As filed with the Securities and Exchange Commission on April 13, 2017

Registration No. 333-215922

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

Amendment

No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

_________________

Commission file number: 000-22563

SG BLOCKS, INC.

(Exact name

of registrant as specified in its charter)

|

Delaware |

|

5030 |

|

95-4463937 |

|

(State or other jurisdiction of |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

195 Montague Street,

14th

Floor, Brooklyn, NY

11201

(Address of registrant’s principal executive

offices, including zip code)

(646)

240-4235

(Registrant’s telephone number, including

area code)

_________________

Paul M. Galvin

SG Blocks, Inc.

195 Montague Street, 14th

Floor

Brooklyn, NY 11201

(646) 240-4235

(Name, address, including zip code and

telephone number, including area code, of agent for service)

_________________

|

Copies to: |

||

|

David

D. Watson |

|

Barry

I. Grossman, Esq. |

_________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨ |

|

Accelerated filer ¨ |

|

Non-accelerated filer ¨ |

|

Smaller reporting company x |

|

(Do not check if a smaller reporting company) |

|

|

CALCULATION OF REGISTRATION FEE

Title of each class of securities to be registered |

|

Proposed |

|

Amount

of |

||

Common Stock, par value $0.01 per share |

|

$ |

13,800,000 |

|

$ |

1,599.42 |

Representative’s Warrant(4) |

|

|

— |

|

|

— |

Common

Stock, par value $0.01 per share, underlying |

|

$ |

862,500 |

|

$ |

99.96 |

Total |

|

$ |

14,662,500 |

|

$ |

1,699.38 |

____________

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of additional shares that the underwriter has the option to purchase.

(2) Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

(3) Includes offering price of shares of common stock that may be sold if the over-allotment option granted to the underwriter is exercised.

(4) No fee pursuant to Rule 457(g) of the Securities Act of 1933, as amended.

(5) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g). The proposed maximum aggregate offering price of the shares underlying the representative’s warrant is $862,500, which is equal to 125% of $690,000 (5% of $13,800,000).

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the Registration Statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS |

|

SUBJECT TO COMPLETION |

|

DATED APRIL 13, 2017 |

Shares

Common Stock

SG Blocks, Inc.

This is a public offering of shares of common stock of SG Blocks, Inc.

We are offering shares of common stock $0.01 par value per share. It is currently estimated that the public offering price per share will be between $ and $ . We intend to list our common stock on The Nasdaq Capital Market under the symbol “SGBX.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page 8 to read about factors you should consider before buying shares of our common stock.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

|

|

|

Price

to |

|

Underwriting |

|

Proceeds to |

|||

|

Per Share |

|

$ |

|

|

$ |

|

|

$ |

|

|

Total |

|

$ |

|

|

$ |

|

|

$ |

|

____________

(1) See “Underwriting” for additional information regarding total underwriter compensation.

We have granted the underwriter a 45-day option to purchase up to additional shares of common stock at the public offering price less the underwriting discount solely to cover over-allotments, if any. If the underwriter exercises this option in full, the total underwriting discounts and commissions will be $ , and the additional proceeds to us, before expenses, from the over-allotment option exercise will be $ .

Delivery of the shares of common stock will be made on or about , 2017.

Joseph Gunnar & Co.

Prospectus dated , 2017

Table of Contents

Through and including , 2017 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for and can provide no assurance as to the reliability of any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

For investors outside the United States: Neither we nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering and the distribution of this prospectus outside of the United States.

i

This prospectus includes statistical and other industry and market data that we obtained from our own internal estimates, industry publications and research, surveys, and studies conducted by third parties. Industry publications and third-party research, surveys, and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys, and studies are reliable, we have not independently verified such data. Accordingly, you are cautioned not to give undue weight to such information.

Our registered trademarks include SGBlocks®. All other registered trademarks or service marks appearing in this prospectus are trademarks or service marks of others.

ii

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes.

As used in this prospectus, unless the context otherwise requires, references to “SGB,” “the Company,” “we,” “us,” and “our” refer to SG Blocks, Inc. and its subsidiaries, as the context requires.

Description of Business

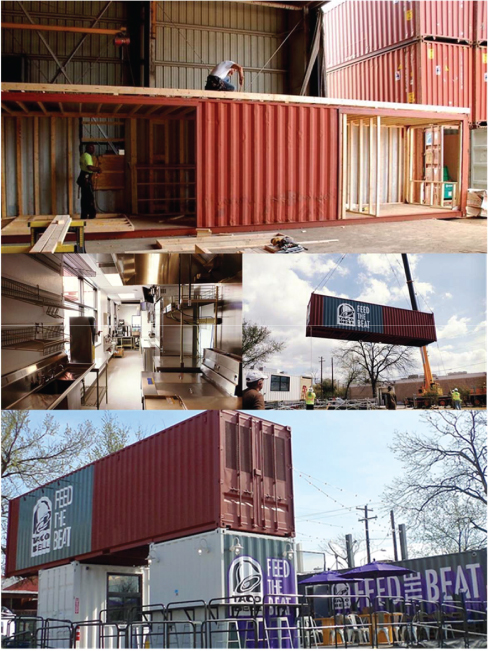

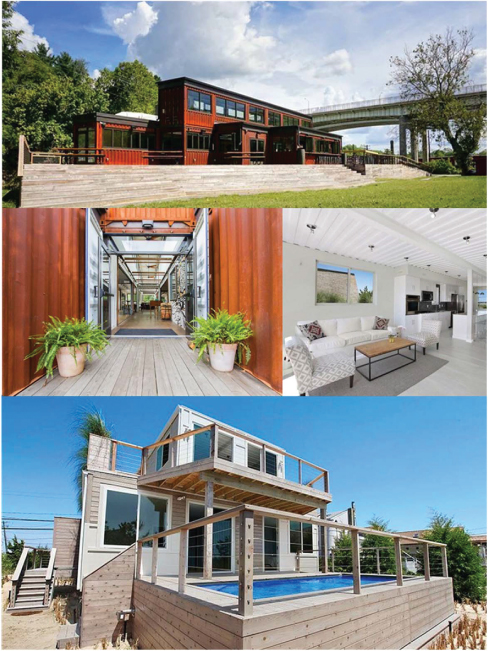

SGB is in the business of modifying cargo shipping containers for use in construction. SGB takes existing steel shipping containers and repurposes them into modules that can be stacked, arranged, or configured to fit any construction application. The use of these repurposed shipping containers, which we refer to as “SG BlocksTM,” allows owners design flexibility and greater construction efficiency than traditional methods of construction. SG BlocksTM also have a particular application in meeting safe and sustainable housing needs, especially in hurricane- and earthquake-prone areas.

Once retained for a construction project, SGB selects shipping containers it determines to be appropriate for the customer’s application, and then redesigns and re-engineers the shipping containers to be configured for that particular use. These configurations often require structural changes, such as wall reconfigurations, the addition of door and window openings, and ceiling operations. Configurations can also include interior pre-finish modularization.

We only use containers which bear an approval plate from the International Convention for Safe Containers (the “CSC”) when creating an SG BlockTM. The CSC approval plate confirms that the containers were originally fabricated in compliance with the CSC, and have been demonstrably maintained to that standard. Using solely CSC certified containers provides us with an assurance that the specific containers that we use will be strong enough for use in construction applications. In addition to ensuring that all of our containers have a CSC approval plate, before selection as an SG BlockTM, every container is inspected for structural damage, out-of-plane dents, warping, water tightness, and overall condition.

Our use of SG BlocksTM is consistent with sustainable or “green” building practices intended to conserve natural resources and reduce impact on the environment. As a repurposed shipping container, an SG BlockTM reuses existing materials in a way that is more efficient than construction made of new steel or wood. It also saves the energy that would otherwise be used to recycle the container into new steel products. SGB considers being a “green” construction option one of the many competitive advantages it offers over traditional construction methods and practices.

SGB’s products have been featured in reports by several leading media outlets, including Fortune, NY Times, NY Post, USA Today, CNN, Washington Post, ABC World News, NBC Nightly News, and Bob Vila. SGB has completed projects for: the United States (“U.S.”) Army, U.S. Navy, U.S. Department of Veteran Affairs, U.S. Southern Command, The City of Santa Monica, The City of Jacksonville, Port of Houston Authority, Aman Resorts, BareBurger, Equinox, HGTV, Lacoste, Marriott Hotels & Resorts, Mini Cooper, Oracle Team USA, Puma, Schneider Electric, Starbucks Coffee, Taco Bell, and Youngwoo & Assoc. LLC.

Target Markets

SGB sells its product throughout the United States. The market for new construction in North America in 2015 was $136 billion. The Modular Building Institute estimated that, in 2015, new permanent modular

1

buildings accounted for $3.7 billion, or 2.7%, of this market.1 SGB believes that SG BlocksTM have a particular application in a number of segments, including:

• Multi-Family Housing

We believe the use of SG BlocksTM can be an attractive option in the market for construction of multi-family housing units.

• Restaurants/Quick Service Restaurants

With our previous experience, we believe that we have the opportunity of leveraging our advantages in cost and speed of construction to build revenue in the restaurant sector.

• Military

We have been able to capture a portion of military construction spending with both permanent build and mobile units. We will continue to expand our relationship with the military, as we believe SG BlocksTM present a practical logistics solution to a large number of military construction needs both in the U.S. and abroad.

• Education

We believe our product can capture a portion of education construction due to our ability to rapidly construct new educational buildings, including student housing, and expand existing educational buildings with minimal site disruption.

• Other markets for expansion

Below are additional sectors we believe have great growth potential for the SG BlocksTM product:

o Electrical and Systems Enclosures

o Office/Commercial

o Hospitality and Entertainment

o Warehouse/Public Storage

o Shopping/Retail Centers

o Athletic Facilities and Support Structures

o Reclamation/Drop Off Centers

o Medical

Our Competitive Strengths

The construction industry is highly competitive. However, SGB believes in the benefits of its technology and views the SG BlocksTM product as complementary to traditional construction methods and not necessarily as competition. There are applications in the construction industry which uniquely lend themselves to the use of SGB’s products, and SGB intends to compete vigorously in those areas.

SGB distinguishes itself on the basis of cost and construction time. The use of SG BlocksTM as a construction method can be less expensive than traditional construction methods, particularly in urban locations and multi-story projects, and construction time can also be reduced. The flexibility of SG BlocksTM construction allows architects, developers, and owners to be more creative and efficient.

In addition, SG BlocksTM are designed to be more durable than traditional construction methods in hurricane, tornado, and blast conditions, and to withstand harsh climates. SGB’s primary focus is on structural integrity and engineering, while still allowing clients to achieve their architectural design.

____________

1 http://www.modular.org/documents/Modular_Advantage/ModularAdvantage_Pub_3-Q_DIGITAL.pdf#28

2

ESR Approval

Effective April 2017, the ICC Evaluation Service, LLC (“ICC-ES”), a subsidiary of the International Code Council (“ICC”), granted SGB an Evaluation Service Report (“ESR”) for the SG Blocks structural building materials. The ICC-ES publishes ESRs to inform the consumer, commercial and residential markets that the specific product listed in the report complies with certain code requirements and indicates, among other things, the requirements or acceptance criteria used to evaluate the product, how the product should be installed to meet the requirements, and how to identify the product. We believe SGB’s ESR will significantly expedite reviews and approvals by building departments and help the SG Blocks™ concept become mainstream and more widely accepted in the construction industry. We also believe the ESR will make it more difficult for other companies in the industry to compete with us because the quality control and design acceptance criteria are specific to SGB and our associated facilities and partners.

Risks Associated with Our Business and this Offering

Since our inception, we have incurred substantial losses. Our business and our ability to execute our business strategy are subject to a number of risks of which you should be aware before making an investment decision. Among these important risks are the following:

• The Company emerged from bankruptcy on June 30, 2016. In connection with the emergence, the Company issued debentures in the principal amount of $2.5 million. In November 2016, the Company issued additional debentures in the principal amount of $937,500. If the Company is unable to generate sufficient funds or obtain replacement financing in order to repay the debentures, the debenture holders could commence legal action against us and foreclose on all of our assets to recover the amounts due. 50% of the Company issued debentures will convert into 458,334 shares of common stock to be issued to Hillair Capital Investments L.P. (“HCI”) simultaneously with the effective date of the Company’s offering. In addition, the Company expects to use a portion of the proceeds from the offering to pay off the balance of the remaining debt to HCI.

• The Company’s ability to continue as a going concern is contingent upon it being able to secure an adequate amount of debt or equity capital to enable it to meet its cash requirements. If we are unable to secure additional financing, further reductions in operating expenses might need to be substantial in order for us to ensure enough liquidity to sustain our operations.

• We have incurred net losses in prior periods, and as we execute our growth strategy in the future, there can be no assurance that we will generate income. The Company’s net loss from operations for the six months ended December 31, 2016 since emergence from bankruptcy was $(1,306,576) and for the six months ended June 30, 2016 before emergence from bankruptcy was $(664,737). We are unable to predict the extent of any future losses or if or when we will become profitable.

• We have a significant concentration of stock ownership. As of April 7, 2017, our directors and officers collectively owned approximately 68.6% of our common stock. These stockholders have significant influence over the outcome of corporate actions requiring stockholder approval and the interests of our majority stockholders may not be the same as or may even conflict with investors’ interests.

For a more detailed discussion of these risks, please see the section entitled “Risk Factors” of this prospectus.

3

Corporate Information

Our principal executive office is located at 195 Montague Street, 14th Floor, Brooklyn, NY 11201, and our telephone number is (646) 240-4235. We maintain a website at www.sgblocks.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus.

We operate under our United States registered trademark “SGBlocks®.” This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus may appear with or without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks, or service marks to imply a relationship with, or endorsement or sponsorship by us of or of us by, any such companies.

4

The Offering

|

Common stock offered by us |

|

shares (or shares if the underwriter exercises its option to purchase additional shares in full). |

|

|

|

|

|

Common stock to be outstanding immediately after this offering |

|

|

|

|

|

|

|

Over-allotment option |

|

We have granted the underwriters a 45-day option to purchase up to an additional offered securities at the public offering price to cover over-allotments, if any. |

|

|

|

|

|

Use of proceeds |

|

We estimate that the net proceeds to us from

this offering, after deducting the underwriting discount and

estimated expenses, will be approximately

$ million, assuming

a public offering price of

$ per share, the

midpoint of the estimated price range set forth on the cover of

this prospectus. We intend to use the net proceeds from this offering for general corporate purposes, including working capital and capital expenditures, such as manufacturing integration and product expansion into new markets, and to repay the remaining portion of the Company’s outstanding debt to HCI. See “Use of Proceeds.” |

|

|

|

|

|

Dividend policy |

|

We currently expect to retain future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. The declaration and payment of any dividends in the future will be at the discretion of our Board of Directors and will depend on a number of factors, including our earnings, capital requirements, overall financial condition, and contractual restrictions. See “Dividend Policy.” |

|

|

|

|

|

Proposed symbol for trading on the Nasdaq Capital Market |

|

|

|

|

|

|

|

Risk Factors |

|

See “Risk Factors” elsewhere in this prospectus for a discussion of risks you should carefully consider before deciding whether to invest in our common stock. |

The number of shares of common stock that will be outstanding after this offering is based on shares of our common stock outstanding as of April , 2017 (including 458,334 shares that we will issue upon effectiveness of this Registration Statement to HCI upon conversion of certain outstanding indebtedness) and excludes (i) 893,599 shares of common stock issuable upon the exercise of options outstanding as of April , 2017 under the SG Blocks, Inc. Stock Incentive Plan and (ii) 458,333 shares of common stock issuable upon conversion of outstanding indebtedness as of April , 2017, which indebtedness will be repaid with proceeds from the offering.

Unless otherwise indicated, the information in this prospectus assumes:

• a 1-for-3 reverse stock split of our common stock and preferred stock, effected on February 28, 2017;

• the conversion of all preferred shares into 1,801,670 shares of common stock, which will occur prior to this offering;

• the conversion of 50% of outstanding convertible debentures into 458,334 shares of common stock to be issued to HCI;

• a public offering price of $ per share of common stock, the midpoint of the estimated price range set forth on the cover of this prospectus; and

• no exercise by the underwriter of its option to purchase up to additional shares of common stock to cover over-allotments, if any.

5

Summary Consolidated Financial and Other Data

The following table presents summary consolidated financial and other data for the periods and at the dates indicated. The consolidated statement of operations for the two fiscal years ended December 31, 2016 and December 31, 2015 and the consolidated balance sheet data as of December 31, 2016 and December 31, 2015 have been derived from audited consolidated financial statements included elsewhere in this prospectus.

The historical results presented below are not necessarily indicative of the results to be expected for any future period. The following summaries of our consolidated financial and operating data for the periods presented should be read in conjunction with “Risk Factors,” “Selected Consolidated Financial and Operating Data,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes, which are included elsewhere in this prospectus.

|

|

|

Predecessor – Year Ended |

|

Predecessor – |

|

Successor – |

||||||

|

Statements of Operations Data(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

2,405,784 |

|

|

$ |

1,056,223 |

|

|

$ |

868,166 |

|

|

Costs and expenses |

|

|

3,851,106 |

|

|

|

1,833,437 |

|

|

|

1,915,774 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(1,445,322 |

) |

|

|

(777,214 |

) |

|

|

(1,047,608 |

) |

|

Loss on extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Change in fair value of financial instruments |

|

|

646,671 |

|

|

|

— |

|

|

|

119,510 |

|

|

Interest expense |

|

|

(1,944,487 |

) |

|

|

(429,017 |

) |

|

|

(267,517 |

) |

|

Interest income |

|

|

22 |

|

|

|

8 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reorganization items |

|

|

— |

|

|

|

541,486 |

|

|

|

(110,768 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,743,116 |

) |

|

$ |

(664,737 |

) |

|

$ |

(1,306,576 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(0.06 |

) |

|

$ |

(0.01 |

) |

|

$ |

(7.97 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42,918,927 |

|

|

|

42,918,927 |

|

|

|

163,786 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

$ |

3,728 |

|

|

$ |

1,629 |

|

|

$ |

293,184 |

|

6

|

|

Predecessor

– |

|

Successor

– |

|||

Balance Sheet Data |

|

|

|

|

|

|

|

Cash and cash equivalents and short-term investments |

|

$ |

497,000 |

|

|

$ |

579,117 |

Total current assets |

|

|

741,216 |

|

|

|

981,149 |

Equipment, net |

|

|

7,229 |

|

|

|

5,559 |

Total assets |

|

|

752,345 |

|

|

|

8,736,131 |

Total debt(4) |

|

|

5,611,841 |

|

|

|

2,446,337 |

Total stockholders’ equity (deficiency) |

|

|

(5,879,637 |

) |

|

|

5,433,295 |

____________

(1) SGB emerged from Chapter 11 bankruptcy on June 30, 2016 (the “Effective Date”). Prior to the Effective Date, the Company was authorized to issue 300,000,000 shares of common stock, par value $0.01 (the “Former Common Stock”), of which 42,918,927 shares were issued and outstanding as of June 29, 2016. On the Effective Date, all previously issued and outstanding shares of the Former Common Stock were deemed discharged, cancelled, and extinguished, and, pursuant to the Plan (as defined below), SGB issued, in the aggregate, 163,786 shares of common stock, par value $0.01, on a post-reverse stock split basis (the “New Common Stock”), to the holders of Former Common Stock, representing 7.5% of SGB’s issued and outstanding New Common Stock (on a fully diluted basis taking into account the preferred shares and the options issued to management pursuant to SGB’s bankruptcy plan of reorganization (the “Plan”)). We have adjusted our historical financial statements to retroactively reflect the common stock authorized and outstanding following the Effective Date.

(2) Upon our emergence from bankruptcy, we adopted fresh start accounting in accordance with the requirements of FASB ASC 852, “Reorganizations”. This resulted in our becoming a new entity for financial reporting purposes. At that time, our assets and liabilities were recorded at their fair values as of the Effective Date. The effects of the Plan and our application of fresh start accounting are reflected in our consolidated financial statements as of December 31, 2016. The related adjustments were recorded as reorganization items on June 30, 2016, resulting in a lack of comparability with the consolidated financial statements prior to that date.

(3) Shares outstanding are reflected to give effect to the reverse stock split (excluding 115 additional shares issued to current stockholders as a result of rounding of fractional shares in connection with the reverse stock split).

(4) The December 31, 2015 debt balance includes a $1,247,310 default penalty on convertible debentures and debtor in possession financing of $600,000 and is net of $393,169 discount, which is the fair value of the conversion option in the debenture. The December 31, 2016 debt balance is net of $991,163 discount, which is the fair value of the conversion option in the debenture.

7

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below before making an investment decision. If any of the following risks or uncertainties occur, our business, prospects, financial condition, or operating results could be materially adversely affected, the trading price of our common stock could decline, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes and schedules, before deciding to purchase any shares of our common stock.

We recently emerged from bankruptcy. We refer to the date we emerged from bankruptcy as the “Effective Date.” We refer to the pre-Effective Date common stock of SGB as the “Former Common Stock” and the post-Effective Date common stock of SGB, after giving effect to a recent 1-for-3 reverse stock split, as the “New Common Stock.” The shares outstanding presented throughout this prospectus exclude 115 additional shares issued to current stockholders as a result of rounding of fractional shares in connection with the reverse stock split.

Risks Related to our Emergence from Bankruptcy

Despite having emerged from bankruptcy on June 30, 2016, SGB continues to be subject to the risks and uncertainties associated with residual Chapter 11 bankruptcy proceedings.

SGB emerged from Chapter 11 bankruptcy on June 30, 2016. The ultimate impact this will have on SGB’s business, financial condition, and results of operations cannot be accurately predicted or quantified. During bankruptcy, SGB operated without interruption and paid all creditors in full. However, we cannot assure you that our recent bankruptcy will not adversely affect SGB’s operations going forward.

Risks Relating to SGB

If we are not successful in our efforts to increase sales or raise capital, we will experience a shortfall in cash over the next twelve months, and our ability to raise capital may be limited.

On December 31, 2016, we had cash and cash equivalents of $549,100. On June 30, 2016, prior to our emergence from bankruptcy, we had cash and cash equivalents of $955,803. For the six months ended December 31, 2016, we reported a net loss of $(1,306,576) and for the six months ended June 30, 2016, we reported a net loss of $(664,737). If we are not successful with our efforts to increase sales, we will experience a shortfall in cash over the next twelve months. If there is a shortfall, we may be forced to reduce operating expenses, among other steps, all of which would have a material adverse effect on our operations going forward.

We may also seek to obtain debt or additional equity financing to meet any cash shortfalls. The type, timing, and terms of any financing we may select will depend on, among other things, our cash needs, the availability of other financing sources, and prevailing conditions in the financial markets. However, there can be no assurance that we would be able to secure additional funds if needed and that, if such funds are available, whether the terms or conditions would be acceptable to us. Moreover, the terms of the secured convertible debentures issued to certain investors, which we expect to repay with proceeds from this offering, require that we obtain the consent of such investors prior to our entering into subsequent financing arrangements. If we are unable to secure additional financing, further reduction in operating expenses might need to be substantial in order for us to ensure enough liquidity to sustain our operations. Any equity financing would be dilutive to our stockholders. If we incur additional debt, we will likely be subject to restrictive covenants that significantly limit our operating flexibility and require us to encumber our assets. If we fail to raise sufficient funds and continue to incur losses, our ability to fund our operations, take advantage of strategic opportunities, or otherwise respond to competitive pressures will be significantly limited. Any of the above limitations could force us to significantly curtail or cease our operations, and you could lose all of your investment in our common stock. These circumstances raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might be necessary should we be unable to continue as a going concern.

8

While we expect to use the proceeds from this offering to repay our secured convertible debentures, if we are unable to make such repayment, we may be restricted in our ability to obtain additional financing.

We issued secured convertible debentures on June 30, 2016 and November 17, 2016 that are convertible into shares of our common stock to HCI. See “Our Emergence From Bankruptcy — Exit Financing” and “Certain Relationships and Related Transactions, and Director Independence — Transactions with Hillair Capital Investments L.P.” While we expect that 50% of the outstanding principal amount of the indebtedness will be converted into common stock upon consummation of the offering and that the remaining 50% will be repaid with the proceeds of this offering, we cannot guarantee that this will occur. Under the terms of the secured debentures, we are restricted in our ability to issue additional shares of common stock as long as any portion of the principal or interest on the secured debentures remains outstanding. Specifically, we may not, without the prior consent of the holders of the secured debentures, sell or grant any option to purchase or sell any common stock (or equivalents thereof) entitling a person to acquire shares of common stock at an effective price per share that is lower than the conversion price for such debentures. We are also precluded under the terms of the secured debentures from, among other things, incurring additional indebtedness (other than permitted indebtedness) or granting any third party a security interest in our assets. Our inability, without the secured debenture holders’ consent, to provide a discount on our stock or to grant a security interest could make it difficult to find parties willing to make additional investments in us or to loan us money and therefore could adversely affect our ability to raise additional funds. See “Use of Proceeds” and elsewhere in this prospectus for a description of the Company’s plans with respect to the repayment of part of the HCI debentures and the conversion of the balance into common stock.

The issuance of shares of our common stock upon conversion of the secured convertible debentures or the conversion of our preferred stock will cause immediate and substantial dilution to our existing stockholders.

As discussed elsewhere in this prospectus, prior to this offering, 458,334 shares of common stock will be issued to HCI upon conversion of the outstanding secured convertible debentures and 1,801,670 shares of common stock will be issued upon the conversion of our preferred shares. The issuance of these shares will result in substantial dilution to the interests and voting power of other stockholders.

While we expect to use the proceeds from this offering to repay our secured convertible debentures, if we are unable to make such repayment, and if we are required for any reason to repay our outstanding secured convertible debentures in the future, we would be required to deplete our working capital, if available, or raise additional funds. Our failure to repay the secured convertible debentures, if required, could result in legal action against us, which could require the sale of substantially all of our assets, currently pledged under a uniform commercial code filing in the state of Delaware.

We expect to use the proceeds from this offering to repay the outstanding secured convertible debentures. If we are unable to repay the outstanding secured convertible debentures from the proceeds of this offering, any event of default in our obligations to the holders of the secured convertible debentures, such as our failure to repay the principal when due, our failure to issue shares of common stock upon conversion by the holder, breach of any covenant, representation, or warranty in the securities purchase agreements for such secured convertible debentures or in the secured convertible debentures, or the commencement of a bankruptcy, insolvency, reorganization, or liquidation proceeding against us, could require the early repayment of the secured convertible debentures. If we are required to repay the secured convertible debentures, we would be required to use our limited working capital and raise additional funds. If we were unable to repay the secured debentures when required, the debenture holders could commence legal action against us and foreclose on all of our assets to recover the amounts due, which could cause a severe limit on our operations.

We have incurred net losses in prior periods, and there can be no assurance that we will generate income in the future.

Our ability to achieve profitability will depend upon our ability to generate and sustain substantially increased revenues. We may incur operating losses in the future as we execute our growth strategy. We intend to make significant expenditures related to marketing, expansion of our website, hiring of additional personnel, and development of our technology and infrastructure. The likelihood that we will generate net income in the future must be considered in light of the difficulties facing the construction industry as a whole, economic conditions, and the competitive environment in which we operate. In addition, although we plan to continue increasing our sales and production capacity as part of our growth strategy, projects may not advance beyond the plan design and approval phase due to reasons beyond our control.

9

Our operating results for future periods are subject to numerous uncertainties, and we may not achieve sufficient revenues to sustain or increase profitability.

The Company’s ability to continue as a going concern is contingent upon securing additional capital.

The Company’s independent registered public accounting firm, Whitley Penn LLP, issued a going concern opinion of the Company’s audited financial statements for the year ended December 31, 2016. The Company expects that through the next 10 to 16 months, the capital requirements to fund the Company’s growth and to cover the operating costs of a public company will consume substantially all of the cash flows that it expects to generate from its operations. The Company further believes that during this period, while the Company is focusing on the growth and expansion of its business, the gross profit that it expects to generate from operations may not generate sufficient funds to cover these anticipated operating costs. Accordingly, the Company believes that it will require external funding to sustain operations and to follow through on the execution of its business plan. However, there can be no assurance that the Company’s plans will materialize and/or that the Company will be successful in funding estimated cash shortfalls through additional debt or equity capital and through the cash generated by the Company’s operations. Given these conditions, the Company’s ability to continue as a going concern is contingent upon it being able to secure an adequate amount of debt or equity capital to enable it to meet its cash requirements. In addition, the Company’s ability to continue as a going concern must be considered in light of the problems, expenses and complications frequently encountered by entrants into established markets, the competitive environment in which the Company operates and the current capital raising environment.

The exercise of outstanding options will dilute the percentage ownership of the then-existing stockholders.

As of April 7, 2017, there are outstanding options to purchase 893,599 shares of common stock. The exercise of such options would dilute the then-existing stockholders’ percentage ownership of our stock, and any sales in the public market of common stock underlying such securities could adversely affect prevailing market prices for the common stock. Moreover, the terms upon which we would be able to obtain additional equity capital could be adversely affected because the holders of such securities can be expected to exercise them at a time when we would, in all likelihood, be able to obtain any needed capital on terms more favorable to us than those provided by such securities. See “Executive Compensation — Narrative Disclosure to Summary Compensation Table — Stock Options.”

We are dependent on the services of key personnel, and the unexpected loss of their services may adversely affect our operations.

Our success depends highly upon the personal efforts and abilities of our senior management team, specifically the efforts of Paul Galvin, our Chief Executive Officer; Mahesh Shetty, our Chief Financial Officer; Stevan Armstrong, our President and Chief Operating Officer; and David Cross, our Vice President of Business Development. The Company has entered into employment agreements with Messrs. Galvin, Armstrong, Cross and Shetty. The employment agreements with Messrs. Galvin, Shetty and Armstrong each provide for two year terms. The loss of the services of one or more of these individuals could have a material adverse effect on our business. Our ability to achieve profitability and generate increased revenue will depend upon our ability to retain and, if necessary, attract experienced management personnel.

The loss of one or a few customers could have a material adverse effect on us.

A few customers have in the past, and may in the future, account for a significant portion of our revenues in any one year or over a period of several consecutive years. For example, in 2016, approximately 69% of our revenue was generated from three customers. Although we have contractual relationships with many of our significant customers, our customers may unilaterally reduce or discontinue their contracts with us

10

at any time. The loss of business from a significant customer could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We rely on certain vendors to supply us with materials and products that, if we were unable to obtain, could adversely affect our business.

We have relationships with key materials vendors, including ConGlobal Industries, Inc. (“ConGlobal”), PVE Sheffler, Teton Buildings, and NRB (USA), Inc., and we rely on suppliers for our purchases of products from them. Any inability to obtain materials or services in the volumes required and at competitive prices from our major trading partners, the loss of any major trading partner, or the discontinuation of vendor financing (if any) may seriously harm our business because we may not be able to meet the demands of our customers on a timely basis in sufficient quantities or at all. Other factors, including reduced access to credit by our vendors resulting from economic conditions, may impair our vendors’ ability to provide products in a timely manner or at competitive prices. We also rely on other vendors for critical services such as transportation, supply chain, and professional services. Any negative impacts to our business or liquidity could adversely impact our ability to establish or maintain these relationships.

Risks Relating to our Business

We depend on the availability and skill of subcontractors, their willingness to work with us, and their selection of suitable and quality building materials.

We rely on subcontractors to perform the actual construction of our building projects and, in many cases, to select and obtain raw materials. Despite our detailed specifications and quality control procedures, in some cases, improper construction processes or defective materials may be used to finish construction of our building projects. We may need to spend money to remediate such problems when they are discovered. Defective products widely used by the construction industry can result in the need to perform extensive repairs to large numbers of buildings. Though subcontracts are written to protect us from substandard performance or materials, pervasive problems could adversely affect our business. The cost to us in complying with our warranty obligations in these cases may be significant if we are unable to recover the cost of repair from subcontractors, materials suppliers, and insurers. Further, the timing and quality of our construction depends on the availability and skill of subcontractors. Although we believe that our relationships with our suppliers and subcontractors are good, there can be no assurance that skilled subcontractors will continue to be available at reasonable rates and in the areas in which we conduct our operations. The inability to contract with skilled subcontractors or general contractors at reasonable costs and on a timely basis could limit our ability to construct and deliver buildings and could erode our profit margins and adversely affect our results of operations and cash flows.

We may have difficulty protecting our proprietary manufacturing processes, which could affect our ability to compete.

The Company uses a proprietary manufacturing process which allows us to be code-compliant in our SG BlocksTM product. Such manufacturing process is unique within the construction industry and is important to ensure SGB’s continued success, and we cannot assure you that our efforts to protect our proprietary rights will be sufficient or effective. If other companies replicate our methodology, SGB could lose its competitive advantage. In addition, we currently have one patent application pending for the system and method for conversion of intermodal shipping containers to universal building modules. Specifically, the present invention (Universal Box) relates to prefabricated modular construction of a structure utilizing converted shipping containers. Any pending or future patent or trademark applications may not lead to issued patents and registered trademarks in all instances. The Company also cannot be assured that the scope of any patents issued in the future will be sufficiently broad to offer meaningful protection. Others may develop or patent similar or superior technologies, products, or services, and our intellectual property rights may be challenged, invalidated, misappropriated, or infringed by others. If we are unable to protect and maintain our intellectual property rights, or if there are any successful intellectual property challenges or infringement proceedings against us, our business and revenue could be materially and adversely affected.

11

Expansion of our operations may strain resources, and our failure to manage growth effectively could harm our ability to attract and retain key personnel and adversely impact our operating results.

Increased orders for our product, SG BlocksTM, have placed, and may continue to place, a strain on our operational, financial, and managerial resources and personnel. In addition, execution of our growth strategy will require further substantial capital and effective planning. Significant rapid growth on top of our current operations could greatly strain our internal resources, leading to a lower quality of customer service, reporting problems, and delays, resulting in a loss of market share and other problems that could adversely affect our financial performance. Our efforts to grow could place an additional strain on our personnel, management systems, liquidity, and other resources. If we do not manage our growth effectively, our operations could be adversely affected, resulting in slower, no, or negative growth, critical shortages of cash, and a failure to achieve or sustain profitability.

Our liability for estimated warranties may be inadequate, which could materially adversely affect our business, financial condition, and results of operations.

We are subject to construction defect and warranty claims arising in the ordinary course of business. These claims are common in the construction industry and can be costly. At this time, our third-party providers offer guarantees and warranties in accordance with industry standards that flow through to our clients. A large number of warranty claims could have a material adverse effect on our results of operations.

We can be adversely affected by failures of persons who act on our behalf to comply with applicable regulations and guidelines.

Although we expect all of our associates (i.e., employees), officers, and directors to comply at all times with all applicable laws, rules, and regulations, there are instances in which subcontractors or others through whom we do business may engage in practices that do not comply with applicable regulations or guidelines. It is possible that our associates may become aware of these practices, but do not take steps to prevent them. If we learn of practices relating to buildings constructed on our behalf that do not comply with applicable regulations or guidelines, we will move actively to stop the non-complying practices as soon as possible, and we will take disciplinary action with regard to our associates who were aware of the practices, including, in some instances, terminating their employment. However, regardless of the steps we take, we may be subject to fines or other governmental penalties, and our reputation may be injured.

The cyclical and seasonal nature of the construction industry causes our revenues and operating results to fluctuate, and we expect this cyclicality and seasonality to continue in the future.

The construction industry is highly cyclical and seasonal and is influenced by many international, national, and regional economic factors, including the availability of consumer and wholesale financing, seasonality of demand, consumer confidence, interest rates, income levels, and general economic conditions, including inflation and recessions. As a result of the foregoing factors, our revenues and operating results fluctuate, and we currently expect them to continue to fluctuate in the future. Moreover, we have and may continue to experience operating losses during cyclical downturns in the construction market. These and other economic factors could have a material adverse effect on demand for our products and our financial condition and operating results.

Cyber security risks related to the technology used in our operations and other business processes, as well as security breaches of company, customer, employee, and vendor information, could adversely affect our business.

We rely on various information technology systems to capture, process, store, and report data and interact with customers, vendors, and employees. Despite careful security and controls design, our information technology systems, and those of our third-party providers, could become subject to cyber-attacks. Network, system, and data breaches could result in misappropriation of sensitive data or operational disruptions, including interruption to systems availability and denial of access to and misuse of applications required by our customers to conduct business with us. In addition, sophisticated hardware and operating system software and applications that we procure from third parties may contain defects in design or manufacture,

12

including “bugs” and other problems that could unexpectedly interfere with the operation of the systems. Misuse of internal applications, theft of intellectual property, trade secrets, or other corporate assets, and inappropriate disclosure of confidential information could stem from such incidents. Delayed sales, slowed production, or other repercussions resulting from these disruptions could result in lost sales, business delays, and negative publicity and could have a material adverse effect on our operations, financial condition, or cash flows.

Risks Relating to the Construction Sector

Our customers may be dependent upon third-party financing, and our financial condition and results of operations could be negatively affected if additional third-party financing for our customers does not become available.

Our business and earnings depend substantially on our clients’ ability to obtain financing for the development of their construction projects. The availability and cost of such financing is further dependent on the number of financial institutions participating in the industry, the departure of financial institutions from the industry, the financial institutions’ lending practices, the strength of the domestic and international credit markets generally, governmental policies, and other conditions, all of which are beyond our control. In light of the current economic climate, some of our projects may not be successful in obtaining additional funds in a timely manner, on favorable terms, or at all. The availability of borrowed funds, especially for construction financing, has been greatly reduced, and lenders may require project developers to invest increased amounts of equity in a project in connection with both new loans and the extension of existing loans. Unfavorable changes in the availability and terms of financing in the industry will have a material adverse effect on certain privately financed projects.

Our results of operations also depend on the ability of any potential privately financed customers to obtain loans for the purchase of new buildings. Over the past few years, lenders have tightened the credit underwriting standards, which have reduced lending volumes. If this trend continues, it would negatively impact our sales, which depend in large part on the availability and cost of financing. In addition, where our potential customers must sell their existing buildings or real estate in order to develop new buildings, increases in mortgage costs and/or lack of availability of mortgages could prevent buyers of potential customers’ existing buildings from obtaining the mortgages they need to complete their purchases, which would result in our potential customers’ inability to make purchases from us. If our potential customers cannot obtain suitable financing, our sales and results of operations would be adversely affected.

The construction industry is highly competitive, and such competition may increase the adverse effects of industry conditions.

We operate in a very competitive environment characterized by competition from numerous local, regional, and national builders. We may compete for financing, raw materials, and skilled management and labor resources. A decline in construction starts could adversely affect demand for our buildings and our results of operations. Increased competition could require us to further increase our selling incentives and/or reduce our prices, which could negatively affect our profits.

There can be no assurance that SG BlocksTM or modular construction techniques will achieve market acceptance and grow; thus, the future of our business and the modular construction industry as a whole is uncertain.

There can be no assurance that we will achieve market acceptance for our SG BlocksTM or that the modular construction market will grow. Our business may be disrupted by the introduction of new products and services and is subject to changing consumer preferences and industry trends, which may adversely affect our ability to plan for the future development and marketing of our products. Although SG BlocksTM have particular applications in a wide variety of market segments, there is no assurance that we will be able to expand our relationship within such market segments or, even if we do, that general market acceptance for SG BlocksTM will continue to increase.

13

Government regulations and legal challenges may delay the start or completion of our projects, increase our expenses, or limit our building activities, which could have a negative impact on our operations.

Various domestic and international rules and regulations concerning building, zoning, sales, and similar matters apply to and/or affect the construction industry. Governmental regulation affects construction activities as well as sales activities, mortgage lending activities, and other dealings with consumers. These industries also have experienced an increase in U.S. state and local legislation and regulations that limit the availability or use of land. Municipalities may also restrict or place moratoriums on the availability of utilities, such as water and sewer taps. In some areas, municipalities may enact growth control initiatives, which restrict the number of building permits available in a given year. In addition, we may be required to apply for additional approvals or modify our existing approvals because of changes in local circumstances or applicable law. If governments in locations in which we operate take actions like the ones described, they could adversely affect our business by causing delays, increasing our costs, or limiting our ability to operate in those areas. Further, we may experience delays and increased expenses as a result of legal challenges to our proposed projects, whether brought by governmental authorities or private parties. Failure to comply with laws or regulations applicable to or affecting us, or the passage in the future of new and more stringent laws affecting us, may adversely affect our financial condition or results of operations.

The dangers inherent in our operations and the limits on insurance coverage could expose us to potentially significant liability costs and materially interfere with the performance of our operations.

While we believe our insurance coverage is adequate and in line with our industry’s standards, all construction, including modular construction, involves operating hazards that can cause personal injury or loss of life, severe damage to and destruction of property and equipment, and suspension of operations. The failure of such structures during and after installation can result in similar injuries and damages. Although we believe that our insurance coverage is adequate, there can be no assurance that we will be able to maintain adequate insurance in the future at rates we consider reasonable, or that our insurance coverage will be adequate to cover future claims that may arise. Claims for which we are not fully insured may adversely affect our working capital and profitability. In addition, changes in the insurance industry have generally led to higher insurance costs and decreased availability of coverage. The availability of insurance that covers risks we and our competitors typically insure against may decrease, and the insurance that we are able to obtain may have higher deductibles, higher premiums, and more restrictive policy terms.

Risks Relating to our Common Stock

There has historically been a limited trading market for our common stock, and we cannot assure you that an active trading market will develop for such stock.

Our Former Common Stock was quoted on the Over-The-Counter (“OTC”) Bulletin Board since 1999, but it no longer trades, as such stock no longer exists. Our New Common Stock has not been listed on any exchange and does not trade. We cannot assure you that an active trading market for our common stock will develop or be sustained after this offering. The public offering price for our common stock will be determined by negotiations between the representatives of the underwriters and us. The public offering price may not correspond to the price at which our common stock will trade in the public market subsequent to this offering, and the price of our common stock available in the public market may not reflect our actual financial performance.

Our stock price may be volatile.

After this offering, the market price for our common stock is likely to be volatile, in part because our shares are not currently traded publicly. In addition, the market price of our common stock may fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

• economic and market conditions or trends in our industry or the economy as a whole and, in particular, in the construction industry;

• additions or departures of key personnel;

• sales of our common stock;

14

• operating results that fall below expectations;

• industry developments;

• new laws or regulations or new interpretations of existing laws or regulations applicable to our business;

• material litigation or government disputes;

• the public’s response to press releases or other public announcements by us or third parties, including our filings with the SEC;

• changes in financial estimates or recommendations by any securities analysts who follow our common stock;

• future sales of our common stock by our officers, directors, and significant stockholders; and

• period-to-period fluctuations in our financial results.

In addition, the securities markets have, from time to time, experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. In the past, stockholders have instituted securities class action litigation following periods of market volatility. If we were involved in securities litigation, we could incur substantial costs and our resources and the attention of management could be diverted from our business.

Future sales of our common stock, or the perception in the public markets that these sales may occur, may depress our stock price.

The market price of our common stock could decline significantly as a result of sales of a large number of shares of our common stock in the market after this offering. The sales, or the perception that these sales might occur, could depress the market price. These sales, or the possibility that these sales may occur, also might make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate.

Upon consummation of this offering, we will have shares of common stock outstanding. The shares of common stock offered in this offering will be freely tradable without restriction under the Securities Act of 1933, as amended (the “Securities Act”), except for any shares of common stock that may be held or acquired by our directors, executive officers and other affiliates, the sale of which will be restricted under the Securities Act. In addition, shares subject to outstanding options under the SG Blocks, Inc. Stock Incentive Plan (the “Incentive Plan”) will become eligible for sale in the public market in the future, subject to certain legal and contractual limitations. If our existing stockholders sell substantial amounts of our common stock in the public market, or if the public perceives that such sales could occur, this could have an adverse impact on the market price of our common stock, even if there is no relationship between such sales and the performance of our business.

In connection with, and prior to consummation of, this offering, we and our executive officers, directors, and holders of approximately shares of our common stock, on an as-converted basis, will have each agreed to lock-up restrictions, meaning that we and they and their permitted transferees will not be permitted to sell any shares of our common stock for 180 days (and, in the case of our directors and officers, 365 days) after the date of this prospectus, subject to the exceptions discussed in “Shares Eligible for Future Sale,” without the prior consent of Joseph Gunnar & Co., LLC. Joseph Gunnar & Co., LLC may, in its sole discretion, release all or any portion of the shares of our common stock from the restrictions in any of the lock-up agreements described above. See “Underwriting.”

Also, in the future, we may issue shares of our common stock in connection with investments or acquisitions. The amount of shares of our common stock issued in connection with an investment or acquisition could constitute a material portion of our then-outstanding shares of our common stock.

15

Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval.

Our directors, executive officers, and each of our stockholders who, as of April 7, 2017, owned greater than 5% of our outstanding common stock, beneficially own approximately 89.8% of our common stock. Accordingly, these stockholders will continue to have significant influence over the outcome of corporate actions requiring stockholder approval, including the election of directors, merger, consolidation, or sale of all or substantially all of our assets, or any other significant corporate transaction. The interests of these stockholders may not be the same as or may even conflict with investors’ interests. For example, these stockholders could delay or prevent a change in control of us, even if such a change in control would benefit our other stockholders, which could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of the Company or our assets and might affect the prevailing price of our common stock. The significant concentration of stock ownership may negatively impact the price of our common stock due to investors’ perception that conflicts of interest may exist or arise.

The issuance of additional securities by our Board of Directors (the “Board” or “Board of Directors”) will dilute the ownership interests of our current stockholders and could discourage the acquisition of SGB.

Our Board, without any action by our stockholders, is authorized to designate and issue additional classes or series of capital stock (including classes or series of preferred stock) as it deems appropriate and to establish the rights, preferences, and privileges of such classes or series. The issuance of any new class or series of capital stock would not only dilute the ownership interest of our current stockholders, but may also adversely affect the voting power and other rights of holders of common stock. The rights of holders of preferred stock and other classes of common stock that may be issued may be superior to the rights of the holders of the existing class of common stock in terms of the payment of ordinary and liquidating dividends and voting rights.

In addition, the ability of the Board to designate and issue such undesignated shares could impede or deter an unsolicited tender offer or takeover proposal regarding SGB, and the issuance of additional shares having preferential rights could adversely affect the voting power and other rights of holders of common stock and render more difficult the removal of current management, even if such removal may be in the stockholders’ best interests.

Failure to establish and maintain effective internal controls in accordance with Section 404 of the Sarbanes-Oxley Act of 2002 could have a material adverse effect on our business and stock price.

Rules adopted by the U.S. Securities and Exchange Commission (the “SEC”) pursuant to Section 404 of the Sarbanes-Oxley Act (“Section 404”) require an annual assessment of internal control over financial reporting and, for certain issuers (but not us), an attestation of this assessment by the issuer’s independent registered public accounting firm. During the course of our assessment, we may identify deficiencies that we may not be able to remediate in time to meet our deadline for compliance with Section 404. Testing and maintaining internal controls can divert our management’s attention from other matters that are important to the operation of our business. We also expect the regulations to increase our legal and financial compliance costs, make it more difficult to attract and retain qualified officers and members of our Board of Directors, particularly to serve on the Audit Committee of our Board (the “Audit Committee”), and make some activities more difficult, time consuming, and costly. We may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404, or our independent registered public accounting firm may not be able or willing to issue an unqualified report on the effectiveness of our internal control over financial reporting. If we conclude that our internal control over financial reporting is not effective, we cannot be certain as to the timing of remediation actions and testing or their effect on our operations because there is presently no precedent available by which to measure compliance adequacy.

In connection with its audit report of the Company’s financial statements for the year ended December 31, 2015, Marcum LLP, our former independent registered public accounting firm, communicated to the Company that we did not maintain effective internal controls over financial reporting. Since the date of Marcum’s report, the Company has remedied the deficiencies originally cited by Marcum LLP and will continue to take steps to improve our internal controls to ensure such internal controls are satisfactory.

16

If we are unable to conclude that we have effective internal control over financial reporting, our independent auditors are unable to provide us with an unqualified report as required by Section 404, or we are required to restate our financial statements, we may fail to meet our public reporting obligations and investors could lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock.

We do not expect to pay dividends in the future. Any return on investment may be limited to the value of our common stock.

For the foreseeable future, we intend to retain any earnings to finance the development and expansion of our business, and we do not anticipate paying any cash dividends on our common stock. Any determination to pay dividends in the future will be at the discretion of our Board of Directors and will depend upon results of operations, financial condition, restrictions imposed by applicable law, and other factors our Board of Directors deems relevant. In addition, the 2016 OID Debentures (defined herein), which we expect to repay with the proceeds from this offering, require that HCI be entitled to participate in any dividend or other distribution during the time such debentures remain outstanding, as long as HCI would be deemed to be a holder of common shares on an as-converted basis on the record date for such dividend or distribution. Accordingly, if you purchase shares in this offering, realization of a gain on your investment will depend on the appreciation of the price of our common stock, which may never occur. Investors seeking cash dividends in the foreseeable future should not purchase our common stock.

If securities or industry analysts do not publish research or reports about our business or our industry, or publish negative reports about our business or our industry, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that securities or industry analysts publish about us, our business, our industry, or our competitors. If one or more of the analysts who cover us change their recommendation regarding our stock adversely, change their opinion of the prospects for our company in a negative manner, or provide more favorable relative recommendations about our competitors, our stock price would likely decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

If you purchase shares of common stock sold in this offering, you will incur immediate and substantial dilution.

If you purchase shares of common stock in this offering, you will incur immediate and substantial dilution in the amount of $ per share because the public offering price of $ is substantially higher than the pro forma net tangible book value per share of our outstanding common stock. This dilution is due in large part to the fact that our earlier investors paid substantially less than the public offering price when they purchased their shares. In addition, you may also experience additional dilution upon future equity issuances or the exercise of stock options to purchase common stock granted to our directors, management personnel and consultants under our Incentive Plan. See “Dilution.”

Certain provisions of Delaware law could discourage, delay, or prevent a merger or acquisition at a premium price.

Certain provisions of Delaware law could discourage potential acquisition proposals, delay or prevent a change in control of our company, or limit the price that investors may be willing to pay in the future for shares of our common stock. Because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which prohibits a person who owns in excess of 15% of our outstanding voting stock from merging or combining with us for a period of three years after the date of the transaction in which the person acquired in excess of 15% of our outstanding voting stock, unless the merger or combination is approved in a prescribed manner. Such provisions may discourage, delay, or prevent a merger or acquisition of the Company, including a transaction in which the acquirer may offer a premium price for our common stock.

17

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not enhance the value of our common stock. The failure by our management to apply these funds effectively could delay the development of our product candidates, have a material adverse effect on our business, or cause the price of our common stock to decline. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value. See “Use of Proceeds.”

We intend to apply for listing of our common stock on the Nasdaq Capital Market. If approved for listing, we will be required to meet the Nasdaq Capital Market’s continued listing requirements and other Nasdaq rules, or we may risk delisting. Delisting could negatively affect the price of our common stock, which could make it more difficult for us to sell securities in a future financing or for you to sell your common stock.