UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended | |||||

| OR | |||||

| Transmission Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from ______ to ______ | |||||

Commission file number: 001-32046

(Name of registrant as specified in its charter)

| (State or other jurisdiction of Incorporation or Organization) | (I.R.S. Employer identification No.) | ||||

(Address of principal executive offices including zip code)

(661 ) 723-7723

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act (Check one):

| x | o | Accelerated Filer | |||||||||

| o | Non-accelerated Filer | Smaller reporting company | |||||||||

| Emerging Growth Company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares outstanding of the registrant’s common stock, par value $0.001 per share, as of March 31, 2023, was 19,996,653 .

Simulations Plus, Inc.

FORM 10-Q

For the Quarterly Period Ended February 28, 2023

Table of Contents

| Page | ||||||||

Item 1A. | ||||||||

PART I. FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

| (Unaudited) | (Audited) | |||||||||||||

| (in thousands, except share and per share amounts) | February 28, 2023 | August 31, 2022 | ||||||||||||

| ASSETS | ||||||||||||||

| Current assets | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

Accounts receivable, net of allowance for doubtful accounts of $ | ||||||||||||||

| Prepaid income taxes | ||||||||||||||

| Prepaid expenses and other current assets | ||||||||||||||

| Short-term investments | ||||||||||||||

| Total current assets | ||||||||||||||

| Long-term assets | ||||||||||||||

Capitalized computer software development costs, net of accumulated amortization of $ | ||||||||||||||

| Property and equipment, net | ||||||||||||||

| Operating lease right-of-use assets | ||||||||||||||

Intellectual property, net of accumulated amortization of $ | ||||||||||||||

Other intangible assets, net of accumulated amortization of $ | ||||||||||||||

| Goodwill | ||||||||||||||

| Other assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||||

| Current liabilities | ||||||||||||||

| Accounts payable | $ | $ | ||||||||||||

| Accrued compensation | ||||||||||||||

| Accrued expenses | ||||||||||||||

| Operating lease liability - current portion | ||||||||||||||

| Deferred revenue | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Long-term liabilities | ||||||||||||||

| Deferred income taxes, net | ||||||||||||||

| Operating lease liability | ||||||||||||||

| Total liabilities | ||||||||||||||

| Commitments and contingencies | ||||||||||||||

| Shareholders' equity | ||||||||||||||

Preferred stock, $ | $ | $ | ||||||||||||

Common stock, $ | ||||||||||||||

| Retained earnings | ||||||||||||||

| Accumulated other comprehensive loss | ( | ( | ||||||||||||

| Total shareholders' equity | ||||||||||||||

| Total liabilities and shareholders' equity | $ | $ | ||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the three and six months ended February 28, 2023 and 2022

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||

| (in thousands, except per common share amounts) | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Revenues | ||||||||||||||||||||||||||

| Software | $ | $ | $ | $ | ||||||||||||||||||||||

| Services | ||||||||||||||||||||||||||

| Total revenues | ||||||||||||||||||||||||||

| Cost of revenues | ||||||||||||||||||||||||||

| Software | ||||||||||||||||||||||||||

| Services | ||||||||||||||||||||||||||

| Total cost of revenues | ||||||||||||||||||||||||||

| Gross profit | ||||||||||||||||||||||||||

| Operating expenses | ||||||||||||||||||||||||||

| Research and development | ||||||||||||||||||||||||||

| Selling, general, and administrative | ||||||||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||||||||

| Income from operations | ||||||||||||||||||||||||||

| Other income, net | ||||||||||||||||||||||||||

| Income before income taxes | ||||||||||||||||||||||||||

| Provision for income taxes | ( | ( | ( | ( | ||||||||||||||||||||||

| Net income | $ | $ | $ | $ | ||||||||||||||||||||||

| Earnings per share | ||||||||||||||||||||||||||

| Basic | $ | $ | $ | $ | ||||||||||||||||||||||

| Diluted | $ | $ | $ | $ | ||||||||||||||||||||||

| Weighted-average common shares outstanding | ||||||||||||||||||||||||||

| Basic | ||||||||||||||||||||||||||

| Diluted | ||||||||||||||||||||||||||

| Other comprehensive (loss) income, net of tax | ||||||||||||||||||||||||||

| Foreign currency translation adjustments | ( | ( | ( | |||||||||||||||||||||||

| Comprehensive income | $ | $ | $ | $ | ||||||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

For the three and six months ended February 28, 2023 and 2022

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||||||||||||

| (in thousands, except per common share amounts) | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Common stock and additional paid in capital | ||||||||||||||||||||||||||

| Balance, beginning of period | $ | $ | $ | $ | ||||||||||||||||||||||

| Exercise of stock options | ||||||||||||||||||||||||||

| Stock-based compensation | ||||||||||||||||||||||||||

| Shares issued to Directors for services | ||||||||||||||||||||||||||

| Repurchase and retirement of common shares | ( | ( | ||||||||||||||||||||||||

| Balance, end of period | ||||||||||||||||||||||||||

| Retained earnings | ||||||||||||||||||||||||||

| Balance, beginning of period | ||||||||||||||||||||||||||

| Declaration of dividends | ( | ( | ( | ( | ||||||||||||||||||||||

| Repurchase and retirement of common shares | ( | ( | ||||||||||||||||||||||||

| Net income | ||||||||||||||||||||||||||

| Balance, end of period | ||||||||||||||||||||||||||

| Accumulated other comprehensive (loss) income | ||||||||||||||||||||||||||

| Balance, beginning of period | ( | ( | ( | ( | ||||||||||||||||||||||

| Other comprehensive (loss) income | ( | ( | ( | |||||||||||||||||||||||

| Balance, end of period | ( | ( | ( | ( | ||||||||||||||||||||||

| Total shareholders’ equity | $ | $ | $ | $ | ||||||||||||||||||||||

| Cash dividends declared per common share | $ | $ | $ | $ | ||||||||||||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

SIMULATIONS PLUS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended February 28, | ||||||||||||||

| (in thousands) | 2023 | 2022 | ||||||||||||

| Cash flows from operating activities | ||||||||||||||

| Net income | $ | $ | ||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||||||||

| Depreciation and amortization | ||||||||||||||

| Change in value of contingent consideration | ||||||||||||||

| Amortization of investment (discounts) premiums | ( | |||||||||||||

| Stock-based compensation | ||||||||||||||

| Deferred income taxes | ||||||||||||||

| Currency translation adjustments | ( | |||||||||||||

| (Increase) decrease in | ||||||||||||||

| Accounts receivable | ( | |||||||||||||

| Prepaid income taxes | ||||||||||||||

| Prepaid expenses and other assets | ( | |||||||||||||

| Increase (decrease) in | ||||||||||||||

| Accounts payable | ||||||||||||||

| Other liabilities | ( | ( | ||||||||||||

| Deferred revenue | ( | |||||||||||||

| Net cash provided by operating activities | ||||||||||||||

| Cash flows from investing activities | ||||||||||||||

| Purchases of property and equipment | ( | ( | ||||||||||||

| Purchase of short-term investments | ( | ( | ||||||||||||

| Proceeds from maturities of short-term investments | ||||||||||||||

| Purchased intangibles | ( | |||||||||||||

| Capitalized computer software development costs | ( | ( | ||||||||||||

| Net cash (used in) provided by investing activities | ( | |||||||||||||

| Cash flows from financing activities | ||||||||||||||

| Payment of dividends | ( | ( | ||||||||||||

| Proceeds from the exercise of stock options | ||||||||||||||

| Repurchase and retirement of common shares | ( | |||||||||||||

| Net cash used in financing activities | ( | ( | ||||||||||||

| Net (decrease) increase in cash and cash equivalents | ( | |||||||||||||

| Cash and cash equivalents, beginning of year | $ | $ | ||||||||||||

| Cash and cash equivalents, end of period | $ | $ | ||||||||||||

| Supplemental disclosures of cash flow information | ||||||||||||||

| Income taxes paid | $ | $ | ||||||||||||

| Non-Cash Investing and Financing Activities | ||||||||||||||

| Right of use assets capitalized | $ | $ | ||||||||||||

The accompanying notes are an integral part of these Condensed Consolidated Financial Statements.

Simulations Plus, Inc.

Notes to Condensed Consolidated Financial Statements

(Unaudited)

NOTE 1 – GENERAL

This Quarterly Report on Form 10-Q for the quarter ended February 28, 2023, should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended August 31, 2022, filed with the Securities and Exchange Commission (“SEC”) on October 28, 2022. As contemplated by the SEC under Article 8 of Regulation S-X, the accompanying consolidated financial statements and footnotes have been condensed and therefore do not contain all disclosures required by generally accepted accounting principles. The interim financial data are unaudited; however, in the opinion of Simulations Plus, Inc., the interim data include all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the results for the interim periods. Results for interim periods are not necessarily indicative of those to be expected for the full year.

Organization

Simulations Plus, Inc. (“Simulations Plus”) was incorporated on July 17, 1996. In September 2014, Simulations Plus acquired all of the outstanding equity interests of Cognigen Corporation ("Cognigen") and Cognigen became a wholly owned subsidiary of Simulations Plus, Inc. In June 2017, Simulations Plus acquired DILIsym Services, Inc. ("DILIsym") as a wholly owned subsidiary. In April 2020, Simulations Plus acquired Lixoft, a French société par actions simplifiée ("Lixoft"), as a wholly owned subsidiary pursuant to a stock purchase and contribution agreement. (Simulations Plus together with its subsidiaries, collectively, the "Company,” "we,” "us,” "our").

Effective September 1, 2021, the Company merged both Cognigen and DILIsym with and into Simulations Plus, Inc. through short-form mergers (the “Mergers”). To effectuate the Mergers, the Company filed Certificates of Ownership with the Secretaries of State of the states of Delaware (Cognigen’s and DILIsym’s state of incorporation) and California (Simulation Plus’ state of incorporation). Consummation of the Mergers was not subject to approval of the Company’s stockholders and did not impact the rights of the Company’s stockholders.

Lines of Business

We are a premier developer of drug discovery and development software for modeling and simulation, and for the prediction of molecular properties utilizing both artificial-intelligence-based and machine-learning-based technologies. We also provide consulting services ranging from early drug discovery through preclinical and clinical development analysis and for submissions to regulatory agencies. Our software and consulting services are provided to major pharmaceutical, biotechnology, agrochemical, cosmetics, and food industry companies and academic and regulatory agencies worldwide for use in the conduct of industry-based research.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The consolidated financial statements include the accounts of Simulations Plus and its wholly owned subsidiary, Lixoft. All significant intercompany accounts and transactions are eliminated in consolidation.

Use of Estimates

Our financial statements and accompanying notes are prepared in accordance with accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. Actual results could differ from those estimates.

Reclassifications

Certain numbers in the prior year have been reclassified to conform to the current year's presentation.

Revenue Recognition

We generate revenue primarily from the sale of software licenses and by providing consulting services to the pharmaceutical industry for drug development.

In accordance with ASC 606, we determine revenue recognition through the following steps:

i.Identification of the contract, or contracts, with a customer

ii.Identification of the performance obligations in the contract

iii.Determination of the transaction price

iv.Allocation of the transaction price to the performance obligations in the contract

v.Recognition of revenue when, or as, we satisfy a performance obligation

Components of Revenue

The following is a description of principal activities from which the Company generates revenue. As part of the accounting for these arrangements, the Company must develop assumptions that require judgment to determine the standalone selling price for each performance obligation identified in the contract. Standalone selling prices are determined based on the prices at which the Company separately sells its services or goods.

| Revenue Components | Typical Payment Terms | |||||||

| Software Revenues: | ||||||||

Software revenues are generated primarily from sales of software licenses at the time the software is unlocked, and the term commences. The license period typically is one year or less. Along with the license, a di minimis amount of customer support is provided to assist the customer with the software. Should the customer need more than a di minimis amount of support, they can choose to enter into a separate contract for additional training. Most software is installed on our customers’ servers and the Company has no control of the software once the sale is made. | Payments are generally due upon invoicing on a net 30 basis, unless other payment terms are negotiated with the customer based on customer history. Typical industry standards apply. | |||||||

For certain software arrangements the Company hosts the licenses on servers maintained by the Company. Revenue for those arrangements is accounted as Software as a Service over the life of the contract. These arrangements account for a small portion of software revenues of the Company. | ||||||||

| Consulting Contracts: | ||||||||

| Consulting services provided to our customers are generally recognized over time as the contracts are performed and the services are rendered. The Company measures its consulting revenue based on time expended compared to total estimated hours to complete a project. The Company believes the method chosen for its contract revenue best depicts the transfer of benefits to the customer under the contracts. | Payment terms vary, depending on the size of the contract, credit history and history with the client and deliverables within the contract. | |||||||

| Consortium Member Based Services: | ||||||||

| The performance obligation is recognized on a time elapsed basis, by month, for which the services are provided, as the Company transfers control evenly over the contractual period. | Payment is due at the beginning of the period, generally on a net-30 or -60 basis. | |||||||

Remaining Performance Obligations

Transaction price allocated to remaining performance obligations represents contracted revenue that has not yet been recognized, which includes deferred revenue and unbilled amounts that will be recognized as revenue in future periods. As of February 28, 2023, remaining performance obligations were $10.4 million. Ninety-six percent of the remaining performance obligations are expected to be recognized over the next 12 months, with the remainder expected to be recognized thereafter. Remaining performance obligations estimates are subject to change and are affected by several factors, including contract terminations and changes in the scope of contracts.

Disaggregation of Revenues

The components of disaggregation of revenue for the three and six months ended February 28, 2023 and 2022 were as follows:

| Three Months Ended February 28, | Six Months Ended February 28, | |||||||||||||||||||||||||

| (in thousands) | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Software licenses | ||||||||||||||||||||||||||

| Point in time | $ | $ | $ | $ | ||||||||||||||||||||||

| Over time | ||||||||||||||||||||||||||

| Services | ||||||||||||||||||||||||||

| Over time | ||||||||||||||||||||||||||

| Total revenue | $ | $ | $ | $ | ||||||||||||||||||||||

In addition, the Company allocates revenues to geographic areas based on the locations of its customers. Geographical revenues for the three and six months ended February 28, 2023, and 2022 were as follows:

| (in thousands) | Three Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||||||||

| $ | % of total | $ | % of total | |||||||||||||||||||||||

| Americas | $ | % | $ | % | ||||||||||||||||||||||

| EMEA | % | % | ||||||||||||||||||||||||

| Asia Pacific | % | % | ||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||

| (in thousands) | Six Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||||||||

| $ | % of total | $ | % of total | |||||||||||||||||||||||

| Americas | $ | % | $ | % | ||||||||||||||||||||||

| EMEA | % | % | ||||||||||||||||||||||||

| Asia Pacific | % | % | ||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||

Contract Balances

We receive payments from customers based upon contractual billing schedules, while we recognize revenue when, or as, we satisfy our performance obligations. This timing difference results in accounts receivable, contract assets, and contract liabilities. We record accounts receivable when the right to consideration becomes unconditional. We record a contract asset if the right to consideration is conditioned on something other than the passage of time, such as our future performance. Contract assets are included in prepaid expenses and other current assets on our condensed consolidated balance sheets. We record a contract liability when we have an obligation to transfer goods or services to a customer for which we have either received consideration or a payment is due from a customer. We refer to contract liabilities as deferred revenue on our condensed consolidated balance sheets.

Contract asset balances as of February 28, 2023, and August 31, 2022, were $2.9 million and $1.7 million, respectively.

During the three and six months ended February 28, 2023, the Company recognized $0.4 million and $2.3 million, respectively, of revenue that was included in contract liabilities as of August 31, 2022, and during the three and six months ended February 28, 2022, the Company recognized $0.2 million and $0.5 million, respectively, of revenue that was included in contract liabilities as of August 31, 2021.

Deferred Commissions

Sales commissions earned by our sales force and our commissioned sales representatives are considered incremental and recoverable costs of obtaining a contract with a customer. We apply the practical expedient as described in ASC 340-40-25-4 to expense costs as incurred for sales commissions, since the amortization period of the asset that we otherwise would have recognized is one year or less. This expense is included in the condensed consolidated statements of operations and comprehensive income as selling, general, and administrative expense.

Cash and Cash Equivalents

For purposes of the statements of cash flows, we consider all highly liquid investments purchased with original maturities of three months or less to be cash equivalents.

Accounts Receivable and Allowance for Credit Losses

The Company extends credit to its customers in the normal course of business. The Company evaluates its allowance for credit losses based on its estimate of the collectability of its trade accounts receivable. As part of this assessment, the Company considers various factors including the financial condition of the individual companies with which it does business, the aging of receivable balances, historical experience, changes in customer payment terms, current market conditions, and reasonable and supportable forecasts of future economic conditions. In times of economic turmoil, the Company’s estimates and judgments with respect to the collectability of its receivables is subject to greater uncertainty than in more stable periods. Accounts receivable balances will be charged off against the allowance for credit losses after all means of collection have been exhausted and the potential for recovery is considered remote.

Investments

The Company may invest excess cash balances in short-term and long-term marketable debt securities. Investments may consist of certificates of deposit, money market accounts, government-sponsored enterprise securities, corporate bonds, and/or commercial paper within the parameters of our Investment Policy and Guidelines. The Company accounts for its investments in marketable securities in accordance with ASC 320, Investments – Debt and Equity Securities. This statement requires debt securities to be classified into three categories:

Held-to-maturity—Debt securities that the entity has the positive intent and ability to hold to maturity are measured at amortized cost and are presented at the net amount expected to be collected. Any change in the allowance for credit losses during the period is reflected in earnings. Discounts and premiums to par value of the debt securities are amortized to interest income/expense over the term of the security.

Trading Securities—Debt securities that are bought and held primarily for the purpose of selling in the near term are reported at fair value, with unrealized gains and losses included in earnings.

Available-for-Sale—Debt securities not classified as either securities held-to-maturity or trading securities are reported at fair value. For available-for-sale debt securities in an unrealized loss position, we evaluate as of the balance sheet date whether the unrealized losses are attributable to a credit loss or other factors. The portion of unrealized losses related to a credit loss is recognized in earnings, and the portion of unrealized loss not related to a credit loss is recognized in other comprehensive income (loss).

We classify our investments in marketable debt securities based on the facts and circumstances present at the time of purchase of the securities. We subsequently reassess the appropriateness of that classification at each reporting date. During the quarter ended February 28, 2023, all of our investments were classified as held-to-maturity.

Capitalized Computer Software Development Costs

Software development costs are capitalized in accordance with ASC 985-20. Capitalization of software development costs begins upon the establishment of technological feasibility and is discontinued when the product is available for sale.

The establishment of technological feasibility and the ongoing assessment for recoverability of capitalized software development costs require considerable judgment by management with respect to certain external factors including, but not limited to, technological feasibility, anticipated future gross revenue, estimated economic life, and changes in software and hardware technologies. Capitalized software development costs are comprised primarily of salaries and direct payroll-related costs and the purchase of existing software to be used in our software products.

Amortization of capitalized software development costs is calculated on a product-by-product basis on the straight-line method over the estimated economic life of the products (not to exceed five years ). Amortization of software development costs amounted to $0.4 million and $0.3 million for the three months ended February 28, 2023, and 2022, respectively, and $0.8 million and $0.6 million for the six months ended February 28, 2023, and 2022, respectively. We expect future amortization expense to vary due to increases in capitalized computer software development costs.

We test capitalized computer software development costs for recoverability whenever events or changes in circumstances indicate that the carrying amount may not be recoverable.

Property and Equipment

Property and equipment are recorded at cost, or fair market value for property and equipment acquired in business combinations, less accumulated depreciation and amortization. Depreciation and amortization are calculated using the straight-line method over the estimated useful lives as follows:

| Equipment | |||||

| Computer equipment | |||||

| Furniture and fixtures | |||||

| Leasehold improvements | |||||

Maintenance and minor replacements are charged to expense as incurred. Gains and losses on disposals are included in the results of operations.

Internal-use Software

We have capitalized certain internal-use software costs in accordance with ASC 350-40, which are included in intangible assets. The amortization of such costs is classified as selling, general, and administrative expenses on the condensed consolidated statements of operations. Maintenance of and minor upgrades to internal-use software are also classified as selling, general, and administrative expenses as incurred.

Leases

We determine if an arrangement is a lease at inception. Operating leases are included in operating lease right-of-use (“ROU”) assets and operating lease liabilities (current and long-term) in our condensed consolidated balance sheets.

ROU assets represent our right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease ROU assets and liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. As most of our leases do not provide an implicit rate, we generally use our incremental borrowing rate based on the estimated rate of interest for collateralized borrowing over a similar term of the lease payments at the commencement date. The operating lease ROU asset also includes any lease payments made at or before the commencement date and excludes lease incentives. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense is recognized on a straight-line basis over the lease term.

Supplemental balance sheet information related to operating leases was as follows as of February 28, 2023:

| (in thousands) | ||||||||

| Right of use assets | $ | |||||||

| Lease liabilities, current | $ | |||||||

| Lease liabilities, long-term | $ | |||||||

| Operating lease costs | $ | |||||||

| Weighted-average remaining lease term | ||||||||

| Weighted-average discount rate | % | |||||||

Intangible Assets and Goodwill

We perform valuations of assets acquired and liabilities assumed on each acquisition accounted for as a business combination and recognize the assets acquired and liabilities assumed at their acquisition-date fair value. Acquired intangible assets include customer relationships, software, trade names, and noncompete agreements. We determine the appropriate useful life by performing an analysis of expected cash flows based on historical experience of the acquired businesses. Finite-lived intangible assets are amortized over their estimated useful lives using the straight-line method, which approximates the pattern in which the majority of the economic benefits are expected to be consumed. Finite-lived intangible assets subject to amortization are reviewed for impairment whenever events or circumstances indicate that the carrying amount of these assets may not be recoverable.

Goodwill represents the excess of the cost of an acquired entity over the fair value of the acquired net assets. Goodwill and indefinite-lived intangible assets are tested for impairment annually or when events or circumstances change that would indicate that they might be impaired. Events or circumstances that could trigger an impairment review include, but are not limited to, a significant adverse change in legal factors or in the business climate, an adverse action or assessment by a regulator, unanticipated competition, a loss of key personnel, significant changes in the manner of our use of the acquired assets or the strategy for our overall business, significant negative industry or economic trends, or significant underperformance relative to expected historical or projected future results of operations.

The following table summarizes other intangible assets as of February 28, 2023:

| (in thousands) | Amortization Period | Acquisition Value | Accumulated Amortization | Net Book Value | ||||||||||||||||||||||

| Trade names | None | $ | $ | $ | ||||||||||||||||||||||

| Covenants not to compete | Straight line | |||||||||||||||||||||||||

| Other internal use software | Straight line | |||||||||||||||||||||||||

| Customer relationships | Straight line | |||||||||||||||||||||||||

| ERP | Straight line | |||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

The following table summarizes other intangible assets as of August 31, 2022:

| (in thousands) | Amortization Period | Acquisition Value | Accumulated Amortization | Net Book Value | ||||||||||||||||||||||

| Trade names | None | $ | $ | $ | ||||||||||||||||||||||

| Covenants not to compete | Straight line | |||||||||||||||||||||||||

| Customer relationships | Straight line | |||||||||||||||||||||||||

| ERP | Straight line | |||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

Total amortization expense for the three months ended February 28, 2023, and 2022 was $0.1 million and $0.2 million, respectively, and amortization expense for the six months ended February 28, 2023, and 2022 was $0.3 million and $0.3 million, respectively.

Future amortization of finite-lived intangible assets for the next five years is as follows:

| (in thousands) | ||||||||

Year Ending August 31, | Amount | |||||||

| Remainder of 2023 | $ | |||||||

| 2024 | $ | |||||||

| 2025 | $ | |||||||

| 2026 | $ | |||||||

| 2027 | $ | |||||||

Fair Value of Financial Instruments

Assets and liabilities recorded at fair value in the condensed consolidated balance sheets are categorized based upon the level of judgment associated with the inputs used to measure their fair value. The categories are as follows:

| Level Input: | Input Definition: | |||||||

| Level I | Inputs that are unadjusted, quoted prices for identical assets or liabilities in active markets at the measurement date. | |||||||

| Level II | Inputs, other than quoted prices included in Level I, that are observable for the asset or liability through corroboration with market data at the measurement date. | |||||||

| Level III | Unobservable inputs that reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. | |||||||

For certain of our financial instruments, including accounts receivable, accounts payable, and accrued compensation and other accrued expenses, the carrying amounts are representative of their fair value due to their short maturities.

The following tables summarize our short-term investments as of February 28, 2023, and August 31, 2022:

| February 28, 2023 | ||||||||||||||||||||||||||

| (in thousands) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||||

| Commercial notes (due within one year) | $ | $ | $ | ( | $ | |||||||||||||||||||||

| Term deposits (due within one year) | ||||||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | |||||||||||||||||||||

| August 31, 2022 | ||||||||||||||||||||||||||

| (in thousands) | Amortized Cost | Gross Unrealized Gains | Gross Unrealized Losses | Fair Value | ||||||||||||||||||||||

| Commercial notes (due within one year) | $ | $ | $ | ( | $ | |||||||||||||||||||||

| Term deposits (due within one year) | ||||||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | |||||||||||||||||||||

Research and Development Costs

Research and development costs are charged to expense as incurred until technological feasibility has been established. These costs include salaries, laboratory experiments, and purchased software that was developed by other companies and incorporated into, or used in the development of, our final products.

Income Taxes

We account for income taxes in accordance with ASC 740, which requires the recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns.

Under this method, deferred income taxes are recognized for the tax consequences in future years of differences between the tax bases of assets and liabilities and their financial reporting amounts at each year-end based on enacted tax laws and statutory tax rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized. The provision for income taxes represents the tax payable for the period and the change during the period in deferred tax assets and liabilities.

Intellectual property

The following table summarizes intellectual property as of February 28, 2023:

| (in thousands) | Amortization Period | Acquisition Value | Accumulated Amortization | Net Book Value | ||||||||||||||||||||||

| Termination/nonassertion agreement-TSRL Inc. | Straight line | |||||||||||||||||||||||||

| Developed technologies–DILIsym acquisition | Straight line | |||||||||||||||||||||||||

| Intellectual rights of Entelos Holding Company | Straight line | |||||||||||||||||||||||||

| Developed technologies–Lixoft acquisition | Straight line | |||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

The following table summarizes intellectual property as of August 31, 2022:

| (in thousands) | Amortization Period | Acquisition Value | Accumulated Amortization | Net Book Value | ||||||||||||||||||||||

| Royalty Agreement buy out-Enslein Research | Straight line | $ | $ | $ | ||||||||||||||||||||||

| Termination/nonassertion agreement-TSRL Inc. | Straight line | |||||||||||||||||||||||||

| Developed technologies–DILIsym acquisition | Straight line | |||||||||||||||||||||||||

| Intellectual rights of Entelos Holding Company | Straight line | |||||||||||||||||||||||||

| Developed technologies–Lixoft acquisition | Straight line | |||||||||||||||||||||||||

| $ | $ | $ | ||||||||||||||||||||||||

Total amortization expense for intellectual property agreements for the three months ended February 28, 2023 and 2022 was $0.4 million and $0.4 million, respectively, and amortization expense for intellectual property agreements for the six months ended February 28, 2023 and 2022 was $0.7 million and $0.7 million, respectively.

Future amortization of intellectual property for the next five years is as follows:

| (in thousands) | ||||||||

Year Ending August 31, | Amount | |||||||

| Remainder of 2023 | $ | |||||||

| 2024 | $ | |||||||

| 2025 | $ | |||||||

| 2026 | $ | |||||||

| 2027 | $ | |||||||

| Three Months Ended February 28, | Six Months Ended February 28, | |||||||||||||||||||||||||

| (in thousands) | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Numerator | ||||||||||||||||||||||||||

| Net income attributable to common shareholders | $ | $ | $ | $ | ||||||||||||||||||||||

| Denominator | ||||||||||||||||||||||||||

| Weighted-average number of common shares outstanding during the year | ||||||||||||||||||||||||||

| Dilutive effect of stock options | ||||||||||||||||||||||||||

| Common stock and common stock equivalents used for diluted earnings per share | ||||||||||||||||||||||||||

Impairment of Long-lived Assets

We account for the impairment and disposition of long-lived assets in accordance with ASC 360. Long-lived assets to be held and used are reviewed for events or changes in circumstances that indicate that their carrying value may not be recoverable. We measure recoverability by comparing the carrying amount of an asset to the expected future undiscounted net cash flows generated by the asset. If we determine that the asset may not be recoverable, or if the carrying amount of an asset exceeds its estimated future undiscounted cash flows, we recognize an impairment charge to the extent of the difference between the fair value and the asset's carrying amount. No

Recently Issued Accounting Standards

None.

NOTE 3 – OTHER INCOME (EXPENSE), NET

The components of other income (expense), net for the three and six months ended February 28, 2023, and 2022, were as follows:

| Three Months Ended February 28, | Six Months Ended February 28, | |||||||||||||||||||||||||

| (in thousands) | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Interest income | $ | $ | $ | $ | ||||||||||||||||||||||

| Change in valuation of contingent consideration | ( | ( | ||||||||||||||||||||||||

| Gain on sale of assets | ||||||||||||||||||||||||||

| Gain (loss) on currency exchange | ||||||||||||||||||||||||||

| Total other income, net | $ | $ | $ | $ | ||||||||||||||||||||||

NOTE 4 – COMMITMENTS AND CONTINGENCIES

Leases

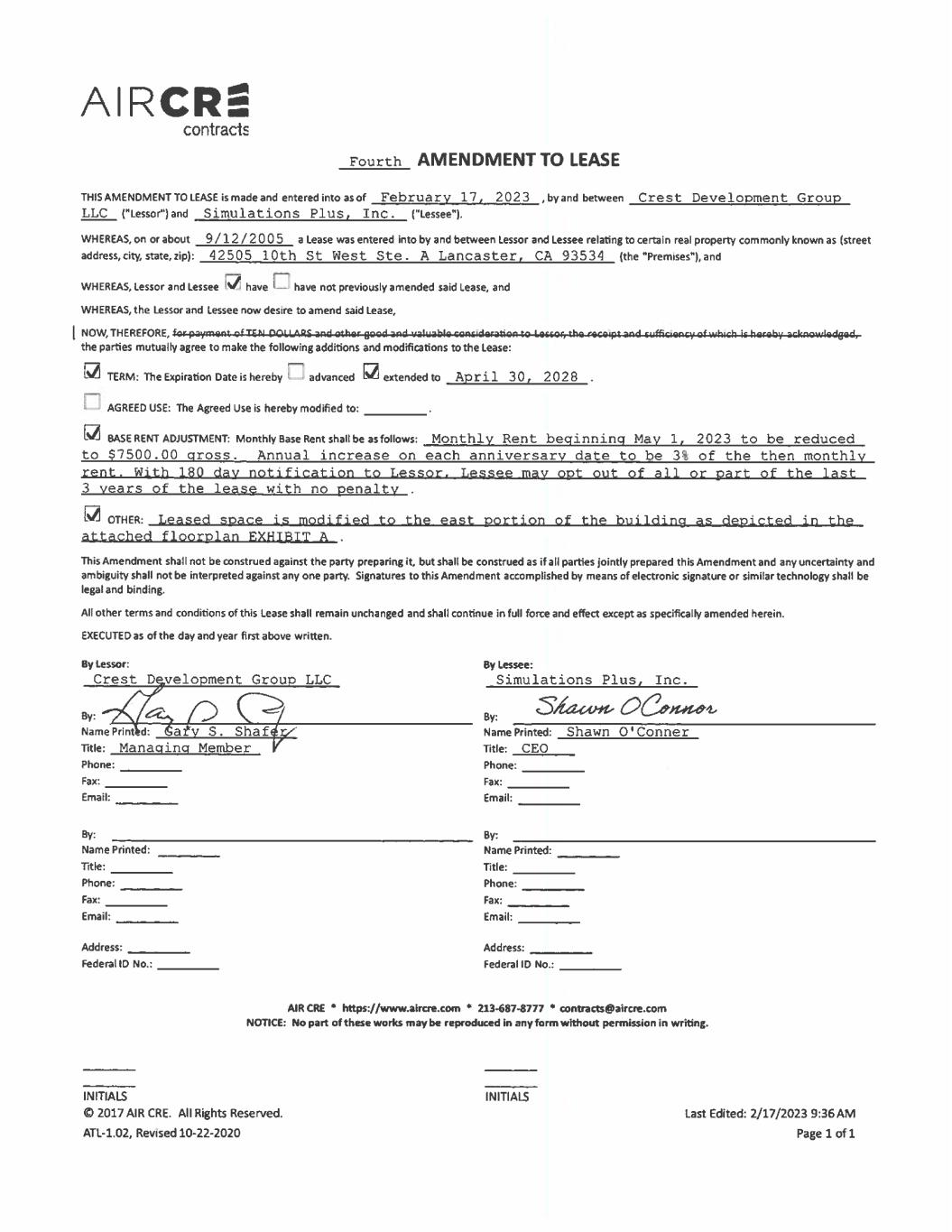

On February 17, 2023, we entered into an amendment, effective May 1, 2023, to the lease agreement for our office space in Lancaster, California, where our corporate headquarters are located. The amendment extends the lease term through April 30, 2028, reduces the leased square footage from 9,255 to approximately 4,200 , and reduces the monthly base rent from $18 thousand per month to $8 thousand per month with an annual increase of 3 %. The amended lease agreement gives the Company the right, upon 180 days’ prior notice, to opt out of all or part of the last three years of the lease term with no penalty.

We lease 4,317 square feet of office space in Buffalo, New York. The lease term extends to November 30, 2026, and the base rent is $7 thousand per month with an annual 2 % increase. The lease agreement provides the Company with two -year renewal options and the right to terminate the lease with one year 's prior written notice with certain penalties.

We have a data center colocation space in Buffalo, New York, with a lease term through November 30, 2026, and rent of $4 thousand per month with an annual 3 % increase.

We lease 3,386 square feet of office space in Durham, North Carolina. The lease term extends to September 30, 2023, and the base rent is $8 thousand per month with an annual 3 % increase.

We lease 2,300 square feet of office space in Paris, France. The lease term extends to November 30, 2024, and the rent is $5 thousand per month, which amount is subject to adjustment each December based on a consumer price index.

Rent expense, including common area maintenance fees for the three months ended February 28, 2023, and 2022 was $0.1 million and $0.1 million, respectively, and was $0.3 million and $0.3 million for the six months ended February 28, 2023, and 2022, respectively.

Lease liability maturities as of February 28, 2023, were as follows:

| (in thousands) | Year Ending August 31, | Amount | |||||||||

| Remainder of 2023 | $ | ||||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| Total undiscounted liabilities | |||||||||||

| Less: imputed interest | ( | ||||||||||

| Total operating lease liabilities (including current portion) | $ | ||||||||||

Employment Agreements

In the normal course of business, the Company has entered into employment agreements with certain of its executive officers that may require compensation payments upon termination.

Income Taxes

We follow guidance issued by the FASB with regard to our accounting for uncertainty in income taxes recognized in the financial statements. Such guidance prescribes a recognition threshold of more likely than not and a measurement process for financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. In making this assessment, a company must determine whether it is more likely than not that a tax position will be sustained upon examination, based solely on the technical merits of the position, and must assume that the tax position will be examined by taxing authorities. Our policy is to include interest and penalties related to income tax expense. We file income tax returns with the IRS and various state jurisdictions as well as with the countries of India and France. Our federal income tax returns for fiscal years 2019 through 2021 are open for audit, and our state tax returns for fiscal years 2018 through 2021 remain open for audit.

Our review of prior year tax positions using the criteria and provisions presented in guidance issued by FASB did not result in a material impact on our financial position or results of operations.

Litigation

We are not a party to any legal proceedings and are not aware of any pending or threatened legal proceedings of any kind.

NOTE 5 – SHAREHOLDERS' EQUITY

Shares Outstanding

Shares of Company common stock outstanding for the three and six months ended February 28, 2023 and 2022 were as follows:

| Three Months Ended February 28, | Six Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||||||

| Common stock outstanding, beginning of period | ||||||||||||||||||||||||||

| Common stock repurchased during the period * | ( | ( | ||||||||||||||||||||||||

| Common stock issued during the period | ||||||||||||||||||||||||||

| Common stock outstanding, end of period | ||||||||||||||||||||||||||

*Common stock repurchased per the ASR Agreement, as discussed in further detail in this footnote, below.

Dividends

The Company’s Board of Directors declared cash dividends during the fiscal years 2023 and 2022. The details of dividends paid are in the following tables:

| (in thousands, except dividend per share) | Fiscal Year 2023 | |||||||||||||||||||||||||

| Record Date | Distribution Date | Number of Shares Outstanding on Record Date | Dividend per Share | Total Amount | ||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| Total | $ | |||||||||||||||||||||||||

| (in thousands, except dividend per share) | Fiscal Year 2022 | |||||||||||||||||||||||||

| Record Date | Distribution Date | Number of Shares Outstanding on Record Date | Dividend per Share | Total Amount | ||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| $ | ||||||||||||||||||||||||||

| Total | $ | |||||||||||||||||||||||||

Stock Option Plans

On December 23, 2016, the Company's Board of Directors adopted, and on February 23, 2017, its shareholders approved, the Company's 2017 Equity Incentive Plan (the "2017 Plan"), under which a total of 1.0 million shares of common stock were reserved for issuance. The 2017 plan would have terminated in December 2026. The 2017 Plan was replaced by the Company’s 2021 Plan (as defined below), and as a result, no further issuances of shares may be made under the 2017 Plan.

On April 9, 2021, the Company's Board of Directors adopted, and on June 23, 2021, its shareholders approved, the Company's 2021 Equity Incentive Plan (the “2021 Plan,” and together with the 2017 Plan, the "Plans"), under which a total of 1.3 million shares of common stock were initially reserved for issuance. On October 20, 2022, the Company’s Board of Directors approved, and on February 9, 2023, its shareholders approved, an amendment to the 2021 Plan to increase the number of shares of common stock authorized for issuance thereunder from 1.3 million shares to 1.55 million shares of common stock of the Company. The 2021 Plan will terminate in 2031.

As of February 28, 2023, employees and directors held Qualified Incentive Stock Options ("ISOs") and Non-Qualified Stock Options ("NQSOs") to purchase an aggregate of 1.6 million shares of common stock at exercise prices ranging from $6.85 to $66.14 per share.

The following tables summarize information about stock options:

| (in thousands, except per share and weighted-average amounts) | ||||||||||||||||||||

| Transactions During The Six Months Ended February 28, 2023 | Number of Options | Weighted-Average Exercise Price Per Share | Weighted-Average Remaining Contractual Life | |||||||||||||||||

| Outstanding, August 31, 2022 | $ | |||||||||||||||||||

| Granted | ||||||||||||||||||||

| Exercised | ( | |||||||||||||||||||

| Canceled/Forfeited | ( | |||||||||||||||||||

| Outstanding, February 28, 2023 | $ | |||||||||||||||||||

| Vested and Exercisable, February 28, 2023 | $ | |||||||||||||||||||

| Vested and Expected to Vest, February 28, 2023 | $ | |||||||||||||||||||

The total grant-date fair value of nonvested stock options as of February 28, 2023, was $16.2 million and is amortizable over a weighted-average period of 3.66 years.

The fair value of these options was estimated at the date of grant using the Black-Scholes option-pricing model. The Black-Scholes option-valuation model was developed for use in estimating the fair value of traded options, which do not have vesting restrictions and are fully transferable. In addition, option-valuation models require the input of highly subjective assumptions, including the expected stock price volatility.

The following table summarizes the fair value of the options, including both ISOs and NQSOs, granted during the current fiscal year 2023 and fiscal year 2022:

| (in thousands, except prices) | Six Months Ended February 28, 2023 | Fiscal Year 2022 | ||||||||||||

| Estimated fair value of awards granted | $ | $ | ||||||||||||

| Unvested Forfeiture Rate | % | % | ||||||||||||

| Weighted-average grant price | $ | $ | ||||||||||||

| Weighted-average market price | $ | $ | ||||||||||||

| Weighted-average volatility | % | % | ||||||||||||

| Weighted-average risk-free rate | % | % | ||||||||||||

| Weighted-average dividend yield | % | % | ||||||||||||

| Weighted-average expected life | ||||||||||||||

The exercise prices for the options outstanding at February 28, 2023, ranged from $6.85 to $66.14 , and the information relating to these options is as follows:

(in thousands except prices)

| Exercise Price | Awards Outstanding | Awards Exercisable | ||||||||||||||||||||||||||||||||||||||||||

| Low | High | Quantity | Weighted -Average Remaining Contractual Life | Weighted-Average Exercise Price | Quantity | Weighted-Average Remaining Contractual Life | Weighted-Average Exercise Price | |||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||||

| $ | $ | |||||||||||||||||||||||||||||||||||||||||||

During the three and six months ended February 28, 2023, we issued 3,645 and 7,160 shares of stock valued at $0.1 million and $0.3 million, respectively, to our nonmanagement directors as compensation for board-related duties.

The balances of our par-value common stock and additional paid-in capital as of February 28, 2023, were $11 thousand and $137.8 million, respectively.

Share Repurchases

On January 11, 2023, the Company entered into an accelerated share repurchase agreement (the “ASR Agreement”) with Morgan Stanley & Co. LLC (“Morgan Stanley”) to repurchase an aggregate of $20 million of the Company’s outstanding common shares. The ASR Agreement was executed as part of the Company’s existing $50 million share repurchase program.

Pursuant to the terms of the ASR Agreement, the Company made an initial payment, using available cash balances, of $20 million to Morgan Stanley and received an initial delivery of 408,685 shares of Company common stock. These 408,685 shares were retired and are treated as authorized, unissued shares. The final number of shares to be repurchased will be based on the volume-weighted average price of the Company’s common stock during the term of the ASR Agreement, less a discount and subject to adjustments. At final settlement, under certain circumstances, Morgan Stanley may be required to deliver to the Company additional shares of the Company’s common stock, or the Company may be required to deliver to Morgan Stanley additional shares of the Company’s common stock (or, at the Company’s election, to make a cash payment to Morgan Stanley). The final settlement is expected to be completed during the third quarter of fiscal 2023. The Company estimates that the final additional share delivery from Morgan Stanley to the Company pursuant to the ASR Agreement will be approximately 91,000 shares.

The ASR Agreement contains the principal terms and provisions governing the transaction, including, but not limited to, the mechanism used to determine the number of shares that will be delivered, the required timing of delivery of the shares, the circumstances under which Morgan Stanley is permitted to make adjustments to valuation and calculation periods and various acknowledgments, representations and warranties made by the Company and Morgan Stanley to one another.

NOTE 6 – CONCENTRATIONS AND UNCERTAINTIES

Financial instruments that potentially subject the Company to concentration of credit risk consist principally of cash, cash equivalents, trade accounts receivable, and short-term investments. The Company holds cash and cash equivalents with balances that exceed FDIC insured limits. Cash maintained in excess of these limits is on deposit with a large, national bank. Accordingly, the Company does not have depository exposure to regional banks. In addition, the Company holds cash at a bank in France that is not FDIC-insured. Historically, the Company has not experienced any losses in such accounts, and management believes that the financial institutions at which its cash is held are stable; however, no assurances can be provided. While the Company may be exposed to credit losses due to the nonperformance of its counterparties, the Company does not expect the settlement of these transactions to have a material effect on its results of operations, cash flows, or financial condition.

Revenue concentration shows that international sales accounted for 31 % and 33 % of revenue for the six months ended February 28, 2023, and 2022, respectively. Our four largest customers in terms of revenue accounted for 6 %, 5 %, 3 %, and 3 % of revenue for the six months ended February 28, 2023. Our four largest customers in terms of revenue accounted for 11 %, 5 %, 4 %, and 4 % of revenue for the six months ended February 28, 2022.

Accounts receivable concentrations show that our six largest customers in terms of accounts receivable each comprised between 5 % and 13 % of accounts receivable as of February 28, 2023; our three largest customers in terms of accounts receivable comprised between 4 % and 19 % of accounts receivable as of February 28, 2022.

We operate in the biosimulation market, which is highly competitive and changes rapidly. Our operating results could be significantly affected by our ability to develop new products and find new distribution channels for new and existing products.

NOTE 7 – SEGMENT REPORTING

The Company applies ASC 280, Segment Reporting, in determining reportable segments. The Company has two reportable segments: Software and Services. Segment information is presented in the same manner that the chief operating decision maker ("CODM") reviews certain financial information based on these reportable segments. The CODM reviews revenue and gross profit for both of the reportable segments. Gross profit is defined as revenue less cost of revenue incurred by the segment.

No operating segments have been aggregated to form the reportable segments. The Company does not allocate assets at the reportable segment level as these are managed on an entity-wide group basis and, accordingly, the Company does not report asset information by segment. The Company does not allocate operating expenses that are managed on an entity-wide group basis and, accordingly, the Company does not allocate and report operating expenses at a segment level. There are no internal revenue transactions between the Company’s segments.

The following tables summarize the results for each segment for the three months ended February 28, 2023, and 2022:

| (in thousands) | Three Months Ended February 28, 2023 | |||||||||||||||||||

| Software | Services | Total | ||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||

| Cost of revenues | ||||||||||||||||||||

| Gross profit | $ | $ | $ | |||||||||||||||||

| Gross margin | % | % | % | |||||||||||||||||

Our software business and services business represented 67 % and 33 % of total revenue, respectively, for the three months ended February 28, 2023.

| (in thousands) | Three Months Ended February 28, 2022 | |||||||||||||||||||

| Software | Services | Total | ||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||

| Cost of revenues | ||||||||||||||||||||

| Gross profit | $ | $ | $ | |||||||||||||||||

| Gross margin | % | % | % | |||||||||||||||||

Our software business and services business represented 66 % and 34 % of total revenue, respectively, for the three months ended February 28, 2022.

The following tables summarize the results for each segment for the six months ended February 28, 2023, and 2022:

| (in thousands) | Six Months Ended February 28, 2023 | |||||||||||||||||||

| Software | Services | Total | ||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||

| Cost of revenues | ||||||||||||||||||||

| Gross profit | $ | $ | $ | |||||||||||||||||

| Gross margin | % | % | % | |||||||||||||||||

Our software business and services business represented 60 % and 40 % of total revenue, respectively, for the six months ended February 28, 2023.

| (in thousands) | Six Months Ended February 28, 2022 | |||||||||||||||||||

| Software | Services | Total | ||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||

| Cost of revenues | ||||||||||||||||||||

| Gross profit | $ | $ | $ | |||||||||||||||||

| Gross margin | % | % | % | |||||||||||||||||

Our software business and services business represented 63 % and 37 % of total revenue, respectively, for the six months ended February 28, 2022.

NOTE 8 – EMPLOYEE BENEFIT PLAN

NOTE 9 - SUBSEQUENT EVENTS

Dividend Declared

On Wednesday, April 5, 2023, our Board of Directors declared a quarterly cash dividend of $0.06 per share to our shareholders. The dividend in the amount of approximately $1.2 million will be distributed on Monday, May 1, 2023, for shareholders of record as of Monday, April 24, 2023.

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This document and the documents incorporated in this document by reference contain forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact contained in this document and the materials accompanying this document are forward-looking statements.

The forward-looking statements are based on the beliefs of our management, as well as assumptions made by and information currently available to our management. Frequently, but not always, forward-looking statements are identified by the use of the future tense and by words such as “believes,” expects,” “anticipates,” “intends,” “will,” “may,” “could,” “would,” “projects,” “continues,” “estimates” or similar expressions. Forward-looking statements are not guarantees of future performance and actual results could differ materially from those indicated by the forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by the forward-looking statements.

The forward-looking statements contained or incorporated by reference in this document are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), and are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. These statements include declarations regarding our plans, intentions, beliefs, or current expectations.

Among the important factors that could cause actual results to differ materially from those indicated by forward-looking statements are the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the year ended August 31, 2022, filed with the Securities and Exchange Commission (“SEC”) on October 28, 2022, and elsewhere in this document and in our other filings with the SEC.

Forward-looking statements are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this document are made as of the date of this document and we do not undertake any obligation to update forward-looking statements to reflect new information, subsequent events, or otherwise.

General

BUSINESS

OVERVIEW

Simulations Plus, Inc., incorporated in 1996, is a premier developer of drug discovery and development software for modeling and simulation, and for the prediction of molecular properties utilizing both artificial intelligence and machine-learning-based technology. We also provide consulting services ranging from early drug discovery through preclinical and clinical development analysis and for submissions to regulatory agencies. Our software and consulting services are provided to major pharmaceutical, biotechnology, agrochemical, cosmetics, and food industry companies and academic and regulatory agencies worldwide for use in the conduct of industry-based research. The Company is headquartered in Southern California, with offices in Buffalo, NY; Research Triangle Park, NC; and Paris, France. Our common stock has traded on the Nasdaq Global Select Market under the symbol “SLP” since May 13, 2021, prior to which it traded on the Nasdaq Capital Market under the same symbol.

We are a global leader, delivering relevant, cost-effective software and creative and insightful consulting services. Pharmaceutical and biotechnology companies and hospitals use our software programs and scientific consulting services to guide early drug discovery (molecule design screening and lead optimization), preclinical and clinical development programs, and the development of generic medicines after patent expiration, including using our software products and services to enhance their understanding of the properties of potential new therapies and to use emerging data to improve formulations, select and justify dosing regimens, support the generics industry, optimize clinical trial designs, and simulate outcomes in special populations, such as in elderly and pediatric patients.

Results of Operations

Comparison of Three Months Ended February 28, 2023 and 2022

| (in thousands) | Three Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | $ Change | % Change | |||||||||||||||||||||||

| Revenue | $ | 15,750 | $ | 14,796 | $ | 954 | 6 | % | ||||||||||||||||||

| Cost of revenue | 2,620 | 2,830 | (210) | (7) | % | |||||||||||||||||||||

| Gross profit | 13,130 | 11,966 | 1,164 | 10 | % | |||||||||||||||||||||

| Research and development | 1,317 | 902 | 415 | 46 | % | |||||||||||||||||||||

| Selling, general, and administrative | 7,779 | 5,584 | 2,195 | 39 | % | |||||||||||||||||||||

| Total operating expenses | 9,096 | 6,486 | 2,610 | 40 | % | |||||||||||||||||||||

| Income from operations | 4,034 | 5,480 | (1,446) | (26) | % | |||||||||||||||||||||

| Other income, net | 1,034 | 53 | 981 | 1,851 | % | |||||||||||||||||||||

| Income before income taxes | 5,068 | 5,533 | (465) | (8) | % | |||||||||||||||||||||

| Provision for income taxes | (894) | (1,124) | 230 | (20) | % | |||||||||||||||||||||

| Net income | $ | 4,174 | $ | 4,409 | $ | (235) | (5) | % | ||||||||||||||||||

Revenues

Revenues increased by $1.0 million, or 6%, to $15.8 million for the three months ended February 28, 2023, compared to $14.8 million for the three months ended February 28, 2022. This increase is primarily due to a $0.7 million, or 7%, increase in software-related revenue and $0.2 million, or 4%, increase in service-related revenue when compared to the three months ended February 28, 2022.

Cost of revenues

Cost of revenues remained relatively consistent with a slight decrease of $0.2 million, or 7%, for the three months ended February 28, 2023, compared to the three months ended February 28, 2022. The decrease is primarily due to a $0.3 million, or 13%, decrease in service-related cost of revenue, offset by an increase of $0.1 million, or 8%, in software-related cost of revenue when compared to the three months ended February 28, 2022.

Gross profit

Gross profit increased by $1.2 million, or 10%, to $13.1 million for the three months ended February 28, 2023, compared to $12.0 million for the three months ended February 28, 2022. The increase in gross profit is due to an increase in gross profit for our software business of $0.7 million, or 7%, and an increase in gross profit for our services business of $0.5 million, or 17%.

Overall gross margin percentage was 83% and 81% for the three months ended February 28, 2023, and 2022, respectively.

Research and development

We incurred $2.1 million of research and development costs during the three months ended February 28, 2023. Of this amount, $0.8 million was capitalized as a part of capitalized software development costs and $1.3 million was expensed. We incurred $1.6 million of research and development costs during the three months ended February 28, 2022. Of this amount, $0.7 million was capitalized and $0.9 million was expensed. The overall increase in research and development costs is primarily due to the development of the newest version of our MonolixSuite product, version 2023R1, which was released on February 28, 2023, as well as an increase in personnel costs from market compensation adjustments following the Company's engagement during fiscal year 2022 of an external consulting firm, Arthur J. Gallagher & Co., to complete a full market study on the compensation payable to our employees compared to those of our peers. The Company rebuilt its career grading system based on the results of the compensation study to ensure competitive and equitable pay for all our employees across the organization in base salary, cash bonus, and stock option grants. We believe that the market study and resulting compensation adjustments were necessary in light of the highly competitive employment market to attract and retain superior talent.

Selling, general, and administrative expenses

Selling, general, and administrative ("SG&A") expenses increased by $2.2 million, or 39%, to $7.8 million for the three months ended February 28, 2023, compared to $5.6 million for the three months ended February 28, 2022. This increase was primarily due to a $1.7 million increase in employee and labor-related expenses from a 14% headcount increase to meet the robust and growing demand for our services as well as market compensation adjustments following the Company's engagement during fiscal year 2022 of an external consulting firm, Arthur J. Gallagher & Co., to complete a full market study on the compensation payable to our employees compared to those of our peers. The Company rebuilt its career grading system based on the results of the compensation study to ensure competitive and equitable pay for all our employees across the organization in base salary, cash bonus, and stock option grants. We believe that the market study and resulting compensation adjustments were necessary in light of the highly competitive employment market to attract and retain superior talent. The $1.9 million increase in personnel costs includes an increase in stock compensation expense of $0.5 million, an increase in accrued bonuses of $0.6 million, and an increase in base salaries of $0.3 million.

As a percent of revenues, SG&A expense was 49% for the three months ended February 28, 2023, compared to 38% for the three months ended February 28, 2022.

Other income

Total other income was $1.0 million for the three months ended February 28, 2023, compared to total other income of $0.1 million for the three months ended February 28, 2022. The increase is primarily due to an increase in interest income of $0.9 million driven by an increase in interest rates.

Provision for income taxes

The provision for income taxes was $0.9 million for the three months ended February 28, 2023, compared to $1.1 million for the three months ended February 28, 2022. Our effective tax rate decreased to 18% for the three months ended February 28, 2023, from 20% for the three months ended February 28, 2022.

Comparison of Six Months Ended February 28, 2023 and 2022

| (in thousands) | Six Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | $ Change | % Change | |||||||||||||||||||||||

| Revenue | $ | 27,714 | $ | 27,213 | $ | 501 | 2 | % | ||||||||||||||||||

| Cost of revenue | 5,291 | 5,586 | (295) | (5) | % | |||||||||||||||||||||

| Gross profit | 22,423 | 21,627 | 796 | 4 | % | |||||||||||||||||||||

| Research and development | 2,483 | 1,784 | 699 | 39 | % | |||||||||||||||||||||

| Selling, general, and administrative | 15,028 | 10,572 | 4,456 | 42 | % | |||||||||||||||||||||

| Total operating expenses | 17,511 | 12,356 | 5,155 | 42 | % | |||||||||||||||||||||

| Income from operations | 4,912 | 9,271 | (4,359) | (47) | % | |||||||||||||||||||||

| Other income, net | 1,774 | 118 | 1,656 | 1,403 | % | |||||||||||||||||||||

| Income before income taxes | 6,686 | 9,389 | (2,703) | (29) | % | |||||||||||||||||||||

| Provision for income taxes | (1,267) | (1,954) | 687 | (35) | % | |||||||||||||||||||||

| Net income | $ | 5,419 | $ | 7,435 | $ | (2,016) | (27) | % | ||||||||||||||||||

Revenues

Revenues increased by $0.5 million, or 2%, to $27.7 million for the six months ended February 28, 2023, compared to $27.2 million for the six months ended February 28, 2022. This increase is primarily due to an increase of $1.1 million, or 11%, in service-related revenue, partially offset by a $0.6 million, or 3%, decrease in software-related revenue, driven by timing of the software license renewals and foreign currency exchange rate fluctuations when comparing the six months ended February 28, 2023, and 2022.

Cost of revenues

Cost of revenues remained relatively consistent with a slight decrease of $0.3 million, or 5%, for the six months ended February 28, 2023, compared to the six months ended February 28, 2022. The decrease is primarily due to a $0.5 million, or 12%, decrease in service-related cost of revenue, offset by an increase of $0.2 million, or 14%, in software-related cost of revenue when compared to the six months ended February 28, 2022.

Gross profit

Gross profit increased by $0.8 million, or 4%, to $22.4 million for the six months ended February 28, 2023, compared to $21.6 million, for the six months ended February 28, 2022. The increase in gross profit is due to an increase in gross profit for our services business of $1.6 million, or 26%, partially offset by a decrease in gross profit for our software business of $0.8 million, or 5%.

Overall gross margin percentage was 81% and 79% for the six months ended February 28, 2023, and 2022, respectively.

Research and development

We incurred $4.2 million of research and development costs during the six months ended February 28, 2023. Of this amount, $1.7 million was capitalized as a part of capitalized software development costs and $2.5 million was expensed. We incurred $3.3 million of research and development costs during the six months ended February 28, 2022. Of this amount, $1.5 million was capitalized and $1.8 million was expensed. The overall increase in research and development costs is primarily due to the development of the newest version of our MonolixSuite product, version 2023R1, which was released on February 28, 2023 as well as an increase in personnel costs from market compensation adjustments following the Company's engagement during fiscal year 2022 of an external consulting firm, Arthur J. Gallagher & Co., to complete a full market study on the compensation payable to our employees compared to those of our peers. The Company rebuilt its career grading system based on the results of the compensation study to ensure competitive and equitable pay for all our employees across the organization in base salary, cash bonus, and stock option grants. We believe that the market study and resulting compensation adjustments were necessary in light of the highly competitive employment market to attract and retain superior talent.

Selling, general, and administrative expenses

Selling, general, and administrative (“SG&A”) expenses increased by $4.5 million, or 42%, to $15.0 million for the six months ended February 28, 2023, compared to $10.6 million for the six months ended February 28, 2022. This increase was primarily due to a $3.2 million increase in employee and labor related expenses from a 14% headcount increase to meet the robust and growing demand for our services as well as market compensation adjustments following the Company's engagement during fiscal year 2022 of an external consulting firm, Arthur J. Gallagher & Co., to complete a full market study on the compensation payable to our employees compared to those of our peers. The Company rebuilt its career grading system based on the results of the compensation study to ensure competitive and equitable pay for all our employees across the organization in base salary, cash bonus, and stock option grants. We believe that the market study and resulting compensation adjustments were necessary in light of the highly competitive employment market to attract and retain superior talent. The $3.2 million increase in personnel costs includes an increase in accrued bonuses of $1.0 million, an increase in stock compensation of $0.9 million, and an increase in base salaries of $1.0 million.

Additionally, the overall increase in SG&A is due to an increase in merger and acquisition costs of $0.4 million, an increase in commissions to distributors of $0.1 million, and an increase in travel costs of $0.2 million.

As a percent of revenues, SG&A expense was 54% for the six months ended February 28, 2023, compared to 39% for the six months ended February 28, 2022.

Other income

Total other income was $1.8 million for the six months ended February 28, 2023, compared to total other income of $0.1 million for the six months ended February 28, 2022. The increase is primarily due to an increase in interest income of $1.6 million driven by an increase in interest rates.

Provision for income taxes

The provision for income taxes was $1.3 million for the six months ended February 28, 2023, compared to $2.0 million for the six months ended February 28, 2022. Our effective tax rate decreased to 19% for the six months ended February 28, 2023, from 21% for the six months ended February 28, 2022.

Results of Operations by Business Unit

Comparison of Three Months Ended February 28, 2023 and 2022

Revenues

| (in thousands) | Three Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | Change ($) | Change (%) | |||||||||||||||||||||||

| Software | $ | 10,487 | $ | 9,758 | $ | 729 | 7 | % | ||||||||||||||||||

| Services | 5,263 | 5,038 | 225 | 4 | % | |||||||||||||||||||||

| Total | $ | 15,750 | $ | 14,796 | $ | 954 | 6 | % | ||||||||||||||||||

Cost of Revenues

| (in thousands) | Three Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | Change ($) | Change (%) | |||||||||||||||||||||||

| Software | $ | 843 | $ | 780 | $ | 63 | 8 | % | ||||||||||||||||||

| Services | 1,777 | 2,050 | (273) | (13) | % | |||||||||||||||||||||

| Total | $ | 2,620 | $ | 2,830 | $ | (210) | (7) | % | ||||||||||||||||||

Gross Profit

| (in thousands) | Three Months Ended February 28, | |||||||||||||||||||||||||

| 2023 | 2022 | Change ($) | Change (%) | |||||||||||||||||||||||

| Software | $ | 9,644 | $ | 8,978 | $ | 666 | 7 | % | ||||||||||||||||||

| Services | 3,486 | 2,988 | 498 | 17 | % | |||||||||||||||||||||

| Total | $ | 13,130 | $ | 11,966 | $ | 1,164 | 10 | % | ||||||||||||||||||

Software Business

For the three months ended February 28, 2023, the revenue increase of $0.7 million, or 7%, compared to the three months ended February 28, 2022, was primarily due to higher revenues from GastroPlus® of $0.9 million, partially offset by lower revenues from MonolixSuite of $0.2 million. Cost of revenues remained relatively consistent, with a slight increase of $0.1 million, or 8%, during the same periods, and gross profit increased by $0.7 million, or 7%, primarily due to the increase in revenues.

Services Business

For the three months ended February 28, 2023, the revenue increase of $0.2 million, or 4%, compared to the three months ended February 28, 2022, was primarily due to higher revenues from pharmacokinetic and pharmacodynamic (“PKPD”) services of $0.4 million and higher revenues from physiologically based pharmacokinetics (“PBPK”) services of $0.3 million, partially offset by a decrease in revenues from quantitative systems pharmacology/quantitative systems toxicology (“QSP/QST”) services of $0.5 million. Cost of revenues decreased by $0.3 million, or 13%. Gross profit increased by $0.5 million, or 17%, for the same periods.