EXHIBIT 99.1

ENTERPRISE FINANCIAL REPORTS THIRD QUARTER 2018 RESULTS

Reported Third Quarter Highlights

• | Net income of $22.5 million, or $0.97 per diluted share |

• | Return on average assets of 1.63% |

• | Repurchase of 71,007 shares at an average price of $53.26 per share |

Third Quarter Core Highlights1

• | Net income of $20.0 million, or $0.86 per diluted share |

• | Return on average assets of 1.45% |

• | Core net interest margin stable at 3.74% |

St. Louis, Mo. October 22, 2018 – Enterprise Financial Services Corp (NASDAQ: EFSC) (the “Company” or "EFSC") reported net income of $22.5 million for the quarter ended September 30, 2018, an increase of $0.3 million, and $6.2 million as compared to the linked second quarter and prior year quarter, respectively. Earnings per diluted share were $0.97 for the quarter ended September 30, 2018, an increase of 2% and 41%, compared to $0.95 and $0.69 per diluted share for the linked second quarter and prior year period, respectively.

The increase in net income and earnings per diluted share compared to the linked second quarter was primarily due to stable core earnings and a net tax benefit recognized upon finalization of the Company's 2017 tax returns.

Core Results1

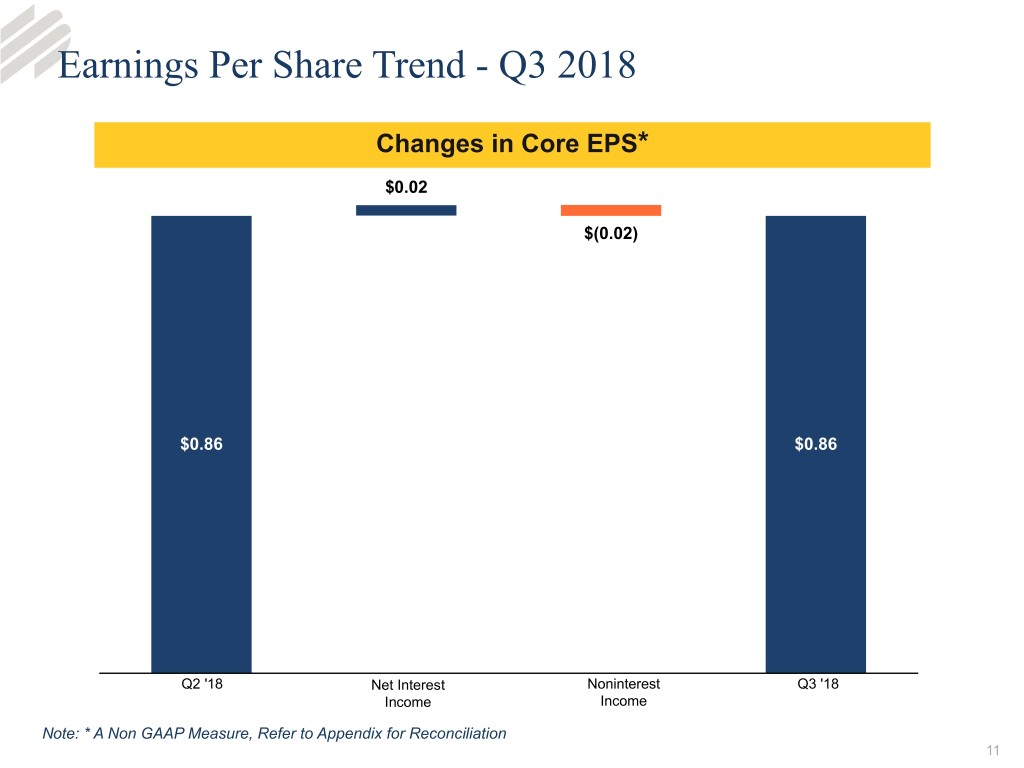

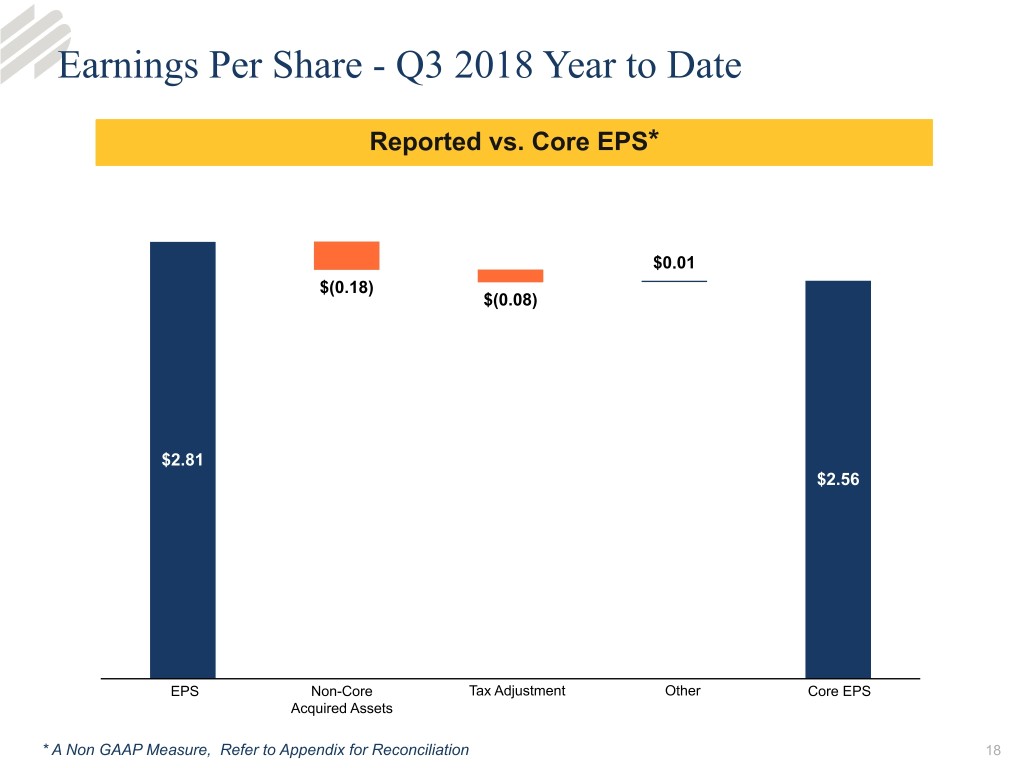

On a core basis1, net income totaled $20.0 million, or $0.86 per diluted share, for each of the quarters ended September 30, 2018 and June 30, 2018. Third quarter 2018 diluted core earnings per share1 grew 30%, or $0.20 per diluted share, from $0.66 for the prior year period which continues to be driven by growth in net interest income mitigated by modest expense growth. The Company's income tax rate for the third quarter of 2018 was 18% compared to 32% in the prior year quarter due to the combination of 2017 federal income tax reform and the Company's tax planning initiatives.

The Company's Board of Directors approved a one cent per common share increase in the Company's quarterly dividend to $0.13 per common share from $0.12 for the fourth quarter of 2018, payable on December 28, 2018 to shareholders of record as of December 14, 2018.

Jim Lally, EFSC’s President and Chief Executive Officer, commented, “Third quarter results reflect another strong earnings per share quarter for our Company. Earnings per share for the third quarter were higher than one year ago by 41% and 30% on a total and core1 basis, respectively. Our profitability remains very strong with year to date return on average assets of 1.62%, a 51 basis point increase over the prior year period.”

Lally added, “Capital levels continue to build in line with our expectations, affording us the flexibility to increase the dividend and continue modest share repurchase activity. We are encouraged by the strength of our balance sheet as we look to enhance our performance in the fourth quarter and 2019.”

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

1

Net Interest Income

Net interest income for the third quarter increased to $48.1 million from the linked second quarter of $47.0 million, and increased $2.5 million from the prior year period. Net interest margin, on a fully tax equivalent basis, was 3.78% for the third quarter, compared to 3.77% in the linked second quarter, and 3.88% in the third quarter of 2017.

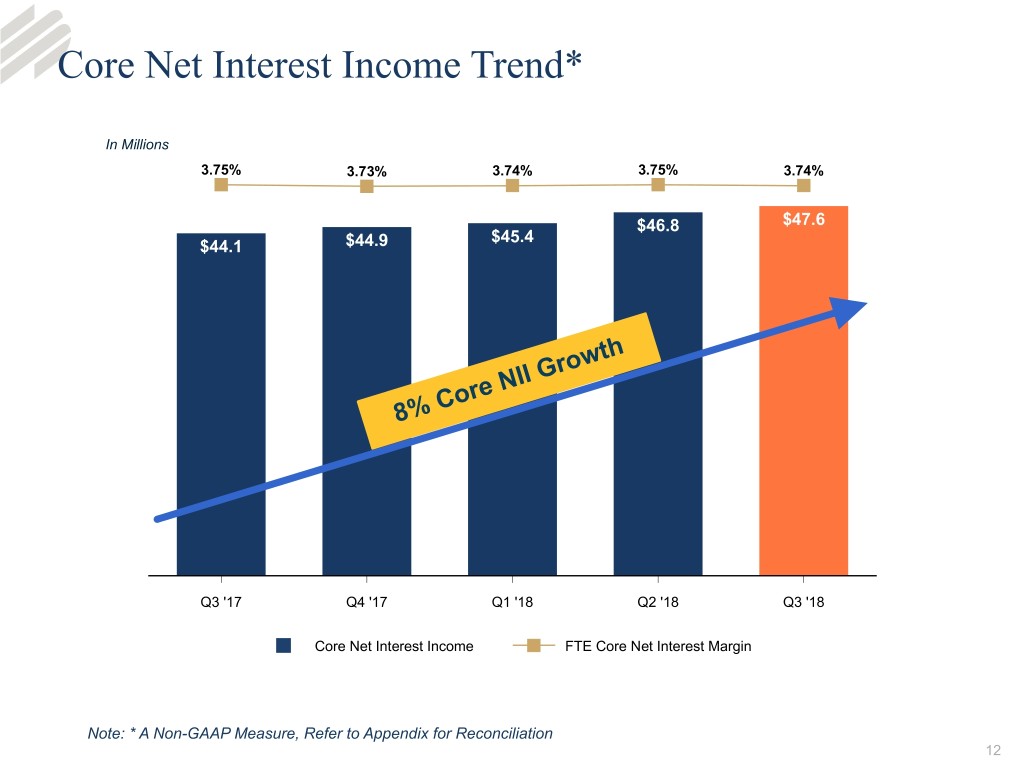

Core net interest income1 increased by $0.8 million in the third quarter of 2018 as compared to the linked quarter due to a $49 million increase in average earning assets during the current quarter driven by portfolio loan growth along with one extra calendar day in the quarter and a relatively stable core net interest margin1 of 3.74% as compared to 3.75% for the linked second quarter.

Core net interest margin1 excludes incremental accretion on non-core acquired loans. See the table below for a quarterly comparison of the Company's core net interest income1 and core net interest margin1.

For the Quarter ended | |||||||||||||||||||

($ in thousands) | September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||

Core net interest income1 | $ | 47,558 | $ | 46,757 | $ | 45,405 | $ | 44,901 | $ | 44,069 | |||||||||

Core net interest margin1, (fully tax equivalent) | 3.74 | % | 3.75 | % | 3.74 | % | 3.73 | % | 3.75 | % | |||||||||

The yield on portfolio loans increased 13 basis points to 5.12% for the current quarter as compared to the linked quarter of 4.99% and 43 basis points from the prior year period of 4.69% due to increasing interest rates on the existing variable-rate loan portfolio and higher rates on newly originated loans. The cost of total deposits also increased 13 basis points from the linked quarter and 40 basis points from the prior year period to 0.86% for the quarter ended September 30, 2018. The increase in the interest rate paid on deposits reflects market interest rate trends, as the Company continues to defend and attract new core deposit relationships. Additionally, the cost of total interest-bearing liabilities increased 18 basis points to 1.34% for the quarter ended September 30, 2018 from 1.16% for the linked quarter and increased 56 basis points from the prior year period of 0.78%.

The Company continues to manage its balance sheet to grow core net interest income1 and expects to maintain core net interest margin1 over the coming quarters as growth in loan yields balance rising deposit prices. However, pressure on funding costs could hinder the expected trends in core net interest margin1.

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

2

Portfolio Loans

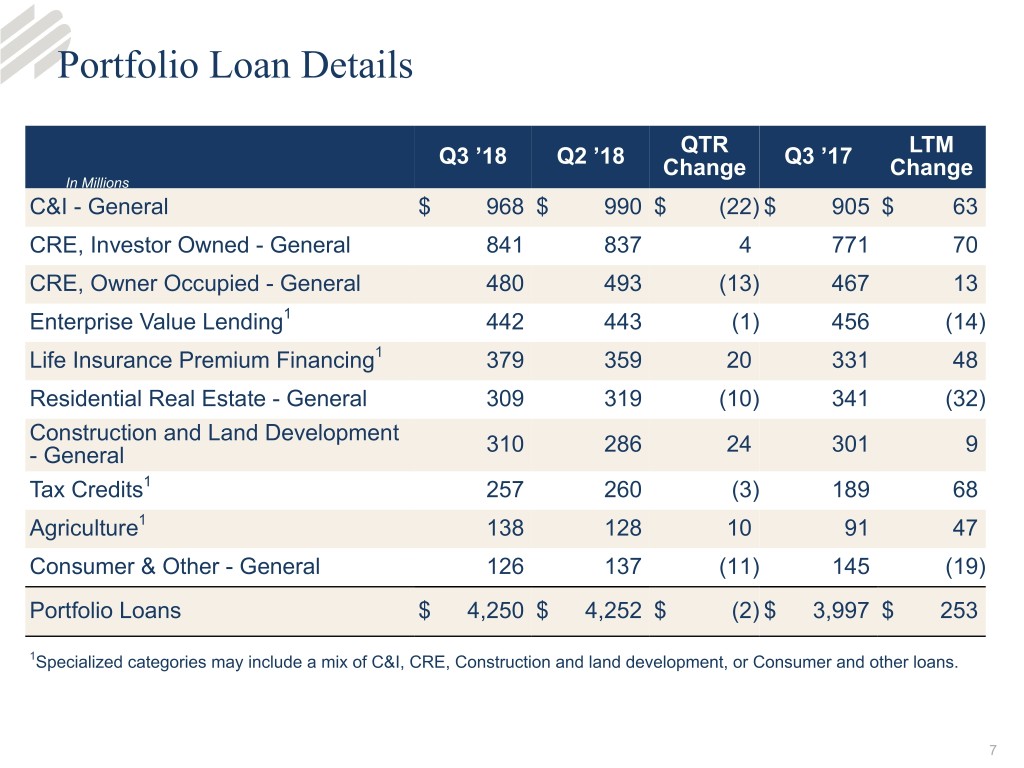

The following table presents portfolio loans with selected specialized lending detail for the most recent five quarters:

At the Quarter ended | |||||||||||||||||||

($ in thousands) | September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||

C&I - general | $ | 967,525 | $ | 990,153 | $ | 945,682 | $ | 936,588 | $ | 905,296 | |||||||||

CRE investor owned - general | 841,310 | 836,516 | 836,499 | 801,156 | 771,348 | ||||||||||||||

CRE owner occupied - general | 480,106 | 493,589 | 471,417 | 468,151 | 467,154 | ||||||||||||||

Enterprise value lendinga | 442,439 | 442,877 | 439,352 | 407,644 | 455,983 | ||||||||||||||

Life insurance premium financinga | 378,826 | 358,787 | 365,377 | 364,876 | 330,957 | ||||||||||||||

Residential real estate - general | 309,053 | 318,841 | 328,966 | 342,140 | 341,311 | ||||||||||||||

Construction and land development - general | 309,879 | 286,482 | 293,938 | 294,123 | 300,697 | ||||||||||||||

Tax creditsa | 256,666 | 260,595 | 244,088 | 234,835 | 188,498 | ||||||||||||||

Agriculturea | 137,760 | 127,849 | 118,862 | 91,031 | 90,768 | ||||||||||||||

Consumer and other - general | 126,194 | 136,647 | 117,901 | 126,115 | 144,489 | ||||||||||||||

Portfolio loans | $ | 4,249,758 | $ | 4,252,336 | $ | 4,162,082 | $ | 4,066,659 | $ | 3,996,501 | |||||||||

Portfolio loan yield | 5.12 | % | 4.99 | % | 4.87 | % | 4.71 | % | 4.69 | % | |||||||||

Total C&I loans to portfolio loans | 48 | % | 48 | % | 48 | % | 47 | % | 47 | % | |||||||||

Variable interest rate loans to portfolio loans | 62 | % | 60 | % | 59 | % | 58 | % | 57 | % | |||||||||

Certain prior period amounts have been reclassified among the categories to conform to the current period presentation. | |||||||||||||||||||

aSpecialized categories may include a mix of C&I, CRE, Construction and land development, or Consumer and other loans. | |||||||||||||||||||

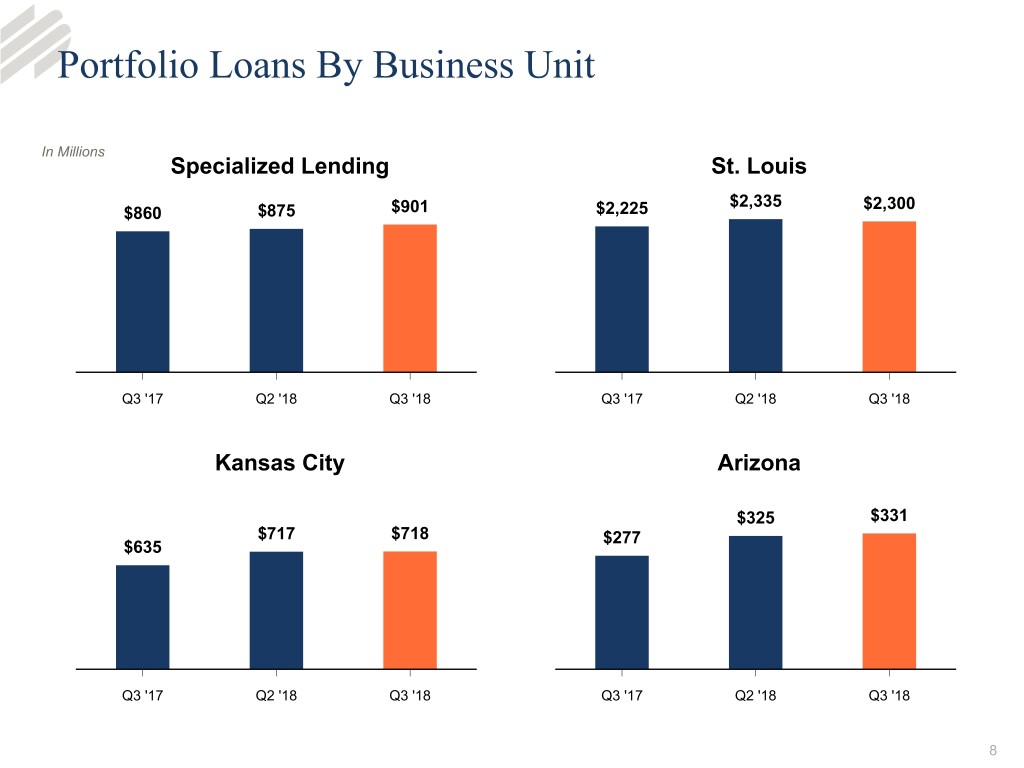

Portfolio loans were $4.2 billion at September 30, 2018, decreasing $3 million, when compared to the linked quarter. On a year-over-year basis, portfolio loans increased $253 million, or 6%. We expect continued total portfolio loan growth in 2018 and 2019 to be a high single digit percentage.

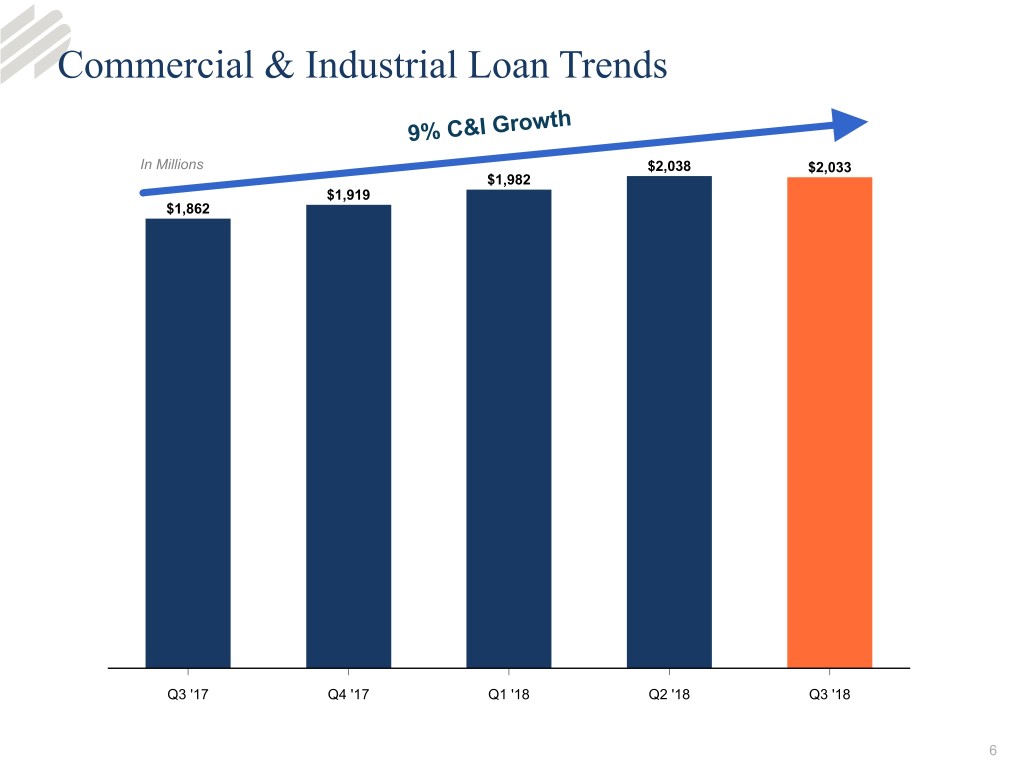

The Company continues to focus on originating high-quality commercial and industrial ("C&I") relationships, as they typically have variable interest rates and allow for cross selling opportunities involving other banking products. Total C&I loans represent 48% of the Company's loan portfolio as of the third quarter of 2018. C&I loan growth supports management's efforts to maintain the Company's asset sensitive interest rate risk position.

Non-Core Acquired Loans

Non-core acquired loans were those acquired from the FDIC and were previously covered by shared-loss agreements. These loans continue to be accounted for as purchased credit impaired ("PCI") loans. Non-core acquired loans totaled $17.7 million at September 30, 2018, a decrease of $5.8 million, or 25% from the linked second quarter, and $16.5 million, or 48%, from the prior year period, primarily as a result of principal payments and loan payoffs. At September 30, 2018, the remaining accretable yield on the portfolio was estimated to be $9 million and the non-accretable difference was approximately $10 million.

The Company estimates 2018 and 2019 pre-tax income from accelerated cash flows and other incremental accretion to be between $2 million and $3 million. Additionally, year-to-date pretax income from non-core acquired assets includes a $2.1 million provision for loan loss reversal as well as $1.0 million of other income from non-core acquired assets.

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

3

Asset Quality: The following table presents the categories of nonperforming assets and related ratios for the most recent five quarters:

For the Quarter ended | |||||||||||||||||||

($ in thousands) | September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||

Nonperforming loans | $ | 17,044 | $ | 14,801 | $ | 15,582 | $ | 15,687 | $ | 8,985 | |||||||||

Other real estate | 408 | 454 | 455 | 498 | 491 | ||||||||||||||

Nonperforming assets | $ | 17,452 | $ | 15,255 | $ | 16,037 | $ | 16,185 | $ | 9,476 | |||||||||

Nonperforming loans to total loans a | 0.40 | % | 0.35 | % | 0.38 | % | 0.39 | % | 0.23 | % | |||||||||

Nonperforming assets to total assets | 0.32 | % | 0.28 | % | 0.30 | % | 0.31 | % | 0.18 | % | |||||||||

Allowance for portfolio loan losses to total loans a | 0.99 | % | 1.00 | % | 0.98 | % | 0.95 | % | 0.97 | % | |||||||||

Net charge-offs (recoveries) | $ | 2,447 | $ | 641 | $ | (226 | ) | $ | 3,313 | $ | 803 | ||||||||

a Excludes loans accounted for as PCI loans

The Company recorded a provision for portfolio loan losses of $2.3 million compared to $2.4 million for the linked quarter and the prior year period, respectively. The provision for the third quarter is reflective of charge-offs in the period and what management believes to be a prudent credit risk posture.

Nonperforming loans increased during the quarter ended September 30, 2018 due to three isolated C&I credits.

Deposits

The following table presents deposits broken out by type:

At the Quarter ended | |||||||||||||||||||

($ in thousands) | September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | ||||||||||||||

Noninterest-bearing accounts | $ | 1,062,126 | $ | 1,050,969 | $ | 1,101,705 | $ | 1,123,907 | $ | 1,047,910 | |||||||||

Interest-bearing transaction accounts | 743,351 | 754,819 | 875,880 | 915,653 | 814,338 | ||||||||||||||

Money market and savings accounts | 1,730,762 | 1,768,793 | 1,655,488 | 1,538,081 | 1,579,767 | ||||||||||||||

Brokered certificates of deposit | 202,323 | 224,192 | 201,082 | 115,306 | 170,701 | ||||||||||||||

Other certificates of deposit | 471,914 | 449,139 | 447,222 | 463,467 | 446,495 | ||||||||||||||

Total deposit portfolio | $ | 4,210,476 | $ | 4,247,912 | $ | 4,281,377 | $ | 4,156,414 | $ | 4,059,211 | |||||||||

Noninterest-bearing deposits to total deposits | 25 | % | 25 | % | 26 | % | 27 | % | 26 | % | |||||||||

Total deposits at September 30, 2018 were $4.2 billion, a decrease of $37 million, or 3% annualized, from June 30, 2018, but an increase of $151 million from September 30, 2017. Average deposit balances for the quarter ended September 30, 2018, increased $25 million from the linked quarter and $323 million compared to the prior year period resulting in higher interest expense on deposits for the current quarter.

Core deposits, defined as total deposits excluding certificates of deposits, were $3.5 billion at September 30, 2018, a decrease of $38 million, or 4% annualized, from the linked quarter, but an increase of $94 million from the prior year period. The Company continues to strengthen and diversify the funding base.

Noninterest-bearing deposits were $1.1 billion at September 30, 2018, an increase of $11 million compared to June 30, 2018, and an increase of $14 million compared to September 30, 2017. The total cost of deposits increased 13 basis points to 0.86% at September 30, 2018 compared to 0.73% at June 30, 2018, and also increased 40 basis points from

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

4

0.46% at September 30, 2017. The cost of deposits reflects interest rate conditions for existing clients as well as rates for new customer acquisition.

Noninterest Income

Total noninterest income for the quarter ended September 30, 2018 was $8.4 million, a decrease of $1.3 million, or 13% from the linked second quarter, and relatively stable with the prior year quarter. The decrease from the linked second quarter was driven by lower miscellaneous income items. Other income in the linked second quarter included a $0.6 million gain from the sale of an equity partnership.

Core noninterest income1 for the quarter ended September 30, 2018 was $8.4 million, a decrease of $0.6 million, or 7% from the linked second quarter, primarily due to lower income from interest rate swaps and other distributions. In addition, the linked second quarter included proceeds of $0.3 million from a bank-owned life insurance policy.

The Company expects growth in core fee income of a high single digit percentage for 2019 over 2018 levels.

Noninterest Expenses

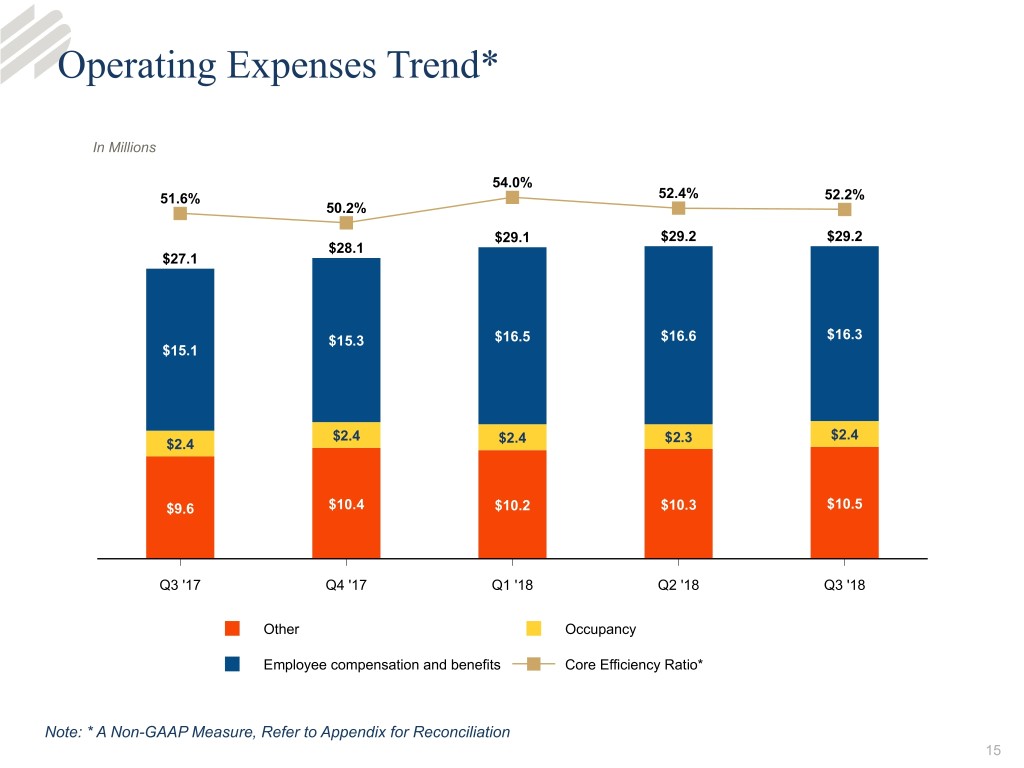

Noninterest expenses were $29.9 million for the quarter ended September 30, 2018, compared to $29.2 million for the quarter ended June 30, 2018, and $27.4 million for the quarter ended September 30, 2017. The increase from the linked quarter was due to a non-recurring excise tax expense which was offset by lower income tax expenses discussed below. Noninterest expenses for the quarter ended September 30, 2017 included $0.3 million of merger related expenses.

Core noninterest expenses1 were $29.2 million for each of the quarters ended September 30, 2018 and June 30, 2018, compared to $27.1 million for the prior year period. Core expenses1 increased over the prior year period due to increases in employee compensation and benefits from investments in revenue producing personnel and $0.8 million of tax credit amortization.

The Company's core efficiency ratio1 was 52.2% for the quarter ended September 30, 2018, compared to 52.4% for the linked quarter and 51.6% for the prior year period. The decrease in the linked quarter is reflective of marginally higher income and holding noninterest expense steady.

The Company expects to continue to invest in revenue producing associates and other infrastructure that supports additional growth. These investments are expected to result in expense growth, at a rate of 35% - 45% of projected revenue growth for 2019, resulting in continued improvements to the Company's efficiency ratio.

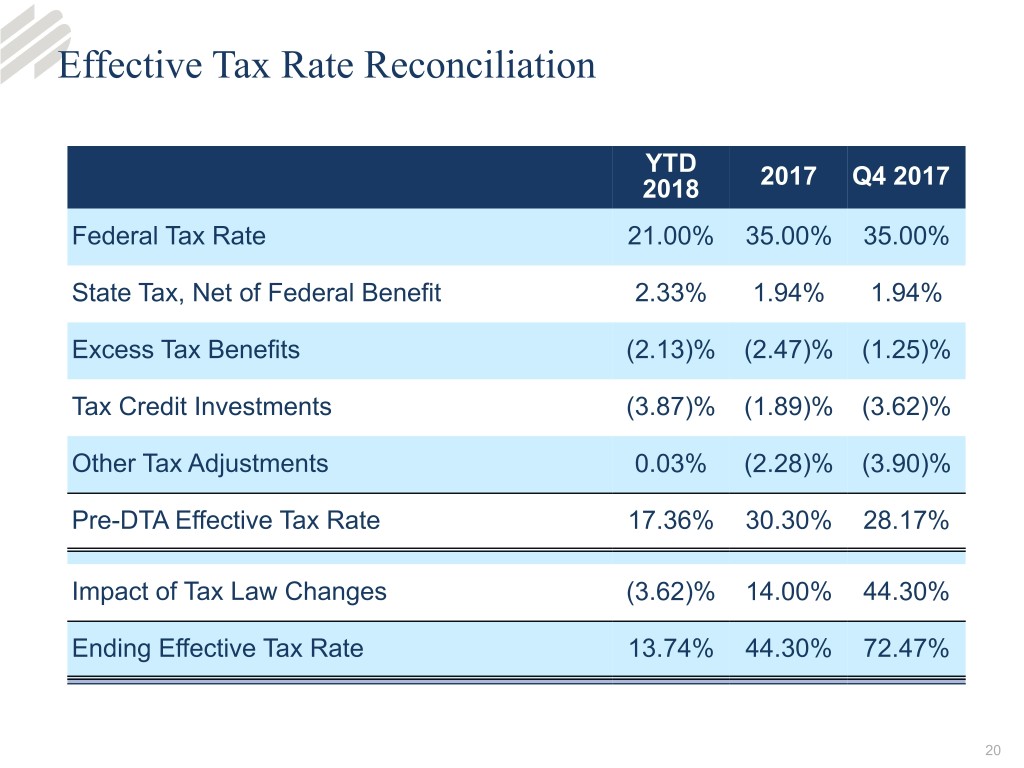

Income Taxes

The Company's effective tax rate was 7% for the quarter ended September 30, 2018 compared to 18% for the quarter ended June 30, 2018, and 33% for the quarter ended September 30, 2017. During the current quarter, the Company finalized its 2017 corporate income tax returns. Tax planning activities associated with the excise tax discussed above, reduced income tax expense by $2.7 million.

The Company expects its effective tax rate for the remainder of 2018 and 2019 to be approximately 18% - 20%.

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

5

Capital

The following table presents various capital ratios:

At the Quarter ended | ||||||||||||||

Percent | September 30, 2018 | June 30, 2018 | March 31, 2018 | December 31, 2017 | September 30, 2017 | |||||||||

Total risk-based capital to risk-weighted assets | 12.94 | % | 12.60 | % | 12.41 | % | 12.21 | % | 12.33 | % | ||||

Common equity tier 1 capital to risk-weighted assets | 9.66 | % | 9.32 | % | 9.07 | % | 8.88 | % | 8.93 | % | ||||

Tangible common equity to tangible assets | 8.54 | % | 8.30 | % | 8.13 | % | 8.14 | % | 8.18 | % | ||||

In the third quarter of 2018, as part of its capital management efforts, the Company repurchased 71,007 shares of its common stock for $3.8 million pursuant to its publicly announced share repurchase program.

Capital ratios for the current quarter are based on the Basel III regulatory capital framework as applied to the Company’s current businesses and operations, and are subject to, among other things, completion and filing of the Company’s regulatory reports and ongoing regulatory review and implementation guidance. The attached tables contain a reconciliation of these ratios to U.S. GAAP financial measures.

For more information contact:

Investor Relations: Keene Turner, Executive Vice President and CFO (314) 512-7233

Media: Karen Loiterstein, Senior Vice President (314) 512-7141

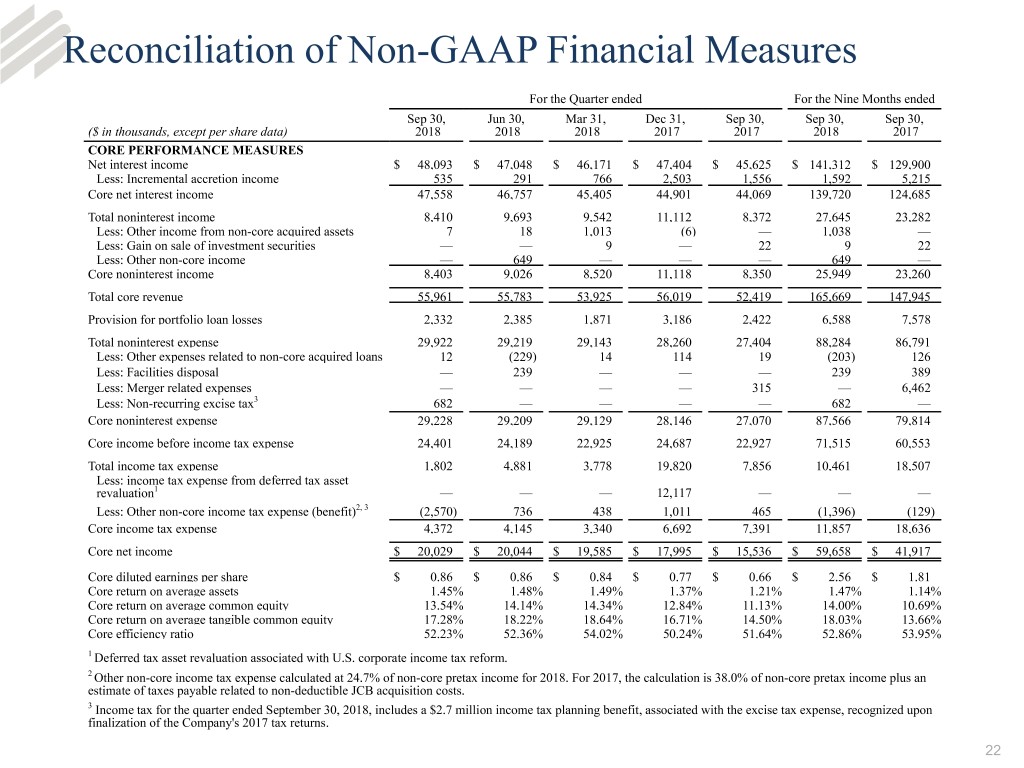

Use of Non-GAAP Financial Measures1

The Company's accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as core net income and core net interest margin, and other core performance measures, regulatory capital ratios, and the tangible common equity ratio, in this release that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company's financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP.

The Company considers its core performance measures presented in this earnings release and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of non-core acquired loans and related income and expenses, the impact of certain non-comparable items, and the Company's operating performance on an ongoing basis. Core performance measures include contractual interest on non-core acquired loans, but exclude incremental accretion on these loans. Core performance measures also exclude the gain or loss on sale of other real estate from non-core acquired loans, and expenses directly related to non-core acquired loans and other assets formerly covered under FDIC loss share agreements. Core performance measures also exclude certain other income and expense items, such as executive separation costs, merger related expenses, facilities charges, deferred tax asset revaluation, and the gain or loss on sale of investment securities, the Company believes to be not indicative of or useful to measure the Company's operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company's capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject.

The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company's performance and capital strength. The Company's management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company's operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

6

preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measure for the periods indicated.

Conference Call and Webcast Information

The Company will host a conference call and webcast at 2:30 p.m. Central time on Tuesday, October 23, 2018. During the call, management will review the third quarter of 2018 results and related matters. This press release as well as a related slide presentation will be accessible on the Company's website at www.enterprisebank.com under “Investor Relations” beginning prior to the scheduled broadcast of the conference call. The call can be accessed via this same website page, or via telephone at 1-877-260-1479 (Conference ID #5159617). A recorded replay of the conference call will be available on the website two hours after the call's completion. Visit http://bit.ly/EFSC3Q2018earnings and register to receive a dial in number, passcode, and pin number. The replay will be available for approximately two weeks following the conference call.

Enterprise Financial Services Corp operates commercial banking and wealth management businesses in metropolitan St. Louis, Kansas City, and Phoenix. The Company is primarily focused on serving the needs of privately held businesses, their owner families, executives and professionals.

Forward-looking Statements

Readers should note that, in addition to the historical information contained herein, this press release contains "forward-looking statements" within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements about the Company's plans, expectations, and projections of future financial and operating results, as well as statements regarding the Company's plans, objectives, expectations or consequences of announced transactions. The Company uses words such as "may," "might," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential," "could," "continue," and “intend”, and variations of such words and similar expressions, in this communication to identify such forward-looking statements. Forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those contemplated from such statements. Factors that could cause or contribute to such differences include, but are not limited to, the Company's ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses and grow the acquired operations, as well as credit risk, changes in the appraised valuation of real estate securing impaired loans, outcomes of litigation and other contingencies, exposure to general and local economic conditions, risks associated with rapid increases or decreases in prevailing interest rates, consolidation in the banking industry, competition from banks and other financial institutions, the Company's ability to attract and retain relationship officers and other key personnel, burdens imposed by federal and state regulation, changes in regulatory requirements, changes in accounting regulation or standards applicable to banks, as well as other risk factors described in the Company's 2017 Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update them in light of new information or future events unless required under the federal securities laws.

1 A non-GAAP measure. Refer to discussion and reconciliation of these measures in the accompanying financial tables.

7

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited)

For the Quarter ended | For the Nine Months ended | ||||||||||||||||||||||||||

($ in thousands, except per share data) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Sep 30, 2018 | Sep 30, 2017 | ||||||||||||||||||||

EARNINGS SUMMARY | |||||||||||||||||||||||||||

Net interest income | $ | 48,093 | $ | 47,048 | $ | 46,171 | $ | 47,404 | $ | 45,625 | $ | 141,312 | $ | 129,900 | |||||||||||||

Provision for portfolio loan losses | 2,332 | 2,385 | 1,871 | 3,186 | 2,422 | 6,588 | 7,578 | ||||||||||||||||||||

Provision reversal for purchased credit impaired loan losses | (69 | ) | (1,995 | ) | — | (279 | ) | — | (2,064 | ) | (355 | ) | |||||||||||||||

Noninterest income | 8,410 | 9,693 | 9,542 | 11,112 | 8,372 | 27,645 | 23,282 | ||||||||||||||||||||

Noninterest expense | 29,922 | 29,219 | 29,143 | 28,260 | 27,404 | 88,284 | 86,791 | ||||||||||||||||||||

Income before income tax expense | 24,318 | 27,132 | 24,699 | 27,349 | 24,171 | 76,149 | 59,168 | ||||||||||||||||||||

Income tax expense1 | 1,802 | 4,881 | 3,778 | 19,820 | 7,856 | 10,461 | 18,507 | ||||||||||||||||||||

Net income1 | $ | 22,516 | $ | 22,251 | $ | 20,921 | $ | 7,529 | $ | 16,315 | $ | 65,688 | $ | 40,661 | |||||||||||||

Diluted earnings per share | $ | 0.97 | $ | 0.95 | $ | 0.90 | $ | 0.32 | $ | 0.69 | $ | 2.81 | $ | 1.75 | |||||||||||||

Return on average assets | 1.63 | % | 1.65 | % | 1.59 | % | 0.57 | % | 1.27 | % | 1.62 | % | 1.11 | % | |||||||||||||

Return on average common equity | 15.22 | % | 15.70 | % | 15.31 | % | 5.37 | % | 11.69 | % | 15.41 | % | 10.37 | % | |||||||||||||

Return on average tangible common equity | 19.42 | % | 20.23 | % | 19.92 | % | 6.99 | % | 15.23 | % | 19.85 | % | 13.25 | % | |||||||||||||

Net interest margin (fully tax equivalent) | 3.78 | % | 3.77 | % | 3.80 | % | 3.93 | % | 3.88 | % | 3.78 | % | 3.87 | % | |||||||||||||

Efficiency ratio | 52.96 | % | 51.50 | % | 52.31 | % | 48.29 | % | 50.75 | % | 52.25 | % | 56.66 | % | |||||||||||||

CORE PERFORMANCE SUMMARY (NON-GAAP)2 | |||||||||||||||||||||||||||

Net interest income | $ | 47,558 | $ | 46,757 | $ | 45,405 | $ | 44,901 | $ | 44,069 | $ | 139,720 | $ | 124,685 | |||||||||||||

Provision for portfolio loan losses | 2,332 | 2,385 | 1,871 | 3,186 | 2,422 | 6,588 | 7,578 | ||||||||||||||||||||

Noninterest income | 8,403 | 9,026 | 8,520 | 11,118 | 8,350 | 25,949 | 23,260 | ||||||||||||||||||||

Noninterest expense | 29,228 | 29,209 | 29,129 | 28,146 | 27,070 | 87,566 | 79,814 | ||||||||||||||||||||

Income before income tax expense | 24,401 | 24,189 | 22,925 | 24,687 | 22,927 | 71,515 | 60,553 | ||||||||||||||||||||

Income tax expense | 4,372 | 4,145 | 3,340 | 6,692 | 7,391 | 11,857 | 18,636 | ||||||||||||||||||||

Net income | $ | 20,029 | $ | 20,044 | $ | 19,585 | $ | 17,995 | $ | 15,536 | $ | 59,658 | $ | 41,917 | |||||||||||||

Diluted earnings per share | $ | 0.86 | $ | 0.86 | $ | 0.84 | $ | 0.77 | $ | 0.66 | $ | 2.56 | $ | 1.81 | |||||||||||||

Return on average assets | 1.45 | % | 1.48 | % | 1.49 | % | 1.37 | % | 1.21 | % | 1.47 | % | 1.14 | % | |||||||||||||

Return on average common equity | 13.54 | % | 14.14 | % | 14.34 | % | 12.84 | % | 11.13 | % | 14.00 | % | 10.69 | % | |||||||||||||

Return on average tangible common equity | 17.28 | % | 18.22 | % | 18.64 | % | 16.71 | % | 14.50 | % | 18.03 | % | 13.66 | % | |||||||||||||

Net interest margin (fully tax equivalent) | 3.74 | % | 3.75 | % | 3.74 | % | 3.73 | % | 3.75 | % | 3.74 | % | 3.71 | % | |||||||||||||

Efficiency ratio | 52.23 | % | 52.36 | % | 54.02 | % | 50.24 | % | 51.64 | % | 52.86 | % | 53.95 | % | |||||||||||||

1 Includes $12.1 million ($0.52 per diluted share) deferred tax asset revaluation charge for the quarter ended December 31, 2017 due to U.S. corporate income tax reform. | |||||||||||||||||||||||||||

2 Refer to Reconciliations of Non-GAAP Financial Measures table for a reconciliation of these measures to GAAP. | |||||||||||||||||||||||||||

8

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

For the Quarter ended | For the Nine Months ended | ||||||||||||||||||||||||||

($ in thousands, except per share data) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Sep 30, 2018 | Sep 30, 2017 | ||||||||||||||||||||

INCOME STATEMENTS | |||||||||||||||||||||||||||

NET INTEREST INCOME | |||||||||||||||||||||||||||

Total interest income | $ | 60,757 | $ | 57,879 | $ | 55,164 | $ | 54,789 | $ | 52,468 | $ | 173,800 | $ | 147,750 | |||||||||||||

Total interest expense | 12,664 | 10,831 | 8,993 | 7,385 | 6,843 | 32,488 | 17,850 | ||||||||||||||||||||

Net interest income | 48,093 | 47,048 | 46,171 | 47,404 | 45,625 | 141,312 | 129,900 | ||||||||||||||||||||

Provision for portfolio loan losses | 2,332 | 2,385 | 1,871 | 3,186 | 2,422 | 6,588 | 7,578 | ||||||||||||||||||||

Provision reversal for purchased credit impaired loan losses | (69 | ) | (1,995 | ) | — | (279 | ) | — | (2,064 | ) | (355 | ) | |||||||||||||||

Net interest income after provision for loan losses | 45,830 | 46,658 | 44,300 | 44,497 | 43,203 | 136,788 | 122,677 | ||||||||||||||||||||

NONINTEREST INCOME | |||||||||||||||||||||||||||

Deposit service charges | 2,997 | 3,007 | 2,851 | 2,897 | 2,820 | 8,855 | 8,146 | ||||||||||||||||||||

Wealth management revenue | 2,012 | 2,141 | 2,114 | 2,153 | 2,062 | 6,267 | 5,949 | ||||||||||||||||||||

Card services revenue | 1,760 | 1,650 | 1,516 | 1,545 | 1,459 | 4,926 | 3,888 | ||||||||||||||||||||

State tax credit activity, net | 192 | 64 | 252 | 2,249 | 77 | 508 | 332 | ||||||||||||||||||||

Gain on sale of other real estate | 13 | — | — | 76 | — | 13 | 17 | ||||||||||||||||||||

Gain on sale of investment securities | — | — | 9 | — | 22 | 9 | 22 | ||||||||||||||||||||

Other income | 1,436 | 2,831 | 2,800 | 2,192 | 1,932 | 7,067 | 4,928 | ||||||||||||||||||||

Total noninterest income | 8,410 | 9,693 | 9,542 | 11,112 | 8,372 | 27,645 | 23,282 | ||||||||||||||||||||

NONINTEREST EXPENSE | |||||||||||||||||||||||||||

Employee compensation and benefits | 16,297 | 16,582 | 16,491 | 15,292 | 15,090 | 49,370 | 46,096 | ||||||||||||||||||||

Occupancy | 2,394 | 2,342 | 2,406 | 2,429 | 2,434 | 7,142 | 6,628 | ||||||||||||||||||||

Merger related expenses | — | — | — | — | 315 | — | 6,462 | ||||||||||||||||||||

Other | 11,231 | 10,295 | 10,246 | 10,539 | 9,565 | 31,772 | 27,605 | ||||||||||||||||||||

Total noninterest expense | 29,922 | 29,219 | 29,143 | 28,260 | 27,404 | 88,284 | 86,791 | ||||||||||||||||||||

Income before income tax expense | 24,318 | 27,132 | 24,699 | 27,349 | 24,171 | 76,149 | 59,168 | ||||||||||||||||||||

Income tax expense | 1,802 | 4,881 | 3,778 | 19,820 | 7,856 | 10,461 | 18,507 | ||||||||||||||||||||

Net income | $ | 22,516 | $ | 22,251 | $ | 20,921 | $ | 7,529 | $ | 16,315 | $ | 65,688 | $ | 40,661 | |||||||||||||

Basic earnings per share | $ | 0.97 | $ | 0.96 | $ | 0.91 | $ | 0.33 | $ | 0.70 | $ | 2.84 | $ | 1.77 | |||||||||||||

Diluted earnings per share | 0.97 | 0.95 | 0.90 | 0.32 | 0.69 | 2.81 | 1.75 | ||||||||||||||||||||

9

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

At the Quarter ended | |||||||||||||||||||

($ in thousands) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | ||||||||||||||

BALANCE SHEETS | |||||||||||||||||||

ASSETS | |||||||||||||||||||

Cash and due from banks | $ | 78,119 | $ | 91,851 | $ | 81,604 | $ | 91,084 | $ | 76,777 | |||||||||

Interest-earning deposits | 81,351 | 87,586 | 63,897 | 64,884 | 108,976 | ||||||||||||||

Debt and equity investments | 775,344 | 756,203 | 752,114 | 741,792 | 708,725 | ||||||||||||||

Loans held for sale | 738 | 1,388 | 1,748 | 3,155 | 6,411 | ||||||||||||||

Portfolio loans | 4,249,758 | 4,252,336 | 4,162,082 | 4,066,659 | 3,996,501 | ||||||||||||||

Less: Allowance for loan losses | 41,892 | 42,007 | 40,263 | 38,166 | 38,292 | ||||||||||||||

Portfolio loans, net | 4,207,866 | 4,210,329 | 4,121,819 | 4,028,493 | 3,958,209 | ||||||||||||||

Non-core acquired loans, net of the allowance for loan losses | 15,378 | 21,062 | 24,376 | 25,980 | 29,258 | ||||||||||||||

Total loans, net | 4,223,244 | 4,231,391 | 4,146,195 | 4,054,473 | 3,987,467 | ||||||||||||||

Other real estate | 408 | 454 | 455 | 498 | 491 | ||||||||||||||

Fixed assets, net | 32,354 | 32,814 | 32,127 | 32,618 | 32,803 | ||||||||||||||

State tax credits, held for sale | 45,625 | 46,481 | 42,364 | 43,468 | 35,291 | ||||||||||||||

Goodwill | 117,345 | 117,345 | 117,345 | 117,345 | 117,345 | ||||||||||||||

Intangible assets, net | 9,148 | 9,768 | 10,399 | 11,056 | 11,745 | ||||||||||||||

Other assets | 153,863 | 134,643 | 134,854 | 128,852 | 145,457 | ||||||||||||||

Total assets | $ | 5,517,539 | $ | 5,509,924 | $ | 5,383,102 | $ | 5,289,225 | $ | 5,231,488 | |||||||||

LIABILITIES AND SHAREHOLDERS' EQUITY | |||||||||||||||||||

Noninterest-bearing deposits | $ | 1,062,126 | $ | 1,050,969 | $ | 1,101,705 | $ | 1,123,907 | $ | 1,047,910 | |||||||||

Interest-bearing deposits | 3,148,350 | 3,196,943 | 3,179,672 | 3,032,507 | 3,011,301 | ||||||||||||||

Total deposits | 4,210,476 | 4,247,912 | 4,281,377 | 4,156,414 | 4,059,211 | ||||||||||||||

Subordinated debentures | 118,144 | 118,131 | 118,118 | 118,105 | 118,093 | ||||||||||||||

Federal Home Loan Bank advances | 401,000 | 361,534 | 224,624 | 172,743 | 248,868 | ||||||||||||||

Other borrowings | 161,795 | 167,216 | 166,589 | 253,674 | 209,104 | ||||||||||||||

Other liabilities | 39,287 | 41,047 | 37,379 | 39,716 | 49,876 | ||||||||||||||

Total liabilities | 4,930,702 | 4,935,840 | 4,828,087 | 4,740,652 | 4,685,152 | ||||||||||||||

Shareholders' equity | 586,837 | 574,084 | 555,015 | 548,573 | 546,336 | ||||||||||||||

Total liabilities and shareholders' equity | $ | 5,517,539 | $ | 5,509,924 | $ | 5,383,102 | $ | 5,289,225 | $ | 5,231,488 | |||||||||

10

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

For the Quarter ended | |||||||||||||||||||

($ in thousands) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | ||||||||||||||

LOAN PORTFOLIO | |||||||||||||||||||

Commercial and industrial | $ | 2,033,278 | $ | 2,038,400 | $ | 1,982,086 | $ | 1,919,145 | $ | 1,861,935 | |||||||||

Commercial real estate | 1,443,088 | 1,445,981 | 1,413,897 | 1,363,605 | 1,332,111 | ||||||||||||||

Construction real estate | 329,288 | 302,514 | 309,227 | 305,468 | 306,410 | ||||||||||||||

Residential real estate | 309,414 | 319,208 | 329,337 | 342,518 | 341,695 | ||||||||||||||

Consumer and other | 134,690 | 146,233 | 127,535 | 135,923 | 154,350 | ||||||||||||||

Total portfolio loans | 4,249,758 | 4,252,336 | 4,162,082 | 4,066,659 | 3,996,501 | ||||||||||||||

Non-core acquired loans | 17,672 | 23,425 | 28,763 | 30,391 | 34,157 | ||||||||||||||

Total loans | $ | 4,267,430 | $ | 4,275,761 | $ | 4,190,845 | $ | 4,097,050 | $ | 4,030,658 | |||||||||

DEPOSIT PORTFOLIO | |||||||||||||||||||

Noninterest-bearing accounts | $ | 1,062,126 | $ | 1,050,969 | $ | 1,101,705 | $ | 1,123,907 | $ | 1,047,910 | |||||||||

Interest-bearing transaction accounts | 743,351 | 754,819 | 875,880 | 915,653 | 814,338 | ||||||||||||||

Money market and savings accounts | 1,730,762 | 1,768,793 | 1,655,488 | 1,538,081 | 1,579,767 | ||||||||||||||

Brokered certificates of deposit | 202,323 | 224,192 | 201,082 | 115,306 | 170,701 | ||||||||||||||

Other certificates of deposit | 471,914 | 449,139 | 447,222 | 463,467 | 446,495 | ||||||||||||||

Total deposit portfolio | $ | 4,210,476 | $ | 4,247,912 | $ | 4,281,377 | $ | 4,156,414 | $ | 4,059,211 | |||||||||

AVERAGE BALANCES | |||||||||||||||||||

Portfolio loans | $ | 4,230,089 | $ | 4,196,875 | $ | 4,108,400 | $ | 3,990,233 | $ | 3,899,493 | |||||||||

Non-core acquired loans | 21,891 | 26,179 | 29,125 | 31,957 | 35,120 | ||||||||||||||

Loans held for sale | 544 | 962 | 1,445 | 3,599 | 5,144 | ||||||||||||||

Debt and equity investments | 755,129 | 743,534 | 740,587 | 708,481 | 711,056 | ||||||||||||||

Interest-earning assets | 5,072,573 | 5,023,607 | 4,948,875 | 4,826,271 | 4,712,672 | ||||||||||||||

Total assets | 5,471,504 | 5,415,151 | 5,340,112 | 5,226,183 | 5,095,494 | ||||||||||||||

Deposits | 4,255,523 | 4,230,291 | 4,124,326 | 4,115,377 | 3,932,038 | ||||||||||||||

Shareholders' equity | 586,765 | 568,555 | 554,066 | 555,994 | 553,713 | ||||||||||||||

Tangible common equity | 459,975 | 441,136 | 426,006 | 427,258 | 425,056 | ||||||||||||||

YIELDS (fully tax equivalent) | |||||||||||||||||||

Portfolio loans | 5.12 | % | 4.99 | % | 4.87 | % | 4.71 | % | 4.69 | % | |||||||||

Non-core acquired loans | 16.93 | % | 12.37 | % | 16.60 | % | 37.53 | % | 23.82 | % | |||||||||

Total loans | 5.18 | % | 5.04 | % | 4.96 | % | 4.97 | % | 4.86 | % | |||||||||

Debt and equity investments | 2.71 | % | 2.58 | % | 2.50 | % | 2.52 | % | 2.49 | % | |||||||||

Interest-earning assets | 4.77 | % | 4.64 | % | 4.54 | % | 4.54 | % | 4.45 | % | |||||||||

Interest-bearing deposits | 1.16 | % | 0.98 | % | 0.82 | % | 0.69 | % | 0.62 | % | |||||||||

Total deposits | 0.86 | % | 0.73 | % | 0.61 | % | 0.50 | % | 0.46 | % | |||||||||

Subordinated debentures | 4.98 | % | 4.94 | % | 4.70 | % | 4.46 | % | 4.42 | % | |||||||||

Borrowed funds | 1.62 | % | 1.41 | % | 1.15 | % | 0.84 | % | 0.85 | % | |||||||||

Cost of paying liabilities | 1.34 | % | 1.16 | % | 0.99 | % | 0.84 | % | 0.78 | % | |||||||||

Net interest margin | 3.78 | % | 3.77 | % | 3.80 | % | 3.93 | % | 3.88 | % | |||||||||

11

ENTERPRISE FINANCIAL SERVICES CORP

CONSOLIDATED FINANCIAL SUMMARY (unaudited) (continued)

For the Quarter ended | |||||||||||||||||||

(in thousands, except % and per share data) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | ||||||||||||||

ASSET QUALITY | |||||||||||||||||||

Net charge-offs (recoveries)1 | $ | 2,447 | $ | 641 | $ | (226 | ) | $ | 3,313 | $ | 803 | ||||||||

Nonperforming loans1 | 17,044 | 14,801 | 15,582 | 15,687 | 8,985 | ||||||||||||||

Classified assets | 73,704 | 74,001 | 77,195 | 73,239 | 80,757 | ||||||||||||||

Nonperforming loans to total loans1 | 0.40 | % | 0.35 | % | 0.38 | % | 0.39 | % | 0.23 | % | |||||||||

Nonperforming assets to total assets2 | 0.32 | % | 0.28 | % | 0.30 | % | 0.31 | % | 0.18 | % | |||||||||

Allowance for loan losses to total loans1 | 0.99 | % | 1.00 | % | 0.98 | % | 0.95 | % | 0.97 | % | |||||||||

Allowance for loan losses to nonperforming loans1 | 245.8 | % | 283.8 | % | 258.4 | % | 243.3 | % | 426.2 | % | |||||||||

Net charge-offs (recoveries) to average loans (annualized)1 | 0.23 | % | 0.06 | % | (0.02 | )% | 0.33 | % | 0.08 | % | |||||||||

WEALTH MANAGEMENT | |||||||||||||||||||

Trust assets under management | $ | 1,174,798 | $ | 1,337,030 | $ | 1,319,259 | $ | 1,330,227 | $ | 1,319,123 | |||||||||

Trust assets under administration | 1,984,859 | 2,165,870 | 2,151,697 | 2,169,946 | 2,102,800 | ||||||||||||||

MARKET DATA | |||||||||||||||||||

Book value per common share | $ | 25.41 | $ | 24.81 | $ | 24.02 | $ | 23.76 | $ | 23.69 | |||||||||

Tangible book value per common share | $ | 19.94 | $ | 19.32 | $ | 18.49 | $ | 18.20 | $ | 18.09 | |||||||||

Market value per share | $ | 53.05 | $ | 53.95 | $ | 46.90 | $ | 45.15 | $ | 42.35 | |||||||||

Period end common shares outstanding | 23,092 | 23,141 | 23,111 | 23,089 | 23,063 | ||||||||||||||

Average basic common shares | 23,148 | 23,124 | 23,115 | 23,069 | 23,324 | ||||||||||||||

Average diluted common shares | 23,329 | 23,318 | 23,287 | 23,342 | 23,574 | ||||||||||||||

CAPITAL | |||||||||||||||||||

Total risk-based capital to risk-weighted assets | 12.94 | % | 12.60 | % | 12.41 | % | 12.21 | % | 12.33 | % | |||||||||

Tier 1 capital to risk-weighted assets | 11.03 | % | 10.68 | % | 10.46 | % | 10.29 | % | 10.36 | % | |||||||||

Common equity tier 1 capital to risk-weighted assets | 9.66 | % | 9.32 | % | 9.07 | % | 8.88 | % | 8.93 | % | |||||||||

Tangible common equity to tangible assets | 8.54 | % | 8.30 | % | 8.13 | % | 8.14 | % | 8.18 | % | |||||||||

1 Excludes loans accounted for as PCI loans. | |||||||||||||||||||

2 Excludes PCI loans and related assets, except for inclusion in total assets. | |||||||||||||||||||

12

ENTERPRISE FINANCIAL SERVICES CORP

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

For the Quarter ended | For the Nine Months ended | ||||||||||||||||||||||||||

($ in thousands, except per share data) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Sep 30, 2018 | Sep 30, 2017 | ||||||||||||||||||||

CORE PERFORMANCE MEASURES | |||||||||||||||||||||||||||

Net interest income | $ | 48,093 | $ | 47,048 | $ | 46,171 | $ | 47,404 | $ | 45,625 | $ | 141,312 | $ | 129,900 | |||||||||||||

Less: Incremental accretion income | 535 | 291 | 766 | 2,503 | 1,556 | 1,592 | 5,215 | ||||||||||||||||||||

Core net interest income | 47,558 | 46,757 | 45,405 | 44,901 | 44,069 | 139,720 | 124,685 | ||||||||||||||||||||

Total noninterest income | 8,410 | 9,693 | 9,542 | 11,112 | 8,372 | 27,645 | 23,282 | ||||||||||||||||||||

Less: Other income from non-core acquired assets | 7 | 18 | 1,013 | (6 | ) | — | 1,038 | — | |||||||||||||||||||

Less: Gain on sale of investment securities | — | — | 9 | — | 22 | 9 | 22 | ||||||||||||||||||||

Less: Other non-core income | — | 649 | — | — | — | 649 | — | ||||||||||||||||||||

Core noninterest income | 8,403 | 9,026 | 8,520 | 11,118 | 8,350 | 25,949 | 23,260 | ||||||||||||||||||||

Total core revenue | 55,961 | 55,783 | 53,925 | 56,019 | 52,419 | 165,669 | 147,945 | ||||||||||||||||||||

Provision for portfolio loan losses | 2,332 | 2,385 | 1,871 | 3,186 | 2,422 | 6,588 | 7,578 | ||||||||||||||||||||

Total noninterest expense | 29,922 | 29,219 | 29,143 | 28,260 | 27,404 | 88,284 | 86,791 | ||||||||||||||||||||

Less: Other expenses related to non-core acquired loans | 12 | (229 | ) | 14 | 114 | 19 | (203 | ) | 126 | ||||||||||||||||||

Less: Facilities disposal | — | 239 | — | — | — | 239 | 389 | ||||||||||||||||||||

Less: Merger related expenses | — | — | — | — | 315 | — | 6,462 | ||||||||||||||||||||

Less: Non-recurring excise tax3 | 682 | — | — | — | — | 682 | — | ||||||||||||||||||||

Core noninterest expense | 29,228 | 29,209 | 29,129 | 28,146 | 27,070 | 87,566 | 79,814 | ||||||||||||||||||||

Core income before income tax expense | 24,401 | 24,189 | 22,925 | 24,687 | 22,927 | 71,515 | 60,553 | ||||||||||||||||||||

Total income tax expense | 1,802 | 4,881 | 3,778 | 19,820 | 7,856 | 10,461 | 18,507 | ||||||||||||||||||||

Less: income tax expense from deferred tax asset revaluation1 | — | — | — | 12,117 | — | — | — | ||||||||||||||||||||

Less: Other non-core income tax expense (benefit)2, 3 | (2,570 | ) | 736 | 438 | 1,011 | 465 | (1,396 | ) | (129 | ) | |||||||||||||||||

Core income tax expense | 4,372 | 4,145 | 3,340 | 6,692 | 7,391 | 11,857 | 18,636 | ||||||||||||||||||||

Core net income | $ | 20,029 | $ | 20,044 | $ | 19,585 | $ | 17,995 | $ | 15,536 | $ | 59,658 | $ | 41,917 | |||||||||||||

Core diluted earnings per share | $ | 0.86 | $ | 0.86 | $ | 0.84 | $ | 0.77 | $ | 0.66 | $ | 2.56 | $ | 1.81 | |||||||||||||

Core return on average assets | 1.45 | % | 1.48 | % | 1.49 | % | 1.37 | % | 1.21 | % | 1.47 | % | 1.14 | % | |||||||||||||

Core return on average common equity | 13.54 | % | 14.14 | % | 14.34 | % | 12.84 | % | 11.13 | % | 14.00 | % | 10.69 | % | |||||||||||||

Core return on average tangible common equity | 17.28 | % | 18.22 | % | 18.64 | % | 16.71 | % | 14.50 | % | 18.03 | % | 13.66 | % | |||||||||||||

Core efficiency ratio | 52.23 | % | 52.36 | % | 54.02 | % | 50.24 | % | 51.64 | % | 52.86 | % | 53.95 | % | |||||||||||||

1 Deferred tax asset revaluation associated with U.S. corporate income tax reform. | |||||||||||||||||||||||||||

2 Other non-core income tax expense calculated at 24.7% of non-core pretax income for 2018. For 2017, the calculation is 38.0% of non-core pretax income plus an estimate of taxes payable related to non-deductible JCB acquisition costs. | |||||||||||||||||||||||||||

3 Income tax for the quarter ended September 30, 2018, includes a $2.7 million income tax planning benefit, associated with the excise tax expense, recognized upon finalization of the Company's 2017 tax returns. | |||||||||||||||||||||||||||

13

NET INTEREST MARGIN TO CORE NET INTEREST MARGIN (FULLY TAX EQUIVALENT) | |||||||||||||||||||||||||||

For the Quarter ended | For the Nine Months ended | ||||||||||||||||||||||||||

($ in thousands) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | Sep 30, 2018 | Sep 30, 2017 | ||||||||||||||||||||

Net interest income | $ | 48,299 | $ | 47,254 | $ | 46,386 | $ | 47,824 | $ | 46,047 | $ | 141,939 | $ | 131,290 | |||||||||||||

Less: Incremental accretion income | 535 | 291 | 766 | 2,503 | 1,556 | 1,592 | 5,215 | ||||||||||||||||||||

Core net interest income | $ | 47,764 | $ | 46,963 | $ | 45,620 | $ | 45,321 | $ | 44,491 | $ | 140,347 | $ | 126,075 | |||||||||||||

Average earning assets | $ | 5,072,573 | $ | 5,023,607 | $ | 4,948,875 | $ | 4,826,271 | $ | 4,712,672 | $ | 5,015,471 | $ | 4,539,350 | |||||||||||||

Reported net interest margin | 3.78 | % | 3.77 | % | 3.80 | % | 3.93 | % | 3.88 | % | 3.78 | % | 3.87 | % | |||||||||||||

Core net interest margin | 3.74 | % | 3.75 | % | 3.74 | % | 3.73 | % | 3.75 | % | 3.74 | % | 3.71 | % | |||||||||||||

At the Quarter ended | |||||||||||||||||||

($ in thousands) | Sep 30, 2018 | Jun 30, 2018 | Mar 31, 2018 | Dec 31, 2017 | Sep 30, 2017 | ||||||||||||||

REGULATORY CAPITAL TO RISK-WEIGHTED ASSETS | |||||||||||||||||||

Shareholders' equity | $ | 586,837 | $ | 574,084 | $ | 555,015 | $ | 548,573 | $ | 546,336 | |||||||||

Less: Goodwill | 117,345 | 117,345 | 117,345 | 117,345 | 117,345 | ||||||||||||||

Less: Intangible assets, net of deferred tax liabilities | 6,888 | 7,355 | 7,831 | 6,661 | 5,825 | ||||||||||||||

Less: Unrealized gains (losses) | (16,627 | ) | (12,580 | ) | (11,563 | ) | (3,818 | ) | (489 | ) | |||||||||

Plus: Other | — | — | — | 12 | 12 | ||||||||||||||

Common equity tier 1 capital | 479,231 | 461,964 | 441,402 | 428,397 | 423,667 | ||||||||||||||

Plus: Qualifying trust preferred securities | 67,600 | 67,600 | 67,600 | 67,600 | 67,600 | ||||||||||||||

Plus: Other | 60 | 60 | 60 | 48 | 48 | ||||||||||||||

Tier 1 capital | 546,891 | 529,624 | 509,062 | 496,045 | 491,315 | ||||||||||||||

Plus: Tier 2 capital | 94,611 | 94,795 | 95,075 | 93,002 | 93,616 | ||||||||||||||

Total risk-based capital | $ | 641,502 | $ | 624,419 | $ | 604,137 | $ | 589,047 | $ | 584,931 | |||||||||

Total risk-weighted assets | $ | 4,958,999 | $ | 4,956,820 | $ | 4,867,491 | $ | 4,822,695 | $ | 4,743,393 | |||||||||

Common equity tier 1 capital to risk-weighted assets | 9.66 | % | 9.32 | % | 9.07 | % | 8.88 | % | 8.93 | % | |||||||||

Tier 1 capital to risk-weighted assets | 11.03 | % | 10.68 | % | 10.46 | % | 10.29 | % | 10.36 | % | |||||||||

Total risk-based capital to risk-weighted assets | 12.94 | % | 12.60 | % | 12.41 | % | 12.21 | % | 12.33 | % | |||||||||

SHAREHOLDERS' EQUITY TO TANGIBLE COMMON EQUITY AND TOTAL ASSETS TO TANGIBLE ASSETS | |||||||||||||||||||

Shareholders' equity | $ | 586,837 | $ | 574,084 | $ | 555,015 | $ | 548,573 | $ | 546,336 | |||||||||

Less: Goodwill | 117,345 | 117,345 | 117,345 | 117,345 | 117,345 | ||||||||||||||

Less: Intangible assets | 9,148 | 9,768 | 10,399 | 11,056 | 11,745 | ||||||||||||||

Tangible common equity | $ | 460,344 | $ | 446,971 | $ | 427,271 | $ | 420,172 | $ | 417,246 | |||||||||

Total assets | $ | 5,517,539 | $ | 5,509,924 | $ | 5,383,102 | $ | 5,289,225 | $ | 5,231,488 | |||||||||

Less: Goodwill | 117,345 | 117,345 | 117,345 | 117,345 | 117,345 | ||||||||||||||

Less: Intangible assets | 9,148 | 9,768 | 10,399 | 11,056 | 11,745 | ||||||||||||||

Tangible assets | $ | 5,391,046 | $ | 5,382,811 | $ | 5,255,358 | $ | 5,160,824 | $ | 5,102,398 | |||||||||

Tangible common equity to tangible assets | 8.54 | % | 8.30 | % | 8.13 | % | 8.14 | % | 8.18 | % | |||||||||

14