UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

For the fiscal year ended

OR

ACT OF 1934

OR

Commission file number

(Exact name of Registrant as specified in its charter) |

(Translation of Registrant’s name into English)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

FAX:

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

| Trading Symbol |

| Name of each exchange on which registered |

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None.

(Title of Class)

Indicate the number of issued and outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by this annual report

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒

Indicate by check mark whether the registrant has submitted electronically and posed on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “ accelerated filer,” and “ emerging growth company” in Rule 12b-2 of the Exchange Act (Check one).

Large accelerated filer | ☐ | ☒ | |

Accelerated filer | ☐ | Emerging Growth Company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standards” refers to any update by the Financial Accounting Standards Board to its accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act 15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board | ☐ | Other | ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

3 | ||||

3 | ||||

4 | ||||

ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| ||

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

| ||

5 | ||||

34 | ||||

54 | ||||

54 | ||||

63 | ||||

71 | ||||

71 | ||||

72 | ||||

73 | ||||

80 | ||||

80 | ||||

81 | ||||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITYHOLDERS AND USE OF PROCEEDS | 81 | |||

81 | ||||

82 | ||||

82 | ||||

82 | ||||

83 | ||||

83 | ||||

PURCHASES OF EQUITY SECURITIES BY ISSUER AND AFFILIATED PURCHASERS | 83 | |||

84 | ||||

84 | ||||

84 | ||||

88 | ||||

88 | ||||

89 | ||||

| 2 |

| Table of Contents |

INTRODUCTION

In this Form 20-F, references to “us”, “we”, the “Company” and “Euro Tech” are to Euro Tech Holdings Company Limited and its subsidiaries unless otherwise expressly stated or the context otherwise requires.

Forward Looking Statements

This annual report contains forward looking statements. Additional written or oral forward looking statements may be made by the Company from time to time in filings with the Commission or otherwise. Such forward looking statements are within the meaning of that term in Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Such statements may include, but not be limited to, projections of revenues, income, or loss, capital expenditures, plans for future operations, financing needs or plans, and plans relating to products or services of the Company, as well as assumptions relating to the foregoing. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” and similar expressions identify forward looking statements, which speak only as of the date the statement was made. Forward looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or underlying the forward looking statements.

These forward-looking statements include, but are not limited to, statements about:

| · | our goals, business plans and growth strategies; |

|

|

|

| · | our expectations regarding demand for and market acceptance of the products we distribute; |

|

|

|

| · | competition in our industries; |

|

|

|

| · | our future business development, results of operations and financial condition; |

|

|

|

| · | expected changes in our revenues and certain cost and expense items and our margins; |

|

|

|

| · | government policies and regulations relating to our corporate structure, business and industry; |

|

|

|

| · | the regulatory environment in which we operate in China and globally; |

|

|

|

| · | our ability to comply with the continued listing standards on the exchange or trading market on which our ordinary shares is listed for trading; |

|

|

|

| · | the impact of the COVID-19 pandemic; |

|

|

|

| · | general economic and business condition in China and elsewhere; |

|

|

|

| · | the impact of the Russian-Ukraine conflicts; |

|

|

|

| · | assumptions underlying or related to any of the foregoing. |

We would like to caution you not to place undue reliance on forward-looking statements and you should read these statements in conjunction with the cautionary statements included in the sections entitled Part I, Item 3D. “Risk Factors” and Item 5. “Operating and Financial Review and Prospects” and the notes to the Company’s Consolidated Financial Statements, describe factors, among others, that could contribute to or cause such differences. Those risks are not exhaustive. We operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

| 3 |

| Table of Contents |

You should not rely upon forward-looking statements as predictions of future events. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

U.S. GAAP, Fiscal Year and Exchange Rate Information

We have prepared our consolidated financial statements in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”). Our fiscal year ends on December 31. References in this annual report to fiscal year 2019, fiscal year 2020, fiscal year 2021, fiscal year 2022 and fiscal year 2023, or Fiscal 2019, Fiscal 2020, Fiscal 2021, Fiscal 2022 and Fiscal 2023, are to the fiscal years ended on December 31, 2019, 2020, 2021, 2022 and 2023 respectively.

The Company maintains its books and records in United States dollars (“US$” or “U.S. Dollars”). Its subsidiaries and affiliates maintain their books and records either in US$, Hong Kong dollars (“HK$” or “Hong Kong Dollars”) or in Chinese Renminbi (“RMB” or “Renminbi”).

Our financial statements are expressed in U.S. Dollars, which is our reporting currency. Certain of our financial data in this annual report on Form 20-F is translated into U.S. Dollars solely for the reader’s convenience. Unless otherwise noted, all convenient translations from Renminbi or Hong Kong Dollars to U.S. Dollars in this annual report were made for fiscal years 2023, 2022 and 2021 at 7.0684 RMB, 6.9061 RMB and 6.3757 RMB to US$1.00, respectively, and at 7.8000 HKD, 7.8000 HKD and 7.8000 HKD to US$1.00, respectively. The exchange rates were substantially the same as the middle rates published by the People’s Bank of China (“PBOC”) on December 31, 2023, 2022 and 2021 respectively.

We make no representation that any Renminbi, Hong Kong Dollars or U.S. Dollar amounts could have been, or could be, converted into U.S. Dollars, Hong Kong Dollars or Renminbi, as the case may be, at any particular rate, at the rate stated above, or at all.

GLOSSARY

The following glossary of terms may clarify the terminology used in this annual report.

Ambient Air: |

| Atmospheric air (outdoor as opposed to indoor air). | ||

|

|

| ||

Anaerobic: |

| Treating wastewater biologically in the absence of air. | ||

|

|

| ||

Atomic Spectrometer: |

| An analytical instrument used to measure the presence of an element in a substance by testing a sample which is aspirated into a flame and atomized. The amount of light absorbed or emitted is measured. The amount of energy absorbed or emitted is proportional to the concentration of the element in the sample. | ||

|

|

| ||

Coalescer: |

| A process that coalesces smaller oil particles to form larger oil particles that can readily float to a tank’s surface. | ||

|

|

| ||

Colorimeter: |

| An analytical instrument that measures substance concentration by color intensity when the substance reacts to a chemical reagent. | ||

|

|

| ||

Human Machine Interface Software: |

| A type of software to interface (or coordinate) the interaction between machine or equipment and a human being. | ||

|

|

| ||

Lamella: |

| Synthetic media installed in a clarifier tank to assist in particle flocculation (coming together in a “floc” or “flakes”). | ||

|

|

| ||

Mass Spectrometer: |

| An analytical instrument that separates and identifies chemical constituents according to their mass-to-charge ratios and is used to identify organic compounds. | ||

|

|

| ||

Membrane Biological Reactor (MBR): |

| A suspended-growth bioreactor combined with a membrane liquid/solids separation unit. The “MBR” uses an advanced membrane technology that treats biological wastes to a quality level which in many industries is sufficient for reuse or low-cost disposal to sewers. | ||

|

|

| ||

pH Controller: |

| A process instrument that measures and controls the acidity or alkalinity of a fluid. | ||

|

|

| ||

Reagent: |

| A chemical substance used to cause a chemical reaction and detect another substance. | ||

|

|

| ||

Sequential Batch Reactor (SBR): |

| A waste-water treatment process that combines aeration and settling in one reactor tank thus saving on space. Used for the treatment of industrial waste-water as well as municipal sewage. The SBR is a batch process that is ideal for waste-waters of changing characteristics. | ||

| 4 |

| Table of Contents |

PART I

ITEM 3. KEY INFORMATION

China Section

Our Corporate Structure

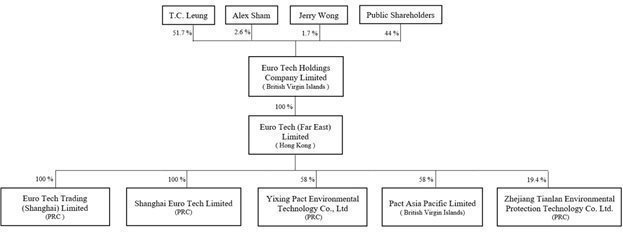

As an investor, you hold an interest in Euro Tech Holdings Company Limited (the “Company” or “Euro Tech”). Euro Tech is a British Virgin Islands holding company and not an operating company. As a holding company with no material operations of its own, Euro Tech conducts its operations through its subsidiaries incorporated in Hong Kong, mainland China and the British Virgin Islands. As an investor, you directly hold an interest in Euro Tech, but you do not directly hold equity interest in Euro Tech’s subsidiaries, i.e., the operating companies of the Company’s business, and this structure involves risks to you.

The Company has one 100% owned subsidiary in Hong Kong, namely, Euro Tech (Far East) Limited (referred to hereinafter as “Far East”). Far East engages in the marketing and trading of water and waste water treatment related process control, analytical and testing instruments, disinfection equipment, supplies and related automation systems.

Far East has two 100% owned subsidiaries in mainland China, both of which are no longer in active business operations. One of such subsidiaries is Euro Tech Trading (Shanghai) Limited (referred to hereinafter as “ETTS”), which ceased its active business operations in 2021. The other one of such subsidiaries is Shanghai Euro Tech Limited (referred to hereinafter as “SET”), which ceased its active business operations in September, 2022. Other than these two companies, Far East does not have any other 100% subsidiaries.

Far East holds 58% of the total equity of Yixing Pact Environmental Technology Co., Ltd., a company incorporated in mainland China (referred to hereinafter as “Yixing”), and Pact Asia Pacific Limited, a company incorporated in the British Virgin Islands (referred to hereinafter as “Pact”), respectively. Yixing focuses on the design, manufacturing and operation of water and waste water treatment machinery and equipment, and Pact focuses on the sale of environmental protection equipment to overseas buyers, as well as undertaking environment protection projects and providing relevant technology advice, training and services.

Far East also holds 19.4% of the total equity of Zhejiang Tianlan Environmental Protection Technology Co. Ltd., a company incorporated in mainland China (referred to hereinafter as “Blue Sky”). Blue Sky focuses on the design, manufacturing, installation, testing of waste-gas treatment equipment and operation management of the treatment of waste gases.

| 5 |

| Table of Contents |

The following diagram illustrates the corporate structure of us and our subsidiaries (including Blue Sky in which we hold only 19.4% of the total equity thereof), as of the date of the annual report:

In addition to the shareholder information disclosed in the chart above, we also note the following:

The shareholders of Yixing are listed below:

Shareholders | Ownership Percentage | |||

1 | Euro Tech (Far East) Limited | 58% | ||

2 | Tamworth Industrial Ltd. | 42% |

The shareholders of Pact are listed below:

|

| Shareholders |

| Ownership Percentage |

1 |

| Euro Tech (Far East) Limited |

| 58% |

2 |

| Tamworth Industrial Ltd. |

| 42% |

Blue Sky is a public company in mainland China and therefore has a number of minority shareholders that are not publicly disclosed. The ten shareholders of Blue Sky with the top ten largest shareholding percentage are listed in the table below. We obtained the information in the table below from Blue Sky’s latest semi-annual report dated August 22, 2023:

|

| Shareholders |

| Ownership Percentage |

1 |

| Zhongbiao WU |

| 25.30% |

2 |

| Euro Tech (Far East) Limited |

| 19.42% |

3 |

| Zhineng WANG |

| 13.65% |

4 |

| Deming WANG |

| 11.37% |

5 |

| Yueai FENG |

| 4.70% |

6 |

| Shan ZHONG |

| 3.94% |

7 |

| Yuling ZHOU |

| 3.93% |

8 |

| Huaming SUN |

| 3.53% |

9 |

| Hangzhou Helan Technology Co. |

| 2.87% |

10 |

| Changjie CHENG |

| 2.48% |

We acknowledge that Chinese regulatory authorities could disallow our holding company structure, which would likely result in a material change in our operations and/or a material change in the value of your securities, including that it could cause the value of such securities to significantly decline or become worthless. Please see “Item 3. Key Information – D. Risk Factors— Risks Related to the Company Itself – Chinese regulatory authorities could disallow our holding company structure” for a more detailed discussion on this matter.

| 6 |

| Table of Contents |

Risks Associated with Being Based in and Having the Majority of Our Operations in China

We conduct a substantial portion of our business through our subsidiaries in mainland China and Hong Kong. We face various legal and operational risks associated with being based in and having the majority of our operations in China. Changes in PRC economic, political or social conditions or government policies could materially adversely affect our business and results of operations. The PRC government has the authority to exert significant influence on the ability of a China-based company, including us, to conduct its business, and investors of Euro Tech and our business face potential uncertainty as a result. The PRC government may intervene or influence our operations at any time. For example, we face risks associated with PRC governmental authorities’ significant oversight and discretion over our businesses and financing activities, the requirement of regulatory approvals for offerings conducted overseas by and foreign investment in China-based issuers, the enforcement of anti-monopoly regime and data security rules, as well as the risk of delisting if the Public Company Accounting Oversight Board of the United States, or the PCAOB, determines at any time that it is unable to conduct complete inspection on our auditors, which may impact our ability to conduct certain businesses, accept foreign investments, or list on a United States stock exchange. In addition, there are risks and uncertainties regarding the enforcement of laws in China, and the rules and regulations in China can change quickly with little advance notice. The materialization of these risks may result in a material adverse change to our business operations and financial condition, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, and cause our shares to significantly decline in value or become worthless. See “Item 3. Key Information – D. Risk Factors— Certain Risks Relating to Doing Business in China — A substantial portion of our operations are located in China through our subsidiaries. Our ability to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters”, “Item 3. Key Information – D. Risk Factors— Certain Risks Relating to Doing Business in China — Changes in the economic and political policies of the PRC government could have a material and adverse effect on our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies” and “Item 3. Key Information – D. Risk Factors — The PRC legal system embodies uncertainties which could limit the available legal protections and expand the government’s power” for a more detailed discussion on this matter.

An investment in our shares involves a high degree of risk and should be considered speculative. You should carefully consider all risk factors set out in “Item 3. Key Information – D. Risk Factors” and other information before investing in our shares. If any event arising from these risks occurs, our business, prospects, financial condition, results of operations or cash flows could be materially adversely affected, the trading price of our shares could decline and all or part of your investment may be lost.

The Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act, or HFCAA, was enacted on December 18, 2020. Pursuant to the HFCAA, if the SEC determines that we have filed audit reports issued by a registered public accounting firm that the PCAOB is unable to inspect or investigate completely for three consecutive years beginning in 2021, the SEC may prohibit our shares from being traded on a national securities exchange or in the over-the-counter market in the United States.

On December 2, 2021, the SEC adopted final amendments implementing the disclosure and submission requirements under the HFCAA, pursuant to which the SEC would identify a “Commission-Identified Issuer” if an issuer has filed an annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction, and will then impose a trading prohibition on an issuer after it is identified as a “Commission-Identified Issuer” for three consecutive years.

| 7 |

| Table of Contents |

On December 16, 2021, the PCAOB issued its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, and the PCAOB included in the report of its determination a list of the accounting firms that are headquartered in mainland China or Hong Kong. This list includes Union Power, the firm which audited our financial statements for the fiscal year ended December 31, 2021 and 2020, and subsequently on June 14, 2022, we were added to the conclusive list of “Commission-Identified Issuer” identified under the HFCAA on the website of the SEC. On December 29, 2022, the United States enacted the Consolidated Appropriations Act, 2023, which amended the HFCAA to require the SEC to prohibit an issuer’s securities from trading in the United States if its auditor is not subject to PCAOB inspections for two consecutive “non-inspection” years instead of three.

In January 2023, we appointed J&S Associate PLT (“J&S”), as our independent registered public accounting firm for the fiscal year ending December 31, 2022 and J&S remains our independent registered public accounting firm for the fiscal year ending December 31, 2023. J&S is headquartered in Malaysia and subject to the inspections by the PCAOB, therefore we believe the appointment of J&S would substantially reduce the risk of us being continued to be identified as “Commission-Identified Issuer” under the HFCAA, and the risk of our securities being prohibited from being traded on a national securities exchange or in the over the counter trading market in the United States due to rules under the HFCAA.

In addition, on December 15, 2022, PCAOB Chair Erica Y. Williams released a statement stating that, for the first time in history, the PCAOB has secured complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong, and the Board voted to vacate the previous determinations to the contrary. For this reason, we do not expect to be identified as a Commission-Identified Issuer following the filing of this annual report.

However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed.

If we continue to be identified as a “Commission-Identified Issuer”, the ramification of such identification includes volatility in the trading price of our securities. We are also subject to the additional compliance requirements under the HFCAA and potentially other requirements under related proposed rules. If our shares are prohibited from trading in the United States, there is no certainty that we will be able to list on a non-U.S. exchange or that a market for our shares will develop outside of the United States. Such a prohibition would substantially impair your ability to sell or purchase our shares when you wish to do so, and the risk and uncertainty associated with delisting would have a negative impact on the price of our shares. Also, such a prohibition would significantly affect our ability to raise capital on terms acceptable to us, or at all, which would have a material adverse impact on our business, financial condition, and prospects.

See “Item 3. Key Information – D. Risk Factors— Risks Related to the Company Itself - The audit report included in this annual report is prepared by an auditor who is not inspected by the Public Company Accounting Oversight Board, and as such, our investors are deprived of the benefits of such inspection. In addition, the enactment of the Holding Foreign Companies Accountable Act and the adoption of any rules, legislations or other efforts to increase U.S. regulatory access to audit information could cause uncertainty and our securities listed on the NASDAQ could be delisted or prohibited from being traded “over-the-counter” if we are unable to meet the PCAOB requirement in time” for a more detailed discussion on this matter.

Permissions or Approvals Required to be Obtained from Chinese Authorities

Our business focuses on the design, sale and distribution of water and waste-water treatment tools and equipment. The group companies that are active in business operations are Far East in Hong Kong, Yixing in mainland China and Pact in the British Virgin Islands. Far East is the Company’s wholly-owned subsidiary. Far East holds 58% of the equity of Yixing and Pact respectively.

| 8 |

| Table of Contents |

Based on our internal assessment, the Company and its subsidiaries are not required to obtain any permissions or approvals from the Chinese authorities to operate their respective business or offer the Company’s securities as currently conducted, except that the group companies located in mainland China should obtain a business license to operate their respective business. As listed in the chart below, such group companies have received their respective business license. None of the Company and its subsidiaries has ever been requested by any Chinese authority to obtain any other permissions or approvals to conduct their respective business or to offer the Company’s securities. In addition, please note that Euro Tech Trading (Shanghai) Limited and Shanghai Euro Tech Limited listed have ceased their active business operations already.

Company | Permission/Approval | Issuing Authority | Validity |

Euro Tech Trading (Shanghai) Limited | Business License | Market Supervision Administration of Free Trade Pilot Zone (Shanghai) | May 13, 2047 |

Shanghai Euro Tech Limited | Business License | Market Supervision Administration of Shanghai | December 8, 2029 |

Yixing Pact Environmental Technology Co., Ltd. | Business License | Market Supervision Administration of Yixing City | Long term |

We did not rely upon an opinion of counsel with respect to our conclusions regarding whether we need permissions and approvals to operate our business and to offer securities to investors. The basis of our assessment above is as follows: (1) the Company has been primarily a distributor of advanced water treatment equipment, laboratory instruments, analyzers, test kits and related supplies and power generation equipment (including recorders and power quality analyzers). We have been in this business for more than 20 years for now and have never been required to apply for any permissions or approvals from the Chinese authorities to conduct our business; (2) we are aware of recent regulatory developments relating to Chinese authorities’ focus on cross-border data transfer, as further described in ”Item 4. Information on the Company — B. Business Overview – Recent Regulatory Update”. We do not believe our listing of ordinary shares requires permissions or approvals from the Chinese authorities. As a distributor of advanced water treatment equipment, laboratory instruments, analyzers, test kits and related supplies and power generation equipment (including recorders and power quality analyzers) to businesses (i.e., not end-customers), we are not deemed as a critical information infrastructure operator or online platform operator which are subject to more stringent requirements under China’s Cybersecurity Review Measures which became effective on February 15, 2022. Our customers in mainland China are corporate customers rather than individual customers, therefore we do not currently have over one million users’ personal information and do not anticipate that we will be collecting over one million users’ personal information in the foreseeable future, which we understand might otherwise subject us to the Cybersecurity Review Measures.

However it is possible that changes in law may render us to be subject to such rules and regulations. It is also possible that in practice the government agencies impose more stringent requirements on us, or that our interpretation of the rules and regulations turn out to be inaccurate. Notably, the PRC government has recently indicated an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers. Please see “Item 3. Key Information – D. Risk Factor – A substantial portion of our operations are located in China through our subsidiaries. Our ability to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters” and “Item 3. Key Information – D. Risk Factor -Our failure to comply with cybersecurity and data protection laws and regulations could lead to government enforcement actions and significant penalties against us, and adversely impact our operating results” for a more detailed discussion on this issue.

Transfer of Cash Through Our Organization

Euro Tech can transfer cash to its subsidiaries through capital contributions and/or intercompany loans, and Euro Tech’s subsidiaries can transfer cash to Euro Tech through dividends or other distributions and/or intercompany loans. Currently Euro Tech’s subsidiaries do not require loans or capital contributions from Euro Tech to fund their operations, and Euro Tech’s subsidiaries do not have any plan to pay any cash dividends in the near future.

Dividends

During the three fiscal years ended December 31, 2021, 2022 and 2023, Euro Tech made cash dividends in an amount of US$1,030,952, US$463,928 and nil to its shareholders (including U.S. investors), respectively. The source of such cash dividends is cash dividends and distributions from Far East. For mainland China and United States federal income tax considerations in connection with an investment in our ordinary shares, see “Item 10. Additional Information—E. Taxation.”

| 9 |

| Table of Contents |

During the three fiscal years ended December 31, 2021, 2022 and 2023, Far East made cash dividends to Euro Tech in an amount of US$1,230,769, US$628,205 and nil, respectively.

Cash transfers for working capital purposes

During the three fiscal years ended December 31, 2021, 2022 and 2023, Far East made cash transfers for working capital purposes to its 100% owned subsidiaries in Shanghai, namely Shanghai Euro Tech Limited and Euro Tech Trading (Shanghai) Limited in an amount of US$210,000, US$277,445 and US$129,200, respectively.

Historical capital contributions

To date, Far East has made capital contribution of US$200,000 to its 100% owned subsidiary, Euro Tech Trading (Shanghai) Limited, to fulfil its obligation to pay in the registered capital of the latter.

To date, Far East has made capital contribution of US$350,000 to its 100% owned subsidiary, Shanghai Euro Tech Limited, to fulfil its obligation to pay in the registered capital of the latter.

During the past three fiscal years, other than the cash transfers described hereto, there were no transfer of other assets among Euro Tech and its subsidiaries.

Restrictions and Limitations on Transfer of Cash and Cash Dividend Distribution

Our cash dividends, if any, will be paid in U.S. dollars. The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. The majority of our income is received in Renminbi and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any.

Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange of China, or SAFE, as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions in the future, and in such event, we may not be able to pay dividends in foreign currencies to our shareholders.

If we are considered a PRC tax resident enterprise for tax purposes, any dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding tax.

Relevant PRC laws and regulations permit the PRC companies to pay dividends only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Additionally, the Company’s PRC subsidiaries can only distribute dividends upon approval of the shareholders after they have met the PRC requirements for appropriation to the statutory reserves. Under PRC laws, rules and regulations, each of our subsidiaries incorporated in mainland China is required to set aside at least 10% of its after-tax profits each year, after making up for previous years’ accumulated losses, if any, to fund certain statutory reserves, until the aggregate amount of such fund reaches 50% of its registered capital.

As a result of these and other restrictions under the PRC laws and regulations, our PRC subsidiaries are restricted to transfer a portion of their cash or assets to the Company. Even though the Company currently does not require any such dividends, loans or advances from the PRC subsidiaries for working capital and other funding purposes, the Company may in the future require additional cash resources from its PRC subsidiaries due to changes in business conditions, to fund future acquisitions and developments, or merely declare and pay dividends to or distributions to the Company’s shareholders.

| 10 |

| Table of Contents |

To the extent cash in the business is in a PRC entity, the funds may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of you or your subsidiaries by the PRC government to transfer cash. Please see “Item 3. Key Information – Risk Factors Summary” and “Item 3. Key Information – D. Risk Factors— The PRC Government Imposes Currency Controls” for details on this matter.

Cash Management Policies For Cash Transfer

Euro Tech and its subsidiaries have adopted substantially similar cash management policies that are described hereinafter in this paragraph. With respect to any transfer of funds, dividends or other distributions to affiliated companies, the finance department of the relevant group company (the “Finance Department”) should receive the requisite approval of the board of directors and/or resolutions of shareholders, before applying to the competent governmental agencies and banks to effectuate the intended transactions. If any of the aforesaid transactions involves payment to an overseas entity, the Finance Department should also submit payment application to Euro Tech’s Chairman and Chief Financial Officer, or CFO, and receive written approval of the transaction from them by email, thereafter the Finance Department can request the Chairman’s authorized representative (who should not be an employee of the relevant group company) to stamp the payment application. With such stamped application, the Finance Department can effectuate the fund transfer through the bank. The Finance Department should also take actions to comply with the rules and requirements of the foreign exchange authority and tax bureau in China, if applicable.

Risk Factors Summary

An investment in our securities is subject to a number of risks, including risks related to our business and industry, risks related to our corporate structure, risks related to doing business in China and risks related to our securities. The following list summarizes some, but not all, of these risks. Please read the information in “Item 3. Key Information – D. Risk Factors” for a more thorough description of these and other risks.

| · | Risks may arise from the legal system in China, including risks and uncertainties regarding the enforcement of laws and that rules and regulations in China can change quickly with little advance notice. See “Item 3. Key Information – D. Risk Factors — The PRC legal system embodies uncertainties which could limit the available legal protections and expand the government’s power” for a more detailed discussion on this matter. |

|

|

|

| · | Chinese government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our securities. Any actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer securities to investors and cause the value of such securities to significantly decline or be worthless. See “Item 3. Key Information – D. Risk Factors — A substantial part of our operations is in China through our subsidiaries. Our ability to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters” for a more detailed discussion on this matter. |

|

|

|

| · | We conduct a substantial portion of our business through our subsidiaries in mainland China and Hong Kong. Adverse changes in the PRC economic, political and social conditions as well as laws and government policies, may materially and adversely affect our business, financial condition, results of operations and growth prospects. See “Item 3. Key Information – D. Risk Factors— Certain Risks Relating to Doing Business in China — A substantial portion of our operations are located in China through our subsidiaries. Our ability to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters” and “Item 3. Key Information – D. Risk Factors— Certain Risks Relating to Doing Business in China — Changes in the economic and political policies of the PRC government could have a material and adverse effect on our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies.” |

|

|

|

| · | The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. To the extent cash in the business is in a PRC entity, the funds may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions and limitations on the ability of you or your subsidiaries by the PRC government to transfer cash. See “Item 3. Key Information – D. Risk Factors—Risks Relating to Doing Business in China—The PRC Government Imposes Currency Controls.” |

| 11 |

| Table of Contents |

| · | The Company has taken actions to streamline its business by reducing its staff, consolidating office and increasing staff efficiencies in order to stem the decline in its revenue, however there is no assurance that these efforts will be successful and that revenue will increase. See “Item 3. Key Information – D. Risk Factors—Risks Relating to the Company’s Business—Actions to Increase Revenue, Decrease Losses and Achieve Profitability may be Unsuccessful.” |

|

|

|

| · | The Company distributes products manufactured by a number of vendors but do not have long-term supply arrangement with such vendors. While alternative source of supply exists, the termination of any existing supply arrangement may still adversely affect the Company’s business. See “Item 3. Key Information – D. Risk Factors— Risks Relating to the Company’s Business—Dependence on Vendors; Lack of Long Term Arrangements; Loss of Vendors.” |

|

|

|

| · | In the event that we identify deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner, our ability to obtain financing could suffer and the market price of our shares could decline. See “Item 3. Key Information – D. Risk Factors— Risks Relating to the Company Itself— We may be exposed to potential risks relating to our internal controls over financial reporting.” |

|

|

|

| · | The market price of our ordinary shares may fluctuate significantly in response to many factors, including without limitation, changes in the general environment and the outlook of the segments in which we operate, regulatory developments in the segment in which we operate, etc. See “Item 3. Key Information – D. Risk Factors— Risks Relating to the Company Itself—The market price of our ordinary shares may be volatile or may decline regardless of our operating performance, and you may not be able to resell your shares at or above the price you paid.” |

|

|

|

| · | The rising inflation and energy cost in Europe, caused largely by the Russia-Ukraine conflicts, will likely affect the business operations of our customers headquartered in Europe. Subsequently these customers will likely take longer to make decisions regarding whether to purchase our products, negotiate for more favorable commercial and financial terms in their dealings with us, and even postpone or cancel their new projects and their purchase orders in China. See “Item 3. Key Information – D. Risk Factors— Certain Risks Relating to the Company’s Business —The Russia-Ukraine conflicts may have already impacted and will likely impact the business operations of our suppliers and customers headquartered in Europe and elsewhere, and subsequently impact the terms of our business relationships with them.” |

A. [RESERVED]

B. CAPITALIZATION AND INDEBTEDNESS

This item does not apply to annual reports on Form 20-F.

C. REASONS FOR THE OFFER AND USE OF PROCEEDS

This item does not apply to annual reports on Form 20-F.

| 12 |

| Table of Contents |

D. RISK FACTORS

An investment in our shares involves a high degree of risk. Below please find a summary of the principal risks we face, organized under relevant headings. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. The risks below are not the only ones we face. Additional risks not currently known by us or that we deem immaterial may also impair our business operations. If any of the following and other risks actually occurs, our business, prospects, financial condition or results of operations could suffer. In that case, the trading price of our shares could decline, and you may lose all or part of your investment. This annual report also contains forward looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward looking statements as a result of certain factors, including the risks we face as described below and elsewhere. See “– Forward Looking Statements.”

Certain Risks Relating to Doing Business in China.

A substantial part of our operations is in China through our subsidiaries. Our ability to operate in China may be impaired by changes in Chinese laws and regulations, including those relating to taxation, environmental regulation, restrictions on foreign investment, and other matters.

We conduct a substantial portion of our business in China through our subsidiaries, whose operations are governed by PRC laws, rules, and regulations. The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Because PRC laws, rules and regulations are relatively new and quickly evolving, and because of the limited number of published decisions and the non-precedential nature of these decisions, and because the laws, rules and regulations often give the relevant regulator certain discretion in how to enforce them, the interpretation and enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable. Therefore, it is possible that our existing operations may be found not to be in full compliance with relevant laws and regulations in the future. In addition, the PRC legal system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and which may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of the violation.

The PRC government has significant oversight and discretion over the conduct of our business, and may intervene in or influence our operations through adopting and enforcing rules and regulatory requirements. In recent years, the PRC government has published new policies that significantly affected certain industries such as the education and internet industries, and we cannot rule out the possibility that it will in the future further release regulations or policies regarding our industry that could require us to seek permission from PRC authorities to continue to operate our business. In addition, in recent years the PRC government has enhanced regulation in areas such as anti-monopoly, anti-unfair competition, cybersecurity and data privacy. The PRC government may further promulgate relevant laws, rules and regulations that may impose additional and significant obligations and liabilities on Chinese companies. These laws and regulations can be complex and stringent, and many are subject to change and uncertain interpretation, which could result in claims, change to our business practices, regulatory investigations, penalties, increased cost of operations, or otherwise affect our business. As a result, our business, financial condition and results of operations could be adversely affected and the trading prices of our ordinary shares could decline.

| 13 |

| Table of Contents |

The PRC government has also enhanced its regulatory oversight of Chinese companies listing overseas, including enhanced oversight of overseas equity financing and listing by Chinese companies. It is uncertain when and whether we will be required to obtain permission from the PRC government to list on U.S. exchanges in the future, and even if such permission is obtained, whether it will be later denied or rescinded. No entity in our organization is currently (i) required to obtain permission from any Chinese authorities to list on any U.S. exchange or issue our ordinary shares to foreign investors or (ii) required to obtain permission from China Securities Regulatory Commission, or CSRC, Cyberspace Administration Commission, or CAC, or any other governmental authority, and no entity in our organization has received any such permissions or any notice of denial of such permissions. However, our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to our business or industry, particularly in the event permission to list on U.S. exchanges becomes required, or if such permission may be withheld or rescinded once granted.

Governmental actions in China, including any decision to intervene or influence our operations at any time or to exert control over an offering of securities conducted overseas and/or foreign investment in China-based issuers, may cause us to make material changes to our operations, may limit or completely hinder our ability to offer or continue to offer securities to investors, and/or may cause the value of such securities to significantly decline or be worthless.

Changes in the economic and political policies of the PRC government could have a material and adverse effect on our business, financial condition and results of operations and may result in our inability to sustain our growth and expansion strategies.

We conduct a substantial portion of our business in China through our subsidiaries. Accordingly, our results of operations, financial condition and prospects are to a significant extent affected by economic and political developments in China. In particular, the PRC government continues to exercise significant control over the economic growth of the PRC through allocating resources, controlling payments of foreign currency-denominated obligations, setting monetary policy and providing preferential treatments to particular industries or companies. In recent years, the PRC government has implemented measures emphasizing the utilization of market forces in reforming the economy. These economic reform measures may be adjusted or modified or applied inconsistently from industry to industry, or across different regions of the country. As a result, some of these measures may benefit the overall economy of the PRC, but may have an adverse effect on us.

The growth of China’s economy has slowed in recent years compared to prior years. There have also been concerns about the relationships among China and other Asian countries, and the relationship between China and the United States, which may result in or intensify potential conflicts in relation to territorial, regional security and trade disputes. The COVID-19 pandemic has severely disrupted business operations, supply chain and workforce availability across the world, leading to substantial declines in business activities that have negatively impacted and may continue to negatively impact our business, financial condition and results of operations. The Russia-Ukraine conflict has resulted in significant disruptions to supply chains, logistics and business activities in the region that have negatively affected the business and operations of some of our customers located in Europe, and subsequently have adverse impact on our business. The conflict has also caused, and continues to intensify, significant geopolitical tensions in Europe and across the globe. The resulting sanctions imposed are expected to have significant impacts on the economic conditions of the countries and markets targeted by such sanctions, and may have unforeseen, unpredictable secondary effects on global energy prices, supply chains and other aspects of the global economy, which increases logistics costs and negatively affects our business operations. Any disruptions or continuing or worsening slowdown, whether as a result of trade conflicts, the COVID-19 pandemic, the Russia-Ukraine conflict or other reasons, could significantly reduce commerce activities in China and globally, which could lead to significant reduction in demand for and spending on the various products and services we offer. Moreover, rising inflation could result in higher costs of services and supplies and a decrease in consumer spending, which could negatively affect our business operations and financial results. An economic downturn, whether actual or perceived, a further decrease in economic growth rates or an otherwise uncertain economic outlook in any market in which we operate could have a material adverse effect on business and consumer spending and, as a result, adversely affect our business, financial condition and results of operations.

Our failure to comply with cybersecurity and data protection laws and regulations could lead to government enforcement actions and significant penalties against us, and adversely impact our operating results.

Regulatory authorities in China and around the world have recently implemented, and may in the future continue to implement, further legislative and regulatory proposals concerning privacy and data protection, particularly relating to the protection of personal information, cybersecurity and cross-border data transmission. These laws and regulations can be complex and the interpretation and application of these laws and regulations are often uncertain, in flux and complicated.

| 14 |

| Table of Contents |

The PRC Cybersecurity Law, which took effect in June 2017, generally governs the construction, operation, maintenance and use of networks in China, subjects network operators to various security protection-related obligations. In addition, the PRC Cybersecurity Law provides that personal information and important data collected and generated by operators of critical information infrastructure in the course of their operations in the PRC should be stored in the PRC, and imposes heightened regulation and additional security obligations on operators of critical information infrastructure. We believe we are neither a network operator nor an operator critical information infrastructure and are compliant with the PRC Cybersecurity Law. However if we are determined by the PRC government to fail to comply with the PRC Cybersecurity Law, we could be subject to fines, suspension of businesses, and revocation of business licenses. On September 14, 2022, the CAC published the Decision of Amending PRC Cybersecurity Law (Draft for Comments), or the Draft Amendment to PRC Cybersecurity Law, which, among other things, aggravated legal liabilities for violations of cybersecurity obligations and critical information infrastructure operators’ obligations. As of the date of this annual report, the Draft Amendment to PRC Cybersecurity Law was released for public comment only, and whether and when it would be promulgated and take effect are subject to change with substantial uncertainty.

In addition, the PRC Data Security Law, which was promulgated by the Standing Committee of the National People’s Congress on June 10, 2021, and took effect on September 1, 2021. The Data Security Law establishes a tiered system for data protection in terms of their importance, data categorized as “important data,” which will be determined by governmental authorities in the form of catalogs, are required to be treated with higher level of protection. Specifically, the Data Security Law provides that operators processing “important data” are required to appoint a “data security officer” and a “management department” to take charge of data security. In addition, such operator is required to evaluate the risk of its data activities periodically and file assessment reports with relevant regulatory authorities. The Measures for Security Assessment for Outbound Data Transfer, which took effect on September 1, 2022, requires mandatory government security review by the CAC prior to cross-border transfer of “important data.”

Numerous regulations, guidelines and other measures have been or are expected to be adopted under the umbrella of, or in addition to, the PRC Cybersecurity Law and PRC Data Security Law. For example, Regulations on the Security Protection of Critical Information Infrastructure, or the CII Protection Regulations, was promulgated by the State Council of the PRC on July 30, 2021 and became effective on September 1, 2021. According to the CII Protection Regulations, critical information infrastructure, or the CII, refers to any important network facilities or information systems of the important industry or field such as public communication and information service, energy, transportation, water conservancy, finance, public services, e-government affairs and national defense science, which may endanger national security, people’s livelihood and public interest in the case of damage, function loss or data leakage. Regulators supervising specific industries are required to formulate detailed guidance to recognize the CII in the respective sectors, and a critical information infrastructure operator, or a CIIO, must take the responsibility to protect the CII’s security by performing certain prescribed obligations. For example, CIIOs are required to conduct network security test and risk assessment, report the assessment results to relevant regulatory authorities, and timely rectify the issues identified at least once a year.

Additionally, in November 2021, the CAC issued the Cyber Data Security Administration Regulations (Draft for Comments), which, among other things, stipulates that a data processor that process “important data” or listed overseas must conduct an annual data security review by itself or by engaging a data security service provider and submit the annual data security review report for a given year to the relevant municipal counterpart of the CAC before January 31 of the following year. As of the date of this annual report, such administration regulations have not been adopted. In January 2022, the CAC and several other administrations also jointly promulgated the amended Cybersecurity Review Measures, or the Cybersecurity Review Measures, which became effective on February 15, 2022, and supersede and replace the current cybersecurity review measures that became effective since June 2020. Pursuant to the Cybersecurity Review Measures, a “critical information infrastructure operator”, or a CIIO, that purchases network products and services, or conducts data process activities, which affect or may affect national security will be subject to the cybersecurity review. The Cybersecurity Review Measures also expands the cybersecurity review to “internet platform operators” in possession of personal information of over one million users if such operators intend to list their securities in a foreign country. Alternatively, relevant governmental authorities in the PRC may initiate cybersecurity review if they determine an operator’s network products or services or data processing activities affect or may affect national security.

Furthermore, the recently issued Opinions on Strictly Cracking Down on Illegal Securities Activities requires (i) speeding up the revision of the provisions on strengthening the confidentiality and archives management relating to overseas issuance and listing of securities and (ii) improving the laws and regulations relating to data security, cross-border data flow, and management of confidential information. The Personal Information Protection Law, which was promulgated by the Standing Committee of the National People’s Congress on August 20, 2021 and took effect on November 1, 2021, integrates the various rules with respect to personal information rights and privacy protection and applies to the processing of personal information within mainland China as well as certain personal information processing activities outside mainland China, including those for the provision of products and services to natural persons within China or for the analysis and assessment of acts of natural persons within China.

| 15 |

| Table of Contents |

We may have access to confidential or personal information in certain of our businesses. Although we endeavor to comply with our privacy policies and other documentation regarding the protection of personal information, we may at times fail to do so or may be perceived to have failed to do so. Moreover, despite our efforts, we may not be successful in achieving compliance if our employees or contractors fail to comply with these policies and documentation.

Moreover, the Cyber Security Law, Data Security Law and relevant regulations are relatively new, uncertainties still exist in relation to their interpretation and implementation. Any change in laws and regulations relating to privacy, data protection and information security and any enhanced and scrutinized governmental enforcement action of such laws and regulations could greatly increase our cost in providing our products and services, limit their use or adoption or require certain changes to be made to our operations. We cannot assure you that we will be compliant with these new laws and regulations described above in all respects, and we may be ordered to rectify and terminate any actions that are deemed illegal by the government authorities and become subject to fines and other government sanctions, which may materially and adversely affect our business, financial condition, and results of operations.

Specifically, given the uncertainties surrounding the interpretation and implementation of the Cyber Security Law, Data Security Law and relevant regulations, we cannot rule out the possibility that we, or certain of our customers or suppliers may be deemed as a CIIO, or an operator processing “important data.” First, if we are deemed as a CIIO, our purchase of network products or services, if deemed to be affecting or may affect national security, will need to be subject to cybersecurity review, before we can enter into agreements with relevant customers or suppliers, and before the conclusion of such procedure, these customers will not be allowed to use our products or services, and we are not allowed to purchase products or services from our suppliers. There can be no assurance that we would be able to complete the applicable cybersecurity review procedures in a timely manner, or at all, if we are required to follow such procedures. Any failure or delay in the completion of the cybersecurity review procedures may prevent us from using certain network products and services, and may result in fines of up to ten times the purchase price of such network products and services being imposed upon us, if we are deemed a CIIO using network products or services without having completed the required cybersecurity review procedures. If the reviewing authority is of the view that the use of such network products or services by us, or by certain of our customers or suppliers, involves risk of disruption, is vulnerable to external attacks, or may negatively affect, compromise, or weaken the protection of national security, we may not be able to provide such products or services to relevant customers, or purchase products or services from relevant suppliers. This could have a material adverse effect on our results of operations and business prospects. Second, the notion of “important data” is not clearly defined by the Cyber Security Law or the Data Security Law. In order to comply with the statutory requirements, we will need to determine whether we possess important data, monitor the important data catalogs that are expected to be published by local governments and departments, perform risk assessments and ensure we are complying with reporting obligations to applicable regulators. We may also be required to disclose to regulators business-sensitive or network security-sensitive details regarding our processing of important data, and may need to pass the government security review or obtain government approval in order to share important data with offshore recipients, which can include foreign licensors, or share data stored in China with judicial and law enforcement authorities outside of China. If judicial and law enforcement authorities outside China require us to provide data stored in China, and we are not able to pass any required government security review or obtain any required government approval to do so, we may not be able to meet the foreign authorities’ requirements. The potential conflicts in legal obligations could have adverse impact on our operations in and outside of China.

| 16 |

| Table of Contents |

Economic Reforms May Not Continue or Impact Positively On the Company; Changing Business Environment.

Over the past several years, the PRC’s government has pursued economic reform policies including encouraging private economic activities and decentralization of economic deregulation. It appears that the PRC government may not continue to pursue these policies or may significantly alter them to our detriment from time to time without notice. Changes in policies by the PRC government resulting in changes in laws, regulations, or their interpretation, or the imposition of confiscatory taxes, restrictions on currency conversion and imports could materially and adversely affect our business and operating results. The nationalization or other expropriations of private enterprises by the PRC government could result in a loss of our investments in actual funds and time and effort, in China.

The Company’s results at times may also be adversely effected by: (1) changes in political, economic and social conditions in the PRC; (2) changes in government policies such as changes in laws and regulations (or their interpretation); (3) the introduction of additional measures to control inflation; (4) changes in the rate or method of taxation; (5) imposition of additional restrictions on currency conversion remittances abroad; (6) reduction in tariff protection and other import restrictions; and (7) a return to the more centrally-planned economy that existed previously.

We Are Subject To International Economic And Political Risks, Over Which We Have Little Or No Control.

Doing business entirely outside the United States subjects us to various risks, including changing economic and political conditions, exchange controls, currency fluctuations, armed conflicts and unexpected changes in United States and foreign laws relating to tariffs, trade restrictions, transportation regulations, foreign investments and taxation. We have no control over most of these risks and other unforeseeable risks and may be unable to anticipate changes in international economic and political conditions and, therefore, unable to alter our business practice in time to avoid the adverse effect of any of these changes.

The International Financial Crisis and Economic Conditions May Have A Material Adverse Impact on Our Business and Financial Conditions.

With deteriorating worldwide economies, global markets have experienced significant turmoil and upheavals characterized by extreme volatility and the volatility in prices and securities and commodities, diminished credit availability, inability to access capital markets, waves of bankruptcies, high unemployment and declining consumer and business confidence. It appears that international economic deterioration has negatively impacted our revenue and other results of operation. We cannot predict the short and long-term impact of these events on our business and financial condition that may be materially and adversely affected in the future.

Our Revenue and Net Income may be Materially and Adversely Affected by any Economic Slowdown in China.

The PRC government has in recent years implemented a number of measures to control the rate of economic growth, including by raising interest rates and adjusting deposit reserve ratios for commercial banks as well as by implementing other measures designed to tighten credit and liquidity. These measures have contributed to a slowdown of the PRC economy. According to the National Bureau of Statistics of China, China’s real GDP growth rate was 6.1%, 2.3%, 8.1%, 2.9% and 5.2 % in 2019, 2020, 2021, 2022 and 2023, respectively. Any continuing or worsening slowdown could significantly reduce domestic commerce in China. An economic downturn, whether actual or perceived, a further decrease in economic growth rates or an otherwise uncertain economic outlook in China or any other market in which we may operate could have a material adverse effect on our business, financial condition and results of operations.

We May be Impacted by Inflation in PRC.

In recent years, the average inflation rate has increased by 2.9%, 2.5%, 0.9%, 2% and 0.2 % in 2019, 2020, 2021, 2022 and 2023, respectively. Efforts by the PRC to curb inflation may also curb economic growth, increase our overhead costs and adversely affect our revenues. Inflationary increases cause a corresponding increase in our general overhead. If the PRC rate of inflation continues to increases, the Chinese government may introduce further measures intended to reduce the inflation rate in the PRC. Any such measures adopted by the Chinese government may not be successful in reducing or slowing the increase in the PRC’s inflation rate. A sustained or increased inflation in the PRC may have an adverse impact on the PRC’s economy and may materially and adversely affect our business and financial results.

| 17 |

| Table of Contents |

The PRC legal system embodies uncertainties which could limit the available legal protections and expand the government’s power.

The PRC legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which decided legal cases have little precedential value. In 1979, the PRC government began to promulgate a comprehensive system of laws and regulations governing economic matters in general. The overall effect of legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investment in China. However, these laws, regulations and legal requirements change frequently with little advance notice, and their interpretation and enforcement involve uncertainties. For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy than in more developed legal systems. In addition, such uncertainties, including the inability to enforce our contracts, could materially and adversely affect our business and operations. Furthermore, the PRC legal system is based in part on government policies and internal rules (some of which are not published on a timely basis or at all) that may have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until sometime after the violation. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. Furthermore, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with regard to the media, ecommerce, education, advertising and retail industries, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the legal protections available to us, and our foreign investors, including you.

You may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based on United States or other foreign laws against us, our management or the experts named in the annual report.

We conduct substantially all of our operations in China and substantially all of our assets are located in China. In addition, our principal offices are located in Hong Kong and all of our directors and executive officers reside within Hong Kong and China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon some of our directors and senior executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, we understand that the PRC currently does not have treaties with the United States or many other countries providing for the reciprocal recognition and enforcement of judgment of courts.

Regulations relating to offshore investment activities by PRC residents may increase the administrative burden we face and create regulatory uncertainties that could restrict our overseas and cross-border investment activity, and a failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose our PRC resident shareholders to liability under PRC law.

China’s State Administration of Foreign Exchange, or SAFE, promulgated the Circular on Relevant Issues Concerning Foreign Exchange Control on Domestic Residents’ Offshore Investment and Financing and Roundtrip Investment through Special Purpose Vehicles, or SAFE Circular No. 37, in July 2014. SAFE Circular No. 37 requires PRC residents to register with local branches of SAFE in connection with their direct establishment or indirect control of an offshore entity, for the purpose of overseas investment and financing, with such PRC residents’ legally owned assets or equity interests in domestic enterprises or offshore assets or interests, referred to in SAFE Circular No.37 as a “special purpose vehicle.” The term “control” under SAFE Circular No. 37 is broadly defined as the operation rights, beneficiary rights or decision-making rights acquired by the PRC residents in the offshore special purpose vehicles or PRC companies by such means as acquisition, trust, proxy, voting rights, repurchase, convertible bonds or other arrangements. SAFE Circular No. 37 further requires amendment to the registration in the event of any changes with respect to the basic information of the special purpose vehicle, such as changes in a PRC resident individual shareholder, name or operation period; or any significant changes with respect to the special purpose vehicle, such as increase or decrease of capital contributed by PRC individuals, share transfer or exchange, merger, division or other material event.

| 18 |

| Table of Contents |

If the shareholders of the offshore holding company who are PRC residents do not complete their registration with the local SAFE branches, the PRC subsidiaries may be prohibited from distributing their profits and proceeds from any reduction in capital, share transfer or liquidation to the offshore company, and the offshore company may be restricted in its ability to contribute additional capital to its PRC subsidiaries. Moreover, failure to comply with SAFE registration and amendment requirements described above could result in liability under PRC law for evasion of applicable foreign exchange restrictions. In February 2015, SAFE issued SAFE Circular No. 13, which took effect on June 1, 2015. SAFE Circular No. 13 has delegated to the qualified banks the authority to register all PRC residents’ investment in “special purpose vehicle” pursuant to the SAFE Circular No. 37, except that those PRC residents who have failed to comply with the SAFE Circular No. 37 will remain to fall into the jurisdiction of the local SAFE branch and must make their supplementary registration application with the local SAFE branch.