SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Material

☐ Soliciting Material under §240.14a-12

Simulations Plus, Inc.

(Name of Registrant as Specified In Its Charter)

_____________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

☐ Fee paid previously with preliminary materials:

____________________________________________________________________________

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| 1) | Amount previously paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held June 23, 2021

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of Simulations Plus, Inc., a California corporation (the “Company”), will be held on Wednesday, June 23, 2021, at 2:00 p.m. Pacific Time. Given the extraordinary circumstances arising from the Novel Coronavirus (“COVID-19”) pandemic, we have adopted a completely virtual format for the Meeting to provide a healthy, consistent and convenient experience to all shareholders regardless of location. You may attend the Meeting virtually via the Internet at www.virtualshareholdermeeting.com/SLP2021, where you will be able to vote electronically and submit questions. The purpose of the Meeting is to approve the adoption of our new 2021 Equity Incentive Plan.

All shareholders are cordially invited to attend the Meeting, although only shareholders of record at the close of business on April 26, 2021, the record date for the Meeting, will be entitled to notice of, and to vote at, the Meeting. A list of shareholders entitled to vote at the Meeting will be open to inspection by the shareholders for a period of 10 days prior to the Meeting. If you want to inspect the shareholder list, email renee@simulations-plus.com to make arrangements. The list of shareholders will also be available during the virtual Meeting itself through the Meeting website for those shareholders who choose to attend.

Our Board of Directors has carefully reviewed and considered the foregoing proposal, and has concluded that adopting our new 2021 Equity Incentive Plan is in the best interests of the Company and its shareholders. Therefore, the Board of Directors has approved this proposal, and recommends that you vote FOR the adoption of our 2021 Equity Incentive Plan.

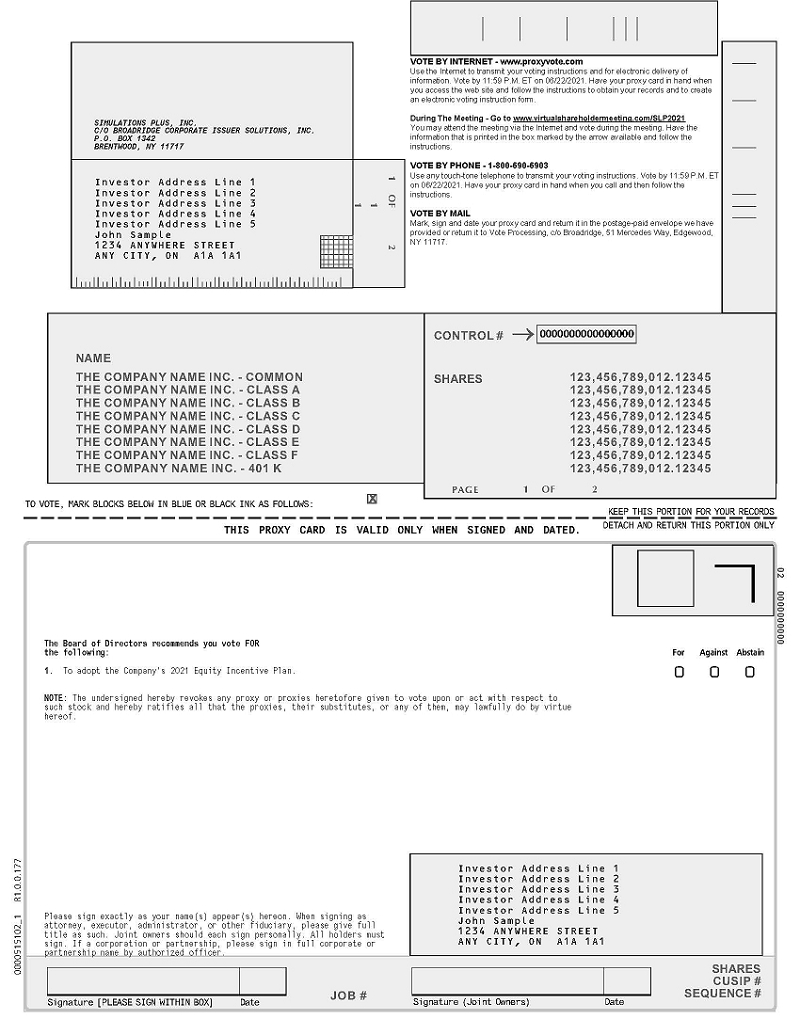

Shares can be voted at the Meeting only if the holder thereof is present virtually or represented by a proxy. To ensure that your shares are represented at the Meeting, we urge you to vote your shares promptly either by proxy over the internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials you received, or, if you requested to receive printed proxy materials, you may vote by marking, dating, and signing the enclosed proxy card and returning it in the postage-paid envelope provided. We encourage you to do so even if you plan to attend the Meeting virtually. The prompt voting of your shares, regardless of the number you hold, will aid the Company in reducing the expense of additional proxy solicitation. You may revoke your proxy at any time before it has been voted at the Meeting. Please note that dissenters’ rights are not available with respect to the proposal to be voted on at the Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be Held on June 23, 2021. This notice of meeting and the accompanying proxy statement will be available at www.proxyvote.com on or about May 21, 2021, and are available on our website at www.simulations-plus.com.

By Order of the Board of Directors

/s/ Will Frederick

Will Frederick

Secretary

May 11, 2021

| i |

Simulations Plus, Inc.

42505 10th Street West

Lancaster, CA 93534

PROXY STATEMENT

FOR THE SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 23, 2021

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

Simulations Plus, Inc. (“we,” “us,” “our,” “Simulations Plus” or the “Company”) is making proxy materials, including this proxy statement (“Proxy Statement”) and the related proxy card, available to its shareholders via the internet on or about May 11, 2021 because its Board of Directors (the “Board”) is soliciting proxies to vote at the special meeting of shareholders (“Meeting”). The Meeting is scheduled to be held on Wednesday, June 23, 2021, at 2:00 p.m. Pacific Time, via live webcast through www.virtualshareholdermeeting.com/SLP2021. You will need the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable). This solicitation is for proxies for use at the Meeting or at any reconvened meeting after an adjournment or postponement of the Meeting.

The sole matter scheduled for a vote at the Meeting is to approve the adoption of our new 2021 Equity Incentive Plan.

Who can vote at the Special Meeting?

Only shareholders of record at the close of business on April 26, 2021, the record date for the Meeting, will be entitled to notice of, and to vote at, the Meeting. The Company’s common stock is currently its only class of voting securities. As of the record date, there were 20,114,775 shares of the Company’s common stock issued and outstanding.

Am I a shareholder of record for purpose of the Special Meeting?

If, on April 26, 2021, your shares were registered directly in your name with our transfer agent, Broadridge Corporate Issuer Solutions, Inc., then you are the shareholder of record for purposes of the Meeting.

What if my shares are held in an account at a brokerage firm, bank or dealer?

If, on April 26, 2021, your shares were held in an account at a brokerage firm, bank, or dealer (commonly referred to as being held in “street name”), and these proxy materials are being forwarded to you by the organization holding your account, the organization holding your account is considered the shareholder of record with respect to your shares for purposes of the Meeting, and you are considered the beneficial owner of such shares. As a beneficial owner, you have the right to direct that organization on how to vote the shares in your account.

You may vote “for” or “against” or abstain from voting altogether on the proposal to be voted on at the Meeting.

Shareholders of Record: Shares Registered in Your Name

If you are a shareholder of record, you may vote your shares by proxy over the internet by following the instructions provided in the Notice of Internet Availability of Proxy Materials you received, or, if you requested to receive printed proxy materials, you may vote by marking, dating, and signing the enclosed proxy card and returning it in the postage-paid envelope provided. Additionally, you may vote your shares virtually at the Meeting by visiting www.virtualshareholdermeeting.com/SLP2021 and using the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable).

| 1 |

If you are voting your shares by proxy over the internet, we request that you cast your vote by June 16, 2021, though you can cast your vote over the internet until 11:59 p.m. Eastern Time the day before the Meeting. If you are voting your shares by returning a proxy card, we request that you return your completed proxy card to us no later than June 8, 2021, though you can return your proxy card at any time as long as we receive it before voting begins at the Meeting. Please note that you may still attend the Meeting and vote virtually, even if you have already voted by proxy via either the internet or mail.

Beneficial Owner: Shares Held in “Street Name”

If you are a beneficial owner of shares held in “street name,” you should have received instructions from the organization holding your shares that you must follow for your shares to be voted. The availability of telephonic or internet voting will depend on the voting process of such organization. Alternatively, you may vote virtually at the Meeting by visiting www.virtualshareholdermeeting.com/SLP2021 and using the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable); however, in order to do so you must obtain a “legal” proxy from the organization holding your shares and present it and proof of identification to the inspector of elections at the Meeting. Please contact the organization that holds your shares if you wish to obtain a “legal” proxy.

Regardless of how your shares are held, and whether or not you plan to attend the Meeting, we encourage you to vote your shares via the internet or by returning a proxy card to ensure that your vote is counted.

If my shares are held in “street name” by a broker or other nominee, will my broker or nominee vote my shares for me?

If your shares are held in street name and you do not instruct your broker or other nominee on how to vote your shares, your broker or other nominee may exercise its discretion to vote your shares only on “routine” matters.

The adoption of our new 2021 Equity Incentive Plan is considered a non-routine matter. Consequently, without your voting instructions, your broker or other nominee cannot vote your shares on this proposal.

If you do not provide voting instructions to your broker or other nominee on the adoption of our 2021 Equity Incentive Plan, your shares will be considered “broker non-votes” as to the adoption of our 2021 Equity Incentive Plan. A broker non-vote will not be considered shares voting or as votes cast with respect to the particular proposal. As a result, a broker non-vote will not have any effect on the outcome of the proposal.

Votes will be counted by the Company’s corporate secretary, who will separately count “for” and “against” votes, abstentions, and “broker non-votes.”

How many “for” votes are needed to approve the proposal?

The adoption of our 2021 Equity Incentive Plan requires the affirmative vote of a majority of the shares of common stock present and voting at the Meeting. Abstentions will have the same effect as “against” votes, and broker non-votes will have no effect.

Each shareholder of record as of April 26, 2021 is entitled to cast one vote for each share of our common stock held by such shareholder of record as of April 26, 2021 on the matter to come before the Meeting.

What is the quorum requirement?

A quorum of shareholders is necessary to hold the Meeting. A quorum will be present if at least a majority of the outstanding shares on the record date are present either virtually or by proxy at the Meeting. On the record date, April 26, 2021, there were 20,114,775 shares outstanding and entitled to vote. Accordingly, 10,057,388 shares must be present either virtually or by proxy at the Meeting in order to establish a quorum at the Meeting.

| 2 |

If you submit a valid proxy (by internet or mail), regardless of whether you abstain from voting on the matter, your shares will be counted as present at the Meeting for purposes of determining a quorum. Broker non-votes will not be counted as present at the Meeting for purposes of determining a quorum. If there is no quorum, a majority of the shares present either virtually or by proxy at the Meeting may adjourn the Meeting to another date.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials?

If you receive more than one Notice of Internet Availability of Proxy Materials, then your shares are registered in more than one name or are registered in different accounts. Please follow the instructions on each Notice of Internet Availability of Proxy Materials to ensure that all of your shares are voted at the Meeting.

What if I vote online or return a proxy card but do not make specific choices?

If you vote online, or return a signed and dated proxy card, without marking any voting selections, all of your shares will be voted “for” the adoption of our 2021 Equity Incentive Plan. If any other matter is properly presented at the Meeting, your proxy (one of the individuals named on your Notice of Internet Availability of Proxy Materials or on your proxy card) will vote your shares using his or her best judgment.

Can I change my vote after submitting my proxy?

You can change your vote with respect to the proposal by revoking your proxy at any time prior to the commencement of voting with respect to the proposal at the Meeting. You may revoke your proxy in one of three ways:

| · | By delivering to our corporate secretary (c/o Will Frederick, Simulations Plus, Inc. 42505 10th Street West, Lancaster, CA 93534) a duly executed proxy bearing a date later than the date of the proxy you wish to revoke. Such later-dated proxy must be delivered before voting begins at the Meeting. |

| · | By delivering to our corporate secretary (c/o Will Frederick, Simulations Plus, Inc. 42505 10th Street West, Lancaster, CA 93534) a written notice of revocation dated later than the date of the proxy you wish to revoke. Such written notice of revocation must be delivered before voting begins at the Meeting. |

| · | By attending the Meeting and voting virtually. Bear in mind that simply attending the Meeting will not, by itself, revoke your proxy. In addition, please recall that if you are a beneficial owner of shares held in “street name” and wish to vote virtually at the Meeting, you must obtain a “legal” proxy from the organization holding your shares and present it to the inspector of elections, along with proof of identification, at the Meeting. |

Following the commencement of voting with respect to the proposal, you may not revoke your proxy or otherwise change your vote with respect to the proposal.

Are dissenters’ rights available with respect to the proposal?

Dissenters’ rights are not available with respect to the proposal to be voted on at the Meeting.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results are expected to be announced at the Meeting. We will report final voting results in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the Meeting.

Who is paying for this proxy solicitation?

We are soliciting proxies from our shareholders on behalf of our Board and will pay for all costs incurred in connection with such solicitation. In addition to soliciting proxies by this Proxy Statement, our directors and employees may also solicit proxies virtually at the Meeting, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks, and other agents for the cost of forwarding proxy materials to beneficial owners.

| 3 |

PROPOSAL: APPROVAL OF THE ADOPTION OF OUR 2021 EQUITY INCENTIVE PLAN

On December 23, 2016, our Board adopted, and on February 23, 2017 the Company’s shareholders approved, our 2017 Equity Incentive Plan (the “2017 Plan”). In late 2020, our Board approved, and recommended that the Company’s shareholders approve, an amendment to the 2017 Plan to increase the number of shares available for issuance under the 2017 Plan. On February 3, 2021, Institutional Shareholder Services, Inc. (“ISS”) issued a report (the “ISS Report”) recommending that the Company’s shareholders vote against the proposed amendment to the 2017 Plan, which recommendation was based primarily on the 2017 Plan (i) permitting repricing and exchange of options without shareholder approval, (ii) permitting the cash buyout of options without prior shareholder approval, (iii) providing for liberal recycling of shares subject to awards, and (iv) permitting broad discretion to accelerate vesting of awards. After ISS made its recommendation, the Company’s shareholders voted against the proposed amendment to the 2017 Plan at the Company’s 2020 Annual Meeting of Shareholders held on February 25, 2021, and as a result, our 2017 Plan was not amended.

The Board believes that it is important for the Company to have a comprehensive equity incentive plan in place so that the Company can attract, retain and incentivize the Company’s officers, directors, employees, and service providers, whose contributions are important to the Company’s success. Therefore, on April 9, 2021, the Board approved, subject to shareholder approval, the adoption of a new 2021 Equity Incentive Plan (the “2021 Plan”). The Board believes that it is in the best interests of the Company and its shareholders to adopt the 2021 Plan so that the Company can continue to be able to issue certain stock-based awards, including performance-based awards, to officers, directors, employees, and service providers, which allows such officers, directors, employees, and service providers to acquire or increase their ownership stake in the Company, thereby aligning their interests with those of the Company’s shareholders.

The purposes of the 2021 Plan are:

| · | to promote the success and enhance the value of the Company by linking the personal interests of the Company’s officers, directors, employees, and service providers to those of the Company’s shareholders and, by providing such individuals with an incentive for performance, to generate returns to the Company’s shareholders; and | |

| · | to provide the Company flexibility to motivate, attract, and retain the services of officers, directors, employees, and service providers, upon whose judgment, interest, and special effort the successful conduct of the Company’s operation is largely dependent. |

The Board believes that the 2021 Plan addresses the issues raised in the ISS Report. As recommended by ISS, the 2021 Plan (i) prohibits repricing or cash purchases of options by the Company without shareholder approval, (ii) provides that shares subject to awards that are used to pay the exercise price or satisfy withholding obligations with respect to awards will not be available for future issuance under the 2021 Plan, and (iii) prohibits discretionary acceleration of vesting of awards (other than in connection with a death, disability or a change in control where a participant terminates employment in certain situations or equity awards are not assumed or substituted for in the transaction).

The 2021 Plan, if approved by shareholders, will replace the 2017 Plan. If the 2021 Plan is approved by shareholders, no further grants of awards will be made under the Company’s 2017 Plan, and any awards that are cancelled or expire under the 2017 Plan will not be reissued. If shareholders do not approve the 2021 Plan, the 2021 Plan will not be effective and the 2017 Plan will remain in effect in accordance with its terms until its expiration. As of May 11, 2021, approximately 630,896 shares of common stock were subject to outstanding awards under our 2017 Plan and 256,848 shares of common stock were available for future awards under our 2017 Plan.

The principal features of the 2021 Plan are summarized below; however, the summary is qualified in its entirety by reference to the 2021 Plan itself, a copy of which is attached hereto as Appendix A.

Reasons for Shareholder Approval of the 2021 Plan

The Board seeks approval of the 2021 Plan by shareholders to meet requirements of the Nasdaq Stock Market and to permit the grant of incentive stock-based awards to our officers, directors, employees, and service providers. In addition, the Board regards shareholder approval of the 2021 Plan as desirable and consistent with corporate governance best practices.

| 4 |

The market for quality personnel is competitive, and the ability to obtain and retain competent personnel is of great importance to the Company’s business operations. We believe that adoption of the 2021 Plan will enhance our ability to attract and retain highly qualified officers, directors, employees, and service providers, and to motivate such individuals to serve the Company and to expend maximum effort to improve our business results by providing to those individuals an opportunity to acquire or increase a direct proprietary interest in our operations and future success. The 2021 Plan also will allow us to promote greater ownership in our Company by our service providers in order to align their interests more closely with the interests of our shareholders.

In addition, shareholder approval will permit designated stock options granted over the next 10 years to qualify as incentive stock options under the Internal Revenue Code (the “Code”). Such qualification can give the holder of the options more favorable tax treatment, as explained below.

The Board approved the 2021 Plan to provide a means to retain the services of the group of persons eligible to receive awards, to secure and retain the services of new members of this group, to provide incentives for such persons to exert maximum efforts for the success of the Company and its affiliates, and to address the issues raised by ISS with respect to the Company’s 2017 Plan. All of the employees, as well as officers, non-employee directors, and service providers of the Company and its affiliates, are eligible to participate in the 2021 Plan.

Summary of Key Terms of the 2021 Plan

| Plan Term: | Ten years. |

| Eligible Participants: | Employees (including officers), directors, and service providers of both the Company and its affiliates. |

| Shares Authorized: | 2,100,000 shares of the Company’s common stock. |

| Award Types: | (i) Incentive Stock Options; (ii) Nonstatutory Stock Options; (iii) Restricted Stock awards, (iv) Restricted Stock Units; (v) Stock Bonus awards; and (vi) Performance-Based Awards. |

| Vesting; Minimum Periods; Discretionary Vesting; Dividends on Unvested Shares: | Vesting schedules are determined by the administrator when each award is granted. Except as to a maximum of five percent (5%) of the number of shares reserved and available for grant and issuance under the 2021 Plan, any awards that vest on the basis of the participant’s continued service will have a minimum vesting period of one year (such requirement, the “Minimum Vesting Requirement”). In addition, the administrator may not use discretion to accelerate the vesting of plan awards (subject to a maximum five percent (5%) of shares under the 2021 Plan that may be accelerated) other than in connection with a death, disability or a change in control (where a participant terminates employment in certain situations or equity awards are not assumed or substituted for in the transaction). No dividends payments will be made on unvested shares subject to grants under the 2021 Plan, but instead any dividends will be deferred until the relevant awards become vested. |

| Award Terms: | Stock options have a term no longer than ten years from the date the options were granted, except in the case of incentive stock options granted to holders of more than 10% of the Company’s voting power, which have a term no longer than five years. |

| Repricing and Buyout Prohibited Without Shareholder Approval: | Repricing, or reducing the exercise price of outstanding options or any similar employee program, or buying out options, without shareholder approval is prohibited under the 2021 Plan. |

| Recoupment: | Awards (and gains realized with respect to such awards) under the 2021 Plan will be subject to recoupment to the extent that an executive officer is determined to have engaged in fraud or intentional illegal conduct materially contributing to a financial restatement, pursuant to a clawback or recoupment policy to be adopted by the Board, or required by law during a participant’s employment or service. |

| 5 |

As permitted by the terms of the 2021 Plan, the Board has delegated administration of the 2021 Plan to the Compensation Committee of the Board. As used herein with respect to the 2021 Plan, the “Board” or “Board” refers to any committee the Board appoints as well as to the Board itself. Subject to the provisions of the 2021 Plan, the Board has the power to construe and interpret the 2021 Plan and awards granted under it and to determine the persons to whom and the dates on which awards will be granted, the number of shares of common stock to be subject to each award, the time or times during the term of each award within which all or a portion of such award may be exercised, the exercise price, the type of consideration and other terms of the award. All decisions, determinations and interpretations by the Board regarding the 2021 Plan shall be final and binding on all participants or other persons claiming rights under the 2021 Plan or any award.

The Board has the power to delegate administration of the 2021 Plan to a committee composed of not fewer than two members of the Board. In the discretion of the Board, a committee may consist solely of two or more non-employee directors in accordance with Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Stock Subject to the 2021 Plan

Subject to shareholder approval of this Proposal, an aggregate of 2,100,000 shares of common stock will be reserved for issuance under the 2021 Plan. Shares issued under the 2021 Plan may be previously unissued shares or reacquired shares of the Company’s common stock bought on the market or otherwise.

If awards granted under the 2021 Plan expire or otherwise terminate without being exercised, or if any shares of common stock issued to a participant pursuant to an award are cancelled, forfeited to, or repurchased by the Company at the original purchase price, such shares of common stock again become available for issuance under the 2021 Plan. If any shares subject to an award are not delivered to a participant because such shares are withheld for the payment of taxes or the award is exercised through a “cashless exercise,” or if shares subject to an award are withheld to satisfy tax withholding obligations related to such award, such shares shall no longer be available for the grant of awards under the 2021 Plan. Notwithstanding the foregoing, and subject to the terms of the 2021 Plan, the aggregate maximum number of shares of common stock that may be issued as incentive stock options will be 2,100,000 shares of common stock.

Incentive stock options may be granted under the 2021 Plan only to employees (including officers) of the Company and its affiliates. Employees (including officers and employees providing services to the Company or an affiliate in a foreign country through an agreement with such country or an agency), directors, and service providers of both the Company and its affiliates are eligible to receive all other types of awards under the 2021 Plan.

No incentive stock option may be granted under the 2021 Plan to any person who, at the time of the grant, owns (or is deemed to own) stock possessing more than 10% of the total combined voting power of the Company or any affiliate of the Company, unless the exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant and the term of the option does not exceed five years from the date of grant. In addition, the aggregate fair market value, determined at the time of grant, of the shares of common stock with respect to which incentive stock options are exercisable for the first time by a participant during any calendar year (under the 2021 Plan and all other such plans of the Company and its Affiliates) may not exceed $100,000.

The following is a description of the permissible terms of stock options issuable under the 2021 Plan. Individual option grants may be more restrictive as to any or all of the permissible terms described below.

Exercise Price; Payment. The exercise price of incentive stock options may not be less than 100% of the fair market value of the stock subject to the option on the date of the grant and, in some cases (see “Eligibility” above), may not be less than 110% of such fair market value. The exercise price of nonstatutory options shall be determined by the Board.

| 6 |

Acceptable consideration for the purchase of common stock issued under the 2021 Plan will be determined by the Board and may include cash, common stock previously owned by the optionee, a deferred payment arrangement, the cashless exercise of the option, consideration received in a “cashless” broker-assisted sale and other legal consideration approved by the Board.

Option Exercise. Stock options granted under the 2021 Plan may become exercisable (“vest”) in cumulative increments as determined by the Board. Such increments may be based on continued service to the Company over a certain period of time, the occurrence of certain performance milestones, or other criteria. Stock options granted under the 2021 Plan may be subject to different vesting terms. Except as to a maximum of 5% of the number of shares reserved and available for grant and issuance under the 2021 Plan, any options that vest on the basis of the participant’s continued service will have a minimum vesting period of one year. In addition, the plan administrator may not use discretion to accelerate the vesting of options (subject to a maximum 5% of shares under the 2021 Plan that may be accelerated) other than in connection with a death, disability or a change in control (where a participant terminates employment in certain situations or equity awards are not assumed or substituted for in the transaction). To the extent provided by the terms of an option, a participant may satisfy any federal, state or local tax withholding obligation relating to the exercise of such option by a cash payment upon exercise, by authorizing the Company to withhold a portion of the stock otherwise issuable to the participant, or by such other method as may be set forth in the option agreement.

Term. The maximum term of stock options issued under the 2021 Plan is 10 years, except that in certain cases (see “Eligibility” above) the maximum term of certain incentive stock options is five years. Stock options under the 2021 Plan generally terminate 60 days after termination of the participant’s service unless (i) such termination is due to the participant’s disability, in which case the option may, but need not, provide that it may be exercised (to the extent the option was exercisable at the time of the termination of service) at any time within six months of such termination; (ii) the participant dies before the participant’s service has terminated, or within three months after termination of such service, in which case the option may, but need not, provide that it may be exercised (to the extent the option was exercisable at the time of the participant’s death) within 12 months of the participant’s death by the person or persons to whom the rights to such option pass by will or by the laws of descent and distribution; or (iii) the option by its terms specifically provides otherwise. If an optionee’s service with the Company, or any affiliate of the Company, ceases with cause, the option will terminate at the time the optionee’s service ceases. In no event may an option be exercised after its expiration date.

A participant’s option agreement may provide that if the exercise of the option following the termination of the participant’s service would be prohibited because the issuance of stock would violate the registration requirements under the Securities Act of 1933, as amended (the “Securities Act”), then the option will terminate on the earlier of (i) the expiration of the term of the option or (ii) three months after the termination of the participant’s service during which the exercise of the option would not be in violation of such registration requirements.

Restrictions on Transfer. Incentive stock options are not transferable except by will or by the laws of descent and distribution, provided that a participant may designate a beneficiary who may exercise an option following the participant’s death. Nonstatutory stock options are transferable to the extent provided in the option agreement.

Terms of Stock Bonuses and Restricted Stock Awards

Stock bonus awards and restricted stock awards are granted through a stock bonus award agreement or restricted stock award agreement.

Payment. Subject to certain limitations, the purchase price for restricted stock or stock bonus awards must be at least the par value of our common stock. The purchase price for a stock purchase award may be payable in cash, or any other form of legal consideration approved by the Board. Stock bonus awards may be granted in consideration for the recipient’s past services for the Company.

Vesting. Common stock under a restricted stock or stock bonus award agreement may be subject to a share repurchase option or forfeiture right in our favor, each in accordance with a vesting schedule and subject to the Minimum Vesting Requirement. If a recipient’s service relationship with us terminates, we may reacquire or receive via forfeiture all of the shares of our common stock issued to the recipient pursuant to a restricted stock or stock bonus award that have not vested as of the date of termination.

| 7 |

Restrictions on Transfer. Rights under a stock bonus or restricted stock bonus agreement may be transferred only as expressly authorized by the terms of the applicable stock bonus or restricted stock purchase agreement.

Dividends. No dividend payments will be made on unvested shares of restricted stock, but instead, any dividends will be deferred until the relevant awards become vested.

Restricted stock unit awards are issued pursuant to a stock unit award agreement.

Payment. Subject to certain limitations, the consideration, if any, for restricted stock unit awards must be at least the par value of our common stock. The consideration for a stock unit award may be payable in any form acceptable to the Board and permitted under applicable law.

Vesting and Settlement. The Board may impose any restrictions or conditions upon the vesting of restricted stock unit awards, or that delay the delivery of the consideration after the vesting of stock unit awards, that it deems appropriate consistent with the Minimum Vesting Requirement. Restricted stock unit awards may be settled in cash or shares of the Company’s common stock, as determined by the Board. No dividend payments will be made on unvested restricted stock unit awards, but instead, any dividends will be deferred until the relevant awards become vested.

Termination of Service. If a restricted stock unit award recipient’s service relationship with the Company terminates, any unvested portion of the restricted stock unit award is forfeited upon the recipient’s termination of service.

The Board may grant awards under the 2021 Plan that are designated “Performance-Based Awards.” Generally, Performance-Based Awards require satisfaction of pre-established performance goals, consisting of one or more business criteria and a targeted performance level with respect to such criteria as a condition of awards being granted or becoming exercisable, or as a condition to accelerating the timing of such events. Performance may be measured over a period of any length specified by the Board. If so determined by the Board, the business criteria used by the Board in establishing performance goals applicable to performance awards to our named executive officers will be selected from among the following: (i) net earnings (either before or after interest, taxes, depreciation and amortization), sales or revenue, net income (either before or after taxes), operating earnings, cash flow (including, but not limited to, operating cash flow and free cash flow), (ii) return on net assets, (iii) return on shareholders’ equity, (iv) return on sales, (v) gross or net profit margin, (vi) working capital, (vii) earnings per share and price per share of common stock, or (viii) the achievement of certain milestones, customer retention rates, licensing, partnership or other strategic transactions, or obtaining a specified level of financing for the Company, as determined by the Board, including the issuance of securities, or the achievement of one or more corporate, divisional or individual scientific or inventive measures.

Transactions not involving receipt of consideration by the Company, such as recapitalization, reincorporation, reclassification, stock dividend, dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, or a change in corporate structure may change the type(s), class(es) and number of shares of common stock subject to the 2021 Plan and outstanding awards. In that event, the 2021 Plan will be appropriately adjusted as to the type(s), class(es) and the maximum number of shares of common stock subject to the 2021 Plan, and outstanding awards will be adjusted as to the type(s), class(es), number of shares and price per share of common stock subject to such awards.

Effects of Certain Corporate Transactions

In the event of a merger, sale of all or substantially all of the assets of the Company or other change of control transaction, unless otherwise determined by the Board, all outstanding awards will be subject to the agreement governing such merger, asset sale or other change of control transaction. Such agreement need not treat all such awards in an identical manner, and it will provide for one or more of the following with respect to each award: (i) the continuation of the award, (ii) the assumption of the award, (iii) the substitution of the award, or (iv) the payment of the excess of the fair market value of the shares subject to the award over the exercise price or purchase price of such shares. In the event the successor corporation refuses to either continue, assume or substitute the shares subject to the award pursuant to the terms of the 2021 Plan, pay the excess of the fair market value of the shares subject to the award over the exercise price or purchase price of such shares, then outstanding awards shall vest and become exercisable as to 100% of the shares subject thereto contingent upon the consummation of such change of control transaction.

| 8 |

Duration, Amendment and Termination

The Board may suspend or terminate the 2021 Plan without shareholder approval or ratification at any time or from time to time. Unless sooner terminated, the 2021 Plan will terminate on April 9, 2031, which is the tenth anniversary of the date of its adoption by the Board.

The Board will have authority to amend or terminate the 2021 Plan. No amendment or termination of the 2021 Plan shall adversely affect any rights under awards already granted to a participant unless agreed to by the affected participant. Additionally, no action may be taken by the Board without shareholder approval to (i) permit the repricing or buyout of outstanding stock options under the 2021 Plan, or (ii) otherwise implement any amendment required to be approved by shareholders to comply with applicable provisions of federal securities laws, state corporate and securities laws, the Code, the rules of any applicable stock exchange or national market system, and the rules of any non-U.S. jurisdiction applicable to awards granted to residents therein.

At the present time, no specific determination has been made as to the grant or allocation of awards under the 2021 Plan. Future awards to the Company’s executive officers and employees are discretionary. Therefore, at this time the benefits that may be received by the Company’s executive officers and other employees if the Company’s shareholders approve the 2021 Plan cannot be determined. Because the value of stock issuable to the Company’s non-employee directors under the 2021 Plan will depend on the fair market value of the Company’s common stock at future dates, it is not possible to determine exactly the benefits that might be received by the Company’s non-employee directors under the 2021 Plan.

Federal Income Tax Information

The following is a brief summary of the current federal income tax consequences that generally apply with respect to awards that may be granted under the 2021 Plan and is based upon laws, regulations, rules and decisions now in effect, all of which are subject to change. The following summary is intended for general information only and does not purport to be a complete analysis of all of the potential tax effects of the 2021 Plan. This summary does not describe any foreign, state or local tax consequences, or various other rules that could apply to a particular individual or to the Company and its subsidiaries under certain circumstances (and references to the Company in this section include the applicable subsidiary, if any). This summary is not tax advice and is not intended or written to be used (and cannot be used by any taxpayer) to avoid penalties that may be imposed on a taxpayer. Tax implications may vary due to individual circumstances. Participants should consult their personal tax advisors about the tax consequences related to awards under the 2021 Plan. Tax consequences are not guaranteed.

Incentive Stock Options. Incentive stock options under the 2021 Plan are intended to be eligible for the federal income tax treatment accorded “incentive stock options” under the Code.

There generally are no federal income tax consequences to the participant or the Company by reason of the grant or exercise of an incentive stock option. However, the exercise of an incentive stock option may give rise to or increase alternative minimum tax liability for the participant.

If a participant holds stock acquired through exercise of an incentive stock option for more than two years from the date on which the option is granted and more than one year from the date on which the shares are transferred to the participant upon exercise of the option, any gain or loss on a disposition of such stock will be a long-term capital gain or loss if the participant held the stock for more than one year.

Generally, if the participant disposes of the stock before the expiration of either of these holding periods (a “disqualifying disposition”), then at the time of disposition the participant will realize taxable ordinary income equal to the lesser of (i) the excess of the stock’s fair market value on the date of exercise over the exercise price, or (ii) the participant’s actual gain, if any, on the purchase and sale. The participant’s additional gain or any loss upon the disqualifying disposition will be a capital gain or loss, which will be long-term or short-term depending on whether the stock was held for more than one year.

To the extent the participant recognizes ordinary income by reason of a disqualifying disposition, the Company will generally be entitled (subject to the requirement of reasonableness, and the satisfaction of a tax reporting obligation) to a corresponding business expense deduction in the tax year in which the disqualifying disposition occurs.

| 9 |

Nonstatutory Stock Options, Restricted Stock Purchase Awards, Restricted Stock Units and Stock Bonuses. Nonstatutory stock options, restricted stock purchase awards, restricted stock units and stock bonuses granted under the 2021 Plan generally have the federal income tax consequences described below.

There generally are no tax consequences to the participant or the Company by reason of the grant of these awards. However, if the exercise price of a nonstatutory stock option can, at any time, be less than the fair market value of the stock on the grant date, Section 409A of the Code imposes ordinary income and employment tax liability on the participant as the option vests in an amount equal to the difference between the fair market value of the stock on the vesting date and the exercise price. In addition, Section 409A imposes a penalty of 20% of such amount and an interest charge. The Company would be responsible for withholding these tax amounts. Upon acquisition of the stock under any of these awards (or settlement of restricted stock units in cash), the participant normally will recognize taxable ordinary income equal to the excess, if any, of the stock’s fair market value on the acquisition date over the purchase price. However, to the extent the stock is subject to certain types of vesting restrictions, the taxable event will be delayed until the vesting restrictions lapse unless the participant elects to be taxed on receipt of the stock. With respect to employees, the Company is generally required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness, and the satisfaction of a tax reporting obligation, the Company will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by the participant.

Upon disposition of the stock, the participant will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for such stock plus any amount recognized as ordinary income upon acquisition (or vesting) of the stock. Such gain or loss will be long-term or short-term depending on whether the stock was held for more than one year. Slightly different rules may apply to participants who acquire stock subject to certain repurchase options or who are subject to Section 16(b) of the Exchange Act.

Dividends and Dividend Equivalent Rights. No taxable income should be recognized upon receipt of a dividend equivalent right award in connection with the receipt of another award under the 2021 Plan. A participant will recognize ordinary income in the year in which a dividend or distribution, whether in cash, securities or other property, is paid on an unrestricted basis to the participant. The amount of that income will be equal to the fair market value of the cash, securities or other property received. The Company is generally required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized, and the Company will generally be entitled to a business expense deduction equal to the amount of the taxable ordinary income recognized by the participant at the time the dividend or distribution is paid to such participant. That deduction will generally be taken for the taxable year in which such ordinary income is recognized.

Section 162(m) of the Code. Section 162(m) of the Code limits deductibility of compensation in excess of $1 million paid to certain executives. The Compensation Committee intends to maximize the tax deductibility of compensation paid to executive officers where possible. However, the Compensation Committee may authorize the payment of compensation to our executive officers that may not be deductible due to the limit imposed by Section 162(m) of the Code in order to continue to attract and retain superior talent.

Sections 280G and 4999 of the Code. Sections 280G and 4999 of the Code impose penalties on persons who pay and persons who receive so-called excess parachute payments. A parachute payment is the value of any amount that is paid to Company officers (or other disqualified individuals) on account of a change in control. If total parachute payments from all sources, including but not limited to stock-based compensation plans, equal or exceed three times an officer’s (or other disqualified individual’s) base amount, meaning his or her five year average taxable compensation, a portion of the parachute payments above one times the base amount will constitute an excess parachute payment. Because of Section 4999 of the Code, the officer (or other disqualified individual) must pay an excise tax equal to 20% of the total excess parachute payments. This tax is in addition to other federal, state, and local income, wage, and employment taxes imposed on the individual’s change in control payments. Moreover, because of Section 280G of the Code, the company paying the compensation is unable to deduct the excess parachute payment.

Benefits to which participants are entitled under the 2021 Plan and associated award agreements could constitute parachute payments under Sections 280G and 4999 of the Code if a change in control of the Company occurs. If this happens, the value of each participant’s parachute payment arising under the 2021 Plan must be combined with other parachute payments the same participant may be entitled to receive under other agreements or plans with the Company or a related entity, such as an employment agreement or a severance agreement.

| 10 |

Section 409A of the Code. Section 409A of the Code provides requirements for certain nonqualified deferred compensation arrangements. If applicable, Section 409A of the Code also imposes penalties (including an additional 20% tax) on the recipient of deferred compensation in the event such compensation fails to comply with Section 409A of the Code. Furthermore, if applicable, Section 409A of the Code imposes certain tax reporting on the Company if such deferred compensation does not comply with Section 409A requirements. Unless otherwise provided by the Compensation Committee, awards granted under the 2021 Plan generally are intended to either comply with or meet the requirements for an exemption from Section 409A of the Code. The Company does not guarantee to any participant that the 2021 Plan or any award granted under the 2021 Plan complies with or is exempt from Section 409A of the Code, and the Company will not have any liability to, or obligation to indemnify or hold harmless, any individual with respect to any tax consequences that arise from any such failure to comply with or meet an exemption under Section 409A of the Code.

The Company intends to file a registration statement on Form S-8 relating to the issuance of our common stock under the 2021 Equity Incentive Plan with the SEC pursuant to the Securities Act as soon as practicable after approval of the 2021 Equity Incentive Plan by our shareholders.

As a result of the 2021 Plan (if this Proposal is approved by our shareholders), the Company will be able to grant awards to eligible recipients including officers, employees, directors, and service providers of the Company and its affiliates, and persons who are reasonably expected to become officers, directors, employees, and service providers. The issuance in the future of awards under the 2021 Plan consisting of full value awards and options to purchase shares of the Company’s common stock may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and voting rights, of the holders of the currently outstanding shares of the Company’s common stock. The increase in the number of authorized but unissued shares of common stock that may be issued as awards under the 2021 Plan may be construed as having an anti-takeover effect by permitting the issuance of shares to purchasers who might oppose a hostile takeover bid or oppose any efforts to amend or repeal certain provisions of the Company’s Articles of Incorporation or Amended and Restated Bylaws. Holders of shares of the Company’s common stock have no preemptive or other subscription rights.

Interest of Certain Persons in Matters to be Acted Upon

Other than with respect to any future receipt of awards under our 2021 Plan (if this Proposal is approved by our shareholders), none of our directors, nominees for director, executive officers, any person who has served as a director or executive officer since the beginning of the last fiscal year, or their associates have any interest, direct or indirect, by security holdings or otherwise, in any of the matters to be acted upon at the Meeting as described in this Proxy Statement.

The adoption of our 2021 Equity Incentive Plan requires the affirmative vote of a majority of the shares of common stock present and voting at the Meeting. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the shareholders and will have the same effect as “against” votes. Broker non-votes are not counted towards a quorum and are also not counted for any purpose in determining whether this matter has been approved.

Recommendation of the Board of Directors

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO APPROVE THE ADOPTION OF THE 2021 EQUITY INCENTIVE PLAN.

| 11 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of April 26, 2021, regarding the beneficial ownership of our common stock by (a) each person known to the Company to own beneficially more than 5% of our common stock, (b) each of our directors, (c) each of our Named Executive Officers (as defined below) for fiscal year 2020, and (d) all of our current directors and executive officers as a group. Information with respect to beneficial ownership is based solely on a review of our capital stock transfer records and on publicly available filings made with SEC by or on behalf of the shareholders listed below.

The percent of class is calculated based on 20,114,775 shares of our common stock (net of treasury shares) outstanding as of April 26, 2021. Beneficial ownership is determined in accordance with the rules of the SEC, which generally attribute beneficial ownership of securities to persons who possess sole or shared voting or investment power with respect to those securities and for such persons includes shares of our common stock issuable to such persons pursuant to the exercise of stock options, warrants or other securities that are exercisable or convertible into shares of our common stock within 60 days of April 26, 2021.

| Beneficial owner (1) (2) |

Amount and Nature of Beneficial Ownership |

Percent of Class |

||||||

| Walter S. Woltosz | 4,528,635 | (3) | 22.49% | |||||

| John R. Kneisel (4) | – | * | ||||||

| Shawn O’Connor | 16,000 | (5) | * | |||||

| Will Frederick (6) | – | * | ||||||

| John DiBella | 141,340 | (7) | * | |||||

| Dr. David L. Ralph | 15,802 | (8) | * | |||||

| Dr. John Paglia | 221 | (9) | * | |||||

| Dr. Daniel Weiner | 2,879 | (10) | * | |||||

| Dr. Lisa LaVange | 3,385 | (11) | * | |||||

| All current directors and executive officers as a group (8 persons) | 4,708,262 | 23.24% | ||||||

| * | Less than 1% |

| (1) | Unless otherwise indicated in the footnotes to the table, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to community property laws, where applicable. |

| (2) | The address of each director and executive officer is c/o the Company, 42505 10th Street West, Lancaster, California 93534-7059. |

| (3) | Consists of 4,503,835 shares of common stock and 24,800 shares of common stock underlying an option exercisable within 60 days of April 26, 2021. The common shares are held jointly with Ms. Virginia Woltosz.

| |

| (4) |

On December 1, 2020, Mr. Kneisel retired as Chief Financial Officer and was replaced by Mr. Frederick.

| |

| (5) |

Consists of 16,000 shares of common stock underlying an option exercisable within 60 days of April 26, 2021.

| |

| (6) |

On December 1, 2020, Mr. Frederick was appointed as Chief Financial Officer upon retirement of Mr. Kneisel.

| |

| (7) |

Consists of 44,840 shares of common stock and 96,500 shares of common stock underlying an option exercisable within 60 days of April 26, 2021.

| |

| (8) |

Consists of 11,802 shares of common stock and 4,000 shares of common stock underlying an option exercisable within 60 days of April 26, 2021.

| |

| (9) |

Consists of 221 shares of common stock.

| |

| (10) |

Consists of 2,879 shares of common stock.

| |

| (11) | Consists of 2,385 shares of common stock and 1,000 shares of common stock underlying an option exercisable within 60 days of April 26, 2021. |

| 12 |

EXECUTIVE COMPENSATION AND OTHER INFORMATION

The following table sets forth certain information concerning compensation paid or accrued for the fiscal years ended August 31, 2020 and 2019, by the Company to or for the benefit of our principal executive officer, and our two most highly compensated executive officers (other than our principal executive officer) for fiscal year 2020. We refer to these executive officers as our Named Executive Officers.

| Summary Compensation Table | ||||||

| Name and Principal Position | Fiscal Year |

Salary ($) |

Bonus (1) ($) |

Option Awards (2) ($) |

All other compensation (3) ($) |

Total ($) |

| Shawn O’Connor | 2020 | 350,000 | 156,000 | 233,400 | – | 739,400 |

| Chief Executive Officer | 2019 | 325,000 | 100,000 | – | – | 425,000 |

| John DiBella | 2020 | 248,400 | 34,700 | 53,500 | 9,936 | 346,536 |

| President Lancaster Division | 2019 | 230,000 | 34,500 | 52,160 | 9.200 | 325,860 |

| John R. Kneisel (4) | 2020 | 214,409 | 29,200 | 53,500 | 8,576 | 305,685 |

| Chief Financial Officer | 2019 | 204,191 | 35,000 | 32,600 | 8,168 | 275,959 |

| (1) | Amount represents bonus earned during the applicable year. |

| (2) | Amount represents the stock-based compensation expense recorded by us for the applicable year measured using the Black-Scholes option pricing model at the grant date based on the fair value of the option award. See the “Grants of Plan-Based Awards” table below. |

| (3) | 401(k) matching. | |

| (4) | On December 1, 2020, Mr. Kneisel retired as Chief Financial Officer and was replaced by Will Frederick. |

Employment and Other Compensation Agreements

Mr. O’Connor’s CEO Employment Agreement

On June 26, 2018, Shawn O’Connor, entered into an employment agreement as the Chief Executive Officer of the Company, which was set to expire on August 31, 2021. Pursuant to the O’Connor employment agreement, Mr. O’Connor received an annual base salary of $325,000, a discretionary bonus of up to $150,000 during the first year of the agreement ($100,000 was paid on this bonus for 2019), and a two-part bonus in the last two years of the agreement, a total of (i) up to $100,000 based on an EBITDA formula, and (ii) up to $50,000 discretionary bonus as determined by the Board. The agreement called for the awarding of 40,000 stock options upon joining the Company and calls for additional stock option awards of up to 25,000 annually to be determined by the Board.

The agreement also provided that we may terminate the agreement without cause upon 30 days written notice, and that upon any such termination our only obligation to Mr. O’Connor would be for a payment equal to 12 months of salary. Further, the agreement provided that we may terminate the agreement for “cause” (as defined in the agreement) and that our only obligation to Mr. O’Connor upon any such termination would be limited to the payment of Mr. O’Connor’s salary and benefits through and until the effective date of any such termination.

| 13 |

Subsequent to the end of the fiscal year ended August 31, 2020, on September 3, 2020, Shawn O’Connor, entered into a new employment agreement as the Chief Executive Officer of the Company, which supersedes and replaces his prior employment agreement and continues until August 31, 2023.

In September 2019, the Compensation Committee awarded a $100,000 discretionary bonus and 20,000 options to Mr. O’Connor for fiscal year ended August 31, 2019 performance and increased his base salary to $350,000 per annum for the fiscal year ended August 31, 2020.

For the fiscal year ended August 31, 2020, the Compensation Committee awarded Mr. O’Connor bonuses totaling $156,000 for exceeding Company strategic and performance goals.

Mr. DiBella’s Employment Agreement

On September 2, 2019, John DiBella, entered into a two-year employment agreement as the President of the Lancaster Division of Simulations Plus. Pursuant to the DiBella employment agreement, Mr. DiBella receives an annual base salary of $248,400, is eligible to receive Company stock options under the 2017 Simulations Plus, Inc. Stock Option Plan of between 5,000 and 15,000 per year, and is eligible to receive an annual performance bonus in an amount between 10% to 20% of salary, to be determined by the Compensation Committee of the Board. The Compensation Committee awarded Mr. DiBella a $34,700 performance bonus for fiscal year 2020 and issued Mr. DiBella 9,300 stock options for 2020.

The agreement also provides that we may terminate the agreement without cause upon 30 days written notice, and that upon any such termination our only obligation to Mr. DiBella would be for a payment equal to the greater of (i) 12 months of salary or (ii) the amount of salary for the remainder of the term of the agreement from the date of notice of termination. Further, the agreement provides that we may terminate the agreement for “cause” (as defined in the agreement) and that our only obligation to Mr. DiBella upon any such termination would be limited to the payment of Mr. DiBella’s salary and benefits through and until the effective date of any such termination.

Mr. Kneisel’s Employment Agreement

On February 8, 2020, John Kneisel, entered into a two-year employment agreement as the Chief Financial Officer of the Company. Pursuant to the Kneisel employment agreement, Mr. Kneisel received an annual base salary of $217,000, was eligible to receive Company stock options under the 2017 Simulations Plus, Inc. Stock Option Plan of between 5,000 and 15,000 per year, and was eligible to receive an annual performance bonus in an amount between 10% and 20% of salary, to be determined by the Compensation Committee of the Board. The Compensation Committee awarded Mr. Kneisel a $29,200 performance bonus for fiscal year 2020.

The agreement also provided that we may terminate the agreement without cause upon 30 days written notice, and that upon any such termination our only obligation to Mr. Kneisel would be for a payment equal to the greater of (i) 12 months of salary or (ii) the amount of salary for the remainder of the term of the agreement from the date of notice of termination. Further, the agreement provided that we may terminate the agreement for “cause” (as defined in the agreement) and that our only obligation to Mr. Kneisel upon any such termination would be limited to the payment of Mr. Kneisel’s salary and benefits through and until the effective date of any such termination.

On December 1, 2020, Mr. Kneisel retired as Chief Financial Officer and was replaced by Will Frederick. Upon retirement, Mr. Kneisel’s employment agreement was terminated.

Other Executive Officers

Bonuses for other executive officers are determined by a review of performance of executive officer as determined by our Chief Executive Officer with the approval by the Board.

Bonuses for other employees are determined by a supervisory review of performance of each employee taking into account factors such as attendance, attitude, longevity, productivity, skill level with respect to the position, and contribution to the Company’s profitability. Each division’s final budget for bonuses is determined by the Chief Executive Officer and Chief Financial Officer with the approval of the Board.

| 14 |

The Company provides 401(k) matching of up to 4% of employees’ salaries or wages up to the U.S. Internal Revenue Service maximum allowable, regardless of their position within the Company.

There are no other perquisites or other benefits of any kind for any officer or any other employee or director of the Company.

The following table discloses information about option grants to the Named Executive Officers during the fiscal year ended August 31, 2020.

| Name | Grant Date | All Other Option Awards: Number of Securities Underlying Options |

Exercise or Base price of Option Awards |

Grant Date Fair Value of Stock and Option Awards (1) |

||||||||||

| Shawn O’Connor | 9/01/19 | 20,000 | $36.11 | 233,400 | ||||||||||

| John DiBella | 12/06/19 | 5,000 | $32.57 | $ | 53,500 | |||||||||

| John Kneisel | 12/06/19 | 5,000 | $32.57 | 53,500 | ||||||||||

| Total | 30,000 | $ | 340,400 | |||||||||||

(1) Amount represents the stock-based compensation expense recorded by us for the applicable year measured using the Black-Scholes option pricing model at the grant date based on the fair value of the option award.

| 15 |

Outstanding Equity Awards at Fiscal Year-End 2020

The following table sets forth information regarding outstanding equity awards held by our Named Executive Officers at the end of fiscal year 2020.

| Outstanding Equity Awards at Fiscal Year-End | |||||

| Name | Option Awards | ||||

| Number of Securities Underlying Unexercised Options (Exercisable) (1) |

Number of Securities Underlying Unexercised Options (Unexercisable) |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options |

Option Exercise Price |

Option Expiration Date | |

| Shawn O’Connor | – | 20,000 | – | $36.11 | 9/01/2029 |

| 16,000 | 24,000 | – | $23.75 | 6/26/2028 | |

| Total | 16,000 | 44,000 | – | ||

| John DiBella | – | 5,000 | – | $32.57 | 12/06/2029 |

| 1,600 | 6,400 | – | $19.81 | 12/11/2028 | |

| 24,000 | 16,000 | – | $10.05 | 2/23/2027 | |

| 8,240 | 2,060 | – | $9.71 | 2/25/2026 | |

| 50,000 | – | – | $6.85 | 8/28/2024 | |

| Total | 83,840 | 29,460 | – | ||

| John Kneisel | – | 5,000 | – | $32.57 | 12/06/2029 |

| 1,000 | 4,000 | – | $19.81 | 12/11/2028 | |

| 15,000 | 10,000 | – | $10.05 | 2/23/2027 | |

| 6,960 | 1,740 | – | $9.71 | 2/25/2026 | |

| 8,800 | – | – | $6.85 | 8/28/2024 | |

| Total | 31,760 | 20,740 | – | ||

| Grand Total | 131,600 | 94,200 | – | ||

__________________

| (1) | All options vest as to 20% of the shares subject to the option on each of the first five anniversaries of the grant date and have a 10-year term, except for the options granted to Mr. O’Connor. Those options granted to Mr. O’Connor vest on each of the first three anniversaries of the grant date at a rate of 40%, 30%, and 30% of the shares subject to the option, respectively. |

Equity Compensation Plan Information

The following table provides information as of August 31, 2020 regarding our equity compensation plans.

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| (a) | (b) | (c) | |

| Equity compensation plans approved by security holders | 1,223,661 | 17.76 | 446,374 |

| Equity compensation plans not approved by security holders | -0- | -0- | -0- |

| Total | 1,223,661 | 17.76 | 446,374 |

| 16 |

Option Exercises and Stock Vested

The following table and related notes summarize the exercise of stock options and/or SSARs and the vesting of other stock awards by the Named Executive Officers while they were serving as Named Executive Officers during fiscal year 2020.

Option Exercises and Stock Vested for Fiscal Year 2020

| Name | Option Awards | Stock Awards | ||||||||||

|

Number of Shares Exercise (#) |

Value Realized on |

Number of Shares Vesting (#) |

Value Realized on Vesting | |||||||||

| Walter Woltosz | – | – | – | – | ||||||||

| Shawn O’Connor | – | – | – | – | ||||||||

| John Kneisel | 4,400 | $146,872 | – | – | ||||||||

| John DiBella | – | – | – | – | ||||||||

Termination or Change of Control

The following discussion summarizes certain information related to the total potential payments which would have been made to the Named Executive Officers in the event of termination of their employment with the Company, including in the event of a change of control, effective August 31, 2020, the last business day of fiscal year 2020.

Employment Agreements. As of August 31, 2020, these Named Executive Officers (Mr. O’Connor, Mr. DiBella and Mr. Kneisel) were parties to an employment agreement with the Company. Under the employment agreements, if we terminate the employment of any of these Named Executive Officers without cause, they will receive severance equal to 12 months’ salary or the employee’s base salary for the remaining term of the agreement, whichever is greater. The Company has no further obligation to pay the employee any other benefits or compensation. Under the terms of these agreements, following a termination of employment for any reason these officers are prohibited for a one-year period following termination from being employed by, owning, operating, controlling, or being connected with any business that competes with the Company. Each executive’s agreement also contains an indefinite non-disclosure provision for the protection of the Company’s confidential information and a one-year non-solicitation of Company employees.

| 17 |

During fiscal year 2020, compensation for non-employee directors consisted of the following:

| Compensation | Effective August 1, 2020 | Prior to August 1, 2020 | ||||||

| Annual cash retainer fee* | $ | 45,000 | $ | 40,000 | ||||

| Cash retainer per meeting attended | $ | 3,500 | $ | 2,500 | ||||

| Additional cash retainer per meeting in excess of 8 meetings per year | $ | 3,500 | $ | 3,500 | ||||

| Additional cash stipend for Audit Committee chair** | $ | 12,500 | $ | 10,000 | ||||

| Additional cash stipend for Compensation Committee chair** | $ | 3,000 | $ | – | ||||

| Additional cash stipend for Nominations Committee chair** | $ | 3,000 | $ | – | ||||

| Additional cash stipend for Chairman of the Board** | $ | 12,500 | $ | – | ||||

| Additional cash stipend for Scientific Advisory Board Chairman | $ | 5,000 | $ | – | ||||

| Annual Stock grants* | $ | 70,000 | $ | 58,000 | ||||

*Prorated for the time of service in the year a new director joins the Board.

** Paid quarterly

On July 17, 2020, the Board reviewed and approved the Nominating Committee’s recommendation to grant its non-employee directors non-qualified options to purchase common stock (“stock options”) taking into consideration market standards and the growth of the business. Options granted were; 5,000 each to Walter Woltosz, Dr. David Ralph, Dr. John Paglia, Dr. Daniel Weiner and Dr. Lisa LaVange. Stock options vest and become exercisable as follows: (i) no option shares will be vested prior to the grant date; and (ii) the balance of the option shares will vest annually on their anniversary date, 40% the first year, 30% the second and 30% the final year measured from the grant date, provided that there has not been a termination of service.

We also reimburse our directors for reasonable out-of-pocket expenses in connection with the attendance at the Board and committee meetings. Mileage expense to attend meetings is reimbursed at the Internal Revenue Service defined rate for business use.

Director Compensation for Fiscal Year 2020

| Name of Director |

Fiscal Year |

Fees earned or paid in cash ($) (1) |

Option Awards ($) (2) (3) |

Stock Grants ($)(4) |

All other compensation ($) |

Total ($) |

| Walter Woltosz | 2020 | 57,500 | 116,336 | 57,980 | – | 231,816 |

| Dr. David L. Ralph | 2020 | 82,833 | 116,336 | 57,980 | – | 257,149 |

| Dr. John K. Paglia | 2020 | 95,250 | 116,336 | 57,980 | – | 269,566 |

| Dr. Daniel Weiner | 2020 | 84,941 | 116,336 | 57,980 | – | 259,257 |

| Dr. Lisa LaVange | 2020 | 83,058 | 116,336 | 57,980 | – | 257,374 |

__________________

| (1) | Represents annual stipend and per meeting fees described above. |

| (2) | Amount represents the stock-based compensation expense recorded by us for the applicable year measured using the Black-Scholes option pricing model at the grant date based on the fair value of the option award. |

| (3) | As of August 31, 2020, the aggregate number of shares subject to outstanding stock options held by each non-employee director was as follows: Dr. Ralph – 23,750, Dr. Paglia – 27,500, Dr. Weiner – 15,416, Mr. Woltosz – 24,800, and Dr. LaVange – 10,000. |

| (4) | Stock grants issued to independent directors as compensation described above. |

| 18 |

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more shareholders sharing the same address by delivering a single proxy statement addressed to those shareholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for shareholders and cost savings for companies.

We have adopted householding for our shareholders who share an address. If you reside at the same address as another shareholder of the Company and wish to receive a separate copy of the applicable materials, you may do so by making a written or oral request to: Renee Bouche, Simulations Plus, Inc., at 42505 10th Street West, Lancaster, CA 93534, or call (661) 723-7723. Upon your request, we will promptly deliver a separate copy to you.

Some brokers household proxy materials, delivering a single proxy statement or notice to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once you have received notice from your broker that they will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement or notice, please notify your broker directly.

Any shareholders who share the same address and currently receive multiple copies of our proxy statements and who wish to receive only one copy in the future may contact their bank, broker, or other holder of record, or the Company at the contact information listed above, to request information about householding.

Shareholders are encouraged to contact the Company with any requests for information or to communicate with the Board via telephone, mail, or through our web site investor information request form at: http://www.simulations-plus.com/InvestorForm.aspx or through the general information request page: http://www.simulations-plus.com/contact.aspx.

Shareholders who intend to submit proposals to the Company’s shareholders at the Fiscal 2021 Annual Meeting of Shareholders but intend to submit such proposals on their own, either from the floor or through their own proxy statement and proxy, must, in order for such matters to be voted upon by the Company’s shareholders, give notice of such to the management of the Company by November 12, 2021, which is one year from 45 calendar days before the Company’s proxy statement for its 2020 Annual Meeting of Shareholders was released to shareholders, unless the corresponding date of the Fiscal 2021 Annual Meeting of the Shareholders has been changed by more than 30 days from the month and day of the Fiscal 2020 Annual Meeting of Shareholders, in which case the deadline is a reasonable time before we begin to print and send our Proxy materials. The persons named as proxies for the FY2021 Annual Meeting of Shareholders will have discretionary authority to vote on any shareholder proposal not included in the Company’s proxy materials for the meeting, unless the Company receives notice of the proposal prior to the 45-day deadline. If proper notice is received by that date, the proxy holders will not have discretionary voting authority except as provided in federal regulations governing shareholder proposals.

The Board knows of no other matters to be presented at the Meeting other than those described above. However, if any other matters properly come before the Meeting, it is intended that any shares voted by proxy will be voted in the discretion of the Board.

| 19 |

====================================================================

2021 EQUITY INCENTIVE PLAN

OF

Simulations Plus, Inc.

====================================================================

| A-1 |

Simulations Plus, Inc.

2021 EQUITY INCENTIVE PLAN

Plan Adopted by the Board: April 9, 2021

Plan Approved by the Shareholders: ________, 2021

Termination Date: April 9, 2031

1. General.

(a) Purposes. The purposes of the Plan are as follows:

(i) To provide additional incentive for selected Employees, Directors and Consultants to further the growth, development and financial success of the Company by providing a means by which such persons can personally benefit through the ownership of capital stock of the Company; and