Table of Contents

File No. 333-

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON JUNE 30, 2015

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| THE SECURITIES ACT OF 1933 | x | |||||

| Pre-Effective Amendment No. | ¨ | |||||

| Post-Effective Amendment No. | ¨ |

EQ ADVISORS TRUST

(Exact Name of Registrant as Specified in Charter)

1290 Avenue of the Americas

New York, New York 10104

(Address of Principal Executive Offices)

(212) 554-1234

(Registrant’s Area Code and Telephone Number)

STEVEN M. JOENK

AXA Equitable Funds Management Group, LLC

1290 Avenue of the Americas

New York, New York 10104

(Name and Address of Agent for Service)

With copies to:

| Patricia Louie, Esq. | Mark C. Amorosi, Esq. | |

| AXA Equitable Funds Management Group, LLC | K&L Gates LLP | |

| 1290 Avenue of the Americas | 1601 K Street, N.W. | |

| New York, NY 10104 | Washington, D.C. 20006 |

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on the 30th day after filing pursuant to Rule 488 under the Securities Act of 1933, as amended.

Title of securities being registered: Class IB shares of beneficial interest in the series of the Registrant designated EQ/Common Stock Index Portfolio and EQ/Core Bond Index Portfolio.

No filing fee is required because the registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended, pursuant to which it has previously registered an indefinite number of shares (File No. 333-17217 and 811-07953).

Table of Contents

EQ ADVISORS TRUST

CONTENTS OF REGISTRATION STATEMENT

This Registration Statement contains the following papers and documents:

| Cover Sheet |

||

| Contents of Registration Statement |

||

| Letter to Shareholders |

||

| Notice of Special Meeting |

||

| Contractholder Voting Instructions |

||

| Part A - Proxy Statement/Prospectus |

||

| Part B - Statement of Additional Information |

||

| Part C - Other Information |

||

| Signature Page |

||

| Exhibits |

||

Table of Contents

AXA EQUITABLE LIFE INSURANCE COMPANY

1290 Avenue of the Americas

New York, New York 10104

[ ], 2015

Dear Contractholder:

Enclosed is a notice and Combined Proxy Statement and Prospectus relating to a Special Meeting of Shareholders of the CharterSM Equity Portfolio and the CharterSM Fixed Income Portfolio (each an “Acquired Portfolio” and together the “Acquired Portfolios”).

Each Acquired Portfolio is a series of AXA Premier VIP Trust (the “Trust”). The Special Meeting of Shareholders of the Acquired Portfolios is scheduled to be held at the Trust’s offices, 1290 Avenue of the Americas, New York, New York 10104, on September 17, 2015 at 2:00 p.m., Eastern time (the “Meeting”). At the Meeting, the shareholders of the Acquired Portfolios who are entitled to vote at the Meeting will be asked to approve the proposals described below.

The Trust’s Board of Trustees (the “Board”) has called the Meeting to request shareholder approval of the reorganization of each Acquired Portfolio into a corresponding series of EQ Advisors Trust (an “Acquiring Portfolio”) (each, a “Reorganization”) as set forth below:

| • | the CharterSM Equity Portfolio into the EQ/Common Stock Index Portfolio, a series of EQ Advisors Trust; and |

| • | the CharterSM Fixed Income Portfolio into the EQ/Core Bond Index Portfolio, a series of EQ Advisors Trust. |

The Board has approved the proposals and recommends that you vote “FOR” the proposal relating to the Acquired Portfolio in which you own shares. Although the Board has determined that a vote “FOR” the proposal is in your best interest, the final decision is yours.

Each Portfolio is managed by AXA Equitable Funds Management Group, LLC. Each Acquiring Portfolio is sub-advised by an investment sub-adviser. In each case, if the Reorganization involving an Acquired Portfolio is approved and implemented, each Contractholder that invests indirectly in the Acquired Portfolio will automatically become a Contractholder that invests indirectly in the corresponding Acquiring Portfolio.

As an owner of a variable life insurance policy and/or a variable annuity contract or certificate that participates in an Acquired Portfolio through the investment divisions of a separate account or accounts established by AXA Equitable Life Insurance Company (“AXA Equitable”), you are entitled to instruct AXA Equitable how to vote the Acquired Portfolio shares related to your interest in those accounts as of the close of business on June 30, 2015. The attached Notice of Special Meeting of Shareholders and Combined Proxy Statement and Prospectus concerning the

Table of Contents

Meeting describe the matters to be considered at the Meeting. You should read the Combined Proxy Statement and Prospectus prior to completing your voting instruction card.

You are cordially invited to attend the Meeting. Since it is important that your vote be represented whether or not you are able to attend, you are urged to consider these matters and to exercise your voting instructions by completing, dating, and signing the enclosed voting instruction card and returning it in the accompanying return envelope at your earliest convenience or by relaying your voting instructions via telephone or the Internet by following the enclosed instructions. For further information on how to instruct AXA Equitable, please see the Contractholder Voting Instructions included herein. Of course, we hope that you will be able to attend the Meeting, and if you wish, you may provide voting instructions in person, even though you may have already returned a voting instruction card or submitted your voting instructions via telephone or the Internet. Please respond promptly in order to save additional costs of proxy solicitation and in order to make sure you are represented.

| Very truly yours,

Steven M. Joenk Managing Director AXA Equitable Life Insurance Company |

Table of Contents

AXA PREMIER VIP TRUST

CharterSM Equity Portfolio

CharterSM Fixed Income Portfolio

1290 Avenue of the Americas

New York, New York 10104

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 17, 2015

To the Shareholders:

NOTICE IS HEREBY GIVEN that a Special Meeting of Shareholders of the CharterSM Equity Portfolio and the CharterSM Fixed Income Portfolio (each an “Acquired Portfolio” and together the “Acquired Portfolios”), each a series of AXA Premier VIP Trust (the “Trust”), will be held on September 17, 2015, at 2:00 p.m., Eastern time, at the offices of the Trust, located at 1290 Avenue of the Americas, New York, New York 10104 (the “Meeting”).

The Meeting will be held to act on the following proposals:

For shareholders of the CharterSM Equity Portfolio only:

1. To approve the Agreement and Plan of Reorganization and Termination (the “Plan of Reorganization”) with respect to the reorganization of the CharterSM Equity Portfolio, a series of the Trust, into the EQ/Common Stock Index Portfolio, a series of EQ Advisors Trust (“EQ Trust”).

For shareholders of the CharterSM Fixed Income Portfolio only:

2. To approve the Plan of Reorganization with respect to the reorganization of the CharterSM Fixed Income Portfolio, a series of the Trust, into the EQ/Core Bond Index Portfolio, a series of EQ Trust.

For shareholders of each Acquired Portfolio:

3. To transact other business that may properly come before the Meeting or any adjournments thereof.

The Board of Trustees of the Trust (the “Board”) unanimously recommends that you vote in favor of the relevant proposal(s).

Please note that owners of variable life insurance policies and/or variable annuity contracts or certificates (the “Contractholders”) issued by AXA Equitable Life Insurance Company (“AXA Equitable”), who have invested in shares of an Acquired Portfolio through the investment divisions of a separate account or accounts of AXA Equitable will be given the opportunity, to the extent required by law, to provide voting instructions on the above proposals.

i

Table of Contents

You should read the Combined Proxy Statement and Prospectus attached to this notice prior to completing your proxy or voting instruction card. The record date for determining the number of shares outstanding, the shareholders entitled to vote and the Contractholders entitled to provide voting instructions at the Meeting and any adjournments or postponements thereof has been fixed as the close of business on June 30, 2015. If you attend the Meeting, you may vote or provide your voting instructions in person.

YOUR VOTE IS IMPORTANT

Please return your proxy or voting instruction card promptly

Regardless of whether you plan to attend the Meeting, you should vote or provide voting instructions by promptly completing, dating, and signing the enclosed proxy or voting instruction card and returning it in the enclosed postage-paid envelope. You also can vote or provide voting instructions through the Internet or by telephone using the 12-digit control number that appears on the enclosed proxy or voting instruction card and following the simple instructions. If you are present at the Meeting, you may change your vote or voting instructions, if desired, at that time. The Board recommends that you vote or provide voting instructions to vote “FOR” each proposal.

| By order of the Board,

Patricia Louie Vice President and Secretary |

Dated: [ ], 2015

New York, New York

ii

Table of Contents

AXA EQUITABLE LIFE INSURANCE COMPANY

CONTRACTHOLDER VOTING INSTRUCTIONS

REGARDING A SPECIAL MEETING OF SHAREHOLDERS OF

CHARTERSM EQUITY PORTFOLIO

CHARTERSM FIXED INCOME PORTFOLIO,

EACH A SERIES OF AXA PREMIER VIP TRUST

TO BE HELD ON SEPTEMBER 17, 2015

Dated: [ ], 2015

GENERAL

These Contractholder Voting Instructions are being furnished by AXA Equitable Life Insurance Company (“AXA Equitable”) to owners of its variable life insurance policies or variable annuity contracts or certificates (the “Contracts”) (the “Contractholders”) who, as of June 30, 2015 (the “Record Date”), had net premiums or contributions allocated to the investment divisions of its separate account or accounts (the “Separate Accounts”) that are invested in shares of the CharterSM Equity Portfolio and/or the CharterSM Fixed Income Portfolio (each an “Acquired Portfolio” and together the “Acquired Portfolios”).

Each Acquired Portfolio is a series of AXA Premier VIP Trust (the “Trust”), a Delaware statutory trust that is registered with the Securities and Exchange Commission as an open-end management investment company.

To the extent required by applicable law, AXA Equitable will offer Contractholders the opportunity to instruct it, as the record owner of all of the shares of beneficial interest in an Acquired Portfolio (the “Shares”) held by the Separate Accounts, as to how it should vote on the respective reorganization proposals (the “Proposals”) that will be considered at the Special Meeting of Shareholders of the Acquired Portfolios referred to in the preceding Notice and at any adjournments or postponements (the “Meeting”). The enclosed Combined Proxy Statement and Prospectus, which you should retain for future reference, concisely sets forth information about the proposed reorganization involving each Acquired Portfolio and the corresponding series of EQ Advisors Trust that a Contractholder should know before completing the enclosed voting instruction card.

AXA Equitable Financial Services Company, LLC, a wholly owned subsidiary of AXA Financial, Inc., is the parent company of AXA Equitable. AXA Financial, Inc. is a wholly owned subsidiary of AXA, a French insurance holding company. The principal executive offices of AXA Equitable Financial Services Company, LLC and AXA Financial, Inc. are located at 1290 Avenue of the Americas, New York, New York 10104.

These Contractholder Voting Instructions and the accompanying voting instruction card, together with the enclosed proxy materials, are being mailed to Contractholders on or about [ ], 2015.

i

Table of Contents

HOW TO INSTRUCT AXA EQUITABLE

To instruct AXA Equitable as to how to vote the Shares held in the investment divisions of its Separate Accounts, Contractholders are asked to promptly complete their voting instructions on the enclosed voting instruction card(s), sign and date the voting instruction card(s), and mail the voting instruction card(s) in the accompanying postage-paid envelope. Contractholders also may provide voting instructions by telephone at 1-866-221-8325 or by Internet at our website at https://www.proxypush.com/AXACP.

If a voting instruction card is not marked to indicate voting instructions but is signed and timely returned, it will be treated as an instruction to vote the Shares “For” the applicable Proposal.

The number of Shares held in the investment division of a Separate Account corresponding to the Acquired Portfolio for which a Contractholder may provide voting instructions was determined as of the Record Date by dividing (i) a Contract’s account value allocable to that investment division by (ii) the net asset value of one Share of the Acquired Portfolio. Each whole Share of an Acquired Portfolio is entitled to one vote as to each matter with respect to which it is entitled to vote and each fractional Share is entitled to a proportionate fractional vote. At any time prior to AXA Equitable’s voting at the Meeting, a Contractholder may revoke his or her voting instructions with respect to that investment division by providing AXA Equitable with a properly executed written revocation of such voting instructions, properly executing later-dated voting instructions by a voting instruction card, telephone or the Internet, or appearing and providing voting instructions in person at the Meeting.

HOW AXA EQUITABLE WILL VOTE

AXA Equitable will vote the Shares for which it receives timely voting instructions from Contractholders in accordance with those instructions. Shares in each investment division of a Separate Account for which AXA Equitable receives a voting instruction card that is signed and timely returned but is not marked to indicate voting instructions will be treated as an instruction to vote the Shares “FOR” a Proposal. Shares in each investment division of a Separate Account for which AXA Equitable receives no timely voting instructions from Contractholders, or that are attributable to amounts retained by AXA Equitable as surplus or seed money, will be voted by AXA Equitable either “FOR” or “AGAINST” a Proposal, or as an abstention, in the same proportion as the Shares for which Contractholders have provided voting instructions to AXA Equitable. As a result of such proportional voting by AXA Equitable, it is possible that a small number of Contractholders could determine whether a Proposal is approved.

OTHER MATTERS

AXA Equitable is not aware of any matters, other than the specified Proposals, to be acted on at the Meeting. If any other matters come before the Meeting, AXA Equitable

ii

Table of Contents

will vote the Shares upon such matters in its discretion. Voting instruction cards may be solicited by directors, officers and employees of AXA Equitable Funds Management Group, LLC, the investment manager of the Trust, or its affiliates as well as officers and agents of the Trust. The principal solicitation will be by mail but voting instructions may also be solicited by telephone, fax, personal interview, the Internet or other permissible means.

If the quorum necessary to transact business at the Meeting is not established with respect to an Acquired Portfolio, or the vote required to approve a Proposal is not obtained at the Meeting, the persons named as proxies may propose one or more adjournments or postponements of the Meeting in accordance with applicable law to permit further solicitation of voting instructions. The persons named as proxies will vote in their discretion on any such adjournment or postponement.

It is important that your Contract be represented. Please promptly mark your voting instructions on the enclosed voting instruction card; then sign and date the voting instruction card and mail it in the accompanying postage-paid envelope. You may also provide your voting instructions by telephone at 1-866-221-8325 or by Internet at our website at https://www.proxypush.com/AXACP.

iii

Table of Contents

PROXY STATEMENT

for

CharterSM Equity Portfolio

CharterSM Fixed Income Portfolio,

each a series of AXA Premier VIP Trust and

PROSPECTUS

for

EQ/Common Stock Index Portfolio

EQ/Core Bond Index Portfolio,

each a series of EQ Advisors Trust

Dated [ ], 2015

1290 Avenue of the Americas

New York, New York 10104

1-877-222-2144

This Combined Proxy Statement and Prospectus (the “Proxy Statement/Prospectus”) is being furnished to owners (the “Contractholders”) of variable life insurance policies and/or variable annuity contracts or certificates (the “Contracts”) issued by AXA Equitable Life Insurance Company (“AXA Equitable”) who, as of June 30, 2015, had net premiums or contributions allocated to the investment divisions of its separate account or accounts (the “Separate Accounts”) that are invested in shares of beneficial interest in the CharterSM Equity Portfolio and/or the CharterSM Fixed Income Portfolio.

The CharterSM Equity Portfolio is referred to herein as the “Equity Portfolio,” and the CharterSM Fixed Income Portfolio is referred to herein as the “Fixed Income Portfolio” (each also an “Acquired Portfolio” and together the “Acquired Portfolios”). Each Acquired Portfolio is a series of AXA Premier VIP Trust (the “Trust”), an open-end management investment company registered with the Securities and Exchange Commission (“SEC”). This Proxy Statement/Prospectus also is being furnished to AXA Equitable as the record owner of shares and to other shareholders that were invested in the Acquired Portfolios as of June 30, 2015. Contractholders are being provided the opportunity to instruct AXA Equitable to approve or disapprove the proposals contained in this Proxy Statement/Prospectus (each, a “Proposal”) in connection with the solicitation by the Board of Trustees of the Trust (the “Board” or “Board of the Trust”) of proxies to be used at the Special Meeting of Shareholders of the Acquired Portfolios to be held at 1290 Avenue of the Americas, New York, New York 10104, on September 17, 2015, at 2:00 p.m., Eastern time, or any adjournment or postponement thereof (the “Meeting”).

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROXY STATEMENT/PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Table of Contents

The Proposals are:

| Proposal | Shareholders Entitled

to Vote on the Proposal | |

| 1. To approve the Agreement and Plan of Reorganization and Termination (the “Plan of Reorganization”) with respect to the reorganization of the Equity Portfolio into the EQ/Common Stock Index Portfolio, a series of EQ Advisors Trust (“EQ Trust”) (the “Stock Index Portfolio”). | Shareholders of the Equity Portfolio. | |

| 2. To approve the Plan of Reorganization with respect to the reorganization of the Fixed Income Portfolio into the EQ/Core Bond Index Portfolio, a series EQ Trust (the “Bond Index Portfolio”). | Shareholders of the Fixed Income Portfolio. |

Each reorganization referred to in Proposals 1-2 above is referred to herein as a “Reorganization” and together as the “Reorganizations.” Each of the Stock Index Portfolio and the Bond Index Portfolio is referred to herein as an “Acquiring Portfolio” and together as the “Acquiring Portfolios.”

This Proxy Statement/Prospectus, which you should retain for future reference, contains important information regarding the Proposals that you should know before voting or providing voting instructions. Additional information about the Trust has been filed with the SEC and is available, without charge, upon oral or written request. This Proxy Statement/Prospectus is being provided to AXA Equitable and mailed to Contractholders and other shareholders on or about [ ], 2015. This Proxy Statement/Prospectus and a proxy or voting instruction card also will be available at https://www.poxydocs.com/AXACP on or about [ ], 2015. It is expected that one or more representatives of AXA Equitable will attend the Meeting in person or by proxy and will vote shares held by AXA Equitable in accordance with voting instructions received from its Contractholders and in accordance with voting procedures established by the Trust.

The following documents have been filed with the SEC and are incorporated by reference into this Proxy Statement/Prospectus:

| 1. | The Prospectus and Statement of Additional Information of the Trust with respect to the Acquired Portfolios, dated May 1, 2015, as supplemented (File Nos. 333-70754 and 811-10509); and |

| 2. | The Statement of Additional Information dated [ ], 2015, relating to the Reorganizations (File No. 333-[ ]). |

For a free copy of any of these documents, please call 1-877-522-5035 or write the Trust at the address above.

Each of the Trust and EQ Trust is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, it must file certain reports and other information with the SEC. You can copy and review information about each of the Trust and EQ Trust, including proxy materials and proxy and information statements, at the SEC’s Public Reference Room in Washington, DC, and at certain of the following SEC Regional Offices: New York Regional Office, 3 World Financial Center, Suite 400, New York, New York 10281;

ii

Table of Contents

Miami Regional Office, 801 Brickell Avenue, Suite 1800, Miami, Florida 33131; Chicago Regional Office, 175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604; Denver Regional Office, 1801 California Street, Suite 1500, Denver, Colorado 80202; Los Angeles Regional Office, 5670 Wilshire Boulevard, 11th Floor, Los Angeles, California 90036; Boston Regional Office, 33 Arch Street, 23rd Floor, Boston, MA 02110; Philadelphia Regional Office, The Mellon Independence Center, 701 Market Street, Philadelphia, PA 19106; Atlanta Regional Office, 3475 Lenox Road, N.E., Suite 1000, Atlanta, GA 30326; Fort Worth Regional Office, Burnett Plaza, Suite 1900, 801 Cherry Street, Unit 18, Fort Worth, TX 76102; Salt Lake Regional Office, 15 W. South Temple Street, Suite 1800, Salt Lake City, UT 84101; and San Francisco Regional Office, 44 Montgomery Street, Suite 2600, San Francisco, CA 94104. You may obtain information on the operation of the Public Reference Room by calling the SEC at (202) 551-8090. Reports and other information about the Trust and EQ Trust are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information from the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Washington, DC 20549, at prescribed rates.

iii

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 6 | ||||

| 7 | ||||

| 8 | ||||

| Comparisons of Investment Objectives, Policies and Strategies |

8 | |||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| Comparison of Investment Objectives, Policies and Strategies |

17 | |||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| Potential Benefits of the Reorganizations to FMG LLC and its Affiliates |

25 | |||

| 26 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 41 | ||||

| 42 | ||||

| 45 | ||||

| 45 |

i

Table of Contents

ii

Table of Contents

You should read this entire Proxy Statement/Prospectus carefully. For additional information, you should consult the Plan of Reorganization, a copy of the form of which is attached hereto as Appendix A.

The Proposed Reorganizations

This Proxy Statement/Prospectus is soliciting shareholders with amounts invested in the Acquired Portfolios as of June 30, 2015, to approve the Plan of Reorganization (with respect to the Acquired Portfolio in which they are invested), whereby each Acquired Portfolio will be reorganized into a corresponding Acquiring Portfolio, as described below. (Each Acquired Portfolio and Acquiring Portfolio is sometimes referred to herein as a “Portfolio,” and together, the “Portfolios.”)

Each Acquired Portfolio offers one class of shares, designated Class B shares (the “Acquired Portfolio Shares”). Each Acquiring Portfolio’s shares are divided into three classes, designated Class IA, Class IB and Class K shares. Only the Class IB shares of each Acquiring Portfolio (the “Acquiring Portfolio Shares”) are involved in the Reorganizations. The rights and preferences of the Acquiring Portfolio Shares are identical to the rights and preferences of the Acquired Portfolio Shares.

The Plan of Reorganization provides, with respect to each Reorganization, for:

| • | the transfer of all the assets of the Acquired Portfolio to the corresponding Acquiring Portfolio in exchange solely for Acquiring Portfolio Shares having an aggregate net asset value equal to the Acquired Portfolio’s net assets and the Acquiring Portfolio’s assumption of all the liabilities of the Acquired Portfolio; |

| • | the distribution to the shareholders (for the benefit of the Separate Accounts, as applicable, and thus the Contractholders) of those Acquiring Portfolio Shares; and |

| • | the complete termination of the Acquired Portfolio. |

The Board of the Trust is proposing the Reorganizations because it believes that they will permit shareholders invested in the Acquired Portfolios, which are small and have limited prospects for future growth and corresponding limited ability to achieve economies of scale, to invest in the corresponding Acquiring Portfolios, which in each case will result in a larger combined portfolio with a broadly similar investment objective that invests in the same asset class (i.e., equity securities and fixed income securities, respectively) pursuant to an indexing strategy and that has better prospects for attracting additional assets and lower expenses. For a detailed description of the Board’s reasons for proposing the Reorganizations, see “Additional Information about the Reorganizations — Board Considerations” below.

1

Table of Contents

A comparison of the investment objectives, policies, strategies and principal risks of each Acquired Portfolio and its corresponding Acquiring Portfolio is included in “Comparison of Investment Objectives, Policies and Strategies” and “Comparison of Principal Risk Factors” below. The Portfolios have identical distribution procedures, purchase procedures, exchange rights and redemption procedures, which are discussed in “Additional Information about the Acquiring Portfolios” section below. Each Portfolio offers its shares to Separate Accounts and certain other eligible investors. Shares of each Portfolio are offered and redeemed at their net asset value without any sales load. You will not incur any sales loads or similar transaction charges as a result of a Reorganization.

Subject to shareholder approval, the Reorganizations are expected to be effective at the close of business on September 25, 2015, or on a later date the Trust decides upon (the “Closing Date”). As a result of each Reorganization, each shareholder that owns shares of an Acquired Portfolio would become an owner of shares of the corresponding Acquiring Portfolio. Each such shareholder would hold, immediately after the Closing Date, Class IB shares of the applicable Acquiring Portfolio having an aggregate value equal to the aggregate value of the Class B shares of the Acquired Portfolio that were held by the shareholder as of the Closing Date. Similarly, each Contractholder whose Contract values are invested in shares of an Acquired Portfolio would become an indirect owner of shares of the corresponding Acquiring Portfolio. Each such Contractholder would indirectly hold, immediately after the Closing Date, Class IB shares of applicable Acquiring Portfolio having an aggregate value equal to the aggregate value of the Class B shares of the Acquired Portfolio that were indirectly held by the Contractholder as of the Closing Date. The Trust believes that there will be no adverse tax consequences to shareholders or Contractholders as a result of the Reorganizations. Please see “Additional Information about the Reorganizations — Federal Income Tax Consequences of the Reorganizations” below for further information.

The Board of Trustees of each of the Trust and EQ Trust has unanimously approved the Plan of Reorganization with respect to each Acquired Portfolio and each Acquiring Portfolio, respectively. Accordingly, the Board of the Trust is submitting the Plan of Reorganization for approval by each Acquired Portfolio’s shareholders. In considering whether to approve the Proposals, you should review the discussion of the Proposals set forth below. In addition, you should review the information in this Proxy Statement/Prospectus that relates to each Proposal and the Plan of Reorganization generally. The Board of the Trust recommends that you vote “FOR” the Proposals to approve the Plan of Reorganization.

PROPOSAL 1: TO APPROVE THE PLAN OF REORGANIZATION WITH RESPECT TO THE REORGANIZATION OF THE CHARTERSM EQUITY PORTFOLIO, A SERIES OF THE TRUST, INTO THE EQ/COMMON STOCK INDEX PORTFOLIO, A SERIES OF EQ TRUST.

2

Table of Contents

This Proposal 1 requests your approval of a Plan of Reorganization pursuant to which the Equity Portfolio will be reorganized into the Stock Index Portfolio. In considering whether you should approve the Proposal, you should note that:

| • | The Portfolios have broadly similar investment objectives. The Equity Portfolio seeks long-term capital appreciation, while the Stock Index Portfolio seeks to achieve a total return (before expenses) that approximates the total return performance of the Russell 3000 Index including reinvestment of dividends, at a risk level consistent with that of the Russell 3000 Index. |

| • | Both Portfolios provide diversified exposure to equity securities. There are, however, differences in the Portfolios’ principal investment policies and strategies of which you should be aware. These are set forth immediately below. For a detailed comparison of the Portfolios’ investment policies and strategies, see “Comparisons of Investment Objectives, Policies and Strategies” below. |

| • | The Equity Portfolio invests in securities of other investment companies (“Underlying Portfolios”) and exchange traded funds (“Underlying ETFs”) such that at least 80% of its net assets are invested in equity securities. The Equity Portfolio allocates its assets to Underlying Portfolios and Underlying ETFs that invest among various equity asset categories, as well as non-traditional (alternative) investments. The asset categories and strategies of the Underlying Portfolios and Underlying ETFs in which the Equity Portfolio may invest are as follows (asset categories and strategies that the Manager considers to be non-traditional (alternative) are indicated with an asterisk*): covered call writing*, domestic large cap equity, domestic mid cap equity, domestic small cap equity, domestic micro-cap equity, emerging markets equity, emerging markets small cap, frontier markets, global equity, international developed equity and international/global small cap equity. Unlike the Stock Index Portfolio, the Equity Portfolio does not utilize an index investment strategy. |

| • | The Stock Index Portfolio utilizes an indexing strategy and generally invests at least 80% of its net assets in common stocks of companies represented in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index that measures the performance of the 3000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Stock Index Portfolio invests in stocks selected by a stratified sampling construction process, commonly referred to as an indexing strategy, in which its investment sub-adviser selects a subset of the companies represented in the Russell 3000 Index based on its analysis of key risk factors and other characteristics. Such factors include industry weightings, market capitalizations, return variability, and yield. Unlike the Equity Portfolio, the Stock Index Portfolio does not invest in Underlying Funds or Underlying ETFs. |

3

Table of Contents

| • | Each Portfolio’s principal risks include equity risk, large-cap, mid-cap company risk and small-cap company risk. The Equity Portfolio also is subject to affiliated portfolio risk, derivatives risk, foreign securities risk (including currency risk and emerging markets risk), futures contract risk, liquidity risk, market risk, micro-cap company risk, non-traditional (alternative) investment risk, portfolio management risk and risks related to investments in Underlying Portfolios and Underlying ETFs as principal risks while the Stock Index Portfolio is not. The Stock Index Portfolio is subject to index strategy risk, while the Equity Portfolio is not directly subject to such risk. For a detailed comparison of the Portfolios’ risks, see “Comparisons of Principal Risk Factors” below. |

| • | AXA Equitable Funds Management Group, LLC (“FMG LLC” or the “Manager”) serves as the investment manager and administrator for each Portfolio. FMG LLC manages the assets of the Equity Portfolio. FMG LLC has selected AllianceBernstein L.P. (“AllianceBernstein”) as the sub-adviser (“Sub-Adviser”) to manage the assets of the Stock Index Portfolio. It is anticipated that FMG LLC will continue to manage and administer, and that AllianceBernstein will continue to sub-advise, the Stock Index Portfolio after the Reorganization. |

| • | The Manager has been granted relief by the SEC to hire, terminate and replace Sub-Advisers and amend sub-advisory agreements subject to the approval of the Board of Trustees and without obtaining shareholder approval. However, FMG LLC may not enter into a sub-advisory agreement on behalf of a Portfolio with an “affiliated person” of the Manager, such as AllianceBernstein, unless the sub-advisory agreement, including compensation, is approved by the Portfolio’s shareholders. For a detailed description of the Manager and the Sub-Adviser to the Stock Index Portfolio, please see “Additional Information about the Acquiring Portfolios — The Manager” and “ — The Sub-Adviser” below. |

| • | The Equity Portfolio and the Stock Index Portfolio had net assets of approximately $5.4 million and $5.8 billion, respectively, as of December 31, 2014. Thus, if the Reorganization of the Equity Portfolio into the Stock Index Portfolio had been in effect on that date, the combined Portfolio would have had net assets of approximately $5.8 billion. |

| • | The Class B shareholders of the Equity Portfolio will receive Class IB shares of the Stock Index Portfolio pursuant to the Reorganization. Shareholders will not pay any sales charges in connection with the Reorganization. Please see “Comparative Fee and Expense Tables,” “Additional Information about the Reorganizations” and “Additional Information about the Acquiring Portfolios” below for more information. |

| • | It is estimated that the total annual operating expense ratio (including acquired fund fees and expenses, if any) for the Stock Index Portfolio’s Class IB shares, for the fiscal year following the Reorganization, will be lower than |

4

Table of Contents

| that of the Equity Portfolio’s Class B shares for the fiscal year ended December 31, 2014. For a more detailed comparison of the fees and expenses of the Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Acquiring Portfolios” below. |

| • | The maximum management fee for the Equity Portfolio is equal to an annual rate of 0.15% of its average daily net assets and the maximum management fee for the Stock Index Portfolio is equal to an annual rate of 0.35% of its average daily net assets. The Portfolios pay different administration fees. The Equity Portfolio pays FMG LLC its proportionate share of an asset-based administration fee, subject to a minimum annual fee of $32,500. The asset-based administration fee is equal to an annual rate of 0.15% of the average daily net assets of the 19 portfolios of the Trust designated in the Trust’s prospectus as “CharterSM Allocation Portfolios.” The Stock Index Portfolio pays FMG LLC its proportionate share of an asset-based administration fee for the Single-Advised Portfolios (defined below), which is equal to an annual rate of 0.12% of the first $3 billion of the aggregate average daily net assets of the Single-Advised Portfolios; 0.11% of the next $3 billion; 0.105% of the next $4 billion; 0.10% of the next $20 billion; 0.0975% of the next $10 billion; and 0.095% thereafter, subject to a minimum annual fee of $30,000. For a more detailed description of the fees and expenses of the Portfolios, including a description of the Single-Advised Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Acquiring Portfolios” below. |

| • | The Equity Portfolio is subject to an expense limitation arrangement while the Stock Index Portfolio is not. Pursuant to a contract, FMG LLC has agreed to make payments or waive its management, administrative or other fees to limit the expenses of the Equity Portfolio through April 30, 2016 (unless the Board of Trustees consents to an earlier revision or termination of this arrangement) (“Expense Limitation Arrangement”) so that the annual operating expenses of the Equity Portfolio (exclusive of taxes, interest, brokerage commissions, dividend and interest expenses on securities sold short, capitalized expenses, fees and expenses of other investment companies in which the Equity Portfolio invests, and extraordinary expenses) do not exceed an annual rate of average daily net assets of 0.65% for Class B shares the Equity Portfolio. |

| • | The Class IB Shares of the Stock Index Portfolio outperformed the Class B Shares of the Equity Portfolio for the one-year period ended December 31, 2014. Please see “Comparative Performance Information” below. |

| • | Following the Reorganization, the combined Portfolio will be managed in accordance with the investment objective, policies and strategies of the Stock Index Portfolio. It is not expected that the Stock Index Portfolio will revise any of its investment policies following the Reorganization to reflect those of the Equity Portfolio. If the Reorganization is approved, all of the Equity Portfolio’s assets (“Transferred Assets”) on the Closing Date will be transferred to the Stock Index Portfolio. It is anticipated that immediately prior to the |

5

Table of Contents

| Closing Date, the Equity Portfolio will liquidate its securities holdings and hold cash. Therefore, it is anticipated that the Transferred Assets will consist of cash. The sale of portfolio holdings by the Equity Portfolio in connection with the Reorganization may result in the Equity Portfolio selling securities at a disadvantageous time and price and could result in it realizing gains (or losses) that would not otherwise have been realized and incurring transaction costs that would not otherwise have been incurred. It is also expected that, over time, the Stock Index Portfolio will use the Transferred Assets to invest in equity securities represented in the Russell 3000 Index. |

| • | Except for brokerage costs incurred in connection with the Reorganization, FMG LLC will bear the expenses of the Reorganization described in this Proxy Statement/Prospectus. |

Comparative Fee and Expense Tables

The following tables show the fees and expenses of the Class B Shares of the Equity Portfolio and the Class IB Shares of the Stock Index Portfolio and the estimated pro forma fees and expenses of the Class IB Shares of the Stock Index Portfolio after giving effect to the proposed Reorganization. Fees and expenses for each Portfolio are based on those incurred by relevant class of its shares for the fiscal year ended December 31, 2014. The pro forma fees and expenses of the Stock Index Portfolio Shares assume that the Reorganization was in effect for the year ended December 31, 2014. The tables below do not reflect any Contract-related fees and expenses, which would increase overall fees and expenses. See a Contract prospectus for a description of those fees and expenses.

Shareholder Fees

(fees paid directly from your investment)

| Equity Portfolio |

Stock Index Portfolio |

Pro

Forma Stock Index | ||

| Not Applicable. | Not Applicable. | Not Applicable. |

Annual Operating Expenses

(expenses that you may pay each year as a percentage of the value of your investment)

| Equity Portfolio | Stock Index Portfolio | Pro Forma Stock Index Portfolio (assuming the Reorganization is approved) |

||||||||||

| Class B | Class IB | Class IB | ||||||||||

| Management Fee |

0.15 | % | 0.35 | % | 0.35 | % | ||||||

| Distribution and/or Service Fees (12b-1 fees) |

0.25 | % | 0.25 | % | 0.25 | % | ||||||

| Other Expenses |

4.24 | % | 0.12 | % | 0.12 | % | ||||||

| Acquired Fund Fees and Expenses |

0.86 | % | N/A | N/A | ||||||||

6

Table of Contents

| Equity Portfolio | Stock Index Portfolio | Pro Forma Stock Index Portfolio (assuming the Reorganization is approved) |

||||||||||

| Class B | Class IB | Class IB | ||||||||||

| Total Annual Portfolio Operating Expenses |

5.50 | % | 0.72 | % | 0.72 | % | ||||||

| Fee Waiver and/or Expense Reimbursement† |

-3.99 | % | N/A | N/A | ||||||||

| Total Annual Portfolio Operating Expenses After Fee Waiver and/ or Expense Reimbursement |

1.51 | % | 0.72 | % | 0.72 | % | ||||||

| † | Pursuant to the Expense Limitation Arrangement, FMG LLC has agreed to make payments or waive its management, administrative or other fees to limit the expenses of the Equity Portfolio through April 30, 2016 (unless the Board of Trustees consents to an earlier revision or termination of this arrangement) so that the annual operating expenses of the Portfolio (exclusive of taxes, interest, brokerage commissions, dividend and interest expenses on securities sold short, capitalized expenses, fees and expenses of other investment companies in which the Portfolio invests, and extraordinary expenses) do not exceed an annual rate of average daily net assets of 0.65% for Class B of the Equity Portfolio. The Expense Limitation Arrangement may be terminated by FMG LLC at any time after April 30, 2016. |

This example is intended to help you compare the costs of investing in the Portfolios with the cost of investing in other investment options. The example assumes that:

| • | You invest $10,000 in a Portfolio for the time periods indicated; |

| • | Your investment has a 5% return each year; |

| • | The Portfolio’s operating expenses remain the same; and |

| • | The Expense Limitation Arrangement with respect to the Equity Portfolio is not renewed. |

This example does not reflect any Contract-related fees and expenses, including redemption fees (if any) at the Contract level. If such fees and expenses were reflected, the total expenses would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Equity Portfolio |

||||||||||||||||

| Class B |

$ | 154 | $ | 1,286 | $ | 2,408 | $ | 5,163 | ||||||||

| Stock Index Portfolio |

||||||||||||||||

| Class IB |

$ | 74 | $ | 230 | $ | 401 | $ | 894 | ||||||||

| Pro Forma Stock Index Portfolio (assuming the Reorganization is approved) |

||||||||||||||||

| Class IB |

$ | 74 | $ | 230 | $ | 401 | $ | 894 | ||||||||

7

Table of Contents

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Portfolio’s performance. During the fiscal year ended December 31, 2014, the portfolio turnover rates for each of the Equity Portfolio and the Stock Index Portfolio were 25% and 4%, respectively, of the average value of the Portfolio.

Comparison of Investment Objectives, Policies and Strategies

The following table compares the investment objectives and principal investment policies and strategies of the Equity Portfolio with those of the Stock Index Portfolio. The Board of the Trust and the Board of EQ Trust may change the investment objective of a respective Portfolio without a vote of that Portfolio’s shareholders. For more detailed information about each Portfolio’s investment strategies and risks, see Appendix B.

| Acquired Portfolio | Acquiring Portfolio | |||

| Equity Portfolio | Stock Index Portfolio | |||

| Investment Objective |

Seeks long-term capital appreciation. | Seeks to achieve a total return before expenses that approximates the total return performance of the Russell 3000 Index, including reinvestment of dividends, at a risk level consistent with that of the Russell 3000 Index. | ||

| Principal Investment Strategies |

The Portfolio pursues its investment objective by investing in other mutual funds managed by the Manager and in investment companies managed by investment managers other than the Manager (affiliated and unaffiliated “Underlying Portfolios”) and Underlying ETFs comprising various asset categories and strategies. The Portfolio will invest in Underlying Portfolios and Underlying ETFs such that at least 80% of its assets (net assets plus the amount of any borrowings for investment purposes) are invested in equity securities (which may include derivatives exposure to equity securities).

The Portfolio allocates its assets to Underlying Portfolios and Underlying ETFs that invest among various equity asset categories, as well as non-traditional (alternative) investments. The asset categories and strategies of the Underlying Portfolios and Underlying ETFs in which |

The Portfolio generally invests at least 80% of its net assets, plus borrowings for investment purposes, in common stocks of companies represented in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index that measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The Portfolio’s investments are selected by a stratified sampling construction process in which the Sub-Adviser selects a subset of the 3,000 companies in the Russell 3000 based on the Sub-Adviser’s analysis of key risk factors and other characteristics. Such factors include industry weightings, market capitalizations, return variability, and yield. This strategy is commonly referred to as an indexing strategy. |

8

Table of Contents

| Acquired Portfolio | Acquiring Portfolio | |||

| Equity Portfolio | Stock Index Portfolio | |||

| the Portfolio invests are as follows (asset categories and strategies that the Manager considers to be non-traditional (alternative) are indicated with an asterisk*):

• Covered Call Writing* • Domestic Large Cap Equity • Domestic Mid Cap Equity • Domestic Small Cap Equity • Domestic Micro-Cap Equity • Emerging Markets Equity • Emerging Markets Small Cap • Frontier Markets • Global Equity • International Developed Equity • International/Global Small Cap Equity.

Non-traditional (alternative) investments are alternatives to traditional equity (stocks) or fixed income (bonds and cash) investments. Non-traditional (alternative) investments have the potential to enhance portfolio diversification and reduce overall portfolio volatility because these investments may not have a strong correlation (relationship) to one another or to traditional market indexes. This approach may involve, for example, holding both long and short positions in securities or using derivatives or hedging strategies. Many non-traditional (alternative) investments strategies are designed to help reduce the role of overall market direction in determining return.

In addition, the Portfolio may invest in Underlying Portfolios and Underlying ETFs that employ derivatives (including futures contracts) for a variety of purposes, including to reduce risk, to seek enhanced returns from certain asset classes, and to level of exposure to certain asset classes. |

Comparison of Principal Risk Factors

An investment in a Portfolio is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in a Portfolio. The following table compares the principal risks of an investment in the Equity Portfolio and the Stock Index Portfolio.

9

Table of Contents

For an explanation of each such risk, see “Additional Information about the Reorganizations — Descriptions of Risk Factors” below.

| Risks |

Stock Index Portfolio |

Equity Portfolio |

||||||

| Affiliated Portfolio Risk |

X | |||||||

| Derivatives Risk |

X | |||||||

| Equity Risk |

X | X | ||||||

| Foreign Securities Risk |

X | |||||||

| Currency Risk |

X | |||||||

| Emerging Markets Risk |

X | |||||||

| Futures Contract Risk |

X | |||||||

| Index Strategy Risk |

X | |||||||

| Large-Cap Company Risk |

X | X | ||||||

| Liquidity Risk |

X | |||||||

| Market Risk |

X | |||||||

| Micro-Cap Company Risk |

X | |||||||

| Mid-Cap and Small-Cap Company Risk |

X | X | ||||||

| Non-Traditional (Alternative) Investment Risk |

X | |||||||

| Portfolio Management Risk |

X | |||||||

| Risks Related to Investments in Underlying Portfolios and Underlying ETFs |

X | |||||||

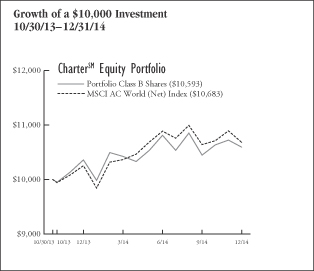

Comparative Performance Information

The bar charts and tables below provide some indication of the risks of investing in each Portfolio by showing changes in the Portfolio’s performance from year to year and by showing how the Stock Index Portfolio’s average annual total returns for the past one-, five- and ten-years, and the Equity Portfolio’s average annual total returns for the past year and since inception, through December 31, 2014, compared to the returns of a broad-based market index. The return of the broad-based market index (and any additional comparative index) shown in the right hand columns below for each Portfolio is the return of the index for the last 10 years or, if shorter, since inception of the share class with the longest history. Past performance is not an indication of future performance.

The performance results do not reflect any Contract-related fees and expenses, which would reduce the performance results.

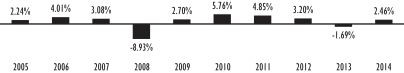

Equity Portfolio - Calendar Year Total Returns (Class B)

| Best quarter (% and time period) 3.71% (2014 2nd Quarter) |

Worst quarter (% and time period) -3.34% (2014 3rd Quarter) | |||||||||||||||||

10

Table of Contents

Stock Index Portfolio - Calendar Year Total Returns (Class IB)

| Best quarter (% and time period) 16.68% (2009 2nd Quarter) |

Worst quarter (% and time period) -25.39% (2008 4th Quarter) | |||||||||||||||||

Equity Portfolio Average Annual Total Returns

(For the periods ended December 31, 2014)

| One Year | Since Inception | |||||||

| Equity Portfolio — Class B Shares |

2.24 | % | 5.05 | % | ||||

| MSCI AC World (Net) Index (reflects no deduction for fees and expenses) |

4.16 | % | 5.81 | % | ||||

Stock Index Portfolio Average Annual Total Returns

(For the periods ended December 31, 2014)

| One Year | Five Years | Ten Years/ Since Inception |

||||||||||

| Stock Index Portfolio — Class IB Shares |

12.03% | 14.86% | 5.58% | |||||||||

| Russell 3000 Index (reflects no deduction for fees and expenses) |

12.56% | 15.63% | 7.94% | |||||||||

The following table shows the capitalization of each Portfolio as of December 31, 2014 and of the Stock Index Portfolio on a pro forma combined basis as of December 31, 2014, after giving effect to the proposed Reorganization. Pro forma net assets may not total and net asset values per share may not recalculate due to rounding of net assets.

| Net Assets (in millions) |

Net Asset Value Per Share |

Shares Outstanding |

||||||||||

| Equity Portfolio — Class IA Shares |

N/A | N/A | N/A | |||||||||

| Stock Index Portfolio — Class IA Shares |

$ | 4,292.8 | $ | 26.27 | 163,395,617 | |||||||

| Equity Portfolio — Class B Share |

$ | 5.4 | $ | 10.15 | 529,959 | |||||||

| Stock Index Portfolio — Class IB Shares |

$ | 1,472.9 | $ | 26.13 | 56,367,324 | |||||||

| Adjustments(a) |

$ | — | $ | — | (324,054 | ) | ||||||

| Pro forma Stock Index Portfolio — Class IB Shares |

$ | 1,478.3 | $ | 26.13 | 56,573,229 | |||||||

| Equity Portfolio — Class K Shares |

N/A | N/A | N/A | |||||||||

| Stock Index Portfolio — Class K Shares* |

N/A | N/A | N/A | |||||||||

| * | Class K shares of the Stock Index Portfolio are not operational. |

| (a) | Reflects adjustment for retired shares of the Equity Portfolio. |

11

Table of Contents

AFTER CAREFUL CONSIDERATION, THE BOARD OF THE TRUST UNANIMOUSLY APPROVED THE PLAN OF REORGANIZATION WITH RESPECT TO THE EQUITY PORTFOLIO. ACCORDINGLY, THE BOARD HAS SUBMITTED THE PLAN OF REORGANIZATION FOR APPROVAL BY THIS PORTFOLIO’S SHAREHOLDERS. THE BOARD RECOMMENDS THAT YOU VOTE “FOR” PROPOSAL 1.

PROPOSAL 2: TO APPROVE THE PLAN OF REORGANIZATION WITH RESPECT TO THE REORGANIZATION OF THE CHARTERSM FIXED INCOME PORTFOLIO, A SERIES OF THE TRUST, INTO THE EQ/CORE BOND INDEX PORTFOLIO, A SERIES OF EQ TRUST.

This Proposal 2 requests your approval of a Plan of Reorganization pursuant to which the Fixed Income Portfolio will be reorganized into the Bond Index Portfolio. In considering whether you should approve the Proposal, you should note that:

| • | The Portfolios have broadly similar investment objectives. The Fixed Income Portfolio seeks a high level of current income, while the Bond Index Portfolio seeks to achieve a total return before expenses that approximates the total return performance of the Barclays Intermediate U.S. Government/Credit Index (the “U.S. Government/Credit Index”), including reinvestment of dividends, at a risk level consistent with that of the U.S. Government/Credit Index. |

| • | Both Portfolios provide diversified exposure to fixed income securities. There are, however, differences in the Portfolios’ principal investment policies and strategies of which you should be aware. These are set forth immediately below. For a detailed comparison of the Portfolios’ investment policies and strategies, see “Comparisons of Investment Objectives, Policies and Strategies” below. |

| • | The Fixed Income Portfolio invests in securities of other investment companies (“Underlying Portfolios”) and exchange traded funds (“Underlying ETFs”) such that at least 80% of its assets are invested in fixed income securities. The Fixed Income Portfolio allocates its assets to Underlying Portfolios and Underlying ETFs that invest among various fixed income asset categories, as well as non-traditional (alternative) investments. The asset categories and strategies of the Underlying Portfolios and Underlying ETFs in which the Fixed Income Portfolio may invest are as follows (asset categories and strategies that the Manager considers to be non-traditional (alternative) are indicated with an asterisk*): convertible securities*, bank loans, emerging market debt securities, floating rate securities, global bond, high yield bond, inflation linked securities, international bond, money market, U.S. government bond, U.S. investment grade bond and U.S. short term investment grade bond. Unlike the Bond Index Portfolio, the Fixed Income Portfolio does not utilize an index investment strategy. |

| • | The Bond Index Portfolio utilizes an indexing strategy and generally invests at least 80% of its net assets in securities that are included in the U.S. Government/Credit Index, which covers the U.S. dollar denominated, |

12

Table of Contents

| investment grade, fixed-rate, taxable bond market, including U.S. Treasury and government-related, corporate, credit and agency fixed-rate debt securities. Unlike the Fixed Income Portfolio, only up to 40% of the Bond Index Portfolio’s assets may be invested in ETFs. |

| • | Each Portfolio’s principal risks include credit risk, interest rate risk, investment grade securities risk and liquidity risk. The Fixed Income Portfolio also is subject to affiliated portfolio risk, bank loans risk, convertible securities risk, derivatives risk, floating rate loan risk, foreign securities risk (including currency risk and emerging markets risk), inflation-indexed bonds risk, non-investment grade securities risk, market risk, money market risk, non-traditional (alternative) investment risk, portfolio management risk, risks related to investments in underlying portfolios and underlying ETFs, and U.S. government securities risk as principal risks, while the Bond Index Portfolio is not. The Bond Index Portfolio is subject to ETF risk, index strategy risk, redemption risk and securities lending risk as principal risks, while the Fixed Income Portfolio is not directly subject to such risks. For a detailed comparison of the Portfolios’ risks, see “Comparisons of Principal Risk Factors” below. |

| • | AXA Equitable Funds Management Group, LLC (“FMG LLC” or the “Manager”) serves as the investment manager and administrator for each Portfolio. FMG LLC manages the assets of the Fixed Income Portfolio. FMG LLC has selected SSgA Funds Management, Inc. (“SSgA FM”) as the sub-adviser (“Sub-Adviser”) to manage the assets of the Bond Index Portfolio. It is anticipated that FMG LLC will continue to manage and administer, and that SSgA FM will continue to sub-advise, the Bond Index Portfolio after the Reorganization. |

| • | The Manager has been granted relief by the SEC to hire, terminate and replace Sub-Advisers and amend sub-advisory agreements subject to the approval of the Board of Trustees and without obtaining shareholder approval. However, FMG LLC may not enter into a sub-advisory agreement on behalf of a Portfolio with an “affiliated person” of the Manager, unless the sub-advisory agreement, including compensation, is approved by the Portfolio’s shareholders. For a detailed description of the Manager and the Sub-Adviser to the Bond Index Portfolio, please see “Additional Information about the Acquiring Portfolios — The Manager” and “ — The Sub-Adviser” below. |

| • | The Fixed Income Portfolio and the Bond Index Portfolio had net assets of approximately $5.2 million and $8.6 billion, respectively, as of December 31, 2014. Thus, if the Reorganization had been in effect on that date, the combined Portfolio would have had net assets of approximately $8.6 billion. |

| • | The Class B shareholders of the Fixed Income Portfolio will receive Class IB shares of the Bond Index Portfolio pursuant to the Reorganization. Shareholders will not pay any sales charges in connection with the Reorganization. |

13

Table of Contents

| Please see “Comparative Fee and Expense Tables,” “Additional Information about the Reorganization” and “Additional Information about the Acquiring Portfolios” below for more information. |

| • | It is estimated that the total annual operating expense ratio (including acquired fund fees and expenses, if any) for the Bond Index Portfolio’s Class IB shares, for the fiscal year following the Reorganization, will be lower than that of the Fixed Income Portfolio’s Class B shares for the fiscal year ended December 31, 2014. For a more detailed comparison of the fees and expenses of the Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Acquiring Portfolios” below. |

| • | The maximum management fee for the Fixed Income Portfolio is equal to an annual rate of 0.15% of its average daily net assets and the maximum management fee for the Bond Index Portfolio is equal to an annual rate of 0.35% of its average daily net assets. The Portfolios pay different administration fees. The Fixed Income Portfolio pays FMG LLC its proportionate share of an asset-based administration fee, subject to a minimum annual fee of $32,500. The asset-based administration fee is equal to an annual rate of 0.15% of the average daily net assets of the 19 portfolios of the Trust designated in the Trust’s prospectus as “CharterSM Allocation Portfolios.” The Bond Index Portfolio pays FMG LLC its proportionate share of an asset-based administration fee for the Single-Advised Portfolios (defined below), which is equal to an annual rate of 0.12% of the first $3 billion of the aggregate average daily net assets of the Single-Advised Portfolios; 0.11% of the next $3 billion; 0.105% of the next $4 billion; 0.10% of the next $20 billion; 0.0975% of the next $10 billion; and 0.095% thereafter, subject to a minimum annual fee of $30,000. For a more detailed description of the fees and expenses of the Portfolios, including a description of the Single-Advised Portfolios, please see “Comparative Fee and Expense Tables” and “Additional Information about the Acquiring Portfolios” below. |

| • | Both Portfolios are subject to an expense limitation arrangement (an “Expense Limitation Agreement”). FMG LLC has entered into an Expense Limitation Agreement with the Trust pursuant to which FMG LLC has agreed to make payments or waive its management, administrative or other fees to limit the expenses of the Fixed Income Portfolio through April 30, 2016 (unless the Board of the Trust consents to an earlier revision or termination of this arrangement) so that the annual operating expenses of the Fixed Income Portfolio (other than interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, expenses of Underlying Portfolios and Underlying ETFs, other expenditures that are capitalized in accordance with generally accepted accounting principles and other extraordinary expenses not incurred in the ordinary course of the Fixed Income Portfolio’s business) do not exceed an annual rate of average daily net assets of 0.65% for Class B shares of the Fixed Income Portfolio. Similarly, FMG LLC has entered into an Expense Limitation Agreement with EQ Trust pursuant to which FMG LLC agreed to make payments or waive its management, administrative and other fees to limit the expenses of the Bond Index Portfolio |

14

Table of Contents

| through April 30, 2016 (unless the Board of Trustees of the EQ Trust consents to an earlier revision or termination of this arrangement) so that the annual operating expenses of the Bond Index Portfolio (other than interest, taxes, brokerage commissions, dividend and interest expenses on securities sold short, expenses of other investment companies in which the Bond Index Portfolio invests, other expenditures that are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Bond Index Portfolio’s business) do not exceed an annual rate of average daily net assets of 0.72% for the Class IB shares of the Bond Index Portfolio. |

| • | The Class IB shares of the Bond Index Portfolio outperformed the Class B shares of the Fixed Income Portfolio for the one-year period ended December 31, 2014. Please see “Comparative Performance Information” below. |

| • | Following the Reorganization, the combined Portfolio will be managed in accordance with the investment objective, policies and strategies of the Bond Index Portfolio. It is not expected that the Bond Index Portfolio will revise any of its investment policies following the Reorganization to reflect those of the Fixed Income Portfolio. If the Reorganization is approved, all of the Fixed Income Portfolio’s assets (“Transferred Assets”) on the Closing Date will be transferred to the Bond Index Portfolio. It is anticipated that immediately prior to the Closing Date, the Fixed Income Portfolio will liquidate its securities holdings and hold cash. Therefore, it is anticipated that the Transferred Assets will consist of cash. The sale of portfolio holdings by the Fixed Income Portfolio in connection with the Reorganization may result in the Fixed Income Portfolio selling securities at a disadvantageous time and price and could result in it realizing gains (or losses) that would not otherwise have been realized and incurring transaction costs that would not otherwise have been incurred. It is also expected that, over time, the Bond Index Portfolio will use the Transferred Assets to invest in fixed income securities represented in the U.S. Government/Credit Index. |

| • | Except for brokerage costs incurred in connection with the Reorganization, FMG LLC will bear the expenses of the Reorganization described in this Proxy Statement/Prospectus. |

Comparative Fee and Expense Tables

The following tables show the fees and expenses of the Class B Shares of the Fixed Income Portfolio and the Class IB Shares of the Bond Index Portfolio and the estimated pro forma fees and expenses of the Class IB Shares of the Bond Index Portfolio after giving effect to the proposed Reorganization. The pro forma fees and expenses of the Bond Index Portfolio Shares assume that the Reorganization was in effect for the year ended December 31, 2014. The tables below do not reflect any Contract-related fees and expenses, which would increase overall fees and expenses. See a Contract prospectus for a description of those fees and expenses.

15

Table of Contents

Shareholder Fees

(fees paid directly from your investment)

| Fixed Income Portfolio |

Bond Index Portfolio |

Pro Forma Bond

Index | ||

| Not Applicable. |

Not Applicable. | Not Applicable. |

Annual Operating Expenses

(expenses that you may pay each year as a percentage of the value of your investment)

| Fixed Income Portfolio |

Bond Index Portfolio |

Pro Forma Bond Index Portfolio (assuming the Reorganization is approved) |

||||||||||

| Class B | Class IB | Class IB | ||||||||||

| Management Fee |

0.15 | % | 0.34 | % | 0.34 | % | ||||||

| Distribution and/or Service Fees (12b-1 fees) |

0.25 | % | 0.25 | % | 0.25 | % | ||||||

| Other Expenses |

3.82 | % | 0.12 | % | 0.12 | % | ||||||

| Acquired Fund Fees and Expenses |

0.65 | % | N/A | N/A | ||||||||

| Total Annual Portfolio Operating Expenses |

4.87 | % | 0.71 | % | 0.71 | % | ||||||

| Fee Waiver and/or Expense Reimbursement† |

-3.57 | N/A | N/A | |||||||||

| Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement |

1.30 | % | 0.71 | % | 0.71 | % | ||||||

| † | Pursuant to an Expense Limitation Arrangement with the Trust, FMG LLC has agreed to make payments or waive its management, administrative or other fees to limit the expenses of the Fixed Income Portfolio through April 30, 2016 (unless the Board of the Trust consents to an earlier revision or termination of this arrangement) so that the annual operating expenses of the Fixed Income Portfolio (exclusive of taxes, interest, brokerage commissions, dividend and interest expenses on securities sold short, capitalized expenses, fees and expenses of other investment companies in which the Fixed Income Portfolio invests, and extraordinary expenses) do not exceed an annual rate of average daily net assets of 0.65% for Class B shares of the Fixed Income Portfolio. The Expense Limitation Arrangement with the Trust may be terminated by FMG LLC at any time after April 30, 2016. |

This example is intended to help you compare the costs of investing in the Portfolios with the cost of investing in other investment options. The example assumes that:

| • | You invest $10,000 in a Portfolio for the time periods indicated; |

| • | Your investment has a 5% return each year; |

| • | The Portfolio’s operating expenses remain the same; and |

| • | The Expense Limitation Arrangement with respect to the Fixed Income Portfolio is not renewed. |

16

Table of Contents

This example does not reflect any Contract-related fees and expenses, including redemption fees (if any) at the Contract level. If such fees and expenses were reflected, the total expenses would be higher. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Fixed Income Portfolio |

||||||||||||||||

| Class B |

$ | 132 | $ | 1,144 | $ | 2,158 | $ | 4,704 | ||||||||

| Bond Index Portfolio |

||||||||||||||||

| Class IB |

$ | 73 | $ | 227 | $ | 395 | $ | 883 | ||||||||

| Pro Forma Bond Index Portfolio (assuming the Reorganization is approved) |

||||||||||||||||

| Class IB |

$ | 73 | $ | 227 | $ | 395 | $ | 883 | ||||||||

Each Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Portfolio’s performance. During the fiscal year ended December 31, 2014, the portfolio turnover rates for each of the Fixed Income Portfolio and the Bond Index Portfolio were 19% and 24%, respectively, of the average value of the Portfolio.

Comparison of Investment Objectives, Policies and Strategies

The following table compares the investment objectives and principal investment policies and strategies of the Fixed Income Portfolio with those of the Bond Index Portfolio. The Board of the Trust and the Board of EQ Trust may change the investment objective of a respective Portfolio without a vote of that Portfolio’s shareholders. For more detailed information about each Portfolio’s investment strategies and risks, see Appendix B.

| Acquired Portfolio | Acquiring Portfolio | |||

| Fixed Income Portfolio | Bond Index Portfolio | |||

| Investment Objective |

Seeks a high level of current income. | Seeks to achieve a total return before expenses that approximates the total return performance of the Barclays Intermediate U.S. Government/Credit Index (“Intermediate Government Credit Index”), including reinvestment of dividends, at a risk level consistent with that of the Intermediate Government Credit Index. |

17

Table of Contents

| Acquired Portfolio | Acquiring Portfolio | |||

| Fixed Income Portfolio | Bond Index Portfolio | |||

|

Principal Investment Strategies |

The Portfolio pursues its investment objective by investing in other mutual funds managed by the Manager and in investment companies managed by investment managers other than the Manager (affiliated and unaffiliated “Underlying Portfolios”) and Underlying ETFs comprising various asset categories and strategies. The Portfolio will invest in Underlying Portfolios and Underlying ETFs such that at least 80% of its assets (net assets plus the amount of any borrowings for investment purposes) are invested in fixed income securities (which may include derivatives exposure to fixed income securities).

The Portfolio allocates its assets to Underlying Portfolios and Underlying ETFs that invest among various fixed income asset categories, as well as non-traditional (alternative) investments. The asset categories and strategies of the Underlying Portfolios and Underlying ETFs in which the Portfolio invests are as follows (asset categories and strategies that the Manager considers to be non-traditional (alternative) are indicated with an asterisk*):

• Convertible Securities* • Bank Loans • Emerging Market Debt Securities • Floating Rate Securities • Global Bond • High Yield Bond • Inflation Linked Securities • International Bond • Money Market • U.S. Government Bond • U.S. Investment Grade Bond • U.S. Short Term Investment Grade Bond

Non-traditional (alternative) investments are alternatives to traditional equity (stocks) or fixed income (bonds and cash) investments. Non-traditional (alternative) investments have the potential to enhance portfolio diversification and reduce overall portfolio volatility because these investments may not have a strong correlation (relationship) to one another or to traditional market indexes.

In addition, the Portfolio may invest in Underlying Portfolios and Underlying ETFs that employ derivatives (including futures contracts) for a variety of purposes, including to reduce risk, to seek enhanced returns from certain asset classes, and to level of exposure to certain asset classes. |

Under normal market conditions, the Portfolio invests at least 80% of its net assets, plus borrowings for investment purposes, in securities that are included in the Intermediate Government Credit Index, which covers the U.S. dollar denominated, investment grade, fixed-rate, taxable bond market, including U.S. Treasury and government-related, corporate, credit and agency fixed rate debt securities. The Manager also may invest up to 40% of the Portfolio’s assets in ETFs that invest in securities included in the Intermediate Government Credit Index.

In seeking to achieve the Portfolio’s investment objective, the Sub-Adviser will employ a stratified sample approach to build a portfolio whose broad characteristics match those of the Intermediate Government Credit Index. This strategy is commonly referred to as an indexing strategy. Individual securities holdings may differ from those of the Intermediate Government Credit Index, and the Portfolio may not track the performance of the Intermediate Government Credit Index perfectly due to expenses and transaction costs, the size and frequency of cash flow into and out of the Portfolio, and differences between how and when the Portfolio and the Intermediate Government Credit Index are valued.

The Portfolio also may lend its portfolio securities to earn additional income. |

18

Table of Contents

Comparison of Principal Risk Factors

An investment in a Portfolio is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose money by investing in a Portfolio. The following table compares the principal risks of an investment in each Portfolio. For an explanation of each such risk, see “Additional Information about the Reorganizations — Descriptions of Risk Factors” below.

| Risks |

Bond Index Portfolio |

Fixed Income Portfolio |

||||||

| Affiliated Portfolio Risk |

X | |||||||

| Bank Loans Risk |

X | |||||||

| Convertible Securities Risk |

X | |||||||

| Credit Risk |

X | X | ||||||

| Derivatives Risk |

X | |||||||

| ETF Risk |

X | |||||||

| Floating Rate Loan Risk |

X | |||||||

| Foreign Securities Risk |

X | |||||||

| Currency Risk |

X | |||||||

| Emerging Markets Risk |

X | |||||||

| Index Strategy Risk |

X | |||||||

| Inflation-Indexed Bonds Risk |

X | |||||||

| Interest Rate Risk |

X | X | ||||||

| Investment Grade Securities Risk |

X | X | ||||||

| Liquidity Risk |

X | X | ||||||

| Market Risk |

X | |||||||

| Money Market Risk |

X | |||||||

| Non-Investment Grade Risk |

X | |||||||

| Non-Traditional (Alternative) Investment Risk |

X | |||||||

| Portfolio Management Risk |

X | |||||||

| Redemption Risk |

X | |||||||

| Risks Related to Investments in Underlying Portfolios and Underlying ETFs |

X | |||||||

| Securities Lending Risk |

X | |||||||

| U.S. Government Securities Risk |

X | |||||||

Comparative Performance Information

The bar charts and tables below provide some indication of the risks of investing in each Portfolio by showing changes in the Portfolio’s performance from year to year and by showing how the Bond Index Portfolio’s average annual total returns for the past one-, five- and ten-years, and the Fixed Income Portfolio’s average annual total returns for one year and since inception, through December 31, 2014, compared to the returns of a broad-based market index. The return of the broad-based market index (and any additional comparative index) shown in the right hand columns below for each Portfolio is the return of the index for the last 10 years or, if shorter, since inception of the share class with the longest history. Past performance is not an indication of future performance.

19

Table of Contents

The performance results do not reflect any Contract-related fees and expenses, which would reduce the performance results.

Fixed Income Portfolio - Calendar Year Total Returns (Class B)

| Best quarter (% and time period) 2.11% (2014 2nd Quarter) |

Worst quarter (% and time period) -1.48% (2014 3rd Quarter) |