Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07883

ICON Funds

(Exact name of registrant as specified in charter)

5299 DTC Blvd. Suite 1200 Greenwood Village, CO 80111

(Address of principal executive offices) (Zip code)

Carrie Schoffman

5299 DTC Blvd. Suite 1200 Greenwood Village, CO 80111

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-790-1600

Date of fiscal year end: September 30, 2016

Date of reporting period: September 30, 2016

Table of Contents

Item 1. Reports to Stockholders.

Table of Contents

Diversified Funds

ICON Bond Fund

ICON Equity Income Fund

ICON Fund

ICON Long/Short Fund

ICON Opportunities Fund

ICON Risk-Managed Balanced Fund

Table of Contents

You can now sign up for electronic delivery of ICON Fund shareholder reports, including prospectuses, annual reports, semiannual reports and proxy statements.

When these materials are available, you will receive an email from ICON with instructions on how to view the documents. Statements, transaction confirmations and other documents that are not available online will continue to be sent to you by U.S. mail.

Visit ICON’s website at www.iconfunds.com to learn more and sign up.

You may change or cancel your participation in eDelivery by visiting www.iconfunds.com, or you can request a hard copy of any of the materials free of charge by calling ICON Funds at 1-800-764-0442.

|

1-800-764-0442

|

●

|

www.iconfunds.com

|

Table of Contents

| 2 | ||||

| Management Overview (Unaudited) and Schedules of Investments |

||||

| 6 | ||||

| 8 | ||||

| 14 | ||||

| 18 | ||||

| 22 | ||||

| 26 | ||||

| 35 | ||||

| 44 | ||||

| 60 | ||||

| 73 | ||||

| 74 | ||||

| 76 | ||||

| 77 | ||||

| 81 | ||||

Table of Contents

| ICON Diversified Funds | About This Report | |

| September 30, 2016 (Unaudited) |

Historical Returns

All total returns mentioned in this Report account for the change in a Fund’s per-share price and the reinvestment of any dividends, capital gain distributions and adjustments for financial statement purposes. If your account is set up to receive Fund distributions in cash rather than to reinvest them, your actual return may differ from these figures. The Funds’ performance results do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares. The Adviser may have reimbursed certain fees or expenses of some of the Funds. If not for these reimbursements, performance would have been lower. Fund results shown, unless otherwise indicated, are at net asset value. If a sales charge (maximum 5.75%) had been deducted, results would have been lower.

Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Performance results represent past performance, and current performance may be higher or lower. Please call 1-800-764-0442 or visit www.iconfunds.com for performance results current to the most recent month-end.

Portfolio Data

This Report reflects ICON’s portfolio holdings as of September 30, 2016, the end of the reporting period. The information is not a complete analysis of every aspect of any sector, industry, security or the Funds.

There are risks associated with mutual fund investing, including the loss of principal. The likelihood of loss may be greater if you invest for a shorter period of time. There is no assurance that the investment process will consistently lead to successful results.

There are risks associated with selling short, including the risk that the ICON Long/Short Fund may have to cover its short position at a higher price than the short price, resulting in a loss. The ICON Long/Short Fund’s loss on a short sale is potentially unlimited as a loss occurs when the value of a security sold short increases. Call options involve certain risks, such as limited gains and lack of liquidity in the underlying securities, and are not suitable for all investors.

Investing in fixed income securities such as bonds involves interest rate risk. When interest rates rise, the value of fixed income securities generally decreases. The ICON Bond Fund and ICON Equity Income Fund may invest up to 35% and 25% of its assets in high-yield bonds that are below investment grade, respectively. ICON Risk-Managed Balanced Fund may invest up to 10% of its assets in high-yield bonds that are below investment grade. High-yield bonds involve a greater risk of default and price volatility than U.S. Government and other higher-quality bonds.

An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

Investments in foreign securities may entail unique risks, including political, market, and currency risks. Financial statements of foreign companies are governed by different accounting, auditing, and financial standards than U.S. companies and may be less transparent and uniform than in the United States. Many corporate governance standards, which help ensure the integrity of public information in the United States, do not exist in foreign countries. In general, there may be less governmental supervision of foreign stock exchanges and securities brokers and issuers. The ICON system relies on the integrity of the financial statements released to the market as part of our analysis.

Investments in other mutual fund companies may entail certain risks. For example, the Fund’s performance depends on the underlying funds in which it invests, and it is subject to the risks of the underlying funds. Additionally, an investment by the Fund or underlying fund in exchange-traded funds generally presents the same primary risks as an investment in a mutual fund.

The prospectus and statement of additional information contain this and other information about the Funds and are available by visiting www.iconfunds.com or calling 1-800-764-0442. Please read the prospectus and statement of additional information carefully.

Financial Intermediary

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may influence the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| 2 | www.iconfunds.com | |

Table of Contents

| ICON Bond Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Q. | How did the Fund perform relative to its benchmark? |

| A. | For the Fund’s fiscal year ended September 30, 2016, the ICON Bond Fund (the Fund) Class S shares outperformed its benchmark, the Barclays Capital U.S. Universal Index (ex-MBS). The Fund returned 7.54% while the Barclays Capital U.S. Universal Index (ex-MBS) returned 6.89%. Total returns for other periods and additional Class shares as of September 30, 2016, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | Similar to last year, many investors began fiscal year 2016 anticipating upward pressure on interest rates as the Federal Reserve began a tightening cycle. However, as the year unfolded, the combination of falling commodity prices and global economic volatility created yet another year of falling interest rates and rallying bond prices. The yield on the 10-year U.S. Treasury began the fiscal year at about 2.04%, rose to 2.34% in mid-November 2015 as investors began pricing in the anticipated rate rise, fell to 1.36% in early July 2016 as prospects for increasing rates fell, and finally finished the fiscal year at 1.59%. In addition to the volatility in the U.S. Treasury market, corporate bond spreads experienced volatility of their own as default concerns for commodity related companies spiked when the price of oil and other industrial metals collapsed to current cycle lows during the first half of the fiscal year. However, those concerns were short-lived as the commodity market calmed and corporate bond spreads reversed course to finish the fiscal year slightly tighter than where they began. |

Over the course of the fiscal year, the Fund maintained a lower overall duration and underexposure to U.S. Treasuries relative to the benchmark, which proved to be a headwind from a curve return standpoint. However, this curve underperformance was offset by positive returns in specific segments of the corporate bond market, closed-end fund arbitrage plays, and investments in preferred securities, resulting in outperformance relative to the benchmark over the course of the fiscal year.

| Q. | How did the Fund’s composition affect performance? |

| A. | As stated above, the Fund outperformed its benchmark during the fiscal year. The outperformance stemmed from positive allocation effect, mainly from selections in the preferred share segment of the market and an overweight position in corporate credit which produced strong relative returns over the course of the fiscal year. Closed-end fund positions also produced strong returns relative to the benchmark, contributing positively to the Fund’s performance. The Fund also had positive selection effect in the corporate bond segment of the market where holdings within the Industrials, Financials, and Energy sectors of the market experienced larger spread tightening movement than the broad market. |

Negative allocation effect came from the Fund’s underexposure to both U.S. Treasuries and Securitized Debt. Based on our internal assumption of risk and returns, we felt as though an overweight allocation to these segments of the market was unwarranted and would rather look to focus on bottom up security selection.

| Q. | What is your investment outlook for the bond market? |

| A. | At the end of fiscal year 2016, both investment grade and high yield corporate bond spreads were trading at levels that we deemed close to fair value. With spreads at these levels we are focused on our bottom up approach to find issue specific opportunities. While we don’t anticipate a substantial upward movement in interest rates over the course of the next 12 months, the Fund is positioned in the lower portion of its duration range as we move into fiscal year 2017. We continue to shy away from interest rate forecasts and remain steadfast in our search for issue specific opportunities. While future bond market volatility might be substantial, we believe our bottom up investment methodology will help the Fund navigate the changing market. |

| Annual Report | September 30, 2016 | 3 | |

Table of Contents

| ICON Bond Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

Average Annual Total Return (as of September 30, 2016)

| Inception Date | 1 Year | 5 Years | 10 Years | Since Inception |

Gross Expense Ratio* |

Net Expense Ratio* | |||||||||||||||||||||||||||||

| ICON Bond Fund - Class S |

5/6/04 | 7.54% | 4.38% | 4.92% | 4.66% | 1.06% | 0.90% | ||||||||||||||||||||||||||||

| ICON Bond Fund - Class C |

10/21/02 | 6.59% | 3.49% | 4.04% | 4.13% | 2.34% | 1.75% | ||||||||||||||||||||||||||||

| ICON Bond Fund - Class A |

9/30/10 | 7.25% | 4.14% | N/A | 3.43% | 1.51% | 1.15% | ||||||||||||||||||||||||||||

| ICON Bond Fund - Class A |

|||||||||||||||||||||||||||||||||||

| (including maximum sales charge of 4.75%) |

9/30/10 | 2.12% | 3.14% | N/A | 2.60% | 1.51% | 1.15% | ||||||||||||||||||||||||||||

| Barclays Capital U.S. Universal Index |

6.11% | 3.62% | 5.00% | 5.09% | N/A | N/A | |||||||||||||||||||||||||||||

| Barclays Capital U.S. Universal Index |

6.89% | 3.96% | 5.06% | 5.30% | N/A | N/A | |||||||||||||||||||||||||||||

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

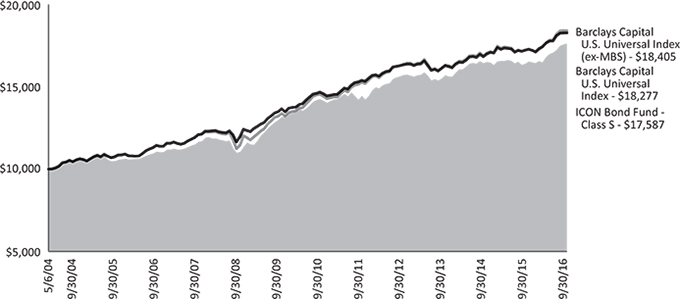

Value of a $10,000 Investment (through September 30, 2016)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Bond Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Bond Fund’s other share classes will vary due to differences in charges and expenses. The Bond Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 4 | www.iconfunds.com | |

Table of Contents

| ICON Bond Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 5 | |

Table of Contents

| ICON Bond Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 6 | www.iconfunds.com | |

Table of Contents

| ICON Bond Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 7 | |

Table of Contents

| ICON Equity Income Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Q. | How did the Fund perform relative to its benchmarks? |

| A. | The ICON Equity Income Fund (the Fund) Class S shares returned 13.30% for the fiscal year ending September 30, 2016, lagging its benchmark, the S&P Composite 1500 Index, which returned 15.49% during the fiscal year. Total returns for other periods and additional Class shares as of September 30, 2016, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | As the fiscal year began, our valuation methodology calculated an overall average value-to-price (V/P) ratio for the equity market of 1.09, meaning we believed fair value for the equity market as a whole was approximately 9% higher than where stocks were trading. While we were anticipating positive returns, the market exceeded our expectations. Stocks with high dividend yields did particularly well over the course of the fiscal year. For example, the Utilities and Telecommunication Services sectors, both comprised largely of stocks with high dividend yields, were up 18.7% and 26.6%, respectively, for the one year period ending September 30, 2016, as measured by the S&P 1500 Utilities Index and the S&P 1500 Telecommunication Services Index. In part, the demand for high dividend yielding stocks came from the decline in interest rates as the 10-year U.S. Treasury fell from approximately 2.04% to approximately 1.60% over the course of the year. High dividend yielding stocks can be an attractive income alternative in a low interest rate environment. |

| Despite the Fund’s tilt toward relatively high dividend yielding stocks, it still lagged the S&P 1500 Index, primarily due to the Fund’s positions in fixed income. |

| Q. | How did the Fund’s composition affect performance? |

| A. | The Fund’s stock selection within the Information Technology sector was the largest detractor to the Fund’s performance relative to the benchmark. The Fund’s holdings in the Information Technology sector returned about 8.5% while the benchmark returns for this sector were above 22%. The Fund’s holdings in the Technology Hardware, Storage & Peripherals industry were particularly difficult for the Fund, with a net loss to the Fund versus a positive return for the benchmark. Further, the Fund’s use of protective puts resulted in a net loss for the Fund as the market rose. |

| The Utilities sector helped to offset some of the losses from the Information Technology sector. The Fund was overweight the Utilities sector compared to the benchmark and this overweight position coupled with stock selection within the sector contributed to the Fund’s performance. The Fund’s holdings in the Multi-Utilities industry were particularly beneficial to the Fund. |

| Q. | What is the outlook for the ICON Equity Income Fund? |

| A. | The overall average V/P ratio for the stocks we track within our system was 1.09 as of September 30, 2016. Given this V/P ratio, we believe the market can continue to rise over the next year, and the Fund currently has an equity to fixed income allocation of approximately 90% equity and 10% fixed income. Additionally, based on our valuation readings, the Fund has a notable position in the Financial sector. We will continue to monitor the equity market to find the best combination of value and dividend for our investors. |

| 8 | www.iconfunds.com | |

Table of Contents

| ICON Equity Income Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

Average Annual Total Return (as of September 30, 2016)

| Inception Date |

1 Year | 5 Years | 10 Years | Since Inception |

Gross Expense Ratio* |

Net Expense Ratio* | |||||||||||||||||||||||||||||

| ICON Equity Income Fund - Class S |

5/10/04 | 13.30% | 13.04% | 5.80% | 6.69% | 1.60% | 1.55% | ||||||||||||||||||||||||||||

| ICON Equity Income Fund - Class C |

11/8/02 | 12.15% | 11.93% | 4.74% | 6.91% | 2.69% | 2.55% | ||||||||||||||||||||||||||||

| ICON Equity Income Fund - Class A |

5/31/06 | 12.97% | 12.76% | 5.52% | 5.38% | 1.87% | 1.80% | ||||||||||||||||||||||||||||

| ICON Equity Income Fund - Class A |

|||||||||||||||||||||||||||||||||||

| (including maximum sales charge of 5.75%) |

5/31/06 | 6.49% | 11.43% | 4.90% | 4.78% | 1.87% | 1.80% | ||||||||||||||||||||||||||||

| S&P Composite 1500 Index |

15.49% | 16.44% | 7.44% | 9.10% | N/A | N/A | |||||||||||||||||||||||||||||

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

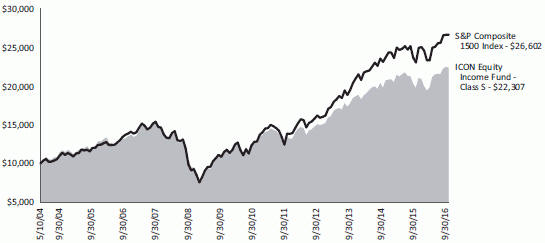

Value of a $10,000 Investment (through September 30, 2016)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Equity Income Fund’s Class S shares on the Class’ inception date of 5/10/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Equity Income Fund’s other share classes will vary due to differences in charges and expenses. The Equity Income Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2016 | 9 | |

Table of Contents

| ICON Equity Income Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 10 | www.iconfunds.com | |

Table of Contents

| ICON Equity Income Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 11 | |

Table of Contents

| ICON Equity Income Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 12 | www.iconfunds.com | |

Table of Contents

| ICON Equity Income Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 13 | |

Table of Contents

| ICON Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Q. | How did the Fund perform relative to its benchmarks? |

| A. | The ICON Fund (the Fund) Class S returned 1.81% for the fiscal year ending September 30, 2016, while its benchmark, the S&P 1500 Index, returned 15.49%. Total returns for other periods and additional Class shares as of September 30, 2016, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | From September 30, 2015, through the market low of February 11, 2016, the Fund underperformed, dropping more than the broad market. The market drop in December 2015 and January 2016, coming after the Federal Reserve raised its target for the Federal Funds rate and hinted at many more increases in 2016, was particularly difficult for the Fund. The Fund’s overweight position in the Financial sector relative to the benchmark hurt performance as the sector stumbled, we believe due to falling interest rates and investor concern that Federal Funds rate hikes would slow the economy. The market rebounded from its February 11, 2016 low and the Fund participated, outperforming its benchmark through September 30, 2016, but the gains were not enough to make up for the underperformance of late 2015 and early 2016. |

| Q. | How did the Fund’s composition affect performance? |

| A. | The five biggest contributors to Fund performance were Thor Industries, Center Point Energy, Martin Marietta Materials, CMS Energy Corporation and Ashland. Thor Industries is in the Consumer Discretionary sector, CMS Energy and CenterPoint Energy are in the Utilities sector and Martin Marietta Materials and Ashland are in the Materials sector. |

The five largest detractors from Fund performance were Encore Capital Group, Polaris Industries, Signature Bank, McKesson Corporation and Royal Caribbean Cruises. Encore, Polaris Industries and McKesson Corporation were sold. The other two remain in the portfolio.

| Q. | What is your investment outlook for the overall market? |

| A. | From December 1, 2014, the broad market was in a sideways range for approximately 19 months. On every advance prices ran into what we have called a “value ceiling” and went no higher. Our estimation of fair value had generally been growing since 2009, but paused and actually declined in 2015 and early 2016. However, in the spring of 2016, our estimate of fair value began growing again and prices responded with many indexes breaking out to all-time highs in August. We ended September 2016 with an overall average market value-to-price (V/P) ratio of 1.09, meaning stock prices in general would need to move higher over the next year to reach our estimate of fair value. As we wrote a year ago, “[w]e do not see any of the behaviors and signs we believe are typical of market peaks and expect the six-year-old bull market to resume.” With a current overall market V/P ratio of 1.09 as of September 30, 2016, we have the same view as we did a year ago. |

| 14 | www.iconfunds.com | |

Table of Contents

| ICON Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

Average Annual Total Return (as of September 30, 2016)

| Inception Date |

1 Year | 5 Years | 10 Years | Since Inception |

Gross Expense Ratio* |

Net Expense Ratio* | |||||||||||||||||||||||||||||

| ICON Fund - Class S |

5/6/04 | 1.81% | 9.95% | 1.03% | 3.04% | 1.09% | 1.09% | ||||||||||||||||||||||||||||

| ICON Fund - Class C |

11/28/00 | 0.65% | 8.81% | 0.26% | 2.56% | 2.27% | 2.25% | ||||||||||||||||||||||||||||

| ICON Fund - Class A |

5/31/06 | 1.37% | 9.57% | 0.50% | 0.04% | 1.55% | 1.50% | ||||||||||||||||||||||||||||

| ICON Fund - Class A (including maximum sales charge of 5.75%) |

5/31/06 | -4.45% | 8.27% | -0.09% | -0.53% | 1.55% | 1.50% | ||||||||||||||||||||||||||||

| S&P Composite 1500 Index |

15.49% | 16.44% | 7.44% | 5.61% | N/A | N/A | |||||||||||||||||||||||||||||

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Since Inception performance results for Class C shares include returns for certain time periods that were restarted as of June 8, 2004.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

Value of a $10,000 Investment (through September 30, 2016)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the ICON Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the ICON Fund’s other share classes will vary due to differences in charges and expenses. The ICON Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2016 | 15 | |

Table of Contents

| ICON Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 16 | www.iconfunds.com | |

Table of Contents

| ICON Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 17 | |

Table of Contents

| ICON Long/Short Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Q. | How did the Fund perform relative to its benchmarks? |

| A. | The ICON Long/Short Fund (the Fund) Class S returned 1.69% for the fiscal year ending September 30, 2016, while its benchmark, the S&P 1500 Index, returned 15.49%. Total returns for other periods and additional Class shares as of September 30, 2016, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | From September 30, 2015, through the market low of February 11, 2016, the Fund underperformed, dropping more than the broad market. The market drop in December 2015 and January 2016, after the Federal Reserve raised its target for the Federal Funds rate and hinted at many more increases in 2016, was particularly difficult for the Fund. The Fund’s overweight position in the Financial sector relative to the benchmark hurt performance as the sector stumbled, we believe due to falling interest rates and investor concern that Federal Funds rate hikes would slow the economy. The market rebounded from its February 11, 2016 low and the Fund participated, outperforming its benchmark through September 30, 2016, but the gains were not enough to make up for the underperformance of late 2015 and early 2016. |

| Q. | How did the Fund’s composition affect performance? |

| A. | The five biggest contributors to Fund performance were Thor Industries, CMS Energy Corporation, Rogers Corporation, CenterPoint Energy and Martin Marietta Materials. Thor Industries is in the Consumer Discretionary sector, CMS Energy and CenterPoint Energy are in the Utilities sector, Rogers Corporation is in the Information Technology sector, and Martin Marietta is in the Materials sector. |

| The five largest detractors from Fund performance were Encore Capital Group, Signature Bank, McKesson Corporation, Polaris Industries and Royal Caribbean Cruises. Encore Capital Group, Polaris Industries and McKesson Corporation were sold. The other two remain in the portfolio. |

| Q. | What is your investment outlook for the overall market? |

| A. | From December 1, 2014, the broad market was in a sideways range for approximately 19 months. On every advance prices ran into what we have called a “value ceiling” and went no higher. Our estimation of fair value had generally been growing since 2009, but paused and actually declined in 2015 and early 2016. However, in the spring of 2016, our estimate of fair value began growing again and prices responded with many indexes breaking out to all-time highs in August. We ended September 2016 with an overall average market value-to-price (V/P) ratio of 1.09, meaning stock prices in general would need to move higher over the next year to reach our estimate of fair value. As we wrote a year ago, “[w]e do not see any of the behaviors and signs we believe are typical of market peaks and expect the six-year-old bull market to resume.” With a current overall market V/P ratio of 1.09 as of September 30, 2016, we have the same view as we did a year ago. |

| 18 | www.iconfunds.com | |

Table of Contents

| ICON Long/Short Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

Average Annual Total Return (as of September 30, 2016)

| Inception Date | 1 Year | 5 Years | 10 Years | Since Inception |

Gross Expense |

Net Expense | ||||||||

|

| ||||||||||||||

| ICON Long/Short Fund - Class S |

5/6/04 | 1.69% | 10.00% | 1.95% | 3.59% | 1.37% | 1.28% | |||||||

| ICON Long/Short Fund - Class C |

10/17/02 | 0.67% | 8.86% | 0.94% | 4.33% | 2.53% | 2.33% | |||||||

| ICON Long/Short Fund - Class A |

5/31/06 | 1.40% | 9.68% | 1.69% | 1.44% | 1.73% | 1.58% | |||||||

| ICON Long/Short Fund - Class A |

||||||||||||||

| (including maximum sales charge of 5.75%) |

5/31/06 | -4.42% | 8.39% | 1.09% | 0.86% | 1.73% | 1.58% | |||||||

| S&P Composite 1500 Index |

15.49% | 16.44% | 7.44% | 9.20% | N/A | N/A | ||||||||

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

Value of a $10,000 Investment (through September 30, 2016)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Long/Short Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Long/Short Fund’s other share classes will vary due to differences in charges and expenses. The Long/Short Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2016 | 19 | |

Table of Contents

| ICON Long/Short Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 20 | www.iconfunds.com | |

Table of Contents

| ICON Long/Short Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 21 | |

Table of Contents

| ICON Opportunities Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Q. | How did the Fund perform relative to its benchmarks? |

| A. | The ICON Opportunities Fund (the Fund) returned 10.76% for the fiscal year ending September 30, 2016, while its benchmark, the S&P Small- Cap 600 Index, returned 18.12%. Total returns for other periods as of September 30, 2016, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors were behind the Fund’s relative performance? |

| A. | For both the fiscal year ended September 30, 2016, and off the market low of February 11, 2016, through September 30, 2016, the S&P Small- Cap 600 Index beat the S&P 500 Index (large cap). From September 30, 2015 through the market low of February 11, 2016 the Fund underperformed and dropped more than its benchmark, the S&P Small-Cap 600 Index. The market drop in December 2015 and January 2016, coming after the Federal Reserve raised its target for the Federal Funds rate and hinted at many more increases in 2016, was particularly difficult for the Fund. The Fund’s overweight position in the Financial sector hurt performance as the sector stumbled, we believe due to falling interest rates and investor concern that Federal Funds rate hikes would slow the economy. The market rebounded from its February 11, 2016 low through September 30, 2016, and the Fund participated in the rebound, but the gains were not enough to make up for the underperformance of late 2015 and early 2016. |

| Q. | How did the Fund’s composition affect performance? |

| A. | The five biggest contributors to Fund performance were Coherent, Inc., BioTelemetry, Inc., Thor Industries, Avery Dennison Corporation and Advanced Energy Industries. Coherent, Inc. and Advanced Energy Industries are in the Information Technology sector, BioTelemetry, Inc. is in the Health Care sector, Thor Industries is in the Consumer Discretionary sector, and Avery Dennison Corporation is in the Materials sector. |

| The five largest detractors from Fund performance were Sucampo Pharmaceuticals, Inc., PRA Group, Encore Capital Group, Acadia Healthcare Company and Libbey. PRA Group, Encore Capital Group and Libbey have been sold. The other two remain in the portfolio. |

| Q. | What is your investment outlook for the overall market? |

| A. | From December 1, 2014, the broad market was in a sideways range for approximately 19 months. On every advance prices ran into what we have called a “value ceiling” and went no higher. Our estimation of fair value had generally been growing since 2009, but paused and actually declined in 2015 and early 2016. However, in the spring of 2016, our estimate of fair value began growing again and prices responded with many indexes breaking out to all-time highs in August. We ended September 2016 with an overall average market value-to-price (V/P) ratio of 1.09, meaning stock prices in general would need to move higher over the next year to reach our estimate of fair value. As we wrote a year ago, “[w]e do not see any of the behaviors and signs we believe are typical of market peaks and expect the six-year-old bull market to resume.” With a current overall market V/P ratio of 1.09 as of September 30, 2016, we have the same view as we did a year ago. |

| 22 | www.iconfunds.com | |

Table of Contents

| ICON Opportunities Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

Average Annual Total Return (as of September 30, 2016)

| Inception Date | 1 Year | Since Inception | Gross Expense Ratio* | Net Expense Ratio* | ||||||

|

| ||||||||||

| ICON Opportunities Fund |

9/28/12 | 10.76% | 11.18% | 1.58% | 1.50% | |||||

| S&P Small Cap Total Return |

18.12% | 14.25% | N/A | N/A | ||||||

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Value of a $10,000 Investment (through September 30, 2016)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Opportunities Fund on the inception date of 9/28/12 to a $10,000 investment made in an unmanaged securities index on that date. The Opportunities Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| Annual Report | September 30, 2016 | 23 | |

Table of Contents

| ICON Opportunities Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 24 | www.iconfunds.com | |

Table of Contents

| ICON Opportunities Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 25 | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Q. | How did the Fund perform relative to its benchmarks? |

| A. | The Risk-Managed Balanced Fund (the Fund) Class S shares returned 4.39% for the fiscal year ended September 30, 2016. The S&P 1500 Index returned 15.49% and the Balanced Blended Benchmark returned 11.84%. The Balanced Blended Benchmark is based on a weighting of 60% S&P 1500 Index and 40% Barclays Capital U.S. Universal Index, rebalanced monthly. Total returns for other periods and additional Class shares as of September 30, 2016, appear in the subsequent pages of this Fund’s Management Overview. |

| Q. | What primary factors influenced the Fund’s relative performance during the period? |

| A. | Fiscal year 2016 proved to be a challenging year for our investment process and for the ICON Risk-Managed Balanced Fund. A combination of underperforming equity securities, especially in the segments of the market that our system found to be the most attractive, and a challenging hedging environment lead to underperformance relative to the benchmarks. |

| According to our valuation methodology, we began fiscal year 2016 with an overall average value-to-price (V/P) ratio for the domestic market of 1.08, indicating the domestic market was priced approximately 8% below our estimate of fair value. Based on this outlook we positioned the Fund in a relatively neutral stance with an approximate 60% equities / 40% fixed income allocation. Additionally, we implemented a hedge strategy by both buying out-of-the-money S&P 500 put options and writing out-of-the-money S&P 500 call options in an attempt to reduce the effects of market volatility on the Fund. From the beginning of the fiscal year through the end of December 2015, the equity market produced a strong return of approximately 7% and the bond market fell by approximately 0.50%. While the Fund was able to mitigate losses in the bond market and participate in this upward move, equity underperformance and hedging losses due to the strong upward move in the equity market resulted in underperformance relative to the benchmark during this initial market move. |

| In early January 2016, our equity valuation model viewed the overall broad domestic market as approximately 5% below our estimate of fair value. While our return expectations were relatively low for the overall market, our system did see distinct valuation differences at both a sector and industry level. While the Fund was slightly underweight equities relative to the blended benchmark, overweight positions were taken in the Financials, Utilities, and Materials sectors in an attempt to take advantage of what we believed to be attractive segments of the market. Additionally, given the lower overall market value readings, the Fund bought out-of-the-money S&P 500 put options and wrote out- of-the-money S&P 500 call options in an attempt to reduce the effects of market based volatility on the Fund. Relative to the fixed income portion of the benchmark, the fixed income portion of the Fund began 2016 with an overweight position in the corporate debt segment of the market and a lower overall duration and treasury exposure. We continued to look for “event driven” opportunities in both credit risk and closed-end fund arbitrage as well. |

| 2016 began with a rather aggressive sell-off as investors digested both macro-economic concerns and the continuation of lower overall interest rates. The combination of these two factors not only pulled down the broad market but also caused the most damage to the Financials sector. Unfortunately, due to our overweight position in this sector, our downside participation during the sell-off was substantially higher than we would have liked. Additionally, our lack of exposure to U.S. Treasuries, generally lower duration, and an aggressive widening of credit spreads resulted in fixed income underperformance as the yield on the 10-year U.S. Treasury fell by 0.61% from a yield of 2.27% on 12/31/15 to a yield of 1.66% on 02/11/16. However, our hedge profile did add value during this time as put option contracts increased in price in response to the increase in market volatility. |

| Around mid-February, the market began to stabilize and our equity valuation model indicated that many segments of the market had become substantially more attractive. Based on this, we increased exposure to both common stocks and equity based closed-end funds. Both of these moves proved to be beneficial as the market rebounded throughout the remainder of the time period. However, due to the aggressive V-shape rebound in the market our written call option positions ran aggressively against us and our long put option contracts fell quickly, detracting from overall fund performance. |

| Ultimately, over fiscal year 2016, while the Fund was able to produce positive risk adjusted returns during a volatile time period, underperformance from the Fund’s equity holdings coupled with losses from its options positions resulted in underperformance relative to the benchmark. |

| Q. | How did the Fund’s composition affect performance? |

| A. | Focusing on the equity portion of the Fund, the largest sector contributors to performance over fiscal year 2016 were the Information Technology, Industrials, and Utilities sectors. The Fund was either overweight the sectors as a whole or held equity securities that produced positive selection effect. Sectors that detracted from Fund performance include the Financials, Real Estate, and Energy sectors. Of these three, the Financials sector produced the largest negative total effect due to the combination of both overweight positions and underperforming equity selections. |

| 26 | www.iconfunds.com | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

| Moving to individual stock performance within the Fund, the largest positive contributors to performance were Facebook, Masco, ITC Holdings Corp, Honeywell International, and St Jude Medical. The five largest detractors from performance were Encore Capital Group, CBRE Group, Signet Jewelers, Allergan, and Plains All-American Pipeline. |

| Focusing on the fixed income portion of the Fund, while we maintained a lower overall duration relative to the fixed income benchmark, the Fund was able to outperform due to strong bottom up bond selections and allocations towards both the preferred and closed-end fund segments of the market. Specific preferred positions that contributed to performance include Ally Financial, Gramercy Property Trust, and Equity Commonwealth. |

| Q. | What is your investment outlook? |

| A. | Our equity valuations concluded fiscal year 2016 with an overall average V/P ratio of 1.09, giving us confidence there is room for the market to rise in the coming year. Currently, our system indicates noticeable discrepancies in sector opportunities. Specifically, we see the Financials and Consumer Discretionary sectors as good bargains. Additionally, our valuation system has identified specific industry opportunities in both the Health Care and Information Technology sectors. The Fund began the year with a slight underweight exposure to the equity market with its allocation and the equity hedge has recently been reduced targeting an equity beta at the upper end of our historical range. In the fixed income portion of the Fund, we continue to be very selective in our individual bond holdings as credit spreads are at levels that we deem as close to historical fair value. We also continue to see opportunities in the closed-end fund market. As always, we look to value as our primary guide and will adjust our positioning as market conditions dictate. |

| Annual Report | September 30, 2016 | 27 | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Management Overview | |

| September 30, 2016 (Unaudited) |

Average Annual Total Return (as of September 30, 2016)

| Inception Date | 1 Year | 5 Years | 10 Years | Since Inception |

Gross Expense Ratio* |

Net Expense Ratio* | ||||||||||||

|

| ||||||||||||||||||

| ICON Risk-Managed Balanced Fund - Class S |

5/6/04 | 4.39% | 7.28% | 3.56% | 3.95% | 1.42% | 1.28% | |||||||||||

| ICON Risk-Managed Balanced Fund - Class C |

11/21/02 | 3.35% | 6.23% | 2.53% | 4.08% | 2.46% | 2.28% | |||||||||||

| ICON Risk-Managed Balanced Fund - Class A |

5/31/06 | 4.18% | 7.02% | 3.32% | 3.26% | 2.50% | 2.25% | |||||||||||

| ICON Risk-Managed Balanced Fund - Class A (including maximum sales charge of 5.75%) |

5/31/06 | -1.78% | 5.76% | 2.71% | 2.67% | 2.50% | 2.25% | |||||||||||

| S&P Composite 1500 Index |

15.49% | 16.44% | 7.44% | 8.78% | N/A | N/A | ||||||||||||

Past performance is not a guarantee of future results. Information about these performance results and the comparative indexes can be found in the About This Report section. The Adviser has agreed to limit certain Fund expenses; without these limitations, returns would have been lower. The limitation provisions may be terminated in the future.

| * | Please see the most recent prospectus for details. |

Class C total returns exclude applicable sales charges. If sales charges were included returns would be lower.

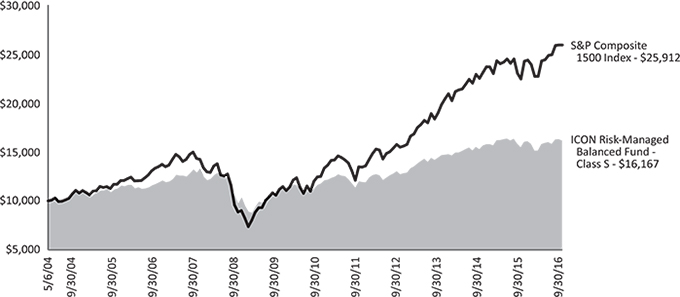

Value of a $10,000 Investment (through September 30, 2016)

Past performance is not a guarantee of future results. The above graph compares a $10,000 investment made in the Risk-Managed Balanced Fund’s Class S shares on the Class’ inception date of 5/6/04 to a $10,000 investment made in an unmanaged securities index on that date. Performance for the Risk-Managed Balanced Fund’s other share classes will vary due to differences in charges and expenses. The Risk-Managed Balanced Fund’s performance in this chart and the performance table assumes the reinvestment of dividends and capital gain distributions but does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemption of Fund shares.

| 28 | www.iconfunds.com | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 29 | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 30 | www.iconfunds.com | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 31 | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 32 | www.iconfunds.com | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 33 | |

Table of Contents

| ICON Risk-Managed Balanced Fund | Schedule of Investments | |

| September 30, 2016 |

| The accompanying notes are an integral part of the financial statements.

| ||

| 34 | www.iconfunds.com | |

Table of Contents

| ICON Diversified Funds | Statements of Assets and Liabilities | |

| September 30, 2016 |

| ICON Bond Fund | ICON Equity Income Fund |

ICON Fund | ||||||||||

|

|

||||||||||||

| Assets |

||||||||||||

| Investments, at cost |

$ | 86,526,530 | $ | 68,862,872 | $ | 44,291,780 | ||||||

|

|

|

|||||||||||

| Investments, at value(a) |

87,722,944 | 70,505,086 | 45,913,602 | |||||||||

| Foreign currency, at value (Cost $–, $8,423 and $–, respectively) |

– | 8,423 | – | |||||||||

| Receivables: |

||||||||||||

| Investments sold |

– | 3,438,114 | 471,971 | |||||||||

| Fund shares sold |

107,669 | 339,156 | 2,285 | |||||||||

| Expense reimbursements due from Adviser |

39,000 | 808 | 2,474 | |||||||||

| Interest |

808,511 | 34,472 | – | |||||||||

| Dividends |

5,483 | 171,749 | 31,234 | |||||||||

| Foreign tax reclaims |

– | 1,782 | – | |||||||||

| Other assets |

22,137 | 44,420 | 19,604 | |||||||||

|

|

|

|||||||||||

| Total assets |

88,705,744 | 74,544,010 | 46,441,170 | |||||||||

|

|

|

|||||||||||

| Liabilities |

||||||||||||

| Payables: |

||||||||||||

| Payable for collateral received on securities loaned |

1,092,875 | 5,989,261 | – | |||||||||

| Loan payable, at value (Cost $–, $– and $431,277) |

– | – | 431,277 | |||||||||

| Investments purchased |

– | 3,108,822 | – | |||||||||

| Fund shares redeemed |

141,865 | 112,529 | 21,646 | |||||||||

| Distributions due to shareholders |

20,120 | 50,807 | – | |||||||||

| Advisory fees |

43,108 | 40,116 | 28,255 | |||||||||

| Transfer agent fees |

8,647 | 11,724 | 7,985 | |||||||||

| Fund accounting fees |

4,725 | 3,340 | 1,881 | |||||||||

| Accrued distribution fees |

4,474 | 11,976 | 10,585 | |||||||||

| Trustee fees and expenses |

3,677 | 2,661 | 1,977 | |||||||||

| Administration fees |

3,716 | 2,744 | 1,950 | |||||||||

| Accrued expenses |

36,698 | 34,859 | 28,696 | |||||||||

|

|

|

|||||||||||

| Total liabilities |

1,359,905 | 9,368,839 | 534,252 | |||||||||

|

|

|

|||||||||||

| Net Assets - all share classes |

$ | 87,345,839 | $ | 65,175,171 | $ | 45,906,918 | ||||||

|

|

|

|||||||||||

| Net Assets - Class S |

$ | 76,656,414 | $ | 37,867,930 | $ | 28,896,978 | ||||||

|

|

|

|||||||||||

| Net Assets - Class C |

$ | 4,589,592 | $ | 10,531,959 | $ | 11,519,992 | ||||||

|

|

|

|||||||||||

| Net Assets - Class A |

$ | 6,099,833 | $ | 16,775,282 | $ | 5,489,948 | ||||||

|

|

|

|||||||||||

| Net Assets Consists of |

||||||||||||

| Paid-in capital |

$ | 88,517,949 | $ | 84,209,406 | $ | 64,945,079 | ||||||

| Accumulated undistributed net investment income/(loss) |

123,417 | 31,918 | – | |||||||||

| Accumulated undistributed net realized gain/(loss) |

(2,491,941) | (20,708,406) | (20,659,983) | |||||||||

| Unrealized appreciation/(depreciation) |

1,196,414 | 1,642,253 | 1,621,822 | |||||||||

|

|

|

|||||||||||

| Net Assets |

$ | 87,345,839 | $ | 65,175,171 | $ | 45,906,918 | ||||||

|

|

|

|||||||||||

| Shares outstanding (unlimited shares authorized, no par value) |

||||||||||||

| Class S |

8,025,162 | 2,425,082 | 2,053,038 | |||||||||

| Class C |

478,920 | 668,436 | 924,713 | |||||||||

| Class A |

641,456 | 1,076,989 | 412,376 | |||||||||

| Net asset value (offering and redemption price per share) |

||||||||||||

| Class S |

$ | 9.55 | $ | 15.62 | $ | 14.08 | ||||||

| Class C |

$ | 9.58 | $ | 15.76 | $ | 12.46 | ||||||

| Class A |

$ | 9.51 | $ | 15.58 | $ | 13.31 | ||||||

| Class A maximum offering price (100%/ (100%-maximum sales charge)) of net asset value adjusted to the nearest cent per share |

$ | 9.98 | $ | 16.53 | $ | 14.13 | ||||||

| (a) Includes securities on loan of |

$ | 1,065,671 | $ | 5,888,869 | $ | – | ||||||

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 35 | |

Table of Contents

| ICON Diversified Funds | Statements of Assets and Liabilities | |

| September 30, 2016 |

| ICON Long/Short Fund |

ICON Opportunities Fund |

ICON Risk-Managed Balanced Fund |

||||||||||

|

|

||||||||||||

| Assets |

||||||||||||

| Investments, at cost |

$ | 16,198,973 | $ | 15,135,439 | $ | 44,223,761 | ||||||

|

|

|

|||||||||||

| Investments, at value(a) |

16,714,215 | 16,097,498 | 44,612,041 | |||||||||

| Receivables: |

||||||||||||

| Investments sold |

472,646 | – | 207,129 | |||||||||

| Fund shares sold |

976 | 604 | 80,879 | |||||||||

| Expense reimbursements due from Adviser |

3,605 | – | 10,110 | |||||||||

| Interest |

– | – | 137,087 | |||||||||

| Dividends |

10,419 | 273 | 16,492 | |||||||||

| Foreign tax reclaims |

– | – | – | |||||||||

| Other assets |

17,961 | 7,674 | 22,039 | |||||||||

|

|

|

|||||||||||

| Total assets |

17,219,822 | 16,106,049 | 45,085,777 | |||||||||

|

|

|

|||||||||||

| Liabilities |

||||||||||||

| Payables: |

||||||||||||

| Payable for collateral received on securities loaned |

– | – | 426,194 | |||||||||

| Loan payable, at value (Cost $498,627, $– and $–) |

498,627 | – | – | |||||||||

| Expense recoupment due to Adviser |

– | 3,706 | – | |||||||||

| Investments purchased |

– | – | 97,686 | |||||||||

| Fund shares redeemed |

30,325 | 7,943 | 127,129 | |||||||||

| Distributions due to shareholders |

– | – | 7,753 | |||||||||

| Advisory fees |

12,086 | 9,518 | 27,906 | |||||||||

| Transfer agent fees |

6,821 | 2,357 | 10,265 | |||||||||

| Fund accounting fees |

1,012 | 1,072 | 4,739 | |||||||||

| Accrued distribution fees |

4,643 | – | 14,384 | |||||||||

| Trustee fees and expenses |

756 | 506 | 1,940 | |||||||||

| Administration fees |

737 | 630 | 1,927 | |||||||||

| Accrued expenses |

24,007 | 21,420 | 32,101 | |||||||||

|

|

|

|||||||||||

| Total liabilities |

579,014 | 47,152 | 752,024 | |||||||||

|

|

|

|||||||||||

| Net Assets - all share classes |

$ | 16,640,808 | $ | 16,058,897 | $ | 44,333,753 | ||||||

|

|

|

|||||||||||

| Net Assets - Class S |

$ | 7,113,901 | $ | – | $ | 20,087,384 | ||||||

|

|

|

|||||||||||

| Net Assets - Class C |

$ | 4,211,085 | $ | – | $ | 15,151,197 | ||||||

|

|

|

|||||||||||

| Net Assets - Class A |

$ | 5,315,822 | $ | – | $ | 9,095,172 | ||||||

|

|

|

|||||||||||

| Net Assets Consists of |

||||||||||||

| Paid-in capital |

$ | 71,239,732 | $ | 15,007,079 | $ | 56,946,628 | ||||||

| Accumulated undistributed net investment income/(loss) |

(6,963) | (30,697) | 68,236 | |||||||||

| Accumulated undistributed net realized gain/(loss) |

(55,107,203) | 120,456 | (13,069,391) | |||||||||

| Unrealized appreciation/(depreciation) |

515,242 | 962,059 | 388,280 | |||||||||

|

|

|

|||||||||||

| Net Assets |

$ | 16,640,808 | $ | 16,058,897 | $ | 44,333,753 | ||||||

|

|

|

|||||||||||

| Shares outstanding (unlimited shares authorized, no par value) |

1,089,148 | |||||||||||

| Class S |

380,324 | – | 1,389,269 | |||||||||

| Class C |

252,924 | – | 1,141,951 | |||||||||

| Class A |

292,676 | – | 644,651 | |||||||||

| Net asset value (offering and redemption price per share) |

$ | 14.74 | ||||||||||

| Class S |

$ | 18.70 | $ | – | $ | 14.46 | ||||||

| Class C |

$ | 16.65 | $ | – | $ | 13.27 | ||||||

| Class A |

$ | 18.16 | $ | – | $ | 14.11 | ||||||

| Class A maximum offering price (100%/ (100%-maximum sales charge)) of net asset value adjusted to the nearest cent per share |

$ | 19.27 | $ | – | $ | 14.97 | ||||||

| (a) Includes securities on loan of |

$ | – | $ | – | $ | 419,967 | ||||||

| The accompanying notes are an integral part of the financial statements.

| ||

| 36 | www.iconfunds.com | |

Table of Contents

| ICON Diversified Funds | Statements of Operations | |

| Year Ended September 30, 2016 |

| ICON Bond Fund | ICON Equity Income Fund |

ICON Fund | ||||||||||

| Investment Income |

||||||||||||

| Interest |

$ | 3,141,390 | $ | 116,333 | $ | 1,155 | ||||||

| Dividends |

562,160 | 2,294,606 | 744,606 | |||||||||

| Foreign taxes withheld |

– | (23,016) | (1,161) | |||||||||

| Income from securities lending, net |

14,170 | 221,774 | 9,160 | |||||||||

| Other income |

– | 14 | – | |||||||||

|

|

|

|||||||||||

| Total investment income |

3,717,720 | 2,609,711 | 753,760 | |||||||||

|

|

|

|||||||||||

|

Expenses |

||||||||||||

| Advisory fees |

511,458 | 378,644 | 373,960 | |||||||||

| Administration fees |

42,743 | 25,318 | 24,996 | |||||||||

| Transfer agent fees |

86,772 | 81,098 | 82,909 | |||||||||

| Distribution fees: |

||||||||||||

| Class C |

39,066 | 76,325 | 124,186 | |||||||||

| Class A |

16,084 | 36,994 | 15,833 | |||||||||

| Registration fees |

36,254 | 37,350 | 33,244 | |||||||||

| Audit and tax service expense |

26,515 | 21,082 | 17,326 | |||||||||

| Fund accounting fees |

33,910 | 20,618 | 18,221 | |||||||||

| Trustee fees and expenses |

13,976 | 8,422 | 7,974 | |||||||||

| Insurance expense |

11,456 | 5,169 | 8,441 | |||||||||

| Custody fees |

7,234 | 6,605 | 3,169 | |||||||||

| Printing fees |

12,589 | 12,722 | 11,359 | |||||||||

| Interest expense |

415 | 315 | 4,942 | |||||||||

| Recoupment of previously reimbursed expenses |

– | 16,522 | 2,969 | |||||||||

| Other expenses |

38,700 | 28,546 | 24,394 | |||||||||

|

|

|

|||||||||||

| Total expenses before expense reimbursement |

877,172 | 755,730 | 753,923 | |||||||||

| Expense reimbursement by Adviser due to expense limitation agreement |

(180,193) | (35,317) | (28,516) | |||||||||

|

|

|

|||||||||||

| Net Expenses |

696,979 | 720,413 | 725,407 | |||||||||

|

|

|

|||||||||||

| Net Investment Income/(Loss) |

3,020,741 | 1,889,298 | 28,353 | |||||||||

|

|

|

|||||||||||

|

Realized and Unrealized Gain/(Loss) |

||||||||||||

| Net realized gain/(loss) on: |

||||||||||||

| Investments |

240,106 | (994,897) | (1,328,436) | |||||||||

| Foreign currency |

– | 198 | – | |||||||||

| Long-term capital gain distributions from other investment companies |

7,949 | 987 | – | |||||||||

|

|

|

|||||||||||

| 248,055 | (993,712) | (1,328,436) | ||||||||||

|

|

|

|||||||||||

| Change in unrealized net appreciation/(depreciation) on: |

||||||||||||

| Investments and foreign currency |

2,838,297 | 5,024,516 | 1,797,942 | |||||||||

|

|

|

|||||||||||

| 2,838,297 | 5,024,516 | 1,797,942 | ||||||||||

|

|

|

|||||||||||

| Net realized and unrealized gain/(loss) |

3,086,352 | 4,030,804 | 469,506 | |||||||||

|

|

|

|||||||||||

| Net Increase/(Decrease) in Net Assets Resulting From Operations |

$ | 6,107,093 | $ | 5,920,102 | $ | 497,859 | ||||||

|

|

|

|||||||||||

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 37 | |

Table of Contents

| ICON Diversified Funds | Statements of Operations | |

| Year Ended September 30, 2016 |

| ICON Long/ Short Fund |

ICON Opportunities Fund |

ICON Risk-Managed Balanced Fund |

||||||||||

| Investment Income |

||||||||||||

| Interest |

$ | 9 | $ | 58 | $ | 621,620 | ||||||

| Dividends |

327,853 | 140,673 | 651,342 | |||||||||

| Foreign taxes withheld |

(221) | – | (2,390) | |||||||||

| Income from securities lending, net |

2,780 | – | 15,046 | |||||||||

| Other income |

– | – | 4,043 | |||||||||

|

|

|

|||||||||||

| Total investment income |

330,421 | 140,731 | 1,289,661 | |||||||||

|

|

|

|||||||||||

| Expenses |

||||||||||||

| Advisory fees |

183,086 | 83,499 | 380,666 | |||||||||

| Administration fees |

10,795 | 5,568 | 25,443 | |||||||||

| Transfer agent fees |

58,674 | 18,369 | 90,855 | |||||||||

| Distribution fees: |

||||||||||||

| Class C |

50,066 | – | 151,556 | |||||||||

| Class A |

17,453 | – | 22,909 | |||||||||

| Registration fees |

34,976 | 9,519 | 38,822 | |||||||||

| Audit and tax service expense |

18,873 | 16,353 | 23,608 | |||||||||

| Fund accounting fees |

8,409 | 5,344 | 26,291 | |||||||||

| Trustee fees and expenses |

3,383 | 1,789 | 8,300 | |||||||||

| Insurance expense |

4,732 | 1,538 | 4,064 | |||||||||

| Custody fees |

3,127 | 2,546 | 11,486 | |||||||||

| Printing fees |

6,165 | 6,145 | 11,254 | |||||||||

| Interest expense |

6,842 | 664 | 2,630 | |||||||||

| Recoupment of previously reimbursed expenses |

9,867 | 11,396 | 5,313 | |||||||||

| Other expenses |

13,321 | 8,190 | 27,346 | |||||||||

|

|

|

|||||||||||

| Total expenses before expense reimbursement |

429,769 | 170,920 | 830,543 | |||||||||

| Expense reimbursement by Adviser due to expense limitation agreement |

(80,331) | (3,029) | (44,620) | |||||||||

|

|

|

|||||||||||

| Net Expenses |

349,438 | 167,891 | 785,923 | |||||||||

|

|

|

|||||||||||

| Net Investment Income/(Loss) |

(19,017) | (27,160) | 503,738 | |||||||||

|

|

|

|||||||||||

|

Realized and Unrealized Gain/(Loss) |

||||||||||||

| Net realized gain/(loss) on: |

||||||||||||

| Investments |

67,924 | 143,820 | 267,235 | |||||||||

| Foreign currency |

– | – | (69) | |||||||||

| Written options |

– | – | (146,066) | |||||||||

| Long-term capital gain distributions from other investment companies |

– | – | 11,386 | |||||||||

|

|

|

|||||||||||

| 67,924 | 143,820 | 132,486 | ||||||||||

|

|

|

|||||||||||

| Change in unrealized net appreciation/(depreciation) on: |

||||||||||||

| Investments and foreign currency |

8,849 | 1,036,666 | 1,179,154 | |||||||||

|

|

|

|||||||||||

| 8,849 | 1,036,666 | 1,179,154 | ||||||||||

|

|

|

|||||||||||

| Net realized and unrealized gain/(loss) |

76,773 | 1,180,486 | 1,311,640 | |||||||||

|

|

|

|||||||||||

| Net Increase/(Decrease) in Net Assets Resulting From Operations |

$ | 57,756 | $ | 1,153,326 | $ | 1,815,378 | ||||||

|

|

|

|||||||||||

| The accompanying notes are an integral part of the financial statements.

| ||

| 38 | www.iconfunds.com | |

Table of Contents

| ICON Diversified Funds | Statements of Changes in Net Assets | |

| ICON Bond Fund | ICON Equity Income Fund | |||||||||||||||

| Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

|||||||||||||

| Operations |

||||||||||||||||

| Net investment income/(loss) |

$ | 3,020,741 | $ | 3,856,226 | $ | 1,889,298 | $ | 1,436,199 | ||||||||

| Net realized gain/(loss) |

240,106 | (2,721,154) | (994,699) | 2,378,033 | ||||||||||||

| Net realized gain/(loss) on long-term capital gain distributions from other investment companies |

7,949 | – | 987 | – | ||||||||||||

| Change in net unrealized appreciation/(depreciation) |

2,838,297 | (1,322,993) | 5,024,516 | (3,911,455) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase/(decrease) in net assets resulting from operations |

6,107,093 | (187,921) | 5,920,102 | (97,223) | ||||||||||||

|

|

|

|||||||||||||||

|

Dividends and Distributions to Shareholders |

||||||||||||||||

| Net investment income |

||||||||||||||||

| Class S |

(2,609,859) | (4,367,039) (a) | (1,164,475) | (760,578) | ||||||||||||

| Class C |

(127,022) | (198,438) (a) | (220,158) | (154,918) | ||||||||||||

| Class A |

(213,454) | (381,214) (a) | (536,706) | (425,141) | ||||||||||||

| Net realized gains |

||||||||||||||||

| Class S |

– | (1,100,327) | – | – | ||||||||||||

| Class C |

– | (49,999) | – | – | ||||||||||||

| Class A |

– | (96,051) | – | – | ||||||||||||

| Return of capital |

||||||||||||||||

| Class S |

– | (281,945) | – | – | ||||||||||||

| Class C |

– | (12,812) | – | – | ||||||||||||

| Class A |

– | (24,612) | – | – | ||||||||||||

|

|

|

|||||||||||||||

| Net decrease from dividends and distributions |

(2,950,335) | (6,512,437) | (1,921,339) | (1,340,637) | ||||||||||||

|

|

|

|||||||||||||||

|

Fund Share Transactions |

||||||||||||||||

| Shares sold |

||||||||||||||||

| Class S |

23,652,490 | 19,939,410 | 22,323,535 | 22,636,893 | ||||||||||||

| Class C |

2,037,494 | 2,204,299 | 4,965,537 | 2,336,246 | ||||||||||||

| Class A |

3,634,359 | 5,041,777 | 5,435,514 | 2,127,508 | ||||||||||||

| Reinvested dividends and distributions |

||||||||||||||||

| Class S |

2,285,962 | 5,264,217 | 1,105,137 | 715,630 | ||||||||||||

| Class C |

92,020 | 160,822 | 167,115 | 105,154 | ||||||||||||

| Class A |

108,802 | 245,318 | 459,085 | 385,989 | ||||||||||||

| Shares repurchased |

||||||||||||||||

| Class S |

(25,213,749) | (33,725,086) | (10,457,028) | (7,873,137) | ||||||||||||

| Class C |

(1,852,274) | (843,849) | (2,082,558) | (796,100) | ||||||||||||

| Class A |

(5,687,994) | (1,286,486) | (3,382,907) | (2,907,210) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase/(decrease) from fund share transactions |

(942,890) | (2,999,578) | 18,533,430 | 16,730,973 | ||||||||||||

|

|

|

|||||||||||||||

| Total net increase/(decrease) in net assets |

2,213,868 | (9,699,936) | 22,532,193 | 15,293,113 | ||||||||||||

|

Net Assets |

||||||||||||||||

| Beginning of year |

85,131,971 | 94,831,907 | 42,642,978 | 27,349,865 | ||||||||||||

|

|

|

|||||||||||||||

| End of year |

$ | 87,345,839 | $ | 85,131,971 | $ | 65,175,171 | $ | 42,642,978 | ||||||||

|

|

|

|||||||||||||||

| Accumulated undistributed net investment income/(loss) |

$ | 123,417 | $ | (2,398) | $ | 31,918 | $ | 73,948 | ||||||||

|

|

|

|||||||||||||||

| (a) | The ICON Bond Fund had a distribution in excess of net investment income during the fiscal year ended September 30, 2015. |

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 39 | |

Table of Contents

| ICON Diversified Funds | Statements of Changes in Net Assets | |

| ICON Bond Fund | ICON Equity Income Fund | |||||||||||||||

| Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

|||||||||||||

| Transactions in Fund Shares |

||||||||||||||||

| Shares sold |

||||||||||||||||

| Class S |

2,542,262 | 2,079,890 | 1,471,811 | 1,503,214 | ||||||||||||

| Class C |

218,630 | 230,646 | 323,130 | 150,250 | ||||||||||||

| Class A |

394,911 | 531,071 | 358,450 | 137,103 | ||||||||||||

| Issued to shareholders in reinvestment of distributions |

||||||||||||||||

| Class S |

245,654 | 556,451 | 73,747 | 46,951 | ||||||||||||

| Class C |

9,850 | 16,961 | 11,022 | 6,871 | ||||||||||||

| Class A |

11,757 | 26,037 | 30,748 | 25,418 | ||||||||||||

| Shares repurchased |

||||||||||||||||

| Class S |

(2,710,665) | (3,548,159) | (706,603) | (503,502) | ||||||||||||

| Class C |

(197,764) | (89,159) | (138,110) | (51,185) | ||||||||||||

| Class A |

(619,858) | (136,282) | (224,896) | (186,068) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase/(decrease) |

(105,223) | (332,544) | 1,199,299 | 1,129,052 | ||||||||||||

|

|

|

|||||||||||||||

| Shares outstanding, beginning of year |

9,250,761 | 9,583,305 | 2,971,208 | 1,842,156 | ||||||||||||

|

|

|

|||||||||||||||

| Shares outstanding, end of year |

9,145,538 | 9,250,761 | 4,170,507 | 2,971,208 | ||||||||||||

|

|

|

|||||||||||||||

| The accompanying notes are an integral part of the financial statements.

| ||

| 40 | www.iconfunds.com | |

Table of Contents

| ICON Diversified Funds | Statements of Changes in Net Assets | |

| ICON Fund | ICON Long/Short Fund | |||||||||||||||

| Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

|||||||||||||

| Operations |

||||||||||||||||

| Net investment income/(loss) |

$ | 28,353 | $ | (305,707) | $ | (19,017) | $ | (272,826) | ||||||||

| Net realized gain/(loss) |

(1,328,436) | 1,666,949 | 67,924 | 1,596,940 | ||||||||||||

| Change in net unrealized appreciation/(depreciation) |

1,797,942 | (3,490,916) | 8,849 | (1,334,483) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase/(decrease) in net assets resulting from operations |

497,859 | (2,129,674) | 57,756 | (10,369) | ||||||||||||

|

|

|

|||||||||||||||

| Fund Share Transactions |

||||||||||||||||

| Shares sold |

||||||||||||||||

| Class S |

1,519,056 | 2,650,530 | 1,759,878 | 13,446,762 | ||||||||||||

| Class C |

455,017 | 570,850 | 196,083 | 1,135,887 | ||||||||||||

| Class A |

356,458 | 673,069 | 635,346 | 2,023,326 | ||||||||||||

| Shares repurchased |

||||||||||||||||

| Class S |

(6,734,706) | (9,474,040) | (11,978,015) | (12,681,757) | ||||||||||||

| Class C |

(2,714,880) | (3,146,732) | (2,239,810) | (1,710,185) | ||||||||||||

| Class A |

(1,906,267) | (1,412,280) | (4,472,867) | (4,078,006) | ||||||||||||

|

|

|

|||||||||||||||

| Net decrease from fund share transactions |

(9,025,322) | (10,138,603) | (16,099,385) | (1,863,973) | ||||||||||||

|

|

|

|||||||||||||||

| Total net decrease in net assets |

(8,527,463) | (12,268,277) | (16,041,629) | (1,874,342) | ||||||||||||

| Net Assets |

||||||||||||||||

| Beginning of year |

54,434,381 | 66,702,658 | 32,682,437 | 34,556,779 | ||||||||||||

|

|

|

|||||||||||||||

| End of year |

$ | 45,906,918 | $ | 54,434,381 | $ | 16,640,808 | $ | 32,682,437 | ||||||||

|

|

|

|||||||||||||||

| Accumulated undistributed net investment income/(loss) |

$ | – | $ | (171,984) | $ | (6,963) | $ | (195,326) | ||||||||

|

|

|

|||||||||||||||

|

Transactions in Fund Shares |

||||||||||||||||

| Shares sold |

||||||||||||||||

| Class S |

108,905 | 174,791 | 98,051 | 668,902 | ||||||||||||

| Class C |

37,939 | 40,080 | 11,912 | 60,489 | ||||||||||||

| Class A |

27,328 | 44,868 | 36,303 | 100,326 | ||||||||||||

| Shares repurchased |

||||||||||||||||

| Class S |

(492,502) | (601,521) | (652,902) | (627,870) | ||||||||||||

| Class C |

(223,446) | (226,313) | (139,906) | (93,775) | ||||||||||||

| Class A |

(147,621) | (95,562) | (256,603) | (207,860) | ||||||||||||

|

|

|

|||||||||||||||

| Net decrease |

(689,397) | (663,657) | (903,145) | (99,788) | ||||||||||||

|

|

|

|||||||||||||||

| Shares outstanding, beginning of year |

4,079,524 | 4,743,181 | 1,829,069 | 1,928,857 | ||||||||||||

|

|

|

|||||||||||||||

| Shares outstanding, end of year |

3,390,127 | 4,079,524 | 925,924 | 1,829,069 | ||||||||||||

|

|

|

|||||||||||||||

| The accompanying notes are an integral part of the financial statements.

| ||

| Annual Report | September 30, 2016 | 41 | |

Table of Contents

| ICON Diversified Funds | Statements of Changes in Net Assets | |

| ICON Opportunities Fund | ICON Risk-Managed Balanced Fund | |||||||||||||||

| Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

Year Ended September 30, 2016 |

Year Ended September 30, 2015 |

|||||||||||||

| Operations |

||||||||||||||||

| Net investment income/(loss) |

$ | (27,160) | $ | (80,515) | $ | 503,738 | $ | 293,801 | ||||||||

| Net realized gain/(loss) |

143,820 | 29,960 | 121,100 | 446,087 | ||||||||||||

| Net realized gain/(loss) on long-term capital gain distributions from other investment companies |

– | – | 11,386 | – | ||||||||||||

| Change in net unrealized appreciation/(depreciation) |

1,036,666 | 587,690 | 1,179,154 | (1,184,909) | ||||||||||||

|

|

|

|||||||||||||||

| Net increase/(decrease) in net assets resulting from operations |

1,153,326 | 537,135 | 1,815,378 | (445,021) | ||||||||||||

|

|

|

|||||||||||||||

| Dividends and Distributions to Shareholders |

||||||||||||||||

| Net investment income |

– | (126,909) | ||||||||||||||

| Class S |

– | – | (301,369) | (195,258) (a) | ||||||||||||

| Class C |

– | – | (60,049) | (45,453) (a) | ||||||||||||

| Class A |

– | – | (92,328) | (80,740) (a) | ||||||||||||

| Net realized gains |

(10,170) | (60,583) (b) | ||||||||||||||

|

|

|

|||||||||||||||

| Net decrease from dividends and distributions |

(10,170) | (187,492) | (453,746) | (321,451) | ||||||||||||

|

|

|

|||||||||||||||

| Fund Share Transactions |

||||||||||||||||

| Shares sold |

6,108,876 | 1,123,562 | ||||||||||||||

| Class S |