Sun Hydraulics Corporation

1500 West University Parkway

Sarasota, FL 34243

September 17, 2013

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, D.C. 20549

Attention: Terence O’Brien, Accounting Branch Chief

RE: Sun Hydraulics Corporation

Form 10-K

Filed March 12, 2013

File No. 0-21835

Dear Mr. O’Brien:

On behalf of Sun Hydraulics Corporation (“the Company”), I am writing in response to the comments set forth in your letter addressed to the undersigned dated September 4, 2013 (the “Comment Letter”). For the convenience of the Staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Staff”), each of the Staff’s comments is repeated below, along with the Company’s response to each comment set forth immediately following the comment.

Comment 1

Form 10-K for the year ended December 29, 2012

Results for the 2012 fiscal year, page 18

1. You state “A stronger than expected fourth quarter allowed us to achieve our highest top line year ever.” This was echoed in the fourth quarter earnings release and the earnings call transcript. On page 23, you disclose that the changes in certain working capital accounts were primarily related to “slower business conditions in the fourth quarter of 2012.” Please explain or reconcile these two statements within the context of the micro-and macro-economic factors significantly affecting your results of operations, financial condition and liquidity.

Response to Comment 1

The Company’s statements above reflect two different comparisons. The first statement relates to the comparison between the outlook for the fourth quarter that was provided in the Company’s third quarter press release and its actual results. The outlook is based on order trends, and at the time of the release the Company expected sales to be approximately $41.0 million. Actual fourth quarter sales were $43.2 million. This was better than had been expected given order trends and the deteriorating market conditions at the time of the earlier public statement.

1

The second statement refers to the comparison to the prior year end. The fourth quarter sales in 2012 were $43.2 million compared to sales of $45.7 million in the fourth quarter of 2011. These slower business conditions compared to the prior year contributed to changes in inventory, accounts receivable, and payables at the end of 2012, affecting cash from operations.

Comment 2

Liquidity and Capital resources, page 22

2. Please tell us and in future filings disclose the amount outstanding under your credit facilities

Response to Comment 2

The Company did not have any amount outstanding under its credit facilities at December 29, 2012. The Company will disclose in future filings the amounts outstanding at the end of the reporting period.

Comment 3

3. Please tell us and disclose in future filings if you were in compliance with all covenants as of fiscal year-end.

Response to Comment 3

The Company was in compliance with all debt covenants at December 29, 2012. The Company will disclose in future filings its compliance with all debt covenants at the end of the reporting period.

Comment 4

4. We note your disclosure of material debt covenants including the required ratios/amounts. In future filings, please disclose the actual ratios/amounts as of each reporting date. This will allow readers to understand how much cushion there is between the required ratios/amounts and the actual ratios/amounts. Please show us what your disclosure would have looked like for 2012 in response to this comment.

Response to Comment 4

The Company will disclose actual ratios/amounts in future filings. Incorporating the actual ratios/amounts at December 29, 2012, would have resulted in the following revised disclosure:

Facility A is subject to debt covenants (capitalized terms are defined therein) including: 1) Minimum Tangible Net Worth of not less than $92 million, increased annually by 50% of Net Income, and 2) Minimum EBITDA of not less than $5 million; and requires the Company to maintain its primary domestic deposit accounts with the bank.

At December 29, 2012, the Company was in compliance with all debt covenants related to Facility A as follows:

Covenant | Required Ratio/Amount | Actual Ratio/Amount |

Minimum Tangible Net Worth | $130 million | $158 million |

Minimum EBITDA | Not less than $5 million | $62 million |

2

If Facility B or Facility C is activated, covenant 2 above will automatically terminate and two additional covenants will be required: 1) Funded Debt to EBITDA ratio equal to or less than 3.0:1.0, and 2) EBIT to Interest Expense ratio of not less than 2.5:1.0. As of December 29, 2012, the Company had not activated Facility B or Facility C.

Comment 5

18. Segment Reporting, page 52

5. We note herein and elsewhere throughout your document your change to a single reportable segment in manufacturing, marketing, selling and distributing your products worldwide, whereas prior to 2012, you had four operating and reportable segments based on the geographic location of your subsidiaries. You state that “Management believes the discrete financial information of the Company’s individual foreign subsidiaries is no longer representative of the business level in those locations, and management no longer makes decisions or assesses performance based on this information.” In order for us to further assess this matter, please provide to us the CODM reports for the last three years and two quarters of 2013. We may have further comment.

Response to Comment 5

The Company changed to a single reportable business segment as this is more representative of the way it operates its business and is more informative to investors. From numerous discussions with analysts, it was clear to management that analysts misinterpreted the Company’s segment disclosure. Previously, segment reporting disclosed how products appeared in the marketplace (“sales from”) as opposed to the growth trend in specific markets. Information about where the Company’s products are used (“sales to”), not where they originate, is more useful to investors because the Company’s performance is based on product demand in its different geographic markets. This is how management views the Company’s business, and the revised disclosure approach permits investors to view the Company from the same perspective.

Reviewing the total sales with total assets provided in the geographic information of our segment footnote provides additional support that the location of the reporting unit is not supporting the sales to that region. Sales to the Asia/Pacific region for 2012, for example, represent 19% of sales, but only 8% of total assets. In the case of Asia/Pacific sales, this ratio indicates that the assets in this region are not entirely generating this portion of sales. Sales to this growing region are increasingly being shipped directly from the United States and not our Korean reporting unit. By breaking down the sales to each geographic region, investors can get a better sense of our market growth.

Had we showed segment information under our old method, sales by segment would have appeared as follows:

United States | Korea | Germany | United Kingdom | Elimination | Consolidated | |||||||||||

Year ended December 29, 2012 | ||||||||||||||||

Sales to unaffiliated customers (in thousands) | $ | 140,109 | $ | 17,791 | $ | 25,952 | $ | 20,515 | - | $ | 204,367 | |||||

Compared to the new segment disclosure for sales to geographic markets, the United States market appears overstated, while Europe and Asia markets appear understated. We included additional information regarding sales to information in our filings, but this was still a common misconception with investors and analysts.

3

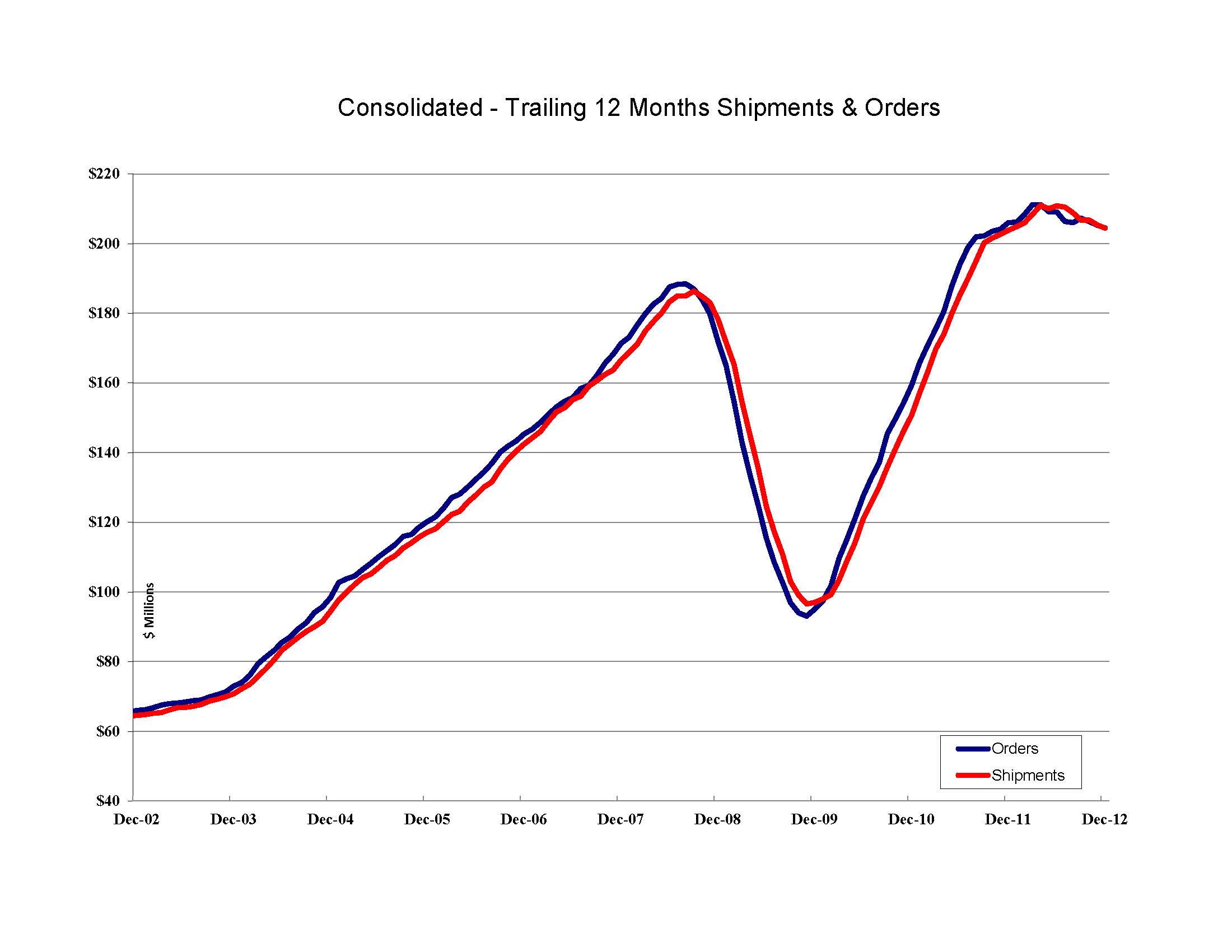

Our CODM reviews reports generated in various formats. These reports include daily, weekly, and monthly sales and orders by customer and geography (on a “sales to” basis). Copies of examples of these sales and orders reports are furnished to the Staff supplementally herewith. Order reports provide an early indication to our CODM of market trends. However, Sun takes a long term view and major operating decisions are based on consolidated results over an extended period of time. Our CODM also reviews monthly operating results of reporting units, and quarterly consolidated results, for general management purposes.

Comment 6

Exhibit 10.4

6. We note that you have not filed the exhibits and the schedules to the Amended and Restated Credit and Security Agreement dated August 11, 2011 filed with your 10-K on March 14, 2012. Please file a complete copy of this agreement with your next filing.

Response to Comment 6

The Company’s Amended and Restated Credit and Security Agreement dated August 1, 2011, contains no schedules and only one exhibit. The sole exhibit is a legal description of real estate located in Sarasota, Florida, on which the Company is constructing a manufacturing facility. The facility is expected to be completed in October of this year. No monies were advanced or any loan proceeds from the credit facility used for this construction project. In fact, no funds at all have been drawn down by the Company under the credit agreement. The Company does not believe that the legal description of the real property is material to an understanding of the credit agreement or in any other respect material to investors.

Comment 7

Schedule 14A filed on April 12, 2013

7. We note that in response to comment 10 of our letter dated November 3, 2008 you agreed that in future filings you would disclose that your code of ethics applies to all employees, including the Chief Executive Officer, Chief Financial Officer, and the person performing the functions of a controller. However, it does not appear that you have included these additional disclosures in your current filing. Please include these disclosures in future filings.

Response to Comment 7

The Company has disclosed that its code of ethics applies to all employees, including the Chief Executive Officer, Chief Financial Officer, and the person performing the functions of a controller. The following sentence is included on page 12 of Schedule 14A, under the caption Certain Relationships and Related Transactions: “Under the Company’s Code of Ethics, all employees, including the CEO, the CFO and the person performing the functions of a controller, are instructed to avoid any personal activity, investment or association which could appear to interfere with their good judgment concerning the Company’s best interests.” In future filings, when the Code of Ethics is first referenced, the Company will disclose that the code applies to all employees.

Comment 8

8. We note that in response to comment 11 of our letter dated November 3, 2008 you agreed that in future filings you would clarify whether and the manner in which the Compensation Committee benchmarks

4

compensation against compensation of other companies. However, it does not appear that you have provided these disclosures. Please include these disclosures in future filings. Please also show us what your disclosure would have looked like for 2012 in response to this comment.

Response to Comment 8

As disclosed in Schedule 14A, to assist in determining appropriate overall compensation, the Committee reviews certain information regarding revenues, income, and executive compensation for other public manufacturing companies, for other businesses operating in Florida and the southeast United States and selected businesses in the U.S. of similar size and scope, as well as selected information regarding compensation practices, including employee benefits, from manufacturing companies in other countries in which the Company operates. The Company will make explicit in future filings that the foregoing data is used for informational purposes, and the Committee does not benchmark compensation against any group or size of company. The Company will also disclose that, as with executive compensation, benchmarks are not applied in determining compensation for directors, although industry data is used as reference points.

Comment 9

9. We note that in response to comment 12 of our letter dated November 3, 2008 you agreed that in future filings you would disclose the elements of individual performance you consider when deciding to increase or decrease the salaries of your executive officers. However, it does not appear that you have disclosed the elements of individual performance you consider when deciding to increase or decrease the salaries of your executive officers. In future filings, please provide these disclosures. Please also show us what your disclosure would have looked like for 2012 in response to this comment.

Response to Comment 9

As disclosed in Schedule 14A, the Company’s overall financial performance influences the general level of salary increases for executive officers, and there are no pre-arranged annual increases or established ranges for salary increases. The chief executive officer, after seeking input from other key managers and reviewing selected market data, recommends to the Compensation Committee increases for the other executive officers based upon his analysis of the individual executive’s experience and past and potential contributions to the Company. The Company does not manage by objective or set performance targets. Therefore, salary adjustments are subjective in nature. In 2010, the Committee did determine that it would be desirable to bring the compensation of the executive officers closer to market and to decrease the gap between the chief executive officer and the other executive officers. To disclose this determination, the compensation discussion in Schedule 14A could have been expanded in 2012 as follows:

“In 2010, the Committee did determine that it would be desirable to bring the compensation of the executive officers closer to market and to decrease the gap between the chief executive officer and the other executive officers. It was agreed with the chief executive officer that this would be done over a period of years. In furtherance of this plan, in 2011, 2012 and 2013, $30,000 salary increases were awarded to Tricia L. Fulton and Tim Twitty and an equivalent increase in British pounds was awarded to Steven Hancox. When Mark Bokorney was named an executive officer in March 2013, he was given a $30,000 salary increase. In March 2013, the Compensation Committee reviewed the chief executive officer’s past three years’ cash and non-cash compensation, the Company’s performance during that period and currently, and the relationship of the compensation of the executive officers as a group and

5

within the Company. Following that review, the chief executive’s salary was increased to $500,000, effective April 12, 2013, the effective date for salary increases for the other executive officers.”

Comment 10

10. We note that in response to comment 13 of our letter dated November 3, 2008 you agreed that in future filings you would elaborate on the manner in which the Compensation Committee establishes the amount of the monetary pool used for long-term compensation, its use of surveys and other compensation data, as well as internal compensation information. You also agreed to provide greater clarity as to how employee performance is evaluated. However, it does not appear that you have included the expanded disclosures. Please provide these disclosures in future filings. Please also show us what your disclosure would have looked like for 2012 in response to this comment.

Response to Comment 10

As disclosed in Schedule 14A, the Compensation Committee determines each year the number of shares for the long-term compensation pool. While the amount of long-term compensation is related to Company performance, it does not move automatically in lock-step with such performance. The Committee has recognized that, at different periods in the economic cycle, long-term compensation might have greater or lesser importance in relationship to salary adjustments. Further, while the level of the pool varies with the Company’s performance, the Committee believes that it is important to reward and incentivize employees even in difficult times. The determination of the size of the long-term compensation pool is very subjective, and the Committee only occasionally reviews surveys or other compensation data. The following statement accurately discloses the Compensation Committee’s determination for 2012:

“Considering the expansion of the long-term compensation pool (excluding the CEO) by 15% and 25%, respectively, over the past two years in recognition of the Company’s exceptionally strong financial performance in those years, the Committee determined to increase the size of the pool for 2012 (excluding the CEO) by slightly more than 4%, from 73,000 to 76,000 shares of restricted stock.”

With respect to how employee performance is evaluated, the Company believes that the following statements accurately disclose the Compensation Committee’s methodology:

“Criteria used by the Committee in these awards include individual responsibilities and performance results and the individual’s years of experience in the industry, with the emphasis on subjective measures such as sustained contributions to the Company, initiative, the effect of the individual on the attitudes and performance of others, and the amount of management required for the individual. No particular weight is given to any specific criterion…. At the Committee’s meeting on October 22, 2012, the CEO presented an overview of his methodology for making recommendations for long-term compensation awards. He explained that, utilizing the three award tiers prescribed by the Committee, he initially made his recommendations without reference to prior year awards. He stated that he looked for significant individual contributions, experience in the industry, time with Sun, and the ability for greater future contributions. He also requested input from the senior members of the leadership group worldwide. The CEO summarized the contributions and described the backgrounds of each of the candidates for whom restricted stock grants in the highest two tiers were recommended and explained why two individuals from 2011 were not recommended for awards and eight individuals were added this year…. Following the departure of the CEO from the meeting and further discussion, the Committee accepted the CEO’s recommendations. In recognition of Mr. Carlson’s strong management

6

performance over the past four quarters, his overall compensation level, and the size of the other executive awards, the Committee granted the CEO an award of 15,000 shares (the same as in 2011).”

To provide further information in response to the Staff’s comment, the compensation discussion in Schedule 14A could have been expanded in 2012 as follows:

“In recognition of her leadership to the accounting and finance areas, participation in marketing and operations and providing leadership for Korea, and in particular with respect to the Seungwon acquisition, Ms. Fulton was awarded 8,100 shares. Having assumed the leadership role of operations in Sarasota, been key in driving productivity gains and his overall leadership of the Company, Mr. Twitty was awarded 8,100 shares. Mr. Hancox has successfully managed the leadership transition in the U.K. and is providing leadership in Europe and was awarded 6,000 shares.”

Sun Hydraulics Corporation acknowledges the following:

• | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

• | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

• | The Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

The Company believes that the foregoing responds fully to each of the questions in the Staff’s September 4, 2013, Comment Letter. Please advise us if you have any questions about our responses.

Respectfully submitted,

SUN HYDRAULICS CORPORATION

By: /s/ Tricia L. Fulton

Tricia L. Fulton

Chief Financial Officer

cc: Allen Carlson, Chief Executive Officer, Sun Hydraulics Corporation

Gregory C. Yadley, Esq., Shumaker, Loop & Kendrick, LLP

7

Example of Daily Orders Report

Incoming Orders Summary for 12/11/2012 to 12/11/2012

Nbr of Orders | Qty | Net Amount | |||||

Type Code | Domestic | ||||||

Customer Type | TC Trade-Distributor, Canada | ||||||

DIST1 | DIST1 | 9 | 249 | 8,140.12 | |||

DIST2 | DIST2 | 5 | 5 | (1,064.64 | ) | ||

DIST3 | DIST3 | 5 | 1,408 | 66,541.78 | |||

DIST4 | DIST4 | 2 | 10 | 329.52 | |||

DIST5 | DIST5 | 1 | 11 | 1,443.21 | |||

DIST6 | DIST6 | 1 | 20 | 185.85 | |||

Total | (23 Orders) | 1,703 | 75,575.84 | 75,575.84 | |||

Customer Type | TD Trade-Distributor, Domestic | ||||||

DIST7 | DIST7 | 9 | 121 | 5,534.20 | |||

DIST8 | DIST8 | 1 | (2 | ) | (92.27 | ) | |

DIST9 | DIST9 | 1 | (6 | ) | (199.68 | ) | |

DIST10 | DIST10 | 1 | 116 | 8,779.66 | |||

DIST11 | DIST11 | 7 | 78 | 5,491.14 | |||

DIST12 | DIST12 | 9 | 519 | 26,849.87 | |||

DIST13 | DIST13 | 1 | 5 | 18.25 | |||

DIST14 | DIST14 | 6 | 64 | 10,114.81 | |||

DIST15 | DIST15 | 1 | 4 | 138.18 | |||

DIST16 | DIST16 | 2 | 14 | 715.24 | |||

DIST17 | DIST17 | 5 | 50 | 6,084.20 | |||

DIST18 | DIST18 | 12 | 77 | 6,546.34 | |||

DIST19 | DIST19 | 16 | 645 | 31,692.85 | |||

DIST20 | DIST20 | 3 | 73 | 2,092.41 | |||

DIST21 | DIST21 | 2 | 12 | 2,543.56 | |||

DIST22 | DIST22 | 2 | 3 | 169.43 | |||

DIST23 | DIST23 | 4 | 103 | 6,918.00 | |||

DIST24 | DIST24 | 2 | 112 | 6,371.04 | |||

DIST25 | DIST25 | 1 | 4 | 256.88 | |||

DIST26 | DIST26 | 3 | 6 | 1,062.99 | |||

Total | (88 Orders) | 1,998 | 121,087.10 | ||||

Customer Type | TM Trade-Distributor, Mexico | ||||||

DIST27 | DIST27 | 1 | 2 | 238.56 | |||

DIST28 | DIST28 | 1 | 1 | 302.13 | |||

Total | (2 Orders) | 3 | 540.69 | ||||

8

Customer Type | TN Trade-NFPA/Other | ||||||

CUST1 | CUST1 | 1 | 2 | 171.2 | |||

CUST2 | CUST2 | 1 | 3 | 145.3 | |||

CUST3 | CUST3 | 1 | 2 | 331.4 | |||

CUST4 | CUST4 | 1 | 1 | 181.14 | |||

CUST5 | CUST5 | 1 | 1 | 319.8 | |||

CUST6 | CUST6 | 1 | 2 | 100.3 | |||

CUST7 | CUST7 | 1 | 14 | 1,887.12 | |||

CUST8 | CUST8 | 1 | 1 | 284.16 | |||

CUST9 | CUST9 | 1 | 145 | 2,432.85 | |||

CUST10 | CUST10 | 1 | 370 | 6,551.90 | |||

CUST11 | CUST11 | 1 | 10 | 103.3 | |||

CUST12 | CUST12 | 1 | 60 | 1,447.80 | |||

CUST13 | CUST13 | 1 | 10 | 821.7 | |||

CUST14 | CUST14 | 3 | 18 | 3,172.80 | |||

Total | (16 Orders) | 639 | 17,950.77 | ||||

Total | Domestic | (129 Orders) | 4,343 | 215,154.40 | |||

9

Type Code | International | ||||||

Customer Type | IG Intercompany-Sun GmbH (Germany) | ||||||

G010 | SUN HYDRAULIK GMBH | 7 | 82 | 6,837.91 | |||

Total | (7 Orders) | 82 | 6,837.91 | ||||

Customer Type | IK Intercompany-Sun Korea | ||||||

P091 | SUN HYDRAULICS KOREA CORP | 1 | 20 | — | |||

Total | (1 Order) | 20 | — | ||||

Customer Type | IL Intercompany-Sun Ltd (UK) | ||||||

J030 | SUN HYDRAULICS LIMITED | 11 | 1,164 | 34,403.66 | |||

Total | (11 Orders) | 1,164 | 34,403.66 | ||||

Customer Type | TF Trade-Distributor/Customer, Foreign | ||||||

CUST15 | CUST15 | 1 | 10 | 80 | |||

CUST16 | CUST16 | 1 | 136 | 3,885.83 | |||

CUST17 | CUST17 | 5 | 31 | 1,752.56 | |||

CUST18 | CUST18 | 1 | 139 | 5,557.73 | |||

CUST19 | CUST19 | 1 | 57 | 1,944.90 | |||

CUST20 | CUST20 | 1 | 18 | 663.63 | |||

CUST21 | CUST21 | 1 | 119 | 5,203.37 | |||

CUST22 | CUST22 | 1 | 2 | 428.14 | |||

CUST23 | CUST23 | 7 | 1,085 | 38,572.13 | |||

CUST24 | CUST24 | 5 | 212 | 8,525.60 | |||

CUST25 | CUST25 | 2 | 4 | 140.02 | |||

CUST26 | CUST26 | 1 | 10 | 391 | |||

CUST27 | CUST27 | 1 | 110 | 3,880.86 | |||

CUST28 | CUST28 | 1 | 86 | 7,327.35 | |||

CUST29 | CUST29 | 1 | 6 | 729.5 | |||

CUST30 | CUST30 | 1 | 4 | 110.24 | |||

CUST31 | CUST31 | 2 | 8 | 793.38 | |||

CUST32 | CUST32 | 3 | 742 | 24,318.95 | |||

CUST33 | CUST33 | 2 | 21 | 781.15 | |||

CUST34 | CUST34 | 1 | 75 | 5,974.00 | |||

Total | (39 Orders) | 2,875 | 111,060.34 | ||||

Total | International | (58 Orders) | 4,141 | 152,301.91 | |||

Grand | (187 Orders) | 8,484 | 367,456.31 | ||||

10

Example of Weekly Orders Report

Incoming Orders Summary for 12/9/2012 to 12/15/2012

Nbr of Orders | Qty | Net Amount | |||||

Type Code | |||||||

Customer Type | |||||||

CUST1 | CUST1 | 2 | 3 | 935.99 | |||

Total | (2 Orders) | 3 | 935.99 | ||||

Total | (2 Orders) | 3 | 935.99 | ||||

Type Code | Domestic | ||||||

Customer Type | TC Trade-Distributor, Canada | ||||||

DIST1 | DIST1 | 16 | 264 | 7,740.25 | |||

DIST2 | DIST2 | 19 | 3,103 | 80,171.65 | |||

DIST3 | DIST3 | 22 | 1,911 | 86,438.23 | |||

DIST4 | DIST4 | 7 | 218 | 19,748.34 | |||

DIST5 | DIST5 | 5 | 65 | 3,705.60 | |||

DIST6 | DIST6 | 5 | 659 | 22,345.03 | |||

Total | (74 Orders) | 6,220 | 220,149.10 | ||||

Customer Type | TD Trade-Distributor, Domestic | ||||||

DIST7 | DIST7 | 58 | 824 | 49,847.63 | |||

DIST8 | DIST8 | 11 | 46 | 3,882.24 | |||

DIST9 | DIST9 | 22 | 2,041 | 70,931.66 | |||

DIST10 | DIST10 | 8 | 203 | 23,293.74 | |||

DIST11 | DIST11 | 51 | 1,316 | 67,739.32 | |||

DIST12 | DIST12 | 32 | 1,799 | 77,111.54 | |||

DIST13 | DIST13 | 5 | 381 | 19,648.49 | |||

DIST14 | DIST14 | 22 | 2,188 | 101,894.86 | |||

DIST15 | DIST15 | 30 | 2,939 | 136,430.04 | |||

DIST16 | DIST16 | 18 | 327 | 15,719.66 | |||

DIST17 | DIST17 | 59 | 4,269 | 159,761.56 | |||

DIST18 | DIST18 | 69 | 2,825 | 166,103.26 | |||

DIST19 | DIST19 | 87 | 3,419 | 206,389.50 | |||

DIST20 | DIST20 | 3 | 241 | 11,970.92 | |||

DIST21 | DIST21 | 14 | 696 | 19,456.57 | |||

DIST22 | DIST22 | 18 | 611 | 29,383.48 | |||

DIST23 | DIST23 | 28 | 1,001 | 40,313.17 | |||

DIST24 | DIST24 | 14 | 213 | 12,634.38 | |||

DIST25 | DIST25 | 27 | 1,324 | 68,727.67 | |||

DIST26 | DIST26 | 7 | 564 | 21,180.72 | |||

DIST27 | DIST27 | 12 | 1,634 | 48,936.82 | |||

DIST28 | DIST28 | 16 | 743 | 49,271.22 | |||

Total | (611 Orders) | 29,604 | 1,400,628.45 | ||||

11

Customer Type | TM Trade-Distributor, Mexico | ||||||

DIST29 | DIST29 | 2 | 9 | 817.2 | |||

DIST30 | DIST30 | 5 | 203 | 7,069.08 | |||

Total | (7 Orders) | 212 | 7,886.28 | ||||

Customer Type | TN Trade-NFPA/Other | ||||||

CUST1 | CUST1 | 1 | 20 | 226.6 | |||

CUST2 | CUST2 | 3 | 108 | 4,049.26 | |||

CUST3 | CUST3 | 2 | 2 | 171.2 | |||

CUST4 | CUST4 | 1 | 1 | — | |||

CUST5 | CUST5 | 4 | 85 | 3,527.69 | |||

CUST6 | CUST6 | 1 | 2 | 331.4 | |||

CUST7 | CUST7 | 2 | 61 | 3,097.48 | |||

CUST8 | CUST8 | 2 | 2 | 599.69 | |||

CUST9 | CUST9 | 2 | 3 | 622.67 | |||

CUST10 | CUST10 | 1 | 1 | 185.73 | |||

CUST11 | CUST11 | 1 | 1 | 181.14 | |||

CUST12 | CUST12 | 2 | 2 | 456.13 | |||

CUST13 | CUST13 | 2 | 4 | 219.81 | |||

CUST14 | CUST14 | 3 | 7 | 408.1 | |||

CUST15 | CUST15 | 1 | 2 | 115.32 | |||

CUST16 | CUST16 | 1 | 16 | 2,747.84 | |||

CUST17 | CUST17 | 2 | 20 | 2,928.36 | |||

CUST18 | CUST18 | 1 | 50 | 2,075.00 | |||

CUST19 | CUST19 | 1 | 1,520 | 38,491.80 | |||

CUST20 | CUST20 | 1 | 275 | 6,058.25 | |||

CUST21 | CUST21 | 2 | 2 | 376.36 | |||

CUST22 | CUST22 | 1 | 145 | 2,432.85 | |||

CUST23 | CUST23 | 2 | 590 | 11,927.40 | |||

CUST24 | CUST24 | 2 | 16 | 1,613.94 | |||

CUST25 | CUST25 | 1 | 10 | 103.3 | |||

CUST26 | CUST26 | 12 | 672 | 22,995.60 | |||

CUST27 | CUST27 | 1 | 100 | 4,555.00 | |||

CUST28 | CUST28 | 4 | 36 | 2,236.12 | |||

CUST29 | CUST29 | 1 | 6 | 150.66 | |||

CUST30 | CUST30 | 5 | 20 | 3,470.50 | |||

CUST31 | CUST31 | 1 | 245 | 12,038.70 | |||

CUST32 | CUST32 | 1 | 30 | 1,425.60 | |||

Total | (67 Orders) | 4,054 | 129,819.50 | ||||

Total | Domestic | (759 Orders) | 40,090 | 1,758,483.33 | |||

12

Type Code | International | ||||||

Customer Type | IG Intercompany-Sun GmbH (Germany) | ||||||

G010 | SUN HYDRAULIK GMBH | 84 | 6,363 | 142,505.99 | |||

Total | (84 Orders) | 6,363 | 142,505.99 | ||||

Customer Type | IK Intercompany-Sun Korea | ||||||

P091 | SUN HYDRAULICS KOREA CORP | 3 | 67 | 5,073.92 | |||

Total | (3 Orders) | 67 | 5,073.92 | ||||

Customer Type | IL Intercompany-Sun Ltd (UK) | ||||||

J030 | SUN HYDRAULICS LIMITED | 34 | 8,400 | 128,287.18 | |||

Total | (34 Orders) | 8,400 | 128,287.18 | ||||

Customer Type | TF Trade-Distributor/Customer, Foreign | ||||||

CUST33 | CUST33 | 7 | 292 | 9,077.56 | |||

CUST34 | CUST34. | 4 | 880 | 26,108.89 | |||

CUST35 | CUST35 | 8 | 59 | 2,288.55 | |||

CUST36 | CUST36 | 1 | 37 | 1,579.23 | |||

CUST37 | CUST37 | 3 | 189 | 8,949.24 | |||

CUST38 | CUST38 | 5 | 354 | 11,185.10 | |||

CUST39 | CUST39 | 3 | 285 | 17,968.19 | |||

CUST40 | CUST40 | 1 | 3 | 185.9 | |||

CUST41 | CUST41 | 1 | 1 | 229.3 | |||

CUST42 | CUST42 | 2 | 18 | 642.45 | |||

CUST43 | CUST43 | 2 | 230 | 10,940.35 | |||

CUST44 | CUST44 | 2 | 119 | 4,236.39 | |||

CUST45 | CUST45 | 1 | 3 | 392.21 | |||

CUST46 | CUST46 | 1 | — | 30 | |||

CUST47 | CUST47 | 3 | 2,098 | 51,907.89 | |||

CUST48 | CUST48 | 8 | 478 | 15,991.88 | |||

CUST49 | CUST49 | 17 | 1,183 | 44,393.36 | |||

CUST50 | CUST50 | 1 | 125 | 3,287.11 | |||

CUST51 | CUST51 | 11 | 854 | 43,868.84 | |||

CUST52 | CUST52 | 5 | 3,648 | 88,176.76 | |||

CUST53 | CUST53 | 12 | 87 | 2,983.29 | |||

CUST54 | CUST54 | 4 | 247 | 8,199.78 | |||

CUST55 | CUST55 | 2 | 95 | 7,680.22 | |||

CUST56 | CUST56 | 5 | 430 | 24,481.85 | |||

CUST57 | CUST57 | 4 | 12 | 1,103.29 | |||

CUST58 | CUST58 | 21 | 1,434 | 56,216.83 | |||

CUST59 | CUST59 | 2 | 13,940 | 376,292.73 | |||

CUST60 | CUST60 | 15 | 4,426 | 115,679.85 | |||

CUST61 | CUST61 | 3 | 34 | 1,545.70 | |||

CUST62 | CUST62 | 1 | 75 | 5,974.00 | |||

Total | (155 Orders) | 31,636 | 941,596.74 | ||||

Total | International | (276 Orders) | 46,466 | 1,217,463.83 | |||

Grand | (1037 Orders) | 86,559 | 2,976,883.15 | ||||

13

Example of Monthly Orders Report

14

Example of Quarterly Sales Report

Worldwide Sales Into Each Region | |||||||||||||||

2012 vs. 2011 | |||||||||||||||

Dollars in Millions | |||||||||||||||

Q4 2012 | Q4 2011 | Q4 - 2012 vs.2011 | |||||||||||||

Increase/(Decrease) | |||||||||||||||

Region | $ | % | |||||||||||||

North America Total | $ | 22.9 | $ | 23.0 | $ | (0.1 | ) | (0.4 | )% | ||||||

Europe Total | 12.1 | 13.2 | (1.1 | ) | (8.3 | )% | |||||||||

Asia Total | 6.8 | 7.6 | (0.9 | ) | (11.8 | )% | |||||||||

Australia/ N.Z. Total | 0.8 | 1.0 | (0.2 | ) | (19.5 | )% | |||||||||

Africa Total | 0.4 | 0.3 | 0.1 | 34 | % | ||||||||||

South America Total | 0.3 | 0.5 | (0.2 | ) | (39.7 | )% | |||||||||

Miscellaneous Total | — | — | — | — | % | ||||||||||

Grand Total | $ | 43.2 | $ | 45.7 | $ | (2.4 | ) | (5.3 | )% | ||||||

15