☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

☒ |

Definitive Proxy Statement |

|||||

☐ |

Definitive Additional Materials |

|||||

☐ |

Soliciting Material under §240.14a-12 |

☒ |

No fee required. | |

☐ |

Fee paid previously with preliminary materials. | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ON THE COVER

|

One Paseo is a deeper notion of mixed-use. It is a place where a two-minute stroll takes you from your luxury apartment to your office, and from your office to a vibrant shopping and dining experience. But One Paseo is more than a convenient lifestyle. It is an attitude. A spirit of community that, even if you don’t live or work here, invites you to meet up, hang out and join in.

Located in one of the most sought after places to live, work, and play, One Paseo is designed with life’s little luxuries in mind. One Paseo is Del Mar’s first true Class A mixed-use development, combining world-class retail, office, and residential.

|

|||

| ABOUT KILROY

|

Kilroy is a place where innovation works. We have made it our mission to provide creative work environments that spark inspiration and productivity for the country’s very best thinkers and doers. Home to approximately 260 employees, we are actively planning, building, and managing millions of square feet of innovative and sustainable properties that positively define the workspace across Los Angeles, San Diego, the San Francisco Bay Area, Seattle, and Austin.

|

|||

KILROY REALTY CORPORATION

12200 W. Olympic Boulevard, Suite 200

Los Angeles, California 90064

April 12, 2024

To Our Stockholders:

I was honored to step into my new role as Kilroy’s chief executive officer in January of this year and am excited to be a part of a platform defined by its premier portfolio, strategic capital allocation, sustainability leadership, and strong balance sheet. Kilroy has been a leader in the real estate industry for over 75 years and has proven to be both resilient and opportunistic throughout many macroeconomic and real estate cycles. I look forward to building on the success that the Company has had under the leadership of my predecessor, John Kilroy, to capture outsized growth opportunities and create sustainable long-term value for our stockholders.

This past year brought positive trends for our sector, with an increase in employees returning to the physical office, as well as an uptick in foot traffic, public transit usage, and domestic travel and tourism. During 2023, Kilroy successfully leased over 1.3 million square feet, our highest annual leasing volume since 2019, and we are excited to continue to capitalize on recent momentum as we work closely with our tenants to respond to the evolving ways that people gather, work, and live in each of our markets.

Kilroy’s longstanding commitment to sustainability continues to differentiate this platform, particularly with our high-quality tenant base, that is focused on many of the same ambitious sustainability goals that we are. We have maintained carbon-neutral operations across our portfolio since 2020, and in 2023, we were awarded the ENERGY STAR Partner of the Year Sustained Excellence Award for the eighth consecutive year. We were also proud to be named the GRESB Regional Sector Leader in the Americas for Development, earning the highly competitive GRESB 5 Star designation, and were included for the fourth year in a row in Bloomberg’s Gender Equality Index.

While our sector continues to face challenges, we believe that Kilroy is exceptionally well-positioned for continued success and industry leadership in the years to come. We have a tremendous Class A portfolio – one of the youngest in the space – that has been built over many years of prudent and thoughtful capital allocation, and an incredible, performance-oriented team across every discipline within our organization. As we navigate challenging market conditions, we will remain focused on the core values that have consistently guided Kilroy’s strategy, and seek to stay ahead of creeping functional obsolescence in our space as we also take advantage of growth opportunities as they present themselves. I look forward to working as part of the Kilroy team as we take a fresh look at every facet of our business, while maintaining the Company’s commitment to innovation, wellness and sustainability, and financial discipline.

Thank you for your investment in Kilroy and your trust in our management team, our Board of Directors, and our mission.

Sincerely,

|

| Angela M. Aman |

| Chief Executive Officer |

KILROY REALTY CORPORATION

12200 W. Olympic Boulevard, Suite 200

Los Angeles, California 90064

April 12, 2024

To Our Fellow Stockholders:

On behalf of the entire Board of Directors, I would like to thank you for your continued investment in and commitment to Kilroy. In 2023, we continued our pursuit of excellence to deliver and maintain a premier real estate portfolio in the most dynamic, innovation-driven markets in the country, while making a positive community impact.

As a result of the chief executive officer succession process announced last year, in January 2024, we welcomed Angela Aman as our new chief executive officer and a director on our Board. Angela is an accomplished real estate executive with a proven, 22-year track record in commercial real estate, financial acumen, and operational expertise. We are confident that her extensive experience, including her experience navigating challenging environments in the retail sector, will assist Kilroy in identifying new avenues for stockholder value creation as we continue to focus on maintaining the quality of our portfolio and strategically allocating capital.

We are grateful to John Kilroy for leading the Company over the last 30+ years and building an impressive portfolio of high-quality assets that position the Company exceptionally well for the future.

As part of the Board’s ongoing refreshment effort, we expressed our commitment to appointing a new director and are excited to announce Daryl Carter, a seasoned real estate executive, as a director nominee at this year’s annual meeting. Mr. Carter was identified through an extensive search by Korn Ferry, a nationally recognized executive search firm, and we are confident that his significant real estate experience through multiple market cycles will bring a valuable perspective to our Board. Additionally, the Board will continue to focus on its refreshment efforts over the next year.

We believe that stockholder feedback is critical for the Board’s governance considerations and are committed to ongoing stockholder engagement. After last year’s annual meeting, we continued to engage with our stockholders on executive compensation, among other key governance topics. In response to our stockholders’ feedback related to legacy chief executive officer compensation and severance arrangements, the Board approved a compensation package for Ms. Aman that reflects our prior commitment to align severance provisions with peer practices and follows market-aligned pay levels.

To reflect the evolving expectations of our tenants and other stakeholders, the Board continues to focus on ensuring that our sustainability strategy and initiatives are effective and closely align with our growth priorities. We continue to advance our energy efficiency programs to support our tenants’ progress toward their carbon emission reduction goals, and to focus on recruiting and developing a diverse workforce to drive our innovation efforts and represent the diverse communities in which we operate.

We look forward to this new chapter of Kilroy’s leadership and growth, and are confident in our uniquely positioned portfolio and high-caliber executive leadership team to continue delivering value to our stakeholders in 2024.

On behalf of all of us at Kilroy, I want to thank all of our stockholders for your continued support and confidence in our future.

Sincerely,

|

|

| Edward F. Brennan, PhD |

| Lead Independent Director |

CONTENTS

CONTENTS

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are based on our current expectations, beliefs and assumptions, and are not guarantees of future performance. Forward-looking statements are generally identified through the inclusion of words such as “believe,” “expect,” “goals,” and “target,” or similar statements or variations of such terms and other similar expressions. Numerous factors could cause actual future performance, results, and events to differ materially from those indicated in the forward-looking statements, including, among others: global market and general economic conditions, including periods of heightened inflation, and their effect on our liquidity and financial conditions and those of our tenants; adverse economic or real estate conditions generally, and specifically, in the States of California, Texas, and Washington; risks associated with our investment in real estate assets, which are illiquid, and with trends in the real estate industry; defaults on or non-renewal of leases by tenants; any significant downturn in tenants’ businesses; our ability to re-lease property at or above current market rates; costs to comply with government regulations, including environmental remediation; the availability of cash for distribution and debt service and exposure to risk of default under debt obligations; increases in interest rates and our ability to manage interest rate exposure; the availability of financing on attractive terms or at all, which may adversely impact our future interest expense and our ability to pursue development, redevelopment and acquisition opportunities and refinance existing debt; a decline in real estate asset valuations, which may limit our ability to dispose of assets at attractive prices or obtain or maintain debt financing, and which may result in write-offs or impairment charges; significant competition, which may decrease the occupancy and rental rates of properties; potential losses that may not be covered by insurance; the ability to successfully complete acquisitions and dispositions on announced terms; the ability to successfully operate acquired, developed, and redeveloped properties; the ability to successfully complete development and redevelopment projects on schedule and within budgeted amounts; delays or refusals in obtaining all necessary zoning, land use, and other required entitlements, governmental permits, and authorizations for our development and redevelopment properties; increases in anticipated capital expenditures, tenant improvement, and/or leasing costs; defaults on leases for land on which some of our properties are located; adverse changes to, or enactment or implementations of, tax laws or other applicable laws, regulations, or legislation, as well as business and consumer reactions to such changes; risks associated with joint venture investments, including our lack of sole decision-making authority, our reliance on co-venturers’ financial condition, and disputes between us and our co-venturers; environmental uncertainties and risks related to natural disasters; risks associated with climate change and our sustainability strategies, and our ability to achieve our sustainability goals; our ability to maintain our status as a REIT. These factors are not exhaustive and additional factors could adversely affect our business and financial performance. For a discussion of additional factors that could materially adversely affect our business and financial performance, see the factors included under the caption “Risk Factors” in our most recent annual report on Form 10-K and subsequent reports on Forms 10-Q and 8-K. All forward-looking statements are based on currently available information, and speak only as of the dates on which they are made. We assume no obligation to update any forward-looking statement that becomes untrue because of subsequent events, new information or otherwise, except to the extent we are required to do so in connection with our ongoing requirements under federal securities laws.

References to our website throughout this Proxy Statement are provided for convenience only and the content on our website does not constitute a part of, and shall not be deemed incorporated by reference into, this Proxy Statement.

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

| Date and Time: | Wednesday, May 22, 2024 at 8:00 a.m. local (Pacific) time | |||

| Place: | Our principal executive offices at 12200 West Olympic Boulevard, Suite 200, Los Angeles, California 90064 | |||

| Items of Business: |

1. |

Elect as directors the eight nominees named in the attached Proxy Statement. | ||

| 2. |

Approve, on an advisory basis, the compensation of our named executive officers. | |||

| 3. |

Ratify the appointment of Deloitte & Touche LLP as our independent auditor for the year ending | |||

| Record Date: | The Board of Directors has fixed the close of business on March 8, 2024 as the record date for determining the stockholders entitled to receive notice of and to vote at the Annual Meeting, or any adjournment(s) or postponement(s) thereof. | |||

| Proxy Voting: | Your vote is very important to us. Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions as soon as possible to ensure your shares are represented at the Annual Meeting. If you vote at the Annual Meeting, your proxy or voting instructions will not be used. | |||

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF | By Order of the Board of Directors, | |

| PROXY MATERIALS | ||

|

The Notice of Annual Meeting, Proxy Statement and our 2023 Annual Report on Form 10-K are available at www.proxyvote.com. Copies of these proxy materials are also available in the Investors — Financial Reports section of our website at https://www.kilroyrealty.com. You are encouraged to access and review all the important information contained in our proxy materials before voting. |

Heidi R. Roth

| |

| Executive Vice President, Chief Administrative Officer and Secretary | ||

| April 12, 2024 :: Los Angeles, California |

| KILROY REALTY | PROXY STATEMENT | 1 |

PROXY SUMMARY

This section highlights information about Kilroy Realty Corporation (“we,” “our,” “us” or the “Company”) and our Board of Directors (the “Board”). This section does not contain all of the information that you should consider and you should read the entire Proxy Statement before voting.

BUSINESS HIGHLIGHTS

Despite a challenging economic backdrop in 2023, we continued to execute on our initiatives, while maintaining significant financial flexibility and liquidity to support our long-term balanced business plan. This was demonstrated by our healthy same store NOI growth, a post-pandemic leasing volume record, and strong development deliveries. Our highly experienced leadership team continued to effectively manage our premier portfolio, while navigating a rapidly evolving business environment.

| LEASING | 2023 CHANGE IN GAAP RENTS(1) |

OFFICE DEVELOPMENT DELIVERIES | ||

| 1.35M SF | 14.8% | 830K SF | ||

|

Highest Annual Leasing Volume Since 2019 |

Strong Increase to Average GAAP Rents on Leases |

Another Strong Year of Development Deliveries | ||

Over the course of 2023, we executed approximately 1,350,000 square feet of leases, our highest annual leasing volume since 2019, with average rental rates that were up 14.8% on a GAAP basis as compared to the prior leases.(1) We added more than $750 million of new developments to our stabilized portfolio, including Indeed Tower, a $690 million, ~760,000 square foot development project located in the Austin CBD, and ended the year with approximately $1.9 billion of liquidity.

More information on the Company’s 2023 performance is detailed on pages 50-52.

| (1) | Change in GAAP rents (leases executed) is calculated as the change between GAAP rents for signed leases and the expiring GAAP rents for the same space. May include leases for which re-leasing timing was impacted by the COVID-19 pandemic and restrictions intended to prevent its spread. Excludes leases for which the space was vacant when the property was acquired by the Company. |

COMPENSATION HIGHLIGHTS

The Executive Compensation Committee of the Board (the “Compensation Committee”) approved the 2023 compensation arrangements for each of the named executive officers identified on page 47 (our “NEOs”). Below are highlights of our 2023 compensation arrangements for our NEOs from the Compensation Discussion and Analysis (the “CD&A”) section of this Proxy Statement.

Angela Aman joined the Company as our Chief Executive Officer (“CEO”) in January 2024 and, in December 2023, the Compensation Committee approved an employment agreement and compensation arrangements for Ms. Aman. The terms of Ms. Aman’s employment with us are discussed in the “Employment Agreement with Angela M. Aman” section of the “Compensation Discussion and Analysis” below. In addition, please see the discussion in the “Extensive Stockholder Engagement and Response to 2023 Vote” section of the “Compensation Discussion and Analysis” below.

Continued Emphasis on Long-Term Incentive Awards and Performance-Based Compensation

| • | Long-term equity compensation, tied to three-year performance and time-based vesting, is the largest component of each NEO’s total compensation opportunity. |

| • | Three-fourths of the 2023 annual equity awards for our NEOs are subject to performance-based vesting requirements and include a performance measure based on our relative TSR(2). |

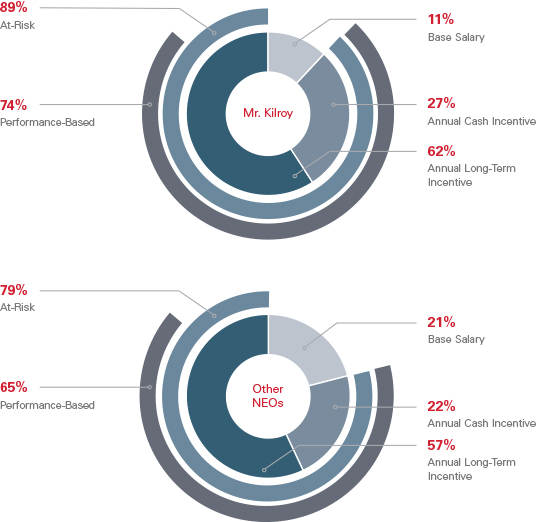

| • | Approximately 89% of Mr. Kilroy’s target TDC(3) for 2023 was not guaranteed but rather was tied to metrics related to Company performance and/or stock price, and therefore meaningfully “at risk.” |

| • | Approximately 79% of our other NEOs’ target TDC for 2023 was not guaranteed but rather was tied to metrics related to Company performance and/or stock price, and therefore meaningfully “at risk.” |

| 2 | PROXY STATEMENT | KILROY REALTY |

2023 Target

Total Direct Compensation

| (2) | For purposes of this Proxy Statement, TSR is calculated assuming dividend reinvestment. |

| (3) | As used in this Proxy Statement, “target TDC” means target total direct compensation, which is the executive’s base salary, target annual cash incentive, and grant date fair value (based on the value approved by the Compensation Committee and used to determine the number of shares subject to the award) of annual long-term incentive awards granted to the executive in 2023. In this Proxy Statement, when presenting the average target TDC for our other NEOs (NEOs other than Mr. Kilroy), Mr. Rose has been excluded because his employment with the Company ended during 2023. |

| KILROY REALTY | PROXY STATEMENT | 3 |

CORPORATE GOVERNANCE HIGHLIGHTS

The Company is committed to good corporate governance, which promotes the long-term interests of stockholders, reinforces accountability of the Board, and helps build public trust in the Company. Highlights include the following:

| Independent Board Leadership and Practices

| ||||||

| Lead Independent Director / Independent Board Chair |

✓* |

Dedicated Board Committee Oversight of Corporate Social Responsibility and Sustainability |

✓ | |||

| Supermajority Board Independence |

7 of 8** |

Dedicated Board Committee Oversight of Succession Planning |

✓ | |||

| Commitment to Diverse Director Candidate Pools |

✓ |

Comprehensive Board Risk Oversight Practices |

✓ | |||

| Active Board Refreshment Plans |

✓ |

Regular Strategic Updates from the CEO |

✓ | |||

| Robust Director Overboarding Policy |

✓ |

Executive Sessions of Independent Directors |

✓ | |||

| Audit, Compensation, and Governance Committees Composed Solely of Independent Directors |

✓ |

Regular Board and Committee Self-Evaluations |

✓ | |||

| Robust Stockholder Rights

| ||||||

| Majority Voting for Directors in Uncontested Elections |

✓ |

Stockholder Right to Call Special Meeting |

✓ | |||

| Annual Director Elections (Declassified Board) |

✓ |

Stockholder Right to Amend Bylaws by Majority Vote |

✓ | |||

| Stockholder Proxy Access Right with Market Standard Terms |

✓ |

No Stockholder Rights Plan |

✓ | |||

| Annual Say-on-Pay Voting |

✓ |

|

| |||

| Compensation Governance Best Practices

| ||||||

| Independent Compensation Consultant |

✓ |

Clawback Policy |

✓ | |||

| Robust Stock Ownership Guidelines for Executives and Non-Employee Directors |

✓ |

No Single Trigger Change in Control Provisions |

✓ | |||

| Minimum Stock Holding Requirements |

✓ |

No Excise Tax Gross-Ups |

✓ | |||

| Anti-Hedging Policy |

✓ |

No Repricing of Underwater Stock Options Without Stockholder Approval |

✓ | |||

| Anti-Pledging Policy |

✓ |

Regular Engagement with Investors |

✓ | |||

| Related Party Transactions Policy |

✓ |

|

| |||

| * | Dr. Brennan, the current Lead Independent Director of our Board, is expected to be appointed independent Board Chair if elected at the Annual Meeting. |

| ** | Includes director nominee Daryl Carter |

| 4 | PROXY STATEMENT | KILROY REALTY |

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY

The Company and its Board maintain a focus on corporate social responsibility and sustainability. We continuously look for new and better ways to foster a diverse and inclusive work environment, improve employee health and safety, engage with our surrounding communities, and minimize our environmental impact, all while creating value for our stockholders. These efforts are overseen by the Corporate Social Responsibility and Sustainability Committee (the “CSR&S Committee”) of our Board. Below are some recent highlights of our human capital, diversity, and sustainability initiatives. (References to our employees in this Proxy Statement include individuals employed through our operating partnership, Kilroy Realty, L.P. (the “Operating Partnership”), as well as through Kilroy Realty TRS, Inc. (the “TRS”).)

Human Capital Development

|

|

CULTURE OF INCLUSION

Continued cultivation of diverse culture of inclusion at the Company |

|

TRAINING AND EDUCATION

Regularly offered training and educational opportunities for employees on a broad range of topics, including diversity and inclusion, sustainability, and professional development |

|

EMPLOYEE ENGAGEMENT

Throughout 2023, Kilroy’s |

The Company is committed to enhancing employee development, satisfaction, and wellness while maintaining a diverse, inclusive, and thriving culture. Our human capital development initiatives in 2023 included the following:

Training and Education. We support the continual growth and development of our employees through various training and education programs throughout their tenure at the Company, from initial onboarding to continued skill building to leadership development. During 2023, across all teams and regions, employees participated in various training and developmental opportunities, including virtual workshops, in-person sessions, “lunch and learns”, online webinars, and conferences. We also conduct annual performance and career development reviews for all employees.

Diversity and Inclusion. We are committed to cultivating a culture of inclusion. To emphasize this commitment, we have developed programs to promote workplace diversity and inclusion, and we continue to require mandatory unconscious bias training for all employees. For the fourth year in a row, the Company has been named to Bloomberg’s Gender Equality Index, and we are proud that 56% of our workforce is female and 42% is racially/ethnically diverse. As of December 31, 2023, two of our seven directors (or approximately 29%) were female. In December 2023, we announced the appointment of Angela Aman as our new CEO and a director on our Board, effective January 22, 2024. Following her appointment, women comprise 38% of our directors.

Employee Health and Wellness. The physical and mental health and wellness of our employees is of central importance to our culture. We evaluate our group health and ancillary benefits annually to ensure that our benefits package is robust and competitive. We are proud to offer several comprehensive medical, dental, and vision benefit programs to our employees and their families, with over 90% of the premiums absorbed by the Company. We periodically conduct wellness surveys to help us better tailor our employee health and wellness programs. In 2023, we selected a new Employee Assistance Program and continued our focus and support of mental health and wellness by providing our employees education on self-care and offering an increased variety of programs. In addition to offering a 401(k) plan with matching contributions, in 2023, we put a focus on employee financial wellness by offering a variety of educational events, web-based workshops, and financial tips, all aimed at helping our employees improve their overall financial well-being.

| KILROY REALTY | PROXY STATEMENT | 5 |

Competitive Benefits and Compensation. While many companies leverage a mix of competitive salaries and ancillary benefits to attract and retain their employees, we have gone beyond traditional structures and placed more emphasis on offering an expanded comprehensive benefits program as noted above, as well as offering other benefits, including fully-funded life and disability insurance, enhanced paid pregnancy and parental leave benefits, parental leave coaching, well-being programs, and other activities coordinated by the Company that align with our core values of belonging, connection, and progress.

Strong Communities and Healthy Planet. We recognize that our buildings are part of the larger community and that we thrive when the communities around us thrive. We are proud to make these communities better places to live and work through our volunteerism and philanthropy initiatives. In response to requests from our employees for increased service opportunities, in the fourth quarter of 2023, we expanded our annual tradition of “Week of Service” into “Month of Service”, transforming it into a more robust effort dedicated to giving back to the communities in which we operate. The Company-wide initiative gave our team enhanced opportunities to connect with local organizations and meaningful causes in the spirit of community enrichment and employee volunteerism. Over 165 employees assisted 18 organizations, dedicating more than 1,000 hours, almost triple the number of volunteer hours provided in 2022.

Diversity and Inclusion at the Company

We strive to create and maintain a workforce that reflects the diversity of our communities. We believe that racial, ethnic and gender diversity within our employee base has been bolstered by our proactive efforts over many years to create an inclusive culture.

| • | Racial and Ethnic Diversity. Approximately 42% of our employees are racially or ethnically diverse. As in prior years, we remain focused on education concerning diversity and inclusion, including by providing educational and other materials to employees and hosting events such as themed lunches to acknowledge and highlight heritage months, holidays and other cultural occasions. More information regarding the diversity of our employees can be found in our 2023 Consolidated US Employer Information Report (EEO-1) that is included as an appendix to our annual Sustainability Report on our website located at https://kilroyrealty.com/sustainability. |

| • | Gender Diversity. Women make up more than half of our workforce. We also have numerous women in key leadership roles, including our CEO, our EVP, Chief Administrative Officer, our SVP, Sustainability, our SVP, Chief Accounting Officer and Controller, our SVP, Corporate Counsel, and multiple other Senior Vice Presidents. Several women in the Company have received awards for their leadership in the real estate industry and/or the local business regions in which we operate. |

GENDER DIVERSITY

| 6 | PROXY STATEMENT | KILROY REALTY |

RACIAL AND ETHNIC DIVERSITY

| • | Bloomberg Gender Equality Index. In 2023, we were listed on the Bloomberg Gender Equality Index for the fourth year in a row. The index aims to track the performance of public companies committed to transparency in gender-data reporting, as measured across five dimensions: female leadership and talent pipeline, equal pay and gender pay parity, inclusive culture, anti-sexual harassment policies, and pro-women brand. |

Diversity on the Board

| Our Nominating/Corporate Governance Committee (the “Governance Committee”) and the Board understand the importance of bringing diverse experience and perspectives to the Board and as such: | ||

| • Board Membership Criteria. Our Governance Committee and Board have committed to including women and individuals from minority groups in the qualified pool from which new director candidates are selected when the Board undergoes any future Board refreshment.

• Board Composition & Refreshment. In 2023, we appointed Angela Aman as our CEO and as a director of our Board. Additionally, in 2020, we appointed a new female independent director, Louisa Ritter to our Board as part of our ongoing board refreshment efforts. Currently, three of our eight current directors (or 37.5%) are female, with one serving as the Chair of the Company’s CSR&S Committee. We have also nominated Daryl Carter as a new director for election at the Annual Meeting. |

Gender, Racial, and Ethnic Diversity of our Director Nominees

| |

| If Mr. Carter is elected to our Board, 12.5% of our directors will be racially or ethnically diverse. The Board undergoes regular evaluation and discussion of its Board refreshment plans. | ||

Sustainability

Our longstanding leadership in sustainability in real estate is globally recognized, and our commitment to advancing progress toward our sustainability ambitions remains strong. Our vision is a resilient portfolio that minimizes the environmental impact of our buildings while maximizing the health and productivity of our tenants, employees, and communities, while also delivering compelling returns to stockholders.

| KILROY REALTY | PROXY STATEMENT | 7 |

Building Certifications. Building certifications like LEED, ENERGY STAR, Fitwel, and the WELL Health-Safety Rating are visible signs at our properties of our commitment to sustainability. We continue to pursue LEED Platinum or LEED Gold certification for all new office and life science development projects and have also achieved LEED certification at many of our existing buildings. As of December 31, 2023, 70% of our total portfolio was LEED certified, with 94% of those certifications at the highest Gold and Platinum levels.

Commitment to Sustainability. We have a longstanding commitment to reduce the energy, greenhouse gas emissions, water consumption, and waste to landfill impacts of our portfolio. We are proud to have achieved carbon-neutral operations since 2020 (see our annual Sustainability Report for more details). In 2023, carbon neutral operations was achieved through the five strategies outlined in the graphic below and the scope of our commitment included all Scope 1, 2, and 3 (downstream leased assets) emissions. We continue to pursue LEED Platinum or LEED Gold certification for all new office and life science development projects, and have also achieved LEED certification at many of our existing buildings, with 73% of our total portfolio LEED certified as of December 31, 2023.

Our carbon-neutral operations claim and associated data is reviewed by an independent third-party in-line with the PAS 2060 Standard. An Independent Limited Assurance Report can be found in the appendix of our annual Sustainability Report.

| 8 | PROXY STATEMENT | KILROY REALTY |

Climate Change & Resilience. We identify climate change as a risk to our business, an opportunity for long-term value creation, and a key driver of long-term strategic business decisions. Climate-related risks and opportunities are overseen by the Board through the CSR&S Committee, and the management team charged with driving progress includes representatives from sustainability, risk management, security, asset management, and engineering. We became a supporter of the Task Force for Climate-Related Financial Disclosures (“TCFD”) in 2018, and our discussion of our climate change risks and opportunities follows that framework. We utilize the S&P Global Climanomics® software platform to assess physical and transition risks related to climate change and to inform asset and portfolio level decision-making. In connection with these analyses, we have updated various Company policies and procedures, including those related to our operations and acquisitions, to manage risks and opportunities. In addition, we have incorporated these analyses into our development strategy. We intend to continue to be proactive in managing climate-related risks, which positions us to capitalize on opportunities available in the transition to a low-carbon economy. More information about our climate change strategy, including our climate change scenario analysis, can be found in our annual Sustainability Report on our website located at https://kilroyrealty.com/sustainability.

Industry Leading Sustainability Practices. We continue to be recognized for our industry-leading sustainability practices.

| • As discussed above, we have made a commitment to and achieved carbon-neutral operations across our portfolio since 2020 through energy efficiency, onsite renewables, offsite renewables, renewable energy certificates, and verified carbon offsets

|

| |

| • Named Regional Sector Leader in the Americas for sustainability performance of our Development (Diversified) portfolio in 2023

| ||

| • Earned the highly competitive GRESB “5 Star” designation for our Development (Diversified) portfolio, ranking in the top 20% of developers worldwide in sustainability performance in 2023

| ||

| • Recipient of the US EPA’s ENERGY STAR Partner of the Year Sustained Excellence Award for each of the last eight years (2016 - 2023)

| ||

| • Named #1 Most Sustainable US REIT by Calvert Research & Management in 2020 - 2023

• Ongoing commitment to LEED certification at new and existing properties, resulting in 70% of the stabilized portfolio being LEED certified at year-end 2023

• Earned ENERGY STAR certifications for 72% of the eligible stabilized portfolio in 2023

• Achieved Fitwel certification, a measure of how well workplaces support the health and wellness of occupants, for 44% of our stabilized portfolio | ||

Sustainability Reporting. We are committed to providing our stockholders with transparency around our ESG sustainability indicators. We publish an annual Sustainability Report that references the Global Reporting Initiative (“GRI”) reporting framework and TCFD recommendations. Our annual Sustainability Report includes comprehensive energy, carbon, water, and waste data and updates on our performance toward our voluntary goals. A third-party assurance provider reviews our sustainability data each year.

To learn more about our ESG efforts, please view our annual Sustainability Report on our website located at https://kilroyrealty.com/sustainability.

| KILROY REALTY | PROXY STATEMENT | 9 |

Commitment to Communities. The Company is committed to building communities to connect perspectives, cultures, and individuals from around the world. We know that healthy, thriving communities are our most powerful asset. As a developer, we have a unique opportunity to engage with our cities, schools, neighborhoods, and workplaces to help our communities flourish. With community connectivity being one of our core values, we believe that our built environment should support our commitment to cultivating a Company culture that makes a positive difference in our employees’ lives by supporting the whole person, celebrating our differences and unique backgrounds, promoting employee health and wellness, and dedicating ourselves to being a responsible corporate citizen with our community service and philanthropic efforts.

|

|

Our employee volunteerism and philanthropy programs are a core element of our culture and have two fundamental areas of focus: strong communities and healthy planet. Those concepts inspire our volunteerism and philanthropy initiatives.

We had a robust showing for our Company-wide 2023 Month of Service where employees were encouraged to participate in a variety of regionally coordinated volunteer efforts. More than 165 Company employees volunteered more than 1,000 hours supporting 18 organizations, including San Diego Humane Society, Meals on Wheels, International Rescue, and Hollywood Food Coalition, among others. |

| 10 | PROXY STATEMENT | KILROY REALTY |

VOTING INFORMATION

VOTING MATTERS AND BOARD RECOMMENDATIONS

Our Board is soliciting your proxy to vote on the following matters at our Annual Meeting to be held at 8:00 a.m. local (Pacific) time on May 22, 2024 at our principal executive offices located at 12200 West Olympic Boulevard, Suite 200, Los Angeles, California 90064, and any potential adjournments or postponements of the Annual Meeting:

| Proposal | Vote Required | Board Recommendation |

Page | |||||

|

Proposal No. 1 |

Election of Eight Director Nominees |

Majority of Votes Cast |

For |

12

| ||||

|

Proposal No. 2 |

Advisory Approval of Compensation of NEOs |

Majority of Votes Cast |

For |

25

| ||||

|

Proposal No. 3 |

Ratification of Appointment of Deloitte & Touche LLP as Independent Auditor for 2024 |

Majority of Votes Cast |

For |

27 |

HOW TO CAST YOUR VOTE

| INTERNET | PHONE | DURING THE MEETING | ||||

| Follow the instructions provided in the notice or separate proxy card or voting instruction form you received. | Follow the instructions provided in the separate proxy card or voting instruction form you received. | Send your completed and signed proxy card or voting instruction form to the address on your proxy card or voting instruction form. | Follow the instructions provided in the notice or separate proxy card or voting instruction form you received. | |||

|

On April 12, 2024, the proxy materials for our Annual Meeting, including this Proxy Statement and our 2023 Annual Report on Form 10-K (the “2023 Annual Report”), were first sent or made available to our stockholders entitled to vote at the Annual Meeting.

|

| KILROY REALTY | PROXY STATEMENT | 11 |

PROPOSAL 1 –

ELECTION OF DIRECTORS

The Board presently consists of eight directors. Each director is serving a term that continues until the Annual Meeting and until his or her successor is duly elected and qualified. As further described below, our Board has selected seven incumbent director nominees, including Angela Aman, who was appointed to the Board in January 2024, and one new director nominee, Daryl Carter, for election at the Annual Meeting. John Kilroy, our previous CEO and Chair of the Board, is retiring from his position on our Board on the date of the Annual Meeting.

NOMINEES FOR DIRECTOR

Upon the recommendation of the Governance Committee, the Board has nominated Angela M. Aman, Edward F. Brennan, PhD, Daryl J. Carter, Jolie A. Hunt, Scott S. Ingraham, Louisa G. Ritter, Gary R. Stevenson, and Peter B. Stoneberg for election to the Board for a term continuing until the annual meeting of stockholders to be held in 2025 and until their respective successors are duly elected and qualified. All of the director nominees, except for Mr. Carter, are currently directors of the Company and all of the director nominees, other than Ms. Aman and Mr. Carter, were previously elected to serve on the Board by our stockholders.

Mr. Carter is standing for election to the Board for the first time and has been nominated to the Board as part of our ongoing Board refreshment process. Mr. Carter is the Founder, Chairman, and CEO of Avanath Capital Management, LLC.

In connection with a comprehensive search process conducted by Korn Ferry (US) (“Korn Ferry”) at the request of the Governance Committee, Korn Ferry identified Mr. Carter as a potential director nominee and assessed Mr. Carter’s candidacy. As part of its assessment, a representative of Korn Ferry interviewed Mr. Carter and presented the results of its evaluation to the Board for discussion. Each of the Board members also met and interviewed Mr. Carter, and Korn Ferry and the Board performed substantial diligence and reference checks on Mr. Carter, including engaging a third party to conduct an extensive background check. The Board met to discuss the results of the background check and interviews and determined to approve Mr. Carter’s nomination for election to the Board.

| 12 | PROXY STATEMENT | KILROY REALTY |

BOARD COMPOSITION

Board Snapshot*

| * | Includes director nominee Daryl Carter, except that tenure information includes only incumbent independent director nominees. |

| KILROY REALTY | PROXY STATEMENT | 13 |

Director Nominee Skills, Experience, and Background

We believe each of the eight director nominees possesses the professional and personal qualifications necessary for effective service as a director. In addition to each nominee’s specific experience, qualifications, and skills, we believe that each nominee has a reputation for integrity, honesty, and adherence to high ethical standards and has demonstrated business acumen and an ability to exercise sound business judgment and that all nominees are committed to driving sustainable, long-term stockholder value. The following chart provides a summary of the director nominees’ skills and core competencies:

| Skill/Qualification

|

Aman

|

Brennan

|

Carter

|

Hunt

|

Ingraham

|

Ritter

|

Stevenson

|

Stoneberg

| ||||||||

|

Target Tenant Industry Experience

Knowledge and experience with the top four industries that make up the majority of our tenant base (Technology; Life Science & Healthcare; Media; and F.I.R.E. — Finance, Insurance and Real Estate)

|

● | ● | ● | ● | ● | ● | ● | ● | ||||||||

|

Executive Leadership

Leadership role as company CEO or President

|

● | ● | ● | ● | ● | ● | ● | ● | ||||||||

|

Public Company Board Service

Experience as a board member of another publicly traded company

|

● | ● | ● | ● | ||||||||||||

|

Investment Experience

Relevant investment, strategic and deal structuring experience

|

● | ● | ● | ● | ● | ● | ● | |||||||||

|

Financial Literacy/Accounting Experience

Financial or accounting experience and an understanding of financial reporting, internal controls and compliance

|

● | ● | ● | ● | ● | ● | ||||||||||

|

Finance/Capital Markets Experience

Experience navigating our capital-raising needs

|

● | ● | ● | ● | ● | ● | ● | |||||||||

|

Risk Management Experience

Experience overseeing and managing company risk

|

● | ● | ● | ● | ● | ● | ● | ● | ||||||||

|

Advanced Degree/Professional Accreditation

Possesses an advanced degree or other professional accreditation that brings additional perspective to our business and strategy

|

● | ● | ● | ● | ● | ● |

| 14 | PROXY STATEMENT | KILROY REALTY |

| Diversity and Other Information

|

Aman

|

Brennan

|

Carter

|

Hunt

|

Ingraham

|

Ritter

|

Stevenson

|

Stoneberg

| ||||||||

|

Gender Diversity

|

● | ● | ● | |||||||||||||

|

Racial/Ethnic Diversity

|

||||||||||||||||

|

Alaskan Native / Native American

|

||||||||||||||||

|

Asian

|

||||||||||||||||

|

Black / African American

|

● | |||||||||||||||

|

Caucasian / White

|

● | ● | ● | ● | ● | ● | ● | |||||||||

|

Hispanic / Latin American

|

||||||||||||||||

|

Native Hawaiian or Other Pacific Islander

|

||||||||||||||||

|

Age

|

44 | 72 | 69 | 45 | 70 | 60 | 67 | 68 | ||||||||

|

Tenure

|

<1 | 21 | N/A | 9 | 17 | 4 | 10 | 10 |

| KILROY REALTY | PROXY STATEMENT | 15 |

DIRECTOR NOMINEE

|

Age: 44 Director Since: 2024 Race/Ethnicity: Caucasian Board Committees - N/A |

ANGELA M. AMAN Chief Executive Officer and Director

| |||||

|

Specific Qualifications, Attributes, Skills and Experience:

Ms. Aman was nominated to serve on our Board because she is a seasoned real estate executive with more than 22 years of commercial real estate, financial, and operational expertise, which she acquired through her experience working with both public and private real estate companies. As our CEO, Ms. Aman also provides a vital link between our Board and our management team. Ms. Aman is a member of Nareit, ICSC, and the Urban Land Institute and currently serves on the Board of Trustees of Equity Residential, where she serves as Chair of the Audit Committee.

| ||||||

|

Career Highlights:

• President, Chief Financial Officer, and Treasurer of Brixmor Property Group from 2023 to 2024, Chief Financial Officer and Treasurer of Brixmor Property Group from 2016 to 2023, and Executive Vice President of Brixmor Property Group from 2016 to 2023.

• Executive Vice President and Chief Financial Officer of Starwood Retail Partners from 2015 to 2016.

• Executive Vice President, Chief Financial Officer and Treasurer of Retail Properties of America, Inc. from 2012 to 2015.

• Member of RREEF real estate securities team from 2005 to 2011, serving as an investment analyst and later as a portfolio manager.

• Member of Deutsche Bank Securities, Inc.’s real estate investment banking group from 2001 to 2005.

• Member of Nareit, ICSC, and the Urban Land Institute.

• Holds a Bachelor’s degree in Economics from The Wharton School, University of Pennsylvania.

Other Public Company Boards:

• Member of the Board of Trustees of Equity Residential (NYSE: EQR), serving as the chair of the audit committee. | ||||||

| 16 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

|

Age: 72 Lead Independent Director Since: 2014 Director Since: 2003 Race/Ethnicity: Caucasian Board Committees - Compensation (Chair) - Governance - Succession Planning |

EDWARD F. BRENNAN, PhD Lead Independent Director*

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Dr. Brennan was nominated to serve on our Board because of his executive management and board of directors experience with both public and private companies and specifically, his over 30 years of experience with companies in the health sciences and medical industries, which are now and have historically been target tenants of the Company. Dr. Brennan has participated in the development, management and financing of new medical technology ventures for over 30 years, including scientific and executive positions with Syntex, Inc., UroSystems, Inc., Medtronic Inc., DepoMed Systems, Inc., and CardioGenesis Corp.

| ||||

|

Career Highlights:

• Special advisor to Abram Scientific, a privately held medical diagnostics company, since March 2020, where he previously served as the acting CEO and a director from 2015 to 2022.

• Chief Integration Officer of ITC Nexus Holding Company, a medical diagnostics company, following the merger of Nexus and International Technidyne Corporation in 2011, and CEO of Nexus Dx, Inc. from 2011 to 2014.

• President and Chief Operating Officer of CryoCor, Inc. from 2005 to 2006 and Chief Executive Officer from 2006 until 2008, when the company was sold to Boston Scientific Corporation.

• Managing Partner of Perennial Ventures, a Seattle-based venture capital firm, from 2001 to 2004.

• Vice President at Tredegar Investments from 2000 to 2001.

• House Manager for the Center for the Performing Arts in the City of Mountain View.

• Member of the board of directors of several private companies, including GreenNinja.org and TargetDX Laboratory.

• Previously served on the Board of Trustees of Goucher College, Baltimore, Maryland.

• Holds Bachelor’s degrees in Chemistry and Biology and a PhD in Biology from the University of California, Santa Cruz.

Other Public Company Boards:

• Member of the board of directors of HemoSense, Inc. from 2000 and Chairman of HemoSense Inc. from 2004 until its sale to Inverness Medical Innovations in 2007.

• Member of the board of directors of CryoCor from 2006 until its sale to Boston Scientific Corporation in 2008.

* Dr. Brennan is expected to be appointed independent Board Chair if elected at the Annual Meeting. | ||||

| KILROY REALTY | PROXY STATEMENT | 17 |

DIRECTOR NOMINEE

|

Age: 69 Director Since: N/A Race/Ethnicity: Black / African American Board Committees - N/A |

DARYL J. CARTER Independent Director

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Mr. Carter was nominated to serve on our Board because of his more than 40 years of diverse real estate experience. Mr. Carter is the Founder, Chairman, and CEO of Avanath Capital Management, LLC, a California-based investment firm that acquires, renovates, and operates apartment properties, with an emphasis on affordable and workforce communities. Mr. Carter is responsible for directing the overall strategy and operations of Avanath. Prior to founding Avanath, Mr. Carter held positions of Executive Managing Director, Regional Vice President and Co-Chairman with various companies.

| ||||

|

Career Highlights:

• Founder, Chairman, and CEO of Avanath Capital Management, LLC since 2008.

• Executive Managing Director of Centerline Capital Group. Mr. Carter became part of the Centerline team when his company, Capri Capital Finance, was acquired by Centerline in 2005. Mr. Carter co-founded and served as Co-Chairman of the Capri Capital family of companies and was instrumental in building Capri to a diversified real estate investment firm with $8 billion in real estate equity and debt investments under management.

• Regional Vice President at Westinghouse Credit Corporation and a Second Vice President at Continental Bank from 1981 to 1991.

• Past Chairman of the National Multifamily Housing Council from 2014 to 2016.

• Holds a Master’s in Architecture and a Master’s in Business Administration, both from the Massachusetts Institute of Technology. Also holds a Bachelor of Science degree in Architecture from the University of Michigan.

• In 2015, Mr. Carter received the MIT Sloan School Distinguished Alumni Award.

Other Public Company Boards:

• Member of the board of directors of Catellus Development Corporation (CDX) from 1994 to 2005.

• Member of the board of directors of Silver Bay Realty Trust (SBY) from 2013 to 2017.

• Member of the board of directors of Whitestone REIT (NYSE: WSR) from 2009 to 2017. | ||||

| 18 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

|

Age: 45 Director Since: 2015 Race/Ethnicity: Caucasian Board Committees - Compensation - Governance - CSR&S (Chair) |

JOLIE A. HUNT Independent Director

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Ms. Hunt was nominated to serve on our Board because of her significant marketing and communications experience, knowledge about trends in the media, entertainment, and technology world, and the use of technology to advance company brands, which she acquired through her experience working with multiple multinational corporations and as the founder and CEO of Hunt & Gather. The Board believes these positions and experience bring additional, unique skills, perspective, and connections to our Board.

| ||||

|

Career Highlights:

• Founder and CEO of Hunt & Gather, a marketing and communications agency that helps launch startup ventures, revive the strategic marketing and communications efforts of established brands, and utilizes discreet influencer relations to pair like-minded people and places together where there is mutual benefit, since 2013.

• Chief Marketing & Communications Officer for AOL, Inc. from 2012 to 2013.

• Senior Vice President, Global Head of Brand & Public Relations at Thomson Reuters from 2008 to 2012.

• Global Director of Corporate & Business Affairs at IBM Corporation from 2006 to 2008.

• Director of Public Relations for the Financial Times from 2002 to 2006.

• Member of the boards of The Lowline and the Civilian Public Affairs Council for West Point Military Academy.

• Holds a Bachelor’s degree in Mass Communication from Boston University and completed the Global Executive Program at Dartmouth University Tuck School of Business and Spain’s IE Business School in 2010. | ||||

| KILROY REALTY | PROXY STATEMENT | 19 |

DIRECTOR NOMINEE

|

Age: 70 Director Since: 2007 Race/Ethnicity: Caucasian Board Committees - Audit (Chair) - Governance |

SCOTT S. INGRAHAM Independent Director

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Mr. Ingraham was nominated to serve on our Board because he possesses extensive financial and real estate knowledge based on his experience as Chairman and CEO of Rent.com, President and CEO of Oasis, a member of the board of trustees, and a member of the nominating and corporate governance committee, audit committee, and compensation committee of Camden, a member of the board of directors and audit committee of LoopNet, and a member of the board of directors and audit committee of RealPage, Inc. Mr. Ingraham also possesses knowledge and familiarity with the Austin and Southwest regions.

| ||||

|

Career Highlights:

• Co-owner of Zuma Capital, a firm engaged in private equity and angel investing, since 2006.

• Co-founder, Chairman and CEO of Rent.com, an Internet-based multi-family real estate site, from 1999 until it was sold to eBay in 2005.

• Co-founder and former President and CEO of Oasis Residential (“Oasis”), a public apartment REIT founded in 1992 that merged with Camden Property Trust (“Camden”) in 1998.

• Prior to co-founding Oasis, Mr. Ingraham’s career was devoted to real estate finance, mortgage, and investment banking.

• Holds a Bachelor’s degree in Business Administration from the University of Texas at Austin.

Other Public Company Boards:

• Trust manager of Camden (NYSE: CPT) since 1998 and audit committee member for six years previously and beginning again in 2016.

• Member of the board of directors of LoopNet (NASDAQ: LOOP) for six years before it was acquired by Co-Star in 2012.

• Member of the board of directors of RealPage, Inc. (NASDAQ: RP) for nine years before it was acquired by a private equity investor in 2021. | ||||

| 20 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

|

Age: 60 Director Since: 2020 Race/Ethnicity: Caucasian Board Committees - Audit - Compensation - Governance |

LOUISA G. RITTER Independent Director

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Ms. Ritter was nominated to serve on our Board because she possesses extensive financial and investment knowledge based on her experiences handling a variety of matters as President at Pisces, and as a banker and corporate executive at a preeminent investment banking firm. She also has a broad range of experience through her non-profit service, having served on finance and governance committees, and having held an array of leadership roles including board chair, and chair of compensation, head search, and personnel committees.

| ||||

|

Career Highlights:

• President of Pisces, Inc. (“Pisces”), a San Francisco-based asset management firm since 2016.

• Served in various capacities at Goldman Sachs for 14 years (from 2001 to 2015), most recently serving as Managing Director in its Executive Office and President of Goldman Sachs Gives. From 2001 to 2012, led various businesses including serving as COO of West Region Investment Banking and Chief of Staff of Global Technology, Media and Telecomm Investment Banking.

• Served for ten years in various capacities (from 1990 to 2000) at Montgomery Securities, which ultimately became Banc of America Securities, where she served as Co-COO of Global Corporate & Investment Banking.

• Member of various non-profit boards including The Hamlin School, Marin Academy, the Management Board of the Stanford School of Business, The Global CO2 Initiative, and the Center for Reproductive Rights, where she serves as Treasurer and on the finance and audit committee, the risk subcommittee, and the diversity, equity and inclusion committee.

• Holds a Bachelor of Arts degree from Yale University and a Master’s degree in Business Administration from the Stanford University Graduate School of Business. | ||||

| KILROY REALTY | PROXY STATEMENT | 21 |

DIRECTOR NOMINEE

|

Age: 67 Director Since: 2014 Race/Ethnicity: Caucasian Board Committees - Compensation - Governance - Succession Planning (Chair) |

GARY R. STEVENSON Independent Director

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Mr. Stevenson was nominated to serve on our Board because of his extensive business and operational experience, including his founding role at OnSport Strategies, and his roles as President of Pac-12 and currently as Deputy Commissioner of Major League Soccer and as President and Managing Director of MLS Business Ventures of Major League Soccer. The Board believes these positions and Mr. Stevenson’s entrepreneurship success bring a diverse set of skills, experiences, and relationships to our Board.

| ||||

|

Career Highlights:

• Deputy Commissioner of Major League Soccer and has been President and Managing Director of MLS Business Ventures of Major League Soccer since 2013.

• President of PAC-12 Enterprises (“Pac-12”) from 2011 to 2013, where he managed a diversified and integrated company, including the Pac-12 Networks and Pac-12 Properties.

• Chairman and CEO of OnSport Strategies, a sports and entertainment consulting company that he founded in 1997 and later sold to Wasserman Media Group in 2007.

• Principal for Wasserman Media Group from 2007 to 2010, to help handle the integration of OnSport Strategies.

• President of NBA Properties, Marketing and Media for the National Basketball Association from 1995 to 1997.

• Chief Operating Officer and Executive Vice President of the Golf Channel from 1994 to 1995.

• Executive Vice President, Business Affairs for PGA Tour from 1987 to 1994.

• Holds a Bachelor’s degree from Duke University and a Master’s degree in Business Administration from George Washington University. | ||||

| 22 | PROXY STATEMENT | KILROY REALTY |

DIRECTOR NOMINEE

|

Age: 68 Director Since: 2014 Race/Ethnicity: Caucasian Board Committees - Audit - Governance (Chair) - CSR&S |

PETER B. STONEBERG Independent Director

| |||

|

Specific Qualifications, Attributes, Skills and Experience:

Mr. Stoneberg was nominated to serve on our Board because of his significant relationships, experience with and knowledge of large and small companies in the high-technology industry, particularly those within the San Francisco Bay Area, which have become target tenants of the Company. Mr. Stoneberg also possesses extensive knowledge in the areas of raising equity and debt capital, and mergers and acquisitions based on his experience at BACI, Montgomery Securities, and Velocity Ventures. Mr. Stoneberg also has experience as an active board member at three companies, including as a member of the audit and compensation committees of Netcom Systems and Cupertino Electric.

| ||||

|

Career Highlights:

• Managing Partner of Velocity Ventures, LLC, a merchant banking and M&A advisory firm that he founded in 2000.

• Managing Partner of Architect Partners, LLC, an investment banking firm, since 2020.

• Managing Partner of Dresner Partners, LLC an investment banking firm, from 2018 to 2020.

• Investment Partner at Bank of America Capital Investors (“BACI”), from 2000 to 2006.

• Senior Managing Director of Montgomery Securities, where he founded and led the Technology M&A group, beginning in 1994 until its acquisition by Bank of America in 1999.

• Served in various investment banking and management roles from 1980 to 1986, including as Managing Director of Broadview Associates, Co-Founder and President of Data/Voice Solutions Corp, and Product Marketing Manager for IBM and ROLM Corp.

• Previous investor and director of Cupertino Electric, Osprey Ventures, Historic Motorsports Productions, Saleslogix Corp., and Netcom Systems.

• President and board member of Atlas Peak Appellation Association, a small, non-profit association of wineries and wine grape growers in Napa, CA.

• Founder of the San Francisco America’s Cup Organizing Committee.

• Chair of the Investment Committee of the St. Francis Sailing Foundation.

• Holds a Bachelor’s degree in Business from the University of Colorado and has completed the Stanford Law School Directors’ College. | ||||

| KILROY REALTY | PROXY STATEMENT | 23 |

VOTE REQUIRED

Each director nominee will be elected at the Annual Meeting if he or she receives a majority of the votes cast with respect to his or her election (that is, the number of votes cast “FOR” the nominee must exceed the number of votes cast “AGAINST” the nominee). The majority voting standard does not apply, however, in a contested election where the number of director nominees exceeds the number of directors to be elected at an annual meeting of stockholders. In such circumstances, directors will instead be elected by a plurality of all the votes cast in the election of directors at the annual meeting at which a quorum is present. The election of directors at the Annual Meeting is not contested.

Under Maryland law, if an incumbent director is not re-elected at a meeting of stockholders at which he or she stands for re-election, then the incumbent director continues to serve in office as a holdover director until his or her successor is elected. To address this “holdover” issue, our Bylaws provide that if an incumbent director is not re-elected due to his or her failure to receive a majority of the votes cast in an uncontested election, the director will promptly tender his or her resignation as a director, subject to acceptance by the Board. The Governance Committee will then make a recommendation to our Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. Our Board will act on the Governance Committee’s recommendation and publicly disclose its decision, along with its rationale, within 90 days after the date of the certification of the election results.

RECOMMENDATION

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

| 24 | PROXY STATEMENT | KILROY REALTY |

PROPOSAL 2 –

ADVISORY APPROVAL OF OUR EXECUTIVE COMPENSATION

We are asking our stockholders to approve the compensation of our NEOs (as identified in the CD&A) as disclosed pursuant to the US Securities and Exchange Commission (the “SEC”) executive compensation disclosure rules and as set forth in this Proxy Statement (including in the compensation tables, the narratives accompanying those tables, and the CD&A). This is commonly referred to as a “Say-on-Pay” vote.

Our executive compensation philosophy is designed to achieve the following objectives:

| • | To align executive compensation with the Company’s corporate strategies, business and ESG objectives, and the creation of long-term value for our stockholders without encouraging unnecessary or excessive risk-taking; |

| • | To provide an incentive to achieve key strategic and financial performance measures by linking short-term incentive award opportunities and a substantial portion of long-term incentive award opportunities to the achievement of corporate strategic and operational performance objectives; |

| • | To set total compensation to be competitive with companies in our peer group identified on page 70, taking into account our active portfolio management strategy and the skill set required to implement that strategy; |

| • | To provide a majority of target TDC(4) for our NEOs in the form of long-term incentive equity awards; and |

| • | To help the Company attract, retain, and incentivize talented and experienced individuals in the highly competitive West Coast and Austin, Texas employment and commercial real estate markets. |

Below are highlights of the 2023 compensation arrangements for our NEOs as approved by the Compensation Committee. Angela Aman joined the Company as our CEO in January 2024 and, in December 2023, the Compensation Committee approved an employment agreement and compensation arrangements for Ms. Aman. Based on peer company data, input received from certain stockholders in recent years, and the advice of its independent compensation consultant, the Compensation Committee set Ms. Aman’s compensation and potential severance at levels significantly less than had been provided to our former CEO, John Kilroy. The terms of Ms. Aman’s employment with us are discussed in the “Employment Agreement with Angela M. Aman” section of the “Compensation Discussion and Analysis” below. Also see the discussion in the “Extensive Stockholder Engagement and Response to 2023 Vote” section of the “Compensation Discussion and Analysis” below.

| • | Annual Short-Term Incentives Based on Performance Measurement Framework. The Compensation Committee determines annual short-term incentives (annual cash bonuses) based on a rigorous performance measurement framework that measures the Company’s actual performance against pre-established financial and operational goals (including ESG goals) and each NEO’s contribution to that performance. The Compensation Committee determined that the final 2023 short-term incentive amounts for our NEOs who received payments under this program would be 125% of their target payout levels. See “Short-Term Incentives — Decisions for 2023; 2023 Key Operating and Financial Goal Setting and Performance” on page 56 for more information about how the goals are set and the Company’s performance. |

| • | Majority of Target TDC is “At Risk”. Approximately 89% of Mr. Kilroy’s target TDC for 2023 and approximately 79% of our other NEOs’ target TDC for 2023 was not guaranteed but rather was tied directly to the performance of the Company, the Company’s stock price and/or individual performance, as shown in the pay mix charts on page 3. |

| (4) | As used in this Proxy Statement, “target TDC” and “target total direct compensation” mean the executive’s base salary, target annual cash incentive, and grant date fair value (based on the value approved by the Compensation Committee and used to determine the number of shares subject to the award) of annual long-term incentive awards granted to the executive in 2023. In this Proxy Statement, when presenting the average target TDC for our other NEOs (NEOs other than Mr. Kilroy), and in presenting the average portion of the other NEOs’ target TDC that is at risk, performance-based, or in the form of long-term incentives, Mr. Rose has been excluded because his employment with the Company ended during 2023. |

| KILROY REALTY | PROXY STATEMENT | 25 |

| • | Majority of Target TDC is in the Form of Long-Term Incentives. The most significant component of each NEO’s total compensation opportunity is in the form of restricted stock units (“RSUs”) that vest over a three-year period. In 2023, approximately 62% of Mr. Kilroy’s (and approximately 57% of our other NEOs’) target TDC was in the form of RSUs. We believe equity compensation helps to align the interests of our NEOs with those of our stockholders. |

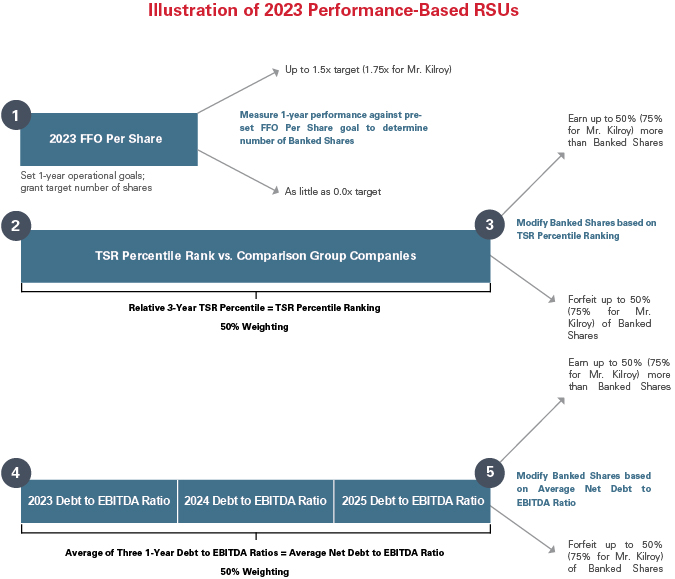

| • | Majority of Long-Term Incentives are Performance-Based. Three-fourths of the 2023 annual equity awards for our NEOs are subject to performance-based vesting requirements. Vesting levels of the 2023 annual equity awards with performance-based vesting requirements were contingent on achievement of a threshold level of FFO per share for 2023. If that goal was achieved, vesting would be determined based on our TSR compared to other office-focused REITs over a three-year period (for 50% of the performance-based awards) and our average ratio of net debt to EBITDA(5) over that period (for the remaining 50% of the performance-based awards). |

We also maintain a range of executive compensation and governance-related policies, which are listed on page 4, that we believe reflect current best practices.

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the related rules of the SEC, our Board requests your advisory Say-on-Pay vote to approve the following resolution at our Annual Meeting:

RESOLVED, that the compensation paid to the Company’s NEOs, as disclosed in this Proxy Statement pursuant to the Securities and Exchange Commission’s executive compensation disclosure rules (which disclosure includes the “Compensation Discussion and Analysis” section, the compensation tables, and the narrative discussion that accompanies the compensation tables), is hereby approved.

This vote is an advisory vote only and will not be binding on the Company, the Board, or the Compensation Committee, and will not be construed as overruling a decision by, or creating or implying any additional fiduciary duty for, the Company, the Board, or the Compensation Committee. However, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values input from the Company’s stockholders, and will consider the outcome of this vote when making future compensation decisions for our NEOs.

The Company’s current policy is to provide our stockholders with an advisory Say-on-Pay vote to approve the compensation of our NEOs each year at the annual meeting of stockholders. Accordingly, it is expected that the next advisory Say-on-Pay vote will be held at the 2025 annual meeting of stockholders.

| (5) | The net debt to EBITDA ratio is calculated as the Company’s consolidated debt balance for the applicable period, divided by the Company’s 2023 EBITDA, for such period. The Company’s 2023 EBITDA reflects our pro rata share of joint ventures and excludes $14.5 million in CEO retirement related costs. Debt is presented net of cash. |

VOTE REQUIRED

The compensation of our NEOs will be approved, on an advisory basis, if a majority of the votes cast at the Annual Meeting are cast in favor of the above proposal.

RECOMMENDATION

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RESOLUTION TO APPROVE, ON AN ADVISORY BASIS, THE COMPENSATION OF THE COMPANY’S NEOs.

| 26 | PROXY STATEMENT | KILROY REALTY |

PROPOSAL 3 –

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITOR

We are seeking stockholder ratification of our appointment of Deloitte & Touche LLP (“Deloitte”), an independent registered public accounting firm, as our independent auditor for the fiscal year ending December 31, 2024. Deloitte has served as our independent auditor since 1995 when the Company was privately held and has continued to serve as such since the Company’s initial public offering in January 1997 and, prior to the Annual Meeting, the Audit Committee is expected to re-appoint Deloitte as our independent auditor for the year ending December 31, 2024. The Audit Committee believes the appointment of Deloitte is in the best interests of the Company and our stockholders.

In considering whether to reappoint Deloitte, the Audit Committee has evaluated Deloitte’s performance and independence. In the course of its review, the Audit Committee considers various factors, including but not limited to: (i) Deloitte’s independence from management, including whether there are any non-audit services provided by Deloitte that are not compatible with Deloitte’s independence; (ii) Deloitte’s qualifications and capabilities, including its experience in the REIT industry; (iii) the experience, qualifications and performance of the existing audit engagement team; (iv) the quality, timeliness and candor of Deloitte’s communications with the Audit Committee and management; (v) the appropriateness of Deloitte’s fees; (vi) Deloitte’s tenure as our independent auditor; (vii) the controls and processes in place that help ensure Deloitte’s continued independence; (viii) any Public Company Accounting Oversight Board’s firm inspection reports; and (ix) the potential impact of appointing a new independent auditor.

The Audit Committee maintains oversight over Deloitte by holding regular executive sessions with Deloitte, performing annual evaluations, and being directly involved in the selection of new lead audit partners pursuant to SEC rules requiring that a new lead audit partner be designated in the normal course every five years to bring a fresh perspective to the audit engagement.

Additional information about Deloitte, including the fees we paid to Deloitte in fiscal years 2023 and 2022, can be found in this Proxy Statement under the caption “Audit and Non-Audit Fees.” The report of the Audit Committee included in this Proxy Statement under the caption “Audit Committee Report” also contains information about the role of Deloitte with respect to the audit of the Company’s annual financial statements.

A representative of Deloitte is expected to be present at our Annual Meeting, be available to respond to appropriate questions, and will have the opportunity to make a statement, if desired.

Stockholder ratification of the appointment of Deloitte as our independent auditor is not required by our Bylaws or otherwise. However, the Board is submitting the appointment of Deloitte to the stockholders for ratification as a matter of good corporate governance. If the stockholders fail to ratify the appointment, the Audit Committee may reconsider whether or not to retain Deloitte. Even if the appointment is ratified, the Audit Committee, in its discretion, may appoint a different independent auditor at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and our stockholders.

VOTE REQUIRED

Ratification of the appointment of Deloitte as our independent auditor will be approved if a majority of the votes cast at the Annual Meeting are cast in favor of the above proposal.

RECOMMENDATION

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE AS OUR INDEPENDENT AUDITOR FOR FISCAL 2024.

| KILROY REALTY | PROXY STATEMENT | 27 |

CORPORATE GOVERNANCE

The Company is committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens accountability of the Board, and helps strengthen public trust in the Company. Highlights include the following:

| Independent Board Leadership and Practices |

| • Lead Independent Director, during any period of time when our Chair is not independent, with a well-defined role and robust responsibilities* |

| • Supermajority of directors are independent (6 of 8 current directors and 7 of 8 director nominees) |

| • Commitment to include women and individuals from minority groups in the qualified pool from which new director candidates are selected |

| • Continued commitment to Board refreshment, with a majority of the Board appointed since 2014 |

| • A range of Independent Director (as defined herein) tenures that provides business cycle and historic knowledge as well as fresh perspectives |

| • Robust director overboarding policy, with a limit of four public company boards for non-employee directors and only one other public company board for the CEO |

| • Dedicated CSR&S Committee responsible for overseeing Company objectives related to sustainability, human capital matters (including diversity and inclusion, health and wellness, and employee engagement), philanthropy and community involvement, good corporate citizenship, and other non-financial objectives that are of significance to the Company and our stockholders |

| • Dedicated Succession Planning Committee that oversees regular succession planning efforts |

| • Comprehensive risk oversight practices, including cybersecurity and insurance |

| • Regular strategic updates from the CEO |

| • Regular executive sessions of Independent Directors |

| • Regular Board and committee self-evaluations |

| Robust Stockholder Rights |

| • Majority voting for directors in uncontested elections |

| • Annual director elections (declassified Board) |

| • Stockholder proxy access aligns with best practices and reflects stockholder feedback |

| • Annual Say-on-Pay voting |

| • Stockholder right to call a special meeting |

| • Stockholder right to amend Bylaws by a majority vote |