| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. | |||||

| Federally chartered | ||||||||||||||||||||||||||||||||||||||||||||

| corporation | ||||||||||||||||||||||||||||||||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | (Address of principal executive offices) | (Zip Code) | (Registrant's telephone number, including area code) | ||||||||||||||||||||||||||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| None | N/A | N/A | ||||||

Large accelerated filer | ☐ | ☒ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

| Table of Contents | ||

| Page | |||||

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |||||

n Introduction | |||||

n Housing and Mortgage Market Conditions | |||||

n Consolidated Results of Operations | |||||

n Consolidated Balance Sheets Analysis | |||||

n Our Portfolios | |||||

n Our Business Segments | |||||

n Risk Management | |||||

l Credit Risk | |||||

l Market Risk | |||||

n Liquidity and Capital Resources | |||||

n Critical Accounting Estimates | |||||

n Regulation and Supervision | |||||

n Forward-Looking Statements | |||||

| FINANCIAL STATEMENTS | |||||

| OTHER INFORMATION | |||||

| CONTROLS AND PROCEDURES | |||||

| EXHIBIT INDEX | |||||

| SIGNATURES | |||||

| FORM 10-Q INDEX | |||||

| Freddie Mac 1Q 2024 Form 10-Q | i | |||||||

| Table of Contents | ||

| Table | Description | Page | ||||||

| 1 | Summary of Consolidated Statements of Income and Comprehensive Income | |||||||

| 2 | Components of Net Interest Income | |||||||

| 3 | Analysis of Net Interest Yield | |||||||

| 4 | Components of Non-Interest Income | |||||||

| 5 | (Provision) Benefit for Credit Losses | |||||||

| 6 | Components of Non-Interest Expense | |||||||

| 7 | Summarized Condensed Consolidated Balance Sheets | |||||||

| 8 | Mortgage Portfolio | |||||||

| 9 | Mortgage-Related Investments Portfolio | |||||||

| 10 | Other Investments Portfolio | |||||||

| 11 | Single-Family Segment Financial Results | |||||||

| 12 | Multifamily Segment Financial Results | |||||||

| 13 | Allowance for Credit Losses Activity | |||||||

| 14 | Allowance for Credit Losses Ratios | |||||||

| 15 | Single-Family New Business Activity | |||||||

| 16 | Single-Family Mortgage Portfolio Newly Acquired Credit Enhancements | |||||||

| 17 | Single-Family Mortgage Portfolio Credit Enhancement Coverage Outstanding | |||||||

| 18 | Serious Delinquency Rates for Credit-Enhanced and Non-Credit-Enhanced Loans in Our Single-Family Mortgage Portfolio | |||||||

| 19 | Credit Quality Characteristics of Our Single-Family Mortgage Portfolio | |||||||

| 20 | Single-Family Mortgage Portfolio Attribute Combinations | |||||||

| 21 | Single-Family Completed Loan Workout Activity | |||||||

| 22 | Multifamily Mortgage Portfolio CRT Issuance | |||||||

| 23 | Credit-Enhanced and Non-Credit-Enhanced Loans Underlying Our Multifamily Mortgage Portfolio | |||||||

| 24 | Credit Quality of Our Multifamily Mortgage Portfolio Without Credit Enhancement | |||||||

| 25 | PVS-YC and PVS-L Results Assuming Shifts of the Yield Curve | |||||||

| 26 | Duration Gap and PVS Results | |||||||

| 27 | PVS-L Results Before Derivatives and After Derivatives | |||||||

| 28 | Earnings Sensitivity to Changes in Interest Rates | |||||||

| 29 | Liquidity Sources | |||||||

| 30 | Funding Sources | |||||||

| 31 | Debt of Freddie Mac Activity | |||||||

| 32 | Maturity and Redemption Dates | |||||||

| 33 | Debt of Consolidated Trusts Activity | |||||||

| 34 | Net Worth Activity | |||||||

| 35 | Regulatory Capital Components | |||||||

| 36 | Statutory Capital Components | |||||||

| 37 | Capital Metrics Under ERCF | |||||||

| 38 | Forecasted House Price Growth Rates | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | ii | |||||||

| Management's Discussion and Analysis | Introduction | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 1 | |||||||

| Management's Discussion and Analysis | Introduction | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 2 | |||||||

| Management's Discussion and Analysis | Introduction | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 3 | |||||||

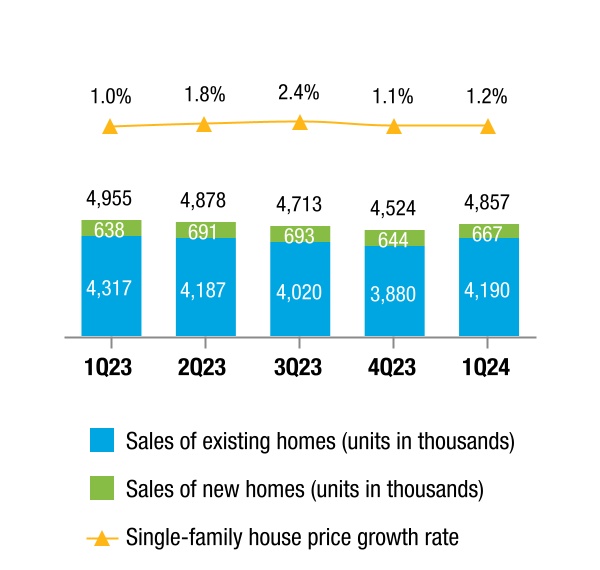

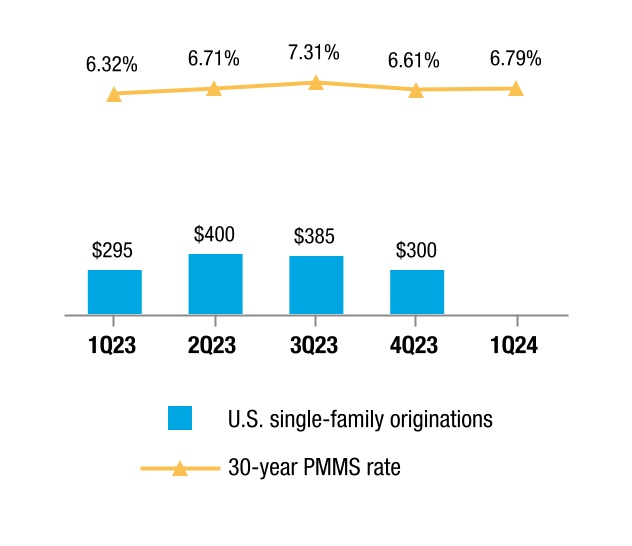

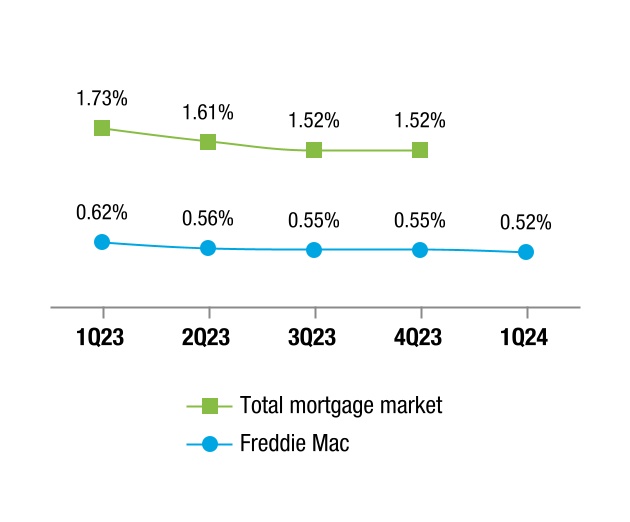

| Management's Discussion and Analysis | Housing and Mortgage Market Conditions | |||||||

Sources: National Association of Realtors, U.S. Census Bureau, and Freddie Mac House Price Index (seasonally adjusted rate).

Sources: National Association of Realtors, U.S. Census Bureau, and Freddie Mac House Price Index (seasonally adjusted rate).

| Freddie Mac 1Q 2024 Form 10-Q | 4 | |||||||

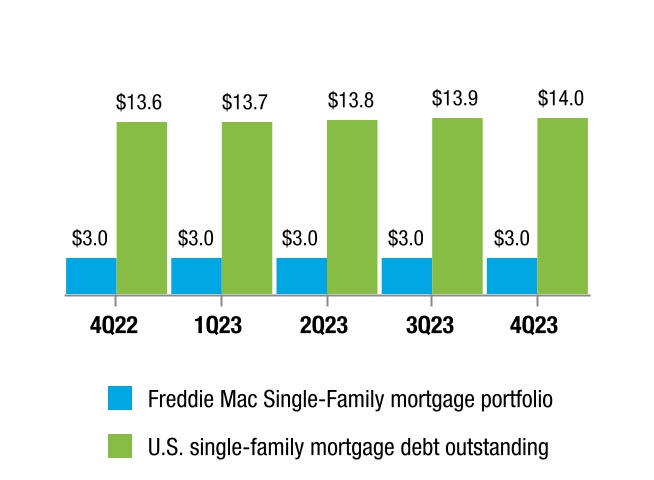

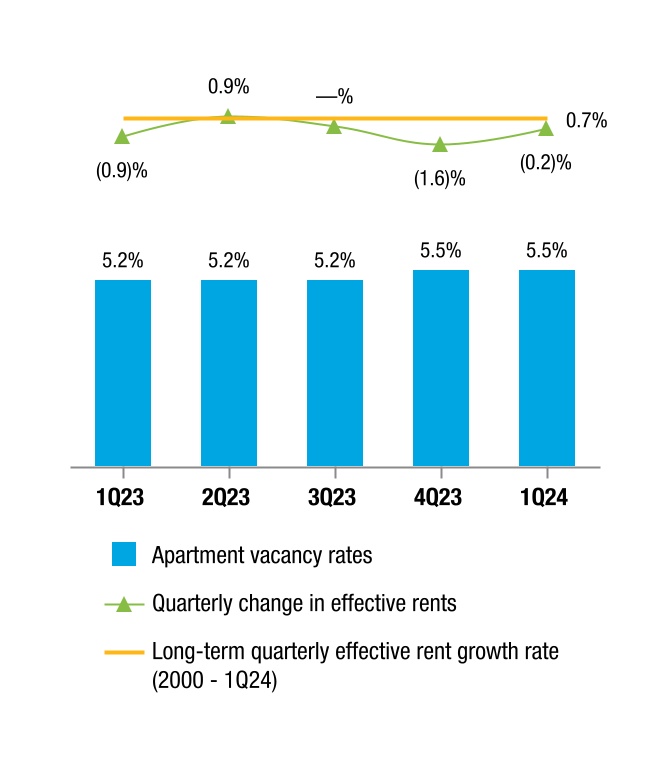

| Management's Discussion and Analysis | Housing and Mortgage Market Conditions | |||||||

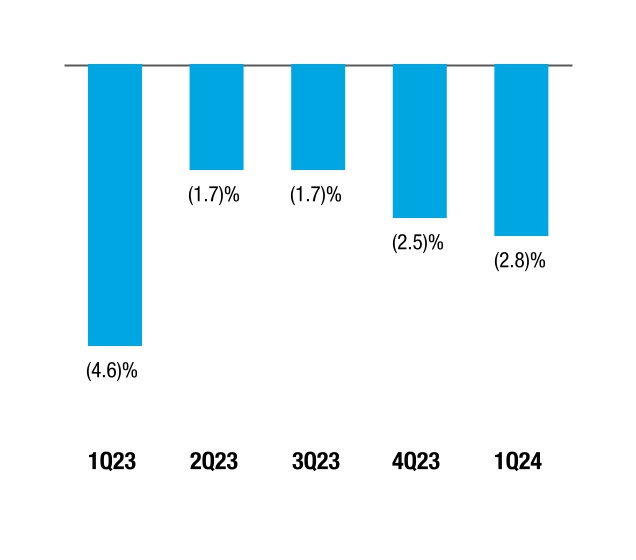

Source: Reis.

Source: Reis.

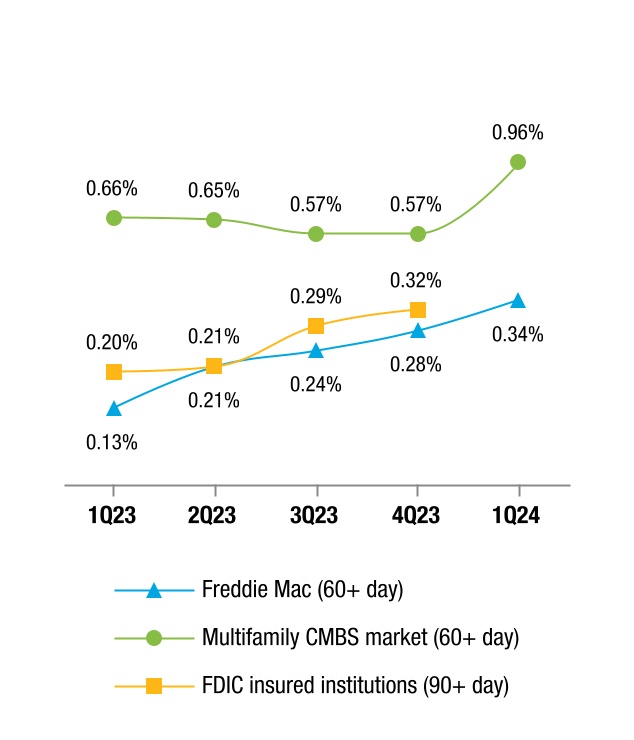

Source: Freddie Mac, FDIC Quarterly Banking Profile, Intex Solutions, Inc., and Wells Fargo Securities (Multifamily CMBS conduit market, excluding REOs). The 1Q 2024 delinquency rate for FDIC insured institutions is not yet available.

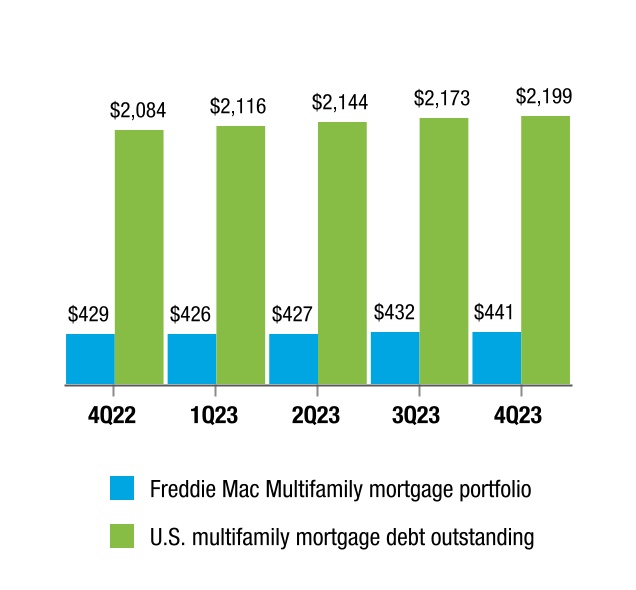

Source: Freddie Mac, FDIC Quarterly Banking Profile, Intex Solutions, Inc., and Wells Fargo Securities (Multifamily CMBS conduit market, excluding REOs). The 1Q 2024 delinquency rate for FDIC insured institutions is not yet available. Source: Freddie Mac and Federal Reserve Financial Accounts of the United States of America. The 1Q 2024 U.S. multifamily mortgage debt outstanding balance is not yet available.

Source: Freddie Mac and Federal Reserve Financial Accounts of the United States of America. The 1Q 2024 U.S. multifamily mortgage debt outstanding balance is not yet available.| Freddie Mac 1Q 2024 Form 10-Q | 5 | |||||||

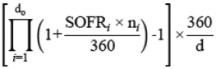

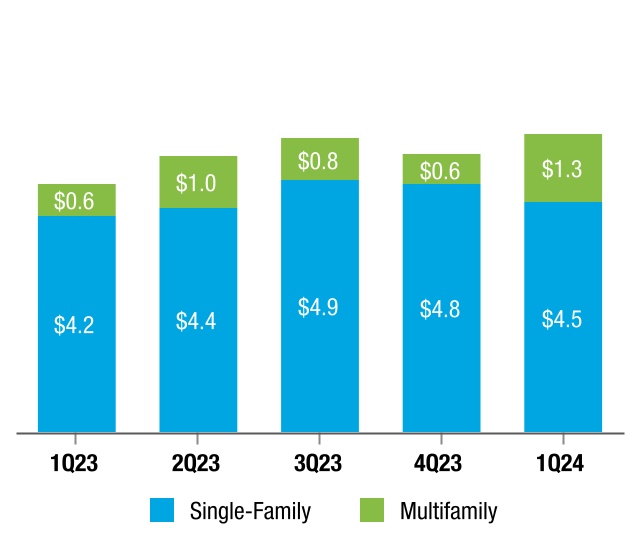

| Management's Discussion and Analysis | Consolidated Results of Operations | |||||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Net interest income | $4,759 | $4,501 | $258 | 6 | % | |||||||||||||||

| Non-interest income | 998 | 326 | 672 | 206 | ||||||||||||||||

| Net revenues | 5,757 | 4,827 | 930 | 19 | ||||||||||||||||

| (Provision) benefit for credit losses | (181) | (395) | 214 | 54 | ||||||||||||||||

| Non-interest expense | (2,122) | (1,932) | (190) | (10) | ||||||||||||||||

| Income before income tax expense | 3,454 | 2,500 | 954 | 38 | ||||||||||||||||

| Income tax expense | (688) | (505) | (183) | (36) | ||||||||||||||||

| Net income | 2,766 | 1,995 | 771 | 39 | ||||||||||||||||

| Other comprehensive income (loss), net of taxes and reclassification adjustments | (25) | 54 | (79) | (146) | ||||||||||||||||

| Comprehensive income | $2,741 | $2,049 | $692 | 34 | % | |||||||||||||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Guarantee net interest income: | ||||||||||||||||||||

| Contractual net interest income | $3,772 | $3,666 | $106 | 3 | % | |||||||||||||||

| Deferred fee income | 166 | 207 | (41) | (20) | ||||||||||||||||

| Total guarantee net interest income | 3,938 | 3,873 | 65 | 2 | ||||||||||||||||

| Investments net interest income | 1,514 | 1,432 | 82 | 6 | ||||||||||||||||

| Impact on net interest income from hedge accounting | (693) | (804) | 111 | 14 | ||||||||||||||||

| Net interest income | $4,759 | $4,501 | $258 | 6 | % | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 6 | |||||||

| Management's Discussion and Analysis | Consolidated Results of Operations | |||||||

| 1Q 2024 | 1Q 2023 | |||||||||||||||||||||||||

| (Dollars in millions) | Average Balance | Interest Income (Expense) | Average Rate | Average Balance | Interest Income (Expense) | Average Rate | ||||||||||||||||||||

| Interest-earning assets: | ||||||||||||||||||||||||||

| Cash and cash equivalents | $12,141 | $125 | 4.09 | % | $13,758 | $121 | 3.51 | % | ||||||||||||||||||

| Securities purchased under agreements to resell | 111,796 | 1,532 | 5.48 | 107,516 | 1,220 | 4.54 | ||||||||||||||||||||

| Investment securities | 41,293 | 470 | 4.56 | 38,126 | 316 | 3.31 | ||||||||||||||||||||

Mortgage loans(1) | 3,100,111 | 26,229 | 3.38 | 3,042,128 | 23,304 | 3.06 | ||||||||||||||||||||

| Other assets | 1,784 | 29 | 6.48 | 1,930 | 26 | 5.30 | ||||||||||||||||||||

| Total interest-earning assets | 3,267,125 | 28,385 | 3.47 | 3,203,458 | 24,987 | 3.12 | ||||||||||||||||||||

| Interest-bearing liabilities: | ||||||||||||||||||||||||||

| Debt of consolidated trusts | 3,035,073 | (21,122) | (2.78) | 2,975,417 | (18,261) | (2.45) | ||||||||||||||||||||

| Debt of Freddie Mac | 180,850 | (2,504) | (5.53) | 187,599 | (2,225) | (4.74) | ||||||||||||||||||||

| Total interest-bearing liabilities | 3,215,923 | (23,626) | (2.94) | 3,163,016 | (20,486) | (2.59) | ||||||||||||||||||||

| Impact of net non-interest-bearing funding | 51,202 | — | 0.05 | 40,442 | — | 0.03 | ||||||||||||||||||||

| Total funding of interest-earning assets | 3,267,125 | (23,626) | (2.89) | 3,203,458 | (20,486) | (2.56) | ||||||||||||||||||||

| Net interest income/yield | $4,759 | 0.58 | % | $4,501 | 0.56 | % | ||||||||||||||||||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Guarantee income | $496 | $466 | $30 | 6 | % | |||||||||||||||

| Investment gains, net | 405 | (225) | 630 | 280 | ||||||||||||||||

| Other income | 97 | 85 | 12 | 14 | ||||||||||||||||

| Non-interest income | $998 | $326 | $672 | 206 | % | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 7 | |||||||

| Management's Discussion and Analysis | Consolidated Results of Operations | |||||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Single-Family | ($120) | ($318) | $198 | 62 | % | |||||||||||||||

| Multifamily | (61) | (77) | 16 | 21 | ||||||||||||||||

| (Provision) benefit for credit losses | ($181) | ($395) | $214 | 54 | % | |||||||||||||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Salaries and employee benefits | ($421) | ($374) | ($47) | (13) | % | |||||||||||||||

| Credit enhancement expense | (597) | (530) | (67) | (13) | ||||||||||||||||

| Benefit for (decrease in) credit enhancement recoveries | 1 | 49 | (48) | (98) | ||||||||||||||||

| Legislative assessments expense: | ||||||||||||||||||||

| Legislated guarantee fees expense | (724) | (708) | (16) | (2) | ||||||||||||||||

| Affordable housing funds allocation | (30) | (27) | (3) | (11) | ||||||||||||||||

| Total legislative assessments expense | (754) | (735) | (19) | (3) | ||||||||||||||||

| Other expense | (351) | (342) | (9) | (3) | ||||||||||||||||

| Non-interest expense | ($2,122) | ($1,932) | ($190) | (10) | % | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 8 | |||||||

| Management's Discussion and Analysis | Consolidated Balance Sheets Analysis | |||||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | March 31, 2024 | December 31, 2023 | $ | % | ||||||||||||||||

| Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $3,531 | $6,019 | ($2,488) | (41) | % | |||||||||||||||

| Securities purchased under agreements to resell | 102,257 | 95,148 | 7,109 | 7 | ||||||||||||||||

| Investment securities, at fair value | 41,400 | 43,275 | (1,875) | (4) | ||||||||||||||||

| Mortgage loans held-for-sale | 12,034 | 12,941 | (907) | (7) | ||||||||||||||||

| Mortgage loans held-for-investment | 3,088,687 | 3,083,665 | 5,022 | — | ||||||||||||||||

| Accrued interest receivable, net | 10,047 | 9,925 | 122 | 1 | ||||||||||||||||

| Deferred tax assets, net | 4,227 | 4,076 | 151 | 4 | ||||||||||||||||

| Other assets | 25,190 | 25,927 | (737) | (3) | ||||||||||||||||

| Total assets | $3,287,373 | $3,280,976 | $6,397 | — | % | |||||||||||||||

| Liabilities and Equity: | ||||||||||||||||||||

| Liabilities: | ||||||||||||||||||||

| Accrued interest payable | $8,712 | $8,812 | ($100) | (1) | % | |||||||||||||||

| Debt | 3,211,742 | 3,208,346 | 3,396 | — | ||||||||||||||||

| Other liabilities | 16,456 | 16,096 | 360 | 2 | ||||||||||||||||

| Total liabilities | 3,236,910 | 3,233,254 | 3,656 | — | ||||||||||||||||

| Total equity | 50,463 | 47,722 | 2,741 | 6 | ||||||||||||||||

| Total liabilities and equity | $3,287,373 | $3,280,976 | $6,397 | — | % | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 9 | |||||||

| Management's Discussion and Analysis | Our Portfolios | |||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||

| (In millions) | Single-Family | Multifamily | Total | Single-Family | Multifamily | Total | ||||||||||||||||||||

| Mortgage loans held-for-investment: | ||||||||||||||||||||||||||

| By consolidated trusts | $2,965,370 | $51,757 | $3,017,127 | $2,963,296 | $47,433 | $3,010,729 | ||||||||||||||||||||

| By Freddie Mac | 35,643 | 10,000 | 45,643 | 33,213 | 11,770 | 44,983 | ||||||||||||||||||||

| Total mortgage loans held-for-investment | 3,001,013 | 61,757 | 3,062,770 | 2,996,509 | 59,203 | 3,055,712 | ||||||||||||||||||||

| Mortgage loans held-for-sale | 3,104 | 9,446 | 12,550 | 3,527 | 9,905 | 13,432 | ||||||||||||||||||||

| Total mortgage loans | 3,004,117 | 71,203 | 3,075,320 | 3,000,036 | 69,108 | 3,069,144 | ||||||||||||||||||||

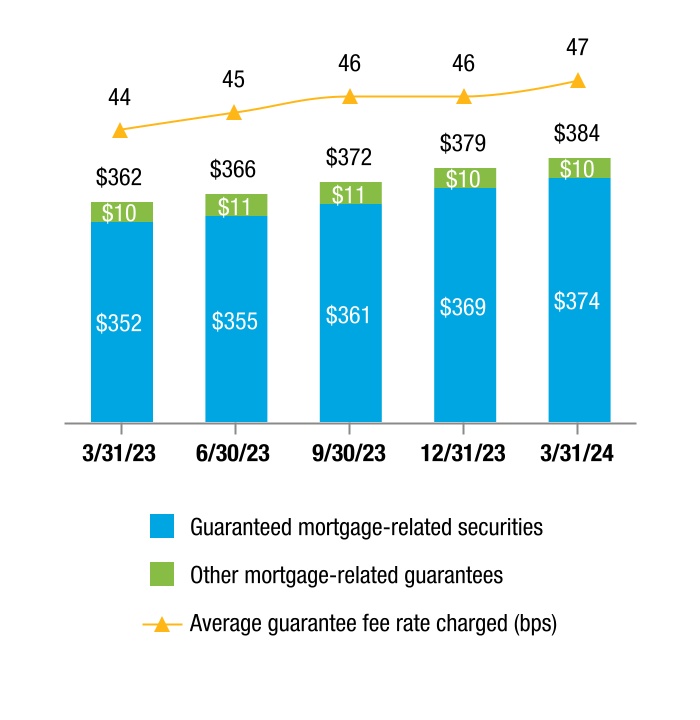

| Mortgage-related guarantees: | ||||||||||||||||||||||||||

| Mortgage loans held by nonconsolidated trusts | 30,324 | 361,164 | 391,488 | 30,182 | 360,928 | 391,110 | ||||||||||||||||||||

| Other mortgage-related guarantees | 8,511 | 10,720 | 19,231 | 8,692 | 10,761 | 19,453 | ||||||||||||||||||||

| Total mortgage-related guarantees | 38,835 | 371,884 | 410,719 | 38,874 | 371,689 | 410,563 | ||||||||||||||||||||

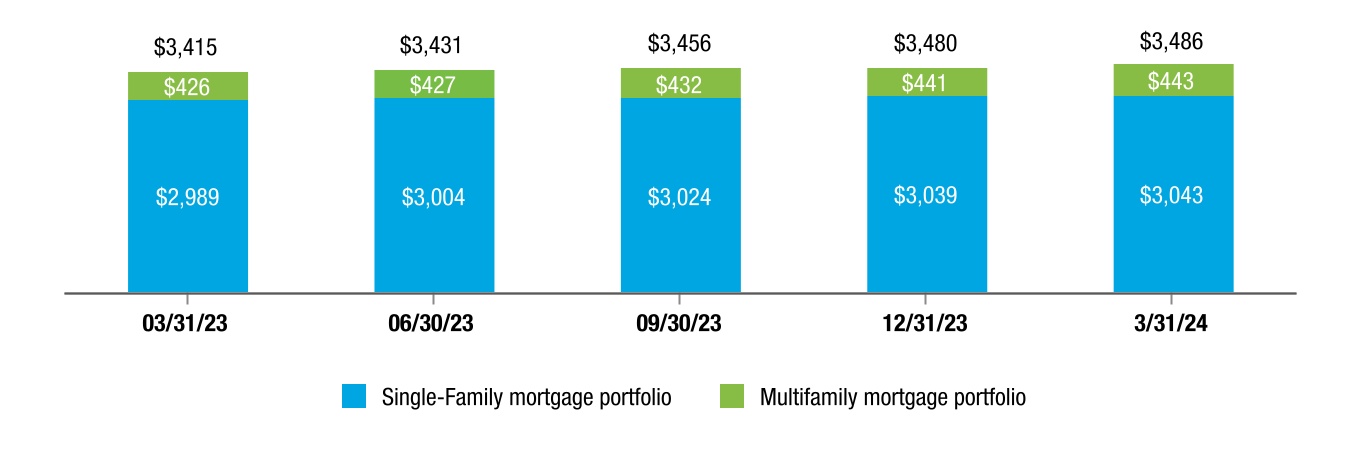

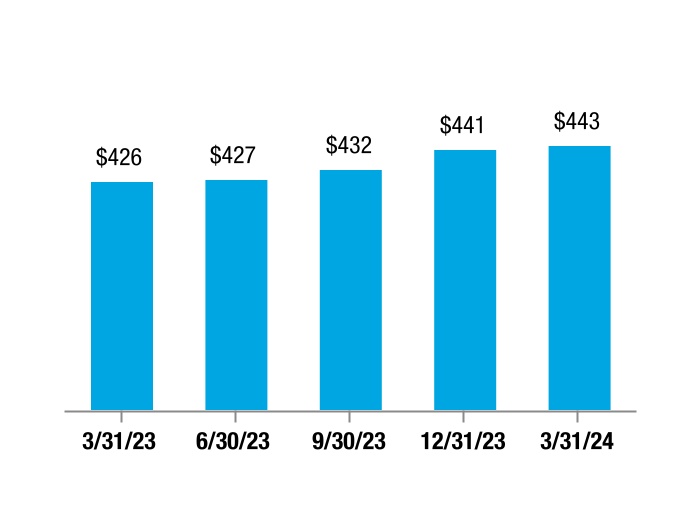

| Total mortgage portfolio | $3,042,952 | $443,087 | $3,486,039 | $3,038,910 | $440,797 | $3,479,707 | ||||||||||||||||||||

| Guaranteed mortgage-related securities: | ||||||||||||||||||||||||||

| Issued by consolidated trusts | $2,975,161 | $51,811 | $3,026,972 | $2,970,707 | $47,436 | $3,018,143 | ||||||||||||||||||||

| Issued by nonconsolidated trusts | 24,762 | 321,905 | 346,667 | 24,600 | 321,262 | 345,862 | ||||||||||||||||||||

| Total guaranteed mortgage-related securities | $2,999,923 | $373,716 | $3,373,639 | $2,995,307 | $368,698 | $3,364,005 | ||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 10 | |||||||

| Management's Discussion and Analysis | Our Portfolios | |||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||

| (In millions) | Single-Family | Multifamily | Total | Single-Family | Multifamily | Total | ||||||||||||||||||||

| Unsecuritized mortgage loans: | ||||||||||||||||||||||||||

Securitization pipeline loans(1) | $9,749 | $13,057 | $22,806 | $8,225 | $15,197 | $23,422 | ||||||||||||||||||||

Other loans(2) | 28,998 | 6,389 | 35,387 | 28,515 | 6,478 | 34,993 | ||||||||||||||||||||

| Total unsecuritized mortgage loans | 38,747 | 19,446 | 58,193 | 36,740 | 21,675 | 58,415 | ||||||||||||||||||||

| Mortgage-related securities: | ||||||||||||||||||||||||||

| Investment securities | 2,916 | 4,486 | 7,402 | 2,667 | 4,613 | 7,280 | ||||||||||||||||||||

| Debt of consolidated trusts | 18,367 | 684 | 19,051 | 18,639 | 660 | 19,299 | ||||||||||||||||||||

| Total mortgage-related securities | 21,283 | 5,170 | 26,453 | 21,306 | 5,273 | 26,579 | ||||||||||||||||||||

| Mortgage-related investments portfolio | $60,030 | $24,616 | $84,646 | $58,046 | $26,948 | $84,994 | ||||||||||||||||||||

| 10% of notional amount of interest-only securities | $23,126 | $22,186 | ||||||||||||||||||||||||

| Mortgage-related investments portfolio for purposes of Purchase Agreement cap | 107,772 | 107,180 | ||||||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||

| (In millions) | Liquidity and Contingency Operating Portfolio | Custodial Account | Other | Total Other Investments Portfolio (1) | Liquidity and Contingency Operating Portfolio | Custodial Account | Other | Total Other Investments Portfolio (1) | ||||||||||||||||||||||||

| Cash and cash equivalents | $1,947 | $1,483 | $101 | $3,531 | $5,041 | $890 | $88 | $6,019 | ||||||||||||||||||||||||

Securities purchased under agreements to resell | 104,243 | 10,777 | 1,037 | 116,057 | 94,904 | 9,396 | 1,093 | 105,393 | ||||||||||||||||||||||||

Non-mortgage related securities(2) | 22,960 | — | 5,593 | 28,553 | 24,153 | — | 6,119 | 30,272 | ||||||||||||||||||||||||

| Other assets | — | — | 6,479 | 6,479 | — | — | 5,555 | 5,555 | ||||||||||||||||||||||||

| Other investments portfolio | $129,150 | $12,260 | $13,210 | $154,620 | $124,098 | $10,286 | $12,855 | $147,239 | ||||||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 11 | |||||||

| Management's Discussion and Analysis | Our Business Segments | |||||||

| Segment | Description | ||||

| Single-Family | Reflects results from our purchase, securitization, and guarantee of single-family loans, our investments in single-family loans and mortgage-related securities, the management of Single-Family mortgage credit risk and market risk, and any results of our treasury function that are not allocated to each segment. | ||||

| Multifamily | Reflects results from our purchase, securitization, and guarantee of multifamily loans, our investments in multifamily loans and mortgage-related securities, and the management of Multifamily mortgage credit risk and market risk. | ||||

| Freddie Mac 1Q 2024 Form 10-Q | 12 | |||||||

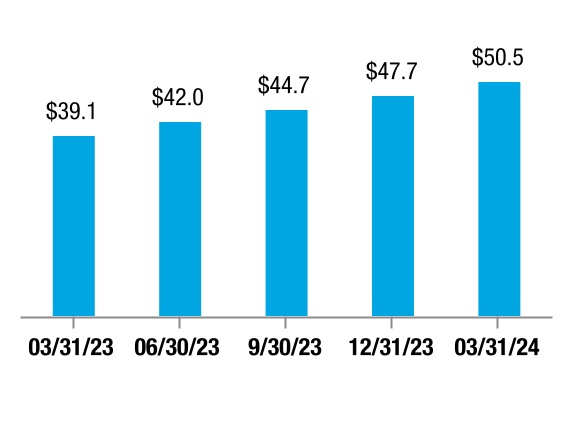

| Management's Discussion and Analysis | Our Business Segments | Single-Family | ||||

| Freddie Mac 1Q 2024 Form 10-Q | 13 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Single-Family | ||||

| Freddie Mac 1Q 2024 Form 10-Q | 14 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Single-Family | ||||

| Freddie Mac 1Q 2024 Form 10-Q | 15 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Single-Family | ||||

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Net interest income | $4,488 | $4,296 | $192 | 4 | % | |||||||||||||||

| Non-interest income | (14) | (93) | 79 | 85 | ||||||||||||||||

| Net revenues | 4,474 | 4,203 | 271 | 6 | ||||||||||||||||

| (Provision) benefit for credit losses | (120) | (318) | 198 | 62 | ||||||||||||||||

| Non-interest expense | (1,925) | (1,783) | (142) | (8) | ||||||||||||||||

| Income before Income tax expense | 2,429 | 2,102 | 327 | 16 | ||||||||||||||||

| Income tax expense | (484) | (425) | (59) | (14) | ||||||||||||||||

| Net income | 1,945 | 1,677 | 268 | 16 | ||||||||||||||||

| Other comprehensive income (loss), net of taxes and reclassification adjustments | (5) | (1) | (4) | (400) | ||||||||||||||||

| Comprehensive income | $1,940 | $1,676 | $264 | 16 | % | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 16 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Multifamily | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 17 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Multifamily | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 18 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Multifamily | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 19 | |||||||

| Management's Discussion and Analysis | Our Business Segments | Multifamily | |||||||

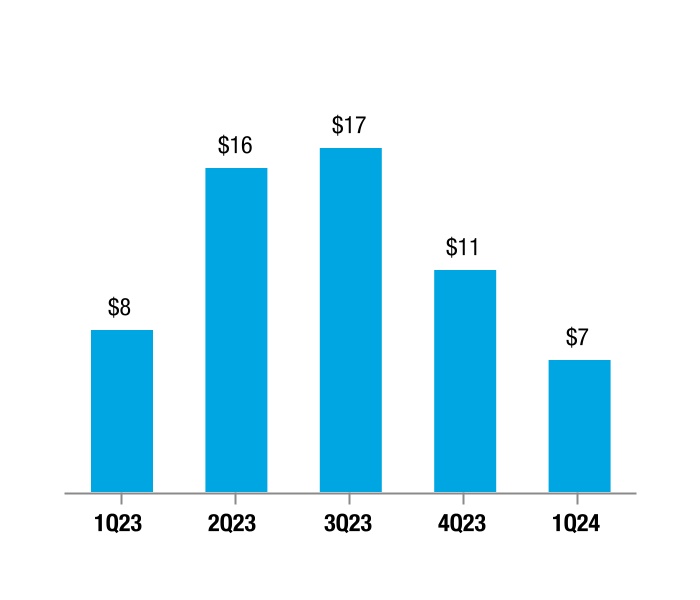

| Change | ||||||||||||||||||||

| (Dollars in millions) | 1Q 2024 | 1Q 2023 | $ | % | ||||||||||||||||

| Net interest income | $271 | $205 | $66 | 32 | % | |||||||||||||||

| Non-interest income | 1,012 | 419 | 593 | 142 | ||||||||||||||||

| Net revenues | 1,283 | 624 | 659 | 106 | ||||||||||||||||

| (Provision) benefit for credit losses | (61) | (77) | 16 | 21 | ||||||||||||||||

| Non-interest expense | (197) | (149) | (48) | (32) | ||||||||||||||||

| Income before income tax expense | 1,025 | 398 | 627 | 158 | ||||||||||||||||

| Income tax expense | (204) | (80) | (124) | (155) | ||||||||||||||||

| Net income | 821 | 318 | 503 | 158 | ||||||||||||||||

| Other comprehensive income (loss), net of taxes and reclassification adjustments | (20) | 55 | (75) | (136) | ||||||||||||||||

| Comprehensive income | $801 | $373 | $428 | 115 | % | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 20 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| 1Q 2024 | 1Q 2023 | ||||||||||||||||||||||

| (Dollars in millions) | Single-Family | Multifamily | Total | Single-Family | Multifamily | Total | |||||||||||||||||

| Allowance for credit losses: | |||||||||||||||||||||||

| Beginning balance | $6,402 | $447 | $6,849 | $7,746 | $147 | $7,893 | |||||||||||||||||

| Provision (benefit) for credit losses | 120 | 61 | 181 | 318 | 77 | 395 | |||||||||||||||||

| Charge-offs | (123) | — | (123) | (90) | — | (90) | |||||||||||||||||

| Recoveries collected | 26 | — | 26 | 32 | — | 32 | |||||||||||||||||

| Net charge-offs | (97) | — | (97) | (58) | — | (58) | |||||||||||||||||

Other(1) | 83 | — | 83 | 91 | — | 91 | |||||||||||||||||

| Ending balance | $6,508 | $508 | $7,016 | $8,097 | $224 | $8,321 | |||||||||||||||||

Average loans outstanding during the period(2) | $3,030,531 | $58,504 | $3,089,035 | $2,985,726 | $47,748 | $3,033,474 | |||||||||||||||||

| Net charge-offs to average loans outstanding | — | % | — | % | — | % | — | % | — | % | — | % | |||||||||||

| Components of ending balance of allowance for credit losses: | |||||||||||||||||||||||

| Mortgage loans held-for-investment | $6,189 | $381 | $6,570 | $7,675 | $160 | $7,835 | |||||||||||||||||

Other(3) | 319 | 127 | 446 | 422 | 64 | 486 | |||||||||||||||||

| Total ending balance | $6,508 | $508 | $7,016 | $8,097 | $224 | $8,321 | |||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 21 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||

| (Dollars in millions) | Single-Family | Multifamily | Total | Single-Family | Multifamily | Total | |||||||||||||||||

| Allowance for credit losses ratios: | |||||||||||||||||||||||

Allowance for credit losses(1) to total loans outstanding | 0.20 | % | 0.64 | % | 0.21 | % | 0.20 | % | 0.57 | % | 0.21 | % | |||||||||||

| Non-accrual loans to total loans outstanding | 0.43 | 0.17 | 0.42 | 0.44 | 0.11 | 0.44 | |||||||||||||||||

| Allowance for credit losses to non-accrual loans | 47.90 | 369.90 | 50.45 | 45.01 | 509.38 | 47.20 | |||||||||||||||||

| Balances: | |||||||||||||||||||||||

| Allowance for credit losses on mortgage loans held-for-investment | $6,189 | $381 | $6,570 | $6,057 | $326 | $6,383 | |||||||||||||||||

Total loans outstanding(2) | 3,033,817 | 59,509 | 3,093,326 | 3,031,136 | 57,107 | 3,088,243 | |||||||||||||||||

Non-accrual loans(2) | 12,921 | 103 | 13,024 | 13,458 | 64 | 13,522 | |||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 22 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| 1Q 2024 | 1Q 2023 | ||||||||||||||||

| (Dollars in millions) | Amount | % of Total | Amount | % of Total | |||||||||||||

| 20- and 30-year, amortizing fixed-rate | $59,091 | 95 | % | $55,469 | 94 | % | |||||||||||

| 15-year or less, amortizing fixed-rate | 2,278 | 4 | 2,214 | 4 | |||||||||||||

| Adjustable-rate | 900 | 1 | 1,282 | 2 | |||||||||||||

| Total | $62,269 | 100 | % | $58,965 | 100 | % | |||||||||||

| Percentage of purchases | |||||||||||||||||

| DTI ratio > 45% | 28 | % | 23 | % | |||||||||||||

| Original LTV ratio > 90% | 25 | 28 | |||||||||||||||

| Transaction type: | |||||||||||||||||

| Guarantor swap | 66 | 72 | |||||||||||||||

| Cash window | 34 | 28 | |||||||||||||||

| Property type: | |||||||||||||||||

| Detached single-family houses and townhouses | 91 | 91 | |||||||||||||||

| Condominium or co-op | 9 | 9 | |||||||||||||||

| Occupancy type: | |||||||||||||||||

| Primary residence | 93 | 92 | |||||||||||||||

| Second home | 2 | 2 | |||||||||||||||

| Investment property | 5 | 6 | |||||||||||||||

| Loan purpose: | |||||||||||||||||

| Purchase | 86 | 86 | |||||||||||||||

| Cash-out refinance | 8 | 9 | |||||||||||||||

| Other refinance | 6 | 5 | |||||||||||||||

| 1Q 2024 | 1Q 2023 | ||||||||||||||||

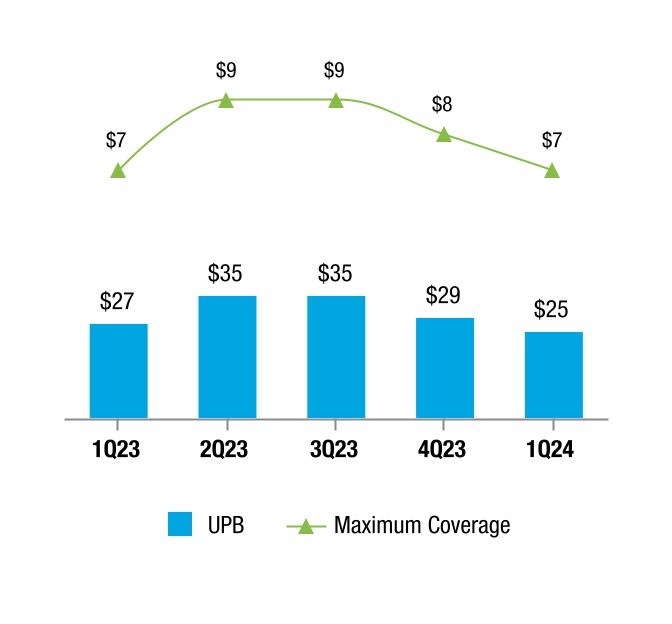

| (In millions) | UPB(1)(2) | Maximum Coverage(3)(4) | UPB(1)(2) | Maximum Coverage(3)(4) | |||||||||||||

| Primary mortgage insurance | $25,135 | $6,616 | $26,518 | $6,920 | |||||||||||||

| CRT transactions: | |||||||||||||||||

| STACR | 41,402 | 1,284 | 14,887 | 611 | |||||||||||||

| ACIS | 15,523 | 559 | — | — | |||||||||||||

| Other | 692 | 107 | 46 | 46 | |||||||||||||

| Total CRT issuance | $57,617 | $1,950 | $14,933 | $657 | |||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 23 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

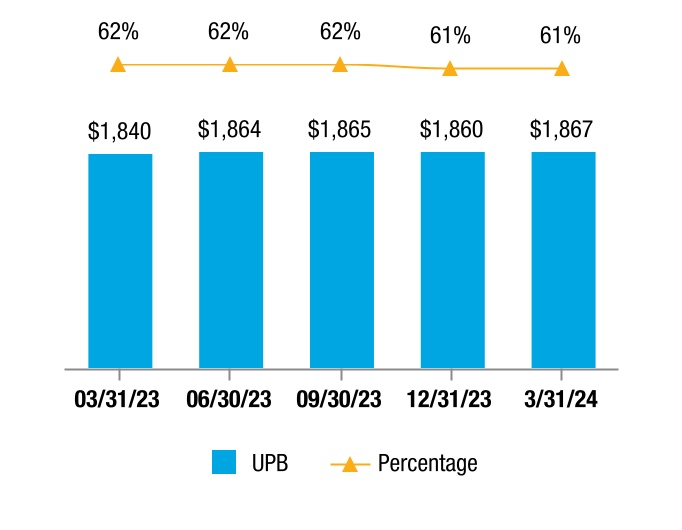

| March 31, 2024 | ||||||||||||||

| (Dollars in millions) | UPB(1) | % of Portfolio | Maximum Coverage(2)(3) | |||||||||||

Primary mortgage insurance(4) | $636,735 | 21 | % | $166,486 | ||||||||||

| STACR | 1,187,102 | 39 | 31,085 | |||||||||||

| ACIS | 804,323 | 26 | 17,535 | |||||||||||

| Other | 39,871 | 1 | 10,911 | |||||||||||

Less: UPB with multiple credit enhancements and other reconciling items(5) | (801,385) | (26) | — | |||||||||||

| Single-Family mortgage portfolio - credit-enhanced | 1,866,646 | 61 | 226,017 | |||||||||||

| Single-Family mortgage portfolio - non-credit-enhanced | 1,176,306 | 39 | N/A | |||||||||||

| Total | $3,042,952 | 100 | % | $226,017 | ||||||||||

| December 31, 2023 | ||||||||||||||

| (Dollars in millions) | UPB(1) | % of Portfolio | Maximum Coverage(2)(3) | |||||||||||

Primary mortgage insurance(4) | $637,037 | 21 | % | $165,738 | ||||||||||

| STACR | 1,175,837 | 39 | 31,222 | |||||||||||

| ACIS | 821,048 | 27 | 17,647 | |||||||||||

| Other | 39,901 | 1 | 11,027 | |||||||||||

Less: UPB with multiple credit enhancements and other reconciling items(5) | (813,966) | (27) | — | |||||||||||

| Single-Family mortgage portfolio - credit-enhanced | 1,859,857 | 61 | 225,634 | |||||||||||

| Single-Family mortgage portfolio - non-credit-enhanced | 1,179,053 | 39 | N/A | |||||||||||

| Total | $3,038,910 | 100 | % | $225,634 | ||||||||||

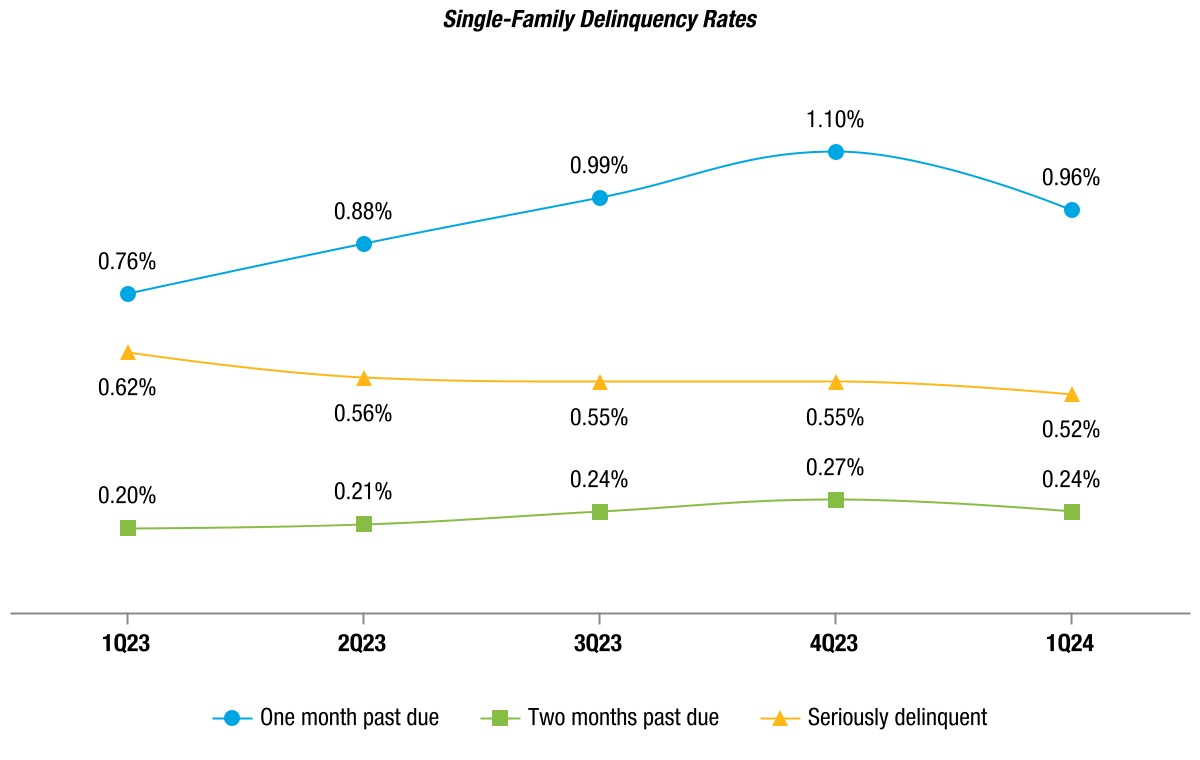

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||

(% of portfolio based on UPB)(1) | % of Portfolio(2) | SDQ Rate | % of Portfolio(2) | SDQ Rate | ||||||||||||||||

| Credit-enhanced: | ||||||||||||||||||||

| Primary mortgage insurance | 21 | % | 0.92 | % | 21 | % | 0.95 | % | ||||||||||||

| CRT and other | 55 | 0.57 | 55 | 0.60 | ||||||||||||||||

| Non-credit-enhanced | 39 | 0.40 | 39 | 0.42 | ||||||||||||||||

| Total | N/A | 0.52 | N/A | 0.55 | ||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 24 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| March 31, 2024 | ||||||||||||||||||||

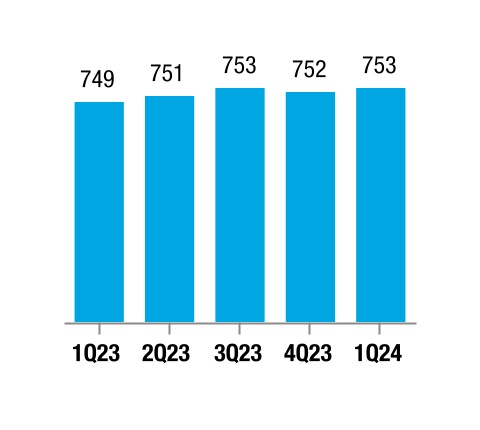

| (Dollars in millions) | UPB | Original Credit Score(1) | Current Credit Score(1)(2) | Original LTV Ratio | Current LTV Ratio | |||||||||||||||

| Single-Family mortgage portfolio year of origination: | ||||||||||||||||||||

| 2024 | $42,481 | 754 | 754 | 78 | % | 78 | % | |||||||||||||

| 2023 | 278,342 | 751 | 744 | 79 | 75 | |||||||||||||||

| 2022 | 426,234 | 746 | 744 | 76 | 68 | |||||||||||||||

| 2021 | 968,107 | 752 | 755 | 71 | 53 | |||||||||||||||

| 2020 | 707,779 | 761 | 767 | 71 | 46 | |||||||||||||||

| 2019 and prior | 620,009 | 738 | 751 | 75 | 34 | |||||||||||||||

| Total | $3,042,952 | 750 | 754 | 73 | 52 | |||||||||||||||

| December 31, 2023 | ||||||||||||||||||||

| (Dollars in millions) | UPB | Original Credit Score (1) | Current Credit Score(1)(2) | Original LTV Ratio | Current LTV Ratio | |||||||||||||||

| Single-Family mortgage portfolio year of origination: | ||||||||||||||||||||

| 2023 | $265,072 | 751 | 745 | 79 | % | 75 | % | |||||||||||||

| 2022 | 433,252 | 745 | 746 | 76 | 68 | |||||||||||||||

| 2021 | 984,004 | 752 | 756 | 71 | 54 | |||||||||||||||

| 2020 | 719,822 | 761 | 768 | 71 | 46 | |||||||||||||||

| 2019 | 119,557 | 746 | 753 | 76 | 46 | |||||||||||||||

| 2018 and prior | 517,203 | 736 | 751 | 75 | 32 | |||||||||||||||

| Total | $3,038,910 | 750 | 755 | 73 | 52 | |||||||||||||||

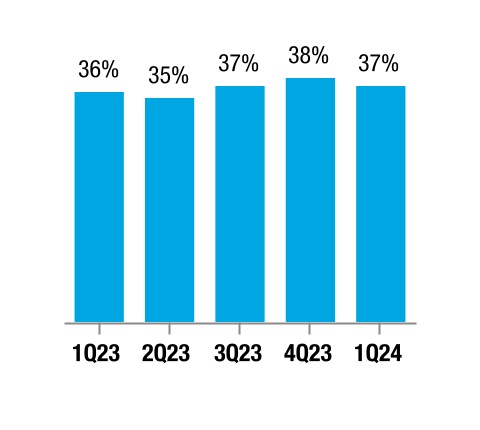

| March 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLTV ≤ 60 | CLTV > 60 to 80 | CLTV > 80 to 90 | CLTV > 90 to 100 | CLTV > 100 | All Loans | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Original credit score | % of Portfolio | SDQ Rate | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate | ||||||||||||||||||||||||||||||||||||||||||||

| 740 and above | 44 | % | 0.15 | % | 15 | % | 0.23 | % | 4 | % | 0.31 | % | 2 | % | 0.29 | % | — | % | NM | 65 | % | 0.17 | % | |||||||||||||||||||||||||||||||||

| 700 to 739 | 12 | 0.49 | 6 | 0.79 | 2 | 0.89 | 1 | 0.73 | — | NM | 21 | 0.58 | ||||||||||||||||||||||||||||||||||||||||||||

| 680 to 699 | 4 | 0.85 | 2 | 1.48 | — | NM | — | NM | — | NM | 6 | 1.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 660 to 679 | 3 | 1.21 | 1 | 2.13 | — | NM | — | NM | — | NM | 4 | 1.40 | ||||||||||||||||||||||||||||||||||||||||||||

| 620 to 659 | 2 | 1.89 | 1 | 3.28 | — | NM | — | NM | — | NM | 3 | 2.10 | ||||||||||||||||||||||||||||||||||||||||||||

| Less than 620 | 1 | 4.30 | — | NM | — | NM | — | NM | — | NM | 1 | 4.63 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | 66 | % | 0.46 | 25 | % | 0.67 | 6 | % | 0.71 | 3 | % | 0.59 | — | % | NM | 100 | % | 0.52 | ||||||||||||||||||||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 25 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| December 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| CLTV ≤ 60 | CLTV > 60 to 80 | CLTV > 80 to 90 | CLTV > 90 to 100 | CLTV > 100 | All Loans | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Original credit score | % of Portfolio | SDQ Rate | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate(2) | % of Portfolio | SDQ Rate | ||||||||||||||||||||||||||||||||||||||||||||

| 740 and above | 45 | % | 0.16 | % | 15 | % | 0.24 | % | 4 | % | 0.32 | % | 1 | % | 0.27 | % | — | % | NM | 65 | % | 0.18 | % | |||||||||||||||||||||||||||||||||

| 700 to 739 | 13 | 0.53 | 5 | 0.82 | 2 | 0.93 | 1 | 0.59 | — | NM | 21 | 0.61 | ||||||||||||||||||||||||||||||||||||||||||||

| 680 to 699 | 4 | 0.90 | 2 | 1.50 | — | NM | — | NM | — | NM | 6 | 1.05 | ||||||||||||||||||||||||||||||||||||||||||||

| 660 to 679 | 3 | 1.28 | 1 | 2.18 | — | NM | — | NM | — | NM | 4 | 1.45 | ||||||||||||||||||||||||||||||||||||||||||||

| 620 to 659 | 2 | 2.00 | 1 | 3.37 | — | NM | — | NM | — | NM | 3 | 2.21 | ||||||||||||||||||||||||||||||||||||||||||||

| Less than 620 | 1 | 4.41 | — | NM | — | NM | — | NM | — | NM | 1 | 4.74 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | 68 | % | 0.49 | 24 | % | 0.70 | 6 | % | 0.72 | 2 | % | 0.52 | — | % | NM | 100 | % | 0.55 | ||||||||||||||||||||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 26 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| 1Q 2024 | 1Q 2023 | ||||||||||||||||

| (UPB in millions, loan count in thousands) | UPB | Loan Count | UPB | Loan Count | |||||||||||||

| Payment deferral plans | $2,670 | 10 | $2,735 | 11 | |||||||||||||

| Loan modifications | 1,382 | 6 | 1,259 | 6 | |||||||||||||

Forbearance plans and other(1) | 1,180 | 5 | 1,490 | 7 | |||||||||||||

| Total | $5,232 | 21 | $5,484 | 24 | |||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 27 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

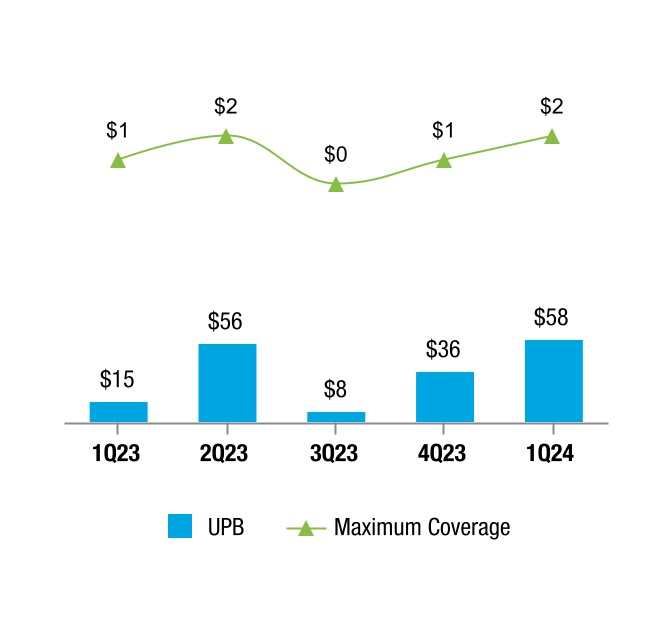

| 1Q 2024 | 1Q 2023 | |||||||||||||||||||

| (In millions) | UPB(1) | Maximum Coverage(2)(3) | UPB(1) | Maximum Coverage(2)(3) | ||||||||||||||||

| Subordination | $6,598 | $399 | $6,149 | $425 | ||||||||||||||||

| SCR | — | — | 1,166 | 105 | ||||||||||||||||

| Lender risk-sharing | — | — | 239 | 48 | ||||||||||||||||

| Total CRT issuance | $6,598 | $399 | $7,554 | $578 | ||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 28 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

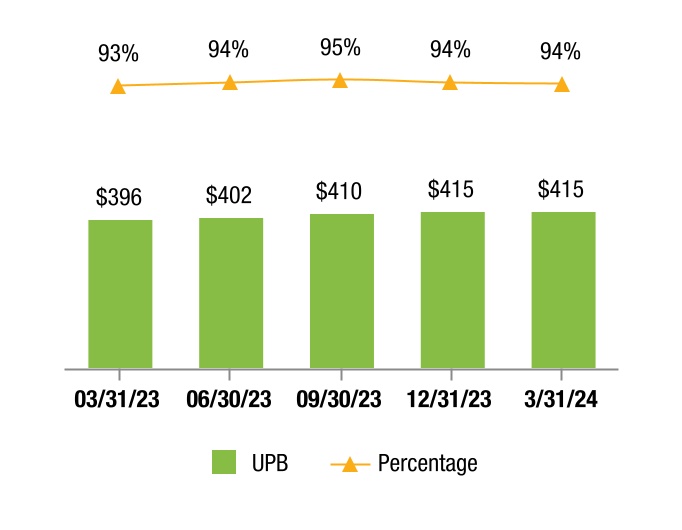

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||

| (Dollars in millions) | UPB | Delinquency Rate | UPB | Delinquency Rate | ||||||||||||||||

| Credit-enhanced: | ||||||||||||||||||||

| Subordination | $359,244 | 0.34 | % | $358,944 | 0.26 | % | ||||||||||||||

| SCR/MCIP | 46,904 | 0.23 | 47,011 | 0.23 | ||||||||||||||||

| Other | 8,779 | 0.86 | 8,844 | 0.89 | ||||||||||||||||

| Total credit-enhanced | 414,927 | 0.34 | 414,799 | 0.27 | ||||||||||||||||

| Non-credit-enhanced | 28,160 | 0.33 | 25,998 | 0.51 | ||||||||||||||||

| Total | $443,087 | 0.34 | $440,797 | 0.28 | ||||||||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||

| (Dollars in millions) | UPB | Delinquency Rate | UPB | Delinquency Rate | ||||||||||||||||

| Mortgage loans held-for-sale | $8,602 | — | % | $8,823 | — | % | ||||||||||||||

| Mortgage loans held-for-investment: | ||||||||||||||||||||

| Held by Freddie Mac | 7,980 | 0.99 | 9,941 | 1.21 | ||||||||||||||||

| Held by consolidated trusts | 9,182 | 0.14 | 4,851 | 0.27 | ||||||||||||||||

| Other mortgage-related guarantees | 2,396 | — | 2,383 | — | ||||||||||||||||

| Total | $28,160 | 0.33 | $25,998 | 0.51 | ||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 29 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||||||||

| PVS-YC | PVS-L | PVS-YC | PVS-L | |||||||||||||||||||||||||||||

| (In millions) | 25 bps | 50 bps | 100 bps | 25 bps | 50 bps | 100 bps | ||||||||||||||||||||||||||

Assuming shifts of the yield curve, (gains) losses on:(1) | ||||||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||

Investments | $316 | $3,047 | $6,015 | ($301) | $3,150 | $6,229 | ||||||||||||||||||||||||||

Guarantees(2) | (15) | (314) | (599) | 34 | (369) | (678) | ||||||||||||||||||||||||||

| Total assets | 301 | 2,733 | 5,416 | (267) | 2,781 | 5,551 | ||||||||||||||||||||||||||

| Liabilities | 56 | (1,496) | (3,044) | (52) | (1,519) | (3,073) | ||||||||||||||||||||||||||

| Derivatives | (357) | (1,267) | (2,494) | 322 | (1,274) | (2,547) | ||||||||||||||||||||||||||

| Total | $— | ($30) | ($122) | $3 | ($12) | ($69) | ||||||||||||||||||||||||||

| PVS | $— | $— | $— | $3 | $— | $— | ||||||||||||||||||||||||||

| 1Q 2024 | 1Q 2023 | |||||||||||||||||||||||||

(Duration gap in months, dollars in millions) | Duration Gap | PVS-YC 25 bps | PVS-L 50 bps | Duration Gap | PVS-YC 25 bps | PVS-L 50 bps | ||||||||||||||||||||

| Average | 0.1 | $2 | $— | — | $3 | $3 | ||||||||||||||||||||

| Minimum | (0.1) | — | — | (0.2) | — | — | ||||||||||||||||||||

| Maximum | 0.2 | 5 | 5 | 0.2 | 9 | 24 | ||||||||||||||||||||

| Standard deviation | 0.1 | 1 | 1 | 0.1 | 2 | 6 | ||||||||||||||||||||

| PVS-L (50 bps) | |||||||||||||||||

| (In millions) | Before Derivatives | After Derivatives | Effect of Derivatives | ||||||||||||||

March 31, 2024 | $1,236 | $— | ($1,236) | ||||||||||||||

December 31, 2023 | 1,261 | — | (1,261) | ||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 30 | |||||||

| Management's Discussion and Analysis | Risk Management | |||||||

| (In millions) | March 31, 2024 | March 31, 2023 | ||||||||||||

Interest Rate Scenarios(1) | ||||||||||||||

| Parallel yield curve shifts: | ||||||||||||||

| +100 bps | $10 | $25 | ||||||||||||

| -100 bps | (10) | (25) | ||||||||||||

| Non-parallel yield curve shifts - long-term interest rates: | ||||||||||||||

| +100 bps | 282 | 118 | ||||||||||||

| -100 bps | (282) | (118) | ||||||||||||

| Non-parallel yield curve shifts - short-term and medium-term interest rates: | ||||||||||||||

| +100 bps | (272) | (92) | ||||||||||||

| -100 bps | 272 | 92 | ||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 31 | |||||||

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

| (In millions) | March 31, 2024(1) | December 31, 2023(1) | Description | ||||||||

| Other Investments Portfolio - Liquidity and Contingency Operating Portfolio | $129,150 | $124,098 | The liquidity and contingency operating portfolio, included within our other investments portfolio, is primarily used for short-term liquidity management. | ||||||||

| Mortgage-Related Investments Portfolio | 24,440 | 24,469 | The liquid portion of our mortgage-related investments portfolio can be pledged or sold for liquidity purposes. The amount of cash we may be able to successfully raise may be substantially less than the balance. | ||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 32 | |||||||

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

| (In millions) | March 31, 2024(1) | December 31, 2023(1) | Description | ||||||||

| Debt of Freddie Mac | $ | $166,419 | Debt of Freddie Mac is used to fund our business activities. | ||||||||

| Debt of Consolidated Trusts | 3,041,927 | Debt of consolidated trusts is used primarily to fund our Single-Family guarantee activities. This type of debt is principally repaid by the cash flows of the associated mortgage loans. As a result, our repayment obligation is limited to amounts paid pursuant to our guarantee of principal and interest and to purchase modified or seriously delinquent loans from the trusts. | |||||||||

| 1Q 2024 | 1Q 2023 | |||||||||||||||||||

| (Dollars in millions) | Par Value | Average Rate(1) | Par Value | Average Rate(1) | ||||||||||||||||

| Short-term: | ||||||||||||||||||||

| Beginning balance | $6,031 | 5.39 | % | $7,716 | 3.49 | % | ||||||||||||||

| Issuances | 15,943 | 5.29 | 50,739 | 4.18 | ||||||||||||||||

| Repayments | — | — | — | — | ||||||||||||||||

| Maturities | (13,043) | 5.26 | (49,739) | 4.04 | ||||||||||||||||

| Total short-term debt | 8,931 | 5.37 | 8,716 | 4.36 | ||||||||||||||||

| Long-term: | ||||||||||||||||||||

| Beginning balance | 168,009 | 3.31 | 170,363 | 2.22 | ||||||||||||||||

| Issuances | 16,438 | 5.38 | 14,192 | 5.33 | ||||||||||||||||

| Repayments | (20,812) | 5.62 | (2,491) | 5.93 | ||||||||||||||||

| Maturities | (3,164) | 2.62 | (680) | 1.50 | ||||||||||||||||

| Total long-term debt | 160,471 | 3.24 | 181,384 | 2.51 | ||||||||||||||||

| Total debt of Freddie Mac, net | $169,402 | 3.35 | % | $190,100 | 2.60 | % | ||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 33 | |||||||

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

| As of March 31, 2024 | As of December 31, 2023 | |||||||||||||||||||

| (In millions) | Contractual Maturity Date | Earliest Redemption Date | Contractual Maturity Date | Earliest Redemption Date | ||||||||||||||||

Debt of Freddie Mac(1): | ||||||||||||||||||||

| 1 year or less | $47,192 | $143,141 | $47,276 | $144,232 | ||||||||||||||||

| 1 year through 2 years | 54,690 | 12,049 | 61,187 | 15,249 | ||||||||||||||||

| 2 years through 3 years | 13,032 | 243 | 15,645 | 447 | ||||||||||||||||

| 3 years through 4 years | 13,154 | 290 | 12,530 | 305 | ||||||||||||||||

| 4 years through 5 years | 14,957 | 345 | 10,947 | 345 | ||||||||||||||||

| Thereafter | 24,328 | 11,285 | 24,278 | 11,285 | ||||||||||||||||

STACR and SCR debt(2) | 2,049 | 2,049 | 2,177 | 2,177 | ||||||||||||||||

| Total debt of Freddie Mac | $169,402 | $169,402 | $174,040 | $174,040 | ||||||||||||||||

| (In millions) | 1Q 2024 | 1Q 2023 | |||||||||

| Beginning balance | $2,999,893 | $2,929,567 | |||||||||

| Issuances | 84,873 | 87,021 | |||||||||

| Repayments and extinguishments | (75,689) | (77,867) | |||||||||

| Ending balance | 3,009,077 | 2,938,721 | |||||||||

Unamortized premiums and discounts | 40,961 | 48,329 | |||||||||

| Debt of consolidated trusts | $3,050,038 | $2,987,050 | |||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 34 | |||||||

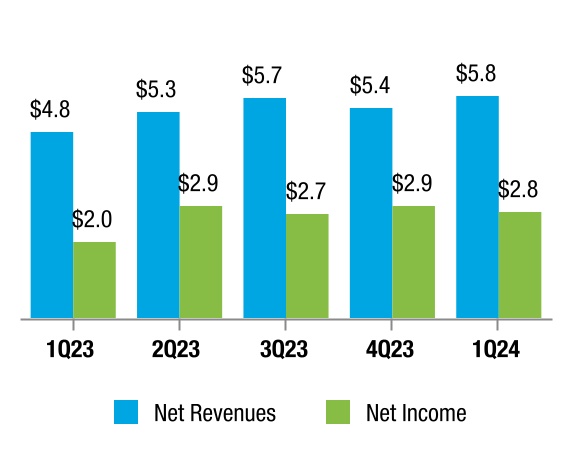

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

| (In millions) | 1Q 2024 | 1Q 2023 | |||||||||

| Beginning balance | $47,722 | $37,018 | |||||||||

| Comprehensive income | 2,741 | 2,049 | |||||||||

| Capital draw from Treasury | — | — | |||||||||

| Senior preferred stock dividends declared | — | — | |||||||||

| Total equity / net worth | $50,463 | $39,067 | |||||||||

| Remaining Treasury funding commitment | $140,162 | $140,162 | |||||||||

| Aggregate draws under Purchase Agreement | 71,648 | 71,648 | |||||||||

| Aggregate cash dividends paid to Treasury | 119,680 | 119,680 | |||||||||

| Liquidation preference of the senior preferred stock | 120,370 | 109,666 | |||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 35 | |||||||

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

| (In billions) | March 31, 2024 | December 31, 2023 | |||||||||||||||||||||

| Total equity | $50 | $48 | |||||||||||||||||||||

| Less: | |||||||||||||||||||||||

| Senior preferred stock | 73 | 73 | |||||||||||||||||||||

| Preferred stock | 14 | 14 | |||||||||||||||||||||

| Common equity | (37) | (39) | |||||||||||||||||||||

| Less: deferred tax assets arising from temporary differences that exceed 10% of CET1 capital and other regulatory adjustments | 4 | 4 | |||||||||||||||||||||

| Common equity Tier 1 capital | (41) | (43) | |||||||||||||||||||||

| Add: Preferred stock | 14 | 14 | |||||||||||||||||||||

| Tier 1 capital | (27) | (29) | |||||||||||||||||||||

| Tier 2 capital adjustments | — | — | |||||||||||||||||||||

| Adjusted total capital | ($27) | ($29) | |||||||||||||||||||||

| (In billions) | March 31, 2024 | December 31, 2023 | |||||||||||||||||||||

| Total equity | $50 | $48 | |||||||||||||||||||||

| Less: | |||||||||||||||||||||||

| Senior preferred stock | 73 | 73 | |||||||||||||||||||||

| AOCI, net of taxes | — | — | |||||||||||||||||||||

| Core capital | (23) | (25) | |||||||||||||||||||||

General allowance for foreclosure losses(1) | 7 | 7 | |||||||||||||||||||||

| Total capital | ($16) | ($18) | |||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 36 | |||||||

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

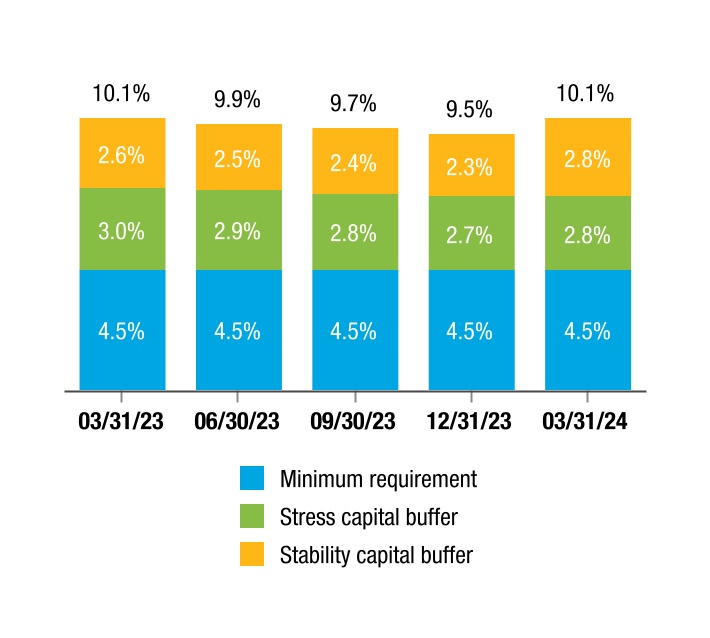

| (In billions) | March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||

| Adjusted total assets | $3,786 | $3,775 | ||||||||||||||||||||||||

| Risk-weighted assets (standardized approach): | ||||||||||||||||||||||||||

| Credit risk | 893 | 884 | ||||||||||||||||||||||||

| Market risk | 54 | 54 | ||||||||||||||||||||||||

| Operational risk | 71 | 71 | ||||||||||||||||||||||||

| Total risk-weighted assets | $1,018 | $1,009 | ||||||||||||||||||||||||

| (In billions) | March 31, 2024 | December 31, 2023 | ||||||||||||||||||||||||

| Stress capital buffer | $28 | $28 | ||||||||||||||||||||||||

| Stability capital buffer | 29 | 23 | ||||||||||||||||||||||||

| Countercyclical capital buffer amount | — | — | ||||||||||||||||||||||||

| PCCBA | $57 | $51 | ||||||||||||||||||||||||

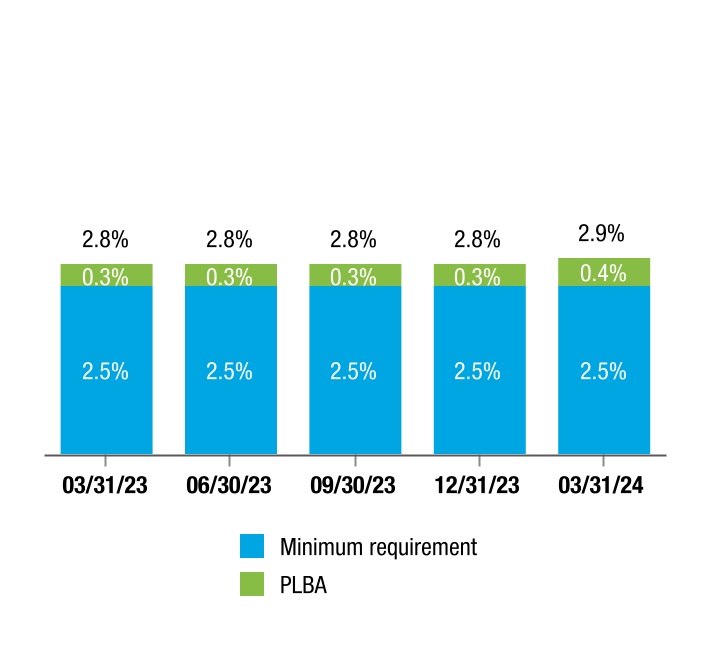

| PLBA | $14 | $11 | ||||||||||||||||||||||||

| March 31, 2024 | ||||||||||||||||||||||||||

| (Dollars in billions) | Minimum Capital Requirement | Applicable Buffer(1) | Capital Requirement (Including Buffer(1)) | Available Capital (Deficit) | Capital Shortfall | |||||||||||||||||||||

| Risk-based capital amounts: | ||||||||||||||||||||||||||

| Total capital | $81 | N/A | $81 | ($16) | ($97) | |||||||||||||||||||||

| CET1 capital | 46 | $57 | 103 | (41) | (144) | |||||||||||||||||||||

| Tier 1 capital | 61 | 57 | 118 | (27) | (145) | |||||||||||||||||||||

| Adjusted total capital | 81 | 57 | 138 | (27) | (165) | |||||||||||||||||||||

Risk-based capital ratios(2): | ||||||||||||||||||||||||||

| Total capital | 8.0 | % | N/A | 8.0 | % | (1.5) | % | (9.5) | % | |||||||||||||||||

| CET1 capital | 4.5 | 5.6 | % | 10.1 | (4.0) | (14.1) | ||||||||||||||||||||

| Tier 1 capital | 6.0 | 5.6 | 11.6 | (2.6) | (14.2) | |||||||||||||||||||||

| Adjusted total capital | 8.0 | 5.6 | 13.6 | (2.6) | (16.2) | |||||||||||||||||||||

| Leverage capital amounts: | ||||||||||||||||||||||||||

| Core capital | $95 | N/A | $95 | ($23) | ($118) | |||||||||||||||||||||

| Tier 1 capital | 95 | $14 | 109 | (27) | (136) | |||||||||||||||||||||

Leverage capital ratios(3): | ||||||||||||||||||||||||||

| Core capital | 2.5 | % | N/A | 2.5 | % | (0.6) | % | (3.1) | % | |||||||||||||||||

| Tier 1 capital | 2.5 | 0.4 | % | 2.9 | (0.7) | (3.6) | ||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 37 | |||||||

| Management's Discussion and Analysis | Liquidity and Capital Resources | |||||||

| December 31, 2023 | ||||||||||||||||||||||||||

| (Dollars in billions) | Minimum Capital Requirement | Applicable Buffer(1) | Capital Requirement (Including Buffer(1)) | Available Capital (Deficit) | Capital Shortfall | |||||||||||||||||||||

| Risk-based capital amounts: | ||||||||||||||||||||||||||

| Total capital | $81 | N/A | $81 | ($18) | ($99) | |||||||||||||||||||||

| CET1 capital | 45 | $51 | 96 | (43) | (139) | |||||||||||||||||||||

| Tier 1 capital | 60 | 51 | 111 | (29) | (140) | |||||||||||||||||||||

| Adjusted total capital | 81 | 51 | 132 | (29) | (161) | |||||||||||||||||||||

Risk-based capital ratios(2): | ||||||||||||||||||||||||||

| Total capital | 8.0 | % | N/A | 8.0 | % | (1.8) | % | (9.8) | % | |||||||||||||||||

| CET1 capital | 4.5 | 5.0 | % | 9.5 | (4.3) | (13.8) | ||||||||||||||||||||

| Tier 1 capital | 6.0 | 5.0 | 11.0 | (2.9) | (13.9) | |||||||||||||||||||||

| Adjusted total capital | 8.0 | 5.0 | 13.0 | (2.9) | (15.9) | |||||||||||||||||||||

| Leverage capital amounts: | ||||||||||||||||||||||||||

| Core capital | $95 | N/A | $95 | ($25) | ($120) | |||||||||||||||||||||

| Tier 1 capital | 95 | $11 | 106 | (29) | (135) | |||||||||||||||||||||

Leverage capital ratios(3): | ||||||||||||||||||||||||||

| Core capital | 2.5 | % | N/A | 2.5 | % | (0.7) | % | (3.2) | % | |||||||||||||||||

| Tier 1 capital | 2.5 | 0.3 | % | 2.8 | (0.8) | (3.6) | ||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 38 | |||||||

| Management's Discussion and Analysis | Critical Accounting Estimates | |||||||

| 12-Month Forward | 13- to 24-Month Forward | ||||||||||

| March 31, 2024 | 0.2 | % | 0.6 | % | |||||||

| December 31, 2023 | 2.8 | 2.0 | |||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 39 | |||||||

| Management's Discussion and Analysis | Regulation and Supervision | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 40 | |||||||

| Management's Discussion and Analysis | Forward-Looking Statements | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 41 | |||||||

| Management's Discussion and Analysis | Forward-Looking Statements | |||||||

| Freddie Mac 1Q 2024 Form 10-Q | 42 | |||||||

| Financial Statements | ||||||||

Financial Statements | ||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 43 | |||||||

| Financial Statements | Condensed Consolidated Statements of Income and Comprehensive Income | ||||

(In millions, except share-related amounts) | 1Q 2024 | 1Q 2023 | |||||||||

| Net interest income | |||||||||||

| Interest income | $ | $ | |||||||||

| Interest expense | ( | ( | |||||||||

| Net interest income | |||||||||||

| Non-interest income | |||||||||||

| Guarantee income | |||||||||||

| Investment gains, net | ( | ||||||||||

| Other income | |||||||||||

| Non-interest income | |||||||||||

| Net revenues | |||||||||||

| (Provision) benefit for credit losses | ( | ( | |||||||||

| Non-interest expense | |||||||||||

| Salaries and employee benefits | ( | ( | |||||||||

| Credit enhancement expense | ( | ( | |||||||||

| Benefit for (decrease in) credit enhancement recoveries | |||||||||||

| Legislative assessments expense | ( | ( | |||||||||

| Other expense | ( | ( | |||||||||

| Non-interest expense | ( | ( | |||||||||

| Income before income tax expense | |||||||||||

| Income tax expense | ( | ( | |||||||||

| Net income | |||||||||||

| Other comprehensive income (loss), net of taxes and reclassification adjustments | ( | ||||||||||

| Comprehensive income | $ | $ | |||||||||

| Net income | $ | $ | |||||||||

| Amounts attributable to senior preferred stock | ( | ( | |||||||||

| Net income attributable to common stockholders | $ | ($ | |||||||||

| Net income per common share | $ | ($ | |||||||||

| Weighted average common shares (in millions) | |||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 44 | |||||||

| Financial Statements | Condensed Consolidated Balance Sheets | ||||

| March 31, | December 31, | ||||||||||

(In millions, except share-related amounts) | 2024 | 2023 | |||||||||

| Assets | |||||||||||

Cash and cash equivalents (includes $ | $ | $ | |||||||||

| Securities purchased under agreements to resell | |||||||||||

| Investment securities, at fair value | |||||||||||

Mortgage loans held-for-sale (includes $ | |||||||||||

Mortgage loans held-for-investment (net of allowance for credit losses of $ | |||||||||||

| Accrued interest receivable, net | |||||||||||

| Deferred tax assets, net | |||||||||||

Other assets (includes $ | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and equity | |||||||||||

| Liabilities | |||||||||||

| Accrued interest payable | $ | $ | |||||||||

Debt (includes $ | |||||||||||

Other liabilities (includes $ | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| Equity | |||||||||||

Senior preferred stock (liquidation preference of $ | |||||||||||

| Preferred stock, at redemption value | |||||||||||

Common stock, $ | |||||||||||

| Retained earnings | ( | ( | |||||||||

| AOCI, net of taxes, related to: | |||||||||||

| Available-for-sale securities | |||||||||||

| Other | ( | ( | |||||||||

| AOCI, net of taxes | ( | ( | |||||||||

Treasury stock, at cost, | ( | ( | |||||||||

Total equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

| March 31, | December 31, | ||||||||||

| (In millions) | 2024 | 2023 | |||||||||

| Assets: | |||||||||||

Cash and cash equivalents (includes $ | $ | $ | |||||||||

| Securities purchased under agreements to resell | |||||||||||

| Investment securities, at fair value | |||||||||||

| Mortgage loans held-for-investment, net | |||||||||||

| Accrued interest receivable, net | |||||||||||

| Other assets | |||||||||||

| Total assets of consolidated VIEs | $ | $ | |||||||||

| Liabilities: | |||||||||||

| Accrued interest payable | $ | $ | |||||||||

| Debt | |||||||||||

| Total liabilities of consolidated VIEs | $ | $ | |||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 45 | |||||||

| Financial Statements | Condensed Consolidated Statements of Equity | ||||

| Shares Outstanding | Senior Preferred Stock | Preferred Stock, at Redemption Value | Common Stock, at Par Value | Retained Earnings | AOCI, Net of Tax | Treasury Stock, at Cost | Total Equity | ||||||||||||||||||||||||||||

| (In millions) | Senior Preferred Stock | Preferred Stock | Common Stock | ||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | ($ | ($ | ($ | $ | ||||||||||||||||||||||||||||

| Comprehensive income: | |||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||||||||||||||

Changes in net unrealized gains (losses) on available-for-sale securities (net of taxes of $ | — | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||

Reclassification adjustment for (gains) losses on available-for-sale securities included in net income (net of taxes of $ | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Other (net of taxes of $ | — | — | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||

| Comprehensive income | — | — | — | — | — | — | ( | — | |||||||||||||||||||||||||||

| Ending balance at March 31, 2024 | $ | $ | $ | ($ | ($ | ($ | $ | ||||||||||||||||||||||||||||

| Balance at December 31, 2022 | $ | $ | $ | ($ | ($ | ($ | $ | ||||||||||||||||||||||||||||

| Comprehensive income: | |||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||||||||||||||

Changes in net unrealized gains (losses) on available-for-sale securities (net of taxes of $ | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Reclassification adjustment for (gains) losses on available-for-sale securities included in net income (net of taxes of $ | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

Other (net of taxes of $ | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||

| Comprehensive income | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||

| Ending balance at March 31, 2023 | $ | $ | $ | ($ | ($ | ($ | $ | ||||||||||||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 46 | |||||||

| Financial Statements | Condensed Consolidated Statements of Cash Flows | ||||

| (In millions) | 1Q 2024 | 1Q 2023 | |||||||||

| Net cash provided by (used in) operating activities | $ | $ | |||||||||

| Cash flows from investing activities | |||||||||||

| Investment securities: | |||||||||||

| Purchases | ( | ( | |||||||||

| Proceeds from sales | |||||||||||

| Proceeds from maturities and repayments | |||||||||||

| Mortgage loans acquired held-for-investment: | |||||||||||

| Purchases | ( | ( | |||||||||

| Proceeds from sales | |||||||||||

| Proceeds from repayments | |||||||||||

| Advances under secured lending arrangements | ( | ( | |||||||||

| Net (increase) decrease in securities purchased under agreements to resell | ( | ( | |||||||||

| Cash flows related to derivatives | |||||||||||

| Other, net | ( | ||||||||||

| Net cash provided by (used in) investing activities | |||||||||||

| Cash flows from financing activities | |||||||||||

| Debt of consolidated trusts: | |||||||||||

| Proceeds from issuance | |||||||||||

| Repayments and redemptions | ( | ( | |||||||||

| Debt of Freddie Mac: | |||||||||||

| Proceeds from issuance | |||||||||||

| Repayments | ( | ( | |||||||||

| Net increase (decrease) in securities sold under agreements to repurchase | ( | ||||||||||

| Other, net | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | ( | ( | |||||||||

| Net increase (decrease) in cash and cash equivalents (includes restricted cash and cash equivalents) | ( | ( | |||||||||

| Cash and cash equivalents (includes restricted cash and cash equivalents) at the beginning of year | |||||||||||

| Cash and cash equivalents (includes restricted cash and cash equivalents) at end of period | $ | $ | |||||||||

| Supplemental cash flow information | |||||||||||

| Cash paid for: | |||||||||||

| Debt interest | $ | $ | |||||||||

| Income taxes | |||||||||||

| Non-cash investing and financing activities (Notes 3 and 6) | |||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 47 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 1 | ||||

| Freddie Mac 1Q 2024 Form 10-Q | 48 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 1 | ||||

| Recently Adopted Accounting Guidance | |||||||||||

| Standard | Description | Date of Adoption | Effect on Consolidated Financial Statements | ||||||||

ASU 2023-02, Investments - Equity Method and Joint Ventures (Topic 323): Accounting for Investments in Tax Credit Structures Using the Proportional Amortization Method | The amendments in this Update expand the use of the proportional amortization method of accounting to equity investments in other tax credit structures that meet certain conditions. This Update also amends those conditions primarily to assess projected benefits on a discounted basis and expands the disclosure requirements of those investments. | January 1, 2024 | The adoption of these amendments did not have a material effect on our consolidated financial statements. See the preceding section Consolidation and Equity Investments for further information. | ||||||||

| Recently Issued Accounting Guidance, Not Yet Adopted Within Our Consolidated Financial Statements | |||||||||||

| Standard | Description | Date of Adoption | Effect on Consolidated Financial Statements | ||||||||

ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures | The amendments in this Update require the disclosure of more detailed quantitative and qualitative information about significant segment expenses that are regularly provided to the CODM and included in each reported measure of segment profit or loss. | December 31, 2024 | We do not expect the adoption of these amendments to have a material effect on our consolidated financial statements. | ||||||||

ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures | The amendments in this Update require annual disclosure of more detailed tax rate reconciliation categories and income taxes paid by geography and jurisdiction. | January 1, 2025 | We do not expect the adoption of these amendments to have a material effect on our consolidated financial statements. | ||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 49 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 2 | ||||

| March 31, 2024 | ||||||||||||||||||||

| Carrying Amounts of the Assets and Liabilities On the Condensed Consolidated Balance Sheets | Total Assets | Maximum Exposure to Loss | ||||||||||||||||||

(In millions) | Investment securities | Accrued Interest Receivable and Other Assets(1) | Liabilities(1) | |||||||||||||||||

| Single-Family: | ||||||||||||||||||||

| Securitization products | $ | $ | $ | $ | $ | |||||||||||||||

Resecuritization products(2) | ||||||||||||||||||||

CRT products(3) | ||||||||||||||||||||

| Total Single-Family | ||||||||||||||||||||

| Multifamily: | ||||||||||||||||||||

Securitization products(4) | ||||||||||||||||||||

CRT products(3) | ||||||||||||||||||||

| Total Multifamily | ||||||||||||||||||||

| Other | ||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 50 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 2 | ||||

| December 31, 2023 | ||||||||||||||||||||

| Carrying Amounts of the Assets and Liabilities On the Condensed Consolidated Balance Sheets | Total Assets | Maximum Exposure to Loss | ||||||||||||||||||

(In millions) | Investment securities | Accrued Interest Receivable and Other Assets(1) | Liabilities(1) | |||||||||||||||||

| Single-Family: | ||||||||||||||||||||

| Securitization products | $ | $ | $ | $ | $ | |||||||||||||||

Resecuritization products(2) | ||||||||||||||||||||

CRT products(3) | ||||||||||||||||||||

| Total Single-Family | ||||||||||||||||||||

| Multifamily: | ||||||||||||||||||||

Securitization products(4) | ||||||||||||||||||||

CRT products(3) | ||||||||||||||||||||

| Total Multifamily | ||||||||||||||||||||

| Other | ||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 51 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||||||||

| (In millions) | Single-Family | Multifamily | Total | Single-Family | Multifamily | Total | ||||||||||||||||||||

| Held-for-sale UPB | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||

| Cost basis and fair value adjustments, net | ( | ( | ( | ( | ||||||||||||||||||||||

| Total held-for-sale loans, net | ||||||||||||||||||||||||||

| Held-for-investment UPB | ||||||||||||||||||||||||||

Cost basis and fair value adjustments, net(1) | ( | ( | ||||||||||||||||||||||||

| Allowance for credit losses | ( | ( | ( | ( | ( | ( | ||||||||||||||||||||

Total held-for-investment loans, net(2) | ||||||||||||||||||||||||||

| Total mortgage loans, net | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||

| (In millions) | 1Q 2024 | 1Q 2023 | |||||||||

| Single-Family: | |||||||||||

| Purchases: | |||||||||||

Held-for-investment loans | $ | $ | |||||||||

Sales of held-for-sale loans(1) | |||||||||||

Multifamily: | |||||||||||

| Purchases: | |||||||||||

Held-for-investment loans | |||||||||||

Held-for-sale loans | |||||||||||

Sales of held-for-sale loans(2) | |||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 52 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| 1Q 2024 | 1Q 2023 | ||||||||||||||||||||||

| (In millions) | UPB | Allowance for Credit Losses Reversed or (Established) | Valuation Allowance (Established) or Reversed | UPB | Allowance for Credit Losses Reversed or (Established) | Valuation Allowance (Established) or Reversed | |||||||||||||||||

| Single-Family reclassifications from: | |||||||||||||||||||||||

| Held-for-investment to held-for-sale | $ | $ | $ | $ | $ | $ | |||||||||||||||||

Held-for-sale to held-for-investment(2) | |||||||||||||||||||||||

| Multifamily reclassifications from: | |||||||||||||||||||||||

| Held-for-investment to held-for-sale | ( | ( | |||||||||||||||||||||

Held-for-sale to held-for-investment(2) | |||||||||||||||||||||||

| Non-Accrual Amortized Cost Basis | Interest Income Recognized(2) | ||||||||||||||||

| (In millions) | March 31, 2024 | December 31, 2023 | 1Q 2024 | ||||||||||||||

| Single-Family: | |||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | ||||||||||||||

| 15-year or less, amortizing fixed-rate | |||||||||||||||||

| Adjustable-rate and other | |||||||||||||||||

| Total Single-Family | |||||||||||||||||

| Total Multifamily | |||||||||||||||||

| Total Single-Family and Multifamily | $ | $ | $ | ||||||||||||||

| Non-Accrual Amortized Cost Basis | Interest Income Recognized(2) | ||||||||||||||||

| (In millions) | March 31, 2023 | December 31, 2022 | 1Q 2023 | ||||||||||||||

| Single-Family: | |||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | ||||||||||||||

| 15-year or less, amortizing fixed-rate | |||||||||||||||||

| Adjustable-rate and other | |||||||||||||||||

| Total Single-Family | |||||||||||||||||

| Total Multifamily | |||||||||||||||||

| Total Single-Family and Multifamily | $ | $ | $ | ||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 53 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| Accrued Interest Receivable, Net | Accrued Interest Receivable Related Charge-Offs | |||||||||||||||||||

| (In millions) | March 31, 2024 | December 31, 2023 | 1Q 2024 | 1Q 2023 | ||||||||||||||||

| Single-Family loans | $ | $ | ($ | ($ | ||||||||||||||||

| Multifamily loans | ( | |||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 54 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| March 31, 2024 | ||||||||||||||||||||||||||

| Year of Origination | Total | |||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2022 | 2021 | 2020 | Prior | ||||||||||||||||||||

Current LTV ratio: | ||||||||||||||||||||||||||

20- and 30-year or more, amortizing fixed-rate | ||||||||||||||||||||||||||

| ≤ 60 | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

> 80 to 90 | ||||||||||||||||||||||||||

| > 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

Total 20- and 30-year or more, amortizing fixed-rate | ||||||||||||||||||||||||||

Current period gross charge-offs(1) | ||||||||||||||||||||||||||

15-year or less, amortizing fixed-rate | ||||||||||||||||||||||||||

| ≤ 60 | ||||||||||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

> 80 to 90 | ||||||||||||||||||||||||||

| > 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

| Total 15-year or less, amortizing fixed-rate | ||||||||||||||||||||||||||

Current period gross charge-offs(1) | ||||||||||||||||||||||||||

Adjustable-rate and other | ||||||||||||||||||||||||||

| ≤ 60 | ||||||||||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

> 80 to 90 | ||||||||||||||||||||||||||

| > 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

| Total adjustable-rate and other | ||||||||||||||||||||||||||

Current period gross charge-offs(1) | ||||||||||||||||||||||||||

Total for all loan product types by current LTV ratio: | ||||||||||||||||||||||||||

≤ 60 | ||||||||||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

> 80 to 90 | ||||||||||||||||||||||||||

| > 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

| Total Single-Family loans | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

Total current period gross charge-offs(1) | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 55 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| December 31, 2023 | ||||||||||||||||||||||||||

| Year of Origination | Total | |||||||||||||||||||||||||

| (In millions) | 2023 | 2022 | 2021 | 2020 | 2019 | Prior | ||||||||||||||||||||

Current LTV ratio: | ||||||||||||||||||||||||||

20- and 30-year or more, amortizing fixed-rate | ||||||||||||||||||||||||||

| ≤ 60 | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

| > 80 to 90 | ||||||||||||||||||||||||||

> 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

Total 20- and 30-year or more, amortizing fixed-rate | ||||||||||||||||||||||||||

Full-year gross charge-offs(1) | ||||||||||||||||||||||||||

15-year or less, amortizing fixed-rate | ||||||||||||||||||||||||||

| ≤ 60 | ||||||||||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

| > 80 to 90 | ||||||||||||||||||||||||||

> 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

| Total 15-year or less, amortizing fixed-rate | ||||||||||||||||||||||||||

Full-year gross charge-offs(1) | ||||||||||||||||||||||||||

Adjustable-rate and other | ||||||||||||||||||||||||||

| ≤ 60 | ||||||||||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

| > 80 to 90 | ||||||||||||||||||||||||||

> 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

| Total adjustable-rate and other | ||||||||||||||||||||||||||

Full-year gross charge-offs(1) | ||||||||||||||||||||||||||

Total for all loan product types by current LTV ratio: | ||||||||||||||||||||||||||

| ≤ 60 | ||||||||||||||||||||||||||

| > 60 to 80 | ||||||||||||||||||||||||||

| > 80 to 90 | ||||||||||||||||||||||||||

> 90 to 100 | ||||||||||||||||||||||||||

> 100 | ||||||||||||||||||||||||||

| Total Single-Family loans | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

Total full-year gross charge-offs(1) | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 56 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| March 31, 2024 | |||||||||||||||||||||||||||||

| Year of Origination | Total | ||||||||||||||||||||||||||||

| (In millions) | 2024 | 2023 | 2022 | 2021 | 2020 | Prior | Revolving Loans | ||||||||||||||||||||||

| Category: | |||||||||||||||||||||||||||||

Pass | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

Special mention | |||||||||||||||||||||||||||||

Substandard | |||||||||||||||||||||||||||||

Doubtful | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| December 31, 2023 | |||||||||||||||||||||||||||||

| Year of Origination | Total | ||||||||||||||||||||||||||||

| (In millions) | 2023 | 2022 | 2021 | 2020 | 2019 | Prior | Revolving Loans | ||||||||||||||||||||||

| Category: | |||||||||||||||||||||||||||||

Pass | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

Special mention | |||||||||||||||||||||||||||||

Substandard | |||||||||||||||||||||||||||||

Doubtful | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||

| March 31, 2024 | |||||||||||||||||||||||

| (In millions) | Current | One Month Past Due | Two Months Past Due | Three Months or More Past Due, or in Foreclosure(2) | Total | Non-Accrual With No Allowance(3) | |||||||||||||||||

| Single-Family: | |||||||||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| 15-year or less, amortizing fixed-rate | |||||||||||||||||||||||

| Adjustable-rate and other | |||||||||||||||||||||||

| Total Single-Family | |||||||||||||||||||||||

| Total Multifamily | |||||||||||||||||||||||

| Total Single-Family and Multifamily | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| December 31, 2023 | |||||||||||||||||||||||

| (In millions) | Current | One Month Past Due | Two Months Past Due | Three Months or More Past Due, or in Foreclosure(2) | Total | Non-Accrual with No Allowance(3) | |||||||||||||||||

| Single-Family: | |||||||||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| 15-year or less, amortizing fixed-rate | |||||||||||||||||||||||

| Adjustable-rate and other | |||||||||||||||||||||||

| Total Single-Family | |||||||||||||||||||||||

| Total Multifamily | |||||||||||||||||||||||

| Total Single-Family and Multifamily | $ | $ | $ | $ | $ | $ | |||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 57 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| 1Q 2024 | ||||||||||||||||||||

| (Dollars in millions) | Payment Delay(2) | Payment Delay and Term Extension | Payment Delay, Term Extension, and Interest Rate Reduction | Total | Total as % of Class of Financing Receivable(3) | |||||||||||||||

| Single-Family: | ||||||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | % | |||||||||||||||

| 15-year or less, amortizing fixed-rate | ||||||||||||||||||||

| Adjustable-rate and other | ||||||||||||||||||||

| Total Single-Family loan restructurings | $ | $ | $ | $ | ||||||||||||||||

| 1Q 2023 | ||||||||||||||||||||

| (Dollars in millions) | Payment Delay(2) | Payment Delay and Term Extension | Payment Delay, Term Extension, and Interest Rate Reduction | Total | Total as % of Class of Financing Receivable(3) | |||||||||||||||

| Single-Family: | ||||||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | % | |||||||||||||||

| 15-year or less, amortizing fixed-rate | ||||||||||||||||||||

| Adjustable-rate and other | ||||||||||||||||||||

| Total Single-Family loan restructurings | $ | $ | $ | $ | ||||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 58 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| 1Q 2024 | ||||||||||||||

| (Dollars in thousands) | Weighted-Average Interest Rate Reduction | Weighted-Average Months of Term Extension | Weighted-Average Payment Deferral or Principal Forbearance(2) | |||||||||||

| Single-Family: | ||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | % | $ | ||||||||||||

| 15-year or less, amortizing fixed-rate | ||||||||||||||

| Adjustable-rate and other | ||||||||||||||

| 1Q 2023 | ||||||||||||||

| (Dollars in thousands) | Weighted-Average Interest Rate Reduction | Weighted-Average Months of Term Extension | Weighted-Average Payment Deferral or Principal Forbearance(2) | |||||||||||

| Single-Family: | ||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | % | $ | ||||||||||||

| 15-year or less, amortizing fixed-rate | ||||||||||||||

| Adjustable-rate and other | ||||||||||||||

| 1Q 2024 | |||||||||||||||||

| (In millions) | Payment Delay | Payment Delay and Term Extension | Payment Delay, Term Extension, and Interest Rate Reduction | Total | |||||||||||||

| Single-Family: | |||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | |||||||||||||

| 15-year or less, amortizing fixed-rate | |||||||||||||||||

| Adjustable-rate and other | |||||||||||||||||

| Total Single-Family | $ | $ | $ | $ | |||||||||||||

| 1Q 2023 | |||||||||||||||||

| (In millions) | Payment Delay | Payment Delay and Term Extension | Payment Delay, Term Extension, and Interest Rate Reduction | Total | |||||||||||||

| Single-Family: | |||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | |||||||||||||

| 15-year or less, amortizing fixed-rate | |||||||||||||||||

| Adjustable-rate and other | |||||||||||||||||

| Total Single-Family | $ | $ | $ | $ | |||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 59 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 3 | ||||

| March 31, 2024 | ||||||||||||||||||||

| (In millions) | Current | One Month Past Due | Two Months Past Due | Three Months or More Past Due | Total | |||||||||||||||

| Single-Family: | ||||||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | $ | |||||||||||||||

| 15-year or less, amortizing fixed-rate | ||||||||||||||||||||

| Adjustable-rate and other | ||||||||||||||||||||

| Total Single-Family | $ | $ | $ | $ | $ | |||||||||||||||

| March 31, 2023 | ||||||||||||||||||||

| (In millions) | Current | One Month Past Due | Two Months Past Due | Three Months or More Past Due | Total | |||||||||||||||

| Single-Family: | ||||||||||||||||||||

| 20- and 30-year or more, amortizing fixed-rate | $ | $ | $ | $ | $ | |||||||||||||||

| 15-year or less, amortizing fixed-rate | ||||||||||||||||||||

| Adjustable-rate and other | ||||||||||||||||||||

| Total Single-Family | $ | $ | $ | $ | $ | |||||||||||||||

| Freddie Mac 1Q 2024 Form 10-Q | 60 | |||||||

| Financial Statements | Notes to the Condensed Consolidated Financial Statements | Note 4 | ||||

| March 31, 2024 | |||||||||||||||||

(Dollars in millions, terms in years) | UPB | Maximum Exposure | Recognized Liability(1) | Maximum Remaining Term | |||||||||||||

| Single-Family mortgage-related guarantees: | |||||||||||||||||

Nonconsolidated securitization products(2) | $ | $ | $ | ||||||||||||||

| Other mortgage-related guarantees | |||||||||||||||||

| Total Single-Family mortgage-related guarantees | |||||||||||||||||

| Multifamily mortgage-related guarantees: | |||||||||||||||||

Nonconsolidated securitization products(2)(3) | |||||||||||||||||