SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

ANNUAL REPORT

September 30, 2020

|

FMI Large Cap Fund Investor Class (Ticker Symbol: FMIHX) Institutional Class (Ticker Symbol: FMIQX) |

FMI International Fund Investor Class (Ticker Symbol: FMIJX) Institutional Class (Ticker Symbol: FMIYX) |

|

FMI Common Stock Fund Investor Class (Ticker Symbol: FMIMX) Institutional Class (Ticker Symbol: FMIUX) |

FMI International Fund II – Currency Unhedged Investor Class (Not Available For Sale) Institutional Class (Ticker Symbol: FMIFX) |

|

FMI Funds, Inc.

Advised by Fiduciary Management, Inc. www.fmifunds.com |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary (such as a broker-dealer or a bank). Instead, the reports will be made available on the Funds’ website www.fmifunds.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary (such as a broker-dealer or a bank) or, if you are a direct investor, by calling 1-800-811-5311.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1-800-811-5311 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Funds held in your account if you invest through your financial intermediary or all Funds held within the fund complex if you invest directly with the Funds.

FMI Funds, Inc.

TABLE OF CONTENTS

Large Cap

Fund

(unaudited)

September 30, 2020

The FMI Large Cap Fund (“Fund”) returned 7.67%1 in the quarter compared to 8.93% for the Standard & Poor’s 500 Index (“S&P 500”), and 5.59% for the Russell 1000 Value Index (“Russell 1000 Value”). While not changing much in the most recent quarter, the spread between value-oriented strategies like the FMI Large Cap Fund and growth stock-dominated indices like the S&P 500, Russell 1000 Index and Russell 1000 Growth Index has widened significantly in recent years. The year-to-date gap between the Russell 1000 Value and Russell 1000 Growth Indices was an astonishing 35.90%. The Fund has handily outperformed the value benchmarks and most of its value peers over 3, 5, and 10-year time frames. With much of the investing world capitulating to the siren song of growth stocks, FMI remains steadfast in our belief that ultimately, fundamentals and good values will trump high valuations and unsustainable growth expectations. We are starting to see some investors call “timeout” on the mad dash to growth stocks, hedging against the idea that the most popular names and the best-looking stock charts can continue to beat value equities. In the quarter, sectors that helped the Fund’s relative performance included Producer Manufacturing, Finance, and Distribution Services. Sectors detracting included Electronic Technology, Retail Trade, and Commercial Services. Eaton Corp. PLC, Berkshire Hathaway Inc., and HD Supply Holdings Inc. were positive relative contributors, while Dollar Tree Inc., Omnicom Group Inc., and Schlumberger Ltd. hurt.

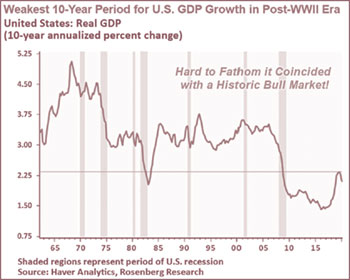

Over several missives prior to the pandemic, we articulated the strange juxtaposition of relative weak U.S. corporate sales and earnings growth compared to high valuations. The S&P 500 (iShares Core S&P 500 ETF as a proxy), grew revenue and operating earnings at 3.4% and 3.6%, respectively, over the 10-year period ending 2019; this includes acquisitions and a record increase in balance sheet leverage. With the S&P 500 constituting such a large swath of the U.S. economy, it is perhaps not surprising that the last ten years has been the slowest decade of economic growth since WWII (see chart to the right). GDP growth had been so weak pundits began talking about using a different measurement for gauging economic well-being.

| 1 | The FMI Large Cap Fund Investor Class (FMIHX) and the FMI Large Cap Fund Institutional Class (FMIQX) had a return of 7.67% and 7.74%, respectively, for the third quarter of 2020. |

The onset of COVID-19 sent the 2020 fundamentals for the economy and most companies down further, yet the market endured just a very short 23 trading days of trouble before resurging to an all-time high. Growth stocks, including most highly speculative ventures, have continued to dominate the landscape, creating the widest performance spread to value stocks in memory. Although the popular and financial media doesn’t describe it as such, it is truly a mania for many equities. Investors have seemingly thrown caution to the wind in their effort to participate. Despite a few short market contractions, to include the fourth quarter of 2018 (66 trading days) and earlier this year, the bull market that began in March of 2009 has the illusion of permanency. Many feel we are in a new, higher-growth paradigm, driven mostly by technology. If that were the case, why is economic growth so slow? Why is productivity over the past decade so weak? It doesn’t add up. Perhaps it is merely the belief that a few companies will have secular growth and the remaining “old economy” companies will struggle. While acknowledging the superior growth of some of the big cap tech names, we think any stock can get too expensive and any trade can be overcrowded. Every frothy market in history has its earmarks; following are a few recent observations:

| ● | The total market value of the NASDAQ Composite stocks recently became larger than the combined value of the developed world stock markets, ex-U.S. (MSCI World ex USA Index). |

| ● | Four tech names – Apple Inc., Amazon.com Inc., Microsoft Corp., and Alphabet Inc. – became bigger than the entire Japanese market, as well as the combined China/Hong Kong stock market. |

| ● | Tesla Inc., barely profitable after 17 years and competing in a highly competitive industry, saw its market cap go up over tenfold (from $38 billion to over $400 billion) in the 12 months ended 8/26/20, including a 75% gain in the three weeks following the 8/10/20 stock split announcement, which has zero fundamental meaning. |

| ● | Apple, whose operating earnings peaked five years ago at $71.2 billion, saw its market capitalization go from about $600 billion five years ago to over $2 trillion recently, including a 40% gain in a little over a month after their stock split was announced on 7/30/20. |

| ● | In Q3 2020, Apple’s market cap became larger than the entire Russell 2000 Index, and also overtook the FTSE 100 Index for the first time. |

| ● | The IPO market is likely to set a record in 2020, and recently Snowflake Inc., a company that had $264 million in sales and lost over $350 million in fiscal 2020, came public with a $33 billion value. On the first day of trading the market value reached $89 billion, larger than Autodesk Inc. and Cerner Corp. combined, which together have approximately $9 billion of highly recurring software revenue. Palantir Technologies Inc., a secretive big data company that has been rumored as an IPO for years, finally pulled the trigger on the last day of the September quarter. This company was founded in 2003 and as far as we can tell, has never turned a profit. In 2019, the company had $742 million in revenue and lost about $580 million. Its market cap on day one stretched to $18 billion. Asana Inc., one of many emerging software-as-a-service companies, also came public on the last day of the quarter and traded to $4.6 billion. It was valued at $1.5 billion in December of 2018; it had fiscal 2020 revenue of approximately $143 million and lost about $119 million. |

| ● | Nikola Corp., a development-stage hydrogen truck company with no revenue, reached a $27 billion market cap this summer before a short seller exposed potential serious flaws. |

| ● | Workhorse Group Inc., a company that for years has been trying to develop electric vehicles, has never made money, and managed to garner less than a half million dollars in 2019 sales, recently sported a market cap of over $3 billion. |

| ● | Gilead Sciences Inc. announced the $21 billion acquisition of Immunomedics Inc., an emerging biotech company with minimal sales and over $300 million of losses last year. Illumina Inc. announced they were buying Grail Inc., a development stage company, for a valuation of $7.1 billion and a 12-year earn-out. Johnson & Johnson announced the purchase of Momenta Pharmaceuticals Inc. for roughly $6.5 billion. It has $30 million in sales for the trailing 12 months ending 6/30/20. |

| ● | As of 9/30/20 there were 415 Health Technology sector stocks in the iShares Russell 2000, and 371 were money-losing. In nearly all cases the companies have never made money. They have been some of the best performing stocks in 2020. |

| ● | Mirati Therapeutics Inc., a company with $3.3 million in revenue and losing over $200 million, has an approximate market value of $7.4 billion and was up 1,319% over the past three years. The CEO makes more than two times the annual revenue of the company. For over 20 years this company has been on the verge of hitting it big! |

| ● | Special Purpose Acquisition Companies (SPAC), empty shell corporations set up to buy companies, have received over $50 billion so far this year. SPAC managers typically get 20% of the SPAC shares. Billy Beane (of Oakland Athletics and Moneyball fame) and Paul Ryan (former congressman from Wisconsin) are in on the action. |

| ● | The High-Tech Strategist reported in September that the top five holdings of Vanguard’s Total Stock Market ETF and SPDR S&P 500 ETF were Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc., and Facebook Inc. These same five stocks were the largest holdings of the iShares Russell 1000 ETF, iShares Russell 3000 ETF and Vanguard Growth ETF. While this is not surprising, one of Vanguard’s largest international ETFs, the Vanguard Total World Stock ETF, had the same top five holdings. Ditto for the Vanguard ESG U.S. Stock ETF. As of 8/31/20, the Fidelity Magellan Fund had these same five in their top six holdings, along with Visa Inc. (trading at nearly 20 times revenue). Same for the Fidelity Independence Equity Fund. The Fidelity Trend Fund had the same five plus Mastercard Inc. (21 times revenue). Fidelity Growth Discovery Fund had the same five, as did the Fidelity Disciplined Equity Fund. We surmise many of the largest fund families look similar. |

| ● | The S&P 500 is more concentrated in the top names than at the peak of the 2000 market. |

| ● | In June, Deutsche Bank estimated that roughly 19% of U.S. companies are “zombie” companies, i.e., their debt servicing costs are greater than their earnings. |

| ● | Since 1947, the median number of hours of work required to purchase one unit of the S&P 500 was 30. As of early July, it is over 140 hours. |

| ● | According to The Leuthold Group, as of 7/10/20, stocks were in the highest decile (10th) of valuations based on the median decile of approximately 50 different valuation measures. |

| ● | Robinhood Financial LLC has added over 3 million customers since the beginning of the year. Measures of retail investor speculation are near their highest ever, including small-sized option trading that now exceeds the trading volume of individual stocks. |

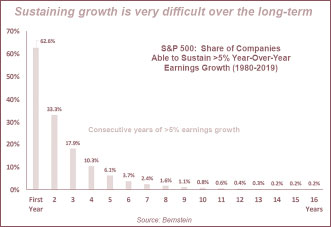

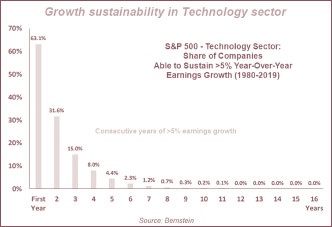

We are not ignorant to the excitement and promise of some of the emerging software companies, and other concepts that essentially defer profits on the income statement in order to grow the top line rapidly and lock in a future stream of profit. Establishing what is perceived to be an unassailable position in the market is easier in the digital world compared to the physical world. Many companies will win with this strategy. Many more will try and fail. Our issue is that most of these companies are being priced as the eventual winners. They can’t all win! Sustaining even 5% growth for more than a few years is difficult (even for the Technology sector), as evidenced by the following charts. The stocks that have captured the imagination of investors depend on sustained success over a very long time horizon. Valuations leave little room for error.

|

|

Growth stocks in particular are sensitive to discount rate changes. This is because so much of the present value depends on compounding higher earnings well into the future. Following is a table from Credit Suisse HOLT, outlining possible return outcomes in different classes of stocks as a result of changes in sector discount rates. This table reveals some interesting scenarios. For example, if sector discount rates went back to just the 3-year median, U.S. Hyper Growth stocks would fall 32% and U.S. cyclical value stocks would decline 7%. If rates went back to their 20-year median, U.S. Tech Large Cap would fall 44% and U.S. Financials would gain 46%. Realize, these are just mathematical calculations, but they inform the possibilities. Our portfolios are far less dependent on the maintenance of historically low interest rates. We are finding excellent values in the cyclicals such as Schlumberger Ltd. and Emerson Electric Co., and in financials, particularly Northern Trust Corp., JPMorgan Chase & Co., and The Charles Schwab Corp.

Probability-weighted valuation upside/downsides for various HOLT Styles, regions

and sectors based on observed discount rates in a given economic regime

| Warranted Valuation Upside/Downside % | |||||||||||||||

| Scenario per Fig 4 (probability weighting) |

US Hyper Growth |

US Tech Large Cap |

US Quality Defensives |

US Quality Growth |

US | Europe Ex UK |

UK | Developing Countries |

US Cyclical Value |

Top 25% Value Developed Markets |

Developed Energy Large Cap |

Developing Financials | UK Financials |

Europe Financials |

US Financials |

| Goldilocks (35%): discount rate@20-year min |

6% | 23% | 4% | 11% | 4% | 0% | 7% | 13% | 19% | 18% | 43% | 72% | 96% | 90% | 84% |

| Normalization (35%): discount rate@3-year median |

-32% | -38% | -17% | -21% | -10% | -7% | -10% | -8% | -7% | -5% | 15% | 14% | 8% | 20% | 28% |

| Status Quo (27%): no change in discount rate |

0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Stagflation (3%): discount rate@20-yr median |

-83% | -44% | -43% | -36% | -19% | -27% | -18% | -13% | -8% | -4% | 21% | 21% | 38% | 35% | 46% |

| Weighted Upside/Downside | -12% | -7% | -6% | -4% | -3% | -3% | -2% | 1% | 4% | 4% | 21% | 31% | 38% | 40% | 41% |

Source: Credit Suisse HOLT®, HOLT Global Viewpoint, September 28, 2020

Two additional investments we highlight this quarter are Comcast Corp. and Dollar Tree Inc.

Comcast Corp. – Cl A (CMCSA)

(Analyst: Dan Sievers)

Description

Comcast Corp. is the combination of Comcast Cable, NBC Universal (NBCU), and Sky PLC (Sky). Comcast Cable is the #1 provider of fixed broadband service in the United States (26 million residential subscribers) with an advantaged top-quality network and a strong and growing business services offering. NBCU and Sky are leading multinational media conglomerates that own strong libraries of existing content and together, invest over $23 billion in content annually. In 2019, revenue contributions were as follows: Cable (53%), NBC Cable Networks (11%), NBC Broadcast Television (9%), NBCU Filmed Entertainment (6%), Universal Studios Theme Parks (5%), Sky (18%), and Corporate & Eliminations (-2%).

Good Business

| ● | Most of Comcast Cable’s cash flow comes from recurring high-margin Residential Broadband and Business Services (not from Video). In 2019, these lines of business each reported over 9% revenue growth and combined for $24.3 billion in revenue. Second quarter 2020 residential net subscriber additions (+232,000) were the strongest 2Q net additions in thirteen years. For the fifteenth consecutive year, in 2020, Comcast is on pace to add more than 1 million broadband subscribers. Comcast Cable’s broadband-centric growth is roughly composed of >4% customer volume, 2-3% price and tiering, and 2% of lost discounts due to unbundling. Comcast’s broadband network is top-quality (soon to be 100% DOCSIS 3.1) and we expect broadband subscriber additions to continue to be strong despite regional investments in 5G fixed wireless (a limited value proposition), as Comcast takes further share from disadvantaged DSL-like competition (25 million subscribers nationally), benefits from demographic tailwinds (younger households have higher broadband penetration), and continues to grow its network footprint (which is over-indexed to growing population centers) beyond 58 million homes passed. Comcast cable is likely to continue to win because its similarly-priced product really is superior (better speed, better reliability, and better extras like xFi WiFi management, Xfinity Flex, and the soon-to-be launched Peacock AVOD service). Comcast’s Wireless business (>2 million subscribers) should reach profitability in 2021. Underlying Cable returns on invested capital are rising. |

| ● | In 2019, Charter Communications Inc. (Comcast competitor) reported typical monthly consumption for broadband-only subscribers surpassed 450GB, which compared to about 8GB of typical monthly consumption of cellular wireless data. 5G mobile networks are likely to remain too capacity-constrained to offer suitable alternatives to cable broadband. Gradual build out of 5G fixed wireless may present a suitable alternative to cable broadband, but will suffer from difficult-to-solve technical challenges (range and reliability issues), will only be available in limited locations, will require huge fiber-centric investment on the part of carriers, and these build outs face similarly daunting overbuilder economics akin to U-verse, FiOS, Google Fiber, or others. |

| ● | NBCU and Sky are likely to face real challenges in parts of their respective businesses due to a changing media landscape, but they also possess real advantages, like strong libraries of existing content, significant annual content investment, a meaningful focus on live sports and news content, and the premiere #2 global theme parks business in Universal Studios. |

| ● | Comcast’s net debt-to-EBITDA (ND/EBITDA) leverage at year-end 2018 was above 3.3 times, but has now fallen below 2.7 times, on its way to Comcast’s traditional 2.0-2.25 times target leverage range (lower than peers) by early 2021. |

Valuation

| ● | At $43.50, Comcast trades at 13.9 times 2019 price-to-earnings (P/E) and 8.8 times enterprise value-to-EBITDA (2019). On a P/E basis, this appears attractive in absolute terms, is well below Comcast’s historical P/E multiple, and represents a substantial discount to the S&P 500. |

| ● | Bernstein recently estimated that $36 is the price investors are paying for Cable & Theme Parks while receiving the rest of NBCU & Sky for free. Additionally, at year-end 2019, noting significant value in Comcast’s investment portfolio (from Hulu, Atairos, and more), Morgan Stanley also recognized the strong enduring value (and growth) in NBCU’s Parks & Films divisions an investor receives at a significant discount to peers. |

Management

| ● | Brian Roberts, son of the late founder Ralph Roberts, became President in 1990, CEO in 2002, and Chairman in 2004. The Roberts family controls one-third voting interest in Comcast through non-traded B shares. Setting the Sky acquisition aside, we view the long-run Roberts track record as very good. |

| ● | Comcast’s divisional performance stacks up well against direct peers in most cases, supporting our view that Comcast possesses a deep bench of strong (though excessively compensated) executive leadership. |

Investment Thesis

Over the past three completed years, pure-play Cable broadband providers (including Charter Communications and Cable One Inc.) have trounced the S&P 500, reflecting strong and durable growth in subscribers, rising margins, and declining capital intensity. Though all industry observers agree that Comcast’s Cable broadband business is top quality (#1), Comcast’s shares lagged the S&P 500 due to investor concerns over its media businesses and its acquisition of Sky. While we take no out-of-consensus positive view of NBC Broadcast and NBC Cable Networks, we see enduring value in the catalog at Universal Studios Film & Television, Universal Studios Theme Parks, and some of Sky’s true direct-to-consumer offerings. Comcast’s customers, content, and brands increase the likelihood of success of its streaming service, Peacock (which just passed 15 million sign-ups). Though the pandemic has pressured Comcast’s media businesses (weaker advertising, paused sports, and delayed film releases) and temporarily closed Comcast’s Theme Parks, its Cable broadband business has strengthened, and continues to grow and drive the bulk of Comcast’s value. As Comcast nears its target 2.0-2.25 times ND/EBITDA leverage range in early 2021 and restarts their share buyback, investor interest is likely to increase.

Dollar Tree Inc. (DLTR)

(Analyst: Matt Sullivan)

Description

Dollar Tree is a leading discount retailer in the United States and Canada, operating over 15,400 total stores, 7,652 (or 49%) of which are operated under the Dollar Tree banner. The other 7,827 stores are operated under the banner of Family Dollar, which was acquired in July 2015. The Dollar Tree banner accounts for around 52% of the combined company revenue and 78% of profits. The Family Dollar banner accounts for the remaining 48% of revenue and 22% of profits.

Good Business

| ● | The Dollar Tree business model is unique within the retail landscape. The $1 price point and constantly changing inventory provide the customer with a differentiated, treasure hunt shopping experience. The ever-changing merchandise in the stores also provides management with the ability to control the company’s gross margin. |

| ● | The Family Dollar banner sells a limited number of necessary consumable products and other general merchandise items at highly attractive prices. The company’s scale, concentrated purchasing, and low-cost locations allows it to sell products at prices well below those of competitors. |

| ● | Both business models are defensive and perform well in most economic environments. The consolidated company has had positive same store sales growth in each of the past fourteen years. |

| ● | The business generates attractive returns on tangible capital that exceed the company’s cost of capital. |

| ● | The customer profile, low average ticket, and types of products sold protect the business from online competition. |

| ● | Both Dollar Tree and Family Dollar possess scale advantages that make them difficult to replicate. |

| ● | The balance sheet is in good shape with ND/EBITDA of approximately 1.1 times. |

| ● | The business is easy to understand. |

Valuation

| ● | Dollar Tree is trading at a valuation discount to the S&P 500 even though it’s a better-than-average company. |

| ● | The stock trades for 15.8 times the next 12-month earnings per share (EPS) forecast, which is a standard deviation below its 5-year average of 17.9 times. |

| ● | The shares are also trading at 0.95 times enterprise value-to-sales, which is about one standard deviation below its 5-year average of 1.33 times. |

Management

| ● | Bob Sasser became Executive Chairman of the Board in September 2017. He was previously CEO from 2004 to September 2017. Prior to that he was Dollar Tree’s COO from 1999 to 2003. |

| ● | Mike Witynski joined the company in 2010 and became President and CEO in July 2020. He was previously COO from July 2015 until December 2019, and Enterprise President from December 2019 until July 2020. |

Investment Thesis

Dollar Tree is a high-quality, defensive business that performs well in most economic environments. While the pandemic has negatively impacted customer traffic at the stores and has increased costs throughout the organization, the business is holding up reasonably well this year; same store sales and EPS are both expected to grow in 2020. We believe that over the next few years, the company will expand its store base and continue to grow its same store sales, and that margins will improve. When including stock buybacks, EPS are expected to grow at a double-digit compound annual rate. The company’s stock is attractively valued, trading at 15.8 times the next 12-months EPS estimate in a very expensive market.

Thank you for your confidence in the FMI Large Cap Fund.

This shareholder letter is unaudited.

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

During the fiscal year ended September 30, 2020, the FMI Large Cap Fund (FMIHX) the “Fund” had a total return of 0.71%(1). The benchmark S&P 500 returned 15.15% in the same period. The Russell 1000 Value Index declined 5.03% in the same period. Relative to the S&P 500, sectors that aided relative performance included Energy Minerals (underweight), Health Services, Utilities (underweight) and Producer Manufacturing. The Fund had little direct exposure to Energy Minerals, an area of weakness due to low hydrocarbon prices and slower demand because of COVID-19. UnitedHealth Group drove the results in Health Services as they grew earnings steadily over the past year. Masco Corp. performed well prior to and during the COVID-19 curtailments, as consumers engaged in more home improvement. Utilities attracted less attention in the S&P 500 because of their slow underlying growth; the Fund had no exposure to Utilities. On the negative side of sector performance, Electronic Technology, Retail Trade, Technology Services and Industrial Services all detracted. The Fund’s cash level also hurt results. TE Connectivity, Dollar Tree, Omnicom Group and Schlumberger were disrupted and impacted by COVID-19 concerns. Additionally, TE Connectivity declined, perhaps due to fears about auto manufacturing volumes, and Schlumberger declined precipitously due to weak energy prices and demand concerns. The oil services related areas of the economy have been extremely difficult in recent years. The Fund’s thesis remains that Schlumberger is one of the strongest players in a necessary business and that it is exceptionally undervalued.

Other stocks that helped performance included Accenture, Dollar General and Progressive Corp. These stocks all benefitted from good earnings growth in an environment where that was difficult to achieve. Southwest Airlines, JPMorgan and Chubb all detracted from relative results. COVID-19 severely disrupted air travel, hurting Southwest Airlines. The market turned against Financials during the period, with additional pressure on JPMorgan because of net interest margin compression, and reserve building related to the economic environment, while Chubb performed well fundamentally in the period, investors feared COVID-19 related claims.

New additions to the Fund over the past twelve months included Comcast Corp., Eaton Corp., Koninklijke Philips, Emerson Electric, Sony and Progressive Corp. Stocks sold during the year included Fox Corp., eBay Inc., Stanley Black & Decker, Cerner Corp., Nutrien, TE Connectivity and Southwest Airlines. As of September 30, 2020, the Fund was significantly overweighted in Producer Manufacturing, Health Services and Finance and meaningfully underweighted in Technology Services, Electronic Technology and Health Technology.

The S&P 500 has been dominated by the largest growth companies, particularly those in the technology sphere. This has driven a wide performance differential between the S&P 500 and funds such as the FMI Large Cap Fund, which are value oriented. The so-called FAAANM stocks (Facebook, Apple, Amazon, Alphabet {Google}, Netflix, and Microsoft), along with other perceived growth stocks, were exceptionally strong over the past year. The S&P 500’s weighting in the top ten names rivals the concentration last seen in the 2000 market peak. Stocks perceived to be in the “growth” camp continued to outperform so called “value” stocks during the year by a very wide margin. Passive investment strategies also continued to see heavy inflows of money, at the expense of active strategies. Many stocks appear overvalued and the S&P 500 index, on most valuation measures, is more expensive than it was at the peak in 2000. The growing use of “adjusted earnings” rather than GAAP earnings by Wall Street and corporate management gives a misleading P/E ratio. With the exception of the fourth calendar quarter of 2018 and a brief period in February and March of 2020, the market has been an in a up phase, driven by growth stocks, since March of 2009. This is extremely long by historical standards.

The Federal Reserve (“Fed”) has undertaken an unprecedented policy of monetary accommodation, both prior to and after COVID-19 became widespread. The Fed’s balance sheet has roughly doubled over the past twelve months. The price of money remains unusually low by historical standards and the Fund managers believe many negative effects, including potential high inflation and currency debasement, are being ignored by the market. The economy went into a sharp recession in February of 2020, primarily due to COVID-19. Debt at both the corporate and government levels has grown significantly. Recent additions to the government debt totals are extraordinary by historical standards. U.S. total federal debt-to-GDP is well over 100% and the highest in the WWII era. Corporate leverage by some measures is at a fifty-year high.

| (1) | The FMI Large Cap Fund Institutional Class (FMIQX) returned 0.84% for the fiscal year ended 9/30/20. |

FMI Large Cap Fund

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)(Continued)

With valuations high and speculative fervor present in the IPO and private equity areas, along with an overwhelming belief that interest rates will stay low for years, the Fund managers feel growth stocks are particularly vulnerable to a change in conditions. The outlook for strong relative performance from value-oriented stocks, while contrarian in nature, is positive.

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI LARGE CAP FUND – INVESTOR CLASS AND STANDARD & POOR’S 500 INDEX(1)

| AVERAGE ANNUALIZED TOTAL RETURN | |||||

| Inception | |||||

| through | |||||

| Inception Date | 1-Year | 5-Year | 10-Year | 9/30/2020 | |

| FMI Large Cap Fund – Investor Class | 12/31/01 | 0.71% | 9.70% | 10.80% | 8.61% |

| FMI Large Cap Fund – Institutional Class | 10/31/16 | 0.84% | N/A | N/A | 10.05% |

| Standard & Poor’s 500 Index(1)* | 15.15% | 14.15% | 13.74% | 8.06% | |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Standard & Poor’s 500 Index consists of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Standard & Poor’s Ratings Group designates the stocks to be included in the Index on a statistical basis. A particular stock’s weighting in the Index is based on its relative total market value (i.e., its market price per share times the number of shares outstanding). Stocks may be added or deleted from the Index from time to time. |

| * | The benchmark since inception returns are calculated since inception of the Investor Class, December 31, 2001 to September 30, 2020. |

An investment cannot be made directly into an index.

SCHEDULE OF INVESTMENTS

September 30, 2020

| Shares | Cost | Value | ||||||||||

| COMMON STOCKS — 98.4% (a) | ||||||||||||

| COMMERCIAL SERVICES SECTOR — 2.2% | ||||||||||||

| Advertising/Marketing Services — 2.2% | ||||||||||||

| 1,520,000 | Omnicom Group Inc. | $ | 101,534,567 | $ | 75,240,000 | |||||||

| CONSUMER DURABLES SECTOR — 3.7% | ||||||||||||

| Electronics/Appliances — 3.7% | ||||||||||||

| 1,650,000 | Sony Corp. — SP-ADR* | 104,693,897 | 126,637,500 | |||||||||

| CONSUMER NON-DURABLES SECTOR — 9.9% | ||||||||||||

| Beverages: Non-Alcoholic — 2.8% | ||||||||||||

| 700,000 | PepsiCo Inc. | 70,012,365 | 97,020,000 | |||||||||

| Food: Major Diversified — 2.9% | ||||||||||||

| 825,000 | Nestlé S.A. — SP-ADR | 34,040,394 | 98,385,375 | |||||||||

| Household/Personal Care — 4.2% | ||||||||||||

| 2,305,000 | Unilever PLC — SP-ADR | 93,152,573 | 142,172,400 | |||||||||

| CONSUMER SERVICES SECTOR — 8.0% | ||||||||||||

| Cable/Satellite TV — 4.0% | ||||||||||||

| 2,910,000 | Comcast Corp. — Cl A | 128,510,595 | 134,616,600 | |||||||||

| Other Consumer Services — 4.0% | ||||||||||||

| 79,000 | Booking Holdings Inc.* | 140,665,297 | 135,143,720 | |||||||||

| DISTRIBUTION SERVICES SECTOR — 2.5% | ||||||||||||

| Wholesale Distributors — 2.5% | ||||||||||||

| 2,100,000 | HD Supply Holdings Inc.* | 83,461,960 | 86,604,000 | |||||||||

| FINANCE SECTOR — 20.8% | ||||||||||||

| Investment Banks/Brokers — 2.8% | ||||||||||||

| 2,595,000 | The Charles Schwab Corp. | 94,952,055 | 94,016,850 | |||||||||

| Major Banks — 2.8% | ||||||||||||

| 975,000 | JPMorgan Chase & Co. | 62,197,660 | 93,863,250 | |||||||||

| Multi-Line Insurance — 6.7% | ||||||||||||

| 1,065,000 | Berkshire Hathaway Inc. — Cl B* | 60,364,576 | 226,781,100 | |||||||||

| Property/Casualty Insurance — 6.0% | ||||||||||||

| 960,000 | Chubb Ltd. | 128,277,883 | 111,475,200 | |||||||||

| 975,000 | Progressive Corp. | 74,036,038 | 92,303,250 | |||||||||

| 202,313,921 | 203,778,450 | |||||||||||

| Regional Banks — 2.5% | ||||||||||||

| 1,115,000 | Northern Trust Corp. | 96,605,324 | 86,936,550 | |||||||||

| HEALTH SERVICES SECTOR — 8.4% | ||||||||||||

| Health Industry Services — 4.6% | ||||||||||||

| 1,370,000 | Quest Diagnostics Inc. | 134,810,438 | 156,851,300 | |||||||||

| Managed Health Care — 3.8% | ||||||||||||

| 415,000 | UnitedHealth Group Inc. | 29,634,444 | 129,384,550 | |||||||||

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2020

| Shares | Cost | Value | ||||||||||

| COMMON STOCKS — 98.4% (a) (Continued) | ||||||||||||

| HEALTH TECHNOLOGY SECTOR — 5.8% | ||||||||||||

| Medical Specialties — 5.8% | ||||||||||||

| 2,420,000 | Koninklijke Philips N.V. — SP-ADR* | $ | 113,229,127 | $ | 114,103,000 | |||||||

| 2,105,000 | Smith & Nephew PLC — SP-ADR | 77,331,297 | 82,305,500 | |||||||||

| 190,560,424 | 196,408,500 | |||||||||||

| INDUSTRIAL SERVICES SECTOR — 1.2% | ||||||||||||

| Oilfield Services/Equipment — 1.2% | ||||||||||||

| 2,635,000 | Schlumberger Ltd. | 51,030,292 | 41,000,600 | |||||||||

| PROCESS INDUSTRIES SECTOR — 2.8% | ||||||||||||

| Industrial Specialties — 2.8% | ||||||||||||

| 780,000 | PPG Industries Inc. | 77,397,847 | 95,222,400 | |||||||||

| PRODUCER MANUFACTURING SECTOR — 16.1% | ||||||||||||

| Building Products — 5.3% | ||||||||||||

| 3,255,000 | Masco Corp. | 113,114,263 | 179,448,150 | |||||||||

| Electrical Products — 4.5% | ||||||||||||

| 1,060,000 | Eaton Corp. PLC | 97,893,785 | 108,151,800 | |||||||||

| 675,000 | Emerson Electric Co. | 31,678,272 | 44,259,750 | |||||||||

| 129,572,057 | 152,411,550 | |||||||||||

| Industrial Conglomerates — 3.2% | ||||||||||||

| 670,000 | Honeywell International Inc. | 60,115,461 | 110,288,700 | |||||||||

| Trucks/Construction/Farm Machinery — 3.1% | ||||||||||||

| 1,220,000 | PACCAR Inc. | 48,890,312 | 104,041,600 | |||||||||

| RETAIL TRADE SECTOR — 12.0% | ||||||||||||

| Apparel/Footwear Retail — 3.1% | ||||||||||||

| 1,875,000 | The TJX Companies Inc. | 64,193,895 | 104,343,750 | |||||||||

| Discount Stores — 8.9% | ||||||||||||

| 840,000 | Dollar General Corp. | 60,480,464 | 176,080,800 | |||||||||

| 1,400,000 | Dollar Tree Inc.* | 124,501,378 | 127,876,000 | |||||||||

| 184,981,842 | 303,956,800 | |||||||||||

| TECHNOLOGY SERVICES SECTOR — 2.2% | ||||||||||||

| Information Technology Services — 2.2% | ||||||||||||

| 335,000 | Accenture PLC | 8,645,057 | 75,706,650 | |||||||||

| TRANSPORTATION SECTOR — 2.8% | ||||||||||||

| Air Freight/Couriers — 2.8% | ||||||||||||

| 1,050,000 | Expeditors International of Washington Inc. | 38,553,785 | 95,046,000 | |||||||||

| Total common stocks | 2,404,005,301 | 3,345,306,345 | ||||||||||

The accompanying notes to financial statements are an integral part of this schedule.

FMI Large Cap Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2020

| Principal Amount | Cost | Value | ||||||||||

| SHORT-TERM INVESTMENTS — 1.6% (a) | ||||||||||||

| Bank Deposit Account — 1.6% | ||||||||||||

| $55,074,261 | U.S. Bank N.A., 0.04%^ | $ | 55,074,261 | $ | 55,074,261 | |||||||

| Total short-term investments | 55,074,261 | 55,074,261 | ||||||||||

| Total investments — 100.0% | $ | 2,459,079,562 | 3,400,380,606 | |||||||||

| Other liabilities, less assets — (0.0%) (a) | (592,530 | ) | ||||||||||

| TOTAL NET ASSETS — 100.0% | $ | 3,399,788,076 | ||||||||||

| * | Non-income producing security. |

| ^ | The rate shown is as of September 30, 2020. |

| (a) | Percentages for the various classifications relate to total net assets. |

| PLC | Public Limited Company |

| SP-ADR | Sponsored American Depositary Receipt |

The accompanying notes to financial statements are an integral part of this schedule.

INDUSTRY SECTORS as a percentage of net assets

as of September 30, 2020 (Unaudited)

|

Common Stock Fund (unaudited) |

September 30, 2020 |

The FMI Common Stock Fund (“Fund”) returned 1.60%1 in the quarter compared to 4.93% for the Russell 2000 Index (“Russell 2000”), and 2.56% for the Russell 2000 Value Index (“Russell 2000 Value”). While not changing much in the most recent quarter, the spread between value-oriented strategies like the FMI Common Stock Fund and growth stock-dominated indices like the Russell 2000 or Russell 2000 Growth Index has widened significantly in recent years. The year-to-date gap between the Russell 2000 Value and Russell 2000 Growth Indices was 25.42%. The Fund has handily outperformed the value benchmarks and most of its value peers over 3, 5, and 10-year time frames. With much of the investing world capitulating to the siren song of growth stocks, FMI remains steadfast in our belief that ultimately, fundamentals and good values will trump high valuations and unsustainable growth expectations. We are starting to see some investors call “timeout” on the mad dash to growth stocks, hedging against the idea that the most popular names and the best-looking stock charts can continue to beat value equities. In the quarter, sectors that helped the Fund’s relative performance included Process Industries, Technology Services, and the absence of meaningful exposure to Energy Minerals. Sectors detracting included Producer Manufacturing, Finance, and Commercial Services. Avery Dennison Corp., Insight Enterprises Inc., and Arrow Electronics Inc. were positive relative contributors, while Armstrong World Industries Inc., Zions Bancorporation, and White Mountains Insurance Group Ltd. hurt.

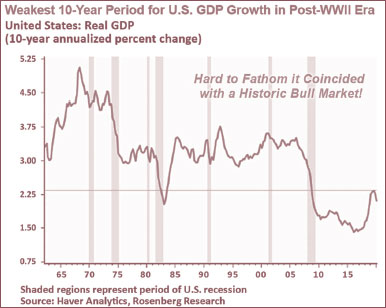

Over several missives prior to the pandemic, we articulated the strange juxtaposition of relative weak U.S. corporate sales and earnings growth compared to high valuations. The S&P 500 (iShares Core S&P 500 ETF as a proxy), grew revenue and operating earnings at 3.4% and 3.6%, respectively, over the 10-year period ending 2019; this includes acquisitions and a record increase in balance sheet leverage. With the S&P 500 constituting such a large swath of the U.S. economy, it is perhaps not surprising that the last ten years has been the slowest decade of economic growth since WWII (see chart to the right). GDP growth had been so weak pundits began talking about using a different measurement for gauging economic well-being.

| 1 | The FMI Common Stock Fund Investor Class (FMIMX) and the FMI Common Stock Fund Institutional Class (FMIUX) both had a return of 1.60% for the third quarter of 2020. |

The onset of COVID-19 sent the 2020 fundamentals for the economy and most companies down further, yet the market endured just a very short 23 trading days of trouble before resurging to an all-time high. Growth stocks, including most highly speculative ventures, have continued to dominate the landscape, creating the widest performance spread to value stocks in memory. Although the popular and financial media doesn’t describe it as such, it is truly a mania for many equities. Investors have seemingly thrown caution to the wind in their effort to participate. Despite a few short market contractions, to include the fourth quarter of 2018 (66 trading days) and earlier this year, the bull market that began in March of 2009 has the illusion of permanency. Many feel we are in a new, higher-growth paradigm, driven mostly by technology. If that were the case, why is economic growth so slow? Why is productivity over the past decade so weak? It doesn’t add up. Perhaps it is merely the belief that a few companies will have secular growth and the remaining “old economy” companies will struggle. While acknowledging the superior growth of some of the big cap tech names, we think any stock can get too expensive and any trade can be overcrowded. Every frothy market in history has its earmarks; following are a few recent observations:

| ● | The total market value of the NASDAQ Composite stocks recently became larger than the combined value of the developed world stock markets, ex-U.S. (MSCI World ex USA Index). |

| ● | Four tech names – Apple Inc., Amazon.com Inc., Microsoft Corp., and Alphabet Inc. – became bigger than the entire Japanese market, as well as the combined China/Hong Kong stock market. |

| ● | Tesla Inc., barely profitable after 17 years and competing in a highly competitive industry, saw its market cap go up over tenfold (from $38 billion to over $400 billion) in the 12 months ended 8/26/20, including a 75% gain in the three weeks following the 8/10/20 stock split announcement, which has zero fundamental meaning. |

| ● | Apple, whose operating earnings peaked five years ago at $71.2 billion, saw its market capitalization go from about $600 billion five years ago to over $2 trillion recently, including a 40% gain in a little over a month after their stock split was announced on 7/30/20. |

| ● | In Q3 2020, Apple’s market cap became larger than the entire Russell 2000 Index, and also overtook the FTSE 100 Index for the first time. |

| ● | The IPO market is likely to set a record in 2020, and recently Snowflake Inc., a company that had $264 million in sales and lost over $350 million in fiscal 2020, came public with a $33 billion value. On the first day of trading the market value reached $89 billion, larger than Autodesk Inc. and Cerner Corp. combined, which together have approximately $9 billion of highly recurring software revenue. Palantir Technologies Inc., a secretive big data company that has been rumored as an IPO for years, finally pulled the trigger on the last day of the September quarter. This company was founded in 2003 and as far as we can tell, has never turned a profit. In 2019, the company had $742 million in revenue and lost about $580 million. Its market cap on day one stretched to $18 billion. Asana Inc., one of many emerging software-as-a-service companies, also came public on the last day of the quarter and traded to $4.6 billion. It was valued at $1.5 billion in December of 2018; it had fiscal 2020 revenue of approximately $143 million and lost about $119 million. |

| ● | Nikola Corp., a development-stage hydrogen truck company with no revenue, reached a $27 billion market cap this summer before a short seller exposed potential serious flaws. |

| ● | Workhorse Group Inc., a company that for years has been trying to develop electric vehicles, has never made money, and managed to garner less than a half million dollars in 2019 sales, recently sported a market cap of over $3 billion. |

| ● | Gilead Sciences Inc. announced the $21 billion acquisition of Immunomedics Inc., an emerging biotech company with minimal sales and over $300 million of losses last year. Illumina Inc. announced they were buying Grail Inc., a development stage company, for a valuation of $7.1 billion and a 12-year earn-out. Johnson & Johnson announced the purchase of Momenta Pharmaceuticals Inc. for roughly $6.5 billion. It has $30 million in sales for the trailing 12 months ending 6/30/20. |

| ● | As of 9/30/20 there were 415 Health Technology sector stocks in the iShares Russell 2000, and 371 were money-losing. In nearly all cases the companies have never made money. They have been some of the best performing stocks in 2020. |

| ● | Mirati Therapeutics Inc., a company with $3.3 million in revenue and losing over $200 million, has an approximate market value of $7.4 billion and was up 1,319% over the past three years. The CEO makes more than two times the annual revenue of the company. For over 20 years this company has been on the verge of hitting it big! |

| ● | Special Purpose Acquisition Companies (SPAC), empty shell corporations set up to buy companies, have received over $50 billion so far this year. SPAC managers typically get 20% of the SPAC shares. Billy Beane (of Oakland Athletics and Moneyball fame) and Paul Ryan (former congressman from Wisconsin) are in on the action. |

| ● | The High-Tech Strategist reported in September that the top five holdings of Vanguard’s Total Stock Market ETF and SPDR S&P 500 ETF were Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc., and Facebook Inc. These same five stocks were the largest holdings of the iShares Russell 1000 ETF, iShares Russell 3000 ETF and Vanguard Growth ETF. While this is not surprising, one of Vanguard’s largest international ETFs, the Vanguard Total World Stock ETF, had the same top five holdings. Ditto for the Vanguard ESG U.S. Stock ETF. As of 8/31/20, the Fidelity Magellan Fund had these same five in their top six holdings, along with Visa Inc. (trading at nearly 20 times revenue). Same for the Fidelity Independence Equity Fund. The Fidelity Trend Fund had the same five plus Mastercard Inc. (21 times revenue). Fidelity Growth Discovery Fund had the same five, as did the Fidelity Disciplined Equity Fund. We surmise many of the largest fund families look similar. |

| ● | The S&P 500 is more concentrated in the top names than at the peak of the 2000 market. |

| ● | In June, Deutsche Bank estimated that roughly 19% of U.S. companies are “zombie” companies, i.e., their debt servicing costs are greater than their earnings. |

| ● | Since 1947, the median number of hours of work required to purchase one unit of the S&P 500 was 30. As of early July, it is over 140 hours. |

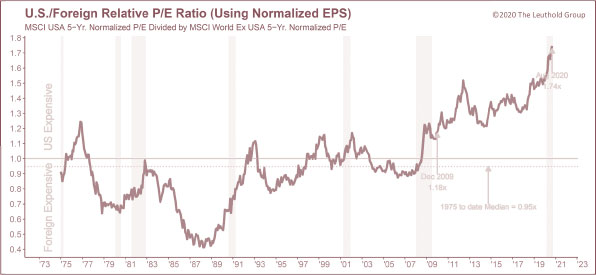

| ● | According to The Leuthold Group, as of 7/10/20, stocks were in the highest decile (10th) of valuations based on the median decile of approximately 50 different valuation measures. |

| ● | Robinhood Financial LLC has added over 3 million customers since the beginning of the year. Measures of retail investor speculation are near their highest ever, including small-sized option trading that now exceeds the trading volume of individual stocks. |

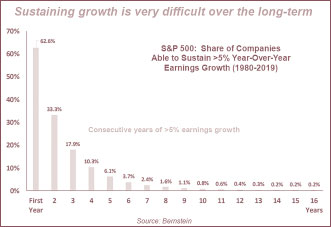

We are not ignorant to the excitement and promise of some of the emerging software companies, and other concepts that essentially defer profits on the income statement in order to grow the top line rapidly and lock in a future stream of profit. Establishing what is perceived to be an unassailable position in the market is easier in the digital world compared to the physical world. Many companies will win with this strategy. Many more will try and fail. Our issue is that most of these companies are being priced as the eventual winners. They can’t all win! Sustaining even 5% growth for more than a few years is difficult (even for the Technology sector), as evidenced by the following charts. The stocks that have captured the imagination of investors depend on sustained success over a very long time horizon. Valuations leave little room for error.

|

|

Growth stocks in particular are sensitive to discount rate changes. This is because so much of the present value depends on compounding higher earnings well into the future. Following is a table from Credit Suisse HOLT, outlining possible return outcomes in different classes of stocks as a result of changes in sector discount rates. This table reveals some interesting scenarios. For example, if sector discount rates went back to just the 3-year median, U.S. Hyper Growth stocks would fall 32% and U.S. cyclical value stocks would decline 7%. If rates went back to their 20-year median, U.S. Tech Large Cap would fall 44% and U.S. Financials would gain 46%. Realize, these are just mathematical calculations, but they inform the possibilities. Our portfolios are far less dependent on the maintenance of historically low interest rates. We are finding excellent values in the cyclicals, such as Flowserve Corp. and Applied Industrial Technologies Inc., and in financials, particularly Ryder System Inc., Kennedy-Wilson Holdings Inc., and Howard Hughes Corp.

Probability-weighted valuation upside/downsides for various HOLT Styles, regions

and sectors based on observed discount rates in a given economic regime

| Warranted Valuation Upside/Downside % | |||||||||||||||

| Scenario per Fig 4 (probability weighting) |

US Hyper Growth |

US Tech Large Cap |

US Quality Defensives |

US Quality Growth |

US | Europe Ex UK | UK | Developing Countries | US Cyclical |

Top 25% Value Developed: Markets | Developed Energy Large Cap | Developing Financials | UK Financials |

Europe Financials | US Financials |

| Goldilocks (35%): discount rate@20-year min |

6% | 23% | 4% | 11% | 4% | 0% | 7% | 13% | 19% | 18% | 43% | 72% | 96% | 90% | 84% |

| Normalization (35%): discount rate@3-year median |

-32% | -38% | -17% | -21% | -10% | -7% | -10% | -8% | -7% | -5% | 15% | 14% | 8% | 20% | 28% |

| Status Quo (27%): no change in discount rate |

0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Stagflation (3%): discount rate @ 20-yr median |

-83% | -44% | -43% | -36% | -19% | -27% | -18% | -13% | -8% | -4% | 21% | 21% | 38% | 35% | 46% |

| Weighted Upside/Downside | -12% | -7% | -6% | -4% | -3% | -3% | -2% | 1% | 4% | 4% | 21% | 31% | 38% | 40% | 41% |

Source: Credit Suisse HOLT ®, HOLT Global Viewpoint, September 28, 2020

Two additional investments we highlight this quarter are Plexus Corp. and TriMas Corp.

Plexus Corp. (PLXS)

(Analyst: Julia Jensen)

Description

Plexus provides electronic manufacturing services (EMS). The firm partners with companies to transform concepts into branded products and delivers them to the market. It operates in four different market sectors: Healthcare and Life Sciences (39% of revenues), Industrial and Commercial (37%), Communications (8%), and Aerospace and Defense (16%). Plexus’ focus is on winning contracts in niche markets that involve high-complexity/low-volume products. The company operates mainly in Malaysia and the U.S., but also in China, Mexico, Scotland, Germany, and Romania.

Good Business

| ● | We consider Plexus to be best-in-class due to its superior margins and returns relative to peers, which have been driven by shifting product mix from low-complexity/high-volume products to high-complexity/low-volume products. |

| ● | Plexus has differentiated itself from peers with its top-notch design team and regulatory expertise. Much of this differentiation is within the Healthcare/Life Sciences sector, where projects with high engineering involvement and regulatory barriers predominate. |

| ● | The company’s business model has a more defensive business mix relative to peers, which has been proven by its relative outperformance in the Great Financial Crisis and the current pandemic-related recession. |

| ● | Plexus is regarded as having higher service levels relative to peers, and has a net promoter score of 84%, which is high relative to the industry benchmark of ~56%. |

| ● | Management is organically focused and does not believe in mergers and acquisitions. We expect 9-12% annual revenue growth for the next five years now that management is largely finished with pruning its networking and communications portfolio. |

| ● | The company has a strong balance sheet with a net debt-to-EBITDA ratio of 0.4 times and $650 million of liquidity. |

Valuation

| ● | Plexus trades at a forward price-to-earnings multiple (P/E) of 16.2 times and a trailing P/E of 17.9 times, which are approximately 50% lower than the weighted average Russell 3000 P/E multiples. |

| ● | Despite performing much better fundamentally throughout the pandemic than the average U.S. business, the shares are still down ~20% from their pre-pandemic high, while the U.S. stock market in aggregate is almost on par with pre-pandemic highs. |

Management

| ● | Plexus’ management team is regarded as one of the best in the industry. The team takes a disciplined approach when selecting new projects, only taking on those that fit their strategy. |

| ● | CEO Todd Kelsey and COO Steven Frisch have been with the company for over 25 years and have held their positions since 2016. All other executives have held their positions for over five years. |

| ● | Management is well-aligned with shareholder interests and focused on growing return on invested capital (ROIC), which comprises 40% of incentive-based compensation. The other compensation is based on revenue growth (40%) and individual goals (20%). Notably, this compensation plan runs deep in the organization and includes all managers. |

Investment Thesis

The EMS industry has historically been a tough one; it has been earmarked by little differentiation and low returns. However, Plexus has been an exception to this characterization due to its disciplined, niche strategy. Over the past decade, management has had an emphasis on shifting to a high-complexity/low-volume product mix. This has transitioned the company’s high-complexity product mix to 93% of the business from 47% in 2008. This change has brought superior design team capabilities, sticky relationships, advanced regulatory knowledge, lower cyclicality, and higher returns. We particularly like that roughly 40% of the business now comes from Healthcare/Life Sciences, given its defensiveness and long product lifecycles. The protective nature of the business mix has been demonstrated throughout the pandemic. We expect continued strong demand for Plexus’ services because recessions tend to drive manufacturing outsourcing, as many businesses lack the capital to manufacture in-house. We think the company will achieve strong growth over the long run, and it is an attractive relative value with a mid-teens earnings multiple potential.

TriMas Corp. (TRS)

(Analyst: Matt Sullivan)

Description

TriMas is a global designer, manufacturer and distributor of engineered products for commercial, industrial, and consumer markets. The company operates in three business segments: Packaging (58% of sales), Aerospace (26%), and Specialty Products (16%). The Packaging business makes specialty closures and dispensers for consumer and industrial products that are sold to a variety of end markets. The Aerospace business is a leading supplier of highly engineered fasteners to the aerospace industry. The Specialty Products business manufactures high and low-pressure steel cylinders, natural gas-powered wellhead engines and compressors, as well as other products. In total, approximately 82% of the company’s consolidated sales come from the U.S., 12% from Europe, 5% from Asia-Pacific, and 1% from Latin America.

Good Business

| ● | We estimate that TriMas’ ROIC is approximately 12%, which exceeds the company’s cost of capital. |

| ● | TriMas’ products typically constitute a small portion of a customer’s total production costs, but are critically important to the end product. |

| ● | The company’s businesses have relatively high barriers to entry. Each business segment exhibits one or more of the following characteristics: the products are highly engineered, patent-protected, sold into industries with stringent regulatory requirements, sold under long-term contracts, have well established and highly regarded brands, and/or the businesses have longstanding relationships with customers. |

| ● | The Packaging and Aerospace businesses are defensive, have the highest barriers to entry, contribute the vast majority of the company’s earnings, and should drive earnings growth going forward. |

| ● | The Packaging business’ dispensers and closures are mainly used in consumer non-durable products, and the Aerospace business sells its products to customers under long-term contracts. |

| ● | The company has a strong balance sheet and is easy to understand. |

Valuation

| ● | The stock trades at 15.0 times our next 12-months earnings per share (EPS) estimate, which is below the company’s 5-year average and is a significant discount to the Russell 2000 as well as other comparable companies serving similar end markets. |

| ● | The stock is trading at 1.6 times enterprise value-to-sales, which is below the company’s 5-year average of 1.7 times. |

Management

| ● | Tom Amato became President and CEO in July 2016. He has more than 25 years of broad industrial experience, having served in several leadership positions at global, multi-billion-dollar businesses, and as a CEO for companies owned by notable private equity firms, including The Carlyle Group Inc. and American Securities LLC. |

| ● | CFO Bob Zalupski joined TriMas in 2002. He has more than 30 years of business and financial management experience. Prior to being named CFO in 2015, he was Vice President, Finance, Corporate Development and Treasurer. |

Investment Thesis

TriMas is a collection of above-average businesses. COVID-19 has negatively impacted two of the company’s three business segments, causing the stock to come under pressure. Offsetting these challenges, the Packaging business (dispensers and closures for cleaning and hygiene products) has experienced a strong increase in demand as a result of the pandemic. We believe the strength in the Packaging business will more than offset weakness in the company’s other segments. Given the fairly resilient fundamental profile during this difficult time, we view the current valuation, at only 15.0 times the next 12-months EPS estimate, as attractive.

Thank you for your confidence in the FMI Common Stock Fund.

This shareholder letter is unaudited.

| FMI Common Stock Fund |

|

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited)

|

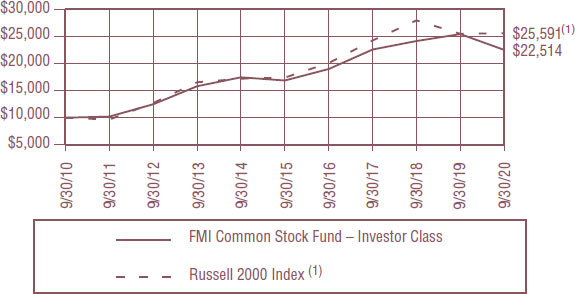

During the fiscal year ended September 30, 2020, the FMI Common Stock Fund (FMIMX) the “Fund” had a total return of negative 11.51%(1). The benchmark Russell 2000 Index returned positive return of 0.39% in the same period. The Russell 2000 Value Index declined 14.88% in the same period. Relative to the Russell 2000, sectors that aided performance included Energy Minerals and Utilities (both underweight), Process Industries and Distribution Services. The Fund had little direct exposure to Energy Minerals, an area of weakness due to low hydrocarbon prices and slower demand because of COVID-19. Utilities attracted less attention in the Russell 2000 because of their slow underlying growth; the Fund had no exposure to Utilities. Avery Dennison Corp. drove the results in Process Industries as most of their pressure sensitive products benefitted from COVID-19. Arrow Electronics and HD Supply performed relatively well as their earnings weren’t dramatically impacted by COVID-19. On the negative side of sector performance, Health Technology, Producer Manufacturing and Electronic Technology all detracted. In Health Technology, Phibro Animal Health Corp. fell due to African Swine Flu and poor execution. Several stocks suffered in the Producer Manufacturing area because of COVID-19, including Carlisle Cos., TriMas Corp., Armstrong World Industries and Woodward Inc. ViaSat declined due to concerns about the balance sheet.

Other stocks that helped relative performance included Penske Automotive, ePlus Corp. and Insight Enterprises. Penske’s results, while not spectacular, were better than the market expected. ePlus and Insight both grew earnings significantly ahead of market expectations in the period. Other stocks that detracted from results included Graham Holdings, FirstCash Inc., Howard Hughes Corp., Zions Bancorporation and other names in finance. Graham reported mixed results throughout the year and investors struggled to grasp the near-term outlook. Almost every stock in the finance arena declined significantly. Worries about low economic growth, interest rates and reserves escalated after COVID-19. The outlook for companies in the finance sector looks positive to the Fund managers. Balance sheets are strong, and expectations are low.

New additions to the Fund over the past twelve months included Houlihan Lokey, Applied Industrial Technologies, Insight Enterprises, A.O Smith, Henry Schein and Flowserve. Stocks sold during the year included Argo Group, ePlus, Watsco, WABCO and ViaSat. As of September 30, 2020, the Fund was significantly overweighted in Producer Manufacturing, Commercial Services, and Distribution Services and meaningfully underweighted in Heath Technology, Technology Services and Electronic Technology.

The Russell 2000 has been driven by Health Technology, Technology Services and Electronic Technology over the past twelve months. The FMI Common Stock Fund managers believe these sectors have the greatest number of speculative stocks anywhere in the stock market. More than three quarters of the nearly 400 Russell 2000 Health Technology companies are money losing, yet that sector gained 34% in the period compared to an increase of 0.39% for the overall Russell 2000. The Technology Services and Electronic Technology areas are also up significantly in a weak market, largely driven by stocks with the highest valuations. On most valuation measures, the Russell 2000 is in the highest decile of historical measures. Passive investment strategies also continued to see heavy inflows of money, at the expense of active strategies. The growing use of “adjusted earnings” rather than GAAP earnings by Wall Street and corporate management gives a misleading P/E ratio.

The Federal Reserve (“Fed”) has undertaken an unprecedented policy of monetary accommodation, both prior to and after COVID-19 became widespread. The Fed’s balance sheet has roughly doubled over the past twelve months. The price of money remains unusually low by historical standards and the Fund managers believe many negative effects, including potential high inflation and currency debasement, are being ignored by the market. The economy went into a sharp recession in February of 2020, primarily due to COVID-19. Debt at both the corporate and government levels has grown significantly. Recent additions to the government debt totals are extraordinary by historical standards. U.S. total federal debt-to-GDP is well over 100% and the highest in the WWII era. Corporate leverage by some measures is at a fifty-year high.

With valuations high and speculative fervor present in the IPO and private equity areas, along with an overwhelming belief that interest rates will stay low for years, the Fund managers feel growth stocks are particularly vulnerable to a change in conditions. The outlook for strong relative performance from value-oriented stocks, while contrarian in nature, is positive.

(1) The FMI Common Stock Fund Institutional Class (FMIUX) returned -11.41% for the fiscal year ending 9/30/20.

| FMI Common Stock Fund |

| MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE (Unaudited) (Continued) |

COMPARISON OF CHANGE IN VALUE OF $10,000 INVESTMENT IN

FMI COMMON STOCK FUND – INVESTOR CLASS AND THE RUSSELL 2000 INDEX(1)

| AVERAGE ANNUALIZED TOTAL RETURN | |||||

| Inception Date | 1-Year | 5-Year | 10-Year |

Inception through 9/30/2020 |

|

| FMI Common Stock Fund –Investor Class | 12/18/81 | -11.51% | 5.94% | 8.45% | 11.06% |

| FMI Common Stock Fund –Institutional Class | 10/31/16 | -11.41% | N/A | N/A | 5.29% |

| Russell 2000 Index(1)* | 0.39% | 8.00% | 9.85% | 9.84% | |

The graph and the table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of a Fund may be lower or higher than the performance quoted. The total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Total return includes change in share prices and in each case includes reinvestments of any dividends, interest and capital gain distributions. Performance data current to the most recent month-end may be obtained by visiting www.fmifunds.com or by calling 1-800-811-5311.

| (1) | The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which comprises the 3,000 largest U.S. companies based on total market capitalization. |

| * | The benchmark since inception returns are calculated since inception of the Investor Class, December 18, 1981 to September 30, 2020. |

An investment cannot be made directly into an index.

FMI Common Stock Fund

September 30, 2020

| Shares | Cost | Value | ||||||||||

| COMMON STOCKS — 95.9% (a) | ||||||||||||

| COMMERCIAL SERVICES SECTOR — 15.7% | ||||||||||||

| Advertising/Marketing Services — 3.1% | ||||||||||||

| 1,275,000 | Interpublic Group of Cos. Inc. | $ | 22,046,035 | $ | 21,254,250 | |||||||

| Miscellaneous Commercial Services — 7.1% | ||||||||||||

| 143,450 | FTI Consulting Inc.* | 16,248,500 | 15,201,396 | |||||||||

| 875,000 | Genpact Ltd. | 14,508,365 | 34,081,250 | |||||||||

| 30,756,865 | 49,282,646 | |||||||||||

| Personnel Services — 5.5% | ||||||||||||

| 160,000 | ManpowerGroup Inc. | 10,005,094 | 11,732,800 | |||||||||

| 490,000 | Robert Half International Inc. | 21,555,688 | 25,940,600 | |||||||||

| 31,560,782 | 37,673,400 | |||||||||||

| CONSUMER SERVICES SECTOR — 2.6% | ||||||||||||

| Other Consumer Services — 2.6% | ||||||||||||

| 45,000 | Graham Holdings Co. | 20,557,975 | 18,184,950 | |||||||||

| DISTRIBUTION SERVICES SECTOR — 13.3% | ||||||||||||

| Electronics Distributors — 3.4% | ||||||||||||

| 300,000 | Arrow Electronics Inc.* | 9,893,291 | 23,598,000 | |||||||||

| Medical Distributors — 2.2% | ||||||||||||

| 260,000 | Henry Schein Inc.* | 13,293,217 | 15,282,800 | |||||||||

| Wholesale Distributors — 7.7% | ||||||||||||

| 200,000 | Applied Industrial Technologies Inc. | 11,992,135 | 11,020,000 | |||||||||

| 850,000 | HD Supply Holdings Inc.* | 33,475,208 | 35,054,000 | |||||||||

| 110,000 | MSC Industrial Direct Co. Inc. | 6,582,555 | 6,960,800 | |||||||||

| 52,049,898 | 53,034,800 | |||||||||||

| ELECTRONIC TECHNOLOGY SECTOR — 3.0% | ||||||||||||

| Aerospace & Defense — 1.0% | ||||||||||||

| 48,000 | Huntington Ingalls Industries Inc. | 8,075,176 | 6,756,000 | |||||||||

| Electronic Components — 2.0% | ||||||||||||

| 200,000 | Plexus Corp.* | 13,910,503 | 14,126,000 | |||||||||

| FINANCE SECTOR — 23.8% | ||||||||||||

| Finance/Rental/Leasing — 6.8% | ||||||||||||

| 495,000 | FirstCash Inc. | 23,620,089 | 28,318,950 | |||||||||

| 440,000 | Ryder System Inc. | 19,888,760 | 18,585,600 | |||||||||

| 43,508,849 | 46,904,550 | |||||||||||

| Investment Banks/Brokers — 3.5% | ||||||||||||

| 403,840 | Houlihan Lokey Inc. | 20,222,031 | 23,846,752 | |||||||||

| Life/Health Insurance — 1.0% | ||||||||||||

| 58,000 | Primerica Inc. | 7,036,706 | 6,562,120 | |||||||||

| Multi-Line Insurance — 2.2% | ||||||||||||

| 19,371 | White Mountains Insurance Group Ltd. | 16,933,458 | 15,090,009 | |||||||||

| Property/Casualty Insurance — 2.8% | ||||||||||||

| 315,000 | W.R. Berkley Corp. | 5,117,323 | 19,262,250 | |||||||||

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2020

| Shares | Cost | Value | ||||||||||

| COMMON STOCKS — 95.9% (a) (Continued) | ||||||||||||

| FINANCE SECTOR — 23.8% (Continued) | ||||||||||||

| Real Estate Development — 4.6% | ||||||||||||

| 250,000 | The Howard Hughes Corp.* | $ | 25,365,386 | $ | 14,400,000 | |||||||

| 1,175,000 | Kennedy-Wilson Holdings Inc. | 22,407,305 | 17,061,000 | |||||||||

| 47,772,691 | 31,461,000 | |||||||||||

| Regional Banks — 2.9% | ||||||||||||

| 695,000 | Zions Bancorporation | 22,072,253 | 20,307,900 | |||||||||

| HEALTH TECHNOLOGY SECTOR — 3.5% | ||||||||||||

| Medical Specialties — 2.8% | ||||||||||||

| 440,000 | Dentsply Sirona Inc. | 14,747,639 | 19,241,200 | |||||||||

| Pharmaceuticals: Major — 0.7% | ||||||||||||

| 290,000 | Phibro Animal Health Corp. | 8,136,930 | 5,046,000 | |||||||||

| PROCESS INDUSTRIES SECTOR — 8.9% | ||||||||||||

| Containers/Packaging — 6.5% | ||||||||||||

| 350,000 | Avery Dennison Corp. | 19,892,257 | 44,744,000 | |||||||||

| Industrial Specialties — 2.4% | ||||||||||||

| 350,000 | Donaldson Co. Inc. | 14,991,016 | 16,247,000 | |||||||||

| PRODUCER MANUFACTURING SECTOR — 20.5% | ||||||||||||

| Building Products — 4.8% | ||||||||||||

| 375,000 | A.O. Smith Corp. | 14,503,877 | 19,800,000 | |||||||||

| 190,000 | Armstrong World Industries Inc. | 7,834,094 | 13,073,900 | |||||||||

| 22,337,971 | 32,873,900 | |||||||||||

| Industrial Machinery — 5.0% | ||||||||||||

| 175,000 | EnPro Industries Inc. | 12,542,480 | 9,871,750 | |||||||||

| 400,000 | Flowserve Corp. | 9,204,782 | 10,916,000 | |||||||||

| 175,000 | Woodward Inc. | 7,110,989 | 14,028,000 | |||||||||

| 28,858,251 | 34,815,750 | |||||||||||

| Miscellaneous Manufacturing — 8.1% | ||||||||||||

| 275,000 | Carlisle Cos. Inc. | 19,562,984 | 33,651,750 | |||||||||

| 990,000 | TriMas Corp.* | 21,908,123 | 22,572,000 | |||||||||

| 41,471,107 | 56,223,750 | |||||||||||

| Trucks/Construction/Farm Machinery — 2.6% | ||||||||||||

| 915,000 | Trinity Industries Inc. | 17,733,771 | 17,842,500 | |||||||||

| RETAIL TRADE SECTOR — 2.4% | ||||||||||||

| Specialty Stores — 2.4% | ||||||||||||

| 350,000 | Penske Automotive Group Inc. | 11,953,975 | 16,681,000 | |||||||||

| TECHNOLOGY SERVICES SECTOR — 2.2% | ||||||||||||

| Information Technology Services — 2.2% | ||||||||||||

| 270,000 | Insight Enterprises Inc.* | 15,266,119 | 15,276,600 | |||||||||

| Total common stocks | 560,196,089 | 661,619,127 | ||||||||||

The accompanying notes to financial statements are an integral part of this schedule.

FMI Common Stock Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2020

| Principal Amount | Cost | Value | ||||||||||

| SHORT-TERM INVESTMENTS — 4.2% (a) | ||||||||||||

| Bank Deposit Account — 4.2% | ||||||||||||

| $ | 29,227,320 | U.S. Bank N.A., 0.04%^ | $ | 29,227,320 | $ | 29,227,320 | ||||||

| Total short-term investments | 29,227,320 | 29,227,320 | ||||||||||

| Total investments — 100.1% | $ | 589,423,409 | 690,846,447 | |||||||||

| Other liabilities, less assets —(0.1%) (a) | (607,514 | ) | ||||||||||

| TOTAL NET ASSETS — 100.0% | $ | 690,238,933 | ||||||||||

| * | Non-income producing security. |

| ^ | The rate shown is as of September 30, 2020. |

| (a) | Percentages for the various classifications relate to total net assets. |

The accompanying notes to financial statements are an integral part of this schedule.

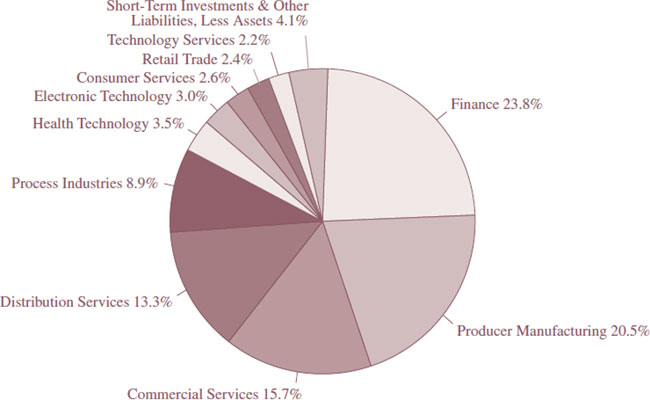

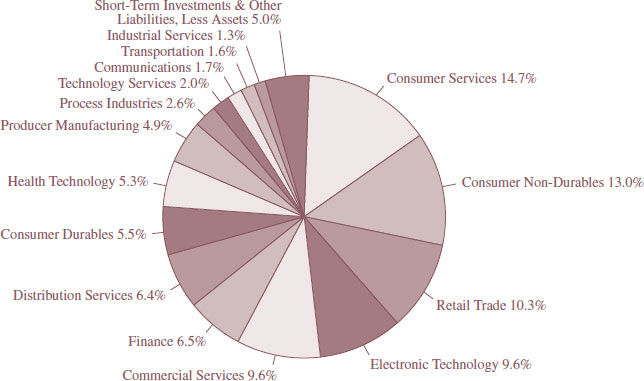

INDUSTRY SECTORS as a percentage of net assets

as of September 30, 2020 (Unaudited)

and

FMI International Fund II – Currency Unhedged

| (unaudited) |

September 30, 2020

Being a value investor in a growth and momentum-driven stock market is a lonely existence, but one that can be quite rewarding through a full cycle. As Warren Buffett once said, it is wise to “be fearful when others are greedy, and greedy when others are fearful.” Today, we are seeing an abundance of greed, notwithstanding a few pockets of fear (hint: international value equities). We have continued to remain true to our research process and value orientation despite the challenging backdrop.

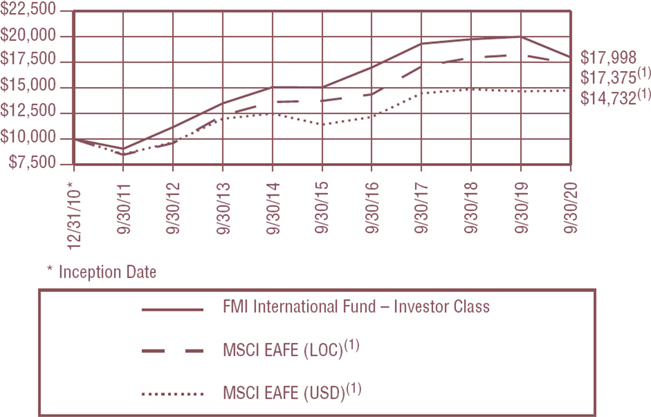

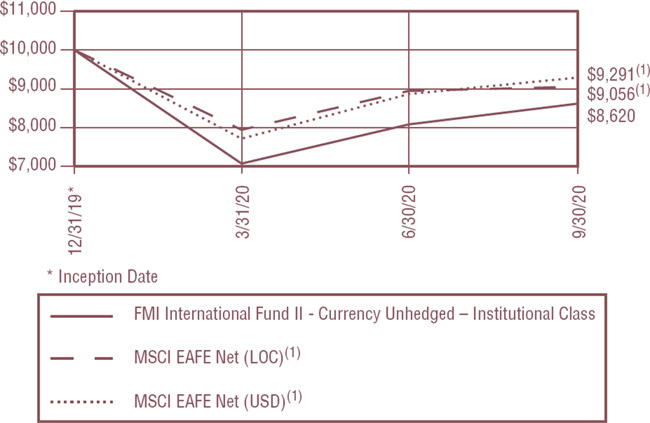

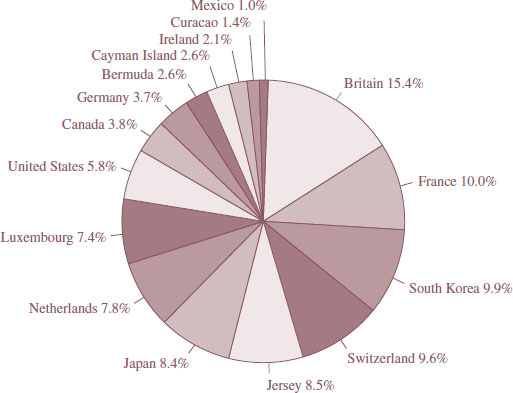

In the third quarter, the FMI International Funds (“Funds”) continued to rebound, advancing 4.53% (currency hedged)1 and 6.62% (currency unhedged)2, which compares with an MSCI EAFE Index gain of 1.22% in local currency (LOC) and 4.80% in U.S. Dollars (USD). Unfortunately, value stocks have continued to fall out of favor, as the MSCI EAFE Value Index declined 2.34% in LOC and gained 1.19% in USD in the period, each lagging their comparable MSCI EAFE Growth Index by over 7%. Performance in the Funds was led by Ferguson PLC, B&M European Value Retail S.A., and Hyundai Motor Co. Preferred, as Amorepacific Corp. Preferred, Chubb Ltd., and Jardine Strategic Holdings Ltd. each detracted. The Consumer Services, Distribution Services, and Consumer Durables sectors were positive contributors, while Producer Manufacturing, Technology Services, and Industrial Services lagged. A weak USD hurt FMI’s currency hedged performance.

In 2020, the Funds have been especially hard-hit by COVID-related headwinds. We look forward to a rebound in several companies where we believe the long-term prospects are far more attractive than they are currently being given credit for. We think we have a number of “coiled springs” in the portfolio, poised to outperform once business starts to normalize. If, for example, our holdings were simply to return to their 52-week highs, the portfolios would be up over 27%, and in our opinion, still be undervalued.

Given the litany of risks investors should be trying to carefully navigate (global pandemic, deep recession, elevated valuations, central bank profligacy, leverage, geopolitical risks, and inflation, to name just a few), there is no better time to own a collection of high-quality companies. Our portfolios are filled with what we feel are durable, competitively advantaged businesses with strong balance sheets and skilled management teams. Not only do these companies have the wherewithal to make it through these tough times, but most should come out even stronger on the other side. The portfolios trade at a significant discount to our benchmarks, which should bode well for future returns.

| 1 | The FMI International Fund [currency hedged] Investor Class (FMIJX) and the FMI International Fund [currency hedged] Institutional Class (FMIYX) had a return of 4.53% and 4.52%, respectively, for the third quarter of 2020. |

| 2 | The FMI International Fund (unhedged) Institutional Class (FMIFX) had a return of 6.62% for the third quarter of 2020. |

Everything but the Kitchen Sink