UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

¨ TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE EXCHANGE ACT

For the transition period from _________ to __________________

000-21777

(Commission File Number)

GOLDEN QUEEN MINING CO. LTD.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | Not Applicable | |

| (State or other jurisdiction of incorporation) | (IRS Employer Identification) No.) |

2300 – 1066 West Hastings Street

Vancouver, British Columbia

V6E 3X2 Canada

(Address of principal executive offices)

Issuer’s telephone number, including area code: (778) 373-1557

Former name, former address and former fiscal year, if changed since last report: N/A

Check whether the registrant (1) filed all reports required to be filed by sections 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Check whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x | Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Check whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No x

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: As at May 9, 2018, the registrant’s outstanding common stock consisted of 300,101,444 shares

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

GOLDEN QUEEN MINING CO. LTD.

Condensed Consolidated Interim Balance Sheets

(amounts expressed in thousands of US dollars - Unaudited)

| March

31, 2018 | December

31, 2017 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash | $ | 18,230 | $ | 2,937 | ||||

| Prepaid expenses and other current assets | 685 | 699 | ||||||

| Inventories (Note 4) | 9,928 | 9,028 | ||||||

| Total current assets | 28,843 | 12,664 | ||||||

| Property, plant, equipment and mineral interests (Note 5) | 141,641 | 141,848 | ||||||

| Advance minimum royalties | 304 | 304 | ||||||

| Total Assets | $ | 170,788 | $ | 154,816 | ||||

| Liabilities and Shareholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 5,894 | $ | 6,984 | ||||

| Credit facility (Note 12 (v)) | - | 3,000 | ||||||

| Current portion of note payable (Note 12 (ii)) | 4,000 | 7,712 | ||||||

| Current portion of loan payable (Note 6) | 7,709 | 7,629 | ||||||

| Derivative liability – Related party warrants (Note 7) | 303 | 441 | ||||||

| Total current liabilities | 17,906 | 25,766 | ||||||

| Note payable (Note 12 (ii)) | 21,942 | 22,387 | ||||||

| Loan payable (Note 6) | 8,150 | 9,614 | ||||||

| Asset retirement obligation (Note 8) | 2,229 | 1,838 | ||||||

| Deferred tax liability | 8,197 | 8,197 | ||||||

| Total liabilities | 58,424 | 67,802 | ||||||

| Temporary Equity | ||||||||

| Redeemable portion of non-controlling interest (Note 12 (iv)) | 22,756 | 24,214 | ||||||

| Shareholders’ Equity | ||||||||

| Common shares, no par value, unlimited shares authorized (2017 - unlimited); 300,101,444 (2017 – 111,148,683) shares issued and outstanding (Note 9) | 95,494 | 71,126 | ||||||

| Additional paid-in capital | 43,898 | 43,853 | ||||||

| Deficit accumulated | (93,917 | ) | (88,500 | ) | ||||

| Total shareholders’ equity attributable to GQM Ltd. | 45,475 | 26,479 | ||||||

| Non-controlling interest (Note 12 (iv)) | 44,133 | 36,321 | ||||||

| Total Shareholders’ Equity | 89,608 | 62,800 | ||||||

| Total Liabilities, Temporary Equity and Shareholders’ Equity | $ | 170,788 | $ | 154,816 | ||||

Going Concern (Note 2)

Commitments and Contingencies (Note 13)

Approved by the Directors:

| “Thomas M. Clay” | “Bryan A. Coates” | ||

| Thomas M. Clay, Director | Bryan A. Coates, Director |

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

| 2 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Condensed Consolidated Interim Statements of Income (Loss) and Comprehensive Income (Loss)

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Revenues | ||||||||

| Metal Sales | $ | 9,585 | $ | 14,804 | ||||

| Cost of Sales | ||||||||

| Direct mining costs | (13,016 | ) | (11,561 | ) | ||||

| Depreciation and depletion (Note 5) | (2,976 | ) | (2,756 | ) | ||||

| Accretion expense | (42 | ) | (30 | ) | ||||

| Income (loss) from mine operations | (6,449 | ) | 457 | |||||

| General and administrative expenses (Note 10) | (1,254 | ) | (1,416 | ) | ||||

| Operating loss | (7,703 | ) | (959 | ) | ||||

| Other income (expenses) | ||||||||

| Gain (loss) on derivative instruments (Note 7) | 138 | (481 | ) | |||||

| Finance expense (Notes 12 (iii) and 12 (v))) | (1,533 | ) | (1,047 | ) | ||||

| Interest income | 35 | 25 | ||||||

| Other expenses | - | (354 | ) | |||||

| Net and comprehensive loss for the period | $ | (9,063 | ) | (2,816 | ) | |||

| Less: Net and comprehensive loss attributable to the non-controlling interest for the period (Note 12 (iv)) | 3,646 | 390 | ||||||

| Net and comprehensive loss attributable to Golden Queen Mining Co Ltd. for the period | $ | (5,417 | ) | $ | (2,426 | ) | ||

| Loss per share – basic (Note 11) | $ | (0.03 | ) | $ | (0.02 | ) | ||

| Loss per share – diluted (Note 11) | $ | (0.03 | ) | $ | (0.02 | ) | ||

| Weighted average number of common shares outstanding - basic | 188,829,263 | 111,080,008 | ||||||

| Weighted average number of common shares outstanding - diluted | 188,829,263 | 111,080,008 | ||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

| 3 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Condensed Consolidated Interim Statements of Shareholders’ Equity, Non-controlling Interest and Redeemable Portion of Non-Controlling Interest

(amounts expressed in thousands of US dollars, except shares amounts)

| Common

shares | Amount | Additional

Paid-in Capital | Deficit

Accumulated | Total

Shareholders’ Equity attributable to GQM Ltd | Non- controlling Interest | Total

Shareholders’ Equity | Redeemable

Portion of Non- controlling Interest | |||||||||||||||||||||||||

| Balance, December 31, 2016 | 111,048,683 | $ | 71,067 | $ | 43,652 | $ | (87,335 | ) | $ | 27,384 | $ | 39,327 | $ | 66,711 | $ | 26,220 | ||||||||||||||||

| Issuance of common shares (Note 9) | 100,000 | 59 | - | - | 59 | - | 59 | - | ||||||||||||||||||||||||

| Stock-based compensation | - | - | 34 | - | 34 | - | 34 | - | ||||||||||||||||||||||||

| Net loss for the period | - | - | - | (2,426 | ) | (2,426 | ) | (234 | ) | (2,660 | ) | (156 | ) | |||||||||||||||||||

| Balance, March 31, 2017 | 111,148,683 | $ | 71,126 | $ | 43,686 | $ | (89,761 | ) | $ | 25,051 | $ | 39,093 | $ | 64,144 | $ | 26,064 | ||||||||||||||||

| Balance, December 31, 2017 | 111,148,683 | $ | 71,126 | $ | 43,853 | $ | (88,500 | ) | $ | 26,479 | $ | 36,321 | $ | 62,800 | $ | 24,214 | ||||||||||||||||

| Issuance of common shares, net of share issue costs (Note 9) | 188,952,761 | 24,368 | - | - | 24,368 | - | 24,368 | - | ||||||||||||||||||||||||

| Capital contribution from non-controlling interest | - | - | - | - | - | 10,000 | 10,000 | - | ||||||||||||||||||||||||

| Stock-based compensation | - | - | 45 | - | 45 | - | 45 | - | ||||||||||||||||||||||||

| Net loss for the period | - | - | - | (5,417 | ) | (5,417 | ) | (2,188 | ) | (7,605 | ) | (1,458 | ) | |||||||||||||||||||

| Balance, March 31, 2018 | 300,101,444 | $ | 95,494 | $ | 43,898 | $ | (93,917 | ) | $ | 45,475 | $ | 44,133 | $ | 89,608 | $ | 22,756 | ||||||||||||||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

| 4 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Condensed Consolidated Interim Statements of Cash Flows

(amounts expressed in thousands of US dollars - Unaudited)

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Operating Activities | ||||||||

| Net loss for the year | $ | (9,063 | ) | $ | (2,816 | ) | ||

| Adjustment to reconcile net loss to cash used in operating activities: | ||||||||

| Depreciation and depletion | 2,976 | 2,756 | ||||||

| Amortization of debt discount and interest accrual | 555 | 286 | ||||||

| Accretion expense | 42 | 30 | ||||||

| Change in fair value of derivative liabilities (Note 7) | (138 | ) | 481 | |||||

| Stock based compensation | 45 | 34 | ||||||

| Unrealized foreign exchange | (43 | ) | (5 | ) | ||||

| Non-cash finder’s fee | - | 59 | ||||||

| Changes in non-cash working capital items: | ||||||||

| Prepaid expenses & other current assets | 14 | (88 | ) | |||||

| Inventory | (900 | ) | (873 | ) | ||||

| Accounts payable & accrued liabilities | (1,595 | ) | 2,301 | |||||

| Interest payable | 713 | 626 | ||||||

| Cash generated from (used in) operating activities | (7,394 | ) | 2,791 | |||||

| Investing activities: | ||||||||

| Additions to property, plant, equipment and mineral interests | (2,071 | ) | (5,236 | ) | ||||

| Cash used in investing activities | (2,071 | ) | (5,236 | ) | ||||

| Financing activities: | ||||||||

| Issuance of common shares, net of share issue costs (Note 9) | 24,368 | - | ||||||

| Repayment of credit facility | (3,000 | ) | - | |||||

| Repayments of loan payable (Note 6) | (1,898 | ) | (1,405 | ) | ||||

| Repayments of note payable and accrued interest | (4,712 | ) | - | |||||

| Capital contribution from non-controlling interest | 10,000 | - | ||||||

| Cash generated from (used in) financing activities | 24,758 | (1,405 | ) | |||||

| Net change in cash and cash equivalents | 15,293 | (3,850 | ) | |||||

| Cash and cash equivalents, beginning balance | 2,937 | 13,301 | ||||||

| Cash and cash equivalents, ending balance | $ | 18,230 | $ | 9,451 | ||||

Supplementary Disclosures of Cash Flow Information

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Cash paid during the period for: | ||||||||

| Interest on loan payable | $ | 235 | $ | 135 | ||||

| Non-cash financing and investing activities: | ||||||||

| Asset retirement costs charged to mineral property interests | $ | 349 | $ | 87 | ||||

| Mining equipment acquired through issuance of debt | $ | 514 | $ | 2,481 | ||||

| Mineral property expenditures included in accounts payable | $ | 165 | $ | 1,524 | ||||

| Non-cash finders’ fee | $ | - | $ | 59 | ||||

| Non-cash amortization of discount and interest expense | $ | 555 | $ | 286 | ||||

| Interest payable converted to principal balance | $ | - | $ | 296 | ||||

See Accompanying Notes to Condensed Consolidated Interim Financial Statements

| 5 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 1. | Nature of Business |

Golden Queen Mining Co. Ltd. (“Golden Queen”, “GQM Ltd.” or the “Company”) is engaged in the operation of the Soledad Mountain Mine (“the Mine”), located in the Mojave Mining District, Kern County, California. The Company owns 50% of Golden Queen Mining Company, LLC (“GQM LLC”), the operator of the Mine. The remaining 50% is owned by Gauss LLC (“Gauss”).

| 2. | Basis of Presentation and Going Concern |

These unaudited condensed consolidated interim financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”). The accounting policies followed in preparing these condensed consolidated interim financial statements are those used by the Company as set out in the audited consolidated financial statements for the year ended December 31, 2017.

Certain information and note disclosures normally included for annual consolidated financial statements prepared in accordance with US GAAP have been omitted. These unaudited condensed consolidated interim financial statements should be read together with the audited consolidated financial statements of the Company for the year ended December 31, 2017.

In the opinion of Management, all adjustments considered necessary (including reclassifications and normal recurring adjustments) to present fairly the financial position, results of operations and cash flows as at March 31, 2018 and for all periods presented, have been included in these unaudited condensed consolidated interim financial statements. The interim results are not necessarily indicative of results for the full year ending December 31, 2018, or future operating periods. For further information, see the Company’s annual consolidated financial statements, including the accounting policies and notes thereto.

The Company consolidates all entities in which it can vote a majority of the outstanding voting stock. In addition, it consolidates entities which meet the definition of a variable interest entity for which it is the primary beneficiary. The primary beneficiary is the party who has the power to direct the activities of a variable interest entity that most significantly impact the entity’s economic performance and who has an obligation to absorb losses of the entity or a right to receive benefits from the entity that could potentially be significant to the entity. We consider special allocations of cash flows and preferences, if any, to determine amounts allocable to non-controlling interests. All intercompany transactions and balances are eliminated on consolidation.

These consolidated financial statements include the accounts of Golden Queen, a limited liability Canadian corporation (Province of British Columbia), its wholly-owned subsidiary, GQM Holdings, a US (State of California) corporation, and GQM LLC, a limited liability company in which Golden Queen has a 50% interest, through GQM Canada’s ownership of GQM Holdings. GQM LLC meets the definition of a Variable Interest Entity. Golden Queen has determined it is the member of the related party group that is most closely associated with GQM LLC and, as a result, is the primary beneficiary who consolidates GQM LLC.

The Company is required to pay the following to the Clay Group on the following dates: $1.7 million of interest and principal on April 1, 2017 (paid); $1.7 million of interest and principal on July 1, 2018; $1.7 million of interest and principal on and October 1, 2018, $1.7 million of interest and principal on January 1, 2019, $3.9 million of interest and principal on April 1, 2019 and $21.7 million of interest and principal on May 21, 2019. Management believes the Company will meet its financial obligations for the 12 months period following the date of these financial statements. However, it is currently unlikely the Company can reimburse the final payment on May 21, 2019. The Company will need to receive cash distributions from GQM LLC to service its debt and such distributions are contingent on GQM LLC’s ability to generate positive cash flows. The Company reviewed the mine plan in light of the three months ended March 31, 2018 results and has determined it is unlikely it will receive sufficient distributions from GQM LLC during this fiscal year to service its debt in early 2019. This situation raises substantial doubt about the Company’s ability to continue as a going concern. Consequently, later in 2018, discussions with the Clay Group to restructure the reimbursement of the last debt payment will be initiated. While the Company has been successful in re-negotiating the debt repayment terms with the Clay Group in the past, there can be no assurance that will be achieved going forward.

The Company’s access to the net assets of GQM LLC is determined by the Board of Managers of GQM LLC. The Board of Managers is not controlled by the Company and therefore there is no guarantee that any access to the net assets of GQM LLC would be provided to the Company in order to continue as a going concern. The Board of Managers of GQM LLC determine when and if distributions from GQM LLC are made to the holders of its membership units at their sole discretion.

| 6 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 2. | Basis of Presentation and Going Concern (continued) |

The unaudited condensed consolidated interim financial statements do not reflect adjustments to the carrying values of the assets and liabilities, the reported revenues and expenses, and the balance sheet classifications used, that would be necessary if the company were unable to realize its assets and settle its liabilities as a going concern in the normal course of operations. Such adjustments could be material.

| 3. | Summary of Accounting Policies and Estimates and Judgements |

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates and judgements have been made by Management in several areas including the accounting for the joint venture transaction and determination of the temporary and permanent non-controlling interest, the recoverability of mineral properties interests, royalty obligations, inventory valuation, asset retirement obligations, and derivative liability – warrants. Actual results could differ from those estimates.

New Accounting Pronouncements

| (i) | In May 2014, ASU 2014-09 was issued related to revenue from contracts with customers. The ASU was further amended in August 2015, March 2016, April 2016, and May 2016 by ASU 2015-14, 2016-08, 2016-10 and 2016- 12. The new standard provides a five-step approach to be applied to all contracts with customers and also requires expanded disclosures about revenue recognition. |

The Company has completed its assessment of the impact of the new revenue standard on the Company's consolidated financial statements and disclosures. The Company has completed the review of all contracts and determined that the adoption of this guidance will not materially impact amounts and timing of revenue recognition. The Company's revenue arises from contracts with customers in which the delivery of doré is the single performance obligation under the customer contract. Product pricing is determined at the point when contract is created by reference to active and freely traded commodity markets, for example, the London Bullion Market for both gold and silver. The Company enters into the contracts with parties who have an ability and intention to meet its obligations with respect to consideration payment, thus ensuring the collectability of such consideration. These contracts are not modified and contain no variable consideration.

| (ii) | In February 2016, FASB issued ASC 842 that requires lessees to recognize lease assets and corresponding lease liabilities on the balance sheet for all leases with terms of more than 12 months. The update, which supersedes existing lease guidance, will continue to classify leases as either finance or operating, with the classification determining the pattern of expense recognition in the income statement. |

The ASU will be effective for annual and interim periods beginning January 1, 2019, with early adoption permitted, and is applicable on a modified retrospective basis with various optional practical expedients. The Company is assessing the impact of this standard.

| (iii) | In August 2016, ASC guidance was issued to amend the classification of certain cash receipts and cash payments in the statement of cash flows. The new guidance is effective for the Company’s fiscal year and interim periods beginning after December 15, 2017. The Company adopted the guidance effective January 1, 2018 and has retrospectively applied this guidance for all periods presented. There is no material impact from adoption of this guidance. |

| 4. | Inventories |

Inventories consist primarily of production from the Company’s operation, in varying stages of the production process and supplies and spare parts, all of which are presented at the lower of cost or net realizable value. For the three months ended March 31, 2018, the Company directly expensed $4.5 million of costs to ensure inventory was recognized at net realizable value. Inventories of the Company are comprised of:

| March

31, 2018 | December

31, 2017 | |||||||

| Stockpile inventory | $ | 251 | $ | 201 | ||||

| In-process inventory | 7,123 | 6,495 | ||||||

| Dore inventory | 461 | 320 | ||||||

| Supplies and spare parts | 2,093 | 2,012 | ||||||

| $ | 9,928 | $ | 9,028 | |||||

| 7 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 5. | Property, Plant, Equipment and Mineral Interests |

| Land | Mineral property interest and claims | Mine development | Machinery and equipment | Buildings and infrastructure | Construction in progress | Interest capitalized | Total | |||||||||||||||||||||||||

| Cost | ||||||||||||||||||||||||||||||||

| At December 31, 2016 | $ | 3,893 | $ | 4,241 | $ | 42,033 | $ | 60,201 | $ | 28,604 | $ | 543 | $ | 5,886 | $ | 145,401 | ||||||||||||||||

| Additions | 98 | 817 | 354 | 17 | - | 19,597 | - | 20,883 | ||||||||||||||||||||||||

| Transfers | - | 222 | 8,625 | 11,239 | - | (20,086 | ) | - | - | |||||||||||||||||||||||

| Disposals | (22 | ) | - | (239 | ) | (1,391 | ) | (207 | ) | - | - | (1,859 | ) | |||||||||||||||||||

| At December 31, 2017 | $ | 3,969 | $ | 5,280 | $ | 50,773 | $ | 70,066 | $ | 28,397 | $ | 54 | $ | 5,886 | $ | 164,425 | ||||||||||||||||

| Additions | 39 | - | 350 | - | - | 2,380 | - | 2,769 | ||||||||||||||||||||||||

| Transfers | - | - | - | 1,190 | - | (1,190 | ) | - | - | |||||||||||||||||||||||

| Disposals | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| At March 31, 2018 | $ | 4,008 | $ | 5,280 | $ | 51,123 | $ | 71,256 | $ | 28,397 | $ | 1,244 | $ | 5,886 | $ | 167,194 | ||||||||||||||||

| Accumulated depreciation and depletion | ||||||||||||||||||||||||||||||||

| At December 31, 2016 | $ | - | $ | 67 | $ | 971 | $ | 7,129 | $ | 2,679 | $ | - | $ | 5 | $ | 10,851 | ||||||||||||||||

| Additions | - | 261 | 2,444 | 6,489 | 2,358 | - | 466 | 12,018 | ||||||||||||||||||||||||

| Disposals | - | - | - | (265 | ) | (27 | ) | - | - | (292 | ) | |||||||||||||||||||||

| At December 31, 2017 | $ | - | $ | 328 | $ | 3,415 | $ | 13,353 | $ | 5,010 | $ | - | $ | 471 | $ | 22,577 | ||||||||||||||||

| Additions | - | 42 | 407 | 1,847 | 582 | - | 98 | 2,976 | ||||||||||||||||||||||||

| Disposals | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| At March 31, 2018 | $ | - | $ | 370 | $ | 3,822 | $ | 15,200 | $ | 5,592 | $ | - | $ | 569 | $ | 25,553 | ||||||||||||||||

| Carrying values | ||||||||||||||||||||||||||||||||

| At December 31, 2017 | $ | 3,969 | $ | 4,952 | $ | 47,358 | $ | 56,713 | $ | 23,387 | $ | 54 | $ | 5,415 | $ | 141,848 | ||||||||||||||||

| At March 31, 2018 | $ | 4,008 | $ | 4,910 | $ | 47,301 | $ | 56,056 | $ | 22,805 | $ | 1,244 | $ | 5,317 | $ | 141,641 | ||||||||||||||||

| 6. | Loan Payable |

As at March 31, 2018 and December 31, 2017, equipment financing balances are as follows:

| March

31, 2018 | December

31, 2017 | |||||||

| Balance, beginning of the year | $ | 17,243 | $ | 15,150 | ||||

| Additions | 654 | 10,727 | ||||||

| Principal repayments | (1,898 | ) | (6,192 | ) | ||||

| Down payments and taxes | (140 | ) | (1,839 | ) | ||||

| Settlements | - | (603 | ) | |||||

| Balance, end of the year | $ | 15,859 | $ | 17,243 | ||||

| Current portion | $ | 7,709 | $ | 7,629 | ||||

| Non-current portion | $ | 8,150 | $ | 9,614 | ||||

The terms of the equipment financing agreements are as follows:

| March

31, 2018 | December

31, 2017 | |||||||

| Total acquisition costs | $ | 37,690 | $ | 35,692 | ||||

| Interest rates | 0.00% ~ 4.50% | 0.00% ~ 4.50% | ||||||

| Monthly payments | $ | 5 ~ 74 | $ | 5 ~ 74 | ||||

| Average remaining life (years) | 1.91 | 2.13 | ||||||

For the three months ended March 31, 2018, the Company made total down payments of $140 (December 31, 2017 – $1,839). The down payments consist of the sales tax on the assets and a 10% payment of the pre-tax purchase price. All of the loan agreements are for a term of four years, except two which are for three years, and are secured by the underlying asset.

| 8 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 6. | Loan Payable (continued) |

The following table outlines the principal payments to be made for each of the remaining years:

| Years | Principal Payments | |||

| 2019 | $ | 7,709 | ||

| 2020 | 4,748 | |||

| 2021 | 2,523 | |||

| 2022 | 879 | |||

| Total | $ | 15,859 | ||

| 7. | Derivative Liabilities |

Share Purchase Warrants – Clay loans (Related Party (see Note 12 (ii))

On June 8, 2015, the Company issued 10,000,000 share purchase warrants to the Clay Group (the “June 2015 Warrants”) in connection with the June 2015 Loan. On February 22, 2018, the Company completed a rights offering at a share price lower than the original exercise price of $0.95 of the June 2015 Warrants. As per an anti-dilution provision included in the June 2015 Loan agreement, the exercise price of the June 2015 Warrants was revised to $0.7831 on the rights offering completion date. The expiry date of June 8, 2020 of the June 2015 Warrants remains unchanged.

On November 18, 2016, the Company issued 8,000,000 share purchase warrants to the Clay Group (the “November 2016 Warrants”) in connection with the November 2016 Loan. On February 22, 2018, the Company completed a rights offering at a share price lower than the original exercise price of $0.85 of the November 2016 Warrants. As per an anti-dilution provision included in the November 2016 Loan agreement, the exercise price of the November 2016 Warrants was revised to $0.6650 on the rights offering completion date. The expiry date of November 18, 2021 of the November 2016 Warrants remains unchanged.

The share purchase warrants meet the definition of a derivative liability instrument as the exercise price is not a fixed price as described above. Therefore, the settlement feature does not meet the “fixed-for-fixed” criteria outlined in ASC 815-40-15.

The fair value of the derivative liabilities related to the Clay Group share purchase warrants as at March 31, 2018 is $303 (December 31, 2017 – $441). The derivative liabilities were calculated using the binomial and the Black-Scholes pricing valuation models with the following assumptions:

| Warrants related to June 2015 Loan | March

31, 2018 | December

31, 2017 | ||||||

| Risk-free interest rate | 1.88 | % | 1.73 | % | ||||

| Expected life of derivative liability | 2.19 years | 2.44 years | ||||||

| Expected volatility | 69.63 | % | 78.59 | % | ||||

| Dividend rate | 0.00 | % | 0.00 | % | ||||

| Warrants related to November 2016 Loan | March

31, 2018 | December

31, 2017 | ||||||

| Risk-free interest rate | 1.88 | % | 1.73 | % | ||||

| Expected life of derivative liability | 3.65 years | 3.89 years | ||||||

| Expected volatility | 75.16 | % | 75.69 | % | ||||

| Dividend rate | 0.00 | % | 0.00 | % | ||||

| 9 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 7. | Derivative Liabilities (continued) |

Share Purchase Warrants – Clay loans (Related Party) (continued)

The change in the derivative share purchase warrants is as follows:

| March

31, 2018 | December

31, 2017 | |||||||

| Balance, beginning of the period | $ | 439 | $ | 5,458 | ||||

| Change in fair value | (137 | ) | (5,019 | ) | ||||

| Balance, end of the period | $ | 302 | $ | 439 | ||||

Share Purchase Warrants

On July 25, 2016, the Company issued a total of 6,317,700 share purchase warrants with an exercise price of C$2.00 and an expiry date of July 25, 2019. As at March 31, 2018, the Company re-measured the share purchase warrants and determined the fair value of the derivative liability to be $1.

| 8. | Asset Retirement Obligations |

Reclamation Financial Assurance

The Company is required to provide the Bureau of Land Management, the State Office of Mine Reclamation and Kern County with a revised reclamation cost estimate annually. The financial assurance is adjusted once the cost estimate is approved.

This estimate, once approved by state and county authorities, forms the basis of reclamation financial assurance. The reclamation assurance provided as at March 31, 2018 was $1,500 (December 31, 2017 – $1,465).

The Company is also required to provide financial assurance with the Lahontan Regional Water Quality Control Board (the “Regional Board”) for closure and reclamation costs related to the lined impoundments, which are defined as the Stage 1 and Stage 2 heap leach pads, the overflow pond, and the solution collection channel. The reclamation financial assurance estimate as at March 31, 2018, is $2,450 (December 31, 2017 – $1,869).

| 10 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 8. | Asset Retirement Obligations (continued) |

Reclamation Financial Assurance (continued)

In addition to the above, the Company is required to obtain and maintain financial assurance for initiating and completing corrective action and remediation of a reasonably foreseeable release from the Project’s waste management units as required by the Regional Board. The reclamation financial assurance estimate as at March 31, 2018 is $278 (December 31, 2017 – $278).

The Company entered into $4,228 (2017 – $3,612) in surety bond agreements in order to release its reclamation deposits and posted a portion of the financial assurance due in 2017. The Company pays a yearly premium of $90 (2017 – $90). Golden Queen Ltd. has provided a corporate guarantee on the surety bonds.

Asset Retirement Obligation

The total asset retirement obligation as at March 31, 2018, was $2,229 (December 31, 2017 – $1,838).

The Company estimated its asset retirement obligations based on its understanding of the requirements to reclaim and remediate its property based on its activities to date. As at March 31, 2018, the Company estimates the cash outflow related to these reclamation activities will be incurred in 2028. Reclamation provisions are measured at the expected value of future cash flows discounted to their present value using a discount rate based on a credit adjusted risk-free interest rate of 8.34% and an inflation rate of 2.41%.

The following is a summary of asset retirement obligations:

| March

31, 2018 | December

31, 2017 | |||||||

| Balance, beginning of the period | $ | 1,838 | $ | 1,366 | ||||

| Accretion | 42 | 126 | ||||||

| Changes in cash flow estimates | 349 | 346 | ||||||

| Balance, end of the period | $ | 2,229 | $ | 1,838 | ||||

| 9. | Share Capital |

The Company’s common shares outstanding are no par value, voting shares with no preferences or rights attached to them.

Common shares

On January 17, 2017, the Company issued 100,000 shares for a total of $59 as finder fees which were recognized in general and administrative expenses in connection with the declaration of commercial production in December 2016.

On February 22, 2018, the Company closed a rights offering and issued 188,952,761 shares for total gross proceeds of $25,036. The Company paid associated fees of $668 which were classified as share issue costs.

Stock options

The Company’s current stock option plan (the “Plan”) was adopted by the Company in 2013 and approved by shareholders of the Company in 2013. The Plan provides a fixed number of 7,200,000 common shares of the Company that may be issued pursuant to the grant of stock options. The exercise price of stock options granted under the Plan shall be determined by the Company’s Board of Directors (the “Board”) but shall not be less than the volume-weighted, average trading price of the Company’s shares on the Toronto Stock Exchange (“TSX”) for the five (5) trading days immediately prior to the date of the grant. The expiry date of a stock option shall be the date so fixed by the Board subject to a maximum term of five (5) years. The Plan provides that the expiry date of the vested portion of a stock option will be the earlier of the date so fixed by the Board at the time the stock option is awarded and the early termination date (the “Early Termination Date”).

| 11 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 9. | Share Capital (continued) |

Stock options (continued)

The Early Termination Date will be the date the vested portion of a stock option expires following the option holder ceasing to be a director, employee or consultant, as determined by the Board at the time of grant, or in the absence thereof at any time prior to the time the option holder ceases to be a director, employee or consultant, in accordance with and subject to the provisions of the Plan. All options granted under the 2013 Plan will be subject to such vesting requirements as may be prescribed by the TSX, if applicable, or as may be imposed by the Board.

The Company has elected to use the Black-Scholes option pricing model to determine the fair value of stock options granted. The compensation expense is amortized on a straight-line basis over the requisite service period, which approximates the vesting period.

The following is a summary of stock option activity during the three months ended March 31, 2018:

| Shares | Weighted Average Exercise Price per Share | |||||||

| Options outstanding, December 31, 2016 | 1,555,000 | $ | 0.85 | |||||

| Options granted | 1,605,001 | $ | 0.38 | |||||

| Options forfeited | (166,667 | ) | $ | 0.64 | ||||

| Options expired | (393,333 | ) | $ | 1.13 | ||||

| Options outstanding, December 31, 2017 and March 31, 2018 | 2,600,001 | $ | 0.54 | |||||

On March 14, 2017, the former CFO of the Company resigned. 146,667 stock options were forfeited on this date as they did not meet the vesting conditions. Accordingly, the share-based compensation associated with the unvested stock options was reversed. The expiry date of 393,333 stock options that had vested was modified to June 14, 2017 pursuant to the terms of the employment agreement. These stock options were not exercised, thus expired during the year ended December 31, 2017.

On March 20, 2017, the Company granted 400,002 options to the Company’s Chief Financial Officer (“CFO”) which are exercisable at a price of $0.65 for a period of five years from the date of grant. 133,334 options vest on March 20, 2018, 133,334 options vest on March 20, 2019 and 133,334 options on March 20, 2020.

The fair value of stock options granted as above was calculated using the following weighted average assumptions:

| 2017 | ||||

| Expected life (years) | 5.00 | |||

| Interest rate | 1.18% ~ 1.70 | % | ||

| Volatility | 77.29% ~ 79.17 | % | ||

| Dividend yield | 0.00 | % | ||

During the three months ended March 31, 2018, the Company recognized $45 (2017 – $34) in stock-based compensation relating to employee stock options that were issued and/or had vesting terms.

| 12 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 9. | Share Capital (continued) |

Stock options (continued)

The following table summarizes information about stock options outstanding and exercisable as at March 31, 2018:

| Expiry Date | Number Outstanding | Number Exercisable | Remaining Contractual Life (years) | Weighted

Average Exercise Price | ||||||||||||

| June 3, 2018 | 50,000 | 50,000 | 0.18 | $ | 1.16 | |||||||||||

| September 3, 2018 | 150,000 | 150,000 | 0.43 | $ | 1.59 | |||||||||||

| September 8, 2020 | 430,000 | 430,000 | 2.44 | $ | 0.58 | |||||||||||

| November 30, 2021 | 365,000 | 121,666 | 3.67 | $ | 0.66 | |||||||||||

| March 20, 2022 | 400,002 | 133,334 | 3.97 | $ | 0.65 | |||||||||||

| October 20, 2022 | 1,204,999 | - | 4.56 | $ | 0.29 | |||||||||||

| Balance, March 31, 2018 | 2,600,001 | 885,000 | 3.67 | $ | 0.54 | |||||||||||

As at March 31, 2018, the aggregate intrinsic value of the outstanding exercisable options was $nil (December, 31, 2017 – $nil).

Warrants

As at March 31, 2018, 24,317,700 warrants were outstanding (December 31, 2017 – 24,317,700).

The following table summarizes information about share purchase warrants outstanding:

| Expiry Date | Number Outstanding | Remaining Contractual Life (years) | Exercise Price | |||||||||

June 8, 2020 (1) | 10,000,000 | 2.19 | $ | 0.7831 | ||||||||

| July 25, 2019 | 6,317,700 | 1.32 | C$ | 2.0000 | ||||||||

November 18, 2021 (1) | 8,000,000 | 3.64 | $ | 0.6650 | ||||||||

| Balance, March 31, 2018 | 24,317,700 | 2.44 | ||||||||||

| (1) | Non-tradable share purchase warrants. |

| 10. | General and Administrative Expenses |

General and administrative expenses are incurred to support the administration of the business that are not directly related to production. Significant components of general and administrative expenses are comprised of the following:

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Audit, legal and professional fees | $ | 240 | $ | 288 | ||||

| Salaries and benefits and director fees | 503 | 560 | ||||||

| Regulatory fees and licenses | 79 | 53 | ||||||

| Insurance | 139 | 133 | ||||||

| Corporate administration | 293 | 382 | ||||||

| $ | 1,254 | $ | 1,416 | |||||

| 13 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 11. | Loss Per Share |

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Numerator: | ||||||||

| Net loss attributable to the shareholders of the Company - numerator for basic and diluted loss per share | $ | (6,050 | ) | $ | (2,426 | ) | ||

| Denominator: | ||||||||

| Weighted average number of common shares outstanding - basic and diluted | 188,829,263 | 111,080,008 | ||||||

| Loss per share – basic and diluted | $ | (0.03 | ) | $ | (0.02 | ) | ||

Weighted average number of shares for the three months ended March 31, 2018 excludes 2,600,001 options (December 31, 2017 – 2,600,001) and 24,317,700 warrants (December 31, 2017 – 24,317,700) that were antidilutive.

| 12. | Related Party Transactions |

Except as noted elsewhere in these consolidated financial statements, related party transactions are disclosed as follows:

| (i) | Compensation of Key Management Personnel, Transactions with Related Parties and Related Party Balances |

For the three months ended March 31, 2018, the Company recognized $195 (for the three months ended March 31, 2017 – $218) salaries and fees for Officers and Directors.

As at March 31, 2018, $nil (December 31, 2017 – $38) was included in prepaid expenses and other current assets for closing fees paid to related parties.

As at March 31, 2018, $835 (December 31, 2017 – $463 for amended fees and accrued interest payable to related parties) was included in accounts payable and accrued liabilities for accrued interest payable to related parties and salaries and fees payable to Officers and Directors.

| (ii) | Note Payable |

On November 18, 2016, the Company entered into a loan with the Clay Group for $31,000 (the “November 2016 Loan”), due on May 21, 2019 and an annual interest rate of 8%, payable quarterly. In connection with the November 2016 Loan the Company issued 8,000,000 common share purchase warrants exercisable for a period of five years expiring November 21, 2021. The common share purchase warrants have an exercise price of $0.85.

On November 10, 2017, the Company and the Clay Group agreed to amend the November 2016 Loan by reducing the 2018 quarterly and 2019 Q1 principal payments from $2,500 to $1,000, adding the reduction of such payments pro-rata to the remaining 2019 payments, and increasing the annual interest rate from 8% to 10% effective January 1, 2018 (the “November 2017 Loan”). This amendment was accounted for as a debt modification.

| 14 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 12. | Related Party Transactions (continued) |

| (ii) | Note Payable (continued) |

The following table summarizes activity on the notes payable:

| March

31, 2018 | December

31, 2017 | |||||||

| Balance, beginning of the period | $ | 30,099 | $ | 26,347 | ||||

| Interest payable transferred to principal balance | - | 2,212 | ||||||

| Accretion of discount on loans | 490 | 1,940 | ||||||

| Capitalized financing and legal fees | - | (400 | ) | |||||

| Accretion of capitalized financing and legal fees | 65 | - | ||||||

| Repayment of loans and interest | (4,712 | ) | - | |||||

| Balance, end of the period | $ | 25,942 | $ | 30,099 | ||||

| Current portion | $ | 4,000 | $ | 7,712 | ||||

| Non-current portion | $ | 21,942 | $ | 22,387 | ||||

| (iii) | Amortization of Discounts and Interest Expense |

The following table summarizes the amortization of discounts and interest on loan:

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Accretion of the November 2017 Loan discount | $ | 490 | $ | 286 | ||||

| Accretion of capitalized financing and legal fees | 65 | - | ||||||

| Interest expense related to the November 2017 Loan | 713 | 626 | ||||||

| Closing and commitment fees related to the Credit Facility | 30 | - | ||||||

| Interest expense related to Komatsu financial loans (1) | 235 | 135 | ||||||

| Accretion of discount and interest on loan | $ | 1,533 | $ | 1,047 | ||||

| (1) | Komatsu is not a related party and has only been included in the above table to reconcile the total interest expense incurred for the period to the amounts capitalized and expensed. |

| (iv) | Joint Venture Transaction |

The Company has presented Gauss’ ownership in GQM LLC as a non-controlling interest amount on the balance sheet within the equity section. However, there are terms in the agreement that provide for the exit from the investment in GQM LLC for an initial member whose interest in GQM LLC becomes less than 20%.

If a member becomes less than a 20% interest holder, its remaining interest will (ultimately) be terminated through one of 3 events at the non-diluted member’s option:

| a. | Through conversion to a net smelter royalty (“NSR”); |

| b. | Through a buy-out (at fair value) by the non-diluted member; or |

| c. | Through a sale process by which the diluted member’s interest is sold. |

The net assets of GQM LLC as at March 31, 2018 and December 31, 2017 are as follows:

| March

31, 2018 | December

31, 2017 | |||||||

| Assets, GQM LLC | $ | 156,998 | $ | 149,095 | ||||

| Liabilities, GQM LLC | (23,221 | ) | (28,024 | ) | ||||

| Net assets, GQM LLC | $ | 133,777 | $ | 121,071 | ||||

| 15 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 12. | Related Party Transactions (continued) |

| (iv) | Joint Venture Transaction (continued) |

Included in the assets above, is $9,622 (December 31, 2017 – $2,606) in cash held by GQM LLC which is directed specifically to fund capital expenditures required to continue with production and to settle GQM LLC’s obligations. The liabilities of GQM LLC do not have recourse to the general credit of Golden Queen except for $2,203 for two mining drill loans and $4,228 in surety bond agreements.

Non-Controlling Interest

The carrying value of the non-controlling interest is adjusted for net income and loss, distributions and contributions pursuant to ASC 810-10 based on the same percentage allocation used to calculate the initial book value of temporary equity.

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Net and comprehensive loss in GQM LLC | $ | (7,294 | ) | $ | (779 | ) | ||

| Non-controlling interest percentage | 50 | % | 50 | % | ||||

| Net and comprehensive loss attributable to non-controlling interest | $ | (3,646 | ) | $ | (390 | ) | ||

| Net and comprehensive loss attributable to permanent non-controlling interest | $ | (2,188 | ) | $ | (234 | ) | ||

| Net and comprehensive loss attributable to temporary non-controlling interest | $ | (1,458 | ) | $ | (156 | ) | ||

| Permanent

Non-Controlling Interest | Temporary

Non-Controlling Interest | |||||||

| Carrying value of non-controlling interest, December 31, 2016 | $ | 39,326 | $ | 26,219 | ||||

| Net and comprehensive loss for the year | (3,005 | ) | (2,005 | ) | ||||

| Carrying value of non-controlling interest, December 31, 2017 | $ | 36,321 | $ | 24,214 | ||||

| Capital contribution | 10,000 | - | ||||||

| Net and comprehensive loss for the period | (2,188 | ) | (1,458 | ) | ||||

| Carrying value of non-controlling interest, March 31, 2018 | $ | 44,133 | $ | 22,756 | ||||

| (v) | Credit Facility |

On May 23, 2017, GQM LLC entered into a $5,000 one-year revolving credit agreement (the “Credit Facility”) in which Gauss Holdings LLC and Auvergne, LLC agreed to extend credit in the form of loans to GQM LLC. The Credit Facility commenced on July 1, 2017, bears interest at a rate of 12% per annum and is subject to a commitment fee of 1% per annum. For the three months ended March 31, 2018, GQM LLC paid commitment fees of $30 (2017 – $nil). As at March 31, 2018, GQM LLC has drawn $nil (December 31, 2017 – $3,000) from the Credit Facility.

| 13. | Commitments and Contingencies |

Royalties

The Company has acquired a number of mineral property interests outright. It has acquired exclusive rights to explore, develop and mine other portions of the Mine under various mining lease agreements with landowners. Royalty amounts due to each landholder over the life of the Mine vary with each property.

| 16 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 13. | Commitments and Contingencies (continued) |

Compliance with Environmental Regulations

The Company’s exploration and development activities are subject to laws and regulations controlling not only the exploration and mining of mineral properties, but also the effect of such activities on the environment. Compliance with such laws and regulations may necessitate additional capital outlays or affect the economics of a mine, and cause changes or delays in the Company’s activities.

Corporate Guaranties

The Company has provided corporate guaranties for two of GQM LLC’s mining drill loans. The Company has also provided a corporate guaranty for GQM LLC’s surety bonds.

| 14. | Financial Instruments |

Fair Value Measurements

All financial assets and financial liabilities are recorded at fair value on initial recognition. Transaction costs are expensed when they are incurred, unless they are directly attributable to the acquisition of qualifying assets, in which case they are added to the costs of those assets until such time as the assets are substantially ready for their intended use or sale.

The three levels of the fair value hierarchy are as follows:

| Level 1 | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

| Level 2 | Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; |

| Level 3 | Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (supported by little or no market activity). |

| March 31, 2018 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Liabilities: | ||||||||||||||||

| Share purchase warrants – Related Party (see Note 8) | $ | 302 | $ | - | $ | 302 | $ | - | ||||||||

| Share purchase warrants – (see Note 8) | 1 | - | 1 | - | ||||||||||||

| $ | 303 | $ | - | $ | 303 | $ | - | |||||||||

| December 31, 2017 | ||||||||||||||||

| Total | Level 1 | Level 2 | Level 3 | |||||||||||||

| Liabilities: | ||||||||||||||||

| Share purchase warrants – Related Party (see Note 8) | $ | 439 | $ | - | $ | 439 | $ | - | ||||||||

| Share purchase warrants – (see Note 8) | 2 | - | 2 | - | ||||||||||||

| $ | 441 | $ | - | $ | 441 | $ | - | |||||||||

Under fair value accounting, assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The fair value measurement of the financial instruments above use observable inputs in option price models such as the binomial and the Black-Scholes valuation models.

Credit Risk

Credit risk is the risk that the counterparty to a financial instrument will cause a financial loss for the Company by failing to discharge its obligations. To mitigate exposure to credit risk on financial assets the Company has established policies to ensure liquidity of funds and ensure counterparties demonstrate minimum acceptable credit worthiness.

| 17 | P a g e |

GOLDEN QUEEN MINING CO. LTD.

Notes to Condensed Consolidated Interim Financial Statements

For the Three Months Ended March 31, 2018 and 2017

(amounts expressed in thousands of US dollars, except shares amounts - Unaudited)

| 14. | Financial Instruments (continued) |

Credit Risk (continued)

The Company maintains its US Dollar and Canadian Dollar cash in bank accounts with major financial institutions with high credit standings. Cash deposits held in the United States are insured by the Federal Deposit Insurance Corporation (“FDIC”) for up to $250 and Canadian Dollar cash deposits held in Canada are insured by the Canada Deposit Insurance Corporation (“CDIC”) for up to C$100.

Certain United States and Canadian bank accounts held by the Company exceed these federally insured limits or are uninsured as they relate to US Dollar deposits held in Canadian financial institutions. As at March 31, 2018, the Company’s cash balances held in United States and Canadian financial institutions include $17,880, which are not fully insured by the FDIC or CDIC. The Company has not experienced any losses on such accounts and management believes that using major financial institutions with high credit ratings mitigates the credit risk in cash.

Interest Rate Risk

The Company holds approximately 55% of its cash in bank deposit accounts with a single major financial institution. The interest rates received on these balances may fluctuate with changes in economic conditions. Based on the average cash balances during the three months ended March 31, 2018, a 1% decrease in interest rates would have reduced the interest income for the three months ended March 31, 2018, by an immaterial amount.

Foreign Currency Exchange Risk

Certain purchases of corporate overhead items are denominated in Canadian Dollar. As a result, currency exchange fluctuations may impact the costs of operations. Specifically, the appreciation of the Canadian Dollar against the US Dollar may result in an increase in the Canadian operating expenses in US dollar terms. As at March 31, 2018, the Company maintained the majority of its cash balance in US Dollars. The Company currently does not engage in any currency hedging activities.

| 18 | P a g e |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

The following discussion of the operating results and financial condition of Golden Queen Mining Co. Ltd. (“Golden Queen”, “GQM Ltd.”, “Company”, “we”, “our” or “us”) is as at May 9, 2018 and should be read in conjunction with the unaudited condensed consolidated interim financial statements of the Company for the three months ended March 31, 2018 and the notes thereto.

The information in this Management’s Discussion and Analysis of Financial Condition and Results of Operations is prepared in accordance with US generally accepted accounting principles (“US GAAP”). All amounts herein are presented in thousands of US dollars, except per share amounts, or unless otherwise noted.

Cautionary Note Regarding Forward-looking Statements

This Form 10-Q contains certain forward-looking statements, which relate to the intent, belief and current expectations of the Company’s management, as well as assumptions and parameters used in the feasibility study referenced in this report. These forward-looking statements are based upon numerous assumptions that involve risks and uncertainties and other factors that may cause actual results to differ materially from those indicated by such forward-looking statements. Such factors include among other things the receipt and compliance with the terms of required approvals and permits, results of operations and commodity prices. In addition, projected mining results, including quantity of ore, grade, production rates, operating costs and recovery rates, are subject to numerous risks normally associated with mining activity of the nature described in this report and in the feasibility study, and as a result actual results may differ substantially from projected results. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date the statements were made.

Cautionary Note to US Investors

We advise US investors that the mineral reserve estimates disclosed in this report have been prepared in accordance with Canadian regulations and may not qualify as “reserves” under the SEC Industry Guide 7. Information concerning mineral resources and reserves set forth herein may not be comparable with information presented by companies using only US standards in their public disclosure.

Mr. Tim Mazanek, SME is a qualified person for the purposes of NI 43-101 and has reviewed and approved the technical information in this Form 10-Q.

The Soledad Mountain Mine

Overview

The Company is engaged in the operation of the Soledad Mountain Mine (“the Mine”), located in the Mojave Mining District, Kern County, California. The Company owns 50% of Golden Queen Mining Company, LLC (“GQM LLC”), the operator of the Mine. The remaining 50% is owned by Gauss LLC (“Gauss”). The Mine is located just outside the town of Mojave in southern California and utilizes conventional open pit mining methods and cyanide heap leach and Merrill-Crowe processes to recover gold and silver from crushed, agglomerated ore. The Mine also produces aggregate.

Highlights: First Quarter Highlights

| · | Total of 3.8 million tons of ore and waste were mined including 1,135 kt of ore; |

| · | Plant processed a total of 806 kt of ore at an average grade of 0.019 oz/t; and |

| · | 6,579 ounces of gold and 58,024 ounces of silver were produced. |

Project Update

In the fourth quarter of 2017, management accelerated the development of the East Pit to access production of sufficient higher-grade ore. In the first quarter of 2018, almost all of the Mine’s production was sourced from the East Pit. Mining results from the East Pit have shown significant positive reconciliation for both tons and grade with the mine plan. Operations during the first quarter of 2018 showed continued improvement in gold ounces loaded on the pad. Mining of the East Pit progressed on schedule.

| 19 | P a g e |

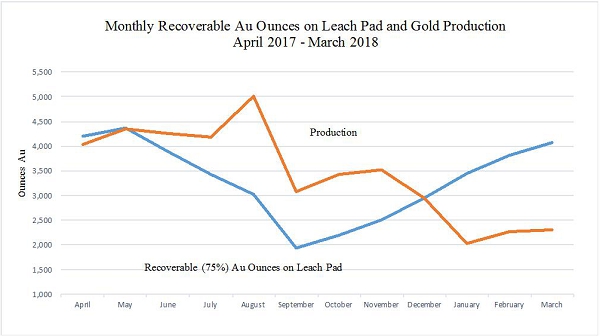

In the second half of 2017, the plant extracted more gold from the leach pad than the net recoverable ounces loaded due to the low grade of the ore loaded during this period, as shown in the figure below. In the first quarter of 2018, the Mine has experienced a lack of available ounces translating to doré as the gold loaded solution circulating on the pad was purged of its gold content during the fourth quarter of 2017. The monthly recoverable gold ounces loaded on leach pad have steadily increased since September 2017, but the impact on production will be from the second quarter of 2018 onward.

Leaching performance is matching the feasibility study - total apparent gold recovery to March 31, 2018 is 71.5%, which Management believes is on track to achieve the life of mine 80% gold recovery.

In the first quarter of 2018, the Company continues to develop the East Pit. It is anticipated that the transition to the East Pit will provide the majority of ore production for at least the next two years where higher ore tonnage and grade and lower waste tons are expected. The plan is to increase delivery of ounces to the heap leach pad by selectively mining higher grade tons as much as practical.

In the process area, pad-loading tonnage and average grade are expected to increase compared to the fourth quarter of 2017. Taking advantage of the good porosity of the heap, flow to the Merrill-Crowe plant is expected to be at capacity. As a result of higher grades in the East Pit and the improved plant throughput, gold production is anticipated to increase throughout the year.

A drilling program commenced in January 2018 and is now complete. A total of 19,520 feet of reverse circulation drilling was completed over 21 holes. This drill program was designed to increase confidence in the currently modelled ore grades and tonnage associated with the Golden Queen vein structure, to improve the Company’s understanding of the Patience vein structure potentially adding ounces to the Company’s reserves and to investigate the Silver Queen vein structure (where historical underground development is illustrated on historic maps but not evidenced in historic extraction reports). The drill results will be analyzed during the second quarter of the year.

As well, the Company is in the process of permitting additional infrastructure for ongoing operations and planned activities that are expected to extend the mine life of Soledad Mountain beyond the initial 11 years contemplated in the 2015 Feasibility Study. The process is anticipated to take approximately 1 to 2 years.

For the three months ended March 31, 2018, the Company recorded aggregate sales of $6. In 2017, the Company was added to the California AB 3098 list, which allows the Company to sell its aggregate to state and municipal agencies. The Company will not include the sale of aggregate in cash flow projections until such time as a long-term contract for the sale of products has been secured.

There is a total of 218 employees currently on site.

| 20 | P a g e |

Results of Operations

The following are the results of operations for the three months ended March 31, 2018 and 2017:

| Three months ended: | ||||||||||

| March 31, | March 31, | |||||||||

| 2018 | 2017 | |||||||||

| Mining - Key Metrics | ||||||||||

| Ore mined | k ton | 1,135 | 852 | |||||||

| Waste mined: ore mined ratio | ore mined ratio | 2.3:1 | 3.8:1 | |||||||

| Gold grade placed | oz/ton | 0.019 | 0.019 | |||||||

| Silver grade placed | oz/ton | 0.313 | 0.232 | |||||||

| Gold sold | oz | 6,529 | 11,160 | |||||||

| Silver sold | oz | 53,612 | 62,095 | |||||||

| Apparent cumulative recovery - gold (1) | % | 71.5 | % | 63.3 | % | |||||

| Apparent cumulative recovery - silver (1) | % | 27.1 | % | 25.3 | % | |||||

| Financial (1) | ||||||||||

| Revenue | $ | 9,585 | 14,804 | |||||||

| Income (loss) from mine operations | $ | (6,449 | ) | 457 | ||||||

| General and administrative expenses | $ | (1,254 | ) | (1,416 | ) | |||||

| Total other expenses | $ | (1,360 | ) | (1,857 | ) | |||||

| Net and comprehensive loss | $ | (9,063 | ) | (2,816 | ) | |||||

| Net and comprehensive loss attributable to GQM Ltd. | $ | (5,417 | ) | (2,426 | ) | |||||

| Average realized gold price (1) | $/oz sold | 1,330 | 1,228 | |||||||

| Average realized silver price (1) | $/oz sold | 16.70 | 17.59 | |||||||

| Total cash costs - net of by-product credits (1) | $/Au oz produced | 2,090 | 1,019 | |||||||

| All-in sustaining costs - net of by-product credits (1) | $/Au oz produced | 2,413 | 1,663 | |||||||

| Total cash costs (1) | $/t placed | 18.06 | 16.08 | |||||||

| Off-site costs (1) | $/t placed | 0.61 | 0.84 | |||||||

| (1) | total cash costs, all-in sustaining costs, apparent cumulative recovery, off-site costs, average realized gold price and average realized silver price are financial performance measures with no standard meaning under US GAAP. Refer to “Non-US GAAP Financial Performance Measures” for further information. |

Financial Results

For the three months ended March 31, 2018, the Company generated revenues from operations of $9,585 from the sale of 6,529 ounces of gold and 53,612 ounces of silver compared to revenues of $14,804 from the sale of 11,160 ounces of gold and 62,095 ounces of silver during the comparable period in 2017, a decrease in revenue of $5,219.

The decrease in revenue is mainly due to a lack of available ounces translating to doré on the leach pad. Although 15,094 ounces of gold was placed on the leach pad in the first quarter of 2018 compared to 14,178 ounces in the first quarter of 2017, revenues from ounces of gold placed on the leach pad will not be realized until later in the year. Because of this situation, the Mine recorded a higher cost per ton (less tons mined) and a higher cost per ounce (less ounces produced).

The costs, excluding depreciation and depletion, applicable to sales incurred during the three months ended March 31, 2018 were $14.6 million (three months ended March 31, 2017 - $11.6 million). The cost of sales, excluding depreciation and depletion, in the current quarter were relatively consistent with the prior quarter (three months ended December 31, 2017 - $15.9 million) and increased compared to respective quarter in prior year due to expensing $4.5 million of costs to ensure inventory was recognized at net realizable value. Costs of sales include mining, processing, maintenance and site support costs. Also, included in the costs of sales are refining, transportation costs, royalties and property taxes.

| 21 | P a g e |

Depreciation and depletion expenses during the three months ended March 31, 2018 were $2,976 compared to $2,756 for the same period in 2017, an increase of $220. The increase in 2018 compared to 2017 was mainly due to the addition of depreciable fixed assets of $19,409 in the third and fourth quarters in 2017.

General and administrative expenses for the three months ended March 31, 2018 were $1,254 compared to $1,416 for the three months ended March 31, 2017, a decrease of $162. The decrease in 2018 compared to 2017 was mainly a result of a decrease in corporate administration costs.

For the three months ended March 31, 2018, the Company incurred finance expenses of $1,533 compared to $1,047 for the three months ended March 31, 2017, an increase of $486. The increase in finance expenses was mainly due to an increase of 2% in the interest rate on the Clay Loan resulting in additional interest of $87 payable, and increased accretion of $269 recorded on the Clay Loan.

For the three months ended March 31, 2018, the Company recorded a gain on derivative instruments of $138 compared to a loss on derivative instruments of $481 for the three months ended March 31, 2017. The gain in 2018 was due to a decrease in the Company’s share price whereas the loss in 2017 was due to an increase in the Company’s share price.

Summary of Quarterly Results

Results for the eight most recent quarters are set out in the table below:

| Results for the quarter ended: | ||||||||||||||||

| 31-Mar-18 | 31-Dec-17 | 30-Sep-17 | 30-Jun-17 | |||||||||||||

| Revenue | $ | 9,585 | $ | 13,939 | $ | 16,496 | $ | 16,882 | ||||||||

| Net and comprehensive income (loss) | $ | (9,063 | ) | $ | (1,327 | ) | $ | (3,224 | ) | $ | 1,192 | |||||

| Net and comprehensive income (loss) attributable to GQM Ltd. | $ | (5,417 | ) | $ | 2,188 | $ | (1,889 | ) | 962 | |||||||

| Basic net income (loss) per share | $ | (0.03 | ) | $ | 0.02 | $ | (0.02 | ) | $ | 0.01 | ||||||

| Diluted net income (loss) per share | $ | (0.03 | ) | $ | 0.02 | $ | (0.02 | ) | $ | 0.01 | ||||||

| Results for the quarter ended: | ||||||||||||||||

| 31-Mar-17 | 31-Dec-16 | 30-Sep-16 | 30-Jun-16 | |||||||||||||

| Revenue | $ | 14,804 | $ | 10,278 | $ | 13,451 | $ | 3,464 | ||||||||

| Net and comprehensive income (loss) | $ | (2,816 | ) | $ | (434 | ) | $ | 3,591 | $ | (3,568 | ) | |||||

| Net and comprehensive income (loss) attributable to GQM Ltd. | $ | (2,426 | ) | $ | 868 | 2,738 | (2,109 | ) | ||||||||

| Basic net income (loss) per share | $ | (0.02 | ) | $ | 0.01 | $ | 0.03 | $ | (0.02 | ) | ||||||

| Diluted net income (loss) per share | $ | (0.02 | ) | $ | 0.01 | $ | 0.03 | $ | (0.02 | ) | ||||||

During the three months ended March 31, 2018, net and comprehensive loss was $9,063 mainly as a result of loss from mine operations of $6,449 due to higher direct mining costs as a result of developing the East Pit and lower revenues due to lower production as a result of less available gold ounces on the leach pad.

In general, the results of operations can vary from quarter to quarter depending upon the nature, timing and cost of activities undertaken, whether or not the Company incurs gains or losses on foreign exchange or grants stock options, and the movements in its derivative liability.

| 22 | P a g e |

Reclamation Financial Assurance and Asset Retirement Obligation

Reclamation Financial Assurance

The Company is required to provide the Bureau of Land Management, the State Office of Mine Reclamation and Kern County with a revised reclamation cost estimate annually. The financial assurance is adjusted once the cost estimate is approved.

This estimate, once approved by state and county authorities, forms the basis of reclamation financial assurance. The reclamation assurance provided as at March 31, 2018 was $1,500 (December 31, 2017 – $1,465).

The Company is also required to provide financial assurance with the Lahontan Regional Water Quality Control Board (the “Regional Board”) for closure and reclamation costs related to the lined impoundments, which are defined as the Stage 1 and Stage 2 heap leach pads, the overflow pond, and the solution collection channel. The reclamation financial assurance estimate as at March 31, 2018, is $2,450 (December 31, 2017 – $1,869).

In addition to the above, the Company is required to obtain and maintain financial assurance for initiating and completing corrective action and remediation of a reasonably foreseeable release from the Project’s waste management units as required by the Regional Board. The reclamation financial assurance estimate as at March 31, 2018 is $278 (December 31, 2017 – $278).

The Company entered into $4,228 (2017 – $3,612) in surety bond agreements in order to release its reclamation deposits and posted a portion of the financial assurance due in 2017. The Company pays a yearly premium of $90 (2016 – $90). GQM Ltd. has provided a corporate guarantee on the surety bonds.

Asset Retirement Obligation

The total asset retirement obligation as at March 31, 2018, was $2,229 (December 31, 2017 – $1,838).

The Company estimated its asset retirement obligations based on its understanding of the requirements to reclaim and remediate its property based on its activities to date. As at March 31, 2018, the Company estimates the cash outflow related to these reclamation activities will be incurred in 2028. Reclamation provisions are measured at the expected value of future cash flows discounted to their present value using a discount rate based on a credit adjusted risk-free interest rate of 8.34% and an inflation rate of 2.41%.

The following is a summary of asset retirement obligations:

| March

31, 2018 | December

31, 2017 | |||||||

| Balance, beginning of the period | $ | 1,838 | $ | 1,366 | ||||

| Accretion | 42 | 126 | ||||||

| Changes in cash flow estimates | 349 | 346 | ||||||

| Balance, end of the period | $ | 2,229 | $ | 1,838 | ||||

Off-balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

Transactions with Related Parties

Except as noted elsewhere in this Form 10-Q, related party transactions are disclosed as follows:

| (i) | Compensation of Key Management Personnel, Transactions with Related Parties and Related Party Balances |

For the three months ended March 31, 2018, the Company recognized $195 (for the three months ended March 31, 2017 – $218) salaries and fees for Officers and Directors.

| 23 | P a g e |

As at March 31, 2018, $nil (December 31, 2017 – $38) was included in prepaid expenses and other current assets for closing fees paid to related parties.

As at March 31, 2018, $835 (December 31, 2017 – $463 for amended fees and accrued interest payable to related parties) was included in accounts payable and accrued liabilities for accrued interest payable to related parties and salaries and fees payable to Officers and Directors.

| (ii) | Note Payable |

On November 18, 2016, the Company entered into a loan with the Clay Group for $31,000 (the “November 2016 Loan”), due on May 21, 2019 and an annual interest rate of 8%, payable quarterly. In connection with the November 2016 Loan the Company issued 8,000,000 common share purchase warrants exercisable for a period of five years expiring November 21, 2021. The common share purchase warrants have an exercise price of $0.85.

On November 10, 2017, the Company and the Clay Group entered into a letter agreement (the “Letter Agreement”) pursuant to which they agreed to amend the November 2016 Loan by reducing the 2018 quarterly and 2019 Q1 principal payments from $2,500 to $1,000, adding the reduction of such payments pro-rata to the remaining 2019 payments, and increasing the annual interest rate from 8% to 10% effective January 1, 2018 (the “November 2017 Loan”). On February 22, 2018, the Company and the Clay Group entered into definitive agreements to amend the terms of the November 2016 Loan and the registration rights agreement in accordance with the Letter Agreement.

The following table summarizes activity on the notes payable:

| March

31, 2018 | December

31, 2017 | |||||||

| Balance, beginning of the period | $ | 30,099 | $ | 26,347 | ||||

| Interest payable transferred to principal balance | - | 2,212 | ||||||

| Accretion of discount on loans | 490 | 1,940 | ||||||

| Capitalized financing and legal fees | - | (400 | ) | |||||

| Accretion of capitalized financing and legal fees | 65 | - | ||||||

| Repayment of loans and interest | (4,712 | ) | - | |||||

| Balance, end of the period | $ | 25,942 | $ | 30,099 | ||||

| Current portion | $ | 4,000 | $ | 7,712 | ||||

| Non-current portion | $ | 21,942 | $ | 22,387 | ||||

| (iii) | Amortization of Discounts and Interest Expense |

The following table summarizes the amortization of discounts and interest on loan:

| Three Months Ended March 31, | Three Months Ended March 31, | |||||||

| 2018 | 2017 | |||||||

| Accretion of the November 2017 Loan discount | $ | 490 | $ | 286 | ||||

| Accretion of capitalized financing and legal fees | 65 | - | ||||||

| Interest expense related to the November 2017 Loan | 713 | 626 | ||||||

| Closing and commitment fees related to the Credit Facility | 30 | - | ||||||

| Interest expense related to Komatsu financial loans (1) | 235 | 135 | ||||||

| Accretion of discount and interest on loan | $ | 1,533 | $ | 1,047 | ||||

(1) Komatsu is not a related party and has only been included in the above table to reconcile the total interest expense incurred for the period to the amounts capitalized and expensed.

| 24 | P a g e |

| (iv) | Joint Venture |

The net assets of GQM LLC as at March 31, 2018 and December 31, 2017 are as follows:

| March

31, 2018 | December

31, 2017 | |||||||

| Assets, GQM LLC | $ | 156,998 | $ | 149,095 | ||||

| Liabilities, GQM LLC | (23,221 | ) | (28,024 | ) | ||||

| Net assets, GQM LLC | $ | 133,777 | $ | 121,071 | ||||

Included in the assets above, is $9,622 (December 31, 2017 – $2,606) in cash held by GQM LLC which is directed specifically to fund capital expenditures required to continue with production and to settle GQM LLC’s obligations. The liabilities of GQM LLC do not have recourse to the general credit of Golden Queen except for $2,203 for two mining drill loans and $4,228 in surety bond agreements.

| (v) | Revolving credit |

On May 23, 2017, GQM LLC entered into a $5,000 one-year revolving credit agreement (the “Credit Facility”) in which Gauss Holdings LLC and Auvergne, LLC agreed to extend credit in the form of loans to GQM LLC. The Credit Facility commenced on July 1, 2017, bears interest at a rate of 12% per annum and is subject to a commitment fee of 1% per annum. For the three months ended March 31, 2018, GQM LLC paid commitment fees of $30 (2017 – $nil). As at March 31, 2018, GQM LLC has drawn $nil (December 31, 2017 – $3,000) from the Credit Facility.

Fair Value of Financial Instruments

Fair Value Measurements

The three levels of the fair value hierarchy are as follows:

| Level 1 | Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities; |

| Level 2 | Quoted prices in markets that are not active, or inputs that are observable, either directly or indirectly, for substantially the full term of the asset or liability; |