UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

0-21777

(Commission File Number)

GOLDEN QUEEN MINING CO.

LTD.

(Name of registrant in its charter)

| British Columbia, Canada | Not Applicable |

| (State or other jurisdiction | (IRS Employer |

| of incorporation or organization) | Identification No.) |

| 6411 Imperial Avenue, West Vancouver, British Columbia, Canada | V7W 2J5 |

| (Address of principal executive offices) | (Zip Code) |

Issuer’s telephone number: (604) 921-7570

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under section 12(g) of the Exchange Act:

Common shares without par value

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [

] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes

[X] No [ ]

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $59,295,332 as at June 30, 2013.

Indicate the number of shares outstanding of each of the registrant’s classes of common equity, as of the latest practicable date: 99,308,683 common shares as at March 17, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K, which Proxy Statement is to be filed within 120 days after the end of the registrant's fiscal year ended December 31, 2013. If the definitive Proxy Statement cannot be filed on or before the 120 day period, the issuer may instead file an amendment to this Form 10-K disclosing the information with respect to Items 10 through 14.

2

Form 10-K

Table of Contents

| Part | Item No. | |

| I | 1 | Business |

| 1A | Risk Factors | |

| 1B | Unresolved Staff Comments | |

| 2 | Properties | |

| 3 | Legal Proceedings | |

| 4 | Mine Safety Disclosures | |

| II | 5 | Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| 6 | Selected Financial Data | |

| 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operation | |

| 7A | Quantitative and Qualitative Disclosures About Market Risk | |

| 8 | Financial Statements and Supplementary Data | |

| 9 | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | |

| 9A | Controls and Procedures | |

| 9B | Other Information | |

| III | 10 | Directors, Executive Officers and Corporate Governance |

| 11 | Executive Compensation | |

| 12 | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| 13 | Certain Relationships and Related Transactions and Director Independence | |

| 14 | Principal Accounting Fees and Services | |

| IV | 15 | Exhibits, Financial Statement Schedules |

| Signatures | ||

3

PART I

FORWARD-LOOKING STATEMENTS

ALL STATEMENTS IN THIS DISCUSSION THAT ARE NOT HISTORICAL ARE FORWARD-LOOKING STATEMENTS WITHIN THE MEANING OF SECTION 21E OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED. STATEMENTS PRECEDED BY, FOLLOWED BY OR THAT OTHERWISE INCLUDE THE WORDS "BELIEVES", "EXPECTS", "ANTICIPATES", "INTENDS", "PROJECTS", "ESTIMATES", "PLANS", "MAY INCREASE", "MAY FLUCTUATE" AND SIMILAR EXPRESSIONS OR FUTURE OR CONDITIONAL VERBS SUCH AS "SHOULD", "WOULD", "MAY" AND "COULD" ARE GENERALLY FORWARD-LOOKING IN NATURE AND NOT HISTORICAL FACTS. THESE FORWARD-LOOKING STATEMENTS WERE BASED ON VARIOUS FACTORS AND WERE DERIVED UTILIZING NUMEROUS IMPORTANT ASSUMPTIONS AND OTHER IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE IN THE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS INCLUDE THE INFORMATION CONCERNING OUR FUTURE FINANCIAL PERFORMANCE, BUSINESS STRATEGY, PROJECTED PLANS AND OBJECTIVES. THESE FACTORS INCLUDE, AMONG OTHERS, THE FACTORS SET FORTH BELOW UNDER THE HEADING "RISK FACTORS." ALTHOUGH WE BELIEVE THAT THE EXPECTATIONS REFLECTED IN THE FORWARD-LOOKING STATEMENTS ARE REASONABLE, WE CANNOT GUARANTEE FUTURE RESULTS, LEVELS OF ACTIVITY, PERFORMANCE OR ACHIEVEMENTS. MOST OF THESE FACTORS ARE DIFFICULT TO PREDICT ACCURATELY AND ARE GENERALLY BEYOND OUR CONTROL.

EXCEPT AS REQUIRED BY LAW, WE ARE UNDER NO OBLIGATION TO PUBLICLY UPDATE ANY OF THE FORWARD-LOOKING STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER THE DATE HEREOF OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS. READERS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS. REFERENCES IN THIS FORM 10-K, UNLESS ANOTHER DATE IS STATED, ARE TO DECEMBER 31, 2013.

AS USED HEREIN, THE "COMPANY," "GOLDEN QUEEN MINING" "WE," "US," "OUR" AND WORDS OF SIMILAR MEANING REFER TO GOLDEN QUEEN MINING CO. LTD.

Item 1. Business.

Glossary

Certain terms used in this Form 10-K are described below. Note that Golden Queen Mining Co. Ltd. (the “Company”) uses Canadian Institute of Mining, Metallurgy and Petroleum definitions for the terms “proven reserves”, “probable reserves”, “measured resources”, “indicated resources” and “inferred resources”, and U.S. investors are cautioned that while these terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.

Advance minimum royalty - Payment made before the start of commercial production under a mining lease agreement with landholders.

Ag – The chemical symbol for silver.

Au – The chemical symbol for gold.

Exploration Stage Company – A company engaged in the search for or exploration of mineral deposits, which is not in either the development or production stage.

Development Stage Company – A company engaged in the preparation of a mineral deposit with reserves for production and which is not in the production stage.

Production Stage Company – A company engaged in the exploitation of a mineral deposit with reserves.

4

Fault or faulting - A fracture in the earth’s crust caused by tectonic forces with displacement along the fracture.

Grade - A term used to assign metal value to resources and reserves, such as gram per tonne (g/t) or troy ounces per ton (oz/ton). Grades are reported both in Imperial and Metric units in this Form 10-K.

Heap leaching – A process which uses dilute sodium-cyanide solutions to percolate through run-of-mine or crushed ore heaped on an impervious pad to dissolve gold and/or silver.

Kriging - A geostatistical method used to assign grades to mineral resource and mineral reserve model blocks.

Mineral deposit - A mineral deposit is a mineralized body, which has been intersected by a sufficient number of drill holes or by underground workings to give an estimate of grade(s) of metal(s) and thus to warrant further exploration or development. A mineral deposit does not qualify as a commercially viable mineral deposit with reserves under standards set by the U.S. Securities and Exchange Commission until a final, comprehensive, economic, technical and legal feasibility study has been completed.

Ore - A natural aggregate of one or more minerals which, at a specified time and place, may be mined and processed and the product(s) sold at a profit or from which some part may be profitably separated.

Mineral Resource - A mineral resource is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic exploitation. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral resources are sub-divided, in order of increasing geological confidence, into inferred, indicated and measured categories.

Mineral Reserve - A mineral reserve is the economically mineable part of an indicated or measured mineral resource as demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, metallurgy, processing, economic factors and other relevant factors that demonstrate, at the time of reporting, that economic exploitation can be justified. A mineral reserve includes diluting materials and allowance for losses that may occur when the material is mined. Mineral reserves are sub-divided in order of increasing confidence into probable and proven categories.

Volcanics - Rock composed of clasts or pieces that are of volcanic composition.

General Development of Business

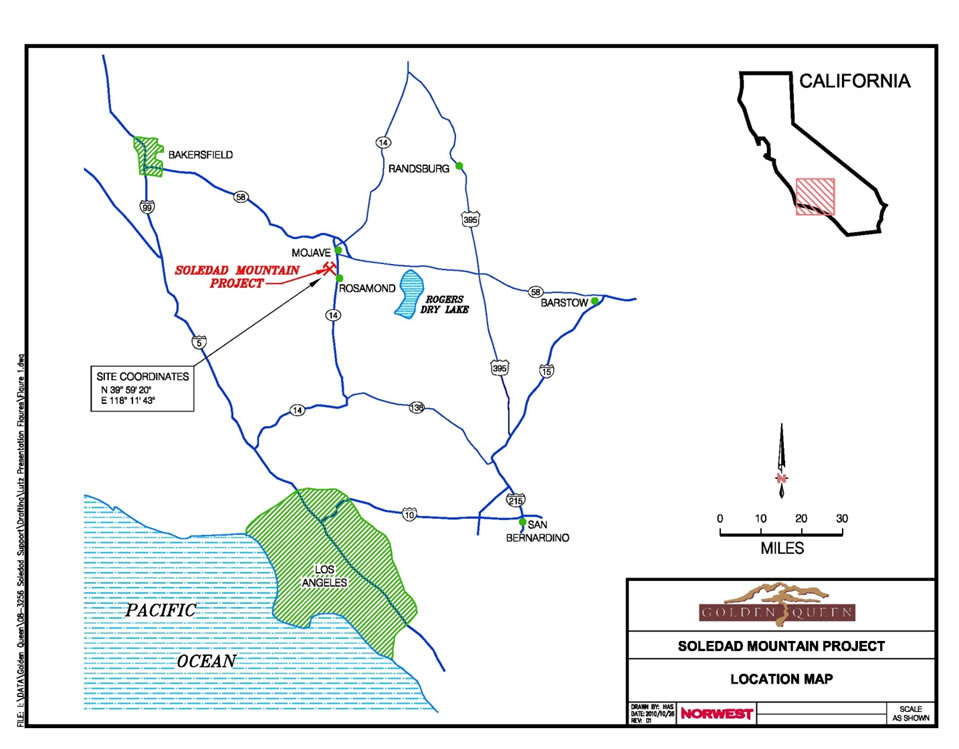

The Company was incorporated under the laws of the Province of British Columbia, Canada in November 1985 and has been exploring its mineral properties (the “Property”) located just south of Mojave in Kern County in southern California since that time.

The Company acquired its initial interest in the Property in 1985 and has since added to its holdings in the area. Work on the Property and on the Soledad Mountain project (the “Project”) is done by Golden Queen Mining Co., Inc., a California corporation and the wholly-owned subsidiary (the “Subsidiary”) of the Company.

The Company explored for gold and silver on the Property and did extensive engineering work on the Project between 1988 and 1999. An independent consulting engineering firm completed a feasibility study for the Project in 1997 with gold and silver prices of $350/oz and $5.50/oz respectively. The Company did additional drilling, underground sampling and metallurgical test work in 1998 and 1999.

The Company had previously reported that it expected to begin producing gold and silver from the Project during the second half of 1998, based on the independent feasibility study and on approvals and permits secured in 1997. Because of relatively low gold and silver prices in the late 1990s and in early 2000 however, the Company was not able to secure financing for the Project and the Project was therefore put on hold in early 2000. Employees were laid off and costs were reduced to the minimum required to maintain rights to the Property. The major landholders agreed to a 3-year moratorium on advance minimum royalty and other property payments or until the prices of gold and silver improved. The Company recorded an asset impairment loss of $28,547,592 for the year ended December 31, 2000 and this asset impairment loss reduced the carrying value of the Property and other assets to their estimated, net realizable value.

5

In order to update the prospects for the economic exploitation of the Soledad Mountain mineral deposit, the Company initiated a detailed review of the Project in mid-2002 to identify new approaches that would reduce both the capital cost to the start of production and future operating costs. This effort was supported and complemented by a substantial amount of work done by independent consulting engineers and contractors. The information was documented and compiled into an in-house report to assist management in determining the prospects for development of the Project at gold and silver prices prevailing in late 2006. The review indicated reasonable prospects for the development of the Project and this was the basis for ongoing work on the Project that has continued to this date.

The Company retracted the historical mineral reserve estimates, which were based on the report prepared by an independent consulting engineering firm in 1998, in 2005 on the basis that they were out of date and not supported by a National Instrument NI 43-101 (“NI 43-101”) technical report, being the Canadian regulation that governs disclosure of technical information by companies engaged in the exploration or development of a mineral deposit(s).

The Company engaged SRK Consulting (U.S.), Inc. (“SRK”), Lakewood, Colorado in 2005 to prepare a NI 43-101 technical report (the “Technical Report (SRK)”) to validate and confirm the mineral resource estimates in compliance with NI 43-101. SRK released the Technical Report (SRK) on March 6, 2006 and this confirmed the mineral resource estimates (see “Exploration & Mineral Resources” heading below).

The Company engaged Norwest Corporation (“Norwest”), Vancouver, British Columbia in 2007 to prepare a further NI 43-101 technical report (the “Technical Report (Norwest)”) to assess mineral reserves for the Project as part of an independent feasibility study based upon technical work that had been completed to the end of 2006. The results of the Norwest study were disclosed in a news release on December 14, 2007 (see “Mineral Reserves” heading below), which is available on SEDAR and on the Company’s website at www.goldenqueen.com.

Refer to section Environmental Issues, Approvals & Permits below for a detailed review. The Project is now fully permitted. The Company has not as yet made a production decision and is continuing to evaluate various financing options for the Project, including equity, debt, and other alternatives. The time required to construct the facilities is expected to range from fifteen to eighteen months once a production decision is made and project financing has been secured.

An updated feasibility study and economic analysis was prepared by Norwest with input from independent consulting engineers and management and the results were disclosed in a news release on October 25, 2012. See section Independent Feasibility Study below for detailed information.

It is expected that the Project will produce two different types of materials with overlapping time frames. Open pit mining and heap leaching as presently planned is approximately fifteen years of mining and leaching for the production of gold and silver, and a further two years of rinsing and drain-down. The processing and sale of waste rock as aggregate is expected to commence early in the mine life and continue for up to thirty years or until the stockpile of quality waste rock has been exhausted. The Company also plans to process and sell leached and rinsed residues from the heap leach operation for a range of uses to local and regional markets. Reclamation will proceed concurrently where feasible, but is nonetheless expected to require two years following cessation of all mining, and a further three years of post-closure monitoring. Monitoring will continue until the reclamation success criteria are met.

There are a number of risks associated with the Project and readers are urged to consider these risks and possible other risks, in order to obtain an understanding of the Project (see “Item 1A. Risk Factors” heading below).

The registered office of the Company is located at 1200 - 750 West Pender Street, Vancouver, BC, Canada V6C 2T8 and its executive offices are located at 6411 Imperial Ave., West Vancouver, BC, Canada, V7W 2J5. The Company’s California office is located at 15772 K Street, Mojave, California, 93501.

6

The U.S. dollar (“$") is used in this Form 10-K and quantities are reported in Imperial units with Metric units in brackets.

Project Background

The Project is located approximately 5miles (8km) south of Mojave in Kern County in southern California. See Figure 1, a Project location map below.

Gold mining on Soledad Mountain dates back to the late 19th century. The largest producer in the area was Gold Fields America Development Co. (“Gold Fields”), a subsidiary of Consolidated Gold Fields of South Africa. Gold Fields operated an underground mine and mill on the property from 1935 to 1942, when the mine was forced to close by War Production Board Order L-208. Production after the war was minimal, as costs had increased while the price of gold remained fixed at $35/oz until 1973.

Exploration & Mineral Resources

The Soledad Mountain mineral deposit is hosted in a volcanic sequence of rhyolite porphyries, quartz latites and bedded pyroclastics that occur on a large dome-shaped feature, called Soledad Mountain, along the margins of a collapsed caldera. Higher-grade precious metals mineralization is associated with steeply dipping, epithermal veins, which occupy faults and fracture zones that cross cut the rock units and generally trend northwest. The veins are contained within siliceous envelopes of lower-grade mineralization that forms the bulk of the mineral resource.

The primary rock types that occur on the Property are rhyolite porphyry and flow-banded rhyolite, quartz latite porphyry, pyroclastics and siliceous vein material. Little or no clay occurs in any of the rocks and the rocks contain upwards of 60% silica as SiO2. Rhyolite porphyry and flow-banded rhyolite were grouped as a single rock type for the metallurgical test work.

Extensive programs of mapping, diamond drilling, reverse-circulation drilling and underground diamond drilling and channel sampling were carried out on the Property between 1985 and 2011. Company geologists managed these programs. The geological database today includes the crosscut assay data recorded on linens by Gold Fields between 1933 and 1942 and the results of exploration done on the Property by Rosario Exploration and Shell/Billiton. The database contains 119,906 samples, generated from 379,326ft (115,648m) of drilling and sampling of underground crosscuts.

Mineral zones were shaped manually by Company geologists to define continuity with a low-grade cut-off grade of 0.008oz/ton AuEq (0.274g/t AuEq). Prices for gold and silver of $325.00/oz and $6.00/oz and recoveries for gold and silver of 78.0% and 60.0% respectively were used to calculate the gold-equivalent cut-off grade for this purpose.

Note:

AuEq is the gold-equivalent grade,

which is calculated as follows:

AuEq g/t = Au g/t +

{(Ag/R1)xR2} g/t where

R1= Au price in

$/oz/Ag price in $/oz; R2= Ag recovery in %/Au recovery in %.

Mineral Resources Development, Inc. (“MRDI”), San Mateo, California did a detailed due diligence review of the geological procedures used by the Company between 1998 and 2000. MRDI also evaluated and confirmed the use of other information included by the Company in its geological database. The work done by MRDI involved statistical analyses, the evaluation of grade capping, the design of appropriate kriging techniques and setting criteria for the classification of resources. Two resource models were developed with input from MRDI. The Company received a final MRDI report with recommendations in May 2000.

The Company engaged SRK Consulting (U.S.), Inc. (“SRK”), Lakewood, Colorado in 2005 to prepare a NI 43-101 technical report (the “Technical Report (SRK)”) to validate and confirm the mineral resource estimates in compliance with NI 43-101. SRK and AMEC E&C Services, Inc. (“AMEC”), Reno, Nevada (AMEC acquired MRDI in 2000) did an exhaustive review of the database information and this included the MRDI recommendations from 2000 and audited the geological model over a period of five months in late 2005 and early 2006. Linear kriging was used to estimate gold and silver grades for all blocks in the model. SRK released the Technical Report (SRK) on March 6, 2006. Peter Clarke, P.Eng., SRK, a Qualified Person (“QP”) as described in NI 43-101, was the QP for the Technical Report (SRK). The Technical Report (SRK) is available on the Company’s web site at www.goldenqueen.com.

7

Infill Drill Program

The Company announced that it had initiated an infill drill program in a news release on October 21, 2010. The drill program commenced in April 2011 and was completed in early May 2011. A total of 20 reverse-circulation drill holes with 6,288ft (1,917m) of drilling were completed in the program.

The drill program was designed to test targets within the areas of the planned North-West and East open pits. Nine holes were drilled in the area of the North-West open pit with a total length of 2,020ft (616m). The North-West open pit is the planned location of the first phase of mining. A total of 11 holes were drilled in the area of the East open pit with a total length of 4,268ft (1,301m). Key program objectives were to support potential reclassification of inferred material to higher-confidence mineral resource categories, and eventually to mineral reserves, to continue to test continuity of mineralization, and provide data for road alignment and road construction purposes.

AMEC integrated the results from the infill drill program into updated mineral resource estimates. The estimate differs from previous estimates because the update has used a lower gold-equivalent cut-off grade, higher gold and silver prices, and estimates of operating costs and recoveries for gold and silver determined in 2011. The previous estimates were based on gold and silver prices and technical parameters from the late 1990s.

The mineral resource prepared by AMEC are set out in Table 1 below. Mineral Resources were determined using precious metals prices of $1,310/oz gold and $24.05/oz silver, a cut-off grade of 0.004 oz/ton AuEq (0.137g/t AuEq), and have an effective date of 29 February, 2012. Mineral Resources are reported inclusive of Mineral Reserves.

Mark Hertel, an AMEC Principal Geologist, is the QP for the Mineral Resources. The NI 43-101 Technical Report is available on the Company’s web site at www.goldenqueen.com.

Note that mineral resources that are not mineral reserves do not have demonstrated economic viability.

Table 1 - Mineral Resources

Effective Date: February 29,

2012

| In-situ Grade | Contained Metal | |||||||

| Gold | Silver | Gold | Silver | |||||

| Classification | tonnes | ton | g/t | oz/ton | g/t | oz/ton | oz | oz |

| Measured | 26,727,000 | 29,400,000 | 0.850 | 0.025 | 13.29 | 0.39 | 729,000 | 11,403,000 |

| Indicated | 118,090,000 | 129,900,000 | 0.442 | 0.013 | 8.53 | 0.25 | 1,675,000 | 32,301,000 |

| Total & Average | 144,817,000 | 159,300,000 | 0.517 | 0.015 | 9.42 | 0.27 | 2,404,000 | 43,704,000 |

| Inferred | 14,545,000 | 16,000,000 | 0.362 | 0.011 | 7.89 | 0.23 | 169,000 | 3,681,000 |

Notes:

| 1. |

The qualified person for the mineral resource is Mark Hertel, SME Registered Member, and an employee of AMEC and he has reviewed and approved this technical information. | |

| 2. |

Mineral Resources are inclusive of Mineral Reserves. | |

| 3. |

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. | |

| 4. |

Mineral Resources are reported at a 0.004oz/ton (0.137g/t) AuEq cutoff. | |

| 5. |

Mineral Resources are reported as undiluted. | |

| 6. |

Mineral Resources are reported within a conceptual pit shell that has been merged with the Mineral Reserve pit. | |

| 7. |

Mineral Resources are reported using a long-term gold price of $1310/oz, silver price of $24.05/oz, mining and processing costs and variable recoveries that are based on rock type classification. | |

| 8. |

Gold-equivalent grades were calculated based on the equation: | |

| AuEq(oz/ton) = Au(oz/ton) + (Ag(oz/ton) * [(Ag price(US$/oz)/Au price(US$/oz)) * (Ag recovery(%)/Au recovery(%))] |

8

| 9. |

Rounding as required by reporting guidelines may result in summation differences between tons, grade and contained metal content. | |

| 10. |

Tonnage is reported in Imperial and Metric units. Grades are reported in troy ounces per short ton and in grams per tonne. | |

| 11. |

Mineral zones were shaped with a cut-off grade of 0.004 oz/ton (0.137 g/t) AuEq. |

The Company has prepared a further drill program with 40 drill holes and approximately 23,500ft (7,200m) of drilling, designed to test a portion of the material classified as inferred within pit shells constructed in 2012. SRK concurred in the Technical Report (SRK) that strategically targeted drilling could upgrade a significant portion of the inferred to the measured or indicated categories. The Company intends to do infill drilling and further exploration once construction of the facilities is under way.

Mineral Reserves

The Company engaged Norwest Corporation (“Norwest”), Vancouver, British Columbia in January 2007 to prepare a NI 43-101 technical report to assess mineral reserves for the Project as part of an independent feasibility study based upon the technical work that had been completed to the end of 2006. The results of the Norwest study were disclosed in a news release dated December 14, 2007.

Norwest completed substantial additional mine design between 2008 and 2012. Norwest prepared an updated feasibility study and economic analysis with input from independent consulting engineers and management and the results were disclosed in a news release on October 25, 2012. This included updated mineral reserves and these are set out in Table 2 below.

Sean Ennis, P.Eng., Norwest, is the QP for the Mineral Reserves.. The NI 43-101 Technical Report is available on the Company’s web site at www.goldenqueen.com.

Table 2 - Mineral Reserves

Effective Date: August

31, 2012

| In-situ Grade | Contained Metal | |||||||

| Gold | Silver | Gold | Silver | |||||

| Reserve Category | tonnes | ton | g/t | oz/ton | g/t | oz/ton | oz | oz |

| Proven | 18,371,000 | 20,250,000 | 0.910 | 0.027 | 14.49 | 0.423 | 537,700 | 8,558,500 |

| Probable | 42,237,000 | 46,558,000 | 0.529 | 0.015 | 10.58 | 0.309 | 717,900 | 14,372,500 |

| Total & Average | 60,608,000 | 66,808,000 | 0.644 | 0.019 | 11.77 | 0.343 | 1,255,600 | 22,931,000 |

Notes:

| 1. |

The qualified person for the mineral reserve is Sean Ennis, Vice President, Mining, P.Eng., APEGBC Registered Member who is employed by Norwest Corporation and he has reviewed and approved this technical information. | |

| 2. |

A gold-equivalent cut-off grade of 0.240 g/t (0.007 oz/ton) was used to estimate the mineral reserves. | |

| 3. |

AuEq is the gold-equivalent grade, which is calculated as follows: | |

| a. |

AuEq g/t = Au g/t + {(Ag/R1)xR2} g/t | |

| b. |

R1 = Au price in $/oz/Ag price in $/oz; R2 = Ag recovery in %/Au recovery in %. | |

Indicated recoveries for gold and silver based upon extensive metallurgical test work done between 1989 and 2007 are 85.0% and 52.5% as discussed in detail in section Mineralogy, Process Development & Flow Sheet below.

Note that open pit optimizations was done with low gold and silver prices of $540.00/oz and $9.00/oz respectively.

Cautionary note to U.S. investors concerning proven or probable reserve estimates: This section uses the terms “proven reserves” and “probable reserves”. We advise U.S. investors that these terms are defined strictly in accordance with applicable Canadian regulations.

The mineral reserves are included in the Measured & Indicated Mineral Resources set out in the table in the section

Exploration & Mineral Resources above.

Exploration Potential

9

Additional geological targets have been identified on the Property. These targets are generally peripheral (east, south and west) to the currently defined mineral resources. In the east, two additional zones of quartz stringer veins have been mapped in the hanging wall of the Karma/Ajax vein system. Toward the south, an extension of the Silver Queen vein system is open and additional vein splits have been mapped on surface. Also, an extension of the Golden Queen vein system appears to be offset by an east-west trending fault. Initial drill results indicate widths of 26ft (8m) with good gold and silver grades.

The exploration work to date has focused on known fault/vein structures central to the deposit. The host volcanics associated with mineralization on the Property extend further to the south and have not been fully evaluated. Further, anomalous gold values have also been found in the low volcanic hills that protrude from the valley floor to the northwest of the Property.

The continuity of mineralization at depth remains untested.

Independent Feasibility Study

Norwest prepared an updated feasibility study and economic analysis with input from independent consulting engineers and management and the results were disclosed in a news release on October 25, 2012.

Open pit mining and heap leaching as presently planned is approximately fifteen years of mining and leaching for the production of gold and silver, and a further two years of rinsing and drain-down. Gold and silver production at the planned ore mining rate is projected to average 77,000 oz and 890,000 oz respectively per year although this is expected to fluctuate considerably from year to year depending upon the ore head grades. Gold and silver production is projected to be 1,067,000 oz of gold and 12,039,000 oz of silver over the period of fifteen years.

Reclamation will proceed concurrently where feasible, but is nonetheless expected to require two years following ending of mining, and a further three years of post-closure monitoring. Monitoring will continue until the reclamation success criteria are met.

The financial analysis was done on a constant dollar, stand-alone basis.

At gold and silver prices of $1,438/oz and $27.65/oz respectively, the trailing 36-month average precious metals prices to the end of September 2012, the Project has a pre-tax indicated internal rate of return (“IRR”) of 64.4%, a net present value (“NPV”) of $735 million with a discount rate of 5% and the undiscounted, cumulative net cash flow is approximately $1.13 billion and this is considered the base case. The all-inclusive average cash cost per ounce of gold produced including sustaining capital and an accrual for closure and reclamation and net of silver credits, is $285/oz. The after-tax IRR is 52.2%, the NPV is $517 million with a discount rate of 5% and the undiscounted, cumulative net cash flow is $800 million. Note that the tax model allows for federal and state taxes and treats the Company and the Project as stand-alone for tax estimates.

The trailing 36-month average precious metals prices are accepted by the U.S. Securities And Exchange Commission when reporting mineral reserves.

At gold and silver prices of $1,749/oz and $33.03/oz respectively, the London p.m. fix for precious metals on October 17, 2012 and the date of the Technical Report, the Project has a pre-tax indicated IRR on capital employed of 82.9% . The NPV is $986 million with a discount rate of 5%, and the undiscounted, cumulative net cash flow is approximately $1.49 billion. The indicated contribution of gold and silver to gross revenues is 83% and 17% respectively. The all-inclusive average cash cost per ounce of gold produced including sustaining capital and net of silver credits, is $256/oz. The after-tax IRR is 65.6%, the NPV is $685 million with a discount rate of 5% and the undiscounted, cumulative net cash flow is $1.04 billion.

10

| Pre-Tax | After-Tax | ||||||

Gold Price |

Silver Price |

NPV @ 5% |

NPV @ 5% |

IRR |

NPV @ 5% |

NPV @ 5% |

IRR |

$/oz |

$/oz |

$ million |

$/share |

% |

$ million |

$/share |

% |

| 1,749 1,438 |

33.03 27.65 |

986 735 |

9.81 7.31 |

82.9 64.4 |

685 517 |

6.82 5.15 |

65.6 52.2 |

The NI 43-101 Technical Report is available on the Company’s website at www.goldenqueen.com.

Technical information is provided in the following sections.

Feasibility Study Capital and Operating Cost Estimates

The feasibility study capital cost estimates were based upon quotes for construction from a number of key vendors and contractors based in southern California. The capital cost was estimated to be $119.0 million and this included mining equipment with a cost of $17.2 million, unallocated cost of $12.5 million and working capital of $10.5 million. These estimates also included all sales taxes. The sustaining capital was estimated to be a further $30.6 million over the life of the gold and silver heap leach operation. The bulk of the sustaining capital would be required for the construction of heap leach pads and for mining equipment replacement.

Detailed operating costs estimates were prepared with information provided by independent consulting engineers and vendors of services and supplies such as diesel fuel and explosives, reagents such as cement and sodium-cyanide and operating supplies and spare parts for both the major mining equipment and support equipment and equipment in the various processing facilities.

Mine Design

Norwest did detailed mine designs between 2008 and 2010 and again in 2012. These detailed mine designs were adapted from the original 2007 designs to reduce waste to ore mining ratios, enhance opportunities for backfill placement and develop pit phasing and access which would lower the costs associated with backfilling. One of the key considerations was also to develop sufficient ore to fill the heap leach pads. Open pit optimizations was done with low gold and silver prices of $540.00/oz and $9.00/oz respectively. There has not been any significant changes to the mine design since the feasibility study.

The average waste to ore mining ratio has been reduced from 2.12:1.0 in 2008 to 1.85:1.0 in 2011 to 1.49 in 2012.

An independent consulting engineer did open pit slope stability analyses in 1995 and these included analyses with the ultimate slopes subjected to a maximum, credible earthquake acceleration of 0.297g. The consulting engineer recommended an ultimate, inter-ramp slope angle of 55o with an indication that this angle could be safely increased to 63.4 o. The Company drilled five diamond drill holes in 1997 specifically to obtain rock strength parameters for further slope stability analyses. An independent consulting engineer did further slope stability analyses and confirmed the ultimate slope angle of 55o. Norwest used an inter-ramp slope angle of 55o for the mine design done in 2012.

Disposal of waste rock will be largely in mined-out phases of the open pit and a single, external waste rock pad will be constructed to provide an area suitable for the aggregate operation. Independent consulting engineers did waste rock heap stability analyses in 1996 and again in 1998 and these were confirmed by Norwest in 2007. A further stability analysis was done in 2010. These analyses concluded that backfilled waste rock and the down-slope portion of the East waste rock storage pad would be stable under both static and seismic loading conditions, both during operations and after closure and reclamation. Some sloughing of the faces of backfilled waste rock or the waste rock pad could occur during significant seismic events in the area.

11

Waste rock will be disposed of at an angle of repose of 37o (1.3:1.0) and a specific volume of 18.1ft 3/ton (that represents a 30% net swell after allowing for partial compaction. Waste rock will be re-sloped to 27o (2.0:1.0) as part of closure and reclamation. The toes of the re-sloped fills will remain within the Approved Project Boundary. There is no groundwater in the areas where waste rock will be disposed of and this will therefore not have an impact on the stability of the East waste rock storage pad.

Open Pit Operation

Standard, open pit mining methods will be used to mine ore and waste rock. Mining operations will include drilling, blasting, loading and hauling and it is expected that the Company will do the mining. All open pit mining will occur in dry conditions above the water table.

Maximum planned mining rates are 13,000 tons (11,800 tonnes) of ore and 27,000 tons (24,500 tonnes) of waste rock per day or 4.55 million tons (4.14 million tonnes) of ore and 9.45 million tons (8.59 million tonnes) of waste rock per year for a combined total of 14.0 million tons (12.73 million tonnes) of ore and waste rock per year and this is the permitted combined ore and waste mining rate. The initial mine life is projected to be fifteen years. The total quantity of ore to be mined, crushed and screened and stacked on the heap leach pads is estimated to be 66.81 million tons (60.73 million tonnes). Total waste rock to be mined is estimated as 99.43 million tons (90.39 million tonnes) of which 19.0 million tons (17.3 million tonnes) is expected to be processed and 15.0 million tons (13.6 million tonnes) sold as aggregate. No contributions from the sale of aggregate have been included in the feasibility study cash flow projections. However, aggregate sales over a period of thirty years are important for the Project as it will permit the Company to meet its closure and reclamation requirements. If no sale of waste rock as aggregate is ever achieved, the initial mine life would be reduced to approximately ten years.

The quantities of both ore and waste rock mined per year will vary from year to year to ensure the most efficient disposal of waste rock in mined-out phases of the open pit.

Ore-from-waste separation will require special attention to ensure that overall grade projections are met.

Underground mine openings will be encountered from time-to-time during open pit mining and this will be allowed for in the detailed mine planning.

The open pit design done by Norwest assumed a loaded downhill ore haul to the primary crusher for the life of the mine. The intent is to replace trucks with a downhill pipe conveyor to convey ore for a number of the mining phases with a reduction in the number of trucks required. Ore will be crushed by an in-pit, portable, primary crusher and fed to the pipe conveyor and conveyed to the coarse ore stockpile. The length of the pipe conveyor will be approximately 1,600ft (500m). Various alternative mine designs are being explored in an effort to make the best possible use of the pipe conveyor and detailed engineering for a pipe conveyor application remains to be completed.

Pipe conveyor technology is well-proven in practice with upwards of 200 installations in Europe and a number of installations in North America. Regenerative braking is typically used in all loaded downhill applications and the power generated would provide a small portion of the power required elsewhere in the Project.

Norwest prepared capital and operating cost estimates for the open pit operation for the updated feasibility study.

Mineralogy, Process Development & Flow Sheet

Studies show that gold is present as native gold and electrum with particles ranging in size from less than 10 micron to greater than 150 micron with the silver content of the electrum as high as 25%. Silver is also present as the mineral acanthite (Ag2S) with some native silver, pyrargyrite (3Ag2S.Sb2S3) and polybasite (9Ag2S.Sb2S3). Pyrite (FeS2), galena (PbS) and chalcopyrite (CuFeS2) are present in minor amounts with no indicated acid-generating potential. Multi-element x-ray fluorescence analyses show only trace quantities of mercury.

12

Test work done on Soledad Mountain ores from 1989 to 2007 shows that these ores are readily amenable to heap leaching provided the ore is crushed and/or ground to relatively small sizes. A range of parameters required to design a heap leach operation, such as agglomerate strength, percolation rates under load and the consumption of cyanide and other reagents, were determined.

It was proposed to crush and screen ore to 100% - 8mesh or 100% - 2.37mm and a four-stage crushing and screening plant using vertical shaft impact crushers in the third and fourth crushing stages was designed for the Project in the 1990s. This approach is referred to as conventional crushing in the following analysis. The Company did a review that provided new insights into the historical test results in 2002. An alternative flow sheet was developed for the Project in late 2002. This was now a three-stage crushing and screening plant with a high-pressure grinding roll (“HPGR”) in the third crushing stage.

Confirmation HPGR tests were required to provide the following:

- The design parameters to both size the equipment and determine the motor sizes for the HPGR;

- The target particle size distributions for the commercial operation; and

- Information to finalize the flow sheet, e.g. the need to recycle edge material.

Samples of rhyolite ore and quartz latite ore were collected for the HPGR tests in July 2003 and in March 2004 respectively. The samples were crushed to 100% passing 1.3 inch (32mm) and 1.4 inch (35mm) respectively by McClelland Laboratories, Inc. (“MLI”), an independent metallurgical laboratory located in Sparks, Nevada. The samples were shipped by airfreight to the test facilities of two HPGR manufacturers in Germany where the actual HPGR tests were done. The crushed samples were returned to the MLI laboratory in Nevada for confirmation leach test work. The following conclusions were drawn based upon the results of bottle roll and column leach tests:

- Recoveries are higher with longer leach times and this confirms the historical findings;

- Recoveries increase with a finer crushed product and this effect is especially pronounced for silver; and

- Recoveries for the HPGR products are consistently higher and extraction rates faster than those obtained from conventional crusher products – the evidence is that this is due to penetration of leach solution into micro-cracks that are created by the high specific press force applied to the ore particles in the HPGR.

The detailed analysis of the leached residues or tails indicated that tests should be done on a high-grade and a low-grade sample to obtain data for the complete range of expected head grades. Two rhyolite samples were taken for this test work in April 2006. The total weight of the two samples was approximately 4,600lb (2,100kg). The samples were shipped by truck to MLI for first-stage crushing and then by airfreight to a HPGR manufacturers’ test facility in Germany where the HPGR tests were done. The samples were returned to MLI and bottle roll tests and column leach tests were started in July and completed in December 2006. Final test results were received and combined with the results from earlier tests for a detailed recovery analysis.

The recoveries used in the October 2012 feasibility study are as follows:

| Primary Rock Types |

Proportion | Gold | Silver |

| % | % | % | |

| Pyroclastics Quartz Latite Rhyolite Undefined |

10.5 21.3 68.1 0.1 |

85.4 89.9 83.4 Average |

52.5 52.5 52.5 Average |

| Total & Average | 100.0 | 85.0 | 52.5 |

13

Tests were done on leached residues from two of the column leach tests to determine the percolation rates under load and the results of the tests were used to design the heap and confirm heap height for the heap leach operation.

The test work shows that the HPGR is expected to have distinct advantages over conventional crushing and screening to size and prepare particles for heap leaching in this particular application. The indicated benefits of using the HPGR will be:

- Higher recoveries in the heap leach operation due to micro-cracks in the ore particles;

- Faster gold and silver extraction rates;

- Stronger agglomerates due to a more favourable overall particle size distribution and this will also impact the percolation rates of solution through the heap;

- Substantially lower capital costs than a conventional crushing - screening plant;

- Manageable dust control with fewer transfer points;

- Lower energy consumption and thus lower operating costs; and

- Exceptional circuit flexibility that will readily permit future upgrades such as a finer HPGR feed size or the recycle of edge product.

A technical paper entitled “Flow Sheet Development And Benefits Of The HPGR” was presented at the RANDOL conference held in Perth, Australia in late-August 2005.

The HPGR consists basically of two counter-rotating rolls – one a fixed roll and the other a ‘floating’ roll. The ‘floating’ roll is mounted on and can move freely on two slides and the grinding forces are applied to the ‘floating’ roll by hydraulic rams. Ore is choke-fed to the gap between the rolls and comminution takes place by inter-particle crushing in the bed of particles. The gap between the rolls is determined by the nip-in characteristics of the feed and the total grinding force applied, which in turn depends upon pressures in the hydraulic system. Each roll is driven by an electric motor via a planetary gear reducer. The total grinding force can range from 750kN to 20,000kN and pressures in the gap can range from 50MPa (approximately 7,000lb/in2) to 250MPa (approximately 36,000lb/in2). The unconfined compressive strengths of Soledad Mountain ores range from 320lb/in2 (2.2MPa) to 17,200lb/in2 (118.9MPa) by comparison.

An independent consulting engineering firm did the design of the crushing-screening plant including the HPGR in 2006. This design was revised in 2008, further updated in 2011 and updated again in 2013. The crushing-screening plant has been designed to process 715ton/h (650t/h) of dry ore for a throughput of 5,119,000 tons (4,650,000 tonnes) of ore per year.

The independent consulting engineering firm also prepared capital and operating cost estimates for the crushing-screening plant for the updated feasibility study in 2012.

Merrill-Crowe Plant

Gold and silver are typically recovered in a heap leach operation by dissolution in a dilute sodium-cyanide solution and then by precipitation with zinc or adsorption on activated carbon. The zinc precipitation process, referred to as the Merrill-Crowe process after its developers, is used to recover gold and silver when the silver to gold ratio in solution is greater than 10:1. The silver to gold ratio is expected to average 15:1 for the Project and a Merrill-Crowe precipitation plant will therefore be required. In the Merrill-Crowe process, zinc dust is metered into the deaerated, pregnant solution and gold and silver are precipitated as micron-sized, metallic particles. The precipitate is dried, mixed with selected fluxes and melted in an induction furnace. The molten mix of gold and silver, i.e. the doré, is poured into moulds. The doré is cooled, cleaned and shipped to a commercial refinery where gold and silver bullion are produced for final sale.

The Merrill-Crowe process is highly efficient and recoveries in a commercial plant typically range upwards of 98%.

14

An independent consulting engineering firm did detailed designs and prepared capital and operating costs estimates for the Merrill-Crowe plant and this includes the refinery for the updated feasibility study in 2012.

The Company has recently increased the flow rate of barren solution to the heap and through the Merrill-Crowe plant based upon recommendations made by the independent consulting engineers. This change was made to extend the available leach time on the heap for enhanced recovery of gold and silver.

The Company has recently added an agglomeration drum to the flow sheet again based upon recommendations made by the independent consulting engineers. The change was made to ensure good percolation rates through the ore on the heap as heap height increases.

The Heap Leach Pad And The Heap

A dilute, sodium-cyanide solution will be used to dissolve gold and silver in the heap leach operation. Extensive procedures will be put in place to protect workers and the environment. The cyanide will be received in dissolved form by truck directly from the manufacturer and will be pumped to a storage tank on site and then to the process.

An independent consulting engineering firm is responsible for the design of the heap leach facility, which has been designed for zero discharge. The design contemplates that the first heap leach pad to be constructed, the Phase 1 pad, will be located on the northern side of Soledad Mountain. A second pad, the Phase 2 pad, will be located on the western side of Soledad Mountain, if required. Both pads will be single-use, dedicated pads.

The following are the design criteria for the Phase 1 pad:

- The pad has been designed as a permanent, single-use pad;

- Dry specific weight of agglomerated ore ranges from 85lb/ft3 (1.36t/m3) to 116lb/ft3 (1.86t/m3)

- Maximum heap height is 200ft (60m);

- Lift height is 33ft (10m);

- The angle of repose of the agglomerated ore is 2.0H:1.0V;

- Slopes are 2.5H:1.0V on the north and west sides and 2.0H:1.0V on the south and east side of the heap;

- Nominal capacity of the two pads is 66.81 million tons (60.73 million tonnes) and

- The Phase 1 heap leach pad will be constructed in either three or four stages.

The Phase 1 heap leach pad will be lined with a composite liner consisting of a compacted soil liner and a geomembrane. The geomembrane will in turn be covered and protected by 18inch (45cm) of a crushed liner protection fill that will act as a drainage layer. A network of perforated pipes will be installed in the liner protection fill. Solution will drain by gravity to a pump box and will be pumped to the Merrill-Crowe plant where gold and silver will be extracted from the pregnant solution. The barren solution will be returned to the heap and drip emitters will be used on the heap to limit evaporation losses. Drip emitters will be covered. An overflow pond is located east and downstream of the pump box.

Detailed site investigations were done in the area where the Phase 1 heap leach pad will be constructed in 2004 and again in 2006. The design of the Phase 1 pad has been completed for construction.

The design of the heap leach pad meets all applicable regulatory requirements. Note that the heap must be reclaimed to approximately 25ft (7.6m) above original contours to meet State of California reclamation requirements.

An earthmoving contractor with experience in constructing heap leach pads prepared the capital cost estimates for the construction of the Phase 1, Stage portion of the pad for the updated feasibility study in 2012.

An equipment manufacturer did the heap leach stacking study for the conveying and stacking system and prepared capital and operating cost estimates for the updated feasibility study in 2012.

Services

15

The Project is located approximately 5 miles (8km) south of Mojave in southern California. The metropolitan areas of Rosamond and Lancaster lie from 9 miles (14km) to 20 miles (32km) to the south. Access to site is from State Route 14 and Silver Queen Road, an existing paved County road. Mojave is a railroad hub for the Burlington Northern/Santa Fe and Union Pacific/Southern Pacific railroad lines. Services such as a hospital, ambulance, fire-protection, garbage and hazardous waste disposal, schools, motels and housing, shopping, airport and recreation are available in Mojave and its surroundings.

Water Supply

A water supply will be required for the operation and it is expected that both ground water and water supplied by the Antelope Valley – East Kern Water Agency will be available for the Project.

A detailed study of the site hydrogeology was completed in 2006 to confirm that groundwater would be a dependable source of water for the Project. As many as 35 wells have been drilled in the greater Project area in the past. Records for some of these wells plus step rate test data from production well PW-1 drilled by the Company indicate that, initially, two production wells can provide the maximum estimated water requirement of 650gal/min (147.6m 3/h). Production well PW-1 is located approximately 3,000ft (1km) north of the Project. A second production well, PW-2, was drilled approximately 1,000ft (300m) north of well PW-1 and cased and tested and a third production well, PW-3, was drilled in an area west of the Project in November 2008 and development of the well has also been completed. Neither PW-2 nor PW-3 had yields high enough to add to the water required on a continuous basis for the Project.

The Company has identified an area to the west of PW-1 that has historically had a number of production wells that have yielded upwards of 600gal/min (136.2m 3/h). It is planned to drill a production well in this area in 2014 to ensure that an adequate supply of groundwater is confirmed to support the Project.

Water samples taken from five characterization wells on site indicate that groundwater can be used in the heap leach process without pre-treatment.

An independent consulting engineering firm did the design for the water supply and the process water and firewater distribution systems and prepared capital and operating cost estimates for the updated feasibility study in 2012. The design for the system has now been redone by an independent consulting engineering firm based in Bakersfield.

The Company filed an application for a water service connection with Antelope Valley – East Kern Water Agency (“AVEK”) in February 2008 to provide a backup water supply. This was mandated as one of the conditions of approval in the Conditional Use Permits that were issued in 2010. An independent consulting engineering firm based in Bakersfield has designed a pipeline and pump station to pump water from four AVEK water storage tanks to site and this will provide a 100% independent water supply for the Project.

The Company is in discussion with the Rosamond Community Services District to determine the availability and feasibility of using recycled water for the Project and initial engineering studies have been completed. This supply will be of interest only once the Project is running smoothly with a positive cash flow and an assured long life.

Power Supply

The regional utility, Southern California Edison (“SCE”), will supply power.

A main power line with three sets of conductors runs along the eastern property boundary. The top two sets of conductors carry 66kV while the bottom set of conductors carries 12,460V and these are the common primary voltages in SCE territory.

SCE provided a rate for power for the updated feasibility study in 2012. The rate structure is complex and a mix of consumption and demand charges applies to peak, mid-peak and off-peak periods.

16

SCE indicates that the power factor is an absolutely critical item in SCE territory. SCE requires a minimum operating power factor of 0.95 and a load-sensitive capacitor bank will be installed to achieve this. SCE may also limit the number of starts permitted for the major motors per day.

It is expected that the Company will install and own the utility tie sub-station, which will transform the incoming voltage of 12,460V to 4,160V and this will be the mine distribution voltage. This decision is supported by a Method of Service study done by SCE in 2012. Overhead transmission lines will distribute power from the utility tie substation to areas where power will be required.

A diesel-powered generator will provide standby power and this will be set beside the Merrill-Crowe plant. Power will be available to operate the pregnant and barren solution pumps in case of a SCE power failure.

An independent consulting engineering firm prepared a detailed motor list and estimated the power consumption for the Project. The firm also prepared a detailed capital cost estimate for the supply of power to the Project for the updated feasibility study in 2012. The engineering firm is currently doing the detailed electrical design and cost estimates for construction in 2014.

Assay Laboratory and Workshop/Warehouse

Detailed designs for all services required for a mining operation such as a workshop and warehouse, diesel fuel and gasoline storage and an assay laboratory have been completed. Detailed capital and operating cost estimates were prepared for these facilities for the updated feasibility study in 2012.

Project Management & Operating Manpower

A management team is being assembled in Mojave to manage the Project. Manpower is expected to average 31 salaried and 143 hourly-paid workers once the mine is in full production with a further 12 to 15 hourly-paid workers required for the aggregate operation. Indications are that skilled workers will be available locally as there are a number of mines and quarries in production in the greater Mojave area.

Construction manpower is expected to peak at 200 with an estimated 141.7 man-years required for construction.

Aggregate

It is expected that a by-product aggregate and construction materials business can be developed once the heap leach operation is in full production, based on the location of the Project in southern California with close proximity to major highways and railway lines. The source of raw materials will be quality waste rock specifically stockpiled for this purpose. The waste rock can be classified into a range of products such as riprap, crushed stone and sand with little further processing. Test work done in the 1990s confirmed the suitability of waste rock as aggregate and construction material. The production and sale of aggregate is expected to commence early in the mine life and continue for up to thirty years or until the stockpile of quality waste rock has been exhausted. The Company also plans to process and sell leached and rinsed residues from the heap leach operation as aggregate or for other uses to local and regional markets.

No contributions from the sale of aggregate have been included in the feasibility study cash flow projections. However, aggregate sales over a period of thirty years are important for the Project as it will permit the Company to meet its closure and reclamation requirements. If no sale of waste rock as aggregate is ever achieved, the initial mine life would be reduced to approximately ten years.

Environmental Issues, Approvals & Permits

Introduction

The Project has received three key permits that allow the Company to construct the facilities and begin mining and processing operations.

17

These are:

| a. |

Conditional Use Permits issued by Kern County (see “CEQA/NEPA” heading below); | |

| b. |

Authorities to Construct permits issued by the Eastern Kern Air Pollution Control District (see “Authority to Construct & Permit to Operate” heading below; and | |

| c. |

Waste Discharge Requirements issued by the Lahontan Regional Water Quality Control Board (see “Water Quality” heading below. |

The environmental issues and the efforts made to secure the three key permits are described in detail under the subheadings “CEQA/NEPA”, “Authority to Construct & Permit to Operate”, and “Water Quality”.

General

The area surrounding Mojave is typical of the western Mojave Desert. The immediate vicinity of the Project is sparsely populated with considerable historical and more recent mining activity. The Standard Hill, Tropico and Cactus mines are located within a radius of 7.5 miles (12km) of the Property.

The Project and the immediate area surrounding the Project or a total of approximately 9,600 acres (3,887 hectares) are included in the Specific Plan (the “Plan”) for Soledad Mountain - Elephant Butte & Vicinity - south of Mojave. This Plan was prepared in March 1973 and adopted by the Kern County Board of Supervisors as Resolution 73-485 on June 18, 1973. Gold and silver mining operations are recognized in the Plan as important land uses and the protection of mineral deposits, potentially of commercial value, is included in the Plan through restriction of incompatible land uses. The Project as presently defined and permitted is consistent with the Plan.

An independent consulting engineering firm reviewed the major approvals and permits that were issued for the Project in the late 1990s and the current regulatory environment in California in 2005. Additional work was indicated due to the time that had passed since these permits were first issued and changes that had been made in the Project. There have also been changes in regulations imposed by two levels of government in California. No significant environmental issues were however identified in the review and furthermore, the footprint of the Project as presently defined has been reduced in both a physical and an environmental sense.

Environmental issues and the status of approvals and permits are summarized in the following sections.

CEQA/NEPA

The Project is subject to the California Environmental Quality Act (“CEQA”) and the National Environmental Policy Act (“NEPA”), each of which requires written analysis of proposed mining activities and their effect on the physical, biological, social and economic resources of the area. This analysis is known under CEQA as an environmental impact report (“EIR”), and under NEPA as an environmental impact statement (“EIS”).

The environmental setting of the Project was documented in a number of baseline studies prepared between 1990 and 1997. The Kern County Board of Supervisors unanimously approved two Conditional Use Permits (“CUP”) for the Project in September 1997 (i.e. CUP Case No. 41, Map No. 213 and CUP Case No. 22, Map No. 214). The Bureau of Land Management subsequently issued its Record of Decision approving the Plan of Operations under NEPA in November 1997.

The State of California introduced backfilling requirements for open pit, metal mines in December 2002. The Company contended that these regulations did not apply to the Project under a grandfathering provision included in the regulation. The Company, therefore, pursued both a favourable interpretation under the regulation and subsequently an amendment of the regulation with the State Mining and Geology Board (the “Board”) in 2006. These efforts were supported by Kern County officials. Both approaches were rejected by the Board and the decision was duly recorded by the Board in January 2007.

The Company completed an Application for a revised Surface Mining and Reclamation Plan, which was submitted to the Kern County Planning & Community Development Department (the “Planning Department”) in April 2007. The Planning Department completed its review of the Application and deemed the Application complete in July 2007. The Planning Department noted that changes proposed for the Project constituted new information that required evaluation of potential impacts and mitigation in a supplemental EIR (“SEIR”). The Planning Department issued a Request for Proposal to prepare the SEIR to a total of 17 qualified consultants in October 2007. The Chambers Group was awarded the contract to prepare the SEIR. The Company signed an agreement with the Planning Department in February 2008 and made a payment of $55,000 which was 50% of the cost of preparing the SEIR. This agreement was approved by the Kern County Board of Supervisors at a meeting on March 11, 2008.

18

The kickoff meeting with the Chambers Group was held on the afternoon of March 12, 2008. The Chambers Group completed the initial review of information provided by the Planning Department and issued a draft Notice of Preparation by mid-June. The Planning Department then terminated the agreement with the Chambers Group due to a conflict of interest related to another project. The Planning Department mailed the Notice of Preparation and the supporting reports to agencies on the mailing list on August 18 with a deadline for responses by September 17. A total of 66 sets of information were mailed by the Planning Department directly plus a further 15 sets were mailed by the State Clearinghouse.

The State Office of Mine Reclamation (“OMR”), accompanied by the Planning Department and Company management, met on site for a due diligence review on September 16, 2008. The OMR indicated that it would require additional time beyond the September 17, 2008 deadline to prepare comments on the Project.

The Planning Department received nine comment letters by September 17, 2008 and two additional comment letters at the end of September plus a twelfth comment letter thereafter. The OMR submitted comments to the Planning Department on September 30, 2008.

The County selected RGP Planning and Development Services (“RGP”) to continue with the preparation of the SEIR. The agreement with RGP was approved by the Kern County Board of Supervisors at a meeting on October 14, 2008. The estimated cost of the work to be done by RGP was $123,800 and the Company paid this amount on September 25, 2008.

A scoping meeting was held on site attended by RGP, the Planning Department, and Company management in October 2008.

The Company submitted responses to ten of the comment letters referred to above to the Planning Department on November 27, 2008 and responses to the OMR’s comment letter on December 16, 2008.

RGP prepared a Progress Report, which the Planning Department released to the public, on December 30, 2008.

The Company’s consulting engineers did extensive studies to confirm the possibility of backfilling mined-out phases of the open pit in January and February 2009. The studies were presented to the Planning Department in a meeting in Bakersfield on March 11. The Planning Department requested that the Project Description be revised to include the backfilling studies and this was done and submitted to the Planning Department on March 24. The Application for the revised Surface Mining and Reclamation Plan was also revised and submitted to the Planning Department on April 5. A further revision of the Application was requested by the Planning Department on May 5 and this was completed and submitted on May 25. The Company recognized that the reviews by the Planning Department added to the overall quality of the Application.

The Planning Department’s target for the release of the SEIR to the public was then late July or early August 2009.

The following two items are of note:

- The Company completed a number of studies and did significant work on site between 2005 and 2010 to document that the environmental setting for the Project had not changed since 1997. The studies were submitted to the Planning Department.

- The Bureau of Land Management confirmed that its Record of Decision approving the Plan of Operations under NEPA in November 1997 remained valid and that no additional reviews or approvals were required before the Company could proceed with the Project.

19

The SEIR was distributed by the Planning Department, as lead agency under the provisions of CEQA, to approximately 430 recipients and notification of release to 985 recipients on January 11, 2010. At the conclusion of the review period, the Planning Department had received 26 responses, including letters supporting the Project, letters that had concerns with the Project, and letters from regulatory agencies designated as responsible agencies under CEQA. Comments were also received from the OMR on the reclamation plan provisions. The lead agency responded in writing to the comments received by February 25, 2010. The Company supported the lead agency’s effort by supplying additional information that was requested. As required by CEQA, the lead agency provided written responses to those who commented no later than 14 days prior to the Project’s consideration by the Kern County Planning Commission “Planning Commission”.

The Planning Commission formally considered the Project on April 8, 2010. At the meeting, the Commission, consisting of a panel of three commissioners, unanimously approved the Project. Two appeals to the approval were filed but subsequently withdrawn. Accordingly, the Commission’s actions became final on May 24. The thirty-day period for filing a lawsuit challenging the SEIR expired on June 23. The Commission certified the SEIR and adopted a Mitigation Measures Monitoring Program and a set of Conditions of Approval for the Project. The Mitigation Measures Monitoring Program and Conditions of Approval for the Project were amended by Commission Resolution No. 171-10 adopted on October 28 and are now final.

Under Condition 107 of the Conditional Use Permits, the Company was required to submit, prior to the commencement of mining, additional information relating to closure and closing reclamation. The Company submitted the required information to the Planning Department on November 28, 2011 and on June 8, 2012. In accordance with the Surface Mining and Reclamation Act of 1975, the Planning Department consulted the OMR. The OMR confirmed in a letter to the Planning Department dated June 29 that the additional information provided by the Company adequately demonstrated compliance with Condition 107.

The Companyannounced that the Planning Department had approved the additional information submitted by the Company in regards to Condition 107 of the Conditional Use Permits for the Project in a news release dated July 12, 2012 and the Project is now fully permitted.

Air Quality

Background Information

The Project lies within the Southeast Desert Air Basin (the “Air Basin”), which falls under the jurisdiction of the Eastern Kern Air Pollution Control District (“EKAPCD”). EKAPCD is charged to regulate sources of air pollution within the basin, pursuant to authority granted under the federal Clean Air Act.

The Air Basin is designated as unclassified for PM10 emissions (that portion of the total suspended particulates less than 10 microns in size) and as a non-attainment area for ozone. The typically windy conditions and very dry nature of the area are responsible for high background PM10 levels recorded at several nearby meteorological monitoring stations.

Fugitive dust from a mining operation on the Property, combined with background dust, may result in unacceptable levels of PM10 emissions in the surrounding areas, especially downwind, and this may present the greatest potential environmental issue for the Project. A PM10 level of 44 micrograms per cubic meter was projected by computer modeling for an annual mining rate of 30 million tons (27 million tonnes) in 1996. This level is below the California attainment standard of 50 micrograms per cubic meter and the Federal standard of 150 micrograms per cubic meter. However, the Company believes that it will achieve compliance with applicable standards by a greater margin, as the modeling methodology assumes worst-case conditions, which are considered unlikely to be encountered in the actual operation based on the planned use of commonly accepted dust control techniques in all phases of the operation.

The Planning Department requested that the Air Quality Assessment and Health Risk Assessment for the Project be redone in February 2009 to provide current information for the SEIR. This study was completed and in the hands of the Planning Department and EKAPCD on July 21, 2009.

EKAPCD transferred an Emission Reduction Credit Certificate from Cactus Gold Mines Company to the Project in February 1999 and this Emission Reduction Credit Certificate remains valid.

20

Authority To Construct & Permit To Operate

The Company had obtained seven Authority to Construct permits dated March 16, 2002. These permits expired on March 16, 2004 and were not renewed due to changes anticipated in the Project.

Ten applications for Authority to Construct permits were submitted to the EKAPCD in February 2011. The EKAPCD confirmed that the information required to support the applications was complete. The draft Authority to Construct permits were received in September 2011. The Company’s consulting engineers and legal counsel completed their review of the draft Authority to Construct permits in January 2012. The Authority to Construct permits were issued by EKAPCD on February 8, 2012. The Authority to Construct permits will be converted to a Permit to Operate after construction has been completed and subject to inspection by EKAPCD.

An eleventh application for an Authority to Construct permit is currently being completed. This Authority to Construct permit is required to allow the Company to mix the historical tailings on site with clay to provide suitable materials for the construction of the lower liner for the heap leach pads.

Meteorological Monitoring Station

The Company was required to install both upwind and downwind meteorological monitoring stations before the start of production and decided to proceed with the upwind monitoring station in May 2006 to add to the background database. The station was designed by an independent consulting engineering firm and commissioned in September 2006. The EKAPCD approved the design of the station in October 2006. Data is being recorded on a continuous basis and quarterly reports are being issued to the EKAPCD.

The equipment for the downwind meteorological monitoring station has been purchased and is in storage in Mojave. Construction of the downwind meteorological station is currently under way.

Water Quality

The Project is located in the northern portion of the Antelope Valley Groundwater Basin. The mean recorded annual rainfall in the surrounding area is approximately 6.14in (156mm). Typical patterns of precipitation are winter rains and summer thunderstorms and these tend to be short-lived and of high intensity. The site is dominated by Soledad Mountain and surface drainage patterns in the area are largely influenced by local topography. This varies from steep, rugged hillsides at the upper elevations to a gently sloping desert floor around the toe of Soledad Mountain. Runoff on the northern side of Soledad Mountain is via a series of gullies or channels, which direct surface flows to the north, northeast and northwest and eventually to the east to the Gloster and Chaffee Hydrologic Areas of the Antelope Hydrologic Unit.

There are no springs or intermittent streams in the immediate area. The closest intermittent stream is approximately 3 miles (5km) to the west. Evaporation rates are high. Groundwater is typically found at depths of 180ft to 200ft (55m to 60m) in the area north of the Project.

The Lahontan Regional Water Quality Control Board (“Regional Board”) is responsible for ensuring compliance with the federal Clean Water Act and California’s Porter-Cologne Water Quality Act. The Company submitted a Report of Waste Discharge (“ROWD”), prepared by a company based in Bakersfield to the Regional Board in June 1997. The Regional Board adopted Board Order No. 6-98-9 in March 1998 at a meeting held in Lancaster and this set the Waste Discharge Requirements for the Project.

Revised Report Of Waste Discharge

The ROWD submitted in 1997 included a design for the heap leach facility done before and in 1997. The Company and its consulting engineers prepared an engineering review that set out significant differences between the layout and designs prepared for the heap leach facility in 1997 and in 2005 and made a presentation to the Regional Board in Victorville in May 2006. The Regional Board requested that the Company submit a revised ROWD to reflect these changes. The Company and its consulting engineers prepared and submitted a revised ROWD to the Regional Board in March 2007.

21

The Regional Board completed its assessment of the revised ROWD and prepared draft Waste Discharge Requirements (“WDRs”) for the Project. The Regional Board waited for confirmation from the Planning Department that the SEIR had been certified before adopting a revised Board Order setting WDRs for the Project.

The Regional Board unanimously approved WDRs and a Monitoring and Reporting Program for the Project at the joint, regular meeting held on July 14, 2010 in South Lake Tahoe, Nevada and Victorville, California. The Board recommended adopting an order approving the WDRs subject only to locating an additional ground water monitoring well. This well was drilled and tested in November 2010. The Board Order was signed by the Executive Officer of the Regional Board on July 23, 2010.

The order approving the WDRs is a critical authorization for the construction and operation of, and establishes the discharge and monitoring standards for the heap leach pads, waste rock stockpiles and other activities that have the potential to affect surface and ground waters.

Closure, Reclamation and Financial Assurance

Closure and reclamation will be done in accordance with the requirements set out in the CUPs and an approved Surface Mining and Reclamation Plan and as set out in the Board Order issued by the Regional Board.

The following general principles apply: