SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

ANNUAL REPORT

September 30, 2021

FMI Large

Cap Fund

Investor Class (Ticker Symbol: FMIHX)

Institutional Class (Ticker Symbol: FMIQX)

FMI Common

Stock Fund

Investor Class (Ticker Symbol: FMIMX)

Institutional Class (Ticker Symbol: FMIUX)

FMI International

Fund

Investor Class (Ticker Symbol: FMIJX)

Institutional Class (Ticker Symbol: FMIYX)

FMI International Fund II - Currency Unhedged

Investor Class (Not Available For Sale)

Institutional Class (Ticker Symbol: FMIFX)

|

FMI Funds, Inc. Advised by Fiduciary Management, Inc. |

FMI Funds, Inc.

TABLE OF CONTENTS

|

|

|

|

|

|

|

1 |

|

|

8 |

|

|

11 |

|

|

13 |

|

|

|

|

|

|

|

|

14 |

|

|

21 |

|

|

23 |

|

|

25 |

|

|

|

|

|

FMI International Fund and FMI International Fund II – Currency Unhedged |

|

|

26 |

|

|

33 |

|

|

|

|

|

|

|

|

38 |

|

|

42 |

|

|

43 |

|

|

|

|

|

|

|

|

44 |

|

|

48 |

|

|

|

|

|

|

|

|

50 |

|

|

52 |

|

|

54 |

|

|

58 |

|

|

65 |

|

|

|

|

|

77 |

|

|

78 |

|

|

80 |

|

|

82 |

|

|

83 |

|

|

87 |

|

|

87 |

|

|

88 |

|

|

88 |

Large Cap

Fund

|

|

(unaudited) |

September 30, 2021 |

The FMI Large Cap Fund (“Fund”) declined 2.65%1 in the September quarter compared to a gain of 0.58% for the Standard & Poor’s 500 Index (“S&P 500”) and a -0.78% return for the Russell 1000 Value Index. Health Technology, Electronic Technology, and Technology Services detracted from relative performance versus the S&P 500. Our underweighting in these technology sectors hurt relative performance. From a stock perspective, Smith & Nephew PLC – SP-ADR, Koninklijke Philips N.V. – SP-ADR (“Philips”), and PPG Industries Inc. all declined in the period; Smith & Nephew was affected by the Delta variant and related surge in COVID-19 cases, Philips by a product recall, and PPG by supply chain delays and higher costs. All of these appear to be temporary headwinds, and we are optimistic about a rebound in each issue. On the positive side, Consumer Durables, Consumer Services, and Transportation all added to relative performance. Sony Group Corp. – SP-ADR, Booking Holdings Inc., and Quest Diagnostics Inc. outperformed from an individual stock perspective. Year-to-date the Fund has underperformed both the growth-driven S&P 500 and the Russell 1000 Value. We have been underweight stocks that have been the biggest beneficiaries of the so-called “COVID trade” and we don’t own many of the deeper-value names that bounced hard once vaccines became available. We do own one of our highest-quality portfolios in memory, at a discount valuation. We are confident that this is a winning combination longer-term, and have recently increased our own investments in the Fund.

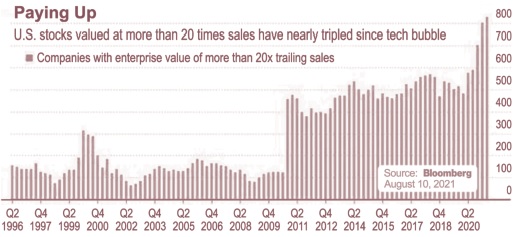

The market favored growth in the latter part of the second quarter, and for most of the third quarter. Worries about the Delta variant and its effect on the economy turned investors toward the same forces that have prevailed since early 2020, when COVID first surfaced. The S&P 500, driven mostly by higher-multiple growth stocks, has performed strongly since the start of the pandemic (+37.3% from February 1, 2020 through September 30, 2021). Curiously, in a time of uncertainty and difficulty, many of the most speculative stocks have done even better. Bitcoin-sensitive stocks were up 274.9%, and the most liquid shorted stocks, popular with the Reddit/Robinhood crowd, were up 172.6%. Non-profitable technology stocks were up 157.7%. In fixed income, speculative grade issues have lapped Treasuries. New issues of money-losing companies are at a record level, and ones that trade for greater than 20 times sales remain commonplace. Currently there are over 800 companies with an enterprise value-to-sales multiple greater than 20 (see the chart on the following page), compared to approximately 300 at the peak of the 2000 market. This measures only companies with sales, so it excludes a significant number of development-stage biopharmaceutical companies with sizeable market values. Historically, the 5-year forward relative return for stocks with a price-to-sales ratio in excess of 15 has been -28%.2 Will this be a new era?

|

1 |

The FMI Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) had a return of -2.65% and -2.60%, respectively, for the third quarter of 2021. |

|

2 |

Eric Savitz. “Pricey Tech Stocks Still Carry Big Risks, Bernstein Analyst Cautions.” Barron’s, March 22, 2021. |

Bob Farrell, a dean of Wall Street thinkers from the mid-1960s through the early 2000s, published his “Ten Market Rules to Remember” in 1998 (see Appendix), the third of which was, “There are no new eras,” meaning that change, technological breakthroughs, and progress are always part of the landscape. Innovation, by its nature, is unique, but its impact within the stock market does not last forever. We haven’t entered a new era for growth. One “proof” of that is the rate of economic growth over recent decades. Despite fantastic innovations in technology, health care, and entertainment, real GDP growth has been relatively steady over each of the past three decades. In fact, even with all the new marvelous technology, productivity growth has actually lagged historical rates over the past ten years. There is no new era to justify today’s extraordinarily high valuations. In the decade ending 2020, the S&P 500 (iShares S&P 500 ETF as a surrogate) revenue and earnings growth were roughly 4.5% and 8.2%, respectively. If eight stocks are removed (Facebook Inc., Apple Inc., Amazon.com Inc., Alphabet Inc. (Google), Microsoft Corp., NVIDIA Corp., Netflix Inc., and Tesla Inc.), the revenue and earnings growth for the remaining companies were approximately -1.5%. Ending 12/31/20, the median stock return of the iShares S&P 500 over the past decade was 11.2%. Multiple expansion is clearly responsible for a large share of the market’s return. Since 2020 was a depressed endpoint, we analyzed the five years ending December 31, 2019. During that period, S&P 500 sales grew at a compound rate of about 5.0%, and earnings advanced at around a 10.6% clip. Without the aforementioned eight names, we estimate that revenue grew just 0.1% and earnings gained 5.2%, compounded. The Fund’s stocks outperformed these fundamentals, yet we lagged the return of this benchmark. The desire to hold the S&P 500 has been a self-fulfilling prophesy in recent times, but we contend that it won’t always be this way. Investors seem immune to the notion that the reverse can happen, and yet history tells us that this occurs with great regularity. It just hasn’t happened recently!

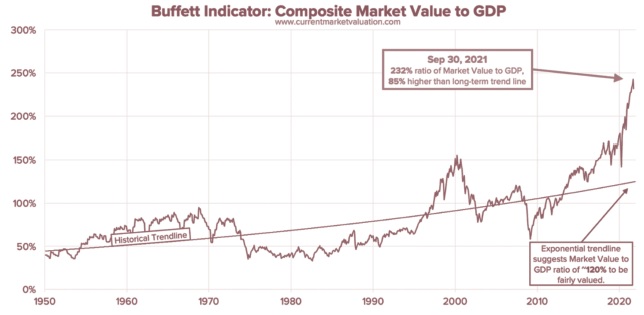

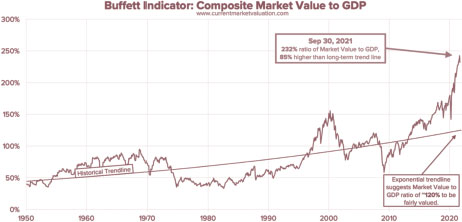

2000 Market Versus Today

Today we have a market picture that is very reminiscent of the 2000 period. Information Technology and Communication Services stocks constituted 39.9% of the market at the end of 1999. Information Technology (to include social media and Amazon) and Communication Services were 42.8% of the S&P 500 as of September 30. Technology’s weighting in the stock market is roughly five times its weighting in the real economy. Valuations were extreme in 2000, and are, on many measures, even more so today. The market capitalization-to-GDP ratio is the highest ever (see chart on the following page). Investor sentiment is very bullish. “Retail” involvement in the market was high in 2000, but with the dawn of free stock trading, has recently expanded dramatically. Margin debt is also near a record high.

There are, however, some important differences. Many companies are “investing” through the income statement rather than the balance sheet. By this we mean that they are expensing customer acquisition or network development expenses on the profit and loss statement, rather than through capital investments made on the balance sheet, and this depresses current earnings. Notable companies like Amazon and Netflix have done this. These successful “deferral” models have been copied by hundreds of companies. Today there is an obsession with top-line growth almost to the total exclusion of profits. It seems that for emerging companies, showing profit is a sign of weakness, because it means one is not driving (spending) hard enough on revenue generation. Some deferral models will work, but many will not. Underpricing a product or service to drive sales growth may, in the end, just turn out to be an unprofitable endeavor. Another big difference between 21 years ago and today is that the cone of overvaluation was fairly confined to a few sectors then, whereas extended valuations permeate most sectors today. At the beginning of 2000, if one avoided tech and telecom, it was possible to build a portfolio of excellent companies with price-to-earnings multiples in the low-to-mid-teens. Buying a portfolio of roughly the same quality today, while avoiding the extremely high multiple ideas, would cost closer to 20 times earnings. Finally, from a macro standpoint, there are several major differences to highlight. Inflation is on the rise today, and was going the other way in the early 2000s. This may eventually influence interest rates, which have been ground-hugging for over a decade. Companies are running hot with leverage up dramatically. The government seems to be on a nonstop spending spree; government debt exceeds $28 trillion and the deficit/GDP is as high as it has been since WWII.

Economic Growth Generally Positive

Despite these concerns, however, we remain generally optimistic about economic growth. A huge contingent of workers remain on the sidelines due to COVID-19. There are roughly 8 million officially unemployed, and perhaps as many as 10 million more who are no longer counted, because they are not actively seeking work. Incentives to forgo work must lessen. It seems like nearly all sectors are complaining about worker shortages: restaurants, hotels, technicians, nurses, tradesmen, and teachers, to name just a few. There are officially an incredible 10.9 million job openings. Wages are rising, which may bring people back into the workforce. As people return to work, economic growth will accelerate, creating even more employment opportunities. Additionally, one of our greatest competitive advantages as a nation is access to immigrant labor. Countries we compete with have low birth rates and highly restrictive immigration. We need comprehensive laws and clarity in this area, but potentially, this is a huge long-range positive.

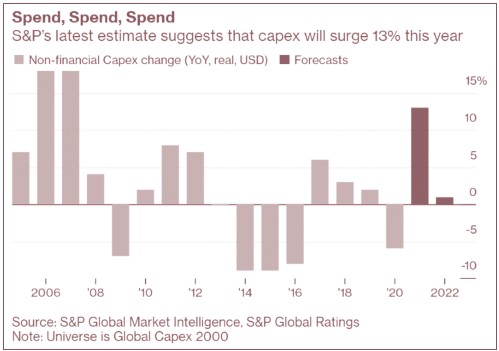

Another important aspect to growth that has been improving lately is capital formation. Orders for durable goods, excluding defense, are up 26.6% year-to-date through August, which is an easy comparison due to COVID, but they are also up 2.2% compared to 2019. According to S&P Global Ratings, global capital expenditures are projected to jump 13% this year. We’ve waited a long time for this, and although it is too early to call it a trend, the signs are encouraging.

Inflation

The inflation we have been warning about over the past few years is here. The Fed claims it is a blip and will soon disappear, i.e., return to 2% (which for some reason is considered good), and in the short run, the Delta variant’s impact could slow the economy and lessen inflation. Additionally, as the most acute supply chain bottlenecks ameliorate, prices are likely to settle down, but the conditions for secularly higher rates of inflation appear to be in place. Wages are very sticky on the downside and constitute a sizeable percentage of most companies’ costs. In nearly every industry we analyze, wages are rising at rates that haven’t been seen in years. Prices for many consumer products, including food and energy, are rising, and prices for nearly every service one could think of are increasing as well. It is beginning to feel more like the 1970s every day. Producer prices have escalated dramatically. The Producer Price Index was up 8.3% for the 12 months ended August, after having gained steadily all year. Inflation psychology seems to have changed, too. People now expect to see higher prices, surcharges, special fees, etc. Moreover, one of the greatest dampeners of inflation over the past 20 years has been China. As more manufacturing moved or threatened to move to China, it suppressed domestic wages and inflation. Cheap imports from China also depressed U.S. product prices. The great migration of hundreds of millions of rural folks moving to Chinese cities has largely played out. Today, China’s working-age population is starting to fall. Wages are rising significantly and import prices are rising. Add to this the massive amount of quantitative easing. Nearly everything that worked to lower inflation for many years is now going in reverse.

Interest Rates

How will rates respond to inflation, and to all the newly created money that is likely to get deployed in coming quarters and years? How will they react to the long-awaited Fed tapering? How will huge deficit spending programs impact rates? How sustainable are deeply negative (~-5% today) real returns on cash and short-term investments? Will a decade-plus of extremely low and unprecedented rates give way to something more normal in the future? We think the answer is yes, although of course, we cannot predict the timing. We envision a different environment than the one that has prevailed in recent years. Buying growth and so-called story stocks and ignoring valuations and balance sheets has been a winning formula for quite some time. We are content to own sound companies with durable business franchises and reasonable valuations, knowing that long-term, this has worked. Below we have highlighted a couple of portfolio companies.

PACCAR Inc. (PCAR)

(Analyst: Dain Tofson)

Overview

PACCAR is a highly efficient manufacturer and financier of light, medium, and heavy-duty trucks and related parts. The company reports three principal segments – Truck, Parts, and Financial Services – and a trivial Other segment, which includes an industrial winches business. In 2020, Truck and Other were 71% of sales and 37% of pretax profit; Parts was 21% of sales, 49% of pretax profit; and Financial Services was 8% of sales, 14% of pretax profit. Geographically, the United States accounted for 56% of sales; Europe, 26%; and other geographies, 18%. The company controls three brands: Peterbilt (United States and Canada), Kenworth (United States, Canada, Mexico, and Australia), and DAF (primarily Europe, Brazil, and Australia); each is supported by a strong, independent dealer network.

Good Business

|

|

● |

PACCAR has been a long-term organic market share gainer in its markets, aided by consistent investment, robust new product development, and a strong independent dealer network. |

|

|

● |

The truck manufacturing industry is highly consolidated in North America, and PACCAR’s manufacturing business operates with few plants, requires little inventory, often generates negative working capital (cash in before delivery), and achieves best-in-class margins. As a result, its manufacturing return on invested capital averages greater than 20% – better than most industrial businesses. |

|

|

● |

Parts sales have grown at a 6% compound annual growth rate (CAGR) over the last 15 years. |

|

|

● |

Although the truck industry is cyclical, PACCAR has been profitable for 82 consecutive years. |

|

|

● |

The company has no manufacturing debt, and the Financial Services segment is conservatively capitalized. |

|

|

● |

The company is investing in alternative powertrain and autonomous driving technology, and commercial production of Peterbilt, Kenworth, and DAF electric trucks began this year. |

|

|

● |

All three of the truck brands carry a premium over competitor truck resale value. |

|

|

● |

Trucking is a necessary business, and market level replacement demand is able to be estimated. |

Valuation

|

|

● |

The stock trades at 2.5 times price-to-book (P/B) versus its 10-year average of 2.9 times. |

|

|

● |

If Financial Services is valued at 1 times book (which is conservative given the historical performance), then PACCAR’s manufacturing business trades at 9.3 times earnings before interest and taxes. |

|

|

● |

PACCAR trades at 13.9 times earnings per share (EPS) versus its 10-year average of 15.1 times. |

|

|

● |

PACCAR dividend yield is 2.6%, including episodic dividends. |

Management

|

|

● |

Preston Feight has been CEO since 2019 and has been with PACCAR for over 20 years, having previously held leadership roles at DAF and Kenworth. He is an engineer by education and is well-suited to oversee PACCAR’s investments in alternative powertrain and autonomous driving technology. |

|

|

● |

Mark and John Pigott, great grandsons of the founder, sit on PACCAR’s board, and the Pigott family is estimated to own around one-third of PACCAR shares. The founding family influence has helped management maintain a customer-first mindset and long-term view. |

|

|

● |

Growth has been organic since 1996, and the dividend payout has averaged 50% for many years. |

|

|

● |

Long-term executive compensation is aligned with shareholders and tied to the 3-year change in net income, return on sales, and return on capital compared with peer companies. |

Investment Thesis

PACCAR is a high-quality, high-return manufacturing business run by a capable management team. It is currently trading at a discount to its history on P/B due to supply chain issues. While frustrating, we believe the supply chain issues are temporary and are masking what is a solid mid-term financial outlook from new products and continued growth in the parts business. On the former, the company is currently undergoing one of the biggest product portfolio updates in its history. We believe the new products will drive solid price realization, market share gains, and earnings upside relative to expectations. On the latter, the parts business has grown at a 6% CAGR over the last 15 years and should continue to grow as PACCAR increases proprietary content on trucks and enhances the distribution network. Ultimately, we believe PACCAR is a quality compounder at an attractive valuation and have added to our position on the stock’s weakness.

Berkshire Hathaway Inc. – Cl B (BRK/B)

(Analyst: Rob Helf)

Description

Berkshire Hathaway is a diversified holding company engaged in several business activities, including Insurance and Reinsurance, Freight Rail Transportation, Utilities and Energy, Manufacturing, Service and Retail, and Finance. Berkshire owns Burlington Northern Santa Fe (BNSF), one of the country’s largest railways and a vital business for transporting a range of products and commodities. Insurers such as GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group are significant contributors to operating income and generators of “float” for reinvestment. Additionally, well-known manufacturers, wholesalers, and retailers owned by the company include: Precision Castparts Corp. (aerospace components), The Lubrizol Corp. (specialty and performance additives), Marmon Holdings, Inc. (diverse industrials), Clayton Homes (traditional and off-site built housing), Benjamin Moore & Co. (paints and coatings), Shaw Industries Group, Inc. (floor coverings), and McLane Co., Inc. (wholesale distribution), to name a few. The businesses are managed on a decentralized basis. Finally, as of 6/30/21 on Berkshire’s Annual Report, their equity portfolio included significant positions in publicly traded Apple Inc. ($124 billion), Bank of America Corp. ($43 billion), American Express Co. ($25 billion), The Coca-Cola Co. ($22 billion), The Kraft Heinz Co. ($13 billion), and others.

Good Business

|

|

● |

The largest contributors to Berkshire’s pre-tax earnings are: Insurance (26%), Manufacturing, Service and Retail (33%), and BNSF (22%). Insurance, Finance, and Utilities cumulatively account for 45% of after-tax income. Overall, the company has a portfolio of necessary businesses. |

|

|

● |

The collection of insurance businesses can be defined as market-leading, strongly profitable (95% combined ratio), financially sound, and characterized by recurring premium revenues. All are rated AA+ or higher. |

|

|

● |

The company’s businesses generally have a significant cost advantage over their competitors. |

|

|

● |

Berkshire’s float from its insurance units totals over $130 billion and is available for acquisitions. This figure has grown at greater than 17.5% per annum since 1970. |

|

|

● |

Its share of undistributed earnings from investees is approximately $12 billion, or $5 per Class B share. |

Valuation

|

|

● |

The stock currently trades at 1.3 times book value, which is a slight discount to its 15-year average of 1.45 times, and the company’s intrinsic value is estimated to far exceed its historical carrying value. |

|

|

● |

The company’s share repurchase program limits potential downside, as it will repurchase shares at or below 1.2 times book value, or $250 per B share. |

|

|

● |

On a sum-of-the parts basis, we conservatively value the Berkshire operating businesses at approximately $210 per B share. The undistributed earnings of the company’s equity portfolio, along with potential returns on the insurance float, adds approximately $140 per B share in value. |

|

|

● |

Based on “look through” EPS, Berkshire trades at 16.3 times, which is a significant discount to the median of a typical S&P 500 company. At a median multiple, the B shares would trade over $400. |

Management

|

|

● |

Warren Buffett (Chairman and CEO, age 91) and Charlie Munger (Vice Chairman, age 97) are the largest shareholders and have been at the helm for over 50 years. Buffett owns 38% of the company. |

|

|

● |

The quality of Berkshire’s management team is very strong, although Buffett’s succession concerns are warranted. Given his age, we believe the market has already discounted his passing. Should the company then be broken up, the sum of the parts vastly exceeds the current market value. |

|

|

● |

It appears that Greg Abel, a vice chairman of Berkshire and presider over the non-insurance businesses, will replace Buffett upon his death or retirement. |

|

|

● |

Todd Combs and Ted Weschler, who both joined in 2011, are very capable investment managers. |

Investment Thesis

Berkshire Hathaway has assembled a collection of industry-leading companies that utilize the advantage of a large, permanent capital base to drive performance. There are some very appealing economically offensive aspects of the portfolio, while the large excess cash position provides defensiveness relative to an expensive market. We expect the game plan to continue, i.e., strong operations and value-added acquisitions that will increase the intrinsic value of the company at above-average rates going forward. We view Berkshire as solid grower (8-10% book value growth) that is attractive relative to the overall market.

Thank you for your confidence in the FMI Large Cap Fund.

Appendix:

Bob Farrell’s Ten Market Rules to Remember

|

|

1. |

Markets tend to return to the mean over time. |

|

|

2. |

Excesses in one direction will lead to an opposite excess in the other direction. |

|

|

3. |

There are no new eras — excesses are never permanent. |

|

|

4. |

Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways. |

|

|

5. |

The public buys the most at the top and the least at the bottom. |

|

|

6. |

Fear and greed are stronger than long-term resolve. |

|

|

7. |

Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. |

|

|

8. |

Bear markets have three stages — sharp down, reflexive rebound and a drawn-out fundamental downtrend. |

|

|

9. |

When all the experts and forecasts agree — something else is going to happen. |

|

|

10. |

Bull markets are more fun than bear markets. |

This shareholder letter is unaudited.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2021, the FMI Large Cap Fund (“Fund”) had a total return of 24.48%1. The benchmark Standard & Poor’s 500 Index (“S&P 500”) returned 30.00% in the same period. The trailing 12-month return for the Russell 1000 Value Index was 35.01%. Relative to the S&P 500, sectors that aided relative performance included Finance, Consumer Durables, and Distribution Services. The Fund had little direct exposure to Communications and Utilities, which aided relative performance. The Charles Schwab Corp., JPMorgan Chase & Co., and Northern Trust Corp. drove the results in the Finance sector, as all achieved better-than-expected results in the face of COVID-19 and low interest rates. Sony Group Corp. – SP-ADR delivered steady growth during an uncertain macro environment. HD Supply Holdings Inc. was acquired from the Fund at a premium. On the negative side of sector performance, Consumer Non-Durables, Producer Manufacturing, and Health Technology all detracted. The Fund’s modest cash level also hurt results. Unilever PLC – SP-ADR struggled in the period because of its outsized exposure to emerging markets, which were disproportionately impacted by COVID-19. Additionally, supply chain issues and inflation hurt margins. Masco Corp. stock, which was strong during the lockdowns, faded in the reopening even though, fundamentally, it has done well. Koninklijke Philips N.V. – SP-ADR (“Philips”) and Smith & Nephew PLC – SP-ADR performed poorly over the past year. Philips was hit by a recall in their sleep apnea area, and Smith & Nephew struggled with hospitals not doing discretionary medical procedures during the COVID-19 crisis. The Fund managers feel that the issues facing these companies are temporary. The Fund had little exposure to commodities and other deep cyclicals, which underpinned a strong rebound in the Russell 1000 Value post the introduction of vaccines.

Other stocks that helped performance included Chubb Ltd., Schlumberger Ltd. and Booking Holdings Inc. Chubb is experiencing a strong pricing cycle. Schlumberger benefitted from the rebound in oil prices and restructuring. Booking Holdings saw hotel activity pick up post the COVID-19 lockdowns. PACCAR Inc., Fresenius Medical Care AG & Co. KGaA, and Dollar General Corp. all detracted from relative results. PACCAR’s stock was disproportionately hit by COVID-19 and the semiconductor shortage; the long-term demand and underlying fundamentals remain solid. Deaths from COVID-19 impacted Fresenius’ customer base more than expected. This was a miscalculation, but it doesn’t change the positive multi-year thesis. Dollar General performed well during COVID but the stock did not benefit as much from a strong rebound in lesser- quality “COVID-19 rebound” retailers. New additions to the Fund over the past twelve months included Micron Technology Inc., Fresenius, Arch Capital Group Ltd., Dover Corp., Alphabet Inc. – Cl A, and Facebook Inc. Stocks sold during the year included HD Supply, Accenture PLC, Honeywell International Inc., Nestlé S.A. – SP-ADR and PepsiCo Inc. As of September 30, 2021, the Fund was significantly overweighted in Producer Manufacturing, Health Services, and Finance. The Fund was meaningfully underweighted in Technology Services, Electronic Technology, and Health Technology.

In the first seven to eight months of the fiscal year, deep value names and sectors drove stock market performance, interrupting a long run for growth stocks. That phenomenon reverted to growth stocks in the middle of May, as the Delta variant impacted both fundamental growth expectations and stock performance. Throughout the fiscal year and for the past several years, the most speculative stocks in the market have done remarkably well. Some of these companies have no earnings and trade at large multiples of revenues. While the Fund is value-oriented, we focus on quality, so it did not participate strongly in the so-called value trade early in the fiscal year. The stocks that bounced the most tended to be those that had weaker balance sheets, were heavily cyclical, or had commodity-driven fundamentals. Some of the most speculative retailers and financial services companies strongly outperformed the quality blue-chip names that the Fund owns in these sectors.

The S&P 500 trades at extremely high levels on nearly all measures of value including sales, earnings, assets, and cash flow. The Fund trades at a meaningful discount to the S&P 500, and the managers believe the quality of the underlying companies is better than the benchmark. Historically, the Fund, with its more cautious positioning, has tended to outperform when stock markets come under pressure, but there is no assurance that the future will look like the past.

|

1 |

The Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) had a return of 24.48% and 24.63%, respectively, for the fiscal year ending 09/30/2021. |

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

The Federal Reserve has undertaken an unprecedented policy of monetary accommodation over the past decade. The Fed’s balance sheet has more than doubled over the past three years. The price of money remains unusually low by historical standards, and the managers believe that several negative effects, including low capital formation, high inflation, and currency debasement, are being ignored by the market. The Fed believes the current elevated rate of inflation is temporary; however, many elements, particularly higher wages and raw material costs, and exceptional money-printing in recent years, may prove this supposition wrong. Rising rates tend to hurt growth stocks relative to value stocks.

Debt at both the corporate and government levels has grown significantly. Recent additions to the government debt totals are extraordinary by historical standards. U.S. total federal debt-to-GDP is well over 100%, and is the highest it has been in the post-WWII era. Corporate leverage, by some measures, is at a 50-year high. High leverage tends to increase downside risk when markets come under pressure. The Fund is less levered than the market.

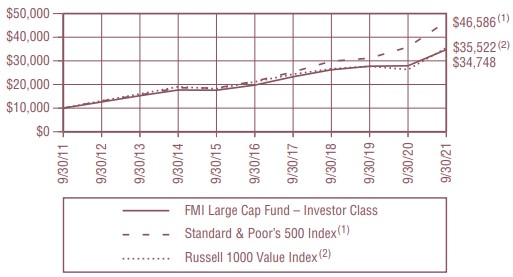

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FMI LARGE CAP FUND – INVESTOR CLASS — STANDARD & POOR’S 500 INDEX(1) AND THE RUSSELL 1000© VALUE INDEX(2)

|

AVERAGE ANNUALIZED TOTAL RETURN |

|||||

|

|

Inception Date |

1-Year |

5-Year |

10-Year |

Inception through |

|

FMI Large Cap Fund – Investor Class |

12/31/01 |

24.48% |

11.97% |

13.26% |

9.37% |

|

FMI Large Cap Fund – Institutional Class |

10/31/16 |

24.63% |

N/A |

N/A |

12.87% |

|

Standard & Poor’s 500 Index(1)* |

|

30.00% |

16.90% |

16.63% |

9.07% |

|

Russell 1000 Value Index(2)* |

|

35.01% |

10.94% |

13.51% |

8.04% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued)

|

(1) |

The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. The index is used herein for comparative purposes in accordance with SEC regulations. |

|

(2) |

The Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index which comprises the 3,000 largest U.S. companies based on total market capitalization. The Russell 1000 Value Index includes equities that exhibit value characteristics and the Russell 1000 Growth Index includes equities that exhibit growth characteristics. The index is used herein for comparative purposes in accordance with SEC regulations. |

|

* |

The benchmark since inception returns are calculated since inception of the Investor Class, December 31, 2001 to September 30, 2021. |

An investment cannot be made directly into an index.

FMI Large Cap Fund

September 30, 2021

|

|

|

|

|

|

|

|

|

|

||

|

Shares |

|

|

|

|

Cost |

|

Value |

|

||

|

COMMON STOCKS — 99.4% (a) |

|

|

|

|

|

|

|

|||

|

COMMERCIAL SERVICES SECTOR — 2.7% |

|

|

|

|

|

|

|

|||

|

|

|

|

Advertising/Marketing Services — 2.7% |

|

|

|

|

|

|

|

|

1,190,000 |

|

|

Omnicom Group Inc. |

|

$ |

79,147,504 |

|

$ |

86,227,400 |

|

|

CONSUMER DURABLES SECTOR — 5.0% |

|

|

|

|

|

|

|

|||

|

|

|

|

Electronics/Appliances — 5.0% |

|

|

|

|

|

|

|

|

1,440,000 |

|

|

Sony Group Corp. — SP-ADR* |

|

|

92,741,405 |

|

|

159,235,200 |

|

|

CONSUMER NON-DURABLES SECTOR — 3.5% |

|

|

|

|

|

|

|

|||

|

|

|

|

Household/Personal Care — 3.5% |

|

|

|

|

|

|

|

|

2,100,000 |

|

|

Unilever PLC — SP-ADR |

|

|

85,890,259 |

|

|

113,862,000 |

|

|

CONSUMER SERVICES SECTOR — 8.5% |

|

|

|

|

|

|

|

|||

|

|

|

|

Cable/Satellite TV — 4.8% |

|

|

|

|

|

|

|

|

2,735,000 |

|

|

Comcast Corp. — Cl A |

|

|

120,377,010 |

|

|

152,968,550 |

|

|

|

|

|

Other Consumer Services — 3.7% |

|

|

|

|

|

|

|

|

50,000 |

|

|

Booking Holdings Inc.* |

|

|

86,729,685 |

|

|

118,693,500 |

|

|

ELECTRONIC TECHNOLOGY SECTOR — 2.9% |

|

|

|

|

|

|

|

|||

|

|

|

|

Semiconductors — 2.9% |

|

|

|

|

|

|

|

|

1,300,000 |

|

|

Micron Technology Inc.* |

|

|

69,278,038 |

|

|

92,274,000 |

|

|

FINANCE SECTOR — 25.0% |

|

|

|

|

|

|

|

|||

|

|

|

|

Investment Banks/Brokers — 4.5% |

|

|

|

|

|

|

|

|

2,005,000 |

|

|

The Charles Schwab Corp. |

|

|

72,815,973 |

|

|

146,044,200 |

|

|

|

|

|

Major Banks — 4.1% |

|

|

|

|

|

|

|

|

810,000 |

|

|

JPMorgan Chase & Co. |

|

|

51,559,902 |

|

|

132,588,900 |

|

|

|

|

|

Multi-Line Insurance — 8.5% |

|

|

|

|

|

|

|

|

1,325,000 |

|

|

Arch Capital Group Ltd.* |

|

|

49,263,536 |

|

|

50,588,500 |

|

|

815,000 |

|

|

Berkshire Hathaway Inc. — Cl B* |

|

|

43,929,357 |

|

|

222,446,100 |

|

|

|

|

|

|

|

|

93,192,893 |

|

|

273,034,600 |

|

|

|

|

|

Property/Casualty Insurance — 5.0% |

|

|

|

|

|

|

|

|

430,000 |

|

|

Chubb Ltd. |

|

|

56,774,344 |

|

|

74,596,400 |

|

|

965,000 |

|

|

Progressive Corp. |

|

|

75,737,513 |

|

|

87,226,350 |

|

|

|

|

|

|

|

|

132,511,857 |

|

|

161,822,750 |

|

|

|

|

|

Regional Banks — 2.9% |

|

|

|

|

|

|

|

|

875,000 |

|

|

Northern Trust Corp. |

|

|

74,975,784 |

|

|

94,333,750 |

|

|

HEALTH SERVICES SECTOR — 11.2% |

|

|

|

|

|

|

|

|||

|

|

|

|

Health Industry Services — 4.8% |

|

|

|

|

|

|

|

|

1,050,000 |

|

|

Quest Diagnostics Inc. |

|

|

102,655,747 |

|

|

152,575,500 |

|

|

|

|

|

Managed Health Care — 3.8% |

|

|

|

|

|

|

|

|

315,000 |

|

|

UnitedHealth Group Inc. |

|

|

22,493,615 |

|

|

123,083,100 |

|

|

|

|

|

Medical/Nursing Services — 2.6% |

|

|

|

|

|

|

|

|

2,425,000 |

|

|

Fresenius Medical Care AG & Co. KGaA |

|

|

98,494,080 |

|

|

84,802,250 |

|

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

|

|

|

|

Cost |

|

|

Value |

|

|

COMMON STOCKS — 99.4% (a) (Continued) |

|

|

|

|

|

|

|

|||

|

HEALTH TECHNOLOGY SECTOR — 5.6% |

|

|

|

|

|

|

|

|||

|

|

|

|

Medical Specialties — 5.6% |

|

|

|

|

|

|

|

|

2,400,000 |

|

|

Koninklijke Philips N.V. — SP-ADR |

|

$ |

112,731,621 |

|

$ |

106,656,000 |

|

|

2,155,000 |

|

|

Smith & Nephew PLC — SP-ADR |

|

|

79,928,399 |

|

|

74,002,700 |

|

|

|

|

|

|

|

|

192,660,020 |

|

|

180,658,700 |

|

|

INDUSTRIAL SERVICES SECTOR — 1.8% |

|

|

|

|

|

|

|

|||

|

|

|

|

Oilfield Services/Equipment — 1.8% |

|

|

|

|

|

|

|

|

1,895,000 |

|

|

Schlumberger Ltd. |

|

|

36,545,384 |

|

|

56,167,800 |

|

|

PROCESS INDUSTRIES SECTOR — 2.7% |

|

|

|

|

|

|

|

|||

|

|

|

|

Industrial Specialties — 2.7% |

|

|

|

|

|

|

|

|

600,000 |

|

|

PPG Industries Inc. |

|

|

59,010,822 |

|

|

85,806,000 |

|

|

PRODUCER MANUFACTURING SECTOR — 13.6% |

|

|

|

|

|

|

|

|||

|

|

|

|

Building Products — 5.0% |

|

|

|

|

|

|

|

|

2,865,000 |

|

|

Masco Corp. |

|

|

98,371,533 |

|

|

159,150,750 |

|

|

|

|

|

Electrical Products — 3.3% |

|

|

|

|

|

|

|

|

400,000 |

|

|

Eaton Corp. PLC |

|

|

36,466,742 |

|

|

59,724,000 |

|

|

505,000 |

|

|

Emerson Electric Co. |

|

|

23,631,135 |

|

|

47,571,000 |

|

|

|

|

|

|

|

|

60,097,877 |

|

|

107,295,000 |

|

|

|

|

|

Industrial Machinery — 2.4% |

|

|

|

|

|

|

|

|

500,000 |

|

|

Dover Corp. |

|

|

67,511,523 |

|

|

77,750,000 |

|

|

|

|

|

Trucks/Construction/Farm Machinery — 2.9% |

|

|

|

|

|

|

|

|

1,175,000 |

|

|

PACCAR Inc. |

|

|

63,628,391 |

|

|

92,731,000 |

|

|

RETAIL TRADE SECTOR — 9.7% |

|

|

|

|

|

|

|

|||

|

|

|

|

Apparel/Footwear Retail — 1.4% |

|

|

|

|

|

|

|

|

680,000 |

|

|

The TJX Companies Inc. |

|

|

23,081,024 |

|

|

44,866,400 |

|

|

|

|

|

Discount Stores — 8.3% |

|

|

|

|

|

|

|

|

715,000 |

|

|

Dollar General Corp. |

|

|

55,535,131 |

|

|

151,680,100 |

|

|

1,190,000 |

|

|

Dollar Tree Inc.* |

|

|

104,944,006 |

|

|

113,906,800 |

|

|

|

|

|

|

|

|

160,479,137 |

|

|

265,586,900 |

|

|

TECHNOLOGY SERVICES SECTOR — 5.9% |

|

|

|

|

|

|

|

|||

|

|

|

|

Internet Software/Services — 5.9% |

|

|

|

|

|

|

|

|

37,000 |

|

|

Alphabet Inc. — Cl A* |

|

|

85,428,024 |

|

|

98,920,240 |

|

|

270,000 |

|

|

Facebook Inc.* |

|

|

85,559,330 |

|

|

91,635,300 |

|

|

|

|

|

|

|

|

170,987,354 |

|

|

190,555,540 |

|

|

TRANSPORTATION SECTOR — 1.3% |

|

|

|

|

|

|

|

|||

|

|

|

|

Air Freight/Couriers — 1.3% |

|

|

|

|

|

|

|

|

340,000 |

|

|

Expeditors International of Washington Inc. |

|

|

12,353,055 |

|

|

40,504,200 |

|

|

|

|

|

Total common stocks |

|

|

2,127,589,872 |

|

|

3,192,617,990 |

|

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2021

|

Principal Amount |

|

|

Cost |

|

Value |

|

||||

|

SHORT-TERM INVESTMENTS — 0.5% (a) |

|

|

|

|

|

|

|

|||

|

|

|

|

Bank Deposit Account — 0.5% |

|

|

|

|

|

|

|

|

$17,056,192 |

|

|

U.S. Bank N.A., 0.006%^ |

|

$ |

17,056,192 |

|

$ |

17,056,192 |

|

|

|

|

|

Total short-term investments |

|

|

17,056,192 |

|

|

17,056,192 |

|

|

|

|

|

Total investments — 99.9% |

|

$ |

2,144,646,064 |

|

|

3,209,674,182 |

|

|

|

|

|

Other assets, less liabilities — 0.1% (a) |

|

|

|

|

|

1,494,261 |

|

|

|

|

|

TOTAL NET ASSETS — 100.0% |

|

|

|

|

$ |

3,211,168,443 |

|

|

* |

Non-income producing security. |

|

^ |

The rate shown is as of September 30, 2021. |

|

(a) |

Percentages for the various classifications relate to total net assets. |

|

PLC |

Public Limited Company |

|

SP-ADR |

Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

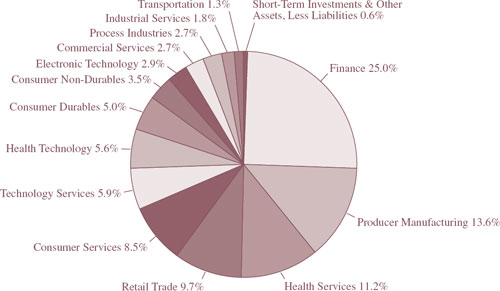

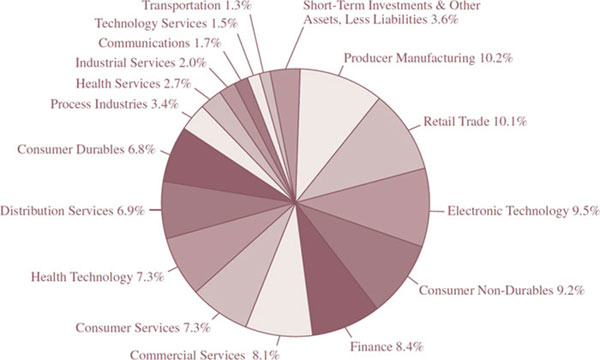

INDUSTRY SECTORS as a percentage of net assets

as of September 30, 2021 (Unaudited)

|

|

|

|

|

|

Common Stock |

|

|

|

Fund |

|

|

|

(unaudited) |

September 30, 2021 |

The FMI Common Stock Fund (“Fund”) gained 0.42%1 in the September quarter compared to declines of 4.36% for the Russell 2000 Index and 2.98% for the Russell 2000 Value Index. Energy Minerals, Transportation, and Industrial Services detracted from relative performance versus the Russell 2000. From a stock perspective, Donaldson Co. Inc., Herbalife Nutrition Ltd., and Insight Enterprises Inc. all declined in the period. On the positive side, Commercial Services, Retail Trade, and Producer Manufacturing all added to relative performance. Interpublic Group of Cos. Inc., FirstCash Inc., and Carlisle Cos. Inc. outperformed from an individual stock perspective. Year-to-date the Fund has outperformed the Russell 2000 by a wide margin, but has modestly underperformed the Russell 2000 Value. We believe the quality of the companies we own are superior to both indices, and most valuation measures are lower. We are confident that this is a winning combination longer-term and have recently increased our own investments in the Fund.

Worries about the Delta variant and its effect on the economy turned investors toward the same forces that have prevailed since early 2020, when COVID first surfaced. The S&P 500, driven mostly by higher-multiple growth stocks, has performed strongly since the start of the pandemic (+37.3% from February 1, 2020 through September 30, 2021). Curiously, in a time of uncertainty and difficulty, many of the most speculative stocks have done even better. Bitcoin-sensitive stocks were up 274.9%, and the most liquid shorted stocks, popular with the Reddit/Robinhood crowd, were up 172.6%. Non-profitable technology stocks were up 157.7%. In fixed income, speculative grade issues have lapped Treasuries. New issues of money-losing companies are at a record level, and ones that trade for greater than 20 times sales remain commonplace. Currently there are over 800 companies with an enterprise value-to-sales multiple greater than 20 (see the chart on the following page), compared to approximately 300 at the peak of the 2000 market. This measures only companies with sales, so it excludes a significant number of development-stage biopharmaceutical companies with sizeable market values. Historically, the 5-year forward relative return for stocks with a price-to-sales ratio in excess of 15 has been -28%.2 Will this be a new era?

Bob Farrell, a dean of Wall Street thinkers from the mid-1960s through the early 2000s, published his “Ten Market Rules to Remember” in 1998 (see Appendix), the third of which was, “There are no new eras,” meaning that change, technological breakthroughs, and progress are always part of the landscape. Innovation, by its nature, is unique, but its impact within the stock market does not last forever. We haven’t entered a new era for growth. One “proof” of that is the rate of economic growth over recent decades. Despite fantastic innovations in technology, health care, and entertainment, real GDP growth has been relatively steady over each of the past three decades. In fact, even with all the new marvelous technology, productivity growth has actually lagged historical rates over the past ten years. There is no new era to justify today’s extraordinarily high valuations. In the decade ending 2020, the S&P 500 (iShares S&P 500 ETF as a surrogate) revenue and earnings growth were roughly 4.5% and 8.2%, respectively. If eight stocks are removed (Facebook Inc., Apple Inc., Amazon.com Inc., Alphabet Inc. (Google), Microsoft Corp., NVIDIA Corp., Netflix Inc., and Tesla Inc.), the revenue and earnings growth for the remaining companies were approximately -1.5%. Ending 12/31/20, the median stock return of the iShares S&P 500 over the past decade was 11.2%. Multiple expansion is clearly responsible for a large share of the market’s return. Since 2020 was a depressed endpoint, we analyzed the five years ending December 31, 2019. During that period, S&P 500 sales grew at a compound rate of about 5.0%, and earnings advanced at around a 10.6% clip. Without the aforementioned eight names, we estimate that revenue grew just 0.1% and earnings gained 5.2%, compounded. The desire to hold the S&P 500 has been a self-fulfilling prophesy in recent times, but we contend that it won’t always be this way. Investors seem immune to the notion that the reverse can happen, and yet history tells us that this occurs with great regularity. It just hasn’t happened recently!

|

1 |

The FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) had a return of 0.42% and 0.45%, respectively, for the third quarter of 2021. |

|

2 |

Eric Savitz. “Pricey Tech Stocks Still Carry Big Risks, Bernstein Analyst Cautions.” Barron’s, March 22, 2021. |

2000 Market Versus Today

Today we have a market picture that is very reminiscent of the 2000 period. Information Technology and Communication Services stocks constituted 39.9% of the market at the end of 1999. Information Technology (to include social media and Amazon) and Communication Services were 42.8% of the S&P 500 as of September 30. Technology’s weighting in the stock market is roughly five times its weighting in the real economy. Valuations were extreme in 2000, and are, on many measures, even more so today. The market capitalization-to-GDP ratio is the highest ever (see chart below). Investor sentiment is very bullish. “Retail” involvement in the market was high in 2000, but with the dawn of free stock trading, has recently expanded dramatically. Margin debt is also near a record high.

There are, however, some important differences. Many companies are “investing” through the income statement rather than the balance sheet. By this we mean that they are expensing customer acquisition or network development expenses on the profit and loss statement, rather than through capital investments made on the balance sheet, and this depresses current earnings. Notable companies like Amazon and Netflix have done this. These successful “deferral” models have been copied by hundreds of companies. Today there is an obsession with top-line growth almost to the total exclusion of profits. It seems that for emerging companies, showing profit is a sign of weakness, because it means one is not driving (spending) hard enough on revenue generation. Some deferral models will work, but many will not. Underpricing a product or service to drive sales growth may, in the end, just turn out to be an unprofitable endeavor. Another big difference between 21 years ago and today is that the cone of overvaluation was fairly confined to a few sectors then, whereas extended valuations permeate most sectors today. At the beginning of 2000, if one avoided tech and telecom, it was possible to build a portfolio of excellent companies with price-to-earnings multiples in the low-to-mid-teens. Buying a portfolio of roughly the same quality today, while avoiding the extremely high multiple ideas, would cost closer to 20 times earnings. Finally, from a macro standpoint, there are several major differences to highlight. Inflation is on the rise today, and was going the other way in the early 2000s. This may eventually influence interest rates, which have been ground-hugging for over a decade. Companies are running hot with leverage up dramatically. The government seems to be on a nonstop spending spree; government debt exceeds $28 trillion and the deficit/GDP is as high as it has been since WWII.

Economic Growth Generally Positive

Despite these concerns, however, we remain generally optimistic about economic growth. A huge contingent of workers remain on the sidelines due to COVID-19. There are roughly 8 million officially unemployed, and perhaps as many as 10 million more who are no longer counted, because they are not actively seeking work. Incentives to forgo work must lessen. It seems like nearly all sectors are complaining about worker shortages: restaurants, hotels, technicians, nurses, tradesmen, and teachers, to name just a few. There are officially an incredible 10.9 million job openings. Wages are rising, which may bring people back into the workforce. As people return to work, economic growth will accelerate, creating even more employment opportunities. Additionally, one of our greatest competitive advantages as a nation is access to immigrant labor. Countries we compete with have low birth rates and highly restrictive immigration. We need comprehensive laws and clarity in this area, but potentially, this is a huge long-range positive.

Another important aspect to growth that has been improving lately is capital formation. Orders for durable goods, excluding defense, are up 26.6% year-to-date through August, which is an easy comparison due to COVID, but they are also up 2.2% compared to 2019. According to S&P Global Ratings, global capital expenditures are projected to jump 13% this year. We’ve waited a long time for this, and although it is too early to call it a trend, the signs are encouraging.

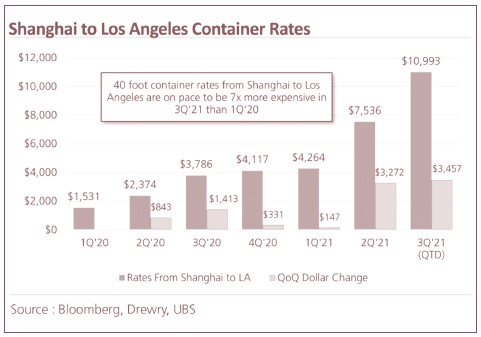

Inflation

The inflation we have been warning about over the past few years is here. The Fed claims it is a blip and will soon disappear, i.e., return to 2% (which for some reason is considered good), and in the short run, the Delta variant’s impact could slow the economy and lessen inflation. Additionally, as the most acute supply chain bottlenecks ameliorate, prices are likely to settle down, but the conditions for secularly higher rates of inflation appear to be in place. Wages are very sticky on the downside and constitute a sizeable percentage of most companies’ costs. In nearly every industry we analyze, wages are rising at rates that haven’t been seen in years. Prices for many consumer products, including food and energy, are rising, and prices for nearly every service one could think of are increasing as well. It is beginning to feel more like the 1970s every day. Producer prices have escalated dramatically. The Producer Price Index was up 8.3% for the 12 months ended August, after having gained steadily all year. Inflation psychology seems to have changed, too. People now expect to see higher prices, surcharges, special fees, etc. Moreover, one of the greatest dampeners of inflation over the past 20 years has been China. As more manufacturing moved or threatened to move to China, it suppressed domestic wages and inflation. Cheap imports from China also depressed U.S. product prices. The great migration of hundreds of millions of rural folks moving to Chinese cities has largely played out. Today, China’s working-age population is starting to fall. Wages are rising significantly and import prices are rising. Add to this the massive amount of quantitative easing. Nearly everything that worked to lower inflation for many years is now going in reverse.

Interest Rates

How will rates respond to inflation, and to all the newly created money that is likely to get deployed in coming quarters and years? How will they react to the long-awaited Fed tapering? How will huge deficit spending programs impact rates? How sustainable are deeply negative (~-5% today) real returns on cash and short-term investments? Will a decade-plus of extremely low and unprecedented rates give way to something more normal in the future? We think the answer is yes, although of course, we cannot predict the timing. We envision a different environment than the one that has prevailed in recent years. Buying growth and so-called story stocks and ignoring valuations and balance sheets has been a winning formula for quite some time. We are content to own sound companies with durable business franchises and reasonable valuations, knowing that long-term, this has worked. Below we have highlighted a couple of portfolio companies.

LGI Homes Inc. (LGIH)

(Analyst: Julia Jensen)

Description

LGI Homes engages in the design, construction, marketing, and sale of new single-family homes in the U.S. It participates in 34 markets across 18 states, with 9,339 closings per year as of 2020. It is the tenth largest residential homebuilder in the U.S., and focuses on building affordable, entry-level spec homes that are move-in ready. The company primarily markets its homes to renters in order to convert them into homeowners. It operates through the following segments: Central (39% of closings, 36% of revenues), Southeast (26% of closings, 24% of revenues), Florida (13% of closings, 12% of revenues), West (11% of closings, 12% of revenues), and Northwest (11% of closings, 16% of revenues). The company was founded in 2003, completed its IPO in 2013, and is headquartered in The Woodlands, Texas.

Good Business

|

|

● |

The company has a unique selling culture with a simple and differentiated business model that is easy to understand and consistently applied across every LGI Homes community in the U.S. |

|

|

● |

Its homes are built quicker and more efficiently than a typical spec home because LGI uses even-flow production, allows for no customization by the buyer, and builds in sets of 3-4 homes simultaneously. |

|

|

● |

LGI uses a highly successful direct-to-consumer sales model and is not reliant on realtors to bring potential buyers to its communities, like most peers. This makes the company less sensitive to underlying demand for housing than the average homebuilder. |

|

|

● |

LGI has been profitable every year since its inception in 2003, even throughout the Great Financial Crisis. |

|

|

● |

It has the highest monthly absorptions (homes closed per community per month) among other homebuilders, at seven homes per community, and has the highest gross margin out of its peers. |

|

|

● |

LGI Homes’ communities are primarily located in southern geographies with favorable migration patterns. |

|

|

● |

LGI is one of the only homebuilders that has earned returns above its cost of capital over the past decade. It has averaged a return on invested capital of ~14% over the past five years. |

|

|

● |

The company’s balance sheet is in good shape, with a net debt-to-total capital ratio of 31% and a net debt-to-EBITDA of 0.9 times. |

Valuation

|

|

● |

The stock is trading at 8.3 times its trailing enterprise value-to-EBIT, which is over a standard deviation below the company’s 5-year average of 11.0 times. |

|

|

● |

It trades at a forward price-to-earnings multiple (P/E) of 8.9 times, half a standard deviation below its 5-year average of 9.6 times. |

Management

|

|

● |

LGI management and directors own nearly 12% of the company, aligning their interests with shareholders, and all named executive officers have long tenures. The management team members are regarded as some of the best operators in the industry. |

|

|

● |

CEO Eric Lipar is one of the founders of the company and owns over 9% of the shares. |

|

|

● |

CFO Charles Merdian has been with the company for 17 years, and in his current position for 11. |

|

|

● |

President and COO Michael Snider has also been with LGI for 17 years, and in his current position for 12 years. |

Investment Thesis

LGI Homes operates quite differently than most peers. What really sets the company apart is its unique, systematic approach in marketing to renters, training its sales staff, and identifying optimal locations to build communities. In contrast to many homebuilders that depend on realtors to bring buyers to their communities, LGI uses a direct-to-consumer approach to actively search for renters and convert them into homeowners. This model has proven extremely effective, as the company has sustainably higher monthly absorption (closing) rates, double its peers. This sales model has also proven to be a more durable and consistent way to sell homes, and better able to withstand a tougher economic environment. Additionally, LGI Homes is well-positioned to benefit from strong economic and secular trends in the industry, such as low U.S. home inventory, low interest rates, migration patterns to the south, strong demand for more affordable single-family housing, urban flight, and increased working from home. LGI should continue to outpace peers while generating good returns as it follows its superior sales model and expands into new communities.

Beacon Roofing Supply Inc. (BECN)

(Analyst: Dan Sievers)

Description

Beacon is the largest publicly traded (#2 overall) distributor of roofing materials and complementary building products in the U.S. and Canada. Beacon serves greater than 90,000 customers and offers 140,000 SKUs from over 400 branches throughout all 50 states (97% of sales) and 6 Canadian provinces (3% of sales). Beacon makes 1.7 million annual deliveries (within a two-hour radius) using its fleet of specialized trucks. Since the sale of the non-core Interiors division (2021), their run-rate sales have been 53% Residential Roofing; 25% Commercial Roofing; and 22% Complementary Building Products (siding, windows, specialty exterior building products, insulation, and waterproofing systems).

Good Business

|

|

● |

Manufacturers and distributors operate in a rational and consolidated market, with the top three distributors accounting for 54% of a $28 billion industry (almost two times what they had ten years ago). |

|

|

● |

The industry is led by ABC Supply Co. Inc. (24% share), Beacon Roofing (20% share), and SRS (10% share), with the remaining 46% held by 1,500 smaller distributors. |

|

|

● |

It is estimated that roughly 80% of roofing sales are replacement, and that the U.S. housing stock is now over 40 years old on average. Ninety-four percent of U.S. re-roofing demand is thought to be non-discretionary. |

|

|

● |

With management’s focus on organic growth and maintaining discipline, rising returns should follow. |

|

|

● |

Aided by the Interiors divestiture, the fiscal third quarter 2021 net debt-to-EBITDA ratio dropped to 2.4 times, providing financial flexibility and likely the ability to buy back stock and issue dividends. |

|

|

● |

Beacon is a simple scale business, and roofing distribution is unlikely to undergo major change. |

Valuation

|

|

● |

Despite newfound financial health and flexibility, and strong fundamentals, Beacon’s shares have receded from $60 in May to $50 in August (-17%), and the stock trades at a discount to its 10-year average for the next twelve months P/E (11 times), enterprise value-to-EBITDA (9 times), and enterprise value-to-sales (0.85 times). With steady execution, we think there is scope for Beacon to trade at a premium to 10-year averages and north of 1 times EV/Sales. |

|

|

● |

If Beacon were to grow 4.5% and reach the low end of their EBITDA margin target by fiscal year 2026 (9%-11%) and were ascribed a 15 P/E ratio, the compound return would be approximately 15%. |

Management

|

|

● |

New CEO Julian Francis has refocused the company on its core Roofing/Exteriors business (divesting Interiors and substantially de-risking the balance sheet), and inward on branch productivity, margin improvement, organic growth, and realizing the benefits of scale. |

|

|

● |

Frank Lonegro, CFO, recently joined Beacon from CSX Corporation, where he was the CFO and Executive VP. |

Investment Thesis

Beacon is a simple business driven by largely non-cyclical, non-discretionary demand. While Beacon has achieved scale in an industry that has consolidated substantially over the last decade, under prior management they were saddled with (1) a challenging and costly integration (2) substantial debt and interest costs, and (3) a separate Interiors business. Under their new CEO they sold Interiors, and are progressing on strategic initiatives. Strong industry fundamentals have led to rapid restoration of financial flexibility and Beacon’s future now looks solid. While expecting a sequential slowdown in growth (in part due to lower y/y storm activity) and a decline in margin, we think enhanced focus on organic growth and structural margin improvement should help reaccelerate future earnings, particularly as replacement demand will likely benefit from the strong build period from 2000-2006.

Thank you for your confidence in the FMI Common Stock Fund.

Appendix:

Bob Farrell’s Ten Market Rules to Remember

|

|

1. |

Markets tend to return to the mean over time. |

|

|

2. |

Excesses in one direction will lead to an opposite excess in the other direction. |

|

|

3. |

There are no new eras — excesses are never permanent. |

|

|

4. |

Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways. |

|

|

5. |

The public buys the most at the top and the least at the bottom. |

|

|

6. |

Fear and greed are stronger than long-term resolve. |

|

|

7. |

Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. |

|

|

8. |

Bear markets have three stages — sharp down, reflexive rebound and a drawn-out fundamental downtrend. |

|

|

9. |

When all the experts and forecasts agree — something else is going to happen. |

|

|

10. |

Bull markets are more fun than bear markets. |

This shareholder letter is unaudited.

|

FMI Common Stock Fund |

|

|

During the fiscal year ended September 30, 2021, the FMI Common Stock Fund (“Fund”) had a total return of 50.49%.1 The benchmark Russell 2000 Index returned 47.68% in the same period. The last twelve month’s return of the Russell 2000 Value Index was 63.92%. Relative to the Russell 2000, sectors that aided relative performance included Health Technology, Technology Services, and Commercial Services. The outperformance in Health Technology was due to the Fund’s relatively low exposure versus the market. No direct exposure to Utilities and Health Services also added to relative performance. Insight Enterprises Inc. drove the results in Technology Services, as the company delivered above-average growth in a choppy demand environment. Interpublic Group of Cos. Inc. and Robert Half International Inc. rebounded from a depressed COVID-19 bottom, leading the results in Commercial Services. On the negative side of sector performance, Energy Minerals, Distribution Services, and Retail Trade all detracted. Energy stocks, particularly speculative ones, bounced dramatically from the COVID-19 bottom. The Fund doesn’t own any stocks in this sector. Equities that hurt in the Distribution Services area included Henry Schein Inc. and Herbalife Nutrition Ltd. Both are performing well fundamentally. All of the Fund’s Retail Services stocks were positive in the period, but deeply depressed mall-based retailers in the indices bounced hard off the bottom, driving strong relative performance versus the Fund.

Other stocks that helped performance included Zions Bancorporation N.A., Ryder System Inc., Houlihan Lokey Inc. — Cl A, Avery Dennison Corp., Carlisle Cos. Inc., and nVent Electric PLC. Solid earnings results were the common denominator with these investments. Other stocks that detracted from results included Plexus Corp., A.O. Smith Corp., W.R. Berkley Corp., Flowserve Corp., and CDK Global Inc. COVID-19 impacted Plexus’ Malaysian manufacturing footprint. The company is managing this situation well and the long-term impacts appear minimal. A.O. Smith and W.R. Berkley were both up during the period, and fundamentally they are solid, but they were not up as much as the market in this sector. Flowserve’s results have been slower to recover from COVID-19 and that has hurt relative stock performance. The managers remain optimistic about the prospects at Flowserve. CDK Global continues to deliver solid free cash flow growth, but the market appears to be concerned about the health of their auto dealer customer base. The managers feel that stronger dealers will continue to consolidate the market, which has been good for CDK Global historically.

New additions to the Fund over the past twelve months included nVent Electric, CDK Global, Brady Corp. — Cl A, LGI Homes Inc., LCI Industries, Simpson Manufacturing Co. Inc., Herbalife Nutrition, Concentrix Corp., KBR Inc., BJ’s Wholesale Club Holdings Inc. and Beacon Roofing Supply Inc. Stocks sold during the year included MSC Industrial Direct Co. Inc., Penske Automotive Group Inc., HD Supply Holdings Inc., Avery Dennison, W.R. Berkley, Armstrong World Industries Inc., and Graham Holdings Co. As of September 30, 2021, the Fund was significantly overweighted in Producer Manufacturing, Commercial Services, and Distribution Services, and meaningfully underweighted in Health Technology, Technology Services, and Energy Minerals.

The Russell 2000 trades at extremely high levels on nearly all measures of value including sales, earnings, assets, and cash flow. The Fund trades at a meaningful discount to the Russell 2000. Historically, the Fund, with its more cautious positioning, has tended to do relatively better when stock markets come under pressure, but there can be no assurances that the future will look like the past. The Fund managers note that nearly 47% of the stocks in the Russell 2000 lose money. The index benefits from passive inflows. Stocks should not grow in excess of their underlying fundamental performance indefinitely. Ultimately, the reversal of this phenomenon should help the Fund.

The Federal Reserve has undertaken an unprecedented policy of monetary accommodation over the past decade. The Fed’s balance sheet has more than doubled over the past two years. The price of money remains unusually low by historical standards’ and the managers believe that several negative effects, including low capital formation, high inflation, and currency debasement, are being ignored by the market. The Fed believes the current elevated rate of inflation is temporary; however, many elements, particularly higher wages and raw material costs, seem more enduring in nature. Rising rates tend to hurt growth stocks relative to value stocks.

Debt at both the corporate and government levels has grown significantly. Recent additions to the government debt totals are extraordinary by historical standards. U.S. total federal debt-to-GDP is well over 100%, and at the highest level in the post-WWII era. Corporate leverage, by some measures, is at a 50-year high. High leverage tends to increase downside risk when markets come under pressure. The Fund is less levered than the market.

|

1 |

The Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) had a return of 50.49% and 50.68%, respectively, for the fiscal year ending 09/30/2021. |

FMI Common Stock Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

(Continued)

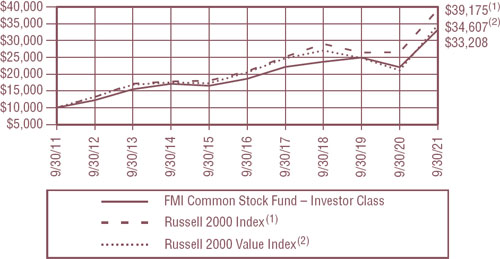

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN FMI COMMON STOCK FUND –INVESTOR CLASS — THE RUSSELL 2000© INDEX(1) AND THE RUSSELL 2000© VALUE INDEX(2)

|

AVERAGE ANNUALIZED TOTAL RETURN |

|||||

|

|

Inception Date |

1-Year |

5-Year |

10-Year |

Inception |

|

FMI Common Stock Fund – Investor Class |

12/18/81 |

50.49% |

12.26% |

12.75% |

11.91% |

|

FMI Common Stock Fund – Institutional Class |

10/31/16 |

50.68% |

N/A |

N/A |

13.25% |

|

Russell 2000 Index(1)* |

|

47.68% |

13.45% |

14.63% |

10.66% |

|

Russell 2000 Value Index(2)* |

|

63.92% |

11.03% |

13.22% |

11.90% |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

|

(1) |

The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. The index is used herein for comparative purposes in accordance with SEC regulations. |

|

(2) |

The Russell 2000 Value Index includes equities that exhibit value characteristics and the Russell 2000 Growth Index includes equities that exhibit growth characteristics. The index is used herein for comparative purposes in accordance with SEC regulations. |

|

* |

The benchmark since inception returns are calculated since inception of the Investor Class, December 18, 1981 to September 30, 2021. |

An investment cannot be made directly into an index.

FMI Common Stock Fund

September 30, 2021

|

Shares |

|

|

|

|

Cost |

|

Value |

|

||

|

COMMON STOCKS — 98.5% (a) |

|

|

|

|

|

|

|

|||

|

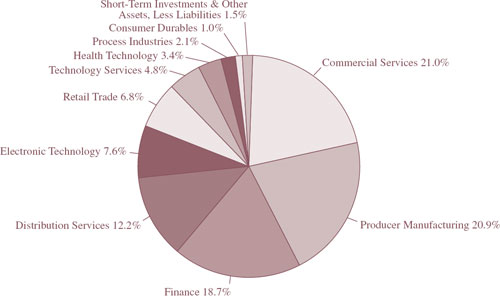

COMMERCIAL SERVICES SECTOR — 21.0% |

|

|

|

|

|

|

|

|||

|

|

|

|

Advertising/Marketing Services — 4.8% |

|

|

|

|

|

|

|