Blue Key Services, LLC; from 2012 to present, Director Achaean Financial Group; from 2011 to 2012, Director US Life Insurance Company in the City of New York. | |||||

| Gloria D. Reeg (1951) |

Consultant† and Trustee | **, † (EQ Trust)

*** (VIP Trust) |

From 2007 to 2016, Chief Investment Officer and Senior Vice President, New York-Presbyterian Hospital; from 2005 to 2007, Trustee and Treasurer, Casey Family Programs (foundation); from 2002 to 2004, Global Head of Fixed Income and Executive Director, Principal Global Investors (asset management firm); 1992 to 2000, Managing Director – Global Consulting, Russell Investment Group. | 118 if elected at the Meeting and at a separate meeting of the shareholders of 1290 Funds | From 2005 to 2007, Trustee, Casey Family Programs (foundation). | |||||

| Gary S. Schpero (1953) |

Lead Independent Trustee | From May 2000 to present, Independent Trustee; from September 2011 to present, Lead Independent Trustee** (EQ Trust)

*** (VIP Trust) |

Prior to January 1, 2000, Partner of Simpson Thacher & Bartlett (law firm) and Managing Partner of the Investment Management and Investment Company Practice Group. | 95 (118 if elected at the Meeting) | From May 2012 to present, Trustee, Blackstone/GSO Senior Floating Rate Term Fund and Blackstone/GSO Long-Short Credit Income Fund; from October 2012 to present, Trustee, Blackstone/GSO Strategic Credit Fund. |

15

Table of Contents

| Name, Address and Year of Birth |

Position(s) Held and/ or to be Held with the Trusts |

Term of Office and Length of Time Served |

Principal Occupation(s) During Past Five Years |

Number of Portfolios in Fund Complex Overseen and/or to be Overseen by Trustee or Nominee for Trustee**** |

Other Directorships Held by Trustee or Nominee for Trustee | |||||

| Kenneth L. Walker (1952) |

Trustee | From January 2012 to present** (EQ Trust)

*** (VIP Trust) |

From May 2002 to March 2016, Partner and from March 2016 to present, employee, The Capital Management Corporation (investment advisory firm). | 95 (118 if elected at the Meeting) | None. | |||||

| Caroline L. Williams (1946) |

Trustee | From January 2012 to present** (EQ Trust)

*** (VIP Trust) |

From July 2010 to December 2012, Executive Vice President, from May 2005 to December 2007, Consultant and from May 2001 to May 2005, Chief Financial and Investment Officer, Nathan Cummings Foundation (non-profit organization); from 1988 to 1992, Managing Director, from 1982 to 1988, Senior Vice President, from 1978 to 1982, Vice President and from 1971 to 1976, Associate, Donaldson, Lufkin & Jenrette Securities Corporation (investment bank); from 1997 to 2009, Director, Hearst-Argyle Television. | 95 (118 if elected at the Meeting) | None. |

| † | Mr. Barnard and Ms. Reeg each currently serves as a consultant to the Board of Trustees of the EQ Trust. It is anticipated that Mr. Barnard and Ms. Reeg will serve as consultants to the EQ Trust until December 31, 2017 (unless extended or otherwise modified), or until their election by shareholders, whichever is earlier. |

| * | Affiliated with the Trust’s investment manager. |

| ** | Each Nominee elected will serve during the lifetime of the EQ Trust until he or she dies, resigns, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner, until the next meeting of shareholders called for the purpose of electing Trustees and until the election and qualification of his or her successor. The EQ Board has adopted a policy that currently provides that each Independent Trustee shall retire from the Board as of the last day of the calendar year in which he or she attains the age of 74 years. |

| *** | Each Nominee elected will hold office for life or until his or her successor is elected or the VIP Trust terminates; except that any Trustee may resign or may be removed, and any Trustee who requests to be retired, or who has become physically or mentally incapacitated or is otherwise unable to serve, may be retired. |

| **** | The registered investment companies in the fund complex include the VIP Trust, the EQ Trust, and 1290 Funds. Mr. Joenk serves as Trustee, President and Chief Executive Officer for each of the registered investment companies in the fund complex, as well as Chairman for each such company. |

16

Table of Contents

Qualifications and Experience of the Nominees

Each current Board believes that all of the Nominees possess substantial executive leadership experience derived from their service as executives, partners and board members of diverse businesses and community and other organizations. Each current Board also believes that the different perspectives, viewpoints, professional experience, education, and individual qualities of each Nominee represent a diversity of experiences and a variety of complementary skills. In determining whether a Nominee is qualified to serve as a Trustee of each Trust, each current Board considered a wide variety of information about the Nominee, and multiple factors contributed to each current Board’s decision. However, there are no specific required qualifications for Board membership. Each Nominee is believed to possess the experience, skills, and attributes necessary to serve the Portfolios and their shareholders because each Nominee demonstrates an exceptional ability to consider complex business and financial matters, evaluate the relative importance and priority of issues, make decisions, and contribute effectively to the deliberations of the New Board.

Information about certain of the specific qualifications and experience of each Nominee relevant to each current Board’s conclusion that the Nominee should serve as a Trustee of each Trust is set forth in the table above. Set forth below are certain additional qualifications, experience, attributes, and skills of each Nominee that each current Board believes support a conclusion that the Nominee should serve as Trustee of each Trust in light of each Trust’s business activities and structure.

Interested Nominee

Steven M. Joenk — Mr. Joenk has a background in the financial services industry, senior management experience with multiple insurance companies, investment management firms and investment companies and multiple years of service as an officer, Trustee and Chairman of the VIP Trust and the EQ Trust and other registered investment companies, including 1290 Funds.

Independent Nominees

Mark A. Barnard — Mr. Barnard has senior management and investment experience with endowments and foundations and multiple years of service on limited partner advisory boards and on the boards of pension entities and an investment company.

Thomas W. Brock — Mr. Brock has a background in the financial services industry, senior management experience with financial services and investment management firms, a year of service as a Trustee of the EQ Trust and 1290 Funds, and multiple years of service on the boards of public companies and organizations, and investment companies.

Donald E. Foley — Mr. Foley has a background in the financial services industry, experience in senior management positions with financial services firms, multiple years of service as a Trustee of the EQ Trust and 1290 Funds, and multiple years of service on the boards of public and private companies and organizations.

17

Table of Contents

Christopher P.A. Komisarjevsky — Mr. Komisarjevsky has experience in senior management positions with global firms providing business consulting services and multiple years of service as a Trustee of the EQ Trust and 1290 Funds.

H. Thomas McMeekin — Mr. McMeekin has a background in the financial services industry, has held senior management positions with insurance companies, has multiple years of service as a Trustee of the EQ Trust and 1290 Funds, and has multiple years of service on the boards of public and private companies and organizations.

Gloria D. Reeg — Ms. Reeg has a background in the financial services industry, senior management and investment experience with investment management firms, a national foundation, and endowment and retirement assets for a top-ranked research hospital, and multiple years of service on the board of a national foundation.

Gary S. Schpero — Mr. Schpero has experience as the managing partner of the investment management practice group at a large international law firm and multiple years of service as a Trustee of the EQ Trust and 1290 Funds, as well as other unaffiliated investment companies.

Kenneth L. Walker — Mr. Walker has a background in the financial services industry, senior management experience with investment management firms and multiple years of service as a Trustee of the EQ Trust and 1290 Funds.

Caroline L. Williams — Ms. Williams has a background in the financial services industry, senior management experience with an investment banking firm, multiple years of service as a Trustee of the EQ Trust and 1290 Funds, and multiple years of service on the boards of public and private companies and organizations.

Structure of the Current EQ Board

The EQ Board currently is comprised of eight Trustees, and there are two vacancies on the Board. Seven of the eight current Trustees are Independent Trustees. Mr. Joenk, who, among other things, serves as Chairman of the EQ Board, is an Interested Trustee. The EQ Board has appointed Mr. Schpero to serve as Lead Independent Trustee. The EQ Trust’s Lead Independent Trustee is recommended by the EQ Trust’s Governance Committee (discussed in more detail below) and approved by the full EQ Board. The Lead Independent Trustee, among other things, chairs meetings of the Independent Trustees, serves as a spokesperson for the Independent Trustees and serves as a liaison between the Independent Trustees and the EQ Trust’s management between Board meetings.

The EQ Board holds six regular meetings each year to consider and address matters involving the EQ Trust and its Portfolios. The EQ Board also may hold special meetings to address matters arising between regular meetings. The Independent Trustees also regularly meet outside the presence of management and are advised by independent legal counsel. These meetings may take place in-person or by telephone.

The EQ Board has established a committee structure that includes an Audit Committee, a Governance Committee, and an Investment Committee (which is divided into sub-committees). All Independent Trustees are members of each Committee. The EQ

18

Table of Contents

Board believes that this structure allows all of the Independent Trustees to participate in the full range of the EQ Board’s oversight responsibilities. The EQ Board reviews its structure regularly and believes that its leadership structure, including the appointment of a Lead Independent Trustee, is appropriate given the asset size of the EQ Trust, the number of Portfolios offered by the EQ Trust, the number of Trustees overseeing the EQ Trust and the EQ Board’s oversight responsibilities, as well as the EQ Trust’s business activities, manager of managers advisory structure and its use as an investment vehicle in connection with the Contracts and retirement plans.

The Audit Committee’s function is to oversee the EQ Trust’s accounting and financial reporting policies and practices and its internal controls, oversee the quality and objectivity of the EQ Trust’s financial statements and the independent audit thereof, and act as a liaison between the EQ Trust’s independent accountants and the EQ Board. To carry out its function, the Audit Committee, among other things, selects, retains or terminates the EQ Trust’s independent accountants and evaluates their independence; meets with the EQ Trust’s independent accountants as necessary to review and approve the arrangements for and scope of the audit and to discuss and consider any matters of concern relating to the EQ Trust’s financial statements and the EQ Trust’s financial reporting and controls; and approves the fees charged by the independent accountants for audit and non-audit services and, to the extent required by applicable law, any non-audit services proposed to be performed for the EQ Trust by the independent accountants. The Audit Committee held three meetings during the fiscal year ended December 31, 2016. Ms. Williams serves as the Chair of the Audit Committee.