0001025835DEF 14Afalse00010258352022-01-012022-12-31iso4217:USDiso4217:USDxbrli:shares00010258352021-01-012021-12-3100010258352020-01-012020-12-310001025835ecd:PeoMemberefsc:StockAwardsAdjustmentsMember2022-01-012022-12-310001025835ecd:PeoMemberefsc:StockAwardsAdjustmentsMember2021-01-012021-12-310001025835ecd:PeoMemberefsc:StockAwardsAdjustmentsMember2020-01-012020-12-310001025835ecd:NonPeoNeoMemberefsc:StockAwardsAdjustmentsMember2022-01-012022-12-310001025835ecd:NonPeoNeoMemberefsc:StockAwardsAdjustmentsMember2021-01-012021-12-310001025835ecd:NonPeoNeoMemberefsc:StockAwardsAdjustmentsMember2020-01-012020-12-310001025835efsc:StockOptionAdjustmentsMemberecd:PeoMember2022-01-012022-12-310001025835efsc:StockOptionAdjustmentsMemberecd:PeoMember2021-01-012021-12-310001025835efsc:StockOptionAdjustmentsMemberecd:PeoMember2020-01-012020-12-310001025835efsc:StockOptionAdjustmentsMemberecd:NonPeoNeoMember2022-01-012022-12-310001025835efsc:StockOptionAdjustmentsMemberecd:NonPeoNeoMember2021-01-012021-12-310001025835efsc:StockOptionAdjustmentsMemberecd:NonPeoNeoMember2020-01-012020-12-310001025835efsc:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-01-012022-12-310001025835efsc:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-01-012021-12-310001025835efsc:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-01-012020-12-310001025835efsc:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310001025835efsc:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310001025835efsc:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310001025835ecd:PeoMemberefsc:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001025835ecd:PeoMemberefsc:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001025835ecd:PeoMemberefsc:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsGrantedInPriorYearsUnvestedMember2022-01-012022-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsGrantedInPriorYearsUnvestedMember2021-01-012021-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsGrantedInPriorYearsUnvestedMember2020-01-012020-12-310001025835ecd:PeoMemberefsc:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001025835ecd:PeoMemberefsc:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001025835ecd:PeoMemberefsc:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsGrantedInPriorYearsVestedMember2022-01-012022-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsGrantedInPriorYearsVestedMember2021-01-012021-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsGrantedInPriorYearsVestedMember2020-01-012020-12-310001025835ecd:PeoMemberefsc:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001025835ecd:PeoMemberefsc:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001025835ecd:PeoMemberefsc:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsThatFailedToMeetVestingConditionsMember2022-01-012022-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsThatFailedToMeetVestingConditionsMember2021-01-012021-12-310001025835ecd:NonPeoNeoMemberefsc:EquityAwardsThatFailedToMeetVestingConditionsMember2020-01-012020-12-31000102583512022-01-012022-12-31000102583522022-01-012022-12-31000102583532022-01-012022-12-31000102583542022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | |

| Filed by the Registrant | [X] |

| Filed by a Party other than the Registrant | [ ] |

| | | | | |

| Check the appropriate box: |

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material under §240.14a-12 |

| | | | | |

| | ENTERPRISE FINANCIAL SERVICES CORP |

| | (Name of Registrant as Specified In Its Charter) |

| | |

| | (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): | |

| [X] | No fee required. | |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ENTERPRISE FINANCIAL SERVICES CORP

150 NORTH MERAMEC AVE

CLAYTON, MISSOURI 63105

NOTICE OF 2023 ANNUAL MEETING OF SHAREHOLDERS The Annual Meeting of Shareholders of Enterprise Financial Services Corp (“2023 Annual Meeting”) will be held on Wednesday, May 10, 2023, at 5:00 p.m. Central Time. The 2023 Annual Meeting will be held virtually. You will not be able to attend the 2023 Annual Meeting physically in-person. To participate in the meeting, visit https://www.virtualshareholdermeeting.com/EFSC2023. Shareholders will be able to attend, submit questions and vote their shares electronically during the 2023 Annual Meeting by logging in with the 16-digit control number included on their proxy card, voting instruction form or notice of internet availability. The 2023 Annual Meeting will begin promptly at 5:00 p.m., Central Time. We encourage you to access the 2023 Annual Meeting prior to the start time. The virtual 2023 Annual Meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones). The platform includes functionality that affords shareholders the same meeting participation rights and opportunities they would have at an in-person meeting. Participants should allow ample time to log in and ensure that they can hear streaming audio prior to the start of the 2023 Annual Meeting.

The 2023 Annual Meeting is for the following purposes:

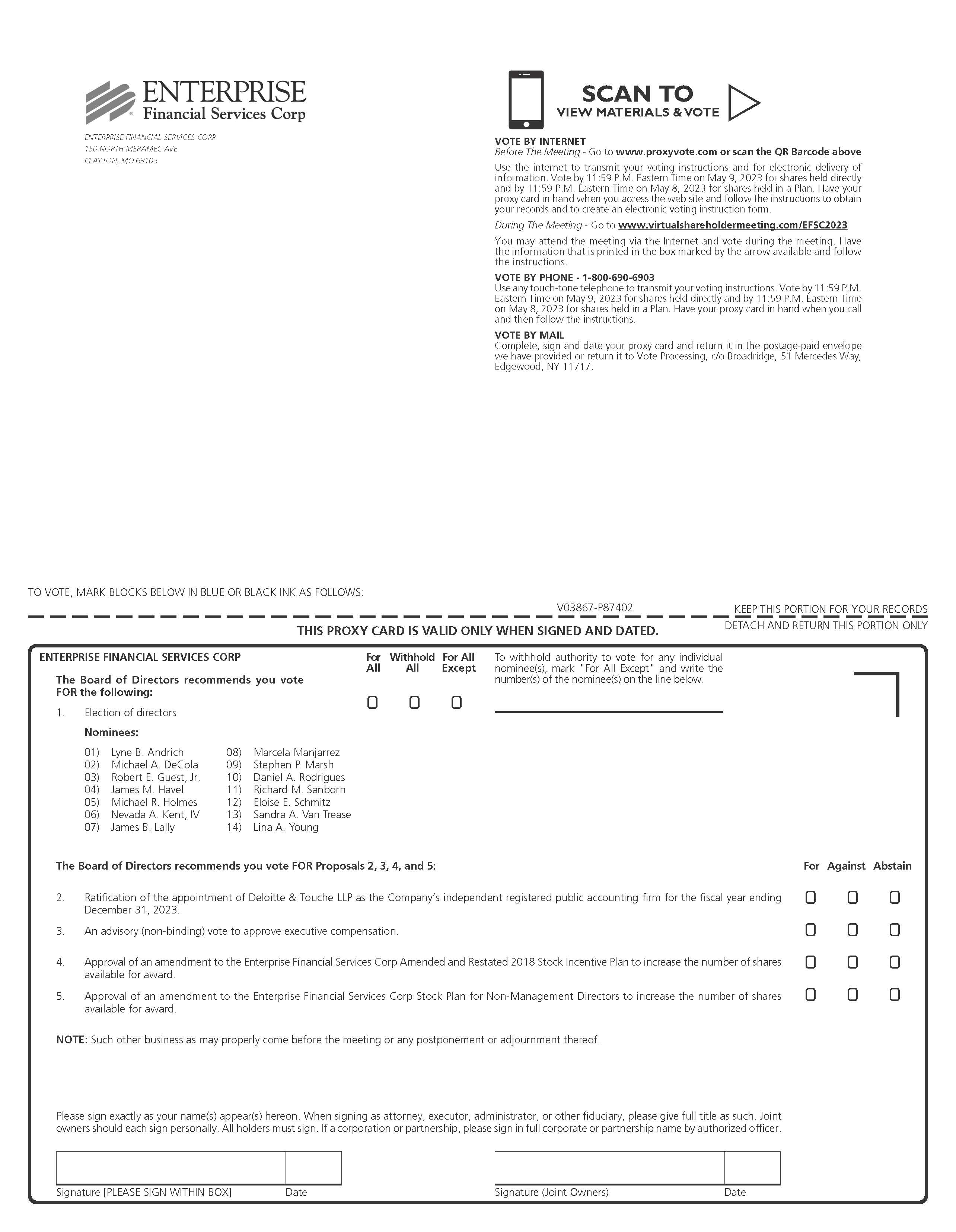

1.To elect as directors the 14 nominees to hold office until the next annual meeting of shareholders or until their successors are elected and have qualified.

2. To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.

3. To approve executive compensation in an advisory vote (non-binding).

4. To approve an amendment to the Enterprise Financial Services Corp Amended and Restated 2018 Stock Incentive Plan increasing the number of shares available for award.

5. To approve an amendment to the Enterprise Financial Services Corp Stock Plan for Non-Management Directors increasing the number of shares available for award.

The Board of Directors has fixed the close of business on March 16, 2023 as the record date for the determination of shareholders entitled to notice of and to vote at the meeting.

It is important that your shares be represented and voted at the meeting. You have four options for voting your shares:

1. vote via the internet,

2. vote via the telephone,

3. complete and return the proxy card sent to you, or

4. vote electronically during the virtual meeting.

For internet or telephone voting, instructions are printed on the proxy card sent to you. You can revoke a proxy at any time prior to its exercise at the 2023 Annual Meeting by following the instructions in the accompanying proxy statement, (“Proxy Statement”).

By Order of the Board of Directors,

Nicole M. Iannacone, Corporate Secretary

Clayton, Missouri,

March 29, 2023

Important Notice Regarding the Availability of Proxy Materials for the 2023 Annual Meeting of Shareholders to be held on Wednesday, May 10, 2023:

This Proxy Statement and our 2022 Annual Report on Form 10-K are available at www.proxyvote.com.

TABLE OF CONTENTS | | | | | |

| Page |

| PROXY STATEMENT | |

| QUESTIONS ABOUT THE MEETING AND THESE PROXY MATERIALS | |

| | |

| PROPOSAL 1. ELECTION OF DIRECTORS | |

| | |

| BOARD AND COMMITTEE INFORMATION | |

| DIVERSITY | |

| DIRECTOR COMPENSATION | |

| EXECUTIVE COMMITTEE | |

| AUDIT COMMITTEE | |

| NOMINATING AND GOVERNANCE COMMITTEE | |

| COMPENSATION COMMITTEE | |

| RISK COMMITTEE | |

| CORPORATE CODE OF ETHICS | |

| ENVIRONMENTAL, SOCIAL AND GOVERNANCE | |

| |

| EXECUTIVE OFFICERS | |

| EXECUTIVE OFFICERS OF THE REGISTRANT | |

| | |

| EXECUTIVE COMPENSATION | |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| COMPENSATION COMMITTEE REPORT | |

| EXECUTIVE EMPLOYMENT AGREEMENTS | |

| SUMMARY COMPENSATION TABLE | |

| ALL OTHER COMPENSATION – SUPPLEMENTAL TABLE | |

| PAY VERSUS PERFORMANCE | |

| GRANTS OF PLAN-BASED AWARDS | |

| OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END | |

| OPTION EXERCISES AND STOCK VESTED | |

| NONQUALIFIED DEFERRED COMPENSATION | |

| POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL | |

| CHIEF EXECUTIVE OFFICER PAY RATIO | |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | |

| | |

| PROPOSAL 2. RATIFICATION OF APPOINTMENT OF DELOITTE & TOUCHE LLP | |

| PROPOSAL 3. ADVISORY (NON-BINDING) APPROVAL OF EXECUTIVE COMPENSATION | |

| PROPOSAL 4. APPROVAL TO AMEND THE ENTERPRISE FINANCIAL SERVICES CORP AMENDED AND RESTATED 2018 STOCK INCENTIVE PLAN TO INCREASE THE NUMBER OF AUTHORIZED SHARES FOR AWARD | |

| PROPOSAL 5. APPROVAL TO AMEND THE ENTERPRISE FINANCIAL SERVICES CORP STOCK PLAN FOR NON-MANAGEMENT DIRECTORS TO INCREASE THE NUMBER OF AUTHORIZED SHARES FOR AWARD | |

| INFORMATION REGARDING BENEFICIAL OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| RELATED PERSON TRANSACTIONS | |

| DELINQUENT SECTION 16(a) REPORTS | |

| AUDIT COMMITTEE REPORT | |

| FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| PROPOSALS OF SHAREHOLDERS | |

| OTHER MATTERS | |

| HOUSEHOLDING | |

| ADDITIONAL INFORMATION | |

APPENDIX A – AMENDMENT TO THE ENTERPRISE FINANCIAL SERVICES CORP AMENDED AND RESTATED 2018 STOCK INCENTIVE PLAN | |

APPENDIX B – AMENDMENT TO THE ENTERPRISE FINANCIAL SERVICES CORP STOCK PLAN FOR NON-MANAGEMENT DIRECTORS | |

APPENDIX C – USE OF NON-GAAP FINANCIAL MEASURES | |

ENTERPRISE FINANCIAL SERVICES CORP

150 NORTH MERAMEC AVE

CLAYTON, MISSOURI 63105

PROXY STATEMENT

These proxy materials are delivered by the Board of Directors (the “Board”) of Enterprise Financial Services Corp (the “Company” or “EFSC”), in connection with the solicitation of proxies to be voted at the 2023 Annual Meeting of Shareholders or any adjournment or postponement thereof. The meeting will be held virtually over the internet on Wednesday, May 10, 2023 at 5:00 p.m. Central Time.

This Proxy Statement and the proxy card were first provided to shareholders on or about March 29, 2023.

QUESTIONS ABOUT THE MEETING AND THESE PROXY MATERIALS

What may I vote on and how does the Board recommend that I vote?

| | | | | | | | |

| Proposal | | Board Voting Recommendation |

1.The election of 14 directors to hold office until the next annual meeting of shareholders or until their successors are elected and have qualified. | | FOR all nominees |

2.The ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | | FOR |

3.An advisory (non-binding) vote to approve executive compensation. | | FOR |

4.The approval of an amendment to the Enterprise Financial Services Corp Amended and Restated 2018 Stock Incentive Plan to increase the number of shares available for award. | | FOR |

5.The approval of an amendment to the Enterprise Financial Services Corp Stock Plan for Non-Management Directors to increase the number of shares available for award. | | FOR |

Who can vote at the meeting? The Board has set March 16, 2023 as the record date (the “Record Date”) for the 2023 Annual Meeting. All shareholders who owned our common stock at the close of business on the Record Date may vote at the 2023 Annual Meeting. On the Record Date, there were 37,310,491 shares of common stock outstanding. Shares held as of the Record Date include shares that are held directly in your name as the shareholder of record and those shares held for you as a beneficial owner through a stockbroker, bank or other nominee.

How do I vote my shares? If your shares are registered directly in your name with our stock transfer agent, Computershare, you are considered a shareholder of record and the beneficial owner of those shares. As a shareholder of record, you have the right to grant your voting proxy directly to the Company, or to vote electronically at the meeting. You may submit your proxy by mail, over the internet at www.proxyvote.com, or via the telephone at 1-800-690-6903.

If your shares are held in a stock brokerage account or by a bank, you are still considered the beneficial owner of those shares, but your shares are said to be held in “street name.” Generally, only shareholders of record may vote electronically at the meeting. If your shares are held in “street name,” you will receive a form from your broker or bank seeking instruction as to how your shares should be voted. Many of our shareholders who hold their shares in “street name” through a nominee have the option to submit their proxies or voting instructions to their nominee electronically by telephone or the internet. These shareholders should review and follow the voting instructions provided by their nominee, including any instructions related to revoking your voting instructions. You are also invited to attend the virtual 2023 Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares electronically at the virtual 2023 Annual Meeting unless you obtain a legal proxy from your broker or bank.

Internet availability of proxy solicitation and other 2023 Annual Meeting materials. We are furnishing proxy materials to some of our shareholders via the internet by mailing a Notice of Internet Availability of Proxy Materials, instead of mailing

printed copies of those materials. The Notice of Internet Availability of Proxy Materials instructs shareholders that our proxy statement, annual report to shareholders, electronic proxy card and related materials are available for viewing, free of charge, on the internet. Shareholders may then access these materials and vote over the internet or request delivery of a full set of materials by mail or email. These rules help us lower the cost of conducting our 2023 Annual Meeting by reducing costs associated with printing and postage.

We mailed the required Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders on or about March 29, 2023. The proxy materials will be posted on the internet, at www.proxyvote.com, no later than the day we begin mailing the Notice and through the conclusion of the 2023 Annual Meeting. If you receive the Notice, you will not receive a paper or email copy of the proxy materials unless you request one in the manner set forth in the Notice. The Notice will also include instructions on how to access and review the proxy materials online, how to vote your shares over the internet, and how to get a paper or email copy of the proxy materials, if that is your preference.

Can I change my vote? Yes. If you are the shareholder of record, you may revoke your proxy at any time before the 2023 Annual Meeting of shareholders by:

•entering a new vote by internet or telephone;

•returning a later-dated proxy card;

•sending written notice of revocation to the Corporate Secretary of the Company; or

•attending the virtual 2023 Annual Meeting and voting electronically.

To change your vote for shares you hold in street name, you will need to follow the instructions provided by your broker or bank.

How are shares of common stock voted at the meeting? Each holder of common stock is entitled to one vote for each share of common stock held with respect to each matter to be voted upon.

All shares of common stock represented at the 2023 Annual Meeting by properly executed proxies received prior to or at the 2023 Annual Meeting which are not properly revoked will be voted at the 2023 Annual Meeting in accordance with the instructions indicated on the proxies. If no contrary instructions are indicated, proxies will be voted FOR the election of the Board’s director nominees in Proposal 1, and FOR Proposals 2, 3, 4 and 5.

How many votes are required to elect each director? A plurality of votes cast at the 2023 Annual Meeting is required for the election of each director, which effectively means that the 14 persons receiving the most votes will be elected as directors. If you indicate “withhold authority to vote” for a particular nominee on your proxy card, your shares will not be voted with respect to those nominees indicated; however, your shares will be counted for purposes of determining whether there is a quorum. There is no cumulative voting for our directors. While directors are elected by a plurality of votes cast, our Board has adopted a majority voting policy for directors. This policy states that in an uncontested election, any nominee who receives a greater number of votes “withheld” from his or her election than votes “for” such election is required to submit his or her resignation to the Board. The Nominating and Governance Committee of the Board is required to make recommendations to the Board with respect to any such tendered resignation. The Board will act on the tendered resignation within 90 days from the certification of the vote and will publicly disclose its decision, including its rationale. Only votes “for” or “withheld” are counted in determining whether a majority has been cast in favor of a nominee. If you cast a “withheld” vote, your vote will have a similar effect as a vote against that director nominee under our majority voting policy for directors. If a nominee fails to receive a majority of the votes cast and the Board accepts the director’s resignation, there would be a vacancy created on the Board. Our Board would then have the option under our By-Laws either to appoint someone to fill the vacancy or to reduce the size of the Board.

How many votes are required to adopt the other proposals?

Each outstanding share of our common stock as of the Record Date is entitled to one vote on each proposal at the 2023 Annual Meeting.

If there is a quorum at the 2023 Annual Meeting, the matters, other than the election of directors, to be voted upon by the shareholders require the following votes for such matter to be approved:

•Proposal 2. Ratification of the Company’s Independent Registered Public Accounting Firm. The affirmative vote of holders of the majority of the shares for which votes are cast at the 2023 Annual Meeting is required for the ratification of the appointment of Deloitte & Touche LLP as the independent registered public accounting firm for the

year ending December 31, 2023. Abstentions will not be counted as votes cast and, therefore, will not affect the outcome.

•Proposal 3. Advisory (non-binding) Vote on Approval of Executive Compensation. The affirmative vote of holders of the majority of the shares for which votes are cast at the 2023 Annual Meeting is required to approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers. Abstentions and broker “non-votes” will not be counted as votes cast and, therefore, will not affect the outcome.

•Proposal 4. Approval of an amendment to the Enterprise Financial Services Corp Amended and Restated 2018 Stock Incentive Plan to increase the number of shares available for award. The affirmative vote of holders of the majority of the shares for which votes are cast at the 2023 Annual Meeting is required to approve the amendment to the Enterprise Financial Services Corp Amended and Restated 2018 Stock Incentive Plan, to, among other things, provide for the addition of 700,000 shares to cover awards under the Amended and Restated 2018 Stock Incentive Plan. Abstentions and broker “non-votes” will not be counted as votes cast and, therefore, will not affect the outcome.

•Proposal 5. Approval of an amendment to the Enterprise Financial Services Corp Stock Plan for Non-Management Directors to increase the number of shares available for award. The affirmative vote of holders of the majority of the shares for which votes are cast at the 2023 Annual Meeting is required to approve the amendment to the Non-Management Director Plan, as amended, to, among other things, provide for the addition of 100,000 shares to cover awards under the Enterprise Financial Services Corp Stock Plan for Non-Management Directors. Abstentions and broker “non-votes” will not be counted as votes cast and, therefore, will not affect the outcome.

If a broker indicates on its proxy that it submits to the Company that it does not have authority to vote certain shares held in “street name,” the shares not voted are referred to as “broker non-votes.” Broker non-votes occur when brokers do not have discretionary voting authority to vote certain shares held in “street name” on particular proposals under the rules of the New York Stock Exchange, and the “beneficial owner” of those shares has not instructed the broker how to vote on those proposals. If you are a beneficial owner and you do not provide instructions to your broker, bank or other nominee, your broker, bank or other nominee is permitted to vote your shares for or against “routine” matters such as Proposal 2, the ratification of the appointment of our independent registered public accounting firm. Brokers are not permitted to exercise discretionary voting authority to vote your shares for or against “non-routine” matters. Of the proposals on which shareholders will be asked to vote on at the 2023 Annual Meeting, Proposal 2, the ratification of the appointment of our independent registered public accounting firm, is a “routine” matter, while Proposal 1, the election of directors; Proposal 3, the advisory vote on approval of executive compensation; Proposal 4, the approval of an amendment to the Enterprise Financial Services Corp Amended and Restated 2018 Stock Incentive Plan; and Proposal 5, the approval of an amendment to the Enterprise Financial Services Corp Stock Plan for Non-Management Directors, are “non-routine” matters.

How do I vote if my shares are held in a benefit plan? If you are a current or former employee of the Company or one of its subsidiaries and you have any portion of your investment funds allocated to the EFSC Common Stock Fund in the EFSC Incentive Savings Plan (“Savings Plan”), you may instruct the Savings Plan’s trustees how to vote the shares of common stock allocated to your account under the Savings Plan. You will instruct the voting of your shares in the same manner as other shareholders, i.e., by submitting your voting instructions by telephone or through the internet or by requesting a proxy card to sign and return. Please see the Notice we sent to you or this Proxy Statement for specific instructions on how to provide voting instructions by any of these methods. Please note that your voting instructions for shares held in the Savings Plan must be returned by 11:59 p.m. Eastern Time on May 8, 2023.

What if I don’t give specific voting instructions or abstain?

If you indicate a choice on your proxy on a particular matter to be acted upon, the shares will be voted as indicated.

If you are a shareholder of record and you return a signed proxy card but do not indicate how you wish to vote, the shares will be voted FOR the director nominees in Proposal 1, and FOR Proposals 2, 3, 4 and 5. If you do not return the proxy card, your shares will not be voted and will not be deemed present for the purpose of determining whether a quorum exists.

Under the rules of the New York Stock Exchange, which regulates stock brokers, Proposal 2, the ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm, is considered a routine matter, and your brokerage firm or other nominee will be entitled to vote your shares in their discretion on this proposal even if you do not provide voting instructions to your broker or other nominee. However, Proposals 1, 3, 4, and 5 are not considered routine matters, and brokers will not be permitted to vote on these matters if beneficial owners fail to provide voting instructions. The uninstructed shares that cannot be voted by brokers on non-routine matters are commonly referred to as “broker non-votes.”

Abstentions and broker “non-votes” (assuming a quorum is present) will have no effect on Proposals 2, 3, 4 and 5. Votes withheld and broker “non-votes” with respect to the election of any nominee for director will not be considered in determining

whether such nominee has received the affirmative vote of a plurality of the votes cast; however, such votes will be considered to have a similar effect as a vote against those director nominees under our majority voting policy.

How can I attend the 2023 Annual Meeting? The 2023 Annual Meeting will be held virtually over the internet. You will be able to participate in the virtual 2023 Annual Meeting and vote your shares electronically by visiting https://www.virtualshareholdermeeting.com/EFSC2023 and entering your sixteen-digit control number located on your proxy card. The virtual 2023 Annual Meeting will begin promptly at 5:00 p.m. Central Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 4:45 p.m. Central Time, and you should allow ample time for logging in. You will have the same rights and opportunities that you would be afforded by an in-person meeting. Registered shareholders who login with their control number will be afforded an opportunity to vote their shares during the meeting and comment on proposals during the meeting. Representatives of the Company will be available to respond to relevant comments and questions.

What if I cannot locate my control number? You must have your control number to vote your shares. The sixteen-digit control number is located on your proxy card. If you are unable to locate your control number or proxy card, please note the following:

•If you shares are held in “street name” (i.e. your shares are held in a stock brokerage account or by a bank), you will need to contact your broker or financial institution directly and ask for their proxy department to obtain the necessary information.

•If you are a registered shareholder (i.e. the shares are registered in your name with our stock transfer agent), please send an email to the Company’s Investor Relations department, investorrelations@enterprisebank.com, and provide information regarding the name of the person holding the shares and the amount of shares owned.

Who pays for this proxy solicitation? The Company will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to solicitation by mail, proxies may be solicited in person or by telephone or by other means by the Company’s directors, officers or employees, who will not receive any additional compensation for solicitation activities. The Company has engaged Broadridge Financial Solutions, Inc., for a fee to be determined, to assist in the distribution and tabulation of proxies. The Company will also reimburse brokerage firms and other nominees, custodians and fiduciaries for costs incurred by mailing proxy materials to the beneficial owners of common stock as of the Record Date.

The date of this Proxy Statement is March 29, 2023.

PROPOSAL 1. ELECTION OF DIRECTORS

The Board, upon recommendation of its Nominating and Governance Committee, has nominated for election the 14 persons named below, each to hold office until the next annual meeting of shareholders or until their successors are elected and have qualified. It is intended that proxies solicited will be voted for such nominees. There is no cumulative voting for our directors. The Board believes that each nominee named below will be able to serve, but should any nominee be unable to serve as a director, the persons named in the proxies have advised that they will vote for the election of such substitute nominee as the Board may propose.

Under our mandatory retirement policy, a director is generally required to retire at the next annual meeting of shareholders after the later of: reaching age 72 or the fourth anniversary of the director’s initial election to the Board, and may not stand for election or re-election thereafter. However, a director need not retire and may stand for re-election if the Board, by unanimous vote, approves a waiver for such director, provided that any such waiver must be renewed annually and no waiver will be made or renewed for any director after reaching the age of 75.

The following biographical information is furnished with respect to each member of the Board, whom also serve as directors and officers (with respect to James B. Lally) of one or more of the Company’s subsidiaries, including Enterprise Bank & Trust (the “Bank” or “EB&T”). In connection with election of the Board nominees to the Company's Board, these nominees will also be elected to the board of directors of the Bank.

There are no family relationships between or among any directors or executive officers, or nominees thereof, of the Company. Except as noted in the director biographies below, none of the Company’s directors or executive officers serves as a director of (i) any company other than EFSC that has a class of securities registered under or that is subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or (ii) any investment company registered under the Investment Company Act of 1940, as amended. Other than Mr. Lally, all of our director nominees have been determined to be independent as defined in Nasdaq Rule 5605(a)(2). In some cases, the relationships that we analyzed include relationships that a director has as a partner, member, shareholder, officer or employee of an organization that has a relationship with the Company. They may also include relationships where a family member of a director is a partner, member, shareholder or officer of an organization that is a competitor of, or has a relationship with, the Company.

| | | | | | | | | | | | | | |

| Name of Nominee | | Age | | Director Since |

| Lyne B. Andrich | | 56 | | 2022 |

| Michael A. DeCola | | 69 | | 2007 |

| | | | |

| Robert E. Guest, Jr. | | 68 | | 2002 |

| James M. Havel | | 68 | | 2014 |

| Michael R. Holmes | | 64 | | 2015 |

| | | | |

| Nevada A. Kent, IV | | 67 | | 2017 |

| James B. Lally | | 55 | | 2017 |

| Marcela Manjarrez | | 49 | | 2022 |

| Stephen P. Marsh | | 67 | | 2022 |

| Daniel A. Rodrigues | | 67 | | 2022 |

| Richard M. Sanborn | | 60 | | 2020 |

| Eloise E. Schmitz | | 58 | | 2017 |

| Sandra A. Van Trease | | 62 | | 2005 |

| Lina A. Young | | 58 | | 2022 |

The biographies of the director nominees below contain information regarding the person’s service as a director, business experience, director positions held currently or at any time during the last five years, information regarding involvement in certain legal or administrative proceedings, if applicable, and the experience, qualifications, attributes or skills that caused the Nominating and Governance Committee and the Board to determine that the person should serve as a director.

Lyne B. Andrich served as Executive Vice President and Chief Financial Officer of CoBiz Financial Inc. (Nasdaq: COBZ) from May 2003 to January 2019, Chief Operating Officer from December 2017 to January 2019 and Controller from May 1997 to May 2003. Ms. Andrich has served on the Board of Directors and as a member of the Audit Committee of Fortis Financial Inc. (a privately held company) since May 2019 and been the Chairperson since May 2020. She has previously served as a member of the Board of Governors for the Denver Zoological Foundation from June 2009 to December 2022 and served as its Chair of the Audit and Finance Committee. Ms. Andrich previously served on the Board of Directors and as a member of the Audit Committee of Whiting Petroleum, Inc. (NYSE: WLL) from September 2019 to August 2020, and served as an advisory board member for the Federal Reserve Bank of Kansas City’s Community Depository Institutions Advisory Council from 2016 through 2018. She brings to the Board extensive banking, financial, auditing, and public company experience.

Michael A. DeCola served as Vice Chairman of HBM Holdings Company (“HBM”) from February 2019 through December 2019. Mr. DeCola was the Chief Executive Officer of HBM from January 2014 to February 2019 (President and Chief Executive Officer from January 2014 through September 2018). Mr. DeCola served as Chairperson of the Board of Mississippi Lime Company, a portfolio company of HBM from January 2014 through December 2019. Mr. DeCola was previously the Chairperson of the St. Louis Regional Business Council and is the former Chairperson of the United Way of Greater St. Louis and a member of the Executive Committee. Mr. DeCola serves on the advisory board of several private, family-owned businesses. He brings to the Board extensive executive management experience and connections within the St. Louis business community.

Robert E. Guest, Jr. has been a partner at the Affinity Law Group since 2007. Mr. Guest brings significant legal experience in commercial activities and in merger and acquisitions. Mr. Guest has over forty years of legal experience and practices in the areas of business growth, mergers and acquisitions, mezzanine debt and capital market financing. Mr. Guest serves on the Board of Directors of the St. Louis Aquarium Foundation and advises private and family-owned businesses on properly installing advisory or fiduciary boards. Bob received his Bachelor of Science degree in accounting from Missouri State University and his Juris Doctor from the University of Missouri at Columbia School of Law. Mr. Guest brings significant experience in legal risk management and strategic business planning to the Board.

James M. Havel has served as the Executive Vice Present and Chief Financial Officer at Clayco since March 2019. Previously, he served as Executive Vice President and Chief Financial Officer of Express Scripts Holding Company (Nasdaq: ESRX) from October 2017 through January 2019. Mr. Havel currently serves on the board of directors of Carestream Dental. From April 2016 through November 2016, Mr. Havel served as Chief Operating Officer of Vatterott Education Centers, a privately-held post-secondary trade school. From January 2015 through March 2016, Mr. Havel served as a financial executive with Express Scripts Holding Company. From April 2011 through December 2014, Mr. Havel served as the Chief Financial Officer of Major Brands Holdings. Prior to July 2010, Mr. Havel was a partner with Ernst & Young LLP. Mr. Havel has also previously advised public and private companies on acquisitions and strategic planning in connection with independent consulting work. Mr. Havel brings extensive financial experience in both public and private company environments to the Board as well as a public accounting background that provides him with insight into the broad range of businesses and industries the Company serves.

Michael R. Holmes has served as Chairperson Emeritus of the Board for Rx Outreach, Inc., since May 2020, having previously served as Chairperson of the Board of Rx Outreach, Inc. since February 2016. Rx Outreach, Inc. is a non-profit pharmacy that dispenses more than 30,000 months of medicine each week to low income individuals across the United States. Previously, he served as President of Rx Outreach, Inc. from October 2010 through January 2016. Prior to that, he served as Executive Vice President of Express Scripts from December 2005 through October 2010, responsible for Corporate Strategy, Research and Clinical Services, Human Resources, Corporate Real Estate, Security, Procurement, and all of its domestic subsidiary businesses. Mr. Holmes has broad public company senior management experience as well as consumer, financial and investment expertise. Mr. Holmes also brings to the Board a valuable perspective on community engagement and underserved markets.

Nevada A. Kent, IV served as an Adjunct Professor of Accounting at Washington University from August 2012 to May 2020. Previously, Mr. Kent worked with Pricewaterhouse Coopers, LLP as Market Managing Partner from July 2004 through June 2012, and Partner from August 1977 through June 2004, performing audit engagements, merger and acquisition engagements, litigation support, and security offerings. Mr. Kent also serves on a number of non-public boards and has over 35 years of auditing experience, including involvement in supervisor roles. He brings his extensive finance and accounting insight to the Board.

James B. Lally joined the Company in 2003 as senior vice president and was named president of the Bank’s Clayton unit in 2008. In 2011, he was appointed President of the St. Louis region and three years later assumed responsibility for commercial banking in all regions. In May 2016, Mr. Lally was named Executive Vice President of EFSC, with responsibility for the Company’s wealth management, private banking and mortgage businesses, as well as its community development entity. Mr.

Lally was named President of EFSC in August 2016 and subsequently became EFSC CEO in May 2017. Prior to EFSC, Mr. Lally served in various commercial banking roles for US Bank and Commerce Bank in St. Louis. Mr. Lally has over 30 years of public banking experience. Mr. Lally brings to the Board his deep knowledge of the financial services industry, the Company and its business.

Marcela Manjarrez has served as Chief Executive Officer of M Strategic Communications Consulting since September 2022. Previously, Ms. Manjarrez served as Executive Vice President, Chief Communications Officer of Centene Corporation (NYSE: CNC) from March 2015 to May 2022. From June 2014 to March 2015, Ms. Manjarrez served as Vice President, Public Affairs for the Federal Reserve Bank of St. Louis. Ms. Manjarrez currently serves on the Board of Directors of Clayco as well as a number of charitable organizations, including Opera Theatre of St. Louis, National Alliance for Hispanic Health and Counterpublic. Additionally, Ms. Manjarrez serves as an advisory board member for Washington University in St. Louis’ Center for Finance and Accounting Research. Ms. Manjarrez brings to the Board her extensive experience in communications.

Stephen P. Marsh served as Chairperson of the Company’s bank subsidiary, Enterprise Bank & Trust (“EB&T”), from 2008 to 2022 and as a member of EB&T’s Board of Directors since 2008. Mr. Marsh previously served as the Executive Vice President, Chairman and Chief Executive Officer of EB&T from 2008 until 2014; and Executive Vice President, Chairman and Chief Credit Officer from 2014 until his retirement in April 2016. Mr. Marsh also served as the President of EB&T from 2006 to 2008 and President of Commercial Banking at EB&T from 2003 to 2006. Prior to joining EB&T, Mr. Marsh served as president and senior loan officer of Southwest Bank from 1992 to 2003. Mr. Marsh serves on the board of directors and Finance Committee of Loyola Academy and previously served on the board of St. Joseph’s Institute for the Deaf, Unity Health Services and the University City Planning Commission. Mr. Marsh brings to the Board his deep level of understanding of the financial services industry combined with his risk management experience in the areas of credit management and regulatory compliance.

Daniel A. Rodrigues has served as executive partner at Hidden Creek Equity since February 2019. Mr. Rodrigues has also served as a member of EB&T’s Board of Directors since May 2016. Previously, Mr. Rodrigues served as the vice president and general manager of KLX Aerospace Solutions from May 2016 to April 2017. Mr. Rodrigues also previously served as chief operating officer for Herndon Products, Inc. from January 2008 to May 2016. Mr. Rodrigues also serves as executive Chairperson at JGB Enterprises, Inc. and serves on the Dean’s Advisory Board of Parks College. Mr. Rodrigues brings to the Board his extensive experience in operations and technology as well of his deep knowledge of EB&T.

Richard M. Sanborn served as a Director, President, and Chief Executive Officer of Seacoast Commerce Banc Holdings (“Seacoast”) (OTC: SCBH) and Seacoast Commerce Bank from October 2007 until it was acquired by the Company in November 2020. Mr. Sanborn previously served on the board of the Federal Reserve Bank of San Francisco, is the past Chair of the Federal Reserve Banks Community Depository Institution Advisory Council, a past Chair of the California Bankers Association, a past member of the American Bankers Association Government Relations Council, a past member of the Independent Community Bankers Association Lending Advisory Committee, and is a current member of the National Association of Corporate Directors. Mr. Sanborn has a B.S. in Accounting from Bentley University and a M.B.A. from California Pacific University. He brings deep knowledge of the banking industry and prior management and leadership experience of another financial institution to the Board.

Eloise E. Schmitz has been the chief executive officer and co-founder since 2013 of LoanNEX in St. Louis, Missouri, a residential mortgage SaaS platform serving mortgage originators and investors. She is also owner and partner of Adreon Investments, an investment partnership in independent restaurants in the St. Louis area. Previously, Ms. Schmitz was executive vice president and chief financial officer of Charter Communications, Inc. (Nasdaq: CHTR). She also has extensive corporate banking experience, having served at the former Mercantile Bank in St. Louis (now US Bank) and the former First Union National Bank in Charlotte, NC (now Wells Fargo). Ms. Schmitz has previously served on several non-public boards including the Board of Trustees for Villa Duchesne Oak Hill in St. Louis, the Advisory Board to Palace Capital Management, LLC, the H. Sophie Newcomb College Institute Director Advisory Council, and the Advisory Board of Women in Cable Television. Ms. Schmitz is a graduate of Tulane University. Ms. Schmitz brings her extensive experience in corporate banking and financial analysis to the Board.

Sandra A. Van Trease served as the Group President of BJC HealthCare, the largest healthcare institution in the St. Louis area, from 2004 through July 2020. Ms. Van Trease was President and Chief Executive Officer at UNICARE, an operating unit of Well Point Inc., a health insurance company, from 2002 through 2004. As an executive of RightChoice (NYSE: RIT) a health insurance company, from 1994 to 2002, she served as its President, Chief Financial Officer and Chief Operating Officer from 2000 through 2002. Ms. Van Trease previously served on the board of directors of Peabody Energy (NYSE: BTU) where she also served as a Chair of their Audit Committee and Chair of the Health, Safety, Security and Environmental Committee. Ms. Van Trease serves as a director of QuikTrip Corporation (a privately held company) and a member of their Audit

Committee since June 2022, a director of Drury Development Corporation (a privately held company) and a member of their Audit Committee as well as a director for the University of Health Sciences and Pharmacy (formerly known as the St. Louis College of Pharmacy), and previously served as a director for Vizient Mid-America and the National Association of ACO’s, in addition to several community organizations. Ms. Van Trease has a MBA and is a non-practicing Certified Public Accountant and Certified Management Accountant. Ms. Van Trease brings her executive management experience and knowledge of publicly-traded company boards as well as strong community service experience to the Board.

Lina A. Young served as Senior Vice President, Chief Information Officer of Peabody Energy (NYSE: BTU) from July 2010 to August 2021. Ms. Young served on a number of non-profit boards, including the Regional Board of Npower, which creates pathways to economic prosperity by launching digital careers for military veterans and young adults from underserved communities, from 2015 through 2019. Ms. Young has served on the Board of ABC to CEO, a non-profit organization preparing the next generation of young women for CEO, since February 2023. Ms. Young holds a Bachelor’s degree in Computer Science from Tulane School of Engineering, a Master’s degree in Information Management and a Master’s degree in Telecommunications from Washington University School of Engineering and Applied Science. Ms. Young brings to the Board deep experience in information technology and knowledge of cyber security risks.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR EACH OF THE

NOMINEES LISTED ABOVE FOR ELECTION AS DIRECTORS OF THE COMPANY.

Directors Who are Not Standing for Re-election at the Annual Meeting

John S. Eulich was the Chairperson and CEO of Aspeq Holdings, Inc. (d/b/a INDEECO), a manufacturing company, from 2005 through 2015. Mr. Eulich was a director of LMI Aerospace, Inc. (“LMIA”) (Nasdaq: LMIA) from 2005 until the company was sold in 2017. He served as Chairperson of the Corporate Governance and Nominating Committee, and was a member of LMIA’s Audit Committee and Compensation Committee. As announced on February 16, 2023, Mr. Eulich is retiring from the Board pursuant to the Company’s retirement policy and will not stand for re-election at the 2023 Annual Meeting.

Peter H. Hui was a founding member and served as the Chairman of the board of First Choice Bank from August 2005 until July 2021, and served as the Chairman of the board of First Choice Bancorp (Nasdaq: FCBP), the holding company of First Choice Bank, following its organization in 2017 until July 2021. In July 2021, First Choice Bancorp was acquired by the Company; following which, Mr. Hui joined the Board as a director. Mr. Hui is the President of Hospitality Unlimited Investment, a company he founded in 1986. As announced on January 26, 2023, Mr. Hui will not stand for re-election at the 2023 Annual Meeting of Shareholders.

BOARD AND COMMITTEE INFORMATION

The Board has determined that having an independent director serve as Chairperson of the Board is in the best interest of shareholders at this time. The structure ensures a greater role for the independent directors in the oversight of the Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of the Board. Director Eulich is the current Chairperson of the Board and has held that position since May 2016. Pursuant to the Company’s retirement policy, Director Eulich will retire when his current term expires at the 2023 Annual Meeting of Shareholders and following the meeting, Director Eulich will cease being a member of the Board as well as the committees on which he serves. The Board has appointed Director DeCola, Vice Chairperson of the Board, to serve as Board Chairperson following Director Eulich’s retirement and subject to Director DeCola’s re-election to the Board at the 2023 Annual Meeting of Shareholders.

The Board is actively involved in oversight of risks that could affect the Company. This oversight is conducted primarily through committees of the Board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees; however, the full Board has retained responsibility for general oversight of risks. The Board satisfies this responsibility through reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within the Company.

All committee members are appointed by the Board on recommendation of the Nominating and Governance Committee. In addition, the Board has established membership standards for each committee which requires that a certain number of committee members must be “independent directors,” as that term is defined in Rule 5605(a)(2) of the Nasdaq rules.

The Board met seven times in 2022. All incumbent directors attended at least 75% of all meetings of the full Board and of those committees on which they served in 2022. The Company’s Board periodically held executive sessions of the members of the Board who met the then current standards of independence. Executive sessions of the Board were presided over by the Chairperson of the Board.

While there is no formal policy concerning director attendance at the annual meeting, all members of the Board are encouraged to attend if reasonably able to do so. Ten out of fourteen of the then serving members of the Board attended the 2022 Annual Meeting of Shareholders.

DIVERSITY

The Company and the Board strongly believe diversity is critical to the Company’s success and creating long-term value for our shareholders. We believe that a board consisting of individual directors with diverse backgrounds ensures broader representation and inspires deeper commitment to management, employees and the communities we serve. While not specific to a particular policy, the Company’s Board prioritizes diversity in gender, demographic background, and professional experience when considering candidates for director as part of its commitment to diversity. At present, 44% of our Board is diverse from a female or underrepresented minorities perspective based on self identification. In addition, the Company is committed to a culture of inclusiveness, equality and diversity at all levels of the Company’s workforce, offering a supportive and understanding environment designed to assist all individuals in realizing their maximum potential, regardless of their differences. Our goal is to ensure that, in carrying out our activities, we promote equality of opportunity and good relations between people of diverse backgrounds, and avoid unlawful discrimination. As of December 31, 2022, approximately 29% of our executive officers, and approximately 55% of our leadership team were diverse from a female or underrepresented minorities perspective based on self identification.

| | | | | | | | | | | |

| Board Diversity Matrix As of March 29, 2023 |

Total Number of Directors(1) | 16 |

| Part I: Gender Identity | Female | Male | Did not Disclose Gender |

| Directors | 5 | 10 | 1 |

| Part II: Demographic Background |

| African American or Black | — | 1 | — |

| Asian | 1 | 1 | — |

| Hispanic or Latinx | 1 | — | — |

| White | 3 | 8 | — |

| Did not Disclose Demographic Background | 1 |

| | | |

(1) As disclosed on January 26, 2023, Peter Hui will not stand for re-election at the 2023 Annual Meeting of Shareholders. In addition, as set forth above, John Eulich will retire from the Board pursuant to the Board’s Retirement Policy also effective as of the 2023 Annual Meeting. |

DIRECTOR COMPENSATION

The following table sets forth compensation paid to each of the Company’s non-employee directors during 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned or Paid in Cash (a) | | Stock

Awards (b) | | All Other Compensation (c) | | Total Annual

Compensation |

Lyne B. Andrich(d) | $ | 21,898 | | | $ | 21,852 | | | $ | — | | | $ | 43,750 | |

| Michael A. DeCola | 33 | | | 98,467 | | | — | | | 98,500 | |

John S. Eulich(e) | 40 | | | 144,960 | | | 5,800 | | | 150,800 | |

| Robert E. Guest, Jr. | 57,281 | | | 52,219 | | | — | | | 109,500 | |

| James M. Havel | 2,298 | | | 93,202 | | | — | | | 95,500 | |

| Michael R. Holmes | 22 | | | 104,478 | | | — | | | 104,500 | |

Peter H. Hui(f) | 66 | | | 92,184 | | | — | | | 92,250 | |

| Nevada A. Kent, IV | 44,685 | | | 44,565 | | | — | | | 89,250 | |

Marcela Manjarrez(d) | 21,898 | | | 21,852 | | | — | | | 43,750 | |

| Stephen P. Marsh | 56,170 | | | 56,080 | | | 8,000 | | | 120,250 | |

| Daniel A. Rodrigues | 56,533 | | | 56,467 | | | 8,400 | | | 121,400 | |

| Richard M. Sanborn | 44,170 | | | 44,080 | | | — | | | 88,250 | |

Anthony R. Scavuzzo(g) | 75,000 | | | — | | | — | | | 75,000 | |

| Eloise E. Schmitz | 47,679 | | | 47,571 | | | — | | | 95,250 | |

| Sandra A. Van Trease | 1,046 | | | 109,454 | | | — | | | 110,500 | |

Lina A. Young(d) | 21,898 | | | 21,852 | | | | | 43,750 | |

| | | | | | | |

| (a) Includes fractional shares paid in cash. |

(b) The amounts shown in this column represent the grant date fair value, computed in accordance with Financial Accounting Standards Board Codification Topic 718, Compensation-Stock Compensation (“ASC 718”). For more information, please refer to Note 15 – Shareholders’ Equity and Compensation Plans included in the Company’s 2022 Consolidated Financial Statements on Form 10-K filed with the Securities and Exchange Commission on February 24, 2023. |

| (c) Includes attendance fees and retainers for service on the Bank’s board of directors prior to the combination of the Board and Bank Board in May 2022. |

| (d) Mses. Andrich, Manjarrez, and Young were appointed to the Board on December 9, 2022. |

| (e) Mr. Eulich is retiring from the Board and will not stand for re-election due to the Board’s mandatory retirement policy. |

| (f) Mr. Hui has elected to not stand for re-election at the 2023 Annual Meeting. |

| (g) Mr. Scavuzzo resigned from the Board on November 22, 2022. |

In 2022, non-employee directors received a $75,000 annual retainer, except for Mr. Eulich who received a $145,000 retainer for his service as Chairperson of the Board and Executive Committee. Annual retainers are paid in July of each year for the upcoming 12-month period. Additionally, members receive $1,250 per board meeting attended. For committee service, the Chairpersons received an additional retainer as follows: Audit Committee - $15,000, Compensation Committee - $10,000, Risk Committee - $15,000 and Nominating and Governance Committee - $10,000. Non-Chairperson committee members receive $1,000 per committee meeting attended.

Generally, non-employee directors receive 50% of their retainer or meeting fees in shares of EFSC common stock unless a non-employee director elects to receive 100% of such director’s retainer and meeting fees in shares. Any election to receive 100% of the retainer and meeting fees in shares will remain in effect until revoked by the non-employee director. The number of shares received by the non-employee director depends on the fair market value of the Company’s common stock on the date of grant. Shares are granted on the date that the cash retainer or meeting fees would otherwise have been paid. Shares are fully vested upon grant.

EXECUTIVE COMMITTEE

The Executive Committee is empowered to act on behalf of, and to exercise the powers of, the full Board in the management of the business and affairs of the Company when the full Board is not in session, except to the extent limited by applicable Delaware law. The charter for the Executive Committee may be found in the investor relations section of the Company’s website at www.enterprisebank.com. All actions by the Executive Committee are reported at the next regular Board meeting. The Executive Committee met twice in 2022.

All members of the Executive Committee meet the Nasdaq independence standards. In 2022, Directors Eulich (Committee Chairperson), DeCola, Guest, and Van Trease served on the committee for the full year. Director Judith Heeter (from January through her retirement as of the annual meeting in May) served on the committee for a portion of the year. Director Holmes was appointed to serve on the committee in May 2022.

AUDIT COMMITTEE

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board by reviewing all audit processes and fees, the financial information provided to the shareholders and the Company’s systems of internal financial controls. The Audit Committee has the authority and responsibility to select and evaluate and, where appropriate, replace the Company’s independent registered public accounting firm.

The Audit Committee is responsible for oversight of Company risks relating to accounting matters, financial reporting, legal and regulatory compliance and the Company’s anonymous “whistleblower” reporting system. To satisfy these oversight responsibilities, the committee separately meets regularly with the Company’s Chief Financial Officer, its Chief Risk Officer, its Director of Internal Audit, the Company’s independent registered public accounting firm, and management. The Audit Committee Chairperson periodically meets between formal committee meetings with the Company’s Chief Financial Officer, its Chief Risk Officer, its Director of Internal Audit, and the Company’s independent registered public accounting firm. The committee also receives regular reports regarding issues such as the status and findings of audits being conducted by the internal auditors and the independent registered public accounting firm, the status of material litigation, accounting changes that could affect the Company’s financial statements and proposed audit adjustments.

All members of the Audit Committee meet the Nasdaq independence standards and meet the additional requirements applicable to Audit Committee members. In 2022, the Audit Committee consisted of Directors Van Trease (Committee Chairperson), Havel, Kent, and Schmitz for the full year. Director Rodrigues was appointed to serve on the committee in May 2022 and Director Andrich was appointed to serve on the committee in February 2023. The Audit Committee met five times in 2022.

The Board has determined that Audit Committee members Van Trease, Andrich, Havel, Kent and Schmitz satisfy the requirements of an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K and satisfy the definition of “financially sophisticated” under Nasdaq Rule 5605(c).

The Company’s Board has determined that none of the Directors on the Audit Committee have a relationship with the Company or the Bank that would interfere with the exercise of independent judgment in carrying out their responsibilities as director. None of them is, nor have they been for the past three years, an employee of the Company or the Bank, and none of their immediate family members is, nor have they been for the past three years, an executive officer of the Company or the Bank.

As noted in the Audit Committee charter, which is available in the investor relations section of the Company’s website at www.enterprisebank.com, the Company’s management is responsible for preparing the Company’s financial statements. The Company’s independent registered public accounting firm is responsible for auditing the financial statements. The activities of the Audit Committee are in no way designed to supersede or alter those traditional responsibilities. The Audit Committee’s role does not provide any special assurances with regard to the Company’s financial statements, nor does it involve a professional evaluation of quality of audits performed by the independent registered public accounting firm. The Audit Committee reassesses the adequacy of the charter on an annual basis.

The Audit Committee has considered whether the provision by the Company’s independent registered public accounting firm of the services covered by the audit fees is compatible with maintaining its independence and has concluded that it is compatible. The Audit Committee is responsible for pre-approving all auditing services and permitted non-auditing services to be performed by the Company’s independent registered public accounting firm. The Chairperson of the Audit Committee has authority to approve in advance all audit or non-audit services to be performed by the independent registered public accounting firm, but must report any such approval to the full Audit Committee at the next regularly scheduled meeting.

The Report of the Audit Committee appears on page 51 of this Proxy Statement.

NOMINATING AND GOVERNANCE COMMITTEE

The Nominating and Governance Committee assists the Board in identifying and recommending qualified director nominees for election at the 2023 Annual Meeting. The charter for the Nominating and Governance Committee may be found in the investor relations section of the Company’s website at www.enterprisebank.com. The committee recommends membership on Board committees, reviews and assesses the Company’s governance guidelines, policies and practices, and oversees an annual Board self-evaluation.

All members of the Nominating and Governance Committee meet the Nasdaq independence standards. In 2022, the Nominating and Governance Committee consisted of Directors DeCola (Committee Chairperson as of May 2022 following the retirement of former Committee Chairperson Heeter), Guest, and Holmes for the full year. Director Havel (from January through June 2022) served on the committee for a portion of the year. Director Van Trease was appointed to serve on the committee in May 2022; Director Schmitz was appointed to serve on the committee in June 2022; and Directors Manjarrez and Young were appointed to serve on the committee in February 2023. The committee met ten times in 2022.

The Nominating and Governance Committee may consider candidates for Board membership coming to its attention through current Board members, search firms, shareholders and other persons. Suggestions for nominees from shareholders are evaluated in the same manner as other nominees. Any shareholder nomination must be submitted in writing to the Company’s Corporate Secretary at: Enterprise Financial Services Corp, 150 North Meramec Ave., Clayton, Missouri 63105, and should include the shareholder’s name, address and the number of the Company’s shares owned by the shareholder, along with the nominee’s name and qualifications in accordance with the procedures set forth in our By-Laws. No shareholder nominations for director were received for the 2023 Annual Meeting.

The Nominating and Governance Committee has the flexibility to consider various factors it deems appropriate in identifying and evaluating potential candidates for director nominees as there is no strict set of qualifications that must be satisfied before a candidate may be considered. These factors may include education, diversity, experience with business and other organizations comparable with EFSC, the interplay of the candidate’s experience with that of other members of the Board, and the extent to which the candidate would be a desirable addition to the Board and to any of the committees of the Board. The Nominating and Governance Committee will evaluate nominees for directors submitted by shareholders in the same manner in which it evaluates other director nominees.

Shareholders may communicate directly to the Board, including individual directors and our presiding Chairperson, by sending a letter to the Board at the following address: Enterprise Financial Services Corp Board of Directors, 150 North Meramec Ave., Clayton, Missouri 63105. All communications directed to the Board will be received and processed by the Company’s Corporate Secretary and will be transmitted to the Chairperson of the Nominating and Governance Committee without any editing or screening.

COMPENSATION COMMITTEE

In 2022, the Compensation Committee consisted of Directors Holmes (Committee Chairperson as of May 2022), DeCola (who served as Committee Chairperson from January through Mary 2022), Eulich, Holmes, Hui, Kent, and Van Trease for the full year. Director Scavuzzo (from January through November 2022) served on the committee for a portion of the year, and Director Andrich was appointed to serve on the committee in February 2023. The Compensation Committee met four times in 2022. The Compensation Committee is comprised solely of non-employee directors, all of whom the Board has determined are independent pursuant to the Nasdaq rules. The responsibilities of the Compensation Committee are set forth in its charter, which is available in the investor relations section of the Company’s website at www.enterprisebank.com, and includes the responsibility for establishing, implementing and continually monitoring compliance with the Company’s compensation philosophy. During 2022, no member was an executive officer of another entity on whose compensation committee or board of directors an executive officer of the Company served.

The Compensation Committee is responsible for risks relating to employment policies and the Company’s compensation and benefits program. To assist it in satisfying these oversight responsibilities, the Compensation Committee has retained its own compensation consultant and meets regularly with management and with outside counsel to understand the financial, human resources and shareholder implications of compensation decisions being made. For additional information regarding our engagement of a compensation consultant, see “Executive Compensation - Overview of the Compensation Process.” The Compensation Committee is also responsible to further the advancement of the Company’s goals related to environmental, health and safety, corporate social responsibility, sustainability and other public policy matters (collectively, “ESG”) (as they

continue to evolve) through the Company’s compensation arrangements, policies and decisions, to the extent the Compensation Committee deems necessary to do so.

The Compensation Committee Report appears on page 24 of this Proxy Statement.

RISK COMMITTEE

The Risk Committee assists the Board in carrying out its responsibilities with respect to the comprehensive oversight of the types and levels of risk being incurred by the organization, and the effectiveness of the methods used to identify, monitor, manage, and report those risks. The charter for the Risk Committee may be found in the investor relations section of the Company’s website at www.enterprisebank.com.

The responsibilities of the Risk Committee are to review the Company’s Risk Appetite Statement and Risk Tolerances, evaluate the Company’s risk priorities, and to monitor and evaluate the Company’s risk profile as determined by management. Additionally, the Risk Committee is responsible for the evaluation and oversight of the implementation of the Company’s strategy on ESG. For additional information, see “Environmental, Social and Governance” below. Also, the Risk Committee oversees the composition and activities of the Company’s Risk Oversight Committee.

In 2022, the Risk Committee consisted of Directors Guest (Committee Chairperson), Hui and Sanborn for the full year. Directors Heeter (from January through her retirement as of the annual meeting in May), Scavuzzo (from January through November 2022) and Schmitz (from January through June 2022) served on the committee for a portion of the year. Directors Marsh and Rodrigues were appointed to serve on the committee in May 2022, Director Havel was appointed to serve on the committee in June 2022 and Directors Manjarrez and Young were appointed to the committee in February 2023. The committee met seven times in 2022. Directors Guest and Sanborn, in particular, have extensive experience in identifying, assessing and/or managing enterprise risk.

CORPORATE CODE OF ETHICS

The Company has implemented a Code of Ethics applicable to our directors, Chief Executive Officer, Chief Financial Officer, other senior management, and to all of our employees. Our Code of Ethics provides fundamental ethical principles to which these individuals are expected to adhere. Our Code of Ethics operates as a tool to help our directors and employees understand and adhere to these high ethical standards required for employment by, or association with, the Company and the Bank. Our Code of Ethics is available on our website at www.enterprisebank.com under the investor relations section. Our shareholders may also obtain written copies at no cost by writing to us at the address: Enterprise Financial Services Corp, 150 North Meramec Ave., Clayton, Missouri 63105. Any future changes or amendment to our Code of Ethics and any waiver that applies to one of our senior financial officers or a member of our Board will be posted on our website.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

We are increasingly focused on key ESG risks and on providing transparency around our ESG efforts. The Risk Committee oversees our ESG risk management efforts. In March 2023, we issued our annual ESG Report. For more information on our focus and enhancement of our ESG efforts, please visit the Corporate Responsibility page on our company website at www.enterprisebank.com.1

1 Information contained in our ESG Report shall not be deemed filed for the purposes of the Securities Exchange Act of 1934, as amended, or deemed incorporated by reference in this filing.

EXECUTIVE OFFICERS

EXECUTIVE OFFICERS OF THE REGISTRANT

The executive officers of the Company, as of March 16, 2023, are as follows:

| | | | | | | | |

| Name | Age | Principal Business Experience |

| James B. Lally | 55 | Chief Executive Officer of Enterprise Financial Services Corp since May 2017, Chief Executive Officer and Chairman of the Board of Directors of Enterprise Bank & Trust since May 2022; President of Enterprise Financial Services Corp since August 2016; Executive Vice President and Director of Fee Businesses for Enterprise Bank & Trust from May 2016 through August 2016; President of Commercial Banking of Enterprise Bank & Trust from 2014 through May 2016; President of the St. Louis Region of Enterprise Bank & Trust from 2011 through 2014.

|

| Keene S. Turner | 43 | Executive Vice President and Chief Financial Officer of Enterprise Financial Services Corp since October 2013; Chief Financial Officer of Enterprise Bank & Trust from 2013 through 2016 and since February 2019; Assistant Corporate Secretary of Enterprise Bank & Trust since May 2022 and Corporate Secretary of Enterprise Bank & Trust from 2013 through May 2022; Executive Vice President and Chief Accounting Officer of National Penn Bancshares, Inc. from February 2010 through October 2013.

|

| Scott R. Goodman | 59 | Executive Vice President of Enterprise Financial Services Corp and President of Enterprise Bank & Trust since April 2013; Executive Vice President and Director of Commercial Banking & Wealth Management of Enterprise Bank & Trust from May 2012 through April 2013.

|

| Douglas N. Bauche | 53 | Chief Credit Officer of Enterprise Bank & Trust since May 2016; President of the St. Louis Region of Enterprise Bank & Trust from March 2014 through April 2016 and from December 2018 through January 2020; President of the St. Charles Region of Enterprise Bank & Trust from March 2000 through March 2014.

|

| Nicole M. Iannacone | 43 | Corporate Secretary of Enterprise Financial Services Corp since January 2018; Executive Vice President of Enterprise Bank & Trust since December 2018; Chief Legal Officer of Enterprise Bank & Trust since 2022; Corporate Secretary of Enterprise Bank & Trust since May 2022; General Counsel of Enterprise Bank & Trust from 2014 to 2022 and Assistant Corporate Secretary of Enterprise Bank & Trust from 2014 to May 2022; Chief Risk Officer of Enterprise Bank & Trust from 2018 to 2022; Senior Vice President of Enterprise Bank & Trust from 2015 to 2018; Vice President of Enterprise Bank & Trust from 2014 to 2015; Attorney at Jenkins & Kling, P.C. from 2005 to 2014.

|

| Mark G. Ponder | 52 | Executive Vice President and Chief Administrative Officer of Enterprise Bank & Trust since December 2018; Senior Vice President and Controller of Enterprise Financial Services Corp from March 2012 to March 2019; Chief Financial Officer of Enterprise Bank & Trust from August 2016 to February 2019.

|

EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

This section provides information regarding our compensation programs for our named executive officers (“Named Executive Officers” or “NEOs”) for 2022, including our overall philosophy, components of compensation that we provide, and the objectives and intended incentives of our programs. Our Named Executive Officers for 2022 were as follows:

| | | | | |

| Name | Title |

James B. Lally | President and Chief Executive Officer, Enterprise Financial Services Corp |

Keene S. Turner | Executive Vice President and Chief Financial Officer, Enterprise Financial Services Corp and Enterprise Bank & Trust |

| Scott R. Goodman | President, Enterprise Bank & Trust |

| Douglas N. Bauche | Chief Credit Officer, Enterprise Bank & Trust |

| Nicole M. Iannacone | Corporate Secretary, Enterprise Financial Services Corp and Enterprise Bank & Trust; and Executive Vice President and Chief Legal Officer, Enterprise Bank & Trust |

Principles. Our compensation philosophy is to provide competitive compensation that rewards executives for performance and management of risk. We develop and administer compensation programs consistent with the following principles:

•Compensation will include a substantial performance-based component which is:

◦based on clearly defined goals;

◦aligned with measurable business results, appropriate risk management and increase in shareholder value; and

◦linked to successful implementation of our business plan.

•Compensation is designed to attract, motivate and retain top talent.

•Compensation will be fair and market competitive.

Executive Compensation at a Glance.

2022 Say on Pay Vote Results: 98% approval of compensation program

Pay “At Risk”: 80% of CEO’s total compensation was variable; average of 75% variable compensation for all other NEOs

2022 Short-Term Incentive Plan (“STIP”) Payments:

•CEO STIP target opportunity increased from 70% of base salary to 80% to better align with market and in recognition of strong performance.

•The primary financial metric for the STIP was changed from Pre-tax, Pre-Provision, Net Revenue (“PPNR”) to Earnings Per Share (“EPS”) and the weighting of the EPS goal was increased to 40%, compared to 30% on PPNR in 2021.

•The profitability financial metric was changed to Return on Average Tangible Common Equity (“ROATCE”) from Return on Average Assets (“ROA”) in 2021.

•The weighting of the asset quality metric was decreased to 10% in 2022, from 20% in 2021.

Long-Term Incentive Plan (“LTIP”) for NEOs:

•60% performance-based restricted stock units (“RSUs”);

•25% non-qualified stock options; and

•15% time-based RSUs.

•Updated the LTIP performance goals to replace the PPNR goal with an EPS metric.

2022 Payout Results:

•STIP payments were paid at 150% of target.

•LTIP awards for the 2020-2022 performance period resulted in performance awards at 132% of target.

Special Stock Awards:

•Issued one-time grants of time-based RSUs to the NEOs to enhance retention.

| | | | | | | | | | | |

| What we do: | | What we don’t do: |

| ü | Align short and long-term incentive plan targets with business goals and shareholder interests | ü | Provide Section 280G gross-up payments |

| ü | Conduct annual say on pay advisory vote | ü | Reward executives for taking excessive, inappropriate or unnecessary risk |

| ü | Conduct shareholder outreach | ü | Allow repricing or backdating of equity awards |

| ü | Retain an independent compensation consultant to advise our Compensation Committee | ü | Spring-load equity awards |

| ü | Use performance metrics that compare our performance to external benchmarks | ü | Provide multi-year guaranteed salary increases or guaranteed bonuses |

| ü | Maintain insider trading policy | ü | Rely exclusively on shareholder return as our only performance metric |

| ü | Maintain clawback policy that applies to NEOs and other executives | ü | Award incentives for below-threshold performance |

| ü | Maintain a stock ownership policy for executive officers | ü | Pay dividends on unearned or unvested equity awards |

| ü | Reevaluate and update the composition of our peer group regularly | ü | Permit hedging and pledging (unless preapproved) of our stock by executives |

| ü | Limit vesting of performance-based RSUs in the event the results of a total shareholder return performance metric are negative | ü | Have single trigger vesting on our equity-based compensation awards |

Fiscal Year 2022. The financial market was volatile in 2022. Inflation was high, resulting in the Federal Reserve increasing the target federal funds rate for the first time since 2018. The target rate increased 425 basis points from a range of 0-25 basis points at the end of 2021, to a range of 425-450 basis points at the end of 2022. Higher interest rates have benefited banks with an asset-sensitive balance sheet, such as the Company, by increasing net interest income and the net interest margin. After several years of excess liquidity in the banking industry from low rates and government stimulus, the rise in interest rates reduced deposit growth and increased interest expense for the industry.

The Company had strong financial performance in 2022, including:

•Record operating revenue (net interest income and noninterest income) of $533 million.

•Record net income and diluted earnings per share of $203 million and $5.31, respectively.

•Increased tangible book value per share2 to $28.67.

•Achieved a PPNR return on average assets2 of 1.9%.

•Achieved a return on average tangible common equity2 of 19.1%.

•Increased total loans by 11%, excluding paycheck protection program loans.

•Maintained strong asset quality, with a ratio of nonperforming assets to total assets of 0.08% and a ratio of net charge-offs to average loans of 0.04%.