UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to 240.14a-12

8x8, Inc.

__________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

______________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

______________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

______________________________________________________________________________________

(5) Total fee paid:

______________________________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

______________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

______________________________________________________________________________________

(3) Filing Party:

______________________________________________________________________________________

(4) Date Filed:

______________________________________________________________________________________

8X8, INC.

NOTICE OF THE 2015 ANNUAL MEETING OF STOCKHOLDERS

JULY 23, 2015

Dear Stockholder:

The 2015 Annual Meeting of Stockholders (the "2015 Annual Meeting") of 8x8, Inc., a Delaware corporation (the "Company"), will be held Thursday, July 23, 2015, at 10:00 a.m., local time, at the corporate offices of the Company at 2125 O'Nel Drive, San Jose, California 95131, for the following purposes:

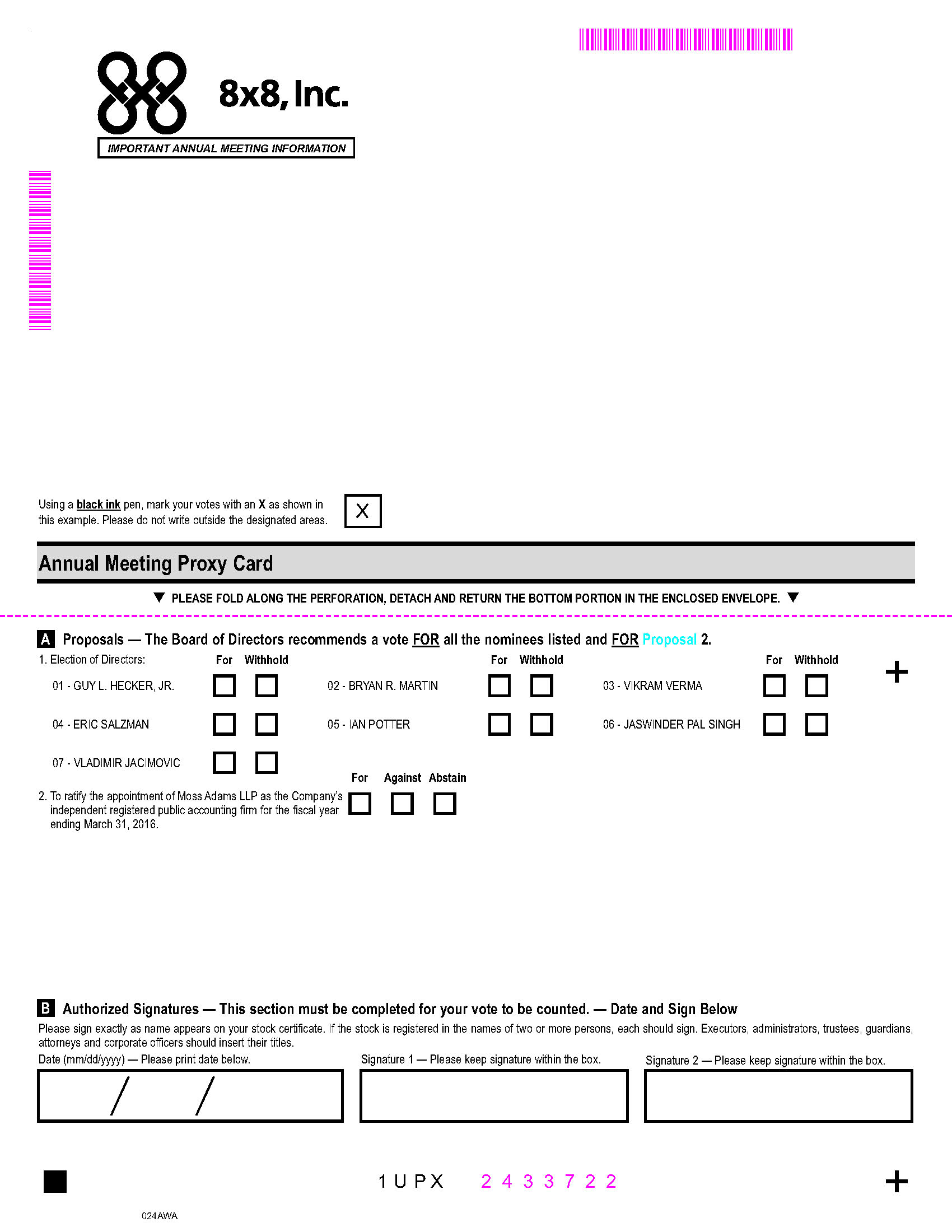

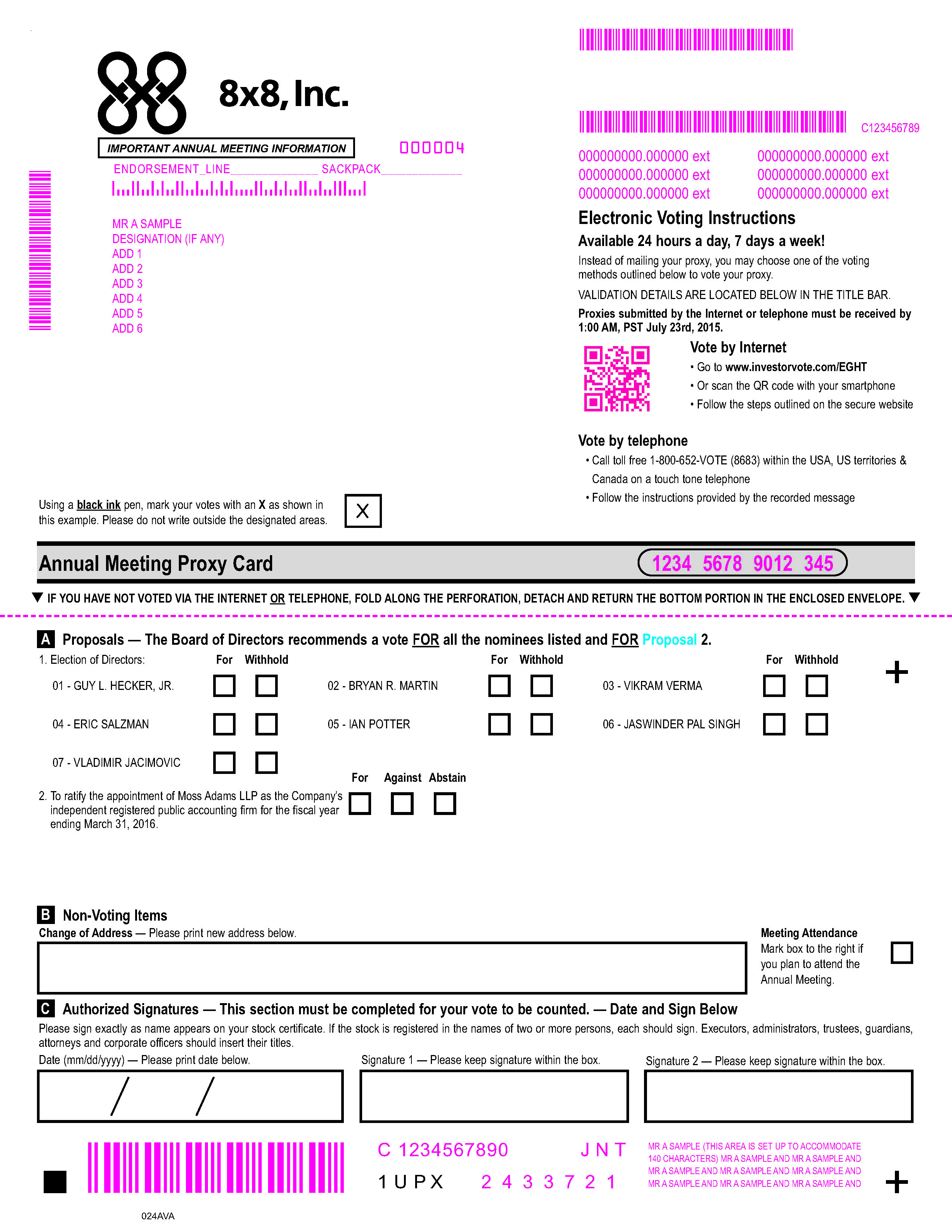

- To elect seven directors to hold office until the 2016 Annual Meeting of Stockholders and until their respective successors have been elected and qualified. The nominees are Bryan R. Martin, Guy L. Hecker, Jr., Vikram Verma, Eric Salzman, Ian Potter, Jaswinder Pal Singh, and Vladimir Jacimovic; and

- To ratify the appointment of Moss Adams LLP as the Company's independent registered public accounting firm for the fiscal year ending March 31, 2016.

These items of business are more fully described in the proxy statement accompanying this notice. Only stockholders of record at the close of business on June 2, 2015, are entitled to notice of and to vote at the 2015 Annual Meeting or at any adjournment or postponement thereof.

All stockholders are cordially invited to attend the 2015 Annual Meeting in person. However, to ensure your representation at the 2015 Annual Meeting, you are urged to vote as promptly as possible. Any stockholder of record attending the 2015 Annual Meeting may vote in person even if he or she has previously returned a proxy. For ten days prior to the 2015 Annual Meeting, a complete list of stockholders entitled to vote at the 2015 Annual Meeting will be available for examination by any stockholder for any purpose relating to this 2015 Annual Meeting, during ordinary business hours at the Company's corporate headquarters located at 2125 O'Nel Drive, San Jose, California 95131.

By Order of the Board of Directors

Bryan R. Martin

Chairman

San Jose, California

June 25, 2015

8X8, INC.

2125 O'Nel Drive

San Jose, California 95131

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The accompanying proxy is solicited by the Board of Directors (the "Board") of 8x8, Inc. (referred to throughout this proxy statement as "8x8," the "Company," "we," "us," and "our"), a Delaware corporation, for use at the 2015 Annual Meeting of Stockholders (the "2015 Annual Meeting") to be held July 23, 2015, at 10:00 a.m., local time, or at any adjournment thereof. The 2015 Annual Meeting will be held at our principal executive offices at 2125 O'Nel Drive, San Jose, California 95131. Our telephone number is (408) 727-1885.

This proxy statement, the accompanying proxy card and our Annual Report on Form 10-K for the year ended March 31, 2015 ("Annual Report") are being mailed on or about June 26, 2015 to all stockholders of our common stock as of the record date of June 2, 2015 (the "Record Date"). On the Record Date, we had 88,172,901 shares of common stock issued and outstanding held in street name or by registered stockholders.

Furthermore, stockholders who wish to view our Annual Report, as filed with the Securities and Exchange Commission, or the SEC, including our audited financial statements, will find it available on the Investor Relations section of our website at http://www.8x8.com. To request a printed copy of our proxy and Annual Report, which we will provide to you free of charge, either: write to 8x8's Investor Relations Department at 8x8, Inc., 2125 O'Nel Drive, San Jose, CA 95131; call us at (866) 587-8516; or email us at 2015@8x8.com.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE 2015 ANNUAL MEETING

Q: What information is contained in this proxy statement?

A: The information in this proxy statement relates to the proposals to be voted on at the 2015 Annual Meeting, the voting process, our corporate governance, the compensation of our directors and named executive officers in fiscal 2015, and certain other required information.

Q: What shares can I vote?

A: Each share of 8x8 common stock issued and outstanding as of the Record Date is entitled to vote on all proposals presented at the 2015 Annual Meeting. You may vote all shares owned by you as of the Record Date, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner in street name.

Q: How many votes am I entitled to per share?

A: Each holder of shares of common stock is entitled to one vote for each share of common stock held as of the Record Date.

Q: Can I attend the 2015 Annual Meeting?

A: You are entitled to attend the 2015 Annual Meeting only if you were an 8x8 stockholder or joint holder as of the Record Date, or if you hold a valid proxy for the 2015 Annual Meeting. You should be prepared to present government-issued photo identification (such as a driver's license or passport) for admittance. If you are not a stockholder of record but hold shares in street name through a broker, trustee or nominee, you should be prepared to provide proof of beneficial ownership as of the Record Date, such as your most recent account statement prior to June 2, 2015, a copy of the voting instruction card provided by your bank, broker, trustee or nominee, or other similar evidence of ownership.

The meeting will begin promptly at 10:00 a.m., local time. Check-in will begin at 9:30 a.m., local time, and you should allow ample time for the check-in procedures.

Q: How can I vote my shares in person at the 2015 Annual Meeting?

A: Shares held in your name as the stockholder of record may be voted by you in person at the 2015 Annual Meeting. Shares held beneficially in street name may be voted by you in person at the 2015 Annual Meeting only if you obtain a valid proxy, or "legal proxy," from the broker, trustee or nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the 2015 Annual Meeting, we recommend that you also submit your voting instructions prior to the meeting to ensure your vote will be counted if you later decide not to attend the meeting.

Q: How can I vote my shares without attending the 2015 Annual Meeting?

A: If you hold shares directly as the stockholder of record, you may direct how your shares are voted without attending the 2015 Annual Meeting in accordance with the instructions included in the proxy statement and proxy. Our Chief Executive Officer and our Chief Financial Officer have been designated by the Board to be the proxy holders for the 2015 Annual Meeting. They will cast votes for Proposal Nos. One and Two at the meeting in accordance with the direction provided in the proxy.

Q: Can I change my vote?

A: Your proxy is revocable and you may change your vote at any time prior to the vote at the 2015 Annual Meeting. If you are the stockholder of record, you may change your vote by granting a new proxy bearing a later date (which automatically revokes the earlier proxy) using any of the methods described above (and until the applicable deadline for each method), by providing a written notice of revocation to 8x8, Inc., Attn: Secretary, 2125 O'Nel Drive, San Jose, CA 95131, prior to your shares being voted, or by attending the 2015 Annual Meeting and voting in person. Attendance at the meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or nominee following the instructions they provided or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person.

Q: How many shares must be present or represented to conduct business at the 2015 Annual Meeting?

A: The quorum requirement for holding and transacting business at the 2015 Annual Meeting is that holders of a majority of the voting power of the issued and outstanding shares of our common stock must be present in person or represented by proxy. Both abstentions and broker non-votes are counted for the purpose of determining the presence of a quorum.

Q: What is the voting requirement to approve each of the proposals?

A: The voting requirements for the proposals that we will consider at the Annual Meeting are:

|

- |

Proposal No. 1-Election of Directors. The seven nominees receiving the most votes cast "FOR" his election shall be elected as directors, provided that pursuant to a policy adopted by the Board, any director nominee who fails to receive more votes cast "FOR" his election than "WITHHELD" is expected to tender his resignation to the Nominating Committee of the Board, which is authorized to consider each resignation tendered under the policy and recommend to the Board whether or not to accept the resignation. |

|

- |

Proposal No. 2-Ratification of Appointment of Moss Adams LLP as Independent Registered Public Accounting Firm. An affirmative vote of the holders of a majority of the shares present or represented by proxy and entitled to vote on this proposal at the Annual Meeting is necessary for approval of this proposal. |

Q: What happens if additional matters are presented at the 2015 Annual Meeting?

A: Other than the items of business described in this proxy statement, we are not aware of any additional business to be acted upon at the 2015 Annual Meeting. If you grant a proxy, the named proxy holders, Vikram Verma and Mary Ellen Genovese, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting except with respect to broker non-votes, as explained below. If, for any reason, any of our nominees is not available as a candidate for director, the named proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

Q: How will votes be counted at the 2015 Annual Meeting?

A: An automated system administered by Broadridge Financial Solutions, Inc. ("Broadridge") will tabulate stockholder votes by proxy instructions submitted by beneficial owners over the Internet, by telephone, or by proxy cards mailed to Broadridge. Our transfer agent, Computershare Investor Services, will tabulate stockholder votes submitted by proxies submitted by stockholders of record other than beneficial owners. The inspector of the election will tabulate votes cast in person at the 2015 Annual Meeting.

Q: How are "broker non-votes" and abstentions treated?

A: Brokers holding shares in street name for customers have discretionary authority to vote on some matters when they have not received instructions from the beneficial owners of shares. Under the Delaware General Corporation Law, an abstaining vote and a broker "non-vote" are counted as present and are, therefore, included for purposes of determining whether a quorum of shares is present at the Annual Meeting. A broker "non-vote" occurs when a broker or other nominee holding shares for a beneficial owner signs and returns a proxy with respect to shares of common stock held in a fiduciary capacity (typically referred to as being held in "street name") but does not vote on a particular matter due to a lack of discretionary voting power and instructions from the beneficial owner. Under listing rules governing voting with respect to shares held in street name, brokers have the discretion to vote such shares on routine matters but not on non-routine matters. At the Annual Meeting, the uncontested election of nominees for the Board is a non-routine matter under these rules. Brokers that do not receive instructions from the beneficial owners of the shares are entitled to vote only on Proposal No. 2 (the ratification of appointment of Moss Adams LLP as our independent registered public accounting firm for the fiscal 2016 audit).

Broker non-votes are considered present but not entitled to vote at the meeting. They will not affect the outcome of the vote on any of the proposals at the Annual Meeting because broker non-votes are excluded from the tabulation of votes cast on each proposal. Abstentions are counted as present and entitled to vote for purposes of establishing a quorum. An abstention will have no effect on the election of directors under Proposals No. 1. However, an abstention will have the same effect as a vote "against" the ratification of the appointment by the Audit Committee of Moss Adams LLP as our independent registered public accounting firm for the fiscal 2016 audit under Proposal No. 2, because a vote in favor of this proposal from a majority of the shares present in person or by proxy and entitled to vote is needed for approval.

Q: Who will serve as inspector of elections?

A: The inspector of elections will be a representative from the Company.

Q: What should I do if I receive more than one set of voting materials?

A: You may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy cards. For example, if you hold your shares in more than one brokerage account, you may receive a separate proxy card for each brokerage account in which you hold shares. If you are a stockholder of record and your shares are registered in more than one name, you will receive more than one proxy card. Please vote using each control number and proxy card that you receive.

Q: Who will bear the cost of soliciting votes for the 2015 Annual Meeting?

A: We are making this solicitation and will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. If you choose to access the proxy materials or vote over the Internet, you are responsible for any Internet access charges you may incur. If you choose to vote by telephone, you are responsible for any telephone charges you may incur. In addition to the mailing of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such solicitation activities.

PROPOSAL NO. ONE:

ELECTION OF DIRECTORS

Nominees

The Board currently consists of seven directors, all of whom have been nominated for re-election at the 2015 Annual Meeting and have agreed to serve if elected.

Proxies cannot be voted for a greater number of persons than the number of nominees named. Each of the directors elected at the 2015 Annual Meeting will hold office until the 2016 Annual Meeting of Stockholders or until his successor has been duly elected and qualified. Unless otherwise instructed, the proxy holders will vote the proxies received by them for each of our seven nominees named below, all of whom are directors currently serving on the Board. In the event that any of our nominees becomes unable or declines to serve as a director at the time of the 2015 Annual Meeting, the proxy holders will vote the proxies for any substitute nominee who is designated by the current Board to fill the vacancy. It is not expected that any nominee listed below will be unable or will decline to serve as a director. The names of the nominees and certain information about each of them are set forth below.

|

Name |

Age |

Principal Occupation |

Director Since |

|

Bryan R. Martin |

47 |

Chairman of the Board and Chief Technology Officer 8x8, Inc. |

2001 |

|

Guy L. Hecker, Jr. (1)(2)(3)(4) |

83 |

Major General, USAF, Retired |

1997 |

|

Vikram Verma |

50 |

Chief Executive Officer, 8x8, Inc. |

2012 |

|

Eric Salzman (1)(3)(4) |

48 |

Managing Member, SarniHaan Capital Partners LLC |

2012 |

|

Ian Potter (1)(3) |

51 |

Managing Partner of Lion City Capital Partners |

2013 |

|

Jaswinder Pal Singh(1) |

49 |

Professor of Computer Science at Princeton University and Chairman and Co-Founder of Gwynnie Bee, Inc. |

2013 |

|

Vladimir Jacimovic |

51 |

Managing Partner, Continuum Capital Partners |

2014 |

(1) Member of the Audit Committee

(2) Lead director

(3) Member of the Compensation Committee

(4) Member of the Nominating Committee

Except as indicated below, each nominee or incumbent director has been engaged in the principal occupation set forth above during the past five years. There are no family relationships between any of our directors or executive officers. There are also no arrangements or understandings between any director, nominee or executive officer and any other person pursuant to which he or she has been or will be selected as a director and/or executive officer.

Bryan R. Martin has served as Chairman of the Board since December 2003, has served as Chief Technology Officer since September 2013, and as a director since February 2001. From February 2002 to September 2013, he served as Chief Executive Officer. From March 2007 to November 2008, and again from April 2011 to December 2011, he served as President. From February 2001 to February 2002, he served as President and Chief Operating Officer. He served as Senior Vice President, Engineering Operations from July 2000 to February 2001 and as the Company's Chief Technical Officer from August 1995 to August 2000. He also served as a director from January 1998 to July 1999. In addition, Mr. Martin served in various technical roles for the Company from April 1990 to August 1995. He received a B.S. and a M.S. in Electrical Engineering from Stanford University. We believe Mr. Martin's qualifications to serve as a director include his tenure as our Chief Executive Officer and as a member of our Board, his more than 25 years of service to us with extensive experience in the development and sale of communications technologies and services and the 47 United States patents issued to him in the fields of semiconductors, computer architecture, video processing algorithms, videophones and communications.

Major General Guy L. Hecker, Jr. has served as a director since August 1997 and lead director since January 2010. He was the founder of Stafford, Burke and Hecker, Inc., a consulting firm based in Alexandria, Virginia, and served as its President from 1982 to 2008. Prior to his retirement from the United States Air Force in 1982, Major General Hecker's duties included serving as Director of the Air Force Office of Legislative Liaison and an appointment in the Office of the Deputy Chief of Staff, Research, Development and Acquisition for the Air Force. Earlier, he served as a pilot and commander in both fighter and bomber aircraft units, including command of a bomber wing and an air division. During his Air Force career, Major General Hecker was awarded a number of military decorations, including the Air Force Distinguished Service Medal, the Silver Star, the Legion of Merit (awarded twice) and the Distinguished Flying Cross. He currently serves on the board of directors of NavCom Defense Electronics. Major General Hecker received a B.A. from The Citadel, an M.A. in International Relations from George Washington University, an honorary Ph.D. in military science from The Citadel and completed the management development program at Harvard Business School. We believe that Major General Hecker's qualifications to serve on the Board include his extensive business and investing experience, including the founding of a successful business at Stafford, Burke and Hecker after retiring from the Air Force and his involvement in venture capital investing including being an initial investor in Micron Computer, a subsidiary of Micron Technology, Inc., prior to its initial public offering and a director and principal shareholder of NavCom Defense Electronics since its founding in 1984.

Vikram Verma has served as Chief Executive Officer since September 2013 and as a director since January 2012. From 2008 to August 2013, Mr. Verma was President of Strategic Venture Development at Lockheed Martin with responsibility for monetizing existing Lockheed Martin technologies in new global commercial markets through technology incubators, intellectual property licensing and international strategic partnerships. From 2006 to 2008, Mr. Verma was President of IS&GS Savi Group, a Lockheed Martin technology and information services division providing real-time supply chain management and security solutions for government and commercial markets worldwide. Prior to that, he was Chairman and Chief Executive Officer of Savi Technology, Inc., a leader in RFID-based tracking and security solutions and a pioneer in using RFID tags to track cargo containers and their content globally via public and private clouds. Savi was acquired by Lockheed Martin in 2006. Mr. Verma holds a B.S degree from the Florida Institute of Technology, a M.S.E degree from University of Michigan and the graduate degree of Engineer in electrical engineering from Stanford University. He has also attended executive management programs at the Harvard Business School, Stanford Graduate School of Business and the University of California at Berkeley Haas School of Business. He has been granted eight patents and has won numerous other accolades including being named a "Technology Pioneer" by the World Economic Forum in Davos, Switzerland and a Tau Beta Pi - Williams Fellow. We believe Mr. Verma's qualifications to serve as a director, in addition to being our Chief Executive Officer, include his experience leading Savi Technology, Inc. through its growth and eventual sale to Lockheed Martin and his expertise bringing advanced technology-based solutions to new domestic and international markets, all of which are critical components for our business success.

Eric Salzman has served as director since February 2012. Mr. Salzman currently serves as the Managing Member of SarniHaan Capital Partners, LLC, a boutique consulting firm he established to provide high impact strategic advice to public and private technology companies and maintains an investment banking affiliation with Monarch Capital Group, LLC. Mr. Salzman previously spent several years at Lehman Brothers Inc., including as Managing Director in the Private Equity and Principal Investing Group and Managing Director in the Global Trading Strategies Division. Prior to Lehman, Mr. Salzman was an investment professional at a private equity affiliate of Credit Suisse Asset Management and was a financial analyst in the M&A Group of First Boston. Mr. Salzman has extensive public and private board experience having served on over twelve boards and is currently a director at three private equity owned technology companies. Mr. Salzman graduated with an MBA from the Harvard Graduate School of Business and a BA Honors from the University of Michigan. We believe Mr. Salzman's qualifications to serve as a director include his 20 years of experience working in the financial services industry, his investment experience in the telecommunications industry and his past experience working in private equity.

Ian Potter has served as a director since September 2013. Mr. Potter is currently a Distinguished Fellow with INSEAD's Global Private Equity Initiative, a Founding Partner of Lion City Applied Science and the Managing Partner of Lion City Capital Partners. Lion City Capital Partners is a privately held investment holding company in Singapore that seeks to make direct investments in technology and natural resources companies. From 1994 until his retirement in 2014, he worked for Morgan Stanley in Asia where he supervised all aspects of the firm's commodity business while serving on a number of internal and external private company boards. During this time, he opened the group's New Delhi, Shanghai, and Tokyo offices and was responsible for developing the group's capacity across the region and expanding its product offerings. Mr. Potter began his career in finance in London and New York working for Chase Manhattan Bank N.A. where he contributed to the development of the bank's interest rate and currency derivatives business. He holds an MBA from INSEAD in France and a BA from Queen's University in Canada. We believe Mr. Potter's qualifications to serve as a director include his 25 years in international business development, management, and operational experience.

Jaswinder Pal Singh has served as a director since October 2013. Dr. Singh is currently a Full Professor of Computer Science at Princeton University, where he has served on the faculty for over 20 years. He is also a director of InMobi, a mobile advertising company, and of Gwynnie Bee, Inc., an Internet technology company in the retail space. Previously, he was Co-founder and Chief Technology Officer at FirstRain, Inc., a SaaS provider of market intelligence solutions for the enterprise, where he led the development of award-winning technologies and products for web-based communication and information access. Dr. Singh also served as an advisor to Right Media, Inc., a SaaS online advertising exchange that was acquired by Yahoo in 2007, and later led the development of Yahoo's innovative next-generation advertising marketplace. Dr. Singh has a BSE degree from Princeton University and obtained his MS and PhD degrees from Stanford University. We believe Dr. Singh's qualifications to serve as a director include his qualification as a leading authority on scalable computing systems, infrastructure and applications and his service to several technology companies. He also is a coauthor of Parallel Computer Architecture: A Hardware-Software Approach, the leading textbook in parallel computing, an inventor under of several patents, and an author of over 75 published research papers.

Vladimir Jacimovic has served as a director since March 2014. Mr. Jacimovic is the Founder and Managing Partner of Continuum Capital Partners, an investment firm that specializes in crossover investments targeting private and public technology companies. Previously, Mr. Jacimovic was a Partner at New Enterprise Associates (NEA), a leading global venture capital firm focused on helping entrepreneurs build transformational businesses across multiple stages, sectors and geographies, and a Managing Director at Crosslink Capital, a leading stage-independent venture capital firm. Since beginning his venture career in 1996, Mr. Jacimovic has been involved in more than 30 investments in software, communications, and technology enabled services. We believe Mr. Jacimovic qualifications to serve as director include his 25 years of investing and operating experience with high growth companies in the technology and services industry with specific expertise in the SaaS, big data and security segments.

Vote Required and Recommendation

The seven nominees receiving the most votes cast "FOR" his selection shall be elected as directors at the Annual Meeting; provided that any director nominee who fails to receive more votes cast "FOR" his selection than "WITHHELD" is expected to tender his resignation to the Nominating Committee of the Board, which is authorized to consider each resignation tendered under the policy and recommend to the Board whether or not to accept the resignation.

The Board unanimously recommends that the stockholders vote "FOR" the election of the nominees set forth above.

PROPOSAL NO. TWO:

RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of the Board is directly responsible for the appointment of our independent registered public accounting firm. The Audit Committee has appointed Moss Adams LLP, Independent Registered Accounting Firm, to audit our financial statements for the fiscal year ending March 31, 2016. The Board proposes that the stockholders ratify this appointment. The Audit Committee understands the need for Moss Adams LLP to maintain objectivity and independence in its audits of our financial statements.

The Audit Committee retained Moss Adams LLP to audit our consolidated financial statements for fiscal 2015 and also to provide other auditing and non-auditing services in fiscal 2015. The Audit Committee has reviewed all non-audit services provided by Moss Adams LLP and has concluded that the provision of such services was compatible with maintaining Moss Adams LLP's independence in the conduct of its auditing functions.

To help ensure the independence of the independent registered public accounting firm, the Audit Committee has adopted a policy for the pre-approval of all audit and non-audit services to be performed for us by our independent registered public accounting firm. The Audit Committee may delegate to one or more of its members the authority to grant the required approvals, provided that any exercise of such authority is presented to the full Audit Committee at its next regularly scheduled meeting.

The following table sets forth the aggregate fees billed to us by Moss Adams LLP for the fiscal years ended March 31, 2015 and 2014:

|

Service Categories |

Fiscal 2015 |

Fiscal 2014 |

|

Audit fees (1) |

$452,000 |

$543,000 |

|

Audit-related fees (2) |

$13,000 |

$12,000 |

|

Tax fees (3) |

$0 |

$101,348 |

|

All other fees (4) |

$2,367 |

$2,367 |

|

Total |

$467,367 |

$658,715 |

|

(1) |

Audit fees consist of fees for professional services provided in connection with (i) the audit of our financial statements; (ii) audit of our internal control over financial reporting; (iii) reviews of our quarterly financial statements; and (iv) filing Form S-8 registration statements with the SEC. |

|

(2) |

Audit-related fees consist of fees for professional services provided in conjunction with the audit of our employee benefit plan. |

|

(3) |

Tax fees consist of fees billed for professional services rendered for tax consultations. |

|

(4) |

All other fees include fees for an online accounting research tool. |

Vote Required and Recommendation

The ratification of the selection of Moss Adams LLP as our independent registered public accounting firm for fiscal 2016 will require the affirmative vote of holders of a majority of the shares entitled to vote on this matter. Abstentions will be counted for purposes of determining the presence or absence of a quorum, but are not counted as affirmative votes. In the event that stockholders fail to ratify the appointment, the Audit Committee may reconsider its selection. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in our best interests.

Representatives of Moss Adams LLP are expected to be present at the annual meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

The Board unanimously recommends that the stockholders vote "FOR" the proposal to ratify our Audit Committee's appointment of Moss Adams LLP to serve as our independent registered public accounting firm for the fiscal year ending March 31, 2016.

CORPORATE GOVERNANCE

Information Regarding the Board and its Committees

The Board held a total of seven meetings during fiscal 2015. The non-employee members of the Board also met four times in regularly scheduled executive sessions without management present. Every director attended all of the meetings of the Board and committees of the Board during the time and upon which such directors served during fiscal 2015. The Board acted three times by written consent during fiscal 2015.

The Board has an Audit Committee, a Compensation Committee, and a Nominating Committee. The Board has adopted charters for each of these committees that are available on our website under "Corporate Governance" which can be found at http://investors.8x8.com.

The Board has determined that the following directors are "independent" as defined under Marketplace Rule 5605(a)(2) of the listing rules of the NASDAQ Stock Market ("NASDAQ"): Major General Hecker, Mr. Salzman, Mr. Potter, Dr. Singh, and Mr. Jacimovic. For a director to be considered independent, the Board must determine that the director does not have any direct or indirect material relationship with us that would impair his independence. The Board has established guidelines to assist it in determining director independence, which conform to the independence requirements in the NASDAQ listing rules. The Board has concluded that there are no business relationships that are material or that would interfere with the exercise of independent judgment by any of the independent directors in their service on the Board or its committees. Each of the Board's Audit, Compensation and Nominating Committees is comprised solely of independent directors in accordance with the NASDAQ listing rules.

Audit Committee

The Audit Committee oversees our corporate accounting and financial reporting process and performs several functions in the performance of this role. Among other responsibilities as set forth in our Audit Committee charter, the Audit Committee evaluates the performance of and assesses the qualifications of the independent auditors; determines and approves the engagement of the independent auditors; determines whether to retain or terminate the existing independent auditors or to appoint and engage new independent auditors; reviews and approves the retention of the independent auditors to perform any proposed permissible non-audit services; monitors the rotation of partners of the independent auditors on our audit engagement team as required by law; confers with management and the independent auditors regarding the effectiveness of internal controls over financial reporting; and discusses with management and the independent auditors the results of the annual audit and the results of the reviews of our quarterly financial statements. The Audit Committee is also responsible for reviewing and approving all business transactions between us and any director, officer, affiliate or related party, including transactions required to be reported in our proxy statement, of which there have been none since the end of fiscal year 2013.

The current members of the Audit Committee are Major General Hecker (Chairman), Mr. Salzman, Mr. Potter, and Dr. Singh. The Board has determined that each of these directors meets the requirements for membership to the Audit Committee, including the independence requirements of the SEC and the NASDAQ listing standards under Marketplace Rule 5605(c)(2) and SEC Rule 10A-3(b)(i). The Board has identified Major General Hecker as the member of the Audit Committee who is an "audit committee financial expert" as defined under Item 407(d)(5)(ii) of Regulation S-K under the Securities Act of 1933 and the Securities Exchange Act of 1934 (the "Exchange Act"), but that status does not impose on his duties, liabilities or obligations that are greater than the duties, liabilities or obligations otherwise imposed on him as a member of our Audit Committee or our Board. The Audit Committee held four meetings during fiscal 2015. The Audit Committee held four executive sessions during fiscal 2015 and did not act by written consent during fiscal 2015.

Compensation Committee

The Compensation Committee recommends the compensation of the Chief Executive Officer to the Board for its approval and reviews the Chief Executive Officer's recommendations to the Board concerning the compensation of our employees and the administration of our stock-based award and employee stock purchase plans. The Compensation Committee held five meetings during fiscal 2015. The Compensation Committee currently consists of Mr. Salzman (Chairman), Major General Hecker, and Mr. Potter, who are independent directors as currently defined in the NASDAQ listing rules. The Compensation Committee acted once by written consent during fiscal 2015.

Nominating Committee

The Nominating Committee is responsible for identifying, reviewing and evaluating candidates to serve as directors of the Company, consistent with criteria approved by the Board, reviewing and evaluating the suitability of incumbent directors for continued service on the Board, recommending to the Board candidates for election to the Board, making recommendations to the Board regarding the membership of the committees of the Board, and assessing the performance of management and the Board. Pursuant to the charter of the Nominating Committee, all members of the Nominating Committee must be qualified to serve under the NASDAQ listing rules and any other applicable law, rule regulation and other additional requirements that the Board deems appropriate. The Nominating Committee currently consists of Major General Hecker (Chairman) and Mr. Salzman. The Nominating Committee held one meeting during fiscal 2015 and has recommended all current directors for nomination to be elected as directors at the May 19, 2015 Annual Meeting. The Nominating Committee did not act by written consent during fiscal 2015.

Board Structure and Lead Director

We believe the current size of the Board is suited to the size of our current operations. Upon appointment of Mr. Verma as Chief Executive Officer, Bryan R. Martin, Chief Executive Officer and Chairman of the Board prior to Mr. Verma's appointment, became our Chief Technology Officer, and retained his position as Chairman of the Board. The Board believes that the separation of the offices of the Chairman and Chief Executive Officer is appropriate at this time because it allows our Chief Executive Officer to focus primarily on our business strategy, operations and corporate vision. However, the Board does not have a policy mandating that the roles of Chairman and Chief Executive Officer continue to be separated. Our Board elects our Chairman and our Chief Executive Officer, and each of these positions may be held by the same person or may be held by different people. We believe it is important that the Board retain flexibility to determine whether the two roles should be separate or combined based upon the Board's assessment of the company's needs and leadership at a given point in time.

In January 2010, the Board created the independent director position of lead director and appointed Major General Hecker to be our first lead director. The lead director is responsible for (i) establishing the agenda for the executive sessions held by non-management directors of the Board and acting as chair of those sessions, (ii) polling the other non-management directors for agenda items both for regular board meetings and executive sessions of the non-management directors and (iii) working with the Chairman of the Board and Chief Executive Officer on the agenda for regular Board meetings.

Consideration of Director Nominees

Stockholder Nominations and Recommendations. It is the policy of the Nominating Committee to consider both recommendations and nominations for candidates to the Board from stockholders. Under our recently amended by-laws, stockholders of record may nominate candidates for director proposed by a stockholder at an annual meeting, or a special meeting of stockholders at which directors are to be elected, by complying timely with the notice requirements set forth in the by-laws. Stockholder recommendations for candidates to the Board must be directed in writing to our Secretary at the address of our principal executive offices at 2125 O'Nel Drive, San Jose, California 95131.

To be timely, a stockholder's notice proposing the nomination of a director at an annual meeting shall be delivered to or mailed and received at the corporation's principal executive offices not less than 90 nor more than 120 calendar days in advance of the first anniversary of the previous year's annual meeting of stockholders, except that if no annual meeting was held in the previous year or the date of the annual meeting is more than 30 calendar days earlier than the date contemplated at the time of the previous year's proxy statement, notice by the stockholder to be timely must be received not later than the close of business on the 10th day following the day on which the date of the annual meeting is publicly announced. A timely notice for the nomination of a director by a stockholder at a special meeting of stockholders must be delivered to or mailed and received by the Secretary no later than the close of business on the later of (i) the 90th day prior to such special meeting, and (ii) the 10th day following the day on which public disclosure of the date of such special meeting is first made. The stockholder's notice must include a number of items of information about the stockholder (and all persons participating with the stockholder in any proxy solicitation for the proposal) and items of information about the candidate, as set forth in our by-laws, including, but not limited to, the candidate's name, age, business address and residence address, the candidate's principal occupation or employment, the stockholder's name and address, the class and number of shares of our stock and other securities, including derivatives, beneficially owned by the proposing stockholder and by such candidate, any short interest in any of our securities held by the proposing stockholder, all voting rights with respect to our stock beneficially owned by the stockholder and others joining in the proposal, and a description of all arrangements or understandings between the stockholder making such recommendation and each candidate and any other person or persons (naming such person or persons) pursuant to which the recommendations are to be made by

the stockholder, as well as any other information relating to such recommended candidate that is required to be disclosed in solicitations of proxies for elections of directors, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act. In addition, if requested, the proposed nominee must furnish additional information to determine whether he or she is eligible to serve as an independent director or that could be material to a reasonable stockholder's understanding of the independence, or lack thereof, of the proposed nominee. Such information may include a written representation and agreement, in the form provided by the Secretary, relating to the nominee's compliance, in his or her individual capacity and on behalf of any person or entity on whose behalf the nomination is being made, if elected as a director, with our corporate governance, conflict of interest, confidentiality and stock ownership and trading policies and guidelines, and all other codes of conduct, policies and guidelines or any rules, regulations and listing standards, in each case as applicable to members of the Board; a written representation and agreement that the proposed nominee (i) is not and will not become a party to any agreement or understanding with, and has not given any commitment or assurance to any person or entity as to how such person, if elected as a director of the corporation, will act or vote on any issue or question, and (ii) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than the corporation with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director unless the terms of such agreement, arrangement or understanding have been provided in writing to the Secretary; and the terms of all agreements, arrangements and understandings between the nominating stockholder(s) and each nominee and any other person or persons, regarding related party dealings that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K of the Exchange Act if the nominating stockholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the "registrant" for purposes of such rule, and the nominee was a director or executive officer of such registrant.

When submitting candidates for nomination to be elected at an annual or special meeting of stockholders, stockholders must follow the notice procedures and provide the information required by our by-laws. You may contact us at 8x8, Inc., Attn: Secretary, 2125 O'Nel Drive, San Jose, CA 95131, for a copy of the relevant by-law provisions regarding the requirements for submitting stockholder proposals and nominating director candidates. Our by-laws also can be found where our filed reports are located on the SEC's website at http://www.sec.gov.

We have never considered or rejected nominations by 5% or more stockholders.

Director Qualifications. Members of the Board should have the highest professional and personal ethics and values, and conduct themselves consistent with our Code of Business Conduct and Ethics. While the Nominating Committee has not established specific minimum qualifications for director candidates, the Nominating Committee believes that candidates and nominees must reflect a Board that is comprised of directors who:

- are predominantly independent;

- have strong integrity;

- have qualifications that will increase overall Board effectiveness;

- meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members; and

- will comply with our corporate governance, conflict of interest, confidentiality, stock ownership, trading policies and guidelines, and all other codes of conduct, policies and guidelines or any rules, regulations and listing standards, in each case as applicable to members of the Board.

Upon completion of its review and evaluation, our Nominating Committee made its recommendation to the Board regarding the candidates. After considering our Nominating Committee's recommendations, our Board determined and approved the existing candidates.

Identifying and Evaluating Director Nominees. Although candidates for nomination to the Board typically are suggested by existing directors or by our executive officers, candidates may come to the attention of the Board through professional search firms, stockholders or other persons. The Nominating Committee will review the qualifications of any candidates who have been properly brought to the Nominating Committee's attention. Such review may, in the Nominating Committee's discretion, include a review solely of information provided to the Nominating Committee or may also include discussions with persons familiar with the candidate, an interview with the candidate or other actions that the Nominating Committee deems proper. The Nominating Committee will consider the suitability of each candidate, including the current members of the Board, in light of the current size

and composition of the Board. In evaluating the qualifications of the candidates, the Nominating Committee may consider many factors, including issues of character, judgment, independence, age, expertise, diversity of experience and perspective, length of service, other commitments and the like. The Nominating Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether the candidate was recommended by a stockholder or not.

Members of the Board are strongly encouraged, but not required, to attend each annual meeting of stockholders. One of our non-employee Board members attended the annual meeting of stockholders in July 2014.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board currently consists of Mr. Salzman (Chairman), Major General Hecker, and Mr. Potter. None of these individuals is currently an officer or employee of ours or was an officer or employee of ours at any time during fiscal 2015. None of our executive officers or directors served as a member of the board or compensation committee of any entity that had one or more executive officers serving as a member of the Board or our Compensation Committee at any time during fiscal 2015.

Code of Business Conduct and Ethics

We are committed to maintaining the highest standards of business conduct and ethics. Our Code of Business Conduct and Ethics (the "Code of Ethics") reflects the values and the business practices and principles of behavior that support this commitment. The Code of Ethics is available on our website under "Corporate Governance" which can be found at http://investors.8x8.com. We will post any amendment to, or a waiver from, a provision of the Code of Ethics that are required to be disclosed by the rules of the SEC or NASDAQ, on our website at http://investors.8x8.com.

Board's Role in the Oversight of Risk

As a relatively small operating company, the entire Board is involved in our risk management practices. The Board as a whole is consulted on any matters which might result in material financial changes, investments or strategic direction of the Company. The Board oversees these risks through its interaction with senior management which occurs at formal Board meetings, committee meetings, and through other periodic written and oral communications. Additionally, the Board has delegated some of its risk oversight activities to its committees. For example, the Compensation Committee oversees the risks associated with compensation for our named executive officers and directors, including whether any of our compensation policies has the potential to encourage excessive risk-taking. The Audit Committee oversees compliance with our Code of Ethics, our financial reporting process and our systems of internal controls and reviews with management our major financial risk exposures and the steps taken to control such exposures.

Stockholder Communications with the Board

The Board has implemented a process by which stockholders may send written communications directly to the attention of the Board or any individual Board member, which is explained on our website at http://investors.8x8.com under the "Investor FAQs" section.

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Fiscal 2015 Director Compensation Table

The following Director Compensation Table sets forth summary information concerning the compensation paid to our non-employee directors in fiscal 2015 for their services as directors.

|

Name (1)(2) |

Fees Earned or |

Stock Awards (3) |

Total |

|

Guy L. Hecker, Jr. |

$120,000 |

$228,520 |

$348,520 |

|

Eric Salzman |

$70,000 |

$228,520 |

$298,520 |

|

Ian Potter |

$65,000 |

$228,520 |

$293,520 |

|

Jaswinder Pal Singh |

$43,000 |

$228,520 |

$271,520 |

|

Vladimir Jacimovic |

$26,000 |

$228,520 |

$254,520 |

(1) Includes only those columns relating to compensation awarded to, earned by, or paid to directors for their services in fiscal 2015. All other columns have

been omitted.

(2) As of March 31, 2015, each of our non-employee directors held outstanding stock options to purchase the following number of shares of our common

stock: Major General Hecker, 400,000; Mr. Salzman, 75,000; Mr. Potter, 75,000; Dr. Singh, 75,000; and Mr. Jacimovic, 75,000. As of March 31, 2015, each of our non-employee

directors held outstanding stock awards in the form of restricted stock units (RSU's), subject to the following number of shares: Major General Hecker, 83,280; Mr. Salzman, 83,280;

Mr. Potter, 33,312; Dr. Singh, 33,312; and Mr. Jacimovic, 33,312.

(3) On October 21, 2014, Major General Hecker, Mr. Salzman, Mr. Potter, Dr. Singh, and Mr. Jacimovic all received a grant of a stock award in the form of

RSUs representing the right to receive 33,312 shares of common stock vesting at the rate of 25% annually. The amounts reported reflect the aggregate grant date fair value of the

stock awards computed in accordance with FASB ASC Topic 718 based on the closing market price of our common stock on the grant date. For a more detailed discussion on the

valuation model and assumptions used to calculate the fair value of our stock awards, refer to note 1 to the consolidated financial statements contained in our 2015 Annual Report

on Form 10-K for our fiscal year ended March 31, 2015.

We use a combination of cash and equity-based compensation to attract and retain qualified candidates to serve on our Board. In setting director compensation, we consider the significant amount of time that our directors expend in fulfilling their duties as well as the skill-level required by us of members of our Board.

Upon a change-in-control, all unvested stock options, stock purchase rights, and restricted stock units then held by directors will accelerate to become fully vested as of the date of such change-in-control. For this purpose, a change-in-control generally means (1) the liquidation or dissolution of the Company; or (2) the sale of stock by stockholders representing more than 50% of our voting stock, a sale, transfer, or other disposition of all or substantially all of our assets, or (3) a merger or consolidation after which the stockholders immediately before such transaction do not retain more than 50% of the outstanding voting stock.

Cash Compensation Paid to Non-Employee Directors

Directors who are also employees do not receive any additional cash compensation for serving as members of our Board.

We paid non-employee directors a cash fee for attendance at Board meetings and reimbursed them for certain expenses in connection with attendance at Board meetings. Non-employee directors receive fees of $2,000 for each telephonic Board and committee meeting and $5,000 for attendance at in-person Board and committee meetings. The Chairman of the Audit Committee is also paid an annual stipend of $10,000. The lead director is paid a quarterly stipend of $10,000. These cash fee amounts for fiscal 2015 were the same for fiscal 2014. A director may elect to defer payment of all or a portion of the annual stipend and meeting fees payable to him to postpone taxation on such amounts.

Equity-Based Grants to Non-Employee Directors

Non-employee directors are eligible to receive awards under the 2012 Plan, but such awards are discretionary, and based on service and time committed. Our policy has been to make initial awards to newly elected or appointed non-employee directors upon joining the Board, typically the grant of an Option to purchase 75,000 shares, vesting annually over four years. It is also our policy to award a stock grant to our non-employee directors upon re-election to the Board, except where the non-employee director's initial term is shorter than six months, and he or she received an initial award upon joining the Board. In fiscal year 2015, in connection with his re-election to our Board, each non-employee director received a grant of a stock award of RSUs representing the right to receive 33,312 shares of our common stock vesting in four equal annual installments, subject to the director's continued service on the Board. This is the same number of shares that we have awarded to non-employee directors for annual service since fiscal 2010.

TRANSACTIONS WITH RELATED PERSONS AND CERTAIN CONTROL PERSONS

We believe during fiscal 2015 there were no transactions, or series of similar transactions, to which we were or are to be a party in which the amount involved exceeded $120,000, and in which any of our directors or executive officers, any holders of more than 5% of our common stock, any members of any such person's immediate family, had or will have a direct or indirect material interest, other than compensation described in the sections titled "Compensation of Non-employee Directors" and "Executive Compensation" above.

It is our policy to require that all transactions between us and any related person, as defined above, must be approved by a majority of our Board, including a majority of independent directors who are disinterested in the transactions to be approved.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our officers and directors and persons who beneficially own more than ten percent of our common stock (collectively, "Reporting Persons") to file reports of beneficial ownership and changes in beneficial ownership with the SEC. Reporting Persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of such reports received or written representations from certain Reporting Persons during the fiscal year ended March 31, 2015, we believe that certain Reporting Persons did not comply with all applicable reporting requirements. Mr. Martin, General Hecker, Mr. Potter, Dr. Singh, and Mr. Jacimovic all filed one late Form 4 to report an individual equity grant in October 2014, which was one day late. For fiscal 2014, Mr. Potter and Mr. Hakeman both filed one late Form 4 to report an individual equity grant in September 2013, which was reported seven days late. Mr. Jacimovic filed one late Form 3 to report himself as a beneficial owner in April 2014, which was filed six days late. Mr. Jacimovic filed one late Form 4 to report an individual equity grant in April 2014, which was seven days late.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee oversees our financial reporting process on behalf of the Board. Management is responsible for our internal controls, financial reporting process and compliance with laws, regulations and ethical business standards. Our independent registered public accounting firm is responsible for performing an integrated audit of our consolidated financial statements and of our internal control over financial reporting in accordance with standards of the public company accounting oversight board (United States), and to issue opinions thereon. The Audit Committee's responsibility is to monitor and oversee these processes. In this capacity, the Audit Committee provides advice, counsel, and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors, and the experience of the Audit Committee's members in business, financial and accounting matters.

The Audit Committee reviewed and discussed our fiscal 2015 audited consolidated financial statements with our management and Moss Adams LLP, our independent registered public accounting firm for fiscal 2015. The Audit Committee reviewed and discussed with management and the independent auditor management's assessment of the effectiveness of the Company's internal control over financial reporting and the independent auditor's opinion about the effectiveness of the Company's internal control over financial reporting. The Audit Committee has discussed with Moss Adams LLP matters required to be discussed by Public Company Accounting Oversight Board Auditing Standard No. 16, "Communications with Audit Committees," as currently in effect. The Audit Committee received written disclosures and a letter from the independent auditors pursuant to the applicable requirements of the PCAOB regarding the independent auditor's communications with the Audit Committee concerning independence, and the Audit Committee discussed with the auditors their independence.

Based upon the Audit Committee's discussions with management and the auditors and the Audit Committee's review of the representations of management and the report of the auditors to the Audit Committee, the Audit Committee recommended to the Board, and the Board approved, the inclusion of our audited consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended March 31, 2015.

THE AUDIT COMMITTEE

Guy L. Hecker, Jr., Chairman

Eric Salzman

Ian Potter

Jaswinder Pal Singh

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

This Compensation Discussion and Analysis provides information regarding the fiscal 2015 compensation program for our Chief Executive Officer, our Chief Financial Officer, and the three executive officers (other than our Chief Executive Officer and Chief Financial Officer) who were serving as the most highly-compensated executive officers of the Company during the fiscal year ended March 31, 2015. During fiscal 2015, these individuals were:

- Vikram Verma, our Chief Executive Officer (our "CEO");

- Bryan R. Martin, the Chairman of our Board and our Chief Technology Officer (our "CTO");

- Mary Ellen Genovese, our Chief Financial Officer (our "CFO");

- Dan Weirich, our former Chief Financial Officer (our "former CFO");

- Darren Hakeman, our Senior Vice President of Product & Strategy;

- Puneet Arora, our Senior Vice President of Global Sales.

We refer to these executive officers collectively in this Compensation Discussion and Analysis and the related compensation tables as the "named executive officers."

Specifically, this Compensation Discussion and Analysis provides an overview of our executive compensation philosophy, the overall objectives of our executive compensation program, and each material element of compensation that we provide to the named executive officers. In addition, we explain how and why the Compensation Committee of our Board (the "Compensation Committee") and our Board arrived at the specific compensation policies and decisions involving the named executive officers during fiscal 2015.

Overview

Fiscal 2015 Business Highlights

Fiscal 2015 was another successful year for us and the execution of our business strategy. As we continued to develop our cloud-based services and increase our focus on mid-market and large distributed enterprises, our revenue continued to improve, while the year represented our sixth consecutive year of profitable growth. Significant financial highlights for the year were as follows:

- Total revenue in fiscal 2015 was $162.4 million, a 26% increase from revenue of $128.6 million for fiscal 2014.

- Gross margin as a percentage of sales in fiscal 2015 was 72%, compared with 71% for fiscal 2014.

- Cash flows provided by operations was $21.2 million, a 42% increase from cash flow provided by operations of $14.9 million in fiscal 2014.

- Revenue churn which we define as the service revenue lost from business customers (after the expiration of 30-day trial) during the period divided by the simple average of business customer service revenue during the same period, which quotient is, in turn, divided by the number of months in the period), was 0.7% in fiscal 2015 compared with 1.3% in fiscal 2014.

Fiscal 2015 Compensation Highlights

In line with our performance and compensation objectives, during fiscal 2015 the Compensation Committee or our Board approved or recommended the following compensation actions for our executive officers, including the named executive officers:

- Compensation Committee approved merit adjustments to the base salaries of two of our incumbent executive officers that ranged from 5.8% to 14.7%;

- Board approved annual cash incentive payments under our Management Incentive Plan ("MIP") based on the achievement of financial targets to our incumbent named executive officers in amounts that ranged from $35,113 to $395,189; and

- Board approved the grant of long-term incentive compensation in the form of options to purchase shares of our common stock, time vested restricted stock units ("RSUs"), and performance-based restricted stock unit awards for shares of our common stock to our incumbent executive officers. Performance vesting stock unit awards ("PSUs") represented approximately 50% of the total long-term incentive value granted to our CEO in fiscal 2015.

The PSU equity awards granted during fiscal 2015 were to be earned based on challenging goals tied to our total shareholder return ("TSR") as follows:

- Absolute TSR PSUs will vest if, during the four-year period following the date of grant, the average closing market price of our common stock exceeds for at least one period of 30 consecutive trading days 150% of its closing market price on the date of grant. If this price hurdle is achieved, then 25% of the shares subject to the award will vest on each consecutive anniversary of the date of grant of the award. Absolute TSR PSUs represent approximately 25% of total long term incentive value granted to our CEO during fiscal 2015.

- Relative TSR PSUs are eligible to vest based on our TSR relative to the TSR of the Nasdaq Composite Index over performance periods ending March 2016, March 2017 and March 2018. For 100% of these shares to vest, our return must exceed the return of the benchmark during the relevant performance period. If the return on the price per share of our common stock is between 0% and 50% lower than the performance return on the NASDAQ Composite Index, then the number of shares of our common stock earned for that measurement period will be reduced by 2% for each 1% by which the performance return on the NASDAQ Composite Index exceeds the performance return on our common stock. Relative TSR PSUs represent approximately 25% of total long term incentive value granted to our CEO during fiscal 2015.

The Committee believes that these performance goals provide the appropriate balance between difficulty and achievability to properly motivate and compensate our executives, and to strongly align the compensation of our executives with shareholder returns.

Significant Management Changes during Fiscal 2015

Ms. Genovese was appointed as our CFO, an executive vice president position, on November 1, 2014. Puneet Arora was appointed as our Senior Vice President of Global Sales on January 5, 2015.

CEO Realized and Realizable Compensation

Pay for performance alignment is an important objective of our Compensation Committee in the design of our executive compensation programs, particularly with regard to the compensation of the CEO. To further this objective, we offer performance-based cash annual incentives and deliver a significant portion of long term incentive awards in the form of stock options, which require price appreciation for any value to be realized, as well as shares with explicit performance vesting conditions.

Following the end of fiscal 2015, the Committee requested that Compensia, its independent compensation consultant, provide an analysis comparing the value of the compensation of our CEO as reported in the Summary Compensation Table and the value actually realized and realizable as of the end of fiscal year 2015. The Committee requested this information in order to identify the differences that exist between SEC calculations of grant value compared with actual realized value by our CEO, to assess the degree of alignment between pay and performance for our CEO, to evaluate the difficulty of performance goals that drive variable compensation opportunities, and to provide an additional perspective regarding the competitiveness and effectiveness of our CEO's total compensation.

Based on the analysis prepared by Compensia and summarized below, the Compensation Committee determined that the compensation opportunity for our CEO is strongly aligned with our performance and shareholder returns. In particular:

- Compensation actually realized by our CEO has been significantly below the amounts reported in our Summary Compensation Table due to our reliance on long term vesting equity awards and the requirement that a portion of PSU awards granted be earned through the achievement of rigorous performance objectives relating to our Absolute and Relative TSR performance;

- More than 75%, or approximately $4 million, of the potential realizable value associated with outstanding equity awards is subject to performance vesting requirements; if the absolute and relative shareholder return goals tied to outstanding PSUs are not achieved, the CEO will not benefit or receive any realized income from these awards;

- PSUs granted in fiscal 2014 feature similar performance conditions as the fiscal 2015 PSUs described above, including a 150% price hurdle for Absolute TSR PSUs and vesting based on the TSR of our stock relative to the performance of the Nasdaq Composite Index for Relative TSR PSUs; and

- In comparison to the $4.7 million reported total compensation for fiscal 2014, $1.3 million of value has been realized and there is a total of $1.4 million eligible to be earned subject to future time and performance vesting conditions; the total potential realized value of $2.9 million represents a 38% reduction from reported total compensation in the Summary Compensation Table, below.

| Fiscal 2014 Compensation | |||||||||||

| Realized/Realizable Compensation | |||||||||||

| Summary | Potential Realizable | ||||||||||

| Compensation Table | Value | Value as of | |||||||||

| Value | Realized | March 31, 2014 | Total | ||||||||

| Salary | $ | 224,359 | $ | 224,359 | $ | - | $ | 224,359 | |||

| Bonus | - | - | - | - | |||||||

| All Other Compensation | 42,177 | 42,177 | - | 42,177 | |||||||

| Stock Options | 1,791,060 | - | - | - | |||||||

| Time Vesting RSUs | 970,000 | 1,082,000 | - | 1,082,000 | |||||||

| Absolute TSR PSUs | 815,321 | - | 869,400 | 869,400 | |||||||

| Relative TSR PSUs | 812,354 | - | 674,730 | 674,730 | |||||||

| Total | $ | 4,655,271 | $ | 1,348,536 | $ | 1,544,130 | $ | 2,892,666 | |||

| Total Realized/Realizable vs. Reported Compensation | -37.9% | ||||||||||

| EGHT Common Stock Shareholder Return: September 9, 2013 - March 31, 2014 | -13.4% | ||||||||||

| Fiscal 2015 Compensation | |||||||||||

| Realized/Realizable Compensation | |||||||||||

| Summary | Potential Realizable | ||||||||||

| Compensation Table | Value | Value as of | |||||||||

| Value | Realized | March 31, 2015 | Total | ||||||||

| Salary | $ | 432,158 | $ | 432,158 | $ | - | $ | 432,158 | |||

| Bonus | 395,189 | 395,189 | - | 395,189 | |||||||

| All Other Compensation | 2,949 | 2,949 | - | 2,949 | |||||||

| Stock Options | 775,947 | - | 296,641 | 296,641 | |||||||

| Time Vesting RSUs | 792,824 | - | 970,805 | 970,805 | |||||||

| Absolute TSR PSUs | 765,035 | - | 1,195,589 | 1,195,589 | |||||||

| Relative TSR PSUs | 791,057 | - | 1,241,453 | 1,241,453 | |||||||

| Total | $ | 3,955,159 | $ | 830,296 | $ | 3,704,488 | $ | 4,534,784 | |||

| Total Realized/Realizable vs. Reported Compensation | 14.6% | ||||||||||

| EGHT Common Stock Shareholder Return: October 21, 2014 - March 31, 2015 | 11.8% | ||||||||||

- Compensation realized includes actual base salary and bonus earned, all other compensation, and the value of RSUs awarded during the relevant fiscal year that have vested and settled in shares of common stock as of March 31, 2015 and 2014. Realized value from RSUs is based on the closing price of our common stock on the actual vesting date.

- Potential Realizable Value includes intrinsic value of outstanding equity awards as of March 31, 2015 based on the $8.40 closing price of our stock as of that date.

- Stock option realizable value includes the in-the-money value of both vested and unvested options awarded.

- RSU realizable value reflects the face value of outstanding unvested awards with no adjustment to reflect the probability of vesting.

- PSU realizable value reflects the face value at March 31, 2015 of remaining unvested outstanding awards for which achievement of performance targets remains possible, with no adjustment to reflect the probability of achieving such targets, and of vesting of shares.

- September 9, 2013 is used as the starting point for Fiscal Year 2014 total shareholder return calculation as this was the commencement of Mr. Verma's employment as CEO.

Realized compensation is not a substitute for total compensation. For more information about total compensation as calculated under SEC rules, see the notes accompanying the Fiscal 2015 Summary Compensation Table below.

The difference between reported and realized compensation for fiscal 2014 and 2015 is due primarily to the multi-year vesting associated with long term incentive awards. Realized value associated with fiscal year 2014 is also lower than the reported value of compensation due a portion of the fiscal 2014 Relative TSR PSU award that will never be obtained because the TSR performance target was not achieved for the performance period applicable to a portion of that award ending on March 31, 2015. The potential realizable value associated with fiscal 2014 equity awards is below the reported value primarily due to the fact that fiscal 2014 stock option awards are underwater as of March 31, 2015.

Mr. Verma was not a named executive officer, or an employee, during fiscal 2013.

The Committee will continue to monitor the status of outstanding equity awards, the level of achievement of our performance goals and the level of compensation realized by our executives. This information is an important factor in decision-making as a supplement to the target value of pay and value of equity awards as reported in the Summary Compensation Table.

Fiscal 2015 Executive Compensation Policies and Practices

We endeavor to maintain sound governance standards consistent with our executive compensation policies and practices. The Compensation Committee evaluates our executive compensation program on an ongoing basis to ensure that it is consistent with our short-term and long-term goals given the dynamic nature of our business and the market in which we compete for executive talent. The following policies and practices were in effect during fiscal 2015:

- Independent Compensation Committee. The Compensation Committee is comprised solely of independent directors who have

established effective means for communicating with stockholders regarding their executive compensation ideas and concerns.

- Independent Compensation Committee Advisors. The Compensation Committee engaged its own compensation consultant to assist

with its fiscal 2015 compensation reviews. This consultant performed no consulting or other services for the Company.

- Annual Executive Compensation Review. The Compensation Committee conducts an annual review and approval of our compensation

strategy, including a review of our compensation peer group used for comparative purposes and a review of our compensation-related risk profile to ensure that our compensation-related

risks are not reasonably likely to have a material adverse effect on the Company.

- Executive Compensation Policies and Practices. Our compensation philosophy and related corporate governance policies and practices are complemented by several specific compensation practices that are designed to align our executive compensation with long-term stockholder interests, including the following:

- Compensation At-Risk. Our executive compensation program is designed so that a significant portion of our executive officers' compensation is "at risk" based on corporate performance, as well as equity-based to align the interests of our executive officers and stockholders.

- No Retirement Plans. We do not currently offer, nor do we have plans to provide, pension arrangements, retirement plans, or nonqualified deferred compensation plans or arrangements to our executive officers.

- No Special Health or Welfare Benefits. Our executive officers participate in broad-based company-sponsored health and welfare benefits programs on the same basis as our other full-time, salaried employees.