UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________

FORM 10-K

____________________________________________

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 27, 2014 | Commission file number 0-21835 | |

____________________________________________

SUN HYDRAULICS CORPORATION

(Exact Name of Registration as Specified in its Charter)

____________________________________________

FLORIDA | 59-2754337 | |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |

1500 WEST UNIVERSITY PARKWAY SARASOTA, FLORIDA | 34243 | |

(Address of Principal Executive Offices) | (Zip Code) | |

941/362-1200

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “accelerated filer,” “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | o | |||

Non-accelerated filer | o | Smaller Reporting Company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the shares of voting common stock held by non-affiliates of the Registrant, computed by reference to the closing sales price of such shares on the Nasdaq Stock Market, LLC, as of the last business day of the Registrant’s most recently completed second fiscal quarter was $908,821,678.

The Registrant had 26,583,384 shares of common stock, par value $.001, outstanding as of February 19, 2015.

2

PART 1

ITEM 1. BUSINESS

Overview

Sun Hydraulics Corporation (“Sun,” the “Company” or “We”) was founded in 1970, in Sarasota, FL, USA, and for the past 45 years has provided global capital goods industries with hydraulics components and systems used to transmit power and control force, speed and motion. Sun’s products typically add a fine degree of precision and safety to the machinery and equipment in which they are used.

On a component level, Sun designs and manufactures screw-in hydraulic cartridge valves, manifolds, and integrated fluid power packages and subsystems. The Company’s products provide an important control function within a hydraulic system, to control rates and direction of fluid flow and to regulate and control pressures.

Sun’s screw-in hydraulic cartridge valves use a fundamentally different design platform compared to most other competitive product offerings, which are often referred to as industry common products. The Company’s cartridge valves, from the first models in the early 1970s, were designed to be able to operate reliably at higher pressures, making them equally suitable for both industrial and mobile applications. Until recently, most other companies’ screw-in cartridge valves were only suitable for use in mobile applications. Sun’s brand has grown and become identified as a product able to withstand the rigors of industrial use, where operating cycles and pressures are higher and more frequent.

To complement the high pressure, high duty cycle nature of its cartridge valves, Sun offers the broadest array of standard manifolds of any cartridge valve manufacturer. These products, available in both aluminum and ductile iron allow the Company’s cartridge valves to be easily and conveniently installed in machinery and equipment. Sun’s standard manifolds feature common interfaces, ports and industry standard patterns to make them applicable for use in any country.

All of Sun’s standard cartridge valves and manifolds are offered in multiple versions and size ranges. The product array features five different capacities (this represents flow rates or could conveniently be referenced as horsepower), with capacity doubling with each successive size. Each version offers a subtle variation of functionality. This allows machine designers to choose a product that is optimal to the operating conditions of the equipment they are designing. Sun is unique in the industry in approaching product development in this matrix manner, which yields a product line of extreme breadth and depth. Sun’s broad scope of product offering, coupled with the high performance characteristics of its cartridge valves, makes Sun a leader in its industry.

To fully leverage its cartridge product family, the Company routinely competes in the custom manifold and integrated package market. This activity entails designing custom manifolds which incorporate multiple standard cartridge valves to create a unique and machine specific solution for a particular customer. Because of the unique nature of Sun’s cartridge valve designs, manifolds may be designed and machined to make them significantly smaller, sometimes greater than 50% smaller, when compared to manifolds that use only industry common cartridge valves. The same design characteristics that allow manifolds to be smaller also allow them to operate more efficiently by incorporating angular drillings in the design. Integrated packages allow customers to order a single part number, reduce assembly and labor time on the factory floor, and easily locate a complete hydraulic control system anywhere on a machine.

In recent years, the Company has aggressively expanded its offering of electrically-actuated cartridge valves. Despite being a late entrant in the industry with these types of products, Sun’s design approach has allowed the Company to quickly offer a full range of electrically-actuated cartridge valves, helping to increase the competiveness of the integrated package offerings. Because hydraulics systems are increasingly taking signals from on-board electronic control systems, it is necessary for hydraulic products to be capable of digital communication.

To further augment its capabilities in the electronic area, the Company, in 2011, acquired High Country Tek, Inc. (“HCT”), which designs and manufactures a range of standard and customizable electronic control modules used to interpret electronic signals. In 2013, the Company acquired WhiteOak Controls Inc. ("WhiteOak"), which was merged into HCT. WhiteOak designs and produces complementary electronic control products. In 2014, the Company entered into a technology licensing agreement with Sturman Industries ("Sturman") to utilize Sturman's digital valve technology in fluid power markets. The addition of these capabilities with Sun’s legacy products and capabilities expands the scope of unique product solutions the Company can offer its customers.

Sun’s products are sold globally through a combination of wholly-owned companies, representative sales offices and independent and authorized distributors. Sun has operations in the United States, England, Germany, France, South Korea, China and India. Activities at these locations range from technical support, to inventory, to distributor management, to custom manifold design and manufacturing. Sun’s global distribution network includes representation in almost all industrialized markets. Distributors are the local experts in Sun’s products. They typically hold local inventory and transact all business with

3

customers. This arrangement helps to keep selling, general and administrative costs to a minimum, with above industry average inventory turns and free cash flows.

In 2014, 50% of consolidated sales went to customers in the Americas, 30% to customers in Europe, the Middle East and Africa, and 20% to customers in the Asia/Pacific Region. In 2014, sales to any single customer or distributor did not exceed 7% of total net sales.

The Company has been profitable every year since 1972 and has paid a dividend every quarter since going public in January 1997. The Company’s executive offices are located at 1500 West University Parkway, Sarasota, Florida 34243, and its telephone number is (941) 362-1200. The Company’s website is www.sunhydraulics.com.

Industry Background

Sun is part of the fluid power industry, in which either air (pneumatics) or oil (hydraulics) is used to transmit power and provide motion control for many types of machinery, equipment and vehicles. The modern fluid power industry developed around World War II as both hydraulics and pneumatics were widely adopted as effective means of motion control. Hydraulics, because of its mechanical advantage, is typically used when significant work needs to be accomplished or heavy loads need to be moved. Hydraulics systems also provide precise positioning and movement of lighter loads. Examples where hydraulics are routinely used include steering and braking activities in construction, agricultural and marine equipment; raising work platforms and ladders in construction and fire and rescue equipment; holding and clamping parts or moving machine elements in machine tools; and measuring in laboratory test equipment; controlling the direction and pitch of blades in windmills - the list of uses of hydraulics is wide and varied and encompasses almost all industries.

Valves are major components of a hydraulic system, along with pumps and actuators. These devices are complemented by a wide range of ancillary and supporting products that includes, but is not limited to, hoses, fittings, accumulators, regulators, heat exchangers, sensors and lubricants. Valves provide the function of directing the flow of fluid, setting the rate of its flow and regulating pressures in the system.

Screw-in hydraulic cartridge valves, the type of product the Company manufactures, were initially developed in the late 1950s and early 1960s as an alternative to the then existing technology, which we refer to as conventional valves. Conventional valves were typically single purpose devices made with cumbersome iron casting that were limited in how they could be installed in machinery and equipment. In times of economic expansion, these types of products could become difficult to obtain due to the inability to easily source castings. Screw-in cartridge valves are made from easily obtainable commercial steels, which make supply more consistent. More importantly, multiple cartridge valves can be combined together in a single block of machined aluminum, ductile iron or steel, to create a hydraulic integrated circuit, which in almost all respects is analogous to an electronic integrated circuit. The hydraulic integrated circuit provides significant benefits to the machine designer, including: ease of order and inventory control, ease of location in machinery and equipment, reduced labor and assembly time, proprietary control systems and a way to differentiate machinery and equipment.

The hydraulics industry is comprised of large, multi-national companies that make all the types of components that are needed to create a hydraulic system, companies that make specific components of a system, such as Sun, and companies that make specialty components.

The hydraulics industry is increasingly influenced by the electronic industry, as more machinery and equipment is equipped with on board electronic control systems. This affects purchasing decisions, hydraulic components, design criteria, machine and vehicle performance, safety and many other attributes and characteristics. The line between electronics and hydraulics is blurring and the two technologies must be able to digitally communicate. The Company expects this trend will continue in the future.

Strategy

Sun will continue to design, manufacture, market and support, on a worldwide basis, differentiated high-performance and high-quality products and systems. The Company believes this focus supports its business objectives of generating sustainable revenue growth that will consistently yield above-average returns on capital while achieving a high level of customer satisfaction. Key elements of the Company’s strategy include the following:

Deliver Value Through High-Quality, High-Performance Products. The Company’s products are designed with operating and performance characteristics that exceed those of many functionally similar products. The Company’s products provide high value because they generally operate more reliably and at higher flow rates and pressures than competitive offerings of the same size.

4

Achieve a High Level of Customer Satisfaction. Sun schedules orders to the customer’s request date. The Company believes that its long-term success is dependent upon its reputation in the marketplace, which in turn is a result of its ability to service its customers. The Company tests 100% of its screw-in cartridge valves to ensure the highest level of performance on a consistent basis. Through our products and services, Sun will seek to create value for its customers by helping them differentiate their own product and service offerings.

Offer a Wide Variety of Standard Products. Sun offers the most comprehensive range of screw-in cartridge valves and manifolds in the world. The Company’s products contain a high degree of common content to minimize work in process and maximize manufacturing efficiency. Products are designed for use by a broad base of industries to minimize the risk of dependence on any single market segment or customer.

Expand the Product Line. New products are designed to complement existing products and this has a synergistic effect. Where possible, new products use existing parts and generally fit into existing cavities. The Company will continue to develop new non-electrical and electrically-actuated cartridge valves, including solenoid and proportional valves. The Company believes its electrically-actuated cartridge valves help to increase sales of the Company’s other cartridge valves and allow the Company to compete more effectively for integrated package business.

Expand Electronics Capabilities. Through acquisition and internal development, the Company has continued to expand its electronics capabilities. This is important because many machines and vehicles have central electronic control systems which direct all system activities, including those of the hydraulics system. The Company will continue to foster the evolution of its electronic controls capabilities to support creating superior solutions for its customers.

Capitalize on Integrated Package Opportunities. Sun designs and manufactures integrated packages which incorporate the Company’s screw-in cartridge valves. To support this effort, the Company designs and manufactures manifolds at its operations in Sarasota, Florida, USA, Coventry, England, Erkelenz, Germany, and Incheon, Korea. Some of the Company’s distributors also design and manufacture integrated packages which contain the Company’s screw-in cartridge valves. Sun encourages competitive manifold manufacturers to utilize the Company’s screw-in cartridge valves in their integrated package designs. The Company believes that customers in the future will increasingly require integrated packages more than isolated components.

Expand Global Presence. Sun intends to continue to expand its global presence in the areas of distribution and international operations. The Company has strong distributor representation in most developed and developing markets, including North and South America, Western Europe, Asia, Australia, and South Africa. The Company will continue to expand its presence in key areas including, but not limited to, Eastern Europe, Russia, China and India. A strong local presence helps the Company compete for integrated package business, where proximity to its customers is beneficial.

Maintain a Horizontal Organization with Entrepreneurial Spirit. Sun believes that maintaining its horizontal management structure is critical to retaining key personnel and an important factor in attracting top talent. The Company believes this culture encourages communication, creativity, entrepreneurial spirit and individual responsibility among employees, and has a large impact on operating results.

Leverage Manufacturing Capability and Know-how as Competitive Advantages. Sun believes its process expertise is a competitive advantage. The Company’s strong process capability is critical in achieving the high performance characteristics of its screw-in cartridge valves and integrated packages. The Company’s in-house heat-treatment capability, somewhat unique in the industry, is critical to the durability and differentiation of the Company’s cartridge valve products.

Sell Through Distributors. Due to the variety of potential customers and the Company’s desire to avoid overhead costs, North America sales are made primarily through independent distributors. Sun’s international locations sell both to direct customers and through independent distributors. Many of the Company’s distributors sell products manufactured by other companies and act as system integrators by providing complete hydraulic systems to customers.

Develop Closer Relations with Key Customers. The Company maintains close relationships with some OEMs and end users of its products. These relationships help the Company understand and predict future marketplace needs and provide a venue to test and refine new product offerings. The Company recognizes it may sometimes be required to enter into direct transactional relationships to gain business with certain large OEMs. The Company intends to be selective in developing these relationships to avoid unnecessary bureaucracy and cost.

Form Strategic Relationships/Acquisitions. When management deems it to be of strategic benefit, Sun may enter into relationships with other hydraulics manufacturers including, but not limited to, marketing, brand labeling and other non-exclusive or exclusive agreements. In the future the Company expects to expand its internally developed products and

5

capabilities through investments in outside firms. These investments could be full acquisitions, joint ventures, partial ownership investments or other agreements.

Capture value for our stakeholders. Through our culture and organizational structure, we prudently manage our resources and strive to balance operational efficiencies with developing innovative products and services. This allows us to provide superior value to our customers by delivering high quality, reliable products to the customer’s schedule which, in turn, has resulted in sustained profits for the Company. In addition to quarterly cash dividends, Sun has developed a shared distribution which allows stakeholders, including shareholders and employees, to participate in the profits Sun earns.

Products

Screw-in Hydraulic Cartridge Valves

Sun’s screw-in hydraulic cartridge valves are offered in five size ranges and include both electrically actuated and non-electrically actuated products. The floating construction pioneered by the Company results in a self alignment characteristic that provides performance and reliability advantages compared to most competitors’ product offerings. This floating construction differentiates the Company’s products from those of most of its competitors, who design and manufacture rigid screw-in cartridge valves that fit a common cavity. Some competitors manufacture certain products that fit the Company’s cavity.

Standard Manifolds

A manifold is a solid block of metal, usually aluminum or ductile iron, which is machined to create threaded cavities and channels into which screw-in cartridge valves can be installed and through which the hydraulic fluid flows.

The variety of standard manifolds offered by Sun is unmatched by any screw-in cartridge valve or manifold competitor. These products allow customers to easily integrate the Company’s screw-in cartridge valves into their machinery and equipment. Once designed, standard manifolds require minimal, if any, maintenance engineering over the life of the product and can be manufactured at each of the Company’s manufacturing operations.

Integrated Packages (using custom designed manifolds)

An integrated package consists of multiple cartridge valves assembled into a custom designed manifold for a specific customer to provide the specific operating characteristics of a customer’s circuit.

The advantages of Sun screw-in cartridge valves translate to integrated packages designed by the Company and result in products that are smaller in size with enhanced operating performance. Due to the self-alignment characteristic, the Company’s integrated packages do not routinely require testing once assembled, something often required when using competitive cartridge valves. Additionally, the Company has internally-developed proprietary expert system software that it uses to manufacture custom manifolds efficiently in low volumes. Integrated packages provide many benefits to end users and equipment manufacturers, including reduced assembly time, order simplification, reduced leakage points, aesthetics, potentially fewer hose and fitting connections, and more control functions in a single location.

Electronic Controllers

Sun, through its subsidiary High Country Tek (“HCT”), designs and manufactures electronic controllers, which manage the function of electrically actuated valves. HCT’s products range from simple one valve, manually adjusted controllers to fully integrated hydraulic control systems managing multiple hydraulic valves as well as other input and output products such as joysticks and displays. All controllers are potted and therefore impervious to outside influence, making them ideal for mobile, industrial and marine applications.

HCT’s products in combination with the Sun product line enable integration at the next level by optimizing manifolds, cartridge valves and electronic controllers into solutions for complete systems or as building blocks for our distributors and direct customers.

Engineering

Sun’s engineers play an important role in all aspects of the business, including design, manufacturing, sales, marketing and technical support. Engineers work within a disciplined set of design parameters that encourages the repeated incorporation of existing parts into new products. Engineers work closely with manufacturing personnel to define the processes required to manufacture products reliably and consistently.

6

Manufacturing

The Company utilizes a process intensive manufacturing operation that makes extensive use of automated handling and assembly technology (including robotics) where possible to perform repetitive tasks, thus promoting manufacturing efficiencies and workplace safety. The Company is somewhat vertically integrated and has the capability to manufacture many of the parts that go into its products.

At its Sarasota, Florida, manufacturing plants, the Company has extensive testing facilities that allow it to test fully all cartridge valve products. A metallurgist and complete metallurgical laboratory support the Company’s design engineers and in-house heat treatment.

The Company holds minimal finished goods inventory, typically at its overseas facilities, and relies on its distributors to purchase and maintain sufficient inventory to meet customers’ demands. Most raw materials, including aluminum and steel, are delivered on a just-in-time basis. These and other raw materials are commercially available from multiple sources.

The Company controls most critical finishing processes in-house but relies on a small network of outside manufacturers to machine cartridge parts to varying degrees of completeness. Many high-volume machining operations are performed exclusively at outside suppliers. The Company is selective in establishing its supplier base and attempts to develop and maintain long-term relationships with suppliers.

The Company continually reviews all of its suppliers to improve the quality of incoming parts and to assess opportunities for better control of both price and quality. The Company’s quality systems at the U.S. facilities are in compliance with ISO 9001:2008 for design, manufacture, and distribution of high performance screw-in hydraulic cartridge valves and manifolds used to control force, speed and motion in fluid power systems. Those in the U.K. are certified to ISO 9001:2008 for the design and manufacture of aluminum and ferrous manifold bodies, hydraulic control valves and cartridge valves. Quality systems in Germany are certified to ISO 9001:2008 for the design, distribution and manufacturing of hydraulic components for mobile and industrial applications. Finally, quality systems in Korea are certified to ISO 9001:2008 and 14001:2004 for the design, development, production and servicing of hydraulic valves.

Sales and Marketing

Sun products are sold globally, primarily through independent fluid power distributors. Technical support is provided by each of the Company’s operations (Florida, England, Germany, France, Korea, India and China).

The Company currently has 91 distributors, 69 of which are located outside the United States and a majority of which have strong technical backgrounds or capabilities, which enable them to develop practical, efficient, and cost-effective fluid power systems for their customers. In 2014, sales to the Company’s largest distributor represented less than 7% of net sales.

In addition to distributors, the Company sells directly to other companies within the hydraulics industry, including competitors, which incorporate the Company’s products into their hydraulic products or systems. The Company believes that making it easy for other manufacturers to buy its products offers these manufacturers a better alternative to developing similar products themselves.

To a limited degree, the Company sells product directly to OEMs. The Company recognizes that, to gain access to certain large OEM accounts, it may have to deal directly with customers in the areas of sales and support.

The Company provides end users with technical information through its website and catalogues, including all information necessary to specify and obtain the Company’s products. The Company believes this approach helps stimulate demand for the Company’s products. The Company’s website is comprehensive and easy to use with product information available 24 hours a day, seven days a week around the world, in multiple languages.

Customers

Customers are broadly classified as mobile or industrial customers.

Mobile applications involve equipment that generally is not fixed in place and is often operated in an uncontrolled environment, such as construction, agricultural, mining, and fire and rescue and other utility equipment. Mobile customers historically account for approximately two-thirds of the Company’s net sales.

7

Industrial applications involve equipment that generally is fixed in place in a controlled environment. Examples include automation machinery, presses, plastics machinery such as injection molding equipment, and machine tools. Industrial applications historically account for approximately one-third of the Company’s net sales.

In recent years, new applications have emerged that blend requirements of the mobile and industrial markets and do not fit conveniently into either category. Some of these applications include animatronics, wind power, wave power, solar power and amusement park rides. The Company expects its products to continue to be applied in areas outside of traditional mobile or industrial markets.

The Company does not warrant its products for use in any of the following applications, (i) any product that comes under the Federal Highway Safety Act, such as steering or braking systems for passenger-carrying vehicles or on-highway trucks, (ii) aircraft or space vehicles, (iii) ordnance equipment, (iv) life support equipment, and (v) any product that, when sold, would be subject to the rules and regulations of the United States Nuclear Regulatory Commission. These “application limitations” have alleviated the need for the Company to maintain the internal bureaucracy necessary to conduct business in these market segments.

Competition

The Company’s competitors include full-line producers and niche suppliers similar to the Company. Most competitors market globally. Full-line producers have the ability to provide total hydraulic systems to their customers, including components functionally similar to those manufactured by Sun. The industry has experienced significant consolidation in recent years. Notably, large, full-line producers have acquired most of the independent screw-in hydraulic cartridge valve companies.

Most of the Company’s competitors produce screw-in cartridge valves that fit an industry common cavity that sometimes allows their products to be interchangeable. The industry common cavity is not currently supported by any national or global standards organizations, although there is an ongoing effort to standardize a modified version of this cavity in the United States. The International Standards Organization (ISO) has a standard screw-in cartridge cavity that is different from the industry common cavity, but the Company is not aware of any major competitor that currently produces a full line of standard products conforming to the ISO standard. The Company does not manufacture a product that fits either the industry common or the ISO standard cavity. Some competitors manufacture selected screw-in cartridge valves that fit the Company’s cavity. (See Risk Factors: The marketplace could adopt an industry standard cavity.)

A new class of competitors is emerging in low cost production areas such as Asia and Eastern Europe. These competitors will typically copy both the Company’s products and like products designed by competitors to fit industry common cavities. One of the barriers to these offshore competitors gaining a foothold in established markets is establishing suitable channels or routes to market. The Company recognizes this new class of competitor exists and will continue to monitor its growth and impact.

The Company believes that it competes based upon the quality, reliability, price, value, speed of delivery and technological characteristics of its products and services.

Employees

As of December 27, 2014, Sun had 719 full-time employees in the United States, 25 at HCT, 61 in England, 36 in Germany, one in France, 60 in Korea, two in India and five in China. Over 90% of its employees are engaged in manufacturing, distribution, and engineering functions. No employees are represented by a union in any of the Company’s operating units, and management believes that relations with its employees are good. Employees are paid either hourly or with an annual salary at rates that are competitive with other companies in the industry and geographic areas in which they operate. Management believes that Sun’s culture, competitive salaries and wages, above average health and retirement plans, and its safe and pleasant working environment discourage employee turnover and encourage efficient, high-quality production. Nevertheless, due to the nature of the Company’s manufacturing business, it is sometimes difficult to attract skilled personnel. (See Risk Factors: We are dependent upon key employees and skilled personnel.)

Patents and Trademarks

The Company believes that the growth of its business is dependent upon the quality and functional performance of its products and its relationship with the marketplace, rather than the extent of its patents and trademarks. The Company’s principal trademark is registered internationally in the following countries: Argentina, Australia, Brazil, Canada, Chile, China, France, Germany, India, Italy, Japan, Korea, Mexico, Peru, Spain, Sweden, Switzerland, the United Kingdom, the United States and the European Union. While the Company believes that its patents have significant value, the loss of any single patent would not have a material adverse effect on the Company.

8

Available Information

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, as well as its proxy statements and other materials which are filed with or furnished to the Securities and Exchange Commission (“SEC”) are made available, free of charge, on or through the Sun website under the heading “Investor Relations - Reports - SEC Filings,” as soon as reasonably practicable after they are filed with, or furnished to, the SEC.

ITEM 1A. - RISK FACTORS

FACTORS INFLUENCING FUTURE RESULTS - FORWARD-LOOKING STATEMENTS This Annual Report contains “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) that are based on current expectations, estimates, forecasts, and projections, our beliefs, and assumptions made by us, including (i) our strategies regarding growth, including our intention to develop new products; (ii) our financing plans; (iii) trends affecting our financial condition or results of operations; (iv) our ability to continue to control costs and to meet our liquidity and other financing needs; (v) the declaration and payment of dividends; and (vi) our ability to respond to changes in customer demand domestically and internationally, including as a result of standardization. In addition, we may make other written or oral statements, which constitute forward-looking statements, from time to time. Words such as “may,” “expects,” “projects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. Similarly, statements that describe our future plans, objectives or goals also are forward-looking statements. These statements are not guarantees of future performance and are subject to a number of risks and uncertainties, including those discussed below and elsewhere in this report. Our actual results may differ materially from what is expressed or forecasted in such forward-looking statements, and undue reliance should not be placed on such statements. All forward-looking statements are made as of the date hereof, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Factors that could cause actual results to differ materially from what is expressed or forecasted in such forward-looking statements include, but are not limited to: (i) conditions in the capital markets, including the interest rate environment and the availability of capital; (ii) changes in the competitive marketplace that could affect our revenue and/or cost bases, such as increased competition, lack of qualified engineering, marketing, management or other personnel, and increased labor and raw materials costs; (iii) new product introductions, product sales mix and the geographic mix of sales nationally and internationally; and the following risk factors:

Sales in our industry are subject to economic cycles. The capital goods industry in general, and the hydraulics industry in particular, are subject to economic cycles, which directly affect customer orders, lead times and sales volume. Economic downturns generally have a material adverse effect on our business and results of operations, as they did in 2009. Cyclical economic expansions such as those of 2014, provide a context where demand for capital goods is stimulated, creating increased demand for the products we produce. In the future, continued weakening or improvement in the economy will directly affect orders and influence results of operations.

We are subject to intense competition. The hydraulic valve industry is intensely competitive, and competition comes from a large number of companies, some of which are full-line producers and others that are niche suppliers like us. Full-line producers have the ability to provide total hydraulic systems to customers, including components functionally similar to those manufactured by us. We believe that we compete based upon quality, reliability, price, value, speed of delivery and technological characteristics. Many screw-in cartridge valve competitors are owned by corporations that are significantly larger and have greater financial resources than we have. A new class of competitor has recently emerged in low cost production areas such as Asia and Eastern Europe with look-alike products. We cannot assure that we will continue to be able to compete effectively with these companies.

Most of Sun’s competitors either manufacture manifolds or have sources that they use on a regular basis. In addition, there are many independent manifold suppliers that produce manifolds incorporating various manufacturers’ screw-in cartridge valves, including those made by us. Finally, there are many small, independent machine shops that produce manifolds at very competitive prices. We believe that competition in the manifold and integrated package business is based upon quality, price, performance, proximity to the customer and speed of delivery. Many competitors have very low overhead structures and we cannot assure that we will be able to continue to compete effectively with these companies.

In addition, we compete in the sale of hydraulic valves, manifolds and integrated packages with certain of our customers, who also may be competitors. Generally, these customers purchase cartridge valves from us to meet a specific need in a system that cannot be filled by any valve they make themselves. To the extent that we introduce new products in the future that increase competition with such customers, it may have an adverse effect on our relationships with them.

9

We are subject to risks relating to international sales. International sales represent a significant proportion of our consolidated sales. In 2014, approximately 57% of our net sales were outside of the United States. We will continue to expand the scope of operations outside the United States, both through direct investment and distribution, and expect that international sales will continue to account for a substantial portion of net sales in future periods. International sales are subject to various risks, including unexpected changes in regulatory requirements and tariffs, longer payment cycles, difficulties in receivable collections, potentially adverse tax consequences, trade or currency restrictions, and, particularly in emerging economies, potential political and economic instability and regional conflicts.

Furthermore, our international operations generate sales in a number of foreign currencies, particularly British pounds, the Euro, and the Korean Won. Therefore, our financial condition and results of operations can be affected by fluctuations in exchange rates between the United States dollar and these currencies. Any or all of these factors could have a material adverse effect on our business, financial condition and results of operations.

We are subject to various risks relating to our growth strategy. In pursuing our growth strategy, we intend to expand our presence in existing markets and enter new markets. In addition, we may pursue acquisitions and joint ventures to complement our business. Many of the expenses arising from expansion efforts may have a negative effect on operating results until such time, if at all, that these expenses are offset by increased revenues. We cannot assure that we will be able to improve our market share or profitability, recover our expenditures, or successfully implement our growth strategy. See “Item 1. - Business - Strategy.”

The expansion strategy also may require substantial capital investment for the construction of new facilities and their effective operation. We may finance the acquisition of additional assets using cash from operations, bank or institutional borrowings, or through the issuance of debt or equity securities. We cannot assure that we will be able to obtain financing from bank or institutional sources or through the equity or debt markets or that, if available, such financing will be on acceptable terms.

Our culture, by encouraging initiative, and both individual and collaborative responsibility, has substantially contributed to our success and operating results. Because our employees are able to readily shift their job functions to accommodate the demands of the business and changes in the market, we are a nimble, creative and innovative organization. As we increase the number of our employees and grow into new geographic markets, our culture will likely shift and evolve in new ways. Because our culture promotes the drivers of our success, our inability to protect and align our core values and culture with the evolving needs of the business could adversely affect our continued success.

We are dependent upon key employees and skilled personnel. Our success depends, to some extent, upon a number of key individuals. The loss of the services of one or more of these individuals could have a material adverse effect on our business. Future operating results depend to a significant degree upon the continued contribution of key management and technical personnel and the skilled labor force. As the Company continues to expand internationally, additional management and other key personnel will be needed. Competition for management and engineering personnel is intense and other employers may have greater financial and other resources to attract and retain these employees. We conduct a substantial part of our operations in Sarasota, Florida. Continued success is dependent on the Company’s ability to attract and retain a skilled labor force at this location. There are no assurances that we will continue to be successful in attracting and retaining the personnel required to develop, manufacture and market our products and expand our operations. See “Item 1. - Business - Employees.”

We are subject to fluctuations in the prices of raw materials. The primary raw materials used in the manufacture of our products are aluminum, ductile iron and steel. We cannot assure that prices for such materials will not increase or, if they do, that we will be able to increase the prices for our products to maintain our profit margins. If future price increases do not adequately cover material cost increases, our operating results may be adversely affected.

We are dependent upon our parts suppliers. Our largest expense in cost of sales is the cost of purchasing cartridge valve parts. Our manufacturing costs and output could be materially and adversely affected by operational or financial difficulties experienced by, or cost increases from, one or more of our suppliers.

We are subject to risks relating to our information technology systems. We rely extensively on information technology systems to manage and operate our business. Our results of operations and financial condition could be materially and adversely affected if we experienced a significant business disruption due to the failure of these systems to function properly, or unauthorized access to our systems.

10

Hurricanes could cause a disruption in our operations which could adversely affect our business, results of operations, and financial condition. A significant portion of our operations are located in Florida, a region that is susceptible to hurricanes. Such weather events can cause disruption to our operations and could have a material adverse effect on our overall results of operations. While we have property insurance to partially reimburse us for wind losses resulting from a named storm, such insurance would not cover all possible losses.

We are subject to risks relating to changes in our tax rates, unfavorable resolution of tax contingencies, or exposure to additional income tax liabilities. We are subject to income taxes in the United States and various non-U.S. jurisdictions. Domestic and international tax liabilities are subject to the allocation of income among various tax jurisdictions. Our effective tax rate could be affected by changes in the mix among earnings in countries with differing statutory tax rates or changes in tax laws. We are subject to on-going tax audits in various jurisdictions. If these audits result in assessments different from amounts reserved, future financial results may include unfavorable adjustments to our tax liabilities, which could have a material adverse effect on our results of operations.

The marketplace could adopt an industry standard cavity that would not accommodate our products. Our screw-in cartridge valves fit into a unique cavity for which, to date, few other manufacturers have designed products. Accordingly, our screw-in cartridge valves are not interchangeable with those of other manufacturers. Most competitive manufacturers produce screw-in cartridge valves that fit into an industry common cavity. There is an ongoing effort in the United States to produce a standard for screw-in hydraulic cartridge valve cavities based on the industry common cavity. Additionally, the International Standards Organization (“ISO”) has an existing industry standard for screw-in hydraulic cartridge valve cavities, which is different from our cavity and the industry common cavity. In our view, the industry common cavity, as well as the suggested standardized form of this cavity, and the ISO standard cavity, fail to address critical functional requirements, which could result in performance and safety problems of significant magnitude for end users. To our knowledge, no major competitor has converted its standard product line to fit the ISO standard cavity. Any move by a substantial number of screw-in cartridge valve and manifold manufacturers toward the adoption of ISO standard or another standard, based on the existing industry common cavity, could have a material adverse effect on our business, financial condition and results of operation. See “Item 1. - Business - Competition.”

We are subject to the cost of environmental compliance and the risk of failing to comply with environmental laws. Our operations involve the handling and use of substances that are subject to federal, state and local environmental laws and regulations that impose limitations on the discharge of pollutants into the soil, air and water and establish standards for their storage and disposal. We believe that our current operations are in substantial compliance with applicable environmental laws and regulations, and have not suffered any material adverse effects due to compliance with environmental laws and regulations in the past. However, new laws and regulations, or stricter interpretations of existing laws or regulations, could have a material adverse effect on our business, financial condition and results of operations.

We are subject to the risk of liability for defective products. The application of many of our products entails an inherent risk of product liability. We cannot assure that we will not face any material product liability claims in the future or that the product liability insurance we maintain at such time will be adequate to cover such claims.

We may decide to reduce or eliminate dividends. Although we have paid a cash dividend each quarter since our common stock began publicly trading in 1997, we cannot assure that funds will be available for this purpose in the future. The declaration and payment of dividends is subject to the sole discretion of our board of directors and will depend upon our profitability, financial condition, capital needs, acquisition opportunities, future prospects and other factors deemed relevant by the board, and may be restricted by the terms of our credit facilities.

Certain anti-takeover provisions may hinder or prevent a change in control. Our Articles of Incorporation provide for a classified board of directors. In addition, the Articles give the board of directors the authority, without further action by the shareholders, to issue and fix the rights and preferences of a new class, or classes, of preferred stock. These and other provisions of the Articles and our Bylaws may deter or delay changes in control, including transactions in which shareholders might otherwise receive a premium for their shares over then current market prices. In addition, these provisions may limit the ability of shareholders to approve transactions that they may deem to be in their best interests.

We are subject to control by certain shareholders and management. Christine L. Koski, the daughter of the deceased founder of the Company, Robert E. Koski, is a member of the board of directors. She, along with other family members, own or control approximately 14% of the outstanding shares of our common stock. Accordingly, the members of the Koski family have the ability to influence significantly the election of our directors and the outcome of certain corporate actions requiring

11

shareholder approval, and to influence our business. Such influence could preclude any acquisition of the Company and could adversely affect the price of our common stock. Our directors and executive officers as a group beneficially own or control approximately 11% of the outstanding shares of our common stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

The Company owns major facilities in the United States, United Kingdom, Germany, and Korea, as set forth below.

The Company owns a 69,000 square foot facility in Sarasota, Florida, which houses manufacturing, design, marketing and other administrative functions. The Sarasota facility is well suited for the design, testing and manufacture of the Company’s products.

The Company also owns a 77,000 square foot manufacturing facility in Manatee County, Florida. This facility, constructed in 1997, has a productive capacity similar to the Sarasota facility.

In 2013, the Company opened its third U.S. manufacturing facility. This new facility, in Manatee County, is located adjacent to its existing Manatee County facility. The facility provides an additional 58,000 square feet of production space and 17,000 square feet of office space, dedicated to the design and manufacturing of our integrated package business.

The close proximity of the Florida facilities allows us to quickly shift resources, including machinery and people, to effectively meet changing business requirements.

The Company also owns vacant land in Manatee County, Florida, adjacent to its existing facilities for future expansion requirements. In total, the Company owns 27 acres of contiguous property.

The Company owns a 37,000 square foot facility in Coventry, England. This operation, while primarily acting as a distributor, is also involved in manifold design and manufacturing.

The Company owns a 45,000 square foot distribution and manufacturing facility in Erkelenz, Germany. This facility is well suited to house equipment used for manufacturing and testing of the Company’s products. Currently, a small portion of the manufacturing area is utilized and the remainder is leased on an annual basis to an outside company.

The Company owns a 10,000 square foot distribution and manufacturing facility in Incheon, Korea. Additionally, the Company leases a 38,000 square foot distribution and manufacturing facility in Incheon, Korea. Subsequent to year end, the Company's owned facility was listed for sale.

There is no mortgage or other significant encumbrance on any of the Company’s properties. The Company believes that its properties have been adequately maintained, are generally in good condition, and are suitable and adequate for its business as presently conducted. The extent of utilization of the Company's properties varies from time to time and among its facilities.

ITEM 3. LEGAL PROCEEDINGS

The Company from time to time is involved in routine litigation incidental to the conduct of its business. The Company does not believe that any pending litigation will have a material adverse effect on its consolidated financial position or results of operations.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

12

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY,

RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

The Common Stock of the Company has been trading publicly under the symbol SNHY on the Nasdaq Global Select Market since the Company’s initial public offering on January 9, 1997. The following table sets forth the high and low closing sale prices of the Company’s Common Stock as reported by the Nasdaq Global Select Market and the dividends declared for the periods indicated.

High | Low | Dividends declared | ||||

2014 | ||||||

First quarter | 44.740 | 34.990 | 0.180 | |||

Second quarter | 44.310 | 36.660 | 0.090 | |||

Third quarter | 42.110 | 35.910 | 1.090 | |||

Fourth quarter | 42.940 | 33.840 | 0.090 | |||

2013 | ||||||

First quarter | 33.160 | 26.080 | 0.180 | |||

Second quarter | 33.610 | 29.640 | 0.090 | |||

Third quarter | 36.300 | 30.000 | 0.090 | |||

Fourth quarter | 43.270 | 34.950 | 0.090 | |||

Holders

There were 174 shareholders of record of Common Stock on February 19, 2015. The number of record holders was determined from the records of the Company’s transfer agent and does not include beneficial owners of Common Stock whose shares are held in the names of securities brokers, dealers, and registered clearing agencies. The Company believes that there are approximately 13,000 beneficial owners of Common Stock.

Dividends

Quarterly dividends of $0.09 per share were paid on the 15th day of each month following the date of declaration.

In addition to the regular quarterly dividends, the Company declared shared distribution cash dividends in 2014 and 2013 equal to $0.09 per share. The 2014 dividend was paid on March 31, 2014, to shareholders of record on March 15, 2014, and the 2013 dividend was paid on March 31, 2013, to shareholders of record on March 15, 2013.

In light of the Company's strong cash position, ability to generate on-going cash, and strong financial performance in the first half of 2014, the Company declared a special cash dividend of $1.00 per share that was paid on October 24, 2014, to shareholders of record as of October 10, 2014.

The Company’s board of directors declared a shared distribution cash dividend of $0.09 per share, payable on March 31, 2015, to shareholders of record as of March 15, 2015.

The Company’s board of directors currently intends to continue to pay a quarterly dividend of $0.09 per share during 2015. However, the declaration and payment of future dividends is subject to the sole discretion of the board of directors, and any determination as to the payment of future dividends will depend upon the Company's profitability, financial condition, capital needs, acquisition opportunities, future prospects and other factors deemed pertinent by the board of directors.

13

Stock Split

On June 9, 2011, the Company declared a three-for-two stock split, effected in the form of a 50% stock dividend, to shareholders of record on June 30, 2011, payable on July 15, 2011. The Company issued approximately 8,500,000 shares of common stock as a result of the stock split.

The effect of this stock split on outstanding shares, earnings per share and dividends per share has been retroactively applied to all periods presented.

Equity Compensation Plans

Information called for by Item 5 is provided in Note 14 of our 2014 Audited Financial Statements (Item 8 of this report).

Issuer Purchases of Equity Securities

The Company did not repurchase any of its stock during the fourth quarter of 2014.

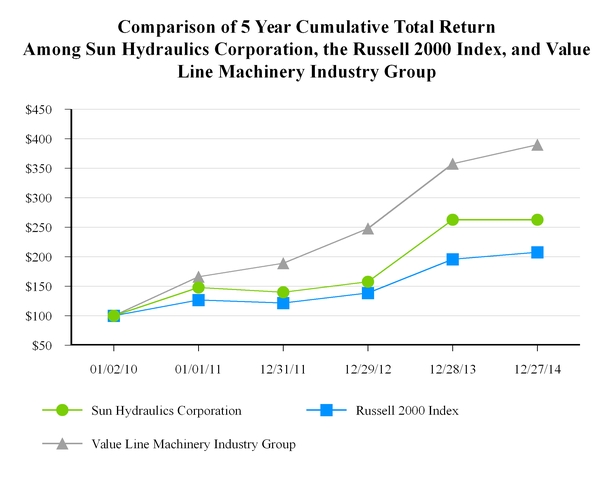

Five-Year Stock Performance Graph

The following graph compares cumulative total return among Sun, the Russell 2000 Index and the Value Line Machinery Industry Group, from January 2, 2010, to December 27, 2014, assuming $100 invested in each on January 2, 2010. Total return assumes reinvestment of any dividends for all companies considered within the comparison. The stock price performance shown in the graph is not necessarily indicative of future price performance.

14

1/2/2010 | 1/1/2011 | 12/31/2011 | 12/29/2012 | 12/28/2013 | 12/27/2014 | |||||||

Sun Hydraulics Corporation | 100.00 | 148.08 | 139.83 | 157.82 | 262.94 | 262.98 | ||||||

Russell 2000 Index | 100.00 | 126.85 | 121.56 | 138.56 | 195.89 | 207.64 | ||||||

Value Line Machinery Industry Group | 100.00 | 166.30 | 189.30 | 247.94 | 357.88 | 389.91 | ||||||

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

The following summary should be read in conjunction with the consolidated financial statements and related notes contained herein. See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Item 1. Business."

The Company reports on a fiscal year that ends on the Saturday closest to December 31st. Each quarter consists of thirteen weeks.

Year ended | ||||||||||||||||

December 27, 2014 | December 28, 2013 | December 29, 2012 | December 31, 2011 | January 1, 2011 | ||||||||||||

(in thousands except per share data) | ||||||||||||||||

Statement of Operations: | ||||||||||||||||

Net Sales | $ | 227,673 | $ | 205,267 | $ | 204,367 | $ | 204,171 | $ | 150,695 | ||||||

Gross Profit | 93,892 | 82,961 | 80,572 | 79,215 | 52,343 | |||||||||||

Operating Income | 64,071 | 56,171 | 54,409 | 55,269 | 31,039 | |||||||||||

Income before income taxes | 65,742 | 57,172 | 55,853 | 57,586 | 31,643 | |||||||||||

Net income | $ | 43,775 | $ | 37,984 | $ | 37,398 | $ | 37,677 | $ | 21,400 | ||||||

Basic net income per common share | $ | 1.65 | $ | 1.45 | $ | 1.44 | $ | 1.47 | $ | 0.84 | ||||||

Diluted net income per common share | $ | 1.65 | $ | 1.45 | $ | 1.44 | $ | 1.47 | $ | 0.84 | ||||||

Dividends per common share | $ | 1.45 | $ | 0.45 | $ | 1.48 | $ | 0.40 | $ | 0.57 | ||||||

Other Financial Data: | ||||||||||||||||

Depreciation and amortization | $ | 8,718 | $ | 7,227 | $ | 7,186 | $ | 6,721 | $ | 6,873 | ||||||

Capital expenditures | 10,667 | 17,935 | 13,359 | 10,143 | 3,856 | |||||||||||

Balance Sheet Data: | ||||||||||||||||

Cash and cash equivalents | $ | 56,843 | $ | 54,912 | $ | 34,478 | $ | 42,834 | $ | 33,206 | ||||||

Working capital | 119,815 | 115,038 | 90,198 | 89,744 | 66,150 | |||||||||||

Total assets | 222,764 | 213,478 | 175,121 | 167,528 | 132,034 | |||||||||||

Total debt | — | — | — | — | — | |||||||||||

Shareholders' equity | 198,259 | 191,428 | 155,273 | 145,276 | 115,024 | |||||||||||

15

ITEM 7. MANAGEMENT'S DISCCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Sun is a leading designer and manufacturer of high-performance screw-in hydraulic cartridge valves and manifolds, which control force, speed and motion as integral components in fluid power systems. The Company sells its products globally through wholly owned subsidiaries and independent distributors. Sales outside the United States for the year ended December 27, 2014, were approximately 57% of total net sales.

Approximately two-thirds of product sales are used by the mobile market, which is characterized by applications where the equipment is not fixed in place, the operating environment is often unpredictable, and duty cycles are generally moderate to low. Some examples of the mobile market include equipment used in off-road construction, agriculture, fire and rescue, utilities, oil fields, and mining.

The remaining one-third of sales are used by industrial markets, which are characterized by equipment that is fixed in place, typically in a controlled environment, and which operates at higher pressures and duty cycles. Power units, automation machinery, metal cutting machine tools and plastics machinery are some examples of industrial equipment. The Company sells to both markets with a single product line.

In recent periods, the Company’s products have been used by emerging markets that have characteristics of both the mobile and industrial markets and do not conveniently fit either classification exclusively. These markets include alternative energy equipment including wind, wave and solar equipment, animatronics and staging for theater and cinema. The Company sells to these markets the same products used in its traditional markets.

Management and Operations Philosophy

Since its inception, Sun has operated as an entrepreneurial enterprise, with an emphasis on individual employee empowerment and a disinclination to create bureaucracy, a formal management structure or administrative impediments to innovation, efficiency and customer service. Accordingly, the Company’s organization, management structure, and reporting and decision-making systems are highly unified and unlayered.

In addition to representative and sales offices located throughout the world, Sun has three subsidiaries outside the United States (in the UK, Germany and Korea) and one U.S. subsidiary. These entity distinctions arose out of historical considerations or as the result of acquisitions. Nevertheless, and increasingly as it has developed into a global enterprise, the Company is operated and managed on a consolidated basis. Much of the Company’s primary financial and operations data is reported from Sun’s various legal entities, which are separate tax-payers and, in many cases, subject to statutory audits in the countries in which they are organized. This information from Sun locations around the world is then compiled and aggregated, with appropriate consolidating entries, on a monthly basis. However, we do not manage or make decisions based on the individual legal entity information. Instead, this is done on the basis of the consolidated information.

Sun has always employed a leadership model in which all management personnel have line responsibilities and participate across functional lines and in multiple areas, including geographical areas. Through a common vision, shared values and networks of informal, overlapping relationships, the Company has emphasized a unified approach. The CEO oversees the Company with a constant focus on consolidated results.

With oversight from its Board of Directors and an emphasis on transparent communication across the entire Company, Sun’s operating strategy and business is based upon the creation and manufacture of a comprehensive line of functional products which are sold, through distribution and directly, worldwide for use in a host of mobile and industrial applications. This unified focus places a premium on the delivery of Sun products for fluid power solutions anywhere in the world in the most efficient manner, with little regard for traditional geographic or entity differentiation. Instead, Sun’s management looks at where products are sold - the Americas, Europe (which includes the Middle East and Africa), and Asia/Pacific. Decisions as to resource allocation, expansion of facilities and personnel, and capital investment are all made based on information on “sales to” customers, not information about “sales from” Sun subsidiary entities. This reflects the fact that sales are routinely specified, originated or sold beyond and regardless of entity or geographic boundaries. In particular, many of the sales in Europe and Asia come directly from the US and never pass through one of Sun’s subsidiary entities in those regions.

16

Management’s focus is on overall Company performance and the evaluation of opportunities for additional “sales to” customers. Sun’s CEO truly acts as the chief executive for the entire business; he and the other management leaders oversee operations worldwide, without an intermediate reporting bureaucracy in each location in which Sun has a legal entity. Using “shared offices,” leadership responsibilities are disbursed throughout the Company, with minimal formal reporting relationships and maximum collaboration among employees worldwide. By focusing on total net orders and total net sales, not individual legal entity performance, Sun is able to better serve its customers. This philosophy permeates not only the management approach to decision-making, but also the Company’s compensation system, which is based on company-wide performance, and not individual or entity-level management-by-objective criteria.

Industry Conditions

Demand for the Company’s products is dependent on demand for the capital goods into which the products are incorporated. The capital goods industries in general, and the fluid power industry specifically, are subject to economic cycles. According to the National Fluid Power Association (the fluid power industry’s trade association in the United States), the United States index of shipments of hydraulic products increased 6% in 2014, after decreasing 5% in 2013 and increasing 1% in 2012.

The Company’s order trend has historically tracked closely to the United States Purchasing Managers Index (PMI), with the PMI providing a six to ten months leading indication of business conditions. A PMI above 50 indicates economic expansion in the manufacturing sector and when below 50, it indicates economic contraction. The index decreased to 55.1 in December 2014, from 56.1 (seasonally adjusted) in December 2013. Although down in December on a year over year basis, the index showed considerable strength in the manufacturing sector for much of 2014. The index in January 2015 was 53.1, indicating growth, albeit at a slower rate, for the 20th consecutive month.

Results for the 2014 fiscal year

(in millions except net income per share) | ||||||||

December 27, 2014 | December 28, 2013 | Increase | ||||||

Twelve Months Ended | ||||||||

Net sales | $ | 227.7 | $ | 205.3 | 11 | % | ||

Net income | $ | 43.8 | $ | 38.0 | 15 | % | ||

Net income per share: | ||||||||

Basic | $ | 1.65 | $ | 1.45 | 14 | % | ||

Diluted | $ | 1.65 | $ | 1.45 | 14 | % | ||

Three Months Ended | ||||||||

Net sales | $ | 54.8 | $ | 49.1 | 12 | % | ||

Net income | $ | 10.3 | $ | 8.3 | 24 | % | ||

Net income per share: | ||||||||

Basic | $ | 0.39 | $ | 0.32 | 22 | % | ||

Diluted | $ | 0.39 | $ | 0.32 | 22 | % | ||

Demand was strong throughout the fourth quarter. All geographic end markets expanded in the quarter, led by robust demand in North America, which was up 18%. Asia/Pacific and Europe were each up 5%. For the year, the Company was able to drive double digit top and bottom line growth. Its performance led the Board to once again declare a shared distribution, recognizing the importance of both employees and shareholders.

The Company made significant investments for future growth in 2014, and management is seeing positive signs as a result. With the addition of its third U.S. facility, the larger physical footprint provides the capacity to grow and drive operational improvements. This leads to faster response times to better satisfy customers. New products, including prototype valves utilizing the new licensed Sturman technology, are creating interesting opportunities with both existing and new customers. Product development efforts increase the Company's capabilities and enhance its offering of integrated package solutions. Management anticipates continued product development and new product releases in 2015.

Despite some headwinds, 2015 is off to a good start. The breadth and depth of the Company's product line lends itself well to serving diverse end-user markets and eliminating reliance on any one industry. Geographically, there are pockets of strength,

17

including North America and parts of Europe. In China, the Company has expanded its customer base, which mitigates a slowdown in Asia/Pacific. Management believes it is well positioned to respond to business conditions in 2015. Diverse end markets, coupled with on-going investment in products and marketing efforts prepare Sun for future business growth. The Company also has the infrastructure in place and a strong balance sheet to capitalize on opportunities. The Company ended 2014 with cash and marketable securities of $100.5 million, and zero dollars of long-term debt.

Dividends

The Company declared quarterly dividends of $0.09 per share during 2014. These dividends were paid on the 15th day of the month following the date of declaration. Additionally, in 2014, the Company declared a shared distribution cash dividend of $0.09 per share that was paid on March 31, 2014, to shareholders of record on March 15, 2014.

In light of the Company's strong cash position, ability to generate on-going cash, and strong financial performance in the first half of 2014, the Company declared a special cash dividend of $1.00 per share that was paid on October 24, 2014, to shareholders of record as of October 10, 2014.

In February 2015, the Board elected to once again apportion a shared distribution for employees and shareholders based on the

Company’s 2014 results. The shared distribution consists of a 10.0% contribution of salaries to all eligible employees, most of which will be paid into retirement plans via Sun Hydraulics stock, and a $0.09 per share dividend to shareholders, totaling approximately $6.1 million. The shared distribution concept was introduced in 2008 as a way to reward both shareholders and employees when Sun has a successful year.

The shared distribution dividend will be issued to shareholders of record on March 15, 2015, with payment on March 31, 2015.

Outlook

First quarter 2015 revenues are expected to be approximately $55 million, down 3% from the first quarter of 2014, primarily driven by a strong U.S. Dollar against the Euro. Earnings per share are estimated to be $0.40 to $0.42 compared to $0.43 in the same period a year ago. The first quarter will look similar on the top line to the fourth quarter, but operationally the Company expects to drive more profit to the bottom line.

Results of Operations

The following table sets forth, for the periods indicated, certain items in the Company’s statements of operations as a percentage of net sales.

For the year ended | ||||||||||

December 27, 2014 | December 28, 2013 | December 29, 2012 | December 31, 2011 | January 1, 2011 | ||||||

Net sales | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % |

Gross profit | 41.2 | % | 40.4 | % | 39.4 | % | 38.8 | % | 34.7 | % |

Operating income | 28.1 | % | 27.4 | % | 26.6 | % | 27.1 | % | 20.6 | % |

Income before income taxes | 28.9 | % | 27.9 | % | 27.3 | % | 28.2 | % | 21.0 | % |

Comparison of Years Ended December 27, 2014 and December 28, 2013

Net Sales

Net sales were $227.7 million, an increase of $22.4 million, compared to $205.3 million in 2013. Demand for our products in 2014 was primarily driven by increased demand in all major global end markets, which primarily include capital goods equipment. Price increases, effective October 1, 2013, and December 1, 2014, contributed approximately 2% to sales. Exchange rates had a positive impact on sales in both 2014 and 2013 of approximately $1.6 million and $1.1 million, respectively. New product sales (defined as products introduced within the last five years) continue to make up 10%-15% of total sales.

Asian/Pacific sales increased 8.5% or $3.6 million, to $45.9 million in 2014, primarily related to demand from Korea and China. Exchange rates had a $0.8 million positive impact on Asia/Pacific sales in 2014. EAME sales increased 13.1% or $8.0 million, to $69.2 million in 2014, primarily related to demand in Germany and the United Kingdom. Significant increases were

18

also noted in Austria, Ireland, and Spain. Additionally, currency had a $0.8 million positive impact to EAME sales in 2014. Sales to the Americas increased 10.6% or $10.8 million, to $112.5 million in 2014, driven by U.S. demand.

Gross Profit

Gross profit increased $10.9 million or 13.2% to $93.9 million in 2014, compared to $83.0 million in 2013. Gross profit as a percentage of net sales increased to 41.2% in 2014, compared to 40.4% in 2013.

The increase in gross profit was primarily attributable to increased sales volume in the current period of approximately $7.0 million. Pricing added approximately $5.0 million to gross profit. This was partially offset by increased material and overhead expenses, related to indirect labor costs including overtime, building maintenance and repairs, and depreciation on our new facility.

Selling, Engineering, and Administrative Expenses

Selling, engineering and administrative expenses in 2014 were $29.8 million, a $3.0 million, or 11.3%, increase, compared to $26.8 million in 2013. The change for 2014 was related to increases in compensation, including stock compensation and currency effects, of approximately $1.0 million. The remainder is primarily made up of outside services of $0.6 million and marketing efforts in Asia and R&D, each totaling approximately $0.5 million.

Operating Income

Operating income increased $7.9 million or 14.1% to $64.1 million in 2014, compared to $56.2 million in 2013, with operating margins of 28.1% and 27.4% for 2014 and 2013, respectively.

The Company derives its operating income based on the consolidated results of its legal entities. The Company has made the decision to consolidate engineering and manufacturing for the most part in the U.S. The Company’s foreign subsidiaries primarily act as part of our sales and distribution channel. This structure results in different operating margins between the legal entities due to the mix of products, channels to market, and industries present in different geographic regions.

Products manufactured in the U.S. are sold worldwide. Pricing, operations and cost structure are the primary reasons that operating income in the U.S. is higher than foreign subsidiary operating income, which we expect will continue. Our German and UK entities act as value add distributors. These entities sell to both end use customers in their respective regions, as well as to third party distributors in certain parts of Europe. UK margins have historically been lower than Germany margins. This is due to the fact that, in the UK, we manufacture iron manifolds for the European market. This results in higher overhead costs primarily related to machinery and equipment, and the employment of nearly twice as many people as in Germany. Margins are lowest in our Korean entity. Korea, more than any other subsidiary, sells direct to large OEM customers where pricing pressure is most pronounced.

The U.S. legal entity contributed $52.3 million to our consolidated operating income during 2014 compared to $45.5 million during 2013, an increase of $6.8 million. Increased revenue contributed approximately $4.7 million to operating income, while margin expansion, primarily related to pricing, contributed $2.1 million. Increased revenue volume was driven by sales to North America, China, and to Europe, specifically Spain. Increasingly, the US legal entity ships products directly to customers around the world. Third party export sales from the US were $60.1 million in 2014 compared to $54.2 million in 2013. As demand strengthens internationally, the US legal entity will benefit from these direct export sales.

Our Korean subsidiary contributed $1.2 million to our consolidated operating income during 2014 compared to $1.8 million during 2013, a decrease of $0.6 million. Margins contracted from 9.3% in 2013 to approximately 5.6% in 2014, representing a $0.8 million decrease in operating income. The decrease was primarily related to increased material, labor and overhead costs. The decrease in operating income was partially offset by higher revenue.

Our German subsidiary contributed $6.6 million to our consolidated operating income during 2014 compared to $5.5 million during 2013, an increase of $1.1 million. Higher volume added approximately $0.6 million, with the remainder resulting from margin expansion. Operating margins were 23.2% and 21.2%, in 2014 and 2013, respectively. The margin growth was attributable to material cost decreases related to purchases of material in U.S. Dollars and a strengthening Euro during the first half of the year.

Our U.K. subsidiary contributed $3.9 million to our consolidated operating income during 2014 compared to $3.5 million during 2013, an increase of $0.4 million. Higher volume contributed $0.6 million, which was partially offset by a decrease in margins from 19.8% to 18.9%.

19

Interest Income, Net

Net interest income for 2014 was $1.6 million compared to net interest income of $1.0 million for 2013. Total average cash and marketable securities for 2014 was $97.2 million compared to total average cash and marketable securities for 2013 of $82.9 million. Interest derived from investments in corporate and municipal bonds, mutual funds, certificates of deposit, and money market funds increased approximately $0.3 million in 2014. The remaining increase is related to interest received on a tax refund at our German subsidiary.

Foreign Currency Transaction (Gain) Loss, Net