UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Date of the earliest event reported)

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging Growth Company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure |

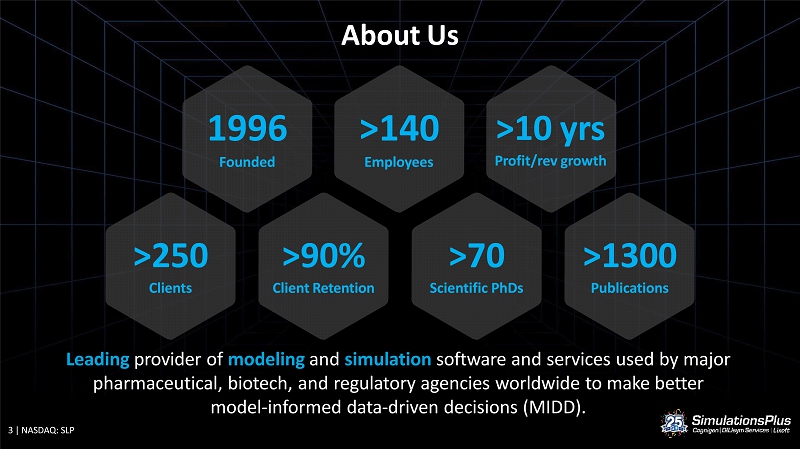

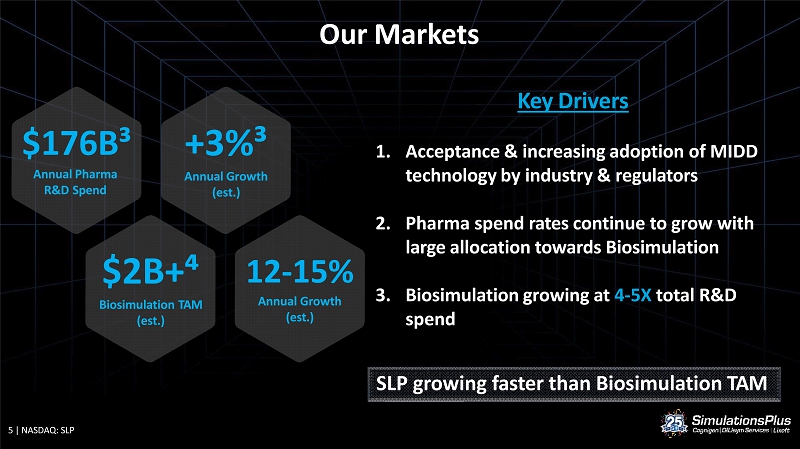

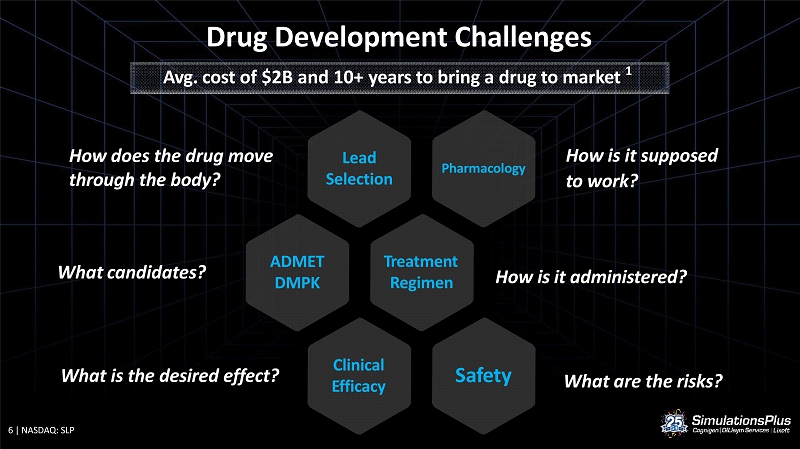

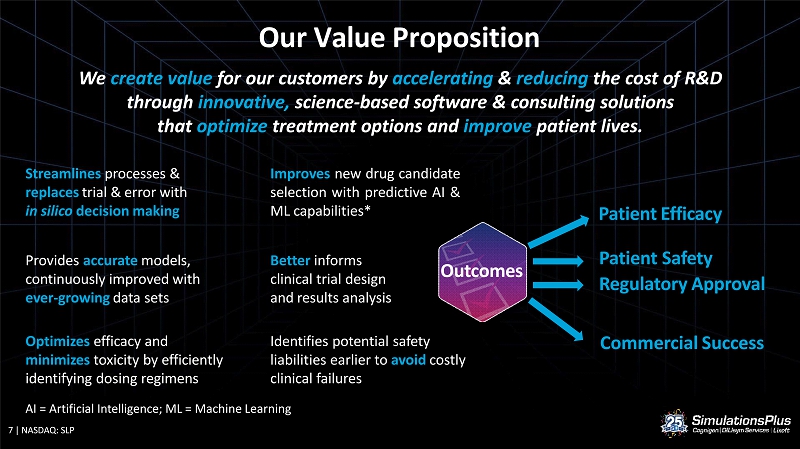

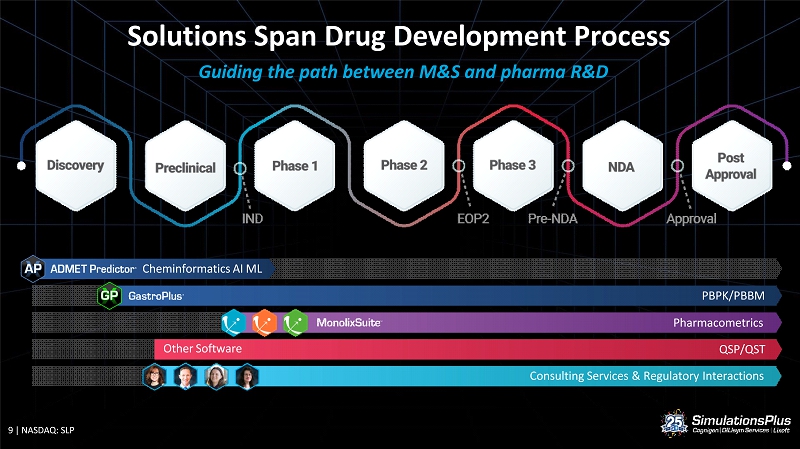

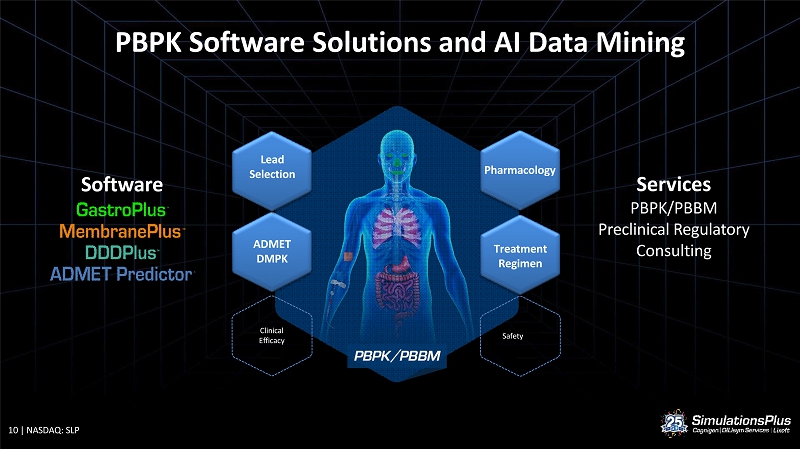

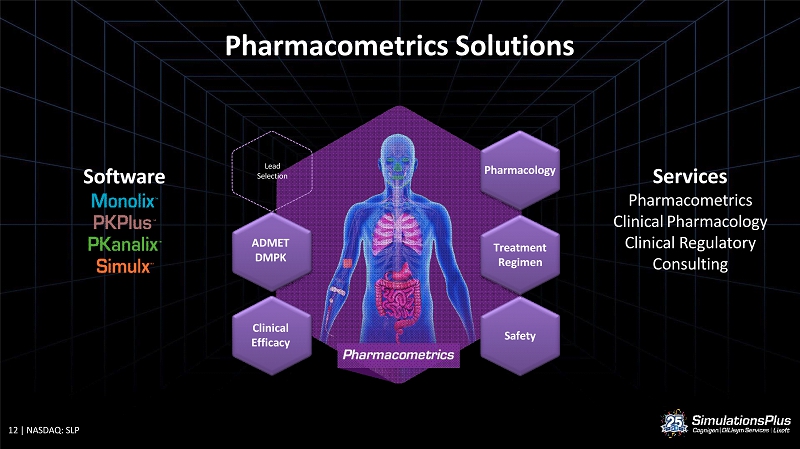

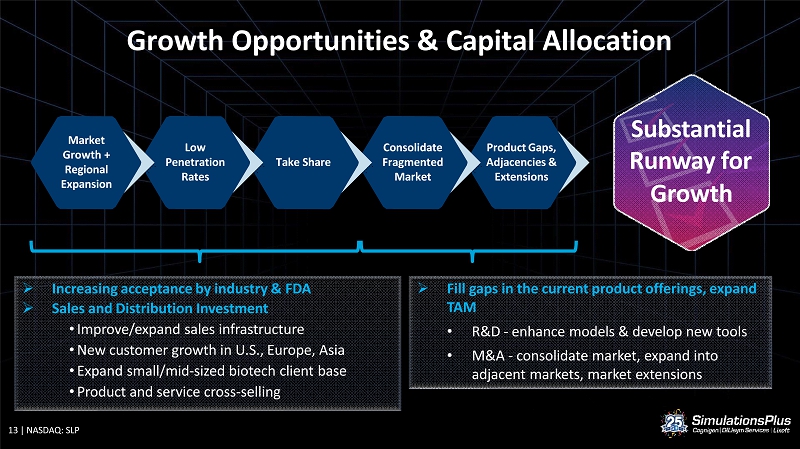

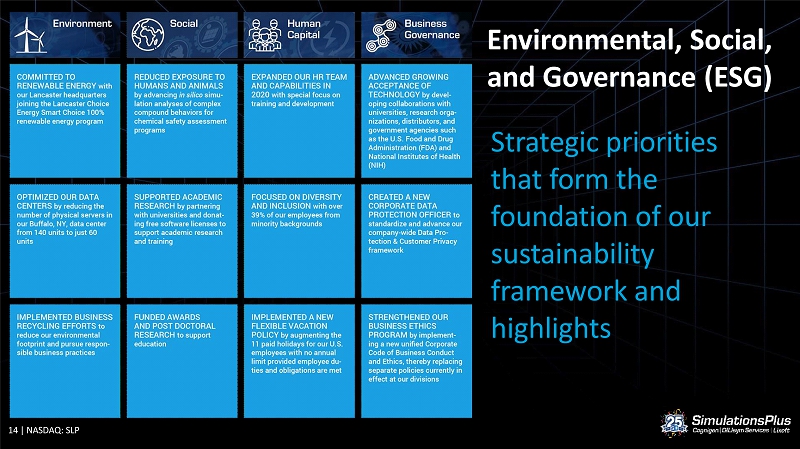

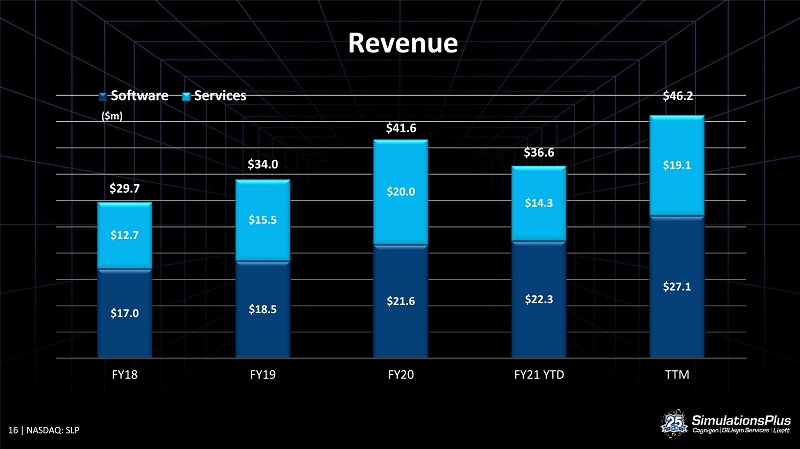

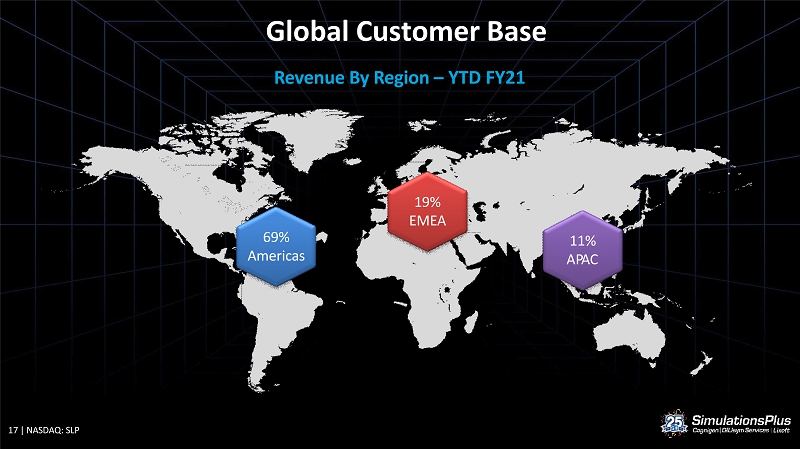

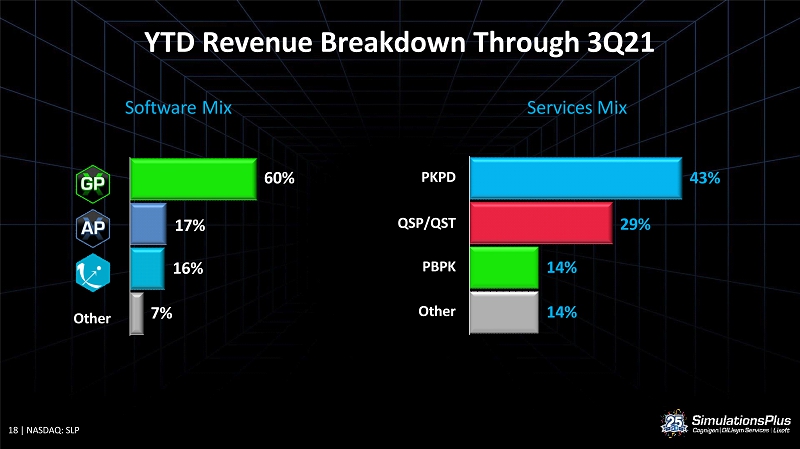

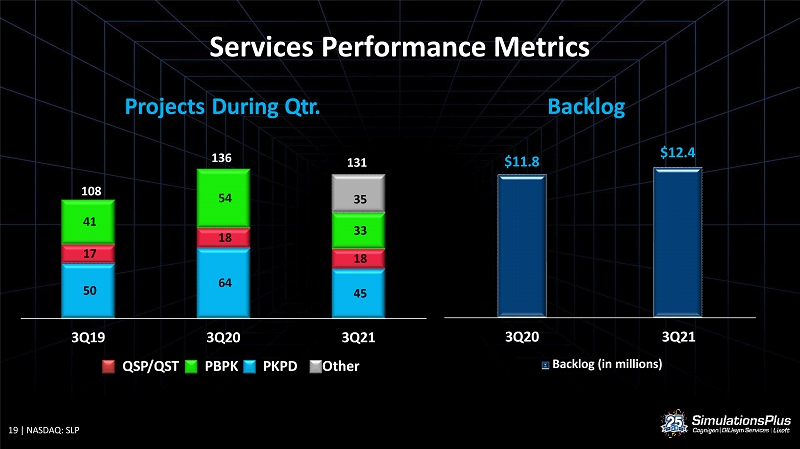

On September 20, 2021, Simulations Plus, Inc., a California corporation (the “Company”), presented at the Bank of America Securities 2021 Tech Solutions for Drug Discovery Conference using the presentation attached as Exhibit 99.1 to this Current Report on Form 8-K. The presentation has also been posted to the Company’s website in the “Investors” section.

The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed subject to the requirements of Item 10 of Regulation S-K, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as expressly set forth by specific reference in such filing. The furnishing of this information hereby shall not be deemed an admission as to the materiality of any such information.

Forward-Looking Statements

This Current Report on Form 8-K (the “Report”), including the disclosures set forth herein and in Exhibit 99.1 attached hereto, contains certain forward-looking statements that involve substantial risks and uncertainties. When used herein, the terms “anticipates,” “expects,” “estimates,” “believes” and similar expressions, as they relate to us or our management, are intended to identify such forward-looking statements.

Forward-looking statements in this Report or hereafter, including in other publicly available documents filed with the Securities and Exchange Commission (the “Commission”), reports to the stockholders of the Company and other publicly available statements issued or released by us involve known and unknown risks, uncertainties and other factors which could cause our actual results, performance (financial or operating) or achievements to differ from the future results, performance (financial or operating) or achievements expressed or implied by such forward-looking statements. Such future results are based upon management’s best estimates based upon current conditions and the most recent results of operations. These forward-looking statements speak only as of the date of this Current Report and are subject to a number of risks, uncertainties and assumptions. The events and circumstances reflected in such forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements due to risks, uncertainties and other factors described in the Company’s press releases and in its filings with the Commission, including under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K and any subsequent filings with the SEC. Moreover, the Company operates in a very competitive and rapidly changing environment. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict all risks and uncertainties. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

| Item 9.01 | Financial Statements and Exhibits |

(d) Exhibits

| 99.1 | Investor conference presentation, dated September 20, 2021. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

SIMULATIONS PLUS, INC. | |

| Dated: September 21, 2021 | By: /s/ Will Frederick |

| Will Frederick | |

| Chief Financial Officer |